Grundläggande statistik

| Institutionella ägare | 139 total, 136 long only, 0 short only, 3 long/short - change of −6,71% MRQ |

| Genomsnittlig portföljallokering | 0.7582 % - change of 14,89% MRQ |

| Institutionella aktier (lång) | 10 940 029 (ex 13D/G) - change of 0,10MM shares 0,94% MRQ |

| Institutionellt värde (lång) | $ 710 505 USD ($1000) |

Institutionellt ägande och aktieägare

PIMCO ETF Trust - PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund (US:ZROZ) har 139 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 10,940,029 aktier. Största aktieägare inkluderar Mirae Asset Global Investments Co., Ltd., Bank Of America Corp /de/, LPL Financial LLC, Adviser Investments LLC, Envestnet Asset Management Inc, RiverFront Investment Group, LLC, Consolidated Planning Corp, GenWealth Group, Inc., Morgan Stanley, and Raymond James Financial Inc .

PIMCO ETF Trust - PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund (ARCA:ZROZ) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 16, 2025 is 69,12 / share. Previously, on September 16, 2024, the share price was 86,76 / share. This represents a decline of 20,33% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

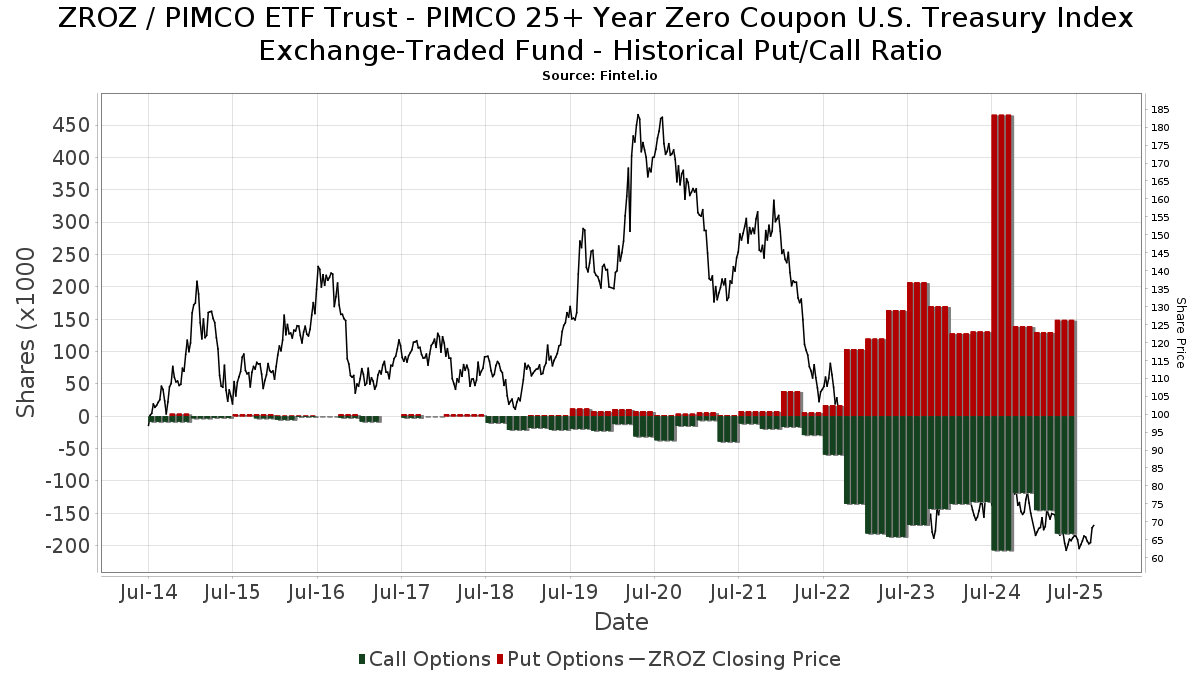

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-16 | 13F | GenWealth Group, Inc. | 295 344 | 0,94 | 19 809 | −5,49 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 10 000 | 671 | ||||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 42 052 | 2,69 | 2 820 | −3,85 | ||||

