Grundläggande statistik

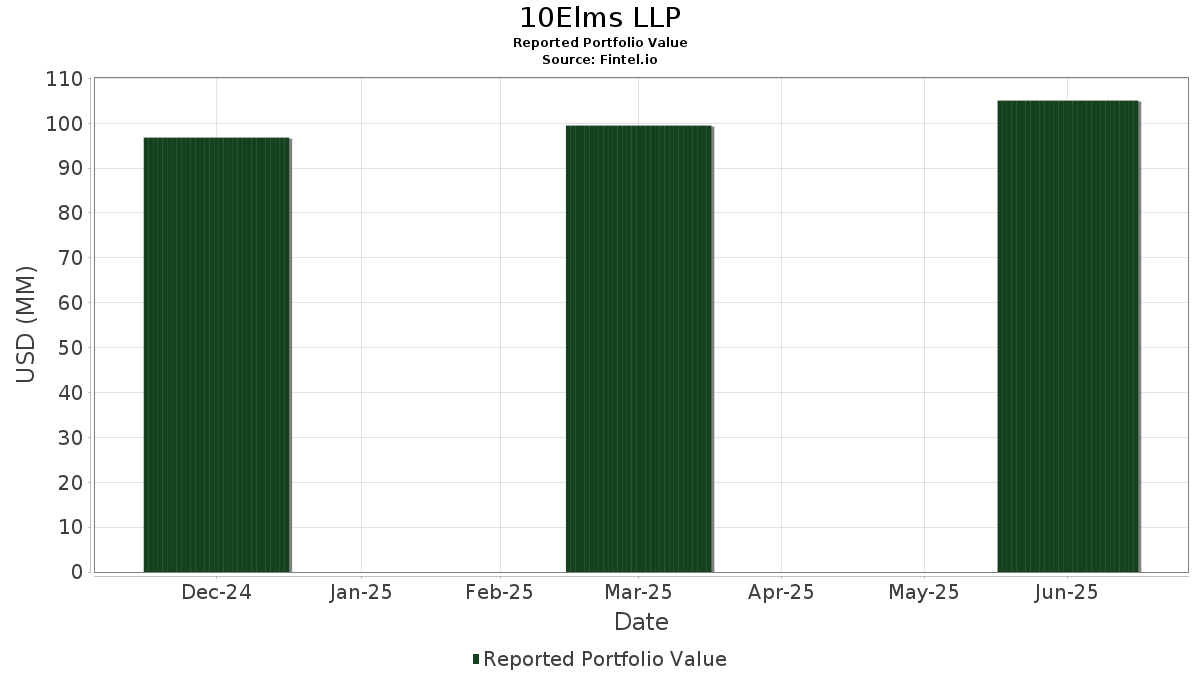

| Portföljvärde | $ 105 046 200 |

| Aktuella positioner | 503 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

10Elms LLP har redovisat 503 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 105 046 200 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). 10Elms LLPs största innehav är iShares Trust - iShares Core MSCI EAFE ETF (US:IEFA) , The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund (US:XLK) , iShares, Inc. - iShares Core MSCI Emerging Markets ETF (US:IEMG) , The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund (US:XLV) , and iShares Trust - iShares MSCI USA Min Vol Factor ETF (US:USMV) . 10Elms LLPs nya positioner inkluderar North Texas Tollway Authority (US:US66285WSS60) , AUSTIN TX CMNTY CLG DIST PUBLIC FAC CORP LEASE REVENUE (US:US052405FE27) , New York (State of) Dormitory Authority (Icahn School of Medicine at Mount Sinai), Series 2015, Ref. RB (US:US64990BQK25) , Bank of Nova Scotia (The) (CA:US06418GAD97) , and New York Metropolitan Transportation Authority Revenue (US:US59261AFR32) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 0,02 | 5,56 | 5,2964 | 0,8171 | |

| 0,12 | 10,03 | 9,5443 | 0,5478 | |

| 0,07 | 4,33 | 4,1199 | 0,3393 | |

| 0,01 | 1,69 | 1,6123 | 0,2877 | |

| 0,01 | 0,44 | 0,4161 | 0,2415 | |

| 0,01 | 1,54 | 1,4631 | 0,2239 | |

| 0,01 | 2,19 | 2,0875 | 0,1801 | |

| 0,05 | 2,48 | 2,3563 | 0,1485 | |

| 0,01 | 0,17 | 0,1649 | 0,1435 | |

| 0,00 | 0,80 | 0,7646 | 0,1291 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 0,03 | 3,77 | 3,5850 | −0,5436 | |

| 0,02 | 2,82 | 2,6800 | −0,4850 | |

| 0,04 | 2,84 | 2,6994 | −0,2179 | |

| 0,10 | 2,77 | 2,6403 | −0,2121 | |

| 0,01 | 0,45 | 0,4280 | −0,1153 | |

| 0,00 | 0,55 | 0,5234 | −0,1036 | |

| 0,05 | 2,26 | 2,1488 | −0,1026 | |

| 0,01 | 1,35 | 1,2839 | −0,1014 | |

| 0,00 | 0,43 | 0,4076 | −0,0985 | |

| 0,00 | 0,05 | 0,0475 | −0,0977 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-14 för rapporteringsperioden 2025-06-30. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| IEFA / iShares Trust - iShares Core MSCI EAFE ETF | 0,12 | 1,52 | 10,03 | 12,02 | 9,5443 | 0,5478 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0,02 | 1,81 | 5,56 | 24,84 | 5,2964 | 0,8171 | |||

| IEMG / iShares, Inc. - iShares Core MSCI Emerging Markets ETF | 0,07 | 3,46 | 4,33 | 15,08 | 4,1199 | 0,3393 | |||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | 0,03 | −0,68 | 3,77 | −8,33 | 3,5850 | −0,5436 | |||

| USMV / iShares Trust - iShares MSCI USA Min Vol Factor ETF | 0,03 | 4,07 | 3,26 | 4,32 | 3,1016 | −0,0384 | |||

| BND / Vanguard Bond Index Funds - Vanguard Total Bond Market ETF | 0,04 | −2,53 | 2,84 | −2,31 | 2,6994 | −0,2179 | |||

| QUAL / iShares Trust - iShares MSCI USA Quality Factor ETF | 0,02 | −16,42 | 2,82 | −10,58 | 2,6800 | −0,4850 | |||

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 0,10 | 3,13 | 2,77 | −2,26 | 2,6403 | −0,2121 | |||

| SPY / SPDR S&P 500 ETF | 0,00 | 0,00 | 2,71 | 10,45 | 2,5756 | 0,1132 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0,05 | 7,19 | 2,48 | 12,70 | 2,3563 | 0,1485 | |||

| MTUM / iShares Trust - iShares MSCI USA Momentum Factor ETF | 0,01 | −6,95 | 2,43 | 10,62 | 2,3110 | 0,1051 | |||

| XLI / The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund | 0,02 | −0,76 | 2,31 | 11,67 | 2,1968 | 0,1199 | |||

| BNDX / Vanguard Charlotte Funds - Vanguard Total International Bond ETF | 0,05 | −0,62 | 2,26 | 0,80 | 2,1488 | −0,1026 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0,01 | 6,83 | 2,19 | 15,55 | 2,0875 | 0,1801 | |||

| USIG / iShares Trust - iShares Broad USD Investment Grade Corporate Bond ETF | 0,04 | 3,42 | 1,96 | 4,14 | 1,8664 | −0,0259 | |||

| XLY / The Select Sector SPDR Trust - The Consumer Discretionary Select Sector SPDR Fund | 0,01 | 16,78 | 1,69 | 28,55 | 1,6123 | 0,2877 | |||

| VYMI / Vanguard Whitehall Funds - Vanguard International High Dividend Yield ETF | 0,02 | 5,05 | 1,68 | 14,17 | 1,6036 | 0,1208 | |||

| XLC / The Select Sector SPDR Trust - The Communication Services Select Sector SPDR Fund | 0,01 | 10,80 | 1,54 | 24,68 | 1,4631 | 0,2239 | |||

| VLUE / iShares Trust - iShares MSCI USA Value Factor ETF | 0,01 | −7,81 | 1,35 | −2,18 | 1,2839 | −0,1014 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0,00 | 3,26 | 1,31 | 14,21 | 1,2476 | 0,0939 | |||

| XLP / The Select Sector SPDR Trust - The Consumer Staples Select Sector SPDR Fund | 0,01 | 0,28 | 1,17 | −0,59 | 1,1176 | −0,0695 | |||

| IBDR / iShares Trust - iShares iBonds Dec 2026 Term Corporate ETF | 0,05 | 2,45 | 1,17 | 2,64 | 1,1106 | −0,0322 | |||

| IBDT / iShares Trust - iShares iBonds Dec 2028 Term Corporate ETF | 0,05 | 8,19 | 1,15 | 8,88 | 1,0976 | 0,0331 | |||

| IBDS / iShares Trust - iShares iBonds Dec 2027 Term Corporate ETF | 0,03 | 6,11 | 0,85 | 6,56 | 0,8046 | 0,0069 | |||

| IBDQ / iShares Trust - iShares iBonds Dec 2025 Term Corporate ETF | 0,03 | −4,81 | 0,83 | −4,73 | 0,7869 | −0,0850 | |||

| EMB / iShares Trust - iShares J.P. Morgan USD Emerging Markets Bond ETF | 0,01 | 5,30 | 0,83 | 7,69 | 0,7865 | 0,0151 | |||

| SOXX / iShares Trust - iShares Semiconductor ETF | 0,00 | 0,15 | 0,80 | 27,06 | 0,7646 | 0,1291 | |||

| BX / Blackstone Inc. | 0,00 | −2,12 | 0,69 | 4,86 | 0,6570 | −0,0054 | |||

| DVYE / iShares, Inc. - iShares Emerging Markets Dividend ETF | 0,02 | 4,21 | 0,69 | 9,39 | 0,6547 | 0,0228 | |||

| LQD / iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF | 0,01 | 0,00 | 0,68 | 0,89 | 0,6455 | −0,0304 | |||

| IBHE / iShares Trust - iShares iBonds 2025 Term High Yield and Income ETF | 0,03 | 0,00 | 0,66 | 0,00 | 0,6269 | −0,0347 | |||

| IBDU / iShares Trust - iShares iBonds Dec 2029 Term Corporate ETF | 0,03 | 18,11 | 0,65 | 19,13 | 0,6230 | 0,0708 | |||

| AB / AllianceBernstein Holding L.P. - Limited Partnership | 0,02 | 0,00 | 0,63 | 6,59 | 0,6009 | 0,0055 | |||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | 0,01 | −11,23 | 0,63 | −8,08 | 0,5961 | −0,0886 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0,02 | 0,00 | 0,61 | −9,17 | 0,5850 | −0,0951 | |||

| KKR / KKR & Co. Inc. | 0,00 | 0,00 | 0,61 | 15,07 | 0,5818 | 0,0479 | |||

| IBMO / iShares Trust - iShares iBonds Dec 2026 Term Muni Bond ETF | 0,02 | 1,71 | 0,61 | 2,01 | 0,5804 | −0,0207 | |||

