Grundläggande statistik

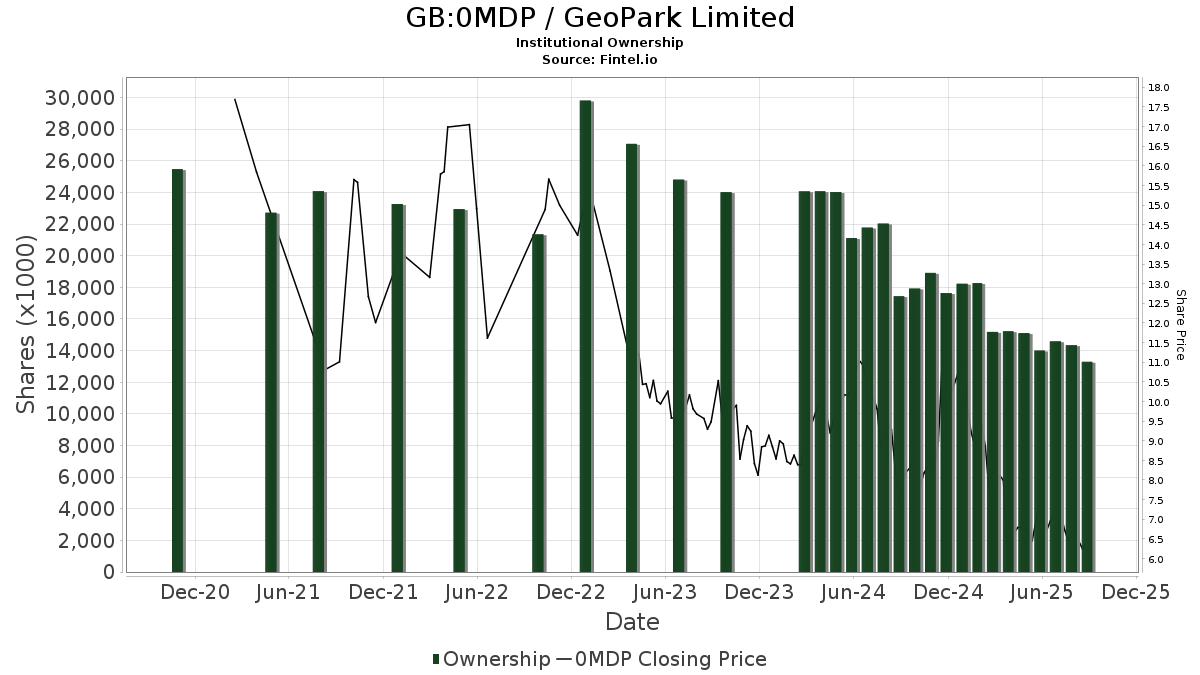

| Institutionella aktier (lång) | 13 291 432 - 25,77% (ex 13D/G) - change of −1,02MM shares −7,13% MRQ |

| Institutionellt värde (lång) | $ 86 990 USD ($1000) |

Institutionellt ägande och aktieägare

GeoPark Limited (GB:0MDP) har 99 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 13,292,517 aktier. Största aktieägare inkluderar Renaissance Technologies Llc, Captrust Financial Advisors, BlackRock, Inc., UBS Group AG, Millennium Management Llc, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd., Citadel Advisors Llc, PEAPX - International Emerging Markets Fund R-3, Militia Capital Partners, LP, and COLO - Global X MSCI Colombia ETF .

GeoPark Limited (LSE:0MDP) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 15, 2025 is 6,30 / share. Previously, on September 16, 2024, the share price was 7,64 / share. This represents a decline of 17,45% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 33 186 | 2,41 | 216 | −17,24 | ||||

| 2025-05-23 | NP | PRINCIPAL VARIABLE CONTRACTS FUNDS INC - International Emerging Markets Account Class 1 | 8 693 | 0,00 | 70 | −12,50 | ||||

| 2025-08-08 | 13F | Principal Financial Group Inc | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | JustInvest LLC | 0 | −100,00 | 0 | |||||

| 2025-04-01 | NP | JIEIX - abrdn International Sustainable Leaders Fund Institutional Class | 18 084 | −54,99 | 166 | −47,45 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 19 378 | −73,12 | 0 | |||||

| 2025-08-14 | 13F | Ubs Oconnor Llc | 228 367 | 1 489 | ||||||

| 2025-08-06 | 13F | Savant Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 20 100 | 54,62 | 131 | 24,76 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | 330 105 | −3,97 | 2 152 | −22,51 | ||||

| 2025-08-25 | NP | EITEX - Parametric Tax-Managed Emerging Markets Fund Institutional Class | 11 800 | 0,00 | 77 | −20,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 27 800 | −2,11 | 181 | −20,96 | |||

| 2025-07-23 | 13F | Armstrong, Fleming & Moore, Inc | 207 224 | 1 351 | ||||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 72 917 | 3,76 | 475 | −16,23 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 1 255 | 8 | ||||||

| 2025-08-14 | 13F | Petrus Trust Company, LTA | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Vident Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 216 677 | 27,91 | 1 413 | 3,22 | ||||

