Grundläggande statistik

| Institutionella ägare | 171 total, 169 long only, 0 short only, 2 long/short - change of 24,64% MRQ |

| Genomsnittlig portföljallokering | 0.2490 % - change of −1,91% MRQ |

| Institutionella aktier (lång) | 3 534 584 (ex 13D/G) - change of 0,62MM shares 21,13% MRQ |

| Institutionellt värde (lång) | $ 384 649 USD ($1000) |

Institutionellt ägande och aktieägare

abrdn Platinum ETF Trust - abrdn Physical Platinum Shares ETF (US:PPLT) har 171 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 3,534,584 aktier. Största aktieägare inkluderar Brevan Howard Capital Management LP, CENTRAL TRUST Co, PenderFund Capital Management Ltd., Morgan Stanley, Hollencrest Capital Management, UBS Group AG, Barclays Plc, Citadel Advisors Llc, Bnp Paribas Arbitrage, Sa, and Royal Bank Of Canada .

abrdn Platinum ETF Trust - abrdn Physical Platinum Shares ETF (ARCA:PPLT) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 11, 2025 is 126,29 / share. Previously, on September 12, 2024, the share price was 89,84 / share. This represents an increase of 40,57% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

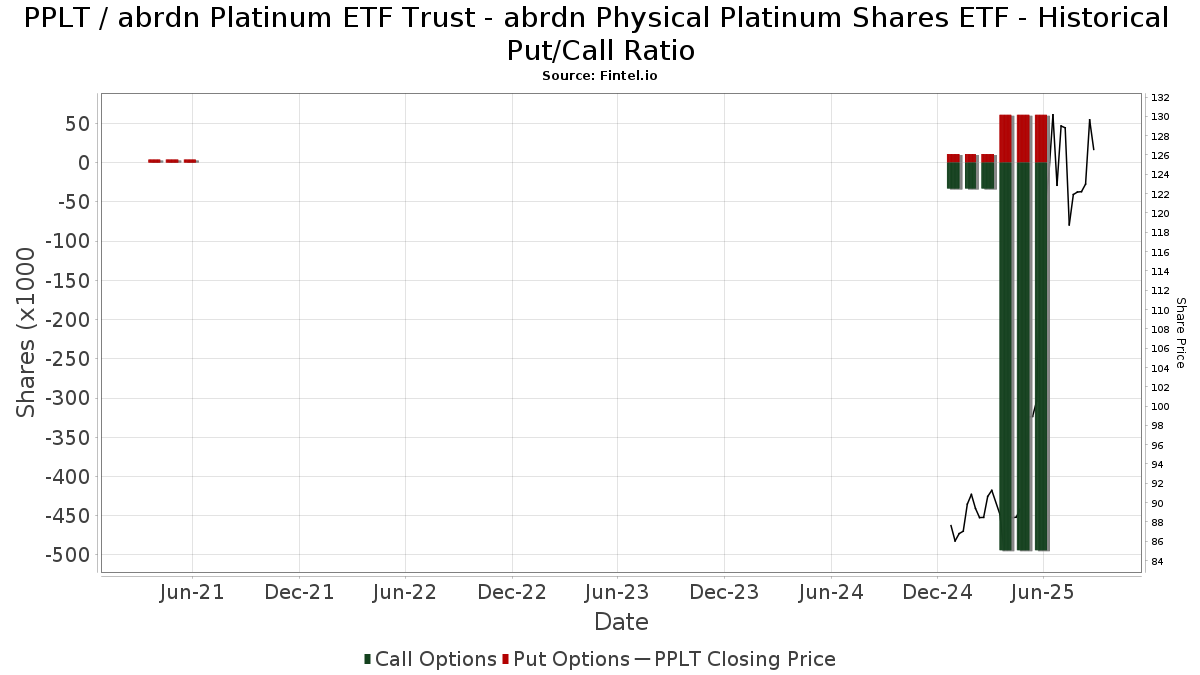

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-16 | 13F | PFS Partners, LLC | 67 | 0,00 | 8 | 33,33 | ||||

| 2025-08-15 | 13F | Keel Point, LLC | 16 433 | −7,98 | 2 019 | 23,79 | ||||

| 2025-07-23 | 13F | WESPAC Advisors, LLC | 8 321 | −2,09 | 1 022 | 31,70 | ||||

| 2025-08-27 | 13F/A | Putney Financial Group LLC | 117 | 0,00 | 14 | 40,00 | ||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 100 | 53,85 | 12 | 140,00 | ||||

