Grundläggande statistik

| Portföljvärde | $ 76 163 740 |

| Aktuella positioner | 106 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

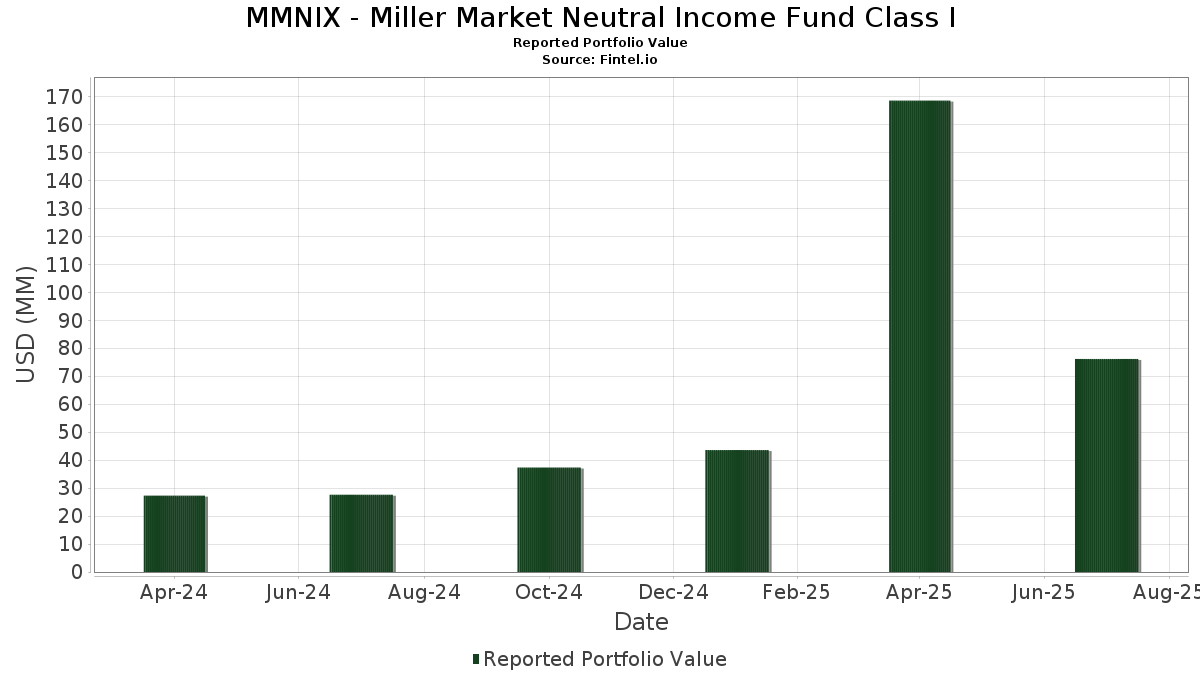

MMNIX - Miller Market Neutral Income Fund Class I har redovisat 106 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 76 163 740 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). MMNIX - Miller Market Neutral Income Fund Class Is största innehav är CONV. NOTE (US:US531229AQ58) , CONV. NOTE (US:US08265TAD19) , CONV. NOTE (DK:US04351PAD33) , Tyler Technologies Inc (US:US902252AB17) , and Ormat Technologies, Inc. 2.500%, Due 07/15/2027 (US:US686688AB85) . MMNIX - Miller Market Neutral Income Fund Class Is nya positioner inkluderar CONV. NOTE (US:US531229AQ58) , CONV. NOTE (US:US08265TAD19) , CONV. NOTE (DK:US04351PAD33) , Tyler Technologies Inc (US:US902252AB17) , and Ormat Technologies, Inc. 2.500%, Due 07/15/2027 (US:US686688AB85) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 34,50 | 47,5208 | 47,5208 | ||