| 2025-05-14 | 13F | Price T Rowe Associates Inc /md/ | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 413 | 57,63 | 3 | 0,00 | ||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 1 464 | 123,17 | 10 | 80,00 | ||||

| 2025-08-14 | 13F | Parvin Asset Management, LLC | 65 975 | 0,00 | 430 | −19,32 | ||||

| 2025-08-28 | NP | DODEX - Dodge & Cox Emerging Markets Stock Fund | 82 059 | −11,63 | 535 | −28,67 | ||||

| 2025-08-14 | 13F | State Street Corp | 26 986 | 0,00 | 176 | −19,72 | ||||

| 2025-08-19 | 13F | State of Wyoming | 6 987 | −42,42 | 46 | −54,08 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 0 | −100,00 | 0 | |||||

| 2025-05-21 | 13F | Acadian Asset Management Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-29 | NP | TIFF INVESTMENT PROGRAM - TIFF Multi-Asset Fund | Short | −1 085 | −9 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 2 920 | 0,00 | 19 | −17,39 | ||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Vennlight Capital Management, LP | 108 800 | 709 | ||||||

| 2025-08-14 | 13F | Susquehanna Fundamental Investments, Llc | 0 | −100,00 | 0 | |||||

| 2025-05-02 | 13F/A | Mackenzie Financial Corp | 282 080 | −17,15 | 2 615 | −2,43 | ||||

| 2025-06-13 | NP | abrdn Funds - abrdn Emerging Markets Dividend Active ETF | 17 284 | 116 | ||||||

| 2025-08-13 | 13F | Apis Capital Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 864 | 2,73 | 6 | −16,67 | ||||

| 2025-08-12 | 13F | Entropy Technologies, LP | 15 190 | 99 | ||||||

| 2025-08-06 | 13F | Stokes Family Office, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 37 136 | −13,71 | 242 | −30,26 | ||||

| 2025-08-28 | NP | EWX - SPDR(R) S&P(R) EMERGING MARKETS SMALL CAP ETF | 26 986 | 0,00 | 176 | −19,72 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 644 383 | −0,74 | 4 201 | −19,90 | ||||

| 2025-05-13 | 13F | State of Tennessee, Treasury Department | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Puff Wealth Management, Llc | 13 000 | 0,00 | 85 | −20,00 | ||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Nebula Research & Development LLC | 27 028 | 11,52 | 176 | −9,74 | ||||

| 2025-05-28 | NP | SMLV - SPDR SSGA US Small Cap Low Volatility Index ETF This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 20 145 | 27,58 | 163 | 10,96 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 137 200 | −55,25 | 895 | −63,91 | ||||

| 2025-08-08 | 13F | JBF Capital, Inc. | 15 000 | 0,00 | 98 | −19,83 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 2 837 160 | −5,35 | 18 498 | −23,63 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 974 | 43,02 | 6 | 20,00 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 36 945 | −32,72 | 241 | −45,82 | ||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 61 481 | 401 | ||||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 25 906 | −0,67 | 0 | |||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F/A | Barclays Plc | 4 743 | −64,34 | 0 | |||||

| 2025-05-14 | 13F | Trexquant Investment LP | 0 | −100,00 | 0 | |||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 915 | 6 | ||||||

| 2025-07-24 | 13F | Standard Life Aberdeen plc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 281 802 | −22,97 | 1 837 | −37,83 | ||||

| 2025-07-29 | NP | PHSWX - Parvin Hedged Equity Solari World Fund | 20 000 | 0,00 | 126 | −22,84 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 129 100 | −6,92 | 842 | −24,91 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 163 169 | 57,45 | 1 064 | 27,00 | ||||

| 2025-06-26 | NP | CRNSX - CATHOLIC RESPONSIBLE INVESTMENTS INTERNATIONAL SMALL-CAP FUND Institutional Shares | 4 710 | 32 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 186 830 | −30,84 | 1 218 | −44,18 | ||||

| 2025-05-13 | 13F | Skopos Labs, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | BlackRock, Inc. | 612 640 | 44,34 | 3 994 | 16,48 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 26 229 | 171 | ||||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 77 178 | 358,60 | 503 | 272,59 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 550 | −4,18 | 4 | −25,00 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 705 | 56,67 | 5 | 33,33 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 225 800 | 12,45 | 1 472 | −9,25 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Dodge & Cox | 84 545 | −14,47 | 551 | −30,95 | ||||

| 2025-08-12 | 13F | Cornerstone Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | EntryPoint Capital, LLC | 24 664 | −3,71 | 161 | −22,33 | ||||

| 2025-08-14 | 13F | CoreCommodity Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Glenorchy Capital Ltd | 181 274 | 1,43 | 1 182 | −18,16 | ||||

| 2025-04-29 | NP | WEUSX - Siit World Equity Ex-us Fund - Class A | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Numerai GP LLC | 58 560 | 9,77 | 382 | −11,60 | ||||

