Grundläggande statistik

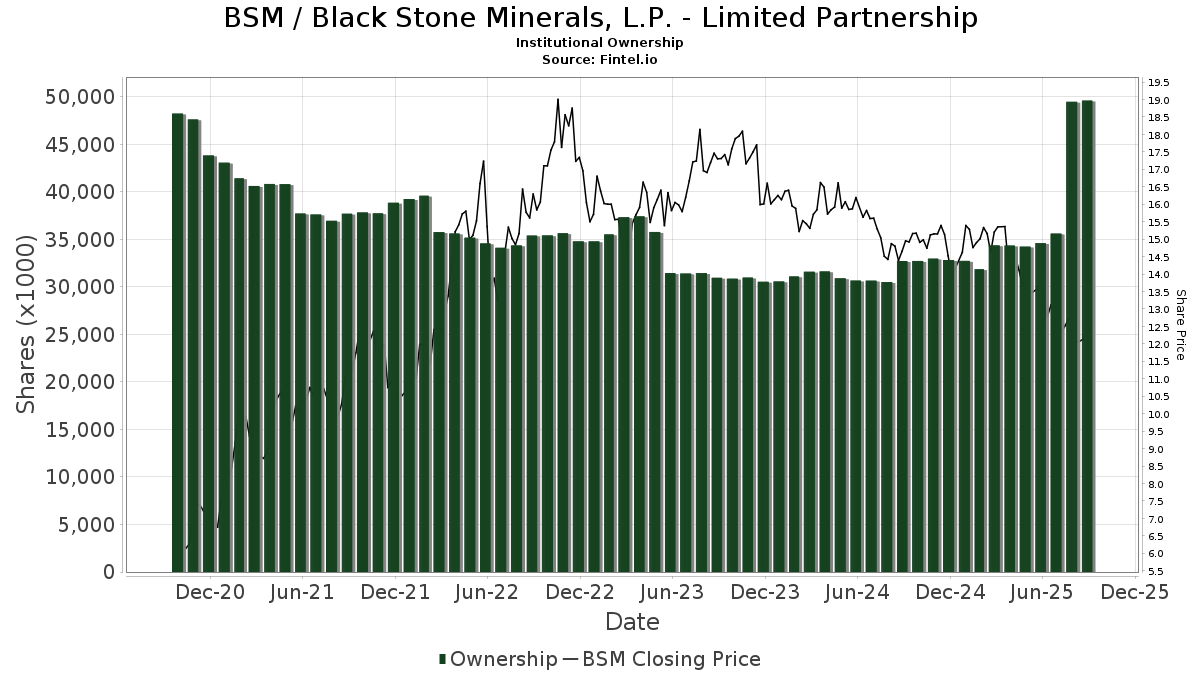

| Institutionella aktier (lång) | 49 612 875 - 23,42% (ex 13D/G) - change of 15,01MM shares 43,39% MRQ |

| Institutionellt värde (lång) | $ 467 414 USD ($1000) |

Institutionellt ägande och aktieägare

Black Stone Minerals, L.P. - Limited Partnership (US:BSM) har 211 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 49,612,875 aktier. Största aktieägare inkluderar Kingstone Capital Partners Texas, LLC, William Marsh Rice University, Morgan Stanley, Bank Of America Corp /de/, Penn Davis Mcfarland Inc, Investment Management Associates Inc /adv, Natixis, UBS Group AG, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd., and DIV - Global X SuperDividend U.S. ETF .

Black Stone Minerals, L.P. - Limited Partnership (NYSE:BSM) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 10, 2025 is 12,32 / share. Previously, on September 11, 2024, the share price was 14,65 / share. This represents a decline of 15,90% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

