Grundläggande statistik

| Institutionella ägare | 309 total, 308 long only, 0 short only, 1 long/short - change of 2,64% MRQ |

| Genomsnittlig portföljallokering | 0.5489 % - change of −12,72% MRQ |

| Institutionella aktier (lång) | 95 864 273 (ex 13D/G) - change of 10,42MM shares 12,20% MRQ |

| Institutionellt värde (lång) | $ 2 246 647 USD ($1000) |

Institutionellt ägande och aktieägare

VanEck ETF Trust - VanEck J.P. Morgan EM Local Currency Bond ETF (US:EMLC) har 309 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 95,864,273 aktier. Största aktieägare inkluderar Charles Schwab Investment Management Inc, Sei Investments Co, Proficio Capital Partners LLC, Neuberger Berman Group LLC, Valmark Advisers, Inc., Asset Management One Co., Ltd., D. E. Shaw & Co., Inc., Varma Mutual Pension Insurance Co, UBS Group AG, and IMC-Chicago, LLC .

VanEck ETF Trust - VanEck J.P. Morgan EM Local Currency Bond ETF (ARCA:EMLC) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 12, 2025 is 25,50 / share. Previously, on September 16, 2024, the share price was 25,09 / share. This represents an increase of 1,63% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

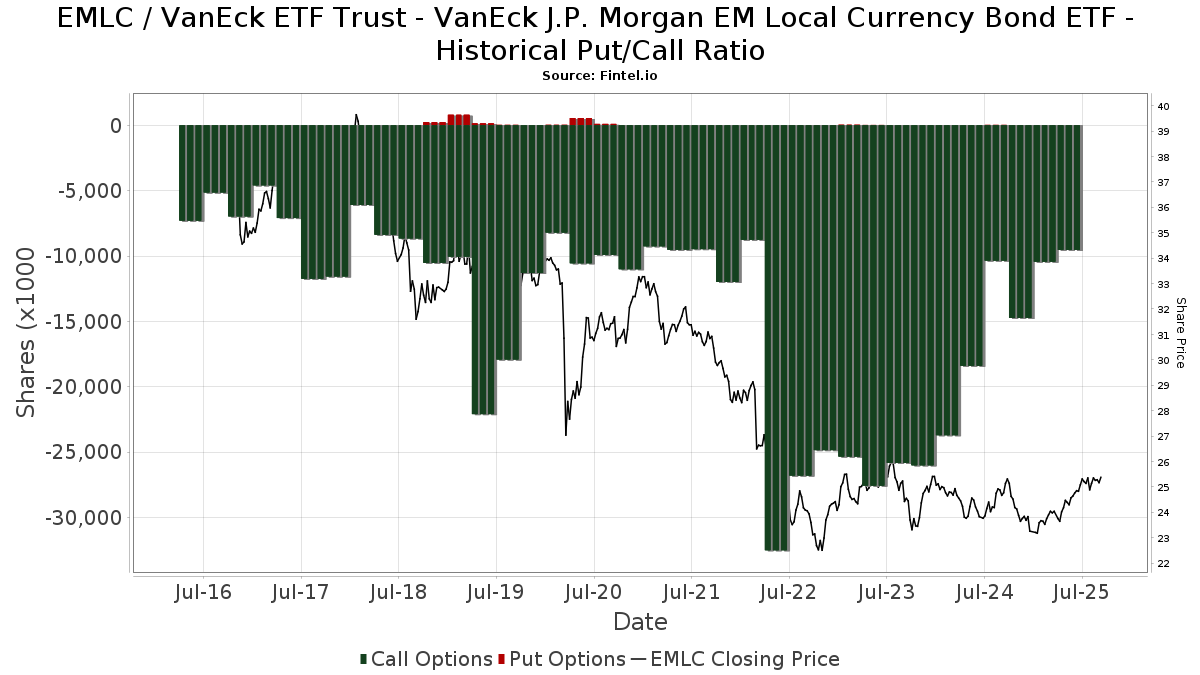

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-07 | 13F | Allworth Financial LP | 44 342 | −34,47 | 1 124 | −31,75 | ||||

| 2025-08-14 | 13F | Hancock Whitney Corp | 109 141 | 320,68 | 2 767 | 346,85 | ||||

| 2025-07-24 | 13F | Comprehensive Money Management Services LLC | 27 670 | 0,02 | 701 | 6,21 | ||||

| 2025-08-04 | 13F | Center for Financial Planning, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-29 | NP | WAVLX - Wavelength Interest Rate Neutral Fund | 193 041 | 36,97 | 4 764 | 42,89 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 5 513 | 0,00 | 140 | 6,11 | ||||

| 2025-08-14 | 13F | Betterment LLC | 58 285 | 54,49 | 1 | |||||

| 2025-05-02 | 13F | United Community Bank | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 13 777 | 6,20 | 347 | 12,34 | ||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 307 250 | 0,00 | 7 789 | 6,25 | ||||

| 2025-08-26 | NP | BlackRock Strategic Global Bond Fund, Inc. - BlackRock Strategic Global Bond Fund, Inc. Investor A This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 21 689 | −50,00 | 550 | −46,91 | ||||

