Grundläggande statistik

| Institutionella ägare | 654 total, 644 long only, 6 short only, 4 long/short - change of −5,88% MRQ |

| Genomsnittlig portföljallokering | 1.0177 % - change of −12,75% MRQ |

| Institutionella aktier (lång) | 330 232 780 (ex 13D/G) - change of −57,16MM shares −14,76% MRQ |

| Institutionellt värde (lång) | $ 6 563 404 USD ($1000) |

Institutionellt ägande och aktieägare

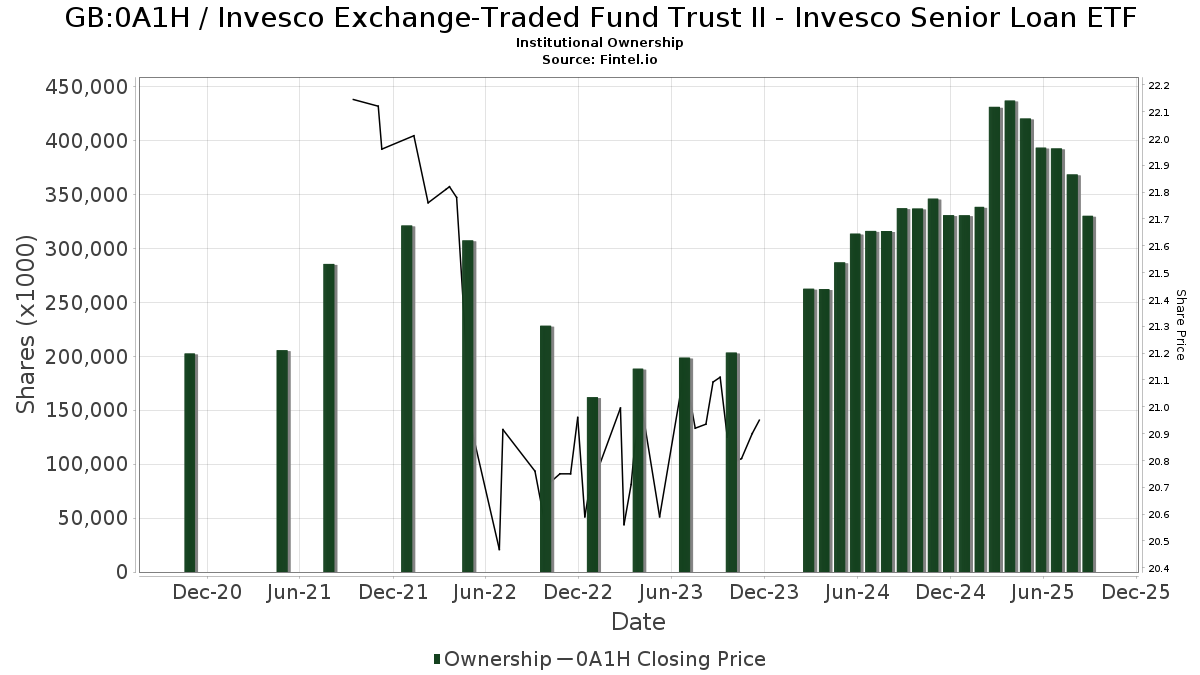

Invesco Exchange-Traded Fund Trust II - Invesco Senior Loan ETF (GB:0A1H) har 654 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 330,234,896 aktier. Största aktieägare inkluderar Healthcare Of Ontario Pension Plan Trust Fund, BlackRock, Inc., Morgan Stanley, Investment Management Corp of Ontario, Manufacturers Life Insurance Company, The, Invesco Ltd., Charles Schwab Investment Management Inc, UBS Group AG, Barclays Plc, and Bank Of America Corp /de/ .

Invesco Exchange-Traded Fund Trust II - Invesco Senior Loan ETF (LSE:0A1H) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-06 | 13F | Prospera Financial Services Inc | 72 543 | 9,06 | 1 518 | 10,25 | ||||

| 2025-08-26 | NP | PSFRX - Virtus Newfleet Senior Floating Rate Fund Class A | 77 095 | 60,70 | 1 613 | 62,34 | ||||

| 2025-07-30 | 13F | Strategic Blueprint, LLC | 26 837 | −5,25 | 561 | −4,27 | ||||

| 2025-08-28 | NP | RSFLX - Victory Floating Rate Fund Class A | 400 000 | 0,00 | 8 368 | 1,06 | ||||

| 2025-08-05 | 13F | J. W. Coons Advisors, LLC | 19 760 | −1,50 | 413 | −0,48 | ||||

| 2025-08-14 | 13F | Macquarie Group Ltd | 844 157 | 0,00 | 17 660 | 1,06 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 451 388 | 53,55 | 9 | 50,00 | ||||

| 2025-08-01 | 13F | Pasadena Private Wealth, LLC | 27 550 | 1,47 | 576 | 2,49 | ||||

| 2025-08-27 | NP | ACEFX - Absolute Strategies Fund Institutional Shares | Short | −1 600 | −33 | |||||

| 2025-07-22 | 13F | Wealthcare Capital Management Llc | 26 650 | −7,27 | 558 | −6,23 | ||||

| 2025-07-28 | 13F | Deroy & Devereaux Private Investment Counsel Inc | 30 875 | −4,63 | 1 | |||||

| 2025-08-28 | NP | PLFLX - Aristotle Floating Rate Income Fund Class A | 1 972 072 | −46,66 | 41 256 | −46,10 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 270 997 | 21,84 | 5 669 | 23,13 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Warren Averett Asset Management, LLC | 72 046 | −1,34 | 1 507 | −0,26 | ||||

| 2025-08-08 | 13F | Emerald Investment Partners, Llc | 3 491 | −1,66 | 73 | 0,00 | ||||

| 2025-08-12 | 13F | Stelac Advisory Services LLC | 43 797 | −36,07 | 916 | −35,49 | ||||

| 2025-07-29 | NP | WAVLX - Wavelength Interest Rate Neutral Fund | 365 701 | −29,90 | 7 629 | −30,24 | ||||

| 2025-08-14 | 13F | Bnp Paribas | 3 189 985 | 31,15 | 66 734 | 32,55 | ||||

| 2025-08-06 | 13F | Strategic Financial Partners, Ltd. | 22 255 | 466 | ||||||

| 2025-08-13 | 13F | Fiduciary Group LLC | 12 740 | 11,36 | 267 | 12,71 | ||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Planwiser Financial, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | Opal Wealth Advisors, LLC | 12 316 | 1,79 | 258 | 2,80 | ||||

| 2025-08-14 | 13F | BancorpSouth Bank | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Virtue Capital Management, LLC | 167 110 | 1 524,48 | 3 496 | 1 548,58 | ||||

| 2025-03-26 | NP | MHITX - MFS High Income Fund A | 899 500 | 0,00 | 18 934 | 0,29 | ||||

| 2025-05-30 | NP | AIM VARIABLE INSURANCE FUNDS (INVESCO VARIABLE INSURANCE FUNDS) - Invesco Oppenheimer V.I. Global Strategic Income Fund Series II | 734 000 | 0,00 | 15 194 | −1,76 | ||||

| 2025-07-24 | 13F | Mainstay Capital Management Llc /adv | 22 012 | 73,15 | 460 | 74,90 | ||||

| 2025-08-12 | 13F | Cutter & CO Brokerage, Inc. | 0 | −100,00 | 0 | |||||

| 2025-05-06 | 13F | WT Wealth Management | 150 633 | 112,24 | 3 118 | 108,56 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 88 664 | −14,32 | 1 855 | −13,40 | ||||

| 2025-08-11 | 13F | Traub Capital Management LLC | 960 | 20 | ||||||

| 2025-05-30 | NP | RMIF - LHA Risk-Managed Income ETF | 345 705 | 0,00 | 7 156 | −1,76 | ||||

| 2025-07-08 | 13F | Everpar Advisors Llc | 23 006 | 0,96 | 481 | 2,12 | ||||

| 2025-07-17 | 13F | Charles Schwab Trust Co | 104 503 | −2,58 | 2 186 | −1,53 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | FIXP - FolioBeyond Enhanced Fixed Income Premium ETF | 102 973 | −38,74 | 2 134 | −39,71 | ||||

| 2025-07-18 | 13F | PFG Investments, LLC | 16 894 | 4,33 | 353 | 5,37 | ||||

| 2025-07-31 | 13F | Topsail Wealth Management, LLC | 660 | 0,00 | 14 | 0,00 | ||||

| 2025-08-11 | 13F | First American Trust, Fsb | 12 386 | 0,00 | 259 | 1,17 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 13 745 | −4,05 | 0 | |||||

| 2025-08-13 | 13F | Crabel Capital Management, LLC | 260 418 | 149,77 | 5 448 | 152,41 | ||||

| 2025-07-29 | NP | JRTGX - Multi-Index 2030 Lifetime Portfolio Class 1 | 527 056 | 1,67 | 10 994 | 1,19 | ||||

| 2025-08-12 | 13F | Hikari Tsushin, Inc. | 2 483 848 | 0,00 | 51 962 | 1,06 | ||||

| 2025-08-26 | NP | Blackrock Floating Rate Income Trust This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 540 400 | 0,00 | 11 305 | 1,06 | ||||

| 2025-08-14 | 13F | Comerica Bank | 244 078 | 7,64 | 5 106 | 8,80 | ||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 71 | 2,90 | 1 | 0,00 | ||||

| 2025-08-28 | NP | FLOAX - Power Floating Rate Index Fund Class A | 762 130 | 491,59 | 15 944 | 498,01 | ||||

| 2025-07-21 | 13F | AEGON USA Investment Management, LLC | 36 000 | −49,30 | 753 | −48,74 | ||||

| 2025-07-31 | 13F | Catalyst Capital Advisors LLC | 901 688 | 26,81 | 18 863 | 28,16 | ||||

| 2025-08-26 | NP | Blackrock Debt Strategies Fund, Inc. This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 961 200 | 0,00 | 20 108 | 1,07 | ||||

| 2025-08-04 | 13F | Center for Financial Planning, Inc. | 0 | −100,00 | 0 | |||||

| 2025-05-13 | 13F | CacheTech Inc. | 67 452 | 21,81 | 1 396 | 19,73 | ||||

| 2025-07-22 | 13F | Wealthcare Capital Partners, LLC | 23 106 | 9,54 | 483 | 10,78 | ||||

| 2025-05-01 | 13F | Quest 10 Wealth Builders, Inc. | 4 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | XTX Topco Ltd | 25 728 | −10,66 | 538 | −9,73 | ||||