| 2025-08-25 | NP | MDFIX - Matisse Discounted Bond CEF Strategy Institutional Class | 8 700 | 584 | ||||||

| 2025-07-09 | 13F | Krilogy Financial LLC | 193 864 | 8,90 | 13 002 | 1,97 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 18 900 | 60,17 | 1 246 | 49,94 | |||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 6 300 | −43,24 | 415 | −46,93 | |||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 4 917 | 42,23 | 330 | 33,20 | ||||

| 2025-08-15 | 13F | E Fund Management Co., Ltd. | 0 | −100,00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 28 456 | −64,48 | 1 909 | −66,75 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 3 200 | 0,00 | 215 | −6,55 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 31 106 | 2,12 | 2 086 | −4,36 | ||||

| 2025-08-08 | 13F | Gts Securities Llc | 75 153 | 126,60 | 5 041 | 112,21 | ||||

| 2025-08-14 | 13F | Coppell Advisory Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | North Ridge Wealth Advisors, Inc. | 4 162 | 43,86 | 279 | 34,78 | ||||

| 2025-08-14 | 13F | UBS Group AG | 28 427 | −54,29 | 1 907 | −57,21 | ||||

| 2025-07-24 | 13F | Blair William & Co/il | 10 527 | −24,75 | 706 | −29,54 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 394 | 18,32 | 26 | 13,04 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 85 506 | 34,80 | 5 735 | 26,21 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 43 090 | 0,54 | 2 890 | −4,18 | ||||

| 2025-08-19 | 13F | Delos Wealth Advisors, LLC | 1 636 | 110 | ||||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 212 426 | 46,44 | 14 247 | 37,12 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-07-29 | NP | RORO - ATAC US Rotation ETF | 19 950 | −18,05 | 1 287 | −28,32 | ||||

| 2025-08-14 | 13F | Shepherd Kaplan Krochuk, Llc | 47 814 | 36,02 | 3 207 | 27,37 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 181 | 12 | ||||||

| 2025-03-27 | NP | RLGAX - RiverFront Asset Allocation Growth & Income Investor Shares | 19 839 | 28,70 | 1 347 | 15,72 | ||||

| 2025-07-18 | 13F | Consolidated Planning Corp | 297 625 | 210,70 | 19 962 | 190,93 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 70 180 | −85,39 | 4 707 | −86,32 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 152 308 | 1 690,81 | 10 215 | 1 577,34 | ||||

| 2025-09-02 | 13F | Investors Towarzystwo Funduszy Inwestycyjnych Spolka Akcyjna | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-15 | 13F | CHB Investment Group, LLC | 32 257 | 1,10 | 2 | 0,00 | ||||

| 2025-07-15 | 13F | Elevated Capital Advisors, LLC | 9 286 | 0,00 | 665 | 0,00 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 4 149 | 0,00 | 278 | −6,40 | ||||

| 2025-04-30 | 13F | Pineridge Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-05-28 | 13F | Intrua Financial, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 248 389 | −17,86 | 16 660 | −23,09 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 1 034 715 | 27,64 | 69 398 | 19,52 | ||||

| 2025-08-13 | 13F | Callodine Capital Management, LP | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | StoneX Group Inc. | 10 000 | 671 | ||||||

| 2025-07-16 | 13F | Arlington Capital Management, Inc. | 61 733 | 0,18 | 4 140 | −6,21 | ||||

| 2025-08-13 | 13F | Okabena Investment Services Inc | 31 977 | 0,00 | 2 145 | −6,38 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 79 186 | 5,87 | 5 311 | −0,88 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 18 553 | −1,91 | 1 244 | −8,12 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 0 | −100,00 | 0 | |||||

| 2025-05-01 | 13F | Quest 10 Wealth Builders, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 23 895 | 18 864,29 | 1 603 | 17 700,00 | ||||

