Grundläggande statistik

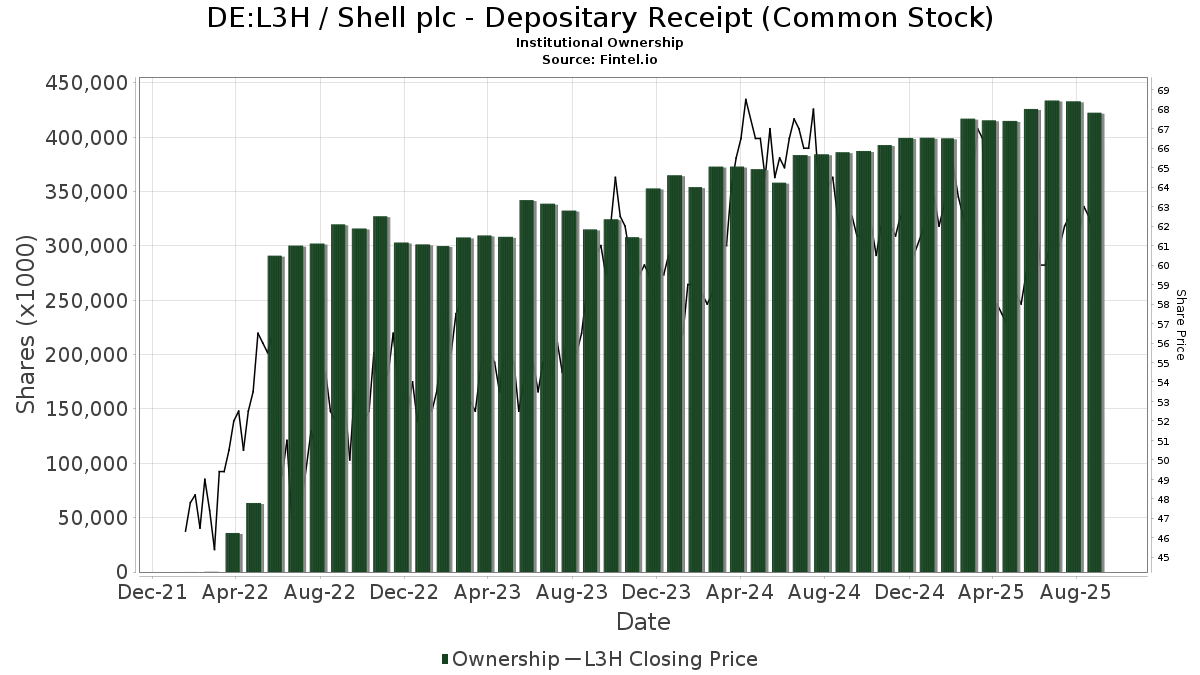

| Institutionella ägare | 1679 total, 1654 long only, 2 short only, 23 long/short - change of −0,53% MRQ |

| Aktiepris | 61,50 |

| Genomsnittlig portföljallokering | 0.4617 % - change of −6,21% MRQ |

| Institutionella aktier (lång) | 422 575 143 (ex 13D/G) - change of −3,48MM shares −0,82% MRQ |

| Institutionellt värde (lång) | $ 28 387 818 USD ($1000) |

Institutionellt ägande och aktieägare

Shell plc - Depositary Receipt (Common Stock) (DE:L3H) har 1679 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 422,575,143 aktier. Största aktieägare inkluderar Fmr Llc, Fisher Asset Management, LLC, Dimensional Fund Advisors Lp, Eagle Capital Management Llc, FCTDX - Strategic Advisers Fidelity U.S. Total Stock Fund, Morgan Stanley, Bank Of America Corp /de/, Dfa Investment Trust Co - The Dfa International Value Series, Wellington Management Group Llp, and Price T Rowe Associates Inc /md/ .

Shell plc - Depositary Receipt (Common Stock) (DB:L3H) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 9, 2025 is 61,50 / share. Previously, on September 11, 2024, the share price was 60,50 / share. This represents an increase of 1,65% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

Important Note

In an effort to reduce load times for our mobile users, we are testing some ways to deliver lighter pages.

In this first test, we will deliver only the most recent 750 transactions (out of 1915 for this stock). If you are interested in loading *all* the transactions for this company, click the "load all" button below. This is just a test and if you don't like it, please let us know by submitting some gentle feedback via the link at the bottom of this page.

Load All| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-12 | 13F | Southeast Asset Advisors Inc. | 5 380 | 22,83 | 379 | 18,13 | ||||

| 2025-06-26 | NP | AABFX - Thrivent Balanced Income Plus Fund Class A | 3 198 | 0,00 | 206 | −1,90 | ||||

| 2025-07-08 | 13F | Choice Wealth Advisors, LLC | 2 976 | 0,00 | 210 | −4,13 | ||||

| 2025-07-22 | 13F | Net Worth Advisory Group | 8 030 | 4,30 | 565 | 0,18 | ||||

| 2025-08-27 | NP | THRIVENT SERIES FUND INC - Thrivent Diversified Income Plus Portfolio Class A | 1 968 | 0,00 | 139 | −4,17 | ||||

| 2025-07-17 | 13F | Janney Capital Management LLC | 117 622 | −1,77 | 8 | 0,00 | ||||

| 2025-07-30 | 13F | Pittenger & Anderson Inc | 68 835 | 22,62 | 4 847 | 17,82 | ||||

| 2025-08-08 | 13F | Avalon Trust Co | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Avant Capital LLC | 6 748 | 0,00 | 475 | −3,85 | ||||

| 2025-07-21 | 13F | CenterStar Asset Management, LLC | 8 450 | 595 | ||||||

| 2025-07-15 | 13F | Drum Hill Capital, LLC | 58 269 | −1,69 | 4 103 | −5,55 | ||||

| 2025-08-12 | 13F | Bahl & Gaynor Inc | 28 050 | −12,48 | 1 975 | −15,89 | ||||

| 2025-06-03 | 13F/A | First National Bank Of Omaha | 12 677 | −11,82 | 929 | −1,80 | ||||

| 2025-07-17 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Center for Financial Planning, Inc. | 112 | 0,00 | 8 | −12,50 | ||||

| 2025-07-10 | 13F | Moody National Bank Trust Division | 16 985 | −1,40 | 1 196 | −5,31 | ||||

| 2025-08-22 | NP | QBA2Q - Balanced Portfolio Initial Class | 216 600 | −12,59 | 15 251 | −16,01 | ||||

| 2025-04-25 | 13F | Kieckhefer Group Llc | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Cromwell Holdings LLC | 6 552 | 0,00 | 461 | −3,96 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 11 693 | −24,08 | 1 | −100,00 | ||||

| 2025-08-15 | 13F | Keel Point, LLC | 6 743 | 24,78 | 475 | 20,00 | ||||

| 2025-07-30 | 13F | Wallace Advisory Group, LLC | 9 906 | 26,92 | 726 | 48,57 | ||||

| 2025-07-14 | 13F | Farmers Trust Co | 6 492 | 0,11 | 457 | −3,79 | ||||

| 2025-08-14 | 13F | Harding Loevner Lp | 3 312 679 | −1,29 | 233 274 | −5,09 | ||||

| 2025-07-15 | 13F | Kempner Capital Management Inc. | 86 050 | 0,00 | 6 059 | 100 883,33 | ||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 71 711 | 8,92 | 5 049 | 4,66 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 34 073 | −4,80 | 2 399 | −8,50 | ||||

| 2025-07-25 | 13F | Concord Wealth Partners | 464 | 0,00 | 33 | −5,88 | ||||

| 2025-07-30 | 13F | Evermay Wealth Management Llc | 100 | 0,00 | 7 | 0,00 | ||||

| 2025-06-24 | NP | FISEX - Franklin Equity Income Fund Class A | 875 000 | −11,17 | 56 420 | −13,02 | ||||

| 2025-08-13 | 13F | Crescent Grove Advisors, LLC | 5 727 | 403 | ||||||

| 2025-08-14 | 13F | Turim 21 Investimentos Ltda. | 345 | 0,00 | 24 | −4,00 | ||||

| 2025-07-30 | 13F | Avidian Wealth Solutions, LLC | 23 919 | 1,98 | 1 684 | −1,98 | ||||

| 2025-06-26 | NP | SNTKX - Steward International Enhanced Index Fund Class A | 144 811 | −2,76 | 9 337 | −4,78 | ||||

| 2025-08-26 | NP | NQVAX - Nuveen NWQ Multi-Cap Value Fund - Class A This fund is a listed as child fund of Nuveen Asset Management, LLC and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 267 760 | 1,38 | 18 853 | −2,59 | ||||

| 2025-07-22 | 13F | Marks Group Wealth Management, Inc | 6 356 | −5,98 | 448 | −9,70 | ||||

| 2025-07-21 | 13F | Hilltop National Bank | 22 946 | 5,98 | 1 616 | 19,10 | ||||

| 2025-06-26 | NP | AAUTX - Thrivent Large Cap Value Fund Class A | 227 087 | 0,00 | 14 643 | −2,08 | ||||

| 2025-08-07 | 13F | BOK Financial Private Wealth, Inc. | 1 186 | −26,01 | 84 | −29,06 | ||||

| 2025-07-31 | 13F | Kornitzer Capital Management Inc /ks | 399 941 | −9,89 | 28 160 | −13,42 | ||||

| 2025-07-10 | 13F | Global Financial Private Client, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Hrt Financial Lp | 201 880 | −10,42 | 14 | −12,50 | ||||

| 2025-07-31 | 13F | Linden Thomas Advisory Services, LLC | 8 733 | 17,60 | 615 | 12,87 | ||||

| 2025-06-27 | NP | AADEX - American Beacon Large Cap Value Fund Institutional Class | 293 336 | −14,24 | 18 914 | −16,02 | ||||

| 2025-07-15 | 13F | McAdam, LLC | 4 729 | 1,87 | 333 | −2,35 | ||||

| 2025-08-14 | 13F | Corient IA LLC | 5 000 | 0,00 | 352 | −3,83 | ||||

| 2025-07-01 | 13F | Park National Corp /oh/ | 23 216 | 0,22 | 1 635 | −3,71 | ||||

| 2025-08-13 | 13F | Legacy Capital Wealth Partners, LLC | 5 693 | −4,14 | 401 | −8,05 | ||||

| 2025-07-29 | 13F | Beverly Hills Private Wealth, LLC | 7 821 | −4,06 | 551 | −7,87 | ||||

| 2025-07-30 | 13F | Birch Hill Investment Advisors LLC | 6 500 | 0,00 | 458 | −3,99 | ||||

| 2025-08-13 | 13F | Kilter Group LLC | 26 | 2 | ||||||

| 2025-08-13 | 13F | Bollard Group LLC | 24 319 | 5,69 | 2 | 0,00 | ||||

| 2025-07-30 | 13F | Klingenstein Fields & Co Lp | 236 505 | −2,10 | 16 652 | −5,93 | ||||

| 2025-07-16 | 13F | Advisors Management Group Inc /adv | 38 231 | −1,24 | 3 | 0,00 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 932 | 6,51 | 66 | 1,56 | ||||

| 2025-08-05 | 13F | EPG Wealth Management LLC | 12 711 | 0,20 | 895 | −3,77 | ||||

| 2025-07-15 | 13F | FLP Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | BKD Wealth Advisors, LLC | 7 005 | −5,83 | 493 | −9,54 | ||||

| 2025-07-23 | 13F | Regency Capital Management Inc.\DE | 73 557 | −0,85 | 5 179 | −4,73 | ||||

| 2025-08-15 | 13F | Semmax Financial Advisors Inc. | 300 | 0,00 | 22 | 10,53 | ||||