| 2025-07-15 | 13F | Family Investment Center, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | Chris Bulman Inc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 10 614 | 6,24 | 0 | |||||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 6 760 | 0,00 | 141 | 1,44 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 848 830 | −74,61 | 17 758 | −74,34 | ||||

| 2025-08-28 | NP | SSIZX - Sierra Tactical Core Income Fund Class A Shares | 6 190 400 | 161,15 | 129 503 | 163,93 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 28 705 | −1,86 | 601 | −0,83 | ||||

| 2025-08-12 | 13F | Ensign Peak Advisors, Inc | 5 366 416 | −30,87 | 112 265 | −30,14 | ||||

| 2025-08-05 | 13F | iA Global Asset Management Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Castlekeep Investment Advisors Llc | 111 435 | −0,86 | 2 331 | 0,21 | ||||

| 2025-08-22 | 13F/A | TT Capital Management LLC | 113 704 | 46,98 | 2 379 | 48,53 | ||||

| 2025-07-17 | 13F | HCR Wealth Advisors | 151 413 | 1,93 | 3 168 | 2,99 | ||||

| 2025-08-06 | 13F | Axim Planning & Wealth | 10 534 | 220 | ||||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 58 046 | 35,50 | 1 214 | 34,59 | ||||

| 2025-08-07 | 13F | Readystate Asset Management Lp | 54 981 | 0,20 | 1 150 | 1,32 | ||||

| 2025-07-30 | 13F | BTS Asset Management, Inc. | 14 434 | −3,11 | 302 | −2,27 | ||||

| 2025-08-14 | 13F | Parallax Volatility Advisers, L.P. | 1 | 0 | ||||||

| 2025-08-14 | 13F | Parallax Volatility Advisers, L.P. | Put | 250 000 | −66,67 | 5 230 | −66,31 | |||

| 2025-08-14 | 13F | Diversify Wealth Management, Llc | 306 743 | 17,49 | 6 429 | 18,79 | ||||

| 2025-05-29 | NP | APOIX - Short Duration Inflation Protection Bond Fund Investor Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 361 300 | −5,67 | 7 479 | −7,32 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 54 595 | −89,90 | 1 142 | −89,79 | ||||

| 2025-07-18 | 13F | Ninety One North America, Inc. | 20 000 | 0,00 | 418 | 0,97 | ||||

| 2025-08-06 | 13F | Summit Investment Advisors, Inc. | 32 310 | 13,32 | 675 | 13,85 | ||||

| 2025-08-14 | 13F | Clark Capital Management Group, Inc. | 99 540 | 2 082 | ||||||

| 2025-06-26 | NP | NMYHX - Nuveen High Yield Managed Accounts Portfolio Common Shares | 8 500 | 0,00 | 176 | −1,12 | ||||

| 2025-08-12 | 13F | Ameritas Investment Partners, Inc. | 7 311 | 28,06 | 153 | 28,81 | ||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 512 190 | −31,12 | 10 715 | −30,39 | ||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 93 000 | −72,91 | 2 | −85,71 | ||||

| 2025-08-08 | 13F | Mittelman Wealth Management | 48 376 | 79,90 | 1 012 | 82,01 | ||||

| 2025-05-29 | NP | ACSKX - Short Duration Fund C Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 277 500 | −7,41 | 5 744 | −9,03 | ||||

| 2025-08-06 | 13F | Black Swift Group, LLC | 33 725 | −70,97 | 706 | −70,67 | ||||

| 2025-08-11 | 13F | Elequin Capital Lp | 38 645 | 41,72 | 808 | 43,26 | ||||

| 2025-03-27 | NP | BlackRock ETF Trust II - BlackRock Flexible Income ETF This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 713 883 | 36 077 | ||||||

| 2025-07-15 | 13F | McAdam, LLC | 197 485 | −5,67 | 4 131 | −4,66 | ||||

| 2025-07-18 | 13F | New Wave Wealth Advisors Llc | 17 259 | −0,86 | 361 | 0,28 | ||||

| 2025-07-21 | 13F | Creative Capital Management Investments LLC | 5 583 | −17,90 | 117 | −17,14 | ||||

| 2025-08-18 | 13F | Ashford Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Richards, Merrill & Peterson, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-25 | NP | BNY Mellon Alcentra Global Multi-Strategy Credit Fund, Inc. | 95 626 | 2 000 | ||||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Put | 38 000 | −40,62 | 795 | −40,03 | |||

| 2025-07-29 | 13F | Private Trust Co Na | 9 750 | 35,34 | 204 | 36,24 | ||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 253 651 | −11,14 | 5 306 | −10,19 | ||||

| 2025-08-14 | 13F | McIlrath & Eck, LLC | 2 063 | 0,00 | 43 | 2,38 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 16 294 | 0,00 | 341 | 0,89 | ||||

| 2025-07-17 | 13F | Independence Bank of Kentucky | 3 825 | 80 | ||||||

| 2025-07-31 | 13F | Moser Wealth Advisors, LLC | 183 | 4 | ||||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 406 406 | 5,34 | 9 | 14,29 | ||||

| 2025-08-08 | 13F | Advyzon Investment Management, LLC | 27 041 | 13,39 | 566 | 14,60 | ||||

| 2025-08-26 | NP | VMAFX - Virtus Newfleet Floating Rate MACS | 30 865 | 646 | ||||||

| 2025-06-27 | NP | PCSIX - PACE Strategic Fixed Income Investments Class P | 82 474 | 0,00 | 1 709 | −1,61 | ||||

| 2025-05-28 | NP | TIYRX - TIAA-CREF High-Yield Fund Retail Class | 353 940 | −50,00 | 7 327 | −50,88 | ||||

| 2025-06-24 | NP | FAFRX - Franklin Floating Rate Daily Access Fund Class A | 613 270 | 0,00 | 12 707 | −1,57 | ||||

| 2025-08-01 | 13F | New York Life Investment Management Llc | 493 605 | −70,51 | 10 326 | −70,20 | ||||

| 2025-07-10 | 13F | Worth Asset Management, LLC | 12 746 | −62,18 | 267 | −61,84 | ||||

| 2025-07-22 | 13F | Appleton Partners Inc/ma | 145 866 | 0,09 | 3 | 0,00 | ||||

| 2025-08-13 | 13F | Loomis Sayles & Co L P | 128 000 | −68,63 | 2 678 | 33 362,50 | ||||

| 2025-08-04 | 13F | MeadowBrook Investment Advisors LLC | 3 424 | 0,00 | 72 | 1,43 | ||||

| 2025-07-11 | 13F | Brendel Financial Advisors LLC | 124 803 | −0,39 | 3 | 0,00 | ||||

| 2025-08-11 | 13F | Western Wealth Management, LLC | 10 150 | 0,00 | 212 | 0,95 | ||||

| 2025-08-13 | 13F | Garner Asset Management Corp | 95 991 | −13,13 | 2 008 | −12,20 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 61 991 | 3,08 | 1 297 | 4,09 | ||||

| 2025-07-23 | 13F | Motiv8 Investments LLC | 41 506 | −23,46 | 868 | −22,64 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 26 464 | 2,76 | 554 | 3,75 | ||||

| 2025-07-16 | 13F | Cadent Capital Advisors, LLC | 10 665 | −53,79 | 223 | −53,25 | ||||

| 2025-07-14 | 13F | Cobblestone Asset Management LLC | 24 584 | −9,70 | 514 | −8,70 | ||||

| 2025-08-11 | 13F | Citigroup Inc | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-12 | 13F | Hillsdale Investment Management Inc. | 28 550 | −31,12 | 597 | −30,42 | ||||

| 2025-08-14 | 13F | Diameter Capital Partners LP | Put | 0 | −100,00 | 0 | ||||

| 2025-07-23 | 13F | Eagle Strategies LLC | 19 245 | 65,21 | 403 | 66,80 | ||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 695 483 | 35,86 | 14 550 | 37,31 | ||||

| 2025-07-31 | 13F | Wright Fund Managment, LLC | 4 668 134 | 0,00 | 96 630 | 0,00 | ||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 3 111 | −0,67 | 65 | 1,56 | ||||

| 2025-08-05 | 13F | Carolinas Wealth Consulting Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Elios Financial Group Inc. | 15 584 | 17,30 | 326 | 18,55 | ||||

| 2025-07-22 | 13F | Grimes & Company, Inc. | 169 224 | −98,35 | 3 540 | −98,33 | ||||

| 2025-06-26 | NP | AAINX - Thrivent Opportunity Income Plus Fund Class A | 46 926 | −42,42 | 972 | −43,32 | ||||

| 2025-05-28 | NP | THRIVENT SERIES FUND INC - Thrivent Opportunity Income Plus Portfolio Class A | 2 000 | 0,00 | 41 | −2,38 | ||||

| 2025-07-30 | 13F | Onyx Bridge Wealth Group LLC | 11 413 | −97,86 | 239 | −97,84 | ||||

| 2025-07-15 | 13F | Optima Capital Llc | 50 024 | 55,66 | 1 047 | 57,29 | ||||

| 2025-08-18 | 13F | Hollencrest Capital Management | 3 442 | 1,95 | 72 | 4,35 | ||||

| 2025-07-17 | 13F | Greenleaf Trust | 30 185 | 631 | ||||||

| 2025-08-12 | 13F | Horizon Financial Services, Llc | 3 184 | 0,09 | 67 | 1,54 | ||||

| 2025-04-29 | 13F | Lee Danner & Bass Inc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-07 | 13F | Insight Wealth Strategies, LLC | 882 447 | 0,71 | 18 470 | 1,83 | ||||

| 2025-05-28 | NP | THRIVENT SERIES FUND INC - Thrivent Moderately Conservative Allocation Portfolio Class A | 6 000 | −50,00 | 124 | −50,79 | ||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 16 290 | 0,00 | 341 | 0,89 | ||||

| 2025-08-07 | 13F | 1620 Investment Advisors, Inc. | 11 592 | −0,60 | 243 | 0,41 | ||||

| 2025-07-23 | 13F | Nbt Bank N A /ny | 12 765 | 0,00 | 267 | 1,14 | ||||

| 2025-07-21 | 13F | Mechanics Financial Corp | 240 | 0,00 | 5 | 25,00 | ||||

| 2025-08-27 | NP | QCILRX - Inflation-Linked Bond Account Class R1 | 475 737 | 0,00 | 9 952 | 1,07 | ||||

| 2025-08-14 | 13F | Man Group plc | 1 547 307 | 26,58 | 32 370 | 27,92 | ||||

| 2025-03-25 | NP | FLARX - Pioneer Floating Rate Fund : Class A | 328 600 | −0,42 | 6 917 | −0,13 | ||||