| 2,76 | 3,8065 | 3,8065 | ||

| 2,34 | 3,2211 | 3,2211 | ||

| 2,01 | 2,7712 | 2,7712 | ||

| 1,96 | 2,7030 | 2,7030 | ||

| 1,78 | 2,4455 | 2,4455 | ||

| 1,76 | 2,4244 | 2,4244 | ||

| 1,72 | 2,3705 | 2,3705 | ||

| 1,69 | 2,3319 | 2,3319 | ||

| 1,65 | 2,2692 | 2,2692 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| −0,03 | −1,95 | −2,6890 | −2,6890 | |

| −0,00 | −1,40 | −1,9327 | −1,9327 | |

| −0,19 | −1,21 | −1,6691 | −1,6691 | |

| −0,01 | −1,20 | −1,6594 | −1,6594 | |

| −0,00 | −0,88 | −1,2066 | −1,2066 | |

| −0,01 | −0,87 | −1,2034 | −1,2034 | |

| −0,04 | −0,87 | −1,2008 | −1,2008 | |

| −0,01 | −0,86 | −1,1817 | −1,1817 | |

| −0,00 | −0,78 | −1,0770 | −1,0770 | |

| −0,02 | −0,74 | −1,0171 | −1,0171 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-09-03 för rapporteringsperioden 2025-07-31. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | Genomsnittligt aktiepris | Aktier (MM) |

ΔAktier (%) |

ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BNP CASH DEPOSIT ACCT / STIV (N/A) | 34,50 | 47,5208 | 47,5208 | ||||||

| SMCI / Super Micro Computer, Inc. - Depositary Receipt (Common Stock) | 2,76 | 3,8065 | 3,8065 | ||||||

| N2ET34 / Cloudflare, Inc. - Depositary Receipt (Common Stock) | 2,34 | 3,2211 | 3,2211 | ||||||

| ITRI / Itron, Inc. | 2,01 | 2,7712 | 2,7712 | ||||||

| ARRY 2 7/8 07/01/31 / DBT (US04271TAC45) | 1,96 | 2,7030 | 2,7030 | ||||||

| US531229AQ58 / CONV. NOTE | 1,95 | 60,30 | 2,6931 | 0,4207 | |||||

| US08265TAD19 / CONV. NOTE | 1,93 | 163,61 | 2,6557 | −0,1014 | |||||

| US04351PAD33 / CONV. NOTE | 1,89 | 1,34 | 2,6051 | −0,8721 | |||||

| AEIS / Advanced Energy Industries, Inc. | 1,84 | 95,23 | 2,5389 | 0,7800 | |||||

| US902252AB17 / Tyler Technologies Inc | 1,81 | 42,95 | 2,4991 | −0,8847 | |||||

| RBRK 0 06/15/30 / DBT (US781154AC39) | 1,78 | 2,4455 | 2,4455 | ||||||

| US3434125080 / FLUOR CORP PC 6.5% PERP | 1,76 | 33,43 | 2,4255 | −0,0330 | |||||

| BOX / Box, Inc. | 1,76 | 2,4244 | 2,4244 | ||||||

| G2WR34 / Guidewire Software, Inc. - Depositary Receipt (Common Stock) | 1,72 | 3,80 | 2,3734 | −0,7176 | |||||

| Z2SC34 / Zscaler, Inc. - Depositary Receipt (Common Stock) | 1,72 | 2,3705 | 2,3705 | ||||||

| US686688AB85 / Ormat Technologies, Inc. 2.500%, Due 07/15/2027 | 1,70 | 9,24 | 2,3464 | −0,5585 | |||||

| ALRM / Alarm.com Holdings, Inc. | 1,69 | 2,3319 | 2,3319 | ||||||

| PPL 2 7/8 03/15/28 / DBT (US69352PAS20) | 1,68 | −2,16 | 2,3081 | −0,8819 | |||||

| C1NP34 / CenterPoint Energy, Inc. - Depositary Receipt (Common Stock) | 1,67 | −1,42 | 2,3011 | −0,8561 | |||||

| CYBR / CyberArk Software Ltd. | 1,65 | 2,2692 | 2,2692 | ||||||

| PSN / Parsons Corporation | 1,64 | 3,21 | 2,2607 | −0,7024 | |||||

| COLL / Collegium Pharmaceutical, Inc. | 1,64 | 59,98 | 2,2531 | 0,3472 | |||||

| D2AS34 / DoorDash, Inc. - Depositary Receipt (Common Stock) | 1,63 | 2,2467 | 2,2467 | ||||||