| 2025-07-31 | 13F | Carrera Capital Advisors | 75 472 | −75,16 | 5 062 | −76,74 | ||||

| 2025-07-15 | 13F | FLP Wealth Management, LLC | 15 147 | −0,33 | 1 085 | 4,03 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 29 620 | 317,18 | 1 987 | 290,94 | ||||

| 2025-08-13 | 13F | WCG Wealth Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 500 | 0,00 | 34 | −5,71 | ||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 3 500 | 0,00 | 235 | −6,40 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 1 672 | 0,00 | 112 | −5,88 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 65 | 0,00 | 4 | 0,00 | ||||

| 2025-04-30 | 13F | Allworth Financial LP | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 38 207 | 3,90 | 2 563 | −2,70 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 7 431 | 3,55 | 498 | −3,11 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 8 175 | −0,29 | 548 | −6,64 | ||||

| 2025-08-06 | 13F | Valtinson Bruner Financial Planning LLC | 49 748 | −10,58 | 3 337 | −16,27 | ||||

| 2025-07-09 | 13F | Fermata Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-05-30 | NP | ERNZ - TrueShares Active Yield ETF | 77 492 | 4 842,09 | 5 551 | 5 086,92 | ||||

| 2025-04-30 | 13F | Beverly Hills Private Wealth, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-15 | 13F | Revisor Wealth Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 6 671 | 35,84 | 0 | |||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 66 307 | 70,12 | 4 | 100,00 | ||||

| 2025-08-13 | 13F | Level Four Advisory Services, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | RiverFront Investment Group, LLC | 433 899 | 74,05 | 29 102 | 62,98 | ||||

| 2025-07-14 | 13F | Sowell Financial Services LLC | 3 274 | 220 | ||||||

| 2025-07-28 | 13F | Mutual Advisors, LLC | 18 391 | 13,25 | 1 181 | 6,69 | ||||

| 2025-08-28 | NP | GHMS - Goose Hollow Multi-Strategy Income ETF | 45 000 | 3 018 | ||||||

| 2025-04-23 | 13F | Econ Financial Services Corp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 47 | 27,03 | 3 | 50,00 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 2 363 | 158 | ||||||

| 2025-07-23 | 13F | Matisse Capital | 8 700 | 584 | ||||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 14 139 | 948 | ||||||

| 2025-08-05 | 13F | Prosperity Wealth Management, Inc. | 6 176 | 50,56 | 414 | 41,30 | ||||

| 2025-08-19 | 13F | Marex Group plc | 58 757 | 3 941 | ||||||

| 2025-05-12 | 13F | LaSalle St. Investment Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | West Branch Capital LLC | 205 | 1,49 | 14 | −7,14 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 3 007 | 202 | ||||||

| 2025-07-25 | 13F | Cwm, Llc | 4 842 | −68,30 | 0 | −100,00 | ||||

| 2025-05-12 | 13F | Aveo Capital Partners, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Andina Capital Management, LLC | 22 937 | −22,72 | 1 538 | −27,62 | ||||

| 2025-08-05 | 13F | Cassaday & Co Wealth Management LLC | 37 270 | 9,74 | 2 500 | 2,75 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 62 | 4 | ||||||

| 2025-08-29 | 13F | Evolution Wealth Management Inc. | 41 | 3 | ||||||

| 2025-04-17 | 13F | Howard Bailey Securities, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 350 | −65,00 | 23 | −67,61 | ||||

| 2025-08-14 | 13F | Comerica Bank | 8 590 | −13,17 | 576 | −18,64 | ||||

| 2025-07-10 | 13F | Oliver Lagore Vanvalin Investment Group | 200 | −49,87 | 14 | −48,15 | ||||

| 2025-07-28 | 13F | Axxcess Wealth Management, Llc | 9 009 | 604 | ||||||

| 2025-07-16 | 13F | Maridea Wealth Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 120 555 | 18,26 | 8 086 | 10,72 | ||||

