Grundläggande statistik

| Institutionella aktier (lång) | 433 662 742 - 61,66% (ex 13D/G) - change of −7,02MM shares −1,59% MRQ |

| Institutionellt värde (lång) | $ 7 541 674 USD ($1000) |

Institutionellt ägande och aktieägare

Plains All American Pipeline, L.P. - Limited Partnership (US:PAA) har 450 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 433,670,879 aktier. Största aktieägare inkluderar Alps Advisors Inc, AMLP - ALERIAN MLP ETF, Invesco Ltd., MLPRX - Invesco Oppenheimer SteelPath MLP Income Fund Class C, Goldman Sachs Group Inc, Blackstone Group Inc, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd., UBS Group AG, MLPA - Global X MLP ETF, and Tortoise Capital Advisors, L.l.c. .

Plains All American Pipeline, L.P. - Limited Partnership (NasdaqGS:PAA) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 11, 2025 is 17,35 / share. Previously, on September 12, 2024, the share price was 17,41 / share. This represents a decline of 0,34% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

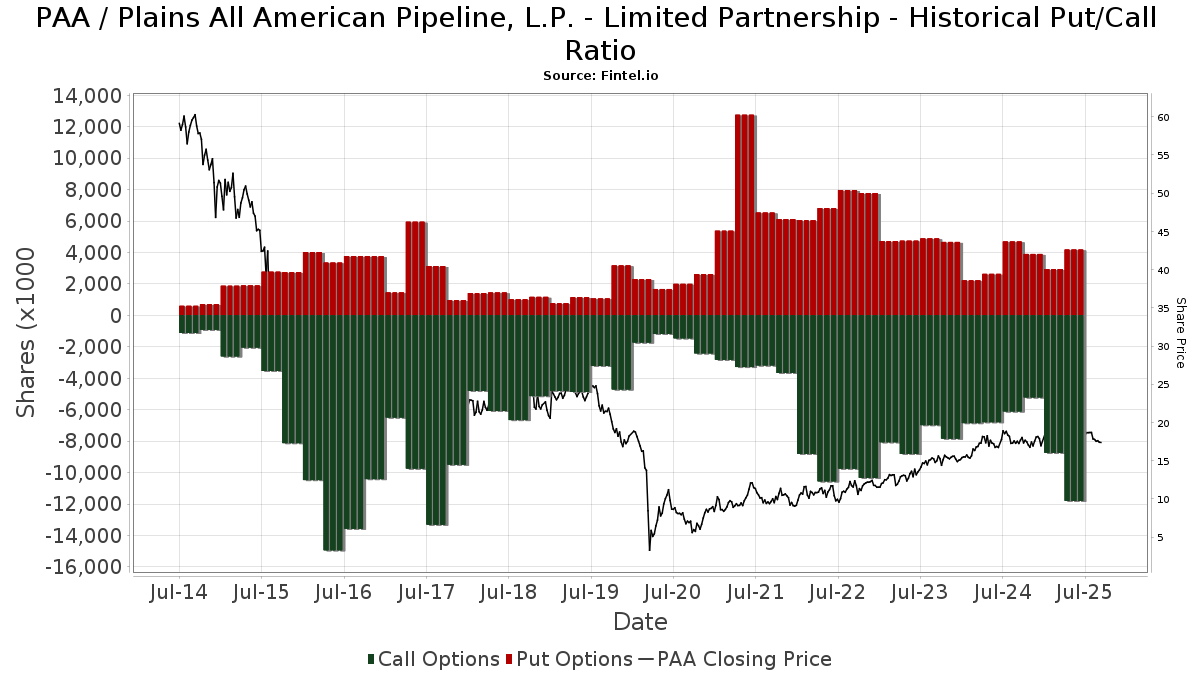

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13D/G-Arkiveringar

Vi presenterar 13D/G-arkiveringar separat från 13F-arkiveringar på grund av att de behandlas olika av SEC. 13D/G-arkiveringar kan lämnas in av grupper av investerare (med en ledare), medan 13F-arkiveringar inte kan det. Detta leder till situationer där en investerare kan lämna in en 13D/G-ansökan med ett värde för de totala aktierna (vilket motsvarar alla aktier som ägs av investerargruppen), men sedan lämna in en 13F-ansökan med ett annat värde för de totala aktierna (vilket motsvarar enbart deras eget ägande). Detta innebär att aktieägandet i 13D/G-arkiveringar och 13F-arkiveringar ofta inte är direkt jämförbara, så vi presenterar dem separat.

Notera: Från och med den 16 maj 2021 visar vi inte längre ägare som inte har lämnat in en 13D/G under det senaste året. Tidigare visade vi hela historiken för 13D/G-arkiveringar. I allmänhet måste enheter som är skyldiga att lämna in 13D/G-arkiveringar lämna in minst en gång per år innan de lämnar in en stängningsarkivering. Fonder avslutar dock ibland positioner utan att lämna in en avslutande arkivering (dvs. de avvecklar), så att visa hela historiken resulterade ibland i förvirring om det nuvarande ägandet. För att förhindra förvirring visar vi nu endast "nuvarande" ägare - det vill säga ägare som har lämnat in en ansökan under det senaste året.

Upgrade to unlock premium data.

| Fil Datum | Formulär | Investerare | Föregående aktier |

Senaste aktier |

Δ Aktier (Procent) |

Ägande (Procent) |

Δ Ägande (Procent) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-07-09 | ALPS ADVISORS INC | 68,977,355 | 74,402,915 | 7.87 | 10.58 | 7.96 |

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-29 | 13F | Beverly Hills Private Wealth, LLC | 10 434 | 0,00 | 191 | −8,17 | ||||

| 2025-08-13 | 13F | Fort Sheridan Advisors Llc | 123 688 | 0,00 | 2 266 | −8,41 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1 515 907 | −7,33 | 27 771 | −15,11 | ||||

| 2025-05-15 | 13F | Ancora Advisors, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Brown Advisory Inc | 33 737 | 1,20 | 618 | −7,21 | ||||

| 2025-08-13 | 13F | MONECO Advisors, LLC | 63 357 | −0,36 | 1 161 | −8,73 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 5 902 037 | −42,92 | 108 125 | −47,72 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 193 994 | 1,60 | 3 554 | −6,94 | ||||

| 2025-08-15 | 13F | Northeast Financial Consultants Inc | 21 800 | 0,00 | 399 | −8,49 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 206 219 | −79,11 | 3 778 | −80,87 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Lyell Wealth Management, Lp | 13 900 | 0,00 | 255 | −8,63 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | Call | 285 100 | 0,00 | 5 223 | −8,40 | |||

| 2025-07-17 | 13F | Archford Capital Strategies, LLC | 11 574 | 0,00 | 212 | −8,23 | ||||

| 2025-08-29 | NP | SOAAX - Spirit Of America Real Estate Income And Growth Fund Class A | 2 000 | 0,00 | 37 | −10,00 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 38 552 | 0,00 | 706 | −8,43 | ||||

| 2025-08-14 | 13F | Sentinel Wealth Management, Inc. | 12 206 | 0 | ||||||

| 2025-05-14 | 13F | Walleye Trading LLC | Call | 0 | −100,00 | 0 | ||||

| 2025-06-26 | NP | HMSFX - Hennessy BP Midstream Fund Investor Class | 438 196 | 4,18 | 7 651 | −8,14 | ||||

| 2025-08-15 | 13F | Security National Bank Of Sioux City Iowa /ia/ | 12 400 | 0,00 | 227 | −8,47 | ||||

| 2025-07-16 | 13F | Patron Partners Advisors, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-19 | 13F | State of Wyoming | 43 000 | 70,40 | 788 | 56,15 | ||||

