Grundläggande statistik

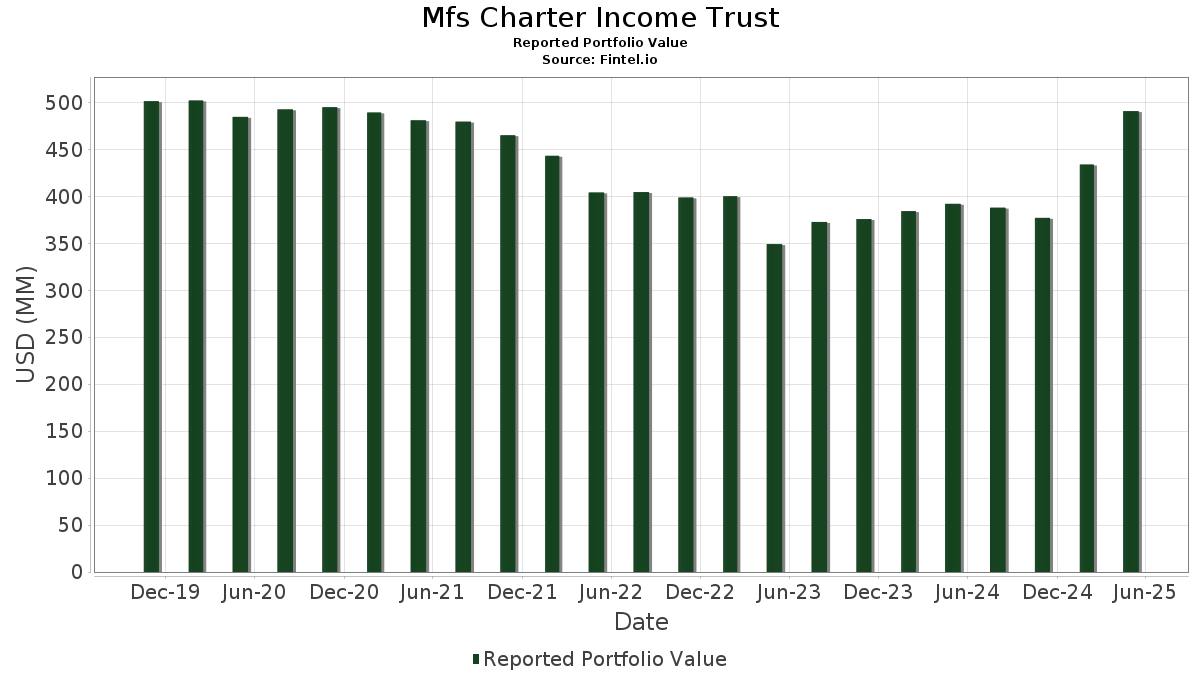

| Portföljvärde | $ 490 650 725 |

| Aktuella positioner | 1 748 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

Mfs Charter Income Trust har redovisat 1 748 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 490 650 725 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). Mfs Charter Income Trusts största innehav är United States Treasury Note/Bond (US:US91282CFF32) , United States Treasury Note/Bond (US:US912810SQ22) , Australia Government Bond (AU:AU000XCLWAP3) , US TREASURY N/B 4.125000% 08/31/2030 (US:US91282CHW47) , and MFS Institutional Money Market Portfolio (US:US55291X1090) . Mfs Charter Income Trusts nya positioner inkluderar United States Treasury Note/Bond (US:US91282CFF32) , United States Treasury Note/Bond (US:US912810SQ22) , Australia Government Bond (AU:AU000XCLWAP3) , US TREASURY N/B 4.125000% 08/31/2030 (US:US91282CHW47) , and US TREASURY N/B 4.75% 11-15-53 (US:US912810TV08) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 1,89 | 0,6797 | 0,6797 | ||

| 1,89 | 0,6797 | 0,6797 | ||

| 1,22 | 0,4383 | 0,4383 | ||

| 1,22 | 0,4383 | 0,4383 | ||

| 6,58 | 6,58 | 2,3716 | 0,4084 | |

| 1,04 | 0,3730 | 0,3730 | ||

| 1,04 | 0,3730 | 0,3730 | ||

| 0,95 | 0,3423 | 0,3423 | ||

| 0,95 | 0,3423 | 0,3423 | ||

| 0,91 | 0,3281 | 0,3281 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 4,92 | 1,7722 | −0,8347 | ||

| 0,34 | 0,1237 | −0,3926 | ||

| 0,77 | 0,2787 | −0,2322 | ||

| 0,77 | 0,2787 | −0,2322 | ||

| 0,08 | 0,0283 | −0,1992 | ||

| 2,13 | 0,7662 | −0,1873 | ||

| 0,57 | 0,2059 | −0,1747 | ||

| 0,84 | 0,3023 | −0,1546 | ||

| 4,96 | 1,7852 | −0,1458 | ||

| 0,56 | 0,2022 | −0,1422 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-07-25 för rapporteringsperioden 2025-05-31. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US91282CFF32 / United States Treasury Note/Bond | 14,69 | −0,16 | 5,2918 | 0,1123 | |||||

| US912810SQ22 / United States Treasury Note/Bond | 9,15 | −4,72 | 3,2953 | −0,0846 | |||||

| AU000XCLWAP3 / Australia Government Bond | 8,77 | 4,13 | 3,1585 | 0,1942 | |||||

| US91282CHW47 / US TREASURY N/B 4.125000% 08/31/2030 | 7,04 | 0,23 | 2,5362 | 0,0633 | |||||

| US55291X1090 / MFS Institutional Money Market Portfolio | 6,58 | 18,07 | 6,58 | 18,04 | 2,3716 | 0,4084 | |||

| U.S. Treasury Notes / DBT (US91282CJZ59) | 6,20 | −1,49 | 2,2349 | 0,0175 | |||||

| U.S. Treasury Notes / DBT (US91282CJZ59) | 6,20 | −1,49 | 2,2349 | 0,0175 | |||||

| US912810TV08 / US TREASURY N/B 4.75% 11-15-53 | 5,61 | 7,97 | 2,0214 | 0,1920 | |||||

| US912810TS78 / United States Treasury Note/Bond | 4,96 | −9,65 | 1,7852 | −0,1458 | |||||

| US91282CHK09 / United States Treasury Note/Bond | 4,92 | −33,56 | 1,7722 | −0,8347 | |||||

| US91282CJG78 / U.S. Treasury Notes | 4,89 | −0,02 | 1,7628 | 0,0399 | |||||

| KR103502G966 / Korea Treasury Bond | 2,14 | −8,13 | 0,7697 | −0,0491 | |||||

| GB00BJQWYH73 / United Kingdom Gilt | 2,13 | −22,21 | 0,7662 | −0,1873 | |||||

| US1248EPCD32 / CCO Holdings LLC / CCO Holdings Capital Corp. | 1,92 | −11,58 | 0,6909 | −0,0725 | |||||

| U.S. Treasury Notes / DBT (US91282CMM00) | 1,89 | 0,6797 | 0,6797 | ||||||

| U.S. Treasury Notes / DBT (US91282CMM00) | 1,89 | 0,6797 | 0,6797 | ||||||

| US30251GBC06 / FMG Resources August 2006 Pty Ltd | 1,76 | 0,06 | 0,6337 | 0,0148 | |||||

| CND100063XD1 / China Government Bond | 1,48 | 1,44 | 0,5342 | 0,0197 | |||||

| GR0114029540 / Hellenic Republic Government Bond | 1,43 | 9,55 | 0,5167 | 0,0555 | |||||

| GR0114029540 / Hellenic Republic Government Bond | 1,43 | 9,55 | 0,5167 | 0,0555 | |||||

| US76774LAC19 / Ritchie Bros Holdings Inc | 1,41 | 2,76 | 0,5095 | 0,0249 | |||||

| Jane Street Group / JSG Finance Inc / DBT (US47077WAD02) | 1,39 | 4,05 | 0,4994 | 0,0304 | |||||

| Jane Street Group / JSG Finance Inc / DBT (US47077WAD02) | 1,39 | 4,05 | 0,4994 | 0,0304 | |||||

| US12543DBM11 / CHS/Community Health Systems Inc | 1,36 | 17,65 | 0,4902 | 0,0829 | |||||

| KR103502GA67 / Korea Treasury Bond | 1,33 | −14,81 | 0,4808 | −0,0708 | |||||

| JP1300731N17 / JAPAN (30 YEAR ISSUE) 0.700000% 12/20/2051 | 1,25 | −6,79 | 0,4507 | −0,0217 | |||||

| US1248EPCE15 / CCO Holdings LLC / CCO Holdings Capital Corp | 1,24 | 2,48 | 0,4469 | 0,0207 | |||||

| China Government Bond / DBT (CND10008S8G8) | 1,22 | 0,4383 | 0,4383 | ||||||

| China Government Bond / DBT (CND10008S8G8) | 1,22 | 0,4383 | 0,4383 | ||||||

| US12511VAA61 / CDI Escrow Issuer Inc | 1,21 | 4,24 | 0,4348 | 0,0273 | |||||

| US432833AF84 / Hilton Domestic Operating Co Inc | 1,20 | 1,78 | 0,4340 | 0,0174 | |||||

| US18539UAD72 / Clearway Energy Operating LLC | 1,20 | −8,45 | 0,4331 | −0,0295 | |||||

| Albertsons Cos Inc / Safeway Inc / New Albertsons LP / Albertsons LLC / DBT (US01309QAB41) | 1,20 | 309,25 | 0,4308 | 0,3278 | |||||

| Albertsons Cos Inc / Safeway Inc / New Albertsons LP / Albertsons LLC / DBT (US01309QAB41) | 1,20 | 309,25 | 0,4308 | 0,3278 | |||||

| ES0000012L60 / Spain Government Bond | 1,19 | 8,00 | 0,4281 | 0,0407 | |||||

| US749571AJ42 / RHP Hotel Properties LP / RHP Finance Corp | 1,17 | 1,74 | 0,4212 | 0,0166 | |||||

| US893647BS53 / TransDigm Inc | 1,16 | 0,52 | 0,4176 | 0,0116 | |||||

| US69331CAJ71 / PG&E Corp | 1,15 | 21,62 | 0,4156 | 0,0817 | |||||

| Baldwin Insurance Group Holdings LLC / Baldwin Insurance Group Holdings Finance / DBT (US05825XAA72) | 1,13 | 3,57 | 0,4078 | 0,0233 | |||||

| Baldwin Insurance Group Holdings LLC / Baldwin Insurance Group Holdings Finance / DBT (US05825XAA72) | 1,13 | 3,57 | 0,4078 | 0,0233 | |||||

| US146869AM47 / Carvana Co. | 1,13 | 16,53 | 0,4066 | 0,0656 | |||||

| Primo Water Holdings Inc / Triton Water Holdings Inc / DBT (US74168RAB96) | 1,11 | 0,45 | 0,4004 | 0,0110 | |||||

| Primo Water Holdings Inc / Triton Water Holdings Inc / DBT (US74168RAB96) | 1,11 | 0,45 | 0,4004 | 0,0110 | |||||

| US70932MAD92 / PennyMac Financial Services Inc | 1,11 | 12,03 | 0,3995 | 0,0512 | |||||

| US70932MAD92 / PennyMac Financial Services Inc | 1,11 | 12,03 | 0,3995 | 0,0512 | |||||

| JP1201711L13 / Japan Government Twenty Year Bond | 1,09 | 20,09 | 0,3942 | 0,0733 | |||||

| Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer / DBT (US01883LAG86) | 1,08 | −8,61 | 0,3904 | −0,0271 | |||||

| Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer / DBT (US01883LAG86) | 1,08 | −8,61 | 0,3904 | −0,0271 | |||||

| XS1319820897 / Southern Gas Corridor CJSC | 1,08 | −0,09 | 0,3875 | 0,0085 | |||||

| US00185PAA93 / APi Escrow Corp | 1,06 | 10,55 | 0,3813 | 0,0442 | |||||

| US88033GDQ01 / CORP. NOTE | 1,06 | 8,07 | 0,3813 | 0,0362 | |||||

| US92332YAB74 / Venture Global LNG, Inc. | 1,05 | 9,54 | 0,3767 | 0,0406 | |||||

| US98313RAH93 / Wynn Macau Ltd | 1,04 | −0,76 | 0,3761 | 0,0057 | |||||

| US205768AS39 / Comstock Resources Inc | 1,04 | 2,07 | 0,3732 | 0,0160 | |||||

| TransDigm Inc / DBT (US893647BY22) | 1,04 | 0,3730 | 0,3730 | ||||||

| TransDigm Inc / DBT (US893647BY22) | 1,04 | 0,3730 | 0,3730 | ||||||

| Azorra Finance Ltd / DBT (US05480AAA34) | 1,03 | 3,74 | 0,3703 | 0,0216 | |||||

| Azorra Finance Ltd / DBT (US05480AAA34) | 1,03 | 3,74 | 0,3703 | 0,0216 | |||||

| US78466CAC01 / SS&C Technologies Holdings Inc. | 1,02 | 2,22 | 0,3660 | 0,0161 | |||||

| US05605HAC43 / BWX Technologies Inc | 1,02 | −1,17 | 0,3658 | 0,0041 | |||||

| XS1793329225 / Ivory Coast Government International Bond | 1,00 | 7,78 | 0,3593 | 0,0336 | |||||

| Six Flags Entertainment Corp /Six Flags Theme Parks Inc/ Canada's Wonderland Co / DBT (US83002YAA73) | 0,99 | 3,33 | 0,3577 | 0,0194 | |||||

| Six Flags Entertainment Corp /Six Flags Theme Parks Inc/ Canada's Wonderland Co / DBT (US83002YAA73) | 0,99 | 3,33 | 0,3577 | 0,0194 | |||||

| US87470LAD38 / Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp | 0,98 | 2,61 | 0,3544 | 0,0168 | |||||

| US019736AG29 / Allison Transmission Inc | 0,98 | −1,61 | 0,3522 | 0,0025 | |||||