| 2025-07-14 | 13F | Seed Wealth Management, Inc. | 7 227 | −6,93 | 509 | −10,72 | ||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 37 693 | 84,98 | 3 | 100,00 | ||||

| 2025-08-07 | 13F | CSM Advisors, LLC | 334 111 | 24 | ||||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 1 559 330 | −47,42 | 109 792 | −49,48 | ||||

| 2025-08-26 | NP | Blackrock Energy & Resources Trust This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 539 841 | 7,17 | 38 010 | 2,97 | ||||

| 2025-07-17 | 13F | DiNuzzo Private Wealth, Inc. | 50 | 0,00 | 4 | 0,00 | ||||

| 2025-08-14 | 13F | Headinvest, Llc | 0 | −100,00 | 0 | |||||

| 2025-04-29 | 13F | Truist Financial Corp | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 7 849 | −16,04 | 553 | −19,42 | ||||

| 2025-08-14 | 13F | Select Asset Management & Trust | 7 074 | 0,00 | 0 | |||||

| 2025-07-24 | 13F | Lmcg Investments, Llc | 24 042 | −1,23 | 1 693 | −5,10 | ||||

| 2025-07-07 | 13F | Retirement Wealth Solutions LLC | 237 | −5,20 | 17 | −11,11 | ||||

| 2025-07-25 | 13F | Fifth Third Wealth Advisors LLC | 15 043 | 216,43 | 1 059 | 204,31 | ||||

| 2025-08-12 | 13F/A | Boston Partners | 933 527 | 4,26 | 65 746 | 0,28 | ||||

| 2025-07-17 | 13F | Avondale Wealth Management | 173 | 0,00 | 12 | 0,00 | ||||

| 2025-07-29 | 13F | Hoese & Co LLP | 300 | 0,00 | 21 | 0,00 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 731 294 | −0,68 | 51 490 | −4,57 | ||||

| 2025-05-23 | NP | EQ ADVISORS TRUST - EQ/Large Cap Core Managed Volatility Portfolio Class IB | 21 726 | 1 592 | ||||||

| 2025-08-13 | 13F | Van Hulzen Asset Management, LLC | 182 830 | 0,55 | 12 873 | −3,38 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 7 272 | 10,18 | 512 | 6,00 | ||||

| 2025-04-04 | 13F | Kings Path Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | Signature Wealth Management Partners, LLC | 4 168 | 0,00 | 293 | −3,93 | ||||

| 2025-07-23 | NP | EIPI - FT Energy Income Partners Enhanced Income ETF | 411 072 | −1,27 | 27 221 | −3,08 | ||||

| 2025-08-04 | 13F | HBK Sorce Advisory LLC | 16 326 | −3,48 | 1 150 | −7,26 | ||||

| 2025-08-05 | 13F | American Assets Investment Management, LLC | 286 000 | 29,41 | 20 137 | 24,35 | ||||

| 2025-07-15 | 13F | tru Independence LLC | 78 301 | 0,09 | 5 513 | −3,82 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 329 578 | −9,98 | 23 206 | −13,51 | ||||

| 2025-07-22 | 13F | Appleton Partners Inc/ma | 3 024 | 7,04 | 0 | |||||

| 2025-07-24 | 13F | Villere St Denis J & Co Llc | 5 000 | 0,00 | 352 | −3,83 | ||||

| 2025-05-07 | 13F | Sheaff Brock Investment Advisors, LLC | 4 157 | 0,00 | 305 | 16,92 | ||||

| 2025-05-15 | 13F | Moore Capital Management, Lp | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Marco Investment Management Llc | 4 272 | 6,61 | 301 | 2,39 | ||||

| 2025-07-09 | 13F | Fermata Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Legacy Bridge, LLC | 600 | 0,00 | 42 | −2,33 | ||||

| 2025-07-14 | 13F | Westend Capital Management LLC | 1 866 | 0,00 | 131 | −3,68 | ||||

| 2025-08-11 | 13F | Portside Wealth Group, LLC | 36 157 | 2,25 | 2 546 | −1,78 | ||||

| 2025-07-23 | 13F | Canopy Partners, LLC | 4 513 | 2,34 | 318 | −1,86 | ||||

| 2025-08-05 | 13F | Hunter Associates Investment Management Llc | 15 497 | −9,36 | 1 | 0,00 | ||||

| 2025-08-13 | 13F | Millstone Evans Group, LLC | 575 | 0,00 | 40 | −4,76 | ||||

| 2025-07-17 | 13F | Argus Investors' Counsel, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-29 | NP | DIVGX - Guardian Dividend Growth Fund Class I | 17 285 | 22,19 | 1 217 | 17,47 | ||||

| 2025-03-27 | NP | TMLAX - Transamerica MLP & Energy Income A | 19 555 | −61,83 | 1 288 | −62,80 | ||||

| 2025-08-29 | NP | Gabelli Global Utility & Income Trust | 7 200 | 0,00 | 507 | −3,98 | ||||

| 2025-08-14 | 13F | Summit Trail Advisors, Llc | 13 745 | 968 | ||||||

| 2025-08-13 | 13F | Grantham, Mayo, Van Otterloo & Co. LLC | 125 778 | −7,09 | 8 856 | −10,73 | ||||

| 2025-05-15 | 13F | 40 North Management LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-07-21 | 13F | Stock Yards Bank & Trust Co | 11 093 | 18,78 | 781 | 14,18 | ||||

| 2025-06-26 | NP | FINVX - Fidelity Series International Value Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 7 232 248 | −6,94 | 466 335 | −8,87 | ||||

| 2025-07-30 | 13F | Argonautica Private Wealth Management, Inc | 6 846 | −2,33 | 482 | −6,04 | ||||

| 2025-04-23 | 13F | Sabal Trust CO | 4 103 | 1,28 | 301 | 18,58 | ||||

| 2025-07-17 | 13F | HCR Wealth Advisors | 3 651 | 0,00 | 257 | −3,75 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 3 769 | 10,95 | 265 | 6,85 | ||||

| 2025-08-07 | 13F | Mawer Investment Management Ltd. | 4 590 494 | −6,88 | 323 217 | −10,53 | ||||

| 2025-06-18 | NP | NATIONWIDE MUTUAL FUNDS - Nationwide Fundamental All Cap Equity Portfolio Class R6 | 13 023 | 0,00 | 840 | −2,10 | ||||

| 2025-08-07 | 13F | Mitsubishi UFJ Kokusai Asset Management Co., Ltd. | 8 080 | 27,10 | 569 | 22,15 | ||||

| 2025-08-14 | 13F | Principia Wealth Advisory, LLC | 58 | 4 | ||||||

| 2025-07-18 | 13F | Victrix Investment Advisors | 18 355 | 1,24 | 1 292 | 2,87 | ||||

| 2025-06-25 | NP | BVEFX - Becker Value Equity Fund Retail Class | 15 346 | 0,00 | 990 | −2,08 | ||||

| 2025-08-08 | 13F | Smithfield Trust Co | 9 674 | 0,00 | 1 | |||||

| 2025-08-04 | 13F | Assetmark, Inc | 61 946 | 19,30 | 4 362 | 14,64 | ||||

| 2025-07-08 | 13F | Atlas Brown,Inc. | 4 842 | 0,00 | 341 | −3,95 | ||||

| 2025-07-16 | 13F | West Branch Capital LLC | 1 439 | 0,00 | 101 | −3,81 | ||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 6 932 | 2,77 | 488 | −1,21 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 3 240 141 | −0,62 | 228 138 | −4,51 | ||||

| 2025-07-29 | NP | CVFCX - Pioneer Disciplined Value Fund : Class A | 29 949 | −67,55 | 1 983 | −68,15 | ||||

| 2025-07-10 | 13F | Tompkins Financial Corp | 2 438 | −29,11 | 172 | −32,14 | ||||

| 2025-07-11 | 13F | Essex Savings Bank | 6 438 | −2,38 | 453 | −6,21 | ||||

| 2025-07-18 | 13F | Brookmont Capital Management | 59 908 | −2,04 | 4 218 | −5,87 | ||||

| 2025-08-05 | 13F | Wellington Shields Capital Management, LLC | 23 475 | −16,24 | 1 653 | −19,53 | ||||

| 2025-07-17 | 13F | SeaBridge Investment Advisors LLC | 3 200 | 0,00 | 225 | −3,85 | ||||

| 2025-07-18 | 13F | Founders Capital Management | 770 | 0,00 | 54 | −3,57 | ||||

| 2025-07-31 | 13F/A | Avion Wealth | 1 142 | −0,61 | 0 | |||||

| 2025-07-29 | NP | MEFOX - Meehan Focus Fund | 52 850 | 0,00 | 3 500 | −1,85 | ||||

| 2025-06-26 | NP | LAFFX - LORD ABBETT AFFILIATED FUND INC Class A | 732 290 | −34,51 | 47 218 | −35,87 | ||||

| 2025-08-06 | 13F | Valued Wealth Advisors LLC | 6 | 0,00 | 0 | |||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Addison Capital Co | 2 961 | 0,14 | 208 | −3,70 | ||||

| 2025-08-14 | 13F | LaSalle St. Investment Advisors, LLC | 7 804 | −3,51 | 1 | |||||

| 2025-08-14 | 13F | Gluskin Sheff & Assoc Inc | 37 707 | −33,80 | 2 655 | −36,40 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 166 236 | 10,08 | 11 725 | 5,91 | ||||

| 2025-07-17 | 13F | City Holding Co | 2 570 | −21,17 | 181 | −24,37 | ||||

| 2025-08-13 | 13F | Beutel, Goodman & Co Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-18 | 13F | First Pacific Financial | 500 | 25,00 | 35 | 20,69 | ||||

| 2025-08-04 | 13F | Mesirow Financial Investment Management, Inc. | 24 452 | 4,02 | 1 722 | −0,06 | ||||

| 2025-08-07 | 13F | Teachers Retirement System Of The State Of Kentucky | 762 190 | 0,00 | 54 | −3,64 | ||||

| 2025-05-15 | 13F | Concorde Asset Management, LLC | 4 823 | 0,00 | 308 | 1,99 | ||||

| 2025-08-12 | 13F | Gladstone Institutional Advisory LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Summitry Llc | 10 446 | 19,14 | 735 | 14,49 | ||||

| 2025-08-11 | 13F | Dorsey & Whitney Trust CO LLC | 10 869 | −24,32 | 765 | −27,28 | ||||

| 2025-07-29 | NP | FIKDX - Kempner Multi-Cap Deep Value Fund Institutional Class | 39 454 | 0,00 | 2 613 | −1,84 | ||||

| 2025-08-12 | 13F | Segall Bryant & Hamill, Llc | 57 526 | −7,26 | 4 050 | −10,89 | ||||

| 2025-07-30 | 13F | Whittier Trust Co | 34 262 | 10,88 | 2 412 | 6,54 | ||||

| 2025-08-12 | 13F | New Republic Capital, LLC | 3 913 | −12,07 | 276 | −15,64 | ||||

| 2025-07-21 | 13F/A | Point72 Asset Management, L.P. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-15 | 13F | Auxier Asset Management | 16 151 | −0,31 | 1 137 | −4,21 | ||||

| 2025-08-04 | 13F | Integrity Alliance, Llc. | 0 | −100,00 | 0 | |||||

| 2025-07-07 | 13F | TruWealth Advisors, LLC | 332 544 | 2,60 | 23 415 | −1,41 | ||||

| 2025-07-15 | 13F | Alpha Omega Wealth Management LLC | 5 046 | −1,64 | 355 | −5,33 | ||||