| 2025-08-14 | 13F | Janus Henderson Group Plc | 964 507 | 20 177 | ||||||

| 2025-08-13 | 13F | Centiva Capital, LP | 478 193 | 10 004 | ||||||

| 2025-08-13 | 13F | Jones Road Capital Management, L.p. | 0 | −100,00 | 0 | |||||

| 2025-05-29 | NP | ACITX - Inflation-adjusted Bond Fund Investor Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 558 800 | −5,66 | 11 567 | −7,31 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 122 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | MGB Wealth Management, LLC | 3 200 | 0,00 | 67 | 0,00 | ||||

| 2025-06-26 | NP | AABFX - Thrivent Balanced Income Plus Fund Class A | 8 836 | −26,37 | 183 | −27,38 | ||||

| 2025-08-14 | 13F | Little Harbor Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-25 | 13F/A | Promus Capital, LLC | 428 | 0,00 | 9 | 0,00 | ||||

| 2025-08-14 | 13F | New England Asset Management Inc | 245 | 0,00 | 5 | 0,00 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 948 889 | 2,32 | 19 851 | 3,41 | ||||

| 2025-07-21 | 13F | Yeomans Consulting Group, Inc. | 321 232 | −48,47 | 6 723 | −47,89 | ||||

| 2025-08-12 | 13F | Corebridge Financial, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Investment Management Corp of Ontario | 9 726 878 | 34,71 | 203 486 | 36,14 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 50 638 | 1 059 | ||||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 584 | 5,23 | 12 | 9,09 | ||||

| 2025-07-30 | 13F | LGT Financial Advisors LLC | 133 | 3 | ||||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 95 324 | −66,57 | 1 994 | −66,21 | ||||

| 2025-08-14 | 13F | III Capital Management | 0 | −100,00 | 0 | |||||

| 2025-04-18 | NP | MUSI - American Century Multisector Income ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 87 146 | 1,01 | 1 827 | 0,27 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 48 920 | 6,92 | 1 023 | 8,03 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 64 632 | −2,05 | 1 | 0,00 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 581 689 | −0,17 | 12 169 | 0,89 | ||||

| 2025-08-26 | NP | Ivy Variable Insurance Portfolios - Ivy VIP High Income Class II | 424 157 | 0,00 | 8 873 | 1,06 | ||||

| 2025-07-31 | 13F | Prudent Man Advisors, LLC | 47 700 | 0,00 | 998 | 1,01 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 334 | 7 | ||||||

| 2025-08-14 | 13F | Stifel Financial Corp | 123 470 | −20,49 | 2 583 | −19,66 | ||||

| 2025-08-15 | 13F | Asset Allocation Strategies LLC | 83 956 | 12,88 | 1 756 | 14,10 | ||||

| 2025-08-14 | 13F | Winton Capital Group Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Edenbrook Capital, LLC | Put | 200 000 | −60,00 | 4 184 | −59,57 | |||

| 2025-07-24 | NP | LFRAX - Lord Abbett Floating Rate Fund Class A | 3 900 384 | −13,02 | 81 362 | −13,44 | ||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 9 288 158 | −8,48 | 194 308 | −7,51 | ||||

| 2025-08-11 | 13F | CBIZ Investment Advisory Services, LLC | 29 | −75,63 | 1 | −100,00 | ||||

| 2025-06-25 | NP | RFRAX - Columbia Floating Rate Fund Class A | 190 000 | 0,00 | 3 937 | −1,58 | ||||

| 2025-08-04 | 13F | Joseph P. Lucia & Associates, LLC | 16 808 | 28,82 | 352 | 30,00 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 3 235 144 | −43,69 | 67 529 | −43,22 | ||||

| 2025-08-11 | 13F | Shenkman Capital Management Inc | 3 737 000 | 37,18 | 87 056 | 54,87 | ||||

| 2025-08-11 | 13F | FSC Wealth Advisors, LLC | 8 819 | 8,08 | 184 | 9,52 | ||||

| 2025-08-27 | NP | THRIVENT SERIES FUND INC - Thrivent Moderately Aggressive Allocation Portfolio Class A | 14 857 | −35,40 | 311 | −34,87 | ||||

| 2025-07-10 | 13F | Rfg Holdings, Inc. | 1 771 270 | 2,08 | 37 055 | 3,16 | ||||

| 2025-08-11 | 13F | Oder Investment Management, LLC | 25 449 | 9,38 | 532 | 10,14 | ||||

| 2025-07-21 | 13F | Quattro Financial Advisors Llc | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 3 153 | 26,93 | 66 | 27,45 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 8 710 101 | −21,81 | 182 215 | −20,98 | ||||

| 2025-08-01 | 13F | Bank of Jackson Hole Trust | 179 | 0,00 | 4 | 0,00 | ||||

| 2025-08-26 | NP | Blackrock Credit Allocation Income Trust This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 170 000 | 0,00 | 3 556 | 1,05 | ||||

| 2025-05-28 | NP | THRIVENT SERIES FUND INC - Thrivent Balanced Income Plus Portfolio Class A | 2 500 | −28,57 | 52 | −30,14 | ||||

| 2025-08-05 | 13F | Welch & Forbes Llc | 62 199 | −39,54 | 1 301 | −38,89 | ||||

| 2025-08-13 | 13F | Cary Street Partners Financial Llc | 47 088 | −0,36 | 985 | 0,72 | ||||

| 2025-08-05 | 13F | Sumitomo Life Insurance Co | 2 167 247 | −35,26 | 45 339 | −34,57 | ||||

| 2025-07-31 | 13F | LJI Wealth Management, LLC | 14 604 | −9,87 | 306 | −8,96 | ||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | MAI Capital Management | 24 546 | 0,44 | 514 | 1,58 | ||||

| 2025-08-26 | NP | Blackrock Ltd Duration Income Trust This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 80 000 | 0,00 | 1 674 | 1,03 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 224 081 | −21,02 | 4 688 | −20,18 | ||||

| 2025-07-28 | 13F | IFG Advisors, LLC | 87 889 | 5,46 | 1 839 | 6,55 | ||||

| 2025-08-01 | 13F | Brookwood Investment Group LLC | 48 930 | 16,97 | 1 024 | 18,27 | ||||

| 2025-07-18 | 13F | SOA Wealth Advisors, LLC. | 1 357 | 1,95 | 28 | 3,70 | ||||

| 2025-05-20 | NP | GFRAX - Goldman Sachs High Yield Floating Rate Fund Class A Shares | 906 825 | 0,00 | 18 771 | −1,75 | ||||

| 2025-08-14 | 13F | Hilltop Holdings Inc. | 41 944 | 5,92 | 877 | 7,08 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-29 | NP | Pioneer Floating Rate Trust | 150 000 | −66,67 | 3 129 | −68,41 | ||||

| 2025-08-07 | 13F | LFA - Lugano Financial Advisors SA | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | City Holding Co | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-29 | NP | AIM INVESTMENT SECURITIES FUNDS (INVESCO INVESTMENT SECURITIES FUNDS) - Invesco SMA High Yield Bond Fund | 15 000 | 313 | ||||||

| 2025-08-14 | 13F | Capstone Investment Advisors, Llc | 0 | −100,00 | 0 | |||||

| 2025-05-12 | 13F | SOUTH STATE Corp | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 62 926 | 318,92 | 1 316 | 325,89 | ||||

| 2025-07-23 | 13F | DMG Group, LLC | 23 956 | −49,98 | 501 | −49,45 | ||||

| 2025-08-07 | 13F | Verus Capital Partners, Llc | 55 401 | 149,96 | 1 159 | 152,84 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | −100,00 | 0 | |||||

| 2025-05-05 | 13F | Mariner Investment Group Llc | Put | 0 | −100,00 | 0 | ||||

| 2025-08-28 | NP | BTSAX - BTS Managed Income Fund Class A Shares | 13 607 | −4,31 | 285 | −3,40 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 29 620 | 2,45 | 620 | 3,34 | ||||

| 2025-05-15 | 13F | Citadel Advisors Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-03-28 | NP | QAI - IQ Hedge Multi-Strategy Tracker ETF | 913 353 | 30,87 | 19 226 | 31,24 | ||||

| 2025-07-29 | NP | JLGOX - Multi-Index Lifestyle Growth Portfolio Class 1 | 890 546 | −4,71 | 18 577 | −5,17 | ||||

| 2025-08-11 | 13F | Trajan Wealth LLC | 861 827 | −0,87 | 18 029 | 0,18 | ||||

| 2025-08-28 | NP | SIRAX - Sierra Tactical All Asset Fund Class A | 196 900 | −83,08 | 4 119 | −82,90 | ||||

| 2025-08-28 | NP | TFAFX - Tactical Growth Allocation Fund Class I | 7 400 | −20,43 | 155 | −19,79 | ||||

| 2025-07-09 | 13F | VisionPoint Advisory Group, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-04-30 | 13F | BCJ Capital Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Tradewinds Capital Management, LLC | 115 373 | −1,20 | 2 414 | −0,17 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 21 128 | −9,08 | 442 | −8,32 | ||||

| 2025-07-16 | 13F | Ironwood Wealth Management, Inc. | 1 113 227 | 0,04 | 23 322 | 2,59 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 11 520 | 10,90 | 241 | 12,09 | ||||

| 2025-07-30 | 13F | IMG Wealth Management, Inc. | 4 491 | 29,24 | 94 | 30,99 | ||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 652 | 0,00 | 14 | 0,00 | ||||

| 2025-08-11 | 13F | Estate Counselors, LLC | 445 295 | 9 316 | ||||||

| 2025-07-22 | 13F | Sage Financial Group Inc | 71 107 | −22,41 | 1 488 | −21,61 | ||||

| 2025-07-28 | 13F | Td Asset Management Inc | 4 608 001 | −8,88 | 96 399 | −7,92 | ||||

| 2025-07-23 | 13F | Pillar Financial Advisors, LLC | 81 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | 10Elms LLP | 455 | 0,00 | 10 | 0,00 | ||||

| 2025-06-26 | NP | BlackRock Funds V - BlackRock Floating Rate Income Portfolio Investor A Shares | 1 896 257 | −59,36 | 39 290 | −60,00 | ||||

| 2025-04-29 | NP | Northern Lights Fund Trust IV - Brookstone Yield ETF | 343 799 | 3,75 | 7 206 | 3,02 | ||||