| 2025-05-13 | 13F | WESCAP Management Group, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Carrera Capital Advisors | 30 317 | 13,18 | 3 725 | 52,23 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 1 800 | 3,15 | 221 | 38,99 | ||||

| 2025-08-13 | 13F | Copley Financial Group, Inc. | 11 361 | −2,12 | 1 396 | 31,60 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 128 100 | 958,68 | 15 740 | 1 324,34 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 43 700 | 1 113,89 | 5 369 | 1 536,89 | |||

| 2025-08-14 | 13F | Ancora Advisors, LLC | 15 102 | 1,56 | 1 856 | 36,60 | ||||

| 2025-08-06 | 13F | Moors & Cabot, Inc. | 2 655 | 326 | ||||||

| 2025-08-14 | 13F | Dauntless Investment Group, LLC | 4 616 | 0,00 | 567 | 34,68 | ||||

| 2025-08-06 | 13F | Legacy Investment Solutions, LLC | 100 | 0,00 | 12 | 50,00 | ||||

| 2025-08-14 | 13F | Intrepid Family Office Llc | 50 000 | 6 144 | ||||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 50 | 0,00 | 6 | 50,00 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 215 | 0,00 | 26 | 36,84 | ||||

| 2025-08-12 | 13F | Bokf, Na | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 550 | 68 | ||||||

| 2025-08-14 | 13F | PenderFund Capital Management Ltd. | 312 200 | 24,88 | 38 360 | 276,30 | ||||

| 2025-08-12 | NP | PCAFX - Prospector Capital Appreciation Fund | 3 820 | 0,00 | 469 | 34,38 | ||||

| 2025-08-12 | NP | POPFX - Prospector Opportunity Fund | 29 475 | 0,00 | 3 622 | 34,46 | ||||

| 2025-08-04 | 13F | AMG National Trust Bank | 4 916 | −48,05 | 604 | −30,09 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 2 513 | 309 | ||||||

| 2025-07-16 | 13F | Signaturefd, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-28 | 13F | Pettinga Financial Advisors, LLC | 7 285 | −13,89 | 895 | 15,93 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 2 493 | 40,61 | 304 | 91,19 | ||||

| 2025-08-14 | 13F | Letson Investment Management, Inc. | 3 100 | 0,00 | 381 | 34,28 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 10 103 | 87,79 | 1 241 | 152,75 | ||||

| 2025-07-14 | 13F | Painted Porch Advisors LLC | 89 | 39,06 | 11 | 100,00 | ||||

| 2025-07-31 | 13F | Ingalls & Snyder Llc | 15 064 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 101 478 | −0,79 | 12 468 | 33,40 | ||||

| 2025-07-28 | 13F | Axxcess Wealth Management, Llc | 2 206 | 271 | ||||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 11 860 | −5,59 | 1 457 | 27,03 | ||||

| 2025-07-18 | 13F | Woodward Diversified Capital, Llc | 4 805 | −6,37 | 590 | 26,07 | ||||

| 2025-07-08 | 13F | Gradient Investments LLC | 44 523 | 6,48 | 5 471 | 43,19 | ||||

| 2025-07-21 | 13F | J. Safra Sarasin Holding AG | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Sprott Inc. | 36 791 | 195,08 | 4 521 | 296,84 | ||||

| 2025-08-05 | 13F | X-Square Capital, LLC | 14 825 | 2 | ||||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Raffles Associates Lp | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Sender Co & Partners, Inc. | 44 155 | −5,88 | 5 425 | 26,57 | ||||

| 2025-08-12 | 13F | Hikari Tsushin, Inc. | 6 496 | 798 | ||||||

| 2025-08-14 | 13F | Atomi Financial Group, Inc. | 9 053 | 110,05 | 1 112 | 182,95 | ||||

| 2025-07-22 | 13F | JGP Global Gestao de Recursos Ltda. | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Brookwood Investment Group LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F/A | Claudia M.p. Batlle, Crp (r) Llc | 4 847 | 596 | ||||||

| 2025-05-14 | 13F | Northwestern Mutual Wealth Management Co | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 5 | −95,45 | 1 | −100,00 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 133 150 | 44 283,33 | 16 | |||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 2 | 0 | ||||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 537 | 0,00 | 66 | 32,65 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 0 | |||||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 447 | 0,00 | 55 | 35,00 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 63 278 | 188,55 | 7 775 | 288,12 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-07-15 | 13F | West Oak Capital, LLC | 270 | 0 | ||||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 1 992 | 245 | ||||||