| 2025-07-28 | 13F | Mowery & Schoenfeld Wealth Management, LLC | 1 | −99,77 | 0 | −100,00 | ||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 11 059 | 779 | ||||||

| 2025-08-11 | 13F | Pin Oak Investment Advisors Inc | 12 258 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | Diversify Advisory Services, LLC | 5 089 | 20,94 | 368 | 33,45 | ||||

| 2025-08-27 | NP | TIQIX - Touchstone Global ESG Equity Fund Class Y | 453 997 | 26,63 | 31 966 | 21,67 | ||||

| 2025-05-08 | 13F | Plante Moran Financial Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Banco Bilbao Vizcaya Argentaria, S.a. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 928 | 67 | ||||||

| 2025-07-31 | 13F | Vaughan David Investments Inc/il | 7 432 | 20,01 | 1 | |||||

| 2025-07-15 | 13F | Riverbridge Partners Llc | 3 278 | −0,61 | 231 | −4,56 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 129 953 | 2,53 | 9 | 0,00 | ||||

| 2025-07-16 | 13F | Kathmere Capital Management, LLC | 8 494 | 1,19 | 598 | −2,76 | ||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | Gratus Wealth Advisors, LLC | 11 462 | −1,10 | 807 | −4,95 | ||||

| 2025-07-25 | 13F | JustInvest LLC | 130 309 | 2,08 | 9 180 | −1,87 | ||||

| 2025-08-13 | 13F | Avestar Capital, LLC | 5 530 | 389 | ||||||

| 2025-08-11 | 13F | Hopwood Financial Services, Inc. | 196 | 0,00 | 14 | −7,14 | ||||

| 2025-08-12 | 13F | Change Path, LLC | 8 620 | 6,99 | 607 | 2,71 | ||||

| 2025-08-04 | 13F | Creekmur Asset Management LLC | 276 | 0,73 | 19 | −5,00 | ||||

| 2025-05-15 | 13F | Lloyd Harbor Capital Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Trinity Legacy Partners, LLC | 3 439 | 0,00 | 243 | 4,74 | ||||

| 2025-08-14 | 13F | LMR Partners LLP | Put | 27 300 | −16,77 | 1 922 | −20,02 | |||

| 2025-07-24 | NP | FIDJX - Fidelity SAI Sustainable Sector Fund | 23 965 | 0,00 | 1 587 | −1,86 | ||||

| 2025-07-11 | 13F | Grove Bank & Trust | 1 890 | 9,25 | 133 | 5,56 | ||||

| 2025-07-29 | 13F | Albert D Mason Inc | 7 550 | 2,15 | 532 | −1,85 | ||||

| 2025-08-14 | 13F | LMR Partners LLP | Call | 21 500 | −18,56 | 1 514 | −21,77 | |||

| 2025-07-28 | 13F | Twin Tree Management, LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-06-30 | NP | RGEF - Rockefeller Global Equity ETF | 250 401 | −5,93 | 16 146 | −7,89 | ||||

| 2025-07-17 | 13F | Independence Bank of Kentucky | 14 891 | −0,10 | 1 048 | −4,03 | ||||

| 2025-04-10 | 13F | Bremer Bank National Association | 64 926 | 6,20 | 4 758 | 24,20 | ||||

| 2025-08-12 | 13F | Clear Street Markets Llc | 8 374 | 590 | ||||||

| 2025-05-15 | 13F | Aquatic Capital Management LLC | 0 | −100,00 | 0 | |||||

| 2025-07-11 | 13F | First PREMIER Bank | 2 500 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | Cutter & CO Brokerage, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Tyche Wealth Partners LLC | 3 562 | −2,84 | 251 | −6,72 | ||||

| 2025-08-14 | 13F | UBS Group AG | Call | 1 022 700 | 43,26 | 72 008 | 37,65 | |||

| 2025-08-14 | 13F | UBS Group AG | Put | 225 200 | −37,94 | 15 856 | −40,38 | |||

| 2025-08-14 | 13F | UBS Group AG | 1 580 767 | −38,97 | 111 302 | −41,36 | ||||

| 2025-07-09 | 13F | Graves-Light Private Wealth Management, Inc. | 3 196 | 0,00 | 225 | −3,85 | ||||

| 2025-08-06 | 13F | Moors & Cabot, Inc. | 42 553 | −9,72 | 2 996 | −13,26 | ||||

| 2025-08-26 | 13F | Nautilus Advisors LLC | 5 220 | 0,00 | 368 | −3,93 | ||||

| 2025-08-22 | NP | Fidelity Central Investment Portfolios LLC - Fidelity U.S. Equity Central Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 709 200 | −17,19 | 49 935 | −20,43 | ||||

| 2025-08-13 | 13F | Portland Global Advisors LLC | 11 670 | −23,70 | 822 | −26,70 | ||||

| 2025-08-27 | NP | Advanced Series Trust - Ast Capital Growth Asset Allocation Portfolio | 85 127 | −10,43 | 5 994 | −13,94 | ||||

| 2025-07-15 | 13F | Armis Advisers, LLC | 3 010 | 218 | ||||||

| 2025-07-17 | 13F | Alliance Wealth Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Plan Group Financial, LLC | 4 481 | 0,00 | 315 | −3,96 | ||||

| 2025-07-28 | NP | NBSSX - Neuberger Berman Focus Fund Investor Class | 150 337 | −26,52 | 9 955 | −27,87 | ||||

| 2025-05-13 | 13F | Employees Retirement System of Texas | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Morse Asset Management, Inc | 110 | 8 | ||||||

| 2025-05-09 | 13F | Levin Capital Strategies, L.p. | 0 | −100,00 | 0 | |||||

| 2025-07-28 | NP | NDGAX - Neuberger Berman Dividend Growth Fund Class A | 10 075 | −27,49 | 667 | 43,75 | ||||

| 2025-08-07 | 13F | Ellerson Group Inc /adv | 6 835 | 0,00 | 501 | 0,00 | ||||

| 2025-07-21 | 13F | Asset Advisors Investment Management, LLC | 6 000 | 0,00 | 422 | −3,87 | ||||

| 2025-04-10 | 13F | Chatham Capital Group, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Cerity Partners LLC | 391 909 | 2,97 | 27 594 | −1,06 | ||||

| 2025-07-16 | 13F | Cove Private Wealth, LLC | 3 655 | 257 | ||||||

| 2025-08-14 | 13F | McIlrath & Eck, LLC | 28 | 0,00 | 2 | −50,00 | ||||

| 2025-08-13 | 13F | ESL Trust Services, LLC | 3 984 | 0,00 | 281 | −3,78 | ||||

| 2025-07-15 | 13F | Cranbrook Wealth Management, LLC | 60 | 0,00 | 4 | 0,00 | ||||

| 2025-07-29 | 13F | Accretive Wealth Partners, LLC | 4 000 | 0,00 | 282 | 8,08 | ||||

| 2025-08-12 | 13F | Evelyn Partners Investment Management LLP | 18 977 | 23 621,25 | 674 | −4,26 | ||||

| 2025-08-13 | 13F | Beacon Pointe Advisors, LLC | 35 445 | 1,14 | 2 496 | −2,84 | ||||

| 2025-06-26 | NP | FFLV - Fidelity Fundamental Large Cap Value ETF | 2 989 | 58,15 | 193 | 54,84 | ||||

| 2025-08-13 | 13F | Manning & Napier Advisors Llc | 221 764 | 54,01 | 15 615 | 47,97 | ||||

| 2025-07-11 | 13F | Lantz Financial LLC | 4 953 | −1,08 | 349 | −4,92 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 6 525 591 | 8,17 | 459 467 | 3,93 | ||||

| 2025-07-16 | 13F | Meridian Investment Counsel Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | First Eagle Investment Management, LLC | 608 425 | 22,88 | 42 839 | 18,07 | ||||

| 2025-07-17 | 13F | Sage Rhino Capital Llc | 13 275 | 0,16 | 935 | −3,81 | ||||

| 2025-06-27 | NP | ZABDFX - American Beacon Diversified Fund AAL Class | 22 200 | −12,60 | 1 431 | −14,41 | ||||

| 2025-08-19 | NP | BUFIX - Buffalo International Fund Investor Class | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-06-26 | NP | LDFVX - Lord Abbett Fundamental Equity Fund Class A | 620 927 | −0,20 | 40 037 | −2,28 | ||||

| 2025-05-13 | 13F | Centerpoint Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Baldwin Investment Management, LLC | 6 672 | −4,60 | 470 | −8,40 | ||||

| 2025-06-26 | NP | AWSHX - WASHINGTON MUTUAL INVESTORS FUND Class A | 6 501 855 | 419 240 | ||||||

| 2025-08-29 | NP | SA FUNDS INVESTMENT TRUST - SA International Value Fund | 346 564 | 14 244,54 | 24 402 | 27 628,41 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 320 174 | −1,09 | 22 545 | −4,95 | ||||

| 2025-07-01 | 13F | Confluence Investment Management Llc | 13 989 | −38,65 | 985 | −41,08 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 306 206 | −2,15 | 21 560 | −5,98 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 854 800 | −41,02 | 60 186 | −43,33 | |||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 150 607 | 5,37 | 10 605 | 1,25 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 834 572 | 158,19 | 58 762 | 148,08 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 158 800 | 67,51 | 11 181 | 60,97 | |||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 6 276 | 442 | ||||||

| 2025-08-13 | 13F | Scotia Capital Inc. | 27 756 | −14,67 | 1 954 | −18,00 | ||||

| 2025-07-30 | 13F | Legacy Wealth Asset Management, LLC | 8 359 | 1,19 | 589 | −2,81 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 3 584 230 | −7,49 | 252 366 | −11,11 | ||||

| 2025-08-07 | 13F | Vise Technologies, Inc. | 36 303 | 43,14 | 2 556 | 60,96 | ||||

| 2025-08-29 | NP | JAKWX - John Hancock Disciplined Value Global Long/Short Fund Class NAV | 68 922 | 4 853 | ||||||

| 2025-06-26 | NP | THMAX - Thrivent Moderate Allocation Fund Class A | 19 276 | 0,00 | 1 243 | −2,13 | ||||

| 2025-07-17 | 13F | Hanson & Doremus Investment Management | 5 851 | 0,00 | 0 | |||||

| 2025-04-22 | 13F | Verde Servicos Internacionais S.A. | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | CAPROCK Group, Inc. | 37 778 | 22,41 | 2 768 | 43,20 | ||||

| 2025-08-06 | 13F | Cetera Trust Company, N.A | 4 390 | 4,77 | 309 | 0,65 | ||||

| 2025-08-04 | 13F | Savvy Advisors, Inc. | 14 793 | 19,39 | 1 042 | 14,77 | ||||

| 2025-08-14 | 13F | Wetherby Asset Management Inc | 43 057 | −0,94 | 3 032 | 11,31 | ||||

| 2025-08-11 | 13F | Shufro Rose & Co Llc | 23 514 | 0,00 | 1 723 | 0,00 | ||||

| 2025-07-15 | 13F | Elevated Capital Advisors, LLC | 6 499 | 0,00 | 476 | 0,00 | ||||

| 2025-08-27 | NP | Advanced Series Trust - Ast Hotchkis & Wiley Large-cap Value Portfolio | 68 473 | −24,40 | 4 821 | −27,36 | ||||

| 2025-08-14 | 13F | Murphy & Mullick Capital Management Corp | 319 | 0,00 | 23 | 0,00 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 5 925 | −77,87 | 0 | −100,00 | ||||

| 2025-05-12 | 13F | Aigen Investment Management, Lp | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Winch Advisory Services, LLC | 471 | 0,86 | 33 | −2,94 | ||||

