Grundläggande statistik

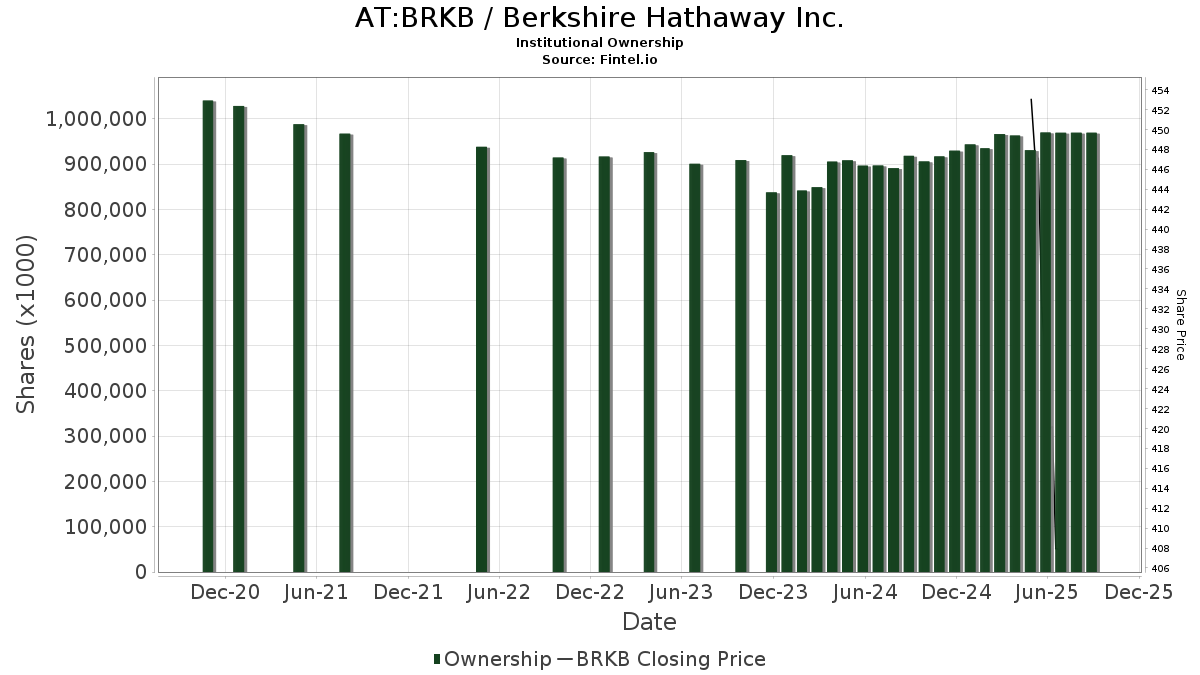

| Institutionella aktier (lång) | 977 149 749 - 71,84% (ex 13D/G) - change of 14,15MM shares 1,48% MRQ |

| Institutionellt värde (lång) | $ 453 017 242 USD ($1000) |

Institutionellt ägande och aktieägare

Berkshire Hathaway Inc. (AT:BRKB) har 5682 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 977,166,797 aktier. Största aktieägare inkluderar Vanguard Group Inc, BlackRock, Inc., State Street Corp, VTSMX - Vanguard Total Stock Market Index Fund Investor Shares, VFINX - Vanguard 500 Index Fund Investor Shares, Geode Capital Management, Llc, Morgan Stanley, Bill & Melinda Gates Foundation Trust, FXAIX - Fidelity 500 Index Fund, and Spdr S&p 500 Etf Trust .

Berkshire Hathaway Inc. (WBAG:BRKB) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of July 10, 2025 is 408,50 / share. Previously, on May 9, 2025, the share price was 455,45 / share. This represents a decline of 10,31% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

Important Note

In an effort to reduce load times for our mobile users, we are testing some ways to deliver lighter pages.

In this first test, we will deliver only the most recent 750 transactions (out of 6029 for this stock). If you are interested in loading *all* the transactions for this company, click the "load all" button below. This is just a test and if you don't like it, please let us know by submitting some gentle feedback via the link at the bottom of this page.

Load All| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-27 | NP | TRANSAMERICA SERIES TRUST - Transamerica BlackRock Global Allocation VP Initial | 7 834 | 2,55 | 3 806 | −6,47 | ||||

| 2025-08-08 | 13F | Woodley Farra Manion Portfolio Management Inc | 1 385 | 9,66 | 673 | 0,00 | ||||

| 2025-07-29 | 13F | Hoese & Co LLP | 439 | 9,75 | 213 | 0,00 | ||||

| 2025-08-05 | 13F | Landmark Wealth Management, Inc. | 3 628 | 0,00 | 1 762 | −8,80 | ||||

| 2025-08-12 | 13F | Wayfinding Financial, LLC | 2 484 | −2,05 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | Symmetry Investments LP | 10 578 | −37,78 | 5 138 | −43,25 | ||||

| 2025-07-18 | 13F | Founders Capital Management | 645 | 0,00 | 313 | −8,75 | ||||

| 2025-08-05 | 13F | Hunter Associates Investment Management Llc | 4 344 | 0,00 | 2 | 0,00 | ||||

| 2025-08-05 | 13F | Fullcircle Wealth Llc | 12 434 | 0,58 | 5 709 | −13,03 | ||||

| 2025-05-15 | 13F | Altshuler Shaham Ltd | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F/A | Torno Capital, Llc | 1 500 | −25,00 | 690 | −15,13 | ||||

| 2025-07-22 | 13F | Wealthcare Capital Management Llc | 2 971 | −11,63 | 1 443 | −19,39 | ||||

| 2025-07-22 | 13F | Siligmueller & Norvid Wealth Advisors LLC | 691 | −1,43 | 326 | −12,87 | ||||

| 2025-08-13 | 13F | Loomis Sayles & Co L P | 342 | −16,59 | 166 | |||||

| 2025-07-08 | 13F | Choice Wealth Advisors, LLC | 1 691 | −3,59 | 821 | −12,10 | ||||

| 2025-07-28 | 13F | Mowery & Schoenfeld Wealth Management, LLC | 1 199 | 11,64 | 582 | 1,75 | ||||

| 2025-08-14 | 13F | Clark Capital Management Group, Inc. | 5 254 | 20,59 | 2 552 | 10,00 | ||||

| 2025-08-08 | 13F | Davis Selected Advisers | 553 845 | −18,37 | 269 041 | −25,54 | ||||

| 2025-08-11 | 13F | Tower Bridge Advisors | 13 626 | 0,00 | 6 619 | −8,78 | ||||

| 2025-08-14 | 13F | Tennessee Valley Asset Management Partners | 45 555 | 1,88 | 22 129 | −7,08 | ||||

| 2025-07-15 | 13F | Optima Capital Llc | 1 463 | 1,60 | 711 | −7,31 | ||||

| 2025-07-21 | 13F | Stock Yards Bank & Trust Co | 54 190 | −33,74 | 26 324 | −39,57 | ||||

| 2025-07-11 | 13F | Westfuller Advisors, LLC | 2 933 | 1 425 | ||||||

| 2025-07-30 | 13F | Adams Diversified Equity Fund, Inc. | 95 443 | 18,79 | 46 363 | 8,35 | ||||

| 2025-08-26 | NP | BlackRock Funds IV - BlackRock Systematic Multi-Strategy Fund Investor A Shares This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 311 | −46,90 | 1 123 | −51,58 | ||||

| 2025-07-22 | 13F | Awm Capital, Llc | 702 | 1,01 | 341 | −7,84 | ||||

| 2025-07-15 | 13F | Marquette Asset Management, LLC | 1 695 | 0,00 | 823 | −8,76 | ||||

| 2025-07-18 | 13F | Ewa, Llc | 2 393 | 7,70 | 1 162 | −1,78 | ||||

| 2025-08-12 | 13F | Aldebaran Capital, Llc | 42 172 | −1,61 | 20 486 | −10,26 | ||||

| 2025-08-14 | 13F | 10Elms LLP | 660 | 0,00 | 321 | −8,83 | ||||

| 2025-07-23 | 13F | Canopy Partners, LLC | 3 366 | 38,01 | 1 635 | 25,87 | ||||

| 2025-08-01 | 13F | Lipe & Dalton | 605 | 0,00 | 0 | |||||

| 2025-06-30 | NP | RSP - Invesco S&P 500 Equal Weight ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 283 750 | −13,40 | 151 310 | −1,47 | ||||

| 2025-08-08 | 13F | Gts Securities Llc | 6 913 | −21,23 | 3 358 | −28,14 | ||||

| 2025-08-12 | 13F | SlateStone Wealth, LLC | 32 815 | 4,91 | 16 | −6,25 | ||||

| 2025-07-23 | 13F | WESPAC Advisors, LLC | 446 | 0,68 | 217 | −8,09 | ||||

| 2025-03-12 | 13F/A | Private Capital Management Llc | 8 107 | 2,31 | 3 298 | −1,05 | ||||

| 2025-08-04 | 13F | REDW Wealth LLC | 2 914 | 3,30 | 1 416 | −5,79 | ||||

| 2025-07-30 | 13F | Citizens & Northern Corp | 1 574 | −10,06 | 765 | −18,03 | ||||

| 2025-07-29 | 13F | MPS Loria Financial Planners, LLC | 3 531 | 0,00 | 1 715 | −8,78 | ||||

| 2025-08-20 | NP | MUNDX - Mundoval Fund | 1 600 | 0,00 | 777 | −8,80 | ||||

| 2025-08-06 | 13F | Columbia River Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | NP | PBUS - Invesco PureBeta MSCI USA ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 180 580 | 17,02 | 91 005 | 14,77 | ||||

| 2025-07-14 | 13F | Westend Capital Management LLC | 194 | 0,00 | 94 | −8,74 | ||||

| 2025-08-05 | 13F | AAFCPAs Wealth Management, LLC | 1 569 | −6,38 | 762 | −14,69 | ||||

| 2025-07-28 | NP | PWTAX - UBS U.S. Allocation Fund Class A | 5 789 | −20,69 | 2 917 | −22,21 | ||||

| 2025-08-06 | 13F | Agf Management Ltd | 79 066 | −15,30 | 38 408 | −22,75 | ||||

| 2025-07-22 | 13F | Signature Wealth Management Partners, LLC | 2 786 | 1,94 | 1 353 | −7,01 | ||||

| 2025-08-11 | 13F | GFI Investment Counsel Ltd. | 1 197 | 0,00 | 581 | −8,79 | ||||

| 2025-08-07 | 13F | 1620 Investment Advisors, Inc. | 1 600 | 1,52 | 778 | −7,39 | ||||

| 2025-07-22 | 13F | Appleton Partners Inc/ma | 32 454 | 23,78 | 16 | 15,38 | ||||

| 2025-08-15 | 13F | Harvest Fund Management Co., Ltd | 3 421 | −55,79 | 2 | −75,00 | ||||

| 2025-08-01 | 13F | Delta Investment Management, LLC | 21 843 | −5,32 | 10 611 | −13,65 | ||||

| 2025-08-11 | 13F | Greenland Capital Management LP | Call | 2 400 | 200,00 | 1 166 | 173,47 | |||

| 2025-08-11 | 13F | Greenland Capital Management LP | Put | 1 000 | 486 | |||||

| 2025-07-21 | 13F | Patriot Financial Group Insurance Agency, LLC | 24 087 | 18,50 | 11 701 | 8,09 | ||||

| 2025-08-14 | 13F | Monograph Wealth Advisors, Llc | 2 121 | 3,82 | 1 030 | −5,33 | ||||

| 2025-08-05 | 13F | Capital Management Associates /ny/ | 3 000 | 0,00 | 1 457 | −8,77 | ||||

| 2025-08-01 | 13F | Shilanski & Associates, Inc. | 4 612 | 1,07 | 2 240 | −7,82 | ||||

| 2025-07-29 | 13F | Lutz Financial Services LLC | 4 461 | 1,16 | 2 167 | −7,71 | ||||

| 2025-04-22 | 13F | Veridan Wealth LLC | 1 360 | 16,44 | 724 | 33,58 | ||||

| 2025-07-17 | 13F | R.H. Investment Group, LLC | 11 296 | 0,04 | 5 487 | −8,75 | ||||

| 2025-07-17 | 13F | Independence Bank of Kentucky | 9 068 | 3,84 | 4 405 | −5,31 | ||||

| 2025-08-13 | 13F | Mirabella Financial Services Llp | 5 548 | −75,81 | 2 707 | −77,91 | ||||

