Grundläggande statistik

| Institutionella aktier (lång) | 79 229 003 - 47,43% (ex 13D/G) - change of 11,70MM shares 17,33% MRQ |

| Institutionellt värde (lång) | $ 2 598 658 USD ($1000) |

Institutionellt ägande och aktieägare

Millicom International Cellular S.A. (US:TIGO) har 262 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 79,229,003 aktier. Största aktieägare inkluderar Dodge & Cox, DODFX - Dodge & Cox International Stock Fund, Brandes Investment Partners, Lp, Price T Rowe Associates Inc /md/, BlackRock, Inc., Boston Partners, Barclays Plc, Swedbank AB, Arrowstreet Capital, Limited Partnership, and State Street Corp .

Millicom International Cellular S.A. (NasdaqGS:TIGO) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 5, 2025 is 47,15 / share. Previously, on September 9, 2024, the share price was 26,54 / share. This represents an increase of 77,66% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

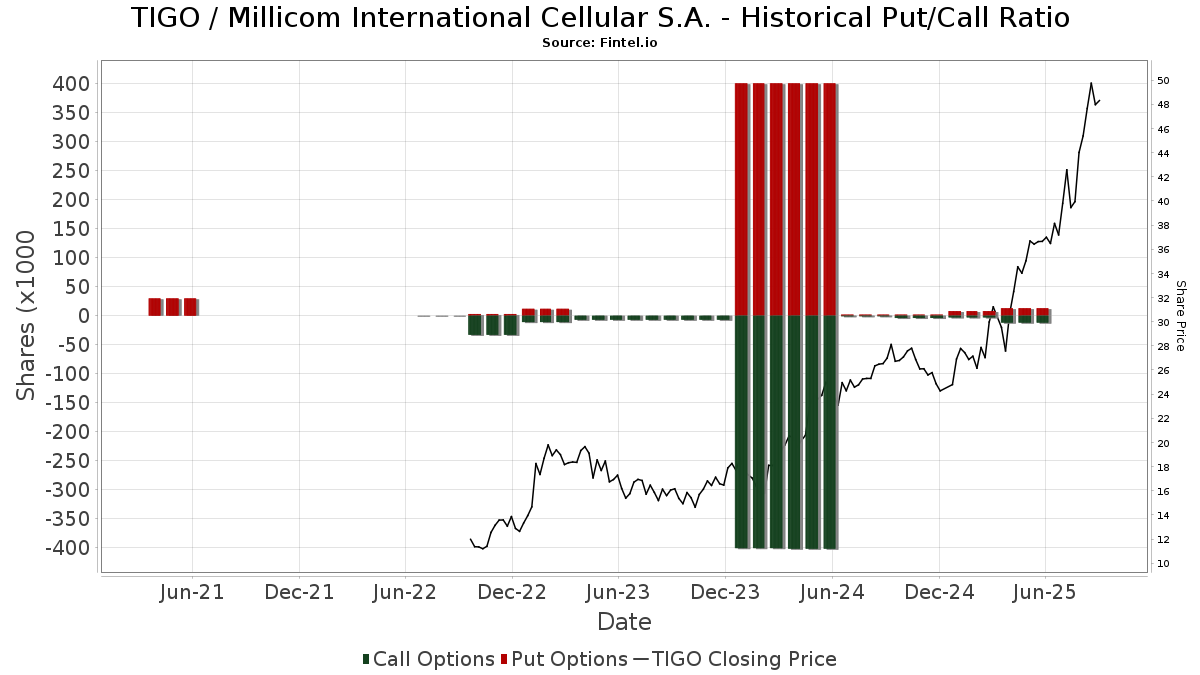

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13D/G-Arkiveringar

Vi presenterar 13D/G-arkiveringar separat från 13F-arkiveringar på grund av att de behandlas olika av SEC. 13D/G-arkiveringar kan lämnas in av grupper av investerare (med en ledare), medan 13F-arkiveringar inte kan det. Detta leder till situationer där en investerare kan lämna in en 13D/G-ansökan med ett värde för de totala aktierna (vilket motsvarar alla aktier som ägs av investerargruppen), men sedan lämna in en 13F-ansökan med ett annat värde för de totala aktierna (vilket motsvarar enbart deras eget ägande). Detta innebär att aktieägandet i 13D/G-arkiveringar och 13F-arkiveringar ofta inte är direkt jämförbara, så vi presenterar dem separat.

