Grundläggande statistik

| Institutionella ägare | 176 total, 156 long only, 4 short only, 16 long/short - change of −3,28% MRQ |

| Genomsnittlig portföljallokering | 0.0587 % - change of 44,45% MRQ |

| Institutionella aktier (lång) | 20 286 927 (ex 13D/G) - change of 3,71MM shares 22,35% MRQ |

| Institutionellt värde (lång) | $ 430 914 USD ($1000) |

Institutionellt ägande och aktieägare

ETF Series Solutions - U.S. Global Jets ETF (US:JETS) har 176 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 20,286,927 aktier. Största aktieägare inkluderar Morgan Stanley, Jpmorgan Chase & Co, Citadel Advisors Llc, Bank Of America Corp /de/, Goldman Sachs Group Inc, Susquehanna International Group, Llp, Jane Street Group, Llc, Citadel Advisors Llc, Bank Of America Corp /de/, and Barclays Plc .

ETF Series Solutions - U.S. Global Jets ETF (ARCA:JETS) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 12, 2025 is 25,99 / share. Previously, on September 13, 2024, the share price was 19,28 / share. This represents an increase of 34,80% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

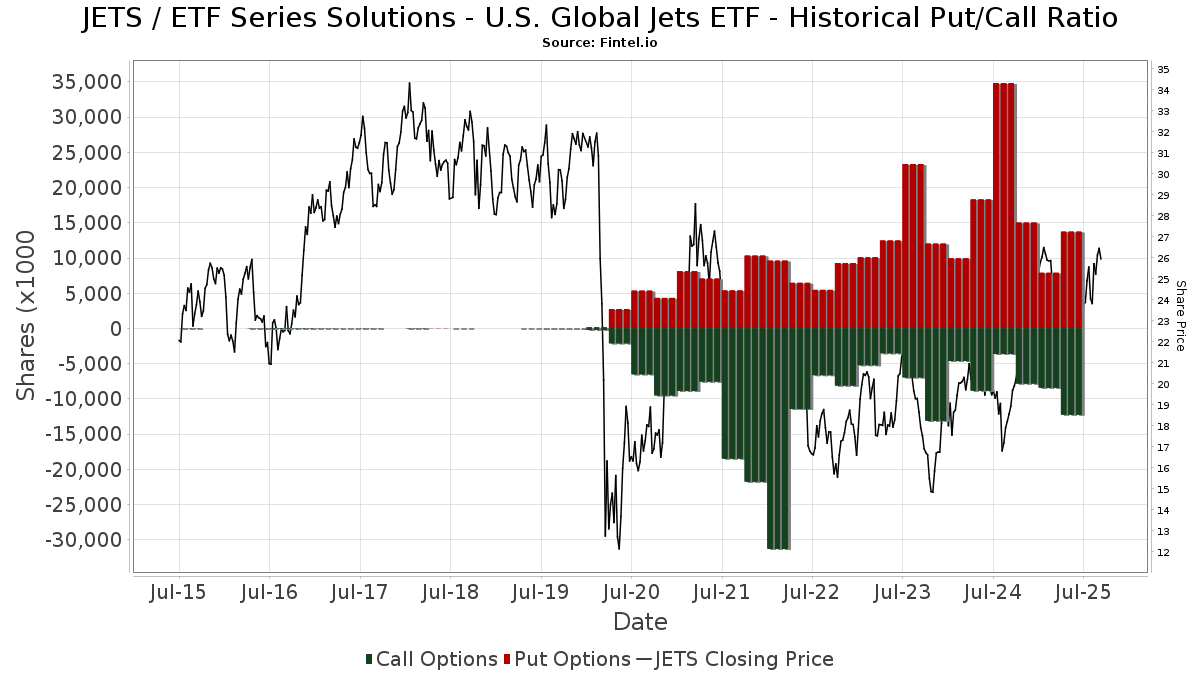

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | Put | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Candelo Capital Management LP | Put | 100 000 | 2 297 | |||||

| 2025-08-07 | 13F | Ibex Wealth Advisors | 0 | −100,00 | 0 | |||||

| 2025-04-23 | 13F | Mascagni Wealth Management, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-14 | 13F | Walleye Capital LLC | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Walleye Capital LLC | Put | 0 | −100,00 | 0 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 9 604 | −96,57 | 220 | −96,23 | ||||

