Grundläggande statistik

| Institutionella aktier (lång) | 123 790 959 - 20,71% (ex 13D/G) - change of 6,08MM shares 5,16% MRQ |

| Institutionellt värde (lång) | $ 511 737 USD ($1000) |

Institutionellt ägande och aktieägare

Ardagh Metal Packaging S.A. (US:AMBP) har 260 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 123,790,959 aktier. Största aktieägare inkluderar Canyon Capital Advisors Llc, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd., BlackRock, Inc., Goldman Sachs Group Inc, Private Management Group Inc, Platinum Equity Llc, DIV - Global X SuperDividend U.S. ETF, Empyrean Capital Partners, LP, Arrowstreet Capital, Limited Partnership, and Millennium Management Llc .

Ardagh Metal Packaging S.A. (NYSE:AMBP) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 11, 2025 is 3,58 / share. Previously, on September 12, 2024, the share price was 3,38 / share. This represents an increase of 5,92% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

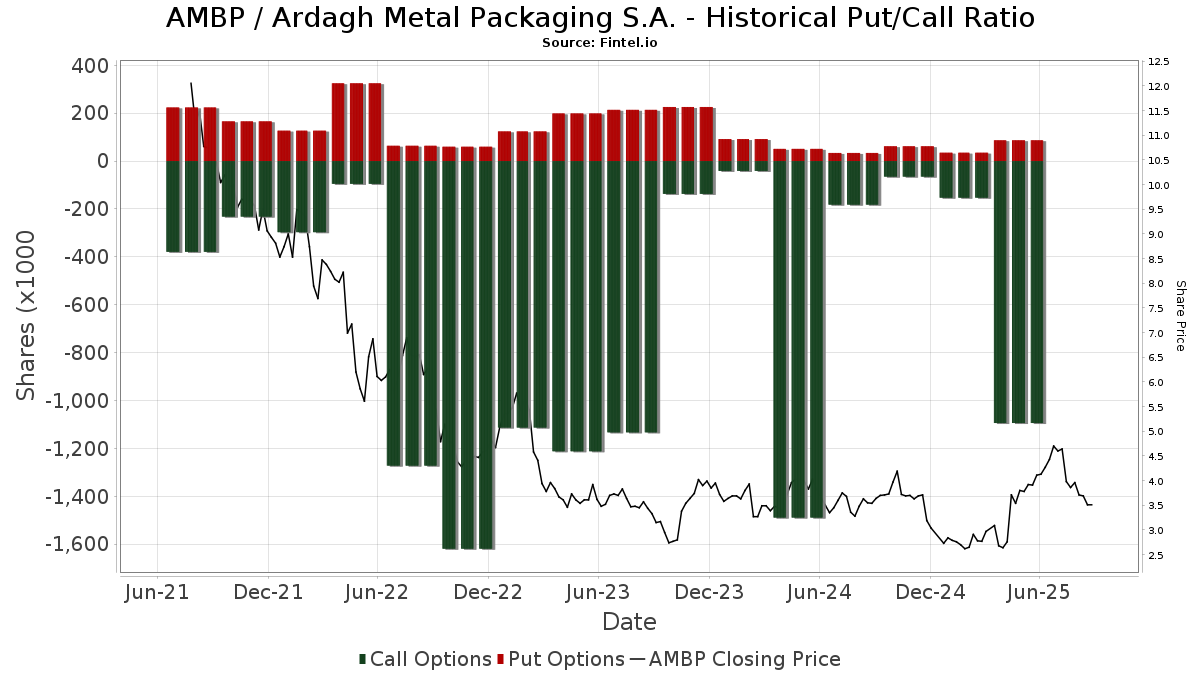

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 40 518 | 173 | ||||||

| 2025-08-13 | 13F | Cerity Partners LLC | 20 063 | 41,63 | 86 | 102,38 | ||||

| 2025-08-27 | NP | ALLIANZ VARIABLE INSURANCE PRODUCTS TRUST - AZL DFA U.S. Core Equity Fund | 14 926 | 64 | ||||||

| 2025-08-27 | NP | SPSCX - Sterling Capital Behavioral Small Cap Value Equity Fund INSTITUTIONAL SHARES | 75 680 | 324 | ||||||

