Grundläggande statistik

| Institutionella ägare | 151 total, 150 long only, 0 short only, 1 long/short - change of 1,33% MRQ |

| Genomsnittlig portföljallokering | 0.2989 % - change of −9,84% MRQ |

| Institutionella aktier (lång) | 11 098 255 (ex 13D/G) - change of −1,15MM shares −9,39% MRQ |

| Institutionellt värde (lång) | $ 278 861 USD ($1000) |

Institutionellt ägande och aktieägare

Invesco DB Multi-Sector Commodity Trust - Invesco DB Agriculture Fund (US:DBA) har 151 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 11,098,255 aktier. Största aktieägare inkluderar Wells Fargo & Company/mn, New York Life Investment Management Llc, Morgan Stanley, Bank Of America Corp /de/, QAI - IQ Hedge Multi-Strategy Tracker ETF, 1832 Asset Management L.P., Kestra Advisory Services, LLC, HighTower Advisors, LLC, Jpmorgan Chase & Co, and Cambria Investment Management, L.P. .

Invesco DB Multi-Sector Commodity Trust - Invesco DB Agriculture Fund (ARCA:DBA) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 8, 2025 is 27,28 / share. Previously, on September 9, 2024, the share price was 24,65 / share. This represents an increase of 10,67% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

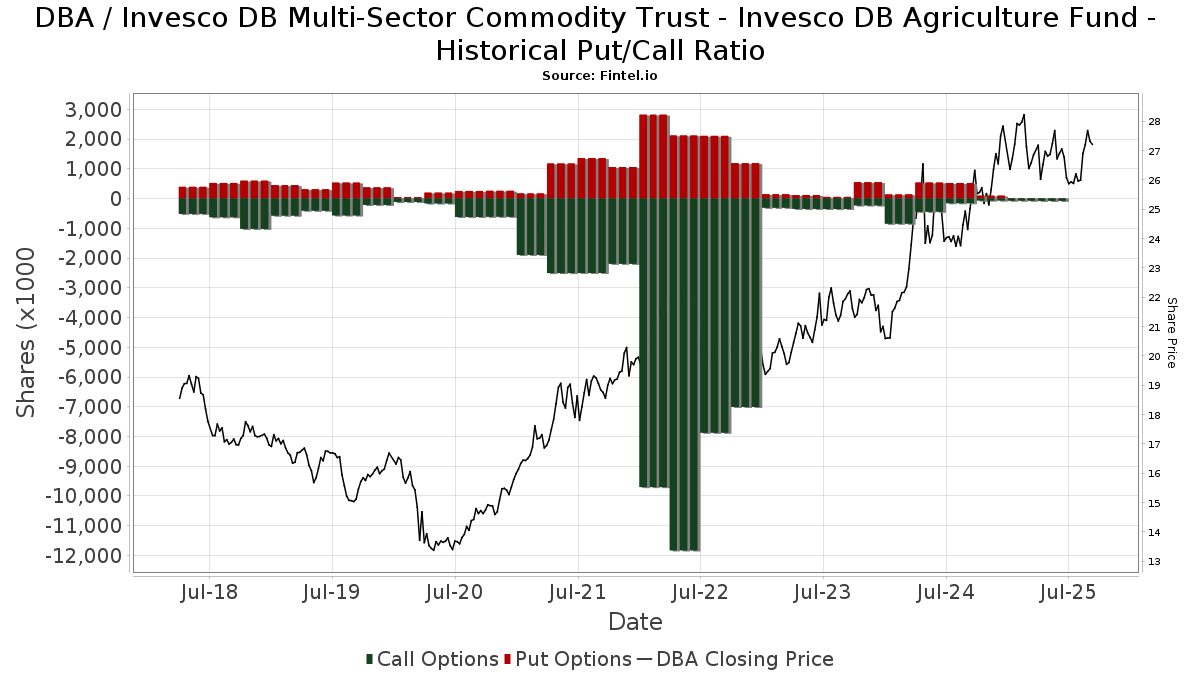

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-13 | 13F | VestGen Advisors, LLC | 76 917 | 2 011 | ||||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 25 644 | 27,23 | 671 | 25,70 | ||||

