Grundläggande statistik

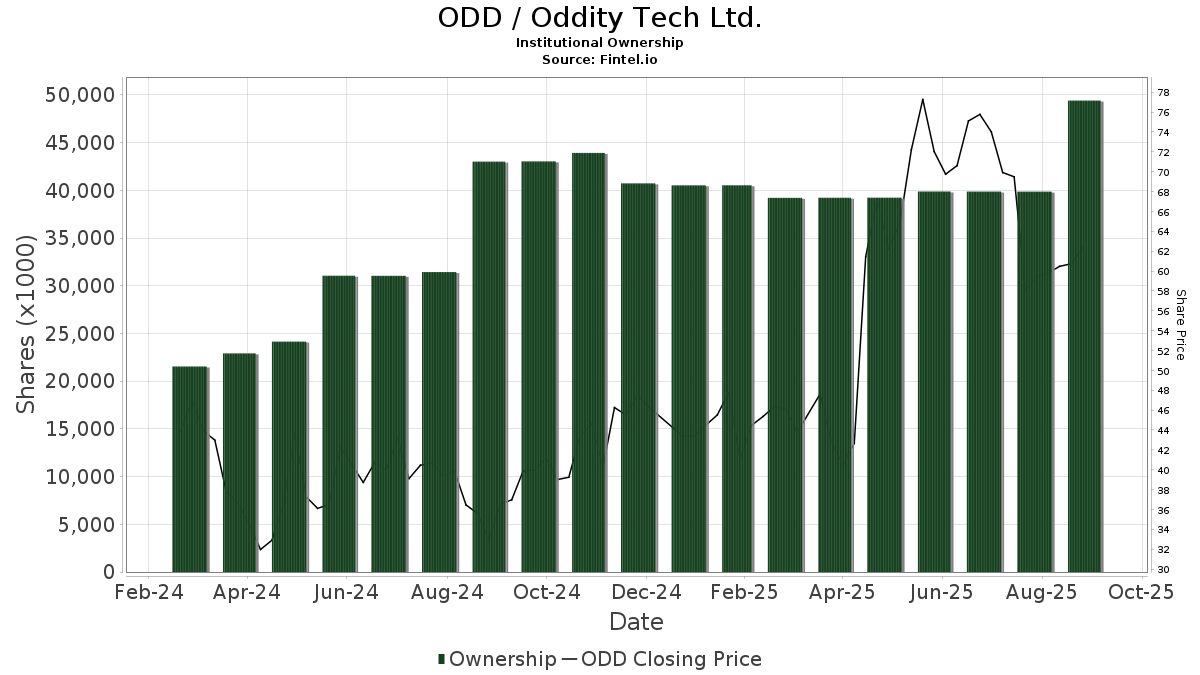

| Institutionella aktier (lång) | 49 413 649 - 111,59% (ex 13D/G) - change of 9,53MM shares 23,90% MRQ |

| Institutionellt värde (lång) | $ 3 552 441 USD ($1000) |

Institutionellt ägande och aktieägare

Oddity Tech Ltd. (US:ODD) har 247 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 49,422,515 aktier. Största aktieägare inkluderar Baillie Gifford & Co, Catterton Management Company, L.L.C., Fmr Llc, Morgan Stanley, D. E. Shaw & Co., Inc., MSD Partners, L.P., Massachusetts Financial Services Co /ma/, Franklin Resources Inc, Fundsmith LLP, and Granahan Investment Management Inc/ma .

Oddity Tech Ltd. (NasdaqGM:ODD) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 12, 2025 is 62,82 / share. Previously, on September 16, 2024, the share price was 34,81 / share. This represents an increase of 80,47% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