| 2025-07-17 | 13F | Beacon Capital Management, LLC | 200 | 0,00 | 5 | 0,00 | ||||

| 2025-05-06 | 13F | Venturi Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Game Plan Financial Advisors, LLC | 5 | 0,00 | 0 | |||||

| 2025-04-25 | 13F | New Millennium Group LLC | 0 | −100,00 | 0 | |||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Millennium Management Llc | Call | 1 180 000 | 96,67 | 27 105 | 117,49 | |||

| 2025-07-16 | 13F | Moisand Fitzgerald Tamayo, LLC | 4 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Millennium Management Llc | 26 480 | −74,77 | 608 | −72,10 | ||||

| 2025-05-09 | 13F | Sfmg, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Millennium Management Llc | Put | 50 000 | −50,00 | 1 148 | −44,73 | |||

| 2025-08-12 | 13F | Park Square Financial Group, LLC | 400 | 0,00 | 9 | 12,50 | ||||

| 2025-08-13 | 13F | Capital Fund Management S.a. | 171 877 | −31,58 | 3 948 | −24,32 | ||||

| 2025-08-14 | 13F | Symmetry Investments LP | 132 400 | 3 041 | ||||||

| 2025-05-15 | 13F | Banque Transatlantique SA | 0 | −100,00 | 0 | |||||

| 2025-07-18 | 13F | Cooper Financial Group | 9 673 | −17,13 | 222 | −8,26 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | Put | 2 776 700 | 1 397,68 | 63 781 | 1 556,62 | |||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | Call | 813 800 | 121,80 | 18 693 | 145,30 | |||

| 2025-05-09 | 13F | Highland Peak Capital, LLC | Put | 0 | −100,00 | 0 | ||||

| 2025-08-18 | 13F/A | Nomura Holdings Inc | Call | 700 000 | 16 079 | |||||

| 2025-08-12 | 13F | Marshall & Sterling Wealth Advisors Inc. | 271 | 0,00 | 6 | 20,00 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 6 444 | −22,35 | 148 | −29,52 | ||||

| 2025-08-14 | 13F | Atom Investors LP | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 36 417 | −27,49 | 1 | −100,00 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 1 470 649 | 727,48 | 33 781 | 815,20 | ||||

| 2025-08-19 | 13F | Anchor Investment Management, LLC | 250 | 0,00 | 6 | 0,00 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 2 171 | 29,92 | 50 | 53,13 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 219 968 | 5 053 | ||||||

| 2025-08-26 | NP | LCR - Leuthold Core ETF | 49 728 | 2,55 | 1 142 | 13,41 | ||||

| 2025-07-29 | NP | MVFG - Monarch Volume Factor Global Unconstrained Index ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-05 | 13F | Transce3nd, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Financial Perspectives, Inc | 218 | 0,00 | 5 | 25,00 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 409 | −70,97 | 9 | −68,97 | ||||

| 2025-08-05 | 13F | Fourth Dimension Wealth, LLC | 22 | 0,00 | 1 | |||||

| 2025-04-30 | 13F | Stratos Wealth Partners, LTD. | 0 | −100,00 | 0 | |||||

| 2025-05-19 | 13F | Heck Capital Advisors, LLC | 0 | 0 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 1 780 000 | 368,79 | 40 887 | 418,46 | |||

| 2025-07-29 | 13F | Salomon & Ludwin, LLC | 64 | 0,00 | 2 | 0,00 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 13 040 | 0,00 | 271 | −18,18 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 1 250 500 | 447,50 | 28 724 | 505,59 | |||

| 2025-08-14 | 13F | Parallax Volatility Advisers, L.P. | 1 | −100,00 | 0 | −100,00 | ||||

| 2025-08-11 | 13F | VSM Wealth Advisory, LLC | 102 | −49,50 | 2 | −50,00 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 9 367 | 0,00 | 215 | 10,82 | ||||

| 2025-05-12 | 13F | Kohmann Bosshard Financial Services, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 1 257 | 0,00 | 29 | 7,69 | ||||

| 2025-08-11 | 13F | Western Wealth Management, LLC | 10 844 | 0,00 | 249 | 10,67 | ||||

| 2025-05-13 | 13F | Bank Of Montreal /can/ | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-07-22 | 13F | Mascoma Wealth Management LLC | 182 | 0,00 | 4 | 33,33 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 388 | 0,00 | 9 | 0,00 | ||||

