Grundläggande statistik

| Institutionella ägare | 199 total, 196 long only, 2 short only, 1 long/short - change of 16,37% MRQ |

| Genomsnittlig portföljallokering | 0.6731 % - change of 69,20% MRQ |

| Institutionella aktier (lång) | 26 734 108 (ex 13D/G) - change of 7,24MM shares 37,16% MRQ |

| Institutionellt värde (lång) | $ 685 383 USD ($1000) |

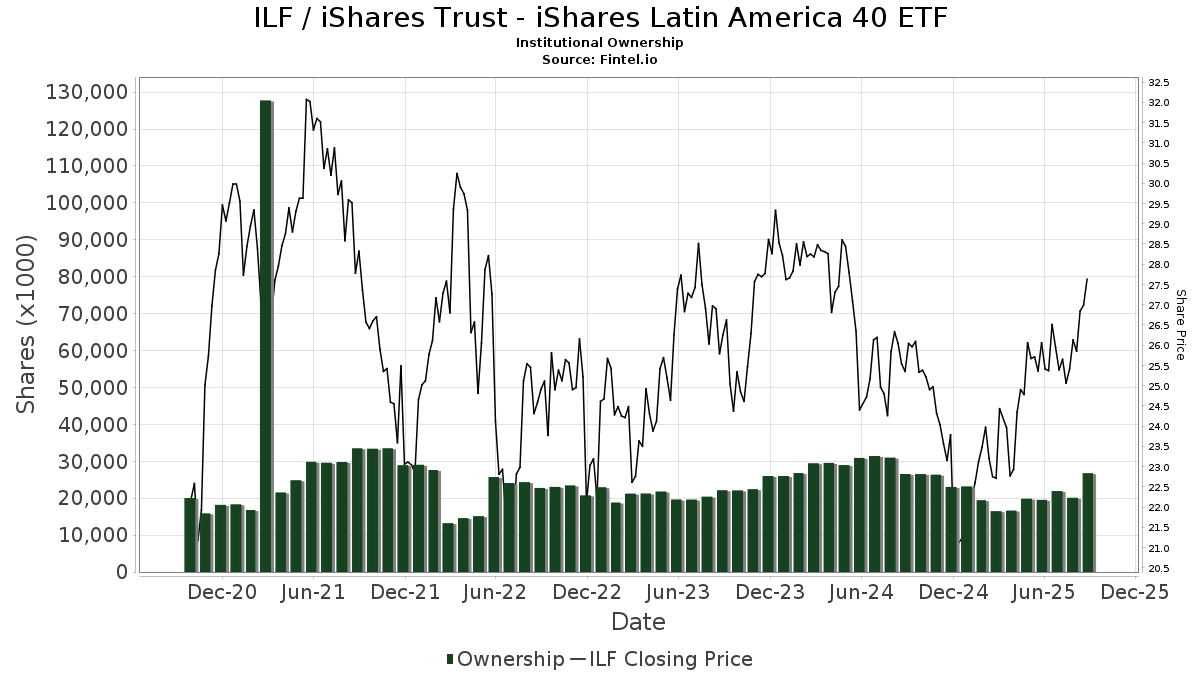

Institutionellt ägande och aktieägare

iShares Trust - iShares Latin America 40 ETF (US:ILF) har 199 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 26,735,955 aktier. Största aktieägare inkluderar Morgan Stanley, Assetmark, Inc, FIL Ltd, CLSM - Cabana Target Leading Sector Moderate ETF, New Harbor Financial Group, LLC, TDSC - Cabana Target Drawdown 10 ETF, Wells Fargo & Company/mn, Exchange Traded Concepts, Llc, IYLD - iShares Morningstar Multi-Asset Income ETF, and Osborne Partners Capital Management, Llc .

iShares Trust - iShares Latin America 40 ETF (ARCA:ILF) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 12, 2025 is 27,94 / share. Previously, on September 13, 2024, the share price was 25,89 / share. This represents an increase of 7,92% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