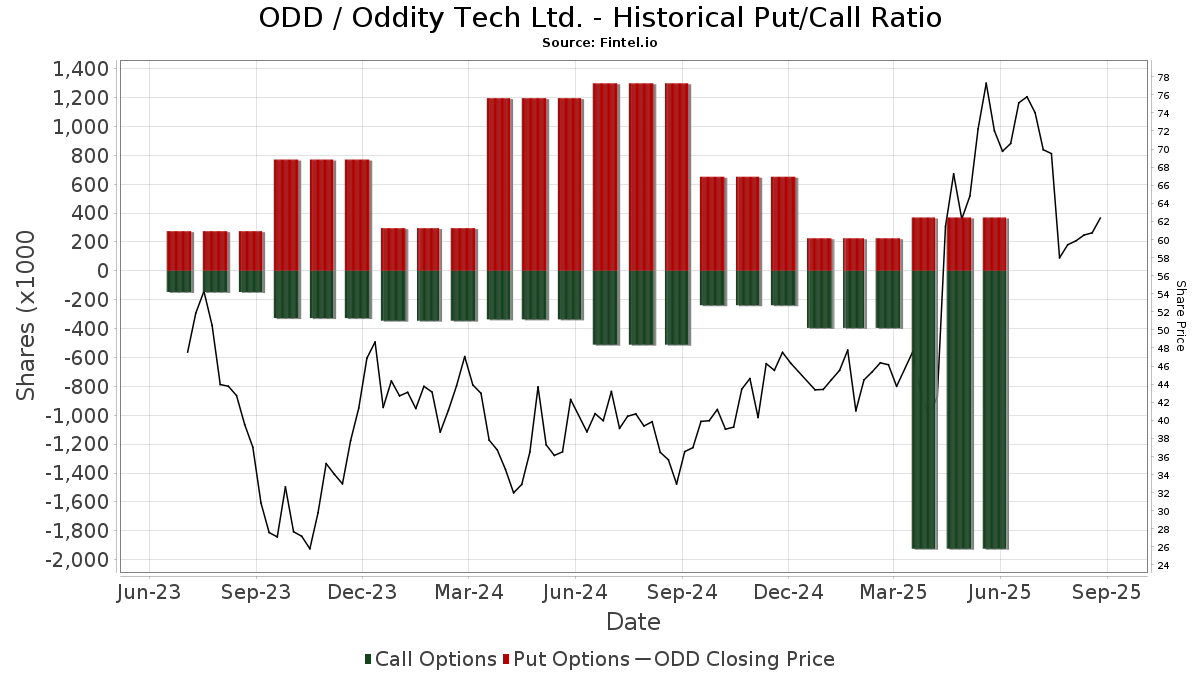

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13D/G-Arkiveringar

Vi presenterar 13D/G-arkiveringar separat från 13F-arkiveringar på grund av att de behandlas olika av SEC. 13D/G-arkiveringar kan lämnas in av grupper av investerare (med en ledare), medan 13F-arkiveringar inte kan det. Detta leder till situationer där en investerare kan lämna in en 13D/G-ansökan med ett värde för de totala aktierna (vilket motsvarar alla aktier som ägs av investerargruppen), men sedan lämna in en 13F-ansökan med ett annat värde för de totala aktierna (vilket motsvarar enbart deras eget ägande). Detta innebär att aktieägandet i 13D/G-arkiveringar och 13F-arkiveringar ofta inte är direkt jämförbara, så vi presenterar dem separat.

Notera: Från och med den 16 maj 2021 visar vi inte längre ägare som inte har lämnat in en 13D/G under det senaste året. Tidigare visade vi hela historiken för 13D/G-arkiveringar. I allmänhet måste enheter som är skyldiga att lämna in 13D/G-arkiveringar lämna in minst en gång per år innan de lämnar in en stängningsarkivering. Fonder avslutar dock ibland positioner utan att lämna in en avslutande arkivering (dvs. de avvecklar), så att visa hela historiken resulterade ibland i förvirring om det nuvarande ägandet. För att förhindra förvirring visar vi nu endast "nuvarande" ägare - det vill säga ägare som har lämnat in en ansökan under det senaste året.

Upgrade to unlock premium data.

| Fil Datum | Formulär | Investerare | Föregående aktier |

Senaste aktier |

Δ Aktier (Procent) |

Ägande (Procent) |

Δ Ägande (Procent) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-09-05 | LCGP3 Pro Makeup, L.P. | 4,037,472 | 3,537,472 | -12.38 | 8.00 | -13.98 | ||

| 2025-08-05 | FRANKLIN RESOURCES INC | 2,639,692 | 1,645,414 | -37.67 | 3.70 | -36.21 | ||

| 2025-05-23 | Holtzman Oran | 18,399,450 | 12,899,450 | -29.89 | 23.00 | -29.01 | ||

| 2025-05-06 | MORGAN STANLEY | 2,416,716 | 5.50 | |||||

| 2024-11-12 | FMR LLC | 3,929,945 | 8.69 |

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-09-03 | NP | MMNIX - Miller Market Neutral Income Fund Class I | Short | −7 200 | −505 | |||||

| 2025-08-14 | 13F | Fmr Llc | 3 378 533 | −7,68 | 254 978 | 61,06 | ||||

| 2025-08-14 | 13F | Algert Global Llc | 72 459 | 5 | ||||||

| 2025-08-13 | 13F | Employees Retirement System of Texas | 16 686 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | Susquehanna Fundamental Investments, Llc | 47 980 | 0,00 | 3 621 | 74,51 | ||||