| 2025-07-31 | 13F | Optimum Investment Advisors | 400 | 0,00 | 9 | 12,50 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 13 843 | 0,01 | 318 | 10,45 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 297 | 5,32 | 7 | 20,00 | ||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 9 792 | 225 | ||||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 91 697 | −28,79 | 2 106 | −21,24 | ||||

| 2025-07-15 | 13F | Financial Management Professionals, Inc. | 9 | 0 | ||||||

| 2025-08-01 | 13F | Bank of Jackson Hole Trust | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Parallax Volatility Advisers, L.P. | Put | 86 000 | −85,23 | 1 975 | −83,67 | |||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 68 | −91,32 | 2 | −93,75 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 34 704 | −0,77 | 797 | 9,78 | ||||

| 2025-08-14 | 13F | Parallax Volatility Advisers, L.P. | Call | 150 000 | 0,00 | 3 446 | 10,59 | |||

| 2025-05-12 | 13F | Sandy Spring Bank | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 80 726 | −6,51 | 1 854 | 3,40 | ||||

| 2025-07-30 | 13F | Axecap Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Jefferies Financial Group Inc. | Call | 29 800 | −76,06 | 685 | −73,54 | |||

| 2025-08-14 | 13F | Maven Securities LTD | 16 520 | 6,67 | 379 | 18,07 | ||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 18 | 0,00 | 0 | |||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 3 000 | 70 | ||||||

| 2025-08-13 | 13F/A | StoneX Group Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 49 101 | −66,17 | 1 128 | −62,61 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Put | 11 000 | −90,37 | 253 | −89,37 | |||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 2 315 | 0,00 | 0 | |||||

| 2025-07-30 | 13F | Evermay Wealth Management Llc | 110 | 0,00 | 3 | 0,00 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Call | 23 600 | −81,39 | 542 | −79,42 | |||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 300 | 0,00 | 7 | 0,00 | ||||

| 2025-08-12 | 13F | Insigneo Advisory Services, Llc | 9 439 | 217 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Concentric Capital Strategies, LP | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Pandora Wealth, Inc. | 6 074 | 0,00 | 140 | 10,32 | ||||

| 2025-08-15 | 13F | North Ridge Wealth Advisors, Inc. | 110 | 0,00 | 3 | 0,00 | ||||

| 2025-08-05 | 13F | GHP Investment Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 7 810 | 0,00 | 179 | 10,49 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 606 | 75,14 | 14 | 85,71 | ||||

| 2025-05-15 | 13F | K2 Principal Fund, L.p. | Put | 0 | −100,00 | 0 | ||||

| 2025-07-29 | 13F | Activest Wealth Management | 74 | 0,00 | 2 | 0,00 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Harwood Advisory Group, LLC | 776 | 0,00 | 18 | −10,53 | ||||

| 2025-08-11 | 13F | SFI Advisors, LLC | 19 912 | −5,28 | 457 | 4,82 | ||||

| 2025-08-14 | 13F | Quantitative Investment Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Future Financial Wealth Managment LLC | 168 | 0,00 | 4 | 0,00 | ||||

| 2025-07-25 | 13F | LRI Investments, LLC | 250 | 0,00 | 6 | 0,00 | ||||

| 2025-08-04 | 13F | Spire Wealth Management | 400 | 0,00 | 9 | 12,50 | ||||

| 2025-05-14 | 13F | Legend Financial Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 3 361 | 0,00 | 77 | 11,59 | ||||

| 2025-07-23 | 13F | Vontobel Holding Ltd. | 11 000 | −4,35 | 253 | 5,88 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 302 000 | 358,27 | 6 919 | 396,98 | |||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 351 500 | 15,89 | 8 053 | 25,66 | |||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 27 227 | 23,61 | 624 | 33,98 | ||||

| 2025-07-30 | NP | ENDW - Cambria Endowment Style ETF | 158 | 4 | ||||||

| 2025-05-15 | 13F | Soros Fund Management Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-04-21 | 13F | Friedenthal Financial | 0 | −100,00 | 0 | |||||

| 2025-05-13 | 13F | Equitable Holdings, Inc. | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Sax Wealth Advisors, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | 400 Capital Management LLC | Put | 200 000 | 4 594 | |||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 7 536 | 0,00 | 173 | 10,90 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | Put | 1 300 000 | −67,77 | 30 | −65,06 | |||

