Grundläggande statistik

| Institutionella aktier (lång) | 1 413 620 461 - 41,18% (ex 13D/G) - change of 10,40MM shares 0,74% MRQ |

| Institutionellt värde (lång) | $ 24 484 226 USD ($1000) |

Institutionellt ägande och aktieägare

Energy Transfer LP - Limited Partnership (US:ET) har 1429 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 1,413,682,980 aktier. Största aktieägare inkluderar Alps Advisors Inc, AMLP - ALERIAN MLP ETF, Goldman Sachs Group Inc, Morgan Stanley, Invesco Ltd., Jpmorgan Chase & Co, Blackstone Group Inc, Fmr Llc, Tortoise Capital Advisors, L.l.c., and UBS Group AG .

Energy Transfer LP - Limited Partnership (NYSE:ET) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 8, 2025 is 17,14 / share. Previously, on September 9, 2024, the share price was 15,81 / share. This represents an increase of 8,41% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

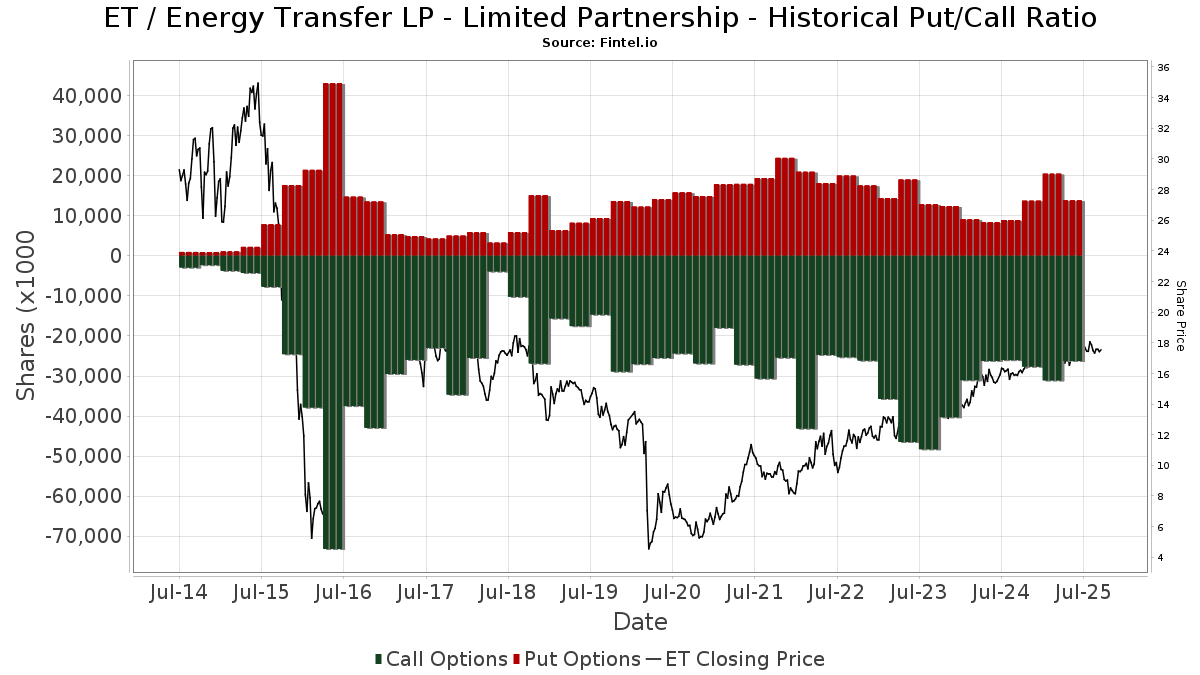

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13D/G-Arkiveringar

Vi presenterar 13D/G-arkiveringar separat från 13F-arkiveringar på grund av att de behandlas olika av SEC. 13D/G-arkiveringar kan lämnas in av grupper av investerare (med en ledare), medan 13F-arkiveringar inte kan det. Detta leder till situationer där en investerare kan lämna in en 13D/G-ansökan med ett värde för de totala aktierna (vilket motsvarar alla aktier som ägs av investerargruppen), men sedan lämna in en 13F-ansökan med ett annat värde för de totala aktierna (vilket motsvarar enbart deras eget ägande). Detta innebär att aktieägandet i 13D/G-arkiveringar och 13F-arkiveringar ofta inte är direkt jämförbara, så vi presenterar dem separat.

Notera: Från och med den 16 maj 2021 visar vi inte längre ägare som inte har lämnat in en 13D/G under det senaste året. Tidigare visade vi hela historiken för 13D/G-arkiveringar. I allmänhet måste enheter som är skyldiga att lämna in 13D/G-arkiveringar lämna in minst en gång per år innan de lämnar in en stängningsarkivering. Fonder avslutar dock ibland positioner utan att lämna in en avslutande arkivering (dvs. de avvecklar), så att visa hela historiken resulterade ibland i förvirring om det nuvarande ägandet. För att förhindra förvirring visar vi nu endast "nuvarande" ägare - det vill säga ägare som har lämnat in en ansökan under det senaste året.

Upgrade to unlock premium data.

| Fil Datum | Formulär | Investerare | Föregående aktier |

Senaste aktier |

Δ Aktier (Procent) |

Ägande (Procent) |

Δ Ägande (Procent) |

|

|---|---|---|---|---|---|---|---|---|

| 2024-09-17 | Warren Kelcy L | 302,399,984 | 8.80 |

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

Important Note

In an effort to reduce load times for our mobile users, we are testing some ways to deliver lighter pages.

In this first test, we will deliver only the most recent 750 transactions (out of 1617 for this stock). If you are interested in loading *all* the transactions for this company, click the "load all" button below. This is just a test and if you don't like it, please let us know by submitting some gentle feedback via the link at the bottom of this page.

Load All| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-10 | 13F | Tompkins Financial Corp | 12 500 | 0,00 | 227 | −2,59 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 75 013 | 272,14 | 1 | |||||

| 2025-08-14 | 13F | Wetherby Asset Management Inc | 23 411 | −0,83 | 424 | −8,23 | ||||

| 2025-04-22 | 13F | Jmac Enterprises Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Centiva Capital, LP | Call | 250 000 | 4 532 | |||||

| 2025-07-14 | 13F | Salvus Wealth Management, LLC | 18 640 | 0,04 | 338 | −2,60 | ||||

| 2025-08-15 | 13F | Security National Bank Of Sioux City Iowa /ia/ | 32 825 | 0,00 | 595 | −2,46 | ||||

| 2025-08-11 | 13F | Perennial Investment Advisors, LLC | 14 063 | 0,17 | 255 | −2,31 | ||||

| 2025-08-01 | 13F | Banco Santander, S.A. | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 40 602 | 8,13 | 736 | 5,44 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 1 698 084 | 5,51 | 30 786 | 2,90 | ||||

| 2025-07-30 | 13F | SkyOak Wealth, LLC | 20 090 | 0,00 | 364 | −2,41 | ||||

| 2025-08-12 | 13F | Southeast Asset Advisors Inc. | 31 642 | 15,40 | 574 | 12,57 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 0 | −100,00 | 0 | |||||

| 2025-06-25 | NP | CDAZX - Multi-Manager Directional Alternative Strategies Fund Institutional Class | 78 461 | 1 298 | ||||||

| 2025-08-15 | 13F/A | Northern Right Capital Management, L.P. | 277 999 | 0,00 | 5 040 | −2,48 | ||||

| 2025-07-11 | 13F | Spring Capital Management, Llc | 29 000 | 0,00 | 526 | −2,60 | ||||

| 2025-06-26 | NP | MSTGX - Morningstar Global Income Fund | 138 419 | −9,69 | 2 289 | −27,06 | ||||

| 2025-08-14 | 13F | Vivaldi Asset Management, LLC | 12 027 | 0,00 | 218 | −2,24 | ||||

| 2025-06-26 | NP | FNSTX - Fidelity Infrastructure Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 5 600 | −55,56 | 93 | −64,34 | ||||

| 2025-07-11 | 13F | Adirondack Trust Co | 7 536 | 7,75 | 137 | 4,62 | ||||

| 2025-08-12 | 13F | Heritage Trust Co | 21 040 | 0,00 | 381 | −2,56 | ||||

| 2025-08-14 | 13F | Hilltop Holdings Inc. | 283 092 | −0,27 | 5 132 | −2,75 | ||||

| 2025-07-14 | 13F | Westend Capital Management LLC | 778 455 | 2,63 | 14 113 | 0,09 | ||||

| 2025-08-12 | 13F | Manchester Capital Management LLC | 3 328 | 0,00 | 60 | −1,64 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | McIlrath & Eck, LLC | 4 013 | 0,00 | 73 | −2,70 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-07-18 | 13F | Founders Capital Management | 5 272 | 25,76 | 96 | 23,38 | ||||

| 2025-08-05 | 13F | Fullcircle Wealth Llc | 33 956 | 18,29 | 604 | 21,77 | ||||

| 2025-07-15 | 13F | McAdam, LLC | 78 459 | −1,66 | 1 422 | −4,11 | ||||

| 2025-07-29 | NP | SPMHX - Invesco Oppenheimer SteelPath MLP Alpha Fund Class R5 | 8 535 690 | 0,18 | 149 204 | −9,22 | ||||

| 2025-08-14 | 13F | UBS Group AG | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-07-29 | 13F | Hoese & Co LLP | 600 | 0,00 | 11 | −9,09 | ||||

| 2025-07-22 | 13F | Signature Wealth Management Partners, LLC | 15 373 | −32,71 | 279 | −34,43 | ||||

| 2025-06-25 | NP | Duff & Phelps Global Utility Income Fund Inc. | 993 185 | 0,00 | 16 427 | −19,24 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 121 592 | −21,29 | 2 | 0,00 | ||||

| 2025-07-22 | 13F | Valley National Advisers Inc | 10 655 | 0,24 | 0 | |||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 512 118 | 7,09 | 9 285 | 4,44 | ||||

| 2025-07-17 | 13F | City Holding Co | 7 000 | 41,04 | 127 | 36,96 | ||||

| 2025-08-11 | 13F | Pin Oak Investment Advisors Inc | 240 894 | −0,80 | 4 | 0,00 | ||||

| 2025-08-13 | 13F | Colonial Trust Advisors | 3 840 | 0,00 | 70 | −2,82 | ||||

| 2025-07-30 | 13F | Green Square Capital Advisors Llc | 102 167 | 0,06 | 1 852 | −2,42 | ||||

| 2025-08-01 | 13F | Tetrad Corp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-08 | 13F | Union Savings Bank | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Marco Investment Management Llc | 27 659 | 1,47 | 501 | −0,99 | ||||

| 2025-07-24 | NP | FSDIX - Fidelity Strategic Dividend & Income Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 382 526 | −15,73 | 6 687 | −23,63 | ||||

| 2025-08-13 | 13F | Summit Financial, LLC | 688 464 | 0,25 | 12 482 | −2,23 | ||||

| 2025-08-27 | NP | Brighthouse Funds Trust I - BlackRock High Yield Portfolio Class A | 88 717 | 112,52 | 1 608 | 249,57 | ||||

| 2025-08-19 | 13F | Campbell Capital Management Inc | 65 000 | −14,70 | 1 178 | −16,81 | ||||

| 2025-08-12 | 13F | Cutter & CO Brokerage, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | Ellenbecker Investment Group | 14 486 | 263 | ||||||

| 2025-08-05 | 13F | Gould Asset Management Llc /ca/ | 36 553 | 7,33 | 663 | 4,58 | ||||

