Grundläggande statistik

| Institutionella ägare | 181 total, 179 long only, 0 short only, 2 long/short - change of 5,23% MRQ |

| Aktiepris | 8,55 |

| Genomsnittlig portföljallokering | 0.2705 % - change of −13,05% MRQ |

| Institutionella aktier (lång) | 172 380 892 (ex 13D/G) - change of 1,30MM shares 0,76% MRQ |

| Institutionellt värde (lång) | $ 1 529 632 USD ($1000) |

Institutionellt ägande och aktieägare

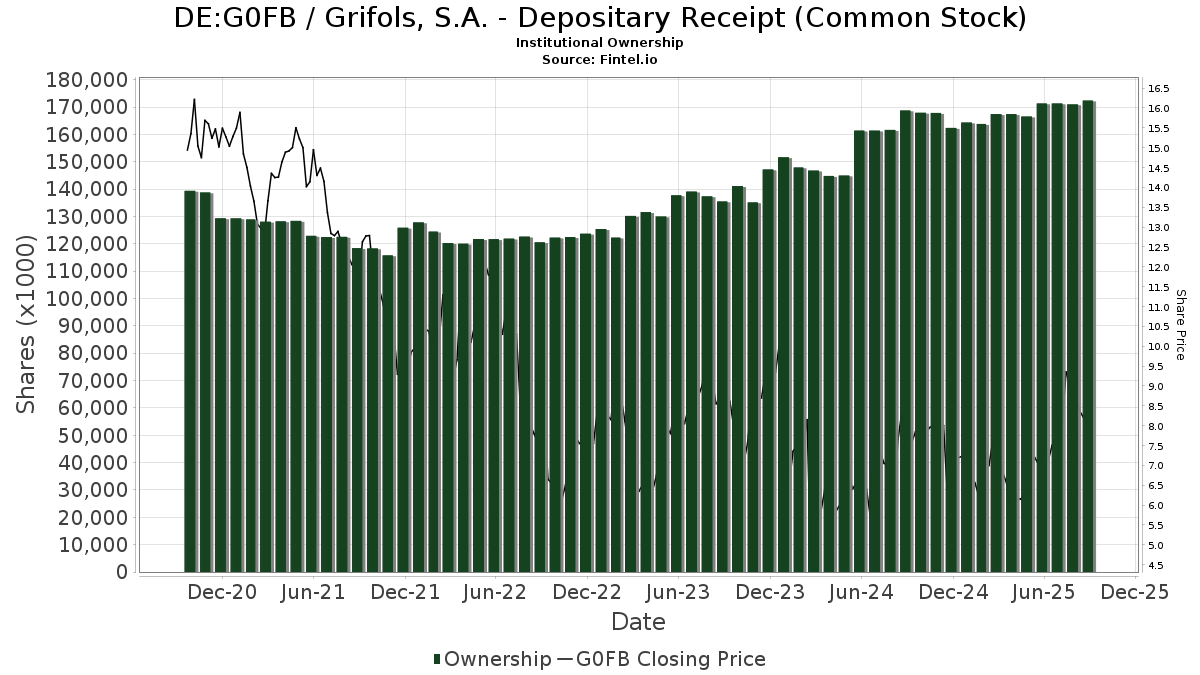

Grifols, S.A. - Depositary Receipt (Common Stock) (DE:G0FB) har 181 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 172,380,892 aktier. Största aktieägare inkluderar Brandes Investment Partners, Lp, Capital World Investors, Permian Investment Partners, LP, ANWPX - NEW PERSPECTIVE FUND Class A, Black Creek Investment Management Inc., Millennium Management Llc, Armistice Capital, Llc, Soleus Capital Management, L.P., IGAAX - International Growth and Income Fund Class A, and BISAX - BRANDES INTERNATIONAL SMALL CAP EQUITY FUND Class A .

