Grundläggande statistik

| Institutionella ägare | 231 total, 231 long only, 0 short only, 0 long/short - change of −2,93% MRQ |

| Genomsnittlig portföljallokering | 0.3894 % - change of −3,16% MRQ |

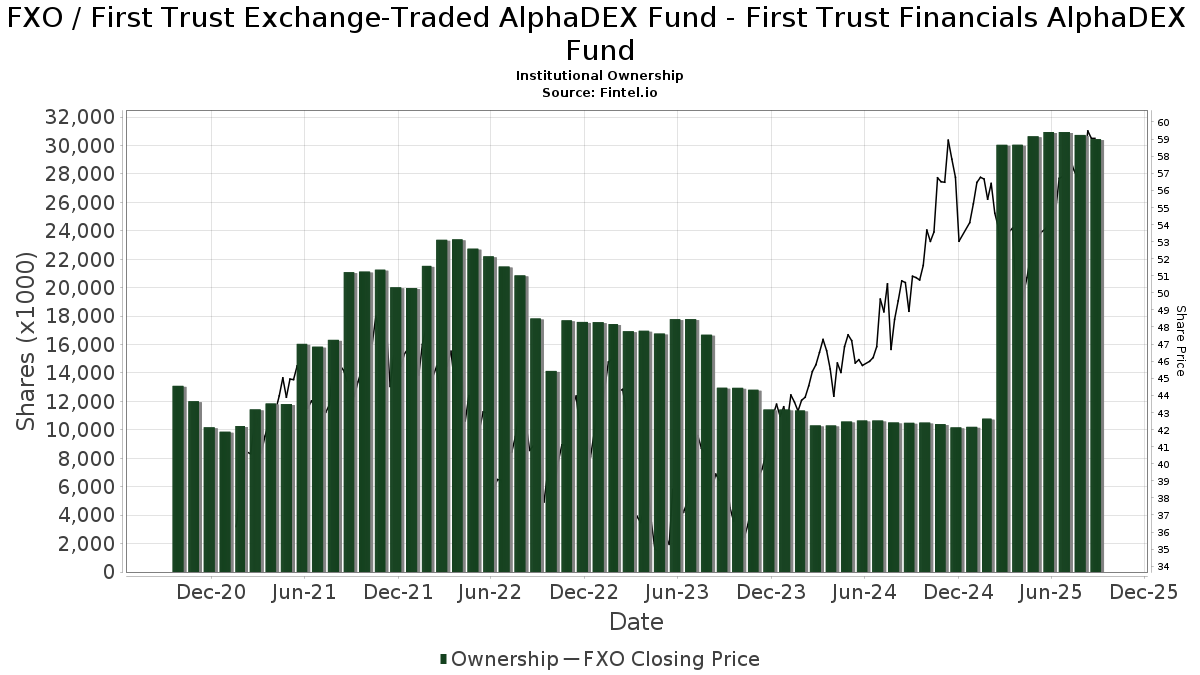

| Institutionella aktier (lång) | 30 447 940 (ex 13D/G) - change of −0,50MM shares −1,62% MRQ |

| Institutionellt värde (lång) | $ 1 653 948 USD ($1000) |

Institutionellt ägande och aktieägare

First Trust Exchange-Traded AlphaDEX Fund - First Trust Financials AlphaDEX Fund (US:FXO) har 231 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 30,447,940 aktier. Största aktieägare inkluderar First Trust Advisors Lp, FV - First Trust Dorsey Wright Focus 5 ETF, Morgan Stanley, Wells Fargo & Company/mn, LPL Financial LLC, Raymond James Financial Inc, UBS Group AG, Bank Of America Corp /de/, Royal Bank Of Canada, and GWM Advisors LLC .

