Grundläggande statistik

| Institutionella aktier (lång) | 157 902 524 - 34,71% (ex 13D/G) - change of −3,30MM shares −2,05% MRQ |

| Institutionellt värde (lång) | $ 13 962 371 USD ($1000) |

Institutionellt ägande och aktieägare

Coca-Cola Europacific Partners PLC (US:CCEP) har 672 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 157,902,524 aktier. Största aktieägare inkluderar BlackRock, Inc., Invesco Ltd., Vanguard Group Inc, Invesco Qqq Trust, Series 1, Goldman Sachs Group Inc, Boston Partners, State Street Corp, Norges Bank, FIL Ltd, and Legal & General Group Plc .

Coca-Cola Europacific Partners PLC (NasdaqGS:CCEP) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 8, 2025 is 90,11 / share. Previously, on September 9, 2024, the share price was 81,54 / share. This represents an increase of 10,51% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

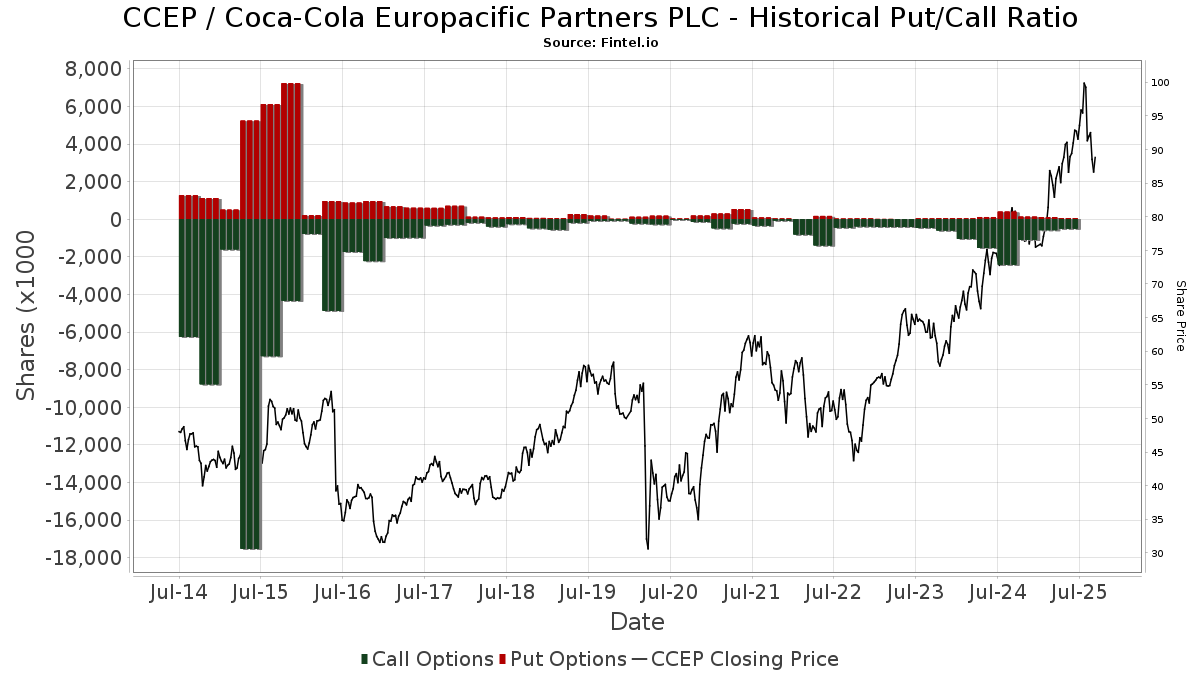

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13D/G-Arkiveringar

Vi presenterar 13D/G-arkiveringar separat från 13F-arkiveringar på grund av att de behandlas olika av SEC. 13D/G-arkiveringar kan lämnas in av grupper av investerare (med en ledare), medan 13F-arkiveringar inte kan det. Detta leder till situationer där en investerare kan lämna in en 13D/G-ansökan med ett värde för de totala aktierna (vilket motsvarar alla aktier som ägs av investerargruppen), men sedan lämna in en 13F-ansökan med ett annat värde för de totala aktierna (vilket motsvarar enbart deras eget ägande). Detta innebär att aktieägandet i 13D/G-arkiveringar och 13F-arkiveringar ofta inte är direkt jämförbara, så vi presenterar dem separat.

Notera: Från och med den 16 maj 2021 visar vi inte längre ägare som inte har lämnat in en 13D/G under det senaste året. Tidigare visade vi hela historiken för 13D/G-arkiveringar. I allmänhet måste enheter som är skyldiga att lämna in 13D/G-arkiveringar lämna in minst en gång per år innan de lämnar in en stängningsarkivering. Fonder avslutar dock ibland positioner utan att lämna in en avslutande arkivering (dvs. de avvecklar), så att visa hela historiken resulterade ibland i förvirring om det nuvarande ägandet. För att förhindra förvirring visar vi nu endast "nuvarande" ägare - det vill säga ägare som har lämnat in en ansökan under det senaste året.

Upgrade to unlock premium data.

| Fil Datum | Formulär | Investerare | Föregående aktier |

Senaste aktier |

Δ Aktier (Procent) |

Ägande (Procent) |

Δ Ägande (Procent) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-05-13 | COCA COLA CO | 87,950,640 | 78,972,727 | -10.21 | 17.10 | -6.04 |

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

Important Note

In an effort to reduce load times for our mobile users, we are testing some ways to deliver lighter pages.

In this first test, we will deliver only the most recent 750 transactions (out of 816 for this stock). If you are interested in loading *all* the transactions for this company, click the "load all" button below. This is just a test and if you don't like it, please let us know by submitting some gentle feedback via the link at the bottom of this page.

Load All| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-11 | 13F | Banque Cantonale Vaudoise | 9 154 | 15,35 | 1 | |||||

| 2025-08-27 | NP | ALLIANZ VARIABLE INSURANCE PRODUCTS TRUST - AZL DFA International Core Equity Fund | 3 519 | 0,00 | 326 | 6,54 | ||||

| 2025-08-14 | 13F | Fieldview Capital Management, LLC | 6 001 | −84,23 | 556 | −83,21 | ||||

| 2025-08-08 | 13F | Forsta Ap-fonden | 36 300 | 34,94 | 3 366 | 43,74 | ||||

| 2025-08-14 | 13F | Strategic Wealth Designers | 104 | 10 | ||||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 33 036 | 6,10 | 3 068 | 12,26 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Plato Investment Management Ltd | 39 | 8,33 | 4 | 0,00 | ||||

| 2025-08-08 | 13F | National Pension Service | 100 595 | 2,69 | 9 327 | 9,41 | ||||

| 2025-08-13 | 13F | NEOS Investment Management LLC | 82 446 | 88,71 | 7 644 | 101,05 | ||||

| 2025-08-14 | 13F | Icon Wealth Advisors, LLC | 1 086 | −25,46 | 101 | −20,63 | ||||

| 2025-05-14 | 13F | Capula Management Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Motco | 399 | −1,48 | 39 | 8,57 | ||||

| 2025-08-26 | NP | Nuveen S&p 500 Buywrite Income Fund This fund is a listed as child fund of Nuveen Asset Management, LLC and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 8 420 | −67,67 | 781 | −65,58 | ||||

| 2025-05-15 | 13F | Optiver Holding B.V. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 1 755 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 567 700 | −4,32 | 53 | 1,96 | ||||

| 2025-08-13 | 13F | Scotia Capital Inc. | 10 931 | 0,91 | 1 013 | 7,43 | ||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 2 479 | 230 | ||||||

| 2025-08-12 | 13F | Manchester Capital Management LLC | 9 | 1 | ||||||

| 2025-08-26 | NP | QCSCRX - Social Choice Account Class R1 | 149 711 | −10,38 | 13 881 | −4,53 | ||||

| 2025-06-23 | NP | UOPIX - Ultranasdaq-100 Profund Investor Class | 19 754 | −16,83 | 1 792 | −3,91 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 135 | 6,30 | 13 | 9,09 | ||||

| 2025-08-21 | NP | MXINX - Great-West International Index Fund Investor Class | 34 071 | 10,32 | 3 139 | 16,69 | ||||

| 2025-05-02 | 13F | Capital A Wealth Management, LLC | 209 | 0,00 | 18 | 12,50 | ||||

| 2025-08-07 | 13F | Montag A & Associates Inc | 232 | −73,27 | 22 | −72,00 | ||||

| 2025-08-15 | 13F | Great West Life Assurance Co /can/ | 318 956 | 7,85 | 30 | 16,00 | ||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 2 375 | 220 | ||||||

| 2025-05-30 | NP | MML SERIES INVESTMENT FUND - MML Fundamental Value Fund Class II | 12 362 | −3,60 | 1 076 | 9,25 | ||||

| 2025-07-17 | 13F | Patton Albertson Miller Group, Llc | 4 475 | 0,00 | 415 | 6,43 | ||||

| 2025-04-22 | 13F | Mendota Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-19 | 13F | State of Wyoming | 1 585 | −4,52 | 147 | 1,39 | ||||

| 2025-08-11 | 13F | Marathon Asset Mgmt Ltd | 1 180 082 | −4,05 | 109 417 | 2,22 | ||||

| 2025-08-14 | 13F | Fiduciary Trust Co | 8 280 | 4,22 | 768 | 11,00 | ||||

| 2025-07-16 | 13F/A | CX Institutional | 48 | 0,00 | 0 | |||||

| 2025-08-07 | 13F | Zions Bancorporation, National Association /ut/ | 20 | 0,00 | 2 | 0,00 | ||||

| 2025-05-06 | 13F | Jackson, Grant Investment Advisers, Inc. | 0 | −100,00 | 0 | |||||

| 2025-05-09 | 13F | GeoWealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Rhumbline Advisers | 83 683 | 1,41 | 7 759 | 8,05 | ||||

| 2025-08-29 | 13F | Centaurus Financial, Inc. | 2 486 | −67,85 | 0 | |||||

| 2025-08-26 | NP | GIEYX - INTERNATIONAL EQUITY FUND Institutional | 15 580 | 4,26 | 1 436 | 10,21 | ||||

| 2025-07-30 | 13F | Green Square Capital Advisors Llc | 11 797 | 0,00 | 1 094 | 6,53 | ||||

| 2025-08-26 | NP | Profunds - Profund Vp Ultranasdaq-100 | 5 065 | 7,38 | 470 | 14,39 | ||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 15 963 | −2,34 | 1 | 0,00 | ||||