| 2025-08-27 | NP | TLEQX - Small-Cap Equity Fund | 27 498 | 118 | ||||||

| 2025-08-13 | 13F | Employees Retirement System of Texas | 33 548 | 0 | ||||||

| 2025-08-14 | 13F | Grizzlyrock Capital, Llc | 224 162 | −87,28 | 959 | −81,98 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | 35 351 | 204,09 | 151 | 331,43 | ||||

| 2025-08-08 | 13F | Principal Financial Group Inc | 153 081 | 1 227,45 | 655 | 1 826,47 | ||||

| 2025-07-30 | NP | AMHYX - INVESCO High Yield Fund Class A | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Hillsdale Investment Management Inc. | 682 863 | 2 923 | ||||||

| 2025-08-13 | 13F | Norges Bank | 292 456 | 1 252 | ||||||

| 2025-08-14 | 13F | Corvex Management LP | 398 835 | 0,00 | 1 707 | 41,78 | ||||

| 2025-08-14 | 13F | Graham Capital Management, L.P. | 69 365 | 297 | ||||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 803 600 | 4,94 | 3 439 | 48,75 | ||||

| 2025-05-27 | NP | Columbia Funds Variable Series Trust II - Variable Portfolio - Partners Small Cap Growth Fund Class 1 | 18 832 | −0,64 | 57 | −1,75 | ||||

| 2025-08-27 | NP | BBGSX - Bridge Builder Small/Mid Cap Growth Fund | 8 054 | −70,42 | 34 | −58,54 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Annis Gardner Whiting Capital Advisors, LLC | 25 465 | 0,00 | 109 | 42,11 | ||||

| 2025-07-28 | NP | AVSC - Avantis U.S. Small Cap Equity ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 28 465 | −73,63 | 111 | −64,08 | ||||

| 2025-05-28 | NP | VANGUARD VARIABLE INSURANCE FUNDS - Small Company Growth Portfolio This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 250 797 | −56,10 | 757 | −55,96 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 152 102 | 0,28 | 649 | 42,32 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 140 693 | 122,74 | 602 | 216,84 | ||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 10 069 139 | 7,99 | 43 096 | 53,04 | ||||

| 2025-07-30 | 13F | Principle Wealth Partners Llc | 38 356 | −7,25 | 164 | 32,26 | ||||

| 2025-08-13 | 13F | Capula Management Ltd | 10 526 | 45 | ||||||

| 2025-08-12 | 13F | Rhumbline Advisers | 177 614 | 13,43 | 760 | 61,02 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 5 020 | 322,20 | 21 | 600,00 | ||||

| 2025-08-12 | 13F | Prudential Financial Inc | 17 115 | 68,95 | 73 | 143,33 | ||||

| 2025-06-27 | NP | DIV - Global X SuperDividend U.S. ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 5 118 464 | 18 990 | ||||||

| 2025-08-04 | 13F | Spire Wealth Management | 13 200 | −5,38 | 56 | 33,33 | ||||

| 2025-08-14 | 13F | Hyperion Capital Advisors LP | 45 000 | 0,00 | 193 | 42,22 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 2 852 | 12 | ||||||

| 2025-07-15 | 13F | Ballentine Partners, LLC | 11 071 | 2,17 | 47 | 46,88 | ||||

| 2025-08-12 | 13F | CenterBook Partners LP | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Price T Rowe Associates Inc /md/ | 69 787 | 7,48 | 0 | |||||

| 2025-08-13 | 13F | Invesco Ltd. | 350 022 | −22,21 | 1 498 | 10,31 | ||||

| 2025-07-15 | 13F | North Star Investment Management Corp. | 1 500 | 0,00 | 6 | 50,00 | ||||

| 2025-07-15 | 13F | SJS Investment Consulting Inc. | 14 | −82,72 | 0 | |||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 63 047 | 0 | ||||||

| 2025-07-09 | 13F | Harbor Capital Advisors, Inc. | 4 193 | 1,53 | 0 | |||||

| 2025-07-15 | 13F | Bfsg, Llc | 46 575 | 1,42 | 199 | 44,20 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 535 229 | 44,44 | 2 | 100,00 | ||||

| 2025-07-31 | 13F | Nisa Investment Advisors, Llc | 960 | −98,54 | 4 | −97,99 | ||||

| 2025-08-13 | 13F | Gabelli Funds Llc | 1 042 772 | 660,89 | 4 463 | 980,63 | ||||

