Grundläggande statistik

| Institutionella ägare | 278 total, 278 long only, 0 short only, 0 long/short - change of 2,58% MRQ |

| Genomsnittlig portföljallokering | 0.2038 % - change of 15,66% MRQ |

| Institutionella aktier (lång) | 38 225 397 (ex 13D/G) - change of 2,18MM shares 6,03% MRQ |

| Institutionellt värde (lång) | $ 1 137 664 USD ($1000) |

Institutionellt ägande och aktieägare

Smith & Nephew plc - Depositary Receipt (Common Stock) (US:SNN) har 278 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 38,225,397 aktier. Största aktieägare inkluderar Bank Of Montreal /can/, River Road Asset Management, LLC, Goldman Sachs Group Inc, Scharf Investments, Llc, Morgan Stanley, Brandes Investment Partners, Lp, Jpmorgan Chase & Co, Optiver Holding B.V., FMIHX - Large Cap Fund Investor Class, and Abc Arbitrage Sa .

Smith & Nephew plc - Depositary Receipt (Common Stock) (NYSE:SNN) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 15, 2025 is 37,38 / share. Previously, on September 16, 2024, the share price was 31,51 / share. This represents an increase of 18,63% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

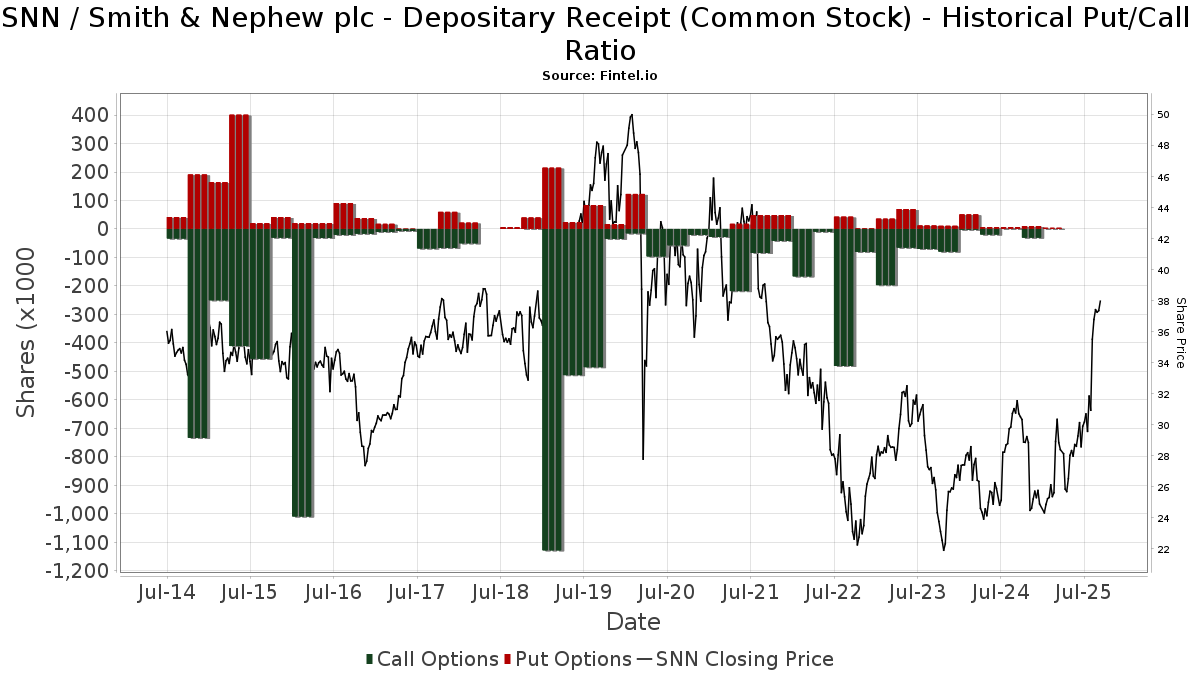

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13D/G-Arkiveringar

Vi presenterar 13D/G-arkiveringar separat från 13F-arkiveringar på grund av att de behandlas olika av SEC. 13D/G-arkiveringar kan lämnas in av grupper av investerare (med en ledare), medan 13F-arkiveringar inte kan det. Detta leder till situationer där en investerare kan lämna in en 13D/G-ansökan med ett värde för de totala aktierna (vilket motsvarar alla aktier som ägs av investerargruppen), men sedan lämna in en 13F-ansökan med ett annat värde för de totala aktierna (vilket motsvarar enbart deras eget ägande). Detta innebär att aktieägandet i 13D/G-arkiveringar och 13F-arkiveringar ofta inte är direkt jämförbara, så vi presenterar dem separat.