| 2025-07-29 | 13F | Stephens Inc /ar/ | 111 785 | 19,51 | 2 048 | 9,47 | ||||

| 2025-08-13 | 13F | Millstone Evans Group, LLC | 240 | 0,00 | 4 | 0,00 | ||||

| 2025-05-14 | 13F | Walleye Trading LLC | Put | 0 | −100,00 | 0 | ||||

| 2025-08-12 | 13F | TCTC Holdings, LLC | 7 050 | 0,00 | 129 | −8,51 | ||||

| 2025-08-08 | 13F | Tortoise Investment Management, LLC | 3 500 | 0,00 | 64 | −8,57 | ||||

| 2025-07-10 | 13F | Oliver Lagore Vanvalin Investment Group | 1 989 | −50,14 | 40 | −42,65 | ||||

| 2025-07-28 | 13F | Rosenberg Matthew Hamilton | 3 888 | 71 | ||||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 3 210 | 0,00 | 59 | −9,37 | ||||

| 2025-08-26 | NP | MDIV - Multi-Asset Diversified Income Index Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 236 921 | 41,32 | 4 340 | 29,47 | ||||

| 2025-07-22 | 13F | Belpointe Asset Management LLC | 10 816 | 0,17 | 198 | −7,91 | ||||

| 2025-05-02 | 13F | Prevail Innovative Wealth Advisors, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Hilltop National Bank | 3 300 | 0,00 | 60 | 7,14 | ||||

| 2025-08-05 | 13F | Pointe Capital Management LLC | 12 536 | 0,00 | 230 | −8,40 | ||||

| 2025-08-13 | 13F | Amundi | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Nomura Holdings Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 18 947 | −23,68 | 347 | −30,74 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 270 209 | −21,28 | 4 950 | −27,90 | ||||

| 2025-08-08 | 13F | Hibernia Wealth Partners, LLC | 11 727 | 215 | ||||||

| 2025-05-15 | 13F | Citadel Advisors Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 4 690 | 0,00 | 86 | −8,60 | ||||

| 2025-07-29 | 13F | BKD Wealth Advisors, LLC | 181 567 | 0,00 | 3 326 | −8,40 | ||||

| 2025-07-25 | 13F | Community Bank, N.A. | 3 000 | 0,00 | 55 | −10,00 | ||||

| 2025-08-13 | 13F | Annandale Capital, LLC | 22 288 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Tetrad Corp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-29 | NP | SCPAX - Siit Large Cap Disciplined Equity Fund - Class A | 71 390 | −67,22 | 1 181 | −73,36 | ||||

| 2025-08-01 | 13F | Pasadena Private Wealth, LLC | 29 640 | 0,00 | 543 | −8,28 | ||||

| 2025-08-13 | 13F | Bollard Group LLC | 1 131 158 | 13,21 | 21 | 5,26 | ||||

| 2025-07-29 | NP | SPMHX - Invesco Oppenheimer SteelPath MLP Alpha Fund Class R5 | 3 694 829 | 0,00 | 61 112 | −18,68 | ||||

| 2025-07-30 | 13F | Avidian Wealth Solutions, LLC | 27 955 | −3,16 | 512 | −11,27 | ||||

| 2025-08-13 | 13F | Argyle Capital Partners, LLC | 13 000 | −10,34 | 238 | −17,93 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 4 573 711 | 35,14 | 83 790 | 23,79 | ||||

| 2025-08-14 | 13F | Spears Abacus Advisors LLC | 10 700 | 0,00 | 196 | −8,41 | ||||

| 2025-07-28 | NP | TOLZ - ProShares DJ Brookfield Global Infrastructure ETF | 34 367 | 20,31 | 568 | −2,24 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 188 345 | 1,16 | 3 663 | −1,61 | ||||

| 2025-07-29 | NP | Kayne Anderson Mlp Investment Co | 4 746 294 | −14,46 | 78 504 | −30,44 | ||||

| 2025-08-11 | 13F | CBIZ Investment Advisory Services, LLC | 1 021 | 19 | ||||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | Put | 600 | 0,00 | 11 | −16,67 | |||

| 2025-08-20 | NP | LSPAX - LoCorr Spectrum Income Fund Class A | 52 401 | 0,00 | 960 | −8,49 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 67 803 | 3,86 | 1 356 | 21,72 | ||||

| 2025-08-12 | 13F | Southeast Asset Advisors Inc. | 17 500 | 16,67 | 321 | 6,67 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 1 689 800 | 14,86 | 30 957 | 5,21 | |||

| 2025-08-14 | 13F | Jane Street Group, Llc | 65 126 | 1 193 | ||||||

| 2025-08-07 | 13F | Allworth Financial LP | 5 696 | 397,90 | 104 | 420,00 | ||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 21 100 | 0,00 | 387 | −8,53 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 162 300 | 221,39 | 2 973 | 194,36 | |||

| 2025-08-14 | 13F | Harwood Advisory Group, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | Call | 0 | −100,00 | 0 | ||||

| 2025-07-30 | 13F | Green Square Capital Advisors Llc | 44 035 | 0,12 | 807 | −8,30 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 1 608 | 0,00 | 29 | −9,37 | ||||

| 2025-08-13 | 13F | Keystone Financial Group | 11 153 | 204 | ||||||

| 2025-08-13 | 13F | Cerity Partners LLC | 104 745 | −9,04 | 1 919 | −16,72 | ||||

| 2025-07-31 | 13F | CNB Bank | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Dividend Asset Capital, Llc | 142 785 | 9,51 | 2 616 | 0,31 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 1 700 | 0,00 | 31 | −8,82 | ||||

| 2025-07-07 | 13F | Trust Co | 750 | 0,00 | 14 | −13,33 | ||||

| 2025-07-17 | 13F | Symmetry Partners, LLC | 28 105 | 0,00 | 515 | −8,54 | ||||

| 2025-07-18 | 13F | First Pacific Financial | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | North Capital, Inc. | 2 976 | −1,65 | 55 | −10,00 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 44 700 | 816 | |||||

| 2025-05-14 | 13F | BOK Financial Private Wealth, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 35 500 | 648 | ||||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 201 400 | 3 678 | |||||

| 2025-06-20 | NP | ABLD - Donoghue Forlines Yield Enhanced Real Asset ETF | 75 476 | 1 097,84 | 1 318 | 962,10 | ||||

| 2025-08-01 | 13F | First National Trust Co | 11 038 | 0,00 | 202 | −8,18 | ||||

| 2025-07-08 | 13F | Zrc Wealth Management, Llc | 1 | 0,00 | 0 | |||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 156 099 | 0,00 | 2 860 | −8,39 | ||||

| 2025-08-04 | 13F | Waterfront Wealth Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Caption Management, LLC | Call | 195 400 | 0,00 | 3 580 | −8,42 | |||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 10 434 | 0,00 | 191 | −8,17 | ||||

| 2025-07-15 | 13F | Bank Of Stockton | 12 363 | −6,08 | 226 | −14,07 | ||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 229 730 | 0,00 | 4 595 | 17,10 | ||||

| 2025-05-09 | 13F | Wealthspire Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Traub Capital Management LLC | 1 000 | 18 | ||||||

| 2025-07-30 | NP | AMLP - ALERIAN MLP ETF | 70 126 610 | −7,62 | 1 159 894 | −24,88 | ||||

| 2025-03-20 | NP | QRFT - QRAFT AI-Enhanced U.S. Large Cap ETF | 681 | −9,56 | 13 | 8,33 | ||||

| 2025-08-13 | 13F | Custom Index Systems, Llc | 49 035 | −5,92 | 898 | −13,82 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 31 233 | 3,42 | 572 | −5,14 | ||||