| 2025-08-15 | 13F | Binnacle Investments Inc | 51 778 | 4,24 | 1 313 | 10,72 | ||||

| 2025-08-04 | 13F | Migdal Insurance & Financial Holdings Ltd. | 1 600 | 0 | ||||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 178 980 | −43,26 | 4 537 | −39,72 | ||||

| 2025-07-29 | 13F | Angeles Wealth Management, Llc | 535 | 14 | ||||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 768 | 70,67 | 19 | 90,00 | ||||

| 2025-07-22 | 13F | Checchi Capital Advisers, LLC | 750 070 | −9,35 | 19 014 | −3,68 | ||||

| 2025-07-18 | 13F | Tanager Wealth Management LLP | 19 386 | −36,56 | 491 | −32,65 | ||||

| 2025-08-07 | 13F | Howard Bailey Securities, Llc | 11 984 | −7,52 | 304 | −1,94 | ||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Covestor Ltd | 376 | 0 | ||||||

| 2025-07-16 | 13F | ORG Partners LLC | 1 259 | 300,96 | 32 | 342,86 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 65 299 | −8,68 | 1 655 | −2,99 | ||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 1 036 274 | 2,67 | 26 270 | 9,08 | ||||

| 2025-08-11 | 13F | Brown Wealth Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Garda Capital Partners Lp | Call | 191 300 | 5,52 | 42 689 | 11,35 | |||

| 2025-08-08 | 13F | Collaborative Wealth Managment Inc. | 186 000 | 1,31 | 4 715 | 7,65 | ||||

| 2025-07-15 | 13F | Main Street Group, LTD | 289 | 0,00 | 7 | 16,67 | ||||

| 2025-08-14 | 13F | Capitolis Liquid Global Markets LLC | 298 800 | −68,80 | 7 575 | −66,85 | ||||

| 2025-08-15 | 13F | Fidelity D & D Bancorp Inc | 92 724 | 2,00 | 2 351 | 8,39 | ||||

| 2025-08-14 | 13F | Maven Securities LTD | Call | 69 700 | −60,01 | 17 170 | −48,72 | |||

| 2025-06-26 | NP | BLACKROCK GLOBAL ALLOCATION FUND, INC. - BLACKROCK GLOBAL ALLOCATION FUND, INC. Investor A This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 531 633 | −50,00 | 13 009 | −48,07 | ||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 167 207 | 4 239 | ||||||

| 2025-07-24 | NP | AIHAX - Horizon Active Income Fund Advisor Class | 1 639 | 0,00 | 40 | 5,26 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 543 | 81,00 | 14 | 116,67 | ||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 2 | 0 | ||||||

| 2025-07-31 | 13F | Brinker Capital Investments, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-27 | NP | Jnl Series Trust - Jnl/blackrock Global Allocation Fund (a) | 84 652 | −50,00 | 2 146 | −46,89 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 4 | 0 | ||||||

| 2025-08-08 | 13F | Fortis Group Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Crabel Capital Management, LLC | 148 221 | 33,01 | 3 757 | 41,35 | ||||

| 2025-08-14 | 13F | Horizon Investments, LLC | 1 639 | 0,00 | 41 | 7,89 | ||||

| 2025-07-28 | 13F | Cutler Investment Counsel Llc | 319 389 | −1,24 | 8 097 | 4,92 | ||||

| 2025-08-14 | 13F | Optiver Holding B.V. | Call | 1 079 900 | 2,04 | 301 163 | 34,57 | |||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 2 630 | 0,11 | 67 | 6,45 | ||||

| 2025-08-13 | 13F | Congress Wealth Management LLC / DE / | 183 992 | 163,45 | 4 664 | 179,95 | ||||

| 2025-06-26 | NP | HFIGX - Hartford Schroders Diversified Growth Fund Class I | 260 984 | 6 386 | ||||||

| 2025-04-23 | 13F | GHP Investment Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Western Asset Management Company, LLC | 16 200 | 0,00 | 411 | 6,22 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 488 | 0,41 | 0 | |||||

| 2025-04-23 | 13F | Spire Wealth Management | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 136 | 0,00 | 3 | 0,00 | ||||

| 2025-08-28 | NP | SSIZX - Sierra Tactical Core Income Fund Class A Shares | 2 173 500 | 98,19 | 55 098 | 110,56 | ||||

| 2025-08-28 | NP | GHMS - Goose Hollow Multi-Strategy Income ETF | 41 432 | 71,86 | 1 050 | 82,61 | ||||

| 2025-06-27 | NP | TRTY - Cambria Trinity ETF | 133 836 | 0,27 | 3 275 | 4,13 | ||||

| 2025-07-11 | 13F | Pinnacle Bancorp, Inc. | 312 | 0,00 | 8 | 0,00 | ||||

| 2025-07-22 | 13F | Net Worth Advisory Group | 16 548 | 1,63 | 419 | 7,99 | ||||