First Trust Exchange-Traded AlphaDEX Fund - First Trust Financials AlphaDEX Fund (ARCA:FXO) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 16, 2025 is 58,82 / share. Previously, on September 17, 2024, the share price was 50,91 / share. This represents an increase of 15,54% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

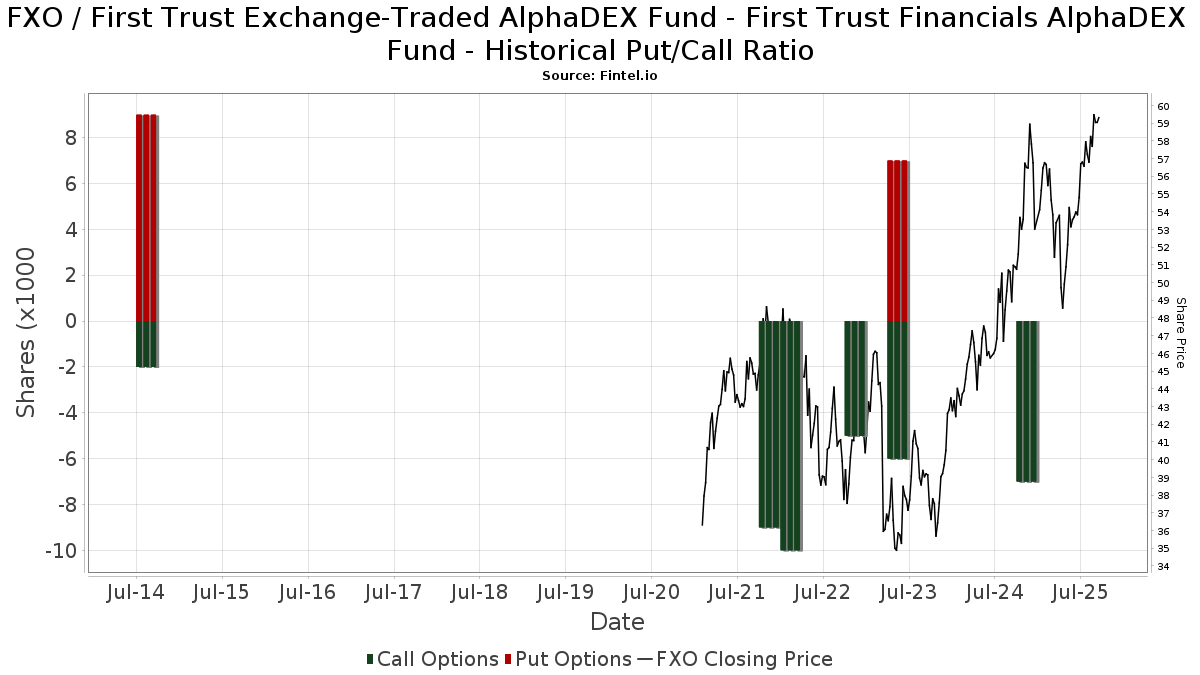

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13D/G-Arkiveringar

Vi presenterar 13D/G-arkiveringar separat från 13F-arkiveringar på grund av att de behandlas olika av SEC. 13D/G-arkiveringar kan lämnas in av grupper av investerare (med en ledare), medan 13F-arkiveringar inte kan det. Detta leder till situationer där en investerare kan lämna in en 13D/G-ansökan med ett värde för de totala aktierna (vilket motsvarar alla aktier som ägs av investerargruppen), men sedan lämna in en 13F-ansökan med ett annat värde för de totala aktierna (vilket motsvarar enbart deras eget ägande). Detta innebär att aktieägandet i 13D/G-arkiveringar och 13F-arkiveringar ofta inte är direkt jämförbara, så vi presenterar dem separat.

Notera: Från och med den 16 maj 2021 visar vi inte längre ägare som inte har lämnat in en 13D/G under det senaste året. Tidigare visade vi hela historiken för 13D/G-arkiveringar. I allmänhet måste enheter som är skyldiga att lämna in 13D/G-arkiveringar lämna in minst en gång per år innan de lämnar in en stängningsarkivering. Fonder avslutar dock ibland positioner utan att lämna in en avslutande arkivering (dvs. de avvecklar), så att visa hela historiken resulterade ibland i förvirring om det nuvarande ägandet. För att förhindra förvirring visar vi nu endast "nuvarande" ägare - det vill säga ägare som har lämnat in en ansökan under det senaste året.