| 2025-08-04 | 13F | Arkadios Wealth Advisors | 42 787 | 5 257 | ||||||

| 2025-07-16 | 13F | Highline Wealth Partners Llc | 0 | −100,00 | 0 | |||||

| 2025-07-11 | 13F | Vanguard Capital Wealth Advisors This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 22 118 | 739,71 | 2 718 | 1 032,08 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 25 074 | 3 | ||||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 8 450 | 185,28 | 1 037 | 284,07 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 1 876 | 231 | ||||||

| 2025-07-18 | 13F | PFG Investments, LLC | 2 965 | −19,52 | 364 | 8,33 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 62 727 | 78,76 | 7 707 | 140,39 | ||||

| 2025-08-14 | 13F | UBS Group AG | 179 450 | 20,74 | 22 049 | 62,38 | ||||

| 2025-07-15 | 13F | Alhambra Investment Partners LLC | 11 452 | 1 407 | ||||||

| 2025-08-12 | 13F | MAI Capital Management | 367 | 252,88 | 45 | 400,00 | ||||

| 2025-05-15 | 13F | GWM Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Napa Wealth Management | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Legend Financial Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Fmr Llc | 139 | −21,02 | 17 | 6,25 | ||||

| 2025-07-24 | 13F | WMG Financial Advisors, LLC | 2 420 | 297 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Daiwa Securities Group Inc. | 4 300 | −45,57 | 1 | |||||

| 2025-08-14 | 13F | Stifel Financial Corp | 32 568 | 8,63 | 4 002 | 46,08 | ||||

| 2025-08-14 | 13F | Cantor Fitzgerald, L. P. | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Lansing Street Advisors | 1 852 | 228 | ||||||

| 2025-08-06 | 13F | Black Swift Group, LLC | 32 845 | 4 036 | ||||||

| 2025-08-05 | 13F | Wakefield Asset Management LLLP | 5 091 | 626 | ||||||

| 2025-05-14 | 13F | Oarsman Capital, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 11 219 | 1 378 | ||||||

| 2025-07-30 | 13F | Bleakley Financial Group, LLC | 21 774 | 2 675 | ||||||

| 2025-07-31 | 13F | Linden Thomas Advisory Services, LLC | 5 698 | 40,90 | 700 | 89,70 | ||||

| 2025-08-14 | 13F | Silvercrest Asset Management Group Llc | 2 300 | 0,00 | 283 | 34,29 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 16 500 | 2 027 | ||||||

| 2025-08-15 | 13F | Global View Capital Management LLC | 7 504 | 922 | ||||||

| 2025-08-18 | 13F | Hollencrest Capital Management | 231 405 | 0,00 | 28 433 | 34,47 | ||||

| 2025-07-31 | 13F | AlTi Global, Inc. | 6 600 | 0,00 | 811 | 34,33 | ||||

| 2025-08-14 | 13F | Manatuck Hill Partners, LLC | 15 000 | 1 843 | ||||||

| 2025-07-18 | 13F | Consolidated Portfolio Review Corp | 16 500 | 3,84 | 2 027 | 39,70 | ||||

| 2025-07-29 | 13F | Salomon & Ludwin, LLC | 35 | 5 | ||||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 9 578 | 176,42 | 1 | |||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 3 410 | −22,85 | 427 | 5,71 | ||||

| 2025-05-05 | 13F | Cypress Capital Management LLC (WY) | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 21 007 | 34,87 | 2 581 | 81,38 | ||||

| 2025-07-22 | 13F | Capital Advisors Inc/ok | 2 465 | 303 | ||||||

| 2025-08-06 | 13F | Legacy Wealth Managment, LLC/ID | 100 | 0,00 | 12 | 33,33 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 318 113 | 24,30 | 39 087 | 67,16 | ||||

| 2025-08-05 | 13F | American Capital Advisory, LLC | 10 | 0,00 | 1 | |||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 700 | −51,72 | 86 | −28,93 | ||||

| 2025-05-13 | 13F | Quadrature Capital Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F/A | Bank Julius Baer & Co. Ltd, Zurich | 4 822 | 592 | ||||||

| 2025-08-14 | 13F | DecisionPoint Financial, LLC | 11 | 1 | ||||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 10 649 | 7,48 | 1 308 | 44,53 | ||||

