Grundläggande statistik

| Institutionella aktier (lång) | 3 427 138 - 18,72% (ex 13D/G) - change of 0,04MM shares 1,27% MRQ |

| Institutionellt värde (lång) | $ 258 137 USD ($1000) |

Institutionellt ägande och aktieägare

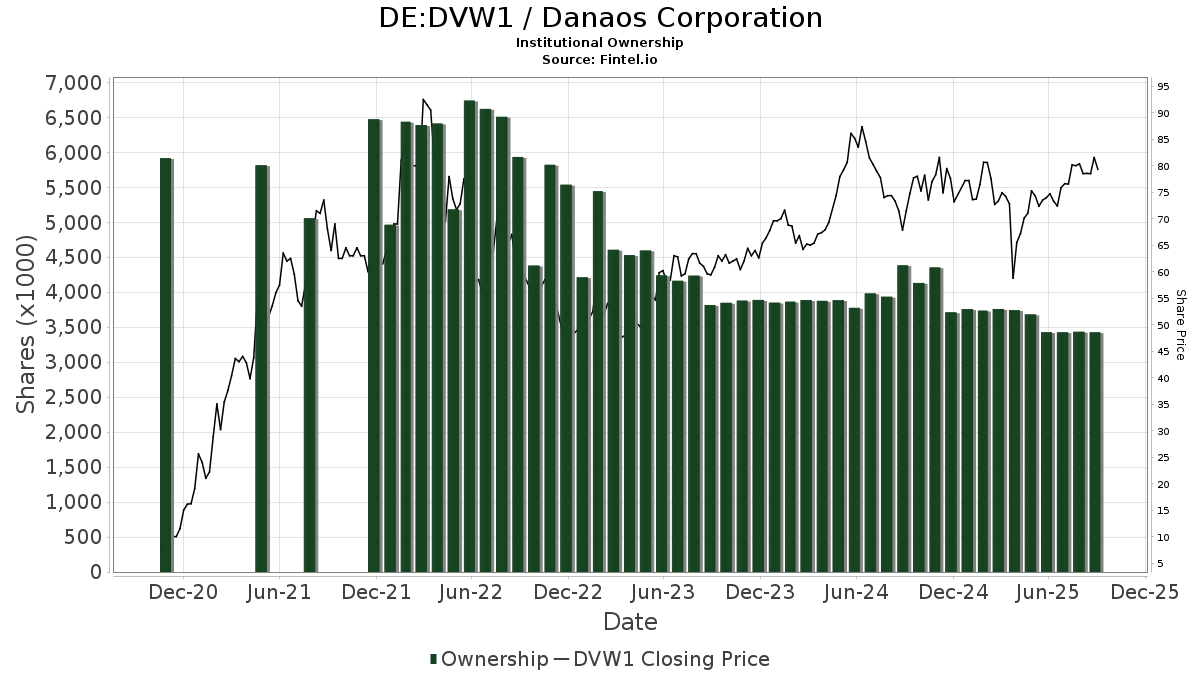

Danaos Corporation (DE:DVW1) har 130 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 3,428,810 aktier. Största aktieägare inkluderar Ion Asset Management Ltd., RBF Capital, LLC, Acadian Asset Management Llc, Arrowstreet Capital, Limited Partnership, No Street GP LP, Morgan Stanley, Susquehanna International Group, Llp, Susquehanna International Group, Llp, Jpmorgan Chase & Co, and Commonwealth Equity Services, Llc .

Danaos Corporation (DB:DVW1) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 22, 2025 is 78,30 / share. Previously, on September 24, 2024, the share price was 73,30 / share. This represents an increase of 6,82% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

AI+ Ask Fintel’s AI assistant about Danaos Corporation.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 648 | −88,74 | 56 | −87,75 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | MAI Capital Management | 179 | 15 | ||||||

| 2025-08-04 | 13F | Spire Wealth Management | 28 | 2 | ||||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 22 319 | −14,95 | 1 925 | −7,54 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 16 848 | −7,58 | 1 453 | 2,18 | ||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 327 | 4,81 | 28 | 16,67 | ||||

| 2025-08-28 | NP | CPAEX - Counterpoint Tactical Equity Fund Class A Shares | 4 636 | 400 | ||||||

| 2025-05-14 | 13F | Peak6 Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 38 100 | 10,43 | 3 286 | 22,03 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 95 707 | 153,07 | 8 254 | 179,76 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 84 500 | 262,66 | 7 287 | 300,83 | |||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 9 202 | 0,00 | 794 | 10,45 | ||||