| 2025-07-18 | 13F | Ninety One UK Ltd | 846 749 | 0,00 | 17 714 | 1,06 | ||||

| 2025-08-11 | 13F | Intrust Bank Na | 40 404 | 0,00 | 845 | 1,08 | ||||

| 2025-08-06 | 13F | Paladin Advisory Group, LLC | 50 | −99,32 | 1 | −99,34 | ||||

| 2025-08-06 | 13F | Ironwood Wealth Management, LLC. | 3 811 | 267,50 | 80 | 276,19 | ||||

| 2025-06-25 | NP | DDFAX - Delaware Floating Rate Fund Class A | 420 000 | 0,00 | 8 702 | −1,57 | ||||

| 2025-08-13 | 13F | Virtus Fixed Income Advisers, LLC | 107 960 | 2 259 | ||||||

| 2025-07-08 | 13F | Webster Bank, N. A. | 175 | 0,00 | 4 | 0,00 | ||||

| 2025-08-13 | 13F | Coco Enterprises, LLC | 199 331 | 4,53 | 4 170 | 8,59 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 219 365 | 3,59 | 4 589 | 4,70 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 8 005 500 | 269,20 | 167 | 279,55 | ||||

| 2025-07-08 | 13F | IAM Advisory, LLC | 37 866 | −0,42 | 792 | 0,64 | ||||

| 2025-08-08 | 13F | Calamos Advisors LLC | 1 946 301 | −31,50 | 40 717 | −30,77 | ||||

| 2025-08-01 | 13F | Advisory Alpha, LLC | 113 339 | −56,24 | 2 371 | −55,58 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 97 170 | 75,19 | 2 033 | 77,00 | ||||

| 2025-08-04 | 13F | Atria Investments Llc | 54 336 | −91,15 | 1 137 | −91,06 | ||||

| 2025-05-14 | 13F | Van Hulzen Asset Management, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-13 | 13F | Adams Wealth Management | 67 452 | 21,81 | 1 396 | 19,73 | ||||

| 2025-07-09 | 13F | Triumph Capital Management | 75 341 | −22,35 | 1 576 | −21,51 | ||||

| 2025-07-14 | 13F | Mechanics Bank Trust Department | 619 920 | 2,92 | 12 969 | 4,02 | ||||

| 2025-08-12 | 13F | Prudential Plc | 1 419 044 | −42,67 | 29 686 | −42,06 | ||||

| 2025-03-27 | NP | Mfs Multimarket Income Trust | 79 443 | −0,57 | 1 672 | −0,30 | ||||

| 2025-07-29 | NP | JLMOX - Multi-Index Lifestyle Moderate Portfolio Class 1 | 925 471 | 1,07 | 19 305 | 0,58 | ||||

| 2025-06-26 | NP | FAPWX - Fidelity Risk Parity Fund Fidelity Advisor Risk Parity Fund: Class M | 2 039 | −29,32 | 42 | −30,00 | ||||

| 2025-07-11 | 13F | Matthew Goff Investment Advisor, LLC | 312 561 | −12,99 | 6 539 | −12,06 | ||||

| 2025-07-30 | 13F | Loring Wolcott & Coolidge Fiduciary Advisors Llp/ma | 585 | 0,00 | 12 | 0,00 | ||||

| 2025-08-06 | 13F | Florin Court Capital LLP | 139 900 | 42,76 | 2 927 | 44,28 | ||||

| 2025-07-16 | 13F | Perigon Wealth Management, LLC | 132 425 | −0,57 | 2 770 | 0,51 | ||||

| 2025-07-10 | 13F | High Net Worth Advisory Group LLC | 19 500 | 11,43 | 408 | 12,43 | ||||

| 2025-06-24 | NP | XFFLX - Franklin Floating Rate Master Series Class A | 191 000 | 0,00 | 3 958 | −1,57 | ||||

| 2025-08-14 | 13F | Camden Capital, LLC | 19 064 | 0,00 | 399 | 1,02 | ||||

| 2025-07-17 | 13F | Beacon Capital Management, LLC | 219 | 0,00 | 5 | 0,00 | ||||

| 2025-06-26 | NP | BlackRock Funds IV - BlackRock Global Long/Short Credit Fund Investor A Shares | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 1 712 | 213,55 | 36 | 218,18 | ||||

| 2025-08-14 | 13F | Hancock Whitney Corp | 11 486 | −45,55 | 240 | −44,95 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 32 414 | −10,12 | 678 | −9,24 | ||||

| 2025-07-29 | NP | JIBOX - Multi-Index Lifestyle Balanced Portfolio Class 1 | 1 824 774 | −3,03 | 38 065 | −3,50 | ||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 329 511 | −14,54 | 6 893 | −13,79 | ||||

| 2025-07-07 | 13F | Bangor Savings Bank | 23 139 | −91,17 | 484 | −91,08 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 3 695 | 1,96 | 77 | 2,67 | ||||

| 2025-08-13 | 13F | Level Four Advisory Services, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Mma Asset Management Llc | 37 496 | −44,80 | 784 | −44,24 | ||||

| 2025-07-17 | 13F | CWA Asset Management Group, LLC | 16 423 | 344 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 618 082 | −82,32 | 12 930 | −82,13 | ||||

| 2025-07-29 | 13F | Woodard & Co Asset Management Group Inc /adv | 1 658 | 258,87 | 35 | 277,78 | ||||

| 2025-07-14 | 13F | Golden State Equity Partners | 35 327 | −0,06 | 739 | 1,09 | ||||

| 2025-07-28 | 13F | Liberty Mutual Group Asset Management Inc. | 500 000 | 10 460 | ||||||

| 2025-08-13 | 13F | Healthcare Of Ontario Pension Plan Trust Fund | 22 866 987 | 0,51 | 478 377 | 1,58 | ||||

| 2025-07-29 | NP | JRLDX - Multi-Index 2010 Lifetime Portfolio Class 1 | 147 111 | −2,08 | 3 069 | −2,54 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 55 300 | −97,53 | 1 157 | −97,50 | |||

| 2025-06-27 | NP | TWBIX - Balanced Fund Investor Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 50 913 | −70,77 | 1 055 | −71,25 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-22 | 13F | Global Assets Advisory, LLC | 20 092 | 421 | ||||||

| 2025-08-04 | 13F | Horizon Wealth Management, LLC | 10 926 | −55,70 | 229 | −55,29 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 128 082 | −56,66 | 2 679 | −56,20 | ||||

| 2025-04-07 | 13F | Howard Financial Services, Ltd. | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | AWIIX - CIBC Atlas Income Opportunities Fund Institutional Class | 657 000 | 0,00 | 13 613 | −1,56 | ||||

| 2025-08-26 | NP | FLBL - Franklin Liberty Senior Loan ETF | 436 413 | 70,87 | 9 130 | 72,67 | ||||

| 2025-08-14 | 13F | Bain Capital Credit, LP | 3 561 802 | 28,24 | 74 513 | 29,60 | ||||

| 2025-04-28 | 13F | Mainstream Capital Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 23 305 | 488 | ||||||

| 2025-07-28 | 13F | Mission Hills Financial Advisory, LLC | 10 465 | 219 | ||||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 1 696 042 | −4,84 | 35 504 | −3,76 | ||||

| 2025-07-22 | 13F | Simplicity Wealth,LLC | 64 636 | −82,82 | 1 352 | −82,64 | ||||

| 2025-08-15 | 13F | Prevail Innovative Wealth Advisors, Llc | 148 633 | −2,15 | 3 109 | −1,11 | ||||

| 2025-08-05 | 13F | Summit Investment Advisory Services, LLC | 31 401 | 657 | ||||||

| 2025-07-29 | NP | LSFAX - Loomis Sayles Senior Floating Rate and Fixed Income Fund Class A | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 98 | −97,94 | 2 | −97,96 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 34 555 | −27,68 | 723 | −27,00 | ||||

| 2025-06-26 | NP | HSNCX - THE HARTFORD STRATEGIC INCOME FUND Class C | 493 000 | 0,00 | 10 215 | −1,57 | ||||

| 2025-08-06 | 13F | Valued Wealth Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | NP | JRLOX - Multi-Index 2020 Lifetime Portfolio Class 1 | 405 100 | 0,82 | 8 450 | 0,34 | ||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 129 546 | −63,00 | 2 710 | −62,61 | ||||

| 2025-08-12 | 13F | Kensington Asset Management, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-26 | NP | Blackrock Floating Rate Income Strategies Fund, Inc. This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 534 300 | 0,00 | 11 178 | 1,06 | ||||

| 2025-07-29 | 13F | Angeles Wealth Management, Llc | 310 467 | −1,85 | 6 495 | −0,81 | ||||

| 2025-05-28 | NP | THRIVENT SERIES FUND INC - Thrivent Diversified Income Plus Portfolio Class A | 3 000 | −33,33 | 62 | −34,04 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 16 183 494 | 0,63 | 338 559 | 1,70 | ||||

| 2025-07-29 | NP | JRLKX - Multi-Index 2015 Lifetime Portfolio Class R4 | 158 589 | −1,98 | 3 308 | −2,45 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 130 180 | 4,47 | 2 723 | 5,58 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 2 637 345 | 44 959,71 | 55 173 | 45 497,52 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 1 660 | 0,00 | 35 | 0,00 | ||||

| 2025-06-24 | NP | MDAKX - MainStay Moderate ETF Allocation Fund Class C | 190 453 | 3,62 | 3 946 | 2,02 | ||||

| 2025-07-28 | NP | JPHAX - JPMorgan Floating Rate Income Fund Class A | 231 000 | −46,40 | 4 819 | −46,66 | ||||

| 2025-07-23 | 13F | Friedenthal Financial | 10 358 | 14,20 | 217 | 15,51 | ||||

| 2025-07-24 | 13F | M1 Capital Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 941 210 | 12,99 | 20 | 11,76 | ||||

| 2025-08-26 | NP | BlackRock Credit Strategies Fund This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 51 000 | 0,00 | 1 067 | 1,04 | ||||

| 2025-06-24 | NP | MOEAX - MainStay Growth ETF Allocation Fund Class A | 159 934 | 0,30 | 3 314 | −1,28 | ||||

| 2025-08-14 | 13F | 1607 Capital Partners, LLC | 4 228 700 | 2,18 | 88 464 | 3,26 | ||||

| 2025-05-23 | NP | Guardian Variable Products Trust - Guardian Core Fixed Income VIP Fund | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Cumberland Partners Ltd | 50 000 | 0,00 | 1 046 | 1,06 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 49 571 | −13,54 | 1 037 | −12,56 | ||||

| 2025-08-05 | 13F | Sigma Planning Corp | 44 056 | −19,00 | 922 | −18,13 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 6 242 | 11,15 | 131 | 12,07 | ||||

