Grundläggande statistik

| Institutionella aktier (lång) | 242 137 013 - 63,50% (ex 13D/G) - change of −3,16MM shares −1,29% MRQ |

| Institutionellt värde (lång) | $ 8 769 338 USD ($1000) |

Institutionellt ägande och aktieägare

Western Midstream Partners, LP - Limited Partnership (US:WES) har 365 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 242,150,955 aktier. Största aktieägare inkluderar Alps Advisors Inc, AMLP - ALERIAN MLP ETF, Invesco Ltd., MLPRX - Invesco Oppenheimer SteelPath MLP Income Fund Class C, Blackstone Group Inc, Goldman Sachs Group Inc, Tortoise Capital Advisors, L.l.c., Chickasaw Capital Management Llc, Neuberger Berman Group LLC, and MLPA - Global X MLP ETF .

Western Midstream Partners, LP - Limited Partnership (NYSE:WES) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 17, 2025 is 38,32 / share. Previously, on September 17, 2024, the share price was 40,05 / share. This represents a decline of 4,33% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

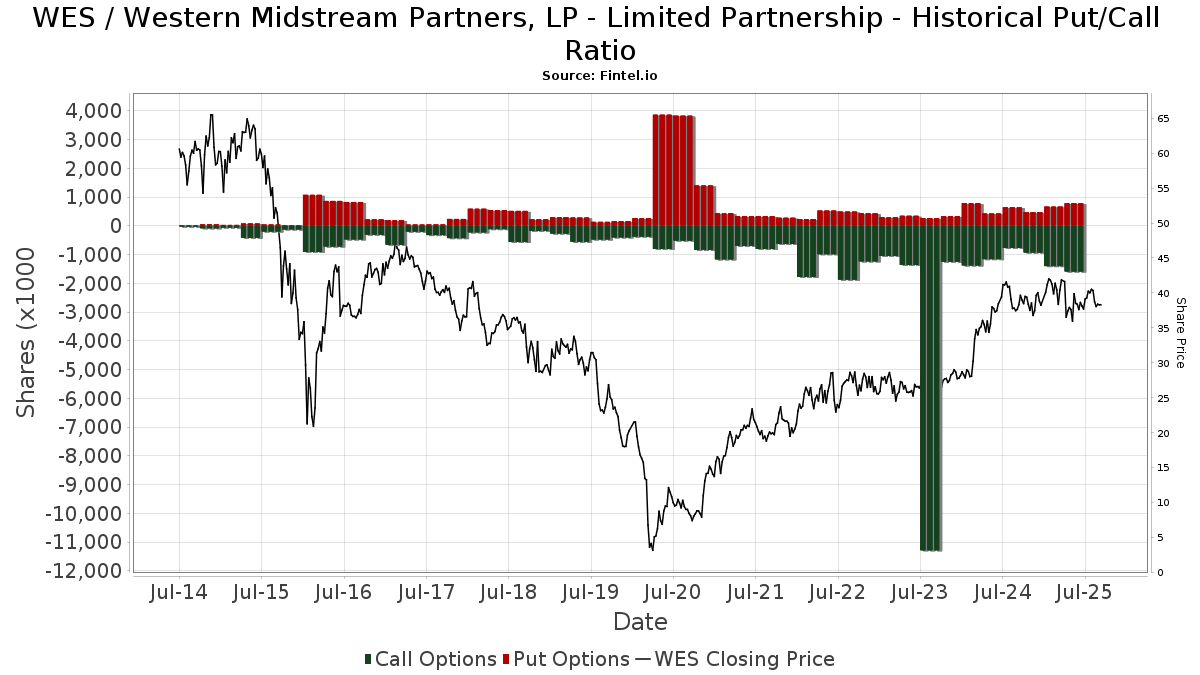

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13D/G-Arkiveringar

Vi presenterar 13D/G-arkiveringar separat från 13F-arkiveringar på grund av att de behandlas olika av SEC. 13D/G-arkiveringar kan lämnas in av grupper av investerare (med en ledare), medan 13F-arkiveringar inte kan det. Detta leder till situationer där en investerare kan lämna in en 13D/G-ansökan med ett värde för de totala aktierna (vilket motsvarar alla aktier som ägs av investerargruppen), men sedan lämna in en 13F-ansökan med ett annat värde för de totala aktierna (vilket motsvarar enbart deras eget ägande). Detta innebär att aktieägandet i 13D/G-arkiveringar och 13F-arkiveringar ofta inte är direkt jämförbara, så vi presenterar dem separat.

Notera: Från och med den 16 maj 2021 visar vi inte längre ägare som inte har lämnat in en 13D/G under det senaste året. Tidigare visade vi hela historiken för 13D/G-arkiveringar. I allmänhet måste enheter som är skyldiga att lämna in 13D/G-arkiveringar lämna in minst en gång per år innan de lämnar in en stängningsarkivering. Fonder avslutar dock ibland positioner utan att lämna in en avslutande arkivering (dvs. de avvecklar), så att visa hela historiken resulterade ibland i förvirring om det nuvarande ägandet. För att förhindra förvirring visar vi nu endast "nuvarande" ägare - det vill säga ägare som har lämnat in en ansökan under det senaste året.

Upgrade to unlock premium data.

| Fil Datum | Formulär | Investerare | Föregående aktier |

Senaste aktier |

Δ Aktier (Procent) |

Ägande (Procent) |

Δ Ägande (Procent) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-07-09 | ALPS ADVISORS INC | 33,824,487 | 34,675,907 | 2.52 | 9.11 | 2.47 |