| 2025-05-15 | 13F | Barclays Plc | 0 | −100,00 | 0 | |||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 157 673 | 0,34 | 3 997 | 6,62 | ||||

| 2025-08-13 | 13F | Bank Of Nova Scotia | 435 000 | 11 027 | ||||||

| 2025-08-13 | 13F | Avos Capital Management, LLC | 182 610 | 15,02 | 4 629 | 22,20 | ||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 60 371 | 18,72 | 1 530 | 26,13 | ||||

| 2025-07-16 | 13F | Signature Resources Capital Management, LLC | 616 | −13,85 | 16 | −11,76 | ||||

| 2025-08-11 | 13F | United Advisor Group, LLC | 17 546 | 445 | ||||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 935 204 | −2,24 | 24 | 4,55 | ||||

| 2025-08-11 | 13F | Annis Gardner Whiting Capital Advisors, LLC | 500 | 13 | ||||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 568 320 | 545,56 | 14 407 | 586,00 | ||||

| 2025-08-05 | 13F | Dravo Bay Llc | 9 842 | 3,50 | 249 | 10,18 | ||||

| 2025-05-08 | 13F | Jefferies Financial Group Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-28 | 13F | Td Asset Management Inc | 432 300 | −12,04 | 10 959 | −6,56 | ||||

| 2025-05-08 | 13F | NorthRock Partners, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 142 516 | −18,22 | 4 | −25,00 | ||||

| 2025-07-23 | 13F | Matisse Capital | 24 900 | 0,00 | 631 | 6,23 | ||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 46 688 | −11,03 | 1 184 | −5,51 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 4 147 381 | 7 395,18 | 105 136 | 7 864,85 | ||||

| 2025-04-25 | 13F | EnRich Financial Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | Evergreen Private Wealth LLC | 66 402 | 6,13 | 1 683 | 12,80 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 68 023 | 84,68 | 1 724 | 96,36 | ||||

| 2025-08-19 | 13F | Delos Wealth Advisors, LLC | 66 224 | −6,54 | 1 679 | −0,71 | ||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 49 | 0,00 | 1 | 0,00 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 2 091 976 | −2,86 | 26 921 | 3,25 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 127 204 | 12,17 | 3 | 50,00 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 223 898 | −90,80 | 5 676 | −90,23 | ||||

| 2025-08-06 | NP | LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP BlackRock Global Allocation Fund Standard Class | 60 974 | −50,00 | 1 546 | −46,89 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 557 401 | 23,40 | 14 125 | 31,13 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 16 696 | 423 | ||||||

| 2025-08-05 | 13F | Dunhill Financial, LLC | 265 | 7 | ||||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 33 574 | 5,14 | 851 | 11,83 | ||||

| 2025-08-13 | 13F | Leuthold Group, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 43 087 | 1 092 | ||||||

| 2025-08-12 | 13F | Adventist Health System Sunbelt Healthcare Corp | 1 366 800 | 34 648 | ||||||

| 2025-08-14 | 13F | Fiduciary Trust Co | 16 458 | 417 | ||||||

| 2025-08-27 | NP | Jnl Series Trust - Jnl/neuberger Berman Strategic Income Fund (a) | 422 681 | 10 715 | ||||||

| 2025-08-13 | 13F | 1832 Asset Management L.P. | 1 534 886 | 1,51 | 38 909 | 7,85 | ||||

| 2025-07-03 | 13F | Whitcomb & Hess, Inc. | 359 976 | 1,28 | 9 125 | 7,61 | ||||

| 2025-08-13 | 13F | Kilter Group LLC | 22 | 1 | ||||||

| 2025-04-24 | 13F | Allspring Global Investments Holdings, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 1 015 | 0,10 | 26 | 4,17 | ||||

| 2025-08-11 | 13F | Absolute Gestao de Investimentos Ltda. | 10 000 | 254 | ||||||

| 2025-07-16 | 13F | Perigon Wealth Management, LLC | 37 772 | 1,12 | 958 | 7,41 | ||||

| 2025-08-19 | 13F | Wealth Group, Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 720 703 | 3,15 | 18 270 | 9,59 | ||||

| 2025-07-17 | 13F/A | Capital Investment Advisors, LLC | 214 700 | −17,62 | 5 443 | −12,48 | ||||

| 2025-08-06 | 13F | Csenge Advisory Group | 31 554 | 7,74 | 779 | 10,20 | ||||

| 2025-05-15 | 13F | Qube Research & Technologies Ltd | 0 | −100,00 | 0 | |||||

| 2025-05-01 | 13F | Fifth Third Securities, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 78 000 | 0,00 | 1 977 | 6,23 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 141 | −93,70 | 4 | −94,34 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 79 104 | −46,35 | 2 005 | −43,01 | ||||

| 2025-07-07 | 13F | Bangor Savings Bank | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | Highline Wealth Partners Llc | 13 | 0 | ||||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 17 625 | −4,66 | 447 | 1,13 | ||||