Grifols, S.A. - Depositary Receipt (Common Stock) (DB:G0FB) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 8, 2025 is 8,55 / share. Previously, on September 9, 2024, the share price was 7,60 / share. This represents an increase of 12,50% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-19 | 13F | State of Wyoming | 191 209 | 1 729 | ||||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 53 785 | 78,58 | 486 | 127,10 | ||||

| 2025-08-14 | 13F | Erste Asset Management GmbH | 27 056 | 0,00 | 240 | 21,94 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 110 135 | 14,51 | 996 | 45,68 | ||||

| 2025-08-14 | 13F | Grizzlyrock Capital, Llc | 166 000 | 1 501 | ||||||

| 2025-04-22 | 13F | Mendota Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Oasis Management Co Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 67 266 | −5,22 | 608 | 20,63 | ||||

| 2025-08-14 | 13F | Fmr Llc | 59 577 | 121,81 | 539 | 183,16 | ||||

| 2025-08-14 | 13F | Point72 (DIFC) Ltd | 1 017 200 | 9 195 | ||||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 4 490 | 41 | ||||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 15 302 | −8,76 | 138 | 15,97 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 6 897 | 3,31 | 62 | 31,91 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 6 568 | −26,09 | 59 | −6,35 | ||||

| 2025-08-14 | 13F | Optiver Holding B.V. | 1 426 | −76,78 | 13 | −72,09 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 286 192 | 4,19 | 2 587 | 32,46 | ||||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 342 892 | 28,90 | 3 100 | 63,88 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 193 789 | 1 045,80 | 1 752 | 1 359,17 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 11 821 | 1 693,78 | 0 | |||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 615 079 | 260,42 | 5 560 | 358,37 | ||||

| 2025-08-12 | 13F | Highland Peak Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Atria Investments Llc | 49 552 | −1,45 | 448 | 25,21 | ||||

| 2025-05-15 | 13F | Crestline Management, LP | 0 | −100,00 | 0 | |||||

| 2025-07-29 | NP | RBB FUND, INC. - Aquarius International Fund | 6 482 | 118,32 | 54 | 39,47 | ||||

| 2025-05-14 | 13F | Toroso Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Legal & General Group Plc | 30 905 | −76,93 | 279 | −70,77 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 17 365 | 24,78 | 157 | 59,18 | ||||

| 2025-08-14 | 13F | Principal Street Partners, LLC | 23 828 | 215 | ||||||

| 2025-07-24 | NP | FNCMX - Fidelity Nasdaq Composite Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 72 167 | 0,00 | 600 | −1,64 | ||||

| 2025-08-14 | 13F | Janus Henderson Group Plc | 3 199 833 | 5,08 | 28 862 | 30,10 | ||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 109 464 | 516,42 | 990 | 684,92 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 3 700 | −59,71 | 33 | −49,23 | ||||

| 2025-05-14 | 13F | First Trust Advisors Lp | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Savant Capital, LLC | 12 076 | 1,36 | 109 | 29,76 | ||||

| 2025-08-14 | 13F | SummitTX Capital, L.P. | 116 679 | 44,92 | 1 055 | 84,27 | ||||

| 2025-07-10 | 13F | Umb Bank N A/mo | 358 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Farallon Capital Management Llc | 28 000 | 0,00 | 253 | 27,14 | ||||

| 2025-08-14 | 13F | Saba Capital Management, L.P. | 269 686 | 2 438 | ||||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 75 | −96,20 | 1 | −100,00 | ||||

| 2025-08-13 | 13F | Gabelli Funds Llc | 71 548 | 0,00 | 647 | 27,17 | ||||

| 2025-08-28 | NP | IBB - iShares Nasdaq Biotechnology ETF | 1 022 134 | −14,02 | 9 240 | 9,32 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 117 990 | 0,78 | 1 067 | 28,13 | ||||

| 2025-08-14 | 13F | Whitebox Advisors Llc | 2 621 468 | −2,11 | 23 698 | 24,46 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 214 | 2 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 110 | −3,51 | 1 | |||||