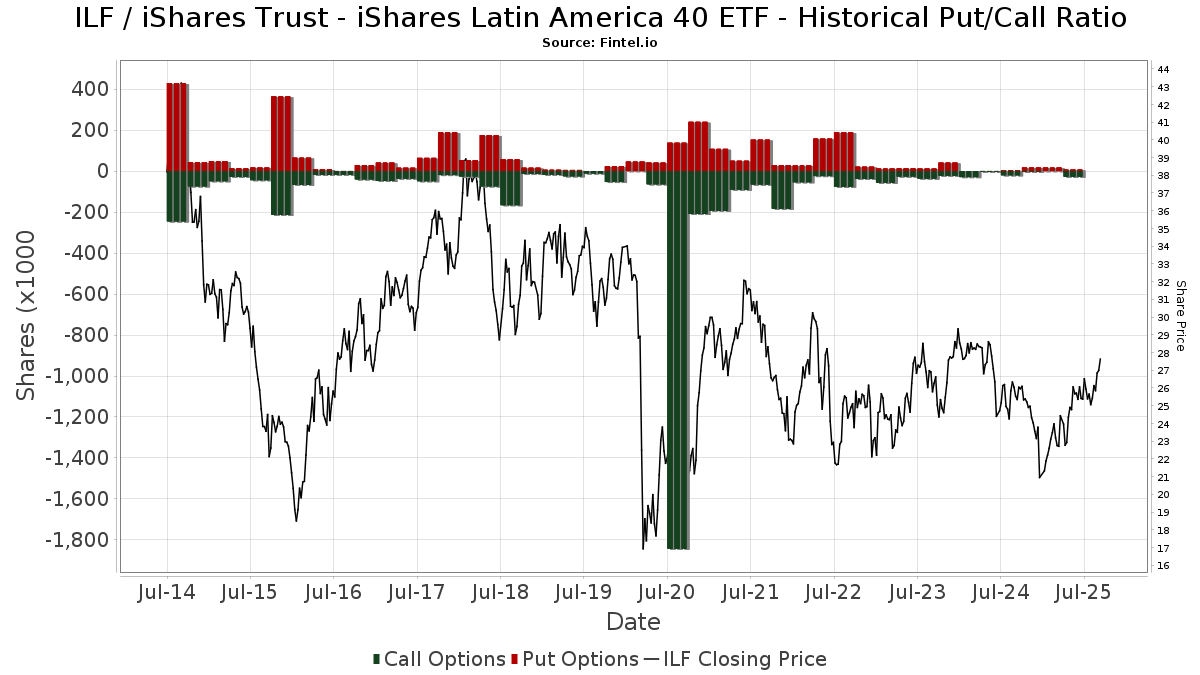

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 11 400 | 290 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 180 622 | −21,39 | 4 734 | −12,50 | ||||

| 2025-07-21 | 13F | Synergy Financial Management, LLC | 16 503 | −24,92 | 433 | −16,44 | ||||

| 2025-05-08 | 13F | Us Bancorp \de\ | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | GWM Advisors LLC | 8 636 | 0,00 | 226 | 11,33 | ||||

| 2025-08-28 | NP | SIRAX - Sierra Tactical All Asset Fund Class A | 183 700 | 4 815 | ||||||

| 2025-08-07 | 13F | David R. Rahn & Associates Inc. | 331 765 | 8 696 | ||||||

| 2025-08-11 | 13F | Rahlfs Capital, Llc | 15 250 | 0,00 | 400 | 11,14 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 58 650 | 1 537 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-31 | 13F | Carrera Capital Advisors | 340 904 | 341,70 | 8 935 | 391,74 | ||||

| 2025-04-30 | 13F | Ramiah Investment Group | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Hilltop Holdings Inc. | 20 799 | 545 | ||||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 556 505 | 31,31 | 14 587 | 46,16 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 796 | 0,00 | 21 | 11,11 | ||||