| 2025-08-05 | 13F | American Assets Investment Management, LLC | 225 800 | 0,00 | 4 094 | −2,48 | ||||

| 2025-08-14 | 13F | Clarity Asset Management, Inc. | 1 543 | 1,85 | 28 | −3,57 | ||||

| 2025-08-12 | 13F | Leigh Baldwin & Co., Llc | 15 666 | 25,76 | 284 | 22,94 | ||||

| 2025-07-15 | 13F | Armis Advisers, LLC | 14 895 | 0,17 | 270 | −2,17 | ||||

| 2025-07-21 | 13F | Mattern Capital Management, Llc | 19 003 | 0,00 | 345 | −2,55 | ||||

| 2025-08-11 | 13F | Western Wealth Management, LLC | 73 112 | 4,34 | 1 326 | 1,77 | ||||

| 2025-04-22 | 13F | Duncker Streett & Co Inc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-12 | 13F | Greenland Capital Management LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-17 | 13F | Independence Bank of Kentucky | 200 | 0,00 | 4 | 0,00 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 689 035 | 7,33 | 12 492 | 4,23 | ||||

| 2025-08-12 | 13F | Edmond De Rothschild Holding S.a. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | ESL Trust Services, LLC | 1 091 | 0,00 | 20 | −5,00 | ||||

| 2025-07-30 | 13F | Principle Wealth Partners Llc | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Agf Management Ltd | 26 485 | −1,50 | 480 | −3,81 | ||||

| 2025-08-04 | 13F | L.m. Kohn & Company | 14 508 | −8,96 | 263 | −11,15 | ||||

| 2025-07-17 | 13F | SeaBridge Investment Advisors LLC | 11 061 | 0,00 | 201 | −2,44 | ||||

| 2025-07-23 | 13F | Nbt Bank N A /ny | 2 000 | 0,00 | 36 | −2,70 | ||||

| 2025-08-07 | 13F | 1620 Investment Advisors, Inc. | 95 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 177 814 | 2,81 | 3 483 | 8,34 | ||||

| 2025-08-08 | 13F | Abrams Capital Management, L.p. | 6 205 777 | 0,00 | 112 511 | −2,47 | ||||

| 2025-08-12 | 13F | Fortem Financial Group, Llc | 181 282 | −7,25 | 3 287 | −9,55 | ||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 147 859 | −1,01 | 2 680 | −3,46 | ||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 1 182 492 | 1,92 | 21 439 | −0,61 | ||||

| 2025-08-13 | 13F | Colonial Trust Co / SC | 1 192 | −23,93 | 22 | −27,59 | ||||

| 2025-08-14 | 13F | Murphy & Mullick Capital Management Corp | 3 020 | 0,00 | 55 | −3,57 | ||||

| 2025-08-20 | NP | LSPAX - LoCorr Spectrum Income Fund Class A | 86 193 | 0,00 | 1 563 | −2,50 | ||||

| 2025-07-30 | 13F | Dudley Capital Management, Llc | 11 887 | 0,00 | 216 | −2,27 | ||||

| 2025-08-13 | 13F | NEOS Investment Management LLC | 116 114 | 2 105 | ||||||

| 2025-07-30 | 13F | Cornerstone Advisory, LLC | 105 575 | 3,75 | 1 914 | 19,03 | ||||

| 2025-07-29 | 13F | Chicago Partners Investment Group LLC | 3 277 148 | −0,08 | 57 153 | 3,17 | ||||

| 2025-07-14 | 13F | Armstrong Advisory Group, Inc | 4 521 | 140,48 | 82 | 125,00 | ||||

| 2025-07-23 | NP | EIPI - FT Energy Income Partners Enhanced Income ETF | 3 447 324 | 19,47 | 60 259 | 8,26 | ||||

| 2025-08-12 | 13F | New Republic Capital, LLC | 115 973 | 0,00 | 2 103 | −2,46 | ||||

| 2025-07-11 | 13F | First PREMIER Bank | 15 288 | 0,00 | 0 | |||||

| 2025-08-11 | 13F | Annis Gardner Whiting Capital Advisors, LLC | 1 500 | 0,00 | 27 | 0,00 | ||||

| 2025-08-13 | 13F | Plan Group Financial, LLC | 100 639 | −36,73 | 1 825 | −38,32 | ||||

| 2025-08-14 | 13F | Beaird Harris Wealth Management, LLC | 1 332 | 0,00 | 24 | 0,00 | ||||

| 2025-06-27 | NP | CHYDX - Calamos High Income Opportunities Fund Class A | 5 575 | 0,00 | 92 | −19,30 | ||||

| 2025-07-18 | 13F | Trust Co Of Vermont | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Gladstone Institutional Advisory LLC | 94 229 | 0,08 | 1 708 | −2,40 | ||||

| 2025-07-03 | 13F | Stephens Group, LLC | 5 574 335 | 0,00 | 101 063 | −2,47 | ||||

| 2025-08-05 | 13F | Carolinas Wealth Consulting Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 902 | 0,00 | 16 | 0,00 | ||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 44 529 | 16,92 | 807 | 14,14 | ||||

| 2025-07-10 | 13F | Atticus Wealth Management, Llc | 5 472 | 1,46 | 99 | −1,00 | ||||

| 2025-07-15 | 13F | Jeppson Wealth Management, Llc | 18 930 | 343 | ||||||

| 2025-08-06 | 13F | Highlander Partners, L.P. | 17 080 | 0,00 | 310 | −2,52 | ||||

| 2025-06-25 | NP | Dnp Select Income Fund Inc | 3 850 062 | 0,00 | 63 680 | −19,24 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 41 999 | 22,87 | 761 | 19,84 | ||||

| 2025-06-26 | NP | EGLAX - Eagle MLP Strategy Fund Class A Shares | 1 362 000 | 11,42 | 22 527 | −10,01 | ||||

| 2025-07-30 | NP | ENFR - Alerian Energy Infrastructure ETF | 1 533 146 | 6,32 | 26 799 | −3,65 | ||||

| 2025-08-11 | 13F | Kingdom Financial Group LLC. | 10 502 | 190 | ||||||

| 2025-07-31 | 13F | Anthracite Investment Company, Inc. | 272 500 | 8,57 | 4 940 | 5,87 | ||||

| 2025-05-13 | 13F | HighTower Advisors, LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-04-29 | NP | SCPAX - Siit Large Cap Disciplined Equity Fund - Class A | 199 253 | −15,84 | 3 844 | −18,25 | ||||

| 2025-08-08 | 13F | CFO4Life Group, LLC | 14 627 | 0,05 | 265 | −2,21 | ||||

| 2025-07-07 | 13F | Wesbanco Bank Inc | 110 157 | 0,23 | 1 997 | −2,25 | ||||

| 2025-08-12 | 13F | Mmbg Investment Advisors Co. | 41 905 | 0,00 | 760 | −2,57 | ||||

| 2025-07-23 | NP | Lmp Capital & Income Fund Inc. | 386 506 | −59,91 | 6 756 | −63,68 | ||||

| 2025-07-31 | 13F | Oppenheimer Asset Management Inc. | 187 393 | −3,26 | 3 397 | −5,64 | ||||

| 2025-07-15 | 13F | Foster Victor Wealth Advisors, LLC | 23 534 | 1,02 | 415 | 9,21 | ||||

| 2025-08-04 | 13F | Joseph P. Lucia & Associates, LLC | 85 916 | −2,66 | 1 558 | −5,06 | ||||

| 2025-07-18 | 13F | Hudson Value Partners, LLC | 64 775 | 0,00 | 1 174 | −2,49 | ||||

| 2025-08-26 | NP | FIRST TRUST VARIABLE INSURANCE TRUST - First Trust Multi Income Allocation Portfolio Class I This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 10 554 | 4,30 | 191 | 1,60 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 47 171 542 | 8,81 | 855 220 | 6,11 | ||||

| 2025-07-08 | 13F/A | Salem Investment Counselors Inc | 384 671 | 0,00 | 6 974 | −2,46 | ||||

| 2025-08-13 | 13F | Cary Street Partners Financial Llc | 161 574 | 3,32 | 2 929 | 0,76 | ||||

| 2025-08-12 | 13F | Tradition Wealth Management, LLC | 30 524 | 2,22 | 553 | −0,36 | ||||

| 2025-08-05 | 13F | Prosperity Consulting Group, LLC | 28 544 | −7,98 | 518 | −10,24 | ||||

| 2025-05-06 | 13F | Poplar Forest Capital LLC | 25 450 | 0,00 | 473 | −5,02 | ||||

| 2025-07-30 | 13F | Crewe Advisors LLC | 773 | −87,43 | 14 | −87,72 | ||||

| 2025-08-11 | 13F | Lake Street Financial Llc | 32 307 | 0,14 | 586 | −2,34 | ||||

| 2025-08-01 | 13F | SYM FINANCIAL Corp | 15 341 | 0,00 | 278 | −2,46 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 18 644 | −11,39 | 338 | −13,55 | ||||

| 2025-07-29 | 13F | Albert D Mason Inc | 79 438 | −0,47 | 1 440 | −2,90 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 70 994 195 | −7,78 | 1 287 125 | −10,06 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | Call | 300 000 | −31,82 | 5 439 | −33,50 | |||

| 2025-07-17 | 13F | Hanson & Doremus Investment Management | 1 952 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | Put | 600 000 | 100,00 | 10 878 | 95,05 | |||

| 2025-04-23 | 13F | Sabal Trust CO | 24 765 | 0,00 | 460 | −5,15 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 145 388 | 6,91 | 3 | 0,00 | ||||

| 2025-07-24 | 13F | Cascade Investment Group, Inc. | 89 615 | 0,75 | 1 625 | −1,75 | ||||

| 2025-08-14 | 13F | Moneta Group Investment Advisors Llc | 1 364 002 | 5,45 | 24 729 | 2,84 | ||||

| 2025-07-28 | 13F | Allianz Asset Management GmbH | 2 849 614 | −32,93 | 51 664 | −34,59 | ||||

| 2025-07-22 | 13F | Foguth Wealth Management, LLC. | 24 422 | 0,41 | 443 | −2,21 | ||||

| 2025-08-08 | 13F | Islay Capital Management, Llc | 1 024 | 0,00 | 19 | −5,26 | ||||

| 2025-08-14 | 13F | Certified Advisory Corp | 10 170 | 0,06 | 184 | −2,13 | ||||

| 2025-07-23 | 13F | Tyche Wealth Partners LLC | 19 763 | 1,58 | 358 | −0,83 | ||||

| 2025-08-12 | 13F | Intellus Advisors LLC | 97 154 | 5,58 | 1 761 | 2,98 | ||||

| 2025-07-29 | 13F | Chevy Chase Trust Holdings, Inc. | 51 401 | −0,05 | 932 | −2,62 | ||||

| 2025-08-15 | 13F | WFA of San Diego, LLC | 4 000 | 73 | ||||||

| 2025-07-15 | 13F | SJS Investment Consulting Inc. | 6 983 | 0,00 | 127 | −2,33 | ||||

| 2025-08-15 | 13F | Asset Allocation Strategies LLC | 41 204 | 17,79 | 747 | 14,92 | ||||

| 2025-07-15 | 13F | World Equity Group, Inc. | 10 464 | 190 | ||||||

| 2025-07-16 | 13F | American National Bank | 9 192 | 1 203,83 | 167 | 1 176,92 | ||||

| 2025-08-05 | 13F | Scarborough Advisors, LLC | 3 114 | −87,32 | 56 | −87,72 | ||||

