Grundläggande statistik

| Institutionella ägare | 672 total, 670 long only, 2 short only, 0 long/short - change of 4,17% MRQ |

| Genomsnittlig portföljallokering | 1.3703 % - change of −4,19% MRQ |

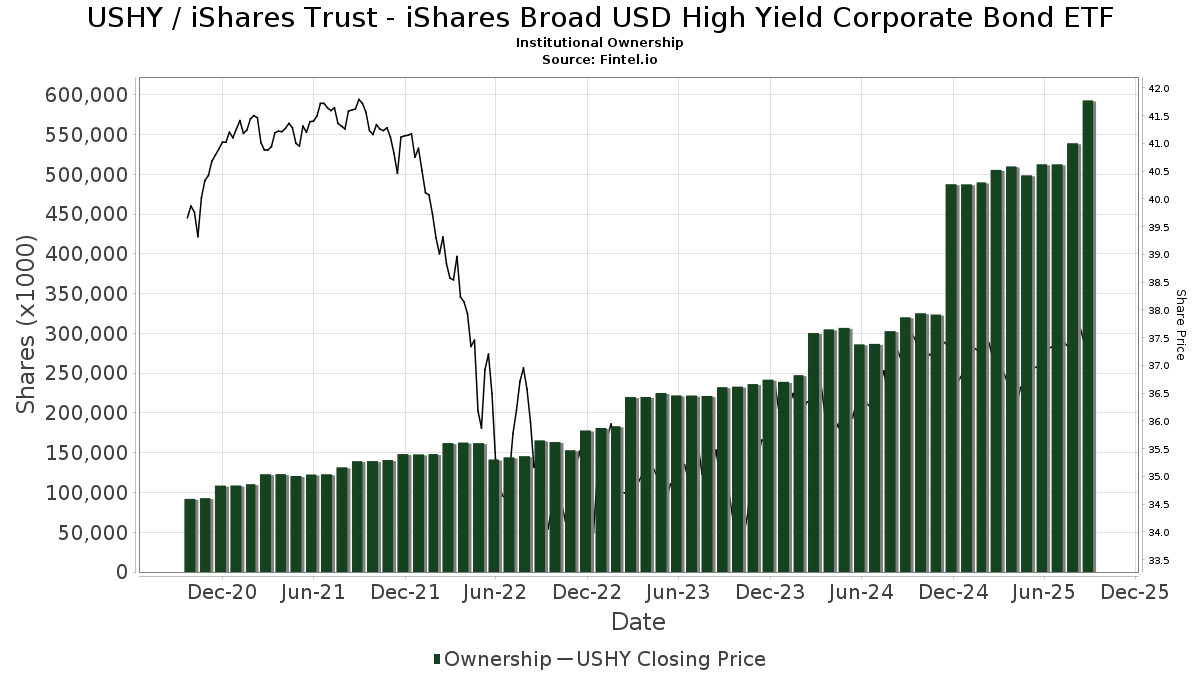

| Institutionella aktier (lång) | 592 628 668 (ex 13D/G) - change of 80,28MM shares 15,67% MRQ |

| Institutionellt värde (lång) | $ 21 046 052 USD ($1000) |

Institutionellt ägande och aktieägare

iShares Trust - iShares Broad USD High Yield Corporate Bond ETF (US:USHY) har 672 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 596,044,963 aktier. Största aktieägare inkluderar Prudential Plc, BlackRock, Inc., Wells Fargo & Company/mn, Northern Trust Corp, Bank Of America Corp /de/, Jpmorgan Chase & Co, BlackRock Funds V - BlackRock High Yield Bond Portfolio Service Shares, Jones Financial Companies Lllp, Ilmarinen Mutual Pension Insurance Co, and Raymond James Financial Inc .

iShares Trust - iShares Broad USD High Yield Corporate Bond ETF (BATS:USHY) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 12, 2025 is 37,69 / share. Previously, on September 16, 2024, the share price was 37,47 / share. This represents an increase of 0,59% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

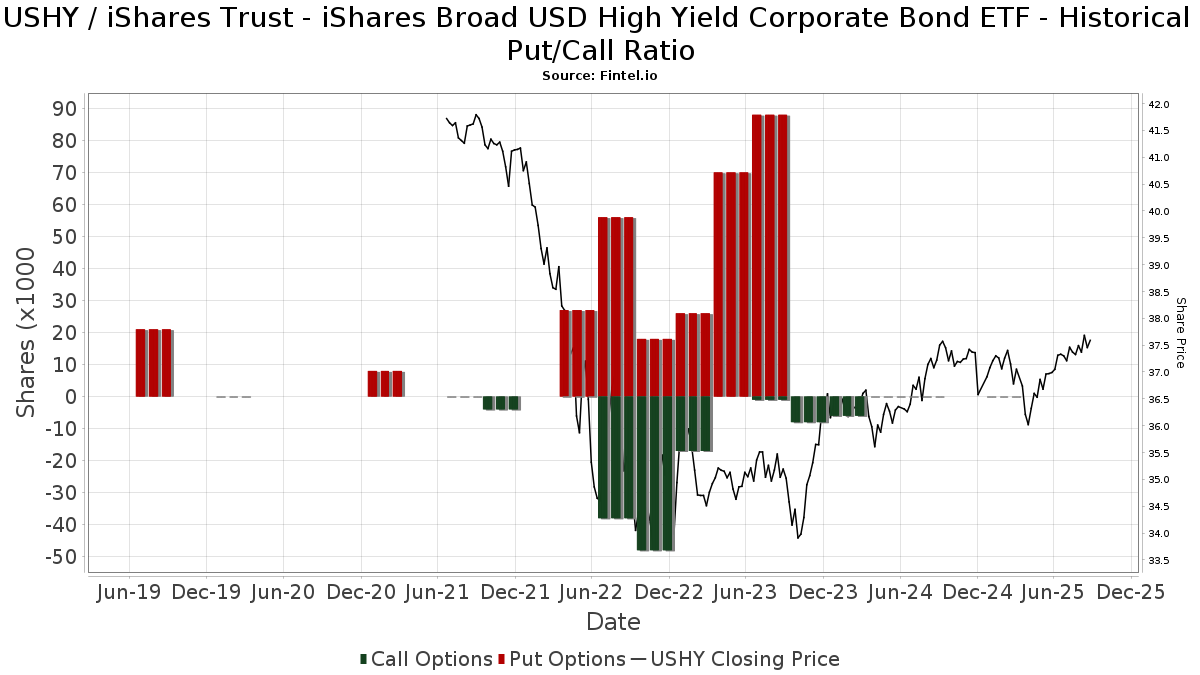

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13D/G-Arkiveringar

Vi presenterar 13D/G-arkiveringar separat från 13F-arkiveringar på grund av att de behandlas olika av SEC. 13D/G-arkiveringar kan lämnas in av grupper av investerare (med en ledare), medan 13F-arkiveringar inte kan det. Detta leder till situationer där en investerare kan lämna in en 13D/G-ansökan med ett värde för de totala aktierna (vilket motsvarar alla aktier som ägs av investerargruppen), men sedan lämna in en 13F-ansökan med ett annat värde för de totala aktierna (vilket motsvarar enbart deras eget ägande). Detta innebär att aktieägandet i 13D/G-arkiveringar och 13F-arkiveringar ofta inte är direkt jämförbara, så vi presenterar dem separat.

Notera: Från och med den 16 maj 2021 visar vi inte längre ägare som inte har lämnat in en 13D/G under det senaste året. Tidigare visade vi hela historiken för 13D/G-arkiveringar. I allmänhet måste enheter som är skyldiga att lämna in 13D/G-arkiveringar lämna in minst en gång per år innan de lämnar in en stängningsarkivering. Fonder avslutar dock ibland positioner utan att lämna in en avslutande arkivering (dvs. de avvecklar), så att visa hela historiken resulterade ibland i förvirring om det nuvarande ägandet. För att förhindra förvirring visar vi nu endast "nuvarande" ägare - det vill säga ägare som har lämnat in en ansökan under det senaste året.

Upgrade to unlock premium data.

| Fil Datum | Formulär | Investerare | Föregående aktier |

Senaste aktier |

Δ Aktier (Procent) |

Ägande (Procent) |

Δ Ägande (Procent) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-04-22 | BlackRock, Inc. | 78,000 | 1,172,683 | 1,403.44 | 0.20 | -98.97 | ||

| 2025-04-15 | BlackRock Portfolio Management LLC | 37,591,883 | 6.90 |

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-13 | 13F | Millstone Evans Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-18 | 13F | Vicus Capital | 82 539 | 6,02 | 3 096 | 8,06 | ||||

| 2025-07-23 | 13F | Venturi Wealth Management, LLC | 1 349 330 | 4 385,21 | 50 613 | 4 472,09 | ||||

| 2025-04-25 | NP | PMSAX - Global Multi-Strategy Fund Class A | 15 560 | 7,05 | 583 | 6,79 | ||||

| 2025-07-11 | 13F | Grove Bank & Trust | 223 846 | 1,56 | 8 396 | 3,49 | ||||

| 2025-07-09 | 13F | VisionPoint Advisory Group, LLC | 80 654 | 4,18 | 3 025 | 6,18 | ||||

| 2025-07-28 | 13F | Axxcess Wealth Management, Llc | 872 245 | −1,99 | 32 718 | −0,13 | ||||

| 2025-07-30 | NP | AMHYX - INVESCO High Yield Fund Class A | 935 000 | 34 623 | ||||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 419 | 0,00 | 16 | 0,00 | ||||

| 2025-08-04 | 13F | Quaker Wealth Management, LLC | 2 | 0 | ||||||

| 2025-07-24 | 13F | Endeavor Private Wealth, Inc. | 31 592 | −51,15 | 1 185 | −50,21 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 16 496 902 | 3,81 | 618 799 | 5,78 | ||||

| 2025-08-08 | 13F | Principal Financial Group Inc | 4 220 839 | 1 134,11 | 158 324 | 1 157,63 | ||||

| 2025-08-27 | NP | TOBAX - Touchstone Active Bond Fund Class A | 35 191 | 1 320 | ||||||

| 2025-07-29 | NP | WAVLX - Wavelength Interest Rate Neutral Fund | 143 215 | −18,45 | 5 303 | −19,36 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 2 908 868 | −9,80 | 109 112 | −8,08 | ||||

| 2025-07-17 | 13F | Coastline Trust Co | 48 | 0,00 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 386 653 | 39,74 | 14 503 | 42,40 | ||||

| 2025-06-23 | NP | IYLD - iShares Morningstar Multi-Asset Income ETF | 468 504 | 2,18 | 17 147 | 0,29 | ||||

| 2025-08-29 | NP | GDMA - Gadsden Dynamic Multi-Asset ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-03-31 | NP | FSHNX - Fidelity Series High Income Fund | 39 100 | 0,00 | 1 458 | 0,48 | ||||

| 2025-08-14 | 13F | Transamerica Financial Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Charles Schwab Trust Co | 97 813 | 206,88 | 3 669 | 212,70 | ||||

| 2025-07-29 | NP | Invesco High Income Trust Ii This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 85 000 | 3 148 | ||||||