| 2025-08-12 | 13F | Wayfinding Financial, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | HORAN Wealth, LLC | 38 580 | 2 716 | ||||||

| 2025-08-08 | 13F | Union Savings Bank | 1 249 | 0,00 | 90 | −1,10 | ||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Godsey & Gibb Associates | 300 | 0,00 | 21 | 0,00 | ||||

| 2025-07-07 | 13F | Wesbanco Bank Inc | 22 746 | 12,83 | 1 602 | 8,40 | ||||

| 2025-08-01 | 13F | Banco Santander, S.A. | 73 108 | −9,30 | 5 148 | −12,85 | ||||

| 2025-08-05 | 13F | Tufton Capital Management | 3 194 | −12,23 | 0 | −100,00 | ||||

| 2025-08-06 | 13F | Kcm Investment Advisors Llc | 4 648 | 3,57 | 327 | −0,30 | ||||

| 2025-08-26 | NP | RPBAX - T. Rowe Price Balanced Fund, Inc. This fund is a listed as child fund of Price T Rowe Associates Inc /md/ and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 142 190 | 5,50 | 10 012 | 1,37 | ||||

| 2025-08-05 | 13F | Prosperity Consulting Group, LLC | 24 342 | −0,79 | 1 714 | −4,73 | ||||

| 2025-08-05 | 13F | Counterweight Ventures, LLC | 3 175 | 0,00 | 224 | −3,88 | ||||

| 2025-07-16 | 13F | Plancorp, LLC | 7 483 | −0,28 | 527 | −4,19 | ||||

| 2025-08-13 | 13F | Loomis Sayles & Co L P | 1 | 0 | ||||||

| 2025-08-05 | 13F | Welch & Forbes Llc | 7 836 | 0,00 | 552 | −4,01 | ||||

| 2025-07-10 | 13F | Atticus Wealth Management, Llc | 414 | 29 | ||||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 20 145 | −15,32 | 1 418 | −18,65 | ||||

| 2025-07-07 | 13F | Douglas Lane & Associates, LLC | 418 159 | −18,72 | 29 443 | −21,90 | ||||

| 2025-08-08 | 13F | Good Life Advisors, LLC | 4 320 | −4,00 | 304 | −7,60 | ||||

| 2025-07-29 | 13F | Birmingham Capital Management Co Inc/al | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Quotient Wealth Partners, LLC | 7 268 | 107,89 | 512 | 99,61 | ||||

| 2025-08-14 | 13F | First Foundation Advisors | 0 | −100,00 | 0 | |||||

| 2025-06-25 | NP | FTLS - First Trust Long/Short Equity ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | Short | −137 725 | −8 881 | |||||

| 2025-08-11 | 13F | Y.D. More Investments Ltd | 400 | 0,00 | 28 | −3,45 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 7 075 359 | 5,39 | 498 176 | 1,26 | ||||

| 2025-06-26 | NP | LIDAX - Lord Abbett International Value Fund Class A | 196 643 | −22,71 | 12 680 | −24,32 | ||||

| 2025-08-14 | 13F | Hotchkis & Wiley Capital Management Llc | 6 412 128 | −13,75 | 451 478 | −17,13 | ||||

| 2025-07-22 | 13F | Eads & Heald Wealth Management | 3 791 | −2,70 | 0 | |||||

| 2025-07-23 | 13F | Nbt Bank N A /ny | 9 125 | −1,08 | 642 | −5,03 | ||||

| 2025-08-13 | 13F | Cutler Capital Management, LLC | 110 656 | −0,36 | 7 791 | −4,26 | ||||

| 2025-07-29 | 13F | Chevy Chase Trust Holdings, Inc. | 1 698 052 | −0,98 | 119 560 | −4,86 | ||||

| 2025-08-13 | 13F | Cary Street Partners Financial Llc | 78 585 | 3,50 | 5 533 | −0,56 | ||||

| 2025-08-08 | 13F | Evolution Wealth Advisors, LLC | 3 175 | 0,00 | 224 | −3,88 | ||||

| 2025-07-22 | 13F | Valeo Financial Advisors, LLC | 21 731 | −11,83 | 1 530 | −15,28 | ||||

| 2025-07-22 | 13F | Confluence Wealth Services, Inc. | 3 241 | −12,36 | 228 | −4,20 | ||||

| 2025-07-16 | 13F | American National Bank | 1 100 | 0,00 | 77 | −3,75 | ||||

| 2025-05-09 | 13F | Haven Private, LLC | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | FDVKX - Fidelity Value Discovery K6 Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 50 063 | −4,82 | 3 228 | −6,79 | ||||

| 2025-08-14 | 13F | Fmr Llc | 94 643 838 | 1,24 | 6 663 873 | −2,72 | ||||

| 2025-07-16 | 13F | Eagle Global Advisors Llc | 99 789 | 0,74 | 7 026 | −3,21 | ||||

| 2025-08-12 | 13F | Triune Financial Partners, LLC | 3 361 | 0,99 | 237 | −2,88 | ||||

| 2025-07-09 | 13F | Procyon Private Wealth Partners, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Warren Averett Asset Management, LLC | 23 470 | 11,30 | 1 653 | 6,93 | ||||

| 2025-07-30 | 13F | Loring Wolcott & Coolidge Fiduciary Advisors Llp/ma | 16 417 | 0,00 | 1 156 | 9,07 | ||||

| 2025-07-29 | 13F | Northeast Investment Management | 6 316 | −0,44 | 445 | −4,31 | ||||

| 2025-08-14 | 13F | Moneta Group Investment Advisors Llc | 4 515 | −35,64 | 318 | −38,33 | ||||

| 2025-07-31 | 13F | Allied Investment Advisors, LLC | 185 186 | 1,96 | 13 039 | −2,04 | ||||

| 2025-08-12 | 13F | Inscription Capital, LLC | 9 268 | −55,04 | 653 | −52,79 | ||||

| 2025-08-13 | 13F | Thornburg Investment Management Inc | 106 230 | 1,87 | 7 480 | −90,21 | ||||

| 2025-07-14 | 13F | Mechanics Bank Trust Department | 3 324 | 0,00 | 234 | −3,70 | ||||

| 2025-08-14 | 13F | Inspire Trust Co, N.a. | 53 000 | −11,67 | 3 732 | −15,13 | ||||

| 2025-07-28 | 13F | Evernest Financial Advisors, LLC | 8 006 | 0,50 | 564 | −3,43 | ||||

| 2025-08-08 | 13F | Everett Harris & Co /ca/ | 355 707 | 0,53 | 25 045 | −3,41 | ||||

| 2025-08-11 | 13F | Intrust Bank Na | 10 381 | −0,26 | 731 | −4,20 | ||||

| 2025-07-18 | 13F | Woodward Diversified Capital, Llc | 3 745 | 21,75 | 264 | 16,89 | ||||

| 2025-06-25 | NP | TROSX - T. Rowe Price Overseas Stock Fund This fund is a listed as child fund of Price T Rowe Associates Inc /md/ and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 3 680 559 | 7,78 | 237 322 | 5,54 | ||||

| 2025-07-25 | 13F | Welch Group, LLC | 3 866 | 13,47 | 272 | 10,12 | ||||

| 2025-07-14 | 13F | Armstrong Advisory Group, Inc | 757 | −30,61 | 53 | −22,06 | ||||

| 2025-07-23 | 13F/A | Euro Pacific Asset Management, LLC | 166 870 | −2,99 | 12 | −8,33 | ||||

| 2025-07-28 | 13F | Rosenberg Matthew Hamilton | 9 026 | 1,26 | 635 | −2,76 | ||||

| 2025-08-12 | 13F | Manchester Capital Management LLC | 565 | −37,22 | 40 | −40,00 | ||||

| 2025-07-25 | 13F | Yousif Capital Management, Llc | 38 919 | 7,35 | 2 740 | 3,16 | ||||

| 2025-07-11 | 13F | Weatherly Asset Management L. P. | 66 161 | 4,40 | 4 658 | 0,32 | ||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 101 843 | −18,94 | 7 171 | −22,12 | ||||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 0 | 0 | ||||||

| 2025-08-11 | 13F | Nikko Asset Management Americas, Inc. | 76 248 | −6,31 | 5 366 | −10,01 | ||||

| 2025-08-12 | 13F | Tableaux Llc | 72 332 | 6 133 | ||||||

| 2025-07-28 | 13F | Courier Capital Llc | 6 738 | 0,37 | 474 | −3,46 | ||||

| 2025-06-30 | NP | PTIN - Pacer Trendpilot International ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Beaird Harris Wealth Management, LLC | 37 | 0,00 | 3 | 0,00 | ||||

| 2025-08-15 | NP | Guardian Variable Products Trust - Guardian Balanced Allocation VIP Fund | 27 080 | 38,61 | 1 907 | 33,19 | ||||

| 2025-08-18 | 13F | N.E.W. Advisory Services LLC | 143 | 0,00 | 10 | 0,00 | ||||

| 2025-08-12 | 13F | Jacobi Capital Management LLC | 3 978 | −31,35 | 280 | −33,96 | ||||

| 2025-08-13 | 13F | Estabrook Capital Management | 7 615 | −0,52 | 536 | −4,29 | ||||

| 2025-07-30 | 13F | Clifford Swan Investment Counsel Llc | 14 261 | −0,75 | 1 004 | −4,56 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 39 041 | 7,90 | 2 749 | 3,66 | ||||

| 2025-08-07 | 13F | Gryphon Financial Partners LLC | 11 114 | −8,16 | 783 | −11,74 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 12 631 | −40,78 | 889 | −33,46 | ||||

| 2025-08-21 | NP | VanEck VIP Trust - VanEck VIP Global Hard Assets Fund Initial Class | 193 900 | −1,37 | 13 652 | −5,23 | ||||

| 2025-05-13 | 13F | SevenBridge Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Financial Gravity Companies, Inc. | 9 | −25,00 | 1 | |||||

| 2025-05-15 | 13F | Cullen Capital Management, LLC | 460 039 | 3,65 | 33 712 | 21,23 | ||||

| 2025-08-27 | NP | RYDEX VARIABLE TRUST - Europe 1.25x Strategy Fund Variable Annuity | 507 | −44,16 | 36 | −46,97 | ||||

| 2025-05-15 | 13F | Texas Permanent School Fund | 78 649 | 5 071 | ||||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 9 801 | −1,87 | 1 | |||||

| 2025-08-13 | 13F | Brandes Investment Partners, Lp | 2 527 597 | 1,26 | 177 969 | −2,70 | ||||

| 2025-07-15 | 13F | Cardinal Capital Management | 56 767 | 1,49 | 3 997 | −2,49 | ||||

| 2025-07-30 | 13F | Crewe Advisors LLC | 14 822 | −4,65 | 1 044 | −8,43 | ||||

| 2025-08-14 | 13F | Camden Capital, LLC | 10 420 | −1,56 | 734 | −5,42 | ||||

| 2025-07-29 | 13F | Tradewinds Capital Management, LLC | 233 | 0,00 | 16 | −5,88 | ||||

| 2025-07-25 | 13F | Cascade Investment Advisors, Inc. | 3 000 | 0,00 | 211 | −3,65 | ||||

| 2025-07-23 | 13F | REAP Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-08 | 13F | Webster Bank, N. A. | 739 | 0,00 | 52 | −3,70 | ||||

| 2025-08-13 | 13F | Haverford Trust Co | 11 525 | −19,08 | 811 | −22,24 | ||||

| 2025-08-14 | 13F | 40 North Management LLC | 5 480 000 | 0,00 | 385 847 | −3,92 | ||||

| 2025-07-30 | 13F | Cookson Peirce & Co Inc | 20 332 | 44,26 | 1 432 | 38,66 | ||||