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-21 | 13F | Hennessy Advisors Inc | 119 770 | 0,00 | 4 635 | −5,50 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 22 592 | 1,97 | 874 | −3,64 | ||||

| 2025-08-26 | NP | XVOL - Acruence Active Hedge U.S. Equity ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-29 | 13F | Arista Wealth Management, LLC | 6 300 | 244 | ||||||

| 2025-06-26 | NP | HMSFX - Hennessy BP Midstream Fund Investor Class | 119 770 | 1,76 | 4 503 | −7,02 | ||||

| 2025-07-30 | NP | Cushing Renaissance Fund | 115 000 | 0,00 | 4 301 | −7,82 | ||||

| 2025-07-22 | 13F | Autumn Glory Partners, LLC | 21 000 | 0,00 | 813 | −5,58 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Chicago Partners Investment Group LLC | 22 598 | 2,60 | 904 | 14,29 | ||||

| 2025-08-13 | 13F | F/M Investments LLC | 10 340 | 0,00 | 400 | −5,44 | ||||

| 2025-08-26 | NP | NMFIX - Multi-manager Global Listed Infrastructure Fund | 73 954 | −38,86 | 2 862 | −42,23 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 1 015 | 39 | ||||||

| 2025-07-22 | 13F | Cedar Mountain Advisors, LLC | 2 036 | 2,31 | 79 | −3,70 | ||||

| 2025-08-04 | 13F | Linscomb & Williams, Inc. | 12 068 | 0,00 | 467 | −5,47 | ||||

| 2025-06-26 | NP | GYLD - Arrow Dow Jones Global Yield ETF | 3 303 | −5,76 | 124 | −13,89 | ||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 29 540 | −14,34 | 1 143 | −19,05 | ||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 176 323 | −0,20 | 6 824 | −5,71 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Cornerstone Management, Inc. | 19 132 | 740 | ||||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 1 800 | 0,00 | 70 | −5,48 | ||||

| 2025-07-29 | 13F | Spirit Of America Management Corp/ny | 132 150 | −18,25 | 5 114 | −22,76 | ||||

| 2025-08-07 | 13F | Alpha Cubed Investments, LLC | 5 432 | −8,80 | 210 | −13,58 | ||||

| 2025-07-24 | 13F | Blair William & Co/il | 17 390 | 86,77 | 673 | 76,38 | ||||

| 2025-08-11 | 13F | VSM Wealth Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Texas Yale Capital Corp. | 539 371 | 23,15 | 20 874 | 16,36 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 8 525 | 6,39 | 330 | 0,30 | ||||

| 2025-08-11 | 13F | Heritage Wealth Advisors | 375 | 0,00 | 15 | −6,67 | ||||

| 2025-08-20 | NP | LSPAX - LoCorr Spectrum Income Fund Class A | 16 728 | 0,00 | 647 | −5,55 | ||||

| 2025-08-13 | 13F | Bollard Group LLC | 15 158 | 7,43 | 1 | |||||

| 2025-08-06 | 13F | Ing Groep Nv | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Cary Street Partner Investment Advisory Llc | 46 680 | 0,00 | 1 807 | −5,54 | ||||

| 2025-08-14 | 13F | Comerica Bank | 6 618 | −86,49 | 256 | −87,24 | ||||

| 2025-06-04 | 13F | Legacy Capital Wealth Management, Llc | 38 035 | 1 462 | ||||||

| 2025-07-17 | 13F | Archford Capital Strategies, LLC | 5 400 | 0,00 | 209 | −5,88 | ||||

| 2025-07-31 | 13F | Oppenheimer Asset Management Inc. | 34 031 | −13,30 | 1 317 | −18,05 | ||||

| 2025-07-30 | 13F | Whittier Trust Co Of Nevada Inc | 30 500 | 0,00 | 1 180 | −5,45 | ||||

| 2025-07-30 | NP | Cushing Mlp Total Return Fund | 173 000 | −21,36 | 6 470 | −27,52 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 631 | 32,01 | 24 | 26,32 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 29 508 | 11,42 | 1 | 0,00 | ||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 5 816 | −14,67 | 225 | −19,35 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 1 863 267 | −20,92 | 72 108 | −25,29 | ||||

| 2025-08-04 | 13F | Roble, Belko & Company, Inc | 10 | 11,11 | 0 | |||||

| 2025-07-29 | NP | PRPAX - PGIM Jennison MLP Fund Class A | 599 414 | 3,93 | 22 418 | −4,21 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 23 029 | 5,97 | 891 | 0,11 | ||||

| 2025-08-14 | 13F | Recurrent Investment Advisors LLC | 1 358 380 | 0,06 | 52 569 | −5,47 | ||||

| 2025-08-14 | 13F | Amplify Investments, Llc | 3 528 | 137 | ||||||

| 2025-03-28 | NP | VLPAX - Virtus Duff & Phelps Select MLP and Energy Fund Class A | 26 934 | −28,52 | 1 108 | −22,03 | ||||

| 2025-08-12 | 13F | BWM Planning, LLC | 28 325 | 0,00 | 1 096 | −5,52 | ||||

| 2025-07-11 | 13F | Kingstone Capital Partners Texas, LLC | 3 994 189 | 157 | ||||||

| 2025-07-29 | NP | Kayne Anderson Mlp Investment Co | 3 223 557 | −12,28 | 120 561 | −19,15 | ||||

| 2025-08-12 | 13F | Skopos Labs, Inc. | 9 | 0,00 | 0 | |||||

| 2025-07-10 | 13F | Oliver Lagore Vanvalin Investment Group | 343 | 2,39 | 14 | 16,67 | ||||

| 2025-08-01 | 13F | Chilton Capital Management Llc | 46 587 | −5,50 | 1 803 | −10,75 | ||||

| 2025-07-10 | 13F | Moody National Bank Trust Division | 7 373 | 1,10 | 285 | −4,36 | ||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 28 775 | 0,00 | 1 114 | −5,52 | ||||

| 2025-08-14 | 13F | Financial Network Wealth Advisors LLC | 777 | 1,83 | 30 | −3,23 | ||||

| 2025-08-13 | 13F | Custom Index Systems, Llc | 22 165 | 11,97 | 858 | 5,80 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 130 | 0,00 | 5 | 0,00 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 5 000 | −10,71 | 194 | −15,72 | ||||

| 2025-08-14 | 13F | Vivaldi Asset Management, LLC | 5 707 | 221 | ||||||

| 2025-07-30 | NP | Tortoise Energy Infrastructure Corp | 1 076 641 | 0,00 | 40 266 | −7,84 | ||||

| 2025-07-30 | NP | Tortoise Essential Assets Income Term Fund | 216 086 | 3 041,24 | 8 082 | 4 315,85 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 488 | −38,07 | 19 | −43,75 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 67 400 | −18,89 | 2 608 | −23,36 | |||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 180 | 0,00 | 7 | −14,29 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 709 | 0,00 | 27 | −6,90 | ||||

| 2025-06-30 | NP | INVESCO ACTIVELY MANAGED EXCHANGE-TRADED FUND TRUST - Invesco SteelPath MLP & Energy Infrastructure ETF | 11 748 | 442 | ||||||