| AMZN / Amazon.com, Inc. | 0,00 | 6,71 | 0,58 | 22,86 | 0,5483 | 0,0777 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0,00 | −13,85 | 0,55 | −11,88 | 0,5234 | −0,1036 | |||

| IBMP / iShares Trust - iShares iBonds Dec 2027 Term Muni Bond ETF | 0,02 | 0,95 | 0,54 | 1,31 | 0,5151 | −0,0222 | |||

| IBMR / iShares Trust - iShares iBonds Dec 2029 Term Muni Bond ETF | 0,02 | 1,81 | 0,50 | 2,69 | 0,4732 | −0,0139 | |||

| IBMQ / iShares Trust - iShares iBonds Dec 2028 Term Muni Bond ETF | 0,02 | 0,00 | 0,49 | 0,41 | 0,4635 | −0,0236 | |||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0,01 | −1,38 | 0,48 | −10,54 | 0,4612 | −0,0829 | |||

| FNDA / Schwab Strategic Trust - Schwab Fundamental U.S. Small Company ETF | 0,02 | −2,66 | 0,47 | 1,73 | 0,4489 | −0,0167 | |||

| XLRE / The Select Sector SPDR Trust - The Real Estate Select Sector SPDR Fund | 0,01 | −15,95 | 0,45 | −16,85 | 0,4280 | −0,1153 | |||

| IBDV / iShares Trust - iShares iBonds Dec 2030 Term Corporate ETF | 0,02 | 26,90 | 0,44 | 28,28 | 0,4195 | 0,0746 | |||

| VEU / Vanguard International Equity Index Funds - Vanguard FTSE All-World ex-US ETF | 0,01 | 127,06 | 0,44 | 152,60 | 0,4161 | 0,2415 | |||

| IBMN / iShares Trust - iShares iBonds Dec 2025 Term Muni Bond ETF | 0,02 | 0,00 | 0,43 | 0,00 | 0,4137 | −0,0229 | |||

| PFF / iShares Trust - iShares Preferred and Income Securities ETF | 0,01 | −0,91 | 0,43 | −0,92 | 0,4122 | −0,0278 | |||

| XLB / The Select Sector SPDR Trust - The Materials Select Sector SPDR Fund | 0,00 | −16,73 | 0,43 | −14,91 | 0,4076 | −0,0985 | |||

| TIP / iShares Trust - iShares TIPS Bond ETF | 0,00 | 3,76 | 0,43 | 2,66 | 0,4052 | −0,0111 | |||

| EMLP / First Trust Exchange-Traded Fund IV - First Trust North American Energy Infrastructure Fund | 0,01 | 0,00 | 0,43 | 0,00 | 0,4050 | −0,0224 | |||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | 0,01 | 0,59 | 0,41 | 2,74 | 0,3927 | −0,0105 | |||

| GOOGL / Alphabet Inc. | 0,00 | 0,00 | 0,37 | 14,07 | 0,3557 | 0,0261 | |||

| FLRN / SPDR Series Trust - SPDR Bloomberg Investment Grade Floating Rate ETF | 0,01 | −1,83 | 0,34 | −1,72 | 0,3267 | −0,0246 | |||

| MUB / iShares Trust - iShares National Muni Bond ETF | 0,00 | 44,44 | 0,34 | 43,04 | 0,3232 | 0,0848 | |||

| US66285WSS60 / North Texas Tollway Authority | 0,33 | −2,94 | 0,3147 | −0,0272 | |||||

| BRK.B / Berkshire Hathaway Inc. | 0,00 | 0,00 | 0,32 | −8,83 | 0,3052 | −0,0481 | |||

| MSFT / Microsoft Corporation | 0,00 | −13,51 | 0,32 | 14,80 | 0,3031 | 0,0238 | |||

| WFC / Wells Fargo & Company | 0,00 | 7,30 | 0,32 | 20,00 | 0,3029 | 0,0358 | |||

| GOOG / Alphabet Inc. | 0,00 | 0,00 | 0,28 | 13,65 | 0,2702 | 0,0189 | |||

| CAT / Caterpillar Inc. | 0,00 | −17,96 | 0,27 | −3,21 | 0,2583 | −0,0241 | |||

| GDV.PRK / The Gabelli Dividend & Income Trust - Preferred Stock | 0,01 | 0,00 | 0,27 | −1,10 | 0,2569 | −0,0175 | |||

| DTEC / ALPS ETF Trust - ALPS Disruptive Technologies ETF | 0,01 | 0,00 | 0,27 | 13,50 | 0,2562 | 0,0178 | |||

| IBDW / iShares Trust - iShares iBonds Dec 2031 Term Corporate ETF | 0,01 | 77,46 | 0,27 | 80,27 | 0,2524 | 0,1043 | |||

| IBB / iShares Trust - iShares Biotechnology ETF | 0,00 | 0,00 | 0,26 | −0,78 | 0,2439 | −0,0165 | |||

| ENFR / ALPS ETF Trust - Alerian Energy Infrastructure ETF | 0,01 | 2,63 | 0,25 | 0,80 | 0,2394 | −0,0110 | |||

| BURLESON TEX WTR & 4 30WRSR UTIL DUE 03/01/30 / MUNI BONDS (121410QB3) | 0,25 | 0,0000 | |||||||

| US052405FE27 / AUSTIN TX CMNTY CLG DIST PUBLIC FAC CORP LEASE REVENUE | 0,25 | −0,40 | 0,2380 | −0,0134 | |||||

| IBHF / iShares Trust - iShares iBonds 2026 Term High Yield and Income ETF | 0,01 | 0,00 | 0,25 | 0,00 | 0,2347 | −0,0130 | |||

| ITA / iShares Trust - iShares U.S. Aerospace & Defense ETF | 0,00 | 4,00 | 0,25 | 28,27 | 0,2335 | 0,0411 | |||

| US64990BQK25 / New York (State of) Dormitory Authority (Icahn School of Medicine at Mount Sinai), Series 2015, Ref. RB | 0,24 | −2,07 | 0,2247 | −0,0177 | |||||

| NVDA / NVIDIA Corporation | 0,00 | 3,50 | 0,23 | 51,30 | 0,2226 | 0,0668 | |||

| PEP / PepsiCo, Inc. | 0,00 | 0,00 | 0,23 | −11,83 | 0,2205 | −0,0439 | |||

| NTRSO / Northern Trust Corporation - Preferred Stock | 0,01 | 0,00 | 0,23 | −1,30 | 0,2169 | −0,0145 | |||

| BWXT / BWX Technologies, Inc. | 0,00 | 0,00 | 0,22 | 45,95 | 0,2065 | 0,0572 | |||

| COST / Costco Wholesale Corporation | 0,00 | 34,38 | 0,21 | 40,40 | 0,2026 | 0,0505 | |||

| GAB.PRG / The Gabelli Equity Trust Inc. - Preferred Security | 0,01 | −1,90 | 0,21 | −5,83 | 0,2004 | −0,0238 | |||

| BCV.PRA / Bancroft Fund Ltd. - Preferred Stock | 0,01 | 0,00 | 0,21 | −1,90 | 0,1966 | −0,0146 | |||

| GULF COAST WASTE DI 5 33SWR UTIL DUE 10/01/33XTRO ASSURED GUARANTY MU / MUNI BONDS (401905FJ8) | 0,20 | 0,0000 | |||||||

| GGT.PRG / The Gabelli Multimedia Trust Inc. - Preferred Stock | 0,01 | −2,17 | 0,20 | −2,91 | 0,1906 | −0,0169 | |||

| SEDGWICK CNTY KANS 4 29FAC BLDG DUE 08/01/29 / MUNI BONDS (81533PJP6) | 0,20 | 0,0000 | |||||||

| WMB / The Williams Companies, Inc. | 0,00 | 0,00 | 0,20 | 4,79 | 0,1883 | −0,0009 | |||

| KMI / Kinder Morgan, Inc. | 0,01 | 0,00 | 0,19 | 3,26 | 0,1813 | −0,0045 | |||

| CWI / SPDR Index Shares Funds - SPDR MSCI ACWI ex-US ETF | 0,01 | −14,99 | 0,18 | −6,25 | 0,1719 | −0,0215 | |||

| AVGO / Broadcom Inc. | 0,00 | 0,00 | 0,18 | 65,74 | 0,1706 | 0,0612 | |||

| VO / Vanguard Index Funds - Vanguard Mid-Cap ETF | 0,00 | 0,00 | 0,18 | 8,48 | 0,1705 | 0,0041 | |||

| IBDX / iShares Trust - iShares iBonds Dec 2032 Term Corporate ETF | 0,01 | 705,88 | 0,17 | 723,81 | 0,1649 | 0,1435 | |||

| IHAK / iShares Trust - iShares Cybersecurity and Tech ETF | 0,00 | 0,00 | 0,17 | 13,33 | 0,1621 | 0,0110 | |||

| PSX / Phillips 66 | 0,00 | 0,00 | 0,16 | −3,59 | 0,1538 | −0,0143 | |||

| ACP.PRA / Abrdn Income Credit Strategies Fund - Preferred Stock | 0,01 | 0,00 | 0,15 | −4,46 | 0,1430 | −0,0150 | |||

| US06418GAD97 / Bank of Nova Scotia (The) | 0,15 | 0,68 | 0,1421 | −0,0071 | |||||

| US59261AFR32 / New York Metropolitan Transportation Authority Revenue | 0,15 | −0,68 | 0,1400 | −0,0094 | |||||

| LNT / Alliant Energy Corporation | 0,00 | 0,00 | 0,14 | −5,88 | 0,1375 | −0,0170 | |||

| IBMS / iShares Trust - iShares iBonds Dec 2030 Term Muni Bond ETF | 0,01 | 33,98 | 0,14 | 35,58 | 0,1348 | 0,0296 | |||

| US59261AJW80 / New York Metropolitan Transportation Authority Revenue | 0,14 | 0,00 | 0,1338 | −0,0074 | |||||

| VTEB / Vanguard Municipal Bond Funds - Vanguard Tax-Exempt Bond ETF | 0,00 | 0,00 | 0,14 | −1,43 | 0,1321 | −0,0091 | |||

| KNG / First Trust Exchange-Traded Fund IV - FT Vest S&P 500 Dividend Aristocrats Target Income ETF | 0,00 | 0,00 | 0,14 | −2,82 | 0,1320 | −0,0114 | |||

| ARLINGTON TEX HIGHE 4 44CHAR EDUC DUE 08/15/44OID XTRO / MUNI BONDS (041806DV9) | 0,13 | 0,0000 | |||||||

| MCD / McDonald's Corporation | 0,00 | 0,66 | 0,13 | −6,38 | 0,1265 | −0,0156 | |||

| ILLINOIS HSG DEV 1 4 30SING HSG DUE 10/01/30XTRO / MUNI BONDS (45201Y7Y7) | 0,13 | 0,0000 | |||||||

| LNG / Cheniere Energy, Inc. | 0,00 | 0,00 | 0,13 | 4,80 | 0,1254 | −0,0004 | |||