| 2025-08-08 | 13F | Gts Securities Llc | 90 436 | 656,66 | 6 368 | 627,66 | ||||

| 2025-04-17 | 13F | Vista Wealth Management Group, LLC | 4 512 | 24,61 | 331 | 46,02 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 13 014 | 7,53 | 916 | 3,39 | ||||

| 2025-08-14 | 13F | Dearborn Partners Llc | 7 753 | 0,28 | 546 | −3,71 | ||||

| 2025-08-14 | 13F | Voloridge Investment Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Centiva Capital, LP | 2 866 | 202 | ||||||

| 2025-08-06 | NP | LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Dimensional International Core Equity Fund Standard Class | 44 162 | −30,14 | 3 109 | −32,88 | ||||

| 2025-08-12 | 13F/A | Cozad Asset Management Inc | 7 954 | −7,12 | 560 | −10,69 | ||||

| 2025-08-15 | 13F/A | Rakuten Securities, Inc. | 1 | −96,97 | 0 | −100,00 | ||||

| 2025-05-15 | 13F | Royal Bank Of Canada | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-12 | 13F | Saturna Capital CORP | 3 800 | 0,00 | 268 | −3,96 | ||||

| 2025-08-15 | 13F | Howland Capital Management Llc | 15 549 | 0,00 | 1 095 | −3,95 | ||||

| 2025-08-13 | 13F | SCS Capital Management LLC | 208 539 | 380,23 | 14 683 | 361,44 | ||||

| 2025-07-29 | 13F | Chicago Partners Investment Group LLC | 3 330 | 242 | ||||||

| 2025-07-08 | 13F | Atwood & Palmer Inc | 15 | 0,00 | 1 | 0,00 | ||||

| 2025-08-29 | NP | GATAX - The Gabelli Asset Fund Class A | 4 600 | −10,68 | 324 | −14,32 | ||||

| 2025-07-24 | 13F | CarsonAllaria Wealth Management, Ltd. | 100 | 0,00 | 7 | 0,00 | ||||

| 2025-08-06 | 13F | RFG - Bristol Wealth Advisors, LLC | 23 658 | −26,22 | 1 666 | −29,12 | ||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 1 600 | 3,23 | 113 | −0,88 | ||||

| 2025-07-15 | 13F | Alhambra Investment Partners LLC | 12 286 | −0,45 | 865 | −4,31 | ||||

| 2025-08-14 | 13F | Interval Partners, LP | 43 407 | 43,37 | 3 056 | 37,78 | ||||

| 2025-07-25 | 13F | Mitchell Capital Management Co | 38 079 | −9,70 | 2 676 | −13,40 | ||||

| 2025-08-14 | 13F | Parallax Volatility Advisers, L.P. | Put | 51 800 | 181,52 | 3 647 | 170,55 | |||

| 2025-08-14 | 13F | Parallax Volatility Advisers, L.P. | 34 816 | −78,96 | 2 451 | −79,79 | ||||

| 2025-08-25 | NP | LEGR - First Trust Indxx Innovative Transaction & Process ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 10 788 | 5,37 | 760 | 1,20 | ||||

| 2025-04-23 | 13F | JCIC Asset Management Inc. | 45 256 | −1,79 | 3 316 | 14,86 | ||||

| 2025-08-13 | 13F | Azimuth Capital Investment Management LLC | 62 800 | −0,41 | 4 422 | −4,33 | ||||

| 2025-08-12 | 13F | American Century Companies Inc | 1 128 056 | 18,54 | 79 426 | 13,90 | ||||

| 2025-08-13 | 13F | Capital Fund Management S.a. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Parallax Volatility Advisers, L.P. | Call | 640 000 | 293,36 | 45 062 | 277,97 | |||

| 2025-08-12 | 13F | Bank OZK | 22 970 | 5,68 | 1 617 | 1,57 | ||||

| 2025-07-28 | 13F | Holistic Planning, LLC | 6 681 | 0,10 | 470 | −3,89 | ||||

| 2025-07-22 | 13F | Investors Asset Management Of Georgia Inc /ga/ /adv | 3 775 | 0,00 | 266 | −3,99 | ||||

| 2025-08-08 | 13F | Quinn Opportunity Partners LLC | 11 000 | 0,00 | 775 | −3,97 | ||||

| 2025-07-31 | 13F | Oppenheimer Asset Management Inc. | 178 164 | 0,05 | 12 545 | −3,87 | ||||

| 2025-08-11 | 13F | Bulltick Wealth Management, LLC | 7 126 | 10,77 | 502 | 6,37 | ||||

| 2025-08-12 | 13F | Evelyn Partners Investment Management Services Ltd | 802 | −91,53 | 13 | −7,69 | ||||

| 2025-08-13 | 13F | Willis Johnson & Associates, Inc. | 283 582 | −3,21 | 19 967 | −7,01 | ||||

| 2025-08-13 | 13F | Smith, Moore & Co. | 10 509 | 32,44 | 740 | 27,19 | ||||

| 2025-08-08 | 13F | Tanglewood Legacy Advisors, LLC | 1 888 | −14,49 | 133 | −18,01 | ||||

| 2025-07-29 | 13F | Wealthstream Advisors, Inc. | 5 866 | 8,23 | 413 | 4,03 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 10 933 | −0,83 | 770 | −4,71 | ||||

| 2025-07-25 | 13F | RHS Financial, LLC | 3 073 | −28,96 | 216 | −31,86 | ||||

| 2025-08-11 | 13F | Alteri Wealth LLC | 3 660 | 258 | ||||||

| 2025-08-19 | 13F/A | Pitcairn Co | 41 325 | −12,70 | 2 910 | −16,12 | ||||

| 2025-08-28 | NP | JINTX - Johnson International Fund | 3 900 | 0,00 | 275 | −3,86 | ||||

| 2025-07-10 | 13F | HF Advisory Group, LLC | 38 465 | 20,33 | 2 708 | 15,63 | ||||

| 2025-08-25 | NP | AMERICAN FUNDS INSURANCE SERIES - Blue Chip Income and Growth Fund Class 1 This fund is a listed as child fund of Capital World Investors and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 378 073 | 0,00 | 26 620 | −3,92 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 56 840 | −2,66 | 4 002 | −6,47 | ||||

| 2025-07-17 | 13F | CWA Asset Management Group, LLC | 28 586 | 18,97 | 2 013 | 14,32 | ||||

| 2025-07-24 | 13F | Cyndeo Wealth Partners, LLC | 14 739 | −0,48 | 1 038 | −4,42 | ||||

| 2025-08-13 | 13F | GM Advisory Group, Inc. | 20 705 | −1,47 | 1 458 | −5,33 | ||||

| 2025-07-08 | 13F/A | Salem Investment Counselors Inc | 2 539 | 0,00 | 179 | −4,30 | ||||

| 2025-07-16 | 13F | Old Port Advisors | 15 370 | 158,97 | 1 082 | 149,31 | ||||

| 2025-07-16 | 13F | PFS Partners, LLC | 5 160 | 0,94 | 363 | −2,94 | ||||

| 2025-08-14 | 13F | Lord, Abbett & Co. Llc | 1 891 881 | −9,23 | 133 | −12,50 | ||||

| 2025-08-15 | 13F | North Ridge Wealth Advisors, Inc. | 2 952 | 0,00 | 208 | −4,17 | ||||

| 2025-08-07 | 13F | 1st Source Bank | 3 059 | 215 | ||||||

| 2025-08-12 | 13F | Investor's Fiduciary Advisor Network, LLC | 11 432 | −1,77 | 1 | |||||

| 2025-07-30 | NP | FSAKX - Strategic Advisers U.S. Total Stock Fund | 518 315 | −16,48 | 34 323 | −18,01 | ||||

| 2025-07-31 | 13F | Briaud Financial Planning, Inc | 1 193 | 12,23 | 0 | |||||

| 2025-07-15 | 13F | Shulman DeMeo Asset Management LLC | 4 256 | −2,76 | 300 | −6,56 | ||||

| 2025-05-15 | 13F | Edmond De Rothschild Holding S.a. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-21 | NP | GHAAX - Global Hard Assets Fund Class A | 340 400 | −7,37 | 23 968 | −11,00 | ||||

| 2025-07-23 | 13F | Hardy Reed LLC | 4 375 | 0,48 | 308 | −3,45 | ||||

| 2025-08-22 | NP | FWATX - Fidelity Advisor Multi-Asset Income Fund Class A This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 96 900 | −67,62 | 6 823 | −68,89 | ||||

| 2025-07-17 | 13F | Oakworth Capital, Inc. | 1 933 | −28,22 | 136 | −30,96 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - International Vector Equity Portfolio Shares | 370 573 | 140,81 | 23 895 | 372,96 | ||||

| 2025-07-15 | 13F | Bfsg, Llc | 1 453 | 1,25 | 102 | −2,86 | ||||

| 2025-08-14 | 13F | Permanens Capital L.P. | 20 704 | 15,41 | 1 458 | 10,88 | ||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 29 580 | −23,15 | 2 083 | −26,17 | ||||

| 2025-07-23 | 13F | Bear Mountain Capital, Inc. | 86 | 0,00 | 6 | 20,00 | ||||

| 2025-07-22 | 13F | Checchi Capital Advisers, LLC | 22 212 | −6,27 | 1 564 | −9,97 | ||||

| 2025-08-11 | 13F | Annis Gardner Whiting Capital Advisors, LLC | 21 131 | 0,88 | 1 488 | −3,06 | ||||

| 2025-04-23 | 13F | Mascagni Wealth Management, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Broyhill Asset Management | 4 740 | 0,00 | 334 | −4,03 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | Call | 101 400 | 121,40 | 7 140 | 112,72 | |||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 7 193 | 8,31 | 527 | 26,68 | ||||

| 2025-07-09 | 13F | Radnor Capital Management, LLC | 12 010 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | First Wilshire Securities Management Inc | 9 600 | 1,26 | 676 | −2,74 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | Put | 85 300 | −0,47 | 6 006 | −4,38 | |||

| 2025-08-06 | 13F | Equity Investment Corp | 1 048 100 | 1,82 | 73 797 | −2,17 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 2 370 | −86,04 | 167 | −86,66 | ||||

| 2025-07-11 | 13F | Bridge Creek Capital Management LLC | 53 134 | 0,73 | 3 741 | −3,21 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 14 100 | −4,99 | 993 | −8,74 | ||||

| 2025-07-30 | 13F | Rehmann Capital Advisory Group | 4 637 | −6,79 | 326 | −10,44 | ||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 22 892 | −62,67 | 1 612 | −64,15 | ||||

| 2025-08-05 | 13F | Centennial Bank/AR/ | 215 | 0,00 | 15 | 0,00 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 2 253 | −46,98 | 160 | −48,87 | ||||

| 2025-08-05 | 13F | Tsfg, Llc | 1 436 | 0,00 | 0 | |||||

| 2025-07-08 | 13F | Goldstone Financial Group, LLC | 3 140 | −4,93 | 226 | −7,02 | ||||

| 2025-06-30 | NP | GCOW - Pacer Global Cash Cows Dividend ETF | 658 213 | 6,73 | 42 442 | 4,51 | ||||

| 2025-07-10 | 13F | HWG Holdings LP | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 43 989 | −8,79 | 3 097 | −12,37 | ||||

| 2025-08-05 | 13F | American Capital Advisory, LLC | 19 087 | −0,24 | 1 344 | −4,14 | ||||

| 2025-08-08 | 13F | Cherokee Insurance Co | 25 439 | 0,00 | 1 791 | −3,92 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 90 224 | −58,84 | 6 353 | −60,46 | ||||