Notera: Från och med den 16 maj 2021 visar vi inte längre ägare som inte har lämnat in en 13D/G under det senaste året. Tidigare visade vi hela historiken för 13D/G-arkiveringar. I allmänhet måste enheter som är skyldiga att lämna in 13D/G-arkiveringar lämna in minst en gång per år innan de lämnar in en stängningsarkivering. Fonder avslutar dock ibland positioner utan att lämna in en avslutande arkivering (dvs. de avvecklar), så att visa hela historiken resulterade ibland i förvirring om det nuvarande ägandet. För att förhindra förvirring visar vi nu endast "nuvarande" ägare - det vill säga ägare som har lämnat in en ansökan under det senaste året.

Upgrade to unlock premium data.

| Fil Datum | Formulär | Investerare | Föregående aktier |

Senaste aktier |

Δ Aktier (Procent) |

Ägande (Procent) |

Δ Ägande (Procent) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-09-04 | Atlas Investissement | 70,470,018 | 70,470,018 | 0.00 | 42.20 | 0.00 |

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-19 | 13F | Delos Wealth Advisors, LLC | 27 | 1 | ||||||

| 2025-08-19 | 13F | Delos Wealth Advisors, LLC | Call | 11 | ||||||

| 2025-08-14 | 13F | Stifel Financial Corp | 5 884 | 220 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 15 772 | 1 612,49 | 1 | |||||

| 2025-08-14 | 13F | Western Standard LLC | 313 943 | 39,27 | 11 763 | 72,40 | ||||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 16 832 | 630 | ||||||

| 2025-08-13 | 13F | Employees Retirement System of Texas | 45 517 | 0,00 | 2 | 0,00 | ||||

| 2025-08-07 | 13F | Zurcher Kantonalbank (Zurich Cantonalbank) | 33 728 | 436,73 | 1 264 | 564,74 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 244 | 0 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-11 | 13F | Vanguard Group Inc | 179 033 | 99,31 | 6 708 | 146,71 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 538 | 0,00 | 20 | 25,00 | ||||

| 2025-08-14 | 13F | Snowden Capital Advisors LLC | 13 253 | −24,80 | 497 | −6,94 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 16 769 | −45,30 | 628 | −32,33 | ||||

| 2025-07-29 | NP | JEVNX - Emerging Markets Fund Class NAV | 60 605 | 2 273 | ||||||

| 2025-08-11 | 13F | Wbi Investments, Inc. | 26 038 | 976 | ||||||

| 2025-08-12 | 13F/A | Boston Partners | 2 956 476 | 22,11 | 110 779 | 51,16 | ||||

| 2025-08-14 | 13F | UBS Group AG | 129 920 | −26,25 | 4 868 | −8,70 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 5 356 | 201 | ||||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 350 | 0,00 | 13 | 30,00 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 168 791 | 1 443,44 | 6 325 | 1 810,57 | ||||

| 2025-08-12 | 13F | Trexquant Investment LP | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Renaissance Group Llc | 292 080 | −6,78 | 10 944 | 15,39 | ||||

| 2025-08-12 | 13F | Sierra Summit Advisors Llc | 22 475 | 842 | ||||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 621 692 | 22,59 | 23 295 | 51,74 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 84 885 | 720,70 | 3 181 | 915,97 | ||||

| 2025-08-14 | 13F | Investor Ab | 20 781 | −69,34 | 779 | −62,07 | ||||

| 2025-08-08 | 13F/A | Sterling Capital Management LLC | 6 838 | 256 | ||||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 4 726 | −91,16 | 0 | −100,00 | ||||

| 2025-07-23 | 13F | Equitable Trust Co | 7 447 | −25,11 | 279 | −7,31 | ||||

| 2025-03-18 | 13F/A | Bank Of America Corp /de/ | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-12 | 13F | Legal & General Group Plc | 155 412 | −2,29 | 5 823 | 20,96 | ||||