| 2025-08-08 | 13F | Good Life Advisors, LLC | 30 044 | −1,40 | 545 | −3,89 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | Put | 5 000 | 28,21 | 92 | 22,67 | |||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Van Hulzen Asset Management, LLC | 17 220 | 0,58 | 312 | −1,89 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 6 702 564 | 2,36 | 121 517 | −0,17 | ||||

| 2025-05-13 | 13F | Teachers Insurance & Annuity Association Of America | 0 | −100,00 | 0 | |||||

| 2025-07-07 | 13F | Taylor & Morgan Wealth Management, LLC | 15 796 | 1,81 | 286 | −0,69 | ||||

| 2025-07-14 | 13F | Caitlin John, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Nwi Management Lp | Call | 673 800 | 12 | |||||

| 2025-06-25 | NP | VLPAX - Virtus Duff & Phelps Select MLP and Energy Fund Class A | 171 774 | 10,57 | 2 841 | −10,69 | ||||

| 2025-05-15 | 13F | Nomura Holdings Inc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-05 | 13F | Wellington Shields Capital Management, LLC | 117 126 | 0,09 | 2 123 | −2,39 | ||||

| 2025-07-24 | 13F | Freedom Day Solutions, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Claro Advisors LLC | 58 741 | 1 065 | ||||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 144 466 | −22,23 | 2 619 | −24,15 | ||||

| 2025-08-13 | 13F | SCS Capital Management LLC | 104 132 | −2,34 | 1 888 | −4,79 | ||||

| 2025-08-06 | 13F | Kcm Investment Advisors Llc | 47 300 | 0,00 | 858 | −2,50 | ||||

| 2025-08-13 | 13F | Brown Advisory Inc | 513 324 | 0,67 | 9 307 | −1,83 | ||||

| 2025-08-05 | 13F | Cambiar Investors Llc | 267 565 | −28,95 | 4 851 | −30,72 | ||||

| 2025-07-18 | 13F | Newman Dignan & Sheerar, Inc. | 14 965 | 271 | ||||||

| 2025-08-12 | 13F | Inscription Capital, LLC | 77 639 | −64,96 | 1 408 | −59,63 | ||||

| 2025-07-15 | 13F | Wealth Effects Llc | 13 814 | 0,00 | 250 | −2,34 | ||||

| 2025-08-14 | 13F | Safeguard Investment Advisory Group, LLC | 13 347 | 8,28 | 242 | 5,24 | ||||

| 2025-07-07 | 13F | Abner Herrman & Brock Llc | 10 000 | 0,00 | 0 | |||||

| 2025-07-23 | 13F | Godsey & Gibb Associates | 4 000 | −16,58 | 73 | −19,10 | ||||

| 2025-05-02 | 13F | General American Investors Co Inc | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 26 169 | −38,26 | 474 | −39,77 | ||||

| 2025-06-26 | NP | FFLV - Fidelity Fundamental Large Cap Value ETF | 705 | 12 | ||||||

| 2025-06-27 | NP | PWV - Invesco Dynamic Large Cap Value ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 800 066 | 0,77 | 13 233 | −18,62 | ||||

| 2025-06-26 | NP | CAMX - Cambiar Aggressive Value ETF | 158 000 | 17,04 | 2 613 | −5,46 | ||||

| 2025-04-01 | NP | CCAPX - CHIRON CAPITAL ALLOCATION FUND CLASS I SHARES | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 129 708 | 1,00 | 2 352 | −1,51 | ||||

| 2025-08-18 | 13F | Hollencrest Capital Management | 5 273 | 3,39 | 96 | 1,06 | ||||

| 2025-07-28 | NP | Neuberger Berman Mlp Income Fund Inc. | 4 160 000 | 0,00 | 72 717 | −9,38 | ||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 384 | −97,90 | 7 | −98,32 | ||||

| 2025-07-23 | 13F | Ellsworth Advisors, LLC | 107 942 | −5,39 | 1 957 | −7,74 | ||||

| 2025-08-29 | 13F | Evolution Wealth Management Inc. | 384 | 7 | ||||||

| 2025-07-08 | 13F | Webster Bank, N. A. | 9 025 | 0,00 | 164 | −2,40 | ||||

| 2025-07-28 | 13F | Morningstar Investment Management LLC | 62 947 | 6,08 | 1 | 0,00 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 332 625 | −4,80 | 6 030 | −7,16 | ||||

| 2025-08-13 | 13F | Haverford Trust Co | 99 564 | 0,00 | 1 805 | −2,43 | ||||

| 2025-07-29 | 13F | Disciplined Investments, LLC | 42 531 | −0,90 | 771 | −3,26 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | 46 941 | 25,69 | 851 | 22,62 | ||||

| 2025-06-26 | NP | FIFNX - Fidelity Founders Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 36 300 | 600 | ||||||

| 2025-07-22 | 13F | Confluence Wealth Services, Inc. | 224 620 | 4 072 | ||||||

| 2025-07-16 | 13F | Dakota Wealth Management | 11 475 | 208 | ||||||

| 2025-08-13 | 13F | Ark & Tlk Investments, Llc | 25 847 | 0,00 | 469 | −2,50 | ||||

| 2025-03-11 | 13F/A | Elequin Capital Lp | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | HBK Sorce Advisory LLC | 18 390 | 4,42 | 333 | 1,83 | ||||

| 2025-05-16 | 13F | Capital & Planning, Llc | 0 | −100,00 | 0 | |||||

| 2025-05-09 | 13F | Marble Harbor Investment Counsel, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-02 | 13F | Capital A Wealth Management, LLC | 1 507 | 13,14 | 28 | 7,69 | ||||

| 2025-08-07 | 13F | Investment Management Corp /va/ /adv | 5 | 0 | ||||||

| 2025-07-14 | 13F | Sowell Financial Services LLC | 331 290 | −0,85 | 6 006 | −3,30 | ||||

| 2025-07-22 | NP | GVIP - Goldman Sachs Hedge Industry VIP ETF | 363 683 | 3,94 | 6 357 | −5,81 | ||||

| 2025-08-05 | 13F | Tsfg, Llc | 3 053 | 160,49 | 0 | |||||

| 2025-08-05 | 13F | Westwood Wealth Management | 15 500 | −10,92 | 281 | −13,00 | ||||

| 2025-07-25 | NP | AMLPX - MainGate MLP Fund Class A | 6 600 000 | 0,00 | 115 368 | −9,38 | ||||

| 2025-08-29 | NP | Highland Global Allocation Fund | 1 127 440 | 0,00 | 20 440 | −2,48 | ||||

| 2025-07-16 | 13F | Asset Allocation & Management Company, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Jacobi Capital Management LLC | 112 094 | 0,82 | 2 032 | −1,65 | ||||

| 2025-08-14 | 13F | Militia Capital Partners, LP | 530 000 | 27,71 | 9 609 | 24,55 | ||||

| 2025-08-18 | 13F | N.E.W. Advisory Services LLC | 2 156 | 1,17 | 39 | 0,00 | ||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 9 611 | 20,92 | 174 | 18,37 | ||||

| 2025-08-05 | 13F | American Capital Advisory, LLC | 8 495 | 0,00 | 154 | −1,91 | ||||

| 2025-08-07 | 13F | David R. Rahn & Associates Inc. | 60 000 | −5,81 | 1 088 | −8,19 | ||||

| 2025-08-05 | 13F | Corps Capital Advisors, LLC | 166 012 | −12,70 | 3 010 | −14,86 | ||||

| 2025-08-28 | NP | BlackRock Variable Series Funds II, Inc. - BlackRock High Yield V.I. Fund Class I This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 93 511 | 183,68 | 1 695 | 366,94 | ||||

| 2025-08-07 | 13F | Payden & Rygel | 1 001 790 | −24,82 | 18 | −25,00 | ||||

| 2025-08-13 | 13F | GM Advisory Group, Inc. | 24 439 | −0,07 | 443 | −2,42 | ||||

| 2025-07-11 | 13F | Hilltop Wealth Advisors, Llc | 37 180 | 0,00 | 674 | −2,46 | ||||

| 2025-04-14 | 13F | Beach Investment Counsel Inc/pa | 2 666 295 | −3,08 | 50 | −7,55 | ||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 280 228 | 6,79 | 5 081 | 4,16 | ||||

| 2025-04-29 | 13F | Lee Danner & Bass Inc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Cary Street Partner Investment Advisory Llc | 157 220 | 0,00 | 2 850 | −2,46 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 360 684 | 0,95 | 6 539 | −1,54 | ||||

| 2025-07-17 | 13F | CWA Asset Management Group, LLC | 72 723 | 28,29 | 1 318 | 25,17 | ||||

| 2025-07-25 | 13F | Welch Group, LLC | 32 085 | 0,73 | 582 | −2,35 | ||||

| 2025-07-10 | 13F | Oliver Lagore Vanvalin Investment Group | 5 022 | −37,36 | 93 | −40,76 | ||||

| 2025-08-08 | 13F/A | Prospect Financial Services LLC | 186 393 | −10,88 | 3 379 | −13,09 | ||||

| 2025-08-05 | 13F | Redwood Wealth Management Group, LLC | 178 480 | −0,80 | 3 236 | −3,26 | ||||

| 2025-08-08 | 13F | Everett Harris & Co /ca/ | 10 697 | 0,00 | 194 | −2,53 | ||||

| 2025-08-12 | 13F | Bedel Financial Consulting, Inc. | 18 569 | 0,39 | 337 | 15,07 | ||||

| 2025-08-04 | 13F | Bridgewealth Advisory Group, LLC | 10 634 | 193 | ||||||

| 2025-07-11 | 13F | Addis & Hill, Inc | 72 263 | 0,37 | 1 310 | −2,09 | ||||

| 2025-07-16 | 13F | Eagle Global Advisors Llc | 6 102 436 | −1,96 | 110 637 | −4,39 | ||||

| 2025-08-11 | 13F | VSM Wealth Advisory, LLC | 963 | 420,54 | 17 | 466,67 | ||||

| 2025-07-24 | 13F | Conning Inc. | 31 667 | 0,00 | 574 | −2,38 | ||||

| 2025-07-18 | 13F | Woodward Diversified Capital, Llc | 13 993 | −32,23 | 254 | −33,94 | ||||

| 2025-08-01 | 13F | Mizuho Markets Americas Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Summit Trail Advisors, Llc | 64 247 | 10,43 | 1 165 | 7,68 | ||||

| 2025-08-06 | 13F | Disciplined Investors, L.L.C. | 15 832 | 0,74 | 287 | −1,71 | ||||

| 2025-06-26 | NP | FNKFX - Fidelity Mid-Cap Stock K6 Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 353 997 | 0,00 | 5 855 | −19,23 | ||||

| 2025-08-12 | 13F | Quantum Private Wealth, LLC | 116 515 | 0,54 | 2 112 | −1,95 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 86 211 | −60,47 | 1 563 | −61,46 | ||||

| 2025-08-14 | 13F | Taconic Capital Advisors LP | 100 000 | 0,00 | 1 813 | −2,47 | ||||

| 2025-07-08 | 13F | Atwood & Palmer Inc | 4 822 | 2 062,33 | 87 | 2 075,00 | ||||

| 2025-06-25 | NP | EMLP - First Trust North American Energy Infrastructure Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 14 350 533 | 24,95 | 237 358 | 0,91 | ||||

| 2025-04-09 | 13F | Selway Asset Management | 149 000 | −9,15 | 2 770 | −13,79 | ||||

| 2025-07-09 | 13F | Procyon Private Wealth Partners, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 1 000 | 0,00 | 18 | 0,00 | ||||