Notera: Från och med den 16 maj 2021 visar vi inte längre ägare som inte har lämnat in en 13D/G under det senaste året. Tidigare visade vi hela historiken för 13D/G-arkiveringar. I allmänhet måste enheter som är skyldiga att lämna in 13D/G-arkiveringar lämna in minst en gång per år innan de lämnar in en stängningsarkivering. Fonder avslutar dock ibland positioner utan att lämna in en avslutande arkivering (dvs. de avvecklar), så att visa hela historiken resulterade ibland i förvirring om det nuvarande ägandet. För att förhindra förvirring visar vi nu endast "nuvarande" ägare - det vill säga ägare som har lämnat in en ansökan under det senaste året.

Upgrade to unlock premium data.

| Fil Datum | Formulär | Investerare | Föregående aktier |

Senaste aktier |

Δ Aktier (Procent) |

Ägande (Procent) |

Δ Ägande (Procent) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-06-16 | Cevian Capital II GP LTD | 65,480,254 | 74,469,925 | 13.73 | 8.50 | 13.48 |

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 36 077 | 4,37 | 1 092 | 11,43 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 13 978 | −7,53 | 428 | 0,00 | ||||

| 2025-08-11 | 13F | GW&K Investment Management, LLC | 66 | 0,00 | 0 | |||||

| 2025-08-08 | 13F | Abc Arbitrage Sa | 898 635 | 1 063,40 | 27 525 | 1 156,28 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 3 068 | 107,30 | 94 | 158,33 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 7 849 | −31,55 | 240 | −26,15 | ||||

| 2025-08-14 | 13F | Corient IA LLC | 10 000 | 0,00 | 306 | 8,13 | ||||

| 2025-08-14 | 13F | Deprince Race & Zollo Inc | 541 722 | −0,36 | 16 593 | 7,58 | ||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 46 086 | 197,10 | 1 412 | 220,68 | ||||

| 2025-07-30 | 13F | Legacy Wealth Asset Management, LLC | 17 998 | 1,69 | 551 | 9,76 | ||||

| 2025-08-14 | 13F | Armistice Capital, Llc | 522 038 | −70,49 | 15 990 | −68,14 | ||||

| 2025-08-05 | 13F | Intellectus Partners, LLC | 9 903 | 0,00 | 303 | 6,32 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 3 709 | 111,94 | 0 | |||||

| 2025-05-15 | 13F | Cubist Systematic Strategies, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Syon Capital Llc | 17 108 | −13,65 | 524 | −6,76 | ||||

| 2025-06-26 | NP | CHTTX - AMG Managers Fairpointe Mid Cap Fund CLASS N SHARES | 136 996 | −2,04 | 3 839 | 8,14 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 776 006 | 15,03 | 23 769 | 24,19 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 73 | 7 200,00 | 2 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 65 840 | −65,25 | 2 017 | −62,49 | ||||

| 2025-08-27 | NP | JNL SERIES TRUST - JNL/DFA International Core Equity Fund (I) | 5 488 | 0,00 | 168 | 8,39 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 2 369 | 6,04 | 73 | 20,00 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 880 | 0,00 | 27 | 8,33 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Vise Technologies, Inc. | 9 205 | 282 | ||||||

| 2025-04-29 | 13F | Wood Tarver Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 103 | −84,32 | 3 | −83,33 | ||||

| 2025-08-11 | 13F | Pinnacle Wealth Planning Services, Inc. | 7 398 | −8,00 | 227 | −0,88 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | Causeway Capital Management Llc | 821 008 | 35,18 | 25 147 | 45,95 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 10 073 | −7,20 | 309 | 0,33 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 1 210 655 | 6 663,44 | 37 082 | 7 214,00 | ||||

| 2025-07-17 | 13F | Catalytic Wealth RIA, LLC | 11 867 | 39,71 | 363 | 51,25 | ||||

| 2025-05-06 | 13F | Venturi Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-07-28 | NP | AVDE - Avantis International Equity ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 143 220 | 10,56 | 4 148 | 10,56 | ||||

| 2025-07-30 | NP | FSAKX - Strategic Advisers U.S. Total Stock Fund | 337 782 | 0,00 | 9 782 | 0,00 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 3 304 | 0,18 | 101 | 9,78 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 71 974 | 65,09 | 2 204 | 78,32 | ||||