| 2025-06-26 | NP | CRNSX - CATHOLIC RESPONSIBLE INVESTMENTS INTERNATIONAL SMALL-CAP FUND Institutional Shares | 6 821 | 419 | ||||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 483 | 4,32 | 36 | 89,47 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 41 400 | 225,98 | 3 124 | 469,03 | |||

| 2025-08-14 | 13F | California State Teachers Retirement System | 41 679 | 23,07 | 3 146 | 114,68 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 367 322 | 595,96 | 27 722 | 1 114,24 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 14 | 1 | ||||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 50 | 0 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 4 700 | −38,16 | 355 | 7,93 | |||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 125 800 | 9 494 | ||||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | Put | 120 000 | 9 056 | |||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 9 | 1 | ||||||

| 2025-08-14 | 13F | Man Group plc | 296 548 | −27,96 | 22 380 | 25,69 | ||||

| 2025-08-14 | 13F | Graham Capital Management, L.P. | 15 706 | 134,52 | 1 185 | 310,03 | ||||

| 2025-05-05 | 13F | Morse Asset Management, Inc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Jefferies Financial Group Inc. | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Symmetry Peak Management Llc | 1 230 | 93 | ||||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Symmetry Peak Management Llc | Call | 40 700 | 3 072 | |||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 31 674 | 21,60 | 2 390 | 112,26 | ||||

| 2025-05-13 | 13F | Mark Sheptoff Financial Planning, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | 40 | 0 | ||||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 6 620 | 500 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 671 724 | 378,47 | 50 695 | 734,76 | ||||

| 2025-05-13 | 13F | Norges Bank | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-15 | 13F | D. E. Shaw & Co., Inc. | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-06 | 13F | Penserra Capital Management LLC | 11 365 | 1 | ||||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 9 435 | 712 | ||||||

| 2025-08-14 | 13F | LM Advisors LLC | 3 571 | 0 | ||||||

| 2025-08-14 | 13F | Nebula Research & Development LLC | 30 236 | 50,15 | 2 282 | 161,88 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 20 790 | −52,81 | 2 | 0,00 | ||||

| 2025-08-12 | 13F | Swiss National Bank | 76 600 | 15,89 | 5 781 | 102,20 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 61 918 | 4 673 | ||||||

| 2025-08-11 | 13F | Y.D. More Investments Ltd | 77 387 | −17,68 | 5 840 | 43,63 | ||||

| 2025-08-13 | 13F | Winslow Capital Management, LLC | 179 907 | −67,91 | 13 578 | −44,01 | ||||

| 2025-08-19 | 13F | State of Wyoming | 2 609 | −58,04 | 197 | −26,87 | ||||

| 2025-08-14 | 13F | G2 Investment Partners Management LLC | 139 320 | 93,43 | 10 514 | 237,53 | ||||

| 2025-08-04 | 13F | Yorktown Management & Research Co Inc | 5 650 | 426 | ||||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 418 695 | 31 599 | ||||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 6 | 0 | ||||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Aigen Investment Management, Lp | 17 391 | 1 312 | ||||||

| 2025-08-27 | NP | INSAX - Catalyst Insider Buying Fund Class A | 11 380 | −30,53 | 859 | 21,19 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 624 685 | 784,28 | 47 145 | 1 442,67 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 72 | 3 500,00 | 5 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 188 354 | 3,60 | 14 215 | 80,76 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | Put | 11 400 | 860 | |||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 761 200 | 434,55 | 57 448 | 832,58 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 5 703 | −24,69 | 430 | 31,50 | ||||

| 2025-08-14 | 13F | Quarry LP | 460 | −68,10 | 35 | −45,16 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 1 675 | −1,47 | 126 | 72,60 | ||||

| 2025-08-14 | 13F | Driehaus Capital Management Llc | 543 159 | 40 992 | ||||||

| 2025-08-12 | 13F | Clal Insurance Enterprises Holdings Ltd | 280 300 | −45,64 | 21 | −4,55 | ||||

| 2025-08-14 | 13F | Fortress Investment Group LLC | 175 000 | 13 207 | ||||||

| 2025-07-31 | 13F | Washington Trust Advisors, Inc. | 79 | 0,00 | 6 | 66,67 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 80 307 | 21,15 | 6 061 | 111,37 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 43 300 | −9,41 | 3 268 | 58,06 | |||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 16 500 | 71,88 | 1 245 | 200,00 | |||

