Grundläggande statistik

| Institutionella aktier (lång) | 10 659 324 078 - 71,83% (ex 13D/G) - change of 242,72MM shares 2,33% MRQ |

| Institutionellt värde (lång) | $ 2 061 496 109 USD ($1000) |

Institutionellt ägande och aktieägare

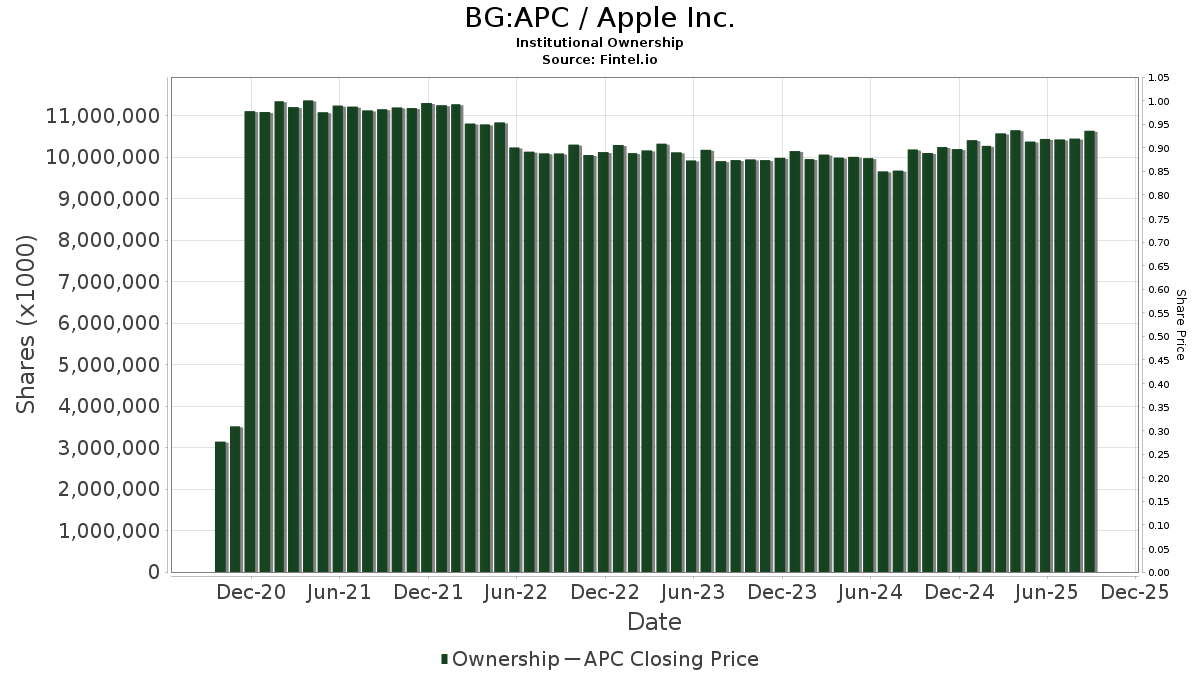

Apple Inc. (BG:APC) har 7702 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 10,659,694,171 aktier. Största aktieägare inkluderar Vanguard Group Inc, BlackRock, Inc., State Street Corp, VTSMX - Vanguard Total Stock Market Index Fund Investor Shares, VFINX - Vanguard 500 Index Fund Investor Shares, Geode Capital Management, Llc, Fmr Llc, Berkshire Hathaway Inc, Morgan Stanley, and Jpmorgan Chase & Co .

Apple Inc. (BUL:APC) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

Important Note

In an effort to reduce load times for our mobile users, we are testing some ways to deliver lighter pages.

In this first test, we will deliver only the most recent 750 transactions (out of 8405 for this stock). If you are interested in loading *all* the transactions for this company, click the "load all" button below. This is just a test and if you don't like it, please let us know by submitting some gentle feedback via the link at the bottom of this page.

Load All| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-05 | 13F | Hunter Associates Investment Management Llc | 145 499 | −10,26 | 30 | −19,44 | ||||

| 2025-07-14 | 13F | RJA Asset Management LLC | 1 123 300 | −11,58 | 230 467 | −18,33 | ||||

| 2025-07-30 | 13F | Adams Diversified Equity Fund, Inc. | 831 000 | −1,47 | 170 496 | −8,99 | ||||

| 2025-07-29 | 13F | Hoese & Co LLP | 2 602 | 0,00 | 534 | −7,63 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | 788 926 | 3,95 | 161 864 | −3,98 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | Put | 62 | −7,58 | |||||

| 2025-08-28 | NP | QTOP - iShares Nasdaq Top 30 Stocks ETF | 62 216 | 17,91 | 12 765 | 8,90 | ||||

| 2025-08-08 | 13F | Woodley Farra Manion Portfolio Management Inc | 57 650 | −1,34 | 11 828 | −8,87 | ||||

| 2025-08-12 | 13F | Associated Banc-corp | 606 664 | −3,60 | 124 469 | −10,96 | ||||

| 2025-08-12 | 13F | Eisler Capital Management Ltd. | Call | 947 600 | 49,42 | 194 372 | 38,06 | |||

| 2025-08-12 | 13F | Eisler Capital Management Ltd. | Put | 2 998 800 | 36,12 | 615 114 | 25,78 | |||

| 2025-07-08 | 13F | Choice Wealth Advisors, LLC | 33 759 | 0,23 | 6 926 | −7,42 | ||||

| 2025-07-21 | 13F | Hudson Valley Investment Advisors Inc /adv | 128 951 | 2,00 | 26 457 | −5,79 | ||||

| 2025-08-11 | 13F | Tower Bridge Advisors | 222 754 | −2,58 | 45 702 | −10,02 | ||||

| 2025-07-15 | 13F | Optima Capital Llc | 5 802 | 13,92 | 1 190 | 5,22 | ||||

| 2025-08-12 | 13F | Eisler Capital Management Ltd. | 357 479 | 99,46 | 73 326 | 84,30 | ||||

| 2025-07-11 | 13F | Westfuller Advisors, LLC | 20 985 | 5,93 | 4 305 | −2,16 | ||||

| 2025-07-22 | 13F | Siligmueller & Norvid Wealth Advisors LLC | 3 427 | −4,17 | 720 | −9,32 | ||||

| 2025-07-29 | NP | WAYFX - WAYCROSS FOCUSED EQUITY FUND | 24 997 | 13,88 | 5 021 | −5,43 | ||||

| 2025-08-08 | 13F | Davis Selected Advisers | 1 265 | 260 | ||||||

| 2025-08-11 | 13F | Annis Gardner Whiting Capital Advisors, LLC | 33 814 | 0,61 | 6 938 | −7,07 | ||||

| 2025-08-14 | 13F | 10Elms LLP | 243 | −62,62 | 50 | −65,97 | ||||

| 2025-07-30 | 13F | Citizens & Northern Corp | 58 164 | −1,97 | 11 934 | −9,45 | ||||

| 2025-08-11 | 13F | Battery Global Advisors, LLC | 6 644 | 0,05 | 1 363 | −7,59 | ||||

| 2025-08-14 | 13F | Peak6 Llc | Call | 2 218 400 | −16,65 | 455 149 | −23,01 | |||

| 2025-08-25 | NP | MAINSTAY VP FUNDS TRUST - MainStay VP MacKay Growth Portfolio Initial Class | 158 588 | 16,77 | 32 537 | 7,85 | ||||

| 2025-07-29 | 13F | MPS Loria Financial Planners, LLC | 284 413 | −6,42 | 58 353 | −13,57 | ||||

| 2025-08-05 | 13F | Fullcircle Wealth Llc | 19 806 | −15,82 | 4 028 | −18,55 | ||||

| 2025-06-26 | NP | DFAC - Dimensional U.S. Core Equity 2 ETF | 7 475 640 | 3,54 | 1 588 574 | −6,77 | ||||

| 2025-07-17 | 13F | R.H. Investment Group, LLC | 21 725 | 1,13 | 4 457 | −6,60 | ||||

| 2025-08-14 | 13F | Peak6 Llc | Put | 1 018 000 | −43,60 | 208 863 | −47,90 | |||

| 2025-08-27 | NP | Jnl Series Trust - Jnl/jpmorgan Global Allocation Fund (a) | 50 416 | 69,08 | 10 344 | 56,17 | ||||

| 2025-07-23 | 13F | WESPAC Advisors, LLC | 12 419 | −0,07 | 2 548 | −7,72 | ||||

| 2025-08-04 | 13F | REDW Wealth LLC | 14 090 | 1,24 | 2 891 | −6,50 | ||||

| 2025-07-15 | 13F | Bfsg, Llc | 85 418 | 1,13 | 17 525 | −6,59 | ||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 166 569 | 20,18 | 34 175 | 2,09 | ||||

| 2025-05-28 | NP | MGLBX - Marsico Global Fund | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-05 | 13F | Roffman Miller Associates Inc /pa/ | 457 159 | −4,70 | 93 795 | −11,98 | ||||

| 2025-07-14 | 13F | Westend Capital Management LLC | 1 902 | −97,26 | 390 | −97,48 | ||||

| 2025-07-09 | 13F | Pacific Capital Wealth Advisors, Inc | 24 264 | −36,49 | 5 094 | −39,97 | ||||

| 2025-07-28 | 13F | Mowery & Schoenfeld Wealth Management, LLC | 15 008 | −1,99 | 3 079 | −9,47 | ||||

| 2025-07-15 | 13F | McAdam, LLC | 80 263 | 7,48 | 16 467 | −0,73 | ||||

| 2025-07-18 | 13F | Ewa, Llc | 33 999 | 5,37 | 6 976 | −2,67 | ||||

| 2025-07-15 | 13F | Marquette Asset Management, LLC | 3 841 | 0,00 | 788 | −7,62 | ||||

| 2025-07-23 | 13F | Canopy Partners, LLC | 53 717 | −2,27 | 11 021 | −9,73 | ||||

| 2025-08-14 | 13F | Light Street Capital Management, Llc | 8 276 | 29,98 | 1 698 | 20,01 | ||||

| 2025-08-14 | 13F | Aragon Global Management, LP | 0 | −100,00 | 0 | |||||

| 2025-08-22 | NP | Columbia Funds Variable Series Trust II - Variable Portfolio - Partners Core Equity Fund Class 3 | 510 245 | −20,83 | 104 687 | −26,87 | ||||

| 2025-03-12 | 13F/A | Private Capital Management Llc | 73 507 | −2,25 | 15 482 | 20,07 | ||||

| 2025-08-13 | 13F | Scotia Capital Inc. | 3 268 070 | −1,72 | 670 474 | −9,23 | ||||

| 2025-08-05 | 13F | Code Waechter LLC | 10 871 | 32,27 | 2 230 | 222 900,00 | ||||

| 2025-08-27 | NP | VITNX - Vanguard Institutional Total Stock Market Index Fund Institutional Shares This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 7 589 234 | 0,41 | 1 557 083 | −7,26 | ||||

| 2025-04-18 | 13F | Wolf Group Capital Advisors | 39 229 | −2,69 | 8 714 | 11,45 | ||||

| 2025-07-17 | NP | JENSX - The Jensen Quality Growth Fund Inc J Shares | 1 695 000 | −39,09 | 340 441 | −48,46 | ||||

| 2025-08-12 | 13F | Cutter & CO Brokerage, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 2 032 400 | 3,37 | 417 011 | −4,52 | ||||

| 2025-08-11 | 13F | Greenland Capital Management LP | Call | 20 100 | 219,05 | 4 124 | 194,71 | |||

| 2025-08-11 | 13F | Greenland Capital Management LP | Put | 8 600 | 1 764 | |||||

| 2025-07-29 | 13F | Ifrah Financial Services, Inc. | 76 434 | 1,24 | 15 682 | −6,49 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 315 951 | −2,78 | 64 824 | −10,20 | ||||

| 2025-08-15 | 13F | Security National Bank Of Sioux City Iowa /ia/ | 31 361 | −0,07 | 6 434 | −7,70 | ||||

| 2025-07-28 | NP | CSM - ProShares Large Cap Core Plus | 88 650 | −8,15 | 17 805 | −23,71 | ||||

| 2025-07-17 | 13F | Rempart Asset Management Inc. | 6 802 | −7,79 | 1 396 | −14,84 | ||||

| 2025-07-16 | 13F | Exeter Financial, LLC | 40 854 | −2,63 | 8 382 | −10,05 | ||||

| 2025-08-20 | NP | QRPNX - AQR Alternative Risk Premia Fund Class N | Short | −2 449 | −0,00 | −502 | −7,55 | |||

| 2025-07-17 | 13F | HCR Wealth Advisors | 529 406 | 0,33 | 108 618 | −7,33 | ||||