| 2025-08-14 | 13F | Hara Capital LLC | 2 157 | −8,49 | 66 | 0,00 | ||||

| 2025-04-23 | 13F | Continuum Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Millennium Management Llc | 408 257 | −73,90 | 12 505 | −71,83 | ||||

| 2025-08-14 | 13F | Wetherby Asset Management Inc | 7 285 | −21,83 | 223 | −2,62 | ||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Callan Family Office, LLC | 8 165 | 250 | ||||||

| 2025-08-13 | 13F | Cary Street Partner Investment Advisory Llc | 125 | 38,89 | 4 | 50,00 | ||||

| 2025-08-12 | 13F | Dimensional Fund Advisors Lp | 440 375 | 32,75 | 13 450 | 43,30 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 8 237 | −0,07 | 252 | 8,15 | ||||

| 2025-08-08 | 13F | TD Capital Management LLC | 39 | 2,63 | 1 | 0,00 | ||||

| 2025-05-14 | 13F | Susquehanna International Group, Llp | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Clark Estates Inc/ny | 675 000 | −20,59 | 20 675 | −14,26 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-07-24 | 13F | CWM Advisors, LLC | 7 273 | 223 | ||||||

| 2025-07-29 | 13F | BKM Wealth Management, LLC | 20 753 | −5,63 | 636 | 1,93 | ||||

| 2025-08-27 | NP | Jnl Series Trust - Jnl Multi-manager Mid Cap Fund (a) | 49 543 | −86,71 | 1 518 | −83,58 | ||||

| 2025-07-11 | 13F | Pinnacle Bancorp, Inc. | 588 | 0,00 | 18 | 12,50 | ||||

| 2025-07-30 | 13F | Whittier Trust Co | 0 | −100,00 | 0 | |||||

| 2025-08-25 | NP | MML SERIES INVESTMENT FUND - MML Income & Growth Fund Initial Class | 62 059 | −4,33 | 1 901 | 3,26 | ||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 424 | −2,53 | 13 | 0,00 | ||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 194 | 7 | ||||||

| 2025-08-14 | 13F | Ancora Advisors, LLC | 230 | 7 | ||||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 12 232 | 23,27 | 375 | 33,10 | ||||

| 2025-08-11 | 13F | WPG Advisers, LLC | 170 | 10,39 | 5 | 25,00 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - 1290 VT Equity Income Portfolio Class IB | 448 094 | −3,51 | 13 725 | 4,17 | ||||

| 2025-08-11 | 13F | Inspire Advisors, LLC | 18 351 | −11,08 | 562 | −3,93 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 8 533 | −46,31 | 261 | −42,00 | ||||

| 2025-07-31 | 13F | Kornitzer Capital Management Inc /ks | 154 254 | 0,00 | 4 725 | 7,95 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 1 003 | 27,77 | 31 | 36,36 | ||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-07 | 13F | Investors Research Corp | 21 009 | 0,00 | 644 | 7,89 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 33 | −83,33 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 336 144 | 192,76 | 10 296 | 216,12 | ||||

| 2025-08-14 | 13F | DRW Securities, LLC | 33 210 | 1 017 | ||||||

| 2025-07-08 | 13F | Gallacher Capital Management LLC | 10 622 | 6,40 | 325 | 14,84 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 96 250 | 2 948 | ||||||

| 2025-08-15 | 13F | Earnest Partners Llc | 70 926 | −1,09 | 2 172 | 6,78 | ||||

| 2025-07-17 | 13F | Clean Yield Group | 605 | −98,31 | 19 | −98,23 | ||||

| 2025-05-01 | 13F | Schechter Investment Advisors, LLC | 32 196 | −8,83 | 913 | 5,18 | ||||

| 2025-08-28 | NP | PMEFX - PENN MUTUAL AM 1847 INCOME FUND I Shares | 13 325 | 0,00 | 408 | 7,94 | ||||

| 2025-07-14 | 13F | Seed Wealth Management, Inc. | 7 570 | −4,54 | 232 | 3,13 | ||||

| 2025-08-18 | NP | HNMDX - HEARTLAND MID CAP VALUE FUND Institutional Class | 344 373 | −2,07 | 10 548 | 5,73 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 3 429 829 | 321,60 | 105 056 | 355,20 | ||||

| 2025-07-30 | NP | DTEC - ALPS DISRUPTIVE TECHNOLOGIES ETF | 27 988 | −21,98 | 811 | −21,97 | ||||

| 2025-07-30 | 13F | Bleakley Financial Group, LLC | 22 339 | 19,76 | 684 | 29,30 | ||||