| 2025-08-14 | 13F | UBS Group AG | 128 174 | 486,29 | 9 673 | 923,60 | ||||

| 2025-08-28 | NP | SEEIX - Sit International Equity Fund - Class I | 5 828 | 440 | ||||||

| 2025-08-14 | 13F | Sphera Management Technology Funds Ltd | 35 000 | 16,67 | 2 641 | 103,62 | ||||

| 2025-07-25 | NP | CMIEX - Multi-Manager International Equity Strategies Fund Institutional Class | 30 046 | 2 236 | ||||||

| 2025-08-14 | 13F | Rip Road Capital Partners LP | 58 094 | 0,00 | 4 384 | 74,45 | ||||

| 2025-04-25 | 13F | New Wave Wealth Advisors Llc | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Jennison Associates Llc | 5 608 | 423 | ||||||

| 2025-07-23 | 13F | Bellevue Asset Management, Llc | 30 | 0,00 | 2 | 100,00 | ||||

| 2025-08-08 | 13F | Police & Firemen's Retirement System of New Jersey | 8 650 | 14,51 | 653 | 100,00 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 1 858 | 38,66 | 140 | 145,61 | ||||

| 2025-05-09 | 13F | R Squared Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | UBS Group AG | Call | 1 303 840 | 98 401 | |||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 56 888 | 98,32 | 4 218 | 228,76 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 51 772 | 3 906 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Sigma Planning Corp | 4 932 | 372 | ||||||

| 2025-08-14 | 13F | Hrt Financial Lp | 55 368 | 4 | ||||||

| 2025-08-14 | 13F | Caption Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 6 736 | 20,89 | 508 | 110,79 | ||||

| 2025-08-14 | 13F | State Street Corp | 367 405 | 38,43 | 27 728 | 141,51 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 75 063 | 12,87 | 5 660 | 96,80 | ||||

| 2025-08-14 | 13F | Peak6 Llc | Call | 24 100 | 30,98 | 1 819 | 128,68 | |||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 550 | −81,35 | 42 | −67,72 | ||||

| 2025-07-29 | NP | ORSIX - NORTH SQUARE DYNAMIC SMALL CAP FUND CLASS I | 16 170 | 1 204 | ||||||

| 2025-08-14 | 13F | Fieldview Capital Management, LLC | 2 930 | 221 | ||||||

| 2025-06-26 | NP | TWAAX - Thrivent International Allocation Fund Class A | 1 455 | 89 | ||||||

| 2025-07-16 | 13F | Eagle Global Advisors Llc | 25 000 | −3,85 | 1 887 | 67,79 | ||||

| 2025-08-14 | 13F | Janus Henderson Group Plc | 938 939 | 7,87 | 70 856 | 89,43 | ||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 21 594 | 1 630 | ||||||

| 2025-08-04 | 13F | Quaker Wealth Management, LLC | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | Call | 16 800 | 16,67 | 1 268 | 103,70 | |||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | Put | 4 800 | 362 | |||||

| 2025-08-12 | 13F | Franklin Resources Inc | 1 645 414 | −26,44 | 124 179 | 28,32 | ||||

| 2025-08-14 | 13F | Penn Capital Management Co Inc | 173 960 | −37,56 | 13 164 | 8,95 | ||||

| 2025-08-14 | 13F | J. Goldman & Co LP | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 168 489 | 3 875,67 | 12 716 | 6 848,09 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 34 577 | 2 610 | ||||||

| 2025-05-15 | 13F | Main Management ETF Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-26 | NP | DVSMX - Driehaus Small Cap Growth Fund Investor Share Class | 96 622 | 7 292 | ||||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 4 853 | 366 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 25 622 | 248,03 | 1 933 | 507,86 | ||||

| 2025-08-14 | 13F | J. Goldman & Co LP | 59 000 | 4 453 | ||||||

| 2025-07-29 | NP | SSEAX - SIIT Screened World Equity Ex-US Fund - Class A | 1 789 | 133 | ||||||

| 2025-08-11 | 13F | Citigroup Inc | 71 412 | 1 935,69 | 5 389 | 3 468,87 | ||||

| 2025-08-14 | 13F | Boothbay Fund Management, Llc | 26 334 | 76,23 | 1 987 | 207,59 | ||||

| 2025-08-14 | 13F | Jain Global LLC | 32 606 | 2 461 | ||||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 107 150 | 16,35 | 8 | 166,67 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 150 | 11 | ||||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 2 979 | 0 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-26 | NP | GFSYX - Strategic Alternatives Fund Institutional | Short | −1 666 | −126 | |||||