| 2025-06-30 | NP | CAPTX - Canterbury Portfolio Thermostat Fund Institutional Shares | 14 945 | 0,00 | 401 | −2,91 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 427 297 | −25,44 | 11 174 | −25,98 | ||||

| 2025-08-08 | 13F | Creative Planning | 11 804 | 28,25 | 309 | 27,27 | ||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-01 | 13F | First National Bank Sioux Falls | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Moors & Cabot, Inc. | 24 022 | 0,97 | 628 | 0,32 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 200 | 5 | ||||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 4 654 | 45,17 | 122 | 44,05 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 15 443 | 0,00 | 404 | −0,74 | ||||

| 2025-08-08 | 13F | Advyzon Investment Management, LLC | 8 424 | 220 | ||||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 26 | 0,00 | 1 | |||||

| 2025-08-19 | 13F | Asset Dedication, LLC | 140 | 0,00 | 4 | 0,00 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 214 622 | −1,43 | 5 612 | −2,13 | ||||

| 2025-08-14 | 13F | UBS Group AG | 107 952 | −42,79 | 2 823 | −43,22 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 61 559 | 4,51 | 1 610 | 3,74 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 89 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | TCG Advisory Services, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-11 | 13F | SILVER OAK SECURITIES, Inc | 37 906 | −3,49 | 991 | −4,62 | ||||

| 2025-08-12 | 13F | Blueprint Investment Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Huntington National Bank | 105 | −0,95 | ||||||

| 2025-08-11 | 13F | Midwest Professional Planners, LTD. | 0 | −100,00 | 0 | |||||

| 2025-04-17 | 13F | FNY Investment Advisers, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Atria Investments Llc | 19 307 | 3,81 | 505 | 3,07 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 8 838 | 0,00 | 0 | |||||

| 2025-08-05 | 13F | Westside Investment Management, Inc. | 5 104 | 0,00 | 133 | −0,75 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 91 648 | 3,10 | 2 397 | 2,35 | ||||

| 2025-07-01 | 13F | Harbor Investment Advisory, Llc | 3 033 | 0,00 | 79 | 0,00 | ||||

| 2025-08-12 | 13F | Picton Mahoney Asset Management | 2 170 | 30,72 | 0 | |||||

| 2025-07-25 | 13F | Sharp Financial Services, LLC | 19 200 | 6,67 | 502 | 5,91 | ||||

| 2025-06-24 | NP | TNMAX - 1290 Multi-Alternative Strategies Fund Class A | 30 740 | 21,79 | 824 | 18,39 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 216 891 | 5 671 | ||||||

| 2025-07-23 | 13F | WestEnd Advisors, LLC | 3 910 | 102 | ||||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 165 033 | 28,03 | 4 289 | 26,27 | ||||

| 2025-08-06 | 13F | OneAscent Wealth Management LLC | 0 | −100,00 | 0 | |||||

| 2025-07-18 | 13F | PFG Investments, LLC | 15 008 | 3,62 | 392 | 2,89 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 471 | 0,00 | 12 | 0,00 | ||||

| 2025-08-13 | 13F | Cambria Investment Management, L.P. | 308 923 | −4,33 | 8 078 | −5,02 | ||||

| 2025-08-13 | 13F | Vermillion & White Wealth Management Group, LLC | 5 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Main Street Financial Solutions, LLC | 16 335 | 427 | ||||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 7 476 | −11,80 | 195 | −13,33 | ||||

| 2025-07-29 | 13F | Sowa Financial Group, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 4 800 | 0,00 | 126 | −0,79 | ||||

| 2025-08-14 | 13F | Private Wealth Advisors, LLC | 184 499 | −0,43 | 4 825 | −1,15 | ||||

| 2025-08-13 | 13F | Custom Index Systems, Llc | 17 511 | −4,60 | 458 | −5,38 | ||||

| 2025-07-10 | 13F | Signal Advisors Wealth, LLC | 8 424 | 0,00 | 220 | −0,45 | ||||