| 2025-04-23 | 13F | Sabal Trust CO | 10 788 | 0,00 | 216 | 16,85 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 64 829 | 0,46 | 1 188 | −7,98 | ||||

| 2025-07-24 | NP | FEIAX - Fidelity Advisor Equity Income Fund Class A This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 221 200 | −43,19 | 3 659 | −53,81 | ||||

| 2025-07-15 | 13F | Mather Group, Llc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Vivaldi Asset Management, LLC | 12 027 | −6,06 | 220 | −14,06 | ||||

| 2025-05-01 | 13F | Westmount Partners, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Silvercrest Asset Management Group Llc | 95 013 | 5,29 | 1 741 | −3,55 | ||||

| 2025-08-04 | 13F | Rede Wealth, LLC | 20 622 | 0,14 | 378 | −8,27 | ||||

| 2025-06-26 | NP | Voya Prime Rate Trust | Short | −8 137 | −0,00 | −142 | −11,80 | |||

| 2025-07-29 | 13F | Oxbow Advisors, LLC | 113 932 | −3,39 | 2 087 | −11,49 | ||||

| 2025-07-29 | 13F | Activest Wealth Management | 1 000 | 0,00 | 18 | −10,00 | ||||

| 2025-07-23 | NP | EIPI - FT Energy Income Partners Enhanced Income ETF | 503 481 | −1,27 | 8 328 | −19,72 | ||||

| 2025-05-14 | 13F | Smartleaf Asset Management LLC | 0 | −100,00 | 0 | |||||

| 2025-07-07 | 13F | Wealth Alliance Advisory Group, LLC | 103 661 | 11,20 | 1 899 | 1,88 | ||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 159 266 | 9,68 | 3 | 0,00 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Call | 49 400 | 28,98 | 905 | 18,15 | |||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Put | 183 200 | 2,00 | 3 356 | −6,57 | |||

| 2025-08-14 | 13F | Royal Bank Of Canada | 592 139 | 6,98 | 10 848 | −2,01 | ||||

| 2025-08-12 | 13F | Park Square Financial Group, LLC | 563 | 0,00 | 10 | −9,09 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 225 818 | 0,00 | 4 137 | −8,41 | ||||

| 2025-07-21 | 13F | F&V Capital Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 1 768 753 | −49,99 | 32 404 | −54,19 | ||||

| 2025-08-14 | 13F | Susquehanna Fundamental Investments, Llc | 202 073 | −21,22 | 3 702 | −27,84 | ||||

| 2025-08-15 | NP | Guardian Variable Products Trust - Guardian Select Mid Cap Core VIP Fund | 28 826 | −1,10 | 528 | −9,28 | ||||

| 2025-08-05 | 13F | Fullcircle Wealth Llc | 26 546 | 69,46 | 476 | 66,08 | ||||

| 2025-08-11 | 13F | NewEdge Wealth, LLC | 14 453 | 0,17 | 258 | −10,42 | ||||

| 2025-07-14 | 13F | U.S. Capital Wealth Advisors, LLC | 366 691 | 34,54 | 6 718 | 23,23 | ||||

| 2025-08-08 | 13F | Citizens Financial Group Inc/ri | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 17 553 | 9,24 | 322 | 0,00 | ||||

| 2025-07-11 | 13F | Adirondack Trust Co | 10 800 | 0,00 | 198 | −8,80 | ||||

| 2025-08-12 | 13F | Cornerstone Wealth Management, LLC | 30 036 | 0,00 | 550 | −8,33 | ||||

| 2025-08-15 | 13F | Brookfield Asset Management Inc. | 6 774 650 | 18,89 | 124 112 | 8,90 | ||||

| 2025-07-18 | 13F | Liberty Capital Management, Inc. | 24 400 | 0,00 | 447 | −8,40 | ||||

| 2025-08-14 | 13F | Fmr Llc | 1 483 984 | −1,57 | 27 187 | −9,84 | ||||

| 2025-07-17 | 13F | Eclectic Associates Inc /adv | 12 772 | 5,55 | 234 | −3,72 | ||||

| 2025-08-26 | NP | Brookfield Real Assets Income Fund Inc. | 116 600 | 4,52 | 2 136 | −4,26 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 29 433 | 12,12 | 539 | 2,67 | ||||

| 2025-07-21 | 13F | Mattern Capital Management, Llc | 13 602 | 0,00 | 249 | −8,46 | ||||

| 2025-08-14 | 13F | Penn Mutual Asset Management, LLC | 19 500 | 0,00 | 357 | −8,46 | ||||

| 2025-07-14 | 13F | IronOak Wealth LLC. | 16 923 | 310 | ||||||

| 2025-08-13 | 13F | Beacon Pointe Advisors, LLC | 64 746 | 1 186 | ||||||

| 2025-06-17 | NP | GSRAX - Goldman Sachs Rising Dividend Growth Fund Class A | 294 383 | −12,19 | 5 140 | −22,57 | ||||

| 2025-04-03 | 13F | Central Pacific Bank - Trust Division | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-28 | NP | Amplify ETF Trust - Amplify Natural Resources Dividend Income ETF | 8 530 | −46,07 | 156 | −50,63 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 3 139 | 58 | ||||||

| 2025-08-18 | 13F | Castleark Management Llc | 70 459 | −29,96 | 1 291 | −35,85 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 17 | 0,00 | 0 | |||||

| 2025-08-08 | 13F | Kingsview Wealth Management, LLC | 14 513 | 14,96 | 266 | 5,16 | ||||

| 2025-08-14 | 13F | Icon Wealth Advisors, LLC | 110 961 | 0,30 | 2 033 | −8,14 | ||||

| 2025-08-11 | 13F | Pin Oak Investment Advisors Inc | 14 300 | 26,55 | 0 | |||||

| 2025-04-17 | 13F | Sound Income Strategies, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Peak6 Llc | 131 869 | 2 416 | ||||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 11 950 | 10,85 | 219 | 1,40 | ||||

| 2025-07-17 | 13F | Sonora Investment Management Group, LLC | 10 584 | 0,00 | 194 | −8,53 | ||||

| 2025-07-30 | 13F | Whittier Trust Co | 10 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Peak6 Llc | Call | 36 100 | −96,80 | 661 | −97,07 | |||

| 2025-08-14 | 13F | DRW Securities, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Gen-Wealth Partners Inc | 1 643 | 0,00 | 30 | −6,25 | ||||

| 2025-08-14 | 13F | Peak6 Llc | Put | 613 200 | 2 465,69 | 11 234 | 2 250,00 | |||

| 2025-08-14 | 13F | Snowden Capital Advisors LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 12 632 | 44,33 | 0 | |||||

| 2025-08-05 | 13F | Gould Asset Management Llc /ca/ | 20 485 | 0,00 | 375 | −8,31 | ||||

| 2025-08-26 | NP | NRIAX - Nuveen Real Asset Income Fund Class A This fund is a listed as child fund of Nuveen Asset Management, LLC and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 280 272 | 36,49 | 5 135 | 25,04 | ||||

| 2025-07-02 | 13F | Doliver Advisors, Lp | 20 778 | −5,46 | 381 | −13,44 | ||||

| 2025-07-23 | 13F | Cohen Capital Management, Inc. | 95 397 | 0,00 | 1 748 | −8,39 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 3 400 | 0,00 | 62 | −8,82 | ||||

| 2025-08-14 | 13F | Financial Network Wealth Advisors LLC | 370 | 0,00 | 7 | −14,29 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 49 629 | 12,87 | 1 | |||||

| 2025-06-25 | NP | AMZA - InfraCap MLP ETF | 3 510 667 | −3,79 | 61 296 | −15,16 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 3 723 | 20,76 | 68 | 11,48 | ||||