| 2025-08-14 | 13F | Mariner, LLC | 3 484 | 263 | ||||||

| 2025-08-14 | 13F | Voloridge Investment Management, Llc | 311 131 | 23 481 | ||||||

| 2025-08-07 | 13F | ProShare Advisors LLC | 11 654 | −57,88 | 880 | −26,51 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 464 269 | 118,73 | 35 038 | 281,59 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 367 390 | 398,93 | 27 727 | 770,52 | ||||

| 2025-05-30 | NP | WIGTX - Seven Canyons World Innovators Fund Institutional Class | 19 400 | 839 | ||||||

| 2025-08-14 | 13F/A | Barclays Plc | 7 416 | 5,84 | 1 | |||||

| 2025-08-14 | 13F | Hood River Capital Management LLC | 715 915 | −2,93 | 54 030 | 69,35 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 3 850 | −74,85 | 0 | |||||

| 2025-08-13 | 13F | Federated Hermes, Inc. | 14 791 | 236,16 | 1 116 | 487,37 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 79 851 | −3,80 | 6 025 | 67,80 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 35 605 | 44,63 | 2 687 | 153,25 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Aurora Investment Counsel | 25 129 | −49,61 | 1 896 | −12,10 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 4 327 | 327 | ||||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 33 | −95,49 | 2 | −93,55 | ||||

| 2025-07-15 | 13F | Td Private Client Wealth Llc | 236 | 18 | ||||||

| 2025-07-31 | 13F | Catalyst Capital Advisors LLC | 11 380 | −30,53 | 859 | 21,19 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 357 216 | 290,17 | 26 959 | 580,78 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 163 785 | 75,91 | 12 361 | 206,93 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 7 065 | 533 | ||||||

| 2025-07-28 | NP | AVDE - Avantis International Equity ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 10 830 | 0,00 | 806 | 56,50 | ||||

| 2025-08-07 | 13F | Zurcher Kantonalbank (Zurich Cantonalbank) | 15 474 | 38,83 | 1 168 | 142,12 | ||||

| 2025-08-29 | 13F | Evolution Wealth Management Inc. | 100 | 8 | ||||||

| 2025-07-17 | 13F | Wd Rutherford Llc | 635 | 48 | ||||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 71 051 | −21,27 | 5 362 | 37,35 | ||||

| 2025-08-27 | NP | THRIVENT SERIES FUND INC - Thrivent International Allocation Portfolio Class A | 2 979 | 225 | ||||||

| 2025-07-17 | 13F | Tempus Wealth Planning, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-07 | 13F | Ibex Investors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Numerai GP LLC | 38 555 | 38,10 | 2 910 | 141,01 | ||||

| 2025-06-26 | NP | USCAX - Small Cap Stock Fund Shares | 48 036 | 14,47 | 2 951 | 47,40 | ||||

| 2025-08-12 | 13F | Jefferies Financial Group Inc. | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-15 | 13F | Morgan Stanley | 3 329 167 | 24,46 | 251 252 | 117,13 | ||||

| 2025-07-28 | NP | AVDS - Avantis International Small Cap Equity ETF | 1 094 | 681,43 | 81 | 1 250,00 | ||||

| 2025-05-15 | 13F | Caption Management, LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-05 | 13F | Catterton Management Company, L.L.C. | 4 037 472 | 0,00 | 304 708 | 74,46 | ||||

| 2025-08-27 | NP | TPAIX - Timothy Israel Common Values Fund Class A | 25 000 | −3,85 | 1 887 | 67,79 | ||||

| 2025-08-12 | 13F | Entropy Technologies, LP | 9 000 | 679 | ||||||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 7 903 | 0,00 | 596 | 74,78 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 13 422 | 16,88 | 1 013 | 104,03 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 58 600 | 623,46 | 4 423 | 1 163,43 | |||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 114 011 | 49,78 | 8 604 | 161,36 | ||||

| 2025-08-14 | 13F | Gotham Asset Management, LLC | 18 520 | −41,26 | 1 397 | 2,42 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 314 700 | 246,59 | 23 750 | 504,63 | |||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 110 | −25,17 | 8 | 33,33 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 6 | 0 | ||||||

| 2025-08-14 | 13F | Canada Pension Plan Investment Board | 56 194 | 0,00 | 4 241 | 74,49 | ||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 8 443 | 1 | ||||||