| 2025-04-29 | 13F | Element Wealth, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Eqis Capital Management, Inc. | 8 025 | 210 | ||||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 150 | 0,00 | 4 | 0,00 | ||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 398 411 | −46,53 | 10 442 | −40,49 | ||||

| 2025-08-27 | NP | RYMSX - Guggenheim Multi-Hedge Strategies Fund Class P | Short | −690 | −49,49 | −18 | −43,75 | |||

| 2025-08-13 | 13F | Provida Pension Fund Administrator | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | DZ BANK AG Deutsche Zentral Genossenschafts Bank, Frankfurt am Main | 377 439 | 9 893 | ||||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 58 295 | 1 528 | ||||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 7 792 | 0,00 | 204 | 11,48 | ||||

| 2025-05-09 | 13F | Headlands Technologies LLC | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Great West Life Assurance Co /can/ | 71 247 | 1,48 | 2 | 0,00 | ||||

| 2025-07-09 | 13F | Massmutual Trust Co Fsb/adv | 49 131 | 17,15 | 1 288 | 30,40 | ||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 844 802 | −69,85 | 22 142 | −66,44 | ||||

| 2025-08-01 | 13F | Biltmore Family Office, LLC | 1 200 | 146,91 | 31 | 181,82 | ||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 10 888 | 0 | ||||||

| 2025-04-17 | 13F | Access Financial Services, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 450 | 0,00 | 12 | 10,00 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 915 291 | 871,03 | 23 990 | 981,07 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 6 624 | 48,19 | 174 | 64,76 | ||||

| 2025-08-12 | 13F | OneAscent Financial Services LLC | 10 989 | 13,15 | 0 | |||||

| 2025-06-23 | NP | IYLD - iShares Morningstar Multi-Asset Income ETF | 743 179 | 18,96 | 18 505 | 29,02 | ||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 0 | −100,00 | 0 | |||||

| 2025-07-01 | 13F | Stonehearth Capital Management, LLC | 242 966 | 6 368 | ||||||

| 2025-08-06 | 13F | Legacy Bridge, LLC | 1 298 | 0,00 | 34 | 13,33 | ||||

| 2025-08-05 | 13F | Alexander Randolph Advisory Inc | 11 442 | 0,00 | 300 | 11,15 | ||||

| 2025-08-14 | 13F | Glenmede Investment Management, LP | 500 | 13 | ||||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 606 | 0,00 | 16 | 7,14 | ||||

| 2025-08-11 | 13F | First American Trust, Fsb | 292 360 | 7 663 | ||||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 448 | 12 | ||||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 13 533 | −18,88 | 0 | |||||

| 2025-07-24 | 13F | Lmcg Investments, Llc | 285 324 | −1,92 | 7 478 | 9,15 | ||||

| 2025-08-12 | 13F | Park Square Financial Group, LLC | 73 | 0,00 | 2 | 0,00 | ||||

| 2025-08-27 | 13F/A | Putney Financial Group LLC | 160 | 0,00 | 4 | 33,33 | ||||

| 2025-08-14 | 13F | Moneda S.A. Administradora General de Fondos | 69 518 | −1,41 | 1 822 | 9,76 | ||||

| 2025-07-01 | 13F | Kera Capital Partners, Inc. | 267 453 | 4,41 | 7 010 | 16,20 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 3 | 0,00 | 0 | |||||

| 2025-07-25 | 13F | Envestnet Portfolio Solutions, Inc. | 20 648 | −48,22 | 541 | −42,39 | ||||

| 2025-08-12 | 13F | Boreal Capital Management LLC | 120 | 3 | ||||||

| 2025-08-12 | 13F | Franklin Resources Inc | 137 | 4 | ||||||

| 2025-07-29 | 13F | Yoffe Investment Management, LLC | 37 099 | 0,25 | 972 | 11,60 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 43 461 | −79,18 | 1 139 | −76,85 | ||||