| 2025-07-28 | NP | AVIV - Avantis International Large Cap Value ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 593 | −93,17 | 54 | −92,78 | ||||

| 2025-08-14 | 13F | Occudo Quantitative Strategies Lp | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Sei Investments Co | 495 908 | −4,05 | 45 981 | 2,22 | ||||

| 2025-07-17 | 13F | Janney Capital Management LLC | 2 260 | −9,31 | 0 | |||||

| 2025-08-14 | 13F | Caisse De Depot Et Placement Du Quebec | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Agf Management Ltd | 925 726 | 55,55 | 85 833 | 65,72 | ||||

| 2025-08-15 | 13F | Harvest Fund Management Co., Ltd | 31 585 | 8,30 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 9 180 | −28,35 | 1 | −100,00 | ||||

| 2025-07-24 | 13F | Capital Advisors, Ltd. LLC | 189 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | Wood Tarver Financial Group, LLC | 9 | 0,00 | 0 | |||||

| 2025-07-29 | 13F | S-Bank Fund Management Ltd | 3 874 | 359 | ||||||

| 2025-08-06 | 13F | Resona Asset Management Co.,Ltd. | 63 539 | 5 891 | ||||||

| 2025-08-04 | 13F | Atria Investments Llc | 7 784 | −15,12 | 722 | −9,65 | ||||

| 2025-08-13 | 13F | Dai-Ichi Life Insurance Company, Ltd | 9 747 | −17,89 | 904 | −12,58 | ||||

| 2025-05-15 | 13F | First Manhattan Co | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 2 350 852 | −0,29 | 217 971 | 6,23 | ||||

| 2025-08-01 | 13F | Rossby Financial, LCC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Beaird Harris Wealth Management, LLC | 19 | 2 | ||||||

| 2025-08-14 | 13F | Towarzystwo Funduszy Inwestycyjnych Pzu Sa | 1 090 | 29,76 | 101 | 38,36 | ||||

| 2025-07-17 | 13F | Moody Lynn & Lieberson, Llc | 2 674 | 0,00 | 248 | 6,47 | ||||

| 2025-08-13 | 13F | Amundi | 3 107 339 | −0,68 | 290 782 | 3,48 | ||||

| 2025-08-13 | 13F | Colonial Trust Co / SC | 400 | 0,00 | 37 | 8,82 | ||||

| 2025-08-13 | 13F | Icon Advisers Inc/co | 18 852 | 1 748 | ||||||

| 2025-07-09 | 13F | Gateway Investment Advisers Llc | 13 750 | −56,18 | 1 275 | −53,33 | ||||

| 2025-06-30 | NP | QYLG - Global X Nasdaq 100 Covered Call & Growth ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 987 | −2,03 | 271 | 13,39 | ||||

| 2025-07-29 | 13F | Regions Financial Corp | 4 118 | −19,21 | 382 | −14,00 | ||||

| 2025-07-25 | 13F | Genesee Capital Advisors, LLC | 11 123 | 1,73 | 1 031 | 8,41 | ||||

| 2025-08-12 | 13F | Public Sector Pension Investment Board | 138 483 | 11,07 | 12 840 | 18,33 | ||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 7 507 | 696 | ||||||

| 2025-08-13 | 13F | Wealthquest Corp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-23 | 13F | West Paces Advisors Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Catalyst Funds Management Pty Ltd | 25 500 | −26,34 | 2 364 | −21,51 | ||||

| 2025-08-14 | 13F | Farringdon Capital, Ltd. | 5 351 | 496 | ||||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 48 763 | −0,05 | 4 521 | 6,45 | ||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 400 434 | −43,20 | 36 941 | −39,79 | ||||

| 2025-08-12 | 13F | Pacer Advisors, Inc. | 35 764 | 44,27 | 3 316 | 53,73 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 375 | 0,54 | 35 | 6,25 | ||||

| 2025-08-06 | 13F | Vestmark Advisory Solutions, Inc. | 20 185 | 161,26 | 1 872 | 178,42 | ||||

| 2025-07-29 | NP | John Hancock Funds II - International Strategic Equity Allocation Fund Class NAV | 28 630 | 12,45 | 2 628 | 19,63 | ||||

| 2025-07-16 | 13F | Hartford Investment Management Co | 2 766 | 256 | ||||||

| 2025-08-13 | 13F | Loomis Sayles & Co L P | 200 | −14,16 | 19 | |||||

| 2025-07-10 | 13F | Baader Bank INC | 4 266 | 55,92 | 396 | 65,97 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 21 445 | 2,59 | 1 988 | 9,29 | ||||

| 2025-08-05 | 13F | Washburn Capital Management, Inc. | 2 250 | 209 | ||||||

| 2025-08-08 | 13F | Massachusetts Financial Services Co /ma/ | 2 442 903 | −10,74 | 226 506 | −4,91 | ||||

| 2025-08-08 | 13F | Alberta Investment Management Corp | 16 900 | −22,12 | 1 567 | −17,06 | ||||

| 2025-07-30 | NP | BCGDX - Blue Current Global Dividend Fund Institutional Class | 28 730 | 0,00 | 2 637 | 6,42 | ||||

| 2025-08-06 | 13F | Ing Groep Nv | 13 245 | 84,14 | 1 228 | 96,17 | ||||

| 2025-08-29 | NP | JGYIX - John Hancock Global Shareholder Yield Fund Class I | 167 609 | −2,42 | 15 541 | 3,96 | ||||

| 2025-05-15 | 13F | Wolverine Trading, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-08 | 13F/A | Salem Investment Counselors Inc | 41 | −8,89 | 4 | 0,00 | ||||

| 2025-07-24 | 13F | Verde Servicos Internacionais S.A. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Annis Gardner Whiting Capital Advisors, LLC | 107 | 10 | ||||||

| 2025-08-13 | 13F | Truvestments Capital Llc | 112 | 0,90 | 10 | 11,11 | ||||

| 2025-07-28 | 13F | Ritholtz Wealth Management | 15 705 | −0,32 | 1 456 | 6,20 | ||||

| 2025-07-15 | 13F | Mather Group, Llc. | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Park Square Financial Group, LLC | 61 | −61,64 | 6 | −61,54 | ||||

| 2025-08-12 | 13F | Aviso Financial Inc. | 3 443 | 4,40 | 319 | 11,15 | ||||

| 2025-08-12 | 13F | Prudential Plc | 91 714 | 40,78 | 8 504 | 49,99 | ||||

| 2025-07-14 | 13F | Abound Wealth Management | 4 | 0,00 | 0 | |||||

| 2025-08-07 | 13F | CSM Advisors, LLC | 149 311 | 14 | ||||||

| 2025-08-08 | 13F | WASHINGTON TRUST Co | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | JHMD - John Hancock Multifactor Developed International ETF | 7 066 | −60,28 | 636 | −54,73 | ||||

| 2025-04-29 | 13F | Chilton Capital Management Llc | 0 | −100,00 | 0 | |||||

| 2025-05-07 | 13F | Advantage Trust Co | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Savant Capital, LLC | 9 962 | 39,25 | 924 | 48,39 | ||||

| 2025-08-27 | NP | HCINX - The Institutional International Equity Portfolio HC Strategic Shares | 4 737 | 5,90 | 439 | 12,85 | ||||

| 2025-08-14 | 13F | Clark Capital Management Group, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Oppenheimer Asset Management Inc. | 72 767 | −1,88 | 6 747 | 4,52 | ||||

| 2025-07-15 | 13F | Bfsg, Llc | 361 | −66,73 | 33 | −64,89 | ||||

| 2025-07-28 | 13F | Td Asset Management Inc | 763 875 | −2,13 | 70 826 | 4,27 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 273 | 0,00 | 25 | 8,70 | ||||

| 2025-08-26 | NP | NOINX - Northern International Equity Index Fund | 68 829 | 15,82 | 6 382 | 23,40 | ||||

| 2025-04-01 | NP | QYLE - Global X Nasdaq 100 ESG Covered Call ETF | 132 | −8,97 | 10 | −9,09 | ||||

| 2025-08-14 | 13F | Norinchukin Bank, The | 13 616 | 9,19 | 1 262 | 16,31 | ||||

| 2025-08-06 | 13F | Penserra Capital Management LLC | 39 | 0,00 | 0 | |||||

| 2025-08-08 | 13F | Gts Securities Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 97 062 | −24,05 | 9 000 | −19,09 | ||||

| 2025-08-14 | 13F | Xponance, Inc. | 2 182 | 202 | ||||||

| 2025-07-09 | 13F | Bruce G. Allen Investments, LLC | 37 | 0,00 | 3 | 0,00 | ||||

| 2025-08-12 | 13F | APG Asset Management N.V. | 370 100 | 3,50 | 29 233 | 1,46 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-12 | 13F | Legal & General Group Plc | 3 620 199 | 6,41 | 334 220 | 12,86 | ||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 3 998 | −0,45 | 371 | 6,02 | ||||

| 2025-08-12 | 13F | Clal Insurance Enterprises Holdings Ltd | 165 | 44,74 | 0 | |||||

| 2025-08-14 | 13F | Investment Management Corp of Ontario | 13 937 | −2,11 | 1 292 | 4,28 | ||||

| 2025-07-22 | 13F | Inlight Wealth Management, LLC | 75 | 0,00 | 7 | 0,00 | ||||

| 2025-07-21 | 13F | HighMark Wealth Management LLC | 41 | 7,89 | 4 | 0,00 | ||||

| 2025-05-08 | 13F | Premier Fund Managers Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 10 522 | −56,64 | 1 | −100,00 | ||||

| 2025-08-04 | 13F | Fisher Funds Management LTD | 64 709 | −10,00 | 6 000 | −4,12 | ||||

| 2025-08-11 | 13F | New Age Alpha Advisors, LLC | 3 162 | −35,57 | 293 | −31,38 | ||||

| 2025-05-15 | 13F | Aster Capital Management (DIFC) Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 860 | 0,94 | 80 | 6,76 | ||||

| 2025-08-27 | NP | MIOFX - Marsico International Opportunities Fund | 44 575 | 69,20 | 4 133 | 80,28 | ||||

| 2025-07-30 | 13F | Crewe Advisors LLC | 515 | 0,00 | 48 | 6,82 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 23 433 | 2 173 | ||||||

| 2025-08-11 | NP | CIUEX - Six Circles International Unconstrained Equity Fund | 37 423 | −32,04 | 3 470 | −27,61 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 2 494 | 231 | ||||||