| 2025-04-29 | NP | SVYAX - SIIT U.S. Managed Volatility Fund - Class A | 35 364 | −52,98 | 101 | −69,94 | ||||

| 2025-08-08 | 13F/A | Sterling Capital Management LLC | 78 570 | 52 631,54 | 336 | |||||

| 2025-08-26 | NP | TLSTX - Stock Index Fund | 1 615 | 0,00 | 7 | 50,00 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 1 378 | −5,36 | 6 | 25,00 | ||||

| 2025-08-14 | 13F | Point72 (DIFC) Ltd | 22 583 | 97 | ||||||

| 2025-08-14 | 13F | Xponance, Inc. | 14 269 | 3,64 | 61 | 48,78 | ||||

| 2025-08-14 | 13F | Occudo Quantitative Strategies Lp | 171 628 | 735 | ||||||

| 2025-06-27 | NP | RSSL - Global X Russell 2000 ETF | 87 324 | 5,27 | 324 | 41,05 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 441 719 | 1 891 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 74 700 | 108,08 | 320 | 195,37 | |||

| 2025-08-14 | 13F | Anchorage Capital Advisors, L.P. | 2 451 062 | −31,94 | 10 491 | −3,54 | ||||

| 2025-04-23 | 13F | Alpine Bank Wealth Management | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 137 541 | 589 | ||||||

| 2025-07-29 | NP | VFMF - Vanguard U.S. Multifactor ETF ETF Shares | 105 602 | −20,50 | 412 | 7,87 | ||||

| 2025-08-14 | 13F | CastleKnight Management LP | 105 500 | 0,00 | 452 | 41,82 | ||||

| 2025-04-16 | 13F | Salem Investment Counselors Inc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Northern Trust Corp | 1 386 812 | −4,74 | 5 936 | 35,01 | ||||

| 2025-08-27 | NP | BBVSX - Bridge Builder Small/Mid Cap Value Fund | 49 775 | 213 | ||||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 4 502 | 0,83 | 19 | 46,15 | ||||

| 2025-07-09 | 13F | Massmutual Trust Co Fsb/adv | 585 | −39,75 | 3 | 0,00 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 6 326 708 | 1,04 | 27 078 | 43,19 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 10 215 | 11,36 | 44 | 59,26 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Davy Global Fund Management Ltd | 314 279 | −4,19 | 1 345 | 35,86 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 96 577 | 19,91 | 413 | 69,96 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 10 945 | 47 | ||||||

| 2025-08-19 | 13F | State of Wyoming | 33 588 | −14,85 | 144 | 20,17 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 0 | −100,00 | 0 | |||||

| 2025-07-29 | NP | ESGV - Vanguard ESG U.S. Stock ETF ETF Shares | 34 064 | 0,00 | 133 | 36,08 | ||||

| 2025-05-15 | 13F | Centiva Capital, LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-06-26 | NP | DFAC - Dimensional U.S. Core Equity 2 ETF | 151 051 | 108,20 | 560 | 180,00 | ||||

| 2025-07-22 | 13F | HFM Investment Advisors, LLC | 11 | 120,00 | 0 | |||||

| 2025-07-22 | 13F | Bay Harbor Wealth Management, LLC | 3 | 50,00 | 0 | |||||

| 2025-08-12 | 13F | Ameritas Investment Partners, Inc. | 14 157 | 0,00 | 61 | 42,86 | ||||

| 2025-07-28 | NP | MSSM - Morgan Stanley Pathway Small-Mid Cap Equity ETF | 5 350 | 0,00 | 21 | 33,33 | ||||

| 2025-05-05 | 13F | Parkworth Wealth Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 295 | 1 | ||||||

| 2025-08-11 | 13F | Covestor Ltd | Call | 33 131 | 0,00 | 0 | ||||

| 2025-08-26 | NP | NSIDX - Northern Small Cap Index Fund | 65 890 | −4,02 | 282 | 36,23 | ||||

| 2025-08-08 | 13F | Intech Investment Management Llc | 78 426 | 9,45 | 336 | 55,09 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 393 491 | 2 | ||||||

| 2025-05-12 | 13F | Aigen Investment Management, Lp | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Intrepid Financial Planning Group LLC | 25 640 | −10,47 | 110 | 26,74 | ||||

| 2025-06-26 | NP | DCOR - Dimensional US Core Equity 1 ETF | 7 474 | −54,82 | 28 | −40,00 | ||||