| 2025-07-28 | 13F | Copia Wealth Management | 12 598 | −2,63 | 330 | 8,55 | ||||

| 2025-07-16 | 13F | Banque Pictet & Cie Sa | 270 000 | 0,00 | 7 077 | 11,29 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 36 901 | −92,22 | 1 | −100,00 | ||||

| 2025-08-12 | 13F | Prudential Financial Inc | 26 500 | 695 | ||||||

| 2025-07-18 | 13F | PFG Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Stifel Financial Corp | 24 104 | −1,39 | 632 | 9,74 | ||||

| 2025-05-16 | 13F | Strait & Sound Wealth Management LLC | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | Park Avenue Securities Llc | 19 040 | −21,72 | 0 | |||||

| 2025-08-14 | 13F | Blue Capital, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Pekin Hardy Strauss, Inc. | 35 712 | −1,84 | 936 | 9,35 | ||||

| 2025-07-10 | 13F | Redhawk Wealth Advisors, Inc. | 83 422 | 2 186 | ||||||

| 2025-08-13 | 13F | BCJ Capital Management, LLC | 50 691 | −13,15 | 1 329 | −3,35 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 26 762 | −24,38 | 701 | −15,85 | ||||

| 2025-05-15 | 13F | Qube Research & Technologies Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 24 399 | 639 | ||||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 89 059 | 32,72 | 2 334 | 47,72 | ||||

| 2025-08-14 | 13F | DRW Securities, LLC | 96 038 | 2 517 | ||||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 76 776 | 2 012 | ||||||

| 2025-08-06 | 13F | Nicholas Hoffman & Company, LLC. | 8 968 | −9,18 | 235 | 1,29 | ||||

| 2025-06-26 | NP | CLSM - Cabana Target Leading Sector Moderate ETF | 1 431 782 | 35 651 | ||||||

| 2025-08-12 | 13F | Osborne Partners Capital Management, Llc | 677 661 | 4,84 | 17 762 | 16,69 | ||||

| 2025-08-13 | 13F | Hudson Portfolio Management LLC | 8 105 | 212 | ||||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 27 251 | −26,41 | 714 | −18,12 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 56 379 | −16,73 | 1 478 | −7,34 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 29 341 | −54,07 | 769 | −48,87 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 432 819 | −36,41 | 11 344 | −29,22 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - EQ/International Core Managed Volatility Portfolio Class IB | 39 947 | −17,03 | 1 047 | −7,59 | ||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 1 105 | 0,00 | 29 | 7,69 | ||||

| 2025-08-11 | 13F | Tidemark, LLC | 76 | 2,70 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 56 900 | −43,82 | 1 491 | −37,48 | ||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 9 824 | 9,99 | 257 | 22,38 | ||||

| 2025-05-15 | 13F | Federation des caisses Desjardins du Quebec | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 2 | −92,00 | 0 | |||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 30 Fund Instl Class | 42 300 | 1 109 | ||||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 11 000 | 4,76 | 288 | 16,60 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 51 599 | −4,49 | 1 352 | 6,29 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 161 623 | 9 026,09 | 4 236 | 11 348,65 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 1 | −66,67 | 0 | |||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 55 525 | −40,49 | 1 | −50,00 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 211 435 | −53,18 | 5 542 | −47,90 | ||||

| 2025-07-07 | 13F | Bangor Savings Bank | 1 100 | 0,00 | 29 | 12,00 | ||||

| 2025-08-14 | 13F | BTG Pactual Asset Management US LLC | 11 893 | 0,00 | 312 | 11,07 | ||||

| 2025-07-18 | 13F | Trust Co Of Vermont | 347 | 0,00 | 9 | 12,50 | ||||

| 2025-07-16 | 13F | RWM Asset Management, LLC | 9 131 | 0,00 | 239 | 11,16 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 241 919 | 468,70 | 6 342 | 532,93 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 192 | 0,00 | 5 | 25,00 | ||||