| 2025-08-12 | 13F | WealthTrak Capital Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 22 299 575 | 7,17 | 834 004 | 9,00 | ||||

| 2025-08-11 | 13F | Empowered Funds, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 11 671 | −2,20 | 438 | −0,46 | ||||

| 2025-08-14 | 13F | Diversify Advisory Services, LLC | 5 733 | 2,50 | 214 | 4,39 | ||||

| 2025-07-08 | 13F | Zrc Wealth Management, Llc | 1 526 | 1,73 | 57 | 3,64 | ||||

| 2025-07-10 | 13F | Bigelow Investment Advisors, LLC | 6 056 | −0,92 | 227 | 1,34 | ||||

| 2025-08-14 | 13F | Strategic Wealth Designers | 0 | 0 | ||||||

| 2025-07-31 | 13F | CAP Partners, LLC | 26 543 | 3,12 | 996 | 5,07 | ||||

| 2025-08-07 | 13F | Vise Technologies, Inc. | 142 422 | 6,11 | 5 342 | 8,20 | ||||

| 2025-08-11 | 13F | Portside Wealth Group, LLC | 18 980 | 10,41 | 712 | 12,50 | ||||

| 2025-05-13 | 13F | CacheTech Inc. | 13 325 | −11,53 | 490 | −11,55 | ||||

| 2025-07-09 | 13F | Harbor Capital Advisors, Inc. | 12 464 | 0 | ||||||

| 2025-06-13 | NP | JHYIX - abrdn Global High Income Fund Institutional Class | 76 440 | 2 798 | ||||||

| 2025-08-28 | 13F/A | Tolleson Wealth Management, Inc. | 167 643 | −3,34 | 6 288 | −1,50 | ||||

| 2025-07-15 | 13F | FLP Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-09 | 13F | Cary Street Partners Financial Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp | 14 399 000 | 526,32 | 540 106 | 538,23 | ||||

| 2025-07-16 | 13F | Octavia Wealth Advisors, LLC | 87 478 | 1,47 | 3 281 | 3,40 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - Equitable Moderate Growth MF/ETF Portfolio Class K | 18 510 | −38,73 | 694 | −37,59 | ||||

| 2025-08-06 | 13F | Moors & Cabot, Inc. | 10 123 | 0,34 | 380 | 2,16 | ||||

| 2025-08-19 | 13F | Hohimer Wealth Management, Llc | 110 765 | −4,35 | 4 155 | −2,53 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 5 777 | −30,16 | 217 | −28,95 | ||||

| 2025-05-12 | 13F | Sandy Spring Bank | 161 | 6 | ||||||

| 2025-07-28 | 13F | Eq Wealth Advisors, Llc | 142 | 0,00 | 5 | 0,00 | ||||

| 2025-05-23 | NP | TRANSAMERICA SERIES TRUST - Transamerica PIMCO Tactical - Growth VP Service | 68 841 | 0,00 | 2 534 | 0,08 | ||||

| 2025-08-13 | 13F | Cheviot Value Management, LLC | 29 | 0,00 | 1 | 0,00 | ||||

| 2025-08-04 | 13F | AMG National Trust Bank | 18 383 | 2,07 | 690 | 4,08 | ||||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 276 400 | −23,98 | 10 368 | −22,54 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 23 453 | 104,03 | 1 | |||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 23 686 | 16,40 | 888 | 18,72 | ||||

| 2025-04-29 | 13F | Td Private Client Wealth Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 835 552 | 206,71 | 31 342 | 212,53 | ||||

| 2025-07-08 | 13F | Twele Capital Management, Inc. | 42 630 | 0,00 | 1 599 | 1,91 | ||||

| 2025-07-31 | 13F | Keeler THomas Management LLC | 175 910 | 6 598 | ||||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 5 617 910 | −9,09 | 211 | −7,49 | ||||

| 2025-08-07 | 13F | PFG Advisors | 5 395 | 202 | ||||||

| 2025-05-15 | 13F | BlueCrest Capital Management Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Leeward Financial Partners, LLC | 59 134 | 6,58 | 2 218 | 8,62 | ||||

| 2025-07-31 | 13F | Japan Science & Technology Agency | 8 819 906 | 0,00 | 330 835 | 1,90 | ||||

| 2025-08-12 | 13F | Cornerstone Wealth Management, LLC | 7 093 | 266 | ||||||

| 2025-05-27 | NP | BlackRock Funds V - BlackRock Strategic Income Opportunities Portfolio Investor A Shares | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-18 | 13F | New Wave Wealth Advisors Llc | 74 319 | −0,34 | 2 788 | 1,53 | ||||

| 2025-07-30 | 13F | BTS Asset Management, Inc. | 805 427 | 274,61 | 30 212 | 281,74 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 4 376 374 | −9,69 | 164 158 | −7,98 | ||||

| 2025-08-12 | 13F | Titleist Asset Management, Llc | 40 678 | −0,31 | 1 526 | 1,53 | ||||

| 2025-07-28 | 13F | Copia Wealth Management | 103 | 4 | ||||||

| 2025-08-12 | 13F | Change Path, LLC | 147 003 | 35,61 | 5 514 | 38,20 | ||||

| 2025-04-23 | 13F | GHP Investment Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F/A | Old Point Trust & Financial Services N A | 120 | −90,68 | 5 | −91,49 | ||||

| 2025-07-10 | 13F | Tompkins Financial Corp | 223 | 0,00 | 8 | 0,00 | ||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Sierra Tactical Bond Fund Investor Class Shares | 8 122 600 | −6,68 | 304 679 | −4,91 | ||||

| 2025-08-14 | 13F | Bragg Financial Advisors, Inc | 7 124 | −4,47 | 267 | −2,55 | ||||

| 2025-08-14 | 13F | Gotham Asset Management, LLC | 41 063 | −0,20 | 1 540 | 1,72 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 20 349 | −5,94 | 763 | −4,15 | ||||

| 2025-04-30 | 13F | Nisa Investment Advisors, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Unison Advisors LLC | 59 243 | 3,07 | 2 222 | 5,06 | ||||

| 2025-08-04 | 13F | Flagship Harbor Advisors, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Summit X, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Personal Cfo Solutions, Llc | 6 444 | 242 | ||||||

| 2025-08-08 | 13F | Advyzon Investment Management, LLC | 13 632 | 47,80 | 511 | 50,74 | ||||

| 2025-05-12 | 13F | Polen Capital Management Llc | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | DHJJ Financial Advisors, Ltd. | 0 | −100,00 | 0 | |||||

| 2025-07-18 | 13F | PFG Investments, LLC | 12 774 | 3,19 | 479 | 5,27 | ||||

| 2025-07-29 | NP | HFND - Unlimited HFND Multi-Strategy Return Tracker ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-25 | 13F | Genesee Capital Advisors, LLC | 8 149 | −26,79 | 306 | −25,43 | ||||

| 2025-08-01 | 13F | New York Life Investment Management Llc | 310 853 | 30,87 | 11 660 | 33,36 | ||||

| 2025-08-28 | NP | BlackRock Funds II - BLACKROCK MANAGED INCOME FUND CLASS K SHARES | 743 531 | 27 890 | ||||||

| 2025-07-18 | 13F | Trust Co Of Vermont | 348 | 13 | ||||||

| 2025-08-26 | NP | Blackrock Floating Rate Income Trust This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 195 000 | 11,43 | 7 314 | 13,55 | ||||

| 2025-07-24 | 13F/A | TFR Capital, LLC. | 10 403 | −1,65 | 390 | 0,26 | ||||

| 2025-07-10 | 13F | Sovran Advisors, LLC | 27 447 | 120,78 | 1 021 | 126,89 | ||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 401 924 | 3,57 | 15 076 | 5,54 | ||||

| 2025-08-18 | 13F | Hollencrest Capital Management | 20 | 0,00 | 1 | |||||

| 2025-08-08 | 13F | Angel Oak Capital Advisors, LLC | 48 500 | −10,81 | 1 819 | −9,10 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 58 937 | 40,55 | 2 | 100,00 | ||||

| 2025-08-14 | 13F | Comerica Bank | 148 390 | −8,58 | 5 566 | −6,83 | ||||

| 2025-08-12 | 13F | Mmbg Investment Advisors Co. | 14 440 | 0,00 | 542 | 1,88 | ||||

| 2025-08-13 | 13F | Loomis Sayles & Co L P | 311 410 | −53,28 | 11 681 | 48 566,67 | ||||

| 2025-08-12 | 13F | Prudential Financial Inc | 404 138 | −2,41 | 15 159 | −0,56 | ||||

| 2025-08-14 | 13F | Harwood Advisory Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Clark Capital Management Group, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | Kathmere Capital Management, LLC | 82 929 | 1,97 | 3 111 | 3,91 | ||||

| 2025-08-12 | 13F | Hillsdale Investment Management Inc. | 11 280 | 26,60 | 423 | 29,36 | ||||

| 2025-07-09 | 13F | Pines Wealth Management, LLC | 14 856 | −23,71 | 555 | −19,21 | ||||

| 2025-07-23 | 13F | Allegiance Financial Group Advisory Services LLC | 400 305 | 6,64 | 15 015 | 8,66 | ||||

| 2025-08-25 | 13F/A | Promus Capital, LLC | 1 881 | 0,00 | 71 | 1,45 | ||||

| 2025-05-07 | 13F | Spectrum Wealth Counsel, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Mpwm Advisory Solutions, Llc | 548 | −16,34 | 21 | −16,67 | ||||

| 2025-06-23 | NP | Global Macro Absolute Return Advantage Portfolio - Global Macro Absolute Return Advantage Portfolio | Short | −2 613 963 | −95 671 | |||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 92 968 | 6,09 | 3 487 | 8,12 | ||||

| 2025-07-17 | 13F | Raleigh Capital Management Inc. | 267 | 1,52 | 10 | 11,11 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 5 668 | 2,11 | 213 | 3,92 | ||||

| 2025-07-07 | 13F | Salem Investment Counselors Inc | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 13 140 | 6,64 | 493 | 8,61 | ||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 1 841 | 8,36 | 69 | 9,68 | ||||

| 2025-08-28 | NP | BlackRock Series Fund, Inc. - BlackRock Global Allocation Portfolio This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 4 187 | 0,00 | 157 | 1,95 | ||||

| 2025-08-12 | NP | KAMIX - Kensington Managed Income Fund Institutional Class Shares | 3 795 450 | −17,54 | 142 367 | −15,97 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 236 694 | 9,58 | 8 878 | 11,66 | ||||

| 2025-07-25 | 13F | Bricktown Capital, LLC | 1 574 912 | 0,26 | 59 075 | 2,17 | ||||

| 2025-08-11 | 13F | Advisor Resource Council | 0 | −100,00 | 0 | |||||

| 2025-07-11 | 13F | First PREMIER Bank | 14 200 | 0,00 | 1 | |||||

| 2025-06-26 | NP | BlackRock ETF Trust II - BlackRock Floating Rate Loan ETF This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 18 000 | −45,45 | 659 | −46,50 | ||||