| 2025-07-07 | 13F | Wesbanco Bank Inc | 18 600 | 0,00 | 1 404 | 74,50 | ||||

| 2025-08-05 | 13F | Pier Capital, LLC | 68 959 | 5 204 | ||||||

| 2025-08-08 | 13F | Massachusetts Financial Services Co /ma/ | 1 709 195 | 32,55 | 128 993 | 131,24 | ||||

| 2025-07-08 | 13F | Atwood & Palmer Inc | 50 | 0,00 | 4 | 50,00 | ||||

| 2025-08-06 | 13F | Baillie Gifford & Co | 6 117 671 | −2,20 | 461 701 | 70,62 | ||||

| 2025-08-14 | 13F | Susquehanna Portfolio Strategies, LLC | 59 108 | 972,55 | 4 461 | 1 773,95 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 10 625 | 109,32 | 1 | |||||

| 2025-07-31 | 13F | Oppenheimer Asset Management Inc. | 3 060 | 231 | ||||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 7 150 | 1 | ||||||

| 2025-05-12 | 13F | Nomura Asset Management Co Ltd | 0 | 0 | ||||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 13 354 | −47,58 | 1 008 | −8,62 | ||||

| 2025-08-08 | 13F | Calamos Advisors LLC | Call | 83 600 | 3 617 | |||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 97 134 | 111,49 | 7 331 | 269,08 | ||||

| 2025-08-08 | 13F | Calamos Advisors LLC | 42 342 | 57,59 | 3 196 | 174,96 | ||||

| 2025-03-18 | 13F/A | Bank Of America Corp /de/ | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-07-07 | 13F | Zevenbergen Capital Investments Llc | 3 750 | 283 | ||||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 33 | 2 | ||||||

| 2025-04-16 | 13F | Wealth Enhancement Advisory Services, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-28 | NP | AVDEX - Avantis International Equity Fund Institutional Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 575 | 0,00 | 43 | 55,56 | ||||

| 2025-08-14 | 13F | Fundsmith LLP | 1 416 956 | −12,27 | 106 938 | 53,05 | ||||

| 2025-07-31 | 13F | State of New Jersey Common Pension Fund D | 14 323 | 74,86 | 1 081 | 205,08 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 32 120 | 2 654,72 | 2 424 | 4 748,00 | ||||

| 2025-07-28 | 13F | Mowery & Schoenfeld Wealth Management, LLC | 21 | 0,00 | 2 | |||||

| 2025-07-23 | 13F | Prime Capital Investment Advisors, LLC | 3 235 | −35,36 | 244 | 12,96 | ||||

| 2025-07-29 | 13F | William Blair Investment Management, Llc | 142 548 | −46,70 | 10 758 | −7,02 | ||||

| 2025-05-08 | 13F | Banque Cantonale Vaudoise | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Cwm, Llc | 175 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 835 315 | 8 711,34 | 63 041 | 15 275,85 | ||||

| 2025-08-13 | 13F | BCJ Capital Management, LLC | 38 217 | 2 884 | ||||||

| 2025-08-05 | 13F | Corton Capital Inc. | 4 202 | 317 | ||||||

| 2025-05-14 | 13F | Peak6 Llc | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Nordea Investment Management Ab | 81 500 | 2,00 | 6 087 | 73,37 | ||||

| 2025-08-14 | 13F | PDT Partners, LLC | 99 165 | −9,45 | 7 484 | 57,97 | ||||

| 2025-08-21 | NP | MXMTX - Great-West Small Cap Growth Fund Investor Class | 35 673 | 12,22 | 2 692 | 95,78 | ||||

| 2025-05-15 | 13F | PharVision Advisers, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 68 | 5 | ||||||

| 2025-08-14 | 13F | Sei Investments Co | 80 421 | 146,14 | 6 069 | 329,51 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 378 | −22,06 | 29 | 40,00 | ||||

| 2025-08-15 | 13F | State of Tennessee, Treasury Department | 20 961 | 64,14 | 1 582 | 186,41 | ||||

| 2025-08-14 | 13F | Granahan Investment Management Inc/ma | 1 355 347 | −12,85 | 102 288 | 52,04 | ||||

| 2025-07-15 | 13F | Sheets Smith Wealth Management | 16 958 | −18,44 | 1 280 | 42,27 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 120 682 | 9 108 | ||||||

| 2025-08-14 | 13F | Fred Alger Management, Llc | 47 841 | −19,72 | 3 611 | 40,09 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 20 380 | 311,22 | 1 538 | 618,69 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 4 565 | 345 | ||||||

| 2025-08-13 | 13F | Capital International Investors | 596 306 | −56,34 | 45 003 | −23,83 | ||||

