Grundläggande statistik

| Institutionella aktier (lång) | 239 725 774 - 49,53% (ex 13D/G) - change of 0,24MM shares 0,10% MRQ |

| Institutionellt värde (lång) | $ 13 421 795 USD ($1000) |

Institutionellt ägande och aktieägare

Cheniere Energy Partners, L.P. - Limited Partnership (US:CQP) har 237 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 239,725,774 aktier. Största aktieägare inkluderar Blackstone Group Inc, Brookfield Asset Management Inc., AMLP - ALERIAN MLP ETF, Alps Advisors Inc, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd., MLPA - Global X MLP ETF, Morgan Stanley, Goldman Sachs Group Inc, Energy Income Partners, LLC, and Jpmorgan Chase & Co .

Cheniere Energy Partners, L.P. - Limited Partnership (NYSE:CQP) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 10, 2025 is 53,14 / share. Previously, on September 11, 2024, the share price was 48,52 / share. This represents an increase of 9,52% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

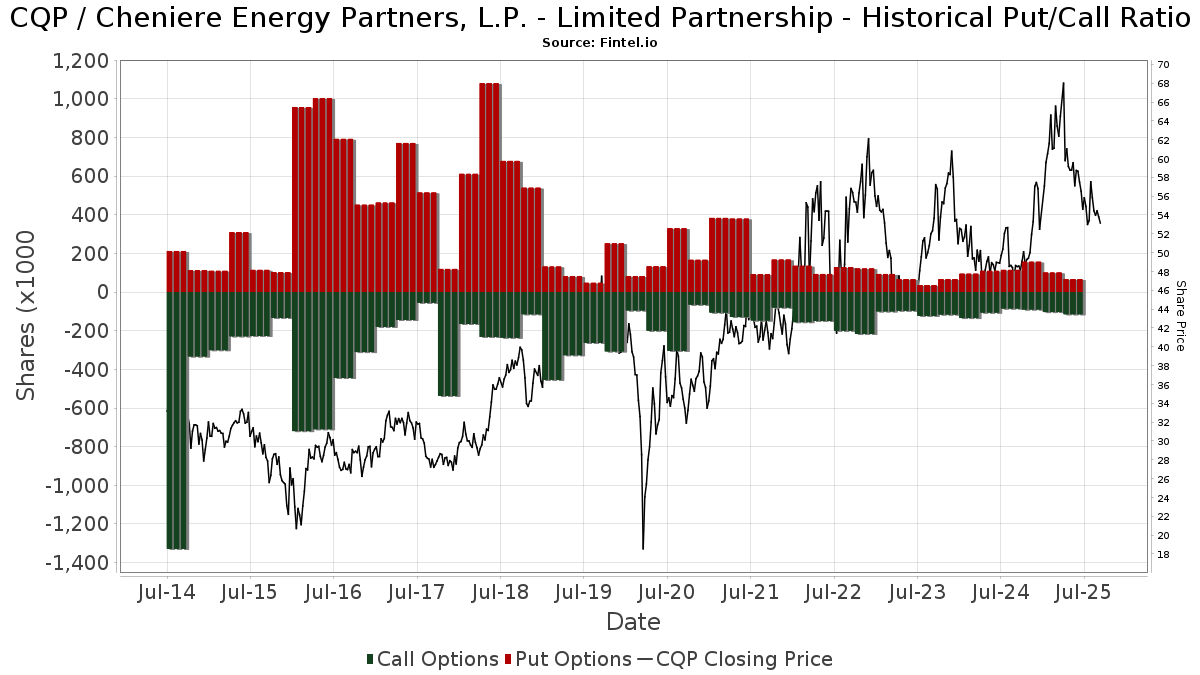

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-22 | 13F | Belpointe Asset Management LLC | 6 442 | −20,20 | 361 | −32,27 | ||||

| 2025-07-23 | 13F | Maryland State Retirement & Pension System | 34 897 | 6,26 | 1 956 | −9,82 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 924 | 25,54 | 52 | 6,25 | ||||

| 2025-07-22 | 13F | Valley National Advisers Inc | 1 341 | 0,00 | 0 | |||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 14 179 | 4,78 | 795 | −11,09 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 30 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 9 312 | −4,17 | 522 | −18,72 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 1 060 623 | 24,11 | 59 448 | 5,33 | ||||