| 2025-08-12 | 13F/A | Boston Partners | 109 018 | −16,07 | 3 339 | −9,39 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | ALLIANZ VARIABLE INSURANCE PRODUCTS TRUST - AZL DFA International Core Equity Fund | 1 754 | 77,17 | 54 | 89,29 | ||||

| 2025-07-28 | 13F | Frazier Financial Advisors, LLC | 1 208 | 1,51 | 37 | 12,12 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 1 921 | −17,45 | 59 | −12,12 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 543 661 | −12,13 | 16 652 | −5,13 | ||||

| 2025-07-31 | 13F | Whipplewood Advisors, LLC | 556 | 82,89 | 17 | 30,77 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 0 | −100,00 | 0 | |||||

| 2025-06-18 | NP | RTSSX - Tax-Managed U.S. Mid & Small Cap Fund Class S | 89 775 | 0,00 | 2 515 | 10,40 | ||||

| 2025-07-25 | 13F | Sivik Global Healthcare LLC | 140 000 | 16,67 | 4 | 33,33 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 54 233 | 51,11 | 1 661 | 63,16 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 253 | −3,44 | 8 | 0,00 | ||||

| 2025-08-13 | 13F | Cary Street Partners Financial Llc | 20 005 | 3,76 | 613 | 12,09 | ||||

| 2025-08-13 | 13F | Brentview Investment Management LLC | 700 | 0,00 | 21 | 10,53 | ||||

| 2025-08-12 | 13F | Entropy Technologies, LP | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 526 420 | 3,33 | 16 124 | 11,57 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 4 325 | 4,24 | 132 | 12,82 | ||||

| 2025-08-26 | NP | BINV - Brandes International ETF | 145 805 | 21,57 | 4 466 | 31,28 | ||||

| 2025-08-11 | 13F | Delta Asset Management Llc/tn | 750 | 0,00 | 23 | 4,76 | ||||

| 2025-08-11 | 13F | Integrated Quantitative Investments LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Atom Investors LP | 12 339 | 0,00 | 378 | 7,71 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 289 462 | 2,11 | 8 866 | 10,25 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 11 200 | 343 | ||||||

| 2025-07-28 | NP | AVSD - Avantis Responsible International Equity ETF | 4 128 | 0,00 | 120 | 0,00 | ||||

| 2025-05-14 | 13F | Rockefeller Capital Management L.P. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Alps Advisors Inc | 28 063 | −4,94 | 860 | 2,63 | ||||

| 2025-05-15 | 13F | Barclays Plc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 34 858 | 14,02 | 1 068 | 23,07 | ||||

| 2025-07-14 | 13F | Ridgewood Investments LLC | 9 887 | −86,81 | 303 | −85,79 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 171 668 | 5 | ||||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 78 | 2 | ||||||

| 2025-07-16 | 13F | Eagle Global Advisors Llc | 55 400 | −8,28 | 1 697 | −0,99 | ||||

| 2025-08-14 | 13F | UBS Group AG | 149 266 | 42,79 | 4 572 | 54,20 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 134 | 1,52 | 4 | 33,33 | ||||

| 2025-08-15 | 13F | Binnacle Investments Inc | 98 | 44,12 | 3 | 200,00 | ||||

| 2025-06-27 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - International Social Core Equity Portfolio Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 8 211 | −17,39 | 230 | −8,73 | ||||

| 2025-05-15 | 13F | Wexford Capital Lp | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 0 | 0 | ||||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 74 380 | 8,26 | 2 | 100,00 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 407 026 | 0,74 | 12 467 | 8,77 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 295 | 9 | ||||||

| 2025-08-08 | 13F | Crossmark Global Holdings, Inc. | 114 358 | −0,10 | 3 503 | 7,85 | ||||

| 2025-05-30 | NP | Liberty All Star Equity Fund | 254 738 | −3,78 | 7 227 | 11,05 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | MSEFX - Litman Gregory Masters Equity Fund Institutional Class | 84 243 | 10,60 | 2 580 | 19,44 | ||||

| 2025-08-12 | 13F | Manchester Capital Management LLC | 21 | 1 | ||||||

| 2025-08-07 | 13F | Montag A & Associates Inc | 386 | 0,00 | 12 | 0,00 | ||||

| 2025-08-06 | 13F | True Wealth Design, LLC | 17 | 0,00 | 1 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 318 | 0,00 | 10 | 0,00 | ||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 0 | −100,00 | 0 | |||||