Upgrade to unlock premium data.

| Fil Datum | Formulär | Investerare | Föregående aktier |

Senaste aktier |

Δ Aktier (Procent) |

Ägande (Procent) |

Δ Ägande (Procent) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-04-07 | FIRST TRUST PORTFOLIOS LP | 15,056,109 | 13,901,118 | -7.67 | 34.62 | -14.22 |

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-25 | NP | FVC - First Trust Dorsey Wright Dynamic Focus 5 ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 175 566 | −32,01 | 9 842 | −28,09 | ||||

| 2025-07-16 | 13F/A | CX Institutional | 4 585 | −76,20 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Park Square Financial Group, LLC | 262 | −0,76 | 15 | 7,69 | ||||

| 2025-08-05 | 13F | Tsfg, Llc | 126 | 0,80 | 0 | |||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 8 226 | −31,17 | 461 | −27,17 | ||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 742 | 0,13 | 42 | 5,13 | ||||

| 2025-08-12 | 13F | Jacobi Capital Management LLC | 24 378 | −0,53 | 1 367 | 5,24 | ||||

| 2025-08-04 | 13F | Kovack Advisors, Inc. | 6 587 | −10,26 | 369 | −5,14 | ||||

| 2025-07-08 | 13F | Choice Wealth Advisors, LLC | 40 601 | 0,00 | 2 276 | 5,81 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 1 301 246 | −10,44 | 72 948 | −5,27 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | Bank & Trust Co | 181 | 0,00 | 10 | 11,11 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | Old National Bancorp /in/ | 3 785 | 0,00 | 212 | 6,00 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 706 | −0,42 | 38 | 2,70 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 242 517 | 3,28 | 14 | 8,33 | ||||

| 2025-07-18 | 13F | Trust Co Of Vermont | 420 | 24 | ||||||

| 2025-08-13 | 13F | Virtue Capital Management, LLC | 130 255 | −6,48 | 7 302 | −1,04 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 387 950 | 5,15 | 21 748 | 11,22 | ||||

| 2025-08-08 | 13F | WASHINGTON TRUST Co | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-05 | 13F | Fortress Wealth Group, LLC | 6 570 | 0,06 | 372 | 11,04 | ||||

| 2025-08-06 | 13F | Centerpoint Advisory Group | 3 920 | 0,00 | 220 | 5,80 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 4 858 | 50,82 | 272 | 60,00 | ||||

| 2025-08-29 | 13F | Centaurus Financial, Inc. | 7 877 | 1,40 | 0 | |||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 5 281 | −3,35 | 296 | 0,34 | ||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 4 319 | 3,87 | 242 | 10,00 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 15 805 | −3,99 | 886 | −0,11 | ||||

| 2025-07-29 | 13F | Koshinski Asset Management, Inc. | 19 733 | 5,22 | 1 106 | 11,38 | ||||

| 2025-05-15 | 13F | Gts Securities Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 1 136 | −24,27 | 64 | −20,25 | ||||

| 2025-07-02 | 13F | Crumly & Associates Inc. | 28 324 | −0,29 | 1 588 | 5,45 | ||||

| 2025-07-29 | 13F | Signature Estate & Investment Advisors Llc | 7 561 | −5,97 | 424 | −0,70 | ||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 89 664 | 3,39 | 5 027 | 9,36 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 641 | −25,29 | 36 | −22,22 | ||||

| 2025-07-17 | 13F | Montis Financial, LLC | 22 188 | −14,39 | 1 244 | −9,47 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 177 400 | −1,63 | 10 | 0,00 | ||||

| 2025-08-01 | 13F | Planning Directions Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Comerica Bank | 15 890 | −2,83 | 891 | 2,77 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 187 967 | −32,65 | 10 537 | −28,76 | ||||

| 2025-05-12 | 13F | Independent Advisor Alliance | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | Minichmacgregor Wealth Management, Llc | 12 713 | 3,31 | 713 | 9,20 | ||||

| 2025-08-13 | 13F | Custom Index Systems, Llc | 13 952 | 46,54 | 782 | 55,16 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 17 585 | −0,68 | 986 | 5,01 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | O'Dell Group, LLC | 296 450 | −15,89 | 16 619 | −11,03 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 15 727 | −9,19 | 882 | −3,93 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 108 730 | 117,46 | 6 095 | 130,00 | ||||