| US90290MAD39 / US FOODS INC 4.75% 02/15/2029 144A | 0,97 | 3,30 | 0,3491 | 0,0188 | |||||

| TCOKZ / Tengizchevroil Finance Co International Ltd | 0,97 | 0,41 | 0,3490 | 0,0094 | |||||

| US699149AH36 / Paraguay Government International Bond | 0,96 | −4,17 | 0,3476 | −0,0067 | |||||

| KeHE Distributors LLC / KeHE Finance Corp / NextWave Distribution Inc / DBT (US487526AC91) | 0,96 | 20,28 | 0,3463 | 0,0647 | |||||

| KeHE Distributors LLC / KeHE Finance Corp / NextWave Distribution Inc / DBT (US487526AC91) | 0,96 | 20,28 | 0,3463 | 0,0647 | |||||

| SUN / Sunoco LP - Limited Partnership | 0,96 | 31,36 | 0,3442 | 0,0882 | |||||

| SUN / Sunoco LP - Limited Partnership | 0,96 | 31,36 | 0,3442 | 0,0882 | |||||

| GR0114029540 / Hellenic Republic Government Bond | 0,95 | 101,91 | 0,3428 | 0,1767 | |||||

| GR0114029540 / Hellenic Republic Government Bond | 0,95 | 101,91 | 0,3428 | 0,1767 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 0,95 | 0,3423 | 0,3423 | ||||||

| 5831 / Shizuoka Financial Group,Inc. | 0,95 | 0,3423 | 0,3423 | ||||||

| Panther Escrow Issuer LLC / DBT (US69867RAA59) | 0,94 | 2,51 | 0,3388 | 0,0156 | |||||

| Panther Escrow Issuer LLC / DBT (US69867RAA59) | 0,94 | 2,51 | 0,3388 | 0,0156 | |||||

| US92682RAA05 / Viking Ocean Cruises Ship VII Ltd | 0,93 | 4,98 | 0,3347 | 0,0233 | |||||

| Bank Gospodarstwa Krajowego / DBT (US06237MAC73) | 0,92 | −0,86 | 0,3311 | 0,0047 | |||||

| Bank Gospodarstwa Krajowego / DBT (US06237MAC73) | 0,92 | −0,86 | 0,3311 | 0,0047 | |||||

| US682357AA69 / Senior Unsecured | 0,92 | 2,12 | 0,3302 | 0,0142 | |||||

| Canada Government Bonds / DBT (CA135087S216) | 0,91 | 0,3281 | 0,3281 | ||||||

| Canada Government Bonds / DBT (CA135087S216) | 0,91 | 0,3281 | 0,3281 | ||||||

| US98311AAB17 / Wyndham Hotels & Resorts Inc | 0,90 | −9,79 | 0,3256 | −0,0271 | |||||

| US36261NAA54 / GYP Holdings III Corp | 0,89 | 1,95 | 0,3208 | 0,0131 | |||||

| US71654QDB59 / Petroleos Mexicanos | 0,89 | −0,23 | 0,3196 | 0,0068 | |||||

| US737446AQ74 / Post Holdings Inc | 0,88 | −5,26 | 0,3178 | −0,0101 | |||||

| Abu Dhabi Developmental Holding Co PJSC / DBT (US00402D2B08) | 0,88 | −0,57 | 0,3168 | 0,0054 | |||||

| Abu Dhabi Developmental Holding Co PJSC / DBT (US00402D2B08) | 0,88 | −0,57 | 0,3168 | 0,0054 | |||||

| USG5975LAE68 / Melco Resorts Finance Ltd | 0,88 | −1,02 | 0,3153 | 0,0039 | |||||

| US44332PAH47 / HUB International Ltd | 0,87 | −19,45 | 0,3152 | −0,0670 | |||||

| US92770QAA58 / Virgin Media Vendor Financing Notes IV DAC | 0,87 | 1,64 | 0,3128 | 0,0121 | |||||

| US78410GAG91 / SBA Communications Corp | 0,87 | 0,12 | 0,3127 | 0,0077 | |||||

| PATK / Patrick Industries, Inc. | 0,86 | 1,65 | 0,3100 | 0,0119 | |||||

| PATK / Patrick Industries, Inc. | 0,86 | 1,65 | 0,3100 | 0,0119 | |||||

| US893647BL01 / CORP. NOTE | 0,86 | −18,10 | 0,3099 | −0,0600 | |||||

| Perrigo Finance Unlimited Co / DBT (US71429MAD74) | 0,86 | 6,08 | 0,3082 | 0,0244 | |||||

| Perrigo Finance Unlimited Co / DBT (US71429MAD74) | 0,86 | 6,08 | 0,3082 | 0,0244 | |||||

| US37185LAP76 / Genesis Energy LP / Genesis Energy Finance Corp | 0,85 | 261,86 | 0,3079 | 0,2248 | |||||

| KR103502GAC2 / Korea Treasury Bond | 0,85 | 2,28 | 0,3073 | 0,0163 | |||||

| India Government Bond / DBT (IN0020230085) | 0,85 | 27,59 | 0,3069 | 0,0740 | |||||

| India Government Bond / DBT (IN0020230085) | 0,85 | 27,59 | 0,3069 | 0,0740 | |||||

| AVTCAP / Avation Capital SA | 0,85 | −0,94 | 0,3055 | 0,0043 | |||||

| US71677KAB44 / PETM 7 3/4 02/15/29 | 0,85 | 0,59 | 0,3051 | 0,0087 | |||||

| US058498AW66 / Ball Corp | 0,84 | 4,08 | 0,3030 | 0,0182 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 0,84 | 0,3029 | 0,3029 | ||||||

| GB00BMV7TC88 / United Kingdom Gilt | 0,84 | 0,3029 | 0,3029 | ||||||

| Concentra Health Services Inc / DBT (US20600DAA19) | 0,84 | 20,72 | 0,3024 | 0,0574 | |||||

| Concentra Health Services Inc / DBT (US20600DAA19) | 0,84 | 20,72 | 0,3024 | 0,0574 | |||||

| US98953GAD79 / Ziggo Bond Co BV | 0,84 | −35,31 | 0,3023 | −0,1546 | |||||

| US060335AB23 / Banijay Entertainment SASU | 0,83 | −0,36 | 0,2991 | 0,0056 | |||||

| US29261AAB61 / ENCOMPASS HEALTH CORP COMPANY GUAR 02/30 4.75 | 0,82 | 2,75 | 0,2968 | 0,0147 | |||||

| XS2288906857 / Oman Government International Bond | 0,82 | −4,19 | 0,2965 | −0,0060 | |||||

| US62482BAB80 / MOZART DEBT MERGER SUB INC | 0,81 | 0,87 | 0,2933 | 0,0090 | |||||

| US983133AA70 / Wynn Resorts Finance LLC / Wynn Resorts Capital Corp 5.125% 10/01/2029 144A | 0,81 | 0,12 | 0,2919 | 0,0071 | |||||

| SCI / Service Corporation International | 0,81 | 20,39 | 0,2918 | 0,0550 | |||||

| SCI / Service Corporation International | 0,81 | 20,39 | 0,2918 | 0,0550 | |||||

| US163851AH15 / Chemours Co/The | 0,81 | −5,05 | 0,2915 | −0,0085 | |||||

| CND10002HV84 / China Government Bond | 0,80 | 0,63 | 0,2896 | 0,0110 | |||||

| US38016LAC90 / Go Daddy Operating Co LLC / GD Finance Co Inc | 0,80 | 3,10 | 0,2882 | 0,0151 | |||||

| US449691AC82 / Iliad Holding SASU | 0,79 | −22,93 | 0,2858 | −0,0767 | |||||

| US501797AW48 / L Brands Inc | 0,78 | 2,36 | 0,2815 | 0,0126 | |||||

| US78433BAB45 / SCIH Salt Holdings Inc | 0,78 | −0,64 | 0,2814 | 0,0047 | |||||

| US96350RAA23 / White Cap Buyer LLC | 0,78 | 8,06 | 0,2804 | 0,0268 | |||||

| US25714PEE43 / Dominican Republic International Bond | 0,78 | −6,83 | 0,2801 | −0,0138 | |||||

| US38869AAA51 / Graphic Packaging International LLC | 0,78 | −11,50 | 0,2800 | −0,0293 | |||||

| US38869AAA51 / Graphic Packaging International LLC | 0,78 | −11,50 | 0,2800 | −0,0293 | |||||

| Italy Buoni Poliennali Del Tesoro / DBT (IT0005582421) | 0,77 | −46,69 | 0,2787 | −0,2322 | |||||

| Italy Buoni Poliennali Del Tesoro / DBT (IT0005582421) | 0,77 | −46,69 | 0,2787 | −0,2322 | |||||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 0,77 | 3,65 | 0,2764 | 0,0156 | |||||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 0,77 | 3,65 | 0,2764 | 0,0156 | |||||

| XS2062490649 / EP INFRASTRUCTUR | 0,76 | 9,97 | 0,2744 | 0,0305 | |||||

| Delek Logistics Partners LP / Delek Logistics Finance Corp / DBT (US24665FAD42) | 0,76 | 4,68 | 0,2739 | 0,0181 | |||||

| Delek Logistics Partners LP / Delek Logistics Finance Corp / DBT (US24665FAD42) | 0,76 | 4,68 | 0,2739 | 0,0181 | |||||

| US00840KAA79 / AG TTMT Escrow Issuer LLC | 0,76 | 3,55 | 0,2738 | 0,0156 | |||||

| US030727AA98 / AmeriTex HoldCo Intermediate LLC | 0,76 | 22,85 | 0,2733 | 0,0558 | |||||

| US350392AA45 / Foundation Building Materials Inc | 0,75 | 3,71 | 0,2719 | 0,0158 | |||||

| US498894AA29 / Knife River Holding Co | 0,75 | 3,01 | 0,2711 | 0,0139 | |||||

| US55282XAJ90 / MF1 Multifamily Housing Mortgage Loan Trust | 0,75 | 0,00 | 0,2711 | 0,0061 | |||||

| US005095AA29 / Acushnet Co | 0,75 | 1,76 | 0,2706 | 0,0105 | |||||

| US25714PEP99 / Dominican Republic International Bond | 0,75 | 0,40 | 0,2705 | 0,0074 | |||||

| US82983MAB63 / Sitio Royalties Operating Partnership LP | 0,75 | −20,28 | 0,2694 | −0,0607 | |||||

| US05765WAA18 / TIBCO Software Inc | 0,75 | 3,32 | 0,2690 | 0,0145 | |||||

| US05765WAA18 / TIBCO Software Inc | 0,75 | 3,32 | 0,2690 | 0,0145 | |||||

| US7846ELAE71 / SPCM SA | 0,74 | 3,67 | 0,2649 | 0,0151 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0,73 | −18,87 | 0,2636 | −0,0537 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0,73 | −18,87 | 0,2636 | −0,0537 | |||||

| US15239XAA63 / Central American Bottling Corp / CBC Bottling Holdco SL / Beliv Holdco SL | 0,73 | 0,83 | 0,2631 | 0,0080 | |||||

| F2IC34 / Fair Isaac Corporation - Depositary Receipt (Common Stock) | 0,73 | 0,2629 | 0,2629 | ||||||

| F2IC34 / Fair Isaac Corporation - Depositary Receipt (Common Stock) | 0,73 | 0,2629 | 0,2629 | ||||||

| US126307AS68 / CSC Holdings LLC | 0,73 | 6,27 | 0,2629 | 0,0211 | |||||

| AU0000274706 / AUSTRALIAN GOVERNMENT /AUD/ REGD REG S SER 168 3.50000000 | 0,73 | 0,2626 | 0,2626 | ||||||

| 511218 / Shriram Finance Limited | 0,73 | −0,82 | 0,2626 | 0,0039 | |||||

| 511218 / Shriram Finance Limited | 0,73 | −0,82 | 0,2626 | 0,0039 | |||||

| US49461MAA80 / Kinetik Holdings LP | 0,73 | 22,35 | 0,2625 | 0,0527 | |||||

| US92769VAJ89 / Virgin Media Finance PLC | 0,73 | 4,47 | 0,2613 | 0,0169 | |||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 0,73 | 0,2612 | 0,2612 | ||||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 0,73 | 0,2612 | 0,2612 | ||||||

| US670001AE60 / Novelis Corp | 0,72 | 0,84 | 0,2606 | 0,0081 | |||||

| GPOR / Gulfport Energy Corporation | 0,72 | 11,27 | 0,2598 | 0,0317 | |||||

| GPOR / Gulfport Energy Corporation | 0,72 | 11,27 | 0,2598 | 0,0317 | |||||

| US70959WAK99 / Penske Automotive Group Inc | 0,72 | 2,42 | 0,2597 | 0,0119 | |||||

| US45434M2C57 / Indian Railway Finance Corp Ltd | 0,71 | 0,28 | 0,2571 | 0,0067 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0,71 | 11,51 | 0,2549 | 0,0313 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0,71 | 11,51 | 0,2549 | 0,0313 | |||||

| US67059TAH86 / NuStar Logistics LP | 0,71 | −0,14 | 0,2540 | 0,0051 | |||||

| Amer Sports Co / DBT (US02352NAA72) | 0,70 | −13,42 | 0,2536 | −0,0324 | |||||

| Amer Sports Co / DBT (US02352NAA72) | 0,70 | −13,42 | 0,2536 | −0,0324 | |||||

| US284902AF02 / Eldorado Gold Corp | 0,70 | 0,57 | 0,2527 | 0,0073 | |||||

| US92332YAC57 / Venture Global LNG Inc | 0,70 | −3,18 | 0,2527 | −0,0024 | |||||

| Empire Communities Corp / DBT (US29163VAG86) | 0,70 | 4,33 | 0,2517 | 0,0159 | |||||

| Empire Communities Corp / DBT (US29163VAG86) | 0,70 | 4,33 | 0,2517 | 0,0159 | |||||

| USA Compression Partners LP / USA Compression Finance Corp / DBT (US91740PAG37) | 0,70 | −0,86 | 0,2507 | 0,0035 | |||||