| 2025-05-15 | 13F | Maverick Capital Ltd | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | Signaturefd, Llc | 11 382 | 237,44 | 49 | 380,00 | ||||

| 2025-08-14 | 13F | Aster Capital Management (DIFC) Ltd | 2 820 | −42,85 | 12 | −14,29 | ||||

| 2025-08-08 | 13F | Police & Firemen's Retirement System of New Jersey | 32 897 | 11,49 | 141 | 57,30 | ||||

| 2025-07-31 | 13F | Brinker Capital Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Voya Investment Management Llc | 40 762 | 2,51 | 174 | 45,00 | ||||

| 2025-07-29 | NP | VRTGX - Vanguard Russell 2000 Growth Index Fund Institutional Shares | 126 384 | −4,26 | 493 | 30,16 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 1 851 894 | −0,42 | 7 926 | 41,13 | ||||

| 2025-08-13 | 13F | Victory Capital Management Inc | 75 130 | 10,31 | 322 | 56,59 | ||||

| 2025-08-14 | 13F | Canyon Capital Advisors Llc | 11 239 492 | −7,75 | 48 105 | 30,74 | ||||

| 2025-06-26 | NP | TIEIX - TIAA-CREF Equity Index Fund Institutional Class | 126 036 | 0,00 | 468 | 33,81 | ||||

| 2025-08-28 | NP | TPMN - Timothy Plan Market Neutral Etf | 28 344 | −3,97 | 121 | 35,96 | ||||

| 2025-07-18 | 13F | PFG Investments, LLC | 20 260 | 0,11 | 87 | 40,98 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 26 996 | 352,65 | 116 | 538,89 | ||||

| 2025-04-29 | 13F | Envestnet Asset Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 452 | −20,28 | 2 | 0,00 | ||||

| 2025-06-27 | NP | SDIV - Global X SuperDividend ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 3 012 385 | 14,78 | 11 176 | 53,71 | ||||

| 2025-07-28 | 13F | Moran Wealth Management, LLC | 53 519 | 229 | ||||||

| 2025-07-16 | 13F | Essex Financial Services, Inc. | 168 164 | −2,61 | 720 | 38,00 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 964 197 | 29,25 | 4 127 | 83,21 | ||||

| 2025-07-17 | 13F | DiNuzzo Private Wealth, Inc. | 3 | 0,00 | 0 | |||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 1 972 | 8 | ||||||

| 2025-08-28 | NP | SLGFX - SIMT Large Cap Index Fund Class F | 1 250 | 0,00 | 5 | 66,67 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 148 | 1 | ||||||

| 2025-08-12 | 13F | BlackRock, Inc. | 8 023 706 | −1,83 | 34 341 | 39,13 | ||||

| 2025-08-11 | 13F | Nordwand Advisors, LLC | 81 000 | −89,27 | 347 | −84,82 | ||||

| 2025-06-30 | NP | VYM - Vanguard High Dividend Yield Index Fund ETF Shares | 557 122 | −5,63 | 2 067 | 26,36 | ||||

| 2025-07-16 | 13F | A. D. Beadell Investment Counsel, Inc. | 38 350 | 0,00 | 0 | |||||

| 2025-08-26 | NP | Profunds - Profund Vp Ultrasmall-cap | 487 | −6,70 | 2 | 100,00 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 29 554 | 126 | ||||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 0 | −100,00 | 0 | |||||

| 2025-06-30 | NP | PRFZ - Invesco FTSE RAFI US 1500 Small-Mid ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 302 886 | −11,06 | 1 124 | 19,09 | ||||

| 2025-05-21 | 13F | Acadian Asset Management Llc | 0 | −100,00 | 0 | |||||

| 2025-07-29 | NP | SMXAX - SIIT Extended Market Index Fund - Class A | 26 950 | 0,00 | 105 | 36,36 | ||||

| 2025-05-28 | NP | QCEQRX - Equity Index Account Class R1 | 74 922 | 0,00 | 226 | 0,44 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 38 820 | −1,02 | 0 | |||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 46 855 | 112,99 | 201 | 203,03 | ||||

| 2025-08-13 | 13F | MetLife Investment Management, LLC | 82 076 | 0,12 | 351 | 42,11 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 175 552 | −35,97 | 751 | −9,19 | ||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 3 546 227 | 3 866,96 | 15 178 | 5 542,01 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 12 800 | 55 | |||||