| 2025-05-30 | NP | TFPN - Blueprint Chesapeake Multi-Asset Trend ETF | 7 440 | −69,80 | 53 | −71,58 | ||||

| 2025-08-26 | NP | BSMC - Brandes U.S. Small-Mid Cap Value ETF | 222 696 | 9,82 | 2 013 | 39,69 | ||||

| 2025-08-13 | 13F | Gamco Investors, Inc. Et Al | 24 000 | 0,00 | 217 | 27,06 | ||||

| 2025-05-15 | 13F | Hrt Financial Lp | 0 | −100,00 | 0 | |||||

| 2025-08-26 | NP | BSCAX - BRANDES SMALL CAP VALUE FUND Class A | 324 340 | 20,34 | 2 932 | 53,03 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 10 767 | 97 | ||||||

| 2025-05-13 | 13F | United Capital Financial Advisers, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Boothbay Fund Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 28 743 | 83,45 | 260 | 133,33 | ||||

| 2025-05-13 | 13F | Schroder Investment Management Group | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | State Street Corp | 361 565 | −25,22 | 3 269 | −4,92 | ||||

| 2025-07-31 | 13F | R Squared Ltd | 10 474 | 95 | ||||||

| 2025-08-14 | 13F | Harris Associates L P | 3 125 900 | −9,10 | 28 258 | 15,57 | ||||

| 2025-08-28 | 13F | China Universal Asset Management Co., Ltd. | 24 502 | 0,13 | 221 | 27,75 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 10 456 | 95 | ||||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 91 183 | 6,29 | 824 | 35,30 | ||||

| 2025-08-26 | NP | BINV - Brandes International ETF | 512 815 | 30,64 | 4 636 | 66,13 | ||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 2 452 728 | 0,00 | 22 | 29,41 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 35 725 | 1,34 | 323 | 28,80 | ||||

| 2025-08-07 | 13F | Legacy Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Capital International Sarl | 629 364 | 7,36 | 5 689 | 36,49 | ||||

| 2025-08-26 | NP | BGEAX - BRANDES GLOBAL EQUITY FUND Class A | 71 406 | 16,08 | 646 | 47,60 | ||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 182 200 | 5,92 | 1 647 | 34,67 | ||||

| 2025-07-08 | 13F | Arlington Trust Co LLC | 95 | 1 | ||||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 350 | 0,00 | 3 | 50,00 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 1 888 176 | 13,17 | 17 069 | 43,90 | ||||

| 2025-07-11 | 13F | Pinnacle Bancorp, Inc. | 1 411 | 0,00 | 13 | 20,00 | ||||

| 2025-08-13 | 13F | Groupe la Francaise | 238 928 | 0,00 | 2 160 | 27,15 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 22 348 | −1,32 | 202 | 25,47 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 202 | −80,14 | 2 | −85,71 | ||||

| 2025-07-30 | 13F | DekaBank Deutsche Girozentrale | 50 000 | 0,00 | 0 | |||||

| 2025-08-04 | 13F | Spire Wealth Management | 1 061 | −15,39 | 10 | 12,50 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | Signaturefd, Llc | 1 892 | −35,69 | 17 | −15,00 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 0 | −100,00 | 0 | |||||

| 2025-07-24 | NP | ONEQ - Fidelity Nasdaq Composite Index Tracking Stock This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 45 441 | 14,04 | 378 | 12,20 | ||||

| 2025-08-08 | NP | QGBLX - Quantified Global Fund Investor Class | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-29 | NP | EMAAX - Enterprise Mergers and Acquisitions Fund Class A | 7 000 | 0,00 | 63 | 28,57 | ||||

| 2025-08-07 | 13F | Mitsubishi UFJ Kokusai Asset Management Co., Ltd. | 47 192 | 2,42 | 427 | 30,28 | ||||

