Grundläggande statistik

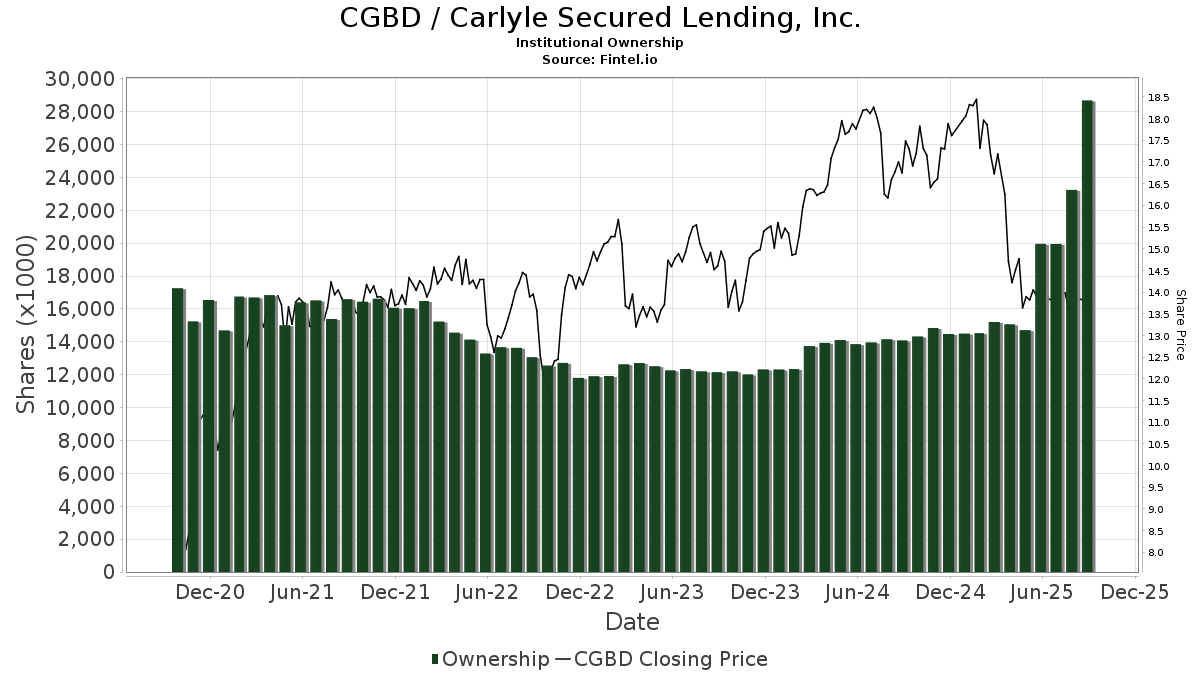

| Institutionella ägare | 167 total, 164 long only, 0 short only, 3 long/short - change of 23,70% MRQ |

| Genomsnittlig portföljallokering | 0.1421 % - change of 7,84% MRQ |

| Institutionella aktier (lång) | 28 671 717 (ex 13D/G) - change of 8,72MM shares 43,69% MRQ |

| Institutionellt värde (lång) | $ 346 216 USD ($1000) |

Institutionellt ägande och aktieägare

Carlyle Secured Lending, Inc. (US:CGBD) har 167 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 28,671,717 aktier. Största aktieägare inkluderar Creative Planning, Morgan Stanley, Prime Capital Investment Advisors, LLC, Van Eck Associates Corp, BIZD - VanEck Vectors BDC Income ETF, Rsm Us Wealth Management Llc, Lsv Asset Management, Bank Of America Corp /de/, Invesco Ltd., and KBWD - Invesco KBW High Dividend Yield Financial ETF .