| USA Compression Partners LP / USA Compression Finance Corp / DBT (US91740PAG37) | 0,70 | −0,86 | 0,2507 | 0,0035 | |||||

| Bulgaria Government International Bonds / DBT (XS2890436087) | 0,70 | −3,34 | 0,2505 | −0,0029 | |||||

| Bulgaria Government International Bonds / DBT (XS2890436087) | 0,70 | −3,34 | 0,2505 | −0,0029 | |||||

| US98372MAC91 / XHR LP 4.875% 06/01/2029 144A | 0,70 | 0,14 | 0,2504 | 0,0059 | |||||

| Shift4 Payments LLC / Shift4 Payments Finance Sub Inc / DBT (US82453AAB35) | 0,69 | 31,44 | 0,2503 | 0,0641 | |||||

| Shift4 Payments LLC / Shift4 Payments Finance Sub Inc / DBT (US82453AAB35) | 0,69 | 31,44 | 0,2503 | 0,0641 | |||||

| Cerdia Finanz GmbH / DBT (US15679GAC69) | 0,69 | 39,52 | 0,2495 | 0,0746 | |||||

| Cerdia Finanz GmbH / DBT (US15679GAC69) | 0,69 | 39,52 | 0,2495 | 0,0746 | |||||

| US88104LAE39 / TERRAFORM POWER OPERATIN | 0,68 | −27,72 | 0,2462 | −0,0868 | |||||

| US097023CW33 / BOEING CO 5.805 5/50 | 0,68 | −2,99 | 0,2459 | −0,0016 | |||||

| US50218KAB44 / Life Time Inc | 0,68 | 7,41 | 0,2455 | 0,0222 | |||||

| US50218KAB44 / Life Time Inc | 0,68 | 7,41 | 0,2455 | 0,0222 | |||||

| Petronas Capital Ltd / DBT (US716743AW96) | 0,68 | 0,2443 | 0,2443 | ||||||

| Petronas Capital Ltd / DBT (US716743AW96) | 0,68 | 0,2443 | 0,2443 | ||||||

| Venture Global LNG Inc / DBT (US92332YAF88) | 0,68 | −7,26 | 0,2440 | −0,0131 | |||||

| Venture Global LNG Inc / DBT (US92332YAF88) | 0,68 | −7,26 | 0,2440 | −0,0131 | |||||

| US46284VAL53 / Iron Mountain Inc | 0,68 | 0,59 | 0,2440 | 0,0068 | |||||

| US91087BAK61 / Mexico Government International Bond | 0,68 | −0,15 | 0,2438 | 0,0054 | |||||

| US02156LAC54 / Altice France SA/France | 0,67 | 57,11 | 0,2431 | 0,0918 | |||||

| US576485AF30 / Matador Resources Co | 0,67 | 0,90 | 0,2425 | 0,0073 | |||||

| US46284VAE11 / Iron Mountain Inc | 0,67 | 2,29 | 0,2412 | 0,0109 | |||||

| US70137WAL28 / Parkland Corp | 0,67 | −32,53 | 0,2410 | −0,1077 | |||||

| Amentum Holdings Inc / DBT (US02352BAA35) | 0,67 | 12,90 | 0,2396 | 0,0319 | |||||

| Amentum Holdings Inc / DBT (US02352BAA35) | 0,67 | 12,90 | 0,2396 | 0,0319 | |||||

| US23345MAB37 / DT MIDSTREAM INC 4.375% 06/15/2031 144A | 0,66 | −16,29 | 0,2389 | −0,0401 | |||||

| TransDigm Inc / DBT (US893647BU00) | 0,66 | 4,93 | 0,2380 | 0,0165 | |||||

| TransDigm Inc / DBT (US893647BU00) | 0,66 | 4,93 | 0,2380 | 0,0165 | |||||

| US69346VAA70 / Performance Food Group Inc 5.5% 10/15/2027 144A | 0,66 | −14,56 | 0,2368 | −0,0341 | |||||

| US34960PAD33 / Fortress Transportation and Infrastructure Investors LLC | 0,66 | 0,46 | 0,2361 | 0,0066 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 0,65 | 0,2360 | 0,2360 | ||||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 0,65 | 0,2360 | 0,2360 | ||||||

| US55337PAA03 / MIWD Holdco II LLC / MIWD Finance Corp | 0,65 | −2,68 | 0,2358 | −0,0011 | |||||

| US29103CAA62 / Emerald Debt Merger Sub LLC | 0,65 | −18,19 | 0,2351 | −0,0456 | |||||

| US69073TAU79 / Owens-Brockway Glass Container, Inc. | 0,65 | 63,57 | 0,2346 | 0,0944 | |||||

| US131347CM64 / Calpine Corp | 0,65 | 0,31 | 0,2343 | 0,0060 | |||||

| MT4648 / Baffinland Iron Mines Corp / Baffinland Iron Mines LP | 0,65 | −2,26 | 0,2343 | −0,0001 | |||||

| EVKG / Ever-Glory International Group, Inc. | 0,65 | −0,15 | 0,2324 | 0,0048 | |||||

| EVKG / Ever-Glory International Group, Inc. | 0,65 | −0,15 | 0,2324 | 0,0048 | |||||

| Medline Borrower LP/Medline Co-Issuer Inc / DBT (US58506DAA63) | 0,64 | 9,40 | 0,2306 | 0,0244 | |||||

| Medline Borrower LP/Medline Co-Issuer Inc / DBT (US58506DAA63) | 0,64 | 9,40 | 0,2306 | 0,0244 | |||||

| JP1201511EC7 / Japan Government Twenty Year Bond | 0,64 | −1,24 | 0,2306 | 0,0025 | |||||

| XS1819680528 / Angolan Government International Bond | 0,64 | −11,17 | 0,2294 | −0,0229 | |||||

| Zegona Finance PLC / DBT (US98927UAA51) | 0,64 | 0,16 | 0,2294 | 0,0057 | |||||

| Zegona Finance PLC / DBT (US98927UAA51) | 0,64 | 0,16 | 0,2294 | 0,0057 | |||||

| US29245JAJ16 / Empresa Nacional del Petroleo | 0,64 | −0,31 | 0,2293 | 0,0046 | |||||

| US29245JAJ16 / Empresa Nacional del Petroleo | 0,64 | −0,31 | 0,2293 | 0,0046 | |||||

| US450913AF55 / IAMGOLD Corp | 0,64 | 2,09 | 0,2292 | 0,0096 | |||||

| US401494AW96 / Guatemala Government Bond | 0,63 | 0,32 | 0,2273 | 0,0060 | |||||

| US401494AW96 / Guatemala Government Bond | 0,63 | 0,32 | 0,2273 | 0,0060 | |||||

| Credit Acceptance Corp / DBT (US225310AS06) | 0,63 | 54,55 | 0,2268 | 0,0833 | |||||

| Credit Acceptance Corp / DBT (US225310AS06) | 0,63 | 54,55 | 0,2268 | 0,0833 | |||||

| US445545AQ90 / Hungary Government International Bond | 0,63 | −2,18 | 0,2266 | 0,0002 | |||||

| GB00B6RNH572 / United Kingdom Gilt | 0,63 | 4,32 | 0,2265 | 0,0142 | |||||

| US60337JAA43 / Minerva Merger Sub Inc | 0,63 | 1,45 | 0,2263 | 0,0080 | |||||

| US039524AB93 / ARCHES BUYER INC 6.125% 12/01/2028 144A | 0,63 | 4,67 | 0,2262 | 0,0150 | |||||

| US74112BAL99 / Prestige Brands Inc 5.125% 01/15/2028 144A | 0,63 | 0,81 | 0,2259 | 0,0071 | |||||

| US04020JAA43 / Aretec Escrow Issuer 2 Inc | 0,63 | 2,96 | 0,2257 | 0,0114 | |||||

| US36168QAL86 / GFL Environmental Inc | 0,63 | −13,07 | 0,2255 | −0,0277 | |||||

| XS1864523300 / Eskom Holdings SOC Ltd | 0,62 | 0,81 | 0,2249 | 0,0067 | |||||

| USL6388GAB60 / Millicom International Cellular SA | 0,62 | 1,46 | 0,2249 | 0,0082 | |||||

| Walker & Dunlop Inc / DBT (US93148PAA03) | 0,62 | 0,2229 | 0,2229 | ||||||

| Walker & Dunlop Inc / DBT (US93148PAA03) | 0,62 | 0,2229 | 0,2229 | ||||||

| STAREN / Star Energy Geothermal Wayang Windu Ltd | 0,62 | −10,19 | 0,2226 | −0,0195 | |||||

| US14985VAE11 / CCM Merger Inc | 0,62 | 0,16 | 0,2224 | 0,0052 | |||||

| US92332YAA91 / Venture Global LNG, Inc. | 0,62 | −0,97 | 0,2216 | 0,0026 | |||||

| US68622TAA97 / Organon Finance 1 LLC | 0,61 | −1,29 | 0,2213 | 0,0023 | |||||

| US46266TAD00 / IQVIA Inc | 0,61 | −0,33 | 0,2208 | 0,0043 | |||||

| Costa Rica Government International Bonds / DBT (USP3699PGN17) | 0,61 | −2,86 | 0,2208 | −0,0012 | |||||

| Costa Rica Government International Bonds / DBT (USP3699PGN17) | 0,61 | −2,86 | 0,2208 | −0,0012 | |||||

| Uzbek Industrial and Construction Bank ATB / DBT (US917935AA60) | 0,61 | −1,13 | 0,2207 | 0,0026 | |||||

| Uzbek Industrial and Construction Bank ATB / DBT (US917935AA60) | 0,61 | −1,13 | 0,2207 | 0,0026 | |||||

| US535219AA75 / Lindblad Expeditions Holdings Inc | 0,61 | 0,66 | 0,2197 | 0,0065 | |||||

| US758071AA21 / Redwood Star Merger Sub Inc | 0,61 | 0,66 | 0,2195 | 0,0065 | |||||

| US85172FAQ28 / Springleaf Finance Corp 6.625% 01/15/2028 | 0,61 | 5,76 | 0,2186 | 0,0165 | |||||

| US85172FAQ28 / Springleaf Finance Corp 6.625% 01/15/2028 | 0,61 | 5,76 | 0,2186 | 0,0165 | |||||

| DE0001174068 / CHINA UNIVERSAL EX INC | 0,61 | 0,2183 | 0,2183 | ||||||

| DE0001174068 / CHINA UNIVERSAL EX INC | 0,61 | 0,2183 | 0,2183 | ||||||

| Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp / DBT (US87470LAL53) | 0,60 | 20,56 | 0,2177 | 0,0410 | |||||

| Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp / DBT (US87470LAL53) | 0,60 | 20,56 | 0,2177 | 0,0410 | |||||

| TKO / Taseko Mines Limited | 0,60 | 1,01 | 0,2173 | 0,0068 | |||||

| TKO / Taseko Mines Limited | 0,60 | 1,01 | 0,2173 | 0,0068 | |||||

| SATS / EchoStar Corporation | 0,60 | −3,22 | 0,2169 | −0,0023 | |||||

| SATS / EchoStar Corporation | 0,60 | −3,22 | 0,2169 | −0,0023 | |||||

| Quikrete Holdings Inc / DBT (US74843PAA84) | 0,60 | 2,21 | 0,2167 | 0,0096 | |||||

| Quikrete Holdings Inc / DBT (US74843PAA84) | 0,60 | 2,21 | 0,2167 | 0,0096 | |||||

| US35906ABG22 / Frontier Communications Corp | 0,60 | −20,82 | 0,2166 | −0,0509 | |||||

| US896288AA51 / TriNet Group Inc | 0,60 | −15,01 | 0,2164 | −0,0322 | |||||

| US12685JAC99 / Cable One Inc | 0,60 | −21,18 | 0,2160 | −0,0517 | |||||

| C2AC34 / CACI International Inc - Depositary Receipt (Common Stock) | 0,60 | 0,2160 | 0,2160 | ||||||

| C2AC34 / CACI International Inc - Depositary Receipt (Common Stock) | 0,60 | 0,2160 | 0,2160 | ||||||

| Jefferson Capital Holdings LLC / DBT (US472481AC47) | 0,60 | 0,2157 | 0,2157 | ||||||

| Jefferson Capital Holdings LLC / DBT (US472481AC47) | 0,60 | 0,2157 | 0,2157 | ||||||

| US59565JAA97 / MIDAS OPCO HOLDINGS LLC | 0,60 | −2,93 | 0,2151 | −0,0015 | |||||

| XS2648489891 / Avis Budget Finance plc | 0,59 | 8,00 | 0,2141 | 0,0203 | |||||

| Raven Acquisition Holdings LLC / DBT (US75420NAA19) | 0,59 | 4,58 | 0,2141 | 0,0139 | |||||

| Raven Acquisition Holdings LLC / DBT (US75420NAA19) | 0,59 | 4,58 | 0,2141 | 0,0139 | |||||

| US Acute Care Solutions LLC / DBT (US90367UAD37) | 0,59 | 2,08 | 0,2127 | 0,0090 | |||||

| US Acute Care Solutions LLC / DBT (US90367UAD37) | 0,59 | 2,08 | 0,2127 | 0,0090 | |||||

| Magnolia Oil & Gas Operating LLC / Magnolia Oil & Gas Finance Corp / DBT (US559665AB08) | 0,59 | −8,14 | 0,2115 | −0,0135 | |||||

| Magnolia Oil & Gas Operating LLC / Magnolia Oil & Gas Finance Corp / DBT (US559665AB08) | 0,59 | −8,14 | 0,2115 | −0,0135 | |||||

| US71654QCC42 / Petroleos Mexicanos Bond | 0,59 | −2,50 | 0,2109 | −0,0005 | |||||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 0,58 | 0,17 | 0,2103 | 0,0051 | |||||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 0,58 | 0,17 | 0,2103 | 0,0051 | |||||