| 2025-08-08 | 13F | Compass Wealth Management LLC | 76 116 | 0,00 | 688 | 27,17 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 61 100 | 78,12 | 552 | 127,16 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Wolverine Asset Management Llc | 164 690 | 0,00 | 1 489 | 27,18 | ||||

| 2025-07-30 | NP | ENDW - Cambria Endowment Style ETF | 1 | 0 | ||||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 114 | 1 | ||||||

| 2025-08-05 | 13F | Advisors Preferred, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Norges Bank | 1 940 000 | 17 538 | ||||||

| 2025-07-02 | 13F | Helen Stephens Group, LLC | 86 466 | 0,00 | 782 | 27,20 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 127 272 | 49,42 | 1 | |||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 2 498 | 193,54 | 23 | 266,67 | ||||

| 2025-08-14 | 13F | Daiwa Securities Group Inc. | 398 | 0,00 | 0 | |||||

| 2025-07-28 | NP | IBBQ - Invesco Nasdaq Biotechnology ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 4 805 | 3,38 | 40 | 0,00 | ||||

| 2025-05-16 | 13F/A | Kestra Investment Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 16 984 | 4,48 | 154 | 33,04 | ||||

| 2025-07-28 | NP | BIB - ProShares Ultra Nasdaq Biotechnology | 4 488 | −14,90 | 37 | −15,91 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 42 900 | 13,19 | 388 | 43,87 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 27 400 | −56,92 | 248 | −45,35 | |||

| 2025-05-15 | 13F | Activest Wealth Management | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 39 185 | 0,00 | 379 | 36,33 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 48 400 | −10,32 | 438 | 14,10 | ||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 30 551 | 1,03 | 254 | −0,78 | ||||

| 2025-08-07 | 13F/A | Credit Industriel Et Commercial | 361 755 | −21,50 | 3 270 | −0,18 | ||||

| 2025-08-25 | NP | AMERICAN FUNDS INSURANCE SERIES - International Growth and Income Fund Class 1 This fund is a listed as child fund of Capital World Investors and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 96 958 | −0,27 | 876 | 26,77 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 55 000 | 30,33 | 497 | 65,67 | |||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 18 748 | 9,53 | 169 | 39,67 | ||||

| 2025-08-13 | 13F | Capital International Ltd /ca/ | 404 486 | 0,00 | 3 657 | 27,17 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 1 002 | 10,60 | 9 | 50,00 | ||||

| 2025-08-14 | 13F | Henry James International Management Inc. | 157 945 | 0,00 | 1 428 | 27,18 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 1 329 | 2 505,88 | 12 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 142 579 | 72,88 | 1 289 | 119,80 | ||||

| 2025-05-06 | 13F | Venturi Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Capital International Inc /ca/ | 195 400 | 1,05 | 1 766 | 28,53 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 792 | 7 | ||||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 647 | −42,39 | 6 | −28,57 | ||||

| 2025-05-14 | 13F | Eisler Capital Management Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 228 | 2 | ||||||

| 2025-08-11 | 13F | Citigroup Inc | 9 836 | 292,97 | 89 | 417,65 | ||||

| 2025-08-07 | 13F | Montag A & Associates Inc | 1 261 | 0,00 | 11 | 37,50 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 506 872 | 4,12 | 4 582 | 32,39 | ||||

| 2025-07-31 | 13F | Anthracite Investment Company, Inc. | 86 688 | −82,86 | 784 | −78,23 | ||||

| 2025-08-13 | 13F | GABELLI & Co INVESTMENT ADVISERS, INC. | 77 728 | 0,00 | 703 | 27,17 | ||||

| 2025-07-22 | 13F | Gf Fund Management Co. Ltd. | 3 123 | 0,00 | 28 | 27,27 | ||||

| 2025-05-05 | 13F | GW&K Investment Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Stifel Financial Corp | 155 512 | 7,49 | 1 406 | 36,67 | ||||