| 2025-08-12 | 13F | Steginsky Capital Llc | 63 698 | 3,06 | 31 | −6,25 | ||||

| 2025-08-27 | NP | PSIAX - PGIM QMA STOCK INDEX FUND Class A | 30 590 | −2,11 | 14 860 | −10,72 | ||||

| 2025-08-08 | 13F | Jupiter Asset Management Ltd | 29 130 | 0,00 | 14 150 | −8,79 | ||||

| 2025-08-12 | 13F | Evelyn Partners Investment Management (Europe) Ltd | 15 986 | 15 124,76 | 13 849 | −11,28 | ||||

| 2025-08-12 | 13F | Eisler Capital Management Ltd. | 26 675 | 533 400,00 | 12 958 | 647 750,00 | ||||

| 2025-08-12 | 13F | Eisler Capital Management Ltd. | Call | 58 300 | 79,38 | 28 320 | 63,60 | |||

| 2025-08-12 | 13F | Eisler Capital Management Ltd. | Put | 251 100 | −31,09 | 121 977 | −37,16 | |||

| 2025-08-04 | 13F | GAM Holding AG | 12 732 | −0,84 | 6 185 | −9,56 | ||||

| 2025-08-11 | 13F | Annis Gardner Whiting Capital Advisors, LLC | 4 528 | 17,67 | 2 200 | 7,32 | ||||

| 2025-07-09 | 13F | Systrade AG | 1 | 729 | ||||||

| 2025-07-22 | 13F | Ellenbecker Investment Group | 3 282 | 27,95 | 1 594 | 16,69 | ||||

| 2025-07-29 | 13F | Madison Wealth Partners, Inc | 4 548 | 3,27 | 2 209 | −5,80 | ||||

| 2025-08-13 | 13F | NEOS Investment Management LLC | 145 753 | 22,92 | 70 802 | 12,12 | ||||

| 2025-08-07 | 13F | Meeder Asset Management Inc | 212 293 | −11,08 | 103 126 | −18,90 | ||||

| 2025-08-14 | 13F | Paragon Private Wealth Management, LLC | 7 018 | −4,84 | 3 409 | −13,19 | ||||

| 2025-08-15 | 13F | Security National Bank Of Sioux City Iowa /ia/ | 12 456 | −4,56 | 6 051 | −12,95 | ||||

| 2025-07-08 | 13F | Apella Capital, LLC | 25 245 | 41,67 | 12 068 | 29,88 | ||||

| 2025-06-30 | NP | INVESCO ACTIVELY MANAGED EXCHANGE-TRADED FUND TRUST - Invesco S&P 500 Equal Weight Income Advantage ETF | 920 | −2,44 | 491 | 11,11 | ||||

| 2025-08-14 | 13F | Lagoda Investment Management, L.P. | 1 890 | −8,47 | 918 | −16,47 | ||||

| 2025-06-04 | 13F | Legacy Capital Wealth Management, Llc | 3 077 | 1 395 | ||||||

| 2025-08-28 | NP | ONEO - SPDR Russell 1000 Momentum Focus ETF This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 83 | −49,39 | 40 | −54,02 | ||||

| 2025-07-11 | 13F | Essex Savings Bank | 11 026 | 0,97 | 5 356 | −7,91 | ||||

| 2025-07-17 | 13F | HCR Wealth Advisors | 11 054 | 1,57 | 5 370 | −7,37 | ||||

| 2025-07-15 | 13F | Armis Advisers, LLC | 5 048 | 23,70 | 2 406 | 10,67 | ||||

| 2025-08-13 | 13F | Scotia Capital Inc. | 610 814 | 5,17 | 296 696 | −4,08 | ||||

| 2025-08-14 | 13F | Fieldview Capital Management, LLC | 7 563 | 3 674 | ||||||

| 2025-07-24 | 13F | Davis-rea Ltd. | 1 067 | −8,57 | 518 | −16,59 | ||||

| 2025-08-20 | 13F | Tull Financial Group, Inc. | 887 | 0,57 | 431 | −8,32 | ||||

| 2025-07-17 | 13F | Guardian Investment Management | 2 930 | −41,16 | 1 423 | −41,66 | ||||

| 2025-07-29 | NP | SIXA - 6 Meridian Mega Cap Equity ETF | 21 424 | 159,65 | 10 797 | 170,92 | ||||

| 2025-07-14 | 13F | Crew Capital Management, Ltd. | 10 999 | 125,16 | 5 343 | 105,38 | ||||

| 2025-07-25 | 13F | Asset Planning,Inc | 3 831 | 0,00 | 1 861 | −8,82 | ||||

| 2025-08-14 | 13F | Broadleaf Partners, LLC | 2 324 | −71,67 | 1 129 | −74,18 | ||||

| 2025-04-18 | 13F | Wolf Group Capital Advisors | 11 692 | −10,65 | 6 227 | 39,57 | ||||

| 2025-08-05 | 13F | Sulzberger Capital Advisors, Inc. | 5 222 | −0,95 | 2 537 | −9,65 | ||||

| 2025-08-12 | 13F | Associated Banc-corp | 89 724 | −0,74 | 43 585 | −9,47 | ||||

| 2025-08-12 | 13F | Hillsdale Investment Management Inc. | 7 025 | 276,68 | 3 413 | 243,61 | ||||

| 2025-08-20 | NP | LSAAX - LoCorr Strategic Allocation Fund Class A | 692 | 37,03 | 336 | 25,37 | ||||

| 2025-08-01 | 13F | Strategic Financial Services, Inc, | 4 500 | 4,29 | 2 186 | −4,92 | ||||

| 2025-07-21 | 13F | Creative Capital Management Investments LLC | 1 963 | −20,97 | 954 | −27,91 | ||||

| 2025-06-26 | NP | DUSA - Davis Select U.S. Equity ETF | 100 584 | 0,00 | 53 636 | 13,78 | ||||

| 2025-07-22 | 13F | Wealthcare Capital Partners, LLC | 7 250 | 1,58 | 3 522 | −7,37 | ||||

| 2025-07-28 | 13F | Tower Wealth Partners, Inc. | 1 578 | 3,27 | 767 | −5,78 | ||||

| 2025-08-12 | 13F | Harbor Advisory Corp /ma/ | 25 152 | −0,98 | 12 218 | −9,68 | ||||

| 2025-08-15 | 13F | Truefg, Llc | 1 499 | 728 | ||||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 447 407 | 2,37 | 217 321 | −6,63 | ||||

| 2025-07-29 | 13F | Members Advisory Group LLC | 765 | 0,26 | 372 | −8,62 | ||||

| 2025-08-14 | 13F | Caxton Corp | 632 | 35,33 | 307 | 23,79 | ||||

| 2025-07-28 | 13F | Eq Wealth Advisors, Llc | 26 456 | −0,20 | 12 852 | −8,97 | ||||

| 2025-08-08 | 13F | Sawgrass Asset Management Llc | 2 472 | 0,86 | 1 201 | −8,05 | ||||

| 2025-08-11 | 13F | Long Road Investment Counsel, LLC | 700 | 0,00 | 340 | −8,60 | ||||

| 2025-08-28 | NP | BlackRock Variable Series Funds, Inc. - BlackRock Global Allocation V.I. Fund Class I This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 573 | −30,04 | 278 | −36,24 | ||||

| 2025-08-26 | NP | Profunds - Profund Vp Bull | 1 590 | −17,91 | 772 | −25,12 | ||||

| 2025-05-14 | 13F | Ofc Financial Planning, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Creekmur Asset Management LLC | 2 466 | 0,94 | 1 198 | −7,92 | ||||

| 2025-06-30 | NP | LGDX - Intech S&P Large Cap Diversified Alpha ETF | 147 | 78 | ||||||

| 2025-08-12 | 13F | Fortem Financial Group, Llc | 2 250 | −10,86 | 1 093 | −18,75 | ||||

| 2025-08-14 | 13F | Karani Asset Management LLC | 1 941 | 943 | ||||||

| 2025-07-31 | 13F | Oppenheimer Asset Management Inc. | 113 129 | −16,66 | 54 955 | −23,99 | ||||

| 2025-08-19 | 13F | Wealth Group, Ltd. | 2 261 | −26,61 | 1 | 0,00 | ||||

| 2025-07-16 | 13F | Motive Wealth Advisors | 2 106 | 11,72 | 1 023 | 1,99 | ||||

| 2025-08-14 | 13F | Anson Funds Management LP | 1 611 | 0,00 | 783 | −8,75 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 9 665 | 0,61 | 4 695 | −8,23 | ||||

| 2025-07-09 | 13F | Westshore Wealth, LLC | 7 513 | 0,00 | 3 650 | −8,80 | ||||

| 2025-07-09 | 13F | Gateway Investment Advisers Llc | 406 376 | −4,65 | 197 405 | −13,03 | ||||

| 2025-08-14 | 13F | Blue Capital, Inc. | 3 537 | −2,24 | 1 718 | 4,82 | ||||

| 2025-07-28 | NP | SPXT - S&P 500 ex-Technology ETF | 11 055 | 4,55 | 5 571 | 2,54 | ||||

| 2025-07-17 | 13F | Park Place Capital Corp | 301 | −8,79 | 147 | −16,00 | ||||

| 2025-08-08 | 13F | eCIO, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-11 | 13F | Halter Ferguson Financial Inc. | 478 | 2,58 | 232 | −6,45 | ||||

| 2025-08-28 | NP | IVV - iShares Core S&P 500 ETF | 21 707 111 | −2,65 | 10 544 663 | −11,20 | ||||

| 2025-07-29 | NP | PRSIX - T. Rowe Price Spectrum Conservative Allocation Fund This fund is a listed as child fund of Price T Rowe Associates Inc /md/ and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 10 316 | −11,78 | 5 199 | −13,48 | ||||

| 2025-07-09 | 13F | Central Bank & Trust Co | 827 | 0,00 | 402 | −8,86 | ||||

| 2025-07-30 | 13F | Axecap Investments, LLC | 2 096 | 1 018 | ||||||

| 2025-07-31 | 13F | Red Wave Investments LLC | 3 535 | 2,82 | 1 717 | −6,23 | ||||

| 2025-08-01 | 13F | MorganRosel Wealth Management, LLC | 383 | 0,00 | 186 | −8,37 | ||||

| 2025-07-11 | 13F | Lincoln Capital LLC | 95 842 | 0,24 | 46 557 | −6,50 | ||||

| 2025-06-26 | NP | DFQTX - U.s. Core Equity 2 Portfolio - Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 813 088 | 0,00 | 433 579 | 13,78 | ||||

| 2025-07-28 | 13F | Copia Wealth Management | 328 | 4,79 | 159 | −4,22 | ||||

| 2025-08-08 | 13F | Stephenson & Company, Inc. | 50 429 | −0,27 | 24 497 | −9,03 | ||||

| 2025-07-17 | 13F | SeaBridge Investment Advisors LLC | 22 023 | 1,17 | 10 698 | −7,72 | ||||

| 2025-05-13 | 13F | Leuthold Group, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Cornerstone Advisory, LLC | 44 380 | 0,33 | 21 558 | −4,88 | ||||

| 2025-07-08 | 13F/A | Salem Investment Counselors Inc | 173 546 | −1,31 | 84 304 | −9,99 | ||||

| 2025-08-28 | NP | SSPIX - SIMT S&P 500 Index Fund Class F | 34 880 | −1,02 | 16 944 | −9,72 | ||||

| 2025-08-05 | 13F | Dillon & Associates Inc | 555 | 6,73 | 0 | |||||

| 2025-08-05 | 13F | Code Waechter LLC | 625 | 8,70 | 304 | |||||

| 2025-08-06 | 13F | Axim Planning & Wealth | 592 | 7,44 | 288 | −2,05 | ||||

| 2025-07-31 | 13F | Moser Wealth Advisors, LLC | 19 172 | 2,29 | 9 313 | −6,69 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | 71 707 | 5,20 | 34 833 | −4,05 | ||||

| 2025-08-26 | 13F | Nautilus Advisors LLC | 4 147 | 42,56 | 2 014 | 30,02 | ||||

| 2025-07-29 | 13F | Schubert & Co | 412 | −5,72 | 200 | −13,79 | ||||

| 2025-08-06 | 13F | Long Run Wealth Advisors, LLC | 2 382 | 1,02 | 1 157 | −7,81 | ||||

| 2025-05-07 | 13F | Sheaff Brock Investment Advisors, LLC | 8 779 | 0,19 | 4 676 | 17,73 | ||||

| 2025-08-14 | 13F | Quarry LP | 717 | 348 | ||||||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 695 089 | 4,50 | 337 653 | −4,69 | ||||

| 2025-07-23 | 13F | Tyche Wealth Partners LLC | 5 217 | −2,21 | 2 534 | −10,81 | ||||

| 2025-08-06 | 13F | Yacktman Asset Management Lp | 326 867 | −13,25 | 158 782 | −20,87 | ||||