| 2025-07-24 | NP | FSDIX - Fidelity Strategic Dividend & Income Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 11 910 | 3,48 | 683 | −12,32 | ||||

| 2025-08-12 | 13F | Tableaux Llc | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Pekin Hardy Strauss, Inc. | 4 000 | 0,00 | 224 | −15,15 | ||||

| 2025-08-14 | 13F | Fred Alger Management, Llc | 52 923 | 0,00 | 2 966 | −15,14 | ||||

| 2025-08-14 | 13F | Bramshill Investments, LLC | 31 436 | 0,96 | 1 762 | −14,35 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Corps Capital Advisors, LLC | 10 452 | 11,19 | 586 | −5,65 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 49 411 | −30,23 | 2 769 | −40,78 | ||||

| 2025-07-29 | NP | MLPEX - Invesco Oppenheimer SteelPath MLP Select 40 Fund Class C | 100 | 0,00 | 6 | −16,67 | ||||

| 2025-08-20 | NP | LSPAX - LoCorr Spectrum Income Fund Class A | 28 809 | 0,00 | 1 615 | −15,14 | ||||

| 2025-04-14 | NP | TPYP - Tortoise North American Pipeline Fund | 45 581 | 1,28 | 3 086 | 17,74 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 5 674 | −9,56 | 318 | −23,19 | ||||

| 2025-07-24 | 13F | Blair William & Co/il | 4 300 | 0,00 | 241 | −14,84 | ||||

| 2025-07-18 | 13F | SOA Wealth Advisors, LLC. | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Your Advocates Ltd., LLP | 145 | 0,00 | 35 | 6,06 | ||||

| 2025-07-22 | 13F | Powell Investment Advisors, LLC | 17 270 | 1,35 | 968 | −14,04 | ||||

| 2025-08-06 | 13F | Disciplined Investors, L.L.C. | 8 446 | 174,04 | 473 | 133,00 | ||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 2 716 326 | −8,04 | 152 250 | −21,95 | ||||

| 2025-07-17 | 13F | Covenant Asset Management, LLC | 7 295 | 0,00 | 409 | −15,18 | ||||

| 2025-07-17 | 13F | Charles Schwab Trust Co | 4 000 | 0,00 | 224 | −15,15 | ||||

| 2025-07-18 | 13F | Founders Capital Management | 22 291 | 2,16 | 1 249 | −13,26 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 7 612 | −2,65 | 427 | −17,44 | ||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 1 751 | 98 | ||||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | Call | 9 000 | 504 | |||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | ArrowMark Colorado Holdings LLC | 21 227 | 0,00 | 1 190 | −15,13 | ||||

| 2025-06-17 | NP | GSRAX - Goldman Sachs Rising Dividend Growth Fund Class A | 19 899 | −14,29 | 1 170 | −17,91 | ||||

| 2025-07-23 | 13F | REAP Financial Group, LLC | 1 859 | 1,42 | 104 | −14,05 | ||||

| 2025-08-07 | 13F | Americana Partners, LLC | 8 911 | 39,00 | 499 | 17,97 | ||||

| 2025-07-30 | 13F | Gables Capital Management Inc. | 600 | 34 | ||||||

| 2025-08-11 | 13F | Alps Advisors Inc | 8 795 690 | −2,48 | 492 998 | −17,23 | ||||

| 2025-08-07 | 13F | Montag A & Associates Inc | 801 | 0,00 | 45 | −15,38 | ||||

| 2025-06-20 | NP | ABLD - Donoghue Forlines Yield Enhanced Real Asset ETF | 18 015 | 25,49 | 1 059 | 40,13 | ||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 200 | 0,00 | 11 | −15,38 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 38 313 | −2,27 | 2 147 | −17,07 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 1 100 | 0,00 | 62 | −15,28 | ||||

| 2025-07-23 | 13F | MADDEN SECURITIES Corp | 16 700 | 0,00 | 936 | −15,06 | ||||

| 2025-08-14 | 13F | Tortoise Capital Advisors, L.l.c. | 803 037 | 12,67 | 45 010 | −4,37 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 10 | 0,00 | 1 | |||||

| 2025-07-25 | 13F | Cwm, Llc | 134 | 0 | ||||||

| 2025-08-01 | 13F | Motco | 300 | 17 | ||||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 3 064 | 6,72 | 172 | −9,52 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 8 236 | 0,17 | 462 | −12,19 | ||||