| 2025-08-14 | 13F | Sei Investments Co | 11 693 | 50 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 134 300 | 57,63 | 575 | 123,35 | |||

| 2025-08-26 | NP | TRSYX - T. Rowe Price Small-Cap Index Fund This fund is a listed as child fund of Price T Rowe Associates Inc /md/ and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 13 199 | 9,34 | 56 | 55,56 | ||||

| 2025-07-29 | NP | VRTIX - Vanguard Russell 2000 Index Fund Institutional Shares | 727 245 | 10,09 | 2 836 | 49,66 | ||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 21 816 | −11,21 | 93 | 25,68 | ||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 1 242 277 | 5 317 | ||||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 2 370 | 81,75 | 10 | 233,33 | ||||

| 2025-08-13 | 13F | Mackenzie Financial Corp | 277 949 | 412,41 | 1 190 | 629,45 | ||||

| 2025-05-15 | 13F | BW Gestao de Investimentos Ltda. | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 2 473 609 | 118,60 | 10 587 | 209,83 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 3 206 422 | 4 791,49 | 13 723 | 6 865,99 | ||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 52 384 | −61,90 | 229 | −45,06 | ||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 32 520 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 408 174 | 33,38 | 1 747 | 88,86 | ||||

| 2025-04-15 | 13F | Mv Capital Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-09 | 13F | Gilman Hill Asset Management, LLC | 1 997 263 | 1,53 | 8 548 | 43,91 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 4 145 | −12,14 | 18 | 21,43 | ||||

| 2025-06-23 | NP | PPNMX - SmallCap Growth Fund I R-3 | 14 481 | −4,05 | 54 | 29,27 | ||||

| 2025-08-14 | 13F | Anchorage Capital Group, L.L.C. | 1 250 000 | 0,00 | 5 350 | 41,72 | ||||

| 2025-06-26 | NP | DFUS - Dimensional U.S. Equity ETF | 32 071 | 94,50 | 119 | 162,22 | ||||

| 2025-05-13 | 13F | Callan Family Office, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 134 000 | 574 | ||||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 80 841 | −16,47 | 346 | 18,15 | ||||

| 2025-05-15 | 13F | Sherbrooke Park Advisers Llc | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 338 569 | −93,37 | 1 449 | −90,60 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 406 | 2 | ||||||

| 2025-07-31 | 13F | R Squared Ltd | 21 718 | 93 | ||||||

| 2025-08-14 | 13F | California State Teachers Retirement System | 10 471 | 0,00 | 45 | 41,94 | ||||

| 2025-05-16 | 13F | Boundary Creek Advisors LP | 0 | −100,00 | 0 | |||||

| 2025-07-09 | 13F | Pallas Capital Advisors LLC | 10 132 | 43 | ||||||

| 2025-08-14 | 13F | Spears Abacus Advisors LLC | 27 760 | 0,00 | 119 | 42,17 | ||||

| 2025-07-18 | 13F | Clarity Financial LLC | 47 600 | −8,89 | 204 | 29,30 | ||||

| 2025-08-14 | 13F | Moore Capital Management, Lp | 100 000 | 0,00 | 428 | 41,72 | ||||

| 2025-07-17 | 13F | Vermillion Wealth Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | State Street Corp | 2 614 586 | 7,37 | 11 190 | 52,16 | ||||

| 2025-08-14 | 13F | Mountaineer Partners Management, LLC | 1 538 484 | 45,45 | 6 585 | 106,14 | ||||

| 2025-08-11 | 13F | ARS Investment Partners, LLC | 13 350 | −96,45 | 57 | −94,96 | ||||

| 2025-08-12 | 13F | Dimensional Fund Advisors Lp | 2 945 060 | 52,14 | 12 605 | 115,65 | ||||

| 2025-08-28 | NP | CPAEX - Counterpoint Tactical Equity Fund Class A Shares | 79 894 | −15,92 | 342 | 19,23 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 415 878 | 11,67 | 1 780 | 58,27 | ||||

| 2025-08-12 | 13F | Clear Street Markets Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | American Century Companies Inc | 29 842 | −62,15 | 128 | −46,64 | ||||

| 2025-08-29 | NP | JAFVX - Strategic Equity Allocation Trust Series NAV | 21 164 | −0,84 | 91 | 40,63 | ||||