| 2025-04-25 | 13F | Kieckhefer Group Llc | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Mawer Investment Management Ltd. | 57 627 | 8,37 | 27 993 | −1,15 | ||||

| 2025-07-17 | 13F | Sfm, Llc | 5 572 | −0,14 | 2 707 | −8,92 | ||||

| 2025-08-14 | 13F | Goldstream Capital Management Ltd | 1 308 | 0,00 | 635 | −8,76 | ||||

| 2025-06-26 | NP | DFVEX - U.s. Vector Equity Portfolio - Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 59 299 | 0,00 | 31 621 | 13,78 | ||||

| 2025-05-14 | 13F | Bridgewater Associates, LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-15 | 13F | Cranbrook Wealth Management, LLC | 1 030 | 2,69 | 500 | −6,37 | ||||

| 2025-08-06 | 13F | Phocas Financial Corp. | 2 412 | 0,00 | 1 172 | −8,80 | ||||

| 2025-08-14 | 13F | Doheny Asset Management /ca | 4 565 | 0,00 | 2 | 0,00 | ||||

| 2025-07-16 | 13F | Falcon Wealth Planning | 3 158 | 32,36 | 1 534 | 20,71 | ||||

| 2025-07-18 | 13F | Victrix Investment Advisors | 17 022 | 2,52 | 8 269 | −5,18 | ||||

| 2025-08-05 | 13F | Washburn Capital Management, Inc. | 3 725 | 26,36 | 1 809 | 15,22 | ||||

| 2025-07-28 | 13F | Wealthspan Partners, Llc | 3 919 | −0,13 | 1 904 | −8,90 | ||||

| 2025-08-13 | 13F | Avestar Capital, LLC | 20 962 | 5,43 | 10 183 | −3,83 | ||||

| 2025-08-11 | 13F | Buckley Wealth Management, LLC | 39 326 | 0,48 | 19 104 | −8,35 | ||||

| 2025-08-05 | 13F | EPG Wealth Management LLC | 6 439 | −0,29 | 3 128 | −9,07 | ||||

| 2025-08-12 | 13F | Prudential Plc | 32 383 | −6,53 | 15 731 | −14,75 | ||||

| 2025-07-24 | 13F/A | TFR Capital, LLC. | 9 369 | 4,47 | 4 551 | −4,71 | ||||

| 2025-07-24 | 13F | Villere St Denis J & Co Llc | 1 453 | 0,00 | 706 | −8,80 | ||||

| 2025-08-08 | 13F | National Pension Service | 2 469 534 | 3,50 | 1 199 626 | −5,60 | ||||

| 2025-06-17 | NP | MINVX - Madison Investors Fund Investors Fund Class Y | 18 124 | −51,37 | 9 665 | −44,67 | ||||

| 2025-07-22 | 13F | Inlight Wealth Management, LLC | 7 488 | −42,11 | 3 637 | −47,20 | ||||

| 2025-07-29 | 13F | Spreng Capital Management, Inc. | 3 686 | −1,23 | 1 791 | −9,91 | ||||

| 2025-08-18 | 13F | Hollencrest Capital Management | 30 386 | −1,00 | 14 761 | −9,70 | ||||

| 2025-08-12 | 13F | Mmbg Investment Advisors Co. | 3 503 | −0,20 | 1 702 | −8,99 | ||||

| 2025-04-28 | NP | GAAVX - GMO Alternative Allocation Fund Class VI | 52 000 | 0,00 | 26 719 | 6,38 | ||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | Put | 100 | 0,00 | 49 | −9,43 | |||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 47 897 | 21,08 | 23 267 | 10,43 | ||||

| 2025-07-25 | 13F | Delaney Dennis R | 795 | −3,05 | 386 | −11,47 | ||||

| 2025-07-30 | 13F | Dudley Capital Management, Llc | 10 591 | 6,57 | 5 145 | −2,80 | ||||

| 2025-08-08 | 13F | Atlantic Trust, LLC | 9 001 | 1,53 | 4 372 | −7,39 | ||||

| 2025-08-14 | 13F | Kemnay Advisory Services Inc. | 29 521 | −7,92 | 14 340 | −16,01 | ||||

| 2025-07-14 | 13F | Seascape Capital Management | 2 658 | −6,67 | 1 | 0,00 | ||||

| 2025-08-05 | 13F | Gladius Capital Management LP | Put | 10 200 | −52,56 | 4 955 | −56,73 | |||

| 2025-08-04 | 13F | L.m. Kohn & Company | 15 561 | −3,42 | 7 559 | −11,90 | ||||

| 2025-08-05 | 13F | Gladius Capital Management LP | 1 466 | −78,96 | 712 | −80,81 | ||||

| 2025-07-22 | NP | GSLIX - Goldman Sachs Large Cap Value Fund Institutional | 21 350 | −0,97 | 10 760 | −2,88 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 11 569 | −89,12 | 5 620 | −90,08 | ||||

| 2025-07-23 | 13F | Gainplan LLC | 1 428 | 4,46 | 694 | −4,81 | ||||

| 2025-08-12 | 13F | Gladstone Institutional Advisory LLC | 33 962 | 2,50 | 16 498 | −6,51 | ||||

| 2025-07-09 | 13F | Biltmore Wealth Management, LLC | 751 | 0,54 | 365 | −8,31 | ||||

| 2025-07-29 | 13F | Kondo Wealth Advisors, Inc. | 866 | −1,59 | 424 | −9,40 | ||||

| 2025-08-15 | 13F | Auxier Asset Management | 23 307 | −4,39 | 11 322 | −12,79 | ||||

| 2025-08-14 | 13F | Utah Retirement Systems | 243 982 | −0,32 | 118 519 | −9,08 | ||||

| 2025-07-17 | 13F | LifeGoal Wealth Advisors | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Stone Point Wealth LLC | 975 | −0,51 | 474 | −9,21 | ||||

| 2025-07-22 | 13F | WJ Interests, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Brookwood Investment Group LLC | 3 680 | −7,12 | 1 788 | −15,31 | ||||

| 2025-07-16 | 13F | First American Bank | 35 065 | 0,02 | 17 034 | −8,77 | ||||

| 2025-07-29 | 13F | Financial Advisors, LLC | 1 323 | 0,46 | 643 | −8,42 | ||||

| 2025-07-29 | NP | SDLAX - SIIT Dynamic Asset Allocation Fund - Class A | 47 728 | 13,82 | 24 053 | 11,64 | ||||

| 2025-05-15 | 13F | Grayhawk Investment Strategies Inc. | 170 | 0,00 | 91 | 16,88 | ||||

| 2025-07-24 | 13F | Zullo Investment Group, Inc. | 4 674 | −14,74 | 2 271 | −22,23 | ||||

| 2025-08-13 | 13F | Haverford Trust Co | 46 477 | 8,79 | 22 577 | −0,77 | ||||

| 2025-07-17 | 13F | Black Point Wealth Management | 4 122 | −72,07 | 2 002 | −74,53 | ||||

| 2025-07-30 | 13F | Phillips Financial Management, Llc | 2 318 | 2,20 | 1 126 | −6,71 | ||||

| 2025-06-26 | NP | IBALX - Transamerica Multi-Managed Balanced A | 27 661 | 4,42 | 14 750 | 18,81 | ||||

| 2025-08-14 | 13F | Axa S.a. | 186 208 | 43,49 | 90 454 | 30,87 | ||||

| 2025-08-28 | NP | TOPC - iShares S&P 500 3% Capped ETF | 410 | 199 | ||||||

| 2025-08-13 | 13F | Healthcare Of Ontario Pension Plan Trust Fund | 477 645 | 31,25 | 232 026 | 19,72 | ||||

| 2025-07-14 | 13F/A | Seek First Inc. | 1 002 | 0,00 | 487 | −8,82 | ||||

| 2025-07-22 | 13F | Coastal Investment Advisors, Inc. | 566 | −11,29 | 275 | −19,17 | ||||

| 2025-07-29 | 13F | Curbstone Financial Management Corp | 8 028 | 1,52 | 3 900 | −7,41 | ||||

| 2025-08-13 | 13F | Portland Global Advisors LLC | 4 516 | 1,83 | 2 194 | −7,12 | ||||

| 2025-08-05 | 13F | Prosperity Consulting Group, LLC | 38 019 | −1,70 | 18 468 | −10,34 | ||||

| 2025-07-25 | 13F | G2 Capital Management, Llc / Oh | 5 628 | 0,00 | 2 734 | −8,81 | ||||

| 2025-07-23 | 13F | First Financial Group Corp | 2 562 | 17,74 | 1 245 | 7,43 | ||||

| 2025-08-06 | 13F | Highlander Partners, L.P. | 1 525 | −25,61 | 741 | −32,17 | ||||

| 2025-08-14 | 13F | Houlihan Financial Resource Group, Ltd. | 1 402 | 32,02 | 1 | |||||

| 2025-07-07 | 13F | Enterprise Bank & Trust Co | 643 | 312 | ||||||

| 2025-07-29 | 13F | Accretive Wealth Partners, LLC | 984 | 3,25 | 478 | −2,25 | ||||

| 2025-08-08 | 13F | Islay Capital Management, Llc | 8 592 | 0,62 | 4 174 | −8,23 | ||||

| 2025-07-09 | 13F | Graves-Light Private Wealth Management, Inc. | 74 402 | −6,36 | 36 142 | −14,59 | ||||

| 2025-08-08 | 13F | Hedeker Wealth, LLC | 10 715 | −7,23 | 5 205 | −15,38 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 6 733 025 | −14,40 | 3 271 | −21,92 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 5 667 | −13,51 | 2 749 | −21,24 | ||||

| 2025-07-31 | 13F | Vaughan David Investments Inc/il | 5 265 | −5,31 | 3 | 0,00 | ||||

| 2025-08-01 | 13F | Facet Wealth, Inc. | 2 658 | 50,85 | 1 254 | 39,02 | ||||

| 2025-08-13 | 13F | Greenwich Wealth Management LLC | 5 840 | −2,44 | 3 | −33,33 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | Put | 35 000 | 0,00 | 17 | −5,56 | |||

| 2025-07-25 | 13F | Westchester Capital Management, Inc. | 57 530 | −0,24 | 27 946 | −9,00 | ||||

| 2025-07-30 | 13F | Tricadia Capital Management, LLC | 21 660 | −9,75 | 10 522 | −17,68 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | Call | 35 000 | 0,00 | 17 | −5,56 | |||

| 2025-07-28 | 13F | Prairie Sky Financial Group LLC | 4 584 | 2,87 | 2 227 | −6,19 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 319 751 | 3,41 | 155 | −5,49 | ||||

| 2025-08-12 | 13F | Evelyn Partners Investment Management LLP | 241 984 | 621,56 | 106 122 | −9,82 | ||||

| 2025-07-11 | 13F | Oak Asset Management, LLC | 1 840 | 0,00 | 894 | −8,78 | ||||

| 2025-07-18 | 13F | United Bank | 1 006 | −42,71 | 489 | −47,81 | ||||

| 2025-07-21 | 13F | Credential Securities Inc. | 21 228 | 17,21 | 3 963 | 9,66 | ||||

| 2025-07-25 | 13F | Orca Investment Management, LLC | 6 821 | −0,58 | 3 313 | −9,33 | ||||

| 2025-08-11 | 13F | Addison Capital Co | 828 | 0,00 | 402 | −8,64 | ||||

| 2025-08-14 | 13F | Interval Partners, LP | 20 070 | 63,57 | 9 749 | 49,20 | ||||

| 2025-07-14 | 13F | Enzi Wealth | 1 106 | −2,12 | 526 | −12,33 | ||||

| 2025-07-16 | 13F | American National Bank | 67 291 | 4,32 | 32 688 | −4,86 | ||||

| 2025-07-31 | 13F | MQS Management LLC | 1 349 | 104,70 | 655 | 87,14 | ||||

| 2025-07-18 | 13F | BCO Wealth Management LLC | 1 019 | 0,00 | 495 | −8,67 | ||||

| 2025-08-18 | NP | GVEQX - Government Street Equity Fund | 1 600 | 0,00 | 777 | −8,80 | ||||

| 2025-08-07 | 13F | Fagan Associates, Inc. | 19 487 | −0,22 | 9 466 | −8,98 | ||||

| 2025-08-29 | 13F | Evolution Wealth Management Inc. | 582 | 283 | ||||||

| 2025-07-17 | 13F | Hanson & Doremus Investment Management | 18 165 | 9 | ||||||

| 2025-08-14 | 13F | Silvercrest Asset Management Group Llc | 118 316 | 0,82 | 57 474 | −8,04 | ||||