| XS2066744231 / Carnival PLC | 0,58 | 0,00 | 0,2098 | 0,0046 | |||||

| XS2066744231 / Carnival PLC | 0,58 | 0,00 | 0,2098 | 0,0046 | |||||

| Encino Acquisition Partners Holdings LLC / DBT (US29254BAB36) | 0,58 | −16,04 | 0,2093 | −0,0343 | |||||

| Encino Acquisition Partners Holdings LLC / DBT (US29254BAB36) | 0,58 | −16,04 | 0,2093 | −0,0343 | |||||

| US25830JAA97 / Dornoch Debt Merger Sub Inc | 0,58 | 0,00 | 0,2091 | 0,0046 | |||||

| US77340RAM97 / Rockies Express Pipeline LLC | 0,58 | 1,05 | 0,2087 | 0,0066 | |||||

| US31556TAC36 / Fertitta Entertainment LLC / Fertitta Entertainment Finance Co Inc | 0,58 | −2,38 | 0,2074 | −0,0001 | |||||

| US432833AN19 / HILTON DOMESTIC OPERATING CO INC 3.625% 02/15/2032 144A | 0,57 | 2,68 | 0,2071 | 0,0103 | |||||

| Z1BR34 / Zebra Technologies Corporation - Depositary Receipt (Common Stock) | 0,57 | 2,50 | 0,2068 | 0,0096 | |||||

| Z1BR34 / Zebra Technologies Corporation - Depositary Receipt (Common Stock) | 0,57 | 2,50 | 0,2068 | 0,0096 | |||||

| US159864AG27 / Charles River Laboratories International Inc | 0,57 | −47,13 | 0,2059 | −0,1747 | |||||

| US92339LAA08 / VERDE PURCHASER LLC 10.5% 11/30/2030 144A | 0,57 | 13,10 | 0,2054 | 0,0277 | |||||

| Freedom Mortgage Holdings LLC / DBT (US35641AAA60) | 0,57 | 5,57 | 0,2050 | 0,0150 | |||||

| Freedom Mortgage Holdings LLC / DBT (US35641AAA60) | 0,57 | 5,57 | 0,2050 | 0,0150 | |||||

| Surgery Center Holdings Inc / DBT (US86881WAF95) | 0,57 | 19,12 | 0,2046 | 0,0370 | |||||

| Surgery Center Holdings Inc / DBT (US86881WAF95) | 0,57 | 19,12 | 0,2046 | 0,0370 | |||||

| US55617LAP76 / Macy's Retail Holdings LLC | 0,56 | 2,73 | 0,2034 | 0,0099 | |||||

| US853496AG21 / Standard Industries Inc/NJ | 0,56 | −42,64 | 0,2022 | −0,1422 | |||||

| US63861CAA71 / NATIONSTAR MTG HLD INC | 0,56 | −20,65 | 0,2021 | −0,0470 | |||||

| AU0000018442 / Australia Government Bond | 0,56 | 59,26 | 0,2016 | 0,0778 | |||||

| Sinclair Television Group Inc / DBT (US829259BH26) | 0,56 | 0,2008 | 0,2008 | ||||||

| Sinclair Television Group Inc / DBT (US829259BH26) | 0,56 | 0,2008 | 0,2008 | ||||||

| US929566AL19 / Wabash National Corp | 0,56 | 33,41 | 0,2001 | 0,0534 | |||||

| PKN / Orlen S.A. | 0,56 | 0,2000 | 0,2000 | ||||||

| PKN / Orlen S.A. | 0,56 | 0,2000 | 0,2000 | ||||||

| DBD / Diebold Nixdorf, Incorporated | 0,55 | 53,89 | 0,1999 | 0,0729 | |||||

| DBD / Diebold Nixdorf, Incorporated | 0,55 | 53,89 | 0,1999 | 0,0729 | |||||

| US91327BAA89 / UNITI GROUP LP / UNITI GROUP FINANCE INC / CSL CAPITAL LLC 6.5% 02/15/2029 144A | 0,55 | 156,02 | 0,1994 | 0,1232 | |||||

| US53219LAV18 / LifePoint Health Inc | 0,55 | 46,81 | 0,1992 | 0,0665 | |||||

| US70052LAC72 / Park Intermediate Holdings LLC / PK Domestic Property LLC / PK Finance Co-Issuer | 0,55 | −0,36 | 0,1987 | 0,0037 | |||||

| US893647BP15 / CORP. NOTE | 0,55 | 2,05 | 0,1975 | 0,0081 | |||||

| US74112BAM72 / Prestige Brands Inc | 0,55 | 6,02 | 0,1969 | 0,0154 | |||||

| US085209AJ33 / Bermuda Government International Bonds | 0,54 | −0,55 | 0,1963 | 0,0037 | |||||

| P2OD34 / Insulet Corporation - Depositary Receipt (Common Stock) | 0,54 | 0,1956 | 0,1956 | ||||||

| P2OD34 / Insulet Corporation - Depositary Receipt (Common Stock) | 0,54 | 0,1956 | 0,1956 | ||||||

| US93710WAA36 / WASH Multifamily Acquisition Inc | 0,54 | 0,00 | 0,1955 | 0,0045 | |||||

| Prairie Acquiror LP / DBT (US73943NAA46) | 0,54 | −0,74 | 0,1941 | 0,0033 | |||||

| Prairie Acquiror LP / DBT (US73943NAA46) | 0,54 | −0,74 | 0,1941 | 0,0033 | |||||

| US65342QAM42 / NEXTERA ENERGY OPERATING REGD 144A P/P 7.25000000 | 0,54 | 3,07 | 0,1940 | 0,0101 | |||||

| Samarco Mineracao SA / DBT (USP8405QAA78) | 0,54 | 0,1932 | 0,1932 | ||||||

| Samarco Mineracao SA / DBT (USP8405QAA78) | 0,54 | 0,1932 | 0,1932 | ||||||

| TRT061124T11 / Turkey Government Bond | 0,54 | −2,73 | 0,1927 | −0,0012 | |||||

| TRT061124T11 / Turkey Government Bond | 0,54 | −2,73 | 0,1927 | −0,0012 | |||||

| Chobani LLC / Chobani Finance Corp Inc / DBT (US17027NAC65) | 0,53 | 3,09 | 0,1923 | 0,0100 | |||||

| Chobani LLC / Chobani Finance Corp Inc / DBT (US17027NAC65) | 0,53 | 3,09 | 0,1923 | 0,0100 | |||||

| US836205BE37 / Republic of South Africa Government International Bond | 0,53 | −5,21 | 0,1904 | −0,0059 | |||||

| US615394AM52 / Moog Inc | 0,53 | −24,53 | 0,1898 | −0,0556 | |||||

| FORGTL / F-Brasile SpA / F-Brasile US LLC | 0,52 | 0,00 | 0,1884 | 0,0040 | |||||

| US46590XAU00 / JBS USA LUX SA / JBS USA Food Co / JBS USA Finance Inc | 0,52 | −18,56 | 0,1882 | −0,0377 | |||||

| Novelis Corp / DBT (US670001AL04) | 0,52 | 5,26 | 0,1876 | 0,0134 | |||||

| Novelis Corp / DBT (US670001AL04) | 0,52 | 5,26 | 0,1876 | 0,0134 | |||||

| SOIAZ / State Oil Co of the Azerbaijan Republic | 0,52 | −0,19 | 0,1875 | 0,0038 | |||||

| US19416MAB54 / Colgate Energy Partners III LLC | 0,52 | −25,57 | 0,1868 | −0,0583 | |||||

| ADANIENSOL / Adani Energy Solutions Limited | 0,52 | 0,1865 | 0,1865 | ||||||

| ADANIENSOL / Adani Energy Solutions Limited | 0,52 | 0,1865 | 0,1865 | ||||||

| US3132DWDS98 / Freddie Mac Pool | 0,52 | −4,09 | 0,1862 | −0,0032 | |||||

| US040114HT09 / Argentine Republic Government International Bond | 0,52 | 6,17 | 0,1859 | 0,0148 | |||||

| US20914UAF30 / Consolidated Energy Finance SA | 0,51 | −7,08 | 0,1847 | −0,0096 | |||||

| NGD / New Gold Inc. | 0,51 | 0,1833 | 0,1833 | ||||||

| NGD / New Gold Inc. | 0,51 | 0,1833 | 0,1833 | ||||||

| BLCO / Bausch + Lomb Corporation | 0,51 | 0,20 | 0,1829 | 0,0045 | |||||

| US640695AA01 / Neptune Bidco US Inc | 0,51 | 5,64 | 0,1826 | 0,0139 | |||||

| US00489LAH69 / Acrisure LLC / Acrisure Finance Inc | 0,51 | 1,40 | 0,1824 | 0,0066 | |||||

| SNAP / Snap Inc. - Depositary Receipt (Common Stock) | 0,50 | 22,63 | 0,1817 | 0,0370 | |||||

| SNAP / Snap Inc. - Depositary Receipt (Common Stock) | 0,50 | 22,63 | 0,1817 | 0,0370 | |||||

| US23345MAA53 / DT MIDSTREAM INC 4.125% 06/15/2029 144A | 0,50 | −36,18 | 0,1808 | −0,0959 | |||||

| TPB / Turning Point Brands, Inc. | 0,50 | 19,33 | 0,1803 | 0,0327 | |||||

| TPB / Turning Point Brands, Inc. | 0,50 | 19,33 | 0,1803 | 0,0327 | |||||

| XS2260457754 / Ipoteka-Bank ATIB | 0,50 | 0,40 | 0,1792 | 0,0048 | |||||

| US67091TAA34 / OCP SA | 0,50 | −2,17 | 0,1792 | 0,0003 | |||||

| US67091TAA34 / OCP SA | 0,50 | −2,17 | 0,1792 | 0,0003 | |||||

| Acrisure LLC / Acrisure Finance Inc / DBT (US00489LAK98) | 0,50 | 2,69 | 0,1788 | 0,0087 | |||||

| Acrisure LLC / Acrisure Finance Inc / DBT (US00489LAK98) | 0,50 | 2,69 | 0,1788 | 0,0087 | |||||

| US01883LAF04 / ALLIANT HOLD / CO-ISSUER REGD 144A P/P 7.00000000 | 0,50 | 1,85 | 0,1787 | 0,0072 | |||||

| China Government Bond / DBT (CND10007YHJ0) | 0,49 | 1,23 | 0,1778 | 0,0061 | |||||

| China Government Bond / DBT (CND10007YHJ0) | 0,49 | 1,23 | 0,1778 | 0,0061 | |||||

| JP1300661L47 / Japan Government Thirty Year Bond | 0,49 | −31,56 | 0,1767 | −0,0732 | |||||

| Husky Injection Molding Systems Ltd / Titan Co-Borrower LLC / DBT (US44805RAA32) | 0,49 | 0,00 | 0,1760 | 0,0040 | |||||

| Husky Injection Molding Systems Ltd / Titan Co-Borrower LLC / DBT (US44805RAA32) | 0,49 | 0,00 | 0,1760 | 0,0040 | |||||

| US71424VAA89 / Permian Resources Operating LLC | 0,49 | −2,40 | 0,1759 | −0,0002 | |||||

| Italy Buoni Poliennali Del Tesoro / DBT (IT0005607970) | 0,49 | 0,00 | 0,1752 | 0,0041 | |||||

| Italy Buoni Poliennali Del Tesoro / DBT (IT0005607970) | 0,49 | 0,00 | 0,1752 | 0,0041 | |||||

| US948565AD85 / Weekley Homes LLC / Weekley Finance Corp | 0,49 | 5,19 | 0,1752 | 0,0125 | |||||

| ACHC / Acadia Healthcare Company, Inc. | 0,49 | 0,1747 | 0,1747 | ||||||

| ACHC / Acadia Healthcare Company, Inc. | 0,49 | 0,1747 | 0,1747 | ||||||

| CNX Resources Corp / DBT (US12653CAL28) | 0,48 | 1,68 | 0,1744 | 0,0067 | |||||

| CNX Resources Corp / DBT (US12653CAL28) | 0,48 | 1,68 | 0,1744 | 0,0067 | |||||

| Gates Corp/DE / DBT (US367398AA27) | 0,48 | 2,11 | 0,1743 | 0,0077 | |||||

| Gates Corp/DE / DBT (US367398AA27) | 0,48 | 2,11 | 0,1743 | 0,0077 | |||||

| XS2239830222 / Morocco Government International Bond | 0,48 | 9,86 | 0,1728 | 0,0191 | |||||

| US24229JAA16 / DEALER TIRE LLC/DT ISSR SR UNSECURED 144A 02/28 8 | 0,48 | 4,60 | 0,1725 | 0,0113 | |||||

| US67091TAE55 / OCP SA | 0,47 | −6,51 | 0,1710 | −0,0075 | |||||

| Nationstar Mortgage Holdings Inc / DBT (US63861CAG42) | 0,47 | 1,08 | 0,1695 | 0,0058 | |||||

| Nationstar Mortgage Holdings Inc / DBT (US63861CAG42) | 0,47 | 1,08 | 0,1695 | 0,0058 | |||||

| 1011778 BC ULC / New Red Finance Inc / DBT (US68245XAR08) | 0,47 | 0,43 | 0,1694 | 0,0043 | |||||

| 1011778 BC ULC / New Red Finance Inc / DBT (US68245XAR08) | 0,47 | 0,43 | 0,1694 | 0,0043 | |||||

| Viking Baked Goods Acquisition Corp / DBT (US92676AAA51) | 0,47 | 68,71 | 0,1691 | 0,0711 | |||||

| Viking Baked Goods Acquisition Corp / DBT (US92676AAA51) | 0,47 | 68,71 | 0,1691 | 0,0711 | |||||

| US836205AY00 / Republic of South Africa Government International Bond | 0,47 | −30,15 | 0,1687 | −0,0673 | |||||

| US836205AY00 / Republic of South Africa Government International Bond | 0,47 | −30,15 | 0,1687 | −0,0673 | |||||