| 2025-08-28 | NP | ABHIX - High-yield Fund Investor Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 53 100 | 0,00 | 1 992 | 1,89 | ||||

| 2025-07-23 | 13F | Nbt Bank N A /ny | 2 233 | 0,00 | 84 | 1,22 | ||||

| 2025-08-14 | 13F | Gen-Wealth Partners Inc | 384 | 14 | ||||||

| 2025-08-06 | 13F | Adviser Investments LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | YANKCOM Partnership | 111 | 0,00 | 4 | 0,00 | ||||

| 2025-07-03 | 13F | CPA Asset Management LLC | 9 384 | 0,00 | 352 | 1,74 | ||||

| 2025-07-17 | 13F | Neumann Capital Management, LLC | 31 427 | 11,78 | 1 179 | 13,93 | ||||

| 2025-07-09 | 13F | First Financial Corp /in/ | 702 | −40,91 | 26 | −39,53 | ||||

| 2025-07-17 | 13F | Independence Bank of Kentucky | 133 | 0,00 | 5 | 0,00 | ||||

| 2025-08-08 | 13F | Gts Securities Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | NEOS Investment Management LLC | 1 182 174 | 23,01 | 44 094 | 25,37 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 1 037 | 221,05 | 0 | |||||

| 2025-05-22 | NP | DEUTSCHE DWS VARIABLE SERIES II - DWS High Income VIP Class A | 30 000 | −40,00 | 1 104 | −39,97 | ||||

| 2025-08-14 | 13F | Murphy & Mullick Capital Management Corp | 69 | 0,00 | 3 | 0,00 | ||||

| 2025-07-18 | 13F | SOA Wealth Advisors, LLC. | 620 | 23 | ||||||

| 2025-07-31 | 13F | Wright Fund Managment, LLC | 11 630 696 | 0,00 | 428 126 | 0,00 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 15 713 | 589 | ||||||

| 2025-08-12 | 13F | DiMeo Schneider & Associates, L.L.C. | 32 534 | 0,00 | 1 220 | 1,92 | ||||

| 2025-07-14 | 13F | Pacifica Partners Inc. | 695 | 0,00 | 26 | 0,00 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | a16z Perennial Management, L.P. | 226 366 | 23 422 | ||||||

| 2025-07-22 | 13F | Grimes & Company, Inc. | 4 445 406 | 166 747 | ||||||

| 2025-07-29 | 13F | Private Trust Co Na | 8 998 | −0,35 | 338 | 1,51 | ||||

| 2025-07-09 | 13F | Catalyst Private Wealth, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-28 | NP | OHYFX - JPMorgan High Yield Fund Class I | 2 409 500 | 508,46 | 89 224 | 504,41 | ||||

| 2025-07-16 | 13F | Rebalance, Llc | 1 711 264 | 0,73 | 64 190 | 2,65 | ||||

| 2025-08-08 | 13F | Emerald Investment Partners, Llc | 0 | −100,00 | 0 | |||||

| 2025-05-01 | 13F | Hughes Financial Services, LLC | 0 | 0 | ||||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 17 265 | −16,45 | 648 | −14,87 | ||||

| 2025-07-18 | 13F | Pure Financial Advisors, Inc. | 14 110 | 57,23 | 529 | 60,30 | ||||

| 2025-07-14 | 13F | Armstrong Advisory Group, Inc | 1 281 | 3,14 | 48 | 6,67 | ||||

| 2025-08-14 | 13F | New England Asset Management Inc | 53 145 | 0,00 | 1 993 | 1,89 | ||||

| 2025-05-01 | 13F | BankPlus Trust Department | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Phillips Financial Management, Llc | 523 249 | 1,63 | 19 627 | 3,57 | ||||

| 2025-08-13 | 13F | Barclays Plc | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 124 090 | 282,91 | 4 655 | 290,44 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 84 315 | 11,08 | 3 163 | 13,17 | ||||

| 2025-07-31 | 13F | Moloney Securities Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-22 | 13F | Carter Financial Group, INC. | 12 060 | 452 | ||||||

| 2025-08-11 | 13F | Citigroup Inc | 2 124 089 | 18,75 | 79 675 | 21,01 | ||||

| 2025-05-02 | 13F | Cullen/frost Bankers, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Shenkman Capital Management Inc | 344 380 | −30,55 | 12 876 | −28,57 | ||||

| 2025-08-14 | 13F | Logan Stone Capital, LLC | 305 733 | −68,93 | 11 468 | −68,34 | ||||

| 2025-07-17 | 13F | Paradigm Financial Partners, Llc | 9 369 | 22,07 | 351 | 24,47 | ||||

| 2025-07-22 | 13F | USAdvisors Wealth Management, LLC | 9 706 | −0,23 | 0 | |||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 88 600 | 3 | ||||||

| 2025-08-14 | 13F | Quartz Partners, LLC | 6 674 | −0,51 | 250 | 1,63 | ||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 9 268 | −57,74 | 348 | −57,00 | ||||

| 2025-06-04 | NP | NTBAX - Navigator Tactical Fixed Income Fund Class A Shares | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Natixis Advisors, L.p. | 90 863 | 4,52 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Moneta Group Investment Advisors Llc | 77 225 | 3,71 | 2 897 | 5,69 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 610 | −34,41 | 23 | −35,29 | ||||

| 2025-04-01 | 13F | Massmutual Trust Co Fsb/adv | 0 | −100,00 | 0 | |||||

| 2025-08-26 | NP | Blackrock Debt Strategies Fund, Inc. This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 125 000 | 31,58 | 4 689 | 34,10 | ||||

| 2025-04-18 | 13F | Halbert Hargrove Global Advisors, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-23 | 13F | Citizens National Bank Trust Department | 143 | 0,00 | 5 | 0,00 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 1 519 300 | 32,72 | 57 | 33,33 | ||||

| 2025-07-25 | 13F | Richardson Financial Services Inc. | 8 385 | 35,59 | 313 | 37,44 | ||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 1 504 | 56 | ||||||

| 2025-05-01 | 13F | High Note Wealth, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Sumitomo Life Insurance Co | 219 900 | −64,28 | 8 248 | −63,60 | ||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 2 009 | −23,84 | 75 | −22,68 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-04-30 | 13F | Sofos Investments, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Acorn Wealth Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Richards, Merrill & Peterson, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | New Millennium Group LLC | 437 | 0,00 | 16 | 0,00 | ||||

| 2025-08-25 | NP | NDAA - Ned Davis Research 360 Dynamic Allocation ETF | 3 714 | 163,59 | 139 | 172,55 | ||||

| 2025-05-14 | 13F | Jane Street Group, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-09 | 13F | Reyes Financial Architecture, Inc. | 176 | 0,00 | 7 | 0,00 | ||||

| 2025-08-14 | 13F | Little Harbor Advisors, LLC | 159 100 | 6 | ||||||

| 2025-07-14 | 13F | Occidental Asset Management, LLC | 22 939 | 100,17 | 860 | 104,28 | ||||

| 2025-07-29 | 13F | Two West Capital Advisors LLC | 5 901 | −2,06 | 221 | 2,33 | ||||

| 2025-08-08 | 13F | Creative Planning | 138 724 | −38,27 | 5 204 | −37,09 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 43 064 | −88,23 | 1 615 | −88,01 | ||||

| 2025-08-08 | 13F | Wrapmanager Inc | 7 951 | −12,19 | 298 | −10,51 | ||||

| 2025-08-11 | 13F | Y.D. More Investments Ltd | 104 903 | −72,98 | 3 935 | −72,47 | ||||

| 2025-07-15 | 13F | Norden Group Llc | 10 026 | 3,19 | 376 | 5,32 | ||||

| 2025-08-05 | 13F | Counterweight Ventures, LLC | 72 952 | 3,35 | 2 736 | 5,31 | ||||

| 2025-08-11 | 13F | Trajan Wealth LLC | 309 413 | 8,59 | 11 606 | 10,66 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 144 821 | 40,54 | 5 432 | 43,21 | ||||

| 2025-04-28 | NP | NCOAX - Nuveen Symphony High Yield Income Fund Class A This fund is a listed as child fund of Nuveen Asset Management, LLC and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 670 996 | 10,17 | 25 129 | 10,67 | ||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 347 | −62,28 | 13 | −60,61 | ||||

| 2025-07-22 | 13F | Simplicity Wealth,LLC | 232 550 | 149,71 | 8 723 | 154,43 | ||||

| 2025-08-11 | 13F | State of Wisconsin - Board of Commissioners of Public Lands | 48 550 | 0,00 | 1 821 | 1,90 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 20 132 | 135,16 | 755 | 139,68 | ||||

| 2025-07-29 | 13F | Chicago Partners Investment Group LLC | 7 882 | −40,16 | 295 | −38,67 | ||||

| 2025-08-15 | 13F | Asset Allocation Strategies LLC | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | GPTCX - GuidePath(R) Conservative Allocation Fund Service Shares | 291 421 | −1,90 | 10 931 | −0,04 | ||||

| 2025-04-22 | 13F | Castleview Partners, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Gladstone Institutional Advisory LLC | 24 003 | 2,54 | 900 | 4,53 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 256 786 | −46,15 | 9 632 | −45,13 | ||||

| 2025-04-10 | 13F | Contravisory Investment Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | BTFAX - BTS Tactical Fixed Income Fund Class A Shares | 558 697 | 265,63 | 20 957 | 272,62 | ||||

| 2025-08-01 | 13F | Advisory Alpha, LLC | 30 986 | −9,12 | 1 162 | −7,41 | ||||

| 2025-06-26 | NP | SPHIX - Fidelity High Income Fund | 1 002 300 | 36 684 | ||||||

| 2025-07-18 | 13F | Ninety One UK Ltd | 150 811 | 0,00 | 5 657 | 1,89 | ||||

| 2025-08-13 | 13F | Farnam Financial LLC | 8 043 | −6,66 | 302 | −5,05 | ||||

| 2025-08-05 | 13F | Scarborough Advisors, LLC | 42 | 0 | ||||||

| 2025-04-28 | 13F | Mainstream Capital Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Legacy Wealth Managment, LLC/ID | 20 | 0,00 | 1 | |||||

| 2025-08-12 | 13F | Howe & Rusling Inc | 213 415 | 2,34 | 8 005 | 4,30 | ||||

| 2025-08-14 | 13F | Bbr Partners, Llc | 5 500 | 206 | ||||||

| 2025-08-07 | 13F | Verus Capital Partners, Llc | 61 122 | 10,46 | 2 293 | 12,57 | ||||

| 2025-08-28 | NP | BTSAX - BTS Managed Income Fund Class A Shares | 23 249 | 287,10 | 872 | 294,57 | ||||

| 2025-05-14 | 13F | Oarsman Capital, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 500 | 19 | ||||||

| 2025-07-14 | 13F | Mechanics Bank Trust Department | 105 686 | −47,89 | 3 964 | −46,90 | ||||

| 2025-07-29 | 13F | Disciplined Investments, LLC | 5 445 | −32,27 | 204 | −30,85 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 11 151 | −9,34 | 418 | −7,52 | ||||