| 2025-08-04 | 13F | Quaker Wealth Management, LLC | 264 | 20 | ||||||

| 2025-08-13 | 13F | Walleye Capital LLC | Call | 11 100 | 21,98 | 838 | 112,98 | |||

| 2025-08-13 | 13F | Walleye Capital LLC | Put | 19 100 | 536,67 | 1 441 | 1 017,05 | |||

| 2025-07-28 | 13F | Td Asset Management Inc | 6 153 | 464 | ||||||

| 2025-08-28 | NP | QCSTRX - Stock Account Class R1 | 30 869 | 13,16 | 2 330 | 97,37 | ||||

| 2025-07-09 | 13F | Harbor Capital Advisors, Inc. | 25 701 | 20,74 | 2 | |||||

| 2025-08-14 | 13F | Altshuler Shaham Ltd | 20 323 | −16,45 | 1 534 | 45,72 | ||||

| 2025-08-12 | 13F | Legal & General Group Plc | 936 | 71 | ||||||

| 2025-08-19 | 13F | Cim, Llc | 25 370 | 1 915 | ||||||

| 2025-08-13 | 13F | Polen Capital Management Llc | 33 751 | 2 547 | ||||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 55 479 | 4 187 | ||||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 3 905 | 296 | ||||||

| 2025-08-14 | 13F | Massar Capital Management, LP | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Migdal Insurance & Financial Holdings Ltd. | 245 764 | −3,91 | 19 | 63,64 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 953 475 | 20,45 | 71 959 | 110,14 | ||||

| 2025-08-13 | 13F | Amundi | 166 549 | 39,61 | 12 509 | 153,99 | ||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 62 503 | 561,34 | 4 717 | 1 056,13 | ||||

| 2025-05-15 | 13F | Centiva Capital, LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Woodline Partners LP | 400 112 | −9,18 | 30 196 | 58,45 | ||||

| 2025-08-12 | 13F | Landscape Capital Management, L.l.c. | 71 652 | 1,50 | 5 408 | 77,10 | ||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 132 095 | −23,58 | 10 | 28,57 | ||||

| 2025-05-15 | 13F | Twinbeech Capital Lp | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 777 411 | 255,04 | 58 671 | 519,42 | ||||

| 2025-08-01 | 13F | Peregrine Capital Management Llc | 145 885 | −3,63 | 11 010 | 68,13 | ||||

| 2025-08-12 | 13F | American Century Companies Inc | 14 300 | 17,26 | 1 079 | 104,74 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 135 400 | 2,81 | 10 219 | 79,36 | |||

| 2025-07-11 | 13F | Diversified Trust Co | 2 721 | 205 | ||||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 22 628 | 361,80 | 1 708 | 709,00 | ||||

| 2025-07-23 | 13F | Klp Kapitalforvaltning As | 14 800 | 8,82 | 1 117 | 89,80 | ||||

| 2025-07-29 | NP | WEUSX - Siit World Equity Ex-us Fund - Class A | 41 423 | 3 083 | ||||||

| 2025-08-12 | 13F | Virtu Financial LLC | 19 225 | 1 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 45 200 | −15,51 | 3 411 | 47,41 | |||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 3 797 | 0 | ||||||

| 2025-08-22 | NP | Columbia Funds Variable Series Trust II - Variable Portfolio - Partners Small Cap Growth Fund Class 1 | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-14 | 13F | Counterpoint Mutual Funds LLC | 10 165 | 767 | ||||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 821 759 | 507,76 | 62 | 1 120,00 | ||||

| 2025-05-15 | 13F | Barclays Plc | Put | 0 | −100,00 | 0 | ||||

| 2025-08-13 | 13F | Bare Financial Services, Inc | 12 | −45,45 | 1 | |||||

| 2025-08-08 | 13F | Principal Financial Group Inc | 10 962 | 827 | ||||||

| 2025-08-14 | 13F | Daiwa Securities Group Inc. | 15 200 | 1 | ||||||

| 2025-08-12 | 13F | Nuveen, LLC | 52 130 | 91,09 | 3 934 | 233,39 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 429 800 | 175,72 | 32 437 | 381,05 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 106 | 8 | ||||||

| 2025-08-28 | NP | CPAEX - Counterpoint Tactical Equity Fund Class A Shares | 10 165 | 767 | ||||||

| 2025-07-31 | 13F | Acuitas Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 10 | 1 | ||||||