| 2025-05-14 | 13F | Custom Index Systems, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Legacy Wealth Asset Management, LLC | 25 642 | −12,29 | 2 378 | −6,56 | ||||

| 2025-07-31 | 13F | CVA Family Office, LLC | 32 | 0,00 | 3 | 0,00 | ||||

| 2025-08-29 | NP | JAFVX - Strategic Equity Allocation Trust Series NAV | 26 732 | 0,74 | 2 479 | 7,32 | ||||

| 2025-05-15 | 13F | Point72 Europe (London) LLP | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Park Place Capital Corp | 1 671 | −0,30 | 156 | 6,90 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 1 456 | 2 647,17 | 135 | 3 250,00 | ||||

| 2025-08-14 | 13F | Axa S.a. | 85 890 | 9,79 | 7 964 | 16,97 | ||||

| 2025-08-13 | 13F | SCS Capital Management LLC | 179 104 | 393,40 | 16 607 | 425,67 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 4 256 | 31,72 | 395 | 40,21 | ||||

| 2025-07-30 | 13F | Exencial Wealth Advisors, Llc | 30 336 | −6,48 | 2 813 | −0,39 | ||||

| 2025-07-31 | 13F | Nisa Investment Advisors, Llc | 100 | 0,00 | 9 | 12,50 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 86 746 | −86,45 | 8 043 | −85,56 | ||||

| 2025-07-28 | 13F | Generali Asset Management SPA SGR | 3 308 | −84,71 | 307 | −83,75 | ||||

| 2025-07-30 | 13F | Gulf International Bank (UK) Ltd | 10 454 | 0,00 | 1 | |||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 156 854 | −3,82 | 14 614 | 2,79 | ||||

| 2025-08-06 | 13F | Legacy Wealth Managment, LLC/ID | 27 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Point72 Asia (Singapore) Pte. Ltd. | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Crestline Management, LP | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Financial Gravity Companies, Inc. | 3 | −50,00 | 0 | |||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 773 | −4,33 | 72 | 1,43 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-26 | NP | GIIYX - International Equity Index Fund Institutional | 46 506 | 0,00 | 4 312 | 6,55 | ||||

| 2025-07-16 | 13F | American National Bank | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Howard Capital Management Inc. | 4 376 | 14,02 | 406 | 21,26 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | Call | 5 700 | 11,76 | 529 | 19,19 | |||

| 2025-08-13 | 13F | Walleye Capital LLC | 557 | −80,37 | 52 | −79,27 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | Put | 5 700 | 235,29 | 529 | 259,18 | |||

| 2025-08-14 | 13F | Sirios Capital Management L P | 31 162 | −1,54 | 2 889 | 4,90 | ||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 155 878 | 14 453 | ||||||

| 2025-07-24 | 13F | E Fund Management (Hong Kong) Co., Ltd. | 198 | 18 | ||||||

| 2025-07-30 | 13F | DekaBank Deutsche Girozentrale | 823 086 | −0,19 | 75 | 5,71 | ||||

| 2025-08-15 | 13F | State of Tennessee, Treasury Department | 48 470 | 1,65 | 4 494 | 8,32 | ||||

| 2025-07-28 | NP | AVSD - Avantis Responsible International Equity ETF | 1 311 | 58,14 | 120 | 69,01 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 597 | 110,21 | 55 | 129,17 | ||||

| 2025-08-13 | 13F | Brown Advisory Inc | 2 262 | −11,57 | 210 | −5,86 | ||||

| 2025-08-14 | 13F | Dark Forest Capital Management Lp | 3 916 | −74,39 | 363 | −72,71 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 763 755 | 21,65 | 70 758 | 29,63 | ||||

| 2025-08-08 | 13F | Allianz Se | 5 000 | 0,00 | 464 | 6,44 | ||||

| 2025-04-29 | 13F | Hm Payson & Co | 374 | 33 | ||||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 1 635 | 152 | ||||||

| 2025-08-28 | NP | Invesco Qqq Trust, Series 1 This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 9 475 639 | −0,17 | 878 581 | 6,35 | ||||

| 2025-08-12 | 13F | Corebridge Financial, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Creative Planning | 46 567 | 11,39 | 4 318 | 18,66 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 8 000 | 100,00 | 742 | 112,93 | |||

| 2025-08-14 | 13F | Mariner, LLC | 69 781 | 10,08 | 6 470 | 17,28 | ||||

| 2025-08-25 | NP | ICFAX - ICON CONSUMER SELECT FUND Investor Class | 18 852 | 1 748 | ||||||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 3 900 | 362 | |||||

| 2025-08-14 | 13F | UBS Group AG | 1 934 192 | −12,40 | 179 338 | −6,67 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | 198 | 18 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-26 | NP | AVEWX - Ave Maria World Equity Fund | 30 300 | 0,00 | 2 809 | 6,52 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | Mackenzie Financial Corp | 216 061 | −17,69 | 20 033 | −12,31 | ||||

| 2025-08-29 | NP | HDAVX - Janus Henderson Dividend & Income Builder Fund Class A | 76 151 | 0,00 | 7 061 | 6,53 | ||||

| 2025-08-07 | 13F | Axiom International Investors Llc /de | 32 477 | −80,49 | 3 011 | −79,22 | ||||

| 2025-08-13 | 13F | Healthcare Of Ontario Pension Plan Trust Fund | 403 145 | −20,64 | 37 380 | −15,46 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 596 | 1,36 | 52 | 13,33 | ||||

| 2025-08-15 | 13F | United Services Automobile Association | 0 | −100,00 | 0 | |||||

| 2025-07-28 | NP | AVDEX - Avantis International Equity Fund Institutional Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 3 898 | 0,00 | 358 | 6,25 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 19 561 | −2,88 | 2 | 0,00 | ||||

| 2025-08-28 | NP | CIHDX - Cullen International High Dividend Fund Retail Class | 82 063 | 18,45 | 7 609 | 26,19 | ||||

| 2025-08-12 | 13F | Jefferies Financial Group Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Groupe la Francaise | 16 745 | −72,24 | 1 535 | −70,44 | ||||

| 2025-07-29 | 13F | Stratos Wealth Advisors, LLC | 3 418 | −0,52 | 317 | 5,69 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 363 | 61,33 | 34 | 73,68 | ||||

| 2025-04-29 | 13F | Callan Capital, LLC | 7 385 | 25,68 | 643 | 42,35 | ||||

| 2025-07-21 | 13F | Credential Securities Inc. | 2 374 | 8,25 | 96 | 5,49 | ||||

| 2025-08-15 | 13F | Provenance Wealth Advisors, LLC | 22 | 0,00 | 2 | 100,00 | ||||

| 2025-08-07 | 13F | Profund Advisors Llc | 34 161 | 14,12 | 3 167 | 21,57 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 3 206 | 5,15 | 297 | 12,08 | ||||

| 2025-08-11 | 13F | Public Employees Retirement Association Of Colorado | 36 207 | 0,00 | 3 | 0,00 | ||||

| 2025-08-13 | 13F | Fisher Asset Management, LLC | 37 896 | −0,12 | 3 514 | 6,42 | ||||

| 2025-08-12 | 13F | PSI Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-04-23 | 13F | Aspetuck Financial Management LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 180 850 | 13,70 | 16 748 | 21,00 | ||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | FIL Ltd | 3 683 198 | 7,18 | 341 119 | 14,06 | ||||

| 2025-08-14 | 13F | California State Teachers Retirement System | 166 475 | −7,53 | 15 436 | −1,48 | ||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | Call | 0 | −100,00 | 0 | ||||

| 2025-05-28 | NP | VZICX - Vanguard International Core Stock Fund Admiral Shares | 315 407 | 15,52 | 27 450 | 30,89 | ||||

| 2025-06-30 | NP | AIM INTERNATIONAL MUTUAL FUNDS (INVESCO INTERNATIONAL MUTUAL FUNDS) - Invesco Oppenheimer Global Multi-Asset Growth Fund Class R6 | 341 | 164,34 | 31 | 200,00 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 44 950 | 0,09 | 4 168 | 6,63 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 5 392 | 97,58 | 500 | 110,55 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 26 520 | −14,69 | 2 | 0,00 | ||||

| 2025-07-24 | 13F | Callan Family Office, LLC | 2 451 | 227 | ||||||

| 2025-07-08 | 13F | Baker Ellis Asset Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 107 | 5 250,00 | 10 | |||||

| 2025-07-25 | NP | PIIOX - International Equity Index Fund R-3 | 12 213 | −7,03 | 1 121 | −1,06 | ||||

| 2025-07-18 | 13F | Ninety One UK Ltd | 1 273 571 | −0,30 | 118 086 | 6,22 | ||||

| 2025-08-14 | 13F | State Of Wisconsin Investment Board | 89 211 | 50,41 | 8 272 | 60,26 | ||||

| 2025-08-15 | 13F/A | Rakuten Securities, Inc. | 30 | 2 900,00 | 3 | |||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 1 241 | −36,75 | 115 | −32,35 | ||||

| 2025-07-24 | 13F | Cyndeo Wealth Partners, LLC | 141 704 | 2,22 | 13 139 | 8,90 | ||||

| 2025-07-24 | 13F | Blair William & Co/il | 4 415 | −0,20 | 409 | 6,23 | ||||

| 2025-07-14 | 13F | Pacifica Partners Inc. | 14 | 0,00 | 1 | 0,00 | ||||

| 2025-08-12 | 13F | Elo Mutual Pension Insurance Co | 40 186 | 12,65 | 3 726 | 19,88 | ||||

| 2025-07-28 | 13F | Twin Tree Management, LP | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 3 014 | 27,44 | 279 | 36,10 | ||||

| 2025-08-13 | 13F | Bridgewater Associates, LP | 30 988 | 371,16 | 2 873 | 402,27 | ||||

| 2025-07-28 | NP | AVDE - Avantis International Equity ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 69 377 | 9,43 | 6 368 | 16,46 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 5 320 | 114,95 | 493 | 129,30 | ||||

| 2025-07-14 | 13F | Golden State Equity Partners | 3 821 | −12,50 | 354 | −6,84 | ||||

| 2025-07-31 | 13F | State of New Jersey Common Pension Fund D | 92 065 | 0,00 | 8 536 | 6,54 | ||||

| 2025-08-11 | 13F | Qsemble Capital Management, LP | 60 692 | 3,38 | 5 627 | 10,14 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 5 633 | 61,87 | 546 | 80,46 | ||||