| 2025-07-22 | 13F | Valpey Financial Services, LLC | 106 661 | 2 231 | ||||||

| 2025-08-19 | 13F | Cim, Llc | 514 191 | 4,03 | 10 757 | 5,13 | ||||

| 2025-07-29 | NP | NFRAX - Nuveen Symphony Floating Rate Income Fund Class A This fund is a listed as child fund of Nuveen Asset Management, LLC and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 015 737 | 0,00 | 42 048 | −0,48 | ||||

| 2025-05-29 | NP | ADFIX - Diversified Bond Fund Investor Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 648 000 | −7,44 | 54 814 | −9,07 | ||||

| 2025-07-14 | 13F | Sowell Financial Services LLC | 24 707 | 3,86 | 517 | 4,88 | ||||

| 2025-07-14 | 13F | Financial Advisory Partners, Llc | 196 658 | 5,86 | 4 114 | 7,00 | ||||

| 2025-08-07 | 13F | Cascade Financial Partners, LLC | 13 346 | 0,00 | 279 | 1,09 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 0 | −100,00 | 0 | |||||

| 2025-07-10 | 13F | Burns J W & Co Inc/ny | 16 175 | −0,31 | 338 | 0,90 | ||||

| 2025-08-13 | 13F | MetLife Investment Management, LLC | 100 000 | −66,67 | 2 092 | −66,31 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 1 002 | 11,09 | 21 | 11,11 | ||||

| 2025-08-06 | 13F | Founders Financial Securities Llc | 81 263 | 1 700 | ||||||

| 2025-04-03 | 13F | First Hawaiian Bank | 218 389 | −5,16 | 4 521 | −6,82 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 42 505 | 19,15 | 889 | 20,46 | ||||

| 2025-08-13 | 13F | Smith, Moore & Co. | 9 855 | 0,00 | 206 | 1,48 | ||||

| 2025-08-14 | 13F | Lord, Abbett & Co. Llc | 4 096 049 | −12,74 | 86 | −12,37 | ||||

| 2025-07-25 | 13F | Hobbs Group Advisors, LLC | 10 000 | 0,00 | 209 | 0,97 | ||||

| 2025-08-22 | NP | FEDERATED CORE TRUST - Federated Bank Loan Core Fund This fund is a listed as child fund of Federated Hermes, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 976 245 | −11,11 | 20 423 | −10,16 | ||||

| 2025-04-15 | 13F | Transform Wealth, LLC | 567 835 | −36,94 | 11 754 | −38,05 | ||||

| 2025-06-26 | NP | TMAAX - Thrivent Moderately Aggressive Allocation Fund Class A | 13 004 | −34,98 | 269 | −36,10 | ||||

| 2025-05-12 | 13F | Avos Capital Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 0 | −100,00 | 0 | |||||

| 2025-06-27 | NP | Calamos Strategic Total Return Fund | 1 610 745 | 0,00 | 33 375 | −1,57 | ||||

| 2025-07-21 | 13F | Ashton Thomas Securities, Llc | 4 743 | 0,00 | 99 | 1,02 | ||||

| 2025-08-08 | 13F | Massachusetts Financial Services Co /ma/ | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | First Citizens Asset Management, Inc. | 19 034 | −28,20 | 398 | −27,37 | ||||

| 2025-08-14 | 13F | Riggs Asset Managment Co. Inc. | 152 037 | −8,60 | 3 181 | −7,64 | ||||

| 2025-08-13 | 13F | Transce3nd, LLC | 21 | −81,08 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 6 265 015 | 32,21 | 131 064 | 33,61 | ||||

| 2025-08-08 | 13F | Donoghue Forlines LLC | 762 130 | 491,59 | 15 944 | 498,01 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 720 | 71 900,00 | 15 | |||||

| 2025-08-29 | NP | BRMSX - Bramshill Income Performance Fund Institutional Class | 100 000 | 11,11 | 2 092 | 12,29 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 622 481 | 9,46 | 13 022 | 10,63 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 160 | 0,00 | 3 | 0,00 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 4 089 439 | 3,96 | 85 442 | 4,93 | ||||

| 2025-08-18 | 13F | Tactive Advisors, LLC | 19 357 | 405 | ||||||

| 2025-06-26 | NP | TCAAX - Thrivent Moderately Conservative Allocation Fund Class A | 12 292 | −29,76 | 255 | −30,98 | ||||

| 2025-05-08 | 13F | Jefferies Financial Group Inc. | 0 | −100,00 | 0 | |||||

| 2025-05-09 | 13F | Beta Wealth Group, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-30 | NP | WTBN - WisdomTree Bianco Total Return Fund | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Summit Financial, LLC | 34 683 | −11,79 | 726 | −10,82 | ||||

| 2025-08-15 | 13F | First Heartland Consultants, Inc. | 10 880 | 228 | ||||||

| 2025-04-29 | NP | AMHYX - INVESCO High Yield Fund Class A | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-05 | 13F | Nwam Llc | 0 | −100,00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 1 086 183 | −3,94 | 22 706 | −3,00 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 3 245 700 | 257,82 | 67 900 | 261,63 | ||||

| 2025-07-16 | 13F | Mariner Investment Group Llc | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 50 Fund Investor Class | 703 200 | 32,43 | 14 711 | 33,84 | ||||

| 2025-08-14 | 13F | Fmr Llc | 190 096 | −74,38 | 3 977 | −74,11 | ||||

| 2025-05-14 | 13F | Smartleaf Asset Management LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-16 | 13F | BOS Asset Management, LLC | 25 981 | 544 | ||||||

| 2025-05-29 | NP | ACCNX - Core Plus Fund Investor Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 201 000 | −2,90 | 4 161 | −4,61 | ||||

| 2025-07-25 | 13F | Parker Financial LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Anfield Capital Management, LLC | 5 816 | 3,67 | 122 | 4,31 | ||||

| 2025-08-14 | 13F | Ssi Investment Management Llc | 432 174 | −8,41 | 9 041 | −7,43 | ||||

| 2025-05-29 | NP | CPATX - Counterpoint Tactical Income Fund Class A Shares | 4 937 232 | 0,00 | 102 201 | −1,76 | ||||

| 2025-05-15 | 13F | AlTi Global, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Gentry Private Wealth, Llc | 15 762 | −79,69 | 330 | −79,51 | ||||

| 2025-08-13 | 13F | 1832 Asset Management L.P. | 552 830 | −80,92 | 11 565 | −80,71 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Factory Mutual Insurance Co | 1 200 000 | 0,00 | 25 104 | 1,06 | ||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 970 098 | 5,22 | 20 294 | 6,33 | ||||

| 2025-08-05 | 13F | Verity Asset Management, Inc. | 56 540 | −28,57 | 1 183 | −27,84 | ||||

| 2025-07-16 | 13F | Independent Wealth Network Inc. | 62 249 | 6,66 | 1 302 | 7,78 | ||||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Strategic Financial Concepts, LLC | 71 114 | −1,83 | 1 488 | −0,80 | ||||

| 2025-07-16 | 13F | FORM Wealth Advisors, LLC | 488 924 | −25,95 | 10 228 | −25,17 | ||||

| 2025-08-08 | 13F | Kingsview Wealth Management, LLC | 164 591 | 78,54 | 3 443 | 80,45 | ||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 1 703 | 0,12 | 36 | 0,00 | ||||

| 2025-08-18 | 13F | Front Row Advisors LLC | 2 071 | −13,38 | 43 | −12,24 | ||||

| 2025-08-15 | 13F | Courage Capital Management Llc | 648 000 | 0,00 | 14 | 0,00 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 561 233 | 7,61 | 11 735 | 8,70 | ||||

| 2025-07-29 | 13F | Stableford Capital Ii Llc | 15 680 | 0,00 | 328 | 1,86 | ||||

| 2025-08-28 | NP | TFAZX - TFA Tactical Income Fund Class I | 46 200 | 0,00 | 967 | 1,05 | ||||

| 2025-07-24 | 13F | KC Investment Advisors, LLC | 10 868 | −93,18 | 227 | −93,12 | ||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-24 | 13F | Eastern Bank | 650 | 0,00 | 14 | 0,00 | ||||

| 2025-08-11 | 13F | Alteri Wealth LLC | 10 193 | 213 | ||||||

| 2025-07-28 | 13F | Davidson Trust Co | 9 836 | 0,00 | 206 | 0,99 | ||||

| 2025-08-06 | 13F | First Eagle Investment Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | NP | DFRAX - DWS Floating Rate Fund Class A | 81 694 | 766,78 | 1 704 | 764,97 | ||||

| 2025-08-14 | 13F | First Manhattan Co | 350 000 | 0,00 | 7 322 | 1,06 | ||||

| 2025-07-30 | 13F | First Citizens Bank & Trust Co | 230 644 | 49,66 | 4 825 | 51,25 | ||||

| 2025-07-15 | 13F | Fortitude Family Office, LLC | 24 | 0,00 | 1 | |||||

| 2025-07-17 | 13F | Raleigh Capital Management Inc. | 0 | −100,00 | 0 | |||||

| 2025-06-30 | NP | INVESCO ACTIVELY MANAGED EXCHANGE-TRADED FUND TRUST - Invesco High Yield Select ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-08 | 13F | Fiera Capital Corp | 125 000 | 0,00 | 2 615 | 1,08 | ||||

| 2025-07-16 | 13F | Old Port Advisors | 152 836 | −7,84 | 3 197 | −6,85 | ||||

| 2025-05-15 | 13F | Pharo Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-18 | 13F | First United Bank Trust/ | 26 323 | −11,18 | 551 | −10,28 | ||||

| 2025-08-07 | 13F | Runnymede Capital Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Granby Capital Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Concord Asset Management, LLC/VA | 29 844 | 624 | ||||||

| 2025-07-31 | 13F | Optimum Investment Advisors | 7 500 | 0,00 | 157 | 0,65 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 246 178 | −25,38 | 5 150 | −24,59 | ||||

| 2025-08-05 | 13F | Westside Investment Management, Inc. | 461 | 0,00 | 10 | 0,00 | ||||

| 2025-07-28 | 13F | J.Safra Asset Management Corp | 149 007 | 4,39 | 3 114 | 5,42 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 47 164 | 2,23 | 987 | 3,35 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 127 720 | 16,01 | 2 672 | 17,25 | ||||

| 2025-07-24 | 13F | Blair William & Co/il | 21 113 | 2,81 | 442 | 3,76 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 678 079 | −27,69 | 14 185 | −26,92 | ||||

| 2025-08-14 | 13F | Polar Asset Management Partners Inc. | 250 000 | 5 230 | ||||||