| 2025-07-17 | 13F | Wolff Wiese Magana Llc | 116 | −18,88 | 9 | 33,33 | ||||

| 2025-08-14 | 13F | Sculptor Capital LP | 72 200 | 5 449 | ||||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 4 614 | 348 | ||||||

| 2025-08-26 | NP | GSCYX - SMALL CAP EQUITY FUND Institutional | 16 499 | 1 245 | ||||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 281 600 | 3 252,38 | 21 252 | 5 754,55 | ||||

| 2025-08-13 | 13F | Options Solutions, Llc | 25 113 | 1 895 | ||||||

| 2025-07-16 | 13F | ORG Partners LLC | 111 | 1 010,00 | 8 | |||||

| 2025-08-14 | 13F | Ghisallo Capital Management LLC | 150 000 | 11 320 | ||||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 100 | 8 | ||||||

| 2025-08-28 | NP | WMKSX - WesMark Small Company Growth Fund | 18 600 | 0,00 | 1 404 | 74,50 | ||||

| 2025-08-13 | 13F | Jump Financial, LLC | 174 281 | 13 153 | ||||||

| 2025-08-12 | 13F | Jefferies Financial Group Inc. | 10 591 | −79,83 | 799 | −64,82 | ||||

| 2025-08-14 | 13F | Lord, Abbett & Co. Llc | 385 193 | 101,40 | 29 | 262,50 | ||||

| 2025-07-31 | 13F | Orion Capital Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 2 060 732 | 1 747,06 | 155 523 | 3 122,61 | ||||

| 2025-08-18 | 13F | Ashford Capital Management Inc | 564 954 | −21,10 | 42 637 | 37,65 | ||||

| 2025-07-18 | 13F | Robeco Institutional Asset Management B.V. | 34 068 | 2 571 | ||||||

| 2025-08-11 | 13F | Vanguard Group Inc | 34 483 | 19,08 | 2 602 | 107,83 | ||||

| 2025-08-12 | 13F | Trexquant Investment LP | 164 144 | 191,44 | 12 388 | 408,50 | ||||

| 2025-08-14 | 13F | Holocene Advisors, LP | 4 143 | 313 | ||||||

| 2025-08-14 | 13F | MSD Partners, L.P. | 1 781 661 | 0,00 | 134 462 | 74,46 | ||||

| 2025-07-28 | NP | AVSD - Avantis Responsible International Equity ETF | 572 | 0,00 | 43 | 55,56 | ||||

| 2025-08-14 | 13F | Bamco Inc /ny/ | 1 237 433 | −13,33 | 93 389 | 51,20 | ||||

| 2025-05-15 | 13F | Point72 Asset Management, L.P. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 1 434 | 108 | ||||||

| 2025-05-13 | 13F | Knuff & Co LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna Advisors Group, Inc. | 59 200 | 4 468 | ||||||

| 2025-08-01 | 13F | Teacher Retirement System Of Texas | 17 108 | 11,91 | 1 291 | 95,31 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 45 | 0,00 | 3 | 50,00 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 3 | 0 | ||||||

| 2025-08-14 | 13F | USS Investment Management Ltd | 13 058 | 985 | ||||||

| 2025-07-24 | 13F | Blair William & Co/il | 2 700 | 204 | ||||||

| 2025-07-11 | 13F | Harbour Capital Advisors, LLC | 4 435 | 333 | ||||||

| 2025-04-29 | 13F/A | Huntleigh Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-26 | NP | NORTHERN FUNDS - NORTHERN SMALL CAP CORE FUND Class K | 6 894 | −5,55 | 520 | 65,08 | ||||

| 2025-08-07 | 13F | Teachers Retirement System Of The State Of Kentucky | 64 060 | −5,33 | 5 | 100,00 | ||||

| 2025-08-14 | 13F | Frontier Capital Management Co Llc | 285 300 | 21 532 | ||||||

| 2025-04-22 | 13F | Mendota Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-10 | 13F | Moody National Bank Trust Division | 94 216 | −10,93 | 7 110 | 55,38 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 713 | 54 | ||||||

| 2025-08-14 | 13F | Winton Capital Group Ltd | 3 921 | 296 | ||||||

| 2025-08-29 | NP | JAVTX - Janus Henderson Venture Fund Class T | 516 155 | 0,00 | 38 954 | 74,46 | ||||

| 2025-08-08 | 13F | Commonwealth Of Pennsylvania Public School Empls Retrmt Sys | 13 633 | 1 029 | ||||||

| 2025-08-14 | 13F | Shellback Capital, LP | 5 000 | 377 |

Other Listings

| DE:KW7 |