| 2025-08-14 | 13F/A | Barclays Plc | Call | 220 000 | 5 | |||||

| 2025-08-14 | 13F | Murphy & Mullick Capital Management Corp | 450 | 0,00 | 10 | 11,11 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 844 437 | 223,54 | 19 | 280,00 | ||||

| 2025-05-13 | 13F | Summer Road Llc | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 65 | 0,00 | 1 | 0,00 | ||||

| 2025-08-11 | 13F | Synergy Investment Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | Call | 119 100 | 2 736 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 250 166 | 114,25 | 5 746 | 136,95 | ||||

| 2025-05-15 | 13F | Fullerton Fund Management Co Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | Put | 375 000 | 8 614 | |||||

| 2025-07-29 | 13F | Private Trust Co Na | 5 000 | 0,00 | 115 | 10,68 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 72 142 | 40,84 | 1 657 | 55,73 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | Call | 10 000 | 0,00 | 230 | 10,58 | |||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 9 515 | −1,53 | 219 | 9,00 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 8 938 | 205 | ||||||

| 2025-08-05 | 13F | Huntington National Bank | 0 | |||||||

| 2025-08-14 | 13F | DRW Securities, LLC | 12 672 | 290 | ||||||

| 2025-08-07 | 13F | Runnymede Capital Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Blair William & Co/il | 1 991 | 0,25 | 46 | 9,76 | ||||

| 2025-07-15 | 13F | MCF Advisors LLC | 50 | 0,00 | 1 | 0,00 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 185 | 4 | ||||||

| 2025-07-18 | 13F | Institute for Wealth Management, LLC. | 24 103 | 0,98 | 554 | 11,72 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 3 102 | 0,00 | 71 | 10,94 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 500 | 0,00 | 11 | 10,00 | ||||

| 2025-08-14 | 13F | Riggs Asset Managment Co. Inc. | 1 020 | −91,48 | 23 | −90,73 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-04-11 | 13F | Vanguard Capital Wealth Advisors This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 11 938 | 274 | ||||||

| 2025-08-14 | 13F | Gordian Capital Singapore Pte Ltd | 1 | 0,00 | 0 | |||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 20 730 | −3,44 | 476 | 6,97 | ||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | Call | 134 | 0 | |||||

| 2025-08-05 | 13F | Mirae Asset Securities (usa) Inc. | 249 954 | −0,08 | 5 741 | 10,51 | ||||

| 2025-07-31 | 13F | CVA Family Office, LLC | 14 429 | 0,00 | 331 | 10,70 | ||||

| 2025-08-04 | 13F | JDM Financial Group LLC | 250 | 0,00 | 6 | 0,00 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Guardian Wealth Advisors, Llc / Nc | 48 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 60 853 | 1,04 | 1 398 | 11,76 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 2 378 | −0,59 | 55 | 10,20 | ||||

| 2025-08-14 | 13F | Graney & King, LLC | 1 000 | 0,00 | 23 | 10,00 | ||||

| 2025-08-19 | 13F | Slocum, Gordon & Co LLP | 100 | 0,00 | 2 | 0,00 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 385 | −43,63 | 9 | −42,86 | ||||

| 2025-08-14 | 13F | LMR Partners LLP | Put | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 20 | 1 | ||||||

| 2025-08-12 | 13F | Archer Investment Corp | 27 | 0,00 | 1 | |||||

| 2025-04-11 | 13F | Morris Retirement Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 1 100 | 0,00 | 25 | 13,64 | ||||

| 2025-05-01 | 13F | Key FInancial Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Colony Group, LLC | 11 506 | −3,36 | 264 | 11,39 | ||||

| 2025-05-01 | 13F | Bleakley Financial Group, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 0 | −100,00 | 0 | |||||

| 2025-07-09 | 13F | WealthCare Investment Partners, LLC | 16 655 | −2,42 | 402 | 27,71 | ||||

| 2025-07-15 | 13F | Main Street Group, LTD | 340 | −61,36 | 8 | −61,11 | ||||

| 2025-05-06 | 13F | Innova Wealth Partners | Call | 0 | −100,00 | 0 | ||||

| 2025-08-13 | 13F | Hbk Investments L P | Put | 513 300 | −4,32 | 11 791 | 5,81 | |||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 2 302 207 | −19,25 | 52 882 | −10,70 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 20 323 | 0,00 | 467 | 10,43 | ||||