| NBR / Nabors Industries Ltd. | 0,47 | −17,46 | 0,1686 | −0,0310 | |||||

| NBR / Nabors Industries Ltd. | 0,47 | −17,46 | 0,1686 | −0,0310 | |||||

| BZH / Beazer Homes USA, Inc. | 0,47 | 1,74 | 0,1683 | 0,0064 | |||||

| BZH / Beazer Homes USA, Inc. | 0,47 | 1,74 | 0,1683 | 0,0064 | |||||

| US024747AG26 / CORP. NOTE | 0,47 | −24,35 | 0,1681 | −0,0489 | |||||

| US34960PAE16 / Fortress Transportation & Infrastructure Investors LLC | 0,46 | −0,22 | 0,1647 | 0,0034 | |||||

| CLF / Cleveland-Cliffs Inc. | 0,46 | 12,04 | 0,1644 | 0,0208 | |||||

| CLF / Cleveland-Cliffs Inc. | 0,46 | 12,04 | 0,1644 | 0,0208 | |||||

| Amsted Industries Inc / DBT (US032177AK30) | 0,45 | 4,14 | 0,1635 | 0,0102 | |||||

| Amsted Industries Inc / DBT (US032177AK30) | 0,45 | 4,14 | 0,1635 | 0,0102 | |||||

| Wildfire Intermediate Holdings LLC / DBT (US96812HAA68) | 0,45 | −21,57 | 0,1627 | −0,0400 | |||||

| Wildfire Intermediate Holdings LLC / DBT (US96812HAA68) | 0,45 | −21,57 | 0,1627 | −0,0400 | |||||

| GRF / Greiffenberger AG | 0,45 | 0,1616 | 0,1616 | ||||||

| GRF / Greiffenberger AG | 0,45 | 0,1616 | 0,1616 | ||||||

| 1261229 BC Ltd / DBT (US68288AAA51) | 0,45 | 0,1609 | 0,1609 | ||||||

| 1261229 BC Ltd / DBT (US68288AAA51) | 0,45 | 0,1609 | 0,1609 | ||||||

| US35640YAH09 / Freedom Mortgage Corp | 0,45 | −0,22 | 0,1604 | 0,0031 | |||||

| US097751BZ39 / Bombardier, Inc. | 0,45 | 0,23 | 0,1603 | 0,0037 | |||||

| VTLE / Vital Energy, Inc. | 0,44 | −30,24 | 0,1598 | −0,0638 | |||||

| VTLE / Vital Energy, Inc. | 0,44 | −30,24 | 0,1598 | −0,0638 | |||||

| Iliad Holding SASU / DBT (XS2810807334) | 0,44 | 8,07 | 0,1593 | 0,0150 | |||||

| Iliad Holding SASU / DBT (XS2810807334) | 0,44 | 8,07 | 0,1593 | 0,0150 | |||||

| US05552BAA44 / LBM Acquisition LLC | 0,44 | 12,21 | 0,1591 | 0,0208 | |||||

| OPAL BIDCO SAS / DBT (XS3037643486) | 0,44 | 0,1589 | 0,1589 | ||||||

| OPAL BIDCO SAS / DBT (XS3037643486) | 0,44 | 0,1589 | 0,1589 | ||||||

| Icahn Enterprises LP / Icahn Enterprises Finance Corp / DBT (US451102CF29) | 0,44 | 6,04 | 0,1585 | 0,0124 | |||||

| Icahn Enterprises LP / Icahn Enterprises Finance Corp / DBT (US451102CF29) | 0,44 | 6,04 | 0,1585 | 0,0124 | |||||

| US01883LAD55 / Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer | 0,44 | 1,15 | 0,1581 | 0,0055 | |||||

| US43118DAA81 / Hightower Holding LLC | 0,44 | 4,29 | 0,1581 | 0,0101 | |||||

| US61978XAA54 / Motion Bondco DAC | 0,44 | −32,62 | 0,1580 | −0,0712 | |||||

| Champ Acquisition Corp / DBT (US15807XAA81) | 0,44 | 2,59 | 0,1574 | 0,0076 | |||||

| Champ Acquisition Corp / DBT (US15807XAA81) | 0,44 | 2,59 | 0,1574 | 0,0076 | |||||

| US18972EAB11 / Clydesdale Acquisition Holdings, Inc. | 0,43 | −38,61 | 0,1566 | −0,0925 | |||||

| MPT Operating Partnership LP / MPT Finance Corp / DBT (US55342UAQ76) | 0,43 | 19,94 | 0,1540 | 0,0286 | |||||

| MPT Operating Partnership LP / MPT Finance Corp / DBT (US55342UAQ76) | 0,43 | 19,94 | 0,1540 | 0,0286 | |||||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 0,43 | −22,02 | 0,1533 | −0,0387 | |||||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 0,43 | −22,02 | 0,1533 | −0,0387 | |||||

| US46266TAA60 / IQVIA, Inc. | 0,42 | −31,72 | 0,1528 | −0,0658 | |||||

| MTW / The Manitowoc Company, Inc. | 0,42 | −0,71 | 0,1520 | 0,0023 | |||||

| MTW / The Manitowoc Company, Inc. | 0,42 | −0,71 | 0,1520 | 0,0023 | |||||

| US644274AH54 / New Enterprise Stone & Lime Co Inc | 0,42 | −40,03 | 0,1517 | −0,0956 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,42 | −3,45 | 0,1515 | −0,0019 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,42 | −3,45 | 0,1515 | −0,0019 | |||||

| JP1201851P76 / JAPAN GOVERNMENT OF 1.1% 06/20/2043 | 0,42 | −39,63 | 0,1510 | −0,0935 | |||||

| 1011778 BC ULC / New Red Finance Inc / DBT (US68245XAT63) | 0,42 | 44,64 | 0,1507 | 0,0489 | |||||

| 1011778 BC ULC / New Red Finance Inc / DBT (US68245XAT63) | 0,42 | 44,64 | 0,1507 | 0,0489 | |||||

| US019576AB35 / Allied Universal Holdco LLC / Allied Universal Finance Corp | 0,41 | 0,24 | 0,1489 | 0,0036 | |||||

| I1RM34 / Iron Mountain Incorporated - Depositary Receipt (Common Stock) | 0,41 | 0,25 | 0,1476 | 0,0039 | |||||

| I1RM34 / Iron Mountain Incorporated - Depositary Receipt (Common Stock) | 0,41 | 0,25 | 0,1476 | 0,0039 | |||||

| US88033GDK31 / Tenet Healthcare Corp | 0,41 | 0,25 | 0,1476 | 0,0037 | |||||

| US59155LAA08 / METIS MERGER SUB LLC | 0,41 | 3,05 | 0,1466 | 0,0076 | |||||

| US513075BW03 / Lamar Media Corp | 0,41 | 2,78 | 0,1464 | 0,0071 | |||||

| US513075BW03 / Lamar Media Corp | 0,41 | 2,78 | 0,1464 | 0,0071 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,41 | −3,10 | 0,1464 | −0,0012 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,41 | −3,10 | 0,1464 | −0,0012 | |||||

| US53219LAW90 / LIFEPOINT HEALTH INC | 0,40 | 0,00 | 0,1454 | 0,0032 | |||||

| Performance Food Group Inc / DBT (US71376LAF76) | 0,40 | 5,77 | 0,1453 | 0,0108 | |||||

| Performance Food Group Inc / DBT (US71376LAF76) | 0,40 | 5,77 | 0,1453 | 0,0108 | |||||

| ENAPCL / Empresa Nacional del Petroleo | 0,40 | 1,01 | 0,1446 | 0,0046 | |||||

| Corp Financiera de Desarrollo SA / DBT (US21987DAH70) | 0,40 | 0,1444 | 0,1444 | ||||||

| Corp Financiera de Desarrollo SA / DBT (US21987DAH70) | 0,40 | 0,1444 | 0,1444 | ||||||

| USP7721BAE13 / Peru LNG Srl | 0,40 | −10,14 | 0,1441 | −0,0125 | |||||

| MATHOM / Mattamy Group Corp | 0,40 | 9,09 | 0,1428 | 0,0146 | |||||

| Development Bank of Kazakhstan JSC / DBT (US25159XAE31) | 0,40 | −0,25 | 0,1427 | 0,0027 | |||||

| Development Bank of Kazakhstan JSC / DBT (US25159XAE31) | 0,40 | −0,25 | 0,1427 | 0,0027 | |||||

| US031921AB57 / AmWINS Group Inc | 0,39 | 0,51 | 0,1422 | 0,0040 | |||||

| GRUMA B / Gruma, S.A.B. de C.V. | 0,39 | −0,25 | 0,1421 | 0,0028 | |||||

| GRUMA B / Gruma, S.A.B. de C.V. | 0,39 | −0,25 | 0,1421 | 0,0028 | |||||

| XS2308620793 / Serbia International Bond | 0,39 | 8,91 | 0,1410 | 0,0143 | |||||

| US17888HAA14 / Civitas Resources Inc | 0,39 | −3,23 | 0,1405 | −0,0013 | |||||

| QSR / Restaurant Brands International Inc. | 0,39 | 4,32 | 0,1392 | 0,0088 | |||||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 0,39 | 0,26 | 0,1391 | 0,0034 | |||||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 0,39 | 0,26 | 0,1391 | 0,0034 | |||||

| Fiesta Purchaser Inc / DBT (US31659AAB26) | 0,38 | −23,96 | 0,1387 | −0,0392 | |||||

| Fiesta Purchaser Inc / DBT (US31659AAB26) | 0,38 | −23,96 | 0,1387 | −0,0392 | |||||

| CD&R Smokey Buyer Inc / Radio Systems Corp / DBT (US12515KAA60) | 0,38 | −15,42 | 0,1384 | −0,0217 | |||||

| CD&R Smokey Buyer Inc / Radio Systems Corp / DBT (US12515KAA60) | 0,38 | −15,42 | 0,1384 | −0,0217 | |||||

| US25470MAG42 / DISH Network Corp | 0,38 | −2,30 | 0,1383 | 0,0001 | |||||

| XS2388561750 / Republic of Serbia | 0,38 | 6,42 | 0,1376 | 0,0112 | |||||

| US617726AL82 / Morocco Government International Bond | 0,38 | −0,52 | 0,1366 | 0,0023 | |||||

| US75602BAA70 / REAL HERO MERGER SUB 2 6.25% 02/01/2029 144A | 0,38 | −8,89 | 0,1366 | −0,0101 | |||||

| US019576AC18 / ALLIED UNVL HOLDCO LLC / ALLIED UNVL FIN CORP 6% 06/01/2029 144A | 0,38 | 0,00 | 0,1364 | 0,0030 | |||||

| US21925DAA72 / Cornerstone Building Brands, Inc. | 0,38 | 1,62 | 0,1357 | 0,0054 | |||||

| US513075BW03 / Lamar Media Corp | 0,38 | 27,12 | 0,1353 | 0,0312 | |||||

| US513075BW03 / Lamar Media Corp | 0,38 | 27,12 | 0,1353 | 0,0312 | |||||

| US85172FAR01 / Springleaf Finance Corp 5.375% 11/15/2029 | 0,37 | −43,03 | 0,1340 | −0,0961 | |||||

| US118230AJ01 / Buckeye Partners Lp 4.875% Senior Notes 02/01/21 | 0,37 | 3,64 | 0,1335 | 0,0077 | |||||

| US118230AJ01 / Buckeye Partners Lp 4.875% Senior Notes 02/01/21 | 0,37 | 3,64 | 0,1335 | 0,0077 | |||||

| US08163QBK31 / Benchmark 2022-B36 Mortgage Trust | 0,37 | −3,15 | 0,1332 | −0,0012 | |||||

| US25470XAY13 / DISH DBS CORP 7.75% 07/01/2026 | 0,37 | 8,85 | 0,1332 | 0,0135 | |||||

| US46284VAC54 / Iron Mountain Inc | 0,37 | 0,27 | 0,1328 | 0,0036 | |||||

| Standard Building Solutions Inc / DBT (US853191AA25) | 0,37 | −30,23 | 0,1324 | −0,0530 | |||||

| Standard Building Solutions Inc / DBT (US853191AA25) | 0,37 | −30,23 | 0,1324 | −0,0530 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,36 | −1,89 | 0,1312 | 0,0004 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,36 | −1,89 | 0,1312 | 0,0004 | |||||

| US75606DAL55 / REALOGY GROUP LLC / REALOGY CO-ISSUER CORP 5.75% 01/15/2029 144A | 0,36 | 6,76 | 0,1309 | 0,0110 | |||||

| BHC / Bausch Health Companies Inc. | 0,36 | −5,97 | 0,1306 | −0,0050 | |||||

| US92837TAA07 / Austin BidCo Inc | 0,36 | 3,45 | 0,1299 | 0,0071 | |||||

| US08163HAG39 / Benchmark Mortgage Trust, Series 2021-B27, Class XA | 0,36 | −4,52 | 0,1295 | −0,0030 | |||||

| TransMontaigne Partners LLC / DBT (US89377AAA34) | 0,36 | 0,57 | 0,1280 | 0,0037 | |||||

| TransMontaigne Partners LLC / DBT (US89377AAA34) | 0,36 | 0,57 | 0,1280 | 0,0037 | |||||

| Brundage-Bone Concrete Pumping Holdings Inc / DBT (US66981QAB23) | 0,35 | 49,36 | 0,1266 | 0,0436 | |||||

| Brundage-Bone Concrete Pumping Holdings Inc / DBT (US66981QAB23) | 0,35 | 49,36 | 0,1266 | 0,0436 | |||||

| MF1 2024-FL14 LLC / ABS-CBDO (US55416AAE91) | 0,35 | 0,00 | 0,1263 | 0,0028 | |||||

| MF1 2024-FL14 LLC / ABS-CBDO (US55416AAE91) | 0,35 | 0,00 | 0,1263 | 0,0028 | |||||

| US65342QAB86 / NextEra Energy Operating Partners LP | 0,35 | 1,45 | 0,1258 | 0,0044 | |||||