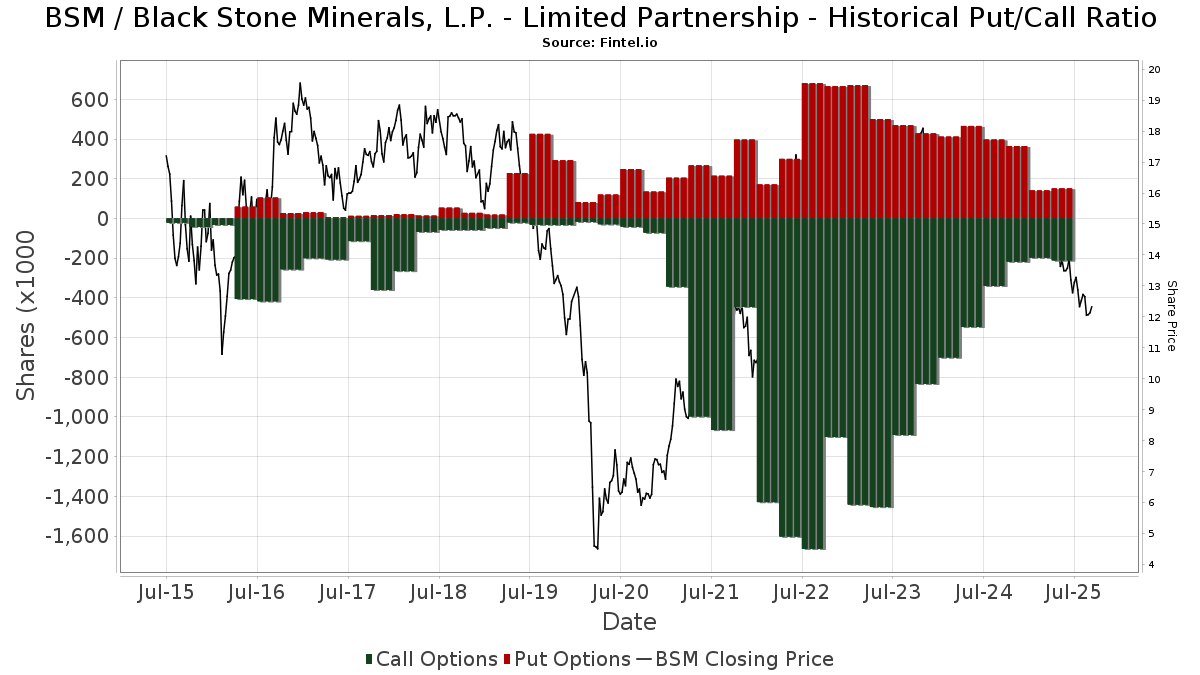

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13D/G-Arkiveringar

Vi presenterar 13D/G-arkiveringar separat från 13F-arkiveringar på grund av att de behandlas olika av SEC. 13D/G-arkiveringar kan lämnas in av grupper av investerare (med en ledare), medan 13F-arkiveringar inte kan det. Detta leder till situationer där en investerare kan lämna in en 13D/G-ansökan med ett värde för de totala aktierna (vilket motsvarar alla aktier som ägs av investerargruppen), men sedan lämna in en 13F-ansökan med ett annat värde för de totala aktierna (vilket motsvarar enbart deras eget ägande). Detta innebär att aktieägandet i 13D/G-arkiveringar och 13F-arkiveringar ofta inte är direkt jämförbara, så vi presenterar dem separat.

Notera: Från och med den 16 maj 2021 visar vi inte längre ägare som inte har lämnat in en 13D/G under det senaste året. Tidigare visade vi hela historiken för 13D/G-arkiveringar. I allmänhet måste enheter som är skyldiga att lämna in 13D/G-arkiveringar lämna in minst en gång per år innan de lämnar in en stängningsarkivering. Fonder avslutar dock ibland positioner utan att lämna in en avslutande arkivering (dvs. de avvecklar), så att visa hela historiken resulterade ibland i förvirring om det nuvarande ägandet. För att förhindra förvirring visar vi nu endast "nuvarande" ägare - det vill säga ägare som har lämnat in en ansökan under det senaste året.