| 2025-08-11 | 13F | Pineridge Advisors LLC | 347 | −3,34 | 9 | 0,00 | ||||

| 2025-08-14 | 13F | Penn Mutual Asset Management, LLC | 18 000 | 0,00 | 456 | 6,29 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 10 034 | −0,02 | 254 | 6,28 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 10 838 | 14,58 | 275 | 21,78 | ||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 304 | −60,52 | 8 | −61,11 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-05-02 | 13F | Signaturefd, Llc | 0 | 0 | ||||||

| 2025-05-29 | NP | SIRAX - Sierra Tactical All Asset Fund Class A | 199 700 | 4 765 | ||||||

| 2025-07-14 | 13F | Armstrong Advisory Group, Inc | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | IFG Advisory, LLC | 12 532 | −17,53 | 318 | −12,43 | ||||

| 2025-05-14 | 13F | Huntington National Bank | 0 | −100,00 | ||||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 372 950 | 1,76 | 9 454 | 8,12 | ||||

| 2025-07-22 | 13F | Olistico Wealth, LLC | 502 | 33,87 | 13 | 50,00 | ||||

| 2025-07-31 | 13F | Wright Fund Managment, LLC | 1 566 251 | 0,00 | 37 371 | 0,00 | ||||

| 2025-08-13 | 13F | Cambria Investment Management, L.P. | 236 017 | 1,89 | 5 958 | 8,80 | ||||

| 2025-07-30 | 13F | First Citizens Bank & Trust Co | 35 402 | 3,85 | 897 | 10,33 | ||||

| 2025-05-29 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 70 Fund Investor Class | 40 300 | 962 | ||||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 27 208 | −68,47 | 690 | −65,45 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 41 691 | 84,68 | 1 057 | 96,28 | ||||

| 2025-07-15 | 13F | Ballentine Partners, LLC | 21 835 | 0,00 | 554 | 6,35 | ||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 34 183 | 56 871,67 | 867 | 86 500,00 | ||||

| 2025-07-07 | 13F | Upper Left Wealth Management, LLC | 159 258 | −0,27 | 4 037 | 5,96 | ||||

| 2025-07-14 | 13F | Clear Harbor Asset Management, LLC | 16 500 | −21,71 | 418 | −16,73 | ||||

| 2025-08-14 | 13F | VPR Management LLC | 316 200 | 0,00 | 8 016 | 6,24 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | BlackRock, Inc. | 1 716 570 | −50,00 | 43 515 | −46,88 | ||||

| 2025-08-14 | 13F | Cibc World Markets Corp | Call | 50 000 | 2 603 | |||||

| 2025-08-13 | 13F | Invesco Ltd. | 11 105 | −6,18 | 282 | −0,35 | ||||

| 2025-07-10 | 13F | Focus Financial Network, Inc. | 43 051 | 1 091 | ||||||

| 2025-08-06 | 13F | Pekin Hardy Strauss, Inc. | 314 448 | 6,75 | 7 971 | 13,42 | ||||

| 2025-07-22 | 13F | Marks Group Wealth Management, Inc | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 200 | 5 | ||||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 337 | 0,90 | 9 | 14,29 | ||||

| 2025-08-01 | 13F | Rossby Financial, LCC | 23 012 | −15,43 | 583 | −12,07 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 1 745 804 | 7,49 | 44 256 | 14,21 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | Call | 30 000 | 0,00 | 1 | ||||

| 2025-08-12 | 13F | Calton & Associates, Inc. | 8 597 | −45,46 | 218 | −42,29 | ||||

| 2025-08-14 | 13F | Financial Network Wealth Advisors LLC | 124 | 0,00 | 3 | 50,00 | ||||

| 2025-08-14 | 13F | Principia Wealth Advisory, LLC | Call | 3 000 | −40,00 | 156 | −30,36 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 0 | −100,00 | 0 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 219 299 | 107,35 | 5 559 | 120,33 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 92 | 0,00 | 2 | 0,00 | ||||

| 2025-08-04 | 13F | Quaker Wealth Management, LLC | Put | 0 | −100,00 | 0 | ||||

| 2025-08-11 | 13F | Elequin Capital Lp | 1 202 | 30 | ||||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 73 285 | 1 857 | ||||||

| 2025-07-25 | 13F | Almanack Investment Partners, LLC. | 185 637 | 4 706 | ||||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 80 271 | −3,77 | 2 035 | 2,21 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 62 522 | −4,50 | 1 585 | 1,41 | ||||

| 2025-08-14 | 13F | Keebeck Wealth Management, LLC | 87 630 | 0,00 | 2 221 | 6,27 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 2 | −98,78 | 0 | −100,00 | ||||

| 2025-07-23 | NP | WAARX - Western Asset Total Return Unconstrained Fund Class I | 16 200 | 0,00 | 400 | 4,18 | ||||

| 2025-08-13 | 13F | Schroder Investment Management Group | 378 621 | 35,99 | 9 598 | 44,79 | ||||

| 2025-05-14 | 13F | Family Wealth Group, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-26 | NP | Northern Lights Variable Trust - TOPS Managed Risk Balanced ETF Portfolio Class 2 shares | 61 288 | −6,67 | 1 554 | −0,83 | ||||