| 2025-08-14 | 13F | Prestige Wealth Management Group LLC | 200 | 0,00 | 11 | −15,38 | ||||

| 2025-07-07 | 13F | Wealth Alliance Advisory Group, LLC | 4 300 | 0,00 | 241 | −14,84 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 9 | −91,00 | 1 | −100,00 | ||||

| 2025-08-26 | NP | MDIV - Multi-Asset Diversified Income Index Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 47 415 | −19,54 | 2 658 | −31,71 | ||||

| 2025-06-26 | NP | GYLD - Arrow Dow Jones Global Yield ETF | 2 129 | −15,72 | 125 | −18,83 | ||||

| 2025-08-08 | 13F | Compass Financial Services Inc | 100 | 6 | ||||||

| 2025-06-27 | NP | Calamos Long/Short Equity & Dynamic Income Trust | 800 | 0,00 | 47 | −4,08 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 4 124 | −15,87 | 231 | −28,48 | ||||

| 2025-07-14 | 13F | Armstrong Advisory Group, Inc | 200 | 11 | ||||||

| 2025-08-14 | 13F | RMB Capital Management, LLC | 11 045 | 619 | ||||||

| 2025-06-27 | NP | Calamos Dynamic Convertible & Income Fund | 1 100 | 0,00 | 65 | −4,48 | ||||

| 2025-07-24 | 13F | Birch Capital Management, LLC | 9 839 | 0,00 | 551 | −15,10 | ||||

| 2025-07-21 | 13F | Quent Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-06-27 | NP | CHYDX - Calamos High Income Opportunities Fund Class A | 385 | 0,00 | 23 | −4,35 | ||||

| 2025-08-14 | 13F | Southport Management, L.l.c. | 19 409 | 0,00 | 1 088 | −15,14 | ||||

| 2025-08-06 | 13F | Texas Yale Capital Corp. | 32 345 | −37,45 | 1 813 | −46,92 | ||||

| 2025-07-21 | 13F | Hennessy Advisors Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna Portfolio Strategies, LLC | 4 882 | 274 | ||||||

| 2025-08-06 | 13F | Penserra Capital Management LLC | 39 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 3 788 | 0,08 | 212 | −14,86 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 997 240 | −2,73 | 55 895 | −17,45 | ||||

| 2025-08-06 | 13F | Heronetta Management, L.P. | 5 810 | 0,00 | 326 | −15,14 | ||||

| 2025-08-12 | 13F | Valueworks Llc | 4 750 | −14,41 | 266 | −27,32 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 1 816 | −29,53 | 101 | −40,59 | ||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 39 436 | −5,64 | 2 210 | −19,93 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 22 899 | 49,92 | 1 284 | 27,28 | ||||

| 2025-07-16 | 13F | ORG Wealth Partners, LLC | 14 019 | 331,62 | 776 | 252,27 | ||||

| 2025-08-14 | 13F | Blackstone Group Inc | 102 346 331 | 0,00 | 5 736 512 | −15,13 | ||||

| 2025-07-29 | 13F | Regions Financial Corp | 7 758 | 0,00 | 435 | −15,23 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-06-27 | NP | Calamos Global Total Return Fund | 180 | 0,00 | 11 | −9,09 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Dividend Asset Capital, Llc | 15 390 | −4,35 | 863 | −18,83 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 8 506 | 0,08 | 477 | −14,97 | ||||

| 2025-08-19 | 13F | State of Wyoming | 9 223 | 50,53 | 517 | 27,72 | ||||

| 2025-08-05 | 13F | Garrison Bradford & Associates Inc | 1 600 | 0,00 | 90 | −15,24 | ||||

| 2025-08-14 | 13F | Hilltop Holdings Inc. | 5 490 | 308 | ||||||

| 2025-08-08 | 13F | WASHINGTON TRUST Co | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 4 682 | −34,81 | 262 | −44,73 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 319 717 | 1,16 | 17 920 | −14,14 | ||||

| 2025-05-30 | NP | MBOX - Freedom Day Dividend ETF | 37 622 | 8,97 | 2 485 | 35,44 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 4 195 | −15,86 | 235 | −28,57 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 300 | 17 | ||||||

| 2025-08-12 | 13F | Bokf, Na | 976 | −24,92 | 55 | −36,47 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 472 | 26 | ||||||