| DUKB34 / Duke Energy Corporation - Depositary Receipt (Common Stock) | 1,61 | −1,83 | 2,2145 | −0,8360 | |||||

| MTSI 0 12/15/29 / DBT (US55405YAC49) | 1,57 | 67,70 | 2,1609 | 0,4173 | |||||

| PRGS / Progress Software Corporation | 1,56 | 37,65 | 2,1507 | 0,0373 | |||||

| BBIO / BridgeBio Pharma, Inc. | 1,55 | 88,79 | 2,1360 | 0,6052 | |||||

| US40637HAF64 / CONV. NOTE | 1,54 | −1,41 | 2,1266 | −0,7901 | |||||

| L2IV34 / LivaNova PLC - Depositary Receipt (Common Stock) | 1,50 | 6,52 | 2,0708 | −0,5597 | |||||

| HAE / Haemonetics Corporation | 1,50 | 2,0645 | 2,0645 | ||||||

| IMCR / Immunocore Holdings plc - Depositary Receipt (Common Stock) | 1,49 | 46,27 | 2,0557 | 0,1548 | |||||

| US26210CAD65 / Dropbox, Inc. | 1,49 | −2,81 | 2,0508 | −0,8017 | |||||

| MTH / Meritage Homes Corporation | 1,48 | 2,0434 | 2,0434 | ||||||

| ITGR 1 7/8 03/15/30 / DBT (US45826HAC34) | 1,47 | −7,18 | 2,0312 | −0,9284 | |||||

| US00971TAL52 / CONV. NOTE | 1,44 | 45,70 | 1,9865 | 0,1425 | |||||

| US60471A1016 / Mirion Technologies, Inc. | 1,42 | 1,9562 | 1,9562 | ||||||

| 360 / Life360, Inc. - Depositary Receipt (Common Stock) | 1,42 | 1,9542 | 1,9542 | ||||||

| US47804M7204 / JHF II STRATEGIC EQ ALLOCATI MUTUAL FUND | 1,37 | 21,28 | 1,8847 | −0,2181 | |||||

| AMPH / Amphastar Pharmaceuticals, Inc. | 1,29 | −0,46 | 1,7801 | −0,6398 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 1,27 | 1,7546 | 1,7546 | ||||||

| W1EC34 / WEC Energy Group, Inc. - Depositary Receipt (Common Stock) | 1,16 | 1,5932 | 1,5932 | ||||||

| TTEK / Tetra Tech, Inc. | 1,14 | 7,14 | 1,5712 | −0,4114 | |||||

| CSGS / CSG Systems International, Inc. | 1,11 | 1,56 | 1,5244 | −0,5057 | |||||

| US393657AM33 / GBX 2 7/8 04/15/28 | 1,07 | 3,39 | 1,4698 | −0,4521 | |||||

| ODD 0 06/15/30 / DBT (US67579RAA86) | 1,06 | 1,4541 | 1,4541 | ||||||

| B2LN34 / BlackLine, Inc. - Depositary Receipt (Common Stock) | 1,04 | 1,4356 | 1,4356 | ||||||

| LMAT / LeMaitre Vascular, Inc. | 1,00 | −3,94 | 1,3771 | −0,5620 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 1,00 | −4,13 | 1,3758 | −0,5655 | |||||

| R2GE34 / Repligen Corporation - Depositary Receipt (Common Stock) | 0,97 | −5,53 | 1,3428 | −0,5796 | |||||

| D1EX34 / DexCom, Inc. - Depositary Receipt (Common Stock) | 0,93 | 2,21 | 1,2750 | −0,4127 | |||||

| G1PI34 / Global Payments Inc. - Depositary Receipt (Common Stock) | 0,91 | 2,02 | 1,2518 | −0,4066 | |||||