| 2025-08-11 | 13F | Raiffeisen Bank International AG | 42 000 | 0,00 | 1 532 | 20,82 | ||||

| 2025-08-12 | 13F | Magnetar Financial LLC | 12 146 | 57,90 | 455 | 96,12 | ||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 5 427 | 0 | ||||||

| 2025-08-29 | NP | JAJJX - International Value Trust NAV | 76 767 | 4,64 | 2 876 | 29,55 | ||||

| 2025-08-12 | 13F | Segall Bryant & Hamill, Llc | 97 577 | 0,31 | 3 656 | 24,18 | ||||

| 2025-08-04 | 13F | Spinnaker Trust | 7 000 | 0,00 | 262 | 24,17 | ||||

| 2025-08-01 | 13F | Logan Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 1 413 | 55,10 | 53 | 92,59 | ||||

| 2025-05-13 | 13F | Semanteon Capital Management, LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 556 928 | 73,09 | 20 868 | 114,27 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 13 115 | −4,15 | 491 | 18,60 | ||||

| 2025-07-18 | 13F | USA Financial Portformulas Corp | 803 | 30 | ||||||

| 2025-05-29 | NP | MMIUX - MassMutual Select T. Rowe Price International Equity Fund Class I | 22 135 | 670 | ||||||

| 2025-08-07 | 13F | Future Fund LLC | 44 491 | 195,27 | 1 667 | 265,57 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 55 035 | 2 062 | ||||||

| 2025-08-26 | NP | CIEQX - Segall Bryant & Hamill International Equity Fund - Institutional Class | 400 | 300,00 | 15 | 366,67 | ||||

| 2025-07-11 | 13F | Bond & Devick Financial Network, Inc. | 6 000 | 225 | ||||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Meritage Portfolio Management | 142 018 | 5 321 | ||||||

| 2025-08-14 | 13F | Wexford Capital Lp | 40 000 | 0,00 | 1 499 | 23,80 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 32 870 | −46,77 | 1 232 | −34,14 | ||||

| 2025-05-15 | 13F | D. E. Shaw & Co., Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | CBOE Vest Financial, LLC | 19 120 | 45,17 | 716 | 79,90 | ||||

| 2025-08-08 | 13F | Quinn Opportunity Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | BTG Pactual Asset Management US LLC | 63 416 | 0,97 | 2 376 | 24,99 | ||||

| 2025-08-12 | 13F | Moon Capital Management Lp | 215 923 | 0,00 | 8 091 | 23,79 | ||||

| 2025-08-26 | NP | TLSTX - Stock Index Fund | 1 285 | 48 | ||||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 453 265 | 61,34 | 16 984 | 99,71 | ||||

| 2025-08-14 | 13F | Voya Investment Management Llc | 25 409 | 952 | ||||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 9 569 | 359 | ||||||

| 2025-08-12 | 13F | Handelsbanken Fonder AB | 23 300 | 1 | ||||||

| 2025-08-28 | NP | New Age Alpha Funds Trust - NAA Opportunity Fund Class C | 3 840 | 144 | ||||||

| 2025-06-26 | NP | JDIBX - John Hancock Disciplined Value International Fund Class A | 1 350 594 | 46 650 | ||||||

| 2025-08-08 | 13F | Police & Firemen's Retirement System of New Jersey | 61 368 | 170,57 | 2 299 | 235,13 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 31 | 1 | ||||||

| 2025-08-13 | 13F | Schroder Investment Management Group | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Mangrove Partners | 1 079 249 | 0,00 | 40 439 | 23,79 | ||||

| 2025-07-28 | NP | NSI - National Security Emerging Markets Index ETF | 1 614 | 38,66 | 61 | 100,00 | ||||

| 2025-08-06 | 13F | BNP Paribas Asset Management Holding S.A. | 288 302 | 11 | ||||||

| 2025-07-24 | 13F | Triodos Investment Management BV | 808 000 | −8,86 | 30 243 | 12,97 | ||||

| 2025-08-14 | 13F | Utah Retirement Systems | 5 430 | 203 | ||||||

| 2025-08-07 | 13F | Addison Advisors LLC | 2 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 381 | 0,00 | 14 | 40,00 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 1 439 114 | 21,91 | 53 924 | 50,91 | ||||