| 2025-07-29 | 13F | Madison Wealth Partners, Inc | 40 245 | 0,13 | 8 257 | −7,51 | ||||

| 2025-05-28 | NP | MIOFX - Marsico International Opportunities Fund | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-29 | NP | Gabelli Equity Trust Inc | 8 440 | −24,24 | 1 732 | −30,03 | ||||

| 2025-08-12 | 13F | Wayfinding Financial, LLC | 36 341 | −3,60 | 7 | −12,50 | ||||

| 2025-06-04 | 13F | Legacy Capital Wealth Management, Llc | 14 072 | 3 524 | ||||||

| 2025-07-16 | 13F | Motive Wealth Advisors | 16 180 | 12,35 | 3 320 | 3,75 | ||||

| 2025-07-31 | 13F | Oppenheimer Asset Management Inc. | 332 406 | −30,10 | 68 200 | −35,43 | ||||

| 2025-08-04 | 13F | GAM Holding AG | 167 187 | −20,12 | 34 302 | −26,22 | ||||

| 2025-07-17 | 13F | Guardian Investment Management | 78 618 | −11,41 | 16 130 | −18,17 | ||||

| 2025-08-01 | 13F | Strategic Financial Services, Inc, | 72 094 | −1,21 | 14 792 | −8,75 | ||||

| 2025-07-24 | 13F | Davis-rea Ltd. | 61 947 | 178,03 | 12 710 | 156,80 | ||||

| 2025-07-22 | 13F | Ellenbecker Investment Group | 37 312 | 1,71 | 7 655 | −6,05 | ||||

| 2025-07-08 | 13F | Apella Capital, LLC | 184 366 | 61,96 | 38 708 | 71,00 | ||||

| 2025-08-14 | 13F | K2 Principal Fund, L.p. | Put | 0 | −100,00 | 0 | ||||

| 2025-07-29 | 13F | Members Advisory Group LLC | 1 034 | −9,38 | 213 | −16,21 | ||||

| 2025-07-25 | 13F | Asset Planning,Inc | 31 361 | −2,51 | 6 434 | −9,95 | ||||

| 2025-08-14 | 13F | Clark Capital Management Group, Inc. | 1 400 845 | 9,92 | 287 411 | 1,52 | ||||

| 2025-06-30 | NP | VT - Vanguard Total World Stock Index Fund ETF Shares | 9 637 280 | 8,31 | 2 047 922 | −2,48 | ||||

| 2025-08-05 | 13F | Carolinas Wealth Consulting Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Gladstone Institutional Advisory LLC | 273 778 | 3,13 | 56 171 | −4,75 | ||||

| 2025-07-28 | 13F | ForthRight Wealth Management, LLC | 9 936 | 0,25 | 2 038 | −7,41 | ||||

| 2025-06-06 | NP | CCOR - Core Alternative ETF | 5 617 | −20,80 | 1 194 | −28,69 | ||||

| 2025-08-08 | 13F | Sawgrass Asset Management Llc | 181 506 | −11,60 | 37 240 | −18,34 | ||||

| 2025-08-08 | 13F | National Pension Service | 28 813 985 | 0,77 | 5 911 765 | −6,93 | ||||

| 2025-08-11 | 13F | Long Road Investment Counsel, LLC | 31 351 | −6,28 | 6 432 | −13,43 | ||||

| 2025-08-04 | 13F | L.m. Kohn & Company | 144 796 | −13,83 | 29 708 | −20,41 | ||||

| 2025-06-26 | NP | FYEE - Fidelity Yield Enhanced Equity ETF | 3 996 | 53,46 | 849 | 38,27 | ||||

| 2025-07-22 | 13F | Red Tortoise LLC | 5 717 | 0,86 | 1 173 | −6,91 | ||||

| 2025-07-09 | 13F | Central Bank & Trust Co | 93 044 | −0,51 | 19 090 | −8,10 | ||||

| 2025-07-11 | 13F | Halter Ferguson Financial Inc. | 12 306 | 3,35 | 2 525 | −4,54 | ||||

| 2025-07-17 | 13F | SeaBridge Investment Advisors LLC | 80 939 | 1,55 | 16 606 | −6,20 | ||||

| 2025-05-14 | 13F | First Wilshire Securities Management Inc | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | OMC Financial Services LTD | 121 938 | −4,59 | 25 018 | −11,88 | ||||

| 2025-07-24 | 13F | Villere St Denis J & Co Llc | 89 752 | −1,24 | 18 414 | −8,78 | ||||

| 2025-07-31 | 13F | Red Wave Investments LLC | 23 517 | −0,15 | 4 825 | −7,78 | ||||

| 2025-08-29 | NP | JGLTX - Janus Henderson Global Technology Portfolio Service Shares | 294 901 | 0,00 | 60 505 | −7,64 | ||||

| 2025-08-19 | 13F | Marex Group plc | Call | 341 500 | 70 066 | |||||

| 2025-08-19 | 13F | Marex Group plc | Put | 377 600 | 77 472 | |||||

| 2025-08-19 | 13F | Marex Group plc | 71 192 | 14 606 | ||||||

| 2025-08-14 | 13F | Goodwin Investment Advisory | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Unison Advisors LLC | 4 047 | 0,00 | 830 | −7,57 | ||||

| 2025-07-29 | NP | SXQG - 6 Meridian Quality Growth ETF | 11 343 | 5,59 | 2 278 | −12,28 | ||||

| 2025-08-08 | 13F | Atlantic Trust, LLC | 94 689 | 7,26 | 19 427 | −0,92 | ||||

| 2025-07-23 | 13F | Tyche Wealth Partners LLC | 125 842 | −0,80 | 25 819 | −8,37 | ||||

| 2025-05-14 | 13F | Potomac Fund Management Inc /adv | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-08 | 13F | Stephenson & Company, Inc. | 7 683 | 7,12 | 1 576 | −1,07 | ||||

| 2025-07-28 | 13F | Tower Wealth Partners, Inc. | 10 537 | 4,52 | 2 162 | −3,48 | ||||

| 2025-07-31 | 13F | Moser Wealth Advisors, LLC | 58 307 | −1,24 | 11 963 | −8,78 | ||||

| 2025-07-11 | 13F | Lincoln Capital LLC | 56 460 | −0,51 | 11 583 | 2,19 | ||||

| 2025-08-04 | 13F | AdvisorShares Investments LLC | 2 275 | 13,75 | 467 | 4,48 | ||||

| 2025-08-26 | 13F | Nautilus Advisors LLC | 27 123 | 0,89 | 5 565 | −6,82 | ||||

| 2025-08-14 | 13F | Utah Retirement Systems | 2 428 688 | −0,49 | 498 294 | −8,09 | ||||

| 2025-08-26 | NP | GARP - iShares Factors US Growth Style ETF | 122 441 | 62,73 | 25 121 | 50,31 | ||||

| 2025-07-16 | 13F | Falcon Wealth Planning | 270 215 | −0,94 | 55 440 | −8,51 | ||||

| 2025-07-14 | 13F | Seascape Capital Management | 29 727 | −1,45 | 6 | 0,00 | ||||

| 2025-08-13 | 13F | Avestar Capital, LLC | Put | 3 500 | −55,13 | 718 | −58,55 | |||

| 2025-06-26 | NP | ILCG - iShares Morningstar Large-Cap Growth ETF | 597 629 | −0,94 | 126 996 | −10,80 | ||||

| 2025-08-13 | 13F | Avestar Capital, LLC | 329 924 | 8,84 | 67 691 | 0,53 | ||||

| 2025-08-11 | 13F | Buckley Wealth Management, LLC | 157 529 | −0,91 | 32 320 | −8,47 | ||||

| 2025-08-08 | 13F | Mittelman Wealth Management | 1 463 | 300 | ||||||

| 2025-06-25 | NP | FTLS - First Trust Long/Short Equity ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 376 473 | −16,74 | 80 001 | −25,03 | ||||

| 2025-08-07 | 13F | Mawer Investment Management Ltd. | 3 960 | 0,00 | 812 | −7,62 | ||||

| 2025-07-15 | 13F | Cranbrook Wealth Management, LLC | 25 148 | 0,40 | 5 160 | −7,26 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 120 540 | −86,72 | 24 731 | −87,74 | ||||

| 2025-06-25 | NP | IQSU - IQ Candriam ESG US Equity ETF | 148 398 | −6,90 | 31 535 | −16,17 | ||||

| 2025-05-15 | 13F | Evergreen Capital Management Llc | Call | 111 | ||||||

| 2025-07-29 | 13F | Kondo Wealth Advisors, Inc. | 12 533 | 4,00 | 2 605 | −2,73 | ||||

| 2025-07-30 | 13F | Sander Capital Advisors Inc | 141 858 | −3,55 | 29 | −9,37 | ||||

| 2025-08-13 | 13F | Avestar Capital, LLC | Call | 3 500 | −86,64 | 718 | −87,66 | |||

| 2025-07-25 | 13F | Delaney Dennis R | 44 539 | 1,59 | 9 138 | −6,16 | ||||

| 2025-07-02 | 13F | Boston Standard Wealth Management, LLC | 3 462 | −13,45 | 710 | −15,78 | ||||

| 2025-08-01 | 13F | Pettee Investors, Inc. | 29 367 | −2,49 | 6 025 | −9,93 | ||||

| 2025-08-15 | 13F | Auxier Asset Management | 28 719 | −2,72 | 5 892 | −10,14 | ||||

| 2025-07-28 | NP | VCBCX - Blue Chip Growth Fund | 476 966 | −1,64 | 95 799 | −18,31 | ||||

| 2025-08-14 | 13F | Kemnay Advisory Services Inc. | 71 813 | 13,58 | 14 734 | 393,07 | ||||

| 2025-07-29 | NP | SIXA - 6 Meridian Mega Cap Equity ETF | 26 626 | 46,91 | 5 348 | 21,99 | ||||

| 2025-07-23 | 13F | Gainplan LLC | 5 426 | −34,33 | 1 113 | −39,35 | ||||

| 2025-06-26 | NP | DURPX - U.S. High Relative Profitability Portfolio Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 511 070 | 10,71 | 321 102 | −0,32 | ||||

| 2025-07-30 | 13F | Dudley Capital Management, Llc | 59 269 | −3,29 | 12 160 | −10,67 | ||||

| 2025-07-22 | NP | FLCC - Federated Hermes MDT Large Cap Core ETF | 5 062 | 48,97 | 1 017 | 23,75 | ||||

| 2025-07-17 | 13F | Stone Point Wealth LLC | 18 033 | −1,96 | 3 700 | −9,45 | ||||

| 2025-08-04 | 13F | Fisher Funds Management LTD | 334 785 | −10,00 | 68 688 | −16,87 | ||||

| 2025-08-29 | NP | SRIGX - Gabelli ESG Fund, Inc. Class AAA | 565 | 4,24 | 116 | −4,17 | ||||

| 2025-07-24 | 13F | Zullo Investment Group, Inc. | 162 135 | −4,40 | 33 265 | −11,70 | ||||

| 2025-06-23 | NP | PPUMX - LargeCap Growth Fund I R-3 | 2 309 340 | −8,18 | 490 735 | −17,33 | ||||

| 2025-07-17 | 13F | Hanson & Doremus Investment Management | 51 236 | 0,56 | 11 | −9,09 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 1 239 536 | −1,00 | 254 316 | −8,56 | ||||

| 2025-07-25 | 13F | G2 Capital Management, Llc / Oh | 30 837 | −0,12 | 6 327 | −7,76 | ||||

| 2025-07-25 | 13F | Endowment Wealth Management, Inc. | 5 492 | 17,80 | 1 127 | 8,79 | ||||

| 2025-07-29 | 13F | Tradewinds Capital Management, LLC | 16 436 | −4,24 | 3 372 | −11,54 | ||||

| 2025-07-23 | 13F | First Financial Group Corp | 21 873 | −11,81 | 4 488 | −18,55 | ||||

| 2025-08-14 | 13F | Byrne Financial Freedom, Llc | 36 121 | 1,11 | 7 411 | −6,60 | ||||

| 2025-07-16 | 13F | First American Bank | 651 076 | −0,18 | 133 581 | −7,80 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 39 522 | −33,49 | 7 944 | −39,82 | ||||

| 2025-07-29 | 13F | Accretive Wealth Partners, LLC | 61 954 | −0,41 | 12 711 | 2,93 | ||||

| 2025-08-05 | 13F | Marion Wealth Management | 37 939 | 0,79 | 7 784 | −6,90 | ||||

| 2025-08-13 | 13F | Bare Financial Services, Inc | 6 168 | 10,72 | 1 266 | 2,26 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 883 828 | 3,31 | 183 456 | −3,46 | ||||