| 2025-07-14 | 13F | Counterpoint Mutual Funds LLC | 79 894 | −15,92 | 342 | 19,23 | ||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 405 | 350,00 | 2 | |||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Walleye Capital LLC | 450 523 | 349,48 | 1 928 | 538,41 | ||||

| 2025-08-14 | 13F | Empyrean Capital Partners, LP | 4 000 000 | 0,00 | 17 120 | 41,72 | ||||

| 2025-08-14 | 13F | Diameter Capital Partners LP | 1 874 121 | −59,47 | 8 021 | −42,56 | ||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 116 941 | 1 | ||||||

| 2025-08-14 | 13F | Peak6 Llc | Call | 14 000 | 60 | |||||

| 2025-07-15 | 13F | Fortitude Family Office, LLC | 21 | 0 | ||||||

| 2025-04-25 | NP | VFVA - Vanguard U.S. Value Factor ETF ETF Shares | 351 537 | 316,16 | 1 009 | 225,16 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 31 198 | −29,49 | 134 | 0,00 | ||||

| 2025-08-28 | NP | NCGFX - New Covenant Growth Fund | 35 612 | 0,00 | 152 | 42,06 | ||||

| 2025-07-29 | 13F | Private Wealth Management Group, LLC | 160 | 0,00 | 1 | |||||

| 2025-06-26 | NP | DFAU - Dimensional US Core Equity Market ETF | 20 187 | 0,00 | 75 | 34,55 | ||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 48 525 | −1,40 | 208 | 39,86 | ||||

| 2025-08-11 | 13F | Covestor Ltd | 11 049 | 38,72 | 0 | |||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 106 851 | 457 | ||||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 2 641 | 810,69 | 11 | |||||

| 2025-06-26 | NP | KCXIX - Knights of Columbus U.S. All Cap Index Fund I Shares | 611 | 9,30 | 2 | 100,00 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-08-26 | NP | Profunds - Profund Vp Small-cap | 319 | −2,15 | 1 | |||||

| 2025-05-14 | 13F | Keeley-Teton Advisors, LLC | 1 599 919 | −0,61 | 4 832 | −0,29 | ||||

| 2025-08-14 | 13F | Shellback Capital, LP | 951 359 | 4 072 | ||||||

| 2025-07-22 | NP | DSMFX - Destinations Small-Mid Cap Equity Fund Class I | 3 524 | 0,00 | 14 | 30,00 | ||||

| 2025-08-07 | 13F | ProShare Advisors LLC | 28 609 | −8,54 | 122 | 29,79 | ||||

| 2025-05-15 | 13F | Quarry LP | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | HEJD - VictoryShares Hedged Equity Income ETF | 30 348 | 38,16 | 130 | 95,45 | ||||

| 2025-07-28 | NP | AVSU - Avantis Responsible U.S. Equity ETF | 1 717 | 8,53 | 7 | 50,00 | ||||

| 2025-08-12 | 13F | Nuveen, LLC | 1 761 440 | 332,96 | 7 539 | 513,84 | ||||

| 2025-05-14 | 13F | Ellevest, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 1 540 879 | −63,45 | 6 595 | −48,21 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 610 882 | 368,97 | 2 615 | 565,14 | ||||

| 2025-04-07 | 13F | GAMMA Investing LLC | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Pathstone Holdings, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Jfs Wealth Advisors, Llc | 2 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Healthcare Of Ontario Pension Plan Trust Fund | 353 000 | 0,00 | 1 511 | 41,65 | ||||

| 2025-08-07 | 13F/A | Tortoise Investment Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 1 650 | 478,95 | 7 | |||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 621 737 | 2 661 | ||||||

| 2025-06-30 | NP | VT - Vanguard Total World Stock Index Fund ETF Shares | 76 458 | 0,00 | 284 | 34,12 | ||||

| 2025-08-14 | 13F | King Street Capital Management, L.p. | 1 750 000 | −37,50 | 7 490 | −11,42 | ||||

| 2025-08-08 | 13F | Creative Planning | 25 471 | 109 | ||||||

| 2025-06-26 | NP | TISBX - TIAA-CREF Small-Cap Blend Index Fund Institutional Class | 195 791 | 0,00 | 726 | 33,95 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 18 839 | 81 | ||||||

| 2025-07-16 | 13F | Dakota Wealth Management | 152 579 | 0,00 | 653 | 41,96 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 13 052 | −30,46 | 56 | −1,79 | ||||