| 2025-05-13 | 13F | Adams Wealth Management | 13 325 | −11,53 | 490 | −11,55 | ||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 15 537 | 18,70 | 583 | 21,00 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 12 133 | 22,87 | 455 | 25,34 | ||||

| 2025-07-30 | 13F | Caliber Wealth Management, LLC / KS | 28 491 | 18,61 | 1 069 | 20,81 | ||||

| 2025-07-31 | 13F | Ssa Swiss Advisors Ag | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 68 | −90,75 | 3 | −92,59 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 236 | 0,00 | 9 | 0,00 | ||||

| 2025-08-28 | NP | HYTR - CP High Yield Trend ETF | 1 630 226 | 27,39 | 61 150 | 29,82 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 618 865 | −4,89 | 23 225 | −2,71 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 789 691 | 1,54 | 29 621 | 3,47 | ||||

| 2025-08-12 | 13F | PSI Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-30 | NP | ENDW - Cambria Endowment Style ETF | 3 055 | 113 | ||||||

| 2025-08-07 | 13F | Winch Advisory Services, LLC | 23 317 | −3,15 | 875 | −1,35 | ||||

| 2025-08-18 | 13F/A | Kestra Investment Management, LLC | 35 050 | 46,06 | 1 315 | 48,81 | ||||

| 2025-07-25 | 13F | Verdence Capital Advisors LLC | 46 253 | 5,18 | 1 735 | 7,17 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 22 054 | 827 | ||||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 9 983 | 7,14 | 374 | 9,68 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | Golden State Equity Partners | 42 731 | −12,83 | 1 603 | −11,20 | ||||

| 2025-07-10 | 13F | High Net Worth Advisory Group LLC | 44 370 | −2,63 | 1 664 | −0,78 | ||||

| 2025-07-10 | 13F | Oliver Lagore Vanvalin Investment Group | 21 | 1 | ||||||

| 2025-07-07 | 13F | First Community Trust Na | 108 | 4 | ||||||

| 2025-07-25 | 13F | Iron Financial, LLC | 7 453 | 0,00 | 280 | 1,82 | ||||

| 2025-05-15 | 13F | Sheridan Capital Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-13 | 13F | Blue Edge Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Beacon Capital Management, LLC | 4 914 | −7,60 | 184 | −5,64 | ||||

| 2025-08-12 | 13F | Prudential Plc | 75 293 185 | −5,55 | 2 824 247 | −3,75 | ||||

| 2025-08-25 | NP | MML Series Investment Fund II - MML iShares 60/40 Allocation Fund Service Class I | 16 336 | 9,76 | 613 | 11,88 | ||||

| 2025-07-11 | 13F | My Legacy Advisors, LLC | 8 314 | 0,00 | 310 | 0,98 | ||||

| 2025-04-23 | 13F | Mascagni Wealth Management, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-17 | 13F | San Luis Wealth Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Baltimore-Washington Financial Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | TFB Advisors LLC | 36 271 | 8,87 | 1 361 | 10,93 | ||||

| 2025-07-30 | 13F | Securian Asset Management, Inc | 126 886 | 0,00 | 4 759 | 1,91 | ||||

| 2025-07-30 | 13F | Atlantic Edge Private Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 19 179 | −10,77 | 719 | −9,10 | ||||

| 2025-07-25 | 13F | LRI Investments, LLC | 39 | 0,00 | 1 | 0,00 | ||||

| 2025-08-28 | NP | GPIFX - GuidePath(R) Flexible Income Allocation Fund Service Shares | 1 107 579 | 99,40 | 41 545 | 103,20 | ||||

| 2025-08-27 | NP | TOUCHSTONE VARIABLE SERIES TRUST - Touchstone Balanced Fund | 22 499 | 844 | ||||||

| 2025-07-23 | 13F/A | Euro Pacific Asset Management, LLC | 14 875 | 0,00 | 1 | |||||

| 2025-07-28 | 13F | Morris Financial Concepts, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | May Hill Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-11 | 13F | Windsor Capital Management, LLC | 33 407 | 19,75 | 1 253 | 22,12 | ||||

| 2025-08-06 | 13F | Founders Financial Securities Llc | 171 308 | 63,94 | 6 426 | 67,49 | ||||

| 2025-08-06 | 13F | Sage Advisory Services, Ltd.Co. | 238 455 | 11,21 | 8 944 | 13,32 | ||||

| 2025-05-01 | 13F | Diversify Wealth Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-10 | 13F | Brooklyn FI, LLC | 6 779 | 0,00 | 254 | 2,01 | ||||

| 2025-08-11 | 13F | Heritage Wealth Advisors | 0 | 0 | ||||||

| 2025-05-15 | 13F | State Of Wisconsin Investment Board | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Wolff Wiese Magana Llc | 272 | 0,00 | 10 | 0,00 | ||||

| 2025-08-14 | 13F | Hurley Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Manning & Napier Advisors Llc | 1 003 025 | 858,44 | 37 623 | 876,71 | ||||

| 2025-07-16 | 13F | RWM Asset Management, LLC | 262 194 | 5,09 | 9 835 | 7,08 | ||||

| 2025-07-30 | 13F | Syntegra Private Wealth Group, LLC | 10 583 | −0,02 | 397 | 1,80 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 20 126 | 27,85 | 755 | 30,22 | ||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 256 358 | −25,27 | 9 616 | −24,27 | ||||

| 2025-08-11 | 13F | Alps Advisors Inc | 373 988 | 41,35 | 14 028 | 44,04 | ||||

| 2025-05-13 | 13F | Landing Point Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-10 | 13F | Wedmont Private Capital | 406 461 | −0,80 | 15 161 | 3,68 | ||||

| 2025-08-07 | 13F | Flagship Wealth Advisors, Llc | 666 | 25 | ||||||

| 2025-05-02 | 13F | Signaturefd, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 9 462 | 5,41 | 355 | 7,27 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 4 898 | −60,72 | 184 | −60,04 | ||||

| 2025-06-26 | NP | TMAAX - Thrivent Moderately Aggressive Allocation Fund Class A | 36 265 | 0,00 | 1 327 | −1,85 | ||||

| 2025-07-21 | 13F | Single Point Partners, LLC | 160 113 | 0,40 | 6 | 20,00 | ||||

| 2025-08-13 | 13F | Truvestments Capital Llc | 1 017 | 38 | ||||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 752 | 28 | ||||||

| 2025-08-14 | 13F | Peapack Gladstone Financial Corp | 41 083 | −58,64 | 2 | −66,67 | ||||

| 2025-08-22 | NP | Variable Insurance Products Fund V - Strategic Income Portfolio Initial Class | 527 400 | 19 783 | ||||||

| 2025-07-23 | 13F | Litman Gregory Asset Management LLC | 32 190 | 0,04 | 1 207 | 1,94 | ||||

| 2025-08-13 | 13F | Fisher Asset Management, LLC | 208 991 | −9,86 | 7 839 | −8,14 | ||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 27 069 | 1 015 | ||||||

| 2025-08-11 | 13F | Independent Advisor Alliance | 9 688 | −23,26 | 363 | −21,77 | ||||

| 2025-07-23 | 13F | Friedenthal Financial | 3 080 | 116 | ||||||

| 2025-08-05 | 13F | Allstate Corp | 1 274 000 | −35,92 | 47 788 | −34,70 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 6 067 | −10,12 | 228 | −8,47 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 610 653 | 6 188,26 | 22 906 | 6 315,97 | ||||

| 2025-06-26 | NP | BlackRock Funds V - BlackRock Floating Rate Income Portfolio Investor A Shares | 311 241 | 58,60 | 11 391 | 55,68 | ||||

| 2025-07-11 | 13F | Pinnacle Bancorp, Inc. | 1 044 | 0,00 | 39 | 2,63 | ||||

| 2025-07-31 | 13F | City State Bank | 56 | 0,00 | 2 | 0,00 | ||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 4 616 | −6,16 | 173 | −4,42 | ||||

| 2025-06-24 | NP | MDAKX - MainStay Moderate ETF Allocation Fund Class C | 107 100 | 1,46 | 3 920 | −0,43 | ||||

| 2025-08-11 | 13F | GW&K Investment Management, LLC | 10 350 | 5,69 | 0 | |||||

| 2025-07-28 | 13F | Chesapeake Wealth Management | 128 330 | 1,15 | 4 814 | 3,08 | ||||

| 2025-08-14 | 13F | 1607 Capital Partners, LLC | 2 021 200 | −3,32 | 75 815 | −1,48 | ||||

| 2025-08-11 | 13F | Covestor Ltd | 10 581 | 27,74 | 0 | |||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Sentinus, LLC | 10 484 | 16,77 | 393 | 19,09 | ||||

| 2025-08-14 | 13F | Hilltop Holdings Inc. | 17 730 | −26,76 | 665 | −25,36 | ||||

| 2025-08-13 | 13F | M&t Bank Corp | 25 472 | −36,35 | 956 | −35,17 | ||||

| 2025-06-24 | NP | MOEAX - MainStay Growth ETF Allocation Fund Class A | 90 140 | −0,12 | 3 299 | −1,96 | ||||

| 2025-07-29 | 13F | Angeles Wealth Management, Llc | 1 466 | 55 | ||||||

| 2025-08-08 | 13F | Good Life Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-08 | 13F | Goldstone Financial Group, LLC | 58 838 | −22,59 | 2 198 | −21,42 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 103 580 | 123,03 | 3 885 | 127,33 | ||||

| 2025-08-14 | 13F | Gerber Kawasaki Wealth & Investment Management | 120 433 | 11,89 | 4 517 | 14,01 | ||||

| 2025-04-28 | NP | FJSIX - Nuveen High Income Bond Fund Class A This fund is a listed as child fund of Nuveen Asset Management, LLC and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 66 827 | 2 503 | ||||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 614 001 | 335,13 | 23 011 | 343,01 | ||||

| 2025-04-22 | 13F | World Equity Group, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Legacy Investment Solutions, LLC | 20 | 0,00 | 1 | |||||

| 2025-08-27 | NP | Jnl Series Trust - Jnl/blackrock Global Allocation Fund (a) | 81 483 | 0,00 | 3 056 | 1,90 | ||||

| 2025-08-01 | 13F | Twin Lakes Capital Management, LLC | 139 | 0,00 | 5 | 0,00 | ||||

| 2025-08-13 | 13F | Baker Avenue Asset Management, LP | 564 075 | 2,36 | 21 158 | 4,31 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 592 | 5,34 | 22 | 10,00 | ||||

| 2025-08-19 | 13F | Anchor Investment Management, LLC | 306 | 11 | ||||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 29 225 | −7,22 | 1 096 | −5,44 | ||||

| 2025-08-15 | 13F | Provenance Wealth Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 2 868 | 20,10 | 108 | 22,99 | ||||

| 2025-05-15 | 13F | Rakuten Investment Management, Inc. | 303 286 | −4,49 | 11 152 | −6,80 | ||||

| 2025-08-12 | 13F | Kensington Asset Management, LLC | 3 795 450 | −18,40 | 142 367 | −16,85 | ||||