| 2025-03-31 | NP | DAACX - Diversified Equity Fund | 77 834 | −0,90 | 18 369 | 3,53 | ||||

| 2025-08-08 | 13F | Islay Capital Management, Llc | 19 609 | −3,42 | 4 023 | −10,78 | ||||

| 2025-07-29 | 13F | May Barnhard Investments LLC | 9 235 | 0,05 | 1 895 | −7,61 | ||||

| 2025-07-18 | 13F | Brookmont Capital Management | 1 092 | 13,04 | 224 | 4,67 | ||||

| 2025-07-11 | 13F | Oak Asset Management, LLC | 147 042 | −1,07 | 30 169 | −8,62 | ||||

| 2025-07-25 | 13F | Westchester Capital Management, Inc. | 158 193 | 0,28 | 32 456 | −7,37 | ||||

| 2025-08-05 | 13F | Prosperity Consulting Group, LLC | 259 076 | −1,44 | 53 155 | −8,97 | ||||

| 2025-07-29 | NP | MEFOX - Meehan Focus Fund | 55 645 | 0,00 | 11 176 | −16,95 | ||||

| 2025-07-28 | 13F | Prairie Sky Financial Group LLC | 108 593 | −2,70 | 22 280 | −10,13 | ||||

| 2025-07-25 | 13F | Orca Investment Management, LLC | 37 354 | 0,37 | 7 664 | −7,31 | ||||

| 2025-06-26 | NP | NEWFX - NEW WORLD FUND INC Class A | 1 241 751 | −22,78 | 263 872 | −30,47 | ||||

| 2025-07-31 | 13F | Vaughan David Investments Inc/il | 29 744 | 3,78 | 6 | 0,00 | ||||

| 2025-08-01 | 13F | Teacher Retirement System Of Texas | 4 626 696 | −6,64 | 949 259 | −13,77 | ||||

| 2025-07-30 | 13F | Phillips Financial Management, Llc | 22 095 | 1,08 | 4 533 | −6,63 | ||||

| 2025-07-14 | 13F | Enzi Wealth | 14 956 | 0,17 | 3 158 | 1,51 | ||||

| 2025-07-23 | 13F | Lattice Capital Management, LLC | 50 000 | −30,01 | 10 258 | −35,35 | ||||

| 2025-08-07 | 13F | Fagan Associates, Inc. | 178 305 | −2,85 | 36 583 | −10,27 | ||||

| 2025-08-14 | 13F | Godshalk Welsh Capital Management, Inc. | 33 392 | −7,19 | 6 851 | −14,27 | ||||

| 2025-07-18 | 13F | BCO Wealth Management LLC | 994 | 204 | ||||||

| 2025-08-14 | 13F | Owl Creek Asset Management, L.P. | Put | 397 700 | −48,35 | 81 596 | −52,29 | |||

| 2025-07-21 | 13F | Credential Securities Inc. | 13 596 | −18,57 | 2 487 | −11,31 | ||||

| 2025-08-11 | 13F | Addison Capital Co | 24 596 | 4,10 | 5 046 | −3,85 | ||||

| 2025-07-28 | 13F | Compass Advisory Group LLC | 13 449 | 47,47 | 2 759 | 36,25 | ||||

| 2025-07-28 | NP | AVLVX - Avantis U.S. Large Cap Value Fund Institutional Class | 47 999 | 0,00 | 9 641 | −16,95 | ||||

| 2025-07-16 | 13F | Plancorp, LLC | 125 703 | 4,09 | 25 790 | −3,85 | ||||

| 2025-07-23 | 13F | Valmark Advisers, Inc. | 202 051 | 3,36 | 41 455 | −4,53 | ||||

| 2025-07-31 | 13F | Peterson Wealth Services | 97 388 | −2,56 | 19 981 | −10,00 | ||||

| 2025-07-28 | 13F | Eq Wealth Advisors, Llc | 1 295 | −20,06 | 266 | −26,18 | ||||

| 2025-08-15 | 13F | Synergy Financial Group, LTD | 22 393 | 5,59 | 4 594 | −2,46 | ||||

| 2025-06-27 | NP | SPTE - SP Funds S&P Global Technology ETF | 24 713 | −0,81 | 5 252 | −10,70 | ||||

| 2025-07-29 | NP | CDGRX - Copeland Risk Managed Dividend Growth Fund Class A shares | 2 830 | −11,01 | 568 | −26,14 | ||||

| 2025-08-26 | NP | FIRST TRUST VARIABLE INSURANCE TRUST - First Trust Multi Income Allocation Portfolio Class I This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 217 | 1,40 | 45 | −6,38 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - EQ/Global Equity Managed Volatility Portfolio Class IB | 127 503 | −7,48 | 26 160 | −14,54 | ||||

| 2025-08-01 | 13F | James Investment Research Inc | 128 220 | −1,73 | 26 307 | −9,24 | ||||

| 2025-07-09 | 13F | GEM Asset Management, LLC | 15 929 | −5,55 | 3 344 | −11,16 | ||||

| 2025-08-12 | 13F/A | Castellan Group, LLC | 1 642 | 0,00 | 337 | −7,69 | ||||

| 2025-07-18 | 13F | Ami Asset Management Corp | 487 448 | −5,43 | 100 010 | −12,65 | ||||

| 2025-04-23 | 13F | Sabal Trust CO | 198 351 | 4,71 | 44 060 | −7,12 | ||||

| 2025-07-15 | 13F | Riverbridge Partners Llc | 32 375 | −0,48 | 6 642 | −8,08 | ||||

| 2025-08-07 | 13F | Palouse Capital Management, Inc. | 10 338 | −0,03 | 2 121 | −7,66 | ||||

| 2025-08-25 | NP | ARVR - First Trust Indxx Metaverse ETF | 271 | −43,89 | 56 | −48,60 | ||||

| 2025-08-22 | NP | QVG2Q - Growth Portfolio Investor Class | 2 106 132 | 0,00 | 432 115 | −7,64 | ||||

| 2025-08-11 | 13F | Harold Davidson & Associates Inc. | 159 937 | −22,20 | 32 814 | −28,14 | ||||

| 2025-07-23 | 13F | Bellevue Asset Management, Llc | 56 068 | −0,58 | 11 504 | −8,17 | ||||

| 2025-06-26 | NP | FQAL - Fidelity Quality Factor ETF This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 309 710 | −1,81 | 65 813 | −11,59 | ||||

| 2025-07-24 | NP | PABU - iShares Paris-Aligned Climate MSCI USA ETF | 644 908 | 10,74 | 129 530 | −8,03 | ||||

| 2025-08-26 | NP | FTHI - First Trust BuyWrite Income ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 374 030 | 28,65 | 76 740 | 18,82 | ||||

| 2025-08-13 | 13F | Plan Group Financial, LLC | 16 573 | 19,85 | 3 400 | 10,71 | ||||

| 2025-07-29 | NP | HVEIX - HVIA Equity Fund Institutional Class | 8 500 | 0,00 | 1 707 | −16,93 | ||||

| 2025-07-30 | NP | QDISX - Fisher Investments Institutional Group Stock Fund for Retirement Plans | 57 | 0,00 | 11 | −15,38 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 4 217 733 | −8,53 | 865 352 | −15,51 | ||||

| 2025-08-14 | 13F | MSA Advisors, LLC | 104 990 | −2,51 | 21 541 | −9,95 | ||||

| 2025-07-30 | NP | QDVSX - Fisher Investments Institutional Group ESG Stock Fund for Retirement Plans | 55 | 0,00 | 11 | −15,38 | ||||

| 2025-07-28 | 13F | Wealthspan Partners, Llc | 19 824 | −1,34 | 4 067 | −8,87 | ||||

| 2025-08-05 | 13F | Scarborough Advisors, LLC | 15 265 | −4,32 | 3 132 | −11,63 | ||||

| 2025-06-23 | NP | UDPIX - Ultradow 30 Profund Investor Class | 3 941 | −15,97 | 837 | −24,32 | ||||

| 2025-05-15 | 13F | Grayhawk Investment Strategies Inc. | 588 | 0,00 | 131 | −11,56 | ||||

| 2025-08-13 | 13F | Haverford Trust Co | 2 481 545 | 0,22 | 509 139 | −7,43 | ||||

| 2025-07-14 | 13F | Abacus Wealth Partners, LLC | 30 577 | −4,53 | 6 273 | −11,82 | ||||

| 2025-08-26 | NP | PRWCX - T. Rowe Price Capital Appreciation Fund This fund is a listed as child fund of Price T Rowe Associates Inc /md/ and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 4 263 096 | 3,86 | 874 659 | −4,07 | ||||

| 2025-07-31 | 13F | Cardinal Point Capital Management, ULC | 237 427 | 560,12 | 48 713 | −8,38 | ||||

| 2025-07-21 | 13F | WT Asset Management Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Greenwich Wealth Management LLC | 204 598 | −0,08 | 42 | −8,89 | ||||

| 2025-08-05 | 13F | Sensible Money, LLC | 31 132 | −2,94 | 6 387 | −10,35 | ||||

| 2025-06-17 | NP | GSEQX - Goldman Sachs Multi-Manager Global Equity Fund Class R6 Shares | 71 180 | 0,00 | 15 126 | −9,96 | ||||

| 2025-07-29 | 13F | Quotient Wealth Partners, LLC | 74 685 | −1,44 | 15 323 | −8,97 | ||||

| 2025-07-22 | NP | GSLIX - Goldman Sachs Large Cap Value Fund Institutional | 22 524 | −0,97 | 4 524 | −17,76 | ||||

| 2025-08-06 | 13F | Destiny Capital Corp/CO | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-30 | NP | ILESX - Fisher Investments Institutional Group U.S. Large Cap Equity Environmental and Social Values Fund | 93 | 0,00 | 19 | −18,18 | ||||

| 2025-05-14 | 13F | Straightline Group Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Nwi Management Lp | 306 100 | 142,74 | 63 | 121,43 | ||||

| 2025-07-25 | 13F | Cerro Pacific Wealth Advisors LLC | 70 869 | −1,02 | 14 540 | −18,90 | ||||

| 2025-08-22 | NP | CZMGX - Multi-Manager Growth Strategies Fund Institutional Class | 25 409 | −97,50 | 5 213 | −97,69 | ||||

| 2025-08-05 | 13F | Meixler Investment Management, Ltd. | 1 347 | −1,68 | 276 | −9,21 | ||||

| 2025-08-15 | 13F | Asset Allocation Strategies LLC | 7 459 | 2,11 | 1 530 | −5,67 | ||||

| 2025-08-28 | NP | GMLGX - GuideMark(R) Large Cap Core Fund Service Shares | 129 501 | −34,34 | 26 570 | −39,35 | ||||

| 2025-08-29 | NP | JABAX - Janus Henderson Balanced Fund Class T | 3 443 727 | −6,52 | 706 549 | −13,66 | ||||

| 2025-08-12 | 13F | Del-Sette Capital Management, LLC | 5 566 | −58,37 | 1 142 | −61,57 | ||||

| 2025-08-29 | NP | MGNDX - Praxis Growth Index Fund Class A | 346 548 | −1,06 | 71 101 | −8,62 | ||||

| 2025-07-07 | 13F | Platt Investment Counsel, LLC | 1 375 | 0,00 | 282 | −7,54 | ||||

| 2025-08-27 | NP | RYDEX VARIABLE TRUST - S&P 500 2x Strategy Fund Variable Annuity | 23 104 | 284,04 | 4 740 | 254,79 | ||||

| 2025-08-11 | 13F | Baldwin Investment Management, LLC | 72 428 | 0,51 | 14 860 | −7,17 | ||||

| 2025-08-13 | 13F | ESG Planning | 30 088 | 2,44 | 6 173 | −5,37 | ||||

| 2025-07-22 | 13F | Inlight Wealth Management, LLC | 2 247 | −0,18 | 461 | −7,82 | ||||

| 2025-08-13 | 13F | Okabena Investment Services Inc | 38 819 | 29,73 | 7 964 | 19,81 | ||||

| 2025-08-27 | NP | RMQHX - Monthly Rebalance NASDAQ-100 2x Strategy Fund Class H | 272 651 | 201,62 | 55 940 | 178,59 | ||||

| 2025-08-26 | NP | FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST - Franklin VolSmart Allocation VIP Fund Class 2 | 19 640 | −3,35 | 4 030 | −10,72 | ||||

| 2025-07-11 | 13F | Afg Fiduciary Services Limited Partnership | 5 968 | 0,73 | 1 240 | 5,26 | ||||

| 2025-07-30 | 13F | Parcion Private Wealth LLC | 157 606 | 0,96 | 32 336 | −6,75 | ||||