| 2025-07-23 | 13F | Maryland State Retirement & Pension System | 175 260 | 6,48 | 6 783 | 0,61 | ||||

| 2025-08-14 | 13F | Dividend Asset Capital, Llc | 64 609 | 0,05 | 2 500 | −5,48 | ||||

| 2025-07-28 | 13F/A | Penbrook Management LLC | 11 600 | 0,00 | 449 | −5,68 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 95 682 | 217,88 | 3 703 | 200,49 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 337 100 | 100,30 | 13 046 | 89,25 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 136 900 | −14,33 | 5 298 | −19,05 | ||||

| 2025-07-08 | 13F | Hickory Point Bank & Trust | 6 350 | 0,00 | 246 | −5,77 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 176 300 | 2,20 | 6 823 | −3,44 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 375 400 | 243,46 | 14 528 | 224,55 | |||

| 2025-08-26 | NP | MDIV - Multi-Asset Diversified Income Index Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 123 294 | −21,92 | 4 771 | −26,23 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 101 477 | 3,70 | 3 927 | −2,02 | ||||

| 2025-07-21 | 13F | Grassi Investment Management | 30 000 | 1 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 57 692 | 39,77 | 2 233 | 32,07 | ||||

| 2025-08-28 | NP | BlackRock Funds V - BlackRock Credit Strategies Income Fund Investor A Shares | 160 | −61,45 | 6 | −40,00 | ||||

| 2025-08-13 | 13F | Per Stirling Capital Management, LLC. | 5 607 | 1,15 | 217 | −4,85 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 9 717 | −97,35 | 376 | −97,50 | ||||

| 2025-05-01 | 13F | Bleakley Financial Group, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-15 | 13F | Hall Laurie J Trustee | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 3 692 788 | 13,16 | 142 911 | 6,91 | ||||

| 2025-08-14 | 13F | Susquehanna Fundamental Investments, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-18 | 13F | First Pacific Financial | 0 | −100,00 | 0 | |||||

| 2025-04-25 | 13F | Kieckhefer Group Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 809 284 | −4,40 | 31 319 | 5,74 | ||||

| 2025-08-11 | 13F | Duff & Phelps Investment Management Co | 0 | −100,00 | 0 | |||||

| 2025-05-13 | 13F | Lee Financial Co | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 7 596 | 2,04 | 294 | −3,62 | ||||

| 2025-08-14 | 13F | Peapack Gladstone Financial Corp | 13 665 | 0,00 | 1 | |||||

| 2025-07-30 | 13F | SkyOak Wealth, LLC | 5 773 | 0,00 | 223 | −5,51 | ||||

| 2025-08-13 | 13F | Wambolt & Associates, LLC | 22 209 | 0,00 | 857 | −6,04 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 6 768 | −0,99 | 262 | −6,79 | ||||

| 2025-06-24 | NP | NBET - Neuberger Berman Carbon Transition & Infrastructure ETF | 21 998 | 73,32 | 827 | 58,43 | ||||

| 2025-08-11 | 13F | Bradley Foster & Sargent Inc/ct | 5 993 | 0,00 | 232 | −5,71 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 1 426 731 | 9,39 | 55 215 | 3,35 | ||||

| 2025-07-14 | 13F | Westend Capital Management LLC | 2 | 0,00 | 0 | |||||

| 2025-06-17 | NP | GSRAX - Goldman Sachs Rising Dividend Growth Fund Class A | 124 470 | −5,06 | 4 680 | −13,24 | ||||

| 2025-07-11 | 13F | Rockwood Wealth Management, LLC | 16 713 | 0,00 | 647 | −5,56 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 21 001 | 95,54 | 813 | 84,97 | ||||

| 2025-07-17 | 13F | Avondale Wealth Management | 6 000 | 200,00 | 232 | 186,42 | ||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 59 280 | 11,55 | 2 294 | 5,42 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 5 900 | −4,58 | 228 | −9,88 | ||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 207 330 | −2,92 | 8 024 | −8,28 | ||||

| 2025-08-06 | 13F | Penserra Capital Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 83 100 | 28,44 | 3 204 | 19,42 | |||

| 2025-07-21 | 13F | F&V Capital Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 41 049 | 34,23 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 59 100 | −1,66 | 2 279 | −8,59 | |||

| 2025-08-12 | 13F | Journey Strategic Wealth Llc | 5 900 | 7,27 | 228 | 1,33 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 533 500 | 4,66 | 20 646 | −1,11 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 10 621 | −62,58 | 435 | −60,09 | ||||

| 2025-08-06 | 13F | SOUTH STATE Corp | 1 251 | 0,00 | 48 | −5,88 | ||||

| 2025-08-14 | 13F | Peak6 Llc | Put | 75 100 | −40,96 | 2 906 | −44,22 | |||

| 2025-08-14 | 13F | Peak6 Llc | Call | 74 400 | −9,05 | 2 879 | −14,06 | |||

| 2025-08-14 | 13F | Peak6 Llc | 53 322 | 396,80 | 2 064 | 369,93 | ||||

| 2025-08-08 | 13F | Creative Planning | 6 878 | 16,99 | 266 | 10,83 | ||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 715 | −4,67 | 28 | −10,00 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 1 099 | 43 | ||||||

| 2025-07-31 | 13F | Resonant Capital Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 6 569 625 | −1,33 | 254 244 | −6,77 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 150 | 0,00 | 6 | −16,67 | ||||

| 2025-06-25 | NP | VRAI - Virtus Real Asset Income ETF | 3 773 | −2,38 | 142 | −11,32 | ||||

| 2025-08-11 | 13F | Empowered Funds, LLC | 122 699 | 4 748 | ||||||

| 2025-08-18 | 13F | Castleark Management Llc | 70 260 | −17,60 | 2 719 | −22,14 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 4 490 | 0 | ||||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 295 | 0 | ||||||

| 2025-03-31 | NP | Innovator ETFs Trust - Innovator IBD Breakout Opportunities ETF | 5 390 | 131,23 | 222 | 234,85 | ||||

| 2025-07-14 | 13F | Farmers & Merchants Investments Inc | 1 566 | 0,00 | 61 | −6,25 | ||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 6 000 | −6,25 | 232 | −11,45 | ||||

| 2025-08-14 | 13F | Summit Trail Advisors, Llc | 11 189 | 433 | ||||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 45 239 | 31,41 | 2 | 0,00 | ||||