| 2025-08-14 | 13F | Silvercrest Asset Management Group Llc | 183 583 | 4,11 | 3 328 | 1,56 | ||||

| 2025-07-21 | 13F | Keystone Financial Group, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Cornell Pochily Investment Advisors, Inc. | 10 513 | 4,68 | 191 | 2,15 | ||||

| 2025-07-10 | 13F | American Financial Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | IAG Wealth Partners, LLC | 11 259 | 6,76 | 204 | 4,08 | ||||

| 2025-07-24 | 13F | Aurora Private Wealth, Inc. | 176 252 | −1,50 | 3 | 0,00 | ||||

| 2025-07-24 | 13F | Cyndeo Wealth Partners, LLC | 21 831 | 86,30 | 396 | 82,03 | ||||

| 2025-08-13 | 13F | Smith, Moore & Co. | 12 293 | 2,54 | 223 | 0,00 | ||||

| 2025-07-11 | 13F | Meriwether Wealth & Planning, LLC | 46 084 | 3,64 | 836 | 1,09 | ||||

| 2025-08-11 | 13F | FSC Wealth Advisors, LLC | 2 750 | 50 | ||||||

| 2025-07-17 | 13F | Oakworth Capital, Inc. | 2 867 | 52 | ||||||

| 2025-07-16 | 13F | PFS Partners, LLC | 500 | −45,36 | 9 | −47,06 | ||||

| 2025-08-04 | 13F | Savvy Advisors, Inc. | 19 353 | 351 | ||||||

| 2025-07-10 | 13F | Arkfeld Wealth Strategies, L.L.C. | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Cascade Financial Partners, LLC | 46 475 | 5,98 | 843 | 3,31 | ||||

| 2025-08-12 | 13F | Country Trust Bank | 1 000 | −33,33 | 18 | −37,93 | ||||

| 2025-06-26 | NP | FMCSX - Fidelity Mid-Cap Stock Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 322 888 | 0,00 | 38 421 | −19,24 | ||||

| 2025-08-11 | 13F/A | Purus Wealth Management, LLC | 11 602 | 210 | ||||||

| 2025-08-13 | 13F | Nbw Capital Llc | 860 092 | 0,62 | 15 593 | −1,87 | ||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Caption Management, LLC | Call | 3 733 800 | −32,10 | 67 694 | −33,78 | |||

| 2025-07-10 | 13F | Wedmont Private Capital | 23 529 | 1,03 | 415 | 9,21 | ||||

| 2025-08-05 | 13F | Aviance Capital Partners, LLC | 26 177 | 0,00 | 475 | −2,47 | ||||

| 2025-07-22 | 13F | Checchi Capital Advisers, LLC | 27 154 | 7,46 | 492 | 4,90 | ||||

| 2025-07-30 | 13F | Clifford Swan Investment Counsel Llc | 13 263 | 0,00 | 240 | −2,44 | ||||

| 2025-08-19 | 13F | State of Wyoming | 31 441 | −20,36 | 570 | −22,24 | ||||

| 2025-07-23 | 13F/A | Euro Pacific Asset Management, LLC | 13 210 | 0,00 | 0 | |||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 712 827 | −7,76 | 12 924 | −10,04 | ||||

| 2025-08-12 | 13F | NFC Investments, LLC | 441 940 | 3,74 | 8 | 14,29 | ||||

| 2025-06-20 | NP | RVRB - Reverb ETF | 285 | 0,00 | 5 | −20,00 | ||||

| 2025-06-26 | NP | GYLD - Arrow Dow Jones Global Yield ETF | 7 032 | 0,00 | 116 | −19,44 | ||||

| 2025-07-29 | 13F | AssuredPartners Investment Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F/A | Kayne Anderson Capital Advisors Lp | 24 064 316 | −0,44 | 436 286 | −2,90 | ||||

| 2025-08-14 | 13F | Voya Financial Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Camden Capital, LLC | 23 740 | −47,17 | 430 | −48,50 | ||||

| 2025-06-26 | NP | FAVFX - Fidelity Advisor Value Fund Class A This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 82 948 | −3,94 | 1 372 | −22,45 | ||||

| 2025-07-24 | NP | FSENX - Energy Portfolio This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 4 929 700 | −4,60 | 86 171 | −13,55 | ||||

| 2025-08-11 | 13F | Lummis Asset Management, LP | 4 070 | 0,00 | 74 | −2,67 | ||||

| 2025-08-13 | 13F | Manning & Napier Advisors Llc | 690 000 | 31,43 | 12 510 | 28,18 | ||||

| 2025-07-24 | 13F | Blair William & Co/il | 572 420 | 0,08 | 10 378 | −2,40 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 399 351 | 25,58 | 7 204 | 21,87 | ||||

| 2025-08-14 | 13F | Cohen & Steers, Inc. | 2 965 892 | −1,88 | 54 | −5,36 | ||||

| 2025-08-06 | 13F | Quadrant Private Wealth Management, LLC | 12 116 | 0,87 | 220 | −1,79 | ||||

| 2025-08-06 | 13F | Legacy Investment Solutions, LLC | 400 | 577,97 | 7 | 600,00 | ||||

| 2025-08-13 | 13F | Estabrook Capital Management | 4 451 | 0,00 | 81 | −2,44 | ||||

| 2025-08-14 | 13F | BancorpSouth Bank | 47 469 | 0,09 | 861 | −2,38 | ||||

| 2025-08-05 | 13F | Freestone Capital Holdings, LLC | 12 674 | 16,45 | 230 | 13,37 | ||||

| 2025-07-17 | 13F | XML Financial, LLC | 39 543 | 5,33 | 717 | 2,73 | ||||

| 2025-08-04 | 13F | Terril Brothers, Inc. | 174 714 | 0,00 | 3 168 | −2,46 | ||||

| 2025-08-14 | 13F | Peapack Gladstone Financial Corp | 13 480 | −5,50 | 0 | |||||

| 2025-08-13 | 13F | Cutler Capital Management, LLC | 393 619 | −5,49 | 7 136 | −7,83 | ||||

| 2025-07-09 | 13F | Lifestyle Asset Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Michels Family Financial, LLC | 24 206 | −6,75 | 439 | −9,13 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 318 742 | −0,31 | 5 779 | −2,79 | ||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 13 575 | 0,00 | 246 | −2,38 | ||||

| 2025-08-11 | 13F | Shufro Rose & Co Llc | 13 028 | 0,00 | 242 | 0,00 | ||||

| 2025-07-11 | 13F | Baugh & Associates, LLC | 113 402 | −4,70 | 1 931 | −7,30 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 224 186 | 17,74 | 4 064 | 14,83 | ||||

| 2025-08-05 | 13F | Chase Investment Counsel Corp | 58 016 | −46,88 | 1 | −50,00 | ||||

| 2025-07-22 | 13F | Cedar Mountain Advisors, LLC | 606 | 1,85 | 11 | −9,09 | ||||

| 2025-07-23 | 13F | Trifecta Capital Advisors, LLC | 7 700 | 0,00 | 140 | −2,80 | ||||

| 2025-08-14 | 13F | Oxford Financial Group Ltd | 10 667 | 0,00 | 193 | −2,53 | ||||

| 2025-07-07 | 13F | Centurion Wealth Management LLC | 10 647 | 0,00 | 193 | −7,21 | ||||

| 2025-05-09 | 13F | Commonwealth Retirement Investments LLC | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | C2C Wealth Management, LLC | 23 797 | 0,00 | 431 | −2,49 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 44 629 | −26,81 | 809 | −28,60 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 627 680 | 8,83 | 11 380 | 6,14 | ||||

| 2025-07-14 | 13F | Buska Wealth Management, LLC | 12 432 | 2,28 | 225 | −4,66 | ||||

| 2025-06-25 | NP | PYVLX - Payden Equity Income Fund (Investor Class) | 823 700 | −37,21 | 13 624 | −49,29 | ||||

| 2025-08-11 | 13F | NewEdge Wealth, LLC | 140 222 | −1,83 | 2 471 | −6,97 | ||||

| 2025-07-29 | 13F | Spirit Of America Management Corp/ny | 429 700 | −23,50 | 7 790 | −25,40 | ||||

| 2025-08-22 | NP | FSTAX - Fidelity Advisor Strategic Income Fund Class A This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 360 500 | 0,00 | 6 536 | −2,48 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 51 538 | −7,44 | 934 | −9,76 | ||||

| 2025-08-05 | 13F | Mission Wealth Management, Lp | 51 534 | −2,73 | 934 | −5,08 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 167 058 | −50,61 | 3 025 | −51,91 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 2 872 247 | −2,03 | 52 076 | −4,46 | ||||

| 2025-08-13 | 13F | Laidlaw Wealth Management LLC | 31 670 | 0,05 | 574 | −2,38 | ||||

| 2025-08-08 | 13F | EagleClaw Capital Managment, LLC | 11 500 | 0,00 | 208 | −2,35 | ||||

| 2025-08-07 | 13F | 1st Source Bank | 22 994 | 0,00 | 417 | −2,58 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 1 051 640 | −0,39 | 19 | 0,00 | ||||

| 2025-08-14 | 13F | Wexford Capital Lp | 575 015 | −9,27 | 10 425 | −11,51 | ||||

| 2025-07-31 | 13F | Optimum Investment Advisors | 3 500 | 0,00 | 63 | −3,08 | ||||

| 2025-08-11 | 13F | Avantax Planning Partners, Inc. | 31 682 | 4,32 | 574 | 1,77 | ||||

| 2025-07-23 | 13F | Hardy Reed LLC | 39 840 | 0,00 | 722 | −2,43 | ||||

| 2025-08-13 | 13F | McGowan Group Asset Management, Inc. | 859 318 | 0,73 | 15 579 | −1,76 | ||||

| 2025-08-14 | 13F | Ripple Effect Asset Management LP | Put | 0 | −100,00 | 0 | ||||

| 2025-08-06 | 13F | Stone House Investment Management, LLC | 2 044 | 1,14 | 37 | 0,00 | ||||

| 2025-08-11 | 13F | Bulltick Wealth Management, LLC | 106 000 | 0,00 | 1 922 | −2,49 | ||||

| 2025-08-14 | 13F | Caption Management, LLC | Put | 190 000 | −88,82 | 3 445 | −89,10 | |||

| 2025-08-05 | 13F | Magnolia Capital Advisors Llc | 33 487 | 4,75 | 607 | 2,19 | ||||

| 2025-08-04 | 13F | Canton Hathaway, LLC | 24 000 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Lyell Wealth Management, Lp | 10 350 | 0,00 | 188 | −2,60 | ||||

| 2025-08-14 | 13F | Zurich Insurance Group Ltd/FI | 3 703 877 | 0,00 | 67 151 | −2,47 | ||||

| 2025-08-11 | 13F | Mcintyre Freedman & Flynn Investment Advisers Inc | 13 490 | 0,00 | 245 | −2,40 | ||||

| 2025-08-07 | 13F | ProShare Advisors LLC | 242 036 | 17,24 | 4 388 | 14,36 | ||||

| 2025-08-12 | 13F | Verity & Verity, LLC | 17 878 | 0,00 | 324 | −2,41 | ||||

| 2025-08-11 | 13F | Anfield Capital Management, LLC | 11 752 | 18,98 | 213 | 16,39 | ||||

| 2025-07-03 | 13F | TrueWealth Advisors, LLC | 16 064 | −16,37 | 291 | −18,49 | ||||

| 2025-07-24 | 13F | PDS Planning, Inc | 22 727 | 2,99 | 412 | 0,49 | ||||

| 2025-08-14 | 13F | Cna Financial Corp | 800 000 | 14,29 | 14 504 | 11,46 | ||||