| 2025-08-28 | NP | MISAX - Victory Trivalent International Small-Cap Fund Class A | 487 198 | −3,11 | 18 255 | 19,94 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 7 300 | −13,10 | 274 | 7,48 | |||

| 2025-08-28 | NP | SLGFX - SIMT Large Cap Index Fund Class F | 2 100 | 79 | ||||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 435 | −14,03 | 16 | 6,67 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 7 218 | 0,00 | 270 | 23,85 | ||||

| 2025-08-13 | 13F | Victory Capital Management Inc | 741 671 | −2,38 | 27 790 | 20,84 | ||||

| 2025-05-15 | 13F | Squarepoint Ops LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 128 385 | −62,15 | 4 811 | −53,15 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 143 814 | 1 144,28 | 5 389 | 1 443,84 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 348 | −23,52 | 13 | 0,00 | ||||

| 2025-07-28 | 13F | Allianz Asset Management GmbH | 49 367 | 1 850 | ||||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 307 044 | −81,66 | 11 505 | −77,29 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 4 955 339 | 101,70 | 185 677 | 149,68 | ||||

| 2025-08-13 | 13F | Mirabella Financial Services Llp | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Mackenzie Financial Corp | 524 229 | 19 643 | ||||||

| 2025-08-19 | 13F | State of Wyoming | 4 655 | 123,37 | 174 | 176,19 | ||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 202 | 0,00 | 7 | 16,67 | ||||

| 2025-08-26 | NP | BEMCX - BRANDES EMERGING MARKETS VALUE FUND Class C | 447 962 | 0,00 | 16 785 | 23,79 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 79 062 | 2 962 | ||||||

| 2025-05-15 | 13F | Point72 Asia (Singapore) Pte. Ltd. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 105 660 | 46,31 | 3 959 | 81,11 | ||||

| 2025-08-13 | 13F | National Bank Of Canada /fi/ | 0 | −100,00 | 0 | |||||

| 2025-07-18 | 13F | Ewa, Llc | 6 757 | 1,78 | 253 | 26,50 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 109 100 | −79,42 | 4 088 | −74,53 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 1 241 263 | 195,09 | 46 510 | 265,30 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 1 000 | 0,00 | 37 | 23,33 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 7 086 | 0,80 | 266 | 51,43 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 3 198 | −42,50 | 120 | −29,17 | ||||

| 2025-08-12 | 13F | American Century Companies Inc | 33 552 | 1 257 | ||||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 9 973 | 16,52 | 374 | 44,02 | ||||

| 2025-08-14 | 13F | Voloridge Investment Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Treasurer of the State of North Carolina | 47 990 | 2 | ||||||

| 2025-08-07 | NP | CLFFX - Clifford Capital Partners Fund Investor Class | 82 000 | −26,92 | 3 073 | −9,54 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 382 956 | −51,85 | 14 349 | −40,40 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 13 188 | 494 | ||||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 18 690 | −38,30 | 700 | −23,58 | ||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 2 169 951 | −3,49 | 81 308 | 19,47 | ||||

| 2025-08-28 | NP | CPAI - Counterpoint Quantitative Equity ETF | 52 363 | 1 962 | ||||||

| 2025-07-29 | 13F | William Blair Investment Management, Llc | 111 655 | 4 184 | ||||||

| 2025-08-14 | 13F | Southeastern Asset Management Inc/tn/ | 1 037 634 | −48,58 | 38 880 | −36,35 | ||||

| 2025-08-29 | NP | JAKWX - John Hancock Disciplined Value Global Long/Short Fund Class NAV | 85 782 | 3 214 | ||||||

| 2025-07-11 | 13F | Perpetual Ltd | 50 750 | −18,73 | 1 902 | 0,58 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 20 | −90,15 | 1 | −100,00 | ||||

| 2025-08-26 | NP | SBHSX - Segall Bryant & Hamill International Small Cap Fund Retail Class | 14 222 | 0,00 | 533 | 23,72 | ||||