| 2025-08-14 | 13F | Tudor Financial Inc. | 13 432 | −18,69 | 753 | −14,06 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 197 351 | 53,97 | 11 071 | 62,90 | ||||

| 2025-08-04 | 13F | Daymark Wealth Partners, Llc | 53 845 | 98,74 | 3 019 | 110,31 | ||||

| 2025-07-29 | 13F | Balboa Wealth Partners | 4 058 | 227 | ||||||

| 2025-07-10 | 13F | Focus Financial Network, Inc. | 7 594 | −14,39 | 426 | −9,57 | ||||

| 2025-04-22 | 13F | Synergy Financial Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Fmr Llc | 4 160 | −6,71 | 233 | −1,27 | ||||

| 2025-05-06 | 13F | Navellier & Associates Inc | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Allworth Financial LP | 2 500 | 0,00 | 140 | 11,11 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 1 734 | −0,69 | 97 | 5,43 | ||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 8 125 | 0 | ||||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 351 062 | 0,20 | 20 021 | 7,83 | ||||

| 2025-08-26 | NP | FIRST TRUST VARIABLE INSURANCE TRUST - First Trust Dorsey Wright Tactical Core Portfolio Class I This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 78 345 | −2,06 | 4 392 | 3,61 | ||||

| 2025-07-18 | 13F | Bartlett & Co. Wealth Management Llc | 900 | 0,00 | 50 | 6,38 | ||||

| 2025-08-11 | 13F | Western Wealth Management, LLC | 37 991 | −1,71 | 2 130 | 3,96 | ||||

| 2025-08-01 | 13F | Motco | 1 100 | 63 | ||||||

| 2025-08-11 | 13F | SFI Advisors, LLC | 117 997 | −4,09 | 6 615 | 1,44 | ||||

| 2025-08-14 | 13F | Transamerica Financial Advisors, Inc. | 41 167 | −1,27 | 2 308 | 115 250,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 2 483 | 3,63 | 139 | 10,32 | ||||

| 2025-08-11 | 13F/A | Purus Wealth Management, LLC | 4 275 | −0,93 | 240 | 4,82 | ||||

| 2025-07-07 | 13F | Vishria Bird Financial Group, LLC | 14 475 | 0,00 | 811 | 5,74 | ||||

| 2025-08-05 | 13F | Sigma Planning Corp | 8 453 | 12,32 | 474 | 18,84 | ||||

| 2025-08-11 | 13F | Plotkin Financial Advisors, LLC | 33 816 | −1,36 | 1 896 | 4,35 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 98 | 0,00 | 5 | 0,00 | ||||

| 2025-08-13 | 13F | Summit Financial, LLC | 162 813 | 9 127 | ||||||

| 2025-08-13 | 13F | Financial Freedom, LLC | 964 | −77,04 | 54 | −75,68 | ||||

| 2025-07-16 | 13F | RWM Asset Management, LLC | 3 672 | 206 | ||||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 67 009 | −10,48 | 3 757 | −5,32 | ||||

| 2025-07-23 | 13F | REAP Financial Group, LLC | 1 794 | −39,25 | 101 | −35,90 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 6 020 | −5,21 | 337 | 0,30 | ||||

| 2025-08-11 | 13F | Regal Investment Advisors LLC | 19 155 | 0,00 | 1 074 | 5,71 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 8 925 | −0,67 | 500 | 5,05 | ||||

| 2025-07-08 | 13F | Ballew Advisors, Inc | 20 826 | −0,47 | 1 191 | 18,15 | ||||

| 2025-07-29 | 13F | Huntleigh Advisors, Inc. | 3 734 | −15,14 | 209 | −10,30 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 14 155 | −86,87 | 794 | −86,12 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 23 | −99,90 | 1 | −99,92 | ||||

| 2025-08-12 | 13F | Cutter & CO Brokerage, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Sargent Investment Group, LLC | 5 500 | 0,00 | 312 | 7,22 | ||||

| 2025-08-14 | 13F | Benjamin Edwards Inc | 211 051 | 30,72 | 11 832 | 38,28 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 4 929 | −14,75 | 276 | −9,80 | ||||