| 2025-07-21 | 13F | Mattern Capital Management, Llc | 5 475 | 0,00 | 212 | −5,80 | ||||

| 2025-07-30 | NP | ENFR - Alerian Energy Infrastructure ETF | 171 490 | −0,69 | 6 414 | −8,48 | ||||

| 2025-07-30 | NP | AMLP - ALERIAN MLP ETF | 34 136 009 | −0,49 | 1 276 687 | −8,29 | ||||

| 2025-08-14 | 13F | Silvercrest Asset Management Group Llc | 41 724 | 4,78 | 1 615 | −1,04 | ||||

| 2025-08-12 | 13F | Jaffetilchin Investment Partners, LLC | 5 201 | 6,38 | 201 | 0,50 | ||||

| 2025-07-22 | 13F | Sl Advisors, Llc | 24 177 | 0,00 | 936 | −5,56 | ||||

| 2025-06-25 | NP | AMZA - InfraCap MLP ETF | 1 536 919 | 0,72 | 57 788 | −7,96 | ||||

| 2025-08-13 | 13F | Fiduciary Group LLC | 9 070 | 78,90 | 351 | 69,57 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Stephens Inc /ar/ | 131 361 | 215,36 | 5 084 | 197,95 | ||||

| 2025-08-06 | 13F | Pekin Hardy Strauss, Inc. | 66 400 | −5,55 | 2 570 | −10,77 | ||||

| 2025-06-26 | NP | EGLAX - Eagle MLP Strategy Fund Class A Shares | 421 390 | 5,59 | 15 844 | −3,51 | ||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 50 435 | 11,89 | 2 | 0,00 | ||||

| 2025-08-01 | 13F | Jennison Associates Llc | 585 704 | −0,40 | 22 667 | −5,90 | ||||

| 2025-07-24 | NP | INFIX - Tortoise MLP & Energy Income Fund Institutional Class Shares | 399 897 | −4,38 | 14 956 | −11,87 | ||||

| 2025-08-06 | 13F | Highlander Partners, L.P. | 6 100 | 0,00 | 236 | −5,22 | ||||

| 2025-06-25 | NP | SMLPX - Westwood Salient MLP & Energy Infrastructure Fund Institutional Shares | 758 591 | −5,32 | 28 523 | −13,49 | ||||

| 2025-08-07 | 13F | Navellier & Associates Inc | 10 360 | 0,00 | 401 | 7,82 | ||||

| 2025-07-30 | NP | MLPX - Global X MLP & Energy Infrastructure ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 874 638 | −11,21 | 107 511 | −18,17 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 34 600 | −15,20 | 1 | 0,00 | |||

| 2025-08-05 | 13F | Sage Capital Management, LLC | 5 582 | −47,16 | 216 | −50,00 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 33 680 | 38,28 | 1 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 28 100 | −51,88 | 1 | −50,00 | |||

| 2025-07-25 | 13F | Quantum Financial Planning Services, Inc. | 8 000 | 310 | ||||||

| 2025-08-04 | 13F | IFG Advisory, LLC | 26 343 | 183,62 | 1 019 | 168,16 | ||||

| 2025-07-15 | 13F | Oxinas Partners Wealth Management LLC | 15 122 | 0,00 | 585 | −5,49 | ||||

| 2025-07-16 | 13F | Cadent Capital Advisors, LLC | 8 577 | 0,89 | 332 | −4,89 | ||||

| 2025-07-29 | NP | OSPPX - Invesco Oppenheimer SteelPath MLP Alpha Plus Fund Class R6 | 1 420 185 | 16,08 | 53 115 | 6,99 | ||||

| 2025-05-09 | 13F | Banco Santander, S.A. | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 65 167 | 1,63 | 2 522 | −4,00 | ||||

| 2025-08-25 | NP | ALEFX - ALPS/Alerian Energy Infrastructure Portfolio Class I | 91 116 | 19,30 | 3 526 | 12,72 | ||||

| 2025-07-31 | 13F | Catalyst Capital Advisors LLC | 472 420 | 2,40 | 18 283 | −3,25 | ||||

| 2025-06-26 | NP | TMLAX - Transamerica MLP & Energy Income A | 124 767 | 10,10 | 4 691 | 0,60 | ||||

| 2025-07-17 | 13F | Sonora Investment Management Group, LLC | 8 500 | 70,00 | 329 | 60,78 | ||||

| 2025-08-11 | 13F | Regal Investment Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-07-30 | NP | BFOR - Barron's 400 ETF | 8 860 | −2,69 | 331 | −10,30 | ||||

| 2025-07-21 | 13F | Quent Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 4 343 | 0,00 | 168 | −5,08 | ||||

| 2025-07-28 | NP | TOLZ - ProShares DJ Brookfield Global Infrastructure ETF | 14 363 | 20,32 | 537 | 10,95 | ||||

| 2025-08-07 | 13F | ProShare Advisors LLC | 15 602 | 20,23 | 604 | 13,56 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 187 568 | 84,48 | 7 | 75,00 | ||||

| 2025-07-28 | 13F | Turtle Creek Wealth Advisors, LLC | 36 882 | 1 427 | ||||||

| 2025-08-13 | 13F | Hollow Brook Wealth Management LLC | 6 176 | 8,81 | 239 | 3,02 | ||||

| 2025-05-15 | 13F | CAPROCK Group, Inc. | 18 006 | 0,77 | 738 | 7,43 | ||||

| 2025-07-28 | 13F | Morningstar Investment Management LLC | 13 301 | 0,00 | 1 | |||||

| 2025-05-30 | NP | FLDZ - RiverNorth Patriot ETF | 359 | 5,59 | 15 | 7,69 | ||||

| 2025-04-30 | 13F | Brown Advisory Inc | 0 | −100,00 | 0 | |||||

| 2025-07-28 | NP | Neuberger Berman Mlp Income Fund Inc. | 1 160 000 | −9,38 | 43 384 | −16,48 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 970 302 | 24,25 | 37 551 | 17,40 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 6 718 | −0,87 | 260 | −6,50 | ||||

| 2025-07-24 | 13F | Baldwin Brothers Inc/ma | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Icon Wealth Advisors, LLC | 10 606 | 2,48 | 410 | −3,07 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 24 814 | 34,92 | 960 | 27,49 | ||||