| 2025-07-23 | NP | Clearbridge Energy Mlp Opportunity Fund Inc. This fund is a listed as child fund of Clearbridge, Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 493 091 | −3,18 | 28 289 | −17,97 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 827 | −8,11 | 46 | −2,13 | ||||

| 2025-08-14 | 13F | Marshall Investment Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 100 | −55,56 | 6 | −64,29 | ||||

| 2025-08-01 | 13F | MorganRosel Wealth Management, LLC | 19 500 | 18,18 | 1 093 | 0,28 | ||||

| 2025-07-15 | 13F | Financial Management Professionals, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-29 | NP | Tortoise Capital Series Trust - TORTOISE NORTH AMERICAN PIPELINE FUND | 40 581 | 2 328 | ||||||

| 2025-05-27 | NP | RNEW - VanEck Green Infrastructure ETF | 1 697 | 0,12 | 112 | 24,44 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 1 000 | 0,00 | 0 | |||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 48 160 | −2,45 | 2 699 | −17,21 | ||||

| 2025-06-25 | NP | EMLP - First Trust North American Energy Infrastructure Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 521 609 | −10,89 | 30 660 | −14,64 | ||||

| 2025-07-15 | 13F | SJS Investment Consulting Inc. | 80 | 1,27 | 4 | −20,00 | ||||

| 2025-08-14 | 13F | Infrastructure Capital Advisors, Llc | 219 395 | −11,83 | 12 297 | −25,16 | ||||

| 2025-07-31 | 13F | BIP Wealth, LLC | 5 000 | 0,00 | 280 | −15,15 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 8 025 | −2,73 | 450 | −17,46 | ||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 602 | 1,01 | 34 | −15,38 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 146 288 | 8 199 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 37 600 | −46,97 | 2 107 | −55,00 | |||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 37 993 | 2 130 | ||||||

| 2025-08-11 | 13F | Aviso Wealth Management | 4 236 | 0,00 | 237 | −15,05 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 80 200 | 69,20 | 4 495 | 43,61 | |||

| 2025-08-28 | NP | AIGOX - Alger Growth & Income Portfolio Class I-2 | 3 108 | 0,00 | 174 | −15,12 | ||||

| 2025-08-14 | 13F | Militia Capital Partners, LP | 12 200 | 35,56 | 2 971 | 42,65 | ||||

| 2025-07-18 | 13F | Naples Global Advisors, Llc | 19 989 | −0,99 | 1 120 | −15,98 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 10 583 | −10,80 | 1 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 1 047 022 | 25,55 | 58 686 | 6,56 | ||||

| 2025-07-18 | 13F | Requisite Capital Management, LLC | 41 905 | 0,00 | 2 349 | −15,14 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 3 660 | 0,69 | 205 | −14,58 | ||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Energy Income Partners, LLC | 1 016 265 | 4,28 | 56 962 | −11,49 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 81 230 | 0,43 | 4 553 | −14,77 | ||||

| 2025-07-28 | NP | TOLZ - ProShares DJ Brookfield Global Infrastructure ETF | 2 868 | 13,95 | 165 | −3,53 | ||||

| 2025-06-25 | NP | EIPX - FT Energy Income Partners Strategy ETF | 53 319 | −15,76 | 3 134 | −19,29 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 615 | 0,00 | 34 | −15,00 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 47 320 | 18,78 | 2 652 | 0,84 | ||||

| 2025-09-02 | NP | EIPIX - EIP Growth and Income Fund Class I | 13 465 | 8,02 | 777 | 6,01 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 21 729 | −10,25 | 1 218 | −23,84 | ||||

| 2025-07-17 | 13F | Vermillion Wealth Management, Inc. | 545 | 0,37 | 31 | −14,29 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 16 331 | 0,50 | 1 | −100,00 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 133 504 | 10,89 | 7 483 | −5,89 | ||||

| 2025-07-23 | NP | EIPI - FT Energy Income Partners Enhanced Income ETF | 157 472 | −1,27 | 9 034 | −16,34 | ||||

| 2025-07-14 | 13F | U.S. Capital Wealth Advisors, LLC | 18 283 | 0,07 | 1 025 | −15,09 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 504 | 0,00 | 28 | −17,65 | ||||

| 2025-07-07 | 13F | Fractal Investments LLC | 194 126 | 0,00 | 10 881 | −15,13 | ||||