| US89788MAC64 / Truist Financial Corp. | 0,12 | 1,67 | 0,1164 | −0,0047 | |||||

| IDV / iShares Trust - iShares International Select Dividend ETF | 0,00 | 0,00 | 0,12 | 11,11 | 0,1150 | 0,0058 | |||

| TVC / Tennessee Valley Authority - Preferred Stock | 0,01 | 0,00 | 0,12 | −1,68 | 0,1122 | −0,0082 | |||

| US718172CS62 / Philip Morris International, Inc. | 0,12 | 1,74 | 0,1119 | −0,0047 | |||||

| US89115A2M37 / Toronto-Dominion Bank | 0,12 | 0,86 | 0,1118 | −0,0057 | |||||

| US375558BX02 / Gilead Sciences, Inc. | 0,12 | 1,75 | 0,1107 | −0,0045 | |||||

| US74460WAF41 / Public Storage | 0,11 | 0,89 | 0,1079 | −0,0051 | |||||

| VBR / Vanguard Index Funds - Vanguard Small-Cap Value ETF | 0,00 | 0,00 | 0,11 | 4,81 | 0,1043 | −0,0009 | |||

| IBHG / iShares Trust - iShares iBonds 2027 Term High Yield and Income ETF | 0,00 | 0,00 | 0,11 | 0,94 | 0,1021 | −0,0047 | |||

| JNJ / Johnson & Johnson | 0,00 | 0,00 | 0,10 | −7,96 | 0,0993 | −0,0145 | |||

| US88579YBJ91 / 3M Co | 0,10 | 1,00 | 0,0970 | −0,0038 | |||||

| SAN FELIPE DEL RIO 4 32GO UTX DUE 08/15/32 / MUNI BONDS (797550HX1) | 0,10 | 0,0000 | |||||||

| HARRIS CNTY TEX HOS 4 31DIST HLTH DUE 02/15/31 / MUNI BONDS (41415WCJ9) | 0,10 | 0,0000 | |||||||

| NEW YORK ST DOR 4 625 27POOL EDR DUE 06/01/27OID XTRO / MUNI BONDS (649903E64) | 0,10 | 0,0000 | |||||||

| CLINTON OKLA PUB WK 4 34COMB TAX DUE 12/01/34XTRO BUILD AMERICA MUTUA / MUNI BONDS (188408AN8) | 0,10 | 0,0000 | |||||||

| PORT FREEPORT T 4 125 31PA TRAN DUE 06/01/31OID / MUNI BONDS (73412PAR4) | 0,10 | 0,0000 | |||||||

| JOHNSON CNTY KA 3 625 34MUNI BLDG DUE 09/01/34OID XTRO / MUNI BONDS (478497XX3) | 0,10 | 0,0000 | |||||||

| KAUFMAN CNTY TEX MU 4 35GO UTX DUE 09/01/35OID / MUNI BONDS (486190EN7) | 0,10 | 0,0000 | |||||||

| US458140AS90 / Intel Corp | 0,10 | 0,00 | 0,0951 | −0,0051 | |||||

| SU / Suncor Energy Inc. | 0,00 | 0,00 | 0,10 | −2,94 | 0,0945 | −0,0087 | |||

| US650116AM80 / New York Transportation Development Corporation, Special Facilities Bonds, LaGuardia Airport Terminal B Redevelopment Project, Series 2016A | 0,10 | 1,02 | 0,0943 | −0,0046 | |||||

| US235286AP65 / FX.RT. MUNI BOND | 0,10 | 2,08 | 0,0933 | −0,0041 | |||||

| WMT / Walmart Inc. | 0,00 | 0,00 | 0,10 | 11,63 | 0,0922 | 0,0048 | |||

| AURORA ILL 3 125 32GO UTX DUE 12/30/32OID / MUNI BONDS (051645Q44) | 0,10 | 0,0000 | |||||||

| QCOM / QUALCOMM Incorporated | 0,00 | 0,00 | 0,10 | 4,35 | 0,0914 | −0,0017 | |||

| US751435AN89 / Ramapo Local Development Corp | 0,10 | −2,06 | 0,0911 | −0,0072 | |||||

| US89352HAM16 / TransCanada PipeLines Ltd | 0,10 | 1,06 | 0,0910 | −0,0037 | |||||

| US718546AK04 / Phillips 66 | 0,10 | 1,06 | 0,0908 | −0,0041 | |||||

| ARLINGTON TEX HIGHE 4 39CHAR EDUC DUE 08/15/39OID XTRO / MUNI BONDS (041806EP1) | 0,09 | 0,0000 | |||||||

| US87638QPR47 / Tarrant County Cultural Education Facilities Finance Corporation, Texas, Hospital Revenue Bonds, Scott & White Healthcare Project, Series 2016A | 0,09 | −2,13 | 0,0877 | −0,0071 | |||||

| PSA.PRF / Public Storage - Preferred Stock | 0,00 | 0,00 | 0,09 | −4,21 | 0,0871 | −0,0085 | |||

| COOK CNTY ILL SCH D 3 35GO LTX DUE 12/01/35 / MUNI BONDS (213759HL0) | 0,09 | 0,0000 | |||||||

| KANE COOK & DU PA 1 5 29GO UTX DUE 12/15/29 / MUNI BONDS (483854JH9) | 0,09 | 0,0000 | |||||||

| ELGIN ILL 2 25GO UTX DUE 12/15/25 / MUNI BONDS (2862997Y2) | 0,09 | 0,0000 | |||||||

| WELLS FARGO & CO 5 9 28 DUE 08/14/28 / CORPORATE BONDS (95001DDT4) | 0,09 | 0,0000 | |||||||

| EVANSTON ILL 2 31GO UTX DUE 12/01/31 / MUNI BONDS (299228JD9) | 0,09 | 0,0000 | |||||||

| US65339KCN81 / NextEra Energy Capital Holdings Inc | 0,09 | 1,16 | 0,0829 | −0,0042 | |||||

| US797440BZ64 / San Diego Gas & Electric Co., Series VVV | 0,09 | 2,38 | 0,0827 | −0,0027 | |||||

| US06368FAC32 / Bank of Montreal | 0,09 | 1,18 | 0,0827 | −0,0037 | |||||

| US29365TAK07 / Entergy Texas, Inc. | 0,09 | 2,38 | 0,0819 | −0,0035 | |||||

| CHAMPAIGN & VERMILL 3 33GO UTX DUE 12/01/33 / MUNI BONDS (158159CE1) | 0,09 | 0,0000 | |||||||

| SAN LEANDRO CAL 3 625 27MUNI BLDG DUE 12/01/27OID XTRO / MUNI BONDS (798451AQ3) | 0,09 | 0,0000 | |||||||

| FBRT.PRE / Franklin BSP Realty Trust, Inc. - Preferred Stock | 0,00 | 0,00 | 0,08 | −1,18 | 0,0808 | −0,0048 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0,00 | 0,00 | 0,08 | 7,69 | 0,0806 | 0,0022 | |||

| UBER / Uber Technologies, Inc. | 0,00 | 12,50 | 0,08 | 43,10 | 0,0799 | 0,0213 | |||

| ARAPAHOE CNTY CO 2 25 34GO UTX DUE 12/01/34OID / MUNI BONDS (03871LDC4) | 0,08 | 0,0000 | |||||||

| US548661ED58 / Lowe's Cos Inc | 0,08 | 2,47 | 0,0793 | −0,0030 | |||||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0,00 | 0,00 | 0,08 | 5,19 | 0,0779 | −0,0001 | |||

| V / Visa Inc. | 0,00 | 0,00 | 0,08 | 1,25 | 0,0777 | −0,0033 | |||

| US718172CV91 / Philip Morris International Inc | 0,08 | 0,00 | 0,0776 | −0,0042 | |||||

| US428236BR31 / Hewlett-packard Co 6.0% 09/15/2041 | 0,08 | 0,00 | 0,0767 | −0,0044 | |||||

| US756109BA12 / Realty Income Corp | 0,08 | 2,56 | 0,0765 | −0,0020 | |||||

| MC HENRY CNTY ILL 1 5 26GO UTX DUE 12/30/26 / MUNI BONDS (580818GH9) | 0,08 | 0,0000 | |||||||

| VIRIDIAN MUN MGMT D 2 34DB UTX DUE 12/01/34OID / MUNI BONDS (92823PNH5) | 0,08 | 0,0000 | |||||||

| US143735YV47 / Carol Stream Park District | 0,08 | 0,00 | 0,0720 | −0,0043 | |||||

| CMDY / iShares U.S. ETF Trust - iShares Bloomberg Roll Select Commodity Strategy ETF | 0,00 | 0,00 | 0,08 | −2,60 | 0,0720 | −0,0062 | |||

| ORLAND PARK ILL 3 46DB UTX DUE 12/01/46 / MUNI BONDS (686356SP2) | 0,07 | 0,0000 | |||||||

| THE GOLDMAN SACHS G 1 25 DUE 12/21/25 / CORPORATE BONDS (38150AEL5) | 0,07 | 0,0000 | |||||||

| EE / Excelerate Energy, Inc. | 0,00 | 0,00 | 0,07 | 2,82 | 0,0698 | −0,0023 | |||

| CHANNAHON ILL FIRE 3 32DB UTX DUE 01/01/32 / MUNI BONDS (15913TAY6) | 0,07 | 0,0000 | |||||||

| GM / General Motors Company | 0,00 | 0,21 | 0,07 | 4,41 | 0,0682 | −0,0005 | |||

| BUD / Anheuser-Busch InBev SA/NV - Depositary Receipt (Common Stock) | 0,00 | 0,00 | 0,07 | 10,94 | 0,0682 | 0,0037 | |||

| MONTGOMERY CNTY TEX 3 32GO UTX DUE 09/01/32OID / MUNI BONDS (61370PLX4) | 0,07 | 0,0000 | |||||||

| INTF / iShares Trust - iShares International Equity Factor ETF | 0,00 | 0,00 | 0,07 | 11,11 | 0,0674 | 0,0033 | |||

| LAKE CNTY ILL WTR & 2 31WRSR UTIL DUE 12/01/31 / MUNI BONDS (509300WF2) | 0,07 | 0,0000 | |||||||

| HARRIS CNTY TEX MUN 2 25DB UTX DUE 09/01/25 / MUNI BONDS (414199PD5) | 0,07 | 0,0000 | |||||||

| ILLINOIS HSG DEV 0 9 28SING HSG DUE 10/01/28XTRO / MUNI BONDS (45201Y7U5) | 0,07 | 0,0000 | |||||||

| SPHD / Invesco Exchange-Traded Fund Trust II - Invesco S&P 500 High Dividend Low Volatility ETF | 0,00 | 0,00 | 0,06 | −5,88 | 0,0617 | −0,0071 | |||

| CHARLOTTE N C 2 34GO UTX DUE 06/01/34 / MUNI BONDS (161035LL2) | 0,06 | 0,0000 | |||||||

| VIRIDIAN MUN MGMT D 1 29DB UTX DUE 12/01/29OID / MUNI BONDS (92823PML7) | 0,06 | 0,0000 | |||||||

| TEXAS ST UNIV SYS F 3 34PUB EDUC DUE 03/15/34 / MUNI BONDS (88278PC69) | 0,06 | 0,0000 | |||||||

| US66285WBT27 / North Texas Tollway Authority, Series 2008 D, Ref. RB | 0,06 | 1,69 | 0,0572 | −0,0023 | |||||