Upgrade to unlock premium data.

| Fil Datum | Formulär | Investerare | Föregående aktier |

Senaste aktier |

Δ Aktier (Procent) |

Ägande (Procent) |

Δ Ägande (Procent) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-05-13 | Carlyle Group Inc. | 14,711,219 | 0 | -100.00 | 0.00 | -100.00 |

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 1 475 | 0,00 | 19 | −13,64 | ||||

| 2025-07-15 | 13F | Kempner Capital Management Inc. | 759 343 | 52,29 | 9 932 | 141 785,71 | ||||

| 2025-07-25 | 13F | Hazlett, Burt & Watson, Inc. | 14 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | Franklin Resources Inc | 67 018 | −7,38 | 877 | −20,65 | ||||

| 2025-07-16 | 13F | William Marsh Rice University | 5 663 476 | 0,00 | 74 078 | −14,34 | ||||

| 2025-08-13 | 13F | Beacon Pointe Advisors, LLC | 99 903 | 0,13 | 1 307 | −14,25 | ||||

| 2025-08-14 | 13F | Hilltop Holdings Inc. | 12 900 | 0,00 | 169 | −14,29 | ||||

| 2025-04-07 | 13F | AdvisorNet Financial, Inc | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Motco | 3 650 | 46 | ||||||

| 2025-07-14 | 13F | Clear Harbor Asset Management, LLC | 52 032 | 0,00 | 681 | −14,36 | ||||

| 2025-07-10 | 13F | Redhawk Wealth Advisors, Inc. | 10 489 | 137 | ||||||

| 2025-08-13 | 13F | Northern Trust Corp | 298 164 | −1,65 | 3 900 | −15,77 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 33 567 | −20,01 | 439 | −31,41 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Mariner, LLC | 14 057 | −71,53 | 184 | −75,73 | ||||

| 2025-08-04 | 13F | Flagship Harbor Advisors, Llc | 26 323 | 1,32 | 344 | −13,13 | ||||

| 2025-07-08 | 13F | Baker Ellis Asset Management LLC | 11 000 | −8,33 | 144 | −21,86 | ||||

| 2025-08-11 | 13F | Rahlfs Capital, Llc | 84 267 | 0,00 | 1 102 | −14,31 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 700 | 16,67 | 9 | 0,00 | ||||

| 2025-08-06 | 13F | Pekin Hardy Strauss, Inc. | 18 000 | 0,00 | 235 | −14,23 | ||||

| 2025-08-12 | 13F | Holderness Investments Co | 10 650 | 139 | ||||||

| 2025-05-12 | 13F | Virtu Financial LLC | 0 | −100,00 | 0 | |||||

| 2025-05-13 | 13F | Aptus Capital Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | Eagle Global Advisors Llc | 89 122 | 0,00 | 1 166 | −14,34 | ||||

| 2025-05-13 | 13F | Lee Financial Co | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 2 543 814 | 0,69 | 33 273 | −13,74 | ||||

| 2025-08-12 | 13F | Indie Asset Partners, LLC | 15 500 | −1,27 | 203 | −15,48 | ||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 260 190 | −1,11 | 3 403 | −15,29 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 10 281 | 135 | ||||||

| 2025-08-06 | 13F | Adviser Investments LLC | 58 873 | 0,00 | 770 | −14,25 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Sumitomo Mitsui Trust Holdings, Inc. | 68 000 | 0,00 | 889 | −14,35 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 11 509 | −23,20 | 151 | −34,21 | ||||

| 2025-07-15 | 13F | Penn Davis Mcfarland Inc | 1 851 892 | −0,53 | 24 223 | −14,80 | ||||

| 2025-06-25 | NP | VRAI - Virtus Real Asset Income ETF | 10 196 | −3,73 | 144 | −6,54 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 5 180 | 0,00 | 68 | −15,19 | ||||

| 2025-06-25 | NP | FTLS - First Trust Long/Short Equity ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 26 114 | −84,67 | 368 | −86,83 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 21 294 | −0,34 | 311 | −4,91 | ||||

| 2025-05-27 | NP | AZBAX - AllianzGI Small-Cap Fund Class A | 15 285 | 98,89 | 233 | 395,74 | ||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 12 987 | 21,29 | 170 | 3,68 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 19 775 | 10,17 | 259 | −5,84 | ||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 10 750 | 0,00 | 141 | −14,63 | ||||