| 2025-08-28 | NP | SMSAX - SIMT Multi-Strategy Alternative Fund Class F | 366 810 | 51,89 | 1 570 | 115,23 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 72 700 | 311 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 123 543 | 529 | ||||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 1 350 | 12,78 | 6 | 66,67 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 399 547 | 16,00 | 2 | 0,00 | ||||

| 2025-08-11 | 13F | Vanguard Group Inc | 1 691 509 | −29,09 | 7 240 | 0,50 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 49 | −97,49 | 0 | −100,00 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 17 701 | −65,04 | 0 | |||||

| 2025-05-02 | 13F | Cornercap Investment Counsel Inc | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Jain Global LLC | 166 221 | 711 | ||||||

| 2025-08-06 | 13F | SOUTH STATE Corp | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | SLLAX - SIMT Small Cap Fund Class F | 81 120 | 347 | ||||||

| 2025-08-13 | 13F | Gamco Investors, Inc. Et Al | 1 476 861 | 6,66 | 6 321 | 51,16 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 26 402 | 56,09 | 119 | 133,33 | ||||

| 2025-08-06 | 13F | Rialto Wealth Management, LLC | 6 | 0 | ||||||

| 2025-08-14 | 13F | Fmr Llc | 11 385 | 42,78 | 49 | 100,00 | ||||

| 2025-05-30 | NP | SVOAX - Simt Us Managed Volatility Fund Class F | 18 853 | −11,78 | 57 | −12,50 | ||||

| 2025-07-29 | NP | SECAX - SIIT Small Cap II Fund - Class A | 130 590 | 509 | ||||||

| 2025-06-23 | NP | SLPIX - Small-cap Profund Investor Class | 141 | −12,42 | 1 | |||||

| 2025-06-26 | NP | DASVX - Dunham Small Cap Value Fund Class A | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 645 792 | 538,51 | 2 764 | 805,90 | ||||

| 2025-08-04 | 13F | Amalgamated Bank | 5 257 | 0,00 | 0 | |||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 10 000 | 0,00 | 43 | 40,00 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 1 873 038 | 23,20 | 8 017 | 74,60 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 566 825 | 78,46 | 2 426 | 152,97 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 729 506 | 310,09 | 3 122 | 481,38 | ||||

| 2025-08-14 | 13F | Cibc World Markets Corp | 17 190 | −46,39 | 74 | −23,96 | ||||

| 2025-06-26 | NP | DFSU - Dimensional US Sustainability Core 1 ETF | 13 390 | 0,00 | 50 | 32,43 | ||||

| 2025-03-31 | NP | VEXPX - VANGUARD EXPLORER FUND Investor Shares | 214 653 | 0,00 | 595 | −24,71 | ||||

| 2025-06-26 | NP | USMIX - Extended Market Index Fund | 16 019 | −5,69 | 59 | 25,53 | ||||

| 2025-08-14 | 13F | Solas Capital Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Corebridge Financial, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Wolverine Asset Management Llc | 127 399 | 0,39 | 545 | 42,30 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 10 795 | −61,08 | 0 | |||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 203 672 | −33,17 | 872 | −5,33 | ||||

| 2025-07-29 | NP | LCIAX - Siit Large Cap Index Fund - Class A | 3 000 | 0,00 | 12 | 37,50 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 478 893 | 48,70 | 2 050 | 110,80 | ||||

| 2025-04-18 | 13F | Clarius Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-12 | 13F | Franklin Resources Inc | 52 295 | 224 | ||||||

| 2025-08-06 | 13F | True Wealth Design, LLC | 157 | −9,77 | 1 | |||||

| 2025-06-26 | NP | DFAS - Dimensional U.S. Small Cap ETF | 526 456 | 65,58 | 1 953 | 121,93 | ||||

| 2025-05-13 | 13F | Boston Partners | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Brighton Jones Llc | 10 937 | 47 | ||||||

| 2025-08-12 | 13F | Virtu Financial LLC | 13 864 | 0 | ||||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Allworth Financial LP | 415 | 2 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 840 400 | 2 321,90 | 3 597 | 3 357,69 | |||

| 2025-08-15 | 13F | WealthCollab, LLC | 330 | 0,00 | 1 | |||||

| 2025-04-29 | 13F | Capital Investment Advisory Services, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 146 940 | 54,50 | 629 | 118,82 | ||||