| 2025-07-17 | 13F | SeaBridge Investment Advisors LLC | 13 392 | 351 | ||||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 49 700 | −90,19 | 1 303 | −89,08 | ||||

| 2025-07-24 | 13F | Robertson Stephens Wealth Management, LLC | 9 759 | −5,10 | 256 | 5,37 | ||||

| 2025-08-12 | 13F | Trexquant Investment LP | 12 918 | −10,45 | 339 | −0,29 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 2 500 | 66 | ||||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 169 807 | 3,05 | 4 451 | 14,69 | ||||

| 2025-07-29 | 13F | Swmg, Llc | 8 052 | 201 | ||||||

| 2025-08-13 | 13F | Natixis | 1 411 | −12,09 | 37 | −2,70 | ||||

| 2025-05-05 | 13F | Morningstar Investment Services LLC | 97 252 | 2 | ||||||

| 2025-08-11 | 13F | Beaumont Capital Management, LLC | 61 588 | 251,77 | 1 614 | 291,75 | ||||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 56 120 | 1 770,67 | 1 471 | 2 000,00 | ||||

| 2025-08-05 | 13F | Crestwood Advisors Group LLC | 8 441 | 221 | ||||||

| 2025-08-11 | 13F | SFI Advisors, LLC | 8 247 | 216 | ||||||

| 2025-08-11 | 13F | ICICI Prudential Asset Management Co Ltd | 154 143 | 0,00 | 4 040 | 11,23 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 61 792 | −3,80 | 1 537 | 1,65 | ||||

| 2025-06-26 | NP | TDSC - Cabana Target Drawdown 10 ETF | 946 924 | 200,48 | 23 578 | 225,89 | ||||

| 2025-08-14 | 13F | Man Group plc | 154 859 | 4 059 | ||||||

| 2025-08-08 | 13F | Banco Bilbao Vizcaya Argentaria, S.a. | 0 | −100,00 | 0 | |||||

| 2025-07-10 | 13F | Professional Financial Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 29 538 | −36,13 | 774 | −28,93 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 170 274 | −3,02 | 4 463 | 7,93 | ||||

| 2025-08-27 | NP | XNAV - FundX Aggressive ETF | 35 500 | 930 | ||||||

| 2025-08-12 | 13F | Ci Investments Inc. | 20 000 | 0,00 | 1 | |||||

| 2025-07-31 | 13F | Ssa Swiss Advisors Ag | 72 800 | 1 848 | ||||||

| 2025-07-31 | 13F | Sharper & Granite LLC | 41 380 | 48,37 | 1 097 | 67,07 | ||||

| 2025-08-14 | 13F | Fmr Llc | 3 304 | 23,28 | 87 | 36,51 | ||||

| 2025-08-19 | 13F | Cape Investment Advisory, Inc. | 363 | 2,25 | 10 | 12,50 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 567 458 | 62,55 | 14 873 | 80,91 | ||||

| 2025-04-09 | 13F | Milestone Asset Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 8 286 | 217 | ||||||

| 2025-07-30 | 13F | Journey Advisory Group, LLC | 319 901 | 30,21 | 8 385 | 44,90 | ||||

| 2025-07-18 | 13F | Gold Investment Management Ltd. | 11 946 | −0,19 | 313 | 11,39 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 1 340 | −3,11 | 35 | 9,38 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 44 121 | −37,80 | 1 156 | −30,78 | ||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-07-08 | 13F | Lowe Wealth Advisors, LLC | 2 341 | 303,62 | 61 | 369,23 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 480 | 0,00 | 13 | 9,09 | ||||

| 2025-08-08 | 13F/A | Ignite Planners, LLC | 8 445 | 211 | ||||||

| 2025-07-29 | 13F | Private Trust Co Na | 1 443 | −23,93 | 38 | −15,91 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 3 635 724 | 12,64 | 95 292 | 25,36 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 1 187 | −52,00 | 31 | −46,55 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 435 775 | 134,70 | 11 422 | 161,23 | ||||