| 2025-08-13 | 13F | M&t Bank Corp | 12 050 | 0,00 | 675 | −15,09 | ||||

| 2025-07-30 | NP | MLPA - Global X MLP ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 189 956 | −8,06 | 125 638 | −22,10 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 3 316 | 165 700,00 | 186 | |||||

| 2025-08-04 | 13F | Linscomb & Williams, Inc. | 25 000 | 0,00 | 1 401 | −15,14 | ||||

| 2025-08-12 | 13F | Mediolanum International Funds Ltd | 31 037 | 67,67 | 7 449 | 77,88 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 9 206 | 1 | ||||||

| 2025-08-13 | 13F | Cerity Partners LLC | 21 050 | 0,12 | 1 180 | −15,06 | ||||

| 2025-08-11 | 13F | Empowered Funds, LLC | 50 420 | −38,89 | 2 826 | −48,14 | ||||

| 2025-08-12 | 13F | Horizon Kinetics Asset Management Llc | 4 000 | 0,00 | 224 | −15,15 | ||||

| 2025-08-08 | 13F | MTM Investment Management, LLC | 1 700 | 95 | ||||||

| 2025-08-14 | 13F | Hrt Financial Lp | 88 139 | 1 689,26 | 5 | |||||

| 2025-06-27 | NP | Calamos Global Dynamic Income Fund | 885 | 0,00 | 52 | −3,70 | ||||

| 2025-08-13 | 13F | McGowan Group Asset Management, Inc. | 240 016 | 0,63 | 13 453 | −14,59 | ||||

| 2025-07-10 | 13F | Kozak & Associates, Inc. | 639 | 0,47 | 35 | −5,41 | ||||

| 2025-07-29 | 13F | Spirit Of America Management Corp/ny | 2 993 | 0,00 | 168 | −15,23 | ||||

| 2025-08-08 | 13F | Creative Planning | 5 326 | 18,36 | 299 | 0,34 | ||||

| 2025-08-07 | 13F | Searle & Co. | 6 000 | 0,00 | 336 | −15,15 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-29 | NP | ECML - Euclidean Fundamental Value ETF | 41 575 | −7,38 | 2 330 | −21,39 | ||||

| 2025-07-30 | NP | AMLP - ALERIAN MLP ETF | 9 169 813 | 7,84 | 526 072 | −8,63 | ||||

| 2025-07-10 | 13F | Chickasaw Capital Management Llc | 14 894 | 1 | ||||||

| 2025-08-11 | 13F | Citigroup Inc | 421 | −98,00 | 24 | −98,34 | ||||

| 2025-08-18 | 13F | Castleark Management Llc | 8 404 | −37,49 | 471 | −46,90 | ||||

| 2025-08-01 | 13F | Oak Grove Capital LLC | 8 400 | −3,45 | 471 | −18,12 | ||||

| 2025-05-08 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 4 500 | 0,00 | 252 | −15,15 | ||||

| 2025-06-27 | NP | Calamos Convertible Opportunities & Income Fund | 4 000 | 0,00 | 235 | −4,08 | ||||

| 2025-08-13 | 13F | Fisher Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Calamos Advisors LLC | 16 365 | 0,00 | 917 | −15,09 | ||||

| 2025-07-30 | NP | BFOR - Barron's 400 ETF | 5 662 | −23,63 | 325 | −35,46 | ||||

| 2025-07-30 | 13F | Evermay Wealth Management Llc | 485 | 0,00 | 27 | −15,62 | ||||

| 2025-08-14 | 13F | Aster Capital Management (DIFC) Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Gryphon Financial Partners LLC | 14 948 | 0,00 | 838 | −15,20 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 11 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 46 885 | −29,36 | 2 628 | −40,06 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 1 612 | 1 339,29 | 90 | 1 185,71 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 22 409 | −8,98 | 1 257 | −22,76 | ||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | ALBAX - Alger Growth & Income Fund Class A | 46 569 | 4,71 | 2 737 | 0,33 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 69 | 76,92 | 4 | 50,00 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 2 325 | −7,92 | 130 | −21,69 | ||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 4 058 | 24,67 | 227 | 6,07 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-06-25 | NP | AMZA - InfraCap MLP ETF | 219 395 | −45,48 | 12 896 | −47,77 | ||||

| 2025-08-14 | 13F | UBS Group AG | 562 313 | 9,70 | 31 518 | −6,90 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-06-20 | NP | RVRB - Reverb ETF | 39 | 0,00 | 2 | 0,00 | ||||