| 2025-07-17 | 13F | Hengehold Capital Management Llc | 82 470 | 1,85 | 1 511 | −6,73 | ||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 15 976 844 | −2,96 | 292 696 | −11,11 | ||||

| 2025-08-13 | 13F | Cheviot Value Management, LLC | 3 540 | 0,00 | 63 | 10,53 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 400 | 300,00 | 7 | 250,00 | ||||

| 2025-08-07 | 13F | Americana Partners, LLC | 273 307 | 6,10 | 5 007 | −2,81 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 2 118 917 | −5,92 | 38 819 | −13,82 | ||||

| 2025-06-25 | NP | Duff & Phelps Global Utility Income Fund Inc. | 422 000 | 0,00 | 7 368 | −11,81 | ||||

| 2025-03-25 | NP | PMAIX - Pioneer Multi-Asset Income Fund : Class A | 194 305 | 0,00 | 3 847 | 21,70 | ||||

| 2025-07-30 | NP | MLPX - Global X MLP & Energy Infrastructure ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 6 170 305 | −12,96 | 102 057 | −29,22 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Boyd Watterson Asset Management Llc/oh | 1 423 | 0,00 | 26 | −7,14 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 14 597 | 15,75 | 267 | 5,95 | ||||

| 2025-07-24 | 13F | Baldwin Brothers Inc/ma | 26 409 | 0,00 | 484 | −8,52 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 460 632 | 90,32 | 8 439 | 74,34 | ||||

| 2025-08-06 | 13F | Paradigm Asset Management Co Llc | 14 162 | 0,00 | 259 | −8,48 | ||||

| 2025-08-13 | 13F | Transce3nd, LLC | 206 | 4 | ||||||

| 2025-07-18 | 13F | PBMares Wealth Management LLC | 18 066 | 0,64 | 331 | −8,08 | ||||

| 2025-05-12 | 13F | Greenland Capital Management LP | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Quantum Financial Planning Services, Inc. | 10 000 | 183 | ||||||

| 2025-08-12 | 13F | Clear Street Markets Llc | 43 900 | 2,81 | 804 | −5,85 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 6 231 899 | 2,40 | 114 168 | −6,20 | ||||

| 2025-08-12 | 13F | Change Path, LLC | 13 863 | 0,09 | 254 | −8,66 | ||||

| 2025-05-12 | 13F | Simplex Trading, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Hallmark Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Fortem Financial Group, Llc | 93 276 | 14,94 | 1 709 | 5,24 | ||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 3 458 | 63 | ||||||

| 2025-08-14 | 13F | Mariner, LLC | 980 143 | 0,62 | 17 955 | −8,16 | ||||

| 2025-08-01 | 13F | Financial Counselors Inc | 0 | −100,00 | 0 | |||||

| 2025-07-24 | NP | FNCMX - Fidelity Nasdaq Composite Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 415 821 | −1,47 | 6 878 | −19,88 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 31 352 | 10,85 | 574 | 1,59 | ||||

| 2025-08-28 | NP | Cohen & Steers Infrastructure Fund Inc | 1 264 432 | 0,00 | 23 164 | −8,40 | ||||

| 2025-08-12 | 13F | Nuveen, LLC | 520 536 | 25,59 | 9 536 | 15,04 | ||||

| 2025-07-15 | 13F | Clarus Group, Inc. | 93 131 | 0,87 | 1 706 | −7,58 | ||||

| 2025-08-12 | 13F | Fulcrum Asset Management LLP | Put | 0 | −100,00 | 0 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 4 952 995 | 6,90 | 90 739 | 22,18 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 4 232 | 93,15 | 78 | 79,07 | ||||

| 2025-08-14 | 13F | TCG Advisory Services, LLC | 91 113 | 5,61 | 1 669 | −3,25 | ||||

| 2025-07-23 | 13F | REAP Financial Group, LLC | 4 552 | 0,00 | 83 | −8,79 | ||||

| 2025-08-06 | 13F | Ing Groep Nv | 2 481 400 | −22,91 | 45 459 | −29,36 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 468 | 0,00 | 54 | 500,00 | ||||

| 2025-08-05 | 13F | Dunhill Financial, LLC | 235 | 4 | ||||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 71 354 | −6,20 | 1 319 | −13,35 | ||||

| 2025-07-22 | 13F | Diligent Investors, LLC | 20 666 | 0,24 | 379 | −8,25 | ||||

| 2025-08-15 | 13F | Ion Asset Management Ltd. | 24 200 | 0,00 | 443 | −8,47 | ||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 66 570 | −0,51 | 1 220 | −8,89 | ||||

| 2025-07-18 | 13F | PFG Investments, LLC | 67 997 | 24,48 | 1 246 | 14,01 | ||||

| 2025-08-04 | 13F | Keybank National Association/oh | 25 802 | 0,00 | 473 | −8,53 | ||||

| 2025-07-16 | 13F | ORG Wealth Partners, LLC | 730 | 0,00 | 13 | −7,14 | ||||

| 2025-07-29 | 13F | Towarzystwo Funduszy Inwestycyjnych Allianz Polska S.A. | 660 | 0,00 | 12 | −7,69 | ||||

| 2025-08-13 | 13F | Jump Financial, LLC | 520 594 | 415,32 | 9 537 | 372,13 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 1 789 720 | −32,69 | 32 788 | −38,35 | ||||

| 2025-08-07 | 13F | King Luther Capital Management Corp | 13 905 | 0,00 | 255 | −8,63 | ||||

| 2025-08-08 | 13F | Islay Capital Management, Llc | 18 300 | 0,00 | 335 | −8,47 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 13 858 | 18,01 | 0 | |||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 28 088 | 0,00 | 515 | −8,38 | ||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 323 590 | 16,74 | 5 928 | 6,95 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 39 778 | 10,10 | 716 | −0,97 | ||||

| 2025-08-26 | 13F | Claris Financial LLC | 15 311 | 0,00 | 280 | 7,28 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 8 327 | 87,88 | 152 | 70,79 | ||||

| 2025-07-28 | 13F | Turtle Creek Wealth Advisors, LLC | 40 820 | 22,46 | 748 | 12,16 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 662 843 | 7,43 | 12 143 | −1,59 | ||||

| 2025-04-29 | 13F | Lee Danner & Bass Inc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 33 379 | −0,73 | 611 | −9,08 | ||||

| 2025-08-13 | 13F | Basso Capital Management, L.p. | 52 700 | 4,36 | 965 | −4,46 | ||||

| 2025-08-13 | 13F | FORA Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 27 550 | −16,64 | 508 | −23,18 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 26 764 | −4,48 | 0 | |||||

| 2025-07-18 | 13F | Naples Global Advisors, Llc | 12 900 | 15,70 | 236 | 5,83 | ||||

| 2025-07-09 | 13F | Gilman Hill Asset Management, LLC | 97 065 | 16,12 | 1 778 | 6,40 | ||||

| 2025-08-13 | 13F | Plan Group Financial, LLC | 15 000 | 275 | ||||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 1 720 900 | 21,70 | 31 527 | 11,47 | |||

| 2025-07-30 | NP | ALTY - Global X SuperDividend Alternatives ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 24 663 | 4,09 | 408 | −15,38 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 1 076 400 | 1,47 | 19 720 | −7,06 | |||

| 2025-08-12 | 13F | MAI Capital Management | 3 327 | 0,00 | 61 | −9,09 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 769 | −50,93 | 14 | −54,84 | ||||

| 2025-07-24 | NP | FSDIX - Fidelity Strategic Dividend & Income Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 199 418 | 3,44 | 3 298 | −15,89 | ||||

| 2025-07-21 | NP | GLPAX - Goldman Sachs MLP Energy Infrastructure Fund Class A Shares | 8 126 786 | −5,65 | 134 417 | −23,28 | ||||