Carlyle Secured Lending, Inc. (NasdaqGS:CGBD) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 11, 2025 is 13,74 / share. Previously, on September 11, 2024, the share price was 16,75 / share. This represents a decline of 17,97% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

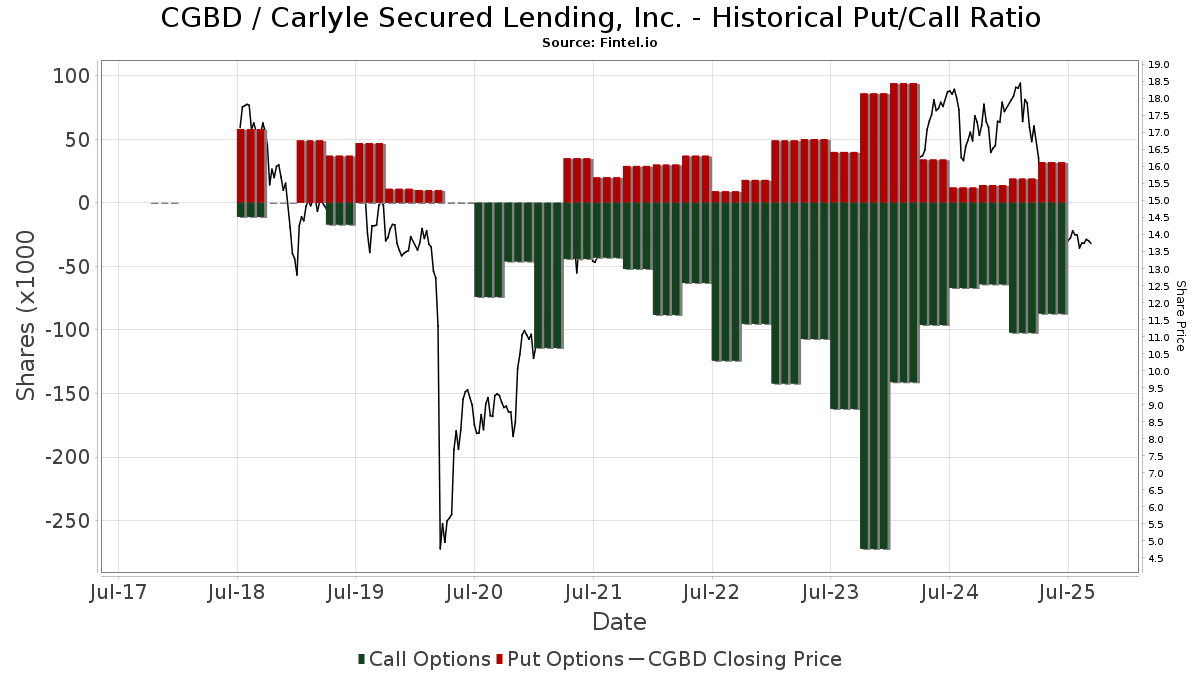

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Brevan Howard Capital Management LP | 10 592 | 145 | ||||||

| 2025-08-06 | 13F | Smh Capital Advisors Inc | 21 925 | 300 | ||||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | −100,00 | 0 | |||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 400 | 0,00 | 0 | |||||

| 2025-08-11 | 13F | United Advisor Group, LLC | 26 115 | 9,18 | 357 | −7,75 | ||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 76 065 | 2,19 | 1 041 | −13,62 | ||||

| 2025-08-11 | 13F | Heritage Wealth Advisors | 2 100 | 0,00 | 29 | −15,15 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 8 797 | −14,57 | 158 | −5,42 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 35 804 | −0,78 | 0 | |||||

| 2025-07-25 | 13F | GFS Advisors, LLC | 49 700 | 680 | ||||||

| 2025-08-13 | 13F | Cerity Partners LLC | 10 698 | 1,84 | 146 | −13,61 | ||||

| 2025-07-09 | 13F | Triumph Capital Management | 49 845 | 19,73 | 682 | 1,19 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 4 313 | 1 011,60 | 59 | 883,33 | ||||

| 2025-08-06 | 13F | Round Rock Advisors, LLC | 46 562 | 1,66 | 637 | −14,17 | ||||

| 2025-06-10 | 13F | Birchbrook, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 22 216 | −31,70 | 304 | −42,40 | ||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 219 146 | 376,09 | 2 998 | 302,82 | ||||