| 2025-07-14 | 13F | Argent Capital Management Llc | 1 658 | −0,72 | 805 | −9,45 | ||||

| 2025-07-28 | 13F | Compass Advisory Group LLC | 2 682 | 0,64 | 1 303 | −8,25 | ||||

| 2025-08-27 | NP | NEUBERGER BERMAN ADVISERS MANAGEMENT TRUST - Sustainable Equity Portfolio Class I | 89 242 | 0,00 | 43 351 | −8,79 | ||||

| 2025-04-23 | 13F | Smith & Howard Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Public Employees Retirement Association Of Colorado | 175 759 | −0,43 | 85 | −9,57 | ||||

| 2025-08-01 | 13F | James Investment Research Inc | 11 789 | 0,56 | 5 727 | −8,28 | ||||

| 2025-08-27 | NP | SENCX - Touchstone Large Cap Focused Fund Class A | 112 872 | −23,62 | 54 830 | −30,33 | ||||

| 2025-08-11 | 13F | Y.D. More Investments Ltd | 12 391 | −2,53 | 6 017 | −11,33 | ||||

| 2025-07-22 | 13F | AMF Pensionsforsakring AB | 408 382 | 66,54 | 198 380 | 51,90 | ||||

| 2025-08-07 | 13F | AllGen Financial Advisors, Inc. | 6 121 | −54,60 | 2 973 | −58,59 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 214 602 | 5,97 | 104 247 | −3,34 | ||||

| 2025-07-31 | 13F | Cardinal Point Capital Management, ULC | 25 569 | 133,40 | 5 305 | −60,43 | ||||

| 2025-08-12 | 13F | Belmont Capital, LLC | 4 385 | 0,00 | 2 130 | −8,78 | ||||

| 2025-07-31 | 13F | Peterson Wealth Services | 17 420 | 0,34 | 8 462 | −8,48 | ||||

| 2025-08-14 | 13F | Bramshill Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-04-23 | 13F | Sabal Trust CO | 18 289 | 1,38 | 9 740 | 19,11 | ||||

| 2025-08-22 | NP | FEAC - Fidelity Enhanced U.S. All-Cap Equity ETF | 92 | 9,52 | 45 | 0,00 | ||||

| 2025-08-08 | 13F | Good Life Advisors, LLC | 12 817 | 2,31 | 6 226 | −6,67 | ||||

| 2025-08-11 | 13F | Bislett Management, Llc | 11 000 | 0,00 | 5 343 | −8,79 | ||||

| 2025-07-09 | 13F | GEM Asset Management, LLC | 1 205 | 26,18 | 576 | 13,16 | ||||

| 2025-08-12 | 13F | Cutter & CO Brokerage, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Trinity Legacy Partners, LLC | 13 450 | 0,15 | 6 339 | −7,78 | ||||

| 2025-08-15 | 13F | Synergy Financial Group, LTD | 1 134 | −1,39 | 551 | −10,13 | ||||

| 2025-08-05 | 13F | Wellington Shields Capital Management, LLC | 5 850 | 103,48 | 2 842 | 85,56 | ||||

| 2025-08-11 | 13F | Harold Davidson & Associates Inc. | 1 909 | −2,40 | 927 | −10,95 | ||||

| 2025-07-17 | 13F | Luminvest Wealth Management LLC | 1 416 | 0,00 | 688 | −8,89 | ||||

| 2025-08-15 | 13F | Cooksen Wealth, LLC | 76 | 49,02 | 37 | 71,43 | ||||

| 2025-07-16 | 13F | Cove Private Wealth, LLC | 4 587 | 88,46 | 2 228 | 71,91 | ||||

| 2025-07-08 | 13F | Webster Bank, N. A. | 11 298 | 2,09 | 5 488 | −6,89 | ||||

| 2025-08-13 | 13F | Plan Group Financial, LLC | 3 624 | 9,98 | 1 760 | 0,28 | ||||

| 2025-07-10 | 13F | Selective Wealth Management, Inc. | 2 042 | 0,00 | 978 | −8,69 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - EQ/Equity 500 Index Portfolio Class IA | 387 902 | 0,00 | 188 431 | −8,79 | ||||

| 2025-08-04 | 13F | Fisher Funds Management LTD | 64 785 | 0,00 | 31 471 | −8,82 | ||||

| 2025-08-05 | 13F | Scarborough Advisors, LLC | 1 438 | 103,11 | 699 | 85,15 | ||||

| 2025-06-10 | NP | LFTPX - Lincoln U.S. Equity Income Maximizer Fund Class I | 631 | 0,00 | 336 | 13,90 | ||||

| 2025-07-24 | 13F | Cross Staff Investments Inc | 15 848 | 2,45 | 7 698 | −6,55 | ||||

| 2025-08-19 | 13F | Marex Group plc | Call | 200 000 | 97 154 | |||||

| 2025-07-14 | 13F | Abacus Wealth Partners, LLC | 3 653 | 3,19 | 1 775 | −5,89 | ||||

| 2025-08-19 | 13F | Marex Group plc | Put | 400 000 | 194 308 | |||||

| 2025-08-14 | 13F | MSA Advisors, LLC | 475 | 0,00 | 231 | −8,73 | ||||

| 2025-08-19 | 13F | Marex Group plc | 207 826 | 100 956 | ||||||

| 2025-07-16 | 13F | Plancorp, LLC | 18 450 | 3,50 | 8 962 | −5,59 | ||||

| 2025-07-29 | 13F | Tradewinds Capital Management, LLC | 1 749 | 0,00 | 850 | −8,81 | ||||

| 2025-07-29 | NP | MEFOX - Meehan Focus Fund | 24 850 | 0,00 | 12 523 | −1,92 | ||||

| 2025-06-25 | NP | LPEFX - ALPS/Red Rocks Listed Private Equity Fund Investor Shares | 5 430 | −4,90 | 2 896 | 8,18 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 27 190 809 | −2,16 | 13 208 480 | −10,76 | ||||

| 2025-07-23 | 13F | Valmark Advisers, Inc. | 58 643 | −0,24 | 28 487 | −9,01 | ||||

| 2025-07-22 | 13F/A | Duncan Williams Asset Management, LLC | 14 625 | 1,39 | 7 104 | −7,52 | ||||

| 2025-07-18 | 13F | Newman Dignan & Sheerar, Inc. | 6 462 | −0,45 | 3 139 | −9,17 | ||||

| 2025-08-15 | 13F | Morse Asset Management, Inc | 2 325 | −75,91 | 1 129 | −78,04 | ||||

| 2025-07-16 | 13F | Rebalance, Llc | 7 877 | −0,35 | 3 826 | −9,12 | ||||

| 2025-07-25 | 13F | Cerro Pacific Wealth Advisors LLC | 4 670 | −4,40 | 2 269 | 2,44 | ||||

| 2025-05-27 | NP | FTCS - First Trust Capital Strength ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 362 403 | −27,18 | 193 009 | 42,05 | ||||

| 2025-07-23 | 13F | Godsey & Gibb Associates | 5 430 | −0,46 | 2 638 | −9,23 | ||||

| 2025-07-29 | 13F | Quotient Wealth Partners, LLC | 11 873 | 0,82 | 5 767 | −8,05 | ||||

| 2025-08-11 | 13F | Baldwin Investment Management, LLC | 18 844 | −1,70 | 9 154 | −10,34 | ||||

| 2025-07-28 | NP | VCGAX - Growth & Income Fund | 20 627 | −4,59 | 10 395 | −6,43 | ||||

| 2025-07-30 | 13F | Loring Wolcott & Coolidge Fiduciary Advisors Llp/ma | 212 953 | −3,16 | 103 446 | −10,70 | ||||

| 2025-07-23 | 13F | Bellevue Asset Management, Llc | 1 273 | 0,00 | 618 | −8,71 | ||||

| 2025-08-05 | 13F | Meixler Investment Management, Ltd. | 27 486 | −2,79 | 13 352 | −11,34 | ||||

| 2025-08-15 | 13F | Asset Allocation Strategies LLC | 880 | 2,44 | 427 | −6,56 | ||||

| 2025-07-21 | 13F | Yeomans Consulting Group, Inc. | 737 | −5,75 | 361 | −13,46 | ||||

| 2025-07-11 | 13F | Bell Bank | 4 512 | −2,10 | 2 192 | −10,72 | ||||

| 2025-07-24 | 13F | Edge Financial Advisors LLC | 784 | −12,79 | 382 | −20,29 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | Put | 67 200 | −20,66 | 32 644 | −27,64 | |||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | Call | 33 700 | 7,67 | 16 370 | −1,79 | |||

| 2025-07-30 | 13F | Parcion Private Wealth LLC | 5 664 | 2,39 | 2 751 | −6,62 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 292 948 | 142 305 | ||||||

| 2025-07-15 | 13F | Wealth Effects Llc | 4 995 | −5,40 | 2 426 | −13,73 | ||||

| 2025-07-21 | 13F | Asset Advisors Investment Management, LLC | 23 243 | 0,00 | 11 291 | −8,79 | ||||

| 2025-05-15 | 13F | Polar Asset Management Partners Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-05 | 13F | Tsfg, Llc | 5 295 | 5,18 | 3 | 0,00 | ||||

| 2025-07-11 | 13F | Afg Fiduciary Services Limited Partnership | 619 | 0,00 | 303 | −5,90 | ||||

| 2025-06-27 | NP | PRF - Invesco FTSE RAFI US 1000 ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 381 623 | −0,30 | 203 500 | 13,44 | ||||

| 2025-08-27 | NP | JNL SERIES TRUST - JNL/Mellon Financial Sector Fund (I) | 363 396 | −0,78 | 176 527 | −9,50 | ||||

| 2025-08-05 | 13F | ADG Wealth Management Group, LLC | 575 | 15,00 | 279 | 4,89 | ||||

| 2025-08-13 | 13F | Okabena Investment Services Inc | 7 542 | 24,83 | 3 664 | 13,86 | ||||

| 2025-08-14 | 13F | Erste Asset Management GmbH | 19 092 | 72,20 | 9 090 | 53,52 | ||||

| 2025-07-24 | 13F | Rice Partnership, LLC | 39 095 | 18 991 | ||||||

| 2025-07-11 | 13F | Compass Ion Advisors, LLC | 11 287 | 0,16 | 5 483 | −8,65 | ||||

| 2025-08-28 | NP | SSBIX - State Street Balanced Index Fund Class K | 10 879 | 1,56 | 5 285 | −7,36 | ||||

| 2025-08-13 | 13F | Morton Community Bank | 0 | −100,00 | 0 | |||||

| 2025-08-06 | NP | LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP JPMorgan Select Mid Cap Value Managed Volatility Fund Standard Class | 3 719 | 6,78 | 1 807 | −2,59 | ||||

| 2025-08-06 | 13F | Cetera Trust Company, N.A | 1 387 | 0,00 | 674 | −8,81 | ||||

| 2025-08-19 | 13F | State of Wyoming | 3 435 | −1,86 | 1 669 | −10,52 | ||||

| 2025-07-25 | 13F | Astoria Portfolio Advisors LLC. | 3 097 | −0,51 | 1 488 | −9,21 | ||||

| 2025-08-11 | NP | CUSUX - Six Circles U.S. Unconstrained Equity Fund | 532 962 | −3,44 | 258 897 | −11,93 | ||||

| 2025-08-13 | 13F | Winslow Asset Management Inc | 1 616 | −9,01 | 1 | |||||

| 2025-06-26 | NP | TIEIX - TIAA-CREF Equity Index Fund Institutional Class | 1 612 693 | 4,09 | 859 969 | 18,43 | ||||

| 2025-07-18 | 13F | Wiser Wealth Management, Inc | 863 | 5,24 | 419 | −3,90 | ||||

| 2025-08-22 | NP | CZMGX - Multi-Manager Growth Strategies Fund Institutional Class | 419 | −98,68 | 204 | −98,80 | ||||

| 2025-08-01 | 13F | Teacher Retirement System Of Texas | 416 843 | −6,35 | 202 490 | −14,58 | ||||

| 2025-08-04 | 13F | KLCM Advisors, Inc. | 6 926 | −3,34 | 3 364 | −11,82 | ||||

| 2025-08-05 | 13F | Tufton Capital Management | 7 394 | 0,00 | 4 | −99,92 | ||||

| 2025-08-14 | NP | BVSIX - Baywood SociallyResponsible Fund Institutional Shares | 1 200 | 0,00 | 583 | −8,92 | ||||

| 2025-07-24 | 13F | VanderPol Investments L.L.C. | 470 | 0,43 | 228 | −8,43 | ||||