| 2025-07-18 | 13F | SOA Wealth Advisors, LLC. | 1 022 | 0,00 | 19 | −10,00 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 17 422 | −17,14 | 319 | −24,05 | ||||

| 2025-04-23 | 13F | Financial Life Planners | 0 | −100,00 | 0 | |||||

| 2025-06-25 | NP | Dnp Select Income Fund Inc | 1 764 900 | −12,41 | 30 815 | −22,76 | ||||

| 2025-08-07 | 13F | American Financial Group Inc | 412 500 | 0,00 | 7 557 | −8,40 | ||||

| 2025-07-11 | 13F | Miller Howard Investments Inc /ny | 2 864 383 | 0,10 | 52 475 | −8,31 | ||||

| 2025-07-28 | 13F | Morningstar Investment Management LLC | 52 623 | 6,73 | 1 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 454 412 | −56,53 | 8 325 | −60,19 | ||||

| 2025-07-10 | 13F | Arkfeld Wealth Strategies, L.L.C. | 15 968 | 0,00 | 293 | 6,93 | ||||

| 2025-08-05 | 13F | Mountain Hill Investment Partners Corp. | 10 | 0 | ||||||

| 2025-08-13 | 13F | Manning & Napier Advisors Llc | 150 000 | 0,00 | 2 748 | −8,40 | ||||

| 2025-05-15 | 13F | Moneta Group Investment Advisors Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 933 500 | 31,13 | 17 102 | 20,11 | |||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 46 288 | 5,93 | 848 | −2,98 | ||||

| 2025-08-26 | NP | NMFIX - Multi-manager Global Listed Infrastructure Fund | 257 714 | 0,00 | 4 721 | −8,40 | ||||

| 2025-08-05 | 13F | Corps Capital Advisors, LLC | 52 468 | 7,14 | 961 | −1,84 | ||||

| 2025-05-05 | 13F | Eagle Bay Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Colony Group, LLC | 35 604 | 4,26 | 652 | −4,40 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 1 191 | 0,00 | 22 | −8,70 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 27 664 | −0,63 | 507 | −8,99 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 59 965 | 2,52 | 1 099 | −6,07 | ||||

| 2025-03-12 | 13F/A | Private Capital Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 24 679 | 90,75 | 452 | 75,19 | ||||

| 2025-07-23 | 13F | Prasad Wealth Partners, LLC | 14 677 | −4,13 | 269 | −12,42 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 123 242 | −2,49 | 2 258 | −10,68 | ||||

| 2025-08-15 | 13F | Binnacle Investments Inc | 290 | 0,00 | 5 | 0,00 | ||||

| 2025-07-29 | NP | FDLS - Inspire Fidelis Multi Factor ETF | 37 878 | −19,39 | 627 | −34,45 | ||||

| 2025-07-30 | 13F | Exencial Wealth Advisors, Llc | 40 308 | 0,00 | 738 | −8,44 | ||||

| 2025-08-11 | 13F | Alps Advisors Inc | 74 402 915 | 7,87 | 1 363 061 | −1,20 | ||||

| 2025-07-24 | 13F | Lee Financial Co | 21 976 | 3,77 | 403 | −4,96 | ||||

| 2025-07-07 | 13F | Walnut Private Equity Partners, Llc | 550 000 | 4,76 | 10 076 | −4,04 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 275 | −87,91 | 5 | −88,89 | ||||

| 2025-08-05 | 13F | Plante Moran Financial Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-11 | 13F | Caldwell Securities, Inc | 9 287 | 0,49 | 170 | −7,61 | ||||

| 2025-07-24 | 13F | Blair William & Co/il | 42 440 | 70,59 | 778 | 56,34 | ||||

| 2025-07-10 | 13F | Security National Bank | 1 000 | 0,00 | 18 | −10,00 | ||||

| 2025-07-14 | 13F | S.A. Mason LLC | 504 | 0,00 | 9 | −10,00 | ||||

| 2025-07-30 | 13F | Atlantic Edge Private Wealth Management, LLC | 650 | 0,00 | 12 | −15,38 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 761 052 | −53,06 | 14 | −59,37 | ||||

| 2025-07-29 | NP | OSPPX - Invesco Oppenheimer SteelPath MLP Alpha Plus Fund Class R6 | 1 520 132 | −0,53 | 25 143 | −19,12 | ||||

| 2025-08-13 | 13F | Financial Freedom, LLC | 811 | 2,27 | 15 | −6,67 | ||||

| 2025-08-14 | 13F | Bramshill Investments, LLC | 57 211 | −0,18 | 1 048 | −8,55 | ||||

| 2025-04-29 | NP | ICAP - InfraCap Equity Income Fund ETF | 11 200 | 8,11 | 228 | 17,62 | ||||

| 2025-08-15 | 13F | Morse Asset Management, Inc | 52 500 | 12,90 | 962 | 3,33 | ||||

| 2025-06-25 | NP | VRAI - Virtus Real Asset Income ETF | 7 796 | −10,93 | 136 | −21,39 | ||||

| 2025-05-30 | NP | PIMCO Energy & Tactical Credit Opportunities Fund | 450 030 | −8,54 | 9 001 | 7,10 | ||||

| 2025-08-14 | 13F | RMB Capital Management, LLC | 60 746 | 1 113 | ||||||

| 2025-08-14 | 13F | Warren Averett Asset Management, LLC | 679 083 | −4,37 | 12 441 | −12,41 | ||||

| 2025-08-14 | 13F | Greenline Partners, LLC | 18 133 | 60,77 | 332 | 47,56 | ||||

| 2025-08-13 | 13F | WealthTrust Axiom LLC | 12 500 | 0,00 | 229 | −8,40 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 8 558 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | RR Advisors, LLC | 159 000 | 0,00 | 3 | −33,33 | ||||

| 2025-07-24 | NP | FMCDX - Fidelity Advisor Stock Selector Mid Cap Fund Class A This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 351 900 | −11,47 | 5 820 | −28,01 | ||||

| 2025-05-15 | 13F | Crawford Fund Management, LLC | Call | 0 | −100,00 | 0 | ||||

| 2025-08-11 | 13F | FSC Wealth Advisors, LLC | 400 | 0,00 | 7 | −12,50 | ||||

| 2025-04-21 | 13F | Boston Trust Walden Corp | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Longfellow Investment Management Co Llc | 1 312 831 | 0,00 | 24 051 | −8,40 | ||||

| 2025-08-14 | 13F | Tortoise Capital Advisors, L.l.c. | 9 487 680 | −23,89 | 173 814 | −30,28 | ||||

| 2025-05-13 | 13F | Aptus Capital Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-22 | NP | DRAFX - Destinations Real Assets Fund Class I | 4 380 | −38,01 | 72 | −49,65 | ||||

| 2025-07-31 | 13F | Jackson Hole Capital Partners, LLC | 55 296 | 2,28 | 1 013 | −6,29 | ||||

| 2025-07-22 | 13F | Chung Wu Investment Group, LLC | 40 278 | 2,54 | 738 | −6,11 | ||||

| 2025-08-01 | 13F | Brookwood Investment Group LLC | 16 379 | 0,02 | 300 | −8,26 | ||||

| 2025-08-14 | 13F | Fayez Sarofim & Co | 1 684 953 | 0,00 | 30 868 | −8,40 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 2 402 500 | 56,97 | 44 014 | 43,79 | |||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 221 | 531,43 | 4 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 22 434 | 411 | ||||||

| 2025-08-25 | NP | MANNING & NAPIER FUND, INC. - Callodine Equity Income Series Class I | 150 000 | 0,00 | 2 748 | −8,40 | ||||