| 2025-07-30 | 13F | Greenup Street Wealth Management Llc | 61 539 | 8,85 | 3 450 | 15,12 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 8 533 | 3,73 | 478 | 9,89 | ||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 1 121 | 65 | ||||||

| 2025-07-25 | 13F | Genesee Capital Advisors, LLC | 33 214 | 1,68 | 1 862 | 7,51 | ||||

| 2025-07-24 | 13F | Cyndeo Wealth Partners, LLC | 30 308 | −7,50 | 1 699 | −2,13 | ||||

| 2025-08-01 | 13F | Ashton Thomas Private Wealth, LLC | 5 253 | −4,82 | 294 | 0,68 | ||||

| 2025-08-05 | 13F | Kesler, Norman & Wride, LLC | 7 157 | −2,23 | 401 | 3,62 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 251 881 | −5,37 | 14 120 | 0,09 | ||||

| 2025-08-12 | 13F | Clearwater Capital Advisors, LLC | 6 478 | −3,30 | 363 | 2,25 | ||||

| 2025-07-23 | 13F | Prime Capital Investment Advisors, LLC | 5 015 | −2,43 | 281 | 3,31 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 296 337 | 121,03 | 17 | 128,57 | ||||

| 2025-05-12 | 13F | Blueprint Investment Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | TriaGen Wealth Management LLC | 40 261 | 83,45 | 2 257 | 94,07 | ||||

| 2025-07-30 | 13F | Pacific Sun Financial Corp | 32 630 | 0,22 | 1 829 | 6,03 | ||||

| 2025-04-09 | 13F | RFG Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Atria Investments Llc | 24 814 | −0,97 | 1 391 | 4,74 | ||||

| 2025-08-08 | 13F | Meridian Wealth Management, LLC | 4 074 | 0,00 | 228 | 6,05 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 136 627 | −4,30 | 7 659 | 1,23 | ||||

| 2025-07-29 | 13F | International Assets Investment Management, Llc | 26 001 | 0,07 | 1 458 | 5,81 | ||||

| 2025-08-13 | 13F | WCG Wealth Advisors LLC | 116 260 | 11,29 | 6 518 | 17,72 | ||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 25 | 0,00 | 1 | 0,00 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 14 735 | −3,73 | 826 | 1,85 | ||||

| 2025-07-24 | 13F | WMG Financial Advisors, LLC | 4 725 | 0,00 | 265 | 5,60 | ||||

| 2025-07-23 | 13F | Prasad Wealth Partners, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-25 | 13F | Hazlett, Burt & Watson, Inc. | 100 | 0,00 | 0 | |||||

| 2025-05-15 | 13F | Millennium Management Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-08 | 13F | Petix & Botte Co | 4 672 | 0,00 | 262 | 5,67 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 64 208 | −17,74 | 4 | −25,00 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 53 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 263 559 | −5,53 | 14 775 | −0,07 | ||||

| 2025-08-14 | 13F | Great Valley Advisor Group, Inc. | 9 452 | −1,93 | 530 | 3,92 | ||||

| 2025-07-30 | 13F | Whittier Trust Co | 35 | 0,00 | 2 | 0,00 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 12 529 | 14,52 | 702 | 21,24 | ||||

| 2025-08-12 | 13F | Financial Advocates Investment Management | 6 502 | −12,19 | 365 | −7,14 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 64 599 | 8,15 | 3 621 | 14,41 | ||||

| 2025-05-08 | 13F | Armis Advisers, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Luminist Capital LLC | 244 | 0,00 | 14 | 8,33 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 3 680 | 206 | ||||||

| 2025-08-13 | 13F | Beacon Pointe Advisors, LLC | 3 583 | 201 | ||||||

| 2025-08-05 | 13F | EPG Wealth Management LLC | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Wagner Wealth Management, Llc | 25 337 | −5,61 | 1 420 | −0,14 | ||||

| 2025-07-22 | 13F | DAVENPORT & Co LLC | 18 694 | 10,33 | 1 048 | 16,59 | ||||

| 2025-08-11 | 13F | United Capital Financial Advisers, Llc | 3 624 | 203 | ||||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 1 802 | 0,00 | 101 | 6,32 | ||||