| 2025-07-31 | 13F | Smith Group Asset Management, LLC | 82 641 | 5,77 | 7 662 | 12,69 | ||||

| 2025-08-18 | 13F | Hollencrest Capital Management | 100 | 0,00 | 9 | 12,50 | ||||

| 2025-08-06 | 13F | BNP Paribas Asset Management Holding S.A. | 594 199 | −9,05 | 55 | −1,79 | ||||

| 2025-08-12 | 13F | Handelsbanken Fonder AB | 231 255 | 51,17 | 21 | 61,54 | ||||

| 2025-07-31 | 13F | Ingalls & Snyder Llc | 17 617 | −4,34 | 2 | 0,00 | ||||

| 2025-08-07 | 13F | ProShare Advisors LLC | 630 777 | 4,97 | 58 486 | 11,83 | ||||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 4 185 | 388 | ||||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 1 005 817 | 148,44 | 93 259 | 164,68 | ||||

| 2025-08-13 | 13F | Qtron Investments LLC | 8 724 | −0,07 | 809 | 6,46 | ||||

| 2025-08-13 | 13F | Ostrum Asset Management | 72 437 | 43,56 | 6 716 | 52,95 | ||||

| 2025-06-23 | NP | OTPIX - Nasdaq-100 Profund Investor Class | 1 849 | −14,08 | 168 | −1,18 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 6 312 | 931,37 | 585 | 1 003,77 | ||||

| 2025-08-01 | 13F | Teacher Retirement System Of Texas | 166 586 | −22,67 | 15 446 | −17,62 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 1 575 774 | −5,54 | 142 558 | 0,05 | ||||

| 2025-07-29 | 13F | William Blair Investment Management, Llc | 511 275 | 47 405 | ||||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 116 | −22,15 | 11 | −16,67 | ||||

| 2025-08-12 | 13F | Financial Advocates Investment Management | 0 | −100,00 | 0 | |||||

| 2025-07-15 | 13F | Ballentine Partners, LLC | 8 501 | 8,33 | 788 | 15,54 | ||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 11 639 | 1,50 | 1 079 | 8,22 | ||||

| 2025-04-10 | 13F | Financial Management Professionals, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Keystone Financial Group, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Railway Pension Investments Ltd | 15 300 | 1 419 | ||||||

| 2025-08-14 | 13F | Fiduciary Management Inc /wi/ | 1 695 346 | −17,11 | 157 192 | −11,70 | ||||

| 2025-05-13 | 13F | Clear Street Markets Llc | 0 | −100,00 | 0 | |||||

| 2025-07-18 | 13F | SOA Wealth Advisors, LLC. | 584 | 1,04 | 54 | 8,00 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 237 | −14,13 | 0 | |||||

| 2025-08-14 | 13F | Compass Wealth Management, LLC/GA | 2 500 | 232 | ||||||

| 2025-08-15 | 13F | WealthCollab, LLC | 127 | 0,00 | 12 | 0,00 | ||||

| 2025-08-14 | 13F | McIlrath & Eck, LLC | 21 | 0,00 | 2 | 0,00 | ||||

| 2025-05-15 | 13F | Siemens Fonds Invest GmbH | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-28 | 13F | Mitchell Mcleod Pugh & Williams Inc | 2 543 | 0,00 | 236 | 6,33 | ||||

| 2025-08-14 | 13F | Nomura Holdings Inc | 7 194 | 8,95 | 667 | 16,20 | ||||

| 2025-08-11 | 13F | Vanguard Group Inc | 10 682 027 | 8,08 | 984 804 | 14,22 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 92 588 | −89,29 | 8 585 | −88,60 | ||||

| 2025-08-06 | 13F | Legacy Investment Solutions, LLC | 27 | 0,00 | 3 | 0,00 | ||||

| 2025-06-30 | NP | CEFA - Global X S&P Catholic Values Developed ex-U.S. ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 533 | 27,82 | 48 | 50,00 | ||||

| 2025-06-26 | NP | USCGX - Capital Growth Fund | 7 795 | −1,75 | 707 | 13,48 | ||||

| 2025-08-27 | NP | BBIEX - Bridge Builder International Equity Fund | 176 953 | −2,84 | 16 407 | 3,51 | ||||

| 2025-08-12 | 13F | Inceptionr Llc | 12 472 | 66,29 | 1 156 | 77,30 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-08-29 | NP | HFQAX - Janus Henderson Global Equity Income Fund Class A | 546 977 | 0,00 | 50 716 | 6,54 | ||||

| 2025-08-13 | 13F | 1832 Asset Management L.P. | 11 700 | 1 085 | ||||||

| 2025-07-15 | 13F | Cigna Investments Inc /new | 4 214 | 10,29 | 0 | |||||

| 2025-08-07 | 13F | Sierra Ocean, Llc | 30 | 0,00 | 3 | 0,00 | ||||

| 2025-08-13 | 13F | Mount Yale Investment Advisors, LLC | 17 264 | 1,09 | 1 601 | 7,67 | ||||

| 2025-08-13 | 13F | Jump Financial, LLC | 25 666 | 18,79 | 2 380 | 26,54 | ||||

| 2025-07-22 | 13F | Capricorn Fund Managers Ltd | 25 000 | −33,24 | 2 318 | −26,55 | ||||

| 2025-08-04 | 13F | Roble, Belko & Company, Inc | 6 | 0,00 | 0 | |||||

| 2025-08-11 | 13F | Bellwether Advisors, LLC | 64 | 6 | ||||||

| 2025-08-14 | 13F | Cibc World Markets Corp | 32 706 | 3 032 | ||||||

| 2025-05-15 | 13F | Evergreen Capital Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Victory Capital Management Inc | 270 644 | −1,52 | 25 094 | 4,92 | ||||

| 2025-07-10 | 13F | Sumitomo Mitsui DS Asset Management Company, Ltd | 24 839 | 22,01 | 2 303 | 30,04 | ||||

| 2025-07-30 | 13F | Whittier Trust Co Of Nevada Inc | 365 | 0,00 | 34 | 6,45 | ||||

| 2025-07-17 | 13F | Halbert Hargrove Global Advisors, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-30 | NP | IAFEX - Fisher Investments Institutional Group All Foreign Equity Environmental and Social Values Fund | 38 | −5,00 | 3 | 0,00 | ||||

| 2025-08-11 | 13F | NewEdge Wealth, LLC | 4 559 | 14,40 | 425 | 22,83 | ||||

| 2025-05-29 | NP | PACAX - Putnam Dynamic Asset Allocation Conservative Fund Class A shares | 3 611 | −22,53 | 314 | −12,29 | ||||

| 2025-07-17 | 13F | Greenleaf Trust | 2 746 | −0,40 | 255 | 6,28 | ||||

| 2025-07-10 | 13F | Guided Capital Wealth Management, LLC | 2 398 | 0,00 | 222 | 6,73 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 351 309 | 442,43 | 33 | 540,00 | ||||

| 2025-05-06 | 13F | Venturi Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Chase Investment Counsel Corp | 51 418 | 1,38 | 5 | 0,00 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 794 | −64,85 | 74 | −57,80 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Susquehanna Fundamental Investments, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 10 943 | 0,43 | 1 015 | 6,96 | ||||

| 2025-08-06 | 13F | Andra AP-fonden | 7 650 | 709 | ||||||

| 2025-05-13 | 13F | Leith Wheeler Investment Counsel Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 350 | 0,00 | 32 | 6,67 | ||||

| 2025-08-14 | 13F | Nissay Asset Management Corp /japan/ /adv | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | Diligent Investors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 723 341 | 10,09 | 67 068 | 17,28 | ||||

| 2025-08-12 | 13F | Mediolanum International Funds Ltd | 135 181 | 9,70 | 12 315 | 15,80 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 743 057 | 1,66 | 68 896 | 8,31 | ||||

| 2025-08-14 | 13F | DZ BANK AG Deutsche Zentral Genossenschafts Bank, Frankfurt am Main | 489 914 | −17,74 | 45 412 | −12,39 | ||||

| 2025-08-14 | 13F | Hilltop Holdings Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 35 928 | 1,17 | 3 331 | 7,80 | ||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 0 | −100,00 | 0 | |||||

| 2025-07-18 | 13F | La Banque Postale Asset Management SA | 65 179 | −21,89 | 6 043 | −16,79 | ||||

| 2025-08-14 | 13F | Price T Rowe Associates Inc /md/ | 265 943 | 250,55 | 25 | 300,00 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 2 359 453 | 10,93 | 216 803 | 17,94 | ||||

| 2025-08-27 | NP | QQH - HCM Defender 100 Index ETF | 4 376 | 14,02 | 406 | 21,26 | ||||

| 2025-08-11 | 13F | WPG Advisers, LLC | 96 | −19,33 | 9 | −20,00 | ||||

| 2025-08-28 | NP | TMMAX - SIMT Tax-Managed Managed Volatility Fund Class F | 38 584 | −21,89 | 3 578 | −16,79 | ||||

| 2025-07-28 | 13F | Bayforest Capital Ltd | 89 | −58,80 | 8 | −55,56 | ||||

| 2025-04-15 | 13F | Transform Wealth, LLC | 146 990 | 5,98 | 12 793 | 20,09 | ||||

| 2025-06-26 | NP | TCIEX - TIAA-CREF International Equity Index Fund Institutional Class | 340 998 | 0,38 | 30 942 | 15,95 | ||||

| 2025-05-02 | 13F | Bailard, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 16 690 | 0,13 | 1 547 | 6,69 | ||||

| 2025-06-25 | NP | BFRE - Westwood LBRTY Global Equity ETF | 135 | 12 | ||||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 4 200 | 9,20 | 389 | 16,47 | ||||

| 2025-08-04 | 13F | Keybank National Association/oh | 5 002 | 1,48 | 464 | 8,18 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 2 393 | 0,00 | 222 | 6,25 | ||||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 14 603 | −8,58 | 1 354 | −2,66 | ||||

| 2025-08-13 | 13F | Manning & Napier Advisors Llc | 36 496 | −8,02 | 3 384 | −2,03 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 45 443 | −2,67 | 4 386 | 7,95 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 2 870 553 | 32,84 | 266 158 | 41,53 | ||||

| 2025-04-23 | 13F | Mascagni Wealth Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 4 839 | −18,38 | 421 | −7,47 | ||||