| 2025-08-14 | 13F | Partners Capital Investment Group, Llp | 498 961 | −59,40 | 18 716 | −58,63 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 488 026 | 292,76 | 18 305 | 300,28 | ||||

| 2025-08-06 | 13F | Atlantic Union Bankshares Corp | 264 | 10 | ||||||

| 2025-08-05 | 13F | Arrowroot Family Office, LLC | 22 191 | 832 | ||||||

| 2025-07-14 | 13F | Counterpoint Mutual Funds LLC | 13 188 558 | 56,99 | 494 703 | 60,06 | ||||

| 2025-05-29 | NP | CRMVX - Conquer Risk Managed Volatility Fund | 467 101 | −46,42 | 17 194 | −46,40 | ||||

| 2025-08-19 | 13F | MRP Capital Investments, LLC | 6 735 | 0,00 | 253 | 2,02 | ||||

| 2025-06-26 | NP | TCAAX - Thrivent Moderately Conservative Allocation Fund Class A | 2 500 | 0,00 | 92 | −2,15 | ||||

| 2025-07-07 | 13F | Wilson & Boucher Capital Management, LLC | 7 100 | −12,35 | 266 | −10,74 | ||||

| 2025-07-22 | 13F | Belpointe Asset Management LLC | 57 534 | 2 158 | ||||||

| 2025-08-04 | 13F | Twin City Private Wealth, Llc | 8 477 | 28,11 | 318 | 30,45 | ||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Financial Network Wealth Advisors LLC | 5 007 | 2,29 | 188 | 3,89 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 24 575 | −31,41 | 922 | −30,12 | ||||

| 2025-07-11 | 13F | Kingstone Capital Partners Texas, LLC | 2 264 431 | 81 | ||||||

| 2025-07-28 | 13F | Rosenberg Matthew Hamilton | 188 | 506,45 | 7 | 600,00 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 56 | −12,50 | 2 | 0,00 | ||||

| 2025-07-23 | 13F | Mullooly Asset Management, Inc. | 19 058 | 1,72 | 715 | 3,63 | ||||

| 2025-08-05 | 13F | Mission Wealth Management, Lp | 35 879 | 4,75 | 1 346 | 6,75 | ||||

| 2025-07-07 | 13F | Capital Asset Advisory Services LLC | 879 733 | −0,76 | 32 796 | 0,70 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 1 500 | 0,00 | 56 | 1,82 | ||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 135 | 5 | ||||||

| 2025-08-14 | 13F | GWM Advisors LLC | 33 472 | −0,39 | 1 256 | 1,54 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 2 228 | −1,76 | 84 | 0,00 | ||||

| 2025-04-24 | 13F | Park Place Capital Corp | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Cornerstone Management, Inc. | 147 998 | −0,63 | 5 551 | 1,26 | ||||

| 2025-04-29 | 13F | Hm Payson & Co | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | F/M Investments LLC | 8 078 | −66,39 | 303 | −65,72 | ||||

| 2025-07-11 | 13F | Harbour Capital Advisors, LLC | 6 700 | −8,77 | 250 | −6,02 | ||||

| 2025-07-09 | 13F | Beacon Financial Group | 10 591 | −1,53 | 397 | 0,51 | ||||

| 2025-08-12 | 13F | Foster Dykema Cabot & Partners, Llc | 1 422 | 0,00 | 53 | 1,92 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 476 | 18 | ||||||

| 2025-08-05 | 13F | Tme Financial, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 78 215 | 26,65 | 2 934 | 29,04 | ||||

| 2025-08-04 | 13F | Lockheed Martin Investment Management Co | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Factory Mutual Insurance Co | 1 355 000 | 0,00 | 50 826 | 1,90 | ||||

| 2025-08-18 | 13F | Front Row Advisors LLC | 670 | 0,00 | 25 | 4,17 | ||||

| 2025-07-17 | 13F | Venture Visionary Partners LLC | 11 124 | −0,23 | 417 | 1,71 | ||||

| 2025-08-28 | NP | CPATX - Counterpoint Tactical Income Fund Class A Shares | 11 558 332 | 191,57 | 433 553 | 197,12 | ||||

| 2025-05-20 | NP | GSHIX - Goldman Sachs High Yield Fund Institutional | 356 595 | 0,00 | 13 126 | 0,05 | ||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 77 265 | 0,00 | 2 898 | 1,90 | ||||

| 2025-04-25 | 13F | Westfuller Advisors, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 421 457 | 15 809 | ||||||

| 2025-08-05 | 13F | Sigma Planning Corp | 165 055 | −1,31 | 6 191 | 0,57 | ||||

| 2025-07-16 | 13F | FORM Wealth Advisors, LLC | 272 994 | −30,52 | 10 240 | −29,19 | ||||

| 2025-07-29 | 13F | Activest Wealth Management | 265 | 1,53 | 10 | 0,00 | ||||

| 2025-08-13 | 13F | 1832 Asset Management L.P. | 3 591 445 | 55,77 | 134 715 | 58,73 | ||||

| 2025-05-06 | 13F | Lifeworks Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Whipplewood Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-28 | 13F | Private Wealth Asset Management, LLC | 7 907 | 0,00 | 297 | 1,72 | ||||

| 2025-07-28 | 13F | Davidson Trust Co | 8 445 | −0,92 | 317 | 0,96 | ||||

| 2025-08-06 | 13F | Rialto Wealth Management, LLC | 196 | 0,00 | 7 | 0,00 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 45 973 300 | 18,60 | 1 724 458 | 20,85 | ||||

| 2025-08-08 | 13F | Kingsview Wealth Management, LLC | 30 629 | 26,11 | 1 149 | 28,56 | ||||

| 2025-08-12 | 13F | Argent Trust Co | 13 398 | 15,59 | 503 | 17,84 | ||||

| 2025-08-11 | 13F | CFS Investment Advisory Services, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | BTG Pactual Asset Management US LLC | 34 185 | −2,47 | 1 258 | −2,48 | ||||

| 2025-08-01 | 13F | Gwn Securities Inc. | 12 545 | −36,98 | 471 | −35,79 | ||||

| 2025-04-22 | 13F | Synergy Financial Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Transce3nd, LLC | 482 | −47,84 | 18 | −47,06 | ||||

| 2025-08-18 | 13F | N.E.W. Advisory Services LLC | 19 | −50,00 | 1 | −100,00 | ||||

| 2025-07-31 | 13F | State of New Jersey Common Pension Fund D | 400 000 | 15 004 | ||||||

| 2025-08-04 | 13F | Quaker Wealth Management, LLC | Put | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 130 201 | 6,35 | 5 | 0,00 | ||||

| 2025-08-13 | 13F | Rinkey Investments | 9 000 | 0,00 | 338 | 1,81 | ||||

| 2025-08-14 | 13F | Prestige Wealth Management Group LLC | 725 945 | −4,13 | 27 230 | −2,30 | ||||

| 2025-07-14 | 13F | Bank & Trust Co | 464 | 0,00 | 17 | 0,00 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - 1290 VT High Yield Bond Portfolio Class IB | 256 750 | 0,00 | 9 631 | 1,90 | ||||

| 2025-07-24 | 13F | Monument Capital Management | 127 608 | −21,21 | 4 787 | −19,72 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 6 760 | 0 | ||||||

| 2025-07-31 | 13F | Buckingham Strategic Partners | 401 208 | 15 049 | ||||||

| 2025-03-27 | NP | BlackRock ETF Trust II - BlackRock Flexible Income ETF This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 179 391 | 0,00 | 43 979 | 0,43 | ||||

| 2025-07-16 | 13F | Independent Wealth Network Inc. | 16 740 | −1,36 | 628 | 0,48 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 243 | −83,78 | 9 | −83,64 | ||||

| 2025-05-28 | NP | THRIVENT SERIES FUND INC - Thrivent Moderately Aggressive Allocation Portfolio Class A | 5 478 | −35,39 | 202 | −35,37 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 223 138 | 0,24 | 8 370 | 2,14 | ||||

| 2025-08-07 | 13F | Everhart Financial Group, Inc. | 6 420 | −2,93 | 241 | −1,23 | ||||

| 2025-07-22 | 13F | Innovative Wealth Building LLC | 70 500 | −13,94 | 2 644 | −12,31 | ||||

| 2025-07-30 | NP | FPCIX - Strategic Advisers Core Income Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 838 504 | 105 110 | ||||||

| 2025-07-24 | NP | DFRAX - DWS Floating Rate Fund Class A | 5 604 | 208 | ||||||

| 2025-04-02 | 13F | Marcum Wealth, LLC | 48 138 | 5,50 | 1 772 | 5,54 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 25 502 | −43,17 | 957 | −42,10 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 50 621 | −30,10 | 1 899 | −28,78 | ||||

| 2025-07-14 | 13F | Sowell Financial Services LLC | 36 340 | −1,17 | 1 363 | 0,74 | ||||

| 2025-07-15 | 13F | Financial Management Professionals, Inc. | 119 | −80,07 | 4 | −80,95 | ||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 576 | 0,00 | 22 | 0,00 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 47 793 | 100,78 | 1 787 | 103,88 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 1 101 515 | −68,18 | 41 318 | −67,58 | ||||

| 2025-07-16 | 13F | ORG Partners LLC | 1 404 | −45,52 | 52 | −44,68 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 33 759 | 4,99 | 1 242 | 4,99 | ||||

| 2025-07-17 | 13F | David Kennon Inc | 110 283 | −22,70 | 4 137 | −21,23 | ||||

| 2025-05-15 | 13F | Proquility Private Wealth Partners, LLC | 14 800 | 545 | ||||||

| 2025-08-27 | NP | TOUCHSTONE VARIABLE SERIES TRUST - Touchstone Bond Fund - Class I | 5 948 | 223 | ||||||

| 2025-07-07 | 13F | Investors Research Corp | 1 918 | 0,00 | 72 | 1,43 | ||||

| 2025-07-14 | 13F | McGlone Suttner Wealth Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Elwood & Goetz Wealth Advisory Group, LLC | 9 836 | 369 | ||||||

| 2025-08-25 | NP | BETFX - Morningstar Balanced ETF Asset Allocation Portfolio Class I | 130 382 | 20,74 | 4 891 | 23,05 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 26 364 | 2,01 | 989 | 3,89 | ||||

| 2025-08-25 | NP | IETFX - Morningstar Income and Growth ETF Asset Allocation Portfolio Class II | 54 214 | 15,29 | 2 034 | 17,51 | ||||

| 2025-08-04 | 13F | Kovack Advisors, Inc. | 5 980 | −7,19 | 224 | −5,49 | ||||

| 2025-08-13 | 13F | Summit Financial, LLC | 11 231 | 4,13 | 421 | 6,05 | ||||

| 2025-08-07 | 13F | FDx Advisors, Inc. | 39 889 | 1 | ||||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 875 803 | 7,26 | 32 851 | 9,30 | ||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 896 | 34 | ||||||

| 2025-08-12 | 13F | Integrated Advisors Network LLC | 65 751 | 0,25 | 2 466 | 2,15 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 26 977 | 21,96 | 1 011 | 24,08 | ||||