| 2025-07-28 | 13F | Mutual Advisors, LLC | 17 062 | 39,80 | 319 | 42,60 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 2 100 | 0,00 | 38 | −9,52 | ||||

| 2025-07-16 | 13F | Magnus Financial Group LLC | 13 881 | 7,43 | 254 | −1,55 | ||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Swf Llc | 0 | −100,00 | 0 | |||||

| 2025-07-24 | NP | FEQTX - Fidelity Equity Dividend Income Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 664 000 | −43,79 | 10 983 | −54,29 | ||||

| 2025-07-17 | 13F | Park Place Capital Corp | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | American National Bank | 980 | 0,00 | 18 | −10,53 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 1 761 | 76,10 | 32 | 60,00 | ||||

| 2025-08-28 | NP | Nuveen Multi-Asset Income Fund This fund is a listed as child fund of Nuveen Asset Management, LLC and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 619 | −68,07 | 30 | −71,29 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 3 608 | −1,37 | 62 | −16,44 | ||||

| 2025-07-14 | 13F | Armstrong Advisory Group, Inc | 1 051 | 19 | ||||||

| 2025-07-29 | 13F | Creekside Partners | 17 500 | 0,00 | 321 | −8,57 | ||||

| 2025-07-22 | 13F | Miracle Mile Advisors, LLC | 14 194 | 0,00 | 260 | −8,13 | ||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 10 431 | 2,92 | 191 | −5,45 | ||||

| 2025-07-21 | 13F | CenterStar Asset Management, LLC | Put | 10 800 | 198 | |||||

| 2025-07-24 | 13F/A | McElhenny Sheffield Capital Management, LLC | 16 990 | 0,00 | 311 | −8,26 | ||||

| 2025-05-14 | 13F | Natixis | 0 | −100,00 | 0 | |||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 19 585 | 0 | ||||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 300 | 0,00 | 5 | −16,67 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 600 | 50,00 | 11 | 25,00 | ||||

| 2025-07-17 | 13F | KWB Wealth | 12 547 | 0,00 | 251 | 16,82 | ||||

| 2025-08-28 | NP | PMEFX - PENN MUTUAL AM 1847 INCOME FUND I Shares | 19 500 | 0,00 | 357 | −8,46 | ||||

| 2025-08-13 | 13F | SCS Capital Management LLC | 34 947 | 0,00 | 640 | −8,31 | ||||

| 2025-08-08 | 13F/A | Prospect Financial Services LLC | 58 519 | −16,85 | 1 072 | −23,81 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 105 263 | 3,34 | 2 | −50,00 | ||||

| 2025-08-13 | 13F | Prossimo Advisors, LLC | 12 343 | 0,00 | 0 | |||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 12 407 | −45,62 | 227 | −41,65 | ||||

| 2025-07-28 | 13F | Bridges Investment Management Inc | 136 937 | 0,00 | 2 509 | −8,40 | ||||

| 2025-07-10 | 13F | Capital Advisory Group Advisory Services, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-29 | 13F | Regions Financial Corp | 32 005 | 190,82 | 586 | 166,36 | ||||

| 2025-07-15 | 13F | Beacon Investment Advisory Services, Inc. | 40 900 | 0,00 | 749 | −8,44 | ||||

| 2025-07-25 | 13F | Sippican Capital Advisors | 31 160 | 0,00 | 571 | −8,51 | ||||

| 2025-07-30 | 13F | Brookstone Capital Management | 17 105 | −4,90 | 313 | −12,81 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 1 777 | 141,11 | 33 | 166,67 | ||||

| 2025-08-14 | 13F | Infrastructure Capital Advisors, Llc | 3 246 142 | 5 877,06 | 59 469 | 5 167,40 | ||||

| 2025-07-21 | 13F | CenterStar Asset Management, LLC | Call | 10 000 | 183 | 1 207,14 | ||||

| 2025-08-14 | 13F | UBS Group AG | 10 405 116 | 27,45 | 190 622 | 16,74 | ||||

| 2025-07-28 | 13F | Allianz Asset Management GmbH | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Chase Investment Counsel Corp | 14 002 | −30,12 | 0 | |||||

| 2025-04-14 | NP | TORIX - Tortoise MLP & Pipeline Fund Institutional Class Shares | 1 302 945 | 7,09 | 26 502 | 16,67 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 59 746 | 4,80 | 1 105 | −3,16 | ||||

| 2025-07-29 | NP | Tortoise Capital Series Trust - Tortoise Energy Infrastructure Total Return Fund A Class | 1 221 136 | 20 198 | ||||||

| 2025-07-16 | 13F | Eagle Global Advisors Llc | 3 876 656 | −8,53 | 71 020 | −16,21 | ||||

| 2025-08-07 | 13F | Samalin Investment Counsel, LLC | 17 973 | 2,18 | 329 | −6,27 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 4 250 | 325,00 | 0 | |||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 80 845 | 6,59 | 1 481 | −2,31 | ||||

| 2025-08-11 | 13F | Birchbrook, Inc. | 400 | 0,00 | 7 | −12,50 | ||||

| 2025-08-01 | 13F | Gwn Securities Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 872 | −31,39 | 16 | −40,00 | ||||

| 2025-08-18 | 13F/A | Westwood Holdings Group Inc | 1 645 511 | −3,08 | 30 146 | −11,22 | ||||

| 2025-05-15 | 13F | Millennium Management Llc | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-26 | NP | CCCAX - Center Coast Brookfield MLP Focus Fund Class A | 5 872 716 | 24,55 | 107 588 | 14,09 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-07-30 | 13F | Whittier Trust Co Of Nevada Inc | 11 076 | −45,96 | 203 | −50,61 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-05-15 | 13F | CAPROCK Group, Inc. | 34 618 | 0,00 | 692 | 17,09 | ||||

| 2025-08-04 | 13F | Moody Aldrich Partners Llc | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Millennium Management Llc | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-07 | 13F | Commerce Bank | 10 465 | −79,26 | 192 | −8,61 | ||||

| 2025-07-23 | NP | Clearbridge Energy Mlp Opportunity Fund Inc. This fund is a listed as child fund of Clearbridge, Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 670 671 | −14,86 | 44 173 | −30,77 | ||||

| 2025-07-31 | 13F | Hartford Financial Management Inc. | 33 940 | 0,00 | 622 | −8,41 | ||||

| 2025-04-14 | NP | TPYP - Tortoise North American Pipeline Fund | 554 331 | 3,09 | 11 275 | 12,32 | ||||

| 2025-08-08 | 13F | MTM Investment Management, LLC | 841 | 15 | ||||||

| 2025-08-08 | 13F | Cornerstone Advisors Asset Management, Inc | 10 000 | 0,00 | 183 | −8,50 | ||||

| 2025-08-11 | 13F | Advisor Resource Council | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 698 458 | 5,07 | 12 796 | −3,76 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 80 515 | 0,79 | 1 475 | −7,64 | ||||

| 2025-08-04 | 13F | ELCO Management Co., LLC | 178 065 | 1,28 | 3 262 | −7,22 | ||||

| 2025-08-08 | 13F | Creative Planning | 63 805 | 2,19 | 1 169 | −6,41 | ||||

| 2025-07-22 | 13F | Valley National Advisers Inc | 500 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Operose Advisors LLC | 1 966 | 2,18 | 36 | −5,26 | ||||

| 2025-08-14 | 13F | Voya Financial Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | FourThought Financial Partners, LLC | 15 268 | 0,00 | 280 | −8,52 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-10 | 13F | Farmers & Merchants Trust Co of Chambersburg PA | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Chicago Partners Investment Group LLC | 212 346 | −1,19 | 3 969 | 10,50 | ||||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 218 180 | 3 997 | ||||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 109 809 | 16,84 | 2 012 | 7,03 | ||||