| 2025-07-31 | 13F | Money Design Co.,Ltd. | 91 600 | 47,69 | 11 | 120,00 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 180 | 22 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 2 097 | −38,97 | 258 | −17,89 | ||||

| 2025-08-08 | 13F | Prospector Partners Llc | 90 669 | −3,52 | 11 140 | 29,75 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 34 480 | −26,85 | 4 | 0,00 | ||||

| 2025-05-12 | 13F | Sandy Spring Bank | 12 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | Warren Averett Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Hara Capital LLC | 258 | 0,00 | 32 | 34,78 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 4 326 | −62,43 | 532 | −49,52 | ||||

| 2025-07-14 | 13F | Ridgewood Investments LLC | 575 | 71 | ||||||

| 2025-07-31 | 13F | Anthracite Investment Company, Inc. | 17 000 | 6,25 | 2 089 | 42,92 | ||||

| 2025-08-01 | 13F | Belvedere Trading LLC | 87 902 | 4 692,91 | 10 801 | 6 367,07 | ||||

| 2025-08-01 | 13F | Belvedere Trading LLC | Call | 5 500 | 129,17 | 676 | 208,22 | |||

| 2025-08-05 | 13F | Strategic Financial Concepts, LLC | 5 032 | −72,37 | 618 | −62,86 | ||||

| 2025-08-01 | 13F | Belvedere Trading LLC | Put | 17 600 | 329,27 | 2 163 | 478,07 | |||

| 2025-08-13 | 13F | Philadelphia Trust Co | 17 638 | −6,50 | 2 | 100,00 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 181 | −2,69 | 22 | 37,50 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 38 529 | −19,96 | 4 734 | 7,64 | ||||

| 2025-07-14 | 13F | Toth Financial Advisory Corp | 30 | 0,00 | 4 | 50,00 | ||||

| 2025-07-01 | 13F | Confluence Investment Management Llc | 6 783 | 175,17 | 833 | 270,22 | ||||

| 2025-07-30 | 13F | Journey Advisory Group, LLC | 32 543 | −2,16 | 3 999 | 31,56 | ||||

| 2025-08-14 | 13F | Brevan Howard Capital Management LP | Call | 360 000 | 44 233 | |||||

| 2025-08-14 | 13F | LaSalle St. Investment Advisors, LLC | 3 859 | 0 | ||||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 125 | 15 | ||||||

| 2025-08-13 | 13F | Summit Financial, LLC | 2 927 | 0,00 | 360 | 34,46 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 5 792 | −51,73 | 712 | −35,13 | ||||

| 2025-09-03 | 13F | Q3 Asset Management | 13 502 | −67,96 | 2 | −66,67 | ||||

| 2025-05-14 | 13F | Jane Street Group, Llc | 4 301 | −96,15 | 393 | −95,77 | ||||

| 2025-08-05 | 13F | Plante Moran Financial Advisors, LLC | 50 | 6 | ||||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 147 | 1,38 | 18 | 38,46 | ||||

| 2025-08-13 | 13F | Generation Capital Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Allworth Financial LP | 297 | 137,60 | 36 | 227,27 | ||||

| 2025-04-11 | 13F | Lake Hills Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | CoreFirst Bank & Trust | 150 | 18 | ||||||

| 2025-08-12 | 13F | Intellus Advisors LLC | 13 323 | 1 637 | ||||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | 6 815 | −3,84 | 1 | |||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 12 753 | 45,25 | 1 567 | 95,26 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 12 428 | 7,75 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | Isthmus Partners, Llc | 3 475 | 0,00 | 427 | 34,38 | ||||

| 2025-07-30 | 13F | Brookstone Capital Management | 2 515 | 309 | ||||||

| 2025-07-29 | 13F | Activest Wealth Management | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-15 | 13F | Citadel Advisors Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 8 122 | 13,01 | 1 | |||||

| 2025-08-01 | 13F | Rossby Financial, LCC | 2 000 | −50,00 | 246 | −30,99 | ||||

| 2025-07-30 | NP | LSOFX - LS Opportunity Fund - Institutional Class | 17 044 | −4,04 | 1 649 | 7,50 | ||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 6 100 | 10,91 | 750 | 51,62 | ||||

| 2025-07-09 | 13F | Reyes Financial Architecture, Inc. | 112 | 14 | ||||||

| 2025-08-12 | 13F | BlackRock, Inc. | 300 | 0,00 | 37 | 33,33 | ||||

| 2025-07-31 | 13F | Briaud Financial Planning, Inc | 6 624 | −26,03 | 1 | |||||

| 2025-08-14 | 13F | Mountain Lake Investment Management LLC | 13 960 | 0,00 | 1 715 | 34,51 | ||||