| 2025-08-04 | 13F | Atria Investments Llc | 13 576 | −10,51 | 356 | −0,56 | ||||

| 2025-07-23 | 13F | Indiana Trust & Investment Management CO | 31 800 | 0,00 | 833 | 11,36 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 616 | 0,00 | 16 | 14,29 | ||||

| 2025-07-29 | 13F | Cottonwood Capital Advisors, Llc | 9 796 | 4,60 | 257 | 16,36 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 555 060 | 47,87 | 14 548 | 64,59 | ||||

| 2025-08-07 | 13F | BOK Financial Private Wealth, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | New Harbor Financial Group, LLC | 964 005 | 25 267 | ||||||

| 2025-07-21 | 13F | Patriot Financial Group Insurance Agency, LLC | 9 421 | 247 | ||||||

| 2025-07-23 | 13F | Heck Capital Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-15 | 13F | Fortitude Family Office, LLC | 188 | 5 | ||||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 152 024 | −2,78 | 3 985 | 8,20 | ||||

| 2025-08-13 | 13F | Bank Of Nova Scotia | 137 733 | −17,54 | 3 610 | −8,24 | ||||

| 2025-08-06 | 13F | Decker Retirement Planning Inc. | 210 | 6 | ||||||

| 2025-08-14 | 13F | Sentinus, LLC | 12 435 | −43,24 | 326 | −36,89 | ||||

| 2025-07-18 | 13F | Centricity Wealth Management, LLC | 1 217 | 32 | ||||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 954 | −36,65 | 25 | −28,57 | ||||

| 2025-08-12 | 13F | Edmond De Rothschild Holding S.a. | 3 722 | 0,00 | 98 | 11,49 | ||||

| 2025-08-14 | 13F | Optiver Holding B.V. | 155 | 0,00 | 4 | 33,33 | ||||

| 2025-07-21 | 13F | Vaughan Nelson Investment Management, L.p. | 2 610 | 0,00 | 68 | |||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 44 148 | 1,73 | 1 157 | 13,32 | ||||

| 2025-03-27 | NP | BLACKROCK GLOBAL ALLOCATION FUND, INC. - BLACKROCK GLOBAL ALLOCATION FUND, INC. Investor A This fund is a listed as child fund of BlackRock, Inc. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 222 628 | 0,00 | 5 112 | −6,67 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 10 900 | 286 | |||||

| 2025-05-15 | 13F | National Wealth Management Group, LLC | 18 360 | 0,97 | 432 | 13,68 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 0 | −100,00 | 0 | |||||

| 2025-07-08 | 13F | Ehrlich Financial Group | 9 923 | −72,53 | 260 | −69,41 | ||||

| 2025-08-14 | 13F | Comerica Bank | 2 978 | −1,91 | 78 | 9,86 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 21 267 | 29,85 | 548 | 40,87 | ||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 70 Fund Investor Class | 36 200 | 949 | ||||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 18 222 | 96,78 | 478 | 147,15 | ||||

| 2025-08-08 | 13F | Family Firm, Inc. | 30 433 | 1,57 | 798 | 13,05 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 1 882 | 288,04 | 49 | 345,45 | ||||

| 2025-05-15 | 13F | Wiley Bros.-aintree Capital, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Banco Santander, S.A. | 116 485 | −21,69 | 3 053 | −12,85 | ||||

| 2025-08-01 | 13F | Solstein Capital, LLC | 39 | 0,00 | 1 | |||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 306 392 | 7,48 | 8 031 | 19,62 | ||||

| 2025-08-29 | 13F | Total Investment Management Inc | 370 | 10 | ||||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Sierra Tactical Core Growth Fund Investor Class Shares | 7 495 | 196 | ||||||

| 2025-08-13 | 13F | GeoWealth Management, LLC | 23 264 | 61,78 | 610 | 80,18 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 245 629 | −22,05 | 6 438 | −13,25 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 29 700 | 778 | ||||||