| 2025-08-12 | 13F | Accredited Wealth Management, LLC | 300 | −72,73 | 8 | −75,00 | ||||

| 2025-05-02 | 13F | Transcendent Capital Group LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 8 900 | 20,27 | 233 | 19,59 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | 17 437 | −70,16 | 456 | −70,44 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 10 000 | −43,82 | 262 | −44,23 | |||

| 2025-07-24 | 13F | Trust Co Of Toledo Na /oh/ | 5 527 | 145 | ||||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 1 315 | 3 187,50 | 34 | 3 300,00 | ||||

| 2025-05-09 | 13F | GeoWealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-13 | 13F | Bank Of Montreal /can/ | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 7 058 | 212,58 | 185 | 211,86 | ||||

| 2025-07-16 | 13F | Perigon Wealth Management, LLC | 171 255 | 408,90 | 4 478 | 405,42 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 791 | 21 | ||||||

| 2025-08-12 | 13F | Insigneo Advisory Services, Llc | 27 003 | 0,00 | 706 | −0,70 | ||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 63 327 | 8,02 | 1 656 | 7,25 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - 1290 VT Multi-Alternative Strategies Portfolio Class IB | 14 570 | 3,70 | 381 | 2,97 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 93 071 | 8,49 | 2 434 | 7,70 | ||||

| 2025-05-28 | NP | GHTA - Goose Hollow Tactical Allocation ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-06 | 13F | Pekin Hardy Strauss, Inc. | 30 570 | −1,85 | 799 | −2,56 | ||||

| 2025-08-14 | 13F | Parallax Volatility Advisers, L.P. | 9 103 | 0,00 | 238 | −0,42 | ||||

| 2025-08-04 | 13F | Mesirow Financial Investment Management, Inc. | 54 243 | 3,83 | 1 418 | 3,05 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 4 477 | 0,00 | 117 | 3,54 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 7 671 | 0,00 | 201 | −0,99 | ||||

| 2025-08-14 | 13F | Daiwa Securities Group Inc. | 151 500 | 5,43 | 4 | 0,00 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 5 889 | 154 | ||||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 61 096 | −10,07 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 10 945 | 17,15 | 286 | 16,26 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 99 664 | 14,00 | 3 | 0,00 | ||||

| 2025-08-08 | 13F/A | Ignite Planners, LLC | 27 928 | 16,67 | 727 | 13,97 | ||||

| 2025-07-22 | 13F | Hillcrest Wealth Advisors - NY, LLC | 11 400 | 0,00 | 298 | −0,67 | ||||

| 2025-08-11 | 13F | Independent Advisor Alliance | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 19 475 | −4,06 | 509 | −4,68 | ||||

| 2025-07-22 | 13F | Knights of Columbus Asset Advisors LLC | 3 314 | −19,93 | 87 | −21,10 | ||||

| 2025-05-14 | 13F | Walleye Trading LLC | Call | 0 | −100,00 | 0 | ||||

| 2025-04-24 | 13F | Wingate Wealth Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | Cwm, Llc | 18 579 | 2,18 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 50 537 | −63,21 | 1 322 | −63,48 | ||||

| 2025-05-15 | 13F | Squarepoint Ops LLC | Call | 0 | −100,00 | 0 | ||||

| 2025-08-11 | 13F | FineMark National Bank & Trust | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 5 317 | 42,59 | 139 | 41,84 | ||||

| 2025-07-31 | 13F | Leavell Investment Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | New York Life Investment Management Llc | 807 885 | −14,77 | 21 126 | −15,38 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 390 | −28,57 | 10 | −28,57 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 913 416 | −3,86 | 23 886 | −4,56 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 90 | 0,00 | 2 | 0,00 | ||||

| 2025-08-12 | 13F | Financial Advocates Investment Management | 22 468 | −59,24 | 588 | −59,55 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 90 857 | 11,24 | 2 376 | 10,41 | ||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 9 862 | 9,27 | 0 | |||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 83 930 | 2 195 | ||||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Mid-American Wealth Advisory Group, Inc. | 241 | 6 | ||||||

| 2025-08-14 | 13F | Modern Wealth Management, LLC | 15 769 | 0,69 | 412 | 0,00 | ||||