| 2025-07-23 | 13F | Vontobel Holding Ltd. | 28 200 | −34,72 | 715 | −30,68 | ||||

| 2025-08-08 | 13F | Creative Planning | 17 319 | −35,53 | 439 | −31,41 | ||||

| 2025-08-26 | NP | Northern Lights Variable Trust - TOPS Moderate Growth ETF Portfolio Class 1 shares | 161 954 | 1,10 | 4 106 | 7,40 | ||||

| 2025-07-28 | 13F | Axxcess Wealth Management, Llc | 7 957 | 202 | ||||||

| 2025-07-15 | 13F | Clarus Group, Inc. | 7 920 | 201 | ||||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 12 780 | −4,17 | 324 | 1,57 | ||||

| 2025-08-14 | 13F | Hilltop Holdings Inc. | 41 446 | −1,14 | 1 051 | 5,00 | ||||

| 2025-08-11 | 13F | Empowered Funds, LLC | 250 746 | −61,00 | 6 326 | −58,57 | ||||

| 2025-07-30 | 13F | Mid-American Wealth Advisory Group, Inc. | 4 | 0 | ||||||

| 2025-07-07 | 13F | Avenue 1 Advisors, LLC | 82 335 | −0,57 | 2 087 | 5,67 | ||||

| 2025-08-14 | 13F | Fmr Llc | 181 291 | 0,41 | 4 596 | 6,66 | ||||

| 2025-08-08 | 13F | Kingsview Wealth Management, LLC | 8 574 | 217 | ||||||

| 2025-08-26 | NP | Northern Lights Variable Trust - TOPS Conservative ETF Portfolio Class 1 shares | 33 182 | −1,24 | 841 | 4,99 | ||||

| 2025-05-02 | 13F | Capital A Wealth Management, LLC | 11 | −84,93 | 0 | −100,00 | ||||

| 2025-08-11 | 13F | FSA Wealth Management LLC | 500 | 13 | ||||||

| 2025-08-26 | NP | Northern Lights Variable Trust - TOPS Managed Risk Moderate Growth ETF Portfolio Class 1 shares | 71 279 | −7,91 | 1 807 | −2,17 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 1 136 179 | 1,33 | 28 802 | 7,65 | ||||

| 2025-05-06 | 13F | Kathleen S. Wright Associates Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | rebel Financial LLC | 181 204 | 4 594 | ||||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 1 | −50,00 | 0 | |||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Main Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 51 140 | 1 296 | ||||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Call | 2 547 200 | 1,30 | 403 793 | 17,42 | |||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 1 962 | −12,88 | 50 | −7,55 | ||||

| 2025-08-07 | 13F | Proficio Capital Partners LLC | 4 792 297 | 5 097 | ||||||

| 2025-08-28 | NP | BlackRock Series Fund, Inc. - BlackRock Global Allocation Portfolio This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 4 113 | −50,01 | 104 | −46,94 | ||||

| 2025-07-18 | 13F | Martel Wealth Advisors Inc | 87 230 | −2,10 | 2 211 | 4,05 | ||||

| 2025-05-07 | 13F | Spectrum Wealth Counsel, LLC | 8 | 0 | ||||||

| 2025-05-22 | 13F | Mattson Financial Services, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F/A | Avion Wealth | 709 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Mount Yale Investment Advisors, LLC | 177 | 4 | ||||||

| 2025-08-08 | 13F | Financial Gravity Companies, Inc. | 512 | 15,58 | 13 | 20,00 | ||||

| 2025-07-14 | 13F | Ridgewood Investments LLC | 8 | 0,00 | 0 | |||||

| 2025-07-21 | 13F | Ping Capital Management, Inc. | Call | 1 400 | 390 | |||||

| 2025-08-07 | 13F | Cahill Financial Advisors Inc | 17 950 | −9,51 | 455 | −3,81 | ||||

| 2025-07-30 | 13F | Bleakley Financial Group, LLC | 43 807 | 29,53 | 1 111 | 37,72 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 11 661 146 | 13,52 | 295 610 | 20,61 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 443 | −45,11 | 11 | −38,89 | ||||

| 2025-08-07 | 13F | Apeiron RIA LLC | 19 477 | −1,64 | 494 | 4,45 | ||||

| 2025-08-14 | 13F | McIlrath & Eck, LLC | 433 | −49,94 | 11 | −50,00 | ||||

| 2025-07-31 | 13F | Wealthfront Advisers Llc | 14 757 | 34,61 | 374 | 43,30 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 1 809 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 613 300 | 15 547 | ||||||

| 2025-07-30 | 13F | Exencial Wealth Advisors, Llc | 33 351 | 3,10 | 845 | 9,60 | ||||

| 2025-08-05 | 13F | ALM First Financial Advisors, LLC | 527 748 | 0,00 | 13 378 | 6,24 | ||||

| 2025-08-08 | 13F | Smithfield Trust Co | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 3 150 932 | 190,27 | 79 876 | 208,40 | ||||

| 2025-07-07 | 13F | Global Wealth Strategies & Associates | 0 | −100,00 | 0 | |||||