| 2025-06-30 | NP | CVY - Invesco Zacks Multi-Asset Income ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 27 084 | −11,70 | 1 018 | −19,33 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 510 134 | −13,85 | 19 742 | −18,60 | ||||

| 2025-08-06 | 13F | Adviser Investments LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Knollwood Investment Advisory, LLC | 301 032 | 0,00 | 11 650 | −5,52 | ||||

| 2025-07-21 | NP | GLEAX - Goldman Sachs MLP & Energy Fund Class A Shares | 249 219 | −5,89 | 9 321 | −13,26 | ||||

| 2025-08-14 | 13F | Gen-Wealth Partners Inc | 110 | 4 | ||||||

| 2025-07-29 | 13F | Albert D Mason Inc | 33 674 | −0,80 | 1 303 | −6,26 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 26 382 | 1,03 | 1 021 | −4,58 | ||||

| 2025-08-08 | 13F | Citizens Financial Group Inc/ri | 5 913 | 229 | ||||||

| 2025-08-15 | 13F | Brookfield Asset Management Inc. | 904 361 | 19,11 | 34 999 | 12,54 | ||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 0 | −100,00 | 0 | |||||

| 2025-07-29 | NP | MLPEX - Invesco Oppenheimer SteelPath MLP Select 40 Fund Class C | 4 085 417 | 6,52 | 152 795 | −1,83 | ||||

| 2025-08-28 | NP | BlackRock Series Fund II, Inc. - BlackRock High Yield Portfolio This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 75 | −5,06 | 3 | 100,00 | ||||

| 2025-07-14 | 13F | U.S. Capital Wealth Advisors, LLC | 99 017 | 11,87 | 3 832 | 5,68 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 8 268 227 | −4,51 | 319 980 | −9,78 | ||||

| 2025-05-20 | 13F/A | Colony Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-21 | NP | GLPAX - Goldman Sachs MLP Energy Infrastructure Fund Class A Shares | 3 312 881 | −4,82 | 123 902 | −12,28 | ||||

| 2025-08-07 | 13F | Americana Partners, LLC | 137 495 | −6,80 | 5 321 | −11,93 | ||||

| 2025-08-28 | NP | BlackRock Variable Series Funds II, Inc. - BlackRock High Yield V.I. Fund Class I This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 3 632 | 42,88 | 141 | 129,51 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 33 723 | 1,34 | 1 305 | −4,26 | ||||

| 2025-08-13 | 13F | VestGen Advisors, LLC | 12 915 | 1,11 | 500 | −4,59 | ||||

| 2025-08-07 | 13F | Fidelis Capital Partners, LLC | 6 300 | 0,00 | 254 | 4,10 | ||||

| 2025-06-26 | NP | Voya Prime Rate Trust | Short | −13 942 | −0,00 | −524 | −8,55 | |||

| 2025-08-11 | 13F | NewEdge Wealth, LLC | 17 352 | 73,52 | 667 | 63,08 | ||||

| 2025-05-12 | 13F | Maia Wealth LLC | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | American Financial Group Inc | 25 000 | 0,00 | 968 | −5,57 | ||||

| 2025-08-11 | 13F | Independent Advisor Alliance | 22 492 | 0,00 | 870 | −5,54 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 5 853 | 13,21 | 227 | 7,11 | ||||

| 2025-08-13 | 13F | Summit Financial, LLC | 94 024 | 0,00 | 3 639 | −5,53 | ||||

| 2025-08-29 | NP | PIMCO Energy & Tactical Credit Opportunities Fund | 336 678 | 7,26 | 13 029 | 1,35 | ||||

| 2025-08-26 | NP | NMHYX - Multi-manager High Yield Opportunity Fund | 250 | 10 | ||||||

| 2025-07-11 | 13F | Miller Howard Investments Inc /ny | 1 469 279 | 2,95 | 56 861 | −2,73 | ||||

| 2025-08-05 | 13F | Westside Investment Management, Inc. | 900 | 0,00 | 35 | −5,56 | ||||

| 2025-08-28 | NP | Amplify ETF Trust - Amplify Natural Resources Dividend Income ETF | 4 436 | −49,32 | 172 | −52,23 | ||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 157 099 | 17,17 | 6 080 | 10,71 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 12 023 | 102,89 | 465 | 92,15 | ||||

| 2025-05-14 | 13F | Smartleaf Asset Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 119 | 142,86 | 5 | 300,00 | ||||

| 2025-04-14 | NP | TPYP - Tortoise North American Pipeline Fund | 231 656 | 2,72 | 9 401 | 2,40 | ||||

| 2025-07-31 | 13F/A | Avion Wealth | 600 | 0,00 | 0 | |||||

| 2025-07-25 | NP | AMLPX - MainGate MLP Fund Class A | 2 850 000 | 0,00 | 106 590 | −7,84 | ||||

| 2025-07-15 | 13F | Fortitude Family Office, LLC | 1 367 | 0,00 | 53 | −5,45 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 24 211 254 | −0,85 | 936 976 | −6,32 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna Portfolio Strategies, LLC | 15 107 | 585 | ||||||

| 2025-03-17 | NP | ABLD - Donoghue Forlines Yield Enhanced Real Asset ETF | 1 924 | −51,83 | 79 | −47,33 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 7 945 | 0,00 | 307 | −5,54 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 9 716 | 4,92 | 376 | −0,79 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 180 700 | −16,80 | 6 993 | −21,39 | |||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 36 700 | 1,94 | 1 420 | −3,66 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 135 600 | 19,16 | 5 248 | 12,57 | |||

| 2025-07-28 | 13F | Allianz Asset Management GmbH | 374 364 | −0,79 | 14 488 | −6,27 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 614 800 | 0,62 | 23 793 | −4,93 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | 21 438 | −81,80 | 830 | −82,82 | ||||

| 2025-08-01 | 13F | Vision Financial Markets Llc | 150 | 0,00 | 6 | −16,67 | ||||

| 2025-07-15 | 13F | Mather Group, Llc. | 0 | −100,00 | 0 | |||||

| 2025-05-05 | 13F | Eagle Bay Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Fayez Sarofim & Co | 26 490 | 0,00 | 1 025 | −5,53 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 9 651 | 374 | ||||||

| 2025-08-28 | NP | BlackRock Funds V - BlackRock High Yield Bond Portfolio Service Shares | 95 168 | −31,30 | 3 683 | 9,39 | ||||