| US1248EPCN14 / CORPORATE BONDS | 0,35 | 3,27 | 0,1253 | 0,0068 | |||||

| US914906AY80 / Univision Communications, Inc. | 0,35 | −1,42 | 0,1251 | 0,0010 | |||||

| XS2232108568 / Maxeda DIY Holding BV | 0,35 | 16,50 | 0,1249 | 0,0202 | |||||

| US78573NAJ19 / Sabre GLBL Inc | 0,35 | 0,00 | 0,1248 | 0,0028 | |||||

| Fiesta Purchaser Inc / DBT (US31659AAA43) | 0,35 | −25,32 | 0,1244 | −0,0384 | |||||

| Fiesta Purchaser Inc / DBT (US31659AAA43) | 0,35 | −25,32 | 0,1244 | −0,0384 | |||||

| IT0005402117 / Italy Buoni Poliennali Del Tesoro | 0,34 | −76,60 | 0,1237 | −0,3926 | |||||

| US92328MAB90 / Venture Global Calcasieu Pass LLC | 0,34 | −42,23 | 0,1235 | −0,0850 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0,34 | −0,87 | 0,1230 | 0,0018 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0,34 | −0,87 | 0,1230 | 0,0018 | |||||

| XS2114850949 / QNB Finance Ltd | 0,34 | 0,59 | 0,1228 | 0,0037 | |||||

| US410345AQ54 / Hanesbrands Inc | 0,34 | 14,86 | 0,1226 | 0,0216 | |||||

| UKT / UNITED KINGDOM GILT BONDS REGS 07/47 1.5 | 0,34 | 52,02 | 0,1223 | 0,0435 | |||||

| US75606DAQ43 / Realogy Group LLC / Realogy Co-Issuer Corp | 0,34 | −2,03 | 0,1220 | 0,0003 | |||||

| US401494AR02 / Guatemala Government Bond | 0,34 | −2,60 | 0,1215 | −0,0006 | |||||

| US17888HAB96 / Civitas Resources Inc | 0,34 | −25,33 | 0,1212 | −0,0376 | |||||

| US29365BAB99 / Entegris Escrow Corp | 0,33 | 6,80 | 0,1190 | 0,0099 | |||||

| XS2170852847 / Synlab Bondco PLC | 0,33 | −1,21 | 0,1175 | 0,0012 | |||||

| XS2170852847 / Synlab Bondco PLC | 0,33 | −1,21 | 0,1175 | 0,0012 | |||||

| VAL / Valaris Limited | 0,32 | 11,38 | 0,1165 | 0,0141 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0,32 | 12,15 | 0,1164 | 0,0149 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0,32 | 12,15 | 0,1164 | 0,0149 | |||||

| BBD.A / Bombardier Inc. | 0,32 | 0,63 | 0,1155 | 0,0035 | |||||

| BBD.A / Bombardier Inc. | 0,32 | 0,63 | 0,1155 | 0,0035 | |||||

| US44332PAG63 / HUB International Ltd | 0,31 | 11,79 | 0,1129 | 0,0140 | |||||

| ROCKIES EXPRESS PIPELINE / DBT (US77340RAU14) | 0,31 | 0,1128 | 0,1128 | ||||||

| ROCKIES EXPRESS PIPELINE / DBT (US77340RAU14) | 0,31 | 0,1128 | 0,1128 | ||||||

| US917288BM35 / Uruguay Government International Bond | 0,31 | −20,57 | 0,1116 | −0,0256 | |||||

| Permian Resources Operating LLC / DBT (US71424VAB62) | 0,31 | −18,95 | 0,1113 | −0,0228 | |||||

| Permian Resources Operating LLC / DBT (US71424VAB62) | 0,31 | −18,95 | 0,1113 | −0,0228 | |||||

| US87276WAE30 / TRTX 2021-FL4 Issuer Ltd | 0,31 | 0,00 | 0,1112 | 0,0026 | |||||

| AmWINS Group Inc / DBT (US031921AC31) | 0,31 | 5,84 | 0,1111 | 0,0085 | |||||

| AmWINS Group Inc / DBT (US031921AC31) | 0,31 | 5,84 | 0,1111 | 0,0085 | |||||

| US097751CA78 / Bombardier, Inc. | 0,31 | 42,59 | 0,1110 | 0,0348 | |||||

| US718286CR66 / Philippine Government International Bond | 0,31 | 0,99 | 0,1105 | 0,0036 | |||||

| XS2066744231 / Carnival PLC | 0,31 | 4,10 | 0,1102 | 0,0070 | |||||

| XS2066744231 / Carnival PLC | 0,31 | 4,10 | 0,1102 | 0,0070 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0,30 | 0,1092 | 0,1092 | ||||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0,30 | 0,1092 | 0,1092 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,30 | −6,79 | 0,1092 | −0,0051 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,30 | −6,79 | 0,1092 | −0,0051 | |||||

| NEXT34 / NextEra Energy, Inc. - Depositary Receipt (Common Stock) | 0,30 | 0,1091 | 0,1091 | ||||||

| NEXT34 / NextEra Energy, Inc. - Depositary Receipt (Common Stock) | 0,30 | 0,1091 | 0,1091 | ||||||

| Albania Government International Bond / DBT (XS3004338714) | 0,30 | 7,12 | 0,1087 | 0,0097 | |||||

| Albania Government International Bond / DBT (XS3004338714) | 0,30 | 7,12 | 0,1087 | 0,0097 | |||||

| US853496AD99 / Standard Industries Inc/NJ | 0,30 | −46,71 | 0,1082 | −0,0900 | |||||

| BBD.A / Bombardier Inc. | 0,30 | 0,1074 | 0,1074 | ||||||

| BBD.A / Bombardier Inc. | 0,30 | 0,1074 | 0,1074 | ||||||

| OPAL BIDCO / DBT (US68348BAA17) | 0,30 | 0,1073 | 0,1073 | ||||||

| OPAL BIDCO / DBT (US68348BAA17) | 0,30 | 0,1073 | 0,1073 | ||||||

| Credit Acceptance Corp / DBT (US225310AQ40) | 0,30 | −0,67 | 0,1067 | 0,0015 | |||||

| Credit Acceptance Corp / DBT (US225310AQ40) | 0,30 | −0,67 | 0,1067 | 0,0015 | |||||

| US040133AA87 / Aretec Escrow Issuer Inc | 0,30 | 7,66 | 0,1065 | 0,0100 | |||||

| XS1566179039 / Nigeria Government International Bond | 0,29 | −40,00 | 0,1063 | −0,0664 | |||||

| US058498AZ97 / Ball Corp | 0,29 | 0,34 | 0,1058 | 0,0027 | |||||

| CHRD / Chord Energy Corporation | 0,29 | 0,1045 | 0,1045 | ||||||

| CHRD / Chord Energy Corporation | 0,29 | 0,1045 | 0,1045 | ||||||

| Adient Global Holdings Ltd / DBT (US00687YAD76) | 0,29 | −1,03 | 0,1040 | 0,0015 | |||||

| Adient Global Holdings Ltd / DBT (US00687YAD76) | 0,29 | −1,03 | 0,1040 | 0,0015 | |||||

| TRT061124T11 / Turkey Government Bond | 0,29 | −3,37 | 0,1037 | −0,0011 | |||||

| TRT061124T11 / Turkey Government Bond | 0,29 | −3,37 | 0,1037 | −0,0011 | |||||

| Venture Global LNG Inc / DBT (US92332YAE14) | 0,29 | −1,71 | 0,1037 | 0,0005 | |||||

| Venture Global LNG Inc / DBT (US92332YAE14) | 0,29 | −1,71 | 0,1037 | 0,0005 | |||||

| Allied Universal Holdco LLC / DBT (US019576AD90) | 0,29 | 5,93 | 0,1030 | 0,0079 | |||||

| Allied Universal Holdco LLC / DBT (US019576AD90) | 0,29 | 5,93 | 0,1030 | 0,0079 | |||||

| US74365PAF53 / Prosus NV | 0,29 | 1,06 | 0,1027 | 0,0034 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 0,28 | −1,05 | 0,1027 | 0,0014 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 0,28 | −1,05 | 0,1027 | 0,0014 | |||||

| US1248EPCP61 / CCO Holdings LLC / CCO Holdings Capital Corp | 0,28 | −36,61 | 0,1023 | −0,0556 | |||||

| US29362UAC80 / ENTEGRIS INC 4.375% 04/15/2028 144A | 0,28 | 0,00 | 0,1016 | 0,0025 | |||||

| US20338HAB96 / Commscope Technologies Llc 5.00% 03/15/2027 144a Bond | 0,28 | 2,58 | 0,1003 | 0,0047 | |||||

| Navoi Mining & Metallurgical Combinat / DBT (XS2902087936) | 0,27 | 0,0990 | 0,0990 | ||||||

| Navoi Mining & Metallurgical Combinat / DBT (XS2902087936) | 0,27 | 0,0990 | 0,0990 | ||||||

| US62482BAA08 / Mozart Debt Merger Sub Inc | 0,27 | 0,74 | 0,0985 | 0,0028 | |||||

| Hightower Holding LLC / DBT (US43118DAB64) | 0,27 | −1,09 | 0,0979 | 0,0013 | |||||

| Hightower Holding LLC / DBT (US43118DAB64) | 0,27 | −1,09 | 0,0979 | 0,0013 | |||||

| Wrangler Holdco Corp / DBT (US37441QAA94) | 0,27 | 0,75 | 0,0962 | 0,0029 | |||||

| Wrangler Holdco Corp / DBT (US37441QAA94) | 0,27 | 0,75 | 0,0962 | 0,0029 | |||||

| 53219LAH2 / LifePoint Health, Inc. Bond | 0,27 | 17,70 | 0,0961 | 0,0163 | |||||

| 53219LAH2 / LifePoint Health, Inc. Bond | 0,27 | 17,70 | 0,0961 | 0,0163 | |||||

| US44332EAP16 / Hub International Ltd., Term Loan | 0,27 | −33,75 | 0,0955 | −0,0454 | |||||

| US44332EAP16 / Hub International Ltd., Term Loan | 0,27 | −33,75 | 0,0955 | −0,0454 | |||||

| US92328MAA18 / Venture Global Calcasieu Pass LLC | 0,26 | −55,80 | 0,0951 | −0,1147 | |||||

| US670001AH91 / Novelis Corp | 0,26 | 1,15 | 0,0948 | 0,0031 | |||||

| US88104LAG86 / TerraForm Power Operating LLC | 0,26 | −36,25 | 0,0944 | −0,0506 | |||||

| US12543DBL38 / CHS/CMNTY HEALTH SYSTEMS INC 6.125% 04/01/2030 144A | 0,26 | 18,64 | 0,0941 | 0,0164 | |||||

| MX0MGO0001D6 / Mexican Bonos Desarr Fixed Rate, Series M | 0,26 | 0,0940 | 0,0940 | ||||||

| US55916AAA25 / Magic Mergeco Inc | 0,26 | 5,28 | 0,0936 | 0,0069 | |||||

| POST / Post Holdings, Inc. | 0,26 | 2,38 | 0,0932 | 0,0043 | |||||

| POST / Post Holdings, Inc. | 0,26 | 2,38 | 0,0932 | 0,0043 | |||||

| CA135087ZS68 / Canadian Government Bond | 0,26 | 18,89 | 0,0930 | 0,0163 | |||||

| Directv Financing LLC / DBT (US25461LAB80) | 0,25 | 1,22 | 0,0898 | 0,0029 | |||||

| Directv Financing LLC / DBT (US25461LAB80) | 0,25 | 1,22 | 0,0898 | 0,0029 | |||||

| LU2445093128 / INTELSAT EMERGENCE SA | 0,01 | 0,00 | 0,25 | 9,73 | 0,0894 | 0,0096 | |||

| GTN / Gray Media, Inc. | 0,25 | 0,0885 | 0,0885 | ||||||

| GTN / Gray Media, Inc. | 0,25 | 0,0885 | 0,0885 | ||||||

| US91087BAN01 / Mexico Government International Bond | 0,25 | −6,49 | 0,0884 | −0,0041 | |||||

| US63938PBU21 / Navistar Financial Dealer Note Master Owner Trust II, Series 2023-1, Class A | 0,24 | −0,41 | 0,0882 | 0,0017 | |||||

| US25470XBD66 / CORP. NOTE | 0,24 | −2,41 | 0,0876 | −0,0002 | |||||

| Windstream Services LLC / Windstream Escrow Finance Corp / DBT (US97381AAA07) | 0,24 | 0,84 | 0,0870 | 0,0025 | |||||

| Windstream Services LLC / Windstream Escrow Finance Corp / DBT (US97381AAA07) | 0,24 | 0,84 | 0,0870 | 0,0025 | |||||

| US603051AE37 / Mineral Resources Ltd | 0,24 | 0,0864 | 0,0864 | ||||||

| US67884XCP06 / Oklahoma Development Finance Authority Revenue Bonds | 0,24 | −2,06 | 0,0859 | 0,0003 | |||||

| US29261AAE01 / COMPANY GUAR 04/31 4.625 | 0,23 | 1,30 | 0,0845 | 0,0030 | |||||

| BBD.A / Bombardier Inc. | 0,23 | 0,86 | 0,0844 | 0,0026 | |||||

| BBD.A / Bombardier Inc. | 0,23 | 0,86 | 0,0844 | 0,0026 | |||||

| TCW CLO 2020-1 Ltd / ABS-CBDO (US87190CBL37) | 0,23 | −0,85 | 0,0842 | 0,0014 | |||||

| TCW CLO 2020-1 Ltd / ABS-CBDO (US87190CBL37) | 0,23 | −0,85 | 0,0842 | 0,0014 | |||||

| MUTHOOTFIN / Muthoot Finance Limited | 0,23 | −1,69 | 0,0840 | 0,0005 | |||||

| MUTHOOTFIN / Muthoot Finance Limited | 0,23 | −1,69 | 0,0840 | 0,0005 | |||||

| US06540MBQ78 / BANK, Series 2022-BNK41, Class AS | 0,23 | −0,43 | 0,0837 | 0,0016 | |||||