| 2025-05-08 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | StoneX Group Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 78 802 | 21,04 | 2 901 | 21,09 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 203 181 | 307,69 | 7 621 | 315,54 | ||||

| 2025-07-10 | 13F | Kmg Fiduciary Partners, Llc | 20 140 | 35,92 | 755 | 38,53 | ||||

| 2025-08-14 | 13F | DSC Meridian Capital LP | 1 013 199 | −15,00 | 38 005 | 88 283,72 | ||||

| 2025-08-12 | 13F | Boreal Capital Management LLC | 0 | 643 | ||||||

| 2025-05-06 | NP | KADIX - Kensington Active Advantage Fund Institutional Class Shares | 48 200 | −1,43 | 1 774 | −1,39 | ||||

| 2025-07-15 | 13F | Heritage Oak Wealth Advisors Llc | 92 624 | 360,22 | 3 474 | 369,46 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | TSA Wealth Managment LLC | 5 549 | 208 | ||||||

| 2025-07-31 | 13F | Brighton Jones Llc | 31 929 | 8,18 | 1 198 | 10,22 | ||||

| 2025-07-24 | NP | HYGY - NEOS Enhanced Income Credit Select ETF | 1 208 022 | −30,69 | 44 733 | −31,47 | ||||

| 2025-08-01 | 13F | Boyd Watterson Asset Management Llc/oh | 11 785 | 163,59 | 442 | 169,51 | ||||

| 2025-07-30 | 13F | Gables Capital Management Inc. | 255 | 10 | ||||||

| 2025-07-29 | 13F | Koshinski Asset Management, Inc. | 9 493 | 4,34 | 356 | 6,59 | ||||

| 2025-08-08 | 13F | Petix & Botte Co | 20 004 | 2,22 | 750 | 4,17 | ||||

| 2025-07-17 | 13F | Symmetry Partners, LLC | 14 503 | −24,08 | 544 | −22,62 | ||||

| 2025-07-16 | 13F | ORG Wealth Partners, LLC | 2 064 | 0,00 | 77 | 1,33 | ||||

| 2025-07-29 | 13F | JTC Employer Solutions Trusteee Ltd | 310 219 | 0,00 | 12 | 0,00 | ||||

| 2025-08-13 | 13F | Edgestream Partners, L.P. | 148 112 | 644,58 | 5 556 | 658,88 | ||||

| 2025-08-14 | 13F | Fmr Llc | 6 984 595 | 7 386,73 | 261 992 | 7 529,35 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 159 | 0 | ||||||

| 2025-06-20 | NP | ABXB - TrimTabs Donoghue Forlines Tactical High Yield ETF | 2 573 | −83,11 | 94 | −83,42 | ||||

| 2025-07-18 | 13F | Liberty Capital Management, Inc. | 12 201 | 122,32 | 458 | 126,24 | ||||

| 2025-06-26 | NP | BYLD - iShares Yield Optimized Bond ETF | 687 176 | −45,25 | 25 151 | −46,27 | ||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 585 | 29 150,00 | 22 | |||||

| 2025-07-29 | 13F | Oxbow Advisors, LLC | 6 960 | 261 | ||||||

| 2025-08-11 | 13F | One Capital Management, LLC | 1 767 633 | 3,09 | 66 304 | 5,05 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 35 043 226 | −12,94 | 1 314 471 | −11,28 | ||||

| 2025-06-23 | NP | Global Opportunities Portfolio - Global Opportunities Portfolio | 4 454 600 | −4,82 | 163 038 | −6,58 | ||||

| 2025-07-30 | NP | FPIOX - Strategic Advisers Income Opportunities Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 50 600 | 1 874 | ||||||

| 2025-05-27 | NP | QHI2Q - High Income Portfolio Initial Class | 21 300 | 0,00 | 784 | 0,13 | ||||

| 2025-07-24 | 13F | Robertson Stephens Wealth Management, LLC | 78 475 | 2 944 | ||||||

| 2025-05-08 | 13F | Eastern Bank | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 131 | 0 | ||||||

| 2025-08-12 | 13F | Insigneo Advisory Services, Llc | 7 199 | −1,46 | 270 | 0,75 | ||||

| 2025-07-31 | 13F | Wealthfront Advisers Llc | 1 225 670 | −4,49 | 45 975 | −2,67 | ||||

| 2025-08-11 | 13F | Ppm America Inc/il | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Blair William & Co/il | 2 353 | 1,12 | 88 | 3,53 | ||||

| 2025-04-25 | NP | QVOY - Q3 All-Season Active Rotation ETF | 17 215 | −16,84 | 645 | −17,01 | ||||

| 2025-07-09 | 13F | Heritage Family Offices, LLP | 251 467 | 0,02 | 9 246 | −0,09 | ||||

| 2025-08-01 | 13F | First Command Advisory Services, Inc. | 498 512 | 15,39 | 18 699 | 17,59 | ||||

| 2025-07-10 | 13F | NorthCrest Asset Manangement, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | WestEnd Advisors, LLC | 14 | 1 | ||||||

| 2025-07-08 | 13F | Arlington Trust Co LLC | 1 000 | 0,00 | 38 | 2,78 | ||||

| 2025-08-14 | 13F | Scott Marsh Financial, LLC | 45 836 | 1 719 | ||||||

| 2025-06-26 | NP | DINAX - Global Fixed Income Opportunities Fund A | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 3 513 071 | 206,92 | 131 776 | 212,76 | ||||

| 2025-03-25 | NP | CPHYX - High Yield Fund Class A | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-06-24 | NP | MNERX - MainStay Conservative ETF Allocation Fund Class R3 | 39 797 | −0,31 | 1 457 | −2,15 | ||||

| 2025-08-08 | 13F | L & S Advisors Inc | 10 893 | −31,62 | 409 | −30,38 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 245 704 | 4 073,67 | 9 216 | 4 166,67 | ||||

| 2025-05-14 | 13F | Family Wealth Group, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-18 | 13F/A | MJT & Associates Financial Advisory Group, Inc. | 4 403 | 0,00 | 165 | 1,85 | ||||

| 2025-07-22 | 13F | Olistico Wealth, LLC | 1 954 | −0,46 | 73 | 1,39 | ||||

| 2025-07-24 | 13F | Drucker Wealth 3.0, LLC | 9 012 | 336 | ||||||

| 2025-05-01 | 13F | Q3 Asset Management | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Signature Estate & Investment Advisors Llc | 111 414 | 1,86 | 4 179 | 3,80 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 36 105 | 50,49 | 1 354 | 53,34 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 107 798 | 28,20 | 4 044 | 30,63 | ||||

| 2025-03-28 | NP | AOHY - Angel Oak High Yield Opportunities ETF | 54 380 | −49,82 | 2 028 | −49,63 | ||||

| 2025-08-07 | 13F/A | Tortoise Investment Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | BlackRock Funds II - BlackRock Dynamic High Income Portfolio Investor A This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 297 150 | 84 076 | ||||||

| 2025-08-14 | 13F | Betterment LLC | 1 294 511 | 9,40 | 49 | 11,63 | ||||

| 2025-08-06 | 13F | Modera Wealth Management, LLC | 18 133 | 2,52 | 680 | 4,45 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 80 052 | 50,47 | 3 003 | 53,32 | ||||

| 2025-06-23 | NP | Global Macro Portfolio - Global Macro Portfolio | Short | −802 332 | −29 365 | |||||

| 2025-08-26 | NP | Blackrock Corporate High Yield Fund, Inc. This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 488 154 | −45,34 | 18 311 | −44,31 | ||||

| 2025-07-15 | 13F | Mather Group, Llc. | 0 | −100,00 | 0 | |||||

| 2025-08-22 | NP | KHYAX - DWS High Income Fund Class A | 100 000 | −65,52 | 3 751 | −64,86 | ||||

| 2025-08-14 | 13F | Nepc Llc | 2 563 323 | 0,00 | 96 150 | 1,90 | ||||

| 2025-08-25 | NP | CETFX - Morningstar Conservative ETF Asset Allocation Portfolio Class I | 46 152 | 19,78 | 1 731 | 22,07 | ||||

| 2025-07-09 | 13F | WealthCare Investment Partners, LLC | 56 679 | 8,05 | 2 118 | 12,07 | ||||

| 2025-08-25 | NP | GETFX - Morningstar Growth ETF Asset Allocation Portfolio Class I | 143 240 | 101,63 | 5 373 | 105,51 | ||||

| 2025-08-27 | NP | TRANSAMERICA SERIES TRUST - Transamerica PIMCO Tactical - Balanced VP Service | 84 925 | −51,71 | 3 186 | −50,80 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Forte Asset Management Llc | 164 403 | −2,90 | 6 167 | −1,06 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - 1290 VT DoubleLine Dynamic Allocation Portfolio Class IB | 67 200 | −39,19 | 2 521 | −38,04 | ||||

| 2025-08-13 | 13F | Gibbs Wealth Management | 97 104 | 3 642 | ||||||

| 2025-07-15 | 13F | MCF Advisors LLC | 266 | 0,00 | 10 | 0,00 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 25 994 | −16,85 | 975 | −15,22 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 2 121 | −34,13 | 80 | −33,05 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 134 | −73,83 | 5 | −72,22 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 5 466 151 | 19,93 | 205 032 | 22,21 | ||||

| 2025-07-30 | 13F | Mid-American Wealth Advisory Group, Inc. | 197 | 7 | ||||||

| 2025-07-18 | 13F | Naples Global Advisors, Llc | 21 817 | −5,62 | 818 | −3,76 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-01 | 13F | Rossby Financial, LCC | 398 | 27,56 | 15 | 27,27 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | Opal Wealth Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-04-08 | 13F | Retirement Wealth Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 1 359 | 11 225,00 | 51 | |||||

| 2025-08-12 | 13F | Franklin Resources Inc | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Atria Investments Llc | 38 767 | 423,17 | 1 454 | 434,56 | ||||

| 2025-08-07 | 13F | Topel & Distasi Wealth Management, LLC | 108 031 | −38,24 | 4 052 | −37,06 | ||||

| 2025-03-27 | NP | LBHYX - Thrivent High Yield Fund Class A | 516 920 | 39,52 | 19 276 | 40,12 | ||||

| 2025-08-12 | 13F | State Farm Mutual Automobile Insurance Co | 10 315 | 423,34 | 387 | 436,11 | ||||

| 2025-07-25 | 13F | Joel Adams & Associates, Inc. | 43 907 | 5,44 | 1 647 | 7,44 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 29 365 210 | 5,74 | 1 101 489 | 7,75 | ||||

| 2025-08-14 | 13F | Modern Wealth Management, LLC | 190 962 | 7 163 | ||||||

| 2025-07-15 | 13F | RVW Wealth, LLC | 21 037 | 0,00 | 789 | 1,94 | ||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 591 461 | −16,16 | 22 186 | −14,56 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 1 136 643 | 11,43 | 42 586 | 13,41 | ||||

| 2025-07-07 | 13F | Global Wealth Strategies & Associates | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Financial Advocates Investment Management | 18 647 | −1,58 | 699 | 0,29 | ||||