| 2025-04-29 | 13F | Hm Payson & Co | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | EP Wealth Advisors, Inc. | 45 750 | 1 196 | ||||||

| 2025-08-14 | 13F | Fmr Llc | 2 809 | 152,38 | 73 | 151,72 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 40 000 | −50,00 | 1 046 | −50,36 | ||||

| 2025-08-08 | 13F | Passaic Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Flagship Harbor Advisors, Llc | 30 970 | 6,75 | 810 | 5,89 | ||||

| 2025-05-16 | 13F/A | Kestra Investment Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Eastern Bank | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | Painted Porch Advisors LLC | 275 | 0,00 | 7 | 0,00 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 43 381 | 2,85 | 1 134 | 2,07 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 249 201 | 14,10 | 6 517 | 13,28 | ||||

| 2025-07-31 | 13F | Intelligent Financial Strategies | 239 | 6 | ||||||

| 2025-07-11 | 13F | Caldwell Securities, Inc | 1 362 | 27,05 | 36 | 25,00 | ||||

| 2025-05-12 | 13F | Providence First Trust Co | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | Capital Wealth Alliance, LLC | 196 693 | −13,36 | 5 145 | −13,99 | ||||

| 2025-08-11 | 13F | ARS Investment Partners, LLC | 10 508 | −76,27 | 275 | −76,72 | ||||

| 2025-08-08 | 13F | Itau Unibanco Holding S.A. | 168 400 | 1,32 | 4 404 | 109 975,00 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 19 973 | 522 | ||||||

| 2025-07-23 | 13F | Tyche Wealth Partners LLC | 12 502 | 8,21 | 327 | 7,24 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 2 260 | 0,00 | 59 | −3,28 | ||||

| 2025-08-08 | 13F | Gts Securities Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 18 319 | 82,42 | 479 | 81,44 | ||||

| 2025-08-13 | 13F | Flow Traders U.s. Llc | 27 255 | −62,12 | 1 | −100,00 | ||||

| 2025-07-14 | 13F | Armstrong Advisory Group, Inc | 1 350 | 0,00 | 35 | 0,00 | ||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 115 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 4 413 | −91,30 | 115 | −91,39 | ||||

| 2025-08-04 | 13F | Amplius Wealth Advisors, LLC | 10 840 | 0,00 | 283 | −0,70 | ||||

| 2025-04-15 | 13F | Simplicity Wealth,LLC | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Hilltop National Bank | 705 | 18 | ||||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 57 685 | −28,51 | 1 508 | −29,04 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 1 359 | 36 | ||||||

| 2025-05-06 | 13F | WT Wealth Management | 23 682 | 38,43 | 624 | 37,22 | ||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 3 000 | 0,00 | 78 | −1,27 | ||||

| 2025-08-13 | 13F | Barclays Plc | 0 | −100,00 | 0 | |||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 10 800 | 0,00 | 282 | −0,70 | ||||

| 2025-08-11 | 13F | Duff & Phelps Investment Management Co | 20 525 | 130,62 | 537 | 129,06 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 219 | 6 | ||||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 30 221 | 40,96 | 790 | 40,07 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 60 800 | 10,75 | 1 590 | 9,89 | |||

| 2025-07-07 | 13F | Park Edge Advisors, LLC | 11 554 | −17,08 | 302 | −17,71 | ||||

| 2025-06-27 | NP | GMOM - Cambria Global Momentum ETF | 228 998 | −6,32 | 6 139 | −9,01 | ||||

| 2025-08-25 | NP | MAINSTAY VP FUNDS TRUST - MainStay VP IQ Hedge Multi-Strategy Portfolio Initial Class | 179 800 | −19,90 | 4 702 | −20,48 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 25 881 | 1 | ||||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 483 845 | 11,17 | 12 653 | 10,37 | ||||

| 2025-08-04 | 13F | Creekmur Asset Management LLC | 399 | −0,25 | 10 | 0,00 | ||||

| 2025-08-06 | 13F | Adviser Investments LLC | 12 583 | 0,00 | 329 | −0,60 | ||||