| 2025-04-17 | 13F | Atlas Financial Advisors, Inc. | 95 284 | −17,66 | 6 538 | −31,45 | ||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 3 946 | 265 | ||||||

| 2025-05-08 | 13F | Hoxton Planning & Management, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 80 656 | −44,62 | 5 410 | −48,15 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 47 | 3 | ||||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 104 126 | −67,03 | 6 805 | −69,92 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-12 | 13F | Richard W. Paul & Associates, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Atria Investments Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Allium Financial Advisors, Llc | 8 883 | 0,00 | 596 | −6,45 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 50 068 | −47,96 | 3 358 | −51,27 | ||||

| 2025-07-15 | 13F | Colonial River Wealth Management, LLC | 9 198 | 8,62 | 599 | −1,16 | ||||

| 2025-07-17 | 13F | Beacon Capital Management, LLC | 41 | 2,50 | 3 | 0,00 | ||||

| 2025-08-05 | 13F | Lord & Richards Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 8 928 | −91,54 | 599 | −92,09 | ||||

| 2025-08-12 | 13F | Eldridge Investment Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-04-29 | 13F | Crew Capital Management, Ltd. | 0 | −100,00 | 0 | |||||

| 2025-05-13 | 13F | Stokes Family Office, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 66 703 | −23,17 | 4 | −33,33 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-04-24 | 13F | Decker Retirement Planning Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 83 900 | 48,76 | 5 627 | 39,32 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 57 596 | 1 231,39 | 3 863 | 1 149,84 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 162 600 | 39,69 | 10 906 | 30,80 | |||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 473 543 | 60,81 | 31 761 | 50,57 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 130 929 | 101,74 | 8 781 | 88,92 | ||||

| 2025-08-12 | 13F | Park Square Financial Group, LLC | 89 | 34,85 | 6 | 25,00 | ||||

| 2025-04-28 | 13F | Swmg, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 35 686 | 2 393 | ||||||

| 2025-07-15 | 13F | Td Private Client Wealth Llc | 113 | −66,27 | 8 | −69,57 | ||||

| 2025-05-15 | 13F | Marshall & Sterling Wealth Advisors Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 142 423 | 27,83 | 10 | 28,57 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 127 | 0,79 | 8 | −11,11 | ||||

| 2025-08-11 | 13F | Annis Gardner Whiting Capital Advisors, LLC | 655 | 44 | ||||||

| 2025-07-30 | 13F | Mid-American Wealth Advisory Group, Inc. | 123 950 | 160,95 | 8 313 | 144,36 | ||||

| 2025-08-05 | 13F | Carolinas Wealth Consulting Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 3 814 | 256 | ||||||

| 2025-08-13 | 13F | Transce3nd, LLC | 33 | 32,00 | 2 | 100,00 | ||||

| 2025-07-29 | 13F | Consilio Wealth Advisors, Llc | 70 553 | 8,04 | 4 652 | −0,53 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 812 933 | −1,44 | 54 523 | −7,72 | ||||

| 2025-07-28 | 13F | Eq Wealth Advisors, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | FSA Wealth Management LLC | 0 | −100,00 | 0 | |||||

| 2025-04-11 | 13F | Horizon Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F | Hollencrest Capital Management | 5 379 | −22,13 | 361 | −27,13 | ||||

| 2025-08-08 | 13F | Glaxis Capital Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | TrueMark Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Authentikos Wealth Advisory, LLC | 31 791 | 2 132 | ||||||

| 2025-07-29 | 13F | Private Trust Co Na | 7 402 | −6,50 | 496 | −12,52 | ||||

| 2025-07-18 | 13F | Provident Wealth Management, LLC | 25 399 | −2,84 | 1 704 | −9,03 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 18 825 | 104,58 | 1 263 | 91,50 | ||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 51 | −62,22 | 3 | −66,67 | ||||

| 2025-05-02 | 13F | Capital A Wealth Management, LLC | 2 | −99,36 | 0 | −100,00 | ||||