| 2025-08-04 | 13F | Migdal Insurance & Financial Holdings Ltd. | 3 000 | 0,00 | 0 | |||||

| 2025-07-10 | 13F | Kozak & Associates, Inc. | 7 | 0,00 | 0 | |||||

| 2025-07-25 | 13F | Ellis Investment Partners, LLC | 56 319 | −7,68 | 1 294 | 2,05 | ||||

| 2025-05-09 | 13F | Scotia Capital Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | State Of Wisconsin Investment Board | 1 172 025 | 8,63 | 26 921 | 20,13 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 28 469 | 0,95 | 654 | 11,62 | ||||

| 2025-08-13 | 13F | Capital Fund Management S.a. | Call | 333 100 | 18,41 | 7 651 | 30,97 | |||

| 2025-08-13 | 13F | Capital Fund Management S.a. | Put | 134 100 | 101,05 | 3 080 | 122,38 | |||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 33 649 | −18,24 | 773 | −9,71 | ||||

| 2025-08-05 | 13F | Westside Investment Management, Inc. | 2 625 | 0,00 | 60 | 11,11 | ||||

| 2025-08-07 | 13F | Cascade Financial Partners, LLC | 9 868 | 0,00 | 227 | 10,78 | ||||

| 2025-08-11 | 13F | HHM Wealth Advisors, LLC | 3 580 | 0,00 | 82 | 10,81 | ||||

| 2025-08-13 | 13F | RPg Family Wealth Advisory, LLC | 28 288 | 3,05 | 650 | 13,86 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 14 923 | −6,56 | 343 | 3,32 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 18 428 | 0,00 | 423 | 10,73 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 408 805 | −1,27 | 9 390 | 9,20 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 327 701 | −1,87 | 8 | 16,67 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 226 328 | 909,76 | 5 199 | 1 017,85 | ||||

| 2025-07-23 | 13F | REAP Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 14 545 | −1,42 | 0 | |||||

| 2025-05-15 | 13F | Raab & Moskowitz Asset Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | WASHINGTON TRUST Co | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | HighMark Wealth Management LLC | 702 | 0,00 | 16 | 14,29 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | 216 011 | 3 169,92 | 4 962 | 3 521,17 | ||||

| 2025-05-15 | 13F | Citadel Advisors Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 796 600 | 334,59 | 18 298 | 380,61 | |||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 333 700 | 27,71 | 7 665 | 41,24 | |||

| 2025-08-14 | 13F | Ancora Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Hallmark Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Waratah Capital Advisors Ltd. | Put | 500 000 | 11 485 | |||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 2 | −99,61 | 0 | −100,00 | ||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 48 528 | −16,24 | 1 | 0,00 | ||||

| 2025-08-13 | 13F | Leuthold Group, Llc | 53 461 | 2,65 | 1 228 | 13,51 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 21 612 | 1,55 | 496 | 12,22 | ||||

| 2025-08-08 | 13F | Emerald Investment Partners, Llc | 3 000 | 0,00 | 69 | 9,68 | ||||

| 2025-07-15 | 13F | Patriot Investment Management Inc. | 18 045 | 0,00 | 414 | 10,70 | ||||

| 2025-07-21 | 13F | Washington Growth Strategies Llc | 78 813 | 375 200,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | SIH Partners, LLLP | 58 722 | 1 349 | ||||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 233 | 0,00 | 5 | 25,00 | ||||

| 2025-08-14 | 13F | Moore Capital Management, Lp | Call | 937 500 | 21 534 | |||||

| 2025-05-13 | 13F | Hartland & Co., LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Cornerstone Planning Group LLC | 294 | 0,00 | 7 | 20,00 | ||||

| 2025-08-14 | 13F | Arete Wealth Advisors, LLC | 11 007 | 0 | ||||||

| 2025-07-29 | 13F | Tradewinds Capital Management, LLC | 25 | −97,90 | 1 | −100,00 | ||||

| 2025-05-06 | 13F | Genoa Capital Gestora de Recursos Ltda. | 43 025 | 733 | ||||||

| 2025-08-05 | 13F | Dunhill Financial, LLC | 136 | 3 | ||||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | GWM Advisors LLC | 2 314 | −26,86 | 53 | −18,46 | ||||

| 2025-05-13 | 13F | Pinnacle Holdings, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 261 | 0,00 | 6 | 0,00 | ||||

| 2025-08-05 | 13F | Mirae Asset Securities (usa) Inc. | Put | 250 000 | 0,00 | 5 742 | 10,59 | |||