| 2025-07-08 | 13F | Arlington Trust Co LLC | 1 000 | 0,00 | 25 | 8,70 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1 783 095 | 20,25 | 45 201 | 27,76 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 38 149 | 247,00 | 963 | 268,58 | ||||

| 2025-08-26 | NP | Northern Lights Variable Trust - TOPS Growth ETF Portfolio Class 2 shares | 203 588 | 6,06 | 5 161 | 12,66 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 511 | −60,96 | 13 | −61,29 | ||||

| 2025-08-07 | 13F | Payden & Rygel | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Transce3nd, LLC | 1 356 | −8,69 | 34 | −2,86 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 667 | −8,25 | 17 | −5,88 | ||||

| 2025-08-07 | 13F | Readystate Asset Management Lp | 21 999 | 558 | ||||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Ocean Park High Income ETF | 21 867 | −12,50 | 554 | −7,05 | ||||

| 2025-05-08 | 13F | Plante Moran Financial Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Raleigh Capital Management Inc. | 2 184 | −9,71 | 55 | −3,51 | ||||

| 2025-05-30 | NP | ERNZ - TrueShares Active Yield ETF | 5 215 | 124 | ||||||

| 2025-07-11 | 13F | International Private Wealth Advisors LLC | 10 345 | 13,48 | 262 | 20,74 | ||||

| 2025-07-22 | 13F | Iron Horse Wealth Management, LLC | 15 | 0,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 11 343 | 32,93 | 288 | 41,38 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 238 | 27,96 | 6 | 50,00 | ||||

| 2025-08-26 | NP | Northern Lights Variable Trust - TOPS Managed Risk Growth ETF Portfolio Class 1 shares | 113 145 | −6,34 | 2 868 | −0,49 | ||||

| 2025-04-21 | 13F | Ronald Blue Trust, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 144 899 | 14,66 | 3 673 | 21,82 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 465 542 | 53,42 | 11 801 | 63,00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-07-10 | 13F | Stewardship Advisors, LLC | 21 365 | 0,42 | 542 | 6,71 | ||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 373 600 | 9 471 | ||||||

| 2025-05-12 | 13F | SOUTH STATE Corp | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 186 536 | 5,68 | 4 729 | 12,28 | ||||

| 2025-04-09 | 13F | Sanders Morris Harris Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-28 | 13F | Allianz Asset Management GmbH | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Warberg Asset Management LLC | Call | 10 000 | −52,38 | 521 | −46,11 | |||

| 2025-07-14 | 13F | Painted Porch Advisors LLC | 327 | 1,55 | 8 | 14,29 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 189 122 | 3 066,28 | 4 794 | 3 276,06 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 48 | 1 100,00 | 1 | |||||

| 2025-08-15 | 13F | Provenance Wealth Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 1 515 123 | −2,45 | 38 408 | 3,65 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 790 000 | −25,35 | 20 026 | −20,69 | ||||

| 2025-08-26 | NP | FFALX - Franklin Founding Funds Allocation Fund Class A | 773 281 | 0,00 | 19 603 | 6,24 | ||||

| 2025-08-14 | 13F | Modern Wealth Management, LLC | 23 500 | 596 | ||||||

| 2025-08-26 | NP | BlackRock Capital Allocation Trust This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 43 791 | −50,00 | 1 110 | −46,86 | ||||

| 2025-08-12 | 13F | Founders Financial Alliance, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 55 207 | −14,20 | 1 | 0,00 | ||||

| 2025-05-15 | 13F | Two Sigma Securities, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 114 017 | 4,84 | 2 885 | 11,18 | ||||

| 2025-08-14 | 13F | Hurley Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Friedenthal Financial | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Spurstone Advisory Services, LLC | 11 | 0,00 | 0 | |||||

| 2025-08-06 | 13F | Vantage Financial Partners, LLC | 9 921 | 1,56 | 251 | 7,73 | ||||

| 2025-08-11 | 13F | WPG Advisers, LLC | 6 533 | −16,44 | 166 | −11,29 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 246 675 | −0,19 | 6 253 | 6,05 | ||||

| 2025-08-06 | 13F | Sage Advisory Services, Ltd.Co. | 51 551 | −0,01 | 1 307 | 6,26 | ||||

| 2025-08-05 | 13F | Tiaa Trust, National Association | 868 662 | 171,92 | 22 021 | 188,90 | ||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 2 091 | 146,58 | 53 | 165,00 | ||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 1 050 195 | −9,58 | 26 622 | −3,94 | ||||

| 2025-07-09 | 13F | Lake Hills Wealth Management, LLC | 80 038 | 2 029 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 14 200 | 360 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 181 305 | 521,06 | 4 596 | 560,34 | ||||

| 2025-04-15 | 13F | Transform Wealth, LLC | 51 422 | −1,45 | 1 227 | 1,74 | ||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 308 | 8 | ||||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 334 677 | 25,74 | 8 484 | 33,61 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 20 512 | 1,13 | 520 | 7,45 | ||||

| 2025-05-14 | 13F | ExodusPoint Capital Management, LP | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 43 | −98,59 | 1 | −98,61 | ||||