| 2025-03-26 | NP | DFIEX - International Core Equity Portfolio - Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 12 095 | 0,00 | 307 | 0,99 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 25 252 | 773 | ||||||

| 2025-08-28 | NP | KOMP - SPDR S&P Kensho New Economies Composite ETF This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 27 933 | −66,42 | 856 | −63,76 | ||||

| 2025-08-14 | 13F | Sei Investments Co | 115 817 | 40,12 | 3 548 | 51,26 | ||||

| 2025-06-27 | NP | SPWO - SP Funds S&P World (ex-US) ETF | 1 583 | 74,34 | 44 | 91,30 | ||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 45 321 | 1 388 | ||||||

| 2025-07-25 | 13F | Yousif Capital Management, Llc | 7 078 | 217 | ||||||

| 2025-07-14 | 13F | Opal Wealth Advisors, LLC | 2 426 | −5,71 | 74 | 2,78 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 13 545 | 11,04 | 0 | |||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 8 122 | 249 | ||||||

| 2025-07-17 | 13F | Oakworth Capital, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Vestmark Advisory Solutions, Inc. | 10 842 | −28,98 | 332 | −23,33 | ||||

| 2025-08-14 | 13F | Fiduciary Management Inc /wi/ | 0 | −100,00 | 0 | |||||

| 2025-06-27 | NP | ARSMX - AMG River Road Small-Mid Cap Value Fund CLASS N SHARES | 177 632 | 3,16 | 4 977 | 13,89 | ||||

| 2025-08-01 | 13F | Riverwater Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-07-15 | 13F | Ballentine Partners, LLC | 8 573 | 263 | ||||||

| 2025-08-12 | 13F | Barrow Hanley Mewhinney & Strauss Llc | 836 318 | −2,21 | 25 616 | 5,58 | ||||

| 2025-07-14 | 13F | Proathlete Wealth Management Llc | 24 | 1 | ||||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 3 436 | −5,63 | 105 | 1,94 | ||||

| 2025-07-18 | 13F | Bartlett & Co. Wealth Management Llc | 63 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 8 617 | 8,08 | 0 | |||||

| 2025-07-31 | 13F | CVA Family Office, LLC | 96 | 0,00 | 3 | 0,00 | ||||

| 2025-08-13 | 13F | Kayne Anderson Rudnick Investment Management Llc | 8 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 188 | −10,48 | 6 | 0,00 | ||||

| 2025-08-13 | 13F | River Road Asset Management, LLC | 3 179 814 | 9,30 | 97 175 | 17,74 | ||||

| 2025-04-29 | 13F | Callan Capital, LLC | 9 180 | 260 | ||||||

| 2025-05-15 | 13F | Old Mission Capital Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 9 505 | −30,56 | 287 | −25,07 | ||||

| 2025-08-19 | NP | BUFIX - Buffalo International Fund Investor Class | 154 254 | 0,00 | 4 725 | 7,95 | ||||

| 2025-07-24 | 13F | Pinnacle West Asset Management, Inc. | 10 325 | 1,47 | 0 | |||||

| 2025-08-13 | 13F | Mount Yale Investment Advisors, LLC | 1 | 0 | ||||||

| 2025-08-27 | NP | Jnl Series Trust - Jnl Multi-manager Small Cap Value Fund (a) | 203 210 | 0,00 | 6 224 | 7,96 | ||||

| 2025-08-07 | 13F | Mitsubishi UFJ Kokusai Asset Management Co., Ltd. | 12 901 | −15,57 | 395 | −8,78 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 47 388 | 100,80 | 1 451 | 116,89 | ||||

| 2025-04-24 | 13F | Decker Retirement Planning Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 10 233 | 30,17 | 313 | 40,36 | ||||

| 2025-07-30 | 13F | Lorne Steinberg Wealth Management Inc. | 262 440 | 0,01 | 8 039 | 7,98 | ||||

| 2025-08-18 | NP | HRVIX - HEARTLAND VALUE PLUS FUND Investor Class | 150 000 | 4 594 | ||||||

| 2025-08-13 | 13F | Bridgewater Associates, LP | 77 315 | 17,75 | 2 368 | 27,18 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 486 178 | 42,81 | 14 890 | 54,19 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 16 872 | −1,45 | 517 | 6,39 | ||||

| 2025-08-11 | 13F | NewEdge Wealth, LLC | 12 028 | 63,20 | 434 | 107,18 | ||||

| 2025-08-05 | 13F | Carolinas Wealth Consulting Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 10 484 | 0 | ||||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 859 | −0,81 | 26 | 8,33 | ||||