| 2025-08-27 | NP | OHIO NATIONAL FUND INC - ON Janus Henderson U.S. Low Volatility Portfolio | 143 745 | −13,56 | 29 492 | −20,16 | ||||

| 2025-07-11 | 13F | Compass Ion Advisors, LLC | 23 549 | −11,78 | 4 831 | −18,52 | ||||

| 2025-07-18 | 13F | Wiser Wealth Management, Inc | 11 282 | 4,14 | 2 315 | −3,82 | ||||

| 2025-07-09 | 13F | Heritage Wealth Architects, Inc. | 3 517 | 71,39 | 722 | 58,46 | ||||

| 2025-08-13 | 13F | Winslow Asset Management Inc | 167 068 | −1,57 | 34 | −8,11 | ||||

| 2025-08-05 | 13F | Tsfg, Llc | 59 871 | −0,18 | 12 | −7,69 | ||||

| 2025-06-26 | NP | FDRR - Fidelity Dividend ETF for Rising Rates This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 171 779 | −2,74 | 36 503 | −12,43 | ||||

| 2025-07-07 | 13F | Abner Herrman & Brock Llc | 103 824 | −0,03 | 21 | −8,70 | ||||

| 2025-07-21 | 13F | Asset Advisors Investment Management, LLC | 34 444 | −2,97 | 7 067 | −10,39 | ||||

| 2025-08-14 | 13F | Family Office Research LLC | 9 450 | −7,80 | 1 939 | −14,85 | ||||

| 2025-08-04 | 13F | Bordeaux Wealth Advisors LLC | 154 831 | −5,00 | 31 767 | −12,26 | ||||

| 2025-07-16 | 13F | Rebalance, Llc | 10 578 | −14,94 | 2 170 | −21,43 | ||||

| 2025-08-04 | 13F | Wealth Management Associates, Inc. | 64 552 | −2,09 | 13 244 | −9,56 | ||||

| 2025-07-29 | NP | WAYEX - WAYCROSS LONG/SHORT EQUITY FUND | 11 628 | −5,36 | 2 335 | −21,41 | ||||

| 2025-07-25 | 13F | Kinneret Advisory, LLC | 186 969 | −0,15 | 38 360 | −7,77 | ||||

| 2025-08-08 | 13F | Strategies Wealth Advisors, LLC | 29 395 | −5,79 | 6 031 | −12,99 | ||||

| 2025-07-14 | 13F | Edge Wealth Management LLC | 183 912 | −1,11 | 37 799 | −8,50 | ||||

| 2025-07-25 | 13F | Prostatis Group LLC | 26 153 | 1,45 | 5 366 | −6,30 | ||||

| 2025-08-25 | NP | MIEAX - MM S&P 500 Index Fund Class R4 | 640 838 | −4,75 | 131 481 | −12,02 | ||||

| 2025-07-17 | 13F | CWA Asset Management Group, LLC | 524 195 | −1,89 | 107 549 | −9,38 | ||||

| 2025-08-04 | 13F | KLCM Advisors, Inc. | 123 458 | 64,80 | 25 330 | 52,22 | ||||

| 2025-08-06 | 13F | EFG Asset Management (North America) Corp. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-05 | 13F | Tufton Capital Management | 95 973 | −5,93 | 20 | −99,92 | ||||

| 2025-07-22 | NP | FLCG - Federated Hermes MDT Large Cap Growth ETF | 89 955 | 1 771,33 | 18 067 | 1 454,82 | ||||

| 2025-05-15 | 13F | Concorde Asset Management, LLC | 15 704 | 5,47 | 3 074 | −17,57 | ||||

| 2025-05-15 | 13F | Crestline Management, LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-09 | 13F | Triumph Capital Management | 21 054 | 28,27 | 4 320 | 18,49 | ||||

| 2025-07-30 | NP | HLAL - Wahed FTSE USA Shariah ETF | 391 663 | 6,11 | 78 666 | −11,88 | ||||

| 2025-08-04 | 13F | Nixon Capital, LLC | 1 017 | 209 | ||||||

| 2025-08-12 | 13F | Guerra Pan Advisors, Llc | 16 257 | −3,75 | 3 335 | −11,09 | ||||

| 2025-08-11 | 13F | Managed Asset Portfolios, Llc | 982 | −98,66 | 202 | −98,76 | ||||

| 2025-08-20 | NP | QNZNX - AQR Sustainable Long-Short Equity Carbon Aware Fund Class N | Short | −302 | −62 | |||||

| 2025-07-28 | 13F | Courier Capital Llc | 269 167 | −1,89 | 55 225 | −9,38 | ||||

| 2025-08-13 | 13F | united american securities inc. (d/b/a uas asset management) | 61 329 | 21,17 | 12 583 | 11,92 | ||||

| 2025-07-10 | 13F | Rockland Trust Co | 258 599 | 1,67 | 53 057 | −6,09 | ||||

| 2025-07-31 | 13F | Auour Investments LLC | 8 268 | 0,00 | 1 696 | −3,42 | ||||

| 2025-07-18 | 13F | CHURCHILL MANAGEMENT Corp | 234 672 | 3,94 | 48 148 | −4,00 | ||||

| 2025-08-14 | 13F | Grace & Mercy Foundation, Inc. | 52 300 | 0,00 | 10 730 | −7,64 | ||||

| 2025-07-24 | NP | FSDIX - Fidelity Strategic Dividend & Income Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 120 445 | 0,00 | 24 191 | −16,95 | ||||

| 2025-07-16 | 13F | New Insight Wealth Advisors | 17 674 | −3,05 | 3 626 | −10,45 | ||||

| 2025-07-24 | NP | BCUS - Bancreek U.S. Large Cap ETF | 16 261 | −12,16 | 3 266 | −27,03 | ||||

| 2025-05-12 | 13F | Pinpoint Asset Management Ltd | 13 500 | −12,43 | 2 999 | −22,33 | ||||

| 2025-07-14 | 13F | BetterWealth, LLC | 144 586 | −1,96 | 29 665 | −9,45 | ||||

| 2025-08-06 | 13F | Able Wealth Management LLC | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-07-25 | 13F | Welch Group, LLC | 375 181 | 4,01 | 76 976 | −2,07 | ||||

| 2025-05-19 | 13F/A | AAFCPAs Wealth Management, LLC | Put | 1 425 | 6,67 | |||||

| 2025-07-15 | 13F | Beacon Investment Advisory Services, Inc. | 298 644 | −4,94 | 61 273 | −12,20 | ||||

| 2025-08-06 | 13F | Able Wealth Management LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 6 382 300 | 7,98 | 1 309 456 | −0,27 | ||||

| 2025-07-28 | 13F | Nestegg Advisors, Inc. | 14 568 | 0,12 | 2 989 | −7,52 | ||||

| 2025-07-07 | 13F | Bangor Savings Bank | 65 113 | −2,64 | 13 359 | −10,07 | ||||

| 2025-08-07 | 13F | Nicollet Investment Management, Inc. | 79 563 | −3,71 | 16 | −11,11 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 39 679 662 | −2,52 | 8 090 237 | −10,31 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | Call | 321 300 | 84,87 | 64 270 | 67,92 | |||

| 2025-08-13 | 13F | Hsbc Holdings Plc | Put | 2 269 500 | 10,12 | 453 968 | 0,02 | |||

| 2025-08-08 | 13F | Evolution Wealth Advisors, LLC | 50 191 | −2,42 | 10 298 | −9,87 | ||||

| 2025-07-25 | NP | SCHX - Schwab U.S. Large-Cap ETF This fund is a listed as child fund of Charles Schwab Investment Management Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 15 086 838 | 2,29 | 3 030 191 | −15,04 | ||||

| 2025-07-31 | 13F | Smith Group Asset Management, LLC | 259 308 | 1,69 | 53 202 | −6,08 | ||||

| 2025-08-13 | 13F | Estabrook Capital Management | 187 538 | −3,35 | 38 477 | −10,73 | ||||

| 2025-08-05 | 13F | Aviance Capital Partners, LLC | 265 410 | −1,48 | 54 454 | −9,00 | ||||

| 2025-07-25 | 13F | Means Investment Co., Inc. | 320 092 | −0,43 | 65 673 | −8,03 | ||||

| 2025-07-14 | 13F | Mechanics Bank Trust Department | 202 174 | −9,31 | 41 480 | −16,24 | ||||

| 2025-08-08 | 13F | Old West Investment Management, LLC | 12 914 | 0,00 | 2 650 | −7,64 | ||||

| 2025-07-14 | 13F | Harbor Group, Inc. | 9 165 | −1,64 | 1 880 | −9,13 | ||||

| 2025-04-10 | 13F | Bremer Bank National Association | 85 676 | 5,98 | 19 031 | −5,99 | ||||

| 2025-08-14 | 13F | Redwood Investment Management, Llc | 48 056 | −20,31 | 10 | −30,77 | ||||

| 2025-07-29 | NP | NIAGX - Nia Impact Solutions Fund | 7 392 | −8,11 | 1 485 | −23,70 | ||||

| 2025-08-14 | 13F | Transamerica Financial Advisors, Inc. | 34 019 | −4,54 | 6 980 | 99 600,00 | ||||

| 2025-08-22 | NP | CLCEX - Multi-Manager Large Cap Growth Strategies Fund Institutional Class | 979 952 | 201 057 | ||||||

| 2025-08-29 | NP | JGYIX - John Hancock Global Shareholder Yield Fund Class I | 33 477 | 16,63 | 6 868 | 7,72 | ||||

| 2025-07-29 | 13F | Elevation Capital Advisory, LLC | 2 166 | 444 | ||||||

| 2025-08-07 | 13F | David R. Rahn & Associates Inc. | 53 549 | −13,00 | 10 987 | −19,64 | ||||

| 2025-08-14 | 13F | Bank Of Hawaii | 166 934 | −2,96 | 34 250 | −10,37 | ||||

| 2025-07-16 | 13F | FCG Investment Co | 55 074 | −6,23 | 11 300 | −13,38 | ||||

| 2025-08-11 | 13F | Artemis Investment Management LLP | 235 564 | 3,33 | 48 331 | −4,56 | ||||

| 2025-07-29 | NP | SIXH - 6 Meridian Hedged Equity-Index Option Strategy ETF | 34 809 | 33,32 | 6 991 | 10,72 | ||||

| 2025-07-21 | 13F | Mendota Financial Group, LLC | 1 148 | −9,18 | 236 | −16,07 | ||||

| 2025-08-20 | NP | LSAAX - LoCorr Strategic Allocation Fund Class A | 5 253 | 21,54 | 1 078 | 12,19 | ||||

| 2025-07-22 | 13F | Herald Investment Management Ltd | 20 400 | −18,40 | 4 183 | −24,64 | ||||

| 2025-08-26 | NP | LEAD - Siren DIVCON Leaders Dividend ETF | 3 171 | 3,02 | 651 | −4,83 | ||||

| 2025-08-26 | NP | IXN - iShares Global Tech ETF | 2 448 698 | −38,66 | 502 399 | −43,34 | ||||

| 2025-08-05 | 13F | Milestone Asset Management, Llc | 40 328 | 17,62 | 8 274 | 8,64 | ||||

| 2025-08-22 | NP | Columbia Funds Variable Series Trust II - CTIVP - MFS Value Fund Class 1 | 58 452 | 11 993 | ||||||

| 2025-08-08 | 13F/A | Prospect Financial Services LLC | 19 848 | −62,62 | 4 072 | −65,47 | ||||

| 2025-08-22 | NP | Tri-continental Corp | 242 536 | −1,11 | 49 761 | −8,66 | ||||

| 2025-08-15 | 13F | Howland Capital Management Llc | 498 516 | 11,17 | 102 281 | 2,68 | ||||

| 2025-06-20 | NP | RVRB - Reverb ETF | 1 362 | 0,00 | 289 | −9,97 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 664 788 | 4,98 | 133 128 | −2,91 | ||||

| 2025-08-26 | NP | INGIX - Voya U.S. Stock Index Portfolio Class I | 1 212 799 | 4,63 | 248 830 | −3,36 | ||||

| 2025-07-15 | 13F | Cardinal Capital Management | 87 738 | 4,75 | 18 001 | −3,25 | ||||

| 2025-06-24 | NP | JVAL - JPMorgan U.S. Value Factor ETF | 45 155 | −23,68 | 9 595 | −31,28 | ||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 24 865 | 5 102 | ||||||

| 2025-07-30 | 13F | Cookson Peirce & Co Inc | 13 930 | −16,45 | 2 858 | −22,85 | ||||

| 2025-07-31 | 13F | Pacitti Group Inc. | 38 775 | −0,10 | 7 955 | −7,73 | ||||

| 2025-08-28 | NP | AGIX - KraneShares Artificial Intelligence and Technology ETF | 4 304 | 5,23 | 883 | −2,75 | ||||