| 2025-07-23 | 13F | Ellsworth Advisors, LLC | 134 574 | 5 208 | ||||||

| 2025-08-13 | 13F | Basso Capital Management, L.p. | 42 150 | 2,43 | 1 631 | −3,20 | ||||

| 2025-08-13 | 13F | RR Advisors, LLC | 453 000 | −2,79 | 18 | −10,53 | ||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 1 591 | 62 | ||||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 100 | 0,00 | 4 | −25,00 | ||||

| 2025-08-14 | 13F | Tortoise Capital Advisors, L.l.c. | 7 416 770 | −6,48 | 287 029 | −11,64 | ||||

| 2025-08-12 | 13F | Sfmg, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Belfer Management LLC | 9 874 | 0,00 | 382 | −5,45 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 347 | −27,86 | 13 | −31,58 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Put | 37 800 | 6,48 | 1 463 | 0,55 | |||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Call | 55 000 | −37,36 | 2 128 | −40,82 | |||

| 2025-08-14 | 13F/A | Barclays Plc | 935 137 | −11,36 | 36 | −16,28 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 176 487 | 165,45 | 6 830 | 150,83 | ||||

| 2025-04-29 | 13F | Hm Payson & Co | 1 121 | 0,00 | 46 | 4,65 | ||||

| 2025-08-26 | NP | Blackrock Corporate High Yield Fund, Inc. This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 6 903 | 267 | ||||||

| 2025-05-14 | 13F | Natixis | 0 | −100,00 | 0 | |||||

| 2025-07-24 | NP | FSDIX - Fidelity Strategic Dividend & Income Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 74 719 | 3,43 | 2 794 | −4,67 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 2 184 451 | −23,41 | 84 538 | −27,64 | ||||

| 2025-08-13 | 13F | M&t Bank Corp | 0 | −100,00 | 0 | |||||

| 2025-07-02 | 13F | Howard Financial Services, Ltd. | 10 951 | 7,21 | 424 | 1,20 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 1 746 | −62,76 | 68 | −65,10 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 68 044 | 17,12 | 2 633 | 10,68 | ||||

| 2025-08-06 | 13F | Heronetta Management, L.P. | 228 586 | 0,36 | 8 846 | −5,18 | ||||

| 2025-04-29 | 13F | Raleigh Capital Management Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Spire Wealth Management | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 277 118 | 7,08 | 10 724 | 1,17 | ||||

| 2025-08-14 | 13F | RMB Capital Management, LLC | 24 871 | 963 | ||||||

| 2025-08-12 | 13F | Inscription Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | BluePath Capital Management, LLC | 27 813 | 28,53 | 1 076 | 21,44 | ||||

| 2025-08-26 | NP | CCCAX - Center Coast Brookfield MLP Focus Fund Class A | 813 465 | 24,29 | 31 481 | 17,44 | ||||

| 2025-08-06 | 13F | Moors & Cabot, Inc. | 7 664 | 2,06 | 297 | −3,58 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 24 756 | 0,00 | 958 | −5,52 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | GWM Advisors LLC | 56 134 | 2 172 | ||||||

| 2025-08-19 | 13F | State of Wyoming | 5 840 | 95,45 | 226 | 85,25 | ||||

| 2025-08-12 | 13F | Longfellow Investment Management Co Llc | 985 718 | 0,00 | 38 147 | −5,52 | ||||

| 2025-07-22 | 13F | Iron Horse Wealth Management, LLC | 1 495 | 58 | ||||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 11 326 | 25,57 | 438 | 18,70 | ||||

| 2025-08-26 | NP | FCG - First Trust Natural Gas ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 380 168 | −11,54 | 14 713 | −16,42 | ||||

| 2025-03-28 | NP | Duff & Phelps Global Utility Income Fund Inc. | 185 000 | 0,00 | 7 613 | 9,05 | ||||

| 2025-07-18 | 13F | PFG Investments, LLC | 40 294 | 2,37 | 1 559 | −3,29 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 51 068 | −2,63 | 1 989 | −7,45 | ||||

| 2025-08-14 | 13F | Voya Financial Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-06-30 | NP | USAI - Pacer American Energy Independence ETF | 59 742 | 2,43 | 2 246 | −6,42 | ||||

| 2025-08-14 | 13F | Fmr Llc | 64 519 | −10,69 | 2 497 | −15,62 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 818 910 | −16,21 | 31 692 | −20,84 | ||||

| 2025-08-04 | 13F | ELCO Management Co., LLC | 60 075 | 6,53 | 2 325 | 0,65 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 208 252 | −1,51 | 8 059 | −6,94 | ||||

| 2025-07-29 | NP | Tortoise Capital Series Trust - Tortoise Essential Energy Fund | 99 531 | −11,97 | 3 722 | −18,88 | ||||

| 2025-05-06 | 13F | Venturi Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Samalin Investment Counsel, LLC | 31 004 | 4,32 | 1 200 | −1,48 | ||||

| 2025-08-04 | 13F | Terril Brothers, Inc. | 367 936 | 0,16 | 14 239 | −5,36 | ||||

| 2025-03-20 | NP | Dnp Select Income Fund Inc | 260 000 | −35,00 | 10 699 | −29,11 | ||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 83 713 | −0,68 | 3 429 | 5,84 | ||||

| 2025-08-12 | 13F | Nuveen, LLC | 7 391 | 3,60 | 286 | −2,05 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 5 961 | 9,88 | 231 | 3,60 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 25 748 | 1 | ||||||

| 2025-08-14 | 13F | Bramshill Investments, LLC | 18 272 | −0,48 | 707 | −5,98 | ||||

| 2025-06-30 | NP | RMLPX - Recurrent MLP & Infrastructure Fund Class I | 1 286 885 | 0,00 | 48 387 | −8,63 | ||||

| 2025-04-14 | NP | TORIX - Tortoise MLP & Pipeline Fund Institutional Class Shares | 2 609 289 | 11,49 | 105 885 | 11,13 | ||||

| 2025-08-14 | 13F | Wetherby Asset Management Inc | 7 450 | −2,61 | 288 | −1,71 | ||||

| 2025-08-11 | 13F | Empirical Finance, LLC | 122 699 | 4 748 | ||||||

| 2025-08-14 | 13F | McIlrath & Eck, LLC | 83 | 3 | ||||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 1 331 | 0,00 | 52 | 0,00 | ||||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 83 713 | 3 240 | ||||||