| 2025-06-25 | NP | VRAI - Virtus Real Asset Income ETF | 20 115 | 24,13 | 135 | −8,78 | ||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 402 871 | 41,38 | 2 627 | 14,07 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 437 783 | −26,32 | 2 854 | −40,54 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | WealthCollab, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 160 312 | −31,08 | 1 045 | −44,39 | ||||

| 2025-07-31 | 13F | R Squared Ltd | 17 256 | 113 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 25 754 | 168 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 102 255 | 4,79 | 667 | −15,46 | ||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 35 825 | 132,25 | 234 | 87,90 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 14 440 | 17,55 | 101 | 1,00 | ||||

| 2025-05-16 | 13F | Dynamic Technology Lab Private Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 540 425 | −30,35 | 3 524 | −43,80 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 106 047 | −18,28 | 691 | −34,06 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 66 288 | 5,98 | 0 | |||||

| 2025-08-14 | 13F | Mork Capital Management, LLC | 70 000 | 0,00 | 456 | −19,29 | ||||

| 2025-08-28 | NP | WLCTX - Wilshire International Equity Fund Investment Class | 5 098 | 99,37 | 33 | 65,00 | ||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 23 373 | 42,67 | 152 | 15,15 | ||||

| 2025-06-27 | NP | COLO - Global X MSCI Colombia ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 288 750 | 45,38 | 1 940 | 6,65 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 221 832 | 92,80 | 1 446 | 55,65 | ||||

| 2025-08-14 | 13F | Militia Capital Partners, LP | 299 000 | 2,94 | 1 949 | −16,92 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 68 129 | −29,98 | 444 | −43,51 | ||||

| 2025-07-30 | NP | DEEP - Roundhill Acquirers Deep Value ETF | 32 852 | 3,92 | 206 | −19,53 | ||||

| 2025-05-30 | NP | JOMEX - JOHCM Emerging Markets Small Mid Cap Equity Fund Class Z Shares | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Banco BTG Pactual S.A. | 81 231 | 26,92 | 530 | 2,32 | ||||

| 2025-08-14 | 13F | Graham Capital Management, L.P. | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 62 270 | 528,04 | 0 | |||||

| 2025-08-11 | 13F | Empowered Funds, LLC | 210 227 | 1 371 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 53 311 | −78,87 | 348 | −82,97 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 254 761 | 0,00 | 1 661 | −19,29 | ||||

| 2025-08-05 | 13F | Freestone Capital Holdings, LLC | 159 789 | 1 042 | ||||||

| 2025-08-13 | 13F | Aristides Capital LLC | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Northern Trust Corp | 14 673 | 0,96 | 96 | −18,80 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 62 000 | 53,47 | 404 | 23,93 | ||||

| 2025-06-27 | NP | IPKW - Invesco International BuyBack Achievers ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 5 701 | 38 | ||||||

| 2025-07-11 | 13F | Annex Advisory Services, LLC | 182 380 | 4,62 | 1 189 | −15,55 | ||||

| 2025-05-09 | 13F | GeoWealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-12 | 13F | Jpmorgan Chase & Co | 0 | −100,00 | 0 | |||||

| 2025-08-19 | 13F | Marex Group plc | 125 000 | 815 | ||||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 245 915 | −17,84 | 1 603 | −33,71 | ||||

| 2025-07-18 | 13F | Deltec Asset Management Llc | 152 000 | 69,83 | 991 | 37,07 | ||||

| 2025-08-08 | 13F | Compass Group Llc | 61 091 | −44,26 | 398 | −55,03 | ||||

| 2025-08-14 | 13F | VR Advisory Services Ltd | 234 685 | 0,00 | 1 530 | −19,30 | ||||

| 2025-05-13 | 13F | Sei Investments Co | 15 370 | 0,00 | 142 | 0,00 | ||||

| 2025-05-01 | 13F | New York State Common Retirement Fund | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 2 646 | 92,16 | 17 | 54,55 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 0 | −100,00 | 0 | |||||

| 2025-06-27 | NP | EAEMX - Parametric Emerging Markets Fund Investor Class | 6 700 | 0,00 | 45 | −26,23 | ||||

| 2025-06-30 | NP | PRFZ - Invesco FTSE RAFI US 1500 Small-Mid ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 85 207 | −32,89 | 573 | −50,82 | ||||

| 2025-08-13 | 13F | Jump Financial, LLC | 115 111 | 0,24 | 751 | −19,09 | ||||

| 2025-08-13 | 13F | Investment Counsel Co Of Nevada | 5 149 | 0,00 | 34 | −19,51 | ||||

| 2025-08-11 | 13F | Empirical Finance, LLC | 210 227 | 73,85 | 1 371 | 40,23 | ||||

| 2025-03-27 | NP | CCNR - ALPS | CoreCommodity Natural Resources ETF | 200 625 | 8,47 | 1 838 | 26,69 | ||||

| 2025-06-23 | NP | PEAPX - International Emerging Markets Fund R-3 | 312 265 | 0,00 | 2 098 | −26,64 | ||||

| 2025-05-15 | 13F | PDT Partners, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Centiva Capital, LP | 36 366 | 237 |