| 2025-07-25 | 13F | 1858 Wealth Management, Llc | 19 283 | 5,21 | 1 081 | 11,33 | ||||

| 2025-08-08 | 13F | Glassman Wealth Services | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Bellwether Advisors, LLC | 4 065 | 0,00 | 228 | 5,58 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 9 023 | −87,31 | 506 | −86,60 | ||||

| 2025-07-24 | 13F | Blair William & Co/il | 10 095 | 0,00 | 566 | 5,61 | ||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 18 146 | 11,66 | 1 017 | 18,12 | ||||

| 2025-07-21 | 13F | Crews Bank & Trust | 1 000 | 0,00 | 56 | 5,66 | ||||

| 2025-08-14 | 13F | Certified Advisory Corp | 24 602 | −5,67 | 1 379 | −0,22 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 10 603 | −6,28 | 1 | |||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 367 834 | −0,87 | 20 621 | 4,85 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 4 858 | 15,53 | 272 | 22,52 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 160 373 | 2,57 | 8 991 | 8,50 | ||||

| 2025-08-14 | 13F | Harmony Asset Management Llc | 41 954 | 0,00 | 2 352 | 5,76 | ||||

| 2025-07-09 | 13F | First Financial Corp /in/ | 3 046 | 0,00 | 171 | 5,59 | ||||

| 2025-07-15 | 13F | MCF Advisors LLC | 400 | 0,00 | 22 | 4,76 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 3 910 | 219 | ||||||

| 2025-04-10 | 13F | Secure Asset Management, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-08 | 13F | Creative Planning | 16 696 | −6,17 | 936 | −0,85 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 9 873 | 17,80 | 553 | 22,08 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 4 436 | −6,33 | 249 | −1,20 | ||||

| 2025-08-14 | 13F | Guardian Wealth Advisors, Llc / Nc | 32 | 0,00 | 2 | 0,00 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 25 012 | −0,58 | 1 402 | 5,18 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 77 | 0,00 | 4 | 0,00 | ||||

| 2025-05-14 | 13F | Capital Analysts, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Level Four Advisory Services, Llc | 6 485 | −5,66 | 364 | −0,27 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 494 325 | −25,01 | 27 712 | −20,68 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 2 700 | 0,00 | 151 | 5,59 | ||||

| 2025-08-08 | 13F | Kingsview Wealth Management, LLC | 31 312 | 0,00 | 1 755 | 5,79 | ||||

| 2025-07-22 | 13F | Coastal Investment Advisors, Inc. | 12 323 | 7,87 | 691 | 14,05 | ||||

| 2025-07-23 | 13F | Morey & Quinn Wealth Partners, LLC | 5 010 | −0,71 | 281 | 4,87 | ||||

| 2025-05-09 | 13F | GeoWealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | ROI Financial Advisors, LLC | 4 516 | 3,67 | 253 | 10,00 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 3 237 | −74,66 | 181 | −73,26 | ||||

| 2025-07-08 | 13F | Davis Investment Partners, LLC | 22 623 | 2,09 | 1 280 | 17,99 | ||||

| 2025-08-14 | 13F | UBS Group AG | 506 477 | −2,86 | 28 393 | 2,75 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 6 890 | 0,00 | 386 | 5,75 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 10 750 | 11,99 | 603 | 18,50 | ||||

| 2025-08-06 | 13F | Eukles Asset Management | 143 | 8 | ||||||

| 2025-08-04 | 13F | Assetmark, Inc | 474 | 0,00 | 27 | 4,00 | ||||

| 2025-07-31 | 13F | Nilsine Partners, LLC | 255 384 | −16,60 | 14 317 | −11,79 | ||||

| 2025-08-08 | 13F | Good Life Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 2 322 169 | 6,18 | 130 181 | 12,32 | ||||

| 2025-08-13 | 13F | StoneX Group Inc. | 32 371 | 3,63 | 1 815 | 9,61 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 102 274 | −48,76 | 5 733 | −45,80 | ||||

| 2025-08-06 | 13F | Vestmark Advisory Solutions, Inc. | 372 412 | 63,96 | 20 877 | 73,44 | ||||