| 2025-07-25 | NP | USBLX - Growth and Tax Strategy Fund | 146 293 | 0,00 | 29 383 | −16,95 | ||||

| 2025-08-07 | 13F | Runnymede Capital Advisors, Inc. | 25 928 | −7,08 | 5 320 | −14,18 | ||||

| 2025-06-27 | NP | TOV - JLens 500 Jewish Advocacy U.S. ETF | 38 878 | 0,00 | 8 262 | 0,00 | ||||

| 2025-07-28 | 13F | Dixon Fnancial Services, Inc. | 16 501 | −2,02 | 3 386 | −9,49 | ||||

| 2025-08-14 | 13F | Algert Global Llc | 152 761 | 0,70 | 31 | −6,06 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 418 763 | 1,62 | 85 918 | −6,14 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 559 032 | 1,33 | 114 697 | −6,41 | ||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 5 692 | −7,43 | 1 168 | −14,51 | ||||

| 2025-08-11 | 13F | WPG Advisers, LLC | 7 086 | −13,63 | 1 454 | −20,25 | ||||

| 2025-08-11 | 13F | Birchbrook, Inc. | 12 029 | 1,46 | 2 468 | −6,30 | ||||

| 2025-08-04 | 13F | Roble, Belko & Company, Inc | 4 304 | 35,90 | 1 | |||||

| 2025-07-21 | 13F | West Financial Advisors, LLC | 18 194 | 0,01 | 3 733 | −7,65 | ||||

| 2025-08-12 | 13F | Tableaux Llc | Put | 370 | ||||||

| 2025-07-24 | NP | SHP ETF Trust - NEOS S&P 500(R) High Income ETF | 1 135 221 | 21,52 | 228 009 | 0,93 | ||||

| 2025-08-07 | 13F | Illumine Investment Management, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-06-18 | NP | POGAX - Putnam Growth Opportunities Fund Class A Shares | 5 217 348 | −2,58 | 1 108 686 | −12,28 | ||||

| 2025-08-12 | 13F | Saturna Capital CORP | 1 835 276 | −12,98 | 376 544 | −19,62 | ||||

| 2025-08-13 | 13F | Alphinity Investment Management Pty Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-15 | 13F | Axis Wealth Partners, LLC | 10 910 | 5,31 | 2 238 | −2,74 | ||||

| 2025-07-16 | 13F | Meridian Financial, LLC | 7 719 | −9,74 | 1 584 | −16,64 | ||||

| 2025-08-27 | NP | RYLDX - Dow 2x Strategy Fund A | 4 436 | −31,79 | 910 | −36,98 | ||||

| 2025-07-31 | 13F | Ag2r La Mondiale Gestion D'actifs | 558 148 | 0,81 | 114 515 | 2,97 | ||||

| 2025-08-14 | 13F | Josh Arnold Investment Consultant, Llc | 331 502 | −1,43 | 68 014 | −8,96 | ||||

| 2025-08-26 | NP | PENN SERIES FUNDS INC - Index 500 Fund | 249 183 | −1,98 | 51 125 | −9,46 | ||||

| 2025-07-30 | 13F | BCK Partners, Inc. | 4 239 | 0,05 | 870 | −7,65 | ||||

| 2025-07-23 | 13F | Klp Kapitalforvaltning As | 5 856 904 | 0,62 | 1 201 661 | −7,06 | ||||

| 2025-07-28 | 13F | Evernest Financial Advisors, LLC | 37 302 | 1,07 | 7 653 | −6,65 | ||||

| 2025-07-28 | 13F | Jag Capital Management, Llc | 248 434 | 3,49 | 50 971 | −4,41 | ||||

| 2025-07-28 | 13F | Jag Capital Management, Llc | Call | 1 000 | 205 | |||||

| 2025-07-17 | 13F | XML Financial, LLC | 122 937 | −5,50 | 25 223 | −12,72 | ||||

| 2025-07-22 | 13F | Relyea Zuckerberg Hanson LLC | 114 757 | 34,81 | 23 545 | 24,51 | ||||

| 2025-08-04 | 13F | Coign Capital Advisors LLC | 7 228 | 1,28 | 1 483 | −6,50 | ||||

| 2025-08-12 | 13F | Dimensional Fund Advisors Lp | 57 085 609 | 1,16 | 11 711 245 | −6,55 | ||||

| 2025-07-31 | 13F | Mcdaniel Terry & Co | 359 094 | −0,15 | 73 675 | 93 159,49 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 1 206 003 | −8,57 | 247 436 | −15,55 | ||||

| 2025-07-30 | NP | LEXI - Alexis Practical Tactical ETF | 5 538 | −18,32 | 1 112 | −32,15 | ||||

| 2025-07-25 | NP | SNPE - Xtrackers S&P 500 ESG ETF | 763 020 | 7,16 | 153 253 | −11,01 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-07-28 | NP | VLCGX - Large Capital Growth Fund | 137 684 | −5,08 | 27 654 | −21,17 | ||||

| 2025-05-12 | 13F | Fiduciary Family Office, Llc | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-07-18 | 13F | Schaeffer Financial LLC | 1 159 | 0,09 | 238 | −7,78 | ||||

| 2025-07-11 | 13F | Scott Capital Advisors, LLC | 3 501 | −6,89 | 739 | −11,50 | ||||

| 2025-08-12 | 13F | Armor Investment Advisors, LLC | 3 700 | 0,08 | 759 | −7,55 | ||||

| 2025-08-05 | 13F | Magnolia Capital Advisors Llc | 46 461 | 1,40 | 9 532 | −6,35 | ||||

| 2025-08-13 | 13F | Rosenblum Silverman Sutton S F Inc /ca | 8 638 | −2,32 | 1 772 | −9,78 | ||||

| 2025-08-04 | 13F | Hutchinson Capital Management/ca | 119 924 | −0,94 | 24 605 | −8,51 | ||||

| 2025-07-11 | 13F | Baugh & Associates, LLC | 66 574 | −4,67 | 12 634 | −15,26 | ||||

| 2025-08-26 | NP | PRWAX - T. Rowe Price New America Growth Fund This fund is a listed as child fund of Price T Rowe Associates Inc /md/ and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 622 444 | −24,01 | 538 047 | −29,81 | ||||

| 2025-06-30 | NP | AIM EQUITY FUNDS (INVESCO EQUITY FUNDS) - Invesco Oppenheimer Main Street All Cap Fund Class R6 | 360 880 | 0,00 | 76 687 | −9,96 | ||||

| 2025-08-13 | 13F | Smith, Moore & Co. | 152 513 | −1,14 | 31 291 | −8,68 | ||||

| 2025-07-16 | 13F | Spinnaker Investment Group, LLC | 41 796 | −7,71 | 8 575 | −14,75 | ||||

| 2025-08-13 | 13F | 1832 Asset Management L.P. | 2 582 340 | −35,52 | 529 819 | −40,44 | ||||

| 2025-08-28 | NP | TMMAX - SIMT Tax-Managed Managed Volatility Fund Class F | 44 166 | 0,00 | 9 062 | −7,64 | ||||

| 2025-07-29 | 13F | Northeast Investment Management | 646 618 | −1,97 | 132 667 | −9,45 | ||||

| 2025-07-16 | 13F | Swisher Financial Concepts, Inc. | 26 294 | 5 395 | ||||||

| 2025-07-25 | 13F | Cascade Investment Advisors, Inc. | 18 463 | −3,21 | 3 788 | −10,60 | ||||

| 2025-08-04 | 13F | Migdal Insurance & Financial Holdings Ltd. | 980 700 | 0,72 | 201 | −6,94 | ||||

| 2025-08-07 | 13F | Atala Financial Inc | 13 070 | 10 791,67 | 2 682 | 268 000,00 | ||||

| 2025-07-28 | NP | PWTAX - UBS U.S. Allocation Fund Class A | 35 701 | −2,05 | 7 171 | −18,65 | ||||

| 2025-08-22 | NP | Columbia Funds Variable Series Trust II - CTIVP - Morgan Stanley Advantage Fund Class 1 | 609 640 | 0,00 | 125 080 | −7,64 | ||||

| 2025-07-08 | 13F | Corepath Wealth Partners Llc | 2 160 | 0,79 | 461 | 7,71 | ||||

| 2025-08-13 | 13F | GABELLI & Co INVESTMENT ADVISERS, INC. | 1 500 | 0,00 | 308 | −7,81 | ||||

| 2025-08-08 | 13F | Tanglewood Legacy Advisors, LLC | 15 616 | −8,31 | 3 204 | −15,33 | ||||

| 2025-06-27 | NP | AIBU - Direxion Daily AI and Big Data Bull 2X Shares | 2 758 | −20,59 | 586 | −28,45 | ||||

| 2025-08-22 | NP | VARIABLE INSURANCE PRODUCTS FUND III - Growth Opportunities Portfolio Initial Class | 879 504 | −4,49 | 180 448 | −11,78 | ||||

| 2025-08-13 | 13F | Gardner Russo & Quinn Llc | 5 149 | −1,91 | 1 056 | −9,36 | ||||

| 2025-07-25 | 13F | Wealth Advisory Team LLC | 1 162 | 238 | ||||||

| 2025-08-15 | 13F | Global View Capital Management LLC | 5 652 | 1,16 | 1 160 | −6,61 | ||||

| 2025-07-23 | 13F | Bluestem Financial Advisors, Llc | 2 447 | −14,38 | 502 | −20,82 | ||||

| 2025-07-18 | 13F | Montgomery Investment Management Inc | 49 973 | −3,78 | 10 253 | −11,13 | ||||

| 2025-08-01 | 13F | Austin Private Wealth, LLC | 75 735 | −3,50 | 15 539 | −10,87 | ||||

| 2025-08-05 | 13F | Allstate Corp | 29 285 | −94,28 | 6 008 | −94,71 | ||||

| 2025-07-25 | 13F | Mitchell Capital Management Co | 138 182 | −13,10 | 29 181 | −17,39 | ||||

| 2025-08-14 | 13F | Crawford Investment Counsel Inc | 251 020 | 5,79 | 51 502 | −2,28 | ||||

| 2025-07-31 | 13F | Hobart Private Capital, LLC | 7 883 | −0,92 | 1 617 | −8,49 | ||||

| 2025-07-30 | 13F | Rehmann Capital Advisory Group | 199 693 | −1,30 | 40 971 | −8,84 | ||||

| 2025-08-14 | 13F | Spears Abacus Advisors LLC | 778 249 | −2,95 | 159 673 | −10,36 | ||||

| 2025-08-12 | 13F | Qvr Llc | 9 525 | 1 954 | ||||||

| 2025-07-14 | 13F | Farmers & Merchants Investments Inc | 456 368 | 1,13 | 93 633 | −6,59 | ||||

| 2025-07-29 | 13F | Wealthstream Advisors, Inc. | 18 545 | 2,44 | 3 805 | −5,40 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 835 246 | −6,70 | 171 | −13,64 | ||||

| 2025-07-31 | 13F | Arrien Investments, Inc. | 3 117 | −2,75 | 640 | −10,13 | ||||

| 2025-07-23 | 13F | Slow Capital, Inc. | 108 161 | 1,52 | 22 191 | −6,23 | ||||

| 2025-07-14 | 13F | Buska Wealth Management, LLC | 1 647 | −1,02 | 338 | −8,67 | ||||

| 2025-07-15 | 13F | Aspire Capital Advisors LLC | 21 680 | −0,42 | 4 448 | −8,02 | ||||

| 2025-07-24 | 13F | Coordinated Financial Services, Inc. | 2 700 | −72,57 | 554 | −77,56 | ||||

| 2025-07-17 | 13F | Alpine Bank Wealth Management | 23 739 | 0,48 | 4 871 | −7,20 | ||||

| 2025-08-14 | 13F | Capitolis Liquid Global Markets LLC | 4 229 848 | 85,19 | 867 838 | 71,05 | ||||

| 2025-04-23 | 13F | JCIC Asset Management Inc. | 112 684 | −1,18 | 25 030 | −12,34 | ||||

| 2025-07-11 | 13F | Colorado Capital Management, Inc. | 35 193 | −0,21 | 7 | 0,00 | ||||

| 2025-07-31 | 13F | Allied Investment Advisors, LLC | 50 475 | −1,36 | 10 356 | −8,89 | ||||

| 2025-07-30 | NP | EGGS - NestYield Total Return Guard ETF | 3 798 | 5 102,74 | 763 | 4 382,35 | ||||

| 2025-08-13 | 13F | Willis Johnson & Associates, Inc. | 52 857 | −0,96 | 10 845 | −8,52 | ||||