| 2025-07-14 | 13F | Farmers & Merchants Investments Inc | 495 | 19 | ||||||

| 2025-08-14 | 13F | Millennium Management Llc | 28 039 | −2,29 | 1 052 | −0,47 | ||||

| 2025-08-15 | 13F | Chapman Financial Group, Llc | 12 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 16 420 973 | 4,77 | 615 951 | 6,76 | ||||

| 2025-08-13 | 13F | Level Four Advisory Services, Llc | 63 182 | 2,01 | 2 370 | 3,95 | ||||

| 2025-07-15 | 13F | Garrett Investment Advisors LLC | 30 361 | −8,61 | 1 139 | −6,87 | ||||

| 2025-07-28 | 13F | Duncker Streett & Co Inc | 213 | 0,00 | 8 | 0,00 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 1 891 | −84,07 | 71 | −83,98 | ||||

| 2025-08-14 | 13F | Horizon Investments, LLC | 163 917 | 78,10 | 6 080 | 81,46 | ||||

| 2025-08-06 | 13F | Mark Sheptoff Financial Planning, Llc | 109 | 0,00 | 4 | 0,00 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 2 682 367 | 75,93 | 100 616 | 79,28 | ||||

| 2025-07-25 | 13F | Hazlett, Burt & Watson, Inc. | 184 | 1,66 | 0 | |||||

| 2025-07-31 | 13F | Oak Harbor Wealth Partners, Llc | 43 660 | −7,23 | 1 638 | −5,48 | ||||

| 2025-08-08 | 13F | TD Capital Management LLC | 164 | −81,41 | 6 | −81,25 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 559 086 | 2,48 | 20 971 | 4,43 | ||||

| 2025-07-22 | 13F | DAVENPORT & Co LLC | 59 964 | 6,21 | 2 249 | 8,23 | ||||

| 2025-08-07 | 13F | Commerce Bank | 5 623 | 0,00 | 211 | 1,94 | ||||

| 2025-07-29 | 13F | Salomon & Ludwin, LLC | 1 | 0,00 | 0 | |||||

| 2025-07-30 | 13F | Whittier Trust Co Of Nevada Inc | 714 | 0,00 | 27 | 0,00 | ||||

| 2025-07-18 | 13F | Consolidated Portfolio Review Corp | 60 280 | −0,89 | 2 261 | 1,03 | ||||

| 2025-07-30 | 13F | Brookstone Capital Management | 68 520 | −10,69 | 2 570 | −8,99 | ||||

| 2025-05-13 | 13F | Measured Risk Portfolios, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Dunhill Financial, LLC | 2 500 | 0,00 | 94 | 1,09 | ||||

| 2025-08-19 | 13F | Cape Investment Advisory, Inc. | 1 238 | 62,47 | 46 | 64,29 | ||||

| 2025-07-23 | 13F | Steel Peak Wealth Management LLC | 0 | −100,00 | 0 | |||||

| 2025-07-09 | 13F | Defined Wealth Management, Llc | 31 196 | 24,51 | 1 170 | 26,90 | ||||

| 2025-07-28 | 13F | Mutual Advisors, LLC | 47 963 | 98,97 | 1 795 | 102,82 | ||||

| 2025-08-13 | 13F | Mackenzie Financial Corp | 840 484 | 7,83 | 31 527 | 9,88 | ||||

| 2025-04-09 | 13F | HBW Advisory Services LLC | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | SWS Partners | 85 703 | 0,11 | 3 215 | 2,00 | ||||

| 2025-08-11 | 13F | TAGStone Capital, Inc. | 7 310 | 8,83 | 273 | |||||

| 2025-08-14 | 13F | Silver Point Capital L.P. | 2 950 000 | 110 654 | ||||||

| 2025-05-29 | NP | SSIZX - Sierra Tactical Core Income Fund Class A Shares | 2 764 600 | 0,00 | 101 765 | 0,05 | ||||

| 2025-07-29 | 13F | International Assets Investment Management, Llc | 8 845 | −4,18 | 332 | −2,36 | ||||

| 2025-08-28 | NP | BlackRock Variable Series Funds, Inc. - BlackRock Global Allocation V.I. Fund Class I This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 130 551 | 0,00 | 4 897 | 1,89 | ||||

| 2025-08-05 | 13F | Tiaa Trust, National Association | 8 868 136 | 112,20 | 331 994 | 115,82 | ||||

| 2025-07-21 | 13F | Ascent Group, LLC | 126 250 | 2,34 | 4 736 | 4,30 | ||||

| 2025-08-27 | NP | TRANSAMERICA SERIES TRUST - Transamerica PIMCO Tactical - Conservative VP Service | 41 860 | −53,02 | 1 570 | −52,13 | ||||

| 2025-08-14 | 13F | UBS Group AG | 2 010 966 | −33,01 | 75 431 | −31,74 | ||||

| 2025-08-08 | 13F | Atlanta Consulting Group Advisors, LLC | 10 233 | 3,59 | 384 | 5,51 | ||||

| 2025-06-23 | NP | PGDIX - Global Diversified Income Fund Institutional Class | 287 237 | −14,13 | 10 513 | −15,72 | ||||

| 2025-07-25 | 13F | Stephens Consulting, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Roman Butler Fullerton & Co | 30 132 | 1 128 | ||||||

| 2025-07-28 | 13F | Toews Corp /adv | 6 149 000 | 230 649 | ||||||

| 2025-08-05 | 13F | Plante Moran Financial Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Wealthgarden F.s. Llc | 9 114 | 0,00 | 341 | 1,49 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 21 582 | −88,55 | 810 | −88,34 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 1 536 717 | −2,39 | 57 642 | −0,53 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 49 | −99,12 | 2 | −99,51 | ||||

| 2025-08-05 | 13F | Ellevest, Inc. | 114 193 | −6,72 | 4 283 | −4,95 | ||||

| 2025-08-01 | 13F | Ashton Thomas Private Wealth, LLC | 34 656 | 2,75 | 1 300 | 4,67 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 12 555 513 | 1,29 | 470 957 | 3,22 | ||||

| 2025-08-11 | 13F | United Capital Financial Advisers, Llc | 238 192 | −19,79 | 8 935 | −18,27 | ||||

| 2025-05-02 | 13F | Transcendent Capital Group LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Kohmann Bosshard Financial Services, LLC | 11 181 | −1,23 | 419 | 0,72 | ||||

| 2025-06-27 | NP | THY - Agility Shares Dynamic Tactical Income ETF | 249 000 | 7,70 | 9 113 | 5,71 | ||||

| 2025-07-18 | 13F | Union Bancaire Privee, UBP SA | 47 000 | 0,00 | 1 758 | 1,68 | ||||

| 2025-07-24 | 13F | Standard Life Aberdeen plc | 86 440 | 59,93 | 3 242 | 63,00 | ||||

| 2025-08-08 | 13F | ERTS Wealth Advisors, LLC | 1 061 940 | −40,90 | 39 833 | −39,78 | ||||

| 2025-08-14 | 13F | Ilmarinen Mutual Pension Insurance Co | 17 080 000 | −0,58 | 641 | 1,27 | ||||

| 2025-07-31 | 13F | Asset Management One Co., Ltd. | 28 369 | 32 508,05 | 1 064 | 35 366,67 | ||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 72 034 | 31,24 | 2 702 | 33,71 | ||||

| 2025-08-11 | 13F | HHM Wealth Advisors, LLC | 1 025 | 0,00 | 38 | 2,70 | ||||

| 2025-08-06 | NP | LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP BlackRock Global Allocation Fund Standard Class | 56 993 | 0,00 | 2 138 | 1,91 | ||||

| 2025-08-25 | NP | MPHAX - MassMutual Premier High Yield Fund Class A | 365 000 | 13 691 | ||||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 1 934 | 1,74 | 73 | 4,35 | ||||

| 2025-06-26 | NP | AAINX - Thrivent Opportunity Income Plus Fund Class A | 341 692 | −9,29 | 12 506 | −10,97 | ||||

| 2025-08-12 | 13F | Archer Investment Corp | 137 | −25,14 | 5 | −16,67 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 163 255 | 1,71 | 6 124 | 3,64 | ||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Ocean Park High Income ETF | 71 828 | −44,16 | 2 694 | −43,09 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 981 399 | 1,88 | 36 812 | 3,82 | ||||

| 2025-06-24 | NP | TNIIX - 1290 Retirement 2020 Fund Class I | 1 310 | 0,00 | 48 | −2,08 | ||||

| 2025-07-23 | 13F | Kingswood Wealth Advisors, Llc | 8 866 | −5,20 | 333 | −3,21 | ||||

| 2025-07-09 | 13F | Riversedge Advisors, Llc | 74 352 | 47,20 | 2 789 | 49,97 | ||||

| 2025-07-31 | 13F | CNB Bank | 60 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 338 106 | −31,36 | 13 | −33,33 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Keystone Global Partners, LLC | 7 228 | −71,97 | 271 | −71,44 | ||||

| 2025-07-22 | 13F | Iron Horse Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 39 789 440 | 4,07 | 1 492 502 | 6,05 | ||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 335 | 48,89 | 13 | 50,00 | ||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 99 072 | −38,81 | 3 716 | −37,64 | ||||

| 2025-05-12 | 13F | Aveo Capital Partners, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Kilter Group LLC | 145 | 5 | ||||||

| 2025-07-03 | 13F | Garde Capital, Inc. | 8 613 | 0,00 | 323 | 1,89 | ||||

| 2025-07-17 | 13F | Fort Washington Investment Advisors Inc /oh/ | 572 228 | 21 464 | ||||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 102 143 | 29,62 | 3 831 | 32,10 | ||||

| 2025-08-27 | NP | EBABX - Eaton Vance Core Plus Bond Fund Class A | 740 000 | 311,11 | 27 757 | 324,22 | ||||

| 2025-08-06 | 13F | Ethos Financial Group, LLC | 98 772 | −62,60 | 3 705 | −61,87 | ||||

| 2025-08-22 | NP | RMIF - LHA Risk-Managed Income ETF | 159 100 | 5 968 | ||||||

| 2025-08-12 | 13F | Barings Llc | 445 500 | 16 711 | ||||||

| 2025-08-14 | 13F | Mariner, LLC | 44 030 | 13,01 | 1 652 | 15,13 | ||||

| 2025-08-11 | 13F | Nations Financial Group Inc, /ia/ /adv | 7 807 | 293 | ||||||

| 2025-08-12 | 13F | Richard W. Paul & Associates, LLC | 31 | 0,00 | 1 | 0,00 | ||||

| 2025-07-21 | 13F | Old Second National Bank Of Aurora | 0 | −100,00 | 0 | |||||

| 2025-06-24 | NP | TNKIX - 1290 Retirement 2030 Fund Class I | 704 | 0,00 | 26 | −3,85 | ||||

| 2025-08-14 | 13F | Aldebaran Financial Inc. | 8 500 | 0,00 | 319 | 1,92 | ||||

| 2025-06-24 | NP | TNJIX - 1290 Retirement 2025 Fund Class I | 146 | −10,43 | 5 | −16,67 | ||||