| 2025-07-22 | 13F | MAS Advisors LLC | 26 176 | 4,14 | 342 | −10,70 | ||||

| 2025-08-13 | 13F | Fiduciary Group LLC | 25 120 | 18,39 | 329 | 1,55 | ||||

| 2025-08-20 | NP | LSPAX - LoCorr Spectrum Income Fund Class A | 61 024 | 0,00 | 798 | −14,29 | ||||

| 2025-06-26 | NP | GYLD - Arrow Dow Jones Global Yield ETF | 8 868 | −5,55 | 125 | −7,41 | ||||

| 2025-08-11 | 13F | Annis Gardner Whiting Capital Advisors, LLC | 500 | 0,00 | 7 | −14,29 | ||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 22 598 | 5,14 | 296 | −10,06 | ||||

| 2025-08-20 | NP | CONWX - Concorde Wealth Management Fund | 100 336 | 0,00 | 1 312 | −14,36 | ||||

| 2025-07-11 | 13F | Caldwell Securities, Inc | 55 790 | 0,00 | 730 | −14,34 | ||||

| 2025-06-25 | NP | CCNR - ALPS | CoreCommodity Natural Resources ETF | 45 177 | 13,46 | 637 | 10,59 | ||||

| 2025-07-29 | 13F | Regions Financial Corp | 395 999 | 1,41 | 5 180 | −13,13 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 399 907 | 1,02 | 5 | −16,67 | ||||

| 2025-08-14 | 13F | Icon Wealth Advisors, LLC | 84 263 | 2,71 | 1 102 | −11,98 | ||||

| 2025-04-15 | 13F | SJS Investment Consulting Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 534 | 7 | ||||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 1 300 | 17 | ||||||

| 2025-08-13 | 13F | Van Hulzen Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | ARGI Investment Services, LLC | 157 | −3,09 | 315 | −14,40 | ||||

| 2025-08-28 | NP | KVLE - KFA Value Line(R) Dynamic Core Equity Index ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-01 | 13F | Chilton Capital Management Llc | 209 | 0,00 | 3 | −33,33 | ||||

| 2025-07-31 | 13F | Mcdaniel Terry & Co | 119 987 | 0,00 | 1 569 | 156 800,00 | ||||

| 2025-08-06 | 13F | O'Brien Greene & Co. Inc | 100 000 | 0,00 | 1 308 | −14,34 | ||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 20 855 | 173,58 | 273 | 134,48 | ||||

| 2025-08-14 | 13F | BancorpSouth Bank | 40 097 | 2,72 | 524 | −12,08 | ||||

| 2025-07-30 | NP | SOAEX - Spirit of America Energy Fund Class A | 164 999 | −27,31 | 2 203 | −35,14 | ||||

| 2025-07-21 | 13F | Hilltop National Bank | 11 900 | 3,48 | 156 | −7,19 | ||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 93 980 | 18,99 | 1 229 | 1,91 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 2 303 | 2,72 | 30 | −11,76 | ||||

| 2025-08-05 | 13F | Chase Investment Counsel Corp | 34 914 | 0,00 | 0 | |||||

| 2025-05-15 | 13F | Hrt Financial Lp | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 1 253 920 | 29,20 | 16 401 | 10,68 | ||||

| 2025-07-15 | 13F | Colonial River Wealth Management, LLC | 19 050 | −3,05 | 253 | −16,00 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 2 | 0 | ||||||

| 2025-08-06 | 13F | Moors & Cabot, Inc. | 63 000 | 1,45 | 824 | −13,08 | ||||

| 2025-08-11 | 13F | Lummis Asset Management, LP | 340 513 | 0,00 | 4 268 | −11,23 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 93 592 | −1,34 | 1 224 | −15,47 | ||||

| 2025-07-01 | 13F | Cullen Investment Group, Ltd. | 15 667 | 2,71 | 205 | −12,07 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 655 630 | 62,73 | 8 576 | 39,39 | ||||

| 2025-08-06 | 13F | Ing Groep Nv | 161 000 | 2 106 | ||||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Zions Bancorporation, National Association /ut/ | 82 533 | 0,00 | 1 080 | −14,37 | ||||