| 2025-08-14 | 13F | Gould Capital, LLC | 7 077 | −0,39 | 3 438 | −9,15 | ||||

| 2025-07-07 | 13F | Somerset Trust Co | 749 | 5,05 | 364 | −4,22 | ||||

| 2025-07-17 | 13F | CWA Asset Management Group, LLC | 75 476 | 2,43 | 36 664 | −6,57 | ||||

| 2025-08-14 | 13F | Godshalk Welsh Capital Management, Inc. | 9 733 | −3,28 | 4 728 | −11,79 | ||||

| 2025-08-07 | 13F | Timonier Family Office, LTD. | 1 150 | 0,00 | 559 | −8,82 | ||||

| 2025-08-13 | 13F | Bank Of Nova Scotia | 281 010 | −14,78 | 136 506 | −22,27 | ||||

| 2025-08-26 | NP | JHDRX - JPMorgan Hedged Equity 2 Fund Class R6 | 168 499 | −8,90 | 81 852 | −16,91 | ||||

| 2025-08-04 | 13F | Wealth Management Associates, Inc. | 798 | 0,00 | 388 | −8,73 | ||||

| 2025-07-22 | 13F | Bank Hapoalim Bm | 3 303 | −10,85 | 2 | 0,00 | ||||

| 2025-07-31 | 13F | Auour Investments LLC | 521 | 0,00 | 253 | −8,66 | ||||

| 2025-08-25 | NP | MML SERIES INVESTMENT FUND - MML Equity Index Fund Class I | 22 210 | −4,28 | 10 789 | −12,70 | ||||

| 2025-08-06 | 13F | Financial Alternatives, Inc | 2 793 | 6,64 | 1 357 | −2,73 | ||||

| 2025-08-08 | 13F | Strategies Wealth Advisors, LLC | 3 405 | 9,49 | 1 654 | −0,12 | ||||

| 2025-07-16 | 13F | Badgley Phelps Wealth Managers, LLC | 143 081 | −9,79 | 69 504 | −17,72 | ||||

| 2025-08-11 | 13F | Intrust Bank Na | 20 024 | −6,33 | 9 727 | −14,56 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 64 713 | 8,87 | 30 537 | −3,54 | ||||

| 2025-05-15 | 13F | Concorde Asset Management, LLC | 1 333 | 17,03 | 698 | 35,27 | ||||

| 2025-08-27 | NP | Brighthouse Funds Trust I - AB Global Dynamic Allocation Portfolio Class B | 23 121 | 0,00 | 11 231 | −8,79 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 111 944 | 23,24 | 54 379 | 12,40 | ||||

| 2025-08-04 | 13F | Nixon Capital, LLC | 610 | 19,61 | 296 | 9,23 | ||||

| 2025-08-20 | NP | NATIONWIDE VARIABLE INSURANCE TRUST - American Century NVIT Multi Cap Value Fund Class I | 36 750 | −6,15 | 17 852 | −14,40 | ||||

| 2025-08-08 | 13F | Cornerstone Advisors, LLC | 88 800 | 7,64 | 43 136 | −1,82 | ||||

| 2025-08-12 | 13F | Guerra Pan Advisors, Llc | 5 389 | 14,20 | 2 618 | 4,14 | ||||

| 2025-07-28 | 13F | Acorn Financial Advisory Services Inc /adv | 2 875 | 8,37 | 1 397 | −1,13 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 314 120 | −56,89 | 152 590 | −60,68 | ||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 16 776 | 8 | ||||||

| 2025-07-30 | NP | OMAH - VistaShares Target 15 Berkshire Select Income ETF | 44 485 | 22 419 | ||||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 16 793 | −6,11 | 8 158 | −14,35 | ||||

| 2025-08-26 | NP | ASYLX - AB Select US Long/Short Portfolio Advisor Class | 76 527 | 99,32 | 37 175 | 81,80 | ||||

| 2025-05-14 | 13F | West Chester Capital Advisors, Inc | 0 | −100,00 | 0 | |||||

| 2025-07-09 | 13F | Triumph Capital Management | 6 783 | 16,03 | 3 295 | 5,81 | ||||

| 2025-07-21 | 13F | Sterling Investment Counsel, LLC | 8 447 | −23,62 | 4 103 | −30,33 | ||||

| 2025-08-11 | 13F | Plum Street Advisors, LLC | 771 | 0,00 | 375 | −8,78 | ||||

| 2025-08-26 | NP | Profunds - Profund Vp Financials | 8 790 | −7,36 | 4 270 | −15,52 | ||||

| 2025-06-27 | NP | EIVPX - Parametric Volatility Risk Premium - Defensive Fund Institutional Class | 24 120 | 1,58 | 12 862 | 15,57 | ||||

| 2025-08-07 | 13F | Aspen Wealth Strategies, LLC | 1 269 | 0,00 | 616 | −8,74 | ||||

| 2025-08-01 | 13F | Fairfield Financial Advisors, LTD | 20 433 | 1,85 | 9 926 | −7,10 | ||||

| 2025-08-12 | 13F | Wealth Dimensions Group, Ltd. | 1 870 | 3,83 | 908 | −5,32 | ||||

| 2025-08-13 | 13F | united american securities inc. (d/b/a uas asset management) | 319 643 | 1,41 | 155 273 | −7,50 | ||||

| 2025-08-26 | NP | AUUYX - AB Select US Equity Portfolio Advisor Class | 28 495 | 48,92 | 13 842 | 35,84 | ||||

| 2025-07-14 | 13F | Edge Wealth Management LLC | 40 699 | −1,41 | 19 753 | −10,15 | ||||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 197 984 | 96 175 | ||||||

| 2025-08-05 | 13F | Integrity Wealth Solutions LLC | 1 443 | 2,92 | 701 | −6,17 | ||||

| 2025-07-22 | NP | FLCV - Federated Hermes MDT Large Cap Value ETF | 886 | −32,52 | 447 | −33,83 | ||||

| 2025-08-12 | 13F | Country Trust Bank | 3 133 | 20,08 | 1 522 | 9,50 | ||||

| 2025-07-10 | 13F | Rockland Trust Co | 22 228 | −69,43 | 10 798 | −72,12 | ||||

| 2025-07-22 | 13F | Macroview Investment Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | MUXAX - Victory S&P 500 Index Fund Class A | 9 249 | −2,13 | 4 493 | −10,73 | ||||

| 2025-07-14 | 13F | BetterWealth, LLC | 1 818 | 0,00 | 883 | −8,78 | ||||

| 2025-08-14 | 13F | Quartz Partners, LLC | 1 124 | 10,52 | 546 | 0,92 | ||||

| 2025-07-09 | 13F | Seaside Wealth Management, Inc. | 555 | −0,18 | 270 | −9,12 | ||||

| 2025-07-18 | 13F | CHURCHILL MANAGEMENT Corp | 38 684 | 1,76 | 18 791 | −7,19 | ||||

| 2025-07-10 | 13F | Stewardship Advisors, LLC | 711 | −3,00 | 345 | −11,54 | ||||

| 2025-08-14 | 13F | Objective Capital Management, LLC | 2 216 | 13,64 | 1 076 | 3,66 | ||||

| 2025-08-12 | 13F | Corebridge Financial, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | Steigerwald, Gordon & Koch Inc. | 3 884 | 0,52 | 1 887 | −8,31 | ||||

| 2025-07-24 | 13F | E Fund Management (Hong Kong) Co., Ltd. | 0 | −100,00 | 0 | |||||

| 2025-07-28 | 13F | Courier Capital Llc | 12 680 | 0,12 | 6 159 | −8,67 | ||||

| 2025-07-24 | 13F | Ramirez Asset Management, Inc. | 300 | 0,00 | 146 | −8,81 | ||||

| 2025-08-14 | 13F | Bridgefront Capital, LLC | 1 347 | 654 | ||||||

| 2025-08-05 | 13F | Aviance Capital Partners, LLC | 18 624 | 0,10 | 9 047 | −8,71 | ||||

| 2025-08-01 | 13F | Twin Lakes Capital Management, LLC | 7 654 | −0,38 | 3 718 | −9,12 | ||||

| 2025-08-07 | 13F | Nicollet Investment Management, Inc. | 748 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Foyston, Gordon, & Payne Inc | 16 323 | 0,00 | 7 929 | −8,79 | ||||

| 2025-08-06 | 13F | HORAN Wealth, LLC | 11 394 | 5 535 | ||||||

| 2025-08-12 | 13F | Quantum Private Wealth, LLC | 4 064 | 0,00 | 1 974 | −8,78 | ||||

| 2025-06-30 | NP | XTR - Global X S&P 500 Tail Risk ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 70 | 16,67 | 37 | 32,14 | ||||

| 2025-07-25 | 13F | Means Investment Co., Inc. | 20 165 | 1,86 | 9 796 | −7,09 | ||||

| 2025-08-27 | NP | ALLIANZ VARIABLE INSURANCE PRODUCTS TRUST - AZL DFA U.S. Core Equity Fund | 18 075 | 0,45 | 8 780 | −8,38 | ||||

| 2025-08-08 | 13F | Evolution Wealth Advisors, LLC | 16 017 | −1,21 | 7 781 | −9,89 | ||||

| 2025-08-14 | 13F | Point72 (DIFC) Ltd | Put | 9 200 | 55,93 | 4 469 | 42,23 | |||

| 2025-07-24 | 13F | Conning Inc. | 11 387 | −3,36 | 5 531 | −11,86 | ||||

| 2025-07-07 | 13F | Bangor Savings Bank | 4 096 | −6,27 | 1 990 | −14,53 | ||||

| 2025-08-14 | 13F | Peapack Gladstone Financial Corp | 147 076 | −1,46 | 71 | −10,13 | ||||

| 2025-08-14 | 13F | Point72 (DIFC) Ltd | Call | 14 100 | −2,08 | 6 849 | −10,69 | |||

| 2025-07-09 | 13F | Taylor Hoffman Capital Management LLC | 2 578 | 0,19 | 1 252 | −8,68 | ||||

| 2025-04-10 | 13F | Bremer Bank National Association | 3 861 | 0,26 | 2 056 | 17,82 | ||||

| 2025-05-16 | 13F | Fred Alger Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-22 | NP | CLCEX - Multi-Manager Large Cap Growth Strategies Fund Institutional Class | 17 908 | 8 699 | ||||||

| 2025-08-14 | 13F | Punch & Associates Investment Management, Inc. | 30 746 | 4,06 | 14 935 | −5,08 | ||||

| 2025-07-14 | 13F | Harbor Group, Inc. | 2 187 | 0,00 | 1 062 | −8,76 | ||||

| 2025-08-08 | 13F | Old West Investment Management, LLC | 17 571 | 2,78 | 8 535 | −6,25 | ||||

| 2025-08-13 | 13F | Estabrook Capital Management | 1 875 | 0,00 | 911 | −8,82 | ||||

| 2025-07-14 | 13F | Mechanics Bank Trust Department | 19 559 | 2,40 | 9 501 | −6,60 | ||||

| 2025-08-07 | 13F | Runnymede Capital Advisors, Inc. | 798 | 6,68 | 388 | −2,76 | ||||

| 2025-08-13 | 13F | Aristides Capital LLC | 0 | −100,00 | 0 | |||||

| 2025-07-25 | NP | FNDX - Schwab Fundamental U.S. Large Company Index ETF This fund is a listed as child fund of Charles Schwab Investment Management Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 781 225 | −5,07 | 393 706 | −6,89 | ||||

| 2025-07-15 | 13F | Beacon Investment Advisory Services, Inc. | 8 353 | 4,28 | 4 058 | −4,88 | ||||

| 2025-08-14 | 13F | Redwood Investment Management, Llc | 4 890 | −16,22 | 2 | −33,33 | ||||

| 2025-07-16 | 13F | Eagle Global Advisors Llc | 28 803 | −2,83 | 13 992 | −11,38 | ||||

| 2025-06-23 | NP | IYF - iShares U.S. Financials ETF | 784 676 | −23,72 | 418 428 | −13,21 | ||||

| 2025-08-14 | 13F | Man Group plc | 140 626 | 53,65 | 68 312 | 40,15 | ||||

| 2025-08-11 | 13F | Semus Wealth Partners LLC | 1 486 | 40,59 | 722 | 28,29 | ||||

| 2025-08-07 | 13F | David R. Rahn & Associates Inc. | 9 121 | −26,69 | 4 430 | −33,13 | ||||

| 2025-08-14 | 13F | Transamerica Financial Advisors, Inc. | 46 | 0,00 | 22 | |||||

| 2025-08-01 | 13F | Milestone Asset Management Group, LLC | 2 889 | 5,82 | 1 403 | −3,44 | ||||

| 2025-08-05 | 13F | Corps Capital Advisors, LLC | 2 525 | −16,61 | 1 227 | −23,95 | ||||