| 2025-08-25 | NP | ANWPX - NEW PERSPECTIVE FUND Class A | 14 039 027 | 0,00 | 126 913 | 27,14 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 8 219 | 127,36 | 74 | 196,00 | ||||

| 2025-08-13 | 13F | Vinva Investment Management Ltd | 28 342 | 385 | ||||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 10 596 | 0,00 | 96 | 26,67 | ||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 4 014 | 2,61 | 36 | 33,33 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 19 764 | −11,19 | 179 | 12,66 | ||||

| 2025-08-28 | NP | KOMP - SPDR S&P Kensho New Economies Composite ETF This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 98 765 | −56,57 | 893 | −44,80 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 7 928 | −0,04 | 72 | 26,79 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 1 926 | 6,70 | 14 | 0,00 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 1 000 | 0,00 | 9 | 50,00 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 48 470 | 11,30 | 438 | 35,60 | ||||

| 2025-08-15 | 13F | Soleus Capital Management, L.P. | 5 756 805 | −18,80 | 52 042 | 3,24 | ||||

| 2025-08-14 | 13F | Flat Footed LLC | 1 634 279 | −7,41 | 14 774 | 17,72 | ||||

| 2025-08-13 | 13F | Capital World Investors | 21 652 749 | 0,61 | 195 741 | 27,92 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 315 | 215,00 | 3 | |||||

| 2025-07-15 | 13F | Ballentine Partners, LLC | 16 179 | 48,87 | 146 | 89,61 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 11 303 | −7,17 | 102 | 18,60 | ||||

| 2025-08-13 | 13F | Natixis Advisors, L.p. | 204 134 | −3,98 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 100 732 | 18,44 | 911 | 50,66 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-08-07 | 13F | Sierra Ocean, Llc | 457 | −24,21 | 4 | 0,00 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 118 472 | 22,29 | 1 071 | 55,52 | ||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 26 291 | 0,23 | 238 | 27,42 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 51 585 | 99,07 | 466 | 153,26 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 9 667 551 | 12,82 | 87 395 | 43,45 | ||||

| 2025-08-29 | NP | OAKEX - Oakmark International Small Cap Fund Investor Class | 2 218 300 | −6,90 | 20 053 | 18,38 | ||||

| 2025-08-14 | 13F | Financial Engines Advisors L.L.C. | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 12 915 | −2,78 | 117 | 23,40 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 214 | −6,96 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 817 827 | 6,44 | 7 393 | 35,35 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 3 110 | 28 | ||||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 579 012 | −13,46 | 5 234 | 10,03 | ||||

| 2025-07-31 | 13F | Peterson Wealth Services | 1 500 | 14 | 30,00 | |||||

| 2025-05-12 | 13F | Helikon Investments Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 57 416 | 81,05 | 519 | 130,67 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 3 017 675 | 52,14 | 27 280 | 93,44 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 240 | 0,00 | 2 | 100,00 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 15 668 | −1,79 | 111 | −5,93 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 193 173 | 69,34 | 1 746 | 115,29 | ||||

| 2025-08-14 | 13F | Permian Investment Partners, LP | 18 627 321 | 3,02 | 168 391 | 30,98 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 628 673 | −85,07 | 5 683 | −81,02 | ||||

| 2025-05-08 | 13F | Plante Moran Financial Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Brandes Investment Partners, Lp | 28 035 461 | 8,91 | 253 441 | 38,48 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 12 250 | 111 | ||||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 158 | 1 | ||||||

| 2025-05-01 | 13F | Schechter Investment Advisors, LLC | 108 110 | 20,06 | 769 | 14,80 | ||||

| 2025-08-14 | 13F | Armistice Capital, Llc | 7 298 000 | −21,34 | 65 974 | 0,01 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - 1290 VT GAMCO Mergers & Acquisitions Portfolio Class IB | 24 000 | 0,00 | 217 | 27,06 | ||||