| 2025-08-13 | 13F | MetLife Investment Management, LLC | 1 711 | 64 | ||||||

| 2025-08-07 | 13F | Fourth Sail Capital LP | 0 | −100,00 | 0 | |||||

| 2025-05-05 | 13F | Morningstar Investment Services LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Kingswood Wealth Advisors, Llc | 10 067 | 377 | ||||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 20 876 | 789 | ||||||

| 2025-08-14 | 13F | Scientech Research LLC | 15 001 | 111,25 | 562 | 162,62 | ||||

| 2025-08-08 | 13F | Calamos Advisors LLC | 119 770 | 464,82 | 4 488 | 600,00 | ||||

| 2025-07-28 | NP | TIEUX - International Equity Fund | 13 409 | −5,40 | 503 | 34,95 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 4 870 | 80,24 | 182 | 124,69 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 120 | 4 | ||||||

| 2025-08-07 | 13F | Los Angeles Capital Management Llc | 0 | −100,00 | 0 | |||||

| 2025-05-02 | 13F | Bogart Wealth, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Macquarie Group Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 12 500 | 454 | |||||

| 2025-08-27 | NP | ALLIANZ VARIABLE INSURANCE PRODUCTS TRUST - AZL Russell 1000 Value Index Fund Class 2 | 2 294 | 86 | ||||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 6 500 | 236 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 37 263 | −19,31 | 1 397 | −0,07 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 94 417 | 376,06 | 3 538 | 489,50 | ||||

| 2025-08-27 | NP | LLGLX - Longleaf Partners Global Fund | 238 202 | −45,35 | 8 925 | −32,35 | ||||

| 2025-08-28 | NP | DODEX - Dodge & Cox Emerging Markets Stock Fund | 217 479 | 145,80 | 8 149 | 204,26 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 58 | −86,51 | 2 | −84,62 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 66 329 | 78,97 | 2 485 | 121,68 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 13 405 | −50,55 | 1 | |||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 117 035 | 27,01 | 4 385 | 57,22 | ||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 62 900 | 2 357 | ||||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 237 | 0,00 | 9 | 14,29 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 34 868 | 21,12 | 1 307 | 49,94 | ||||

| 2025-08-14 | 13F | Petrus Trust Company, LTA | 10 128 | −72,26 | 379 | −65,70 | ||||

| 2025-08-11 | 13F | Absolute Gestao de Investimentos Ltda. | 20 862 | 782 | ||||||

| 2025-08-26 | NP | TSWMX - TSW Emerging Markets Fund Advisor Shares | 1 550 | −55,07 | 58 | −44,23 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 33 443 | 436,38 | 1 | |||||

| 2025-07-30 | 13F | Whittier Trust Co Of Nevada Inc | 15 | 0,00 | 1 | |||||

| 2025-07-23 | 13F | Klp Kapitalforvaltning As | 107 867 | 1,70 | 4 042 | 25,89 | ||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Strs Ohio | 61 312 | 2 297 | ||||||

| 2025-08-13 | 13F | SageView Advisory Group, LLC | 9 025 | 0,28 | 356 | 30,88 | ||||

| 2025-08-12 | 13F | Pacer Advisors, Inc. | 1 | 0 | ||||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 30 469 | −57,35 | 1 142 | −47,22 | ||||

| 2025-07-17 | 13F | CWA Asset Management Group, LLC | 26 173 | 112,67 | 981 | 163,44 | ||||

| 2025-08-04 | 13F | Emerald Advisers, Llc | 22 | 0,00 | 1 | |||||

| 2025-07-29 | 13F | Nordea Investment Management Ab | 223 326 | −33,49 | 8 348 | −16,38 | ||||

| 2025-07-28 | NP | AVDE - Avantis International Equity ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 29 000 | 1 088 | ||||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 607 | 23 | ||||||

| 2025-07-29 | 13F | LB Partners LLC | 402 000 | −22,83 | 15 063 | −5,31 | ||||

| 2025-08-07 | 13F | Beese Fulmer Investment Management, Inc. | 11 803 | −0,69 | 442 | 23,12 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 810 634 | 454,47 | 30 374 | 586,42 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 8 122 | −41,15 | 304 | −27,10 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 1 119 991 | 201,69 | 41 966 | 273,46 | ||||