| Icahn Enterprises LP / Icahn Enterprises Finance Corp / DBT (US451102CK14) | 0,23 | −1,28 | 0,0832 | 0,0006 | |||||

| Icahn Enterprises LP / Icahn Enterprises Finance Corp / DBT (US451102CK14) | 0,23 | −1,28 | 0,0832 | 0,0006 | |||||

| US36179XHU37 / Ginnie Mae II Pool | 0,23 | −5,76 | 0,0826 | −0,0031 | |||||

| EBR / Centrais Elétricas Brasileiras S.A. - Eletrobrás - Depositary Receipt (Common Stock) | 0,23 | −0,44 | 0,0824 | 0,0015 | |||||

| EBR / Centrais Elétricas Brasileiras S.A. - Eletrobrás - Depositary Receipt (Common Stock) | 0,23 | −0,44 | 0,0824 | 0,0015 | |||||

| US00500RAG02 / ACREC 2021-FL1 Ltd | 0,23 | 0,00 | 0,0823 | 0,0017 | |||||

| EBS / Erste Group Bank AG | 0,23 | 0,0818 | 0,0818 | ||||||

| EBS / Erste Group Bank AG | 0,23 | 0,0818 | 0,0818 | ||||||

| US85172FAQ28 / Springleaf Finance Corp 6.625% 01/15/2028 | 0,23 | −44,88 | 0,0815 | −0,0631 | |||||

| US85172FAQ28 / Springleaf Finance Corp 6.625% 01/15/2028 | 0,23 | −44,88 | 0,0815 | −0,0631 | |||||

| US644274AG71 / New Enterprise Stone & Lime Co., Inc. | 0,22 | −0,44 | 0,0808 | 0,0013 | |||||

| VIKCRU / Viking Cruises Ltd | 0,22 | 0,00 | 0,0796 | 0,0019 | |||||

| US192108BC19 / Coeur Mining Inc | 0,22 | −0,45 | 0,0794 | 0,0016 | |||||

| Angel Oak Mortgage Trust 2024-9 / ABS-MBS (US03466JAA79) | 0,22 | −6,81 | 0,0792 | −0,0038 | |||||

| Angel Oak Mortgage Trust 2024-9 / ABS-MBS (US03466JAA79) | 0,22 | −6,81 | 0,0792 | −0,0038 | |||||

| Sabre GLBL Inc / DBT (US78573NAL64) | 0,22 | −42,37 | 0,0790 | −0,0549 | |||||

| Sabre GLBL Inc / DBT (US78573NAL64) | 0,22 | −42,37 | 0,0790 | −0,0549 | |||||

| US05553LAA17 / BCPE ULYSSES INTERMEDIATE INC PIK VAR 04/01/2027 144A | 0,22 | −3,54 | 0,0787 | −0,0009 | |||||

| US88104UAC71 / Terraform Global Operating LLC | 0,22 | −18,11 | 0,0783 | −0,0152 | |||||

| OBX 2024-NQM2 Trust / ABS-MBS (US67118HAA86) | 0,22 | −8,47 | 0,0780 | −0,0052 | |||||

| OBX 2024-NQM2 Trust / ABS-MBS (US67118HAA86) | 0,22 | −8,47 | 0,0780 | −0,0052 | |||||

| US126307BA42 / CSC Holdings, LLC | 0,21 | −54,85 | 0,0773 | −0,0897 | |||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AA47) | 0,21 | 0,0771 | 0,0771 | ||||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AA47) | 0,21 | 0,0771 | 0,0771 | ||||||

| US29362UAD63 / Entegris Inc | 0,21 | −56,29 | 0,0766 | −0,0944 | |||||

| US72431PAA03 / NCI Building Systems Inc 8.00% 04/15/2026 144A | 0,21 | −3,20 | 0,0765 | −0,0006 | |||||

| US72431PAA03 / NCI Building Systems Inc 8.00% 04/15/2026 144A | 0,21 | −3,20 | 0,0765 | −0,0006 | |||||

| US55282XAG51 / MF1 Multifamily Housing Mortgage Loan Trust | 0,21 | 0,00 | 0,0765 | 0,0017 | |||||

| US00135TAD63 / AIB Group PLC | 0,21 | −0,47 | 0,0758 | 0,0012 | |||||

| US02154CAH60 / Altice Financing SA | 0,21 | −2,33 | 0,0757 | −0,0002 | |||||

| JP1300461F39 / Japan Government Thirty Year Bond | 0,21 | 0,0755 | 0,0755 | ||||||

| US62878U2F87 / NBN Co Ltd | 0,21 | 0,48 | 0,0749 | 0,0018 | |||||

| US03880XAJ54 / Arbor Realty Commercial Real Estate Notes 2022-FL1 Ltd | 0,21 | 0,49 | 0,0749 | 0,0022 | |||||

| NAVI / Navient Corporation | 0,21 | 0,0748 | 0,0748 | ||||||

| NAVI / Navient Corporation | 0,21 | 0,0748 | 0,0748 | ||||||

| MTDR / Matador Resources Company | 0,21 | −9,21 | 0,0748 | −0,0055 | |||||

| MTDR / Matador Resources Company | 0,21 | −9,21 | 0,0748 | −0,0055 | |||||

| US05605HAB69 / BWX Technologies Inc | 0,21 | −33,76 | 0,0743 | −0,0353 | |||||

| US55342UAH77 / Mpt Operating Partnership Lp / Mpt Finance Corp 5.00% 10/15/2027 Bond | 0,21 | 0,49 | 0,0740 | 0,0021 | |||||

| US146869AL63 / Carvana Co. | 0,20 | −0,97 | 0,0738 | 0,0011 | |||||

| ECL / Engie Energia Chile S.A. | 0,20 | −0,49 | 0,0733 | 0,0013 | |||||

| ECL / Engie Energia Chile S.A. | 0,20 | −0,49 | 0,0733 | 0,0013 | |||||

| US55977YAA64 / Magyar Export-Import Bank Zrt | 0,20 | 0,00 | 0,0733 | 0,0015 | |||||

| US36168QAQ73 / GFL Environmental Inc | 0,20 | −37,65 | 0,0729 | −0,0414 | |||||

| LOR / L'Oréal S.A. - Depositary Receipt (Common Stock) | 0,20 | 0,0725 | 0,0725 | ||||||

| LOR / L'Oréal S.A. - Depositary Receipt (Common Stock) | 0,20 | 0,0725 | 0,0725 | ||||||

| US67114NAA90 / Oryx Funding Ltd | 0,20 | 0,50 | 0,0723 | 0,0022 | |||||

| CC / The Chemours Company | 0,20 | −11,50 | 0,0722 | −0,0076 | |||||

| CC / The Chemours Company | 0,20 | −11,50 | 0,0722 | −0,0076 | |||||

| Paraguay Government International Bond / DBT (US699149AN04) | 0,20 | −1,49 | 0,0719 | 0,0006 | |||||

| Paraguay Government International Bond / DBT (US699149AN04) | 0,20 | −1,49 | 0,0719 | 0,0006 | |||||

| US17888HAC79 / Civitas Resources Inc | 0,20 | −1,98 | 0,0714 | 0,0003 | |||||

| Angel Oak Mortgage Trust 2024-12 / ABS-MBS (US034932AA18) | 0,20 | −8,41 | 0,0710 | −0,0045 | |||||

| Angel Oak Mortgage Trust 2024-12 / ABS-MBS (US034932AA18) | 0,20 | −8,41 | 0,0710 | −0,0045 | |||||

| NEXT34 / NextEra Energy, Inc. - Depositary Receipt (Common Stock) | 0,20 | 0,0703 | 0,0703 | ||||||

| NEXT34 / NextEra Energy, Inc. - Depositary Receipt (Common Stock) | 0,20 | 0,0703 | 0,0703 | ||||||

| Chile Electricity Lux Mpc II Sarl / DBT (US16882LAA08) | 0,19 | −2,02 | 0,0700 | 0,0002 | |||||

| Chile Electricity Lux Mpc II Sarl / DBT (US16882LAA08) | 0,19 | −2,02 | 0,0700 | 0,0002 | |||||

| US08163EBE41 / Benchmark 2021-B26 Mortgage Trust | 0,19 | −5,39 | 0,0698 | −0,0022 | |||||

| US202712BN45 / Commonwealth Bank of Australia | 0,19 | 0,00 | 0,0698 | 0,0018 | |||||

| US57701RAJ14 / Mattamy Group Corp | 0,19 | 7,26 | 0,0695 | 0,0062 | |||||

| Miter Brands Acquisition Holdco Inc / MIWD Borrower LLC / DBT (US60672JAA79) | 0,19 | 10,34 | 0,0693 | 0,0080 | |||||

| Miter Brands Acquisition Holdco Inc / MIWD Borrower LLC / DBT (US60672JAA79) | 0,19 | 10,34 | 0,0693 | 0,0080 | |||||

| US3132DWFG33 / Freddie Mac Pool | 0,19 | −4,06 | 0,0684 | −0,0010 | |||||

| US78486BAE48 / STWD 2021-FL2 Ltd | 0,19 | −0,53 | 0,0681 | 0,0015 | |||||

| M&T Bank Auto Receivables Trust 2025-1 / ABS-O (US55287XAB10) | 0,19 | −0,53 | 0,0677 | 0,0014 | |||||

| M&T Bank Auto Receivables Trust 2025-1 / ABS-O (US55287XAB10) | 0,19 | −0,53 | 0,0677 | 0,0014 | |||||

| Sabre GLBL Inc / DBT (US78573NAM48) | 0,19 | 0,0669 | 0,0669 | ||||||

| Sabre GLBL Inc / DBT (US78573NAM48) | 0,19 | 0,0669 | 0,0669 | ||||||

| Business Jet Securities 2024-2 LLC / ABS-O (US12326TAA60) | 0,18 | −3,66 | 0,0664 | −0,0010 | |||||

| Business Jet Securities 2024-2 LLC / ABS-O (US12326TAA60) | 0,18 | −3,66 | 0,0664 | −0,0010 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,18 | 0,0661 | 0,0661 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,18 | 0,0661 | 0,0661 | ||||||

| Voyager Parent LLC / DBT (US92921EAA01) | 0,18 | 0,0655 | 0,0655 | ||||||

| Voyager Parent LLC / DBT (US92921EAA01) | 0,18 | 0,0655 | 0,0655 | ||||||

| US08162RAF47 / Benchmark 2021-B23 Mortgage Trust | 0,18 | −4,74 | 0,0653 | −0,0018 | |||||

| Acrisure LLC / Acrisure Finance Inc / DBT (US00489LAL71) | 0,18 | 0,0651 | 0,0651 | ||||||

| Acrisure LLC / Acrisure Finance Inc / DBT (US00489LAL71) | 0,18 | 0,0651 | 0,0651 | ||||||

| US3140XHGD30 / FNMA POOL FS1995 FN 02/52 FIXED VAR | 0,18 | −3,76 | 0,0648 | −0,0010 | |||||

| US30251GBD88 / FMG Resources August 2006 Pty. Ltd. | 0,18 | 22,07 | 0,0641 | 0,0129 | |||||

| US55916AAB08 / Magic Mergeco Inc | 0,18 | −39,59 | 0,0640 | −0,0394 | |||||

| DGZ / DB Gold Short ETN | 0,18 | 0,0638 | 0,0638 | ||||||

| DGZ / DB Gold Short ETN | 0,18 | 0,0638 | 0,0638 | ||||||

| US760942BF85 / Uruguay Government International Bond | 0,18 | −15,79 | 0,0637 | −0,0101 | |||||

| US56085RAA86 / MAJORDRIVE HOLDINGS IV LLC 6.375% 06/01/2029 144A | 0,18 | 0,0635 | 0,0635 | ||||||

| Clydesdale Acquisition Holdings Inc / DBT (US18972EAD76) | 0,18 | 0,0633 | 0,0633 | ||||||

| Clydesdale Acquisition Holdings Inc / DBT (US18972EAD76) | 0,18 | 0,0633 | 0,0633 | ||||||

| NFE Financing LLC / DBT (US62909BAA52) | 0,17 | −56,72 | 0,0629 | −0,0787 | |||||

| NFE Financing LLC / DBT (US62909BAA52) | 0,17 | −56,72 | 0,0629 | −0,0787 | |||||

| US29278GAP37 / Enel Finance International NV | 0,17 | 1,17 | 0,0624 | 0,0020 | |||||

| UCG / UniCredit S.p.A. | 0,17 | 9,55 | 0,0620 | 0,0065 | |||||

| UCG / UniCredit S.p.A. | 0,17 | 9,55 | 0,0620 | 0,0065 | |||||

| US902613AK44 / UBS Group AG | 0,17 | 0,00 | 0,0618 | 0,0013 | |||||

| US126307BB25 / CSC HOLDINGS LLC COMPANY GUAR 144A 12/30 4.125 | 0,17 | −6,56 | 0,0618 | −0,0029 | |||||

| US983133AC37 / Wynn Resorts Finance LLC / Wynn Resorts Capital Corp | 0,17 | −0,59 | 0,0612 | 0,0012 | |||||

| US02156LAF85 / Altice France SA/France | 0,17 | 8,39 | 0,0608 | 0,0062 | |||||

| US203372AX50 / CommScope Inc | 0,17 | 0,0607 | 0,0607 | ||||||

| Directv Financing LLC / Directv Financing Co-Obligor Inc / DBT (US25461LAD47) | 0,17 | −0,59 | 0,0607 | 0,0009 | |||||

| Directv Financing LLC / Directv Financing Co-Obligor Inc / DBT (US25461LAD47) | 0,17 | −0,59 | 0,0607 | 0,0009 | |||||

| LTRI HOLDINGS, LP / EC (000000000) | 0,00 | 0,17 | 0,0605 | 0,0605 | |||||

| LTRI HOLDINGS, LP / EC (000000000) | 0,00 | 0,17 | 0,0605 | 0,0605 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,17 | 0,0597 | 0,0597 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 0,17 | 0,0597 | 0,0597 | ||||||