| US718546AZ72 / PHILLIPS 66 1.3% 02/15/2026 | 0,06 | 0,00 | 0,0558 | −0,0028 | |||||

| LOWER COLO RIV AUTH 4 40ELEC UTIL DUE 05/15/40OID ASSURED GUARANTY MUN / MUNI BONDS (54811BPV7) | 0,06 | 0,0000 | |||||||

| F / Ford Motor Company | 0,01 | −0,49 | 0,06 | 7,55 | 0,0549 | 0,0010 | |||

| ACWX / iShares Trust - iShares MSCI ACWI ex U.S. ETF | 0,00 | −8,08 | 0,06 | 0,00 | 0,0541 | −0,0025 | |||

| THE GOLDMAN SACH 4 75 33 DUE 08/15/33 / CORPORATE BONDS (38143CDS7) | 0,06 | 0,0000 | |||||||

| AMLP / ALPS ETF Trust - Alerian MLP ETF | 0,00 | 0,00 | 0,06 | −5,08 | 0,0535 | −0,0066 | |||

| ACWI / iShares Trust - iShares MSCI ACWI ETF | 0,00 | −31,65 | 0,06 | −24,66 | 0,0529 | −0,0211 | |||

| US785592AS57 / SABINE PASS LIQUEFACTION LLC SR SECURED 03/27 5 | 0,06 | 0,00 | 0,0527 | −0,0029 | |||||

| US969457CH11 / Williams Cos Inc/The | 0,06 | 0,00 | 0,0526 | −0,0031 | |||||

| US89352HAT68 / TransCanada PipeLines Ltd | 0,06 | 0,00 | 0,0524 | −0,0029 | |||||

| GAB.PRK / The Gabelli Equity Trust Inc. - Preferred Stock | 0,00 | 0,00 | 0,05 | −3,64 | 0,0508 | −0,0047 | |||

| BRANCH CNTY MICH BL 4 32REV UTX DUE 05/01/32 / MUNI BONDS (105173MF2) | 0,05 | 0,0000 | |||||||

| US65339KBW99 / NextEra Energy Capital Holdings Inc | 0,05 | 2,00 | 0,0488 | −0,0021 | |||||

| AMT / American Tower Corporation | 0,00 | 0,00 | 0,05 | 2,00 | 0,0486 | −0,0019 | |||

| CHAMBERS CNTY TEX I 4 29GO UTX DUE 09/01/29 / MUNI BONDS (157792QM7) | 0,05 | 0,0000 | |||||||

| US04052FCC77 / AZ INDL DEV AUTH -A | 0,05 | 0,00 | 0,0483 | −0,0026 | |||||

| KING CNTY WASH HSG 4 27MULT HSG DUE 08/01/27 / MUNI BONDS (494762NT0) | 0,05 | 0,0000 | |||||||

| FOND DU LAC WIS WTR 4 26WTR UTIL DUE 09/01/26 / MUNI BONDS (344532MH6) | 0,05 | 0,0000 | |||||||

| US682680BH51 / ONEOK Inc | 0,05 | 0,00 | 0,0482 | −0,0027 | |||||

| KENTUCKY INC KY PUB 4 29OILG IDR DUE 08/01/29XTRO / MUNI BONDS (74440DDP6) | 0,05 | 0,0000 | |||||||

| US45203H7X49 / ILLINOIS ST FIN AUTH REVENUE | 0,05 | 0,00 | 0,0479 | −0,0029 | |||||

| ROYAL BANK OF CA5 2 28F DUE 04/17/28 / FOREIGN BONDS (US $) (78014RMC1) | 0,05 | 0,0000 | |||||||

| US064159HB54 / Bank of Nova Scotia (Halifax, NS) Bond | 0,05 | 0,00 | 0,0476 | −0,0026 | |||||

| AAPL / Apple Inc. | 0,00 | −62,62 | 0,05 | −65,97 | 0,0475 | −0,0977 | |||

| US41415WCM29 / Harris County Hospital District | 0,05 | 0,00 | 0,0475 | −0,0018 | |||||

| US12503MAA62 / Cboe Global Markets Inc | 0,05 | 0,00 | 0,0472 | −0,0025 | |||||

| KELLER TEX 2 26GO LTX DUE 02/15/26 / MUNI BONDS (487685BB4) | 0,05 | 0,0000 | |||||||

| US882555ZN87 / TX MUNI PWR AGY AGM 3.0% 09-01-30 | 0,05 | 0,0472 | 0,0472 | ||||||

| KERRVILLE TEX 3 375 32DB LTX DUE 08/15/32 / MUNI BONDS (492422PD6) | 0,05 | 0,0000 | |||||||

| SOUTH BROWARD HO 3 25 31SYST HLTH DUE 05/01/31OID XTRO / MUNI BONDS (836753MV2) | 0,05 | 0,0000 | |||||||

| US020002BH30 / Allstate Corp/The | 0,05 | 2,08 | 0,0468 | −0,0021 | |||||

| US05565QDH83 / BPLN 3.723 11/28/28 | 0,05 | 2,08 | 0,0468 | −0,0022 | |||||

| HOUSTON TEX INDPT S 4 38GO LTX DUE 02/15/38 / MUNI BONDS (442403LG4) | 0,05 | 0,0000 | |||||||

| US6789084A98 / OKLAHOMA ST DEV FIN AUTH OKSDEV 02/45 FIXED 4.851 | 0,05 | −2,04 | 0,0466 | −0,0029 | |||||

| LUBBOCK COOPER TEX 2 27GO UTX DUE 02/15/27 / MUNI BONDS (549108XU7) | 0,05 | 0,0000 | |||||||

| US05723KAE01 / Baker Hughes, a GE Co., LLC/Baker Hughes Co-Obligor, Inc. | 0,05 | 0,00 | 0,0465 | −0,0026 | |||||

| ROCKETT TEX SPL U 3 1 30WTR UTIL DUE 07/10/30ASSURED GUARANTY MUN / MUNI BONDS (773138GW6) | 0,05 | 0,0000 | |||||||

| LIBERTY TEX 2 27GO LTX DUE 03/01/27 / MUNI BONDS (531286NM0) | 0,05 | 0,0000 | |||||||

| US89114TZN52 / Toronto-Dominion Bank/The | 0,05 | 2,13 | 0,0460 | −0,0020 | |||||

| CITIGROUP INC 3 27 DUE 12/31/27 / CORPORATE BONDS (17298CH35) | 0,05 | 0,0000 | |||||||

| PSA.PRL / Public Storage - Preferred Stock | 0,00 | 0,00 | 0,05 | −4,08 | 0,0452 | −0,0042 | |||

| JOHNSON CNTY KAN 2 25 29WTR UTIL DUE 07/01/29OID / MUNI BONDS (47875PCE5) | 0,05 | 0,0000 | |||||||

| GENERAL ELECTRIC CO 4 32 DUE 06/15/32 / CORPORATE BONDS (36966TKS0) | 0,05 | 0,0000 | |||||||

| US828807DF17 / Simon Property Group LP | 0,05 | 2,22 | 0,0441 | −0,0019 | |||||

| SUB / iShares Trust - iShares Short-Term National Muni Bond ETF | 0,00 | 0,00 | 0,05 | 2,22 | 0,0440 | −0,0021 | |||

| BRIDGESTONE MUN UTI 3 33DB UTX DUE 05/01/33OID / MUNI BONDS (108443SA1) | 0,05 | 0,0000 | |||||||

| MIDWEST CITY OKL 4 25 38RTL IDR DUE 02/01/38XTRO TAXBL / MUNI BONDS (598292AR1) | 0,05 | 0,0000 | |||||||

| TULSA CNTY OKLA IND 4 29FAC BLDG DUE 02/01/29XTRO / MUNI BONDS (899521CD8) | 0,05 | 0,0000 | |||||||

| US743820AA01 / Providence St Joseph Health Obligated Group | 0,05 | 2,22 | 0,0438 | −0,0021 | |||||

| TMUS / T-Mobile US, Inc. | 0,00 | 0,00 | 0,05 | −11,76 | 0,0435 | −0,0079 | |||

| US502431AP47 / L3Harris Technologies, Inc. | 0,05 | 0,00 | 0,0435 | −0,0024 | |||||

| NORTH CAROLINA H 1 45 30SING HSG DUE 01/01/30XTRO / MUNI BONDS (658207K79) | 0,05 | 0,0000 | |||||||

| SAN JACINTO TEX R 4 5 27WTR UTIL DUE 10/01/27OID ASSURED GUARANTY MUN / MUNI BONDS (798055MU0) | 0,05 | 0,0000 | |||||||

| JOHNSTON CNTY N C 1 5 30GO UTX DUE 02/01/30 / MUNI BONDS (479340WP2) | 0,05 | 0,0000 | |||||||

| US126650DS68 / CVS Health Corp | 0,04 | −2,22 | 0,0428 | −0,0025 | |||||

| THE GOLDMAN SACHS G 2 29 DUE 08/30/29 / CORPORATE BONDS (38150AHF5) | 0,04 | 0,0000 | |||||||

| US34074MUF66 / Florida Housing Finance Corp | 0,04 | 2,33 | 0,0422 | −0,0014 | |||||

| DALLAS TEX WTRW 3 125 32WRSR UTIL DUE 10/01/32OID / MUNI BONDS (2354164Y7) | 0,04 | 0,0000 | |||||||

| GREENSBORO N C 1 671 31PKG BLDG DUE 11/01/31TAXBL / MUNI BONDS (395476EN0) | 0,04 | 0,0000 | |||||||

| BRUSHY CREEK MUN 2 25 33GO UTX DUE 06/01/33OID / MUNI BONDS (117464TU1) | 0,04 | 0,0000 | |||||||

| FORT BEND CNTY T 2 75 35GO UTX DUE 09/01/35OID / MUNI BONDS (34680CES4) | 0,04 | 0,0000 | |||||||

| OKLAHOMA DEV FIN AU 4 29IMPT EDUC DUE 06/01/29XTRO / MUNI BONDS (67884GEZ3) | 0,04 | 0,0000 | |||||||

| US92939UAJ51 / WEC Energy Group, Inc. | 0,04 | 0,00 | 0,0388 | −0,0020 | |||||

| US46817MAR88 / Jackson Financial Inc | 0,04 | 0,00 | 0,0385 | −0,0019 | |||||

| LAKES FRESH WTR SUP 2 33GO UTX DUE 09/01/33 / MUNI BONDS (51207MCN3) | 0,04 | 0,0000 | |||||||

| FLORIDA HSG FIN 1 75 33SING HSG DUE 07/01/33XTRO / MUNI BONDS (34074MXR7) | 0,04 | 0,0000 | |||||||

| US816851BQ16 / Sempra Energy | 0,04 | 0,00 | 0,0384 | −0,0021 | |||||

| US6174467X10 / Morgan Stanley | 0,04 | 0,00 | 0,0381 | −0,0022 | |||||

| US756109AZ71 / Realty Income Corp | 0,04 | 0,00 | 0,0371 | −0,0017 | |||||

| US920494FQ98 / VAN ALSTYNE-CTFS OBLI | 0,04 | 0,00 | 0,0369 | −0,0016 | |||||

| O / Realty Income Corporation | 0,00 | 0,00 | 0,04 | 0,00 | 0,0366 | −0,0023 | |||