| 2025-08-05 | 13F | Milestone Asset Management, Llc | 2 617 | −5,15 | 1 271 | −13,48 | ||||

| 2025-08-11 | 13F/A | Purus Wealth Management, LLC | 1 027 | 12,24 | 499 | 2,26 | ||||

| 2025-08-05 | 13F | Mma Asset Management Llc | 1 079 | 0,00 | 524 | −8,71 | ||||

| 2025-08-04 | 13F | ArborFi Advisors, LLC | 1 001 | 1,32 | 486 | −7,60 | ||||

| 2025-08-26 | NP | IWL - iShares Russell Top 200 ETF | 70 199 | −1,46 | 34 101 | −10,12 | ||||

| 2025-08-15 | 13F | Howland Capital Management Llc | 181 421 | −0,91 | 88 129 | −9,62 | ||||

| 2025-08-12 | 13F | Bravias Capital Group, LLC | 12 055 | 6,94 | 5 856 | −2,47 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - U.S. Large Cap Equity Portfolio Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 47 099 | 5,62 | 25 116 | 20,18 | ||||

| 2025-07-22 | 13F | Yoder Wealth Management, Inc. | 1 695 | 6,87 | 823 | −2,49 | ||||

| 2025-08-27 | NP | THRIVENT SERIES FUND INC - Thrivent Balanced Income Plus Portfolio Class A | 712 | −5,19 | 346 | −13,53 | ||||

| 2025-08-08 | 13F/A | Prospect Financial Services LLC | 920 | 16,90 | 447 | 6,44 | ||||

| 2025-07-21 | 13F | Mendota Financial Group, LLC | 7 535 | −3,52 | 3 660 | −12,00 | ||||

| 2025-07-29 | NP | SIXH - 6 Meridian Hedged Equity-Index Option Strategy ETF | 28 009 | 14 115 | ||||||

| 2025-06-26 | NP | FYEE - Fidelity Yield Enhanced Equity ETF | 574 | 50,26 | 306 | 70,95 | ||||

| 2025-04-14 | 13F | Beach Investment Counsel Inc/pa | 3 552 | −9,53 | 2 | 0,00 | ||||

| 2025-08-06 | 13F | Legacy Investment Solutions, LLC | 281 | 0,00 | 137 | 3,03 | ||||

| 2025-06-20 | NP | RVRB - Reverb ETF | 108 | 0,00 | 58 | 14,00 | ||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 658 | −27,61 | 320 | −34,09 | ||||

| 2025-08-14 | 13F | Cibc World Markets Corp | 313 133 | 3,97 | 152 111 | −5,17 | ||||

| 2025-08-05 | 13F | Atlas Wealth LLC | 1 733 | −3,18 | 848 | −11,02 | ||||

| 2025-08-27 | NP | RYDEX VARIABLE TRUST - S&P 500 2x Strategy Fund Variable Annuity | 2 837 | 286,51 | 1 378 | 253,33 | ||||

| 2025-07-24 | 13F/A | McElhenny Sheffield Capital Management, LLC | 520 | −11,41 | 253 | −19,23 | ||||

| 2025-08-14 | 13F | Bank Of Hawaii | 13 091 | −11,29 | 6 359 | −19,09 | ||||

| 2025-08-26 | NP | BNY MELLON VARIABLE INVESTMENT FUND - Growth and Income Portfolio - Initial Shares | 3 330 | −6,33 | 1 618 | −14,58 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 140 072 | −0,56 | 68 043 | −9,30 | ||||

| 2025-08-08 | 13F | Breed's Hill Capital LLC | 2 587 | 1,97 | 1 257 | −7,03 | ||||

| 2025-08-26 | NP | JAVA - JPMorgan Active Value ETF | 87 623 | −37,00 | 42 565 | −42,53 | ||||

| 2025-08-15 | 13F | WealthCollab, LLC | 1 585 | 3,93 | 770 | −5,30 | ||||

| 2025-08-28 | NP | DGT - SPDR(R) Global Dow ETF This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 5 159 | 21,19 | 2 506 | 10,54 | ||||

| 2025-07-15 | 13F | Cigna Investments Inc /new | 17 335 | −1,52 | 8 | −11,11 | ||||

| 2025-07-31 | 13F | Mcdaniel Terry & Co | 25 126 | −0,69 | 12 205 | 93 784,62 | ||||

| 2025-07-31 | 13F | Pacitti Group Inc. | 1 358 | −0,59 | 660 | −9,35 | ||||

| 2025-08-27 | NP | OHIO NATIONAL FUND INC - ON Janus Henderson U.S. Low Volatility Portfolio | 9 964 | −5,32 | 4 840 | −13,63 | ||||

| 2025-07-21 | 13F | Cornell Pochily Investment Advisors, Inc. | 12 022 | −0,12 | 5 840 | −8,91 | ||||

| 2025-08-14 | NP | FLFGX - GLOBAL ALLOCATION FUND Retail Class | 1 789 | −11,00 | 869 | −18,79 | ||||

| 2025-04-09 | 13F | Selway Asset Management | 2 250 | −1,53 | 1 198 | 15,75 | ||||

| 2025-07-18 | 13F | B.O.S.S. Retirement Advisors, LLC | 976 | 5,51 | 474 | −3,66 | ||||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 1 102 | −1,96 | 535 | −10,54 | ||||

| 2025-06-23 | NP | ULPIX - Ultrabull Profund Investor Class | 3 649 | −9,68 | 1 946 | 2,75 | ||||

| 2025-07-28 | 13F | Dixon Fnancial Services, Inc. | 571 | 0,00 | 277 | −8,88 | ||||

| 2025-07-30 | 13F | Clifford Swan Investment Counsel Llc | 170 976 | −1,82 | 83 055 | −10,45 | ||||

| 2025-08-11 | 13F | Birchbrook, Inc. | 3 431 | −2,75 | 1 667 | −11,29 | ||||

| 2025-07-30 | 13F | Cookson Peirce & Co Inc | 2 837 | −3,50 | 1 378 | −11,95 | ||||

| 2025-08-05 | 13F | Carolinas Wealth Consulting Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-14 | 13F | Wealth Advisory Solutions, LLC | 3 985 | −1,46 | 1 936 | −10,13 | ||||

| 2025-08-13 | 13F | Farnam Financial LLC | 6 207 | −0,56 | 3 015 | −9,30 | ||||

| 2025-08-14 | 13F | Inspire Trust Co, N.a. | 10 450 | 43,15 | 5 076 | 30,59 | ||||

| 2025-07-16 | 13F | Meridian Financial, LLC | 759 | 0,00 | 369 | −8,91 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 45 694 | 0,02 | 22 197 | −8,77 | ||||

| 2025-08-04 | 13F | Savvy Advisors, Inc. | 20 941 | 41,07 | 10 172 | 28,68 | ||||

| 2025-07-23 | 13F | Trifecta Capital Advisors, LLC | 4 466 | 4,20 | 2 169 | −4,95 | ||||

| 2025-08-04 | 13F | Terril Brothers, Inc. | 2 302 | 8,53 | 1 118 | −0,97 | ||||

| 2025-08-13 | 13F | Summit Wealth Group Llc / Co | 3 150 | 1 530 | ||||||

| 2025-07-29 | 13F | Stanley-Laman Group, Ltd. | 500 | 0,00 | 243 | −9,02 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 10 600 | −76,96 | 5 149 | −78,98 | ||||

| 2025-07-17 | 13F | Investment Advisory Services Inc /tx /adv | 922 | 0,00 | 448 | −8,96 | ||||

| 2025-07-24 | 13F | CarsonAllaria Wealth Management, Ltd. | 2 503 | 0,00 | 1 216 | −8,85 | ||||

| 2025-08-13 | 13F | Brandes Investment Partners, Lp | 0 | −100,00 | 0 | |||||

| 2025-07-15 | 13F | Verum Partners LLC | 3 679 | −13,09 | 1 787 | −20,72 | ||||

| 2025-08-27 | NP | TOUCHSTONE VARIABLE SERIES TRUST - Touchstone Balanced Fund | 990 | −37,62 | 481 | −43,20 | ||||

| 2025-08-28 | NP | TMMAX - SIMT Tax-Managed Managed Volatility Fund Class F | 7 600 | 0,00 | 3 692 | −8,80 | ||||

| 2025-07-15 | 13F | Axis Wealth Partners, LLC | 640 | 2,89 | 311 | −6,34 | ||||

| 2025-07-30 | 13F | BCK Partners, Inc. | 1 975 | −2,76 | 959 | −11,29 | ||||

| 2025-08-05 | 13F | Freestone Capital Holdings, LLC | 81 680 | −1,62 | 39 678 | −10,27 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 3 292 138 | −4,09 | 1 597 594 | −12,52 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | Call | 10 200 | 0,00 | 4 940 | −8,82 | |||

| 2025-08-13 | 13F | Hsbc Holdings Plc | Put | 19 900 | −7,87 | 9 637 | −16,00 | |||

| 2025-07-28 | 13F | Evernest Financial Advisors, LLC | 4 909 | 13,82 | 2 385 | 3,79 | ||||

| 2025-08-12 | 13F | Brandywine Global Investment Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-10 | 13F | Carderock Capital Management Inc | 785 | 15,44 | 381 | 5,25 | ||||

| 2025-07-28 | 13F | Jag Capital Management, Llc | 7 029 | 3,83 | 3 414 | −5,30 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 436 672 | 9,76 | 212 122 | 0,11 | ||||

| 2025-07-22 | 13F | Relyea Zuckerberg Hanson LLC | 11 141 | 36,25 | 5 412 | 24,28 | ||||

| 2025-08-04 | 13F | Coign Capital Advisors LLC | 1 375 | 17,92 | 668 | 7,58 | ||||

| 2025-07-18 | 13F | RK Asset Management, LLC | 13 363 | −0,14 | 6 | −14,29 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | Call | 100 | 49 | |||||

| 2025-08-11 | 13F | WPG Advisers, LLC | 205 | 6,77 | 100 | −2,94 | ||||

| 2025-07-21 | 13F | West Financial Advisors, LLC | 386 | 0,00 | 188 | −8,78 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 83 335 | 12,36 | 40 482 | 2,48 | ||||

| 2025-06-26 | NP | FEQHX - Fidelity Hedged Equity Fund | 16 547 | 42,30 | 8 824 | 61,92 | ||||

| 2025-07-29 | 13F | Easterly Investment Partners Llc | 5 244 | 256,73 | 2 547 | 225,70 | ||||

| 2025-08-11 | 13F | NewEdge Wealth, LLC | 43 169 | 5,17 | 19 921 | −8,87 | ||||

| 2025-07-22 | NP | LEIFX - FEDERATED EQUITY INCOME FUND INC Class A Shares This fund is a listed as child fund of Federated Hermes, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 46 623 | 0,00 | 23 496 | −1,92 | ||||

| 2025-07-29 | NP | BLUIX - BLUEPRINT GROWTH FUND Institutional Class | 8 105 | 13,31 | 4 085 | 11,13 | ||||

| 2025-05-27 | NP | FTHI - First Trust BuyWrite Income ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 43 363 | 8,64 | 23 094 | 27,65 | ||||

| 2025-07-21 | 13F | Custos Family Office, LLC | 778 | 18,06 | 378 | 7,71 | ||||

| 2025-04-01 | NP | CCAPX - CHIRON CAPITAL ALLOCATION FUND CLASS I SHARES | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-31 | 13F | Allied Investment Advisors, LLC | 3 721 | −2,03 | 1 808 | −10,63 | ||||

| 2025-08-05 | 13F | Magnolia Capital Advisors Llc | 8 636 | 4,77 | 4 195 | −4,44 | ||||

| 2025-08-04 | 13F | Hutchinson Capital Management/ca | 72 240 | −1,53 | 35 092 | −10,18 | ||||

| 2025-06-18 | NP | NWFAX - Nationwide Fund Class A | 81 858 | −4,75 | 43 651 | 8,38 | ||||

| 2025-07-25 | 13F | Wealth Architects, LLC | 26 222 | −9,95 | 12 738 | −17,86 | ||||

| 2025-08-01 | 13F | Taylor Financial Group, Inc. | 9 593 | 0,00 | 4 660 | −8,81 | ||||

| 2025-08-13 | 13F | Rosenblum Silverman Sutton S F Inc /ca | 945 | 0,00 | 459 | −8,75 | ||||

| 2025-08-08 | 13F | EagleClaw Capital Managment, LLC | 9 184 | −3,77 | 4 461 | −12,22 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - EQ/AB Dynamic Growth Portfolio Class IB | 14 804 | 0,00 | 7 191 | −8,79 | ||||