| 2025-08-14 | 13F | State Street Corp | 16 348 | −21,98 | 1 410 | −13,77 | ||||

| 2025-08-19 | 13F | State of Wyoming | 2 128 | 205,31 | 184 | 238,89 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 2 800 | 3,70 | 245 | 14,02 | |||

| 2025-08-14 | 13F | CastleKnight Management LP | 5 100 | −32,89 | 440 | −25,97 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 2 505 | 216 | ||||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 45 497 | 97,00 | 3 924 | 117,70 | ||||

| 2025-08-27 | NP | TIFF INVESTMENT PROGRAM - TIFF Multi-Asset Fund | Short | −1 672 | −144 | |||||

| 2025-04-24 | NP | FNDB - Schwab Fundamental U.S. Broad Market Index ETF This fund is a listed as child fund of Charles Schwab Investment Management Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 96 | −43,20 | 8 | −46,15 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 11 319 | 139,91 | 976 | 165,22 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 3 200 | 276 | ||||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 1 250 | 107 | ||||||

| 2025-05-13 | 13F | Clear Street Markets Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Advisory Research Inc | 36 815 | 50,42 | 3 175 | 66,27 | ||||

| 2025-07-10 | 13F | Redhawk Wealth Advisors, Inc. | 12 594 | 1,49 | 1 086 | 12,19 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 742 | 64 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 82 834 | 39,83 | 7 144 | 54,54 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 7 850 | −36,65 | 677 | −30,02 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 7 940 | 695 | ||||||

| 2025-04-17 | 13F | FNY Investment Advisers, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 18 900 | 158,90 | 1 653 | 185,49 | |||

| 2025-08-12 | 13F | Legal & General Group Plc | 145 | 0,00 | 13 | 9,09 | ||||

| 2025-08-13 | 13F | Corsair Capital Management, L.p. | 14 000 | 180,00 | 1 207 | 209,49 | ||||

| 2025-08-13 | 13F | Centiva Capital, LP | 4 226 | 364 | ||||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 3 289 | 0,03 | 284 | 10,55 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 0 | −100,00 | 0 | |||||

| 2025-04-24 | 13F | U S Global Investors Inc | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 69 863 | 0,72 | 6 | 20,00 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 42 100 | 20,63 | 3 631 | 33,31 | ||||

| 2025-08-13 | 13F | Victory Financial Group, Llc | 4 178 | 360 | ||||||

| 2025-07-18 | 13F | Founders Capital Management | 900 | 0,00 | 78 | 10,00 | ||||

| 2025-08-05 | 13F | GHP Investment Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 282 655 | −5,64 | 24 376 | 4,29 | ||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | Indiana Trust & Investment Management CO | 100 | 0,00 | 9 | 14,29 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Creative Planning | 5 989 | −27,11 | 516 | −19,50 | ||||

| 2025-04-29 | 13F | Envestnet Asset Management Inc | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Walleye Trading LLC | Call | 0 | −100,00 | 0 | ||||

| 2025-05-14 | 13F | Walleye Trading LLC | Put | 0 | −100,00 | 0 | ||||

| 2025-08-08 | 13F | Smithfield Trust Co | 160 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | Rhumbline Advisers | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 3 057 | 264 | ||||||

| 2025-08-04 | 13F | Assetmark, Inc | 468 | 15 500,00 | 40 | |||||

| 2025-08-13 | 13F | Natixis Advisors, L.p. | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 52 | −45,83 | 4 | −42,86 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 71 | −6,58 | 6 | 20,00 | ||||

| 2025-05-29 | NP | OAIEX - Optimum International Fund Class A | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-04-22 | 13F | TrueMark Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 37 290 | 27,07 | 3 218 | 40,46 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 57 598 | −13,09 | 4 967 | −3,95 | ||||

| 2025-08-08 | 13F | Pinney & Scofield, Inc. | 255 | 0,00 | 22 | 10,53 | ||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 126 | 0,00 | 11 | 11,11 | ||||

| 2025-07-08 | 13F | Ballew Advisors, Inc | 3 001 | 0,37 | 263 | 20,09 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-13 | 13F | Jump Financial, LLC | 19 500 | 1 682 | ||||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 184 | −17,86 | 16 | −11,76 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 853 | 11,80 | 74 | 23,73 | ||||

| 2025-08-13 | 13F | Aristides Capital LLC | 2 856 | 246 | ||||||

| 2025-08-28 | NP | SIEMX - SIT EMERGING MARKETS EQUITY FUND - CLASS F, effective 1-31-2017 (formerly Class A) | 4 644 | −43,70 | 400 | −37,79 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 51 008 | −3,12 | 4 399 | 7,06 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 3 797 | −2,99 | 327 | 7,57 | ||||

| 2025-07-30 | NP | DEEP - Roundhill Acquirers Deep Value ETF | 3 128 | −17,10 | 267 | −10,14 | ||||