| 2025-08-14 | 13F | Fiduciary Trust Co | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Cullen Capital Management, LLC | 228 496 | −18,69 | 4 248 | −22,84 | ||||

| 2025-03-25 | NP | PMAIX - Pioneer Multi-Asset Income Fund : Class A | 3 859 188 | 0,00 | 79 036 | 24,27 | ||||

| 2025-08-14 | 13F | Aperture Investors, LLC | Call | 0 | −100,00 | 0 | ||||

| 2025-07-16 | 13F | ORG Wealth Partners, LLC | 405 284 | −0,84 | 7 218 | −5,71 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 94 962 | 0,00 | 1 722 | −2,49 | ||||

| 2025-07-10 | 13F | HWG Holdings LP | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 218 658 | 30,95 | 3 964 | 27,71 | ||||

| 2025-08-13 | 13F | Stablepoint Partners, LLC | 80 936 | 6,24 | 1 467 | 3,60 | ||||

| 2025-07-15 | 13F | Retireful, LLC | 42 002 | −34,23 | 761 | −36,26 | ||||

| 2025-08-08 | 13F | Thompson Davis & Co., Inc. | 21 877 | 108,35 | 397 | 103,08 | ||||

| 2025-08-04 | 13F | Keybank National Association/oh | 211 648 | 9,58 | 3 837 | 6,88 | ||||

| 2025-08-05 | 13F | HFG Advisors, Inc. | 60 098 | −0,93 | 1 090 | −3,37 | ||||

| 2025-08-20 | NP | CONWX - Concorde Wealth Management Fund | 62 500 | 0,00 | 1 133 | −2,41 | ||||

| 2025-07-09 | 13F | Dynamic Advisor Solutions LLC | 144 850 | 14,29 | 2 626 | 11,46 | ||||

| 2025-08-08 | 13F | Citizens Financial Group Inc/ri | 45 864 | 832 | ||||||

| 2025-08-05 | 13F | Strategic Financial Concepts, LLC | 42 757 | 13,29 | 775 | 10,56 | ||||

| 2025-05-13 | 13F | Annandale Capital, LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-07 | 13F | Pinnacle Holdings, LLC | 184 346 | 1,50 | 3 342 | −1,01 | ||||

| 2025-07-17 | 13F | Camelot Portfolios, LLC | 31 209 | 4,91 | 566 | 2,36 | ||||

| 2025-08-04 | 13F | Clear Investment Research, Llc | 822 | 1,86 | 15 | −6,67 | ||||

| 2025-07-15 | 13F | Affinity Wealth Management Llc | 21 744 | 1,49 | 394 | −1,01 | ||||

| 2025-07-09 | 13F | Fermata Advisors, LLC | 13 619 | 18,36 | 247 | 15,49 | ||||

| 2025-08-14 | 13F | PYA Waltman Capital, LLC | 51 983 | −14,33 | 942 | −16,42 | ||||

| 2025-07-29 | 13F | Smithbridge Asset Management Inc/de | 19 572 | 4,37 | 355 | 1,72 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | Put | 0 | −100,00 | 0 | ||||

| 2025-08-28 | NP | USNG - Amplify Samsung U.S. Natural Gas Infrastructure ETF | 7 784 | 141 | ||||||

| 2025-07-16 | 13F | Independent Wealth Network Inc. | 57 703 | 26,04 | 1 046 | 22,91 | ||||

| 2025-07-07 | 13F | Trust Co | 2 000 | 0,00 | 36 | −2,70 | ||||

| 2025-07-15 | 13F | Financial Management Professionals, Inc. | 633 | 0,00 | 11 | 0,00 | ||||

| 2025-08-22 | NP | FWATX - Fidelity Advisor Multi-Asset Income Fund Class A This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 783 300 | −15,40 | 14 201 | −17,49 | ||||

| 2025-08-12 | 13F | Pacer Advisors, Inc. | 379 838 | 1,30 | 6 886 | −1,21 | ||||

| 2025-08-14 | 13F | Spears Abacus Advisors LLC | 137 147 | 0,00 | 2 486 | −2,47 | ||||

| 2025-08-05 | 13F | Atlas Private Wealth Advisors | 22 928 | 1,68 | 416 | −0,95 | ||||

| 2025-08-14 | 13F | Shepherd Kaplan Krochuk, Llc | 224 768 | −2,25 | 4 075 | −4,66 | ||||

| 2025-08-08 | 13F | Firestone Capital Management | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | BlackRock Funds V - BlackRock High Yield Bond Portfolio Service Shares | 2 418 267 | 164,80 | 43 843 | 335,25 | ||||

| 2025-08-19 | 13F | Anchor Investment Management, LLC | 63 030 | −0,98 | 1 143 | −3,47 | ||||

| 2025-08-14 | 13F | Appaloosa Lp | 4 957 235 | 0,00 | 89 875 | −2,47 | ||||

| 2025-06-26 | NP | HMSFX - Hennessy BP Midstream Fund Investor Class | 580 930 | 1,76 | 9 609 | −17,82 | ||||

| 2025-07-17 | 13F | Stockman Wealth Management, Inc. | 63 466 | 1,44 | 1 151 | −1,12 | ||||

| 2025-07-25 | 13F | LRI Investments, LLC | 12 290 | 0,00 | 223 | −2,63 | ||||

| 2025-07-30 | NP | Cushing Renaissance Fund | 581 999 | 1,39 | 10 173 | −8,12 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 1 873 174 | 64,24 | 34 | 57,14 | ||||

| 2025-06-26 | NP | FLKSX - Fidelity Low-Priced Stock K6 Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 484 452 | 409,92 | 8 013 | 311,93 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Sig Brokerage, Lp | Call | 90 000 | 80,00 | 1 632 | 75,57 | |||

| 2025-08-05 | 13F | BEAM Asset Management, LLC | 40 369 | 1,09 | 732 | −1,48 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 161 433 | 2,60 | 2 927 | 0,03 | ||||

| 2025-07-21 | 13F | Empirical Financial Services, LLC d.b.a. Empirical Wealth Management | 31 188 | −6,12 | 565 | −8,43 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 331 960 | −1,13 | 6 018 | −3,57 | ||||

| 2025-07-10 | 13F | Capital Advisory Group Advisory Services, LLC | 41 086 | −37,61 | 745 | −39,22 | ||||

| 2025-08-12 | 13F | Private Management Group Inc | 401 653 | 7 282 | ||||||

| 2025-08-07 | 13F | Nwam Llc | 32 548 | 20,44 | 588 | 16,93 | ||||

| 2025-08-12 | 13F | Integrated Advisors Network LLC | 137 495 | 8,02 | 2 493 | 5,33 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 22 411 | −22,07 | 406 | −23,97 | ||||

| 2025-08-08 | 13F | WP Advisors, LLC | 15 340 | 1,81 | 278 | −0,71 | ||||

| 2025-05-15 | 13F | Aster Capital Management (DIFC) Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Tortoise Investment Management, LLC | 6 828 | 15,42 | 124 | 12,84 | ||||

| 2025-08-04 | 13F | Kovack Advisors, Inc. | 47 027 | −2,27 | 853 | −4,70 | ||||

| 2025-08-13 | 13F | Patient Capital Management, LLC | 4 076 356 | −16,53 | 73 904 | −18,60 | ||||

| 2025-08-14 | 13F | Merewether Investment Management, LP | 1 315 612 | −45,78 | 23 852 | −47,12 | ||||

| 2025-07-10 | 13F | Kozak & Associates, Inc. | 5 135 | 0,35 | 91 | 4,65 | ||||

| 2025-08-14 | 13F | Visionary Wealth Advisors | 175 274 | 392,94 | 3 178 | 381,36 | ||||

| 2025-07-18 | 13F | Madrona Financial Services, LLC | 11 274 | −11,99 | 204 | −14,29 | ||||

| 2025-08-14 | 13F | Recurrent Investment Advisors LLC | 4 792 806 | 1,43 | 86 894 | −1,08 | ||||

| 2025-08-07 | 13F | Legacy Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-09 | 13F | Act Wealth Management, Llc | 20 795 | −4,25 | 377 | −6,45 | ||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 76 223 | 30,42 | 1 382 | 27,16 | ||||

| 2025-07-30 | NP | Tortoise Essential Assets Income Term Fund | 1 078 885 | 263,94 | 18 859 | 229,80 | ||||

| 2025-07-29 | 13F | Aull & Monroe Investment Management Corp | 84 064 | −21,48 | 1 524 | −23,42 | ||||

| 2025-08-11 | 13F | United Advisor Group, LLC | 23 419 | 0,00 | 425 | −2,53 | ||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 160 296 | 3,24 | 2 906 | 0,69 | ||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 924 000 | 0,00 | 16 752 | −2,47 | ||||

| 2025-07-30 | 13F | Evermay Wealth Management Llc | 1 844 | 0,00 | 33 | −2,94 | ||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 27 222 | 57,13 | 0 | |||||

| 2025-08-07 | 13F | Fidelis Capital Partners, LLC | 41 960 | 0,00 | 749 | 2,32 | ||||

| 2025-07-30 | NP | Cushing Mlp Total Return Fund | 815 000 | −9,44 | 14 246 | −17,94 | ||||

| 2025-07-31 | 13F | Brighton Jones Llc | 27 794 | −14,71 | 504 | −16,86 | ||||

| 2025-08-14 | 13F | Full Sail Capital, LLC | 31 789 | 2,96 | 576 | 0,52 | ||||

| 2025-08-12 | 13F | TCTC Holdings, LLC | 48 598 | 3,18 | 881 | 0,69 | ||||

| 2025-08-12 | 13F | WealthTrak Capital Management LLC | 960 | 0,00 | 17 | 0,00 | ||||

| 2025-08-08 | 13F | Vestcor Inc | 20 300 | 0 | ||||||

| 2025-08-07 | 13F | Americana Partners, LLC | 2 676 064 | 17,80 | 48 517 | 14,88 | ||||

| 2025-08-01 | 13F | Boyd Watterson Asset Management Llc/oh | 1 385 | 0,00 | 25 | 0,00 | ||||

| 2025-08-14 | 13F | Douglass Winthrop Advisors, LLC | 16 850 | −48,23 | 305 | −49,59 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 135 395 | 6,20 | 2 455 | 3,54 | ||||

| 2025-08-12 | 13F | Financial Advocates Investment Management | 10 074 | −19,19 | 183 | −21,21 | ||||

| 2025-07-15 | 13F | Fortitude Family Office, LLC | 2 661 | 0,00 | 48 | −2,04 | ||||

| 2025-05-07 | 13F | WMS Partners, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Navellier & Associates Inc | 19 000 | 1,06 | 344 | 13,16 | ||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 680 | 12 | ||||||

| 2025-08-29 | NP | LMORX - Patient Opportunity Trust Class R | 3 100 000 | −18,42 | 56 203 | −20,44 | ||||

| 2025-07-31 | 13F | 180 Wealth Advisors, Llc | 189 299 | −8,68 | 3 432 | −10,95 | ||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 128 135 | −5,18 | 2 323 | −7,52 | ||||

| 2025-07-30 | NP | Tortoise Energy Infrastructure Corp | 2 741 088 | 0,00 | 47 914 | −9,38 | ||||

| 2025-07-09 | 13F | Christopher J. Hasenberg, Inc | 20 288 | 0,00 | 368 | −3,17 | ||||

| 2025-07-11 | 13F | Rockwood Wealth Management, LLC | 131 072 | −0,46 | 2 376 | −2,90 | ||||