| 2025-08-11 | 13F | Greykasell Wealth Strategies, Inc. | 7 633 | −6,87 | 200 | 3,63 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 24 142 | 73,25 | 633 | 92,68 | ||||

| 2025-07-16 | 13F | Old Port Advisors | 95 177 | −22,20 | 2 495 | −13,40 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 658 158 | −12,20 | 17 250 | −2,28 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | RYDEX VARIABLE TRUST - Multi-Hedge Strategies Fund Variable Annuity | Short | −1 157 | −34,89 | −30 | −26,83 | |||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Covestor Ltd | 459 | 32,66 | 0 | |||||

| 2025-08-13 | 13F | Summit Financial, LLC | 27 136 | 711 | ||||||

| 2025-04-15 | 13F | Fifth Third Bancorp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Hrt Financial Lp | 9 461 | 0 | ||||||

| 2025-08-18 | 13F | Tactive Advisors, LLC | 124 747 | 3 270 | ||||||

| 2025-08-13 | 13F | Schroder Investment Management Group | 48 543 | 1 272 | ||||||

| 2025-08-13 | 13F | Metlife Inc | 73 836 | −1,09 | 1 935 | 9,94 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 1 | −99,12 | 0 | −100,00 | ||||

| 2025-07-14 | 13F | Pacifica Partners Inc. | 269 | −19,70 | 7 | −25,00 | ||||

| 2025-08-12 | 13F | EFG Asset Management (Americas) Corp. | 70 011 | 0,62 | 1 835 | 11,97 | ||||

| 2025-08-14 | 13F | FIL Ltd | 1 615 797 | 325 010,06 | 42 350 | 384 900,00 | ||||

| 2025-07-16 | 13F | Cabana Llc | 71 798 | −28,44 | 1 882 | −20,36 | ||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 63 986 | −73,73 | 2 | −80,00 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 1 317 | 3 459,46 | 35 | |||||

| 2025-07-08 | 13F | Heartwood Wealth Advisors LLC | 23 150 | 0,21 | 607 | 11,40 | ||||

| 2025-07-09 | 13F | Finley Financial, LLC | 31 347 | −5,29 | 822 | −1,08 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 16 900 | 1 777,78 | 443 | 2 004,76 | |||

| 2025-07-08 | 13F | Gallacher Capital Management LLC | 78 858 | 3,20 | 2 067 | 14,84 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 8 400 | −54,35 | 220 | −49,19 | |||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 16 701 | 438 | ||||||

| 2025-08-04 | 13F | Assetmark, Inc | 2 064 352 | 1 605,16 | 54 107 | 1 797,79 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 11 848 | 0,80 | 311 | 12,32 | ||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 500 | 0,00 | 12 | 10,00 | ||||

| 2025-07-21 | 13F | Ascent Group, LLC | 16 340 | 428 | ||||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 17 890 | −71,96 | 469 | −68,84 | ||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 7 279 | 251,13 | 0 | |||||

| 2025-08-13 | 13F | Green Harvest Asset Management LLC | 34 220 | 18,78 | 897 | 32,15 | ||||

| 2025-07-09 | 13F | Breakwater Investment Management | 1 205 | 0,00 | 32 | 10,71 | ||||

| 2025-07-30 | 13F | Roman Butler Fullerton & Co | 15 250 | −48,16 | 387 | −42,50 | ||||

| 2025-07-21 | 13F | Verus Financial Partners, Inc. | 11 978 | 1,73 | 311 | 15,24 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | Northern Lights Fund Trust - Sierra Tactical Risk Spectrum 50 Fund Investor Class | 125 700 | 3 295 | ||||||

| 2025-05-29 | NP | Jnl Series Trust - Jnl/blackrock Global Allocation Fund (a) | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-23 | 13F | Venturi Wealth Management, LLC | 250 644 | 6 569 | ||||||

| 2025-08-11 | 13F | Highview Capital Management LLC/DE/ | 130 736 | 3 427 |