| 2025-06-26 | NP | DFIC - Dimensional International Core Equity 2 ETF | 99 153 | 6,76 | 2 778 | 17,86 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 19 238 | 15,77 | 589 | 25,05 | ||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 1 452 | 44 | ||||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 71 | −61,20 | 2 | −60,00 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 17 764 | 2,51 | 544 | 10,79 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 49 841 | 4,60 | 1 527 | 12,95 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 14 839 | 10,66 | 0 | |||||

| 2025-07-24 | 13F | Standard Life Aberdeen plc | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Creative Planning | 62 239 | −13,71 | 1 906 | −6,84 | ||||

| 2025-08-11 | 13F | Cornerstone Planning Group LLC | 29 | 107,14 | 1 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 126 623 | 300,25 | 3 878 | 332,33 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - International Sustainability Core 1 Portfolio Shares | 20 995 | −40,75 | 588 | −34,59 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 411 608 | 173,10 | 12 608 | 194,90 | ||||

| 2025-08-14 | 13F | Principia Wealth Advisory, LLC | 7 | 0 | ||||||

| 2025-08-14 | 13F | Penn Mutual Asset Management, LLC | 13 325 | 0,00 | 408 | 7,94 | ||||

| 2025-07-09 | 13F | Bruce G. Allen Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Brandes Investment Partners, Lp | 1 604 400 | 4,14 | 49 143 | 12,44 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 800 | 0,00 | 25 | 9,09 | ||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 156 | 817,65 | 5 | |||||

| 2025-06-18 | NP | Putnam ETF Trust - Putnam PanAgora ESG International Equity ETF - | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-07 | 13F | Sierra Ocean, Llc | 572 | −12,00 | 18 | −5,56 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 49 | 0,00 | 2 | 0,00 | ||||

| 2025-05-15 | 13F | StoneX Group Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 11 610 | 162,14 | 356 | 184,00 | ||||

| 2025-06-26 | NP | DFAX - Dimensional World ex U.S. Core Equity 2 ETF | 3 398 | −45,01 | 95 | −39,10 | ||||

| 2025-07-10 | 13F | Kozak & Associates, Inc. | 100 | 0,00 | 3 | 50,00 | ||||

| 2025-07-24 | 13F | Thompson Investment Management, Inc. | 787 | 0,00 | 24 | 9,09 | ||||

| 2025-08-15 | 13F | WealthCollab, LLC | 942 | 9,28 | 29 | 16,67 | ||||

| 2025-08-21 | NP | MSCQX - Mercer US Small/Mid Cap Equity Fund Class I | 158 845 | 0,00 | 4 865 | 7,97 | ||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 75 | 2 | ||||||

| 2025-07-30 | NP | ENDW - Cambria Endowment Style ETF | 4 | 0 | ||||||

| 2025-07-17 | 13F | Heritage Investment Group, Inc. | 12 947 | 0,00 | 397 | 7,90 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 17 731 | 5,87 | 543 | 14,32 | ||||

| 2025-08-12 | 13F | American Century Companies Inc | 156 837 | 10,01 | 4 804 | 18,77 | ||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 9 789 | 6,33 | 0 | |||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 42 100 | 76,85 | 1 301 | 87,59 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 539 | −39,23 | 17 | −36,00 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 813 | −21,68 | 23 | −8,00 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 2 292 | −53,80 | 70 | −50,71 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 280 029 | 7,94 | 8 577 | 16,54 | ||||

| 2025-07-14 | 13F | Oliver Luxxe Assets LLC | 168 977 | 5 176 | ||||||

| 2025-05-15 | 13F | Tpg Gp A, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 40 | −45,21 | 1 | −50,00 | ||||

| 2025-07-14 | 13F | Scharf Investments, Llc | 2 083 513 | 0,34 | 63 818 | 8,33 | ||||

| 2025-04-29 | NP | GINX - SGI Enhanced Global Income ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | J. Goldman & Co LP | 276 330 | −58,97 | 8 464 | −55,71 | ||||

| 2025-08-12 | 13F | Saturna Capital CORP | 10 171 | 312 | ||||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 673 | 67,83 | 21 | 81,82 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 17 286 | 529 | ||||||

| 2025-08-12 | 13F | LPL Financial LLC | 67 462 | 16,66 | 2 066 | 25,98 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 4 371 | 24,00 | 134 | 33,00 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 348 | 10,83 | 11 | 25,00 | ||||

| 2025-07-31 | 13F | Richards, Merrill & Peterson, Inc. | 0 | −100,00 | 0 | |||||