| 2025-07-17 | 13F | Park Place Capital Corp | 513 | 27,30 | 19 | 58,33 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 7 344 | 2,03 | 275 | 26,73 | ||||

| 2025-08-12 | 13F | Clifford Capital Partners Llc | 357 985 | −23,56 | 13 414 | −5,38 | ||||

| 2025-08-08 | 13F | KBC Group NV | 14 998 | 95,26 | 1 | |||||

| 2025-08-13 | 13F | Gamco Investors, Inc. Et Al | 783 230 | −7,09 | 29 348 | 15,01 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 2 736 | 0,00 | 103 | 24,39 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 468 | 32,58 | 14 | 75,00 | ||||

| 2025-06-27 | NP | PXF - Invesco FTSE RAFI Developed Markets ex-U.S. ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 3 874 | 134 | ||||||

| 2025-08-13 | 13F | Amundi | 74 484 | 34,11 | 2 840 | 67,75 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 76 390 | 10,70 | 2 862 | 37,07 | ||||

| 2025-08-13 | 13F | Options Solutions, Llc | 11 535 | 432 | ||||||

| 2025-08-13 | 13F | Gabelli Funds Llc | 464 700 | −4,85 | 17 412 | 17,78 | ||||

| 2025-08-14 | 13F | PDT Partners, LLC | 180 309 | 79,41 | 6 756 | 122,09 | ||||

| 2025-08-26 | NP | IWB - iShares Russell 1000 ETF | 74 199 | 2 780 | ||||||

| 2025-08-13 | 13F | Bridgewater Associates, LP | 218 800 | 728,69 | 8 198 | 926,03 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 225 441 | 3,30 | 8 447 | 27,89 | ||||

| 2025-08-12 | 13F | Nuveen, LLC | 455 954 | 407,19 | 17 085 | 527,86 | ||||

| 2025-08-11 | 13F | New Age Alpha Advisors, LLC | 3 840 | 144 | ||||||

| 2025-08-26 | NP | IYZ - iShares U.S. Telecommunications ETF | 365 617 | 13 700 | ||||||

| 2025-08-14 | 13F | Sei Investments Co | 87 433 | 14,44 | 3 276 | 41,70 | ||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 41 311 | 2 | ||||||

| 2025-08-14 | 13F | California State Teachers Retirement System | 113 655 | 11,99 | 4 259 | 38,65 | ||||

| 2025-08-27 | NP | BBVSX - Bridge Builder Small/Mid Cap Value Fund | 2 848 | 107 | ||||||

| 2025-08-26 | NP | NMIEX - Active M International Equity Fund | 9 858 | 4,32 | 369 | 29,02 | ||||

| 2025-08-26 | NP | GIEYX - INTERNATIONAL EQUITY FUND Institutional | 3 332 | 0,00 | 125 | 24,00 | ||||

| 2025-08-26 | NP | IWD - iShares Russell 1000 Value ETF | 228 423 | 8 559 | ||||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 1 781 | −36,16 | 67 | −21,43 | ||||

| 2025-08-29 | NP | JAJBX - Emerging Markets Value Trust Series I | 129 313 | 107,40 | 4 845 | 156,76 | ||||

| 2025-07-28 | NP | AVDEX - Avantis International Equity Fund Institutional Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 808 | 105 | ||||||

| 2025-08-14 | 13F/A | Barclays Plc | 2 848 021 | −15,43 | 107 | 4,95 | ||||

| 2025-08-13 | 13F | Polen Capital Management Llc | 18 753 | 703 | ||||||

| 2025-08-27 | NP | LLINX - Longleaf Partners International Fund | 596 227 | −51,03 | 22 341 | −39,38 | ||||

| 2025-08-13 | 13F | Jump Financial, LLC | 55 807 | −58,12 | 2 091 | −48,17 | ||||

| 2025-08-01 | 13F | Teacher Retirement System Of Texas | 44 356 | −4,22 | 1 662 | 18,63 | ||||

| 2025-08-14 | 13F | Militia Capital Partners, LP | 32 582 | 8,61 | 1 221 | 34,36 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 5 062 | 190 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | LWM Advisory Services, LLC | 10 638 | 0,00 | 399 | 23,60 | ||||