| 2025-07-28 | NP | Invesco Exchange-Traded Fund Trust II - Invesco ESG NASDAQ 100 ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 776 | −1,77 | 255 | 4,53 | ||||

| 2025-05-14 | 13F | Credit Agricole S A | 225 410 | 296,82 | 19 617 | 349,62 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 32 636 | 2,14 | 3 026 | 8,85 | ||||

| 2025-05-15 | 13F | Utah Retirement Systems | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Spire Wealth Management | 167 | −75,87 | 15 | −75,00 | ||||

| 2025-08-26 | NP | AVEFX - Ave Maria Bond Fund | 150 000 | 0,00 | 13 908 | 6,54 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 5 627 | 819,44 | 522 | 942,00 | ||||

| 2025-08-13 | 13F | Federated Hermes, Inc. | 1 109 | −97,22 | 103 | −97,06 | ||||

| 2025-08-26 | NP | AVEDX - Ave Maria Rising Dividend Fund | 350 000 | −6,67 | 32 452 | −0,56 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 8 488 | 18,51 | 787 | 26,32 | ||||

| 2025-08-12 | 13F | Cumberland Partners Ltd | 25 140 | 2 331 | ||||||

| 2025-07-30 | 13F | Princeton Global Asset Management LLC | 91 635 | −1,93 | 8 496 | 4,49 | ||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 1 231 793 | −2,69 | 114 212 | 3,67 | ||||

| 2025-08-13 | 13F | Williamson Legacy Group, LLC | 11 581 | 1 074 | ||||||

| 2025-08-12 | 13F/A | Cozad Asset Management Inc | 5 422 | 0,00 | 503 | 6,58 | ||||

| 2025-03-31 | NP | DAACX - Diversified Equity Fund | 300 | 0,00 | 24 | 4,55 | ||||

| 2025-08-04 | 13F | Retirement Systems of Alabama | 68 804 | 0,00 | 6 380 | 6,53 | ||||

| 2025-08-14 | 13F | Lombard Odier Asset Management (Switzerland) SA | 76 503 | 0,00 | 7 093 | 6,53 | ||||

| 2025-05-13 | 13F | California Public Employees Retirement System | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 121 | −66,85 | 11 | −64,52 | ||||

| 2025-08-14 | 13F | Aperture Investors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Salomon & Ludwin, LLC | 2 | 0 | ||||||

| 2025-07-25 | 13F | Hazlett, Burt & Watson, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-28 | NP | TIEUX - International Equity Fund | 5 764 | 5,55 | 529 | 12,31 | ||||

| 2025-08-14 | 13F | Zurich Insurance Group Ltd/FI | 54 417 | −8,17 | 5 046 | −2,17 | ||||

| 2025-07-31 | 13F | Sumitomo Mitsui Trust Holdings, Inc. | 2 142 715 | 9,99 | 198 673 | 17,19 | ||||

| 2025-07-21 | 13F | 111 Capital | 29 119 | 25,35 | 2 687 | 32,84 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 49 328 | 617,81 | 4 328 | 623,75 | ||||

| 2025-08-18 | 13F | N.E.W. Advisory Services LLC | 36 | 0,00 | 3 | 0,00 | ||||

| 2025-07-11 | 13F | Skyline Advisors, Inc. | 2 935 | 0,00 | 272 | 6,67 | ||||

| 2025-08-01 | 13F | Trust Investment Advisors | 2 465 | 229 | ||||||

| 2025-07-24 | 13F | Standard Life Aberdeen plc | 38 212 | 79,73 | 3 507 | 89,77 | ||||

| 2025-08-07 | 13F | STF Management LP | 6 908 | 2,26 | 641 | 9,03 | ||||

| 2025-06-27 | NP | DAINX - Dunham International Stock Fund Class A | 893 | −86,37 | 81 | −76,59 | ||||

| 2025-04-03 | 13F | First Hawaiian Bank | 3 564 | 0,00 | 310 | 13,55 | ||||

| 2025-08-06 | 13F | Csenge Advisory Group | 0 | −100,00 | 0 | |||||

| 2025-04-22 | 13F | Kentucky Retirement Systems Insurance Trust Fund | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 7 162 | 13,54 | 664 | 20,95 | ||||

| 2025-08-12 | 13F | Marsico Capital Management Llc | 263 344 | 109,25 | 24 417 | 122,95 | ||||

| 2025-08-05 | 13F | iA Global Asset Management Inc. | 111 034 | 72,77 | 10 | 100,00 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 484 274 | 10,49 | 44 564 | 16,90 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 7 047 | 653 | ||||||

| 2025-08-28 | NP | SEEIX - Sit International Equity Fund - Class I | 18 520 | 49,11 | 1 717 | 58,98 | ||||

| 2025-07-24 | 13F | Monument Capital Management | 30 399 | −5,36 | 2 819 | 0,82 | ||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 2 733 | 4,51 | 253 | 11,45 | ||||

| 2025-08-27 | NP | HCESX - The ESG Growth Portfolio HC Strategic Shares | 312 | 0,00 | 29 | 3,70 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 48 | 0,00 | 4 | 0,00 | ||||

| 2025-08-14 | 13F | Spears Abacus Advisors LLC | 44 637 | −7,88 | 4 139 | −1,87 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 124 514 | 75,37 | 11 545 | 86,86 | ||||

| 2025-08-07 | 13F | Aviva Plc | 315 499 | −0,45 | 29 212 | 5,93 | ||||

| 2025-05-12 | 13F | Simplex Trading, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-26 | NP | NMMEX - Active M Emerging Markets Equity Fund | 820 | −80,16 | 76 | −78,83 | ||||

| 2025-08-12 | 13F | Tokio Marine Asset Management Co Ltd | 7 804 | 12,30 | 724 | 19,70 | ||||

| 2025-07-31 | 13F | Whipplewood Advisors, LLC | 705 | −9,38 | 65 | 10,17 | ||||

| 2025-07-23 | 13F | Klp Kapitalforvaltning As | 170 300 | 4,80 | 15 790 | 11,65 | ||||

| 2025-05-13 | 13F | Wahed Invest LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 803 | 74 | ||||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 119 | −3,25 | 11 | 10,00 | ||||

| 2025-08-12 | 13F | Ameritas Investment Partners, Inc. | 15 060 | 0,00 | 1 396 | 6,56 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | BBVSX - Bridge Builder Small/Mid Cap Value Fund | 119 417 | −16,06 | 11 072 | −10,57 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Cullen Capital Management, LLC | 563 792 | −9,96 | 49 067 | 2,02 | ||||

| 2025-08-14 | 13F | Altshuler Shaham Ltd | 2 100 | 0,00 | 195 | 6,59 | ||||

| 2025-07-29 | NP | QQQM - Invesco NASDAQ 100 ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 381 668 | 10,10 | 126 823 | 17,16 | ||||

| 2025-08-06 | 13F | New Millennium Group LLC | 526 | 0,96 | 49 | 6,67 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 125 600 | −77,16 | 11 646 | −75,67 | ||||

| 2025-08-12 | 13F | Ci Investments Inc. | 274 390 | −8,87 | 25 | −3,85 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 3 799 | 17,54 | 352 | 25,27 | ||||

| 2025-08-07 | 13F | Ibex Wealth Advisors | 100 928 | 4,70 | 9 358 | 11,55 | ||||

| 2025-08-05 | 13F | Carolinas Wealth Consulting Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 1 526 | 2,69 | 141 | 9,30 | ||||

| 2025-08-04 | 13F | Capital Performance Advisors Llp | 2 328 | 216 | ||||||

| 2025-08-07 | 13F | Legacy Financial Advisors, Inc. | 4 960 | 1,64 | 460 | 8,25 | ||||

| 2025-08-12 | 13F | Laurel Wealth Advisors LLC | 20 399 | 9 172,27 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Prudential Financial Inc | 18 378 | 74,73 | 1 704 | 86,23 | ||||

| 2025-08-14 | 13F | Man Group plc | 1 001 770 | 219,78 | 92 884 | 240,70 | ||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 6 411 | 1 | ||||||

| 2025-08-14 | 13F | Scientech Research LLC | 7 774 | 117,94 | 721 | 132,26 | ||||

| 2025-05-01 | 13F | Schechter Investment Advisors, LLC | 3 619 | −0,63 | 315 | 12,54 | ||||

| 2025-07-18 | 13F | Bartlett & Co. Wealth Management Llc | 95 | 15,85 | 9 | 14,29 | ||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 3 107 | −3,18 | 288 | 3,23 | ||||

| 2025-08-14 | 13F | Voya Investment Management Llc | 55 930 | 71,91 | 5 186 | 83,15 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 12 383 | 15,31 | 1 148 | 22,91 | ||||

| 2025-07-29 | NP | AIM COUNSELOR SERIES TRUST (INVESCO COUNSELOR SERIES TRUST) - Invesco Nasdaq 100 Index Fund Class R6 | 3 919 | 20,18 | 360 | 27,76 | ||||

| 2025-04-30 | 13F | Sofos Investments, Inc. | 6 | −81,25 | 1 | −100,00 | ||||

| 2025-08-27 | NP | THRIVENT SERIES FUND INC - Thrivent International Index Portfolio Class A | 3 108 | 14,77 | 288 | 22,55 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 6 632 | 2,93 | 615 | 9,64 | ||||

| 2025-07-29 | 13F | Mattson Financial Services, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Trexquant Investment LP | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Barrow Hanley Mewhinney & Strauss Llc | 464 834 | −3,04 | 43 099 | 3,30 | ||||

| 2025-05-15 | 13F | L1 Capital International Pty Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Private Management Group Inc | 43 200 | −66,73 | 4 006 | −64,55 | ||||

| 2025-08-12 | 13F | Swiss National Bank | 698 614 | 17,51 | 64 775 | 25,19 | ||||

| 2025-08-29 | NP | CLPAX - Catalyst/Exceed Defined Risk Fund Class A | 289 | −17,43 | 27 | −13,33 | ||||

| 2025-07-25 | NP | CMIEX - Multi-Manager International Equity Strategies Fund Institutional Class | 9 417 | 1 757,40 | 864 | 1 778,26 | ||||

| 2025-08-07 | 13F | King Luther Capital Management Corp | 4 100 | 0,00 | 380 | 6,74 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 264 564 | −49,27 | 24 530 | −45,96 | ||||

| 2025-08-12 | 13F | TCTC Holdings, LLC | 208 | 0,00 | 19 | 5,56 | ||||

| 2025-08-14 | 13F | Rafferty Asset Management, LLC | 127 240 | −14,91 | 11 798 | −9,34 | ||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 29 | 0,00 | 3 | 0,00 | ||||