| 2025-04-22 | 13F | Mendota Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 1 966 339 | 50,98 | 60 229 | 63,01 | ||||

| 2025-08-12 | 13F | Quadcap Wealth Management, LLC | 9 005 | 2,16 | 276 | 10,00 | ||||

| 2025-08-14 | 13F | Bayesian Capital Management, LP | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Qrg Capital Management, Inc. | 88 137 | 3,04 | 2 700 | 11,25 | ||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 12 138 | 38,94 | 372 | 50,20 | ||||

| 2025-08-14 | 13F | Fmr Llc | 505 016 | 4,33 | 15 469 | 12,64 | ||||

| 2025-07-16 | 13F | Highline Wealth Partners Llc | 8 | 0,00 | 0 | |||||

| 2025-08-04 | 13F | Assetmark, Inc | 108 | 2 600,00 | 3 | |||||

| 2025-08-13 | 13F | Bare Financial Services, Inc | 84 | 3 | ||||||

| 2025-08-04 | 13F | Atria Investments Llc | 22 327 | 12,76 | 684 | 21,75 | ||||

| 2025-08-13 | 13F | Beutel, Goodman & Co Ltd. | 24 455 | 56,21 | 1 | |||||

| 2025-08-14 | 13F | Henry James International Management Inc. | 149 900 | −4,22 | 4 591 | 3,42 | ||||

| 2025-06-26 | NP | DFALX - Large Cap International Portfolio - Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 13 121 | 0,00 | 368 | 10,21 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 54 808 | −79,42 | 1 679 | −77,79 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 5 261 | 219,24 | 161 | 250,00 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 21 | 0,00 | 1 | |||||

| 2025-08-12 | 13F | Clear Street Markets Llc | 51 235 | 1 569 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 0 | −100,00 | 0 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 1 553 | 23,55 | 48 | 34,29 | ||||

| 2025-05-29 | NP | Tekla World Healthcare Fund | 118 710 | −15,93 | 3 368 | −2,97 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 2 434 | −5,33 | 75 | 2,78 | ||||

| 2025-05-05 | 13F | Transce3nd, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-16 | 13F/A | Kestra Investment Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 7 | −65,00 | 0 | |||||

| 2025-08-13 | 13F | Cerity Partners LLC | 28 700 | −7,48 | 879 | −0,11 | ||||

| 2025-08-14 | 13F | Optiver Holding B.V. | 1 150 902 | 714,32 | 35 252 | 779,32 | ||||

| 2025-07-22 | 13F | Highland Capital Management, Llc | 19 835 | −2,65 | 608 | 5,02 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Parvin Asset Management, LLC | 36 375 | −0,75 | 1 114 | 7,22 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 51 728 | −0,29 | 1 584 | 7,68 | ||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 16 | 0,00 | 0 | |||||

| 2025-07-25 | 13F | Cwm, Llc | 1 629 | 22,11 | 0 | |||||

| 2025-06-26 | NP | AFAVX - AMG River Road Focused Absolute Value Fund CLASS I SHARES | 62 485 | 1 751 | ||||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 94 228 | 145,46 | 2 729 | 145,54 | ||||

| 2025-07-02 | 13F | Marotta Asset Management | 10 189 | −19,22 | 312 | −20,41 | ||||

| 2025-07-29 | NP | PHSWX - Parvin Hedged Equity Solari World Fund | 7 000 | 27,27 | 203 | 12,22 | ||||

| 2025-07-28 | 13F | Ritholtz Wealth Management | 10 524 | 322 | ||||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Millennium Management Llc | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-07-15 | 13F | Jarislowsky, Fraser Ltd | 20 825 | −0,83 | 638 | 7,06 | ||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 193 331 | 12,48 | 5 922 | 21,41 | ||||

| 2025-08-13 | 13F | Panagora Asset Management Inc | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Point72 Asset Management, L.P. | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Credential Qtrade Securities Inc. | 0 | −100,00 | 0 | |||||

| 2025-05-08 | 13F | Plante Moran Financial Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-09 | 13F | R Squared Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Heartland Advisors Inc | 513 191 | 42,61 | 15 719 | 53,97 | ||||

| 2025-07-29 | 13F | Harbor Asset Planning, Inc. | 151 | 5 | ||||||

| 2025-07-25 | 13F | JustInvest LLC | 34 688 | 6,06 | 1 063 | 14,56 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 19 855 | 28,84 | 608 | 39,13 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 7 734 | 237 | ||||||