| 2025-08-13 | 13F | Summit Financial, LLC | 62 606 | 7,28 | 1 587 | 14,01 | ||||

| 2025-08-18 | 13F | Front Row Advisors LLC | 62 | 0,00 | 2 | 0,00 | ||||

| 2025-05-27 | NP | GGBFX - Global Bond Fund Investor | 54 000 | 0,00 | 1 288 | 3,29 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 9 371 | 1,51 | 238 | 7,73 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 13 553 | −8,65 | 344 | −2,83 | ||||

| 2025-08-05 | 13F | Ellevest, Inc. | 43 496 | −10,89 | 1 103 | −5,33 | ||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 3 423 | 0,44 | 87 | 6,17 | ||||

| 2025-05-12 | 13F | Advisor Group Holdings, Inc. | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-05-09 | 13F | GeoWealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | Call | 907 500 | −26,48 | 60 854 | 7,25 | |||

| 2025-06-27 | NP | GAA - Cambria Global Asset Allocation ETF | 63 028 | 0,00 | 1 542 | 3,91 | ||||

| 2025-08-07 | 13F | Varma Mutual Pension Insurance Co | 3 100 000 | −24,39 | 78 585 | −19,67 | ||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 174 | 0 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 2 812 232 | 19,99 | 71 290 | 27,49 | ||||

| 2025-05-09 | 13F | Truffle Hound Capital, LLC | Call | 0 | −100,00 | 0 | ||||

| 2025-08-19 | 13F | Cape Investment Advisory, Inc. | 1 785 | 63,76 | 45 | 73,08 | ||||

| 2025-07-31 | 13F | Whipplewood Advisors, LLC | 745 | −97,74 | 19 | 0,00 | ||||

| 2025-07-24 | 13F | Acima Private Wealth, Llc | 277 066 | −3,28 | 7 024 | 2,77 | ||||

| 2025-08-13 | 13F | BCJ Capital Management, LLC | 8 326 | 211 | ||||||

| 2025-07-30 | 13F | Evermay Wealth Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 84 190 | 13,66 | 2 134 | 20,77 | ||||

| 2025-08-07 | 13F | Marathon Trading Investment Management LLC | Call | 8 000 | −88,15 | 2 231 | −36,55 | |||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 9 320 | 236 | ||||||

| 2025-05-02 | 13F | Leo Wealth, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-08-26 | NP | Northern Lights Variable Trust - TOPS Balanced ETF Portfolio Class 1 shares | 159 027 | −1,77 | 4 031 | 4,38 | ||||

| 2025-08-26 | NP | LCORX - Leuthold Core Investment Fund Retail Class | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 30 Fund Instl Class | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-29 | 13F | Balboa Wealth Partners | 16 172 | 77,77 | 410 | 88,48 | ||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 50 Fund Investor Class | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-24 | NP | PLUSX - DWS Multi-Asset Moderate Allocation Fund Class A | 6 363 | 157 | ||||||

| 2025-08-26 | NP | LCR - Leuthold Core ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-26 | NP | GLBIX - Leuthold Global Fund Institutional Class | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 60 856 | −74,98 | 1 543 | −73,43 | ||||

| 2025-08-28 | NP | BlackRock Funds V - BlackRock Strategic Income Opportunities Portfolio Investor A Shares | 890 283 | −50,00 | 22 569 | −46,88 | ||||

| 2025-05-14 | 13F | Jane Street Group, Llc | 102 401 | 263,65 | 2 443 | 275,85 | ||||

| 2025-08-01 | 13F | Solstein Capital, LLC | 5 907 | 182,09 | 150 | 204,08 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 1 372 | −87,52 | 35 | −86,97 | ||||

| 2025-08-13 | 13F | New Harbor Financial Group, LLC | 515 493 | 2,84 | 13 068 | 9,26 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 1 243 089 | 4,76 | 31 512 | 11,30 | ||||

| 2025-05-12 | 13F | Simplex Trading, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Beacon Capital Management, LLC | 45 | 0,00 | 1 | 0,00 | ||||

| 2025-08-01 | 13F | Gwn Securities Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Moore Capital Management, Lp | 900 000 | 42,95 | 22 815 | 51,88 | ||||

| 2025-07-15 | 13F | FLP Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Integrated Capital Management, Inc. | 250 962 | −0,59 | 6 362 | 5,61 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Valmark Advisers, Inc. | 4 105 985 | 2,15 | 104 087 | 8,53 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 48 855 | −0,77 | 1 239 | 5,36 | ||||

| 2025-05-28 | NP | BlackRock ESG Capital Allocation Trust This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 84 550 | 0,00 | 2 017 | 3,28 | ||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Ocean Park Diversified Income ETF | 38 375 | 48,40 | 973 | 57,54 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 679 019 | 37 249,78 | 17 213 | 39 930,23 | ||||

| 2025-04-07 | 13F | GAMMA Investing LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 384 | 2,13 | 10 | 12,50 | ||||