| 2025-08-27 | NP | MXXIX - Marsico 21st Century Fund | 119 262 | 11 058 | ||||||

| 2025-08-11 | 13F | FSA Wealth Management LLC | 64 | 0,00 | 6 | 0,00 | ||||

| 2025-08-14 | 13F | Wexford Capital Lp | 5 834 | 60,89 | 541 | 71,43 | ||||

| 2025-08-01 | 13F | Fjarde Ap-fonden /fourth Swedish National Pension Fund | 48 008 | 27,32 | 4 | 33,33 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 261 826 | 13,14 | 24 277 | 20,54 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 629 504 | −6,42 | 58 368 | −0,30 | ||||

| 2025-08-14 | 13F | Bridgefront Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-15 | 13F | Td Private Client Wealth Llc | 13 615 | 1,76 | 1 262 | 8,42 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 1 496 240 | −11,13 | 139 | −5,48 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 979 | −0,71 | 91 | 5,88 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 11 132 | 3,76 | 1 032 | 10,61 | ||||

| 2025-08-14 | 13F | Holocene Advisors, LP | 514 898 | −72,64 | 47 741 | −70,85 | ||||

| 2025-07-16 | 13F | Ipswich Investment Management Co., Inc. | 15 125 | −1,14 | 1 402 | 5,33 | ||||

| 2025-08-14 | 13F | CIBC Asset Management Inc | 108 634 | 2,03 | 10 073 | 8,70 | ||||

| 2025-07-31 | 13F | 180 Wealth Advisors, Llc | 2 393 | −2,21 | 222 | 4,25 | ||||

| 2025-07-24 | 13F | Forefront Analytics, LLC | 3 291 | 305 | ||||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 2 244 | 4,86 | 215 | 15,59 | ||||

| 2025-08-11 | 13F | Independent Advisor Alliance | 12 859 | 0,65 | 1 192 | 7,29 | ||||

| 2025-05-16 | 13F | Dynamic Technology Lab Private Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-29 | NP | PUTNAM VARIABLE TRUST - Putnam VT International Equity Fund Class IA Shares | 40 900 | −24,26 | 3 560 | −14,18 | ||||

| 2025-07-25 | 13F | JustInvest LLC | 23 585 | 18,79 | 2 187 | 26,56 | ||||

| 2025-07-08 | 13F | Northwest & Ethical Investments L.P. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-15 | 13F | MCF Advisors LLC | 84 | 0,00 | 8 | 0,00 | ||||

| 2025-04-17 | 13F | MEAG MUNICH ERGO, Kapitalanlagegesellschaft mbH | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Elequin Capital Lp | 0 | −100,00 | 0 | |||||

| 2025-06-30 | NP | QTR - Global X NASDAQ 100 Tail Risk ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 72 | −28,71 | 7 | −14,29 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 391 372 | −21,72 | 36 287 | −16,60 | ||||

| 2025-08-13 | 13F | M&t Bank Corp | 6 775 | −16,23 | 629 | −10,80 | ||||

| 2025-07-21 | 13F | Qrg Capital Management, Inc. | 3 112 | −3,50 | 289 | 2,86 | ||||

| 2025-07-10 | 13F | Swedbank AB | 176 819 | 1,27 | 16 395 | 7,89 | ||||

| 2025-05-09 | 13F | Headlands Technologies LLC | 0 | −100,00 | 0 | |||||

| 2025-07-10 | 13F | Fulton Bank, N.a. | 3 540 | 5,64 | 328 | 12,71 | ||||

| 2025-06-30 | NP | INVESCO ACTIVELY MANAGED EXCHANGE-TRADED FUND TRUST - Invesco QQQ Income Advantage ETF | 5 054 | 46,11 | 459 | 69,00 | ||||

| 2025-08-14 | 13F | Royal London Asset Management Ltd | 818 364 | 0,75 | 75 879 | 7,34 | ||||

| 2025-07-18 | 13F | Silchester International Investors LLP | 71 476 | −5,57 | 6 627 | 0,61 | ||||

| 2025-08-15 | 13F | E Fund Management Co., Ltd. | 10 751 | −7,37 | 997 | −1,39 | ||||

| 2025-08-27 | NP | HCIEX - The International Equity Portfolio HC Strategic Shares | 10 781 | 0,00 | 1 000 | 6,50 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 514 | −0,58 | 48 | 6,82 | ||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 181 | 964,71 | 17 | 1 500,00 | ||||

| 2025-07-21 | 13F | ASR Vermogensbeheer N.V. | 9 595 | 15,67 | 890 | 23,30 | ||||

| 2025-08-14 | 13F | Quantessence Capital LLC | 0 | −100,00 | 0 | |||||

| 2025-05-29 | NP | PABAX - Putnam Dynamic Asset Allocation Balanced Fund Class A shares | 14 415 | −22,51 | 1 255 | −12,18 | ||||

| 2025-06-30 | NP | QYLD - Global X NASDAQ 100 Covered Call ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 279 028 | 13,74 | 25 319 | 31,40 | ||||

| 2025-06-30 | NP | QCLR - Global X NASDAQ 100 Collar 95-110 ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 69 | 38,00 | 6 | 100,00 | ||||

| 2025-08-14 | 13F | Voloridge Investment Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 108 424 | 8,27 | 10 053 | 16,33 | ||||

| 2025-08-11 | 13F | GW&K Investment Management, LLC | 44 | 0,00 | 0 | |||||

| 2025-08-27 | NP | ALLIANZ VARIABLE INSURANCE PRODUCTS TRUST - AZL International Index Fund Class 2 | 13 844 | −4,31 | 1 284 | 1,91 | ||||

| 2025-08-14 | 13F | Sit Investment Associates Inc | 61 300 | 0,00 | 6 | 0,00 | ||||

| 2025-07-22 | 13F | Gf Fund Management Co. Ltd. | 91 465 | 2,98 | 8 481 | 9,72 | ||||

| 2025-08-08 | 13F | Commonwealth Of Pennsylvania Public School Empls Retrmt Sys | 60 229 | 2,77 | 5 584 | 9,49 | ||||

| 2025-07-18 | 13F | Naples Global Advisors, Llc | 13 397 | 0,00 | 1 242 | 6,61 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 3 702 | 15,98 | 0 | |||||

| 2025-08-08 | 13F | TD Capital Management LLC | 16 | 0,00 | 2 | 0,00 | ||||

| 2025-08-19 | 13F | Anchor Investment Management, LLC | 2 360 | −11,61 | 219 | −6,03 | ||||

| 2025-07-22 | 13F | Miracle Mile Advisors, LLC | 4 942 | −7,64 | 458 | −1,51 | ||||

| 2025-08-06 | 13F | Richard Bernstein Advisors LLC | 57 845 | 5 363 | ||||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Whittier Trust Co | 337 | 0,00 | 31 | 6,90 | ||||

| 2025-05-29 | NP | PUTNAM VARIABLE TRUST - Putnam VT International Value Fund Class IA Shares | 44 185 | 9,07 | 3 845 | 23,59 | ||||

| 2025-08-12 | 13F | Putnam Fl Investment Management Co | 3 756 | −15,31 | 348 | −9,61 | ||||

| 2025-08-13 | 13F | Blueshift Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-29 | NP | CANTOR SELECT PORTFOLIOS TRUST - Cantor Fitzgerald International Equity Fund Institutional Class | 5 580 | 41,27 | 517 | 50,73 | ||||

| 2025-07-11 | 13F | Pinnacle Bancorp, Inc. | 4 707 | 0,00 | 433 | 6,13 | ||||

| 2025-07-28 | 13F | Moran Wealth Management, LLC | 49 510 | 2,18 | 4 591 | 8,87 | ||||

| 2025-08-05 | 13F | Tiaa Trust, National Association | 3 345 | 3,18 | 310 | 9,93 | ||||

| 2025-07-30 | 13F | Financial Perspectives, Inc | 79 | 0,00 | 7 | 16,67 | ||||

| 2025-08-13 | 13F | Norges Bank | 4 114 876 | 381 335 | ||||||

| 2025-07-09 | 13F | Aaron Wealth Advisors LLC | 2 744 | 11,14 | 254 | 18,69 | ||||

| 2025-08-14 | 13F | Point72 (DIFC) Ltd | 0 | −100,00 | 0 | |||||

| 2025-07-18 | 13F | First United Bank Trust/ | 100 | 0,00 | 9 | 12,50 | ||||

| 2025-05-15 | 13F | CAPROCK Group, Inc. | 8 600 | −1,18 | 749 | 11,98 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 647 266 | −5,44 | 60 015 | 0,74 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | Put | 28 300 | 2 624 | |||||

| 2025-08-14 | 13F | ICONIQ Capital, LLC | 2 486 | 1,35 | 231 | 7,98 | ||||

| 2025-07-31 | 13F | MQS Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Entropy Technologies, LP | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Atala Financial Inc | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Richardson Financial Services Inc. | 0 | −100,00 | 0 | |||||

| 2025-04-23 | 13F | Continuum Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Dynasty Wealth Management, Llc | 7 826 | −8,07 | 726 | −2,03 | ||||

| 2025-08-14 | 13F | Winton Capital Group Ltd | 2 177 | 202 | ||||||

| 2025-07-25 | 13F | Yousif Capital Management, Llc | 2 253 | −16,34 | 209 | −11,11 | ||||

| 2025-06-27 | NP | PXF - Invesco FTSE RAFI Developed Markets ex-U.S. ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 981 | 180 | ||||||

| 2025-08-26 | NP | Profunds - Profund Vp Nasdaq-100 | 3 127 | −9,91 | 290 | −4,30 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 7 170 | 2 424,65 | 665 | 2 666,67 | ||||

| 2025-08-06 | 13F | Adviser Investments LLC | 54 472 | 1,05 | 5 051 | 7,65 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Exane Asset Management | 264 247 | 17,10 | 24 247 | 23,60 | ||||

| 2025-08-05 | 13F | Cherry Tree Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 11 840 | 5,31 | 1 | |||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 35 | −89,20 | 0 | |||||

| 2025-07-17 | 13F | V-Square Quantitative Management LLC | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Generate Investment Management Ltd | 115 281 | 0,00 | 10 689 | 6,54 | ||||