| 2025-06-17 | NP | GSBIX - Goldman Sachs Income Builder Fund Institutional | 237 205 | 0,23 | 15 295 | −1,86 | ||||

| 2025-08-22 | NP | VARIABLE INSURANCE PRODUCTS FUND - Stock Selector All Cap Portfolio Investor Class | 188 800 | −9,79 | 13 293 | −13,33 | ||||

| 2025-08-14 | 13F | Empyrean Capital Partners, LP | 2 300 000 | 0,00 | 161 943 | −3,92 | ||||

| 2025-07-17 | 13F | Chicago Capital, LLC | 5 102 | 11,89 | 359 | 7,49 | ||||

| 2025-07-21 | 13F | Crews Bank & Trust | 1 542 | 4,61 | 109 | 0,00 | ||||

| 2025-08-11 | 13F | Great Lakes Advisors, Llc | 593 888 | 17,51 | 41 816 | 12,90 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 0 | −100,00 | 0 | |||||

| 2025-07-11 | 13F | Kingstone Capital Partners Texas, LLC | 36 045 | 2 | ||||||

| 2025-08-15 | 13F | Northeast Financial Consultants Inc | 9 250 | 0,00 | 651 | −3,84 | ||||

| 2025-07-11 | 13F | Harbour Capital Advisors, LLC | 7 160 | −1,04 | 518 | 2,58 | ||||

| 2025-08-04 | 13F | Atria Investments Llc | 63 325 | 5,65 | 4 459 | 1,50 | ||||

| 2025-05-15 | 13F | Qube Research & Technologies Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Gamco Investors, Inc. Et Al | 10 594 | 7,89 | 746 | 3,62 | ||||

| 2025-07-18 | 13F | Parsons Capital Management Inc/ri | 3 655 | −30,82 | 257 | −33,59 | ||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | Call | 21 400 | −57,62 | 1 507 | −59,30 | |||

| 2025-07-11 | 13F | Thomasville National Bank | 389 595 | 3,76 | 27 431 | −0,31 | ||||

| 2025-08-05 | 13F | Obermeyer Wood Investment Counsel, Lllp | 34 514 | 76,68 | 2 430 | 69,81 | ||||

| 2025-08-14 | 13F | Alyeska Investment Group, L.P. | 1 102 159 | 113,84 | 77 603 | 105,47 | ||||

| 2025-08-12 | 13F | Holderness Investments Co | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F/A | Sendero Wealth Management, LLC | 20 489 | −11,84 | 1 443 | −15,33 | ||||

| 2025-07-29 | NP | EBI - Longview Advantage ETF | 600 | 0,00 | 40 | −2,50 | ||||

| 2025-07-23 | 13F | High Note Wealth, LLC | 173 | 0,00 | 12 | 0,00 | ||||

| 2025-08-12 | 13F | Pacer Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-09 | 13F | Christopher J. Hasenberg, Inc | 19 | 0,00 | 1 | 0,00 | ||||

| 2025-07-30 | 13F | Sentry LLC | 5 760 | 0,00 | 406 | −4,03 | ||||

| 2025-06-26 | NP | HRLIX - The Hartford Global Real Asset Fund Class I | 24 254 | −25,85 | 1 564 | −27,40 | ||||

| 2025-08-08 | 13F | Wiser Advisor Group LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Beaton Management Co. Inc. | 6 450 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | Northstar Financial Companies, Inc. | 6 209 | −19,49 | 437 | −22,65 | ||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | Put | 6 600 | −74,71 | 465 | −75,73 | |||

| 2025-07-30 | 13F | Lafayette Investments, Inc. | 4 103 | 2,58 | 289 | −1,71 | ||||

| 2025-08-11 | 13F | GW&K Investment Management, LLC | 815 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | Ameritas Investment Partners, Inc. | 44 | 0,00 | 3 | 0,00 | ||||

| 2025-08-11 | 13F | Frank, Rimerman Advisors LLC | 16 433 | 280,22 | 1 157 | 266,14 | ||||

| 2025-07-17 | 13F/A | Capital Investment Advisors, LLC | 10 509 | −6,41 | 740 | −10,10 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 17 123 | −93,99 | 1 | −95,00 | ||||

| 2025-07-24 | 13F | Callan Family Office, LLC | 98 803 | 131,74 | 6 957 | 122,66 | ||||

| 2025-08-08 | 13F | Tortoise Investment Management, LLC | 508 | 0,20 | 36 | −5,41 | ||||

| 2025-08-22 | NP | Columbia Funds Variable Series Trust II - CTIVP - DFA International Value Fund Class 1 | 185 989 | 0,00 | 13 095 | −3,92 | ||||

| 2025-08-14 | 13F | Ancora Advisors, LLC | 4 599 | 0,50 | 324 | −3,58 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 279 728 | 10,83 | 19 696 | 6,49 | ||||

| 2025-05-09 | 13F | Fairfield Financial Advisors, LTD | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Wolff Wiese Magana Llc | 81 | 0,00 | 6 | 0,00 | ||||

| 2025-08-06 | 13F | Founders Financial Securities Llc | 3 649 | −65,90 | 257 | −63,74 | ||||

| 2025-07-16 | 13F | Perigon Wealth Management, LLC | 29 676 | −3,73 | 2 089 | −7,48 | ||||

| 2025-08-14 | 13F | Recurrent Investment Advisors LLC | 52 591 | 0,97 | 1 349 | −7,29 | ||||

| 2025-08-12 | 13F | Foster Dykema Cabot & Partners, Llc | 2 327 | 0,00 | 164 | −4,12 | ||||

| 2025-08-14 | 13F | Gallagher Fiduciary Advisors, LLC | 12 164 | −6,67 | 856 | −10,37 | ||||

| 2025-07-24 | NP | FEQTX - Fidelity Equity Dividend Income Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 601 000 | −2,82 | 172 238 | −4,61 | ||||

| 2025-08-07 | 13F | Guardian Capital Lp | 317 512 | 2,55 | 22 356 | −1,47 | ||||

| 2025-08-11 | 13F | Integrated Quantitative Investments LLC | 47 698 | −36,06 | 3 358 | −38,57 | ||||

| 2025-08-04 | 13F | Balentine LLC | 4 623 | −11,10 | 326 | −14,70 | ||||

| 2025-07-28 | NP | NBCR - Neuberger Berman Core Equity ETF | 2 372 | 1,80 | 157 | 0,00 | ||||

| 2025-07-22 | 13F | Belpointe Asset Management LLC | 3 251 | −6,07 | 229 | −9,88 | ||||

| 2025-08-12 | 13F | Strategic Advisors LLC | 4 500 | −30,77 | 317 | −33,61 | ||||

| 2025-08-14 | 13F | Orbis Allan Gray Ltd | 7 333 663 | 13,59 | 516 363 | 9,14 | ||||

| 2025-06-26 | NP | TAAAX - Thrivent Aggressive Allocation Fund Class A | 23 525 | 0,00 | 1 517 | −2,13 | ||||

| 2025-08-07 | 13F | Midwest Trust Co | 21 399 | 1 507 | ||||||

| 2025-08-14 | 13F | Cardiff Park Advisors, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Fiera Capital Corp | 5 058 | 18,12 | 356 | 13,74 | ||||

| 2025-07-28 | 13F | Davidson Trust Co | 4 175 | −8,74 | 294 | −12,54 | ||||

| 2025-08-13 | 13F | Isthmus Partners, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | FIL Ltd | 1 332 | 4,47 | 94 | 0,00 | ||||

| 2025-07-16 | 13F | Crowley Wealth Management, Inc. | 100 | 0,00 | 7 | 0,00 | ||||

| 2025-08-08 | 13F | Creative Planning | 353 650 | 3,18 | 24 901 | −0,86 | ||||

| 2025-07-28 | 13F | Patten & Patten Inc/tn | 5 410 | 10,18 | 381 | 5,85 | ||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 130 366 | 0,17 | 8 633 | −1,67 | ||||

| 2025-07-28 | 13F | Twin Tree Management, LP | Put | 204 700 | 14 413 | |||||

| 2025-07-28 | 13F | Twin Tree Management, LP | Call | 327 400 | 178,88 | 23 052 | 167,95 | |||

| 2025-07-29 | 13F | Aull & Monroe Investment Management Corp | 10 827 | 0,00 | 762 | −3,91 | ||||

| 2025-08-04 | 13F | IFG Advisory, LLC | 2 949 | 208 | ||||||

| 2025-07-11 | 13F | Seacrest Wealth Management, Llc | 28 956 | −2,79 | 2 039 | −6,60 | ||||

| 2025-06-26 | NP | Dfa Investment Trust Co - The Dfa International Value Series This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 8 154 062 | 2 550,37 | 525 774 | 5 105,16 | ||||

| 2025-08-08 | 13F | Letko, Brosseau & Associates Inc | 635 852 | −1,67 | 44 770 | −5,52 | ||||

| 2025-07-18 | 13F | First United Bank Trust/ | 265 | 0,00 | 19 | −5,26 | ||||

| 2025-07-22 | 13F | Mascoma Wealth Management LLC | 54 | 0,00 | 4 | 0,00 | ||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 4 740 | 4,66 | 334 | 0,60 | ||||

| 2025-07-29 | NP | SCPAX - Siit Large Cap Disciplined Equity Fund - Class A | 40 290 | 4,79 | 2 668 | 2,89 | ||||

| 2025-07-17 | 13F | Venture Visionary Partners LLC | 7 670 | 0,05 | 540 | −3,74 | ||||

| 2025-08-06 | 13F | SOUTH STATE Corp | 84 557 | 0,68 | 5 954 | −3,27 | ||||

| 2025-08-13 | 13F | Bare Financial Services, Inc | 102 | 277,78 | 7 | 600,00 | ||||

| 2025-08-14 | 13F | Dagco, Inc. | 30 | 0,00 | 2 | 0,00 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 28 279 | −0,43 | 1 991 | −4,32 | ||||

| 2025-08-26 | NP | BGEAX - BRANDES GLOBAL EQUITY FUND Class A | 20 431 | 6,18 | 1 439 | 1,99 | ||||

| 2025-07-17 | 13F | Investment Research & Advisory Group, Inc. | 165 | 0,00 | 12 | −8,33 | ||||

| 2025-07-29 | 13F | TFC Financial Management | 741 | 0,00 | 52 | −3,70 | ||||

| 2025-07-30 | 13F | Wedgewood Investors Inc /pa/ | 3 000 | 0,00 | 211 | −3,65 | ||||

| 2025-08-14 | 13F | Atom Investors LP | 48 776 | 3 434 | ||||||

| 2025-08-13 | 13F | Gateway Wealth Partners, LLC | 4 207 | 2,26 | 296 | −1,66 | ||||

| 2025-08-07 | 13F | Sierra Ocean, Llc | 739 | 14,93 | 52 | 10,64 | ||||

| 2025-08-27 | NP | RYEIX - Energy Fund Investor Class | 3 323 | −5,70 | 234 | −9,69 | ||||

| 2025-06-26 | NP | DFIC - Dimensional International Core Equity 2 ETF | 1 301 383 | 0,00 | 83 913 | −2,08 | ||||

| 2025-08-07 | 13F | Legacy Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Fisher Asset Management, LLC | 26 392 845 | 3,45 | 1 858 320 | −0,60 | ||||

| 2025-08-12 | 13F | Argent Trust Co | 5 855 | 8,47 | 412 | 4,30 | ||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-07-08 | 13F | Ransom Advisory, Ltd | 4 261 | 300 | ||||||