| 2025-05-29 | NP | DSMC - Distillate Small/Mid Cash Flow ETF | 30 452 | −4,05 | 465 | 0,43 | ||||

| 2025-08-14 | 13F | Mudita Advisors LLP | 760 877 | 0,00 | 9 952 | −14,34 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 538 | 0,00 | 0 | |||||

| 2025-07-29 | 13F | LMG Wealth Partners, LLC | 150 245 | 0,00 | 1 965 | −14,34 | ||||

| 2025-08-04 | 13F | Savvy Advisors, Inc. | 15 420 | 202 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 47 400 | 620 | |||||

| 2025-08-06 | 13F | Savant Capital, LLC | 90 742 | 0,00 | 1 187 | −14,37 | ||||

| 2025-08-19 | 13F | State of Wyoming | 31 657 | −8,22 | 414 | −21,29 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 125 295 | −19,72 | 1 639 | −19,94 | ||||

| 2025-08-12 | 13F | Horizon Kinetics Asset Management Llc | 268 638 | 0,00 | 3 514 | −14,36 | ||||

| 2025-07-30 | 13F | Avidian Wealth Solutions, LLC | 29 000 | 0,00 | 379 | −14,25 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 17 982 | −84,55 | 235 | −86,77 | ||||

| 2025-08-14 | 13F | Bramshill Investments, LLC | 66 594 | 2,87 | 871 | −11,84 | ||||

| 2025-08-13 | 13F | SCS Capital Management LLC | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Franklin Street Advisors Inc /nc | 20 000 | 0,00 | 0 | |||||

| 2025-08-04 | 13F | Creekmur Asset Management LLC | 12 | 0 | ||||||

| 2025-08-05 | 13F | Magnolia Capital Advisors Llc | 10 000 | 0,00 | 131 | −14,47 | ||||

| 2025-08-07 | 13F | Cypress Capital Management LLC (WY) | 600 | 0,00 | 8 | −22,22 | ||||

| 2025-08-12 | 13F | Bahl & Gaynor Inc | 61 500 | 0,00 | 804 | −14,38 | ||||

| 2025-07-14 | 13F | U.S. Capital Wealth Advisors, LLC | 21 956 | 0,86 | 287 | −13,55 | ||||

| 2025-08-12 | 13F | Clear Street Markets Llc | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Vaughan Nelson Investment Management, L.p. | 5 600 | 0,00 | 73 | |||||

| 2025-07-10 | 13F | Moody National Bank Trust Division | 19 136 | 1,18 | 250 | −13,19 | ||||

| 2025-06-27 | NP | ZIG - The Acquirers Fund | 78 737 | −18,52 | 1 111 | −23,61 | ||||

| 2025-07-28 | 13F | Axxcess Wealth Management, Llc | 19 050 | −3,05 | 249 | −17,00 | ||||

| 2025-08-28 | NP | Amplify ETF Trust - Amplify Natural Resources Dividend Income ETF | 12 537 | −55,83 | 164 | −62,36 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 11 438 | 0,01 | 150 | −14,37 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 34 411 | 2,36 | 0 | |||||

| 2025-07-21 | 13F | F&V Capital Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Invesco Ltd. | 94 180 | 10,22 | 1 232 | −5,60 | ||||

| 2025-07-24 | 13F | WMG Financial Advisors, LLC | 15 750 | 206 | ||||||

| 2025-08-13 | 13F | Aristides Capital LLC | 34 396 | 0,00 | 450 | −14,48 | ||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 30 | 0 | ||||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 596 853 | 0,00 | 7 807 | −14,34 | ||||

| 2025-08-13 | 13F | Natixis | 1 457 000 | −1,40 | 19 058 | −15,43 | ||||

| 2025-08-06 | 13F | North Capital, Inc. | 3 000 | 0,00 | 39 | −13,33 | ||||

| 2025-05-06 | 13F | Corps Capital Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | LB Partners LLC | 10 000 | 0,00 | 131 | −14,47 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 37 352 | 489 | ||||||

| 2025-08-14 | 13F | Avenir Corp | 73 900 | 0,00 | 967 | −14,36 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 0 | −100,00 | 0 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 3 513 | 0 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 56 000 | −7,13 | 1 | ||||