| 2025-05-16 | 13F/A | Kestra Investment Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Hi-Line Capital Management, LLC | 28 768 | 2 481 | ||||||

| 2025-08-14 | 13F | RBF Capital, LLC | 418 015 | 0,00 | 36 050 | 10,52 | ||||

| 2025-08-06 | 13F | Malaga Cove Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 0 | −100,00 | 0 | |||||

| 2025-05-09 | 13F | New Age Alpha Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 30 299 | −18,44 | 2 613 | −9,87 | ||||

| 2025-08-05 | 13F | Harel Insurance Investments & Financial Services Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Hrt Financial Lp | 18 992 | 115,16 | 2 | |||||

| 2025-07-16 | 13F | Signaturefd, Llc | 905 | 12,98 | 78 | 25,81 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 18 938 | −60,08 | 1 633 | −55,88 | ||||

| 2025-08-26 | NP | BOAT - SonicShares Global Shipping ETF | 7 850 | 8,43 | 677 | 19,86 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 65 | 6 | ||||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | −100,00 | 0 | |||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Sei Investments Co | 11 024 | −7,59 | 951 | 2,15 | ||||

| 2025-07-25 | 13F | JustInvest LLC | 2 578 | 222 | ||||||

| 2025-07-11 | 13F | Kingstone Capital Partners Texas, LLC | 26 400 | 2 | ||||||

| 2025-08-07 | 13F | Allworth Financial LP | 1 512 | −22,10 | 130 | −16,67 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 13 092 | 1 129 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 5 400 | 5 300,00 | 0 | ||||

| 2025-08-28 | NP | WAGNX - Pabrai Wagons Fund Retail Class | 16 660 | 13,33 | 1 437 | 25,20 | ||||

| 2025-05-09 | 13F | Headlands Technologies LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Bastion Asset Management Inc. | 37 514 | 50,61 | 3 217 | 59,65 | ||||

| 2025-05-09 | 13F | Charles Schwab Investment Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Voloridge Investment Management, Llc | 66 192 | −27,95 | 5 708 | −20,37 | ||||

| 2025-04-28 | 13F | First Horizon Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 1 123 | −17,18 | 97 | −8,57 | ||||

| 2025-08-08 | 13F | Commonwealth Of Pennsylvania Public School Empls Retrmt Sys | 9 071 | 0,00 | 782 | 10,61 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 0 | −100,00 | 0 | |||||

| 2025-04-24 | NP | FNDA - Schwab Fundamental U.S. Small Company Index ETF This fund is a listed as child fund of Charles Schwab Investment Management Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 14 341 | −49,34 | 1 127 | −49,84 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 20 | −25,93 | 2 | −50,00 | ||||

| 2025-08-11 | 13F | Inspire Advisors, LLC | 9 666 | −18,93 | 834 | −10,43 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 50 951 | 271,55 | 4 394 | 310,65 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 23 411 | 719,14 | 2 019 | 804,93 | ||||

| 2025-07-29 | 13F | Morgan Dempsey Capital Management Llc | 4 564 | 41,70 | 394 | 56,57 | ||||

| 2025-08-28 | NP | SEEM - SEI Select Emerging Markets Equity ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-29 | 13F | Millburn Ridgefield Corp | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Pacer Advisors, Inc. | 6 | −50,00 | 1 | |||||

| 2025-08-28 | NP | EWX - SPDR(R) S&P(R) EMERGING MARKETS SMALL CAP ETF | 6 980 | 0,00 | 602 | 10,48 | ||||

| 2025-05-08 | 13F | Moors & Cabot, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 121 | 37,50 | 10 | 66,67 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 41 000 | 791,30 | 3 536 | 887,43 | |||

| 2025-08-14 | 13F | Jane Street Group, Llc | 10 446 | −55,31 | 901 | −50,63 | ||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 7 092 | −31,15 | 612 | −23,91 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 4 200 | 362 | |||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 2 773 | −9,76 | 239 | 0,00 | ||||

| 2025-08-15 | 13F | WealthCollab, LLC | 522 | −7,94 | 45 | 2,27 | ||||

| 2025-05-14 | 13F | Walleye Capital LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | GWM Advisors LLC | 2 605 | 23 581,82 | 225 | |||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 2 | 0,00 | 0 | |||||

| 2025-05-15 | 13F | Millennium Management Llc | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-07-14 | 13F | Counterpoint Mutual Funds LLC | 4 636 | 400 | ||||||

| 2025-05-30 | NP | TFPN - Blueprint Chesapeake Multi-Asset Trend ETF | 5 151 | −9,41 | 402 | −11,87 | ||||