| XS2289899242 / Petra Diamonds US Treasury PLC | 0,16 | −21,74 | 0,0586 | −0,0144 | |||||

| US88948ABM80 / Toll Road Investors Partnership II LP | 0,16 | −7,51 | 0,0579 | −0,0032 | |||||

| US3137FUZG26 / FHLMC Multifamily Structured Pass-Through Certificates, Series K111, Class XAM | 0,16 | −4,82 | 0,0570 | −0,0017 | |||||

| Summer BidCo BV / DBT (XS2758100536) | 0,16 | 13,67 | 0,0570 | 0,0078 | |||||

| Summer BidCo BV / DBT (XS2758100536) | 0,16 | 13,67 | 0,0570 | 0,0078 | |||||

| US822866AG44 / Shelter Growth CRE Issuer Ltd | 0,16 | 0,00 | 0,0567 | 0,0014 | |||||

| US25714PET12 / Dominican Republic International Bond | 0,16 | −0,64 | 0,0560 | 0,0011 | |||||

| US08163AAF03 / BENCHMARK MORTGAGE | 0,16 | −6,06 | 0,0559 | −0,0024 | |||||

| DGZ / DB Gold Short ETN | 0,15 | 0,00 | 0,0547 | 0,0014 | |||||

| US05493EAZ51 / BBCMS Mortgage Trust 2021-C9 | 0,15 | −5,03 | 0,0547 | −0,0016 | |||||

| DGZ / DB Gold Short ETN | 0,15 | 0,00 | 0,0547 | 0,0014 | |||||

| Empire District Bondco LLC / DBT (US291918AA87) | 0,15 | 0,00 | 0,0544 | 0,0012 | |||||

| Empire District Bondco LLC / DBT (US291918AA87) | 0,15 | 0,00 | 0,0544 | 0,0012 | |||||

| US87276WAC73 / TRTX 2021-FL4 Issuer Ltd | 0,15 | 0,00 | 0,0539 | 0,0012 | |||||

| US Foods Inc / DBT (US90290MAJ09) | 0,15 | 0,00 | 0,0534 | 0,0012 | |||||

| US Foods Inc / DBT (US90290MAJ09) | 0,15 | 0,00 | 0,0534 | 0,0012 | |||||

| US118230AM30 / BUCKEYE PARTNERS LP | 0,15 | −6,37 | 0,0532 | −0,0021 | |||||

| US57587GTN50 / MASSACHUSETTS ST HSG FIN AGY HSG REVENUE | 0,15 | −3,29 | 0,0532 | −0,0003 | |||||

| US6174468P76 / Morgan Stanley | 0,15 | 0,69 | 0,0526 | 0,0014 | |||||

| US88581EAF88 / 3650R 2021-PF1 Commercial Mortgage Trust | 0,15 | −4,61 | 0,0526 | −0,0012 | |||||

| US31418EHP88 / Federal National Mortgage Association | 0,15 | −4,61 | 0,0523 | −0,0012 | |||||

| CONSEN / Consolidated Energy Finance SA | 0,14 | −1,37 | 0,0522 | 0,0007 | |||||

| US3137F4XB31 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,14 | −9,43 | 0,0519 | −0,0042 | |||||

| US57563RSU40 / Massachusetts Educational Financing Authority | 0,14 | −1,42 | 0,0504 | 0,0006 | |||||

| US36179W5B07 / Government National Mortgage Association | 0,14 | −4,83 | 0,0500 | −0,0012 | |||||

| BHC / Bausch Health Companies Inc. | 0,14 | −12,10 | 0,0499 | −0,0056 | |||||

| A5G / AIB Group plc | 0,14 | 0,0496 | 0,0496 | ||||||

| A5G / AIB Group plc | 0,14 | 0,0496 | 0,0496 | ||||||

| XS2615937187 / Allwyn Entertainment Financing UK PLC | 0,14 | 8,73 | 0,0496 | 0,0050 | |||||

| US889184AG22 / Toledo Hospital (The), Series AGMC | 0,14 | −4,90 | 0,0492 | −0,0014 | |||||

| Flutter Treasury DAC / DBT (XS3045497347) | 0,14 | 0,0487 | 0,0487 | ||||||

| Flutter Treasury DAC / DBT (XS3045497347) | 0,14 | 0,0487 | 0,0487 | ||||||

| US61747YFG52 / Morgan Stanley | 0,14 | 213,95 | 0,0487 | 0,0333 | |||||

| CEBB / Nationwide Building Society - Preferred Security | 0,14 | 7,14 | 0,0487 | 0,0040 | |||||

| CEBB / Nationwide Building Society - Preferred Security | 0,14 | 7,14 | 0,0487 | 0,0040 | |||||

| ENEL / Enel SpA | 0,13 | 8,06 | 0,0483 | 0,0045 | |||||

| ENEL / Enel SpA | 0,13 | 8,06 | 0,0483 | 0,0045 | |||||

| US31418ECY41 / FNCT UMBS 2.0 MA4586 03-01-42 | 0,13 | −3,62 | 0,0481 | −0,0006 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 0,13 | 0,0479 | 0,0479 | ||||||

| 5831 / Shizuoka Financial Group,Inc. | 0,13 | 0,0479 | 0,0479 | ||||||

| Whitbread Group PLC / DBT (XS2992313721) | 0,13 | 4,80 | 0,0475 | 0,0034 | |||||

| Whitbread Group PLC / DBT (XS2992313721) | 0,13 | 4,80 | 0,0475 | 0,0034 | |||||

| US61692CBK36 / Morgan Stanley Capital I Inc | 0,13 | −5,07 | 0,0473 | −0,0016 | |||||

| XS1328187627 / CRH FINANCE | 0,13 | 0,0470 | 0,0470 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0,13 | 5,69 | 0,0469 | 0,0035 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0,13 | 5,69 | 0,0469 | 0,0035 | |||||

| HMSO / Hammerson Plc | 0,13 | 5,74 | 0,0465 | 0,0035 | |||||

| HMSO / Hammerson Plc | 0,13 | 5,74 | 0,0465 | 0,0035 | |||||

| Tesco Corporate Treasury Services PLC / DBT (XS2824047372) | 0,13 | 4,96 | 0,0461 | 0,0034 | |||||

| Tesco Corporate Treasury Services PLC / DBT (XS2824047372) | 0,13 | 4,96 | 0,0461 | 0,0034 | |||||

| US95003DBP24 / Wells Fargo Commercial Mortgage Trust 2021-C60 | 0,13 | −4,51 | 0,0458 | −0,0011 | |||||

| US3137F4D828 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,13 | −10,00 | 0,0456 | −0,0037 | |||||

| US05635JAB61 / Bacardi Ltd / Bacardi-Martini BV | 0,13 | −2,34 | 0,0453 | 0,0002 | |||||

| DANSKE / Danske Bank A/S | 0,13 | 0,0451 | 0,0451 | ||||||

| DANSKE / Danske Bank A/S | 0,13 | 0,0451 | 0,0451 | ||||||

| US08163GAZ37 / Benchmark 2021-B28 Mortgage Trust | 0,12 | −4,62 | 0,0449 | −0,0012 | |||||

| US073250BW13 / Bayview Financial Revolving Asset Trust 2005-E | 0,12 | −0,81 | 0,0445 | 0,0007 | |||||

| Pachelbel Bidco SpA / DBT (XS2816638956) | 0,12 | 8,04 | 0,0437 | 0,0039 | |||||

| Pachelbel Bidco SpA / DBT (XS2816638956) | 0,12 | 8,04 | 0,0437 | 0,0039 | |||||

| Zegona Finance PLC / DBT (XS2859406212) | 0,12 | 9,09 | 0,0435 | 0,0046 | |||||

| Zegona Finance PLC / DBT (XS2859406212) | 0,12 | 9,09 | 0,0435 | 0,0046 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618N5A332) | 0,12 | −2,46 | 0,0431 | −0,0002 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3618N5A332) | 0,12 | −2,46 | 0,0431 | −0,0002 | |||||

| Amber Finco PLC / DBT (XS2857869163) | 0,12 | 8,26 | 0,0428 | 0,0041 | |||||

| Amber Finco PLC / DBT (XS2857869163) | 0,12 | 8,26 | 0,0428 | 0,0041 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 0,12 | 96,67 | 0,0428 | 0,0214 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 0,12 | 96,67 | 0,0428 | 0,0214 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0,12 | 0,0428 | 0,0428 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0,12 | 0,0428 | 0,0428 | ||||||

| US896288AC18 / TriNet Group, Inc. | 0,12 | 0,86 | 0,0423 | 0,0013 | |||||

| Lottomatica Group Spa / DBT (XS3047452746) | 0,12 | 0,0419 | 0,0419 | ||||||

| Lottomatica Group Spa / DBT (XS3047452746) | 0,12 | 0,0419 | 0,0419 | ||||||

| Parkland Corp / DBT (US70137WAN83) | 0,12 | −0,85 | 0,0419 | 0,0007 | |||||

| Parkland Corp / DBT (US70137WAN83) | 0,12 | −0,85 | 0,0419 | 0,0007 | |||||

| PRY / Prysmian S.p.A. | 0,12 | 10,48 | 0,0418 | 0,0047 | |||||

| PRY / Prysmian S.p.A. | 0,12 | 10,48 | 0,0418 | 0,0047 | |||||

| Iliad Holding SASU / DBT (XS2943818133) | 0,12 | 8,49 | 0,0418 | 0,0043 | |||||

| Iliad Holding SASU / DBT (XS2943818133) | 0,12 | 8,49 | 0,0418 | 0,0043 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 0,12 | 7,48 | 0,0417 | 0,0040 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 0,12 | 7,48 | 0,0417 | 0,0040 | |||||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 0,12 | 7,48 | 0,0417 | 0,0038 | |||||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 0,12 | 7,48 | 0,0417 | 0,0038 | |||||

| NEXI / Nexi S.p.A. | 0,12 | 0,0416 | 0,0416 | ||||||

| NEXI / Nexi S.p.A. | 0,12 | 0,0416 | 0,0416 | ||||||

| BKNG / Booking Holdings Inc. - Depositary Receipt (Common Stock) | 0,12 | 0,0415 | 0,0415 | ||||||

| BKNG / Booking Holdings Inc. - Depositary Receipt (Common Stock) | 0,12 | 0,0415 | 0,0415 | ||||||

| Islandsbanki HF / DBT (XS3028099417) | 0,12 | 0,0415 | 0,0415 | ||||||

| Islandsbanki HF / DBT (XS3028099417) | 0,12 | 0,0415 | 0,0415 | ||||||

| Landsbankinn HF / DBT (XS2913946989) | 0,12 | 10,58 | 0,0415 | 0,0045 | |||||

| Landsbankinn HF / DBT (XS2913946989) | 0,12 | 10,58 | 0,0415 | 0,0045 | |||||

| SSE / SSE plc | 0,12 | 0,0414 | 0,0414 | ||||||

| SSE / SSE plc | 0,12 | 0,0414 | 0,0414 | ||||||

| BE6312822628 / Anheuser-Busch InBev SA/NV | 0,11 | 0,0414 | 0,0414 | ||||||

| BE6312822628 / Anheuser-Busch InBev SA/NV | 0,11 | 0,0414 | 0,0414 | ||||||

| XS0764314695 / CEZ AS | 0,11 | 0,0414 | 0,0414 | ||||||

| XS0764314695 / CEZ AS | 0,11 | 0,0414 | 0,0414 | ||||||

| TDC Net A/S / DBT (XS3060305235) | 0,11 | 0,0413 | 0,0413 | ||||||

| TDC Net A/S / DBT (XS3060305235) | 0,11 | 0,0413 | 0,0413 | ||||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 0,11 | 0,0413 | 0,0413 | ||||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 0,11 | 0,0413 | 0,0413 | ||||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 0,11 | 0,0413 | 0,0413 | ||||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 0,11 | 0,0413 | 0,0413 | ||||||

| T1OW34 / American Tower Corporation - Depositary Receipt (Common Stock) | 0,11 | 0,0413 | 0,0413 | ||||||

| T1OW34 / American Tower Corporation - Depositary Receipt (Common Stock) | 0,11 | 0,0413 | 0,0413 | ||||||

| NBN Co Ltd / DBT (XS3074419006) | 0,11 | 0,0413 | 0,0413 | ||||||

| NBN Co Ltd / DBT (XS3074419006) | 0,11 | 0,0413 | 0,0413 | ||||||

| BIRG / Bank of Ireland Group plc | 0,11 | 0,0413 | 0,0413 | ||||||

| BIRG / Bank of Ireland Group plc | 0,11 | 0,0413 | 0,0413 | ||||||

| CEBB / Nationwide Building Society - Preferred Security | 0,11 | 0,0413 | 0,0413 | ||||||

| CEBB / Nationwide Building Society - Preferred Security | 0,11 | 0,0413 | 0,0413 | ||||||

| Sandoz Finance BV / DBT (XS3032013511) | 0,11 | 0,0412 | 0,0412 | ||||||

| Sandoz Finance BV / DBT (XS3032013511) | 0,11 | 0,0412 | 0,0412 | ||||||

| XS2287912450 / Verisure Midholding AB | 0,11 | 8,57 | 0,0412 | 0,0044 | |||||

| ContourGlobal Power Holdings SA / DBT (XS2988573080) | 0,11 | 8,57 | 0,0412 | 0,0039 | |||||

| ContourGlobal Power Holdings SA / DBT (XS2988573080) | 0,11 | 8,57 | 0,0412 | 0,0039 | |||||

| AV. / Aviva plc | 0,11 | 0,0412 | 0,0412 | ||||||

| AV. / Aviva plc | 0,11 | 0,0412 | 0,0412 | ||||||

| ORAN / Orange S.A. - Depositary Receipt (Common Stock) | 0,11 | 0,0412 | 0,0412 | ||||||