| 2025-08-06 | 13F | First Eagle Investment Management, LLC | 14 564 | 0,00 | 190 | −14,41 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 381 | 2,70 | 5 | −20,00 | ||||

| 2025-07-11 | 13F | Arrow Investment Advisors, LLC | 10 943 | 143 | ||||||

| 2025-04-21 | 13F | ORG Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 10 900 | 67,69 | 0 | ||||

| 2025-08-11 | 13F | Krane Funds Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 127 301 | 42,19 | 1 665 | 21,80 | ||||

| 2025-08-12 | 13F | DiMeo Schneider & Associates, L.L.C. | 477 189 | −35,98 | 6 242 | −45,17 | ||||

| 2025-07-31 | 13F | Anthracite Investment Company, Inc. | 88 104 | 0,00 | 1 152 | −14,35 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 2 053 | 1,38 | 0 | |||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 58 036 | 0,00 | 759 | −14,33 | ||||

| 2025-05-12 | 13F | Fmr Llc | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 7 289 | 7 822,83 | 95 | 9 400,00 | ||||

| 2025-07-29 | NP | FIKDX - Kempner Multi-Cap Deep Value Fund Institutional Class | 169 300 | 2 260 | ||||||

| 2025-07-11 | 13F | Kingstone Capital Partners Texas, LLC | 13 434 351 | 226 | ||||||

| 2025-07-15 | 13F | Financial Management Professionals, Inc. | 1 418 | 2,68 | 19 | −14,29 | ||||

| 2025-08-14 | 13F | Fayez Sarofim & Co | 515 045 | 4,95 | 6 737 | −10,10 | ||||

| 2025-07-15 | 13F | BCS Wealth Management | 17 213 | 16,42 | 0 | |||||

| 2025-07-02 | 13F | Doliver Advisors, Lp | 31 374 | −1,13 | 410 | −15,29 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 3 876 819 | −5,62 | 50 709 | −19,16 | ||||

| 2025-07-15 | 13F | Clarus Group, Inc. | 333 996 | 0,00 | 4 369 | −14,35 | ||||

| 2025-08-08 | 13F/A | Sterling Capital Management LLC | 13 483 | 1,34 | 176 | −13,30 | ||||

| 2025-08-26 | NP | MDIV - Multi-Asset Diversified Income Index Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 315 949 | −9,95 | 4 133 | −22,87 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 36 638 | 51,52 | 479 | 29,81 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 52 900 | 71,75 | 692 | 47,02 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 23 500 | −61,22 | 307 | −66,81 | |||

| 2025-08-12 | 13F | Jefferies Financial Group Inc. | 62 400 | 0,00 | 816 | −14,29 | ||||

| 2025-08-13 | 13F | Epacria Capital Partners, Llc | 578 422 | 0,00 | 7 566 | −14,35 | ||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 13 205 | 1,07 | 173 | −13,57 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 1 021 | 2,51 | 13 | −13,33 | ||||

| 2025-08-12 | 13F | TCTC Holdings, LLC | 6 666 | 0,00 | 87 | −13,86 | ||||

| 2025-07-11 | 13F | LongView Wealth Management | 12 681 | −12,95 | 166 | −25,68 | ||||

| 2025-07-15 | 13F | Mather Group, Llc. | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 12 598 | 11,24 | 165 | −4,65 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 29 450 | 385 | ||||||

| 2025-08-14 | 13F | CoreCommodity Management, LLC | 49 725 | −3,22 | 650 | −17,09 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 174 476 | 50,15 | 2 282 | 28,64 | ||||

| 2025-07-17 | 13F | GraniteShares Advisors LLC | 191 917 | 6,66 | 2 510 | −8,63 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 2 000 | −34,21 | 26 | −43,48 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 67 359 | 0,00 | 881 | −14,30 | ||||

| 2025-08-13 | 13F | Brown Advisory Inc | 896 934 | 0,00 | 11 732 | −14,35 | ||||

| 2025-08-05 | 13F | Welch & Forbes Llc | 58 966 | 0,00 | 771 | −14,33 | ||||

| 2025-08-14 | 13F | Family Management Corp | 39 767 | 0,00 | 520 | −14,33 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 500 | −73,68 | 7 | −79,31 | ||||