| 2025-05-14 | 13F | Walleye Capital LLC | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-05-05 | 13F | IFP Advisors, Inc | 0 | −100,00 | 0 | |||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 164 | −7,87 | 13 | −14,29 | ||||

| 2025-08-14 | 13F | PDT Partners, LLC | 10 640 | 0,00 | 918 | 10,48 | ||||

| 2025-07-15 | 13F | Ballentine Partners, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 775 | 67 | ||||||

| 2025-04-29 | 13F | Td Private Client Wealth Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 4 553 | −52,35 | 393 | −47,38 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-05-22 | NP | MXENX - Great-West Emerging Markets Equity Fund Institutional Class | 10 840 | −3,51 | 846 | −6,01 | ||||

| 2025-05-30 | NP | New Age Alpha Funds Trust - NAA Opportunity Fund Class C | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Aigen Investment Management, Lp | 3 286 | 283 | ||||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 2 727 | 11,08 | 0 | |||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 0 | −100,00 | 0 | |||||

| 2025-03-26 | NP | SFSNX - Schwab Fundamental US Small Company Index Fund Institutional Shares | 2 692 | −51,01 | 213 | −52,67 | ||||

| 2025-08-07 | 13F | Commerce Bank | 2 360 | 204 | ||||||

| 2025-06-30 | NP | PRFZ - Invesco FTSE RAFI US 1500 Small-Mid ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 28 372 | −26,70 | 2 302 | −24,95 | ||||

| 2025-08-14 | 13F | Petrus Trust Company, LTA | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 48 | 0,00 | 4 | 33,33 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 8 395 | −58,68 | 724 | −54,32 | ||||

| 2025-08-07 | 13F | Readystate Asset Management Lp | 6 377 | 550 | ||||||

| 2025-08-07 | 13F | PFG Advisors | 6 637 | 8,18 | 572 | 19,67 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 15 | 1 | ||||||

| 2025-04-24 | 13F | Wingate Wealth Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-06-30 | NP | EELV - Invesco S&P Emerging Markets Low Volatility ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 17 929 | −14,86 | 1 454 | −12,83 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 33 944 | −26,55 | 2 927 | −18,83 | ||||

| 2025-05-28 | NP | LEAIX - Lazard Emerging Markets Equity Advantage Portfolio Institutional Shares | 3 192 | 23,10 | 249 | 20,29 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 3 919 | −75,69 | 338 | −73,21 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 3 000 | 259 | |||||

| 2025-03-28 | NP | HAOSX - Harbor Overseas Fund Institutional Class | 49 | −98,61 | 4 | −98,96 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 348 | 30 | ||||||

| 2025-08-11 | 13F | Semanteon Capital Management, LP | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | SPEM - SPDR(R) Portfolio Emerging Markets ETF | 7 526 | 2,08 | 649 | 12,87 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 100 | −53,92 | 9 | −50,00 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 188 482 | 16,05 | 16 255 | 28,26 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 305 103 | −11,62 | 26 | 0,00 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 272 | 4 433,33 | 23 | |||||

| 2025-07-18 | 13F | Westhampton Capital, LLC | 4 255 | 0,00 | 367 | 10,24 | ||||

| 2025-05-14 | 13F | Peak6 Llc | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-06-30 | NP | SHPP - Pacer Industrials and Logistics ETF | 12 | −7,69 | 1 | −100,00 | ||||

| 2025-08-07 | 13F | Pinnacle Holdings, LLC | 645 | −36,20 | 56 | −29,49 | ||||

| 2025-05-14 | 13F | Peak6 Llc | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Royal Bank Of Canada | 301 | 34,98 | 26 | 52,94 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 378 | 26,00 | 33 | 68,42 | ||||

| 2025-08-14 | 13F | No Street GP LP | 250 000 | 0,00 | 21 560 | 10,52 | ||||

| 2025-05-05 | 13F | Eagle Bay Advisors LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 3 800 | 153,33 | 328 | 179,49 | |||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 2 921 | −94,08 | 252 | −93,48 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 40 729 | 46,51 | 3 512 | 61,92 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 5 900 | −56,87 | 509 | −52,39 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 24 500 | 6,06 | 2 113 | 17,20 | |||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 8 430 | 1 | ||||||

| 2025-08-08 | 13F | Fiera Capital Corp | 15 857 | 0,00 | 1 368 | 10,51 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 4 599 | −60,37 | 397 | −56,24 | ||||

| 2025-08-15 | 13F | Ion Asset Management Ltd. | 654 308 | 15,46 | 56 428 | 27,61 | ||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 14 104 | −4,61 | 1 216 | 5,46 |

Other Listings

| US:DAC | 92,66 US$ |