| 2025-05-14 | 13F | Caitlin John, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 11 765 | 441 | ||||||

| 2025-08-14 | 13F | Man Group plc | 91 632 | 3 433 | 996,81 | |||||

| 2025-08-14 | 13F | Promethos Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 20 875 | −61,57 | 782 | −52,43 | ||||

| 2025-08-11 | 13F | Lsv Asset Management | 78 180 | −67,28 | 3 | −71,43 | ||||

| 2025-08-14 | 13F | Fmr Llc | 188 | 261,54 | 7 | 600,00 | ||||

| 2025-08-14 | 13F | Price T Rowe Associates Inc /md/ | 5 827 912 | 4,46 | 218 | 29,76 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 1 711 | 16,32 | 64 | 45,45 | ||||

| 2025-08-14 | 13F | Susquehanna Portfolio Strategies, LLC | 20 275 | 760 | ||||||

| 2025-08-26 | NP | BISAX - BRANDES INTERNATIONAL SMALL CAP EQUITY FUND Class A | 989 642 | 27,42 | 37 082 | 57,73 | ||||

| 2025-08-18 | 13F/A | Nomura Holdings Inc | 80 134 | −56,69 | 3 003 | −46,39 | ||||

| 2025-08-19 | 13F | Cape Investment Advisory, Inc. | 452 | 20,53 | 17 | 45,45 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 652 | 24 | ||||||

| 2025-08-28 | NP | QCSTRX - Stock Account Class R1 | 244 687 | 172,18 | 9 168 | 236,93 | ||||

| 2025-07-21 | 13F | Hennessy Advisors Inc | 299 900 | 11 237 | ||||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 26 847 | 6,76 | 1 006 | 32,06 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 234 259 | 527,65 | 8 778 | 677,41 | ||||

| 2025-08-14 | 13F | Park West Asset Management LLC | 1 377 477 | −8,84 | 51 614 | 12,85 | ||||

| 2025-08-27 | NP | THRIVENT SERIES FUND INC - Thrivent International Allocation Portfolio Class A | 5 427 | 203 | ||||||

| 2025-08-14 | 13F | State Street Corp | 1 820 070 | 129,23 | 68 198 | 183,76 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 29 232 | 1 095 | ||||||

| 2025-08-08 | 13F | Itau Unibanco Holding S.A. | 703 267 | 52,65 | 13 912 | 106 915,38 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 10 743 | −4,15 | 403 | 18,58 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 767 464 | 228,44 | 28 751 | 306,53 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 35 848 | 21,49 | 1 343 | 50,39 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 47 | 0,00 | 2 | 0,00 | ||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 324 | 12 | ||||||

| 2025-08-14 | 13F | Susquehanna Fundamental Investments, Llc | 17 650 | 0,00 | 661 | 23,78 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | North of South Capital LLP | 52 881 | 17,82 | 1 981 | 45,88 | ||||

| 2025-08-11 | 13F | ARS Investment Partners, LLC | 7 000 | 262 | ||||||

| 2025-08-07 | 13F | Hosking Partners LLP | 518 521 | −2,39 | 19 429 | 20,83 | ||||

| 2025-08-25 | NP | LDVCX - AXS Thomson Reuters Venture Capital Return Tracker Fund Class C Shares | 63 | 2 | ||||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | Counterpoint Mutual Funds LLC | 52 363 | 1 962 | ||||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 10 805 | 0 | ||||||

| 2025-06-27 | NP | COLO - Global X MSCI Colombia ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 75 799 | 2 618 | ||||||

| 2025-08-13 | 13F | Dodge & Cox | 8 836 132 | 1,54 | 331 090 | 25,70 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 3 661 | 0 | ||||||

| 2025-08-26 | NP | NORTHERN FUNDS - U.S. Quality ESG Fund Class I | 21 414 | 802 | ||||||

| 2025-07-25 | 13F | RHS Financial, LLC | 7 416 | 278 | ||||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 127 577 | −4,60 | 4 780 | 18,08 | ||||

| 2025-05-29 | NP | JAKVX - John Hancock Disciplined Value Global Long/Short Fund Class R6 | 32 082 | 971 | ||||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 43 382 | −20,31 | 2 | 0,00 | ||||