| 2025-07-29 | NP | VRTTX - Vanguard Russell 3000 Index Fund Institutional Shares | 9 888 | 0,00 | 39 | 35,71 | ||||

| 2025-07-28 | NP | AVUS - Avantis U.S. Equity ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 42 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Federated Hermes, Inc. | 371 400 | −7,37 | 1 590 | 31,32 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 22 127 | 95 | ||||||

| 2025-08-12 | 13F | Legal & General Group Plc | 27 535 | −6,65 | 118 | 31,46 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 589 352 | −2,98 | 3 | 100,00 | ||||

| 2025-08-07 | 13F | Fidelis Capital Partners, LLC | 20 472 | 0,20 | 79 | 3,95 | ||||

| 2025-08-13 | 13F | Nicolet Advisory Services, Llc | 10 000 | 0,00 | 39 | 50,00 | ||||

| 2025-06-26 | NP | DXUV - Dimensional US Vector Equity ETF | 2 768 | 9,23 | 10 | 42,86 | ||||

| 2025-08-29 | NP | JAEWX - Small Cap Index Trust NAV | 27 361 | −1,82 | 117 | 39,29 | ||||

| 2025-08-07 | 13F | Los Angeles Capital Management Llc | 474 640 | 2 031 | ||||||

| 2025-08-13 | 13F | Jump Financial, LLC | 59 143 | 253 | ||||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 100 | 0 | ||||||

| 2025-06-23 | NP | UAPIX - Ultrasmall-cap Profund Investor Class | 1 476 | −29,91 | 5 | 0,00 | ||||

| 2025-05-15 | 13F | Melqart Asset Management (uk) Ltd | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Cwm, Llc | 40 104 | 9,63 | 0 | |||||

| 2025-08-12 | 13F | Inceptionr Llc | 101 031 | 432 | ||||||

| 2025-08-14 | 13F | Jacobs Levy Equity Management, Inc | 335 064 | −77,99 | 1 434 | −68,81 | ||||

| 2025-08-11 | 13F | Heritage Wealth Advisors | 160 | 0,00 | 1 | |||||

| 2025-08-12 | 13F | Dynamic Technology Lab Private Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Barrow Hanley Mewhinney & Strauss Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Contrarian Capital Management, L.l.c. | 90 000 | −40,00 | 385 | −15,01 | ||||

| 2025-08-14 | 13F | Platinum Equity Llc | 5 311 164 | 0,00 | 22 732 | 41,72 | ||||

| 2025-05-08 | 13F | Parkside Financial Bank & Trust | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-28 | NP | TIAA SEPARATE ACCOUNT VA 1 - Stock Index Account Teachers Personal Annuity Individual Deferred Variable Annuity | 4 201 | 0,00 | 18 | 41,67 | ||||

| 2025-08-12 | 13F | Private Management Group Inc | 5 555 134 | −2,38 | 23 776 | 38,35 | ||||

| 2025-05-15 | 13F | Qube Research & Technologies Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 66 948 | −1,15 | 287 | 40,20 | ||||

| 2025-08-13 | 13F | State Board Of Administration Of Florida Retirement System | 41 290 | 0,00 | 177 | 41,94 | ||||

| 2025-07-10 | 13F | Global Financial Private Client, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | CWA Asset Management Group, LLC | 200 119 | 33,23 | 857 | 88,96 | ||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 23 276 | 100 | ||||||

| 2025-07-30 | 13F | Ethic Inc. | 49 850 | 32,92 | 214 | 87,72 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 2 554 | 2,20 | 11 | 42,86 | ||||

| 2025-07-29 | NP | SLPAX - Siit Small Cap Fund - Class A | 158 900 | 620 | ||||||

| 2025-08-26 | NP | NORTHERN FUNDS - NORTHERN SMALL CAP CORE FUND Class K | 68 637 | −5,57 | 294 | 33,79 | ||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 155 269 | 52,62 | 665 | 116,29 | ||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 599 888 | 2 568 | ||||||

| 2025-07-25 | 13F | Hemington Wealth Management | 78 | 178,57 | 0 | |||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Mariner, LLC | 193 398 | 41,76 | 828 | 100,73 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 0 | −100,00 | 0 | |||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 140 000 | 0,00 | 599 | 41,94 | ||||

| 2025-05-15 | 13F | Shay Capital LLC | 0 | −100,00 | 0 |

Other Listings

| DE:7JZ | 2,92 € |