| 2025-07-21 | 13F | Ascent Group, LLC | 15 646 | 141 | ||||||

| 2025-08-13 | 13F | Capital Group Investment Management Pte. Ltd. | 81 955 | 0,00 | 741 | 27,15 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 16 468 | −20,07 | 149 | −1,99 | ||||

| 2025-05-07 | 13F | Zurcher Kantonalbank (Zurich Cantonalbank) | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Bare Financial Services, Inc | 81 | 1 | ||||||

| 2025-08-14 | 13F | Principia Wealth Advisory, LLC | 20 | 0 | ||||||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 1 988 393 | −7,10 | 17 931 | 17,34 | ||||

| 2025-08-06 | 13F | Vestmark Advisory Solutions, Inc. | 45 820 | 414 | ||||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 4 116 | −24,86 | 37 | −2,63 | ||||

| 2025-06-26 | 13F/A | Deutsche Bank Ag\ | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F/A | Hudson Bay Capital Management LP | 333 690 | 0,00 | 3 017 | 27,15 | ||||

| 2025-08-14 | 13F | UBS Group AG | 2 208 770 | 19,36 | 19 967 | 51,76 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 148 | −23,71 | 0 | |||||

| 2025-08-14 | 13F | Millennium Management Llc | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-04-21 | 13F | Envestnet Portfolio Solutions, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Black Creek Investment Management Inc. | 12 569 638 | −0,96 | 113 630 | 25,93 | ||||

| 2025-08-14 | 13F | Syon Capital Llc | 40 430 | 110,10 | 365 | 168,38 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 2 874 | −85,21 | 0 | |||||

| 2025-08-11 | 13F | Fore Capital, LLC | 30 000 | 100,00 | 271 | 155,66 | ||||

| 2025-05-14 | 13F/A | Torno Capital, Llc | Call | 1 000 | 9 | |||||

| 2025-07-11 | 13F | UMA Financial Services, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-16 | NP | CGIC - Capital Group International Core Equity ETF Share Class | 58 517 | 184,41 | 486 | 180,92 | ||||

| 2025-08-28 | NP | SPDW - SPDR(R) Portfolio Developed World ex-US ETF | 257 040 | 2,78 | 2 324 | 30,65 | ||||

| 2025-08-25 | NP | IGAAX - International Growth and Income Fund Class A | 4 192 407 | 0,00 | 37 899 | 27,14 | ||||

| 2025-07-31 | 13F | Oppenheimer Asset Management Inc. | 62 991 | 4,87 | 569 | 33,26 | ||||

| 2025-05-14 | 13F | Caitlin John, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 3 573 | −2,62 | 32 | 23,08 | ||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 228 203 | −1,73 | 2 | 100,00 | ||||

| 2025-08-26 | NP | BISAX - BRANDES INTERNATIONAL SMALL CAP EQUITY FUND Class A | 3 816 499 | 42,47 | 34 501 | 81,15 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Sei Investments Co | 2 081 535 | 0,78 | 18 817 | 28,14 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 65 481 | −5,87 | 592 | 19,64 | ||||

| 2025-05-15 | 13F | Wolverine Trading, Llc | Put | 0 | −100,00 | 0 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 6 | 0,00 | 0 | |||||

| 2025-05-15 | 13F | Wolverine Trading, Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 4 713 | 18,66 | 43 | 50,00 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 210 | 0,00 | 2 | 0,00 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 57 258 | −0,33 | 1 | |||||

| 2025-05-08 | 13F | BRYN MAWR TRUST Co | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 1 914 228 | −22,02 | 17 305 | −0,86 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 1 489 679 | −12,64 | 13 467 | 11,08 | ||||

| 2025-08-08 | 13F | Creative Planning | 14 273 | −3,48 | 129 | 22,86 |

Other Listings

| US:GRFS | 10,11 US$ |