| 2025-07-23 | 13F | Triasima Portfolio Management inc. | 91 505 | 3 429 | ||||||

| 2025-05-15 | 13F | Occudo Quantitative Strategies Lp | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | BBVLX - Bridge Builder Large Cap Value Fund | 4 407 | 165 | ||||||

| 2025-08-28 | NP | TIAA SEPARATE ACCOUNT VA 1 - Stock Index Account Teachers Personal Annuity Individual Deferred Variable Annuity | 2 245 | 84 | ||||||

| 2025-08-11 | 13F | One Capital Management, LLC | 27 876 | 1 045 | ||||||

| 2025-07-25 | 13F | JustInvest LLC | 32 334 | 17,60 | 1 212 | 45,55 | ||||

| 2025-08-13 | 13F | GABELLI & Co INVESTMENT ADVISERS, INC. | 6 000 | 225 | ||||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 14 005 | 6,22 | 1 | |||||

| 2025-08-12 | 13F | Dynamic Technology Lab Private Ltd | 11 000 | 412 | ||||||

| 2025-08-14 | 13F | Twinbeech Capital Lp | 93 981 | 3 521 | ||||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 20 067 | 19,70 | 1 | |||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 0 | −100,00 | 0 | |||||

| 2025-07-10 | 13F | Swedbank AB | 2 540 158 | −10,50 | 95 180 | 10,79 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 29 | 0,00 | 1 | |||||

| 2025-07-16 | 13F | ORG Partners LLC | 90 | 3 | ||||||

| 2025-08-14 | 13F | Shay Capital LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 34 501 | 1 293 | ||||||

| 2025-08-08 | 13F | Crossmark Global Holdings, Inc. | 139 900 | 5 242 | ||||||

| 2025-08-13 | 13F | Brandes Investment Partners, Lp | 6 624 718 | 2,50 | 248 228 | 26,89 | ||||

| 2025-07-29 | NP | FFND - The Future Fund Active ETF | 16 139 | 18,30 | 605 | 68,99 | ||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 12 881 | 34,36 | 483 | 66,21 | ||||

| 2025-08-11 | 13F | Inspire Advisors, LLC | 16 633 | 623 | ||||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 1 228 | −80,62 | 45 | −76,96 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 10 | −82,76 | 0 | −100,00 | ||||

| 2025-08-11 | 13F | Empirical Finance, LLC | 8 921 | 334 | ||||||

| 2025-08-08 | 13F | Jupiter Asset Management Ltd | 187 352 | −20,40 | 7 020 | −1,46 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 869 184 | 29,06 | 32 568 | 59,76 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 5 973 | 1 981,18 | 216 | 2 600,00 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 772 | 0,00 | 29 | 21,74 | ||||

| 2025-08-13 | 13F | Skandinaviska Enskilda Banken AB (publ) | 153 816 | −15,89 | 5 763 | 4,12 | ||||

| 2025-08-04 | 13F | Amalgamated Bank | 5 861 | 0 | ||||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Winton Capital Group Ltd | 7 023 | 263 | ||||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 48 161 | 75,76 | 1 805 | 117,61 | ||||

| 2025-07-28 | NP | AVSD - Avantis Responsible International Equity ETF | 1 744 | 65 | ||||||

| 2025-07-10 | 13F | TT International Asset Management LTD | 34 515 | 696,19 | 3 582 | 1 174,38 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 325 | 12 | ||||||

| 2025-08-08 | 13F | Vestcor Inc | 102 260 | 4 | ||||||

| 2025-08-14 | 13F | Principal Street Partners, LLC | 11 886 | 445 | ||||||

| 2025-08-15 | 13F | WealthCollab, LLC | 143 | 0,00 | 5 | 25,00 | ||||

| 2025-08-28 | NP | DODFX - Dodge & Cox International Stock Fund | 8 247 010 | 0,00 | 309 015 | 23,79 | ||||

| 2025-08-12 | 13F | Swiss National Bank | 198 422 | −1,39 | 7 435 | 22,07 |

Other Listings

| DE:M4M1 | 40,60 € |