| 2025-08-04 | 13F | Daymark Wealth Partners, Llc | 5 935 | 223 | ||||||

| 2025-08-15 | 13F/A | Florida Financial Advisors, Llc | 5 470 | 205 | ||||||

| 2025-08-14 | 13F | Alaska Permanent Fund Corp | 2 286 619 | 74,34 | 85 497 | 78,10 | ||||

| 2025-08-11 | 13F | Angeles Investment Advisors, LLC | 1 048 000 | −34,66 | 39 310 | −33,42 | ||||

| 2025-08-12 | 13F | Bokf, Na | 1 845 | −79,20 | 69 | −78,83 | ||||

| 2025-08-22 | NP | FSTAX - Fidelity Advisor Strategic Income Fund Class A This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 5 013 200 | 188 045 | ||||||

| 2025-07-08 | 13F | Braun-Bostich & Associates Inc. | 34 639 | −21,60 | 1 299 | −20,11 | ||||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 26 624 | 128,26 | 999 | 132,63 | ||||

| 2025-05-09 | 13F | Cary Street Partner Investment Advisory Llc | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Prime Capital Investment Advisors, LLC | 990 338 | −5,10 | 37 148 | −3,30 | ||||

| 2025-07-18 | 13F | Wetzel Investment Advisors, Inc. | 39 340 | −61,91 | 1 476 | −61,20 | ||||

| 2025-06-26 | NP | BLACKROCK GLOBAL ALLOCATION FUND, INC. - BLACKROCK GLOBAL ALLOCATION FUND, INC. Investor A This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 505 031 | 0,00 | 18 484 | −1,85 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 60 667 | −0,67 | 2 276 | 1,25 | ||||

| 2025-05-08 | 13F | Strategic Advocates LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Trust Co Of Toledo Na /oh/ | 1 080 | 41 | ||||||

| 2025-05-15 | 13F | Marshall Wace, Llp | 0 | −100,00 | 0 | |||||

| 2025-05-05 | 13F | Morningstar Investment Services LLC | 115 938 | −47,02 | 4 | −50,00 | ||||

| 2025-08-25 | 13F | Silverlake Wealth Management Llc | 10 479 | 393 | ||||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 12 740 | 81,90 | 478 | 85,60 | ||||

| 2025-07-31 | 13F/A | Avion Wealth | 58 | 0,00 | 0 | |||||

| 2025-08-06 | 13F | Decker Retirement Planning Inc. | 26 992 | 11 484,55 | 1 012 | 12 550,00 | ||||

| 2025-08-13 | 13F | Victory Financial Group, Llc | 6 145 | −15,78 | 231 | −14,18 | ||||

| 2025-07-15 | 13F | Maseco Llp | 125 135 | 4 694 | ||||||

| 2025-08-13 | 13F | Congress Wealth Management LLC / DE / | 17 105 | 68,84 | 642 | 71,85 | ||||

| 2025-07-18 | 13F | Dogwood Wealth Management LLC | 22 | 1 | ||||||

| 2025-07-28 | 13F | Sagespring Wealth Partners, Llc | 163 280 | −9,07 | 6 125 | −7,34 | ||||

| 2025-07-29 | 13F | Swmg, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Koss-Olinger Consulting, LLC | 1 212 510 | −7,70 | 45 481 | −5,94 | ||||

| 2025-08-14 | 13F | Ausdal Financial Partners, Inc. | 15 773 | −2,31 | 592 | −0,51 | ||||

| 2025-08-04 | 13F | Simon Quick Advisors, Llc | 28 060 | 1 053 | ||||||

| 2025-07-25 | 13F | NorthRock Partners, LLC | 214 | −82,08 | 8 | −81,40 | ||||

| 2025-08-08 | 13F | Security Financial Services, INC. | 12 926 | −62,71 | 485 | −62,07 | ||||

| 2025-08-12 | 13F | Fairscale Capital, LLC | 683 | 68,23 | 26 | 78,57 | ||||

| 2025-08-14 | 13F | Sei Investments Co | 19 392 | 727 | ||||||

| 2025-06-27 | NP | THHYX - Toews Tactical Income Fund | 5 900 000 | −1,67 | 215 940 | −3,49 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 774 867 | 439,68 | 29 | 480,00 | ||||

| 2025-09-03 | 13F | American Trust | 131 310 | 4 925 | ||||||

| 2025-07-14 | 13F | Narus Financial Partners, LLC | 10 630 | −1,07 | 399 | 0,76 | ||||

| 2025-08-06 | 13F | SOUTH STATE Corp | 203 | −55,58 | 8 | −56,25 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 35 | 580,00 | ||||||

| 2025-07-28 | 13F | RFG Advisory, LLC | 15 790 | 39,34 | 592 | 41,97 | ||||

| 2025-08-12 | 13F | Park Square Financial Group, LLC | 102 | 8,51 | 4 | 0,00 | ||||

| 2025-08-13 | 13F | BCJ Capital Management, LLC | 331 281 | 274,64 | 12 426 | 281,75 | ||||

| 2025-07-18 | 13F | Northeast Financial Group, Inc. | 324 016 | 47,40 | 12 154 | 50,20 | ||||

| 2025-08-14 | 13F | Santa Clara Valley Transportation Authority | 614 225 | 0,00 | 23 040 | 1,90 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 990 169 | 2,83 | 37 141 | 4,79 | ||||

| 2025-08-08 | 13F | Massachusetts Financial Services Co /ma/ | 24 800 | 930 | ||||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 162 151 | −12,78 | 6 082 | −11,12 | ||||

| 2025-07-24 | 13F | McKinley Carter Wealth Services, Inc. | 27 150 | −7,25 | 1 018 | −5,48 | ||||

| 2025-07-21 | 13F | Credential Qtrade Securities Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | FC Advisory LLC | 275 659 | 1,52 | 10 340 | 3,44 | ||||

| 2025-08-05 | 13F | Wakefield Asset Management LLLP | 15 707 | 3,10 | 589 | 5,18 | ||||

| 2025-07-31 | 13F | AlTi Global, Inc. | 0 | −100,00 | 0 | |||||

| 2025-06-24 | NP | NSTLX - Neuberger Berman Strategic Income Fund Institutional Class | 315 229 | 11 537 | ||||||

| 2025-04-24 | 13F | Vista Investment Partners Ii, Llc | 0 | −100,00 | 0 | |||||

| 2025-05-12 | 13F | Empirical Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-25 | NP | PRINCIPAL VARIABLE CONTRACTS FUNDS INC - Core Plus Bond Account Class 1 | 221 000 | 8 290 | ||||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 296 | 0,00 | 11 | 10,00 | ||||

| 2025-07-21 | 13F | Clarity Capital Partners LLC | 14 587 | −71,30 | 547 | −70,75 | ||||

| 2025-08-08 | 13F | Condor Capital Management | 23 870 | −0,00 | 895 | 1,94 | ||||

| 2025-08-14 | 13F | Strive Asset Management, LLC | 88 503 | 17,76 | 3 320 | 19,99 | ||||

| 2025-08-11 | 13F | Cornerstone Planning Group LLC | 26 | 0,00 | 1 | |||||

| 2025-07-29 | 13F | Aire Advisors, Llc | 5 795 | −1,48 | 217 | 0,46 | ||||

| 2025-07-30 | 13F | Blume Capital Management, Inc. | 299 | 11 | ||||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 688 | 52,89 | 26 | 56,25 | ||||

| 2025-07-17 | 13F | G&S Capital LLC | 5 863 | 1,72 | 220 | 3,30 | ||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 97 897 | 4 | ||||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 7 574 | 284 | ||||||

| 2025-05-15 | 13F | Ancora Advisors, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-09-12 | 13F/A | Valeo Financial Advisors, LLC | 34 791 | −4,93 | 1 305 | −3,12 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-10 | 13F | Farmers & Merchants Trust Co of Chambersburg PA | 269 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Daiwa Securities Group Inc. | 328 | 864,71 | 0 | |||||

| 2025-08-07 | 13F | Addison Advisors LLC | 612 | 23 | ||||||

| 2025-07-15 | 13F | LeConte Wealth Management, LLC | 42 976 | 87,50 | 1 612 | 91,22 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 220 | 8 | ||||||

| 2025-08-25 | NP | MML Series Investment Fund II - MML iShares 80/20 Allocation Fund Service Class I | 29 514 | 7,35 | 1 107 | 9,39 | ||||

| 2025-06-26 | NP | THMAX - Thrivent Moderate Allocation Fund Class A | 56 000 | 0,00 | 2 050 | −1,87 | ||||

| 2025-08-13 | 13F | SageView Advisory Group, LLC | 20 639 | 49,78 | 772 | 52,27 | ||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Ocean Park Diversified Income ETF | 26 950 | −18,98 | 1 011 | −17,48 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 90 078 | −3,27 | 3 379 | −1,43 | ||||

| 2025-08-13 | 13F | Mount Yale Investment Advisors, LLC | 81 | 3 | ||||||

| 2025-07-10 | 13F | Piscataqua Savings Bank | 168 | 0,00 | 6 | 0,00 | ||||

| 2025-07-18 | 13F | Provident Wealth Management, LLC | 14 221 | −3,20 | 533 | −1,30 | ||||

| 2025-08-12 | 13F | Nuveen, LLC | 226 206 | −1,29 | 8 485 | 0,58 | ||||

| 2025-05-13 | 13F | Quadrature Capital Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Atlas Legacy Advisors, LLC | 41 448 | 5,99 | 1 555 | 7,32 | ||||

| 2025-08-11 | 13F | PFG Private Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Berkshire Asset Management Llc/pa | 6 622 | −3,88 | 248 | −1,20 | ||||

| 2025-08-11 | 13F | Parr Mcknight Wealth Management Group, Llc | 165 549 | −11,41 | 6 210 | −9,73 | ||||

| 2025-07-25 | 13F | Concord Wealth Partners | 2 011 | −3,69 | 75 | −1,32 | ||||

| 2025-07-17 | 13F | Mattern Wealth Management LLC | 8 141 | 6,54 | 305 | 8,54 | ||||

| 2025-08-07 | 13F | Winthrop Capital Management, LLC | 98 | 0,00 | 0 | |||||

| 2025-08-08 | 13F | Glassman Wealth Services | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Strategic Blueprint, LLC | 12 704 | 477 | ||||||

| 2025-08-12 | 13F | Jaffetilchin Investment Partners, LLC | 8 648 | 1,13 | 324 | 3,18 | ||||

| 2025-04-18 | 13F | Wolf Group Capital Advisors | 6 606 | 243 | ||||||

| 2025-03-24 | NP | SGHAX - DWS Global High Income Fund Class A | 38 428 | −69,37 | 1 433 | −69,26 | ||||

| 2025-08-14 | 13F | Snowden Capital Advisors LLC | 14 274 | −0,23 | 535 | 1,71 | ||||

| 2025-08-06 | 13F | Summit Wealth Group, LLC | 337 425 | 982,74 | 13 | 1 100,00 | ||||

| 2025-07-11 | 13F/A | Financiere des Professionnels - Fonds d,investissement inc. | 257 100 | 9 644 | ||||||