| 2025-05-14 | 13F | Group One Trading, L.p. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Macquarie Group Ltd | 12 900 | −80,03 | 176 | −83,16 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 15 341 | −19,89 | 214 | −34,26 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 227 | 440,48 | 3 | |||||

| 2025-08-04 | 13F | Muzinich & Co., Inc. | 352 617 | 81,09 | 4 824 | 53,11 | ||||

| 2025-07-30 | 13F | Denali Advisors Llc | 132 433 | −2,65 | 1 812 | −17,72 | ||||

| 2025-07-23 | 13F | Prime Capital Investment Advisors, LLC | 2 204 508 | 30 158 | ||||||

| 2025-08-08 | 13F | Creative Planning | 4 916 335 | 0,90 | 67 255 | −14,69 | ||||

| 2025-08-15 | 13F | WealthCollab, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Advisory Research Inc | 10 387 | 142 | ||||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 2 200 | 120,00 | 30 | 87,50 | |||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 18 700 | 46,09 | 256 | 23,19 | |||

| 2025-08-14 | 13F | Ieq Capital, Llc | 45 745 | 26,54 | 626 | 7,02 | ||||

| 2025-08-28 | NP | Cliffwater Corporate Lending Fund | 548 617 | 7 505 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 567 546 | 37,89 | 7 764 | 16,59 | ||||

| 2025-08-14 | 13F | Keebeck Wealth Management, LLC | 31 000 | 0,00 | 436 | −12,97 | ||||

| 2025-07-17 | 13F | Patton Albertson Miller Group, Llc | 25 114 | 344 | ||||||

| 2025-07-18 | 13F | Trust Co Of Vermont | 1 080 | 0,00 | 15 | −17,65 | ||||

| 2025-07-10 | 13F | Redhawk Wealth Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 1 199 | 184,80 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 7 300 | −26,26 | 0 | ||||

| 2025-07-29 | 13F | International Assets Investment Management, Llc | 18 125 | 0,00 | 248 | −15,70 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 6 000 | 25,00 | 0 | ||||

| 2025-08-28 | NP | TRIFX - Catalyst/SMH Total Return Income Fund Class A | 7 087 | 97 | ||||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 190 921 | 2,48 | 2 612 | −13,37 | ||||

| 2025-05-02 | 13F | BluePointe Capital Management, LLC | 61 517 | 4,86 | 1 024 | −5,01 | ||||

| 2025-07-28 | 13F | Naviter Wealth, LLC | 90 991 | 1 277 | ||||||

| 2025-07-14 | 13F | Gries Financial Llc | 197 240 | 0,00 | 2 698 | −15,45 | ||||

| 2025-08-11 | 13F | FineMark National Bank & Trust | 40 381 | −2,99 | 552 | −17,98 | ||||

| 2025-04-22 | 13F | Bright Futures Wealth Management, LLC. | 57 064 | −6,92 | 805 | −28,28 | ||||

| 2025-08-13 | 13F | Mackenzie Financial Corp | 25 898 | 3,22 | 354 | −12,59 | ||||

| 2025-07-11 | 13F | Kingstone Capital Partners Texas, LLC | 410 472 | 6 | ||||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 12 424 | 3 608,66 | 170 | 3 280,00 | ||||

| 2025-08-13 | 13F | PharVision Advisers, LLC | 14 041 | 192 | ||||||

| 2025-08-14 | 13F | GWM Advisors LLC | 161 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 11 100 | −4,84 | 152 | −19,68 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 10 664 | 146 | ||||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 63 217 | 21,59 | 865 | 2,73 | ||||

| 2025-05-15 | 13F | Talon Private Wealth, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 11 | 0,00 | 0 | |||||

| 2025-08-11 | 13F | Lsv Asset Management | 860 563 | −31,49 | 12 | −45,00 | ||||

| 2025-08-14 | 13F | BI Asset Management Fondsmaeglerselskab A/S | 219 176 | 9 270,50 | 3 | |||||