| 2025-08-01 | 13F | Providence First Trust Co | 13 830 | 127,54 | 2 837 | 110,15 | ||||

| 2025-08-26 | NP | Forethought Variable Insurance Trust - Global Atlantic BlackRock Disciplined Growth Portfolio Class I Shares | 33 663 | −13,89 | 6 907 | −20,47 | ||||

| 2025-08-14 | 13F | Mbb Public Markets I Llc | 1 198 | −18,61 | 246 | −24,85 | ||||

| 2025-07-31 | 13F | SoundView Advisors Inc. | 6 547 | −8,71 | 1 | 0,00 | ||||

| 2025-08-13 | 13F | Laidlaw Wealth Management LLC | 13 370 | −13,67 | 2 743 | −20,26 | ||||

| 2025-07-10 | 13F | Sumitomo Mitsui DS Asset Management Company, Ltd | 2 235 466 | 4,17 | 458 651 | −3,79 | ||||

| 2025-08-13 | 13F | Idaho Trust Bank | 5 357 | −4,92 | 1 099 | −12,15 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 957 004 | −0,23 | 196 349 | −7,85 | ||||

| 2025-07-29 | 13F | Harbor Asset Planning, Inc. | 5 367 | 1 101 | ||||||

| 2025-07-10 | 13F | HF Advisory Group, LLC | 11 309 | 0,22 | 2 320 | −7,42 | ||||

| 2025-07-08 | 13F | Davis Investment Partners, LLC | 23 555 | 8,19 | 4 895 | 11,02 | ||||

| 2025-07-09 | 13F | Parkside Advisors LLC | 25 729 | −2,87 | 5 279 | −10,28 | ||||

| 2025-07-15 | 13F | Define Financial, Llc | 3 405 | 0,12 | 699 | 3,71 | ||||

| 2025-07-29 | 13F | Lyell Wealth Management, Lp | 183 514 | −1,44 | 37 651 | −8,97 | ||||

| 2025-07-30 | NP | EGGY - NestYield Dynamic Income ETF | 4 410 | 4 100,00 | 886 | 3 440,00 | ||||

| 2025-08-13 | 13F | Morton Community Bank | 2 351 | 0,00 | 482 | −7,66 | ||||

| 2025-07-11 | 13F | Ullmann Financial Group, Inc. | 25 904 | 0,90 | 5 315 | −6,80 | ||||

| 2025-07-29 | 13F | Spirit Of America Management Corp/ny | 38 982 | −11,77 | 7 998 | −18,51 | ||||

| 2025-08-12 | 13F | Atalanta Sosnoff Capital, Llc | 1 322 767 | −7,51 | 271 392 | −14,58 | ||||

| 2025-07-23 | 13F | Penney Financial, LLC | 7 958 | 1,30 | 1 633 | −6,48 | ||||

| 2025-08-14 | 13F | Gould Capital, LLC | 19 735 | 1,45 | 4 049 | −6,32 | ||||

| 2025-07-29 | NP | SCAUX - Invesco Low Volatility Equity Yield Fund Class A | 42 968 | 14,81 | 8 630 | −4,65 | ||||

| 2025-07-15 | 13F | Vannoy Advisory Group, Inc. | 1 532 | 0,00 | 314 | −7,65 | ||||

| 2025-08-05 | 13F | Gruss & Co., LLC | 2 700 | 0,00 | 554 | −7,68 | ||||

| 2025-08-05 | 13F | Lord & Richards Wealth Management, LLC | 3 103 | 64,70 | 637 | 52,15 | ||||

| 2025-08-29 | NP | JADDX - Fundamental All Cap Core Trust NAV | 480 689 | −2,43 | 98 623 | −9,88 | ||||

| 2025-08-04 | 13F | Clear Investment Research, Llc | 14 583 | −1,63 | 2 992 | −9,14 | ||||

| 2025-08-26 | NP | RBCGX - Reynolds Blue Chip Growth Fund | 4 425 | 36,15 | 908 | 25,80 | ||||

| 2025-06-30 | NP | NSFMX - Natixis Sustainable Future 2060 Fund Class N | 1 067 | 4,10 | 227 | −6,22 | ||||

| 2025-07-14 | 13F | Financial Enhancement Group LLC | 53 685 | 1,81 | 11 336 | 7,64 | ||||

| 2025-06-30 | NP | GGME - Invesco Dynamic Media ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 46 027 | 263,94 | 9 781 | 227,75 | ||||

| 2025-08-12 | 13F | Bank OZK | 60 619 | −1,23 | 12 437 | −8,77 | ||||

| 2025-07-15 | 13F | Affinity Wealth Management Llc | 26 469 | −0,21 | 5 431 | −7,83 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 989 700 | 68,14 | 203 | 56,15 | ||||

| 2025-07-09 | 13F | Pps&v Asset Management Consultants, Inc. | 35 213 | 0,47 | 7 225 | −7,19 | ||||

| 2025-08-11 | 13F | Mcintyre Freedman & Flynn Investment Advisers Inc | 1 040 | 0,00 | 213 | −7,79 | ||||

| 2025-08-04 | 13F | Savvy Advisors, Inc. | 195 748 | 38,51 | 40 162 | 27,94 | ||||

| 2025-08-07 | 13F | Comgest Global Investors S.a.s. | 269 818 | −8,48 | 55 359 | −15,46 | ||||

| 2025-07-16 | 13F | Cypress Funds Llc | 148 297 | 0,00 | 30 426 | −7,63 | ||||

| 2025-08-29 | NP | GGGAX - Gamco Global Growth Fund Class A | 24 300 | 0,00 | 4 986 | −7,63 | ||||

| 2025-07-15 | 13F | Accurate Wealth Management, LLC | 104 642 | 3,91 | 22 222 | 11,41 | ||||

| 2025-07-28 | NP | ACGR - American Century Sustainable Growth ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 7 045 | 5,09 | 1 415 | −12,77 | ||||

| 2025-08-13 | 13F | Gladstone Capital Management LLP | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Mason & Associates Inc | 37 877 | 9,87 | 7 771 | 1,49 | ||||

| 2025-07-16 | 13F | BOS Asset Management, LLC | 30 655 | −0,78 | 6 289 | −8,36 | ||||

| 2025-07-24 | 13F | Comprehensive Money Management Services LLC | 4 141 | 3,16 | 850 | −4,71 | ||||

| 2025-07-16 | 13F | Newton One Investments LLC | 9 963 | −4,51 | 2 044 | −11,78 | ||||

| 2025-08-15 | 13F | North Ridge Wealth Advisors, Inc. | 1 417 | −8,40 | 291 | −15,45 | ||||

| 2025-07-23 | 13F | Traphagen Investment Advisors Llc | 137 259 | 31,60 | 28 161 | 21,55 | ||||

| 2025-07-23 | 13F | Gentry Private Wealth, Llc | 6 152 | 98,32 | 1 262 | 83,16 | ||||

| 2025-06-25 | NP | ILCB - iShares Morningstar Large-Cap ETF | 285 815 | −16,10 | 60 736 | −24,45 | ||||

| 2025-08-22 | NP | VARIABLE INSURANCE PRODUCTS FUND - Stock Selector All Cap Portfolio Investor Class | 1 403 530 | 1,92 | 287 962 | −5,86 | ||||

| 2025-08-05 | 13F | Atlas Private Wealth Advisors | 93 569 | −2,52 | 19 199 | −9,96 | ||||

| 2025-08-28 | NP | EFIV - Spdr S&p 500 Esg Etf This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 472 785 | −34,64 | 97 001 | −39,63 | ||||

| 2025-07-16 | 13F | Prakash Investment Advisors Llc | 30 381 | −0,65 | 6 749 | −0,65 | ||||

| 2025-08-04 | 13F | Carret Asset Management, Llc | 324 469 | −2,99 | 66 571 | −10,40 | ||||

| 2025-08-27 | NP | VANGUARD VARIABLE INSURANCE FUNDS - Diversified Value Portfolio This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 243 131 | −0,19 | 49 883 | −7,81 | ||||

| 2025-07-22 | 13F | Hrc Wealth Management, Llc | 23 670 | 1,14 | 4 856 | −6,58 | ||||

| 2025-08-08 | 13F | Turn8 Private Wealth Inc. | 18 052 | 8,45 | 3 770 | 1,95 | ||||

| 2025-08-11 | 13F | Highview Capital Management LLC/DE/ | 51 806 | 2,20 | 10 629 | −5,60 | ||||

| 2025-08-27 | NP | VSLU - Applied Finance Valuation Large Cap ETF | 72 974 | 4,62 | 14 972 | −3,36 | ||||

| 2025-07-30 | 13F | Brookstone Capital Management | 574 673 | −1,22 | 117 906 | −8,76 | ||||

| 2025-08-13 | 13F | Custom Index Systems, Llc | 49 795 | −1,51 | 10 216 | −9,03 | ||||

| 2025-08-27 | NP | RYTTX - S&P 500 2x Strategy Fund A | 48 354 | 0,86 | 9 921 | −6,84 | ||||

| 2025-07-25 | NP | AFLG - First Trust Active Factor Large Cap ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 95 230 | 55,73 | 19 127 | 29,33 | ||||

| 2025-08-25 | NP | SBSPX - QS S&P 500 Index Fund Class A | 187 266 | 2,35 | 38 421 | −5,46 | ||||

| 2025-07-18 | 13F | Bridge Generations Wealth Management Llc | 18 | 0,00 | 4 | 0,00 | ||||

| 2025-08-14 | 13F | Bridgeway Capital Management Inc | 151 324 | 1,76 | 31 047 | −6,01 | ||||

| 2025-07-09 | 13F | Emprise Bank | 21 732 | 3,25 | 4 459 | −4,64 | ||||

| 2025-08-19 | 13F | Cape Investment Advisory, Inc. | 19 617 | 19,64 | 4 025 | 10,49 | ||||

| 2025-06-27 | NP | YOKE - Yoke Core ETF | 20 973 | 4 457 | ||||||

| 2025-07-10 | 13F | Global Financial Private Client, LLC | 65 783 | −0,19 | 13 497 | −7,81 | ||||

| 2025-07-30 | NP | BFSIX - BFS Equity Fund Institutional Class | 11 000 | −12,00 | 2 209 | −26,93 | ||||

| 2025-07-23 | 13F | Guild Investment Management, Inc. | 14 425 | −6,44 | 2 959 | −13,58 | ||||

| 2025-07-28 | NP | VCAAX - Asset Allocation Fund | 26 232 | −6,75 | 5 269 | −22,56 | ||||

| 2025-08-12 | 13F/A | Cozad Asset Management Inc | 152 686 | 6,14 | 31 327 | −1,97 | ||||

| 2025-08-26 | NP | ASYLX - AB Select US Long/Short Portfolio Advisor Class | 185 055 | 34,20 | 37 968 | 23,95 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 49 790 911 | 4,81 | 10 215 601 | −3,20 | ||||

| 2025-08-13 | 13F | MONECO Advisors, LLC | 117 286 | 2,77 | 24 064 | −5,07 | ||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 6 194 450 | −10,64 | 1 270 915 | −2,78 | ||||

| 2025-07-14 | 13F | Clear Harbor Asset Management, LLC | 327 931 | −4,74 | 67 282 | −12,02 | ||||

| 2025-08-07 | 13F | Evoke Wealth, Llc | Put | 72 700 | 14 916 | |||||

| 2025-07-23 | 13F | Joel Isaacson & Co., LLC | 419 132 | 3,45 | 85 993 | −4,45 | ||||

| 2025-08-05 | 13F | Sheridan Capital Management, LLC | 5 865 | 14,35 | 1 203 | 5,62 | ||||

| 2025-08-07 | 13F | Evoke Wealth, Llc | 363 107 | 0,15 | 74 499 | −7,50 | ||||

| 2025-08-29 | NP | GTCAX - Gabelli Global Content & Connectivity Fund Class A | 4 500 | −10,00 | 923 | −16,85 | ||||

| 2025-07-22 | 13F | Iowa State Bank | 80 246 | −0,15 | 16 464 | −7,77 | ||||

| 2025-08-25 | NP | Eaton Vance Tax-managed Buy-write Opportunities Fund | 607 868 | −4,37 | 124 716 | −11,67 | ||||

| 2025-06-17 | 13F | Ridgepath Capital Management LLC | 4 880 | 0,06 | 1 084 | −11,30 | ||||

| 2025-08-28 | NP | DGT - SPDR(R) Global Dow ETF This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 10 510 | 22,20 | 2 156 | 12,88 | ||||

| 2025-08-26 | NP | IWL - iShares Russell Top 200 ETF | 561 055 | −2,18 | 115 112 | −9,65 | ||||