| 2025-07-14 | 13F | CHICAGO TRUST Co NA | 46 131 | 9,72 | 3 248 | 5,45 | ||||

| 2025-08-06 | 13F | Adviser Investments LLC | 23 314 | 247,66 | 1 642 | 234,22 | ||||

| 2025-08-14 | 13F | Merewether Investment Management, LP | 2 446 621 | 2,72 | 172 267 | −1,30 | ||||

| 2025-08-27 | NP | ALLIANZ VARIABLE INSURANCE PRODUCTS TRUST - AZL DFA International Core Equity Fund | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Howe & Rusling Inc | 24 530 | 0,51 | 1 727 | −3,41 | ||||

| 2025-08-13 | 13F | Teramo Advisors, LLC | 3 000 | 0,00 | 211 | −3,65 | ||||

| 2025-08-06 | 13F | Harvest Portfolios Group Inc. | 304 409 | −1,54 | 21 433 | −5,39 | ||||

| 2025-07-08 | 13F | Range Financial Group LLC | 24 705 | 1,41 | 1 739 | −2,58 | ||||

| 2025-07-22 | 13F | Jamison Private Wealth Management, Inc. | 3 445 | −5,10 | 243 | −8,68 | ||||

| 2025-08-27 | NP | THRIVENT SERIES FUND INC - Thrivent Moderate Allocation Portfolio Class A | 1 233 | 0,00 | 87 | −4,44 | ||||

| 2025-07-15 | 13F | Ballentine Partners, LLC | 17 196 | 13,72 | 1 211 | 9,21 | ||||

| 2025-08-12 | 13F | Councilmark Asset Management, LLC | 7 775 | 0,00 | 547 | −3,87 | ||||

| 2025-08-27 | NP | GBVCX - Victory Pioneer Global Value Fund Class C | 972 | −16,13 | 68 | −19,05 | ||||

| 2025-07-28 | 13F | Duncker Streett & Co Inc | 2 960 | −10,25 | 208 | −13,69 | ||||

| 2025-08-13 | 13F | West Family Investments, Inc. | 24 418 | 26,04 | 1 719 | 21,14 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 125 | 1,63 | 9 | −11,11 | ||||

| 2025-08-05 | 13F | Sigma Planning Corp | 9 410 | −1,87 | 663 | −5,70 | ||||

| 2025-07-28 | 13F | Private Wealth Asset Management, LLC | 727 | 0,00 | 51 | −3,77 | ||||

| 2025-08-26 | NP | Blackrock Resources & Commodities Strategy Trust This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 838 292 | −9,81 | 59 024 | −13,34 | ||||

| 2025-08-11 | 13F | Goodman Financial Corp | 4 054 | 11,80 | 285 | 7,55 | ||||

| 2025-07-30 | 13F | Schulhoff & Co Inc | 11 602 | 4,36 | 817 | 0,25 | ||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 12 170 | −4,25 | 857 | −8,06 | ||||

| 2025-08-07 | 13F | Palisade Asset Management, LLC | 3 921 | 0,00 | 276 | −3,83 | ||||

| 2025-08-07 | 13F | Fidelis Capital Partners, LLC | 10 824 | 2,60 | 782 | 12,54 | ||||

| 2025-07-17 | 13F | Beacon Capital Management, LLC | 6 891 | 0,88 | 485 | −3,00 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 5 461 854 | 3,33 | 384 569 | −0,71 | ||||

| 2025-08-27 | NP | Advanced Series Trust - Ast Advanced Strategies Portfolio | 37 390 | −90,92 | 2 633 | −82,44 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | Call | 393 100 | −50,44 | 27 678 | −52,38 | |||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | Put | 393 100 | −20,28 | 27 678 | −23,40 | |||

| 2025-07-31 | 13F | Sentinel Trust Co Lba | 27 750 | 0,84 | 2 | −50,00 | ||||

| 2025-08-14 | 13F | DecisionPoint Financial, LLC | 11 | 1 | ||||||

| 2025-07-14 | 13F | U.S. Capital Wealth Advisors, LLC | 59 164 | −19,02 | 4 166 | −22,19 | ||||

| 2025-07-08 | 13F | Red Spruce Capital, LLC | 20 542 | −0,65 | 1 446 | −4,55 | ||||

| 2025-07-17 | 13F | Forefront Wealth Management Inc. | 36 073 | −0,02 | 2 540 | −3,93 | ||||

| 2025-06-26 | NP | FFEIX - Nuveen Dividend Value Fund Class A This fund is a listed as child fund of Nuveen Asset Management, LLC and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 744 662 | 19,32 | 48 016 | 16,84 | ||||

| 2025-06-27 | NP | AADBX - American Beacon Balanced Fund Institutional Class | 8 435 | −13,35 | 544 | −15,29 | ||||

| 2025-07-21 | 13F | Credential Qtrade Securities Inc. | 53 175 | 7,67 | 3 565 | 9,70 | ||||

| 2025-08-14 | 13F | Becker Capital Management Inc | 214 758 | −0,69 | 15 121 | −4,58 | ||||

| 2025-08-13 | 13F | Transce3nd, LLC | 488 | 0,00 | 34 | −2,86 | ||||

| 2025-07-17 | 13F | Farmers & Merchants Trust Co of Long Beach | 7 112 | −7,71 | 501 | −11,35 | ||||

| 2025-05-05 | 13F | Csenge Advisory Group | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | First Citizens Bank & Trust Co | 3 257 | −11,18 | 229 | −14,55 | ||||

| 2025-06-27 | NP | IENAX - INVESCO Energy Fund Class A | 486 342 | −1,40 | 31 359 | −3,45 | ||||

| 2025-07-23 | 13F | Element Wealth, LLC | 4 994 | −14,59 | 352 | −17,99 | ||||

| 2025-08-07 | 13F | Legacy Financial Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-29 | NP | PJFV - PGIM Jennison Focused Value ETF | 8 501 | 13,02 | 563 | 10,85 | ||||

| 2025-08-07 | 13F | Profund Advisors Llc | 11 971 | 3,59 | 843 | −0,47 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 290 254 | 7,31 | 20 437 | 3,11 | ||||

| 2025-08-08 | 13F | Kingsview Wealth Management, LLC | 15 743 | −26,18 | 1 108 | −29,07 | ||||

| 2025-07-30 | NP | SGHIX - Sextant Global High Income Fund | 3 800 | 0,00 | 252 | −1,95 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 81 013 | −23,05 | 5 764 | −25,09 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 1 854 173 | 1,82 | 130 554 | −2,17 | ||||

| 2025-05-14 | 13F | Oarsman Capital, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Limestone Investment Advisors LP | 36 000 | 2 535 | ||||||

| 2025-08-05 | 13F | Cherry Tree Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Rathbone Brothers plc | 33 165 | −4,34 | 2 335 | −7,78 | ||||

| 2025-07-17 | 13F | Jackson, Grant Investment Advisers, Inc. | 142 | 0,00 | 10 | −10,00 | ||||

| 2025-08-04 | 13F | Kovack Advisors, Inc. | 6 859 | −14,95 | 483 | −18,31 | ||||

| 2025-07-29 | 13F | Werba Rubin Papier Wealth Management | 3 186 | 1,85 | 224 | −2,18 | ||||

| 2025-08-14 | 13F | Henry James International Management Inc. | 10 387 | 0,00 | 731 | −3,94 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 24 425 | 12,70 | 1 720 | 8,25 | ||||

| 2025-08-13 | 13F | Capital International Inc /ca/ | 136 059 | 51,91 | 9 580 | 45,95 | ||||

| 2025-08-07 | 13F | McClarren Financial Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-05-28 | 13F | Silicon Valley Capital Partners | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-14 | 13F | Iams Wealth Management, Llc | 29 203 | 1,13 | 2 056 | −2,84 | ||||

| 2025-04-30 | 13F | Sofos Investments, Inc. | 12 | −73,33 | 1 | −100,00 | ||||

| 2025-07-21 | 13F | Empirical Financial Services, LLC d.b.a. Empirical Wealth Management | 7 164 | 13,75 | 504 | 9,33 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 6 397 | −37,46 | 450 | −39,92 | ||||

| 2025-07-31 | 13F | 180 Wealth Advisors, Llc | 9 400 | 1,44 | 662 | −2,65 | ||||

| 2025-08-04 | 13F | Mill Capital Management, LLC | 34 218 | 0,00 | 2 409 | −3,91 | ||||

| 2025-08-13 | 13F | Trustmark National Bank Trust Department | 24 304 | 4,85 | 1 711 | 0,77 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 9 790 666 | −4,54 | 689 361 | −8,28 | ||||

| 2025-08-12 | 13F | Accredited Wealth Management, LLC | 900 | 0,00 | 63 | −3,08 | ||||

| 2025-08-06 | 13F | Hallmark Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Nwam Llc | 8 227 | 21,90 | 590 | 19,43 | ||||

| 2025-08-25 | NP | QCVAX - Clearwater International Fund | 7 350 | −77,61 | 518 | −56,74 | ||||

| 2025-04-14 | 13F | IMC-Chicago, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Laurel Wealth Advisors LLC | 152 438 | 6 941,02 | 2 | −98,73 | ||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 11 953 | 0,36 | 842 | −3,56 | ||||

| 2025-07-31 | 13F | Harbour Investment Management Llc | 30 638 | −1,35 | 2 157 | −5,19 | ||||

| 2025-04-25 | NP | FGIRX - Fidelity Advisor Growth & Income Fund Class A This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 390 300 | 19,36 | 26 330 | 24,38 | ||||

| 2025-06-27 | NP | SUNAMERICA SERIES TRUST - SA T. Rowe Price VCP Balanced Portfolio Class 3 | 38 878 | 88,93 | 2 507 | 271,26 | ||||

| 2025-07-11 | 13F | Marshall & Sullivan Inc /wa/ | 1 200 | 84 | ||||||

| 2025-08-05 | 13F | Fourth Dimension Wealth, LLC | 682 | 0,00 | 48 | −2,04 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 181 292 | −2,35 | 12 765 | −6,17 | ||||

| 2025-05-07 | 13F | Spectrum Wealth Counsel, LLC | 222 | 0,00 | 16 | 23,08 | ||||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 36 565 | −1,19 | 2 575 | −5,05 | ||||

| 2025-08-12 | 13F | Integrated Advisors Network LLC | 10 626 | −74,24 | 748 | −75,25 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 67 924 | −0,30 | 5 | 0,00 | ||||

| 2025-08-14 | 13F | Eagle Capital Management Llc | 12 913 124 | −17,60 | 909 213 | −20,83 | ||||

| 2025-08-07 | 13F | Americana Partners, LLC | 237 616 | 0,82 | 16 731 | −3,13 | ||||

| 2025-08-13 | 13F | M&t Bank Corp | 214 093 | −0,09 | 15 074 | −4,01 | ||||

| 2025-07-30 | 13F | Forum Financial Management, LP | 34 261 | −16,27 | 2 412 | −19,55 | ||||

| 2025-07-29 | 13F | Signature Estate & Investment Advisors Llc | 10 164 | 3,44 | 716 | −0,69 | ||||

| 2025-07-23 | 13F | Stonegate Investment Group, LLC | 21 025 | 7,67 | 1 480 | 3,50 | ||||

| 2025-08-01 | 13F | Boyd Watterson Asset Management Llc/oh | 8 605 | 0,00 | 606 | −3,97 | ||||

| 2025-07-29 | NP | GAAVX - GMO Alternative Allocation Fund Class VI | 12 761 | 1 540,23 | 845 | 1 408,93 | ||||

| 2025-07-08 | 13F | Next Level Private LLC | 17 046 | 0,35 | 1 200 | −3,54 | ||||