| 2025-08-13 | 13F | RPg Family Wealth Advisory, LLC | 12 444 | −1,64 | 698 | 4,03 | ||||

| 2025-07-07 | 13F | Trust Co Of Oklahoma | 5 283 | 0,00 | 296 | 6,09 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 94 188 | 3,52 | 5 280 | 9,50 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 2 563 615 | −4,82 | 143 716 | 0,68 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 28 745 | 10,98 | 1 599 | 17,40 | ||||

| 2025-07-10 | 13F | HF Advisory Group, LLC | 11 556 | 1,28 | 648 | 7,12 | ||||

| 2025-08-14 | 13F | Hurley Capital, LLC | 1 017 | −2,40 | 57 | 3,64 | ||||

| 2025-07-17 | 13F | Venture Visionary Partners LLC | 5 200 | 0,00 | 292 | 5,82 | ||||

| 2025-08-12 | 13F | Argent Trust Co | 10 000 | 0,00 | 561 | 5,66 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 1 390 | 31,13 | 78 | 37,50 | ||||

| 2025-08-11 | 13F | Brass Tax Wealth Management, Inc | 41 674 | −2,06 | 2 336 | 3,59 | ||||

| 2025-08-12 | 13F | Change Path, LLC | 29 013 | 7,52 | 1 626 | 13,71 | ||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 40 088 | 114,27 | 2 249 | 126,94 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 1 044 135 | 6,63 | 58 534 | 12,79 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 43 387 | 66,86 | 2 432 | 72,85 | ||||

| 2025-04-15 | 13F | Simplicity Wealth,LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-14 | 13F | Caitlin John, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 22 581 | 8,36 | 1 266 | 14,58 | ||||

| 2025-05-14 | 13F | Susquehanna International Group, Llp | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Royal Bank Of Canada | 391 953 | 7,36 | 21 973 | 13,56 | ||||

| 2025-08-12 | 13F | Richmond Investment Services, LLC | 3 908 | 219 | ||||||

| 2025-08-14 | 13F | KKM Financial LLC | 12 909 | −15,17 | 724 | −10,30 | ||||

| 2025-08-13 | 13F | Transce3nd, LLC | 8 597 | −13,13 | 482 | −6,04 | ||||

| 2025-07-07 | 13F | Nova Wealth Management, Inc. | 4 710 | 0,41 | 264 | 6,45 | ||||

| 2025-07-03 | 13F | TrueWealth Advisors, LLC | 9 270 | 7,37 | 520 | 13,57 | ||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 14 039 | 0,15 | 787 | 6,06 | ||||

| 2025-08-25 | NP | FV - First Trust Dorsey Wright Focus 5 ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 13 113 896 | −1,38 | 735 165 | 4,31 | ||||

| 2025-08-13 | 13F | Gateway Wealth Partners, LLC | 7 951 | −3,10 | 446 | 2,53 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 11 872 | 7,94 | 666 | 14,26 | ||||

| 2025-08-07 | 13F | Apeiron RIA LLC | 19 211 | 6,53 | 1 077 | 12,67 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 13 622 132 | −1,93 | 763 657 | 3,73 | ||||

| 2025-07-14 | 13F | Southland Equity Partners LLC | 11 696 | 0,00 | 656 | 5,82 | ||||

| 2025-07-16 | 13F | Register Financial Advisors LLC | 5 010 | 0,00 | 281 | 5,66 | ||||

| 2025-07-07 | 13F | Investors Research Corp | 4 | 0,00 | 0 | |||||

| 2025-08-07 | 13F | Addison Advisors LLC | 1 180 | 0,00 | 66 | 6,45 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 1 150 | 0,00 | 64 | 6,67 | ||||

| 2025-08-05 | 13F | Westside Investment Management, Inc. | 300 | 0,00 | 17 | 6,67 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 68 289 | −4,57 | 3 828 | 0,95 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 543 | 279,72 | 30 | 328,57 | ||||

| 2025-08-12 | 13F | Nemes Rush Group LLC | 0 | −100,00 | 0 | |||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 23 093 | 5,49 | 1 295 | 11,36 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 9 665 | −0,28 | 542 | 5,46 | ||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 117 062 | −50,18 | 6 562 | −47,30 | ||||