| 2025-08-14 | 13F | TCG Advisory Services, LLC | 44 920 | 2,16 | 1 738 | −3,50 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 529 | 2,32 | 0 | |||||

| 2025-06-26 | NP | BlackRock Funds II - BLACKROCK MULTI-ASSET INCOME PORTFOLIO INVESTOR C SHARES | 65 487 | 0,00 | 2 462 | −8,61 | ||||

| 2025-08-12 | 13F | Financial Advocates Investment Management | 9 096 | 352 | ||||||

| 2025-06-30 | 13F/A | Deutsche Bank Ag\ | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Truvestments Capital Llc | 585 | 0,00 | 23 | −4,35 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 72 747 | 20,84 | 2 900 | 17,65 | ||||

| 2025-08-14 | 13F | Militia Capital Partners, LP | 205 000 | 6 733,33 | 7 934 | 6 402,46 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 156 600 | 0,00 | 6 060 | −5,52 | ||||

| 2025-05-02 | 13F | Mountain Hill Investment Partners Corp. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F/A | Perritt Capital Management Inc | 109 | 0,00 | 4 | 0,00 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 33 337 | 0,03 | 1 290 | −5,49 | ||||

| 2025-04-09 | 13F | CenterStar Asset Management, LLC | Call | 0 | −100,00 | 0 | ||||

| 2025-07-29 | NP | Tortoise Capital Series Trust - TORTOISE NORTH AMERICAN PIPELINE FUND | 207 355 | 7 755 | ||||||

| 2025-07-14 | 13F | Painted Porch Advisors LLC | 2 890 | 2,34 | 112 | −3,48 | ||||

| 2025-07-16 | 13F | Eagle Global Advisors Llc | 1 925 950 | −18,82 | 74 534 | −23,30 | ||||

| 2025-07-18 | 13F | Requisite Capital Management, LLC | 33 915 | 6,92 | 1 313 | 1,00 | ||||

| 2025-08-14 | 13F | Blackstone Group Inc | 9 169 479 | −11,92 | 354 859 | −16,78 | ||||

| 2025-07-23 | NP | Clearbridge Energy Mlp Opportunity Fund Inc. This fund is a listed as child fund of Clearbridge, Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 232 943 | −3,92 | 83 512 | −11,45 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 1 640 | 1,05 | 63 | −4,55 | ||||

| 2025-08-28 | 13F/A | Lavaca Capital Llc | 108 000 | 0,00 | 4 180 | −5,52 | ||||

| 2025-08-11 | 13F | Alps Advisors Inc | 34 675 907 | 2,52 | 1 341 958 | −3,14 | ||||

| 2025-03-28 | NP | CZA - Invesco Zacks Mid-Cap ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 46 808 | −7,85 | 1 926 | 0,52 | ||||

| 2025-07-10 | 13F | Chickasaw Capital Management Llc | 6 794 472 | 1,08 | 263 | −4,73 | ||||

| 2025-08-11 | 13F/A | Kayne Anderson Capital Advisors Lp | 3 429 135 | −25,05 | 132 708 | −29,19 | ||||

| 2025-05-05 | 13F | Aire Advisors, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 726 633 | −5,45 | 28 121 | −10,66 | ||||

| 2025-08-27 | NP | Brighthouse Funds Trust I - BlackRock High Yield Portfolio Class A | 3 454 | 10,53 | 134 | 77,33 | ||||

| 2025-07-29 | NP | Tortoise Capital Series Trust - Tortoise Energy Infrastructure Total Return Fund A Class | 2 447 606 | 91 540 | ||||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 4 849 | −2,79 | 188 | −8,33 | ||||

| 2025-07-25 | NP | CSHAX - MainStay Cushing MLP Premier Fund Class A | 700 000 | −26,70 | 26 180 | −32,44 | ||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 4 450 | 13,87 | 172 | 7,50 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 1 759 | 0,00 | 68 | −5,56 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 726 | 2,25 | 28 | −3,45 | ||||

| 2025-08-04 | 13F | Keybank National Association/oh | 35 725 | −3,01 | 1 383 | −8,36 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 25 003 | 39,13 | 968 | 31,39 | ||||

| 2025-07-16 | 13F | American National Bank | 885 | −18,36 | 34 | −22,73 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 71 789 | −30,64 | 2 778 | −34,47 | ||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 200 | 0,00 | 8 | −12,50 | ||||

| 2025-07-15 | 13F | MCF Advisors LLC | 1 300 | 0,00 | 50 | −5,66 | ||||

| 2025-08-18 | 13F/A | Westwood Holdings Group Inc | 1 808 402 | −3,36 | 69 985 | −8,69 | ||||

| 2025-08-14 | 13F | Barnett & Company, Inc. | 5 700 | 0,00 | 221 | −5,58 | ||||

| 2025-05-15 | 13F | Caption Management, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 54 278 | 1,75 | 2 101 | −3,89 | ||||

| 2025-05-08 | 13F | Howard Capital Management Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | MLXAX - Catalyst MLP & Infrastructure Fund Class A | 472 420 | 2,40 | 18 283 | −3,25 | ||||

| 2025-07-29 | NP | MLPRX - Invesco Oppenheimer SteelPath MLP Income Fund Class C | 15 173 546 | 2,71 | 567 491 | −5,34 | ||||

| 2025-07-30 | NP | MLPA - Global X MLP ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 5 158 461 | 15,13 | 192 926 | 6,11 | ||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 226 | 9 | ||||||

| 2025-07-07 | 13F | Fractal Investments LLC | 1 467 506 | 0,00 | 56 792 | −5,52 | ||||

| 2025-07-17 | 13F | Fort Washington Investment Advisors Inc /oh/ | 29 180 | 0,00 | 1 129 | −5,52 | ||||

| 2025-08-14 | 13F | Infrastructure Capital Advisors, Llc | 1 536 919 | 59 479 | ||||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 52 550 | 10,27 | 2 034 | 4,20 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 75 374 | −1,32 | 2 917 | −6,78 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 36 084 | 32,03 | 1 | 0,00 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-16 | 13F | Novem Group | 18 223 | 0,45 | 705 | −5,11 | ||||

| 2025-08-11 | 13F | Westover Capital Advisors, LLC | 7 700 | 0,00 | 298 | −5,71 | ||||