| 2025-08-14 | 13F | Financial Network Wealth Advisors LLC | 78 | 2 | ||||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 237 825 | −18,31 | 7 | −12,50 | ||||

| 2025-08-12 | 13F | Tocqueville Asset Management L.p. | 252 032 | 0,19 | 7 720 | 8,17 | ||||

| 2025-08-14 | 13F | Farringdon Capital, Ltd. | 52 828 | 1 618 | ||||||

| 2025-07-15 | 13F | Mather Group, Llc. | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Point72 (DIFC) Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-02 | 13F | Capital A Wealth Management, LLC | 148 | 0,00 | 4 | 33,33 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 644 525 | 365,06 | 19 742 | 402,19 | ||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 11 936 | 37,83 | 366 | 46,59 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 17 026 | −0,47 | 1 | |||||

| 2025-06-26 | NP | SNTKX - Steward International Enhanced Index Fund Class A | 71 999 | 0,00 | 2 017 | 10,40 | ||||

| 2025-05-15 | NP | FMIHX - Large Cap Fund Investor Class | 955 000 | −9,91 | 27 093 | 3,99 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 12 317 | −35,48 | 377 | −30,31 | ||||

| 2025-07-28 | 13F | Moran Wealth Management, LLC | 121 052 | 3,12 | 3 708 | 11,32 | ||||

| 2025-07-15 | 13F | Td Private Client Wealth Llc | 27 | −48,08 | 1 | −100,00 | ||||

| 2025-06-18 | NP | REAYX - Equity Income Fund Class Y | 37 426 | −8,07 | 1 049 | 1,45 | ||||

| 2025-08-06 | 13F | Equity Investment Corp | 7 772 | −14,28 | 238 | −7,39 | ||||

| 2025-08-13 | 13F | Natixis Advisors, L.p. | 150 162 | 8,82 | 5 | 33,33 | ||||

| 2025-07-11 | 13F | Grove Bank & Trust | 1 790 | −0,61 | 55 | 5,88 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 1 559 | 48 | ||||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 11 645 | 56,31 | 357 | 68,72 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 12 | 500,00 | 0 | |||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 11 949 | −5,71 | 366 | 0,27 | ||||

| 2025-04-07 | 13F | Summit Global Investments | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Colony Group, LLC | 19 145 | −1,51 | 586 | 6,35 | ||||

| 2025-07-28 | NP | AVDEX - Avantis International Equity Fund Institutional Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 4 573 | 0,00 | 132 | 0,00 | ||||

| 2025-08-14 | 13F | State Street Corp | 36 924 | −59,97 | 1 131 | −57,50 | ||||

| 2025-05-06 | 13F | Argonautica Private Wealth Management, Inc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-30 | 13F | Ethic Inc. | 19 466 | −17,44 | 588 | −11,45 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 227 | 38,41 | 7 | 50,00 | ||||

| 2025-07-21 | 13F | Ashton Thomas Securities, Llc | 55 911 | 0,92 | 1 713 | 8,98 | ||||

| 2025-07-29 | 13F | Salomon & Ludwin, LLC | 6 | 0 | ||||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 113 919 | 79,44 | 3 489 | 93,73 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - International Vector Equity Portfolio Shares | 15 300 | 410,00 | 429 | 463,16 | ||||

| 2025-08-07 | 13F | Zions Bancorporation, National Association /ut/ | 88 | −1,12 | 3 | 0,00 | ||||

| 2025-06-26 | NP | DFSI - Dimensional International Sustainability Core 1 ETF | 685 | 19 | ||||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 13 647 | −16,27 | 418 | −9,52 | ||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 8 489 | 62,72 | 260 | 75,68 | ||||

| 2025-08-08 | 13F/A | Sterling Capital Management LLC | 16 550 | 7,29 | 507 | 15,79 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 355 913 | 507,84 | 10 902 | 556,29 | ||||

| 2025-08-27 | NP | TPIAX - Timothy Plan International Fund Class A | 55 400 | −8,28 | 1 697 | −0,99 | ||||

| 2025-07-31 | 13F | Oppenheimer Asset Management Inc. | 63 314 | 18,15 | 1 939 | 27,57 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 2 189 303 | 23,59 | 67 058 | 33,44 | ||||

| 2025-07-08 | 13F | Arlington Trust Co LLC | 40 | 1 | ||||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 12 462 | 4,79 | 381 | 13,73 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - World ex U.S. Core Equity Portfolio Institutional Class Shares | 6 181 | −44,78 | 173 | −39,08 |

Other Listings

| DE:NPWA | 32,20 € |