| 2025-08-12 | 13F | Virtu Financial LLC | 33 023 | 74,11 | 0 | |||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 50 000 | 0,00 | 684 | −15,45 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 22 529 | 308 | ||||||

| 2025-08-13 | 13F | Jump Financial, LLC | 13 100 | 179 | ||||||

| 2025-08-13 | 13F | Fisher Asset Management, LLC | 22 461 | 0,89 | 307 | −14,72 | ||||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 32 410 | 0,00 | 443 | −15,46 | ||||

| 2025-08-05 | 13F | Dunhill Financial, LLC | 498 | 0,00 | 7 | −25,00 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 67 124 | 15,34 | 918 | −2,44 | ||||

| 2025-04-29 | 13F | Raleigh Capital Management Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 34 407 | 33,84 | 471 | 13,25 | ||||

| 2025-08-12 | 13F | Putnam Fl Investment Management Co | 34 483 | 472 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 266 213 | −3,41 | 3 642 | −18,34 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 716 | 0,00 | 10 | −18,18 | ||||

| 2025-05-30 | NP | SMVIX - Simt Small Cap Value Fund Class I | 17 503 | −8,56 | 283 | −17,49 | ||||

| 2025-08-27 | NP | OASVX - Optimum Small-mid Cap Value Fund Class A | 13 100 | −79,72 | 179 | −82,87 | ||||

| 2025-08-14 | 13F | MGB Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 1 785 996 | 48,36 | 24 | 26,32 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 750 | 10 | ||||||

| 2025-08-13 | 13F | Cliffwater LLC | 548 617 | 7 505 | ||||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Summit Trail Advisors, Llc | 146 027 | 2 056 | ||||||

| 2025-08-14 | 13F | Mariner, LLC | 543 376 | 7 433 | ||||||

| 2025-07-23 | 13F | Hager Investment Management Services, Llc | 236 263 | 4,46 | 3 232 | −11,67 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 177 462 | −3,63 | 2 428 | −18,53 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 30 820 | −32,36 | 422 | −42,88 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 6 836 | 0,50 | 0 | |||||

| 2025-08-14 | 13F | Rivernorth Capital Management, Llc | 357 013 | 4 884 | ||||||

| 2025-05-12 | 13F | Eagle Global Advisors Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Northern Trust Corp | 19 401 | 265 | ||||||

| 2025-08-15 | 13F | Caxton Associates Llp | 29 445 | 0,00 | 403 | −15,55 | ||||

| 2025-07-28 | NP | KBWD - Invesco KBW High Dividend Yield Financial ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 615 591 | −1,86 | 8 649 | −22,40 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 577 | −92,10 | 8 | −94,07 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-04-02 | 13F | Marcum Wealth, LLC | 11 314 | 0,00 | 183 | −9,41 | ||||

| 2025-07-23 | 13F | Eagle Strategies LLC | 14 863 | 203 | ||||||

| 2025-08-12 | 13F | LPL Financial LLC | 90 409 | 9,64 | 1 237 | −7,35 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 12 650 | 173 | ||||||

| 2025-08-12 | 13F | Aigen Investment Management, Lp | 14 436 | 197 | ||||||

| 2025-03-28 | NP | DVDN - Kingsbarn Dividend Opportunity ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-14 | 13F | Toth Financial Advisory Corp | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 34 053 | −0,69 | 466 | −16,06 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 1 050 | 14 | ||||||

| 2025-08-08 | 13F | Condor Capital Management | 175 506 | −36,27 | 2 401 | −46,14 | ||||

| 2025-06-26 | NP | LSVQX - LSV Small Cap Value Fund Institutional Class Shares | 95 900 | 6,20 | 1 416 | −15,46 | ||||

| 2025-06-26 | NP | LSVGX - LSV Global Value Fund Institutional Class Shares | 17 200 | 0,00 | 254 | −20,38 | ||||

| 2025-05-06 | 13F | Kovack Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-18 | 13F | Truist Financial Corp | 64 957 | 0,00 | 889 | −15,51 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 15 391 | 0,27 | 0 | |||||