| US796334AS99 / SAN ANTONIO TX PUB FACS CORP LEASE REVENUE | 0,04 | 0,00 | 0,0363 | −0,0021 | |||||

| STLA / Stellantis N.V. | 0,00 | 0,00 | 0,04 | −11,90 | 0,0362 | −0,0065 | |||

| THE GOLDMAN SACH 1 65 27 DUE 06/10/27 / CORPORATE BONDS (38150AGC3) | 0,04 | 0,0000 | |||||||

| US123425HE38 / BUTLER CNTY KS UNIF SCH DIST #375 TOWANDA | 0,04 | 2,78 | 0,0356 | −0,0014 | |||||

| ICAGY / International Consolidated Airlines Group S.A. - Depositary Receipt (Common Stock) | 0,00 | 0,00 | 0,04 | 42,31 | 0,0354 | 0,0084 | |||

| US95040QAN43 / Welltower Inc | 0,04 | 0,00 | 0,0352 | −0,0014 | |||||

| US06406RAZ01 / Bank of New York Mellon Corp. (The), Series J | 0,04 | 0,00 | 0,0351 | −0,0016 | |||||

| OPP.PRB / RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. - Preferred Stock | 0,00 | 0,00 | 0,04 | −7,69 | 0,0351 | −0,0049 | |||

| US254687FL52 / Walt Disney Co/The | 0,04 | 0,00 | 0,0350 | −0,0013 | |||||

| SPHQ / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Quality ETF | 0,00 | 0,00 | 0,04 | 5,88 | 0,0349 | 0,0006 | |||

| RTX / RTX Corporation | 0,00 | 0,00 | 0,04 | 9,09 | 0,0349 | 0,0015 | |||

| IBDY / iShares Trust - iShares iBonds Dec 2033 Term Corporate ETF | 0,00 | 0,04 | 0,0345 | 0,0345 | |||||

| LOVE CNTY OKLA EDL 4 28LEAS SCH DUE 12/01/28XTRO / MUNI BONDS (54713PBF5) | 0,04 | 0,0000 | |||||||

| US06368LGV27 / Bank of Montreal | 0,04 | 0,00 | 0,0341 | −0,0017 | |||||

| US92857WBK53 / Vodafone Group PLC | 0,04 | 0,00 | 0,0339 | −0,0016 | |||||

| BOSSIER PARISH LA P 4 29GO UTX DUE 03/01/29 / MUNI BONDS (100272KE2) | 0,04 | 0,0000 | |||||||

| MISSION TEX REDEV A 4 27TAXI TAX DUE 09/01/27 / MUNI BONDS (605171BS5) | 0,04 | 0,0000 | |||||||

| JPMORGAN CHASE B 4 55 25CD FDIC INS DUE 11/19/25US / CERTIFICATE DEPOSIT (46657VPW4) | 0,04 | 0,0000 | |||||||

| SANTANDER BANK, 4 35 25CD FDIC INS DUE 08/15/25US / CERTIFICATE DEPOSIT (80280JYM7) | 0,03 | 0,0000 | |||||||

| TRUIST BANK 4 25 25CD FDIC INS DUE 09/05/25US / CERTIFICATE DEPOSIT (89788HJD6) | 0,03 | 0,0000 | |||||||

| US843646AM23 / Southern Power Co | 0,03 | 0,00 | 0,0333 | −0,0018 | |||||

| WOORI AMERICA BA 4 25 25CD FDIC INS DUE 10/28/25US / CERTIFICATE DEPOSIT (981059DR6) | 0,03 | 0,0000 | |||||||

| TSLA / Tesla, Inc. | 0,00 | −10,57 | 0,03 | 9,68 | 0,0333 | 0,0012 | |||

| BANK OF AMERICA, 4 05 26CD FDIC INS DUE 02/09/26US / CERTIFICATE DEPOSIT (06051XUU4) | 0,03 | 0,0000 | |||||||

| VTWO / Vanguard Scottsdale Funds - Vanguard Russell 2000 ETF | 0,00 | 0,03 | 0,0332 | 0,0332 | |||||

| US54811BQU88 / LOWER CO RIVER TX AUTH TRANSMISSION 4.0% 05-15-35 | 0,03 | 0,00 | 0,0332 | −0,0013 | |||||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0,00 | 23 333,33 | 0,03 | 0,0331 | 0,0330 | ||||

| CHAMBERS CNTY TE 3 75 28GO UTX DUE 09/01/28 / MUNI BONDS (157792KH4) | 0,03 | 0,0000 | |||||||

| US230614NX31 / Cumberland County Municipal Authority | 0,03 | 0,00 | 0,0329 | −0,0018 | |||||

| US343412AF90 / Fluor Corp | 0,03 | 3,03 | 0,0327 | −0,0007 | |||||

| WICHITA KANS 2 33DB UTX DUE 06/01/33 / MUNI BONDS (967245UJ8) | 0,03 | 0,0000 | |||||||

| INDA / iShares Trust - iShares MSCI India ETF | 0,00 | 0,00 | 0,03 | 10,00 | 0,0318 | 0,0008 | |||

| BBAR / Banco BBVA Argentina S.A. - Depositary Receipt (Common Stock) | 0,00 | 0,00 | 0,03 | −11,11 | 0,0313 | −0,0051 | |||

| XSLV / Invesco Exchange-Traded Fund Trust II - Invesco S&P SmallCap Low Volatility ETF | 0,00 | −30,31 | 0,03 | −30,43 | 0,0307 | −0,0165 | |||

| GOLDMAN SACHS BA 4 75 25CD FDIC INS DUE 07/30/25US / CERTIFICATE DEPOSIT (38150VWC9) | 0,03 | 0,0000 | |||||||

| PG / The Procter & Gamble Company | 0,00 | 0,00 | 0,03 | −8,82 | 0,0303 | −0,0039 | |||

| LAKE CNTY ILL WTR & 2 30WRSR UTIL DUE 12/01/30 / MUNI BONDS (509300WE5) | 0,03 | 0,0000 | |||||||

| US30225VAK35 / Extra Space Storage LP | 0,03 | 3,33 | 0,0296 | −0,0015 | |||||

| US78355HKV05 / Ryder System Inc | 0,03 | 0,00 | 0,0295 | −0,0015 | |||||

| US718172DA46 / Philip Morris International Inc | 0,03 | 0,00 | 0,0294 | −0,0013 | |||||

| BLACKMAN TWP MICH 4 32GO UTX DUE 05/01/32 / MUNI BONDS (092446CB7) | 0,03 | 0,0000 | |||||||

| US29379VCC54 / Enterprise Products Operating LLC | 0,03 | 0,00 | 0,0286 | −0,0017 | |||||

| UCF STAD CORP FLA 3 5 32FAC EDUC DUE 03/01/32OID / MUNI BONDS (90350TAS2) | 0,03 | 0,0000 | |||||||

| JPMORGAN CHASE BA 4 6 25CD FDIC INS DUE 12/19/25US / CERTIFICATE DEPOSIT (46657VPX2) | 0,03 | 0,0000 | |||||||

| VTIP / Vanguard Malvern Funds - Vanguard Short-Term Inflation-Protected Securities ETF | 0,00 | 0,00 | 0,03 | 0,00 | 0,0284 | −0,0014 | |||

| US594612BS17 / State of Michigan | 0,03 | 0,00 | 0,0284 | −0,0015 | |||||

| US04686JAA97 / Athene Holding Ltd | 0,03 | 0,00 | 0,0282 | −0,0014 | |||||

| TULSA OKLA ARPTS 3 5 27AIR TRAN DUE 06/01/27XTRO TAXBL / MUNI BONDS (899647RM5) | 0,03 | 0,0000 | |||||||

| JPM / JPMorgan Chase & Co. | 0,00 | 0,00 | 0,03 | 16,67 | 0,0276 | 0,0029 | |||

| US46647PCP99 / JPMorgan Chase & Co | 0,03 | 0,00 | 0,0275 | −0,0013 | |||||

| US59523UAT43 / MID-AMERICA APARTMENTS LP | 0,03 | 0,00 | 0,0275 | −0,0012 | |||||

| US41401PCT84 / Harris County TX Cultural Education Facilities Finance Corp. Thermal Utility Revenue (TECO Project) | 0,03 | −3,45 | 0,0275 | −0,0021 | |||||

| CVX / Chevron Corporation | 0,00 | 0,00 | 0,03 | −15,15 | 0,0273 | −0,0064 | |||

| NORMAN OKLA 2 25 30GO UTX DUE 06/01/30OID / MUNI BONDS (656168RB9) | 0,03 | 0,0000 | |||||||

| JPMORGAN CHASE & CO 2 28 DUE 11/14/28 / CORPORATE BONDS (48128G3L2) | 0,03 | 0,0000 | |||||||

| U S BANK NTNL AS 4 3 26CD FDIC INS DUE 01/02/26US / CERTIFICATE DEPOSIT (90355UKC8) | 0,03 | 0,0000 | |||||||

| US682680BK80 / ONEOK Inc | 0,03 | 0,00 | 0,0249 | −0,0015 | |||||

| US341081GK75 / Florida Power & Light Co. | 0,03 | 0,00 | 0,0244 | −0,0012 | |||||

| US117510BL09 / Bryan County School Finance Authority, Oklahoma, Educational Facilities Lease Revenue Bonds, Durant Public Schools Project, Refunding Series 2020 | 0,03 | 0,00 | 0,0242 | −0,0014 | |||||

| US143735YT90 / Carol Stream Park District | 0,03 | 0,00 | 0,0241 | −0,0015 | |||||

| EAT / Brinker International, Inc. | 0,00 | 0,03 | 0,0240 | 0,0240 | |||||

| NEW HANOVER CNT 3 125 33HOSP HLTH DUE 10/01/33OID XTRO / MUNI BONDS (644804FE1) | 0,03 | 0,0000 | |||||||

| US882722VP38 / TEXAS ST STATE OF TEXAS | 0,03 | 4,17 | 0,0239 | −0,0009 | |||||

| VT / Vanguard International Equity Index Funds - Vanguard Total World Stock ETF | 0,00 | 29,14 | 0,03 | 47,06 | 0,0239 | 0,0063 | |||