| 2025-08-26 | NP | FIRST TRUST VARIABLE INSURANCE TRUST - First Trust Multi Income Allocation Portfolio Class I This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 746 | 12,01 | 42 | −4,65 | ||||

| 2025-05-15 | 13F | Nomura Holdings Inc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-06-27 | NP | Calamos Convertible & High Income Fund | 4 350 | 0,00 | 256 | −4,14 | ||||

| 2025-07-18 | 13F | PFG Investments, LLC | 15 165 | −21,72 | 850 | −33,54 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 9 480 | 0,00 | 531 | −15,18 | ||||

| 2025-05-12 | 13F | Invesco Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 9 004 | 0,33 | 505 | −14,86 | ||||

| 2025-07-28 | 13F | Granite Group Advisors, LLC | 4 928 | 0,00 | 276 | −15,08 | ||||

| 2025-08-14 | 13F | Harmony Asset Management Llc | 8 700 | 0,00 | 488 | −15,16 | ||||

| 2025-04-28 | 13F | First Horizon Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Fmr Llc | 13 610 | 18,25 | 763 | 0,26 | ||||

| 2025-08-05 | 13F | American Institute for Advanced Investment Management, LLP | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Spire Wealth Management | 5 978 | −6,04 | 335 | −20,24 | ||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 12 219 | −1,17 | 1 | |||||

| 2025-07-30 | NP | MLPX - Global X MLP & Energy Infrastructure ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 550 704 | −12,19 | 31 594 | −25,60 | ||||

| 2025-04-21 | 13F | Ronald Blue Trust, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-04-08 | 13F | Parallel Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-12 | 13F | Quantinno Capital Management LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 6 527 | 0,00 | 366 | −15,31 | ||||

| 2025-06-25 | NP | VRAI - Virtus Real Asset Income ETF | 2 516 | −11,38 | 148 | −15,52 | ||||

| 2025-07-21 | 13F | Wallington Asset Management, LLC | 4 166 | 0,00 | 234 | −15,27 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 2 900 | 2 800,00 | 163 | 2 600,00 | |||

| 2025-08-14 | 13F | Group One Trading, L.p. | 1 684 | 20,11 | 94 | 2,17 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 3 700 | 1 750,00 | 207 | 1 492,31 | |||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 5 479 | 0,50 | 307 | −14,72 | ||||

| 2025-08-12 | 13F | Clearbridge Investments, LLC | 493 091 | −3,18 | 27 638 | −17,83 | ||||

| 2025-07-30 | NP | SOAEX - Spirit of America Energy Fund Class A | 1 380 | 0,00 | 79 | −15,05 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 18 800 | −27,97 | 1 054 | −38,89 | |||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 25 695 | 22,74 | 1 440 | 4,20 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 5 286 | −5,32 | 296 | −19,57 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 21 269 | 114,51 | 1 192 | 82,26 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 15 526 | 6,06 | 870 | −9,94 | ||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 40 993 | −16,06 | 2 707 | 4,36 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 4 635 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 9 500 | −76,77 | 532 | −80,30 | |||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | ABLOX - Alger Balanced Portfolio Class I-2 | 3 246 | 0,00 | 182 | −15,42 | ||||

| 2025-08-12 | 13F | Longfellow Investment Management Co Llc | 131 752 | 0,00 | 7 385 | −15,13 | ||||

| 2025-08-13 | 13F | Everstar Asset Management, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 476 | 180,00 | 27 | 136,36 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 70 | 0,00 | 4 | −25,00 | ||||

| 2025-04-29 | NP | OSPPX - Invesco Oppenheimer SteelPath MLP Alpha Plus Fund Class R6 | 43 907 | −43,83 | 2 973 | −34,72 | ||||

| 2025-04-29 | NP | SPMHX - Invesco Oppenheimer SteelPath MLP Alpha Fund Class R5 | 103 955 | −46,02 | 7 039 | −37,26 | ||||

| 2025-04-30 | 13F | Sofos Investments, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-29 | NP | SOAAX - Spirit Of America Real Estate Income And Growth Fund Class A | 1 613 | 0,00 | 90 | −15,09 | ||||

| 2025-08-05 | 13F | Sigma Planning Corp | 4 069 | −12,51 | 228 | −25,73 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 1 325 | −36,90 | 0 | |||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 417 | 1,46 | 23 | −14,81 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 62 786 | 253,29 | 3 519 | 200,00 | ||||