| 2025-04-17 | 13F | Sfm, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 248 539 | 84,77 | 4 506 | 80,24 | ||||

| 2025-07-29 | 13F | Huntleigh Advisors, Inc. | 111 842 | −40,14 | 2 028 | −41,64 | ||||

| 2025-08-05 | 13F | Fourth Dimension Wealth, LLC | 1 500 | 0,00 | 27 | 0,00 | ||||

| 2025-08-28 | NP | Nuveen Multi-Asset Income Fund This fund is a listed as child fund of Nuveen Asset Management, LLC and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 14 428 | −71,02 | 262 | −71,78 | ||||

| 2025-06-24 | NP | NBET - Neuberger Berman Carbon Transition & Infrastructure ETF | 85 800 | 73,33 | 1 419 | 40,08 | ||||

| 2025-07-30 | 13F | Schulhoff & Co Inc | 27 840 | 11,36 | 505 | 8,62 | ||||

| 2025-08-05 | 13F | GHP Investment Advisors, Inc. | 4 675 | 52,03 | 85 | 47,37 | ||||

| 2025-08-14 | 13F | Bluefin Capital Management, Llc | 102 300 | −31,88 | 1 855 | −33,57 | ||||

| 2025-08-14 | 13F | Bluefin Capital Management, Llc | Put | 87 500 | −14,80 | 5 | −69,23 | |||

| 2025-07-02 | 13F | Helen Stephens Group, LLC | 20 539 | 13,36 | 372 | 10,71 | ||||

| 2025-08-05 | 13F | Sage Capital Management, LLC | 21 759 | 2,61 | 394 | 0,00 | ||||

| 2025-08-14 | 13F | Keebeck Wealth Management, LLC | 318 511 | 1,05 | 5 775 | −1,45 | ||||

| 2025-07-07 | 13F | Modus Advisors, LLC | 41 302 | 0,00 | 749 | −2,48 | ||||

| 2025-07-24 | 13F | Stonebridge Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Fifth Third Wealth Advisors LLC | 20 696 | 0,03 | 375 | −2,34 | ||||

| 2025-05-09 | 13F | Comprehensive Financial Planning, Inc./PA | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 709 786 | 90,18 | 12 918 | 85,02 | ||||

| 2025-07-01 | 13F | Harbor Investment Advisory, Llc | 27 345 | 137,76 | 496 | 132,39 | ||||

| 2025-08-13 | 13F | Amundi | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Talon Private Wealth, LLC | 49 610 | 1,82 | 899 | −0,66 | ||||

| 2025-07-31 | 13F | Conservest Capital Advisors, Inc. | 27 141 | 1,13 | 492 | −1,20 | ||||

| 2025-07-24 | 13F | Baldwin Brothers Inc/ma | 266 003 | −1,02 | 4 823 | −3,48 | ||||

| 2025-08-08 | 13F | Kaizen Financial Strategies | 12 631 | 8,78 | 229 | 6,51 | ||||

| 2025-04-02 | 13F | Marcum Wealth, LLC | 11 869 | −7,61 | 221 | −12,35 | ||||

| 2025-07-15 | 13F | MCF Advisors LLC | 9 195 | 7,18 | 167 | 4,40 | ||||

| 2025-08-05 | 13F | Cherry Tree Wealth Management, LLC | 2 211 | 0,00 | 40 | −2,44 | ||||

| 2025-08-08 | 13F | Compass Wealth Management LLC | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Almanack Investment Partners, LLC. | 18 440 | 9,03 | 334 | 6,37 | ||||

| 2025-07-24 | NP | INFIX - Tortoise MLP & Energy Income Fund Institutional Class Shares | 1 475 343 | −4,15 | 25 789 | −13,15 | ||||

| 2025-08-05 | 13F | Seelaus Asset Management LLC | 15 330 | 23,13 | 278 | 19,91 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 55 616 | 0,03 | 1 008 | −2,42 | ||||

| 2025-08-08 | 13F | King Wealth | 30 767 | 1,37 | 1 | |||||

| 2025-08-11 | 13F | Inspire Advisors, LLC | 79 618 | 76,07 | 1 443 | 71,79 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 145 136 | 7,35 | 2 631 | 4,70 | ||||

| 2025-08-05 | 13F | Partners Group Holding AG | 25 810 | 10,91 | 468 | 8,10 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 6 576 525 | −20,35 | 119 232 | −22,32 | ||||

| 2025-04-25 | NP | FNARX - Natural Resources Portfolio This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 150 200 | −48,54 | 2 897 | −50,03 | ||||

| 2025-08-13 | 13F | Level Four Advisory Services, Llc | 190 758 | 22,57 | 3 458 | 19,53 | ||||

| 2025-07-18 | 13F | Naples Global Advisors, Llc | 56 100 | 71,04 | 1 017 | 67,00 | ||||

| 2025-08-06 | 13F | Mark Sheptoff Financial Planning, Llc | 15 460 | 19,29 | 280 | 16,67 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 3 839 | 70 | ||||||

| 2025-08-11 | 13F | Pinnacle Wealth Planning Services, Inc. | 3 887 215 | 6,36 | 70 475 | 3,73 | ||||

| 2025-07-22 | NP | DRAFX - Destinations Real Assets Fund Class I | 39 031 | −14,02 | 682 | −22,06 | ||||

| 2025-08-29 | NP | HHCAX - Highland Long/Short Healthcare Fund Class A | 49 200 | 892 | ||||||

| 2025-08-12 | 13F | White Pine Capital Llc | 21 030 | 0,00 | 381 | −2,31 | ||||

| 2025-08-13 | 13F | Congress Wealth Management LLC / DE / | 40 778 | 4,38 | 739 | 1,51 | ||||

| 2025-07-31 | 13F | Leavell Investment Management, Inc. | 28 745 | 0,01 | 521 | −2,43 | ||||

| 2025-08-13 | 13F | Icapital Wealth Llc | 26 029 | 0,00 | 472 | −2,48 | ||||

| 2025-06-27 | NP | Calamos Dynamic Convertible & Income Fund | 15 585 | 0,00 | 258 | −19,44 | ||||

| 2025-08-28 | NP | QCSTRX - Stock Account Class R1 | 1 | 0,00 | 0 | |||||

| 2025-08-11 | 13F | United Capital Financial Advisers, Llc | 27 032 | 46,51 | 490 | 43,27 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 59 537 | 13,87 | 1 079 | 11,12 | ||||

| 2025-05-30 | NP | FLDZ - RiverNorth Patriot ETF | 881 | −3,19 | 16 | −5,88 | ||||

| 2025-04-22 | 13F | Connective Portfolio Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-02 | 13F | Doliver Advisors, Lp | 31 057 | −3,68 | 563 | −6,01 | ||||

| 2025-07-10 | 13F | Professional Financial Advisors, LLC | 16 401 | 0,00 | 297 | −2,30 | ||||

| 2025-07-25 | 13F | JustInvest LLC | 39 845 | 1,44 | 723 | −0,96 | ||||

| 2025-08-14 | 13F | RBF Capital, LLC | 1 000 000 | 0,00 | 18 130 | −2,47 | ||||

| 2025-08-14 | 13F | Modern Wealth Management, LLC | 13 579 | 33,78 | 246 | 30,85 | ||||

| 2025-07-18 | 13F | First Pacific Financial | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | Chapin Davis, Inc. | 98 039 | 0,96 | 1 777 | −1,55 | ||||

| 2025-08-11 | 13F | FineMark National Bank & Trust | 36 894 | −7,60 | 669 | −9,97 | ||||

| 2025-08-05 | 13F | Tiaa Trust, National Association | 15 102 | 1,66 | 274 | −1,09 | ||||

| 2025-06-25 | NP | SMLPX - Westwood Salient MLP & Energy Infrastructure Fund Institutional Shares | 7 140 335 | 11,05 | 118 101 | −10,31 | ||||

| 2025-08-05 | 13F | Ninepoint Partners LP | 78 832 | 0,00 | 1 429 | −2,46 | ||||

| 2025-08-15 | 13F | Brookfield Asset Management Inc. | 14 068 948 | −3,81 | 255 070 | −6,19 | ||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 1 522 647 | −1,83 | 27 606 | −4,26 | ||||

| 2025-08-11 | 13F | HHM Wealth Advisors, LLC | 2 270 | 54,42 | 41 | 51,85 | ||||

| 2025-06-03 | 13F | Invst, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | Sl Advisors, Llc | 378 868 | 0,00 | 6 869 | −2,48 | ||||

| 2025-08-14 | 13F | UBS Group AG | Call | 138 800 | 0,00 | 2 516 | −2,48 | |||

| 2025-04-16 | 13F | F&V Capital Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 33 576 026 | 1,59 | 608 733 | −0,93 | ||||

| 2025-07-17 | 13F/A | Capital Investment Advisors, LLC | 306 152 | −1,34 | 5 551 | −3,78 | ||||

| 2025-07-25 | 13F | Quantum Financial Planning Services, Inc. | 10 000 | 181 | ||||||

| 2025-07-31 | 13F | Sentinel Trust Co Lba | 207 000 | 0,00 | 4 | 0,00 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 3 634 004 | 5,36 | 66 497 | 3,71 | ||||

| 2025-07-15 | 13F | Northside Capital Management, LLC | 1 888 076 | 34 231 | ||||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 899 176 | 0,29 | 16 302 | −2,18 | ||||

| 2025-07-24 | NP | FPURX - Fidelity Puritan Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 6 361 540 | 2,87 | 111 200 | −6,78 | ||||

| 2025-08-12 | 13F | Horizon Kinetics Asset Management Llc | 439 947 | 7,52 | 7 976 | 4,86 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 3 812 | 5,16 | 69 | 2,99 | ||||

| 2025-05-15 | 13F | IronBridge Private Wealth, LLC | 10 584 | 0,24 | 197 | −4,85 | ||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 12 785 | 7,92 | 232 | 5,00 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 1 024 606 | 8,83 | 18 412 | 5,21 | ||||

| 2025-08-14 | 13F | Fairview Capital Investment Management, Llc | 10 026 | 0,00 | 182 | −2,69 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Put | 69 900 | 0,00 | 1 267 | −2,46 | |||

| 2025-08-28 | NP | BlackRock Series Fund II, Inc. - BlackRock High Yield Portfolio This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 847 | 33 | ||||||

| 2025-08-14 | 13F | Arete Wealth Advisors, LLC | 38 826 | 2,25 | 1 | |||||

| 2025-07-17 | 13F | Summit Financial Strategies, Inc. | 85 184 | 0,12 | 1 544 | −2,34 | ||||

| 2025-07-17 | 13F | Guyasuta Investment Advisors Inc | 13 127 | 238 | ||||||

| 2025-08-01 | 13F | Centerpoint Advisors, LLC | 434 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Texas Capital Bank Wealth Management Services Inc | 373 043 | −42,71 | 6 763 | −44,12 | ||||

| 2025-07-25 | 13F | NorthRock Partners, LLC | 39 192 | −3,15 | 711 | −5,59 | ||||

| 2025-08-08 | 13F | Bouchey Financial Group Ltd | 41 402 | 0,00 | 751 | −2,47 | ||||

| 2025-04-25 | 13F | New Wave Wealth Advisors Llc | 0 | −100,00 | 0 | |||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 5 450 | −0,67 | 99 | −3,92 | ||||

| 2025-07-30 | 13F | Private Capital Advisors, Inc. | 850 047 | 1,00 | 15 411 | −1,50 | ||||