| COP / ConocoPhillips | 0,00 | 0,00 | 0,03 | −13,79 | 0,0238 | −0,0056 | |||

| COLUMBUS CNTY N C L 4 32WRSR UTIL DUE 06/01/32 / MUNI BONDS (199049AU1) | 0,03 | 0,0000 | |||||||

| HARRIS CNTY TEX MUN 3 28GO UTX DUE 09/01/28 / MUNI BONDS (413910ED8) | 0,02 | 0,0000 | |||||||

| US172967KG57 / CITIGROUP INC SR UNSECURED 01/26 3.7 | 0,02 | 0,00 | 0,0237 | −0,0013 | |||||

| TULSA OKLA INDL 3 75 26UNIV EDUC DUE 10/01/26OID / MUNI BONDS (89965QAZ1) | 0,02 | 0,0000 | |||||||

| US822582BT82 / Shell Interntn Bond | 0,02 | 0,00 | 0,0235 | −0,0012 | |||||

| HOLLAND MICH 3 35 27GO LTX DUE 12/01/27TAXBL / MUNI BONDS (435164TX6) | 0,02 | 0,0000 | |||||||

| XOM / Exxon Mobil Corporation | 0,00 | 0,00 | 0,02 | −11,11 | 0,0234 | −0,0039 | |||

| GGT.PRE / The Gabelli Multimedia Trust Inc. - Preferred Security | 0,00 | 0,00 | 0,02 | 0,00 | 0,0234 | −0,0015 | |||

| US89114QCP19 / Toronto-Dominion Bank/The | 0,02 | 0,00 | 0,0233 | −0,0011 | |||||

| LANSING MICH TA 3 655 29DB UTX DUE 06/01/29TAXBL / MUNI BONDS (516447CC1) | 0,02 | 0,0000 | |||||||

| US483233RK04 / KALAMAZOO HOSP-UNREFD | 0,02 | 0,00 | 0,0232 | −0,0011 | |||||

| GEORGIA ST HSG & 2 45 28SING HSG DUE 12/01/28XTRO / MUNI BONDS (37353PCV9) | 0,02 | 0,0000 | |||||||

| FORD MOTOR CREDIT C 4 27 DUE 08/20/27 / CORPORATE BONDS (34540TRS3) | 0,02 | 0,0000 | |||||||

| T / AT&T Inc. | 0,00 | 0,00 | 0,02 | 4,35 | 0,0230 | −0,0007 | |||

| US65339KBY55 / NextEra Energy Capital Holdings Inc | 0,02 | 4,35 | 0,0230 | −0,0011 | |||||

| US546399DP82 / LOUISIANA PUB FACS AUTH REVENUE | 0,02 | 0,00 | 0,0228 | −0,0009 | |||||

| UNIVERSITY OKLA REV 3 33PUB EDUC DUE 07/01/33OID / MUNI BONDS (91476PRV2) | 0,02 | 0,0000 | |||||||

| LLY / Eli Lilly and Company | 0,00 | 0,00 | 0,02 | −4,17 | 0,0223 | −0,0026 | |||

| US91476PNP98 / UNIVERSITY OF OKLAHOMA/THE | 0,02 | 0,00 | 0,0222 | −0,0013 | |||||

| THE GOLDMAN SACH 1 55 27 DUE 07/29/27 / CORPORATE BONDS (38150AH24) | 0,02 | 0,0000 | |||||||

| US92340LAH24 / VEREIT OPER PARTNERSHIP LP 2.2% 06/15/2028 | 0,02 | 4,55 | 0,0219 | −0,0008 | |||||

| PRUDENTIAL FINL, 4 05 34 DUE 11/15/34 / CORPORATE BONDS (74432AYZ7) | 0,02 | 0,0000 | |||||||

| ALLY BANK 3 3 25CD FDIC INS DUE 12/23/25US / CERTIFICATE DEPOSIT (02007GTY9) | 0,02 | 0,0000 | |||||||

| OKLAHOMA ST WTR RES 3 35WRSR UTIL DUE 10/01/35OID XTRO / MUNI BONDS (67920QLY2) | 0,02 | 0,0000 | |||||||

| GDV.PRH / The Gabelli Dividend & Income Trust - Preferred Stock | 0,00 | 0,00 | 0,02 | −4,35 | 0,0217 | −0,0023 | |||

| SO / The Southern Company | 0,00 | 0,00 | 0,02 | 0,00 | 0,0212 | −0,0012 | |||

| US906400FQ41 / UNION CO -REV | 0,02 | 4,76 | 0,0210 | −0,0007 | |||||

| BANK OF AMERICA, NT 4 26CD FDIC INS DUE 01/02/26US / CERTIFICATE DEPOSIT (06051XMG4) | 0,02 | 0,0000 | |||||||

| KANNAPOLIS N C 2 153 33PKG DUE 04/01/33TAXBL / MUNI BONDS (484580CL7) | 0,02 | 0,0000 | |||||||

| LVMUY / LVMH Moët Hennessy - Louis Vuitton, Société Européenne - Depositary Receipt (Common Stock) | 0,00 | 0,02 | 0,0200 | 0,0200 | |||||

| CARTER CNTY OKLA PU 4 29LEAS SCH DUE 12/01/29XTRO / MUNI BONDS (146201EQ7) | 0,02 | 0,0000 | |||||||

| US89236TKL88 / TOYOTA MOTOR CREDIT CORP | 0,02 | 0,00 | 0,0196 | −0,0011 | |||||

| US26441CBW47 / Duke Energy Corp | 0,02 | 0,00 | 0,0194 | −0,0010 | |||||

| MS / Morgan Stanley | 0,00 | 0,00 | 0,02 | 25,00 | 0,0192 | 0,0024 | |||

| ONEOK, INC 5 26 DUE 03/01/26 / CORPORATE BONDS (682680BR3) | 0,02 | 0,0000 | |||||||

| PSA.PRG / Public Storage - Preferred Stock | 0,00 | 0,00 | 0,02 | 0,00 | 0,0191 | −0,0020 | |||

| ROYAL BANK OF C5 25 28F DUE 04/28/28 / FOREIGN BONDS (US $) (78014RMN7) | 0,02 | 0,0000 | |||||||

| WILMINGTON N C 4 1 32GO UTX DUE 06/01/32TAXBL / MUNI BONDS (971668N95) | 0,02 | 0,0000 | |||||||

| LANCASTER TEX 4 35GO LTX DUE 02/15/35 / MUNI BONDS (514444ZJ0) | 0,02 | 0,0000 | |||||||

| SCAGO EDL FACS 4 118 26IMPT SCH DUE 12/01/26XTRO TAXBL BUILD AMERICA / MUNI BONDS (80585RAS4) | 0,02 | 0,0000 | |||||||

| GRAND RIVER DAM AUT 4 38ELEC UTIL DUE 06/01/38 / MUNI BONDS (386442WY9) | 0,02 | 0,0000 | |||||||

| RICHMOND CNTY GA HO 3 32SYST HLTH DUE 01/01/32OID XTRO / MUNI BONDS (764603BR6) | 0,02 | 0,0000 | |||||||

| NEW HAVEN MICH C 2 76 27GO UTX DUE 05/01/27TAXBL / MUNI BONDS (645172LA3) | 0,02 | 0,0000 | |||||||

| UNIVERSITY HAWAI 3 65 31PUB EDUC DUE 10/01/31XTRO TAXBL / MUNI BONDS (91428LMF0) | 0,02 | 0,0000 | |||||||

| THE TORONTO-DOMI1 1 26F DUE 09/20/26 / FOREIGN BONDS (US $) (89114TR61) | 0,02 | 0,0000 | |||||||

| US38150AHN81 / Goldman Sachs Group, Inc. | 0,02 | 0,00 | 0,0182 | −0,0009 | |||||

| THE GOLDMAN SACHS G 2 28 DUE 12/15/28 / CORPORATE BONDS (38150AG90) | 0,02 | 0,0000 | |||||||

| ABBV / AbbVie Inc. | 0,00 | 0,00 | 0,02 | −10,53 | 0,0166 | −0,0032 | |||

| C / Citigroup Inc. | 0,00 | 0,00 | 0,02 | 21,43 | 0,0163 | 0,0019 | |||

| COUNCIL ROCK PA SCH 2 32GO LTX DUE 11/15/32 / MUNI BONDS (222263L78) | 0,02 | 0,0000 | |||||||

| KO / The Coca-Cola Company | 0,00 | 0,00 | 0,02 | −5,88 | 0,0162 | −0,0011 | |||

| PFE / Pfizer Inc. | 0,00 | 0,00 | 0,02 | −5,88 | 0,0162 | −0,0017 | |||

| US637432NW12 / National Rural Utilities Cooperative Finance Corp | 0,02 | 0,00 | 0,0160 | −0,0005 | |||||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0,00 | 0,00 | 0,02 | 14,29 | 0,0154 | 0,0007 | |||

| TRUIST BANK 4 3 26CD FDIC INS DUE 06/12/26US / CERTIFICATE DEPOSIT (89788HJU8) | 0,02 | 0,0000 | |||||||

| DD / DuPont de Nemours, Inc. | 0,00 | 0,00 | 0,02 | −11,76 | 0,0150 | −0,0022 | |||

| GSIE / Goldman Sachs ETF Trust - Goldman Sachs ActiveBeta International Equity ETF | 0,00 | 0,00 | 0,02 | 15,38 | 0,0148 | 0,0008 | |||

| AVONDALE MICH SCH D 4 32GO UTX DUE 05/01/32 / MUNI BONDS (054375UT5) | 0,02 | 0,0000 | |||||||

| SPLV / Invesco Exchange-Traded Fund Trust II - Invesco S&P 500 Low Volatility ETF | 0,00 | 0,00 | 0,02 | 0,00 | 0,0145 | −0,0012 | |||

| US89115A2S07 / Toronto-Dominion Bank (The) | 0,02 | 0,00 | 0,0145 | −0,0008 | |||||

| US47233JAG31 / Jefferies Group LLC / Jefferies Group Capital Finance Inc | 0,02 | 0,00 | 0,0144 | −0,0007 | |||||

| THE GOLDMAN SACH 5 25 26 DUE 09/15/26 / CORPORATE BONDS (38141ET82) | 0,02 | 0,0000 | |||||||

| DANSVILLE MICH SCHS 4 32GO UTX DUE 05/01/32 / MUNI BONDS (236388BN3) | 0,02 | 0,0000 | |||||||

| WELLS FARGO BANK 5 35 25CD FDIC INS DUE 11/21/25US / CERTIFICATE DEPOSIT (949764JD7) | 0,02 | 0,0000 | |||||||

| US682680BD48 / ONEOK Inc | 0,02 | 0,00 | 0,0143 | −0,0008 | |||||

| BANK OF AMERICA, 5 05 25CD FDIC INS DUE 09/29/25US / CERTIFICATE DEPOSIT (06051XBS0) | 0,02 | 0,0000 | |||||||

| US65339KBS87 / NextEra Energy Capital Holdings Inc | 0,02 | 0,00 | 0,0143 | −0,0008 | |||||

| GNT.PRA / GAMCO Natural Resources, Gold & Income Trust - Preferred Security | 0,00 | 0,00 | 0,02 | 0,00 | 0,0143 | −0,0010 | |||

| US91472TBH68 / University of North Carolina at Wilmington | 0,02 | 7,14 | 0,0143 | −0,0008 | |||||