| 2025-08-07 | 13F | Guardian Partners Inc. | 26 096 | 24,55 | 677 | 19,65 | ||||

| 2025-04-25 | 13F | Perissos Private Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | Savior LLC | 64 845 | 10,12 | 1 696 | 9,28 | ||||

| 2025-05-15 | 13F | IHT Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Spire Wealth Management | 46 728 | 1,08 | 1 222 | 0,33 | ||||

| 2025-05-09 | 13F | Plan Group Financial, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 31 121 | −19,29 | 814 | −19,90 | ||||

| 2025-07-17 | 13F | Vermillion Wealth Management, Inc. | 2 061 | 0,00 | 54 | −1,85 | ||||

| 2025-08-05 | 13F | Key FInancial Inc | 1 860 | 0,00 | 49 | 0,00 | ||||

| 2025-08-01 | 13F | Solstein Capital, LLC | 20 523 | 0,00 | 537 | −0,74 | ||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 87 229 | 48,54 | 2 281 | 47,54 | ||||

| 2025-08-14 | 13F | Comerica Bank | 5 547 | 0,00 | 145 | −0,68 | ||||

| 2025-08-12 | 13F | Weaver Consulting Group | 10 640 | 0,00 | 278 | −0,71 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 22 772 | 107,83 | 595 | 106,60 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 1 486 | 0,00 | 39 | −2,56 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 0 | −100,00 | 0 | |||||

| 2025-04-28 | 13F | Heritage Oak Wealth Advisors Llc | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 709 984 | −33,66 | 18 566 | −34,13 | ||||

| 2025-07-10 | 13F | Clare Market Investments LLC | 15 915 | 14,99 | 416 | 14,29 | ||||

| 2025-07-16 | 13F | BOS Asset Management, LLC | 8 489 | 0,00 | 222 | −0,90 | ||||

| 2025-08-26 | NP | PDPAX - Virtus Rampart Alternatives Diversifier Fund Class A | 20 525 | 130,62 | 537 | 129,06 | ||||

| 2025-08-08 | 13F | Citizens Financial Group Inc/ri | 121 676 | −0,58 | 3 182 | −1,30 | ||||

| 2025-08-13 | 13F | 1832 Asset Management L.P. | 555 547 | 8,46 | 14 528 | 7,67 | ||||

| 2025-08-14 | 13F | Ancora Advisors, LLC | 100 | 0,00 | 3 | 0,00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 698 437 | −0,98 | 18 264 | −1,69 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 125 | 3 | ||||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 471 132 | 0,30 | 12 320 | −0,42 | ||||

| 2025-08-13 | 13F | M Holdings Securities, Inc. | 16 654 | 0 | ||||||

| 2025-05-12 | 13F | Kohmann Bosshard Financial Services, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 30 905 | −0,80 | 808 | −1,59 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 111 102 | −3,23 | 2 905 | −3,94 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 33 539 | 9,81 | 1 | |||||

| 2025-08-05 | 13F | Intellectus Partners, LLC | 33 345 | 0,00 | 872 | −0,80 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 98 219 | −10,32 | 2 568 | −10,96 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 22 | 22,22 | 1 | |||||

| 2025-07-09 | 13F | Camelot Technology Advisors, Inc. | 25 274 | −11,95 | 661 | −12,70 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 247 | 6 | ||||||

| 2025-08-08 | 13F | Kingsview Wealth Management, LLC | 10 649 | −10,95 | 278 | −11,46 | ||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 500 | 0,00 | 13 | 0,00 | ||||

| 2025-06-25 | NP | QAI - IQ Hedge Multi-Strategy Tracker ETF | 606 448 | −14,25 | 16 259 | −16,71 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 44 250 | 32,73 | 1 157 | 30,59 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 27 227 | 10,63 | 712 | 9,72 | ||||

| 2025-06-27 | NP | TRTY - Cambria Trinity ETF | 79 925 | −3,39 | 2 143 | −6,18 | ||||

| 2025-05-14 | 13F | Susquehanna International Group, Llp | Put | 0 | −100,00 | 0 | −100,00 |