| 2025-07-21 | 13F | DHJJ Financial Advisors, Ltd. | 38 | 0,00 | 2 | 0,00 | ||||

| 2025-08-06 | 13F | Stonebridge Financial Planning Group, LLC | 3 700 | 207 | ||||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Trexquant Investment LP | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | HFG Advisors, Inc. | 21 266 | 0,43 | 1 192 | 6,24 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 995 | 56 | ||||||

| 2025-07-31 | 13F | Leelyn Smith, LLC | 7 222 | −7,30 | 405 | −1,94 | ||||

| 2025-08-05 | 13F | Claro Advisors LLC | 5 773 | 6,65 | 324 | 12,94 | ||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 328 983 | 2,84 | 18 441 | 8,73 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 6 503 | 9,57 | 372 | 18,15 | ||||

| 2025-08-08 | 13F | MTM Investment Management, LLC | 4 221 | 0,00 | 237 | 5,36 | ||||

| 2025-07-24 | 13F | Horizon Bancorp Inc /in/ | 898 | 0,00 | 0 | |||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 47 250 | −6,70 | 2 649 | −1,34 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 17 990 | 1,65 | 1 009 | 7,58 | ||||

| 2025-04-30 | 13F | TradeWell Securities, LLC. | 103 405 | 3,07 | 5 480 | 0,92 | ||||

| 2025-07-29 | 13F | Stephens Inc /ar/ | 9 590 | 0,03 | 538 | 5,71 | ||||

| 2025-07-23 | 13F | Kingswood Wealth Advisors, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-07 | 13F | Private Advisory Group LLC | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | PFG Advisors | 7 468 | 0,13 | 419 | 5,82 | ||||

| 2025-07-18 | 13F | QTR Family Wealth, LLC | 4 336 | 0,00 | 243 | 6,11 | ||||

| 2025-07-23 | 13F | Bellevue Asset Management, Llc | 1 566 | 0,26 | 88 | 6,10 | ||||

| 2025-07-21 | 13F | TFG Advisers LLC | 5 879 | 0,34 | 330 | 6,13 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 3 877 | −82,29 | 217 | −81,29 | ||||

| 2025-08-11 | 13F | Tidemark, LLC | 830 | 0,24 | 47 | 6,98 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 4 740 | −51,73 | 266 | −49,04 | ||||

| 2025-08-13 | 13F | Proactive Wealth Strategies LLC | 40 773 | 0,29 | 2 | 0,00 | ||||

| 2025-08-26 | NP | DALI - First Trust Dorsey Wright DALI 1 ETF This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 253 960 | −0,06 | 14 237 | 5,70 | ||||

| 2025-08-12 | 13F | Founders Financial Alliance, LLC | 49 | −97,20 | 3 | −97,83 | ||||

| 2025-08-14 | 13F | Garden State Investment Advisory Services LLC | 35 317 | −3,10 | 1 980 | 2,49 | ||||

| 2025-07-11 | 13F | SILVER OAK SECURITIES, Inc | 1 714 | 96 | ||||||

| 2025-07-23 | 13F | Schrum Private Wealth Management LLC | 25 718 | 0,00 | 1 442 | 5,72 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 141 | 8 | ||||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 91 489 | 4,58 | 5 | 25,00 | ||||

| 2025-07-24 | 13F | Monument Capital Management | 95 578 | 0,40 | 5 358 | 6,20 | ||||

| 2025-08-05 | 13F | Fourth Dimension Wealth, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-20 | 13F/A | Coppell Advisory Solutions LLC | 3 835 | 213 | ||||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 1 756 | −12,64 | 98 | −7,55 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 83 400 | 4 675 | ||||||

| 2025-07-11 | 13F | Seacrest Wealth Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Huntington National Bank | 24 | −4,17 | ||||||

| 2025-07-17 | 13F | LexAurum Advisors, LLC | 6 037 | −6,13 | 338 | −0,59 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-11 | 13F | Y.D. More Investments Ltd | 4 200 | 20,00 | 235 | 27,03 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 1 645 | 0,00 | 92 | 5,75 |

Other Listings

| MX:FXO |