| 2025-05-28 | 13F | Intrua Financial, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Cohen & Steers, Inc. | 1 370 402 | −10,16 | 25 | −16,67 | ||||

| 2025-07-29 | NP | MLPEX - Invesco Oppenheimer SteelPath MLP Select 40 Fund Class C | 6 159 426 | 3,36 | 101 877 | −15,95 | ||||

| 2025-06-26 | NP | MSTQX - Morningstar U.S. Equity Fund | 13 188 | 0,00 | 230 | −11,88 | ||||

| 2025-07-15 | 13F | North Star Investment Management Corp. | 2 000 | 0,00 | 37 | −10,00 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 13 219 | 6,94 | 242 | −2,02 | ||||

| 2025-08-07 | 13F | Atala Financial Inc | 21 349 | 0,00 | 391 | −8,22 | ||||

| 2025-07-29 | 13F | Spirit Of America Management Corp/ny | 269 300 | −18,96 | 4 934 | −25,77 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Put | 155 100 | 29,36 | 2 841 | 18,47 | |||

| 2025-08-01 | 13F | GoalVest Advisory LLC | 9 399 | 0,00 | 172 | −8,02 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Call | 984 600 | 52,49 | 18 038 | 39,67 | |||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 363 557 | 4,09 | 6 660 | −4,65 | ||||

| 2025-04-25 | 13F | New Wave Wealth Advisors Llc | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Maryland State Retirement & Pension System | 418 310 | 6,21 | 7 663 | −2,72 | ||||

| 2025-07-24 | 13F | Wealthstar Advisors, Llc | 41 383 | 10,81 | 758 | 1,61 | ||||

| 2025-07-29 | NP | Tortoise Capital Series Trust - TORTOISE NORTH AMERICAN PIPELINE FUND | 496 174 | 8 207 | ||||||

| 2025-07-14 | 13F | Counterpoint Mutual Funds LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 8 457 | −23,65 | 155 | −30,32 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Westover Capital Advisors, LLC | 23 000 | 0,00 | 421 | −8,48 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 18 165 677 | −14,09 | 332 795 | −21,31 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 9 500 | 0,00 | 0 | |||||

| 2025-07-22 | 13F | DAVENPORT & Co LLC | 12 000 | 0,00 | 220 | −8,75 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 404 921 | 4,14 | 7 418 | −4,60 | ||||

| 2025-07-10 | 13F | Chickasaw Capital Management Llc | 2 557 762 | 8,68 | 47 | −2,13 | ||||

| 2025-08-12 | 13F | Clearbridge Investments, LLC | 2 671 371 | −14,88 | 48 940 | −22,03 | ||||

| 2025-08-14 | 13F | CoreFirst Bank & Trust | 5 255 | 96 | ||||||

| 2025-04-14 | 13F | IMC-Chicago, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-28 | 13F | Naviter Wealth, LLC | 14 763 | 2,43 | 270 | −7,22 | ||||

| 2025-08-28 | NP | FGIAX - Nuveen Global Infrastructure Fund Class A This fund is a listed as child fund of Nuveen Asset Management, LLC and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 39 113 | 5,75 | 717 | −3,11 | ||||

| 2025-08-13 | 13F | Crescent Grove Advisors, LLC | 220 540 | 10,07 | 4 040 | 0,82 | ||||

| 2025-08-05 | 13F | Aviance Capital Partners, LLC | 17 346 | −0,78 | 318 | −9,17 | ||||

| 2025-07-28 | 13F | Ritholtz Wealth Management | 15 100 | 0,00 | 277 | −8,61 | ||||

| 2025-08-11 | 13F/A | Kayne Anderson Capital Advisors Lp | 5 119 534 | −7,28 | 93 790 | −15,07 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 9 700 | 0,82 | 178 | −7,81 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 2 200 | −0,45 | 40 | −9,09 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Optimum Investment Advisors | 17 600 | 0,00 | 322 | −8,52 | ||||

| 2025-07-30 | 13F | Clifford Swan Investment Counsel Llc | 16 015 | −2,29 | 293 | −10,40 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 500 | 0,00 | 9 | −10,00 | ||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 10 939 | 0,37 | 200 | −7,83 | ||||

| 2025-08-12 | 13F | Bokf, Na | 100 720 | −0,92 | 1 845 | −9,25 | ||||

| 2025-07-24 | 13F | CWM Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 9 304 | 5,14 | 170 | −3,41 | ||||

| 2025-08-12 | 13F | Inscription Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-07 | 13F | Fractal Investments LLC | 3 832 658 | 0,00 | 70 214 | −8,40 | ||||

| 2025-08-14 | 13F | Glenview Trust Co | 22 076 | 404 | ||||||

| 2025-08-13 | 13F | HAP Trading, LLC | Call | 173 900 | 21,61 | 19 | −59,57 | |||

| 2025-07-10 | 13F | Secure Asset Management, LLC | 22 168 | 40,54 | 406 | 28,89 | ||||

| 2025-07-17 | 13F | CWA Asset Management Group, LLC | 242 023 | −4,95 | 4 434 | −12,94 | ||||

| 2025-07-31 | 13F | City State Bank | 2 550 | 0,00 | 47 | −9,80 | ||||

| 2025-08-26 | NP | Nuveen Real Asset Income & Growth Fund This fund is a listed as child fund of Nuveen Asset Management, LLC and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 137 630 | 36,77 | 2 521 | 25,30 | ||||

| 2025-07-14 | 13F | Farmers & Merchants Investments Inc | 3 146 | 0,00 | 58 | −8,06 | ||||

| 2025-07-08 | 13F | Atwood & Palmer Inc | 2 304 | 42 | ||||||

| 2025-07-08 | 13F/A | Salem Investment Counselors Inc | 200 | 0,00 | 4 | −25,00 | ||||

| 2025-07-28 | 13F | Callahan Advisors, LLC | 21 733 | 0,09 | 398 | −8,29 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 12 625 | −73,54 | 231 | −75,79 | ||||

| 2025-08-07 | 13F | ProShare Advisors LLC | 36 375 | 17,15 | 666 | 7,42 | ||||

| 2025-07-14 | 13F | Cushing Asset Management, Lp | 145 300 | −21,08 | 2 662 | −27,73 | ||||

| 2025-08-08 | 13F | Cercano Management LLC | 85 192 | 0,00 | 1 561 | −8,40 | ||||

| 2025-08-13 | 13F | Nbw Capital Llc | 624 089 | −4,81 | 11 433 | −12,81 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 111 268 | 757,09 | 2 038 | 686,87 | ||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 73 507 | 0,00 | 1 347 | −8,44 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 1 395 | 0,00 | 26 | −7,41 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 10 338 | 0,00 | 189 | −8,25 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 143 667 | 3,75 | 2 632 | −4,98 | ||||

| 2025-06-30 | NP | CVY - Invesco Zacks Multi-Asset Income ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 47 343 | −10,04 | 827 | −20,65 | ||||

| 2025-07-30 | NP | MLPA - Global X MLP ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 10 044 697 | −0,64 | 166 139 | −19,20 | ||||

| 2025-07-24 | 13F | Trust Co Of Toledo Na /oh/ | 50 982 | 934 | ||||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 35 732 | 5,03 | 655 | −3,82 | ||||

| 2025-08-06 | 13F | Chancellor Financial Group WB LP | 11 957 | 9,13 | 219 | 0,00 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 1 650 | 0,00 | 30 | −9,09 | ||||

| 2025-08-05 | 13F | Financial Sense Advisors, Inc. | 16 174 | −3,69 | 296 | −11,64 | ||||