| 2025-07-22 | 13F | Autumn Glory Partners, LLC | 31 600 | 0,00 | 413 | −14,32 | ||||

| 2025-06-30 | NP | CVY - Invesco Zacks Multi-Asset Income ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 84 689 | 3,50 | 1 195 | 0,84 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 137 887 | −19,80 | 1 804 | −31,31 | ||||

| 2025-05-13 | 13F | Wealthedge Investment Advisors, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Mraz, Amerine & Associates, Inc. | 132 598 | 7,58 | 1 734 | −7,62 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | −100,00 | 0 | |||||

| 2025-05-13 | 13F | Clear Street Markets Llc | Put | 0 | −100,00 | 0 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 22 288 | 0,00 | 292 | −14,41 | ||||

| 2025-07-17 | 13F | Nicholson Meyer Capital Management, Inc. | 14 687 | 0,00 | 192 | −14,29 | ||||

| 2025-07-16 | 13F | ORG Wealth Partners, LLC | 14 238 | 0,00 | 187 | −14,22 | ||||

| 2025-05-08 | 13F | Clark Estates Inc/ny | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 1 353 | 32,00 | 18 | 13,33 | ||||

| 2025-07-17 | 13F | Wolff Wiese Magana Llc | 1 000 | 0,00 | 13 | −13,33 | ||||

| 2025-08-12 | 13F | Skopos Labs, Inc. | 51 | 0,00 | 1 | |||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 10 113 | 132 | ||||||

| 2025-08-12 | 13F | Waterloo Capital, L.P. | 21 000 | 0,00 | 275 | −14,37 | ||||

| 2025-08-13 | 13F | Virtus ETF Advisers LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Independent Advisor Alliance | 74 998 | 2,06 | 981 | −12,66 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 142 886 | 19,18 | 1 869 | 2,08 | ||||

| 2025-08-14 | 13F | Concorde Financial Corp | 601 495 | −0,31 | 7 868 | −14,61 | ||||

| 2025-07-29 | 13F | Tweedy, Browne Co LLC | 20 855 | 273 | ||||||

| 2025-08-13 | 13F | Annandale Capital, LLC | 14 382 | 0,00 | 0 | |||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 2 981 | 71,72 | 39 | 46,15 | ||||

| 2025-08-14 | 13F | Peak6 Llc | Call | 12 400 | 0,00 | 162 | −14,29 | |||

| 2025-08-04 | 13F | Investment Management Associates Inc /adv | 1 577 887 | 2,77 | 20 639 | −11,97 | ||||

| 2025-06-27 | NP | DIV - Global X SuperDividend U.S. ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 899 843 | 15,20 | 12 697 | 1,91 | ||||

| 2025-07-31 | 13F | Board of Trustees of The Leland Stanford Junior University | 147 852 | 0,00 | 1 934 | −14,36 | ||||

| 2025-05-14 | 13F | Custom Index Systems, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Creative Planning | 13 685 | 2,01 | 179 | −12,75 | ||||

| 2025-08-13 | 13F | Jump Financial, LLC | 94 025 | 1 230 | ||||||

| 2025-08-14 | 13F | Ancora Advisors, LLC | 41 899 | −9,19 | 548 | −22,16 | ||||

| 2025-07-21 | 13F | Empirical Financial Services, LLC d.b.a. Empirical Wealth Management | 17 000 | 0,00 | 222 | −14,29 | ||||

| 2025-08-05 | 13F | Gruss & Co., LLC | 71 016 | 0,00 | 929 | −14,39 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-18 | 13F | Bartlett & Co. Wealth Management Llc | 32 746 | 0,00 | 428 | −14,40 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 500 | 0,00 | 7 | −14,29 | ||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 32 747 | 0,00 | 428 | −14,40 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 20 290 | −25,79 | 265 | −36,45 | ||||

| 2025-08-08 | 13F | Grandfield & Dodd, Llc | 30 382 | 397 | ||||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 39 700 | −8,31 | 519 | −21,48 | |||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 48 375 | 207,63 | 606 | 152,50 | ||||