| WKC / World Kinect Corporation | 0,85 | 4,41 | 1,1753 | −0,3473 | |||||

| AVAV / AeroVironment, Inc. | 0,47 | 0,6408 | 0,6408 | ||||||

| US09248U7182 / BlackRock Liquidity Funds: T-Fund, Institutional Shares | 0,22 | 185,53 | 0,2992 | 0,1570 | |||||

| BE / Bloom Energy Corporation | 0,00 | −100,00 | 0,00 | −100,00 | 1,3243 | ||||

| DXCM / DexCom, Inc. | Short | −0,00 | −0,00 | −0,15 | 13,28 | −0,2003 | 0,0391 | ||

| PCG / PG&E Corporation | Short | −0,01 | −34,30 | −0,16 | −44,37 | −0,2182 | 0,3111 | ||

| AMPH / Amphastar Pharmaceuticals, Inc. | Short | −0,01 | −17,82 | −0,17 | −29,67 | −0,2395 | 0,2198 | ||

| GPN / Global Payments Inc. | Short | −0,00 | −0,00 | −0,20 | 4,74 | −0,2753 | 0,0801 | ||

| IMCR / Immunocore Holdings plc - Depositary Receipt (Common Stock) | Short | −0,01 | 38,46 | −0,24 | 50,64 | −0,3250 | −0,0334 | ||

| AVAV / AeroVironment, Inc. | Short | −0,00 | −0,24 | −0,3318 | −0,3318 | ||||

| RGEN / Repligen Corporation | Short | −0,00 | −17,24 | −0,28 | −30,00 | −0,3871 | 0,3585 | ||

| MTH / Meritage Homes Corporation | Short | −0,00 | 17,07 | −0,32 | 15,77 | −0,4453 | 0,0752 | ||

| OMCL / Omnicell, Inc. | Short | −0,01 | −0,84 | −0,37 | −1,62 | −0,5041 | 0,1890 | ||

| AKAM / Akamai Technologies, Inc. | Short | −0,00 | 44,12 | −0,37 | 36,63 | −0,5151 | −0,0047 | ||

| LMAT / LeMaitre Vascular, Inc. | Short | −0,00 | −0,00 | −0,39 | −10,57 | −0,5372 | 0,2743 | ||

| LIVN / LivaNova PLC | Short | −0,01 | 8,99 | −0,41 | 24,32 | −0,5638 | 0,0497 | ||

| BSY / Bentley Systems, Incorporated | Short | −0,01 | 161,82 | −0,42 | 189,58 | −0,5751 | −0,0308 | ||

| GBX / The Greenbrier Companies, Inc. | Short | −0,01 | −2,04 | −0,44 | 5,06 | −0,6017 | 0,1728 | ||

| HAE / Haemonetics Corporation | Short | −0,01 | −0,48 | −0,6630 | −0,6630 | ||||

| AUR / Aurora Innovation, Inc. | Short | −0,09 | −0,49 | −0,6811 | −0,6811 | ||||

| CSGS / CSG Systems International, Inc. | Short | −0,01 | 5,26 | −0,50 | 9,43 | −0,6884 | 0,1631 | ||

| ODD / Oddity Tech Ltd. | Short | −0,01 | −0,50 | −0,6950 | −0,6950 | ||||

| ALRM / Alarm.com Holdings, Inc. | Short | −0,01 | 38,81 | −0,51 | 41,50 | −0,6999 | −0,0308 | ||

| WKC / World Kinect Corporation | Short | −0,02 | 28,97 | −0,51 | 40,22 | −0,7025 | −0,0247 | ||

| BL / BlackLine, Inc. | Short | −0,01 | 11,76 | −0,51 | 27,18 | −0,7038 | 0,0441 | ||

| ZS / Zscaler, Inc. | Short | −0,00 | −0,54 | −0,7474 | −0,7474 | ||||

| DBX / Dropbox, Inc. | Short | −0,02 | −4,76 | −0,54 | −9,35 | −0,7486 | 0,3684 | ||

| TTEK / Tetra Tech, Inc. | Short | −0,02 | 23,66 | −0,60 | 45,83 | −0,8199 | −0,0587 | ||