| 2025-06-27 | NP | CPLSX - Calamos Phineus Long/Short Fund Class A | 940 000 | −150,00 | 18 631 | −138,07 | ||||

| 2025-07-24 | 13F | Strengthening Families & Communities, LLC | 1 000 | 0,00 | 23 | 10,00 | ||||

| 2025-05-12 | 13F | Independent Advisor Alliance | 0 | −100,00 | 0 | |||||

| 2025-05-20 | 13F/A | Colony Group, LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 8 494 | −1,15 | 195 | 9,55 | ||||

| 2025-08-08 | 13F | Creative Planning | 12 439 | −31,21 | 286 | −24,00 | ||||

| 2025-07-24 | 13F | Stonebridge Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | PFG Private Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-07 | 13F | Nova Wealth Management, Inc. | 3 695 | −5,13 | 85 | 5,00 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 1 926 | 285,20 | 44 | 340,00 | ||||

| 2025-04-30 | 13F | Cerity Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 12 617 | 3,70 | 0 | |||||

| 2025-08-14 | 13F | Fmr Llc | 7 868 | −28,49 | 181 | −21,05 | ||||

| 2025-08-18 | 13F | Hollencrest Capital Management | 500 | 0,00 | 11 | 10,00 | ||||

| 2025-07-10 | 13F | Sovran Advisors, LLC | 8 515 | 204 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 63 018 | −19,08 | 1 448 | −10,51 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 3 044 200 | 519,24 | 69 925 | 584,87 | |||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-04-25 | 13F | New Wave Wealth Advisors Llc | 0 | −100,00 | 0 | |||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 575 | 0,00 | 13 | 18,18 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | Put | 1 500 | 3 446 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 4 883 653 | 62,31 | 112 178 | 79,50 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 172 384 | 213,80 | 3 960 | 247,28 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 1 509 300 | −67,13 | 34 669 | −63,65 | |||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 2 100 | −11,58 | 48 | −2,04 | ||||

| 2025-08-14 | 13F | Comerica Bank | 2 200 | 0,00 | 51 | 11,11 | ||||

| 2025-05-15 | 13F | Centiva Capital, LP | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-07-07 | 13F | Roxbury Financial LLC | 2 756 | −4,64 | 63 | −10,00 | ||||

| 2025-07-31 | 13F/A | Avion Wealth | 100 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Healthcare Of Ontario Pension Plan Trust Fund | Call | 0 | −100,00 | 0 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 881 | 0,00 | 20 | 11,11 | ||||

| 2025-05-15 | 13F | Centiva Capital, LP | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Peak6 Llc | Put | 119 500 | 2 745 | |||||

| 2025-08-14 | 13F | Peak6 Llc | 33 431 | 768 | ||||||

| 2025-07-25 | 13F | Cwm, Llc | 5 356 | 4,51 | 0 | |||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 22 | 46,67 | 1 | |||||

| 2025-07-31 | 13F | CNB Bank | 736 | 0,00 | 17 | 6,67 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 272 | 0,00 | 6 | 20,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 1 144 900 | 152,18 | 26 298 | 178,91 | |||

| 2025-04-24 | 13F | Sims Investment Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 668 217 | 523,09 | 15 349 | 589,18 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 2 269 900 | 74,30 | 52 140 | 92,76 | |||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 31 473 | 4,96 | 723 | 16,08 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 10 222 | 235 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 3 634 844 | 24,91 | 83 492 | 38,14 | ||||

| 2025-08-18 | 13F | N.E.W. Advisory Services LLC | 221 | 0,00 | 5 | 25,00 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 3 660 | 84 | ||||||

| 2025-04-22 | 13F | Synergy Financial Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-04-28 | 13F/A | Elliott Investment Management L.P. | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-08 | 13F | Gts Securities Llc | 69 812 | 1 604 | ||||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 88 728 | 2 038 | ||||||

| 2025-08-14 | 13F | UBS Group AG | Put | 1 192 600 | 27 394 | |||||

| 2025-08-14 | 13F | Old Mission Capital Llc | 44 959 | −7,72 | 1 033 | 2,08 | ||||

| 2025-08-14 | 13F | UBS Group AG | 146 686 | −64,70 | 3 369 | −60,96 | ||||

| 2025-08-14 | 13F | UBS Group AG | Call | 1 024 400 | 23 530 |