| 2025-08-12 | 13F | Archer Investment Corp | 8 000 | 0,00 | 147 | −8,75 | ||||

| 2025-08-14 | 13F | Sei Investments Co | 20 064 | −61,99 | 368 | −65,21 | ||||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 28 918 | 14,54 | 530 | 4,96 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 599 600 | 26,63 | 11 | 11,11 | |||

| 2025-06-27 | NP | PMACX - Victory Pioneer Multi-Asset Income Fund Class C | 194 305 | 3 393 | ||||||

| 2025-08-14 | 13F | Blackstone Group Inc | 15 986 460 | −1,87 | 292 872 | −10,11 | ||||

| 2025-08-07 | 13F | Pinnacle Holdings, LLC | 5 560 | 0,00 | 102 | −9,01 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 53 334 | 19,12 | 977 | 9,16 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 214 200 | 49,27 | 4 | 50,00 | |||

| 2025-06-25 | NP | FTLS - First Trust Long/Short Equity ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 217 138 | 76,53 | 3 791 | 55,69 | ||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 494 855 | −3,17 | 9 066 | −11,31 | ||||

| 2025-08-13 | 13F | Summit Financial, LLC | 60 668 | 6,00 | 1 111 | −2,88 | ||||

| 2025-08-13 | 13F | Callodine Capital Management, LP | 150 000 | 0,00 | 2 748 | −8,40 | ||||

| 2025-07-31 | 13F | Oppenheimer Asset Management Inc. | 56 859 | 0,93 | 1 042 | −7,55 | ||||

| 2025-05-06 | 13F | Venturi Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 15 247 | 5,16 | 279 | −3,46 | ||||

| 2025-08-13 | 13F | Victory Capital Management Inc | 194 305 | 3 560 | ||||||

| 2025-08-26 | NP | GAFCX - Virtus AlphaSimplex Global Alternatives Fund Class C | 6 032 | 111 | ||||||

| 2025-05-09 | 13F | Atlantic Trust, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Hardy Reed LLC | 41 850 | 0,00 | 767 | −8,48 | ||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 33 572 | 13,16 | 615 | 3,71 | ||||

| 2025-08-11 | 13F | Independent Advisor Alliance | 69 889 | 0,46 | 1 280 | −7,98 | ||||

| 2025-08-13 | 13F | F/M Investments LLC | 34 686 | 0,00 | 635 | −8,37 | ||||

| 2025-08-07 | 13F | Cascade Financial Partners, LLC | 10 266 | 188 | ||||||

| 2025-08-13 | 13F | Invesco Ltd. | 32 602 733 | 10,15 | 597 282 | 0,89 | ||||

| 2025-06-26 | NP | GYLD - Arrow Dow Jones Global Yield ETF | 6 749 | −16,13 | 118 | −26,42 | ||||

| 2025-08-14 | 13F | Mountain Lake Investment Management LLC | 88 281 | 1 617 | ||||||

| 2025-08-19 | 13F | Anchor Investment Management, LLC | 191 | 0,00 | 3 | 0,00 | ||||

| 2025-08-06 | 13F | Texas Yale Capital Corp. | 577 343 | −0,67 | 10 577 | −9,02 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 133 686 | −0,75 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 637 545 | −2,72 | 11 680 | −10,89 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 1 898 | −64,44 | 35 | −67,92 | ||||

| 2025-08-13 | 13F | Colonial Trust Co / SC | 0 | −100,00 | 0 | |||||

| 2025-05-06 | 13F | Assetmark, Inc | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 602 204 | 0,86 | 11 032 | −7,61 | ||||

| 2025-06-26 | NP | BlackRock Funds II - BLACKROCK MULTI-ASSET INCOME PORTFOLIO INVESTOR C SHARES | 220 018 | 0,00 | 3 842 | −11,82 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Cfm Wealth Partners Llc | 19 051 | 0,00 | 349 | −8,40 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 454 | −55,62 | 8 | −52,94 | ||||

| 2025-08-14 | 13F | Pingora Partners LLC | 13 233 | 0,00 | 242 | −8,33 | ||||

| 2025-08-14 | 13F | Concorde Financial Corp | 300 | 5 | ||||||

| 2025-07-30 | 13F | Evermay Wealth Management Llc | 2 000 | 0,00 | 37 | −10,00 | ||||

| 2025-07-22 | 13F | Kessler Investment Group, LLC | 594 | 0,00 | 11 | −9,09 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 160 928 | 8,80 | 2 948 | −0,34 | ||||

| 2025-07-29 | 13F | Arista Wealth Management, LLC | 11 600 | 213 | ||||||

| 2025-09-12 | 13F/A | Valeo Financial Advisors, LLC | 21 101 | 48,42 | 387 | 35,92 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-15 | 13F | Fortitude Family Office, LLC | 2 232 | 0,00 | 41 | −9,09 | ||||

| 2025-07-29 | NP | MLPRX - Invesco Oppenheimer SteelPath MLP Income Fund Class C | 20 033 333 | 14,91 | 331 351 | −6,55 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 789 100 | 23,76 | 14 456 | 13,36 | |||

| 2025-08-14 | 13F | Energy Income Partners, LLC | 1 131 106 | −1,81 | 20 722 | −10,06 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 34 900 | −64,55 | 639 | −67,55 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 3 447 500 | 143,98 | 63 158 | 123,49 | |||

| 2025-07-17 | 13F | Wolff Wiese Magana Llc | 500 | 0,00 | 9 | −10,00 | ||||

| 2025-07-08 | 13F/A | Adams Asset Advisors, LLC | 787 922 | 3,24 | 14 435 | −5,43 | ||||

| 2025-04-21 | 13F | PSI Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-04-29 | NP | SLCAX - Siit Large Cap Fund - Class A | 77 134 | 766,48 | 1 569 | 844,58 | ||||

| 2025-07-21 | 13F | Sovereign Investment Advisors, LLC | 528 931 | 0,00 | 9 690 | 4,33 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 398 179 | −5,61 | 7 295 | −13,54 | ||||

| 2025-08-21 | NP | EINC - VanEck Vectors Energy Income ETF | 126 496 | 12,50 | 2 317 | 3,07 | ||||

| 2025-07-14 | 13F | R.H. Dinel Investment Counsel, Inc. | 17 000 | 0,00 | 311 | −8,53 | ||||

| 2025-07-21 | 13F | Hennessy Advisors Inc | 438 196 | 0,00 | 8 028 | −8,40 | ||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 600 | 0,00 | 11 | −16,67 | ||||

| 2025-08-14 | 13F | Hancock Whitney Corp | 12 310 | 226 | 4,17 | |||||

| 2025-09-10 | 13F | WT Wealth Management | 42 713 | 36,42 | 783 | 24,92 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 177 155 | 3,11 | 3 245 | −5,56 | ||||

| 2025-07-30 | NP | SOAEX - Spirit of America Energy Fund Class A | 281 300 | −14,83 | 4 653 | −30,75 | ||||

| 2025-07-15 | 13F | SJS Investment Consulting Inc. | 500 | 0,00 | 9 | −10,00 | ||||

| 2025-08-13 | 13F | Stablepoint Partners, LLC | 19 125 | 0,00 | 350 | −8,38 | ||||

| 2025-08-11 | 13F | Avantax Planning Partners, Inc. | 18 700 | 16,88 | 343 | 6,88 | ||||

| 2025-08-11 | 13F | Duff & Phelps Investment Management Co | 1 856 900 | −15,09 | 34 018 | −22,22 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 2 141 893 | 4,68 | 39 | −2,50 | ||||

| 2025-07-24 | NP | ONEQ - Fidelity Nasdaq Composite Index Tracking Stock This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 164 007 | 0,50 | 2 713 | −18,29 | ||||

| 2025-07-23 | 13F | Prime Capital Investment Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Wealth Alliance | 11 690 | 0,05 | 214 | −8,15 |