| 2025-07-31 | 13F | McCarthy Asset Management, Inc. | 10 561 | 0,25 | 191 | −2,05 | ||||

| 2025-07-23 | 13F | Kingswood Wealth Advisors, Llc | 37 771 | −18,21 | 685 | −20,74 | ||||

| 2025-07-24 | 13F | Lee Financial Co | 42 160 | 0,00 | 764 | −2,43 | ||||

| 2025-08-13 | 13F | Natixis | 17 476 924 | −3,87 | 316 857 | −5,72 | ||||

| 2025-07-08 | 13F | Adamsbrown Wealth Consultants Llc | 11 605 | 1,59 | 210 | −0,94 | ||||

| 2025-08-06 | 13F | Adviser Investments LLC | 29 322 | 1,69 | 532 | −0,93 | ||||

| 2025-08-18 | 13F/A | Westwood Holdings Group Inc | 16 679 980 | −0,64 | 302 408 | −3,10 | ||||

| 2025-08-01 | 13F | Cobblestone Capital Advisors Llc /ny/ | 135 393 | 4,24 | 2 455 | 1,66 | ||||

| 2025-06-27 | NP | TBG - TBG Dividend Focus ETF | 251 518 | −1,58 | 4 160 | −20,50 | ||||

| 2025-08-01 | 13F | Financial Counselors Inc | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Ami Investment Management Inc | 10 997 | 0,00 | 199 | −2,45 | ||||

| 2025-04-29 | 13F | Centered Wealth LLC dba Miller Equity Capital Advisors | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Samalin Investment Counsel, LLC | 54 090 | 0,53 | 981 | −2,00 | ||||

| 2025-07-31 | 13F/A | Avion Wealth | 50 300 | −6,61 | 1 | −100,00 | ||||

| 2025-08-12 | 13F | Viawealth, Llc | 13 702 | 1,81 | 248 | −0,80 | ||||

| 2025-08-11 | 13F | Nations Financial Group Inc, /ia/ /adv | 298 986 | 0,12 | 5 421 | −2,36 | ||||

| 2025-08-12 | 13F | Bokf, Na | 686 163 | −19,29 | 12 440 | −21,29 | ||||

| 2025-08-14 | 13F | Ruggaard & Associates LLC | 12 987 | 0,00 | 235 | −2,49 | ||||

| 2025-07-09 | 13F | Pallas Capital Advisors LLC | 24 727 | 33,93 | 448 | 30,61 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 1 010 | −62,10 | 18 | −63,27 | ||||

| 2025-08-14 | 13F | Sig Brokerage, Lp | Put | 0 | −100,00 | 0 | ||||

| 2025-08-04 | 13F | Prairie Wealth Advisors, Inc. | 33 250 | 0,61 | 603 | −1,95 | ||||

| 2025-08-01 | NP | General American Investors Co Inc | 1 020 030 | 0,00 | 18 493 | 0,00 | ||||

| 2025-08-26 | NP | Ivy Variable Insurance Portfolios - Ivy VIP Energy Class II | 57 529 | −46,28 | 1 043 | −47,59 | ||||

| 2025-07-23 | 13F | High Note Wealth, LLC | 2 200 | 0,00 | 40 | −2,50 | ||||

| 2025-08-08 | 13F | Advisors Capital Management, LLC | 488 636 | 1,50 | 8 859 | −1,02 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 247 599 | 2,85 | 4 489 | 0,29 | ||||

| 2025-07-09 | 13F | Wolff Financial Management Llc | 13 171 | 0,16 | 0 | |||||

| 2025-08-05 | 13F | Levin Capital Strategies, L.p. | 12 534 | 0,00 | 227 | −2,58 | ||||

| 2025-07-23 | 13F | Venturi Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Country Club Bank /gfn | 14 816 | −5,07 | 270 | −7,88 | ||||

| 2025-08-28 | NP | Elevation Series Trust - RiverNorth Patriot ETF | 1 041 | 19 | ||||||

| 2025-07-08 | 13F | Northstar Advisory Group, LLC | 25 952 | 471 | ||||||

| 2025-08-18 | 13F/A | Nomura Holdings Inc | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-07-29 | 13F | CapWealth Advisors, LLC | 17 425 | 1,75 | 316 | −0,94 | ||||

| 2025-06-27 | NP | Calamos Convertible & High Income Fund | 61 575 | 0,00 | 1 018 | −19,27 | ||||

| 2025-07-11 | 13F | Miller Howard Investments Inc /ny | 5 214 638 | 3,60 | 94 541 | 1,03 | ||||

| 2025-07-17 | 13F | Centennial Wealth Advisory LLC | 10 874 | −7,57 | 197 | −9,63 | ||||

| 2025-07-16 | 13F | Magnus Financial Group LLC | 30 801 | 65,43 | 558 | 61,27 | ||||

| 2025-08-12 | 13F | Zacks Investment Management | 10 393 | 188 | ||||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 4 189 | 76 | ||||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 96 987 | 5,47 | 1 758 | 2,87 | ||||

| 2025-08-12 | 13F | FourThought Financial Partners, LLC | 85 623 | 1,19 | 1 552 | −1,27 | ||||

| 2025-08-28 | 13F/A | Lavaca Capital Llc | 192 800 | 0,00 | 3 495 | −2,48 | ||||

| 2025-07-25 | 13F | GFS Advisors, LLC | 70 000 | 0,00 | 1 269 | −2,46 | ||||

| 2025-07-02 | 13F | Howard Financial Services, Ltd. | 188 309 | 3,44 | 3 414 | 0,89 | ||||

| 2025-07-18 | 13F | Chelsea Counsel Co | 94 050 | 370,25 | 1 705 | 359,57 | ||||

| 2025-08-14 | 13F | Glenview Trust Co | 77 665 | 1 408 | ||||||

| 2025-08-18 | 13F/A | Nomura Holdings Inc | Call | 400 000 | 0,00 | 7 252 | −2,47 | |||

| 2025-08-06 | 13F | Van Cleef Asset Management,Inc | 17 090 | 0,00 | 310 | −2,52 | ||||

| 2025-08-04 | 13F | BLB&B Advisors, LLC | 49 051 | −2,00 | 889 | −4,41 | ||||

| 2025-05-16 | 13F | Resources Management Corp /ct/ /adv | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | SOUTH STATE Corp | 3 727 | −10,39 | 68 | −12,99 | ||||

| 2025-08-01 | 13F | Private Wealth Partners, LLC | 66 500 | 0,00 | 1 206 | −2,51 | ||||

| 2025-08-12 | 13F | SHEPHERD WEALTH MANAGEMENT Ltd LIABILITY Co | 15 500 | 271 | ||||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 1 657 760 | 105,68 | 30 055 | 100,59 | ||||

| 2025-08-13 | 13F | Mount Yale Investment Advisors, LLC | 100 | 2 | ||||||

| 2025-06-26 | NP | TMLAX - Transamerica MLP & Energy Income A | 587 323 | 13,23 | 9 714 | −8,55 | ||||

| 2025-07-25 | 13F | Griffin Asset Management, Inc. | 87 289 | 2,32 | 1 583 | −0,19 | ||||

| 2025-07-30 | 13F | Sanders Morris Harris Llc | 61 962 | −27,27 | 1 123 | −29,33 | ||||

| 2025-07-10 | 13F | Redhawk Wealth Advisors, Inc. | 23 000 | −3,17 | 417 | −5,67 | ||||

| 2025-08-14 | 13F | Bramshill Investments, LLC | 94 101 | −0,18 | 1 706 | −2,63 | ||||

| 2025-05-06 | 13F | Summit Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Stonegate Investment Group, LLC | 39 418 | 11,98 | 715 | 9,17 | ||||

| 2025-08-26 | NP | NRIAX - Nuveen Real Asset Income Fund Class A This fund is a listed as child fund of Nuveen Asset Management, LLC and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 910 953 | −10,70 | 16 516 | −12,90 | ||||

| 2025-07-30 | 13F/A | KPP Advisory Services LLC | 38 039 | 5,06 | 690 | 2,38 | ||||

| 2025-08-12 | 13F | one8zero8, LLC | 47 839 | 0,00 | 867 | −2,47 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 119 035 | 58,41 | 2 158 | 54,58 | ||||

| 2025-08-12 | 13F | Ensign Peak Advisors, Inc | 555 230 | 0,00 | 10 066 | −2,47 | ||||

| 2025-08-05 | 13F | Next Capital Management LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | NP | MLOAX - Cohen & Steers MLP & Energy Opportunity Fund, Inc. Class A | 418 709 | −2,84 | 7 319 | −11,95 | ||||

| 2025-07-29 | 13F | Empirical Asset Management, LLC | 34 016 | 0,02 | 617 | −2,53 | ||||

| 2025-07-28 | 13F | Turtle Creek Wealth Advisors, LLC | 703 587 | 9,53 | 12 756 | 6,83 | ||||

| 2025-07-21 | NP | GLEAX - Goldman Sachs MLP & Energy Fund Class A Shares | 2 161 628 | −2,67 | 37 785 | −11,80 | ||||

| 2025-08-14 | 13F | Advisor OS, LLC | 46 467 | −6,95 | 842 | −9,27 | ||||

| 2025-05-14 | 13F | Oarsman Capital, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | Call | 595 000 | 116,36 | 10 787 | 111,01 | |||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 30 159 930 | −19,37 | 546 800 | −21,37 | ||||

| 2025-08-14 | 13F | Financial Advisory Service, Inc. | 33 651 | −0,24 | 610 | −2,71 | ||||

| 2025-07-28 | 13F | Sagespring Wealth Partners, Llc | 21 940 | 0,71 | 398 | −1,73 | ||||

| 2025-07-10 | 13F | Focus Financial Network, Inc. | 26 827 | −26,14 | 486 | −28,00 | ||||

| 2025-08-14 | 13F | Kamunting Street Capital Management, L.P. | 2 023 186 | 20,48 | 36 680 | 17,50 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | Put | 275 000 | 0,00 | 4 986 | −2,48 | |||

| 2025-08-14 | 13F | Alden Global Capital LLC | 744 513 | 17,80 | 13 498 | 14,89 | ||||

| 2025-07-16 | 13F | Novem Group | 31 559 | 0,76 | 572 | −1,72 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 32 368 | −2,46 | 587 | −4,87 | ||||

| 2025-07-22 | 13F | Red Door Wealth Management, LLC | 15 605 | 283 | ||||||

| 2025-08-04 | 13F | Noesis Capital Mangement Corp | 42 377 | 0,08 | 768 | −2,41 | ||||

| 2025-07-17 | 13F | Fort Washington Investment Advisors Inc /oh/ | 417 575 | 25,54 | 7 571 | 22,43 | ||||

| 2025-08-14 | 13F | Aspen Grove Capital, LLC | 30 001 | 0,00 | 544 | −2,51 | ||||

| 2025-07-07 | 13F | Kings Path Partners LLC | 8 000 | 0,00 | 145 | −2,03 | ||||

| 2025-07-30 | 13F | Bleakley Financial Group, LLC | 30 239 | 28,75 | 548 | 25,69 | ||||

| 2025-08-14 | 13F | Wealth Preservation Advisors, LLC | 2 360 | −44,60 | 43 | −46,84 | ||||

| 2025-07-11 | 13F | Enhancing Capital LLC | 80 640 | 0,00 | 1 462 | −2,47 | ||||

| 2025-07-31 | 13F | University Of Texas/texas Am Investment Managment Co | 7 249 | 0,00 | 131 | −2,24 | ||||

| 2025-08-12 | 13F | Walled Lake Planning & Wealth Management, Llc | 28 025 | 28,56 | 508 | 25,43 | ||||