| 2025-03-21 | 13F | Prostatis Group LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Police & Firemen's Retirement System of New Jersey | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 74 099 | −8,86 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Toronto Dominion Bank | 600 000 | 15 210 | ||||||

| 2025-08-12 | 13F | Franklin Resources Inc | 773 281 | 0,00 | 19 603 | 6,24 | ||||

| 2025-08-13 | 13F | Capital Markets Trading UK LLP | Call | 800 100 | 6,89 | 42 | 20,59 | |||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 352 | −3,56 | 9 | 0,00 | ||||

| 2025-07-24 | NP | SPDAX - DWS Multi-Asset Conservative Allocation Fund Class A | 36 724 | 906 | ||||||

| 2025-07-18 | 13F | Truist Financial Corp | 211 515 | 1,20 | 5 362 | 7,50 | ||||

| 2025-07-18 | 13F | Bartlett & Co. Wealth Management Llc | 5 284 | −9,30 | 134 | −4,32 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 0 | −100,00 | 0 | |||||

| 2025-07-25 | NP | ABWAX - AB All Market Total Return Portfolio Class A | 220 470 | 2 279,34 | 5 441 | 1 960,98 | ||||

| 2025-08-14 | 13F | Navigoe, LLC | 61 | 0 | ||||||

| 2025-07-08 | 13F | Webster Bank, N. A. | 3 393 | 0,00 | 86 | 7,50 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 134 469 | 71,65 | 3 409 | 82,34 | ||||

| 2025-08-14 | 13F | Sei Investments Co | 8 566 916 | 2,66 | 217 174 | 9,07 | ||||

| 2025-07-30 | 13F | Fairway Wealth LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Manning & Napier Advisors Llc | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Compass Capital Corp /ma/ /adv | 8 787 | 0,08 | 221 | 4,25 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 10 978 | 278 | ||||||

| 2025-08-08 | 13F | NAN FUNG TRINITY (HK) Ltd | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Asset Management One Co., Ltd. | 3 475 495 | 1,84 | 88 104 | 8,20 | ||||

| 2025-08-12 | 13F | Coston, McIsaac & Partners | 0 | −100,00 | 0 | |||||

| 2025-04-30 | 13F | Sofos Investments, Inc. | 512 | 12 | ||||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 9 509 | −3,93 | 241 | 2,12 | ||||

| 2025-07-16 | 13F | Diversified Enterprises, LLC | 16 122 | −4,89 | 409 | 0,99 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 7 813 | 4,47 | 198 | 11,24 | ||||

| 2025-07-18 | 13F | Viewpoint Investment Partners Corp | 1 407 300 | −17,00 | 35 675 | −11,82 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 955 | −14,27 | 24 | −7,69 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 28 247 | −4,98 | 716 | 0,99 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 1 979 300 | −12,95 | 131 032 | 11,99 | |||

| 2025-07-21 | 13F | Consilium Wealth Advisory, LLC | 9 750 | 247 | ||||||

| 2025-05-23 | 13F | SWAN Capital LLC | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Columbus Macro, LLC | 20 449 | 518 | ||||||

| 2025-08-11 | 13F | Greykasell Wealth Strategies, Inc. | 689 | 0,00 | 17 | 6,25 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Cwm, Llc | 3 667 | −21,58 | 0 | |||||

| 2025-08-29 | NP | GDMA - Gadsden Dynamic Multi-Asset ETF | 250 067 | −61,11 | 6 339 | −58,68 | ||||

| 2025-06-25 | NP | AVGAX - BNY Mellon Dynamic Total Return Fund Class A | 152 047 | −7,79 | 3 721 | −4,22 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 46 765 | 6,20 | 1 185 | 12,86 | ||||

| 2025-08-14 | 13F | Comerica Bank | 109 063 | 54,72 | 2 765 | 64,43 | ||||

| 2025-08-26 | NP | Northern Lights Variable Trust - TOPS Managed Risk Flex ETF Portfolio | 135 091 | −8,10 | 3 425 | −2,37 | ||||

| 2025-05-22 | NP | EXCPX - Unconstrained Bond Series Class S | 950 390 | 0,00 | 22 676 | 3,25 | ||||

| 2025-08-12 | 13F | TCTC Holdings, LLC | 2 214 | 56 | ||||||

| 2025-07-21 | 13F | Barrett & Company, Inc. | 15 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 15 700 | 26,61 | 398 | 34,58 | |||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 10 842 | 0,36 | 275 | 6,61 | ||||

| 2025-08-13 | 13F | CMT Capital Markets Trading GmbH | Call | 1 792 000 | −14,36 | 93 | −3,12 | |||

| 2025-07-17 | 13F | K2 Financial Inc. | 62 078 | 2,16 | 1 555 | 5,64 | ||||

| 2025-07-25 | 13F | RHS Financial, LLC | 101 021 | −7,87 | 2 561 | −2,14 | ||||

| 2025-07-21 | 13F | CenterStar Asset Management, LLC | Call | 41 200 | 140,94 | 11 490 | 217,73 | |||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 91 525 | 179,47 | 2 320 | 197,06 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 68 796 | 1 744 |