| 2025-08-29 | NP | Highland Global Allocation Fund | 139 050 | 0,00 | 5 381 | −5,51 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 82 091 | −30,92 | 3 177 | −34,74 | ||||

| 2025-08-13 | 13F | Prossimo Advisors, LLC | 5 409 | 0,00 | 0 | |||||

| 2025-05-08 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Summit Financial Wealth Advisors, LLC | 5 000 | 205 | ||||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 6 645 | −38,64 | 257 | −41,99 | ||||

| 2025-08-01 | 13F | Pavion Blue Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | West Financial Advisors, LLC | 110 | 2,80 | 4 | 0,00 | ||||

| 2025-06-25 | NP | Ultimus Managers Trust - Westwood Salient Enhanced Midstream Income ETF | 54 116 | 5,06 | 2 035 | −4,01 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 210 | 0,00 | 8 | 0,00 | ||||

| 2025-08-13 | 13F | Nbw Capital Llc | 311 118 | −0,35 | 12 040 | −5,84 | ||||

| 2025-08-26 | NP | UMI - USCF Midstream Energy Income Fund | 206 527 | 22,46 | 7 993 | 15,71 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 9 337 | 5,21 | 361 | −0,55 | ||||

| 2025-08-14 | 13F | Highland Capital Management Fund Advisors, L.p. | 139 050 | 0,00 | 5 381 | −5,51 | ||||

| 2025-08-14 | 13F | Snowden Capital Advisors LLC | 10 965 | 29,49 | 424 | 22,54 | ||||

| 2025-07-28 | 13F | Curated Wealth Partners LLC | 6 400 | 0,00 | 248 | −5,73 | ||||

| 2025-07-23 | 13F | Abel Hall, LLC | 10 000 | 0,00 | 387 | −5,38 | ||||

| 2025-07-14 | 13F | Cushing Asset Management, Lp | 1 203 900 | −9,73 | 46 591 | −14,71 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 6 150 | 1,13 | 238 | −4,42 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 10 757 | 4,46 | 416 | −1,19 | ||||

| 2025-07-14 | 13F | Armstrong Advisory Group, Inc | 500 | 19 | ||||||

| 2025-07-23 | 13F | Tectonic Advisors Llc | 142 430 | 2,32 | 5 512 | −3,32 | ||||

| 2025-07-23 | 13F | Cfm Wealth Partners Llc | 44 944 | 0,00 | 1 739 | −5,49 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 4 205 | −5,61 | 163 | −10,99 | ||||

| 2025-08-27 | NP | Mason Capital Fund Trust - Fundamentals First ETF | 1 272 | 0,00 | 49 | −5,77 | ||||

| 2025-08-28 | NP | USNG - Amplify Samsung U.S. Natural Gas Infrastructure ETF | 3 528 | 137 | ||||||

| 2025-08-07 | 13F | Bearing Point Capital, Llc | 5 800 | 0,00 | 224 | −5,49 | ||||

| 2025-05-14 | 13F | Bbr Partners, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | Elevation Series Trust - RiverNorth Patriot ETF | 438 | 17 | ||||||

| 2025-08-08 | 13F | MTM Investment Management, LLC | 1 000 | 39 | ||||||

| 2025-07-22 | 13F | Investors Asset Management Of Georgia Inc /ga/ /adv | 6 932 | 0,00 | 268 | −5,30 | ||||

| 2025-07-30 | 13F | Brookstone Capital Management | 12 457 | 10,74 | 482 | 4,78 | ||||

| 2025-07-08 | 13F/A | Adams Asset Advisors, LLC | 327 105 | 1,03 | 12 659 | −4,55 | ||||

| 2025-07-30 | NP | SOAEX - Spirit of America Energy Fund Class A | 137 650 | −14,85 | 5 148 | −21,51 | ||||

| 2025-07-30 | NP | ORR - Militia Long/Short Equity ETF | 116 294 | 4 349 | ||||||

| 2025-08-14 | 13F | Warren Averett Asset Management, LLC | 316 065 | 1,24 | 12 232 | −4,35 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 8 558 | −49,01 | 349 | −49,34 | ||||

| 2025-08-21 | NP | EINC - VanEck Vectors Energy Income ETF | 50 435 | 11,89 | 1 952 | 5,69 | ||||

| 2025-06-26 | NP | BlackRock ETF Trust II - BlackRock High Yield ETF This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 326 | 12 | ||||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 89 419 | 55,31 | 3 460 | 46,73 | ||||

| 2025-07-30 | 13F | Princeton Global Asset Management LLC | 700 | 0,00 | 27 | −3,57 | ||||

| 2025-07-21 | 13F | Sovereign Investment Advisors, LLC | 274 479 | 0,00 | 10 622 | 8,87 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 1 275 | 49 | ||||||

| 2025-07-24 | 13F | Cyndeo Wealth Partners, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Jump Financial, LLC | 111 445 | 469,09 | 4 313 | 437,66 | ||||

| 2025-08-13 | 13F | Cary Street Partners Financial Llc | 1 017 | 0,00 | 39 | −4,88 | ||||

| 2025-08-12 | 13F | Pacer Advisors, Inc. | 60 767 | 1,75 | 2 352 | −3,88 | ||||

| 2025-08-12 | 13F | Clearbridge Investments, LLC | 2 232 943 | −3,92 | 86 415 | −9,22 | ||||

| 2025-05-15 | 13F | Nomura Holdings Inc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-07 | 13F | Pinnacle Holdings, LLC | 67 201 | 1,03 | 2 601 | −4,55 | ||||

| 2025-06-26 | NP | MSTQX - Morningstar U.S. Equity Fund | 13 301 | −52,51 | 500 | −56,60 | ||||

| 2025-07-28 | 13F | Mutual Advisors, LLC | 9 793 | 58,98 | 399 | 66,95 | ||||

| 2025-07-23 | 13F | Hardy Reed LLC | 13 450 | −28,65 | 521 | −32,64 | ||||

| 2025-07-29 | NP | SPMHX - Invesco Oppenheimer SteelPath MLP Alpha Fund Class R5 | 3 463 036 | 16,70 | 129 518 | 7,56 | ||||

| 2025-08-12 | 13F | Investor's Fiduciary Advisor Network, LLC | 5 500 | 0,00 | 0 | |||||

| 2025-08-04 | 13F | Daymark Wealth Partners, Llc | 45 774 | 0,59 | 1 771 | −4,94 |