| 2025-07-24 | 13F | Belfer Management LLC | 21 700 | 0,00 | 393 | −2,48 | ||||

| 2025-08-12 | 13F | Fortis Capital Management LLC | 36 501 | 2,57 | 662 | 0,00 | ||||

| 2025-08-12 | 13F | Fulcrum Asset Management LLP | Put | 0 | −100,00 | 0 | ||||

| 2025-08-28 | NP | BlackRock Funds V - BlackRock Credit Strategies Income Fund Investor A Shares | 4 101 | 74 | ||||||

| 2025-08-13 | 13F | BCJ Capital Management, LLC | 13 433 | 0,04 | 244 | −2,41 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 301 061 | −3,83 | 5 458 | −6,20 | ||||

| 2025-08-14 | 13F | Helium Advisors LLC | 23 112 | −0,66 | 419 | −3,01 | ||||

| 2025-08-07 | 13F | Weil Company, Inc. | 14 594 | 13,97 | 265 | 10,92 | ||||

| 2025-08-12 | 13F | Holderness Investments Co | 60 157 | 5,86 | 1 091 | 3,22 | ||||

| 2025-07-16 | 13F | True North Advisors, LLC | 98 006 | −1,62 | 1 777 | −4,05 | ||||

| 2025-07-17 | 13F | Albion Financial Group /ut | 2 953 | 1,79 | 54 | 0,00 | ||||

| 2025-08-08 | 13F | Smithfield Trust Co | 13 731 | 0,00 | 0 | |||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 22 510 | 242 | 15,24 | |||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 1 690 769 | 223,70 | 30 654 | 215,68 | ||||

| 2025-08-07 | 13F | Summit X, LLC | 10 196 | 0,00 | 185 | −2,65 | ||||

| 2025-08-08 | 13F | L & S Advisors Inc | 10 930 | 0,28 | 198 | −1,98 | ||||

| 2025-08-14 | 13F | Potentia Wealth | 12 798 | −25,52 | 232 | −27,27 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 151 956 | 1,32 | 2 755 | −1,22 | ||||

| 2025-06-25 | NP | WHGHX - Westwood High Income Fund Institutional Shares | 42 981 | −4,37 | 711 | −22,83 | ||||

| 2025-07-16 | 13F | ORG Partners LLC | 30 | 0,00 | 1 | |||||

| 2025-07-25 | 13F | Concord Wealth Partners | 7 819 | 1,81 | 142 | −0,70 | ||||

| 2025-08-07 | 13F | Argent Advisors, Inc. | 62 468 | 0,32 | 1 133 | −2,16 | ||||

| 2025-07-29 | 13F | FLC Capital Advisors | 19 793 | 0,00 | 359 | −2,45 | ||||

| 2025-07-15 | 13F | Xcel Wealth Management, LLC | 18 150 | 30,58 | 329 | 27,52 | ||||

| 2025-08-14 | 13F | Aldebaran Financial Inc. | 21 425 | 0,00 | 388 | −2,51 | ||||

| 2025-08-06 | 13F | Warm Springs Advisors Inc. | 0 | −100,00 | 0 | |||||

| 2025-04-23 | 13F | Financial Life Planners | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Empire Financial Management Company, LLC | 63 525 | −2,31 | 1 152 | −4,72 | ||||

| 2025-07-28 | 13F | Bridges Investment Management Inc | 264 422 | 0,00 | 4 794 | −2,48 | ||||

| 2025-08-05 | 13F | Gibraltar Capital Management, Inc. | 60 486 | 18,52 | 1 097 | 15,61 | ||||

| 2025-07-30 | 13F | Whittier Trust Co | 25 617 | 0,00 | 464 | −2,52 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 76 601 | 68,33 | 1 389 | 62,91 | ||||

| 2025-07-30 | NP | FCTDX - Strategic Advisers Fidelity U.S. Total Stock Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 832 100 | 22,81 | 14 545 | 11,29 | ||||

| 2025-07-21 | 13F | Pflug Koory, LLC | 10 | 0 | ||||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 63 434 | 6,86 | 1 | 0,00 | ||||

| 2025-07-22 | 13F | Highland Capital Management, Llc | 51 318 | 930 | ||||||

| 2025-08-13 | 13F | Berkshire Asset Management Llc/pa | 33 002 | 0,12 | 598 | 4,55 | ||||

| 2025-07-31 | 13F | Carnegie Capital Asset Management, LLC | 25 720 | 466 | ||||||

| 2025-05-07 | 13F | Spectrum Wealth Counsel, LLC | 80 | 0,00 | 1 | 0,00 | ||||

| 2025-07-14 | 13F | Hoey Investments, Inc | 516 | 0,00 | 9 | 0,00 | ||||

| 2025-08-13 | 13F | Beutel, Goodman & Co Ltd. | 1 500 | 0,00 | 0 | |||||

| 2025-08-06 | 13F | SP Asset Management LLC | 26 561 | 482 | ||||||

| 2025-07-29 | 13F | Private Trust Co Na | 22 782 | 31,07 | 413 | 27,86 | ||||

| 2025-06-26 | NP | PGJAX - PGIM Jennison Global Infrastructure Fund Class A | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-06-25 | NP | WWICX - Westwood Income Opportunity Fund C Class Shares | 490 825 | −5,30 | 8 118 | −23,52 | ||||

| 2025-07-11 | 13F | Vanguard Capital Wealth Advisors This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 10 010 | 0,00 | 181 | −2,69 | ||||

| 2025-07-23 | 13F | Indiana Trust & Investment Management CO | 11 796 | 0,00 | 214 | −2,74 | ||||

| 2025-08-26 | NP | GOP - Unusual Whales Subversive Republican Trading ETF | 14 420 | −8,56 | 261 | −10,92 | ||||

| 2025-08-12 | 13F | PSI Advisors, LLC | 226 929 | −9,32 | 4 114 | −11,56 | ||||

| 2025-07-24 | 13F | GFG Capital, LLC | 3 640 | −95,20 | 66 | −95,39 | ||||

| 2025-06-30 | NP | RMLPX - Recurrent MLP & Infrastructure Fund Class I | 4 324 033 | 0,00 | 71 520 | −19,24 | ||||

| 2025-07-21 | 13F | Hilltop National Bank | 5 584 | 3,71 | 101 | −3,81 | ||||

| 2025-08-08 | 13F | Westbourne Investment Advisors, Inc. | 17 700 | 321 | ||||||

| 2025-08-08 | 13F | Wealth Alliance | 15 664 | 1,89 | 284 | −0,70 | ||||

| 2025-07-17 | 13F | Kavar Capital Partners Group, Llc | 16 900 | 0,00 | 306 | −2,55 | ||||

| 2025-08-11 | 13F | Invenio Wealth Partners Llc | 31 716 | 0,00 | 575 | −2,38 | ||||

| 2025-07-28 | 13F | Cornerstone Wealth Group, LLC | 11 582 | 210 | ||||||

| 2025-08-14 | 13F | Infrastructure Capital Advisors, Llc | 3 642 271 | 4,25 | 66 034 | 1,67 | ||||

| 2025-07-11 | 13F | Mallini Complete Financial Planning LLC | 35 211 | −3,13 | 638 | −5,48 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | 36 223 | −41,64 | 657 | −43,10 | ||||

| 2025-05-07 | 13F | Sheaff Brock Investment Advisors, LLC | 85 318 | −18,28 | 1 586 | −22,44 | ||||

| 2025-07-31 | 13F | West Michigan Advisors, Llc | 13 528 | 0,45 | 245 | −2,00 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 2 720 786 | −0,44 | 49 328 | −2,90 | ||||

| 2025-07-30 | 13F | Fogel Capital Management, Inc. | 441 619 | 3,20 | 8 007 | 0,64 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | Call | 150 000 | 0,00 | 2 720 | −2,47 | |||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F/A | Boston Partners | 197 526 | −44,81 | 3 581 | −46,17 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | Put | 120 000 | 2 176 | |||||

| 2025-08-18 | 13F | Ashford Capital Management Inc | 230 803 | 0,00 | 4 184 | −2,47 | ||||

| 2025-08-07 | 13F | Searle & Co. | 23 344 | −11,39 | 423 | −13,50 | ||||

| 2025-08-08 | 13F | Gts Securities Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Change Path, LLC | 55 656 | 14,95 | 1 009 | 12,11 | ||||

| 2025-08-06 | 13F | Chancellor Financial Group WB LP | 18 597 | 12,05 | 337 | 9,42 | ||||

| 2025-08-04 | 13F | Creekmur Asset Management LLC | 4 305 | 2,31 | 78 | 0,00 | ||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 586 | 11 | ||||||

| 2025-07-17 | 13F | Wagner Wealth Management, Llc | 26 477 | 480 | ||||||

| 2025-07-30 | 13F | Avidian Wealth Solutions, LLC | 101 678 | −5,62 | 1 843 | −7,94 | ||||

| 2025-08-04 | 13F | Amplius Wealth Advisors, LLC | 14 231 | 2,77 | 258 | 0,39 | ||||

| 2025-06-25 | NP | Ultimus Managers Trust - Westwood Salient Enhanced Midstream Income ETF | 428 253 | 17,95 | 7 083 | −4,73 | ||||

| 2025-08-08 | 13F | Creative Planning | 1 095 122 | 6,02 | 19 855 | 3,40 | ||||

| 2025-06-23 | NP | High Income Opportunities Portfolio - High Income Opportunities Portfolio | 75 000 | 0,00 | 1 240 | −19,27 | ||||

| 2025-07-24 | 13F | Ulland Investment Advisors, LLC | 14 000 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Crescent Grove Advisors, LLC | 316 889 | 47,62 | 5 745 | 43,98 | ||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 1 036 611 | 125,33 | 18 795 | 119,76 | ||||

| 2025-07-07 | 13F | Fractal Investments LLC | 5 018 781 | 0,18 | 90 990 | −2,29 | ||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 82 383 | −3,40 | 1 494 | −5,80 | ||||

| 2025-08-14 | 13F | LMR Partners LLP | Call | 544 400 | 9 870 | |||||

| 2025-07-25 | 13F | Ellis Investment Partners, LLC | 15 418 | 4,64 | 280 | 2,20 | ||||

| 2025-08-04 | 13F | Integrity Alliance, Llc. | 14 937 | −37,28 | 271 | −38,91 | ||||

| 2025-06-26 | NP | FCMVX - Fidelity Mid Cap Value K6 Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 32 998 | 142,63 | 546 | 96,04 | ||||

| 2025-07-25 | NP | CSHAX - MainStay Cushing MLP Premier Fund Class A | 5 590 000 | 0,00 | 97 713 | −9,38 | ||||

| 2025-07-24 | 13F | Costello Asset Management, INC | 294 | −25,57 | 5 | −28,57 | ||||

| 2025-08-14 | 13F | Fortress Private Ledger, Llc | 74 621 | −1,94 | 1 353 | −4,38 | ||||

| 2025-07-22 | 13F | FFG Partners, LLC | 1 310 541 | −12,05 | 23 760 | −14,23 | ||||

| 2025-07-31 | 13F | Kornitzer Capital Management Inc /ks | 162 600 | 0,00 | 2 948 | −2,48 | ||||

| 2025-08-14 | 13F | Monetary Management Group Inc | 64 000 | 0,00 | 1 160 | −2,44 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 4 179 | 436,46 | 76 | 435,71 | ||||

| 2025-08-12 | 13F | Bahl & Gaynor Inc | 277 929 | 3,65 | 5 039 | 1,08 | ||||