| MORGAN STANLEY F 5 25 27 CALLED 100 EFF 10292025 / CORPORATE BONDS (61766YLS8) | 0,02 | 0,0000 | |||||||

| PORT FREEPORT T 4 125 32PA TRAN DUE 06/01/32OID / MUNI BONDS (73412PAS2) | 0,01 | 0,0000 | |||||||

| WELLS FARGO BANK 4 25 26CD FDIC INS DUE 03/11/26US / CERTIFICATE DEPOSIT (949764QN7) | 0,01 | 0,0000 | |||||||

| US015271AH27 / Alexandria Real Estate Equities Inc. | 0,01 | 0,00 | 0,0142 | −0,0008 | |||||

| UNIVERSITY OKLA R 2 9 26PUB EDUC DUE 07/01/26TAXBL / MUNI BONDS (91476PQU5) | 0,01 | 0,0000 | |||||||

| TOPEKA KANS 2 27DB UTX DUE 08/15/27 / MUNI BONDS (8905684J4) | 0,01 | 0,0000 | |||||||

| NEW ORLEANS LA 3 32GO UTX DUE 12/01/32 / MUNI BONDS (64763FWL9) | 0,01 | 0,0000 | |||||||

| KANSAS ST DEV FIN A 3 33PUB EDUC DUE 03/01/33OID XTRO / MUNI BONDS (4854292Q6) | 0,01 | 0,0000 | |||||||

| BANK OF AMERICA, 4 1 26CD FDIC INS DUE 01/15/26US / CERTIFICATE DEPOSIT (06051XNJ7) | 0,01 | 0,0000 | |||||||

| THE GOLDMAN SACHS G 2 28 DUE 05/17/28 / CORPORATE BONDS (38150AFQ3) | 0,01 | 0,0000 | |||||||

| KANSAS ST DEV F 3 125 35PUB EDUC DUE 03/01/35OID XTRO / MUNI BONDS (4854292S2) | 0,01 | 0,0000 | |||||||

| ILLINOIS HSG DEV 1 4 29SING HSG DUE 10/01/29XTRO / MUNI BONDS (45203MAS0) | 0,01 | 0,0000 | |||||||

| MORGAN STANLEY F STEP 29 DUE 10/29/29MULTI STEP CPN / CORPORATE BONDS (61766YGP0) | 0,01 | 0,0000 | |||||||

| US34959EAB56 / Fortinet Inc | 0,01 | 0,00 | 0,0126 | −0,0005 | |||||

| VWOB / Vanguard Whitehall Funds - Vanguard Emerging Markets Government Bond ETF | 0,00 | 0,01 | 0,0124 | 0,0124 | |||||

| WELLS FARGO BANK 5 25 25CD FDIC INS DUE 09/19/25US / CERTIFICATE DEPOSIT (949764FV1) | 0,01 | 0,0000 | |||||||

| CITIGROUP INC 2 32 DUE 08/18/32 / CORPORATE BONDS (17298CJY5) | 0,01 | 0,0000 | |||||||

| US354613AL54 / Franklin Resources, Inc. | 0,01 | 9,09 | 0,0115 | −0,0005 | |||||

| WELLS FARGO BANK 4 25 25CD FDIC INS DUE 12/05/25US / CERTIFICATE DEPOSIT (949764QH0) | 0,01 | 0,0000 | |||||||

| APPALACHIAN ST 3 375 32PUB EDUC DUE 07/15/32OID / MUNI BONDS (037777TG4) | 0,01 | 0,0000 | |||||||

| RIV.PRA / RiverNorth Opportunities Fund, Inc. - Preferred Stock | 0,00 | 0,00 | 0,01 | 0,00 | 0,0111 | −0,0007 | |||

| SCHG / Schwab Strategic Trust - Schwab U.S. Large-Cap Growth ETF | 0,00 | 0,00 | 0,01 | 22,22 | 0,0109 | 0,0010 | |||

| GUT.PRC / The Gabelli Utility Trust - Preferred Stock | 0,00 | 0,00 | 0,01 | −8,33 | 0,0107 | −0,0014 | |||

| US64972ELD93 / NEW YORK CITY NY HSG DEV CORP MF HSG REVENUE | 0,01 | −9,09 | 0,0102 | −0,0009 | |||||

| US682680BJ18 / ONEOK Inc | 0,01 | 0,00 | 0,0098 | −0,0005 | |||||

| US969457CK40 / WILLIAMS COMPANIES INC | 0,01 | 0,00 | 0,0098 | −0,0005 | |||||

| US13607LNG40 / Canadian Imperial Bank of Commerce | 0,01 | 0,00 | 0,0097 | −0,0005 | |||||

| US718547AT95 / Phillips 66 | 0,01 | 0,00 | 0,0097 | −0,0005 | |||||

| THE GOLDMAN SACHS G 5 30 DUE 11/15/30 / CORPORATE BONDS (38141E3S6) | 0,01 | 0,0000 | |||||||

| ALBANY-DOUGHERTY GA 4 32STHG EDUC DUE 06/01/32XTRO / MUNI BONDS (012173JC5) | 0,01 | 0,0000 | |||||||

| CLINTON OKLA PUB WK 4 34LEAS SCH DUE 10/01/34OID XTRO / MUNI BONDS (188411AT9) | 0,01 | 0,0000 | |||||||

| OK DFA LSE 4 28IMPT EDUC DUE 06/01/28XTRO / MUNI BONDS (67884FU95) | 0,01 | 0,0000 | |||||||

| US386316ND10 / GRAND RAPID WTR 5% 1/1/36 | 0,01 | 0,00 | 0,0096 | −0,0006 | |||||

| US16412XAG07 / CHENIERE CORP CHRISTI HD SR SECURED 06/27 5.125 | 0,01 | 0,00 | 0,0096 | −0,0005 | |||||

| US3599008A89 / Fulton County GA Development Authority Revenue (Piedmont Healthcare Inc. Project) | 0,01 | 0,00 | 0,0096 | −0,0005 | |||||

| MAINE MUN BD BK 5 093 25MUBB DUE 11/01/25XTRO TAXBL / MUNI BONDS (5604595E5) | 0,01 | 0,0000 | |||||||

| JPMORGAN CHASE FI 5 2 28 DUE 04/28/28 / CORPORATE BONDS (48133U5X6) | 0,01 | 0,0000 | |||||||

| NEW ORLEANS LA 3 625 31GO UTX DUE 12/01/31OID / MUNI BONDS (64763FVN6) | 0,01 | 0,0000 | |||||||

| US751435AL24 / Ramapo Local Development Corp | 0,01 | 11,11 | 0,0095 | −0,0005 | |||||

| THE GOLDMAN SACHS G 5 27 DUE 09/15/27 / CORPORATE BONDS (38150AP58) | 0,01 | 0,0000 | |||||||

| US346668DH65 / FORSYTH MT POLL CONTROL REVENUE | 0,01 | 0,00 | 0,0095 | −0,0004 | |||||

| US429326ZV69 / HIDALGO CNTY TX | 0,01 | 0,00 | 0,0095 | −0,0004 | |||||

| UNIVERSITY N C 2 479 25PUB EDUC DUE 12/01/25XTRO TAXBL / MUNI BONDS (914713N65) | 0,01 | 0,0000 | |||||||

| FORT BEND CNTY TEX 3 28GO UTX DUE 09/01/28OID BUILD AMERICA MUTUAL / MUNI BONDS (34683CJK3) | 0,01 | 0,0000 | |||||||

| OTTAWA CNTY MICH 3 7 28GO LTX DUE 11/01/28OID TAXBL / MUNI BONDS (689225TT7) | 0,01 | 0,0000 | |||||||

| US345370CR99 / Ford Motor Comp Bond | 0,01 | 0,00 | 0,0094 | −0,0005 | |||||

| US679191KP09 / OK AGRIC & MECH CLGS | 0,01 | 0,00 | 0,0093 | −0,0007 | |||||

| US55178CAG87 / LYNWOOD CA HSG AUTH REVENUE | 0,01 | 0,00 | 0,0093 | −0,0005 | |||||

| WILMINGTON N C L 1 13 26FAC REC DUE 06/01/26TAXBL / MUNI BONDS (971697JK4) | 0,01 | 0,0000 | |||||||

| US05463HAB78 / AXIS Specialty Finance LLC | 0,01 | 0,00 | 0,0092 | −0,0004 | |||||

| WESTERN CAROLINA UN 4 39STHG EDUC DUE 06/01/39XTRO / MUNI BONDS (957897JU6) | 0,01 | 0,0000 | |||||||

| UNIVERSITY OKLA 3 75 33PUB EDUC DUE 07/01/33OID / MUNI BONDS (91476PKV9) | 0,01 | 0,0000 | |||||||

| OKLAHOMA ST WTR 3 125 34POOL AUTH DUE 04/01/34OID XTRO / MUNI BONDS (67919PMJ9) | 0,01 | 0,0000 | |||||||

| THE GOLDMAN SACHS G 1 26 DUE 08/17/26 / CORPORATE BONDS (38150AET8) | 0,01 | 0,0000 | |||||||

| US13063BN814 / State of California | 0,01 | 0,00 | 0,0091 | −0,0006 | |||||

| BKLN / Invesco Exchange-Traded Fund Trust II - Invesco Senior Loan ETF | 0,00 | 0,00 | 0,01 | 0,00 | 0,0091 | −0,0004 | |||

| US276480AH30 / Eastern Gas Transmission & Storage Inc | 0,01 | 0,00 | 0,0090 | −0,0004 | |||||

| COLUMBUS CNTY N C 3 5 35WRSR UTIL DUE 06/01/35OID / MUNI BONDS (199049AR8) | 0,01 | 0,0000 | |||||||

| GREENSBORO N C L 1 67 28REV UTX DUE 04/01/28TAXBL / MUNI BONDS (395476FU3) | 0,01 | 0,0000 | |||||||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0,00 | 0,00 | 0,01 | 28,57 | 0,0089 | 0,0009 | |||

| GENERAL ELECTRIC CO 4 32 DUE 07/15/32 / CORPORATE BONDS (36966TKV3) | 0,01 | 0,0000 | |||||||

| SEDGWICK CNTY KANS 3 34GO UTX DUE 11/01/34 / MUNI BONDS (815645PK6) | 0,01 | 0,0000 | |||||||

| US548661DX22 / Lowe's Cos Inc | 0,01 | 0,00 | 0,0088 | −0,0003 | |||||

| US94106LBQ14 / Waste Management Inc | 0,01 | 0,00 | 0,0088 | −0,0003 | |||||

| WILMINGTON N C L 1 88 29FAC REC DUE 06/01/29TAXBL / MUNI BONDS (971697JN8) | 0,01 | 0,0000 | |||||||

| BUNCOMBE CNTY N C 2 4 30REV LTX DUE 06/01/30TAXBL / MUNI BONDS (120525HY9) | 0,01 | 0,0000 | |||||||

| NORTH CAROLINA CENT 3 34PUB EDUC DUE 10/01/34OID / MUNI BONDS (65819PCL0) | 0,01 | 0,0000 | |||||||

| US880461W380 / Tennessee Housing Development Agency | 0,01 | 12,50 | 0,0086 | −0,0003 | |||||