| 2025-08-13 | 13F | Sun Life Financial Inc | 0 | −100,00 | 0 | |||||

| 2025-07-29 | NP | JFIAX - Floating Rate Income Fund Class A | 698 251 | −15,75 | 14 566 | −16,15 | ||||

| 2025-08-11 | 13F | WPG Advisers, LLC | 3 484 | −19,24 | 73 | −19,10 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Wambolt & Associates, LLC | 19 783 | −7,39 | 414 | −6,33 | ||||

| 2025-04-25 | 13F | Albion Financial Group /ut | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 38 800 | −98,39 | 812 | −98,37 | |||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 658 670 | 2,13 | 14 | 0,00 | ||||

| 2025-08-11 | 13F | Brown Wealth Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-05-06 | 13F | PFG Advisors | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Guardian Wealth Advisors, Llc / Nc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 1 202 593 | 25 152 | ||||||

| 2025-05-27 | NP | MAINSTAY VP FUNDS TRUST - MainStay VP IQ Hedge Multi-Strategy Portfolio Initial Class | 289 887 | 10,15 | 6 001 | 8,21 | ||||

| 2025-07-15 | 13F | First City Capital Management, Inc. | 23 853 | −0,20 | 499 | 1,01 | ||||

| 2025-07-11 | 13F | SILVER OAK SECURITIES, Inc | 886 | 0,00 | 19 | 0,00 | ||||

| 2025-08-12 | 13F | Western Asset Management Company, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Whittier Trust Co | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Ethos Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Guardian Asset Advisors, LLC | 181 610 | 7,88 | 3 799 | 9,04 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 45 494 | −53,26 | 954 | −52,68 | ||||

| 2025-08-12 | 13F | Choate Investment Advisors | 16 810 | 0,00 | 352 | 1,15 | ||||

| 2025-08-07 | 13F | Guidance Capital, Inc | 150 479 | −1,70 | 3 144 | −1,23 | ||||

| 2025-07-31 | 13F | Wealthfront Advisers Llc | 106 862 | 3,78 | 2 236 | 4,88 | ||||

| 2025-05-06 | 13F | Journey Strategic Wealth Llc | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Forefront Analytics, LLC | 27 105 | 176,98 | 567 | 178,82 | ||||

| 2025-07-24 | 13F | Insight Inv LLC | 16 354 | −0,80 | 342 | 0,29 | ||||

| 2025-08-14 | 13F | BTG Pactual Asset Management US LLC | 5 870 | 0,00 | 123 | 0,83 | ||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 0 | 0 | ||||||

| 2025-07-23 | 13F | Ti-trust, Inc | 156 536 | 15,95 | 3 275 | 17,18 | ||||

| 2025-08-13 | 13F | Trustmark National Bank Trust Department | 504 015 | 2,24 | 10 544 | 3,32 | ||||

| 2025-05-12 | 13F | Independent Advisor Alliance | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-29 | NP | Northern Lights Fund Trust - Ocean Park High Income ETF | 95 560 | 41,68 | 1 978 | 39,20 | ||||

| 2025-07-09 | 13F | Dynamic Advisor Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 3 323 097 | 4,82 | 69 519 | 5,94 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 155 923 | 34,27 | 3 262 | 35,71 | ||||

| 2025-04-22 | 13F | Synergy Financial Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Sig Brokerage, Lp | 60 000 | 1 255 | ||||||

| 2025-08-12 | 13F | Insigneo Advisory Services, Llc | 12 500 | 0,00 | 262 | 1,16 | ||||

| 2025-08-13 | 13F | Everstar Asset Management, LLC | 20 600 | 0,00 | 431 | 0,94 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-30 | NP | IOBAX - ICON FLEXIBLE BOND FUND Investor Class | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 15 697 | −18,46 | 328 | −17,59 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 10 000 | −72,44 | 209 | −72,17 | ||||

| 2025-07-16 | 13F | TigerOak Management, L.L.C. | 161 885 | 6,33 | 3 387 | 7,46 | ||||

| 2025-07-09 | 13F | Westbourne Investments, Inc. | 15 805 | 331 | ||||||

| 2025-08-14 | 13F | Price T Rowe Associates Inc /md/ | 0 | −100,00 | 0 | |||||

| 2025-07-07 | 13F | Aletheian Wealth Advisors LLC | 74 672 | 14,81 | 1 562 | 16,05 | ||||

| 2025-08-13 | 13F | Cliffwater LLC | 5 902 | 0,00 | 123 | 0,82 | ||||

| 2025-07-17 | 13F | Symmetry Partners, LLC | 10 491 | 219 | ||||||

| 2025-08-14 | 13F | DSC Meridian Capital LP | 1 131 319 | −19,16 | 23 667 | 84 425,00 | ||||

| 2025-05-28 | NP | AAHYX - Thrivent Diversified Income Plus Fund Class A | 7 000 | −26,32 | 145 | −28,00 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-04-23 | 13F | Continuum Advisory, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-29 | NP | ASIHX - Strategic Income Fund C Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 48 760 | −1,96 | 1 009 | −3,63 | ||||

| 2025-08-12 | 13F | Integrated Advisors Network LLC | 105 072 | 162,67 | 2 198 | 165,46 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 522 | −22,78 | 11 | −23,08 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 63 137 | −50,96 | 1 321 | −50,47 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 0 | −100,00 | 0 | |||||

| 2025-05-06 | NP | KAMIX - Kensington Managed Income Fund Institutional Class Shares | 1 503 940 | 0,00 | 31 132 | −1,76 | ||||

| 2025-07-09 | 13F | Harbor Capital Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-04-22 | 13F | Castleview Partners, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | GW&K Investment Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-19 | NP | LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP American Century Balanced Fund Service Class | 70 075 | 3,09 | 1 451 | 1,26 | ||||

| 2025-04-24 | NP | Mfs Intermediate High Income Fund | 22 838 | −1,56 | 479 | −2,25 | ||||

| 2025-08-13 | 13F | Edgestream Partners, L.P. | 496 384 | 187,69 | 10 384 | 190,79 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 77 975 | 47,36 | 1 631 | 48,95 | ||||

| 2025-08-04 | 13F | Bay Colony Advisory Group, Inc d/b/a Bay Colony Advisors | 234 225 | 12,75 | 4 900 | 13,88 | ||||

| 2025-05-08 | NP | QBDSX - Quantified Managed Income Fund Investor Class Shares | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-15 | 13F | Heritage Oak Wealth Advisors Llc | 14 012 | −79,00 | 293 | −78,77 | ||||

| 2025-08-01 | 13F | Boyd Watterson Asset Management Llc/oh | 12 073 | 0,00 | 253 | 1,20 | ||||

| 2025-08-04 | 13F | Adell Harriman & Carpenter Inc | 153 848 | −0,19 | 3 218 | 0,88 | ||||

| 2025-05-14 | 13F | BOK Financial Private Wealth, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 240 054 | 86,20 | 5 | 150,00 | ||||

| 2025-03-26 | NP | HYPPX - MFS High Yield Pooled Portfolio Fund Shares | 273 635 | −4,72 | 5 760 | −4,45 | ||||

| 2025-08-13 | 13F | Wealthedge Investment Advisors, Llc | 11 461 | 240 | ||||||

| 2025-07-30 | 13F | Gables Capital Management Inc. | 233 | 0,00 | 5 | 0,00 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 1 121 | 12,10 | 23 | 15,00 | ||||

| 2025-08-15 | 13F | Strategic Investment Advisors / MI | 708 898 | −9,22 | 14 820 | −8,32 | ||||

| 2025-08-12 | 13F | Forge First Asset Management Inc. | 963 300 | 0,00 | 20 152 | 1,06 | ||||

| 2025-08-14 | 13F | UBS Group AG | 8 397 079 | 161,58 | 175 667 | 164,36 | ||||

| 2025-05-13 | 13F | Adviser Investments LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Signature Estate & Investment Advisors Llc | 88 551 | 17,23 | 1 852 | 18,49 | ||||

| 2025-06-24 | NP | MNERX - MainStay Conservative ETF Allocation Fund Class R3 | 117 337 | −0,26 | 2 431 | −1,82 | ||||

| 2025-07-23 | 13F | Elm3 Financial Group, LLC | 21 501 | −8,27 | 450 | −7,42 | ||||

| 2025-08-25 | NP | SFHIX - Shenkman Capital Floating Rate High Income Fund Institutional Class | 417 780 | 13,22 | 8 740 | 14,41 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 41 147 | 12,47 | 861 | 13,61 | ||||

| 2025-06-30 | NP | AIM INVESTMENT FUNDS (INVESCO INVESTMENT FUNDS) - Invesco Oppenheimer Global Strategic Income Fund Class R6 | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-29 | 13F | Koshinski Asset Management, Inc. | 10 616 | 222 | ||||||

| 2025-04-11 | 13F | Signal Advisors Wealth, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-27 | NP | BlackRock Funds V - BlackRock Strategic Income Opportunities Portfolio Investor A Shares | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 3 048 920 | 13,46 | 63 783 | 14,66 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 16 800 | −96,63 | 351 | −96,60 | |||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 24 772 | −37,05 | 518 | −36,36 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 161 559 | 37,18 | 3 380 | 38,65 | ||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 15 370 | 45,14 | 322 | 46,58 | ||||

| 2025-04-30 | 13F | J Hagan Capital, Inc. | 213 659 | 4 502 | ||||||

| 2025-07-14 | 13F | Iams Wealth Management, Llc | 28 106 | 588 | ||||||

| 2025-08-08 | 13F | Investment Partners, Ltd. | 16 012 | −35,45 | 335 | −34,89 | ||||

| 2025-08-13 | 13F | Federated Hermes, Inc. | 976 245 | −11,11 | 20 423 | −10,16 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 88 475 | 86,09 | 1 831 | 82,92 | ||||

| 2025-07-29 | 13F | SAM Advisors, LLC | 288 720 | 6,00 | 6 040 | 7,13 | ||||

| 2025-07-18 | 13F | SimpliFi, Inc. | 20 528 | 4,70 | 429 | 5,93 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 38 700 | 205,74 | 809 | 208,40 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 89 600 | −18,62 | 1 873 | −17,89 | |||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 2 804 927 | −68,17 | 58 679 | −67,84 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 3 352 465 | 0,00 | 70 134 | 1,07 | ||||

| 2025-08-12 | 13F | Ci Investments Inc. | 53 650 | −96,01 | 1 | −96,30 | ||||

| 2025-05-30 | NP | GPICX - GuidePath(R) Conservative Income Fund | 39 186 | −31,07 | 811 | −32,25 | ||||