| 2025-08-12 | 13F | Legal & General Group Plc | 459 870 | 38,44 | 6 291 | 17,13 | ||||

| 2025-07-29 | 13F | Novare Capital Management Llc | 194 680 | 10,64 | 2 663 | −6,43 | ||||

| 2025-08-07 | 13F | Cascade Financial Partners, LLC | 43 840 | 600 | ||||||

| 2025-07-14 | 13F | U.S. Capital Wealth Advisors, LLC | 13 850 | 34,34 | 189 | 13,86 | ||||

| 2025-07-25 | 13F | 1858 Wealth Management, Llc | 41 343 | 566 | ||||||

| 2025-08-07 | 13F | Allworth Financial LP | 2 528 | 0,00 | 35 | −5,56 | ||||

| 2025-08-14 | 13F | Oxford Asset Management Llp | 37 198 | 509 | ||||||

| 2025-08-06 | 13F | Savant Capital, LLC | 18 874 | 3,15 | 258 | −12,84 | ||||

| 2025-07-31 | 13F | Sumitomo Mitsui Trust Holdings, Inc. | 264 138 | 44,02 | 3 613 | 21,77 | ||||

| 2025-07-31 | 13F/A | Avion Wealth | 500 | 0,00 | 0 | |||||

| 2025-04-11 | 13F | Herbst Group, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 11 790 | 0,00 | 161 | −15,26 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 334 700 | −35,24 | 4 579 | −45,25 | ||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 1 458 028 | 20 529 | ||||||

| 2025-08-12 | 13F | MAI Capital Management | 20 797 | 285 | ||||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 11 163 | −57,17 | 153 | −63,90 | ||||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 116 342 | −0,25 | 1 592 | −15,69 | ||||

| 2025-08-14 | 13F | Quarry LP | 4 636 | 130,99 | 63 | 96,88 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 180 466 | 2 469 | ||||||

| 2025-08-04 | 13F | Canton Hathaway, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | MQS Management LLC | 38 917 | 532 | ||||||

| 2025-07-02 | 13F | Doliver Advisors, Lp | 122 581 | 1 677 | ||||||

| 2025-08-12 | 13F | BlackRock, Inc. | 264 185 | 33,88 | 3 614 | 13,22 | ||||

| 2025-06-27 | NP | LBO - WHITEWOLF Publicly Listed Private Equity ETF | 5 481 | 14,26 | 81 | −10,11 | ||||

| 2025-07-23 | 13F | PARK CIRCLE Co | 71 225 | 0,00 | 974 | −15,45 | ||||

| 2025-08-12 | 13F | Magnetar Financial LLC | 34 727 | 475 | ||||||

| 2025-08-11 | 13F | Greenland Capital Management LP | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 17 890 | 245 | ||||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 52 234 | 735 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 10 700 | −75,40 | 146 | −79,23 | |||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-05-15 | 13F | Parvin Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 50 389 | 689 | ||||||

| 2025-07-29 | 13F | Arista Wealth Management, LLC | 17 573 | 240 | ||||||

| 2025-07-15 | 13F | Clarus Group, Inc. | 21 291 | 0,00 | 291 | −15,41 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 32 590 | 36,46 | 446 | 15,28 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 70 945 | 0,77 | 971 | −14,84 | ||||

| 2025-07-29 | 13F | Activest Wealth Management | 8 125 | −40,80 | 111 | −50,00 | ||||

| 2025-08-11 | 13F | EMC Capital Management | 6 521 | −49,92 | 0 | |||||

| 2025-07-21 | 13F | Catalina Capital Group, LLC | 19 239 | 263 | ||||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 152 607 | 376,17 | 2 088 | 302,90 | ||||

| 2025-08-12 | 13F | Trexquant Investment LP | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Transcend Wealth Collective, Llc | 25 015 | 342 | ||||||

| 2025-08-12 | 13F | YANKCOM Partnership | 64 | 0,00 | 1 | −100,00 | ||||

| 2025-04-17 | 13F | Grimes & Company, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 242 989 | −29,73 | 3 324 | −40,59 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 779 586 | 18,50 | 10 665 | 0,19 | ||||