| 2025-08-20 | 13F/A | Thompson Davis & Co., Inc. | 4 733 | −14,02 | 971 | −20,54 | ||||

| 2025-08-22 | NP | FFIDX - Fidelity Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 603 800 | −10,54 | 329 052 | −17,37 | ||||

| 2025-06-27 | NP | QQQE - Direxion NASDAQ-100(R) Equal Weighted Index Shares | 54 302 | 9,47 | 11 539 | −1,43 | ||||

| 2025-07-08 | 13F | Arlington Trust Co LLC | 67 060 | 0,54 | 13 759 | −7,14 | ||||

| 2025-07-28 | 13F | Corundum Trust Company, INC | 6 540 | −0,09 | 1 342 | −7,77 | ||||

| 2025-08-14 | 13F | Fmr Llc | 306 758 594 | −6,50 | 62 937 661 | −13,64 | ||||

| 2025-06-27 | NP | WINN - Harbor Long-Term Growers ETF | 255 442 | 11,08 | 54 281 | 0,02 | ||||

| 2025-08-07 | 13F | Cincinnati Financial Corp | 2 797 016 | −0,44 | 573 864 | −8,05 | ||||

| 2025-07-31 | 13F | Warburton Capital Management, LLC | 7 474 | 14,33 | 2 | 0,00 | ||||

| 2025-07-11 | 13F | Wealth Management Partners, LLC | 53 135 | 0,48 | 11 156 | −5,03 | ||||

| 2025-07-15 | 13F | First City Capital Management, Inc. | 13 558 | −19,13 | 2 782 | −25,32 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - EQ/Large Cap Growth Managed Volatility Portfolio Class IB | 912 446 | −8,52 | 187 207 | −15,50 | ||||

| 2025-07-16 | 13F | BankPlus Wealth Management LLC | 23 523 | −1,26 | 4 826 | −8,79 | ||||

| 2025-08-13 | 13F | Standard Family Office LLC | 1 996 | 0,00 | 410 | −7,67 | ||||

| 2025-08-14 | 13F | Freestone Grove Partners LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-04 | 13F | One Day In July LLC | 39 407 | −1,65 | 8 085 | −9,16 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - EQ/Large Cap Value Managed Volatility Portfolio Class IB | 105 688 | −10,90 | 21 684 | −17,70 | ||||

| 2025-07-08 | 13F | First International Bank & Trust | 4 950 | −27,27 | 1 016 | −32,83 | ||||

| 2025-07-28 | NP | AGOX - Adaptive Growth Opportunities ETF | 3 195 | −2,20 | 642 | −18,86 | ||||

| 2025-07-24 | NP | SHP ETF Trust - FIS Knights of Columbus Global Belief ETF | 4 868 | 0,00 | 978 | −16,99 | ||||

| 2025-07-30 | NP | ONOF - Global X Adaptive U.S. Risk Management ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 35 468 | −6,72 | 7 124 | −22,53 | ||||

| 2025-07-25 | 13F | Lion Street Advisors, LLC | 28 078 | 0,36 | 5 761 | −7,31 | ||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 1 423 336 | 30,38 | 292 026 | 20,43 | ||||

| 2025-07-02 | 13F | Crumly & Associates Inc. | 19 022 | −2,99 | 3 903 | −10,40 | ||||

| 2025-08-26 | NP | ISBAX - VY(R) Columbia Contrarian Core Portfolio Class ADV | 18 112 | −9,98 | 3 716 | −16,85 | ||||

| 2025-08-12 | 13F | Retirement Planning Co of New England, Inc. | 35 209 | −0,34 | 7 224 | −7,95 | ||||

| 2025-08-14 | 13F | Alight Capital Management LP | 35 000 | 7 181 | ||||||

| 2025-06-27 | NP | FICEX - FROST GROWTH EQUITY FUND Institutional Class Shares | 82 444 | −4,70 | 17 519 | −14,19 | ||||

| 2025-07-10 | 13F | Kmg Fiduciary Partners, Llc | 287 069 | 2,66 | 58 898 | −5,18 | ||||

| 2025-08-13 | 13F | North Growth Management Ltd. | 37 000 | 0,00 | 8 | −12,50 | ||||

| 2025-08-26 | NP | LCDS - JPMorgan Fundamental Data Science Large Core ETF | 3 387 | 1,53 | 695 | −6,34 | ||||

| 2025-08-28 | NP | SEIQ - SEI Enhanced U.S. Large Cap Quality Factor ETF | 106 202 | 15,75 | 21 789 | 6,91 | ||||

| 2025-08-13 | 13F | Valued Retirements, Inc. | 14 999 | −0,52 | 3 077 | −8,12 | ||||

| 2025-08-05 | 13F | BEAM Asset Management, LLC | 27 903 | −1,44 | 5 725 | −8,97 | ||||

| 2025-07-24 | 13F | Grace & White Inc /ny | 12 179 | 0,00 | 2 499 | −7,65 | ||||

| 2025-07-22 | 13F | DBK Financial Counsel, LLC | 6 252 | 13,92 | 1 283 | 5,17 | ||||

| 2025-08-13 | 13F | Trustmark National Bank Trust Department | 107 437 | −2,11 | 22 043 | −9,59 | ||||

| 2025-08-14 | 13F | Talon Private Wealth, LLC | 25 405 | −57,90 | 5 212 | −61,20 | ||||

| 2025-08-13 | 13F | Congress Wealth Management LLC / DE / | 1 922 034 | 9,18 | 394 344 | 1,01 | ||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 928 218 | 35,35 | 190 442 | 25,02 | ||||

| 2025-08-22 | NP | MBAAX - Global Strategist Portfolio Class A Shares | 54 488 | 3,51 | 11 179 | −4,39 | ||||

| 2025-07-29 | 13F | Aspiriant, Llc | 300 315 | −12,82 | 61 616 | −19,48 | ||||

| 2025-06-27 | NP | SUNAMERICA SERIES TRUST - SA Goldman Sachs Multi-Asset Insights Portfolio Class 1 | 5 653 | −20,50 | 1 201 | −28,43 | ||||

| 2025-08-13 | 13F | Acorns Advisers, LLC | 32 632 | 26,55 | 7 | 20,00 | ||||

| 2025-08-13 | 13F | Bank Of Nova Scotia Trust Co | 69 545 | 0,56 | 14 269 | −7,12 | ||||

| 2025-08-11 | 13F | Amara Financial, Llc. | 1 517 | 22,34 | 311 | 13,09 | ||||

| 2025-07-29 | NP | PREFX - T. Rowe Price Tax-Efficient Equity Fund This fund is a listed as child fund of Price T Rowe Associates Inc /md/ and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 457 000 | 0,00 | 91 788 | −16,95 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 277 763 | 2,72 | 56 989 | −5,12 | ||||

| 2025-08-06 | 13F | Raelipskie Partnership | 26 048 | 5,76 | 5 344 | −2,32 | ||||

| 2025-08-14 | 13F | Physicians Financial Services, Inc. | 216 046 | −2,01 | 44 | −8,33 | ||||

| 2025-08-28 | NP | ITOT - iShares Core S&P Total U.S. Stock Market ETF | 17 506 018 | 2,19 | 3 591 710 | −5,61 | ||||

| 2025-08-05 | 13F | Cherry Tree Wealth Management, LLC | 13 444 | −2,41 | 2 758 | −9,84 | ||||

| 2025-08-27 | NP | Jnl Series Trust - Jnl/blackrock Global Allocation Fund (a) | 200 569 | −6,66 | 41 151 | −13,79 | ||||

| 2025-07-30 | 13F | White Lighthouse Investment Management Inc. | 29 218 | −1,13 | 5 995 | −8,68 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 1 696 100 | 7,52 | 347 989 | −0,69 | |||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 1 303 400 | 14,23 | 267 419 | 5,51 | |||

| 2025-07-16 | 13F | Embree Financial Group | 134 963 | −0,30 | 27 690 | −7,91 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | 5 000 | −44,89 | 1 026 | −49,13 | ||||

| 2025-08-14 | 13F | Marathon Capital Management | 53 349 | −4,62 | 10 946 | −11,90 | ||||

| 2025-06-24 | NP | QAACX - Federated MDT All Cap Core Fund Class A Shares | 319 754 | 16,92 | 67 948 | 5,27 | ||||

| 2025-08-12 | 13F | Accredited Wealth Management, LLC | 8 270 | 1 697 | ||||||

| 2025-08-28 | NP | BlackRock Variable Series Funds, Inc. - BlackRock Advantage Large Cap Value V.I. Fund Class I This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 537 | 11,52 | 521 | 2,97 | ||||

| 2025-08-11 | NP | CUSUX - Six Circles U.S. Unconstrained Equity Fund | 5 542 078 | −7,66 | 1 137 068 | −14,71 | ||||

| 2025-07-15 | 13F | ACT Advisors, LLC. | 8 315 | 0,78 | 1 706 | −6,93 | ||||

| 2025-08-18 | NP | PACIFIC SELECT FUND - Equity Index Portfolio Class I | 1 517 396 | 0,77 | 311 324 | −6,92 | ||||

| 2025-08-13 | 13F | West Family Investments, Inc. | 68 775 | 46,79 | 14 111 | 35,58 | ||||

| 2025-07-22 | 13F | Jamison Private Wealth Management, Inc. | 116 947 | −13,56 | 23 994 | −20,16 | ||||

| 2025-08-11 | 13F | Advisor Resource Council | Put | 1 900 | 0,00 | 390 | ||||

| 2025-05-13 | 13F | Bulltick Wealth Management, LLC | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 72 008 | 1,93 | 14 774 | −5,86 | ||||

| 2025-08-11 | 13F | Advisor Resource Council | Call | 1 300 | 0,00 | 267 | ||||

| 2025-08-11 | 13F | Advisor Resource Council | 29 702 | −78,92 | 6 094 | −75,95 | ||||

| 2025-07-18 | 13F | Philip James Wealth Mangement, LLC | 21 271 | 0,00 | 4 364 | −7,62 | ||||

| 2025-07-22 | 13F | Berger Financial Group, Inc | 164 925 | −2,36 | 33 838 | −9,82 | ||||

| 2025-06-27 | NP | INFO - Harbor PanAgora Dynamic Large Cap Core ETF | 20 016 | 1,43 | 4 253 | −8,68 | ||||

| 2025-07-17 | 13F | Farmers & Merchants Trust Co of Long Beach | 142 621 | 10,04 | 29 262 | 1,64 | ||||

| 2025-08-05 | 13F | Connable Office Inc | 49 365 | 7,87 | 10 128 | −0,36 | ||||

| 2025-08-08 | 13F/A | Sterling Capital Management LLC | 772 054 | 23,53 | 158 402 | 14,09 | ||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-25 | 13F | Almanack Investment Partners, LLC. | 59 886 | 176,32 | 12 287 | 155,21 | ||||

| 2025-06-26 | NP | FLCPX - Fidelity SAI U.S. Large Cap Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 4 502 893 | −0,20 | 956 865 | −10,14 | ||||

| 2025-08-28 | NP | QWLD - SPDR MSCI World StrategicFactors ETF | 17 942 | 10,94 | 3 681 | 2,48 | ||||

| 2025-08-01 | 13F | Motley Fool Wealth Management, LLC | 10 346 | −41,66 | 2 123 | −46,13 | ||||

| 2025-07-31 | 13F | Fiduciary Wealth Partners, LLC | 11 004 | −31,49 | 2 258 | −36,73 | ||||

| 2025-08-12 | 13F | Winnow Wealth Llc | 1 604 | 165,56 | 329 | 145,52 | ||||

| 2025-08-25 | NP | EMOT - First Trust S&P 500 Economic Moat ETF | 452 | 28,41 | 93 | 17,95 | ||||

| 2025-07-24 | 13F | Drucker Wealth 3.0, LLC | 71 920 | 3,00 | 15 185 | −2,10 | ||||

| 2025-06-27 | NP | UPSD - Aptus Large Cap Upside ETF | 8 907 | 43,66 | 1 893 | 29,32 | ||||

| 2025-07-31 | 13F | Saybrook Capital /nc | 151 839 | −8,36 | 31 153 | −15,35 | ||||

| 2025-08-27 | NP | SSPY - Stratified LargeCap Index ETF | 3 094 | 39,18 | 635 | 28,60 | ||||

| 2025-08-14 | 13F | Archon Partners LLC | 255 000 | 0,00 | 52 318 | −7,64 | ||||

| 2025-07-25 | 13F | Priebe Wealth Holdings LLC | 3 230 | −49,71 | 663 | −53,58 | ||||

| 2025-07-15 | 13F | IMS Capital Management | 56 698 | −2,34 | 11 633 | −9,80 | ||||