| 2025-07-29 | NP | ACPSX - Invesco Core Plus Bond Fund Class A | 112 000 | 0,00 | 2 336 | −0,47 | ||||

| 2025-04-21 | 13F | Kingswood Wealth Advisors, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-29 | NP | JLCGX - Multi-Index Lifestyle Conservative Portfolio Class 1 | 995 497 | 1,54 | 20 766 | 1,06 | ||||

| 2025-07-18 | 13F | Bartlett & Co. Wealth Management Llc | 1 314 | 27 | ||||||

| 2025-08-13 | 13F | Blue Fin Capital, Inc. | 154 470 | 2,23 | 3 232 | 1,51 | ||||

| 2025-07-29 | 13F | TrueMark Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Impact Partnership Wealth, LLC | 36 643 | 767 | ||||||

| 2025-08-14 | 13F | CIBC Asset Management Inc | 2 973 509 | 91,64 | 62 206 | 93,68 | ||||

| 2025-07-18 | 13F/A | MJT & Associates Financial Advisory Group, Inc. | 13 | −7,14 | 0 | |||||

| 2025-07-22 | 13F | Olistico Wealth, LLC | 2 486 | 19,00 | 52 | 20,93 | ||||

| 2025-07-18 | 13F | Naples Global Advisors, Llc | 15 335 | 4,78 | 321 | 5,96 | ||||

| 2025-08-11 | 13F | Mount Lucas Management LP | 129 518 | −0,91 | 2 710 | 0,15 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 748 437 | −4,51 | 15 656 | −3,50 | ||||

| 2025-07-17 | 13F/A | Capital Investment Advisors, LLC | 16 215 | 339 | ||||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 949 | 20 | ||||||

| 2025-05-14 | 13F | Susquehanna International Group, Llp | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-05-12 | 13F | Mitsubishi UFJ Kokusai Asset Management Co., Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Sykon Capital Llc | 86 134 | 1 802 | ||||||

| 2025-05-29 | NP | ASDVX - Short Duration Strategic Income Fund Investor Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 155 163 | 0,00 | 3 212 | −1,77 | ||||

| 2025-07-11 | 13F | AA Financial Advisors, LLC | 15 979 | 17,52 | 334 | 18,86 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Whittier Trust Co Of Nevada Inc | 74 985 | 0,00 | 1 568 | 0,97 | ||||

| 2025-08-14 | 13F | Graham Capital Management, L.P. | 0 | −100,00 | 0 | |||||

| 2025-05-01 | 13F | Focused Wealth Management, Inc | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | 4Thought Financial Group Inc. | 13 948 | −3,06 | 292 | −2,02 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 46 220 | −1,87 | 967 | −0,82 | ||||

| 2025-08-14 | 13F | Sequent Planning LLC | 15 280 | 7,38 | 320 | 8,50 | ||||

| 2025-07-30 | 13F | Brookstone Capital Management | 635 278 | −1,59 | 13 290 | −0,54 | ||||

| 2025-07-23 | 13F | Castle Rock Wealth Management, LLC | 20 798 | −19,60 | 435 | −18,88 | ||||

| 2025-08-12 | 13F | Left Brain Wealth Management, LLC | 61 882 | 4,77 | 1 295 | 5,89 | ||||

| 2025-08-14 | 13F | Quarry LP | Put | 0 | −100,00 | 0 | ||||

| 2025-07-22 | 13F | Marks Group Wealth Management, Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Destination Wealth Management | 122 333 | 5,78 | 2 559 | 6,94 | ||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 757 843 | −32,94 | 15 854 | −32,22 | ||||

| 2025-07-31 | 13F | Whipplewood Advisors, LLC | 170 | −79,54 | 4 | 0,00 | ||||

| 2025-08-19 | 13F | Cape Investment Advisory, Inc. | 4 400 | 26,44 | 92 | 27,78 | ||||

| 2025-08-18 | NP | PACIFIC SELECT FUND - Floating Rate Income Portfolio Class I | 145 000 | −69,49 | 3 033 | −69,16 | ||||

| 2025-08-14 | 13F | Matrix Private Capital Group Llc | 167 774 | 18,22 | 3 510 | 19,48 | ||||

| 2025-07-28 | 13F | Mutual Advisors, LLC | 12 990 | 272 | ||||||

| 2025-07-28 | NP | SDSI - American Century Short Duration Strategic Income ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-15 | 13F | Kestra Investment Management, LLC | 552 | 0,00 | 11 | 0,00 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 154 785 | −78,08 | 3 238 | −77,85 | ||||

| 2025-06-27 | NP | Calamos Global Total Return Fund | 45 865 | −75,81 | 950 | −76,20 | ||||

| 2025-08-08 | 13F | Creative Planning | 17 980 | −9,37 | 376 | −8,29 | ||||

| 2025-08-14 | 13F | Dark Forest Capital Management Lp | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Copperwynd Financial, LLC | 11 461 | 240 | ||||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-07 | 13F | Commerce Bank | 39 734 | 0,47 | 831 | 1,59 | ||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 12 030 | 11,60 | 252 | 12,56 | ||||

| 2025-08-11 | 13F | United Capital Financial Advisers, Llc | 13 584 | 0,27 | 284 | 1,43 | ||||

| 2025-07-28 | 13F | Galilei Investment Office LLP | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Salomon & Ludwin, LLC | 740 | 0,00 | 16 | 0,00 | ||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 485 874 | −5,94 | 10 164 | −4,94 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Inspire Advisors, LLC | 770 190 | 2,26 | 16 112 | 3,35 | ||||

| 2025-07-22 | 13F | DAVENPORT & Co LLC | 16 655 | 4,84 | 348 | 6,10 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 11 550 | −71,98 | 242 | −71,75 | ||||

| 2025-08-14 | 13F | Napa Wealth Management | 36 087 | −42,46 | 755 | −41,91 | ||||

| 2025-05-27 | NP | MFS VARIABLE INSURANCE TRUST II - MFS High Yield Portfolio Initial Class | 108 587 | −3,05 | 2 248 | −4,75 | ||||

| 2025-07-21 | 13F | Triad Wealth Partners, LLC | 13 427 | −4,87 | 281 | −4,11 | ||||

| 2025-08-06 | 13F | Nvwm, Llc | 10 133 | −31,94 | 212 | −31,49 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 12 351 599 | 15,47 | 258 395 | 16,70 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 376 921 | −18,89 | 8 | −22,22 | ||||

| 2025-07-22 | 13F | Miracle Mile Advisors, LLC | 77 654 | −7,21 | 1 625 | −6,24 | ||||

| 2025-08-15 | 13F | Chapman Financial Group, Llc | 800 | 0,00 | 17 | 0,00 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Continental Investors Services, Inc. | 36 384 | 3,71 | 761 | 4,82 | ||||

| 2025-03-27 | NP | ITTAX - Hartford Multi-Asset Income and Growth Fund Class A | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-08 | 13F | CNO Financial Group, Inc. | 1 887 000 | −11,28 | 39 476 | −10,34 | ||||

| 2025-08-13 | 13F | Amundi | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Solstein Capital, LLC | 7 777 | 0,00 | 163 | 1,25 | ||||

| 2025-07-18 | 13F | Consolidated Portfolio Review Corp | 15 493 | −5,89 | 324 | −4,71 | ||||

| 2025-07-15 | 13F | Td Private Client Wealth Llc | 61 960 | 4,98 | 1 296 | 6,14 | ||||

| 2025-07-31 | 13F | Jackson Hole Capital Partners, LLC | 216 | 0,00 | 5 | 0,00 | ||||

| 2025-08-14 | 13F | Sig Brokerage, Lp | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-13 | 13F | Victory Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 22 795 | −61,43 | 477 | −61,52 | ||||

| 2025-08-27 | NP | RYDEX VARIABLE TRUST - Multi-Hedge Strategies Fund Variable Annuity | Short | −323 | −30,09 | −7 | −33,33 | |||

| 2025-08-04 | 13F | Spire Wealth Management | 235 421 | 19,82 | 4 925 | 21,10 | ||||

| 2025-08-06 | 13F | Csenge Advisory Group | 13 715 | 13,57 | 286 | 15,32 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 29 672 | −3,15 | 621 | −3,88 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 12 544 | −14,01 | 262 | −12,96 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 0 | |||||||

| 2025-08-13 | 13F | Great Diamond Partners, LLC | 119 954 | 0,90 | 2 509 | 1,99 | ||||

| 2025-08-13 | 13F | One William Street Capital Management, L.p. | 500 000 | 10 460 | ||||||

| 2025-06-26 | NP | DYFI - IDX DYNAMIC FIXED INCOME ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 33 730 | 17,61 | 706 | 18,89 | ||||

| 2025-08-14 | 13F | Operose Advisors LLC | 36 809 | −2,55 | 770 | −1,41 | ||||

| 2025-07-25 | 13F | Total Clarity Wealth Management, Inc. | 67 443 | −34,38 | 1 411 | −34,87 | ||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 58 020 | −39,28 | 1 214 | −38,68 | ||||

| 2025-07-24 | 13F | Aurora Private Wealth, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | American Institute for Advanced Investment Management, LLP | 14 899 | 0,00 | 312 | 0,97 | ||||

| 2025-05-02 | 13F | Transcendent Capital Group LLC | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | NorthRock Partners, LLC | 2 292 | −22,09 | 48 | −21,67 | ||||

| 2025-05-15 | 13F | Fortress Private Ledger, Llc | 0 | −100,00 | 0 | |||||

| 2025-06-03 | 13F | Invst, LLC | 23 031 | −3,18 | 477 | −4,99 | ||||

| 2025-08-14 | 13F | Hilton Capital Management, LLC | 1 548 463 | 32 394 | ||||||

| 2025-08-14 | 13F | Arete Wealth Advisors, LLC | 45 356 | 19,62 | 1 | |||||

| 2025-08-13 | 13F | HAP Trading, LLC | Call | 11 100 | 2 | |||||

| 2025-08-14 | 13F | Ausdal Financial Partners, Inc. | 194 518 | 0,94 | 4 069 | 2,01 | ||||

| 2025-08-29 | NP | Princeton Private Investment Fund | 95 374 | 0,00 | 1 995 | 1,06 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 2 590 | 1,97 | 54 | 3,85 | ||||

| 2025-08-14 | 13F | Bramshill Investments, LLC | 100 000 | −62,96 | 2 092 | −62,57 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 1 240 683 | 8,67 | 25 955 | 9,83 | ||||