| 2025-08-21 | NP | BIZD - VanEck Vectors BDC Income ETF | 1 651 647 | 47,15 | 22 595 | 24,42 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 32 249 | 71,99 | 441 | 45,54 | ||||

| 2025-08-14 | 13F | AllSquare Wealth Management LLC | 1 400 | 0,00 | 19 | −13,64 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 1 191 | 0,00 | 16 | −15,79 | ||||

| 2025-08-12 | 13F | Dynamic Technology Lab Private Ltd | 37 061 | 507 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 2 295 522 | −2,29 | 31 403 | −17,38 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 2 630 | 71,90 | 36 | 45,83 | ||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 32 175 | −7,62 | 521 | −16,67 | ||||

| 2025-08-29 | 13F | Total Investment Management Inc | 1 | 0 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 54 125 | −11,47 | 741 | −25,18 | ||||

| 2025-08-11 | 13F | Universal- Beteiligungs- und Servicegesellschaft mbH | 102 650 | −21,34 | 1 404 | −33,49 | ||||

| 2025-07-31 | 13F | Whipplewood Advisors, LLC | 34 802 | 476 | ||||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 34 003 | 9,31 | 0 | |||||

| 2025-08-14 | 13F | Comerica Bank | 88 367 | 0,00 | 1 209 | −15,47 | ||||

| 2025-06-25 | NP | VPC - Virtus Private Credit Strategy ETF | 47 489 | −10,15 | 701 | −28,54 | ||||

| 2025-08-28 | NP | AOG Institutional Diversified Fund | 34 483 | 472 | ||||||

| 2025-05-13 | 13F | Aptus Capital Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | RNCOX - RiverNorth Core Opportunity Fund Class R | 17 446 | 239 | ||||||

| 2025-08-13 | 13F | Truvestments Capital Llc | 487 | 0,00 | 7 | −14,29 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 81 453 | 62,60 | 1 114 | 24,05 | ||||

| 2025-07-01 | 13F | Harbor Investment Advisory, Llc | 450 | −89,31 | 6 | −91,18 | ||||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 32 175 | 440 | ||||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 795 522 | −25,08 | 10 883 | −36,66 | ||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | Rivernorth Opportunities Fund, Inc. | 126 873 | 1 736 | ||||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 68 681 | 43,17 | 940 | 21,01 | ||||

| 2025-08-15 | 13F | Great West Life Assurance Co /can/ | 45 932 | 4,65 | 1 | |||||

| 2025-08-06 | 13F | Ethos Financial Group, LLC | 174 172 | 1,34 | 2 383 | −14,32 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 167 300 | 2 289 | ||||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 223 857 | −9,86 | 3 062 | −23,79 | ||||

| 2025-08-06 | 13F | Financial Alternatives, Inc | 17 591 | 0,00 | 241 | −15,49 | ||||

| 2025-08-14 | 13F | Harwood Advisory Group, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-15 | 13F | Northeast Financial Consultants Inc | 102 219 | 139,00 | 1 398 | 102,02 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 180 | 3 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 50 800 | 98,44 | 695 | 67,63 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | 41 015 | −76,64 | 561 | −80,25 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 24 300 | 80,00 | 332 | 52,29 | |||

| 2025-08-28 | NP | RNDLX - RiverNorth/DoubleLine Strategic Income Fund Class R | 172 931 | 2 366 | ||||||

| 2025-07-18 | 13F | Chelsea Counsel Co | 340 | 0,00 | 5 | −20,00 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 67 308 | 9,07 | 921 | −7,82 | ||||

| 2025-07-31 | 13F | Catalyst Capital Advisors LLC | 7 087 | 97 | ||||||

| 2025-08-13 | 13F | SCS Capital Management LLC | 11 314 | 0,00 | 159 | −15,43 | ||||

| 2025-07-25 | 13F | Verdence Capital Advisors LLC | 40 413 | −1,35 | 553 | −16,62 |