| PRGS / Progress Software Corporation | Short | −0,01 | 31,05 | −0,60 | 5,10 | −0,8246 | 0,2366 | ||

| ITGR / Integer Holdings Corporation | Short | −0,01 | −13,85 | −0,61 | −26,07 | −0,8371 | 0,6925 | ||

| PSN / Parsons Corporation | Short | −0,01 | 6,33 | −0,62 | 17,99 | −0,8586 | 0,1255 | ||

| BOX / Box, Inc. | Short | −0,02 | −0,74 | −1,0171 | −1,0171 | ||||

| CYBR / CyberArk Software Ltd. | Short | −0,00 | −0,78 | −1,0770 | −1,0770 | ||||

| WEC / WEC Energy Group, Inc. | Short | −0,01 | 2,86 | −0,79 | 2,48 | −1,0819 | 0,3464 | ||

| COLL / Collegium Pharmaceutical, Inc. | Short | −0,03 | 50,86 | −0,79 | 66,95 | −1,0860 | −0,2058 | ||

| MTSI / MACOM Technology Solutions Holdings, Inc. | Short | −0,01 | 86,29 | −0,79 | 146,42 | −1,0910 | −0,4918 | ||

| LIF / Life360, Inc. | Short | −0,01 | −0,86 | −1,1817 | −1,1817 | ||||

| MIR / Mirion Technologies, Inc. | Short | −0,04 | −0,87 | −1,2008 | −1,2008 | ||||

| RBRK / Rubrik, Inc. | Short | −0,01 | −0,87 | −1,2034 | −1,2034 | ||||

| DASH / DoorDash, Inc. | Short | −0,00 | −0,88 | −1,2066 | −1,2066 | ||||

| DUK / Duke Energy Corporation | Short | −0,01 | −1,35 | −0,89 | −1,66 | −1,2233 | 0,4590 | ||

| ORA / Ormat Technologies, Inc. | Short | −0,01 | 49,25 | −0,89 | 83,95 | −1,2317 | −0,3255 | ||

| HALO / Halozyme Therapeutics, Inc. | Short | −0,01 | −8,54 | −0,90 | −10,72 | −1,2392 | 0,6375 | ||

| BBIO / BridgeBio Pharma, Inc. | Short | −0,02 | 73,64 | −0,90 | 114,25 | −1,2438 | −0,4576 | ||

| GWRE / Guidewire Software, Inc. | Short | −0,00 | 10,26 | −0,97 | 21,80 | −1,3401 | 0,1478 | ||

| ASND / Ascendis Pharma A/S - Depositary Receipt (Common Stock) | Short | −0,01 | −6,56 | −0,99 | −4,91 | −1,3624 | 0,5747 | ||

| CNP / CenterPoint Energy, Inc. | Short | −0,03 | −0,00 | −1,02 | 0,10 | −1,4065 | 0,4937 | ||

| PPL / PPL Corporation | Short | −0,03 | −2,02 | −1,04 | −4,24 | −1,4307 | 0,5890 | ||

| AEIS / Advanced Energy Industries, Inc. | Short | −0,01 | 127,27 | −1,04 | 224,30 | −1,4353 | −0,8364 | ||

| NET / Cloudflare, Inc. | Short | −0,01 | −1,20 | −1,6594 | −1,6594 | ||||

| ARRY / Array Technologies, Inc. | Short | −0,19 | −1,21 | −1,6691 | −1,6691 | ||||

| FLR / Fluor Corporation | Short | −0,02 | 24,14 | −1,23 | 101,98 | −1,6893 | −0,5582 | ||

| FWONK / Formula One Group | Short | −0,01 | 63,29 | −1,29 | 84,86 | −1,7833 | −0,4782 | ||

| ITRI / Itron, Inc. | Short | −0,01 | 13,04 | −1,30 | 26,59 | −1,7843 | 0,1233 | ||

| TYL / Tyler Technologies, Inc. | Short | −0,00 | −1,40 | −1,9327 | −1,9327 | ||||

| SMCI / Super Micro Computer, Inc. | Short | −0,03 | −1,95 | −2,6890 | −2,6890 |