| 2025-08-28 | NP | BlackRock Series Fund, Inc. - BlackRock Global Allocation Portfolio This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 10 731 | 0,00 | 224 | 0,90 | ||||

| 2025-08-12 | 13F | Archer Investment Corp | 1 000 | 0,00 | 21 | 0,00 | ||||

| 2025-07-31 | 13F | Gill Capital Partners, Llc | 32 399 | 0,00 | 678 | 1,04 | ||||

| 2025-08-11 | 13F | Cordatus Wealth Management LLC | 10 203 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Sei Investments Co | 2 980 790 | −14,22 | 62 356 | −13,31 | ||||

| 2025-06-11 | NP | SGHAX - DWS Global High Income Fund Class A | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-15 | 13F | Bay Capital Advisors, LLC | 241 009 | 45,13 | 5 042 | 46,67 | ||||

| 2025-08-11 | 13F | Angeles Investment Advisors, LLC | 1 665 780 | 34 848 | ||||||

| 2025-08-11 | 13F | PAX Financial Group, LLC | 11 979 | 6,52 | 251 | 7,76 | ||||

| 2025-08-26 | NP | TFPN - Blueprint Chesapeake Multi-Asset Trend ETF | 61 505 | 7,11 | 1 287 | 8,25 | ||||

| 2025-07-29 | NP | JRTBX - Multi-Index 2025 Lifetime Portfolio Class 1 | 659 290 | 3,02 | 13 753 | 2,52 | ||||

| 2025-05-14 | 13F | Endurance Services Ltd | 0 | −100,00 | 0 | |||||

| 2025-04-24 | NP | MGBAX - MFS Global Bond Fund A | 416 290 | 8 725 | ||||||

| 2025-08-13 | 13F | Cerity Partners LLC | 929 364 | 5,07 | 19 633 | 7,23 | ||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 150 | −91,09 | 3 | −91,18 | ||||

| 2025-08-27 | NP | Calamos Aksia Alternative Credit & Income Fund | 289 691 | 145,81 | 6 060 | 148,46 | ||||

| 2025-08-22 | NP | Columbia Funds Variable Series Trust II - CTIVP - American Century Diversified Bond Fund Class 1 | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-19 | 13F/A | Carronade Capital Management, LP | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 514 | −84,61 | 11 | −85,51 | ||||

| 2025-08-13 | 13F | Congress Wealth Management LLC / DE / | 282 677 | −4,81 | 5 914 | −3,79 | ||||

| 2025-06-27 | NP | Calamos Global Dynamic Income Fund | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-01 | 13F | Yukon Wealth Management, Inc. | 9 589 | 201 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 3 943 994 | 83,61 | 82 508 | 85,56 | ||||

| 2025-07-28 | NP | SOUAX - American Beacon Sound Point Floating Rate Income Fund A Class | 408 881 | 52,16 | 8 529 | 50,37 | ||||

| 2025-08-27 | NP | RYMSX - Guggenheim Multi-Hedge Strategies Fund Class P | Short | −193 | −45,63 | −4 | −42,86 | |||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 10 588 | 0,24 | 221 | 1,38 | ||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 45 774 | −30,64 | 958 | −29,94 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 131 367 | −12,29 | 2 748 | −11,35 | ||||

| 2025-08-12 | 13F | American Beacon Advisors, Inc. | 241 497 | 5 052 | ||||||

| 2025-08-12 | 13F | American Century Companies Inc | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | SIOAX - SIMT MULTI-ASSET INCOME FUND Class F | 146 255 | 0,00 | 3 060 | 1,06 | ||||

| 2025-08-14 | 13F | West Coast Financial LLC | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | Novem Group | 131 571 | 4,67 | 2 752 | 5,81 | ||||

| 2025-08-12 | 13F | Park Square Financial Group, LLC | 2 313 | 0,57 | 48 | 2,13 | ||||

| 2025-08-14 | 13F | Alaska Permanent Fund Corp | 250 000 | 0,00 | 5 232 | 1,00 | ||||

| 2025-08-13 | 13F | SageView Advisory Group, LLC | 46 687 | 13,03 | 977 | 14,15 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 46 425 | 62,67 | 970 | 64,13 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 1 520 029 | 13,91 | 31 799 | 18,32 | ||||

| 2025-07-25 | 13F | Almanack Investment Partners, LLC. | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Stephens Inc /ar/ | 337 113 | −4,34 | 7 052 | −3,33 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 12 530 | 13,42 | 262 | 12,93 | ||||

| 2025-08-12 | 13F | NFP Retirement, Inc. | 404 387 | 8 460 | ||||||

| 2025-08-11 | 13F | Advisor Resource Council | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 51 008 | 5,06 | 1 067 | 6,27 | ||||

| 2025-08-21 | NP | MOFTX - Mercer Opportunistic Fixed Income Fund Class I | 300 000 | 6 276 | ||||||

| 2025-07-17 | 13F | Keystone Global Partners, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Waterloo Capital, L.P. | 0 | −100,00 | 0 | |||||

| 2025-07-02 | 13F | Central Pacific Bank - Trust Division | 187 225 | −10,54 | 3 917 | −9,58 | ||||

| 2025-05-15 | 13F | Talon Private Wealth, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-07 | 13F | Curtis Advisory Group, LLC | 12 757 | 267 | ||||||

| 2025-05-14 | 13F/A | Integrated Investment Consultants, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-29 | NP | DFLAX - BNY Mellon Floating Rate Income Fund Class A | 313 435 | 163,79 | 6 538 | 162,57 | ||||

| 2025-06-27 | NP | AGBVX - Global Bond Fund Investor Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 418 674 | −72,63 | 8 675 | −73,06 | ||||

| 2025-07-14 | 13F | Signature Securities Group Corporation | 45 094 | −1,09 | 943 | 0,00 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 223 552 | 14,51 | 4 677 | 15,71 | ||||

| 2025-07-14 | 13F | Counterpoint Mutual Funds LLC | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 30 Fund Instl Class | 552 200 | 69,69 | 11 552 | 71,50 | ||||

| 2025-05-15 | 13F | EP Wealth Advisors, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 230 019 | 159,98 | 4 812 | 162,81 | ||||

| 2025-07-15 | 13F | Peddock Capital Advisors, Llc | 85 399 | 20,67 | 1 787 | 21,99 | ||||

| 2025-08-14 | 13F | Mpwm Advisory Solutions, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Nuveen, LLC | 2 499 974 | −12,40 | 52 299 | −11,47 | ||||

| 2025-05-30 | NP | ERNZ - TrueShares Active Yield ETF | 23 406 | −72,63 | 485 | −73,13 | ||||

| 2025-08-06 | 13F | Decker Retirement Planning Inc. | 39 | 1 | ||||||

| 2025-08-14 | 13F | Toronto Dominion Bank | 0 | −100,00 | 0 | |||||

| 2025-07-10 | 13F | Focus Financial Network, Inc. | 16 613 | 4,53 | 348 | 5,79 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 15 259 | 59,68 | 316 | 56,72 | ||||

| 2025-05-14 | 13F | Blue Investment Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-29 | NP | CFRAX - Catalyst/CIFC Floating Rate Income Fund Class A | 901 688 | 26,81 | 18 863 | 28,16 | ||||

| 2025-05-08 | 13F | Strategic Advocates LLC | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 11 210 | 235 | ||||||

| 2025-08-06 | NP | LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Delaware Diversified Income Fund Service Class | 157 700 | 3 299 | ||||||

| 2025-08-28 | NP | BlackRock Funds V - BlackRock Credit Strategies Income Fund Investor A Shares | 186 000 | 0,00 | 3 891 | 1,06 | ||||

| 2025-07-23 | 13F | Clear Creek Financial Management, LLC | 92 048 | 18,24 | 1 926 | 19,49 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 50 537 | 31,08 | 1 057 | 32,46 | ||||

| 2025-07-23 | 13F | Tyche Wealth Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 254 094 | −37,49 | 5 | −37,50 | ||||

| 2025-07-25 | 13F | Concord Wealth Partners | 29 844 | 21,80 | 624 | 23,08 | ||||

| 2025-04-23 | 13F | International Assets Investment Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Compass Rose Asset Management, LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-08 | 13F | Savant Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | REAP Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | West Paces Advisors Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Vantage Financial Partners, LLC | 9 655 | −0,50 | 202 | 0,50 | ||||

| 2025-07-30 | NP | HCYAX - HILTON TACTICAL INCOME FUND Investor Class | 180 300 | 126,15 | 3 761 | 123,47 | ||||

| 2025-08-14 | 13F | FC Advisory LLC | 65 823 | −11,59 | 1 377 | −10,64 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 219 | 184,42 | 5 | 300,00 | ||||

| 2025-08-14 | 13F | Dimension Capital Management Llc | 17 840 | 0,00 | 373 | 1,08 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 131 996 | 18,25 | 2 769 | 19,87 | ||||

| 2025-05-28 | NP | THRIVENT SERIES FUND INC - Thrivent Moderate Allocation Portfolio Class A | 12 000 | −81,25 | 248 | −81,60 | ||||

| 2025-07-16 | 13F | Kennicott Capital Management Llc | 23 653 | 0,00 | 495 | 1,02 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 1 435 257 | −3,18 | 30 026 | −2,15 | ||||

| 2025-05-15 | 13F | Logan Stone Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-18 | 13F | Truist Financial Corp | 431 550 | 13,24 | 9 028 | 14,45 | ||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 33 247 | −3,69 | 696 | −2,66 | ||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 1 777 | −98,95 | 37 | −98,95 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 29 298 | −1,89 | 613 | −0,97 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 54 132 | 8,27 | 1 132 | 9,48 | ||||

| 2025-08-12 | 13F | APG Asset Management US Inc. | 1 480 000 | 0,00 | 30 976 | 0,96 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 21 384 | 11,49 | 447 | 12,59 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 247 773 | −12,95 | 5 183 | −12,03 | ||||

| 2025-08-12 | 13F | Richmond Investment Services, LLC | 17 452 | 365 | ||||||

| 2025-05-12 | 13F | Meitav Dash Investments Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 3 031 709 | −18,61 | 63 423 | −17,74 | ||||

| 2025-08-28 | 13F | China Universal Asset Management Co., Ltd. | 2 972 | 62 | ||||||

| 2025-07-17 | 13F | Wagner Wealth Management, Llc | 57 195 | −2,15 | 1 197 | −1,08 | ||||

| 2025-07-09 | 13F | Fiduciary Alliance LLC | 87 694 | 1 835 | ||||||

| 2025-08-11 | 13F | Wbi Investments, Inc. | 16 940 | 52,30 | 354 | 53,91 | ||||