| 2025-07-17 | 13F | XML Financial, LLC | 39 096 | 1,40 | 18 992 | −7,51 | ||||

| 2025-08-07 | 13F | SFE Investment Counsel | 4 706 | −7,65 | 2 286 | −15,77 | ||||

| 2025-08-13 | 13F | Smith, Moore & Co. | 10 152 | 14,09 | 4 932 | 4,07 | ||||

| 2025-07-24 | NP | FCFMX - Fidelity Series Total Market Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 633 425 | 8,69 | 1 327 141 | 6,60 | ||||

| 2025-08-05 | 13F | Main Street Research LLC | 116 181 | 4,27 | 56 437 | −4,89 | ||||

| 2025-08-08 | 13F | Tanglewood Legacy Advisors, LLC | 966 | 0,00 | 469 | −8,75 | ||||

| 2025-08-26 | NP | PENN SERIES FUNDS INC - Index 500 Fund | 30 581 | −1,39 | 14 855 | −10,06 | ||||

| 2025-08-19 | NP | GARTX - Goldman Sachs Absolute Return Tracker Fund Class A | 22 643 | −66,93 | 10 999 | −69,84 | ||||

| 2025-07-16 | 13F | Swisher Financial Concepts, Inc. | 642 | 312 | ||||||

| 2025-07-21 | 13F | Keystone Financial Group, Inc. | 756 | 0,00 | 358 | −7,49 | ||||

| 2025-07-22 | 13F | Capricorn Fund Managers Ltd | 13 592 | −15,96 | 6 603 | −23,35 | ||||

| 2025-08-12 | 13F | Triune Financial Partners, LLC | 2 873 | −0,03 | 1 396 | −8,82 | ||||

| 2025-08-25 | NP | Eaton Vance Tax-managed Buy-write Opportunities Fund | 21 946 | 0,00 | 10 661 | −8,80 | ||||

| 2025-07-09 | 13F | Procyon Private Wealth Partners, LLC | 19 750 | −25,48 | 9 594 | −32,02 | ||||

| 2025-08-04 | 13F | Roble, Belko & Company, Inc | 2 718 | 0,00 | 1 | 0,00 | ||||

| 2025-08-13 | 13F | Menard Financial Group LLC | 1 827 | −2,25 | 888 | −7,31 | ||||

| 2025-08-14 | NP | FLDOX - MODERATE ALLOCATION FUND Retail Class | 10 706 | −12,82 | 5 201 | −20,49 | ||||

| 2025-08-27 | NP | VTSMX - Vanguard Total Stock Market Index Fund Investor Shares | 57 029 190 | 1,71 | 27 703 070 | −7,23 | ||||

| 2025-07-18 | 13F | Montgomery Investment Management Inc | 634 | 0,00 | 308 | −8,90 | ||||

| 2025-07-21 | 13F | Seros Financial, LLC | 19 397 | 3,26 | 9 422 | −5,82 | ||||

| 2025-07-31 | 13F | Ag2r La Mondiale Gestion D'actifs | 49 784 | 1,59 | 24 184 | −2,07 | ||||

| 2025-07-16 | 13F | Tru Independence Asset Management 2, Llc | 10 021 | 0,30 | 4 868 | −8,53 | ||||

| 2025-07-23 | 13F | Klp Kapitalforvaltning As | 496 213 | 3,46 | 241 045 | −5,63 | ||||

| 2025-07-24 | NP | BLACKROCK BALANCED CAPITAL FUND, INC. - BLACKROCK BALANCED CAPITAL FUND, INC. Investor A This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 5 304 | 27,65 | 2 673 | 25,26 | ||||

| 2025-08-04 | 13F | Migdal Insurance & Financial Holdings Ltd. | 2 501 | 1 | ||||||

| 2025-07-11 | 13F | Assenagon Asset Management S.A. | 979 993 | −34,45 | 476 051 | −40,21 | ||||

| 2025-08-04 | 13F | Horizon Wealth Management, LLC | 3 881 | −2,93 | 1 885 | −11,46 | ||||

| 2025-08-27 | NP | VQNPX - Vanguard Growth and Income Fund Investor Shares This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 144 342 | −6,81 | 70 117 | −15,00 | ||||

| 2025-07-25 | 13F | Cascade Investment Advisors, Inc. | 2 180 | −9,54 | 1 059 | −17,54 | ||||

| 2025-08-11 | 13F | Synergy Investment Management, LLC | 878 | 7,86 | 427 | −1,62 | ||||

| 2025-08-14 | 13F | Fiduciary Management Inc /wi/ | 449 290 | −31,54 | 218 252 | −37,56 | ||||

| 2025-08-28 | NP | GMLGX - GuideMark(R) Large Cap Core Fund Service Shares | 16 530 | −32,09 | 8 030 | −38,07 | ||||

| 2025-07-17 | 13F | Michels Family Financial, LLC | 1 649 | −0,78 | 801 | −9,49 | ||||

| 2025-07-22 | 13F | Cedar Mountain Advisors, LLC | 1 853 | −2,63 | 900 | −11,15 | ||||

| 2025-07-22 | 13F | Sutton Place Investors Llc | 2 510 | 8,99 | 1 219 | −0,57 | ||||

| 2025-08-13 | 13F | Gardner Russo & Quinn Llc | 1 154 566 | −2,21 | 560 854 | −10,80 | ||||

| 2025-05-14 | 13F | Mizuho Bank, Ltd. | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | Spinnaker Investment Group, LLC | 4 273 | −11,29 | 2 076 | −19,10 | ||||

| 2025-08-06 | NP | LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Dimensional U.S. Core Equity 1 Fund Standard Class | 37 368 | 0,00 | 18 152 | −8,79 | ||||

| 2025-08-13 | 13F | 1832 Asset Management L.P. | 91 480 | −80,40 | 44 438 | −82,12 | ||||

| 2025-08-07 | 13F | Gryphon Financial Partners LLC | 26 221 | −5,94 | 12 738 | −14,21 | ||||

| 2025-07-29 | NP | VFAIX - Vanguard Financials Index Fund Admiral Shares | 2 134 487 | −2,22 | 1 075 696 | −4,10 | ||||

| 2025-08-01 | 13F | Providence First Trust Co | 447 | 217 | ||||||

| 2025-08-15 | 13F | Global View Capital Management LLC | 2 596 | −5,36 | 1 261 | −13,63 | ||||

| 2025-07-24 | 13F | Coordinated Financial Services, Inc. | 3 662 | 1,86 | 1 779 | 9,15 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 269 705 | 5,45 | 131 015 | −3,82 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 70 829 | 0,09 | 34 407 | −8,71 | ||||

| 2025-07-23 | 13F | Slow Capital, Inc. | 11 988 | −2,35 | 5 823 | −10,94 | ||||

| 2025-07-30 | 13F | Rehmann Capital Advisory Group | 43 200 | −3,10 | 20 985 | −11,62 | ||||

| 2025-07-29 | 13F | Lyell Wealth Management, Lp | 16 827 | 128,16 | 8 174 | 108,15 | ||||

| 2025-07-30 | 13F | Jackson Thornton Asset Management, Llc | 1 505 | 4,01 | 719 | −4,14 | ||||

| 2025-08-28 | NP | WFIVX - Wilshire 5000 Index Fund Investment Class | 6 417 | −1,00 | 3 117 | −9,70 | ||||

| 2025-07-11 | 13F | Colorado Capital Management, Inc. | 3 128 | 0,32 | 2 | 0,00 | ||||

| 2025-08-05 | 13F | Allstate Corp | 2 745 | −93,95 | 1 333 | −94,49 | ||||

| 2025-07-21 | 13F | HT Partners LLC | 2 710 | −0,91 | 1 316 | −9,62 | ||||

| 2025-07-17 | 13F | Alpine Bank Wealth Management | 7 606 | −3,08 | 3 695 | −11,61 | ||||

| 2025-07-09 | 13F | Dynamic Advisor Solutions LLC | 40 628 | 1,57 | 19 736 | −7,36 | ||||

| 2025-07-31 | 13F | Hobart Private Capital, LLC | 487 | 237 | ||||||

| 2025-08-01 | 13F | Austin Private Wealth, LLC | 3 612 | 42,71 | 1 755 | 30,12 | ||||

| 2025-07-28 | 13F | Davidson Investment Advisors | 554 | 22,03 | 269 | 11,62 | ||||

| 2025-08-12 | 13F | Gitterman Wealth Management, LLC | 1 818 | 28,03 | 883 | 16,80 | ||||

| 2025-06-27 | NP | TOV - JLens 500 Jewish Advocacy U.S. ETF | 4 839 | 0,00 | 2 580 | 0,00 | ||||

| 2025-07-25 | 13F | Carbahal Olsen Financial Services Group, LLC | 2 389 | 1,01 | 1 161 | −7,86 | ||||

| 2025-06-27 | NP | YOKE - Yoke Core ETF | 6 151 | 3 280 | ||||||

| 2025-07-29 | 13F | Wealthstream Advisors, Inc. | 2 599 | 1,88 | 1 263 | −7,07 | ||||

| 2025-08-14 | 13F | Spears Abacus Advisors LLC | 342 352 | −2,39 | 166 304 | −10,97 | ||||

| 2025-07-29 | 13F | Citizens Business Bank | 520 | −11,41 | 253 | −19,23 | ||||

| 2025-08-14 | 13F | Capitolis Liquid Global Markets LLC | 425 700 | 204,72 | 206 792 | 177,94 | ||||

| 2025-06-26 | NP | FQAL - Fidelity Quality Factor ETF This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 46 094 | −8,54 | 24 580 | 11,22 | ||||

| 2025-04-23 | 13F | JCIC Asset Management Inc. | 180 | 0,00 | 96 | 17,28 | ||||

| 2025-08-08 | 13F | Citizens Financial Group Inc/ri | 70 958 | 80,62 | 34 469 | 64,74 | ||||

| 2025-07-15 | 13F | Aspire Capital Advisors LLC | 5 024 | 1,31 | 2 441 | −7,61 | ||||

| 2025-06-25 | NP | FTLS - First Trust Long/Short Equity ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 64 979 | 20,08 | 34 650 | 36,62 | ||||

| 2025-08-13 | 13F | Capula Management Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Stone House Investment Management, LLC | 134 | 8,94 | 65 | 0,00 | ||||

| 2025-08-11 | 13F | Empowered Funds, LLC | 67 033 | 35,60 | 32 563 | 23,68 | ||||

| 2025-08-14 | 13F | Crawford Investment Counsel Inc | 17 972 | −1,81 | 8 730 | −10,43 | ||||

| 2025-07-31 | 13F | SoundView Advisors Inc. | 563 | 10,83 | 0 | |||||

| 2025-08-12 | 13F | Evelyn Partners Investment Management Services Ltd | 76 907 | 186,58 | 36 439 | 49,17 | ||||

| 2025-08-13 | 13F | Willis Johnson & Associates, Inc. | 2 406 | −8,10 | 1 169 | −16,21 | ||||

| 2025-07-09 | 13F | Parkside Advisors LLC | 3 110 | 20,82 | 1 511 | 10,22 | ||||

| 2025-07-29 | 13F | Northeast Investment Management | 136 249 | −1,29 | 66 186 | −9,97 | ||||

| 2025-07-28 | 13F | Revolve Wealth Partners, LLC | 6 541 | −0,17 | 3 177 | −8,94 | ||||

| 2025-08-13 | 13F | Idaho Trust Bank | 8 821 | 2,09 | 4 285 | −6,89 | ||||

| 2025-08-13 | 13F | Laidlaw Wealth Management LLC | 1 626 | −45,51 | 790 | −50,35 | ||||

| 2025-08-14 | 13F | Mbb Public Markets I Llc | 489 | −32,08 | 238 | −38,12 | ||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 2 933 | −2,04 | 1 380 | −12,78 | ||||

| 2025-07-28 | NP | CSM - ProShares Large Cap Core Plus | 9 363 | −1,26 | 4 719 | −3,16 | ||||

| 2025-07-16 | 13F | NovaPoint Capital, LLC | 32 797 | −10,07 | 15 932 | −17,98 | ||||

| 2025-07-18 | 13F | Benchmark Wealth Management, LLC | 2 556 | −5,16 | 1 242 | −13,52 | ||||

| 2025-08-27 | NP | MUHLX - Muhlenkamp Fund Institutional Class Shares | 25 199 | 0,00 | 12 241 | −8,79 | ||||

| 2025-07-15 | 13F | Define Financial, Llc | 1 353 | 0,00 | 657 | −7,33 | ||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 807 | 392 | ||||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 139 227 | −7,23 | 67 632 | −15,38 | ||||