| US174610AS45 / Citizens Financial Group Inc | 0,01 | 12,50 | 0,0086 | −0,0003 | |||||

| JPMORGAN CHASE & CO 2 28 DUE 12/24/28 / CORPORATE BONDS (48128G3E8) | 0,01 | 0,0000 | |||||||

| WELLS FARGO BANK, 4 2 25CD FDIC INS DUE 12/31/25US / CERTIFICATE DEPOSIT (949764QV9) | 0,01 | 0,0000 | |||||||

| WELLS FARGO BANK 4 25 26CD FDIC INS DUE 03/05/26US / CERTIFICATE DEPOSIT (949764QJ6) | 0,01 | 0,0000 | |||||||

| CITIGROUP INC 3 31 DUE 08/30/31 / CORPORATE BONDS (17298CH76) | 0,01 | 0,0000 | |||||||

| WELLS FARGO & CO STEP 29 DUE 10/31/29MULTI STEP CPN / CORPORATE BONDS (95001DAY6) | 0,01 | 0,0000 | |||||||

| US81762PAE25 / SERVICENOW INC 1.4% 09/01/2030 | 0,01 | 0,00 | 0,0082 | −0,0002 | |||||

| OKLAHOMA AGRIC 4 347 47PUB EDUC DUE 08/01/47TAXBL / MUNI BONDS (678505JP4) | 0,01 | 0,0000 | |||||||

| US74340XBR17 / Prologis LP | 0,01 | 0,00 | 0,0081 | −0,0003 | |||||

| US423452AG66 / Helmerich & Payne Inc | 0,01 | 0,00 | 0,0079 | −0,0005 | |||||

| JPMORGAN CHASE & 1 6 30 DUE 12/23/30 / CORPORATE BONDS (48128GY95) | 0,01 | 0,0000 | |||||||

| FLG.PRA / Flagstar Financial, Inc. - Preferred Stock | 0,00 | 0,00 | 0,01 | −11,11 | 0,0078 | −0,0017 | |||

| UBS BANK USA 3 4 25CD FDIC INS DUE 09/02/25US / CERTIFICATE DEPOSIT (90348J5H9) | 0,01 | 0,0000 | |||||||

| US67910HQB95 / OKLAHOMA ST MUNI PWR | 0,01 | −12,50 | 0,0075 | −0,0007 | |||||

| BARCLAYS BANK PLC 4 26F DUE 10/15/26 / FOREIGN BONDS (US $) (06738JGY4) | 0,01 | 0,0000 | |||||||

| EFAV / iShares Trust - iShares MSCI EAFE Min Vol Factor ETF | 0,00 | 0,00 | 0,01 | 16,67 | 0,0071 | 0,0002 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0,00 | 0,00 | 0,01 | 0,00 | 0,0070 | −0,0002 | |||

| BAC.PRL / Bank of America Corporation - Preferred Stock | 0,00 | 0,00 | 0,01 | 0,00 | 0,0069 | −0,0005 | |||

| AUB.PRA / Atlantic Union Bankshares Corporation - Preferred Stock | 0,00 | 0,00 | 0,01 | 0,00 | 0,0069 | −0,0005 | |||

| WELLS FARGO BANK, 4 8 26CD FDIC INS DUE 01/12/26US / CERTIFICATE DEPOSIT (949764KS2) | 0,01 | 0,0000 | |||||||

| MO / Altria Group, Inc. | 0,00 | 0,00 | 0,01 | −14,29 | 0,0065 | −0,0005 | |||

| KMB / Kimberly-Clark Corporation | 0,00 | 0,00 | 0,01 | −14,29 | 0,0064 | −0,0011 | |||

| COF / Capital One Financial Corporation | 0,00 | 0,01 | 0,0063 | 0,0063 | |||||

| EEMV / iShares, Inc. - iShares MSCI Emerging Markets Min Vol Factor ETF | 0,00 | 0,00 | 0,01 | 0,00 | 0,0056 | 0,0001 | |||

| COBB CNTY GA DEV AU 4 30STHG EDUC DUE 07/15/30XTRO / MUNI BONDS (19078VBX5) | 0,01 | 0,0000 | |||||||

| US031162DP23 / Amgen Inc | 0,01 | 0,00 | 0,0049 | −0,0003 | |||||

| APD / Air Products and Chemicals, Inc. | 0,00 | 0,00 | 0,01 | 0,00 | 0,0048 | −0,0005 | |||

| TEXAS WOMANS UNIV R 4 34PUB EDUC DUE 07/01/34 / MUNI BONDS (882874GL8) | 0,01 | 0,0000 | |||||||

| CITIGROUP INC 2 31 DUE 10/16/31 / CORPORATE BONDS (17298CKL1) | 0,00 | 0,0000 | |||||||

| US29250NAL91 / Enbridge Inc | 0,00 | 0,00 | 0,0047 | −0,0003 | |||||

| LAVACA-NAVIDAD R 3 25 28WRSR UTIL DUE 08/01/28OID / MUNI BONDS (519385EX2) | 0,00 | 0,0000 | |||||||

| US124857AQ69 / ViacomCBS Inc | 0,00 | 0,00 | 0,0047 | −0,0002 | |||||

| FORT BEND CNTY 3 125 29GO UTX DUE 09/01/29OID ASSURED GUARANTY MUN / MUNI BONDS (34682JKP6) | 0,00 | 0,0000 | |||||||

| HARRIS CNTY TEX M 2 5 26GO UTX DUE 09/01/26OID HARRIS CNTY TEX MUN / MUNI BONDS (41421DSC1) | 0,00 | 0,0000 | |||||||

| US96949LAD73 / Williams Cos Inc/The | 0,00 | 0,00 | 0,0047 | −0,0002 | |||||

| US78016EZM29 / Royal Bank of Canada | 0,00 | 0,00 | 0,0047 | −0,0002 | |||||

| IWS / iShares Trust - iShares Russell Mid-Cap Value ETF | 0,00 | 0,00 | 0,00 | 0,00 | 0,0047 | −0,0000 | |||

| US45663NBR26 / INFIRMARY HEALTH SYSTEM SPECIAL CARE FACILITIES FINANCING AUTHORITY OF MOBILE | 0,00 | 0,00 | 0,0046 | −0,0002 | |||||

| THE GOLDMAN SACHS G 1 26 DUE 02/26/26 / CORPORATE BONDS (38150AF34) | 0,00 | 0,0000 | |||||||

| HARNETT CNTY N C 3 5 36SPLO DUE 06/01/36OID / MUNI BONDS (41333TAT5) | 0,00 | 0,0000 | |||||||

| UNIVERSITY OKLA REV 4 39PUB EDUC DUE 07/01/39OID / MUNI BONDS (91476PNN4) | 0,00 | 0,0000 | |||||||

| HARRIS CNTY TEX M 3 5 33WRSR UTIL DUE 12/01/33OID / MUNI BONDS (41422PEW4) | 0,00 | 0,0000 | |||||||

| UNIVERSITY N C 2 127 31PUB EDUC DUE 04/01/31XTRO TAXBL / MUNI BONDS (914716V93) | 0,00 | 0,0000 | |||||||

| DURHAM N C LTD O 1 35 29VP DUE 10/01/29TAXBL / MUNI BONDS (26678PGB0) | 0,00 | 0,0000 | |||||||

| IBHI / iShares Trust - iShares iBonds 2029 Term High Yield and Income ETF | 0,00 | 0,00 | 0,00 | 0,00 | 0,0034 | −0,0001 | |||

| EVRG / Evergy, Inc. | 0,00 | 0,00 | 0,00 | 0,00 | 0,0024 | −0,0001 | |||

| CVS / CVS Health Corporation | 0,00 | −55,56 | 0,00 | −75,00 | 0,0019 | −0,0024 | |||

| CHARLOTTE-MECKLENBU 4 39SYST HLTH DUE 01/15/39OID XTRO / MUNI BONDS (160853RS8) | 0,00 | 0,0000 | |||||||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0,00 | 0,00 | 0,00 | 0,00 | 0,0018 | 0,0000 | |||

| HYPD / Hyperion DeFi, Inc. | 0,00 | 0,00 | 0,00 | 0,0009 | 0,0008 | ||||

| PHDG / Invesco Actively Managed Exchange-Traded Fund Trust - Invesco S&P 500 Downside Hedged ETF | 0,00 | 0,00 | 0,00 | 0,0009 | −0,0001 | ||||

| SPDW / SPDR Index Shares Funds - SPDR Portfolio Developed World ex-US ETF | 0,00 | 0,00 | 0,00 | 0,0005 | 0,0000 | ||||

| ALL / The Allstate Corporation | 0,00 | 0,00 | 0,00 | 0,0002 | −0,0000 | ||||

| EMGF / iShares, Inc. - iShares Emerging Markets Equity Factor ETF | 0,00 | 0,00 | 0,00 | 0,0001 | 0,0000 | ||||

| FNDF / Schwab Strategic Trust - Schwab Fundamental International Equity ETF | 0,00 | 0,00 | 0,00 | 0,0001 | 0,0000 | ||||

| GEM / Goldman Sachs ETF Trust - Goldman Sachs ActiveBeta Emerging Markets Equity ETF | 0,00 | 0,00 | 0,00 | 0,0000 | 0,0000 | ||||

| PLD / Prologis, Inc. | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| HD / The Home Depot, Inc. | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| DGCB / Dimensional ETF Trust - Dimensional Global Credit ETF | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| GS / The Goldman Sachs Group, Inc. | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| DFAI / Dimensional ETF Trust - Dimensional International Core Equity Market ETF | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| ALLIANCEBERNSTEIN HLDXXXSUBMITTED FOR CASH EXP: 04/01/2025 / REORG STOCK (018992107) | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| CL / Colgate-Palmolive Company | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| EOG / EOG Resources, Inc. | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| DFAE / Dimensional ETF Trust - Dimensional Emerging Core Equity Market ETF | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| MA / Mastercard Incorporated | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| WBD / Warner Bros. Discovery, Inc. | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| MRK / Merck & Co., Inc. | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| DFAS / Dimensional ETF Trust - Dimensional U.S. Small Cap ETF | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| DFS / Discover Financial Services | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| UNH / UnitedHealth Group Incorporated | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| SHM / SPDR Series Trust - SPDR Nuveen ICE Short Term Municipal Bond ETF | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| UNP / Union Pacific Corporation | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| BMY / Bristol-Myers Squibb Company | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| DOV / Dover Corporation | 0,00 | −100,00 | 0,00 | −100,00 | −0,0018 | ||||

| DHR / Danaher Corporation | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| SBUX / Starbucks Corporation | 0,00 | −100,00 | 0,00 | −100,00 | −0,0066 | ||||

| ACN / Accenture plc | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| CSCO / Cisco Systems, Inc. | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| DFUS / Dimensional ETF Trust - Dimensional U.S. Equity Market ETF | 0,00 | −100,00 | 0,00 | 0,0000 | |||||

| DFCF / Dimensional ETF Trust - Dimensional Core Fixed Income ETF | 0,00 | −100,00 | 0,00 | 0,0000 |