| 2025-08-06 | 13F | Adviser Investments LLC | 598 288 | −30,77 | 40 127 | −35,18 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 21 | 0,00 | 1 | 0,00 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 88 274 | 5,16 | 5 921 | −1,53 | ||||

| 2025-07-18 | 13F | B.O.S.S. Retirement Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 23 215 | 55,55 | 1 557 | 45,69 | ||||

| 2025-08-14 | 13F | Fmr Llc | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Cyndeo Wealth Partners, LLC | 103 388 | 1,52 | 6 934 | −4,94 | ||||

| 2025-07-08 | 13F | Legacy Private Trust Co. | 36 153 | −38,64 | 2 425 | −42,56 | ||||

| 2025-08-14 | 13F | Byrne Financial Freedom, Llc | 0 | −100,00 | 0 | |||||

| 2025-05-07 | 13F | Rareview Capital LLC | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | ORG Partners LLC | 45 | −83,64 | 3 | −89,47 | ||||

| 2025-08-14 | 13F | Capitolis Liquid Global Markets LLC | 38 200 | −32,86 | 2 562 | −37,13 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 6 988 | 7,72 | 469 | 0,86 | ||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 3 610 | 242 | ||||||

| 2025-05-12 | 13F | Delphi Financial Group, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 86 560 | 16,19 | 5 708 | 8,73 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 10 124 | 2,47 | 657 | −7,21 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 22 807 | 45,41 | 1 530 | 36,15 | ||||

| 2025-08-18 | 13F | Goodman Advisory Group, LLC | 25 681 | −81,40 | 1 722 | −82,59 | ||||

| 2025-05-14 | 13F | Van Hulzen Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 101 814 | 5,83 | 6 830 | −1,67 | ||||

| 2025-07-16 | 13F | Lloyd Advisory Services, LLC. | 3 382 | −9,77 | 227 | −15,67 | ||||

| 2025-04-15 | 13F | Collier Financial | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-30 | 13F | Paragon Advisors, LLC | 54 609 | −32,98 | 3 663 | −37,25 | ||||

| 2025-07-11 | 13F | Pinnacle Bancorp, Inc. | 992 | 0,00 | 67 | −7,04 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 59 600 | −4,79 | 3 997 | −10,86 | |||

| 2025-08-14 | 13F | Boyer & Corporon Wealth Management, LLC | 7 713 | 517 | ||||||

| 2025-07-14 | 13F | Pacifica Partners Inc. | 100 | 0,00 | 7 | −14,29 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 27 416 | 18,25 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Visionary Wealth Advisors | 3 265 | −46,34 | 219 | −49,66 | ||||

| 2025-07-16 | 13F | Formidable Asset Management, LLC | 5 962 | 0,00 | 427 | 0,00 | ||||

| 2025-08-04 | 13F | Great Lakes Retirement, Inc. | 5 532 | −3,76 | 371 | −9,73 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 21 572 | 102,16 | 1 447 | 89,27 | ||||

| 2025-08-12 | 13F | Timber Creek Capital Management LLC | 41 362 | 10,77 | 2 765 | 3,40 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 9 722 | 40,33 | 652 | 31,45 | ||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 91 661 | 16,12 | 6 148 | 8,72 | ||||

| 2025-08-14 | 13F | Benjamin Edwards Inc | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Integrity Alliance, Llc. | 4 851 | 15,78 | 325 | 8,33 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 1 500 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 31 | −84,73 | 2 | −85,71 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 3 381 | −9,23 | 227 | −15,04 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 52 | 92,59 | 3 | 200,00 | ||||

| 2025-07-24 | 13F | E Fund Management (Hong Kong) Co., Ltd. | 0 | −100,00 | 0 | |||||

| 2025-05-05 | 13F | Creekmur Asset Management LLC | 0 | −100,00 | 0 | |||||

| 2025-07-01 | 13F | Confluence Investment Management Llc | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 2 723 767 | 46,66 | 182 683 | 39,61 |

Other Listings

| MX:ZROZ |