| 2025-07-17 | 13F | James Hambro & Partners | 2 633 | −44,03 | 540 | −48,37 | ||||

| 2025-07-11 | 13F | Annex Advisory Services, LLC | 428 462 | 9,36 | 87 907 | 1,01 | ||||

| 2025-08-28 | NP | SPGM - SPDR(R) Portfolio MSCI Global Stock Market ETF | 172 613 | 5,59 | 35 415 | −2,47 | ||||

| 2025-07-15 | 13F | Wela Strategies, Inc. | 2 331 | −1,31 | 478 | −8,78 | ||||

| 2025-07-23 | 13F | Richwood Investment Advisors, LLC | 11 925 | −0,54 | 2 447 | −8,15 | ||||

| 2025-08-06 | 13F | Malaga Cove Capital, LLC | 17 052 | −3,74 | 3 499 | −11,08 | ||||

| 2025-04-09 | 13F | Compass Investment Advisers LLC | 927 | 232 | ||||||

| 2025-08-07 | 13F | Meeder Advisory Services, Inc. | 328 348 | −2,39 | 67 367 | −9,84 | ||||

| 2025-08-26 | NP | ITRAX - VY(R) T. Rowe Price Capital Appreciation Portfolio Class ADV | 443 837 | 7,21 | 91 062 | −0,98 | ||||

| 2025-08-08 | 13F | Pioneer Trust Bank N A/or | 118 981 | 1,27 | 24 411 | −6,46 | ||||

| 2025-08-14 | 13F | Mane Global Capital Management Lp | 0 | −100,00 | 0 | |||||

| 2025-07-02 | 13F | Helen Stephens Group, LLC | 11 783 | 1,30 | 2 418 | −6,43 | ||||

| 2025-07-25 | NP | NFEAX - Columbia Large Cap Growth Opportunity Fund Class A | 324 148 | −0,33 | 65 105 | −17,22 | ||||

| 2025-07-14 | 13F | Iams Wealth Management, Llc | 13 765 | −14,53 | 2 824 | −21,05 | ||||

| 2025-08-05 | 13F | Navalign, LLC | 101 445 | −0,58 | 20 814 | −8,17 | ||||

| 2025-08-08 | 13F | Glaxis Capital Management, LLC | 3 520 | 722 | ||||||

| 2025-05-15 | 13F | Proquility Private Wealth Partners, LLC | 7 362 | 3,52 | 1 635 | −8,15 | ||||

| 2025-08-08 | 13F | Glynn Capital Management Llc | 18 490 | −3,39 | 3 794 | −10,77 | ||||

| 2025-07-17 | 13F | Consolidated Capital Management, Llc | 56 671 | 12,95 | 11 627 | 4,32 | ||||

| 2025-07-30 | 13F | Bayshore Asset Management, Llc | 7 008 | 0,00 | 1 438 | −7,65 | ||||

| 2025-08-13 | 13F | Level Four Advisory Services, Llc | 516 635 | 2,19 | 105 998 | −5,62 | ||||

| 2025-07-07 | 13F | Schulz Wealth, LTD. | 3 286 | 0,24 | 674 | −7,42 | ||||

| 2025-07-15 | 13F | GSB Wealth Management, LLC | 44 966 | −3,64 | 9 226 | −11,01 | ||||

| 2025-07-15 | 13F | Garrett Investment Advisors LLC | 47 417 | −1,38 | 9 729 | −8,91 | ||||

| 2025-08-29 | NP | JAGRX - Janus Henderson Research Portfolio Service Shares | 230 420 | 5,54 | 47 275 | −2,52 | ||||

| 2025-07-22 | NP | GFVAX - Goldman Sachs Focused Value Fund Class A Shares | 6 154 | −1,24 | 1 236 | −17,93 | ||||

| 2025-08-11 | 13F | HHM Wealth Advisors, LLC | 69 485 | 0,57 | 14 256 | −7,11 | ||||

| 2025-07-23 | 13F | Austin Asset Management Co Inc | 23 794 | −5,02 | 4 882 | −12,28 | ||||

| 2025-07-31 | 13F | Conservest Capital Advisors, Inc. | 18 058 | 2,43 | 3 705 | −5,39 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - U.S. Sustainability Core 1 Portfolio Shares | 2 017 593 | 9,20 | 428 739 | −1,67 | ||||

| 2025-07-17 | 13F | Guyasuta Investment Advisors Inc | 92 873 | −0,28 | 19 055 | −7,89 | ||||

| 2025-08-08 | 13F | ProVise Management Group, LLC | 80 564 | 2,36 | 16 529 | −5,46 | ||||

| 2025-07-09 | 13F | Christopher J. Hasenberg, Inc | 168 | 0,00 | 34 | −8,11 | ||||

| 2025-08-14 | 13F | Sherbrooke Park Advisers Llc | 1 423 | −33,32 | 292 | −38,61 | ||||

| 2025-08-27 | NP | ALLIANZ VARIABLE INSURANCE PRODUCTS TRUST - AZL MSCI Global Equity Index Fund | 73 177 | −4,90 | 15 014 | −12,16 | ||||

| 2025-08-04 | 13F | JDM Financial Group LLC | 19 836 | 0,10 | 4 070 | −7,54 | ||||

| 2025-07-28 | NP | EARAX - Eaton Vance Richard Bernstein All Asset Strategy Fund Class A | 26 108 | −25,10 | 5 244 | −37,80 | ||||

| 2025-08-06 | NP | LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Blended Large Cap Growth Managed Volatility Fund Standard Class | 405 628 | −4,45 | 83 223 | −11,75 | ||||

| 2025-08-28 | NP | TOPC - iShares S&P 500 3% Capped ETF | 1 464 | 300 | ||||||

| 2025-08-26 | NP | JGRO - JPMorgan Active Growth ETF | 1 532 048 | 12,24 | 314 330 | 3,67 | ||||

| 2025-07-07 | 13F | Trust Co Of Oklahoma | 66 287 | 0,40 | 13 600 | −7,26 | ||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 15 378 387 | −10,63 | 3 155 105 | −17,46 | ||||

| 2025-07-25 | 13F | Keener Financial Planning LLC | 5 091 | 16,58 | 1 | |||||

| 2025-08-04 | 13F | Impact Partnership Wealth, LLC | 47 237 | 4,25 | 9 692 | −3,72 | ||||

| 2025-06-26 | NP | BlackRock ETF Trust - BlackRock Large Cap Growth ETF This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 241 | −0,44 | 476 | −10,36 | ||||

| 2025-08-25 | NP | GCHDX - Gotham Hedged Core Fund Institutional Class | 1 106 | 3,66 | 227 | −4,64 | ||||

| 2025-07-18 | 13F | Northstar Group, Inc. | 152 963 | 0,33 | 31 384 | −7,33 | ||||

| 2025-08-25 | NP | RND - First Trust Bloomberg R&D Leaders ETF | 818 | 3,02 | 168 | −5,11 | ||||

| 2025-07-22 | 13F | Visionary Horizons, LLC | 3 125 | −4,55 | 641 | −11,83 | ||||

| 2025-07-10 | 13F | Professional Financial Advisors, LLC | 12 392 | −8,65 | 2 543 | −15,63 | ||||

| 2025-08-26 | NP | Profunds - Profund Vp Nasdaq-100 | 41 339 | −10,09 | 8 482 | −16,95 | ||||

| 2025-08-14 | 13F | Pecaut & Co. | 38 070 | −3,42 | 7 811 | −10,79 | ||||

| 2025-07-30 | 13F | Rothschild Capital Partners, LLC | 152 863 | −3,23 | 31 363 | −10,62 | ||||

| 2025-08-13 | 13F | Nicolet Bankshares Inc | 67 041 | 3,54 | 13 755 | −4,37 | ||||

| 2025-07-23 | 13F | Peak Financial Management, Inc. | 20 694 | −42,48 | 4 246 | −46,88 | ||||

| 2025-07-31 | 13F | Oak Harbor Wealth Partners, Llc | 56 995 | −0,87 | 11 694 | −8,43 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 97 116 | −7,52 | 32 784 | 40,54 | ||||

| 2025-08-08 | 13F | Thrive Capital Management, LLC | 14 213 | −4,97 | 2 916 | −12,22 | ||||

| 2025-05-27 | NP | PRUDENTIAL SERIES FUND - VALUE PORTFOLIO Class I | 59 870 | −33,36 | 13 299 | −40,90 | ||||

| 2025-07-02 | 13F | Doliver Advisors, Lp | 25 240 | −2,11 | 5 178 | −9,59 | ||||

| 2025-07-14 | 13F | Chapin Davis, Inc. | 101 851 | −1,82 | 20 897 | −9,31 | ||||

| 2025-08-14 | 13F | CoreFirst Bank & Trust | 44 994 | −4,62 | 9 231 | −11,90 | ||||

| 2025-07-22 | NP | GSPIX - Goldman Sachs Capital Growth Fund Institutional | 383 796 | −2,03 | 77 085 | −18,63 | ||||

| 2025-07-25 | 13F | NorthRock Partners, LLC | 729 644 | 2,27 | 149 699 | −5,54 | ||||

| 2025-04-30 | 13F | J Hagan Capital, Inc. | 21 884 | 5 480 | ||||||

| 2025-07-25 | 13F | NorthRock Partners, LLC | Put | 7 000 | −42,15 | 1 436 | −46,56 | |||

| 2025-07-09 | 13F | Summit Financial Consulting LLC | 3 363 | −12,15 | 690 | −18,82 | ||||

| 2025-06-25 | NP | IMRFX - Columbia Global Opportunities Fund Class A | 25 595 | −9,45 | 5 439 | −18,48 | ||||

| 2025-08-12 | 13F | PKS Advisory Services, LLC | 57 956 620 | 98 916,98 | 12 106 | −6,72 | ||||

| 2025-07-16 | 13F | MontVue Capital Management, Inc. | 2 882 | 0,38 | 591 | −7,22 | ||||

| 2025-08-06 | NP | LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP ClearBridge QS Select Large Cap Managed Volatility Fund Standard Class This fund is a listed as child fund of Clearbridge, Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 105 707 | −3,22 | 21 688 | −10,61 | ||||

| 2025-08-13 | 13F | RPg Family Wealth Advisory, LLC | 37 538 | −23,23 | 7 702 | −29,09 | ||||

| 2025-05-29 | NP | SEASONS SERIES TRUST - SA T. Rowe Price Growth Stock Portfolio Class 1 | 96 940 | −2,79 | 21 533 | −13,77 | ||||

| 2025-07-30 | 13F | Bleakley Financial Group, LLC | 616 693 | 2,57 | 126 527 | −5,27 | ||||

| 2025-07-09 | 13F | Byrne Asset Management LLC | 31 014 | 2,20 | 6 363 | −5,59 | ||||

| 2025-04-29 | NP | SWSAX - SIIT World Select Equity Fund Class A | 4 119 | 7,21 | 996 | 9,33 | ||||

| 2025-08-14 | 13F | Janus Henderson Group Plc | 28 226 446 | −4,67 | 5 790 938 | −10,25 | ||||

| 2025-07-11 | 13F | Marshall & Sullivan Inc /wa/ | 25 185 | −13,64 | 5 167 | −20,23 | ||||

| 2025-08-14 | 13F | XY Capital Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-06-23 | NP | Eaton Vance Tax Advantaged Global Dividend Income Fund | 169 438 | −18,59 | 36 006 | −26,70 | ||||

| 2025-08-11 | 13F | TAGStone Capital, Inc. | 7 841 | 55,61 | 1 798 | 179 700,00 | ||||

| 2025-08-25 | NP | MMBDX - MassMutual Premier Balanced Fund Class A | 17 523 | −8,44 | 3 595 | −15,43 | ||||

| 2025-08-27 | NP | BRGIX - Bridges Investment Fund | 57 300 | −17,91 | 11 756 | −24,17 | ||||

| 2025-07-15 | 13F | Northside Capital Management, LLC | 104 300 | 81,75 | 21 399 | 67,87 | ||||

| 2025-07-23 | 13F | Ameliora Wealth Management Ltd. | 27 169 | −12,01 | 5 574 | −18,72 | ||||

| 2025-08-29 | NP | FICHX - Cantor Growth Equity Fund Institutional Class | 88 278 | 2,08 | 18 112 | −5,72 | ||||

| 2025-08-01 | 13F | Centerpoint Advisors, LLC | 45 223 | −0,44 | 9 | −10,00 | ||||

| 2025-08-14 | 13F | Golden Unicorn (BVI) Ltd | 700 000 | 0,00 | 143 619 | −7,64 | ||||

| 2025-07-08 | 13F | Silverleafe Capital Partners, LLC | 63 485 | −3,86 | 13 025 | −11,20 | ||||