| 2025-07-02 | 13F | Doliver Advisors, Lp | 4 132 | 0,00 | 291 | −3,97 | ||||

| 2025-08-27 | NP | THRIVENT SERIES FUND INC - Thrivent Global Stock Portfolio Class A | 27 689 | 0,00 | 1 950 | −3,94 | ||||

| 2025-04-11 | 13F | Sulzberger Capital Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Buckingham Strategic Partners | 8 090 | −43,95 | 570 | −46,07 | ||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 133 747 | −31,87 | 9 417 | −34,53 | ||||

| 2025-07-18 | 13F | Columbia Asset Management | 40 512 | 0,25 | 2 852 | −3,68 | ||||

| 2025-07-15 | 13F | Northside Capital Management, LLC | 4 010 | 282 | ||||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 157 535 | 26,49 | 11 092 | 21,54 | ||||

| 2025-05-23 | NP | EQ ADVISORS TRUST - EQ/JPMorgan Value Opportunities Portfolio Class IB | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-27 | NP | THRIVENT SERIES FUND INC - Thrivent Aggressive Allocation Portfolio Class A | 16 928 | 0,00 | 1 192 | −3,95 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 36 567 | 0,53 | 2 575 | −3,41 | ||||

| 2025-08-22 | NP | FGLGX - Fidelity Series Large Cap Stock Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 6 567 700 | 2,45 | 462 432 | −1,56 | ||||

| 2025-07-14 | 13F | Chapin Davis, Inc. | 3 728 | 0,08 | 262 | −3,68 | ||||

| 2025-07-22 | 13F | Berger Financial Group, Inc | 3 779 | 0,08 | 266 | −3,62 | ||||

| 2025-05-14 | 13F | Transamerica Financial Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Entropy Technologies, LP | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Pullen Investment Management, LLC | 7 891 | −6,81 | 556 | −10,48 | ||||

| 2025-03-25 | NP | AOBLX - Pioneer Balanced ESG Fund : Class A | 56 108 | −2,06 | 3 695 | −4,55 | ||||

| 2025-08-14 | 13F | Beck Mack & Oliver Llc | 13 647 | 0,00 | 961 | −4,00 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | Call | 3 400 | 239 | |||||

| 2025-08-14 | 13F | Millennium Management Llc | 457 069 | −75,73 | 32 182 | −76,68 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 6 702 | −28,18 | 472 | −21,63 | ||||

| 2025-08-11 | 13F | Royce & Associates Lp | 70 000 | 0,00 | 4 929 | −3,92 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 25 584 | −3,52 | 1 801 | −7,31 | ||||

| 2025-07-25 | NP | CWGIX - CAPITAL WORLD GROWTH & INCOME FUND Class A This fund is a listed as child fund of Capital World Investors and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 14 207 | −99,93 | 941 | −99,86 | ||||

| 2025-07-21 | 13F | Hardman Johnston Global Advisors LLC | 5 000 | 0,00 | 352 | −3,83 | ||||

| 2025-07-18 | 13F | Naples Global Advisors, Llc | 3 906 | −5,67 | 275 | −9,24 | ||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 19 610 | 1,49 | 1 406 | 0,29 | ||||

| 2025-08-06 | 13F | Thompson Siegel & Walmsley Llc | 16 020 | 1,26 | 1 | 0,00 | ||||

| 2025-05-01 | 13F | Schechter Investment Advisors, LLC | 33 585 | −4,48 | 2 461 | 11,76 | ||||

| 2025-06-26 | NP | HFCVX - Hennessy Cornerstone Value Fund Investor Class | 82 000 | 0,00 | 5 287 | −2,07 | ||||

| 2025-05-15 | 13F | Hiddenite Capital Partners LP | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Millennium Management Llc | Put | 8 700 | −29,84 | 613 | −32,60 | |||

| 2025-08-06 | 13F | Wsfs Capital Management, Llc | 8 367 | 41,81 | 589 | 36,34 | ||||

| 2025-08-12 | 13F | Evelyn Partners Asset Management Ltd | 276 | −63,20 | 19 | −69,84 | ||||

| 2025-08-14 | 13F | Alliance Wealth Advisors, LLC /UT | 8 481 | 3,59 | 597 | −0,33 | ||||

| 2025-05-12 | 13F | Aveo Capital Partners, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | FineMark National Bank & Trust | 171 671 | −0,60 | 12 087 | −4,50 | ||||

| 2025-07-31 | 13F | Leavell Investment Management, Inc. | 19 371 | −8,11 | 1 364 | −11,72 | ||||

| 2025-08-26 | NP | TQMVX - T. Rowe Price QM U.S. Value Equity Fund This fund is a listed as child fund of Price T Rowe Associates Inc /md/ and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 4 428 | −9,78 | 312 | −13,37 | ||||

| 2025-07-31 | 13F | Brighton Jones Llc | 10 039 | 51,72 | 707 | 45,87 | ||||

| 2025-08-06 | 13F | Atlantic Union Bankshares Corp | 110 144 | 1 853,95 | 7 755 | 1 777,72 | ||||

| 2025-05-13 | 13F | StrongBox Wealth, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Aprio Wealth Management, LLC | 4 363 | −54,28 | 307 | −56,08 | ||||

| 2025-08-06 | 13F | Mark Sheptoff Financial Planning, Llc | 750 | 0,00 | 53 | −3,70 | ||||

| 2025-07-23 | 13F | Ameliora Wealth Management Ltd. | 1 720 | 0,00 | 121 | −3,97 | ||||

| 2025-07-28 | 13F | Galilei Investment Office LLP | 63 920 | 2 250 | ||||||

| 2025-07-31 | 13F | Sage Mountain Advisors LLC | 8 322 | −4,48 | 586 | −8,31 | ||||

| 2025-08-12 | 13F | AIMZ Investment Advisors, LLC | 5 275 | 0,00 | 371 | −3,89 | ||||

| 2025-08-12 | 13F | SPX Equities Gestao de Recursos Ltda | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Bleakley Financial Group, LLC | 55 492 | 22,12 | 3 907 | 17,36 | ||||

| 2025-08-01 | 13F | Gwn Securities Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Pinnacle Wealth Planning Services, Inc. | 5 996 | −16,26 | 422 | −19,47 | ||||

| 2025-07-29 | NP | JDVRX - PGIM JENNISON VALUE FUND Class R | 131 248 | 44,92 | 8 691 | 42,27 | ||||

| 2025-08-01 | 13F | Financial Counselors Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Helium Advisors LLC | 3 448 | 0,41 | 243 | −3,59 | ||||

| 2025-07-29 | NP | PBQAX - PGIM Jennison Blend Fund Class A | 151 274 | −4,45 | 10 017 | −6,21 | ||||

| 2025-07-24 | 13F | Stonebridge Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-10 | 13F | Security National Bank | 200 | 14 | ||||||

| 2025-07-08 | 13F | Gillespie Robinson & Grimm Inc | 3 989 | 0,00 | 281 | −4,11 | ||||

| 2025-07-22 | 13F | Red Tortoise LLC | 608 | 0,00 | 43 | −4,55 | ||||

| 2025-07-28 | 13F | Aries Wealth Management | 9 100 | 5,69 | 641 | 1,59 | ||||

| 2025-07-30 | 13F | Phoenix Holdings Ltd. | 24 500 | −1,08 | 1 724 | −5,22 | ||||

| 2025-07-29 | NP | NWQAX - Nuveen NWQ Flexible Income Fund Class A This fund is a listed as child fund of Nuveen Asset Management, LLC and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 17 000 | −68,05 | 1 126 | −66,34 | ||||

| 2025-06-26 | NP | FBCV - Fidelity Blue Chip Value ETF This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 39 363 | −0,93 | 2 538 | −2,98 | ||||

| 2025-04-21 | 13F | Boston Trust Walden Corp | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Dodge & Cox | 57 213 | −0,44 | 4 028 | −4,32 | ||||

| 2025-08-14 | 13F | Quantitative Investment Management, LLC | 3 979 | 0 | ||||||

| 2025-07-14 | 13F | Capital CS Group, LLC | 6 544 | 461 | ||||||

| 2025-07-29 | NP | GIMFX - GMO Implementation Fund | 16 084 | −79,71 | 1 065 | −59,80 | ||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 928 | 0,00 | 65 | −4,41 | ||||

| 2025-08-14 | 13F | RBF Capital, LLC | 10 000 | 0,00 | 704 | −3,83 | ||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 11 900 | 31,59 | 838 | 26,44 | ||||

| 2025-08-14 | 13F | Stamos Capital Partners, L.p. | 192 334 | 69,29 | 13 542 | 62,67 | ||||

| 2025-08-11 | 13F | Cordatus Wealth Management LLC | 5 359 | −2,08 | 0 | |||||

| 2025-08-12 | 13F | SHEPHERD WEALTH MANAGEMENT Ltd LIABILITY Co | 3 600 | 259 | ||||||

| 2025-08-13 | 13F | Huber Capital Management LLC | 175 301 | −13,67 | 12 343 | −17,05 | ||||

| 2025-08-29 | 13F | Total Investment Management Inc | 9 | 1 | ||||||

| 2025-08-18 | 13F | Front Row Advisors LLC | 200 | 14 | ||||||

| 2025-07-25 | 13F | GFS Advisors, LLC | 32 177 | 2 266 | ||||||

| 2025-07-16 | 13F | ORG Partners LLC | 315 | 15,38 | 22 | 15,79 | ||||

| 2025-07-21 | 13F | Syntax Research, Inc. | 83 | 0,00 | 6 | −16,67 | ||||

| 2025-09-09 | 13F | NWF Advisory Services Inc. | 4 222 | 297 | ||||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 9 140 | 2,19 | 644 | −1,83 | ||||

| 2025-06-26 | NP | BLACKROCK GLOBAL ALLOCATION FUND, INC. - BLACKROCK GLOBAL ALLOCATION FUND, INC. Investor A This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-18 | 13F | Chelsea Counsel Co | 5 012 | 0,00 | 353 | −4,09 | ||||

| 2025-07-24 | 13F | Eastern Bank | 6 841 | −2,76 | 482 | −6,60 | ||||

| 2025-08-14 | 13F | Peak6 Llc | Put | 108 400 | 310,61 | 7 632 | 294,62 | |||

| 2025-08-14 | 13F | Peak6 Llc | Call | 806 300 | −19,27 | 56 772 | −22,44 | |||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 174 109 | 7,26 | 12 259 | 3,07 | ||||

| 2025-08-28 | NP | SIMS - SPDR S&P Kensho Intelligent Structures ETF This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 291 | −18,41 | 161 | −21,46 | ||||

| 2025-07-11 | 13F | Phillips Wealth Planners LLC | 3 475 | −9,39 | 248 | 3,78 | ||||

| 2025-08-05 | 13F | Tiaa Trust, National Association | 9 426 | −13,59 | 664 | −17,02 | ||||

| 2025-08-13 | 13F | Colonial Trust Co / SC | 1 266 | −28,19 | 89 | −31,01 | ||||

| 2025-07-24 | 13F | Morton Brown Family Wealth, LLC | 83 | 0,00 | 6 | −16,67 | ||||

| 2025-07-30 | NP | FILFX - Strategic Advisers International Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 183 199 | −94,18 | 12 131 | −88,46 | ||||

| 2025-08-13 | 13F | Level Four Advisory Services, Llc | 24 791 | −6,60 | 1 746 | −10,28 | ||||

| 2025-04-17 | 13F | FNY Investment Advisers, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | BLB&B Advisors, LLC | 3 459 | −1,42 | 244 | −5,45 |

Other Listings

| MX:SHEL1 N | |

| US:SHEL | 72,62 US$ |