| 2025-07-24 | 13F | MFA Wealth Services | 1 968 | −8,68 | 956 | −16,65 | ||||

| 2025-08-26 | NP | MASTER INVESTMENT PORTFOLIO - S&P 500 Index Master Portfolio | 1 744 244 | 2,09 | 847 301 | −6,88 | ||||

| 2025-07-08 | 13F | Davis Investment Partners, LLC | 1 250 | 612 | ||||||

| 2025-07-10 | 13F | HF Advisory Group, LLC | 8 329 | −13,22 | 4 046 | −20,86 | ||||

| 2025-08-08 | 13F | Cherokee Insurance Co | 6 600 | 0,00 | 3 206 | −8,79 | ||||

| 2025-07-14 | 13F | Financial Enhancement Group LLC | 4 137 | 2,48 | 1 969 | −6,37 | ||||

| 2025-07-14 | 13F | Farmers & Merchants Investments Inc | 100 030 | 0,14 | 48 592 | −8,66 | ||||

| 2025-08-01 | 13F | Gwn Securities Inc. | 5 630 | −86,83 | 2 739 | −87,34 | ||||

| 2025-03-27 | NP | PWS - Pacer WealthShield ETF | 1 076 | −12,38 | 504 | −6,32 | ||||

| 2025-07-17 | 13F | Financial Partners Group, LLC | 27 399 | −1,81 | 13 310 | −10,44 | ||||

| 2025-07-21 | 13F | Rainey & Randall Investment Management Inc. | 518 | −0,58 | 252 | −9,39 | ||||

| 2025-08-13 | 13F | Pinkerton Retirement Specialists, LLC | 9 740 | 6,41 | 4 731 | −2,93 | ||||

| 2025-08-06 | 13F | ORBA Wealth Advisors, L.L.C. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Marshall Wace, Llp | Call | 3 700 | 428,57 | 1 797 | 383,06 | |||

| 2025-08-13 | 13F | Marshall Wace, Llp | 235 132 | 710,02 | 114 220 | 638,86 | ||||

| 2025-08-14 | NP | FLDFX - BALANCED FUND Retail Class | 36 641 | −12,46 | 17 799 | −20,15 | ||||

| 2025-07-16 | 13F | Ascent Capital Management, LLC | 1 195 | −0,17 | 580 | −8,95 | ||||

| 2025-07-10 | 13F | Sumitomo Mitsui DS Asset Management Company, Ltd | 191 396 | 6,01 | 92 974 | −3,31 | ||||

| 2025-08-12 | 13F/A | Cozad Asset Management Inc | 13 365 | 0,19 | 6 492 | −8,61 | ||||

| 2025-08-20 | NP | AQGNX - AQR Global Equity Fund Class N | 7 000 | 0,00 | 3 400 | −8,80 | ||||

| 2025-08-13 | 13F | Alpha Family Trust | 3 820 | 0,00 | 1 856 | −8,80 | ||||

| 2025-07-22 | 13F | Sava Infond d.o.o. | 6 040 | −34,28 | 2 934 | −40,05 | ||||

| 2025-07-30 | 13F | Sonata Capital Group Inc | 14 284 | −2,50 | 7 | −14,29 | ||||

| 2025-07-30 | 13F | Townsend & Associates, Inc | 57 877 | 52,94 | 28 017 | 46,05 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | Put | 400 | 194 | |||||

| 2025-08-06 | 13F | ROI Financial Advisors, LLC | 4 180 | 33,29 | 2 031 | 21,56 | ||||

| 2025-08-28 | NP | SVTAX - Simt Global Managed Volatility Fund Class F | 9 426 | −19,53 | 4 579 | −26,61 | ||||

| 2025-08-12 | 13F | Bank OZK | 498 | −10,91 | 242 | −18,86 | ||||

| 2025-08-04 | 13F | Clear Investment Research, Llc | 915 | 0,00 | 444 | −8,83 | ||||

| 2025-08-11 | 13F | Bulltick Wealth Management, LLC | 14 979 | 381,79 | 7 276 | 339,64 | ||||

| 2025-07-29 | 13F | Spirit Of America Management Corp/ny | 4 120 | 2,49 | 2 001 | −6,50 | ||||

| 2025-07-15 | 13F | Affinity Wealth Management Llc | 1 010 | 0,00 | 491 | −8,75 | ||||

| 2025-07-17 | 13F | Clean Yield Group | 2 392 | −30,40 | 1 162 | −36,56 | ||||

| 2025-06-26 | NP | DFEOX - U.s. Core Equity 1 Portfolio - Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 914 576 | −4,18 | 487 698 | 9,03 | ||||

| 2025-07-29 | 13F | Harbor Asset Planning, Inc. | 737 | 358 | ||||||

| 2025-07-18 | 13F | jvl associates llc | 800 | 1,27 | 389 | −7,62 | ||||

| 2025-08-14 | 13F | Voya Financial Advisors, Inc. | 6 310 | −7,71 | 3 065 | −14,84 | ||||

| 2025-08-13 | 13F | Davis Asset Management, L.P. | 180 000 | 0,00 | 87 439 | −8,79 | ||||

| 2025-08-18 | NP | PACIFIC SELECT FUND - Hedged Equity Portfolio Class P | 14 592 | 1,87 | 7 088 | −7,08 | ||||

| 2025-06-26 | NP | TLARX - Transamerica Large Core R | 2 780 | 361,79 | 1 482 | 425,53 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 54 421 | 2,71 | 26 | −7,14 | ||||

| 2025-07-11 | 13F | Ullmann Financial Group, Inc. | 3 084 | 2,70 | 1 498 | −6,32 | ||||

| 2025-08-12 | 13F | Ci Investments Inc. | 61 013 | 35,16 | 30 | 20,83 | ||||

| 2025-07-22 | 13F | Valeo Financial Advisors, LLC | 196 512 | −33,63 | 56 310 | −10,25 | ||||

| 2025-06-26 | NP | FIFNX - Fidelity Founders Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 10 506 | 127,11 | 5 602 | 158,39 | ||||

| 2025-07-25 | 13F | Mitchell Capital Management Co | 21 354 | −35,57 | 10 118 | −42,68 | ||||

| 2025-07-10 | 13F | Burns J W & Co Inc/ny | 41 964 | −0,36 | 20 385 | −9,12 | ||||

| 2025-08-12 | 13F | Dimensional Fund Advisors Lp | 7 121 422 | −2,81 | 3 459 452 | −11,34 | ||||

| 2025-08-06 | 13F | Paulson Wealth Management Inc. | 1 131 | 0,00 | 549 | −8,80 | ||||

| 2025-08-14 | 13F | Peak6 Llc | Call | 18 700 | −72,54 | 9 084 | −74,96 | |||

| 2025-08-14 | 13F | Peak6 Llc | Put | 32 500 | −62,12 | 15 788 | −65,45 | |||

| 2025-07-31 | 13F | Mason & Associates Inc | 15 926 | 4,38 | 7 737 | −4,79 | ||||

| 2025-08-14 | 13F | Peak6 Llc | 4 880 | 162 566,67 | 2 371 | 236 900,00 | ||||

| 2025-07-24 | 13F | Elite Wealth Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Shell Asset Management Co | 71 547 | 8,17 | 35 | −2,86 | ||||

| 2025-07-30 | 13F | Brookstone Capital Management | 36 844 | −5,73 | 17 898 | −14,01 | ||||

| 2025-07-23 | 13F | Traphagen Investment Advisors Llc | 8 737 | 2,84 | 4 244 | −6,19 | ||||

| 2025-06-18 | NP | RMYAX - Multi-Strategy Income Fund Class A | 844 | 1,56 | 450 | 15,68 | ||||

| 2025-07-23 | 13F | Gentry Private Wealth, Llc | 1 715 | 0,65 | 833 | −8,16 | ||||

| 2025-07-24 | 13F | Horizon Bancorp Inc /in/ | 2 062 | 41,04 | 1 | |||||

| 2025-08-15 | 13F | North Ridge Wealth Advisors, Inc. | 460 | 0,00 | 223 | −8,61 | ||||

| 2025-08-13 | 13F | Kennondale Capital Management LLC | 7 015 | 0,00 | 3 408 | −8,81 | ||||

| 2025-08-11 | 13F | Highview Capital Management LLC/DE/ | 1 394 | 0,00 | 677 | −8,76 | ||||

| 2025-08-05 | 13F | Atlas Private Wealth Advisors | 2 141 | 0,38 | 1 040 | −8,37 | ||||

| 2025-07-21 | 13F | TFG Advisers LLC | 486 | 0,00 | 236 | −8,53 | ||||

| 2025-07-22 | 13F | Hrc Wealth Management, Llc | 858 | 17,70 | 417 | 7,22 | ||||

| 2025-08-26 | NP | FIRST TRUST VARIABLE INSURANCE TRUST - First Trust Capital Strength Hedged Equity Portfolio Class I | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-22 | NP | PHEQ - Parametric Hedged Equity ETF | 2 953 | 9,82 | 1 434 | 0,14 | ||||

| 2025-07-09 | 13F | Emprise Bank | 4 269 | −6,57 | 2 074 | −14,80 | ||||

| 2025-08-01 | 13F | Signature Wealth Management Group | 659 | 0,15 | 320 | −8,57 | ||||

| 2025-08-04 | 13F | Buck Wealth Strategies, LLC | 647 | 48,74 | 314 | 35,93 | ||||

| 2025-08-13 | 13F | Echo45 Advisors LLC | 984 | 16,17 | 478 | 5,76 | ||||

| 2025-05-01 | 13F | GoalFusion Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Carret Asset Management, Llc | 59 591 | 0,07 | 28 948 | −8,72 | ||||

| 2025-08-13 | 13F | Cloverfields Capital Group, Lp | 12 452 | 0,23 | 6 049 | −8,59 | ||||

| 2025-08-08 | 13F | Turn8 Private Wealth Inc. | 7 618 | 2,67 | 3 629 | −8,18 | ||||

| 2025-08-25 | NP | SBSPX - QS S&P 500 Index Fund Class A | 22 998 | 3,01 | 11 172 | −6,04 | ||||

| 2025-07-16 | 13F | Newton One Investments LLC | 217 | 0,00 | 105 | −8,70 | ||||

| 2025-07-15 | 13F | Accurate Wealth Management, LLC | 6 746 | 0,99 | 3 227 | −7,72 | ||||

| 2025-07-24 | 13F | Lokken Investment Group LLC | 4 966 | 4,26 | 2 412 | −4,89 | ||||

| 2025-07-14 | 13F | Toth Financial Advisory Corp | 1 017 | 5,17 | 494 | −4,08 | ||||

| 2025-07-28 | 13F | Rosenberg Matthew Hamilton | 1 889 | 1,50 | 918 | −7,47 | ||||

| 2025-07-16 | 13F | BOS Asset Management, LLC | 2 234 | 0,99 | 1 085 | −7,89 | ||||

| 2025-06-24 | NP | FCEUX - Franklin U.S. Core Equity (IU) Fund Advisor | 53 711 | 48,11 | 28 641 | 68,53 | ||||

| 2025-07-16 | 13F | Independent Wealth Network Inc. | 4 850 | −1,98 | 2 356 | −10,63 | ||||

| 2025-06-26 | NP | FLCPX - Fidelity SAI U.S. Large Cap Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 549 430 | 0,43 | 292 984 | 14,26 | ||||

| 2025-07-31 | 13F | Stegent Equity Advisors, Inc. | 1 190 | 2,76 | 578 | −6,17 | ||||

| 2025-08-11 | 13F | Cannon Advisors, Inc. | 796 | −7,01 | 387 | −15,16 | ||||

| 2025-06-16 | 13F | Peterson Wealth Management | 1 297 | −77,34 | 691 | −73,41 | ||||

| 2025-07-28 | 13F | Corundum Trust Company, INC | 666 | −0,15 | 324 | −9,01 | ||||

| 2025-07-30 | 13F | Paralel Advisors LLC | 251 000 | 0,00 | 121 928 | −8,79 | ||||

| 2025-03-28 | NP | WLDR - Affinity World Leaders Equity ETF | 875 | −5,61 | 410 | −1,91 | ||||

| 2025-08-13 | 13F | Capula Management Ltd | Put | 0 | −100,00 | 0 | ||||

| 2025-07-10 | 13F | Global Financial Private Client, LLC | 1 580 | 6,68 | 768 | −2,66 | ||||

| 2025-07-16 | 13F | Old Port Advisors | 15 841 | −0,97 | 7 695 | −9,67 | ||||

| 2025-07-23 | 13F | Guild Investment Management, Inc. | 1 546 | −0,26 | 751 | −8,97 | ||||

| 2025-07-28 | 13F | Cutler Investment Counsel Llc | 5 050 | 9,78 | 2 453 | 0,16 | ||||