| 2025-08-13 | 13F | Gabelli Funds Llc | 40 900 | −0,73 | 3 792 | 5,77 | ||||

| 2025-06-26 | NP | USNQX - Nasdaq-100 Index Fund | 204 452 | −0,69 | 18 552 | 14,72 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 53 285 | 20,00 | 4 941 | 27,85 | ||||

| 2025-07-21 | 13F | J. Safra Sarasin Holding AG | 120 745 | −3,89 | 11 195 | 2,39 | ||||

| 2025-08-28 | NP | SMINX - SIMT Tax-Managed International Managed Volatility Fund Class F | 1 137 | −73,92 | 105 | −72,30 | ||||

| 2025-07-29 | NP | SIEYX - International Equity Portfolio Class A | 960 | −6,80 | 88 | 0,00 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Access Investment Management LLC | 5 500 | 0,00 | 510 | 20,62 | ||||

| 2025-08-28 | NP | VNIE - Vontobel International Equity Active ETF | 3 090 | 287 | ||||||

| 2025-07-21 | 13F | Credential Qtrade Securities Inc. | 27 947 | 9,95 | 1 955 | 15,21 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 135 892 | −24,86 | 12 592 | −19,94 | ||||

| 2025-07-16 | 13F | Brown, Lisle/cummings, Inc. | 30 | 0,00 | 3 | 0,00 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 4 037 | 12,29 | 374 | 19,87 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 3 649 | 338 | ||||||

| 2025-08-12 | 13F | MAI Capital Management | 414 | 113,40 | 38 | 137,50 | ||||

| 2025-08-29 | NP | MPLAX - Praxis International Index Fund Class A | 21 706 | 0,00 | 2 013 | 6,51 | ||||

| 2025-08-13 | 13F | Korea Investment CORP | 188 394 | 31,77 | 17 395 | 39,85 | ||||

| 2025-07-17 | 13F | Beacon Capital Management, LLC | 98 | 1,03 | 9 | 12,50 | ||||

| 2025-05-13 | 13F | FCG Investment Co | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Aristotle Capital Management, LLC | 1 974 046 | −0,07 | 183 037 | 6,47 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 5 014 | 22,74 | 465 | 30,70 | ||||

| 2025-08-08 | 13F | Vestcor Inc | 70 540 | 1,69 | 7 | 0,00 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 61 398 | −16,47 | 5 693 | −11,01 | ||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 3 390 | 0,00 | 314 | 6,44 | ||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 2 743 | −1,47 | 254 | 4,96 | ||||

| 2025-07-17 | 13F/A | Capital Investment Advisors, LLC | 3 397 | 315 | ||||||

| 2025-05-15 | 13F | Rakuten Investment Management, Inc. | 22 546 | 1 946 | ||||||

| 2025-08-29 | NP | JVMAX - John Hancock Disciplined Value Mid Cap Fund Class A | 1 323 645 | −16,04 | 122 728 | −10,55 | ||||

| 2025-08-08 | 13F | Principal Financial Group Inc | 13 534 | −9,00 | 1 255 | −3,09 | ||||

| 2025-07-16 | 13F | Strategic Investment Solutions, Inc. /IL | 14 | 0,00 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | OHIO NATIONAL FUND INC - ON Nasdaq-100® Index Portfolio | 7 064 | −5,17 | 655 | 0,93 | ||||

| 2025-08-11 | 13F | Cornerstone Planning Group LLC | 62 | 51,22 | 6 | 100,00 | ||||

| 2025-04-25 | NP | VFTNX - Vanguard FTSE Social Index Fund Institutional Shares | 107 823 | 1,38 | 9 301 | 12,71 | ||||

| 2025-08-14 | 13F | Worldquant Millennium Advisors Llc | 128 072 | 168,48 | 11 875 | 186,05 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 1 690 796 | 4,68 | 156 771 | 11,52 | ||||

| 2025-05-15 | 13F | Fwl Investment Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 10 | 1 | ||||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 1 749 163 | 25,89 | 162 182 | 34,12 | ||||

| 2025-08-14 | 13F | Principal Street Partners, LLC | 22 248 | 197,04 | 2 063 | 216,74 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 1 907 | −5,69 | 176 | −0,57 | ||||

| 2025-08-27 | NP | ALLIANZ VARIABLE INSURANCE PRODUCTS TRUST - AZL MSCI Global Equity Index Fund | 942 | 0,00 | 87 | 7,41 | ||||

| 2025-08-13 | 13F | Westerkirk Capital Inc. | 400 | 37 | ||||||

| 2025-06-26 | NP | NUDM - Nuveen ESG International Developed Markets Equity ETF | 21 221 | 0,65 | 1 926 | 16,24 | ||||

| 2025-08-29 | NP | MFDX - PIMCO RAFI Dynamic Multi-Factor International Equity ETF | 2 261 | 2,03 | 210 | 8,85 | ||||

| 2025-05-05 | 13F | Foundry Partners, LLC | 150 340 | −19,36 | 13 084 | −8,63 | ||||

| 2025-05-14 | 13F | Groupama Asset Managment | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | State Street Corp | 4 729 040 | 5,33 | 438 477 | 12,22 | ||||

| 2025-08-14 | 13F | Daiwa Securities Group Inc. | 52 641 | 3,92 | 5 | 0,00 | ||||

| 2025-06-27 | NP | QQQE - Direxion NASDAQ-100(R) Equal Weighted Index Shares | 139 597 | −16,88 | 12 667 | −3,98 | ||||

| 2025-08-07 | 13F | Mitsubishi UFJ Kokusai Asset Management Co., Ltd. | 235 004 | 17,19 | 21 790 | 24,85 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 15 387 511 | 4,79 | 1 426 730 | 11,64 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 5 859 | 0,57 | 543 | 7,10 | ||||

| 2025-08-08 | 13F | M&G Plc | 89 578 | −28,28 | 8 331 | −23,33 | ||||

| 2025-07-25 | NP | USIFX - International Fund Shares | 22 354 | −5,61 | 2 052 | 0,44 | ||||

| 2025-05-14 | 13F | REAP Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Schwartz Investment Counsel Inc | 531 300 | −4,49 | 49 262 | 1,75 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-28 | NP | SEIE - SEI Select International Equity ETF | 9 616 | 892 | ||||||

| 2025-08-07 | 13F | Allworth Financial LP | 3 311 | 1,22 | 307 | 6,60 | ||||

| 2025-07-15 | 13F | North Star Investment Management Corp. | 0 | −100,00 | 0 | |||||

| 2025-07-11 | 13F | Grove Bank & Trust | 80 | 0,00 | 7 | 16,67 | ||||

| 2025-05-15 | 13F | Millennium Management Llc | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-08 | 13F | Police & Firemen's Retirement System of New Jersey | 37 328 | 3,30 | 3 461 | 10,08 | ||||

| 2025-07-10 | 13F | Redhawk Wealth Advisors, Inc. | 11 611 | −0,65 | 1 077 | 5,80 | ||||

| 2025-08-07 | 13F | Varma Mutual Pension Insurance Co | 75 200 | 6 973 | ||||||

| 2025-07-16 | 13F | Highline Wealth Partners Llc | 46 | 0,00 | 4 | 0,00 | ||||

| 2025-08-06 | 13F | Metis Global Partners, LLC | 7 036 | 9,14 | 652 | 16,22 | ||||

| 2025-08-13 | 13F | Shelton Capital Management | 52 129 | −2,42 | 4 833 | 3,96 | ||||

| 2025-07-28 | 13F | Private Wealth Asset Management, LLC | 10 | 0,00 | 1 | |||||

| 2025-07-23 | 13F | High Note Wealth, LLC | 406 | 0,00 | 38 | 5,71 | ||||

| 2025-07-18 | 13F | Robeco Institutional Asset Management B.V. | 32 140 | −49,98 | 2 980 | −46,71 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 200 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 12 000 | −27,27 | 1 | 0,00 | |||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 2 300 | 210 | |||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 271 469 | −9,21 | 25 171 | −3,28 | ||||

| 2025-08-14 | 13F | Point72 Hong Kong Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 549 393 | 15,29 | 50 940 | 22,83 | ||||

| 2025-07-15 | 13F | Bay Capital Advisors, LLC | 3 800 | 0,00 | 352 | 6,67 | ||||

| 2025-08-15 | 13F | Binnacle Investments Inc | 45 | 0,00 | 4 | 33,33 | ||||

| 2025-06-30 | NP | VT - Vanguard Total World Stock Index Fund ETF Shares | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-23 | 13F | Vontobel Holding Ltd. | 355 807 | −41,70 | 32 907 | −36,61 | ||||

| 2025-06-30 | NP | VYM - Vanguard High Dividend Yield Index Fund ETF Shares | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-17 | 13F | Albion Financial Group /ut | 144 | 0,00 | 13 | 8,33 | ||||

| 2025-08-14 | 13F | Wallace Hart LLC | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Allen Investment Management LLC | 3 000 | 0,00 | 278 | 6,51 | ||||

| 2025-07-29 | 13F | BKM Wealth Management, LLC | 6 681 | −14,72 | 619 | −9,10 | ||||

| 2025-06-26 | NP | TSONX - TIAA-CREF Social Choice International Equity Fund Institutional Class | 73 982 | −2,63 | 6 713 | 12,48 | ||||

| 2025-07-28 | 13F | Fairman Group, LLC | 30 | 0,00 | 3 | 0,00 | ||||

| 2025-08-28 | NP | QCSTRX - Stock Account Class R1 | 410 037 | −54,48 | 38 019 | −51,50 | ||||

| 2025-06-30 | NP | QRMI - Global X NASDAQ 100 Risk Managed Income ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 627 | 16,98 | 57 | 33,33 | ||||

| 2025-06-23 | NP | PINZX - Overseas Fund (f/k/a International Value Fund I) Institutional Class | 2 430 | −18,48 | 220 | −5,98 | ||||

| 2025-08-14 | 13F | Ilmarinen Mutual Pension Insurance Co | 160 000 | −3,03 | 15 | 0,00 | ||||

| 2025-08-13 | 13F | Kayne Anderson Rudnick Investment Management Llc | 40 428 | 4,27 | 3 749 | 11,08 | ||||

| 2025-08-29 | NP | JVANX - International Equity Index Trust NAV | 6 887 | 0,00 | 635 | 5,84 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 286 969 | −80,28 | 26 608 | −78,99 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 1 136 | 13,26 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 4 300 | −65,32 | 399 | −63,11 | |||

| 2025-08-14 | 13F | Fmr Llc | 2 263 641 | −61,42 | 209 885 | −58,90 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 18 700 | −95,39 | 1 734 | −95,09 | |||