| 2025-08-14 | 13F | Wealth Preservation Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Guardian Wealth Management, Inc. | 12 082 | 0,60 | 158 | −13,66 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 1 700 | −69,64 | 22 | −74,12 | |||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 300 | 0,00 | 4 | −25,00 | ||||

| 2025-05-14 | 13F | Group One Trading, L.p. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-22 | 13F | Belpointe Asset Management LLC | 14 975 | 8,02 | 196 | −7,58 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 36 463 | 0 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | −100,00 | 0 | |||||

| 2025-05-29 | NP | PMEFX - PENN MUTUAL AM 1847 INCOME FUND I Shares | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 515 | 0,00 | 7 | −14,29 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 175 728 | 19,13 | 2 299 | 2,04 | ||||

| 2025-08-04 | 13F | Bristlecone Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | TPDAX - Timothy Plan Defensive Strategies Fund Class A | 1 128 | 0,00 | 15 | −17,65 | ||||

| 2025-06-27 | NP | FERRX - First Eagle Global Real Assets Fund Class R6 | 14 564 | 154,84 | 205 | 150,00 | ||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 1 623 | 0,00 | 21 | −12,50 | ||||

| 2025-08-26 | NP | GAFCX - Virtus AlphaSimplex Global Alternatives Fund Class C | 7 667 | 92,30 | 100 | 66,67 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 32 100 | 52,86 | 420 | 30,94 | |||

| 2025-07-29 | 13F | Spirit Of America Management Corp/ny | 142 999 | −34,70 | 1 870 | −44,08 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 114 864 | −16,25 | 1 502 | −28,27 | ||||

| 2025-07-29 | NP | COPY - Tweedy, Browne Insider + Value ETF | 12 936 | 146,54 | 173 | 120,51 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 86 000 | 1,18 | 1 125 | −13,34 | |||

| 2025-08-08 | 13F | Cetera Investment Advisers | 71 222 | −2,17 | 932 | −16,20 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 12 537 | −88,30 | 164 | −90,03 | ||||

| 2025-05-06 | 13F | Venturi Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-02 | 13F | Howard Financial Services, Ltd. | 91 882 | 0,24 | 1 202 | −14,15 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 1 632 | −25,24 | 0 | |||||

| 2025-05-13 | 13F | Penn Mutual Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 263 307 | 6,57 | 3 444 | −8,70 | ||||

| 2025-08-29 | NP | GraniteShares ETF Trust - GraniteShares HIPS US High Income ETF | 191 917 | 6,66 | 2 510 | −8,63 | ||||

| 2025-08-14 | 13F | Fwl Investment Management, Llc | 285 | 0,00 | 4 | −25,00 | ||||

| 2025-07-08 | 13F | Arlington Trust Co LLC | 6 250 | 0,00 | 82 | −14,74 | ||||

| 2025-08-12 | 13F | Bokf, Na | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Hill Investment Group Partners, LLC | 177 487 | 0,00 | 2 322 | −14,35 | ||||

| 2025-07-11 | 13F | Diversified Trust Co | 16 787 | 0,00 | 220 | −14,45 | ||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 963 313 | 5,45 | 12 600 | −9,67 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 255 007 | 53,63 | 3 335 | 31,61 | ||||

| 2025-08-13 | 13F | Fort Sheridan Advisors Llc | 36 540 | −34,36 | 478 | −43,88 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 333 834 | −11,33 | 4 367 | −24,06 | ||||

| 2025-07-30 | 13F/A | Alpha Wealth Funds, LLC | 11 200 | −20,00 | 146 | −31,46 | ||||

| 2025-06-26 | NP | HMSFX - Hennessy BP Midstream Fund Investor Class | 25 000 | 353 | ||||||

| 2025-05-12 | 13F | Linscomb & Williams, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-28 | 13F | Cypress Wealth Services, LLC | 21 437 | 0,00 | 280 | −14,37 | ||||

| 2025-07-30 | NP | ALTY - Global X SuperDividend Alternatives ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 29 184 | 3,55 | 390 | −7,60 |