| 2025-04-29 | 13F | Hm Payson & Co | 1 000 | 0,00 | 66 | 24,53 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 5 500 | 308 | |||||

| 2025-07-14 | 13F | Toth Financial Advisory Corp | 835 | 0,00 | 47 | −16,36 | ||||

| 2025-08-13 | 13F | Quest Investment Management Llc | 5 789 | 324 | ||||||

| 2025-08-14 | 13F | DRW Securities, LLC | 9 630 | 541 | ||||||

| 2025-07-14 | 13F | Ridgewood Investments LLC | 729 | 0,00 | 41 | −16,67 | ||||

| 2025-08-15 | 13F | Brookfield Asset Management Inc. | 101 620 376 | 0,00 | 5 695 822 | −15,13 | ||||

| 2025-05-23 | 13F | SWAN Capital LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 10 700 | −2,73 | 600 | −17,49 | |||

| 2025-06-25 | NP | ECLN - First Trust EIP Carbon Impact ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 8 473 | 0,00 | 498 | −4,05 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 5 561 | 41,14 | 312 | 19,62 | ||||

| 2025-07-30 | 13F | Whittier Trust Co | 350 | 0,00 | 20 | −17,39 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 2 200 | −45,00 | 0 | ||||

| 2025-08-13 | 13F | Van Hulzen Asset Management, LLC | 12 418 | 0,00 | 696 | −15,12 | ||||

| 2025-08-14 | 13F | Fayez Sarofim & Co | 6 829 | 0,00 | 383 | −15,11 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 1 000 | 0,00 | 56 | −15,15 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 565 | 0 | ||||||

| 2025-07-28 | 13F | Davidson Trust Co | 4 000 | 0,00 | 224 | −15,15 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 1 100 | −69,44 | 0 | ||||

| 2025-08-08 | 13F | Smithfield Trust Co | 1 323 | 0,00 | 0 | |||||

| 2025-04-23 | 13F | Mascagni Wealth Management, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 30 771 | 6,79 | 1 725 | −9,36 | ||||

| 2025-08-28 | NP | Amplify ETF Trust - Amplify Natural Resources Dividend Income ETF | 1 573 | −58,00 | 88 | −64,37 | ||||

| 2025-06-27 | NP | Calamos Strategic Total Return Fund | 5 050 | 0,00 | 297 | −4,21 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 2 061 | 0,00 | 109 | −19,85 | ||||

| 2025-07-17 | 13F | Wolff Wiese Magana Llc | 250 | 0,00 | 14 | −12,50 | ||||

| 2025-07-17 | 13F | Beacon Capital Management, LLC | 104 | 1,96 | 6 | −16,67 | ||||

| 2025-08-12 | 13F | Cornerstone Wealth Management, LLC | 5 859 | 0,00 | 328 | −15,03 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 1 726 | 0,00 | 97 | −15,04 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 1 205 | 0,00 | 68 | −15,19 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 19 231 | −15,17 | 1 | 0,00 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 19 487 | 0,00 | 1 092 | −15,09 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 609 034 | −7,56 | 34 | −20,93 | ||||

| 2025-08-21 | NP | EINC - VanEck Vectors Energy Income ETF | 12 219 | 14,55 | 685 | −2,84 | ||||

| 2025-07-11 | 13F | Miller Howard Investments Inc /ny | 104 438 | 0,27 | 5 854 | −14,90 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 3 907 | 0 | ||||||

| 2025-08-14 | 13F | Fairview Capital Investment Management, Llc | 264 140 | −32,58 | 14 805 | −42,77 | ||||

| 2025-07-22 | 13F | Chung Wu Investment Group, LLC | 1 000 | 56 | ||||||

| 2025-07-21 | NP | GLPAX - Goldman Sachs MLP Energy Infrastructure Fund Class A Shares | 697 696 | −9,38 | 40 027 | −23,22 | ||||

| 2025-06-25 | NP | FTLS - First Trust Long/Short Equity ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 11 458 | −74,41 | 674 | −67,04 | ||||

| 2025-08-18 | 13F/A | Westwood Holdings Group Inc | 11 245 | 0,00 | 630 | −15,09 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 1 307 | 47,35 | 73 | 28,57 | ||||

| 2025-06-26 | NP | HMSFX - Hennessy BP Midstream Fund Investor Class | 10 790 | 1,79 | 634 | −2,46 |