| 2025-08-12 | 13F | Financial Advocates Investment Management | Call | 1 000 | 123 | |||||

| 2025-08-12 | 13F | Financial Advocates Investment Management | 1 019 | 125 | ||||||

| 2025-08-13 | 13F | Scotia Capital Inc. | 12 690 | 243,07 | 1 559 | 362,61 | ||||

| 2025-08-05 | 13F | Cassaday & Co Wealth Management LLC | 2 253 | 0,00 | 277 | 34,63 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 345 | 0,00 | 43 | 40,00 | ||||

| 2025-07-22 | 13F | DAVENPORT & Co LLC | 86 046 | 2 768,20 | 10 572 | 3 758,39 | ||||

| 2025-05-12 | 13F | Citigroup Inc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | BCJ Capital Management, LLC | 27 457 | 3 374 | ||||||

| 2025-08-14 | 13F | Comerica Bank | 544 | 0,00 | 67 | 34,69 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 165 | −5,71 | 20 | 33,33 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 116 203 | −0,61 | 14 278 | 33,64 | ||||

| 2025-07-25 | 13F | Pandora Wealth, Inc. | 1 000 | 0,00 | 123 | 34,07 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 2 865 | −61,27 | 352 | −47,85 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 618 | 43,06 | 76 | 92,31 | ||||

| 2025-08-07 | 13F | Rathbone Brothers plc | 19 560 | 9,27 | 2 403 | 46,97 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 86 | 0,00 | 0 | |||||

| 2025-08-29 | NP | GDMA - Gadsden Dynamic Multi-Asset ETF | 20 728 | 2 547 | ||||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 2 200 | 270 | ||||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 1 211 | 0,00 | 149 | 34,55 | ||||

| 2025-08-06 | 13F | Pekin Hardy Strauss, Inc. | 26 500 | 117,77 | 3 256 | 193,07 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 55 | 7 | ||||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 5 262 | 647 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 36 | 0,00 | 4 | 33,33 | ||||

| 2025-08-14 | 13F | Betterment LLC | 1 720 | 0 | ||||||

| 2025-08-12 | 13F | Tocqueville Asset Management L.p. | 1 780 | 219 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 43 699 | −74,83 | 5 369 | −66,15 | ||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 3 988 | 490 | ||||||

| 2025-07-08 | 13F | Arlington Trust Co LLC | 332 | 0,00 | 41 | 33,33 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Benjamin Edwards Inc | 2 988 | 367 | ||||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 0 | −100,00 | 0 | ||||

| 2025-07-03 | 13F | Arvest Investments, Inc. | 21 784 | −2,16 | 2 677 | 31,56 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-08-12 | 13F | Twin Focus Capital Partners, Llc | 2 400 | 0,00 | 295 | 34,25 | ||||

| 2025-07-07 | 13F | Hedges Asset Management LLC | 9 600 | −9,43 | 1 180 | 21,80 | ||||

| 2025-07-18 | 13F | Founders Capital Management | 200 | 0,00 | 25 | 33,33 | ||||

| 2025-07-29 | 13F | Mattson Financial Services, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 2 190 | 0,00 | 269 | 34,50 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 1 920 | 236 | ||||||

| 2025-08-12 | 13F | LPL Financial LLC | 79 815 | 16,57 | 9 807 | 56,75 | ||||

| 2025-07-08 | 13F | First International Bank & Trust | 6 145 | 755 | ||||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 10 365 | 51,20 | 1 274 | 103,35 | ||||

| 2025-07-22 | 13F | Net Worth Advisory Group | 1 635 | 201 | ||||||

| 2025-07-25 | 13F | Cwm, Llc | 1 | −98,68 | 0 | |||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 700 | 0,00 | 86 | 36,51 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 250 410 | 17,68 | 30 768 | 58,24 | ||||

| 2025-07-23 | 13F | BankPlus Trust Department | 115 | 0,00 | 14 | 40,00 | ||||

| 2025-05-23 | 13F | SWAN Capital LLC | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | 43 935 | 41,14 | 5 398 | 89,80 | ||||

| 2025-08-11 | 13F | Pin Oak Investment Advisors Inc | 0 | 0 |

Other Listings

| MX:PPLT |