| 2025-07-28 | 13F | Allianz Asset Management GmbH | 243 050 | 14,79 | 22 536 | 22,29 | ||||

| 2025-05-15 | 13F | Schonfeld Strategic Advisors LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-08 | 13F | Mitsubishi UFJ Trust & Banking Corp | 115 523 | 20,42 | 10 711 | 28,29 | ||||

| 2025-05-30 | NP | MML SERIES INVESTMENT FUND - MML Income & Growth Fund Initial Class | 21 174 | −1,80 | 1 843 | 11,23 | ||||

| 2025-06-23 | 13F/A | Nicholas Hoffman & Company, LLC. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | MetLife Investment Management, LLC | 22 500 | 1,81 | 2 086 | 8,48 | ||||

| 2025-07-29 | 13F | Virginia Retirement Systems Et Al | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | New Age Alpha Funds Trust - NAA World Equity Income Fund Class P | 926 | −36,92 | 86 | −33,07 | ||||

| 2025-08-11 | 13F | Dorsey & Whitney Trust CO LLC | 4 788 | −2,68 | 444 | 3,50 | ||||

| 2025-07-30 | 13F | Ethic Inc. | 19 821 | 6,55 | 1 806 | 11,35 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 222 906 | 63,60 | 20 668 | 74,29 | ||||

| 2025-08-13 | 13F | Panagora Asset Management Inc | 12 013 | 0,00 | 1 114 | 6,51 | ||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 3 108 | 14,77 | 0 | |||||

| 2025-08-12 | 13F | Wayfinding Financial, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Millstone Evans Group, LLC | 21 | 0,00 | 2 | 0,00 | ||||

| 2025-07-23 | 13F | Louisiana State Employees Retirement System | 33 600 | −0,30 | 3 115 | 6,24 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 44 | −41,33 | 4 | −33,33 | ||||

| 2025-08-14 | 13F | Canada Pension Plan Investment Board | 17 994 | 0,00 | 1 668 | 6,51 | ||||

| 2025-08-06 | 13F | Price Capital Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 2 291 | 24,04 | 212 | 32,50 | ||||

| 2025-08-14 | 13F | PDT Partners, LLC | 12 100 | 1 122 | ||||||

| 2025-08-01 | 13F | Logan Capital Management Inc | 7 | 0,00 | 1 | |||||

| 2025-07-07 | 13F | Nova Wealth Management, Inc. | 22 | 2 | ||||||

| 2025-08-29 | NP | JVLAX - John Hancock Disciplined Value Fund Class A | 1 336 324 | 2,20 | 123 904 | 8,88 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 2 215 | 13,36 | 202 | 19,64 | ||||

| 2025-08-13 | 13F | Lansforsakringar Fondforvaltning AB (publ) | 87 303 | 16,36 | 8 095 | 23,97 | ||||

| 2025-08-12 | 13F | DnB Asset Management AS | 1 348 765 | −1,81 | 95 425 | −3,00 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 2 234 | −74,84 | 207 | −69,60 | ||||

| 2025-07-22 | NP | DIEFX - Destinations International Equity Fund Class I | 3 623 | 333 | ||||||

| 2025-07-08 | 13F | Gradient Investments LLC | 8 145 | 17,89 | 755 | 25,62 | ||||

| 2025-07-30 | 13F | Blume Capital Management, Inc. | 11 | 1 | ||||||

| 2025-07-11 | 13F | Assenagon Asset Management S.A. | 22 382 | 15,57 | 2 075 | 23,15 | ||||

| 2025-04-25 | 13F | Tradewinds Capital Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 7 428 | 2,46 | 689 | 9,03 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 156 | 0,00 | 14 | 7,69 | ||||

| 2025-04-25 | NP | ESGV - Vanguard ESG U.S. Stock ETF ETF Shares | 44 397 | 3,09 | 3 830 | 14,64 | ||||

| 2025-08-14 | 13F | USS Investment Management Ltd | 45 723 | 0,00 | 4 239 | 6,54 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 3 354 | 12,02 | 311 | 19,62 | ||||

| 2025-08-27 | NP | QCGLRX - Global Equities Account Class R1 | 324 451 | 0,35 | 30 083 | 6,91 | ||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 0 | −100,00 | 0 | |||||

| 2025-06-25 | NP | CDAZX - Multi-Manager Directional Alternative Strategies Fund Institutional Class | 3 364 | 5,99 | 305 | 22,49 | ||||

| 2025-08-14 | 13F | Janus Henderson Group Plc | 1 491 957 | 137 908 | ||||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 1 576 | 2,01 | 146 | 8,96 | ||||

| 2025-08-14 | 13F | Jain Global LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 9 | 1 | ||||||

| 2025-08-08 | 13F | KBC Group NV | 39 545 | 4,66 | 4 | 0,00 | ||||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 88 348 | 13,43 | 8 192 | 20,85 | ||||

| 2025-08-13 | 13F | Epoch Investment Partners, Inc. | 1 396 447 | −26,44 | 129 479 | −21,64 | ||||

| 2025-05-02 | 13F | Sachetta, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 185 200 | 34,20 | 17 172 | 42,97 | |||

| 2025-08-14 | 13F | Macquarie Group Ltd | 39 297 | 0,18 | 3 644 | 6,74 | ||||

| 2025-06-30 | NP | IDLV - Invesco S&P International Developed Low Volatility ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 16 038 | 4,82 | 1 455 | 21,15 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 720 | 67 | ||||||

| 2025-08-12 | 13F | Dimensional Fund Advisors Lp | 52 664 | 0,11 | 4 875 | 6,60 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 11 800 | −52,80 | 1 094 | −49,70 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 2 473 | −98,35 | 229 | −98,24 | ||||

| 2025-08-13 | 13F | Ossiam | 22 561 | 2,92 | 2 092 | 9,65 | ||||

| 2025-08-21 | NP | MXECX - Great-West Core Strategies: International Equity Fund Institutional Class | 6 108 | 0,00 | 566 | 6,59 | ||||

| 2025-08-13 | 13F | Schroder Investment Management Group | 200 976 | 0,91 | 18 634 | 8,42 | ||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 2 317 | −0,69 | 211 | 4,98 | ||||

| 2025-08-28 | NP | VNIYX - VONTOBEL INTERNATIONAL EQUITY FUND Y Shares | 28 144 | −54,58 | 2 610 | −51,61 | ||||

| 2025-08-28 | 13F | China Universal Asset Management Co., Ltd. | 10 427 | −8,41 | 967 | −2,42 | ||||

| 2025-06-26 | NP | CRTVX - CATHOLIC RESPONSIBLE INVESTMENTS MULTI-STYLE US EQUITY FUND Investor Shares | 22 472 | −4,67 | 2 039 | 10,16 | ||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 269 982 | −11,68 | 25 033 | −5,91 | ||||

| 2025-08-13 | 13F | State Board Of Administration Of Florida Retirement System | 14 481 | 0,00 | 1 343 | 6,51 | ||||

| 2025-07-22 | 13F | LGT Group Foundation | 5 335 | 0,00 | 495 | 6,47 | ||||

| 2025-06-27 | NP | PRF - Invesco FTSE RAFI US 1000 ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 32 515 | −21,50 | 2 950 | −9,31 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Diversify Advisory Services, LLC | 2 515 | 234 | ||||||

| 2025-08-14 | 13F | Millennium Management Llc | 12 650 | −95,29 | 1 173 | −94,99 | ||||

| 2025-08-13 | 13F | Legacy Capital Wealth Partners, LLC | 4 397 | −4,58 | 408 | 1,50 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 11 858 949 | 14,74 | 1 099 562 | 22,24 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 1 699 604 | 20,62 | 157 587 | 28,51 | ||||

| 2025-07-10 | 13F | Perkins Coie Trust Co | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Virtu Financial LLC | 29 745 | 201,61 | 3 | |||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 22 | 0,00 | 2 | 100,00 | ||||

| 2025-08-01 | 13F | Tevis Investment Management | 74 715 | −0,80 | 6 928 | 19,76 | ||||

| 2025-08-28 | NP | New Age Alpha Variable Funds Trust - NAA WORLD EQUITY INCOME SERIES | 2 236 | −35,00 | 207 | −30,77 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 2 266 570 | −25,20 | 210 156 | −20,31 | ||||

| 2025-08-01 | 13F | First Command Advisory Services, Inc. | 19 | 0,00 | 2 | 0,00 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 17 826 | −49,65 | 1 653 | −46,38 | ||||

| 2025-08-11 | 13F | Parr Mcknight Wealth Management Group, Llc | 29 353 | −1,37 | 2 722 | 5,06 | ||||

| 2025-08-14 | 13F | Oddo Bhf Asset Management Sas | 11 561 | −6,59 | 1 072 | −0,56 | ||||

| 2025-08-27 | NP | HCSRX - The Catholic SRI Growth Portfolio HC Strategic Shares | 245 | 33,15 | 23 | 37,50 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 3 284 | 25,10 | 305 | 33,33 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 25 480 | 6,64 | 2 363 | 13,61 | ||||

| 2025-08-26 | NP | NSRKX - NORTHERN GLOBAL SUSTAINABILITY INDEX FUND Class K | 11 130 | 3,10 | 1 032 | 9,80 | ||||

| 2025-08-28 | NP | MAICX - Victory Trivalent International Fund - Core Equity Class A | 9 916 | −7,98 | 919 | −1,92 | ||||

| 2025-08-14 | 13F | BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp | 719 682 | −0,04 | 66 736 | 6,37 | ||||

| 2025-08-12 | 13F/A | Boston Partners | 6 109 899 | −10,89 | 567 377 | −5,01 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 143 | 9,16 | 13 | 18,18 | ||||

| 2025-08-06 | 13F | Achmea Investment Management B.V. | 31 128 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 88 462 | 22,30 | 8 202 | 30,29 | ||||

| 2025-07-29 | 13F | Beverly Hills Private Wealth, LLC | 6 696 | −10,51 | 621 | −4,76 | ||||

| 2025-08-14 | 13F | Synovus Financial Corp | 36 171 | 3,91 | 3 354 | 10,70 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 6 405 835 | 3,23 | 593 949 | 9,98 | ||||

| 2025-08-06 | 13F | Sienna Gestion | 23 494 | 0,00 | 1 989 | 0,05 | ||||

| 2025-04-22 | 13F | Synergy Financial Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Huntington National Bank | 2 041 | −6,07 | 189 | 0,00 |