Grundläggande statistik

| Institutionella aktier (lång) | 86 994 252 - 89,59% (ex 13D/G) - change of 2,20MM shares 2,60% MRQ |

| Institutionellt värde (lång) | $ 754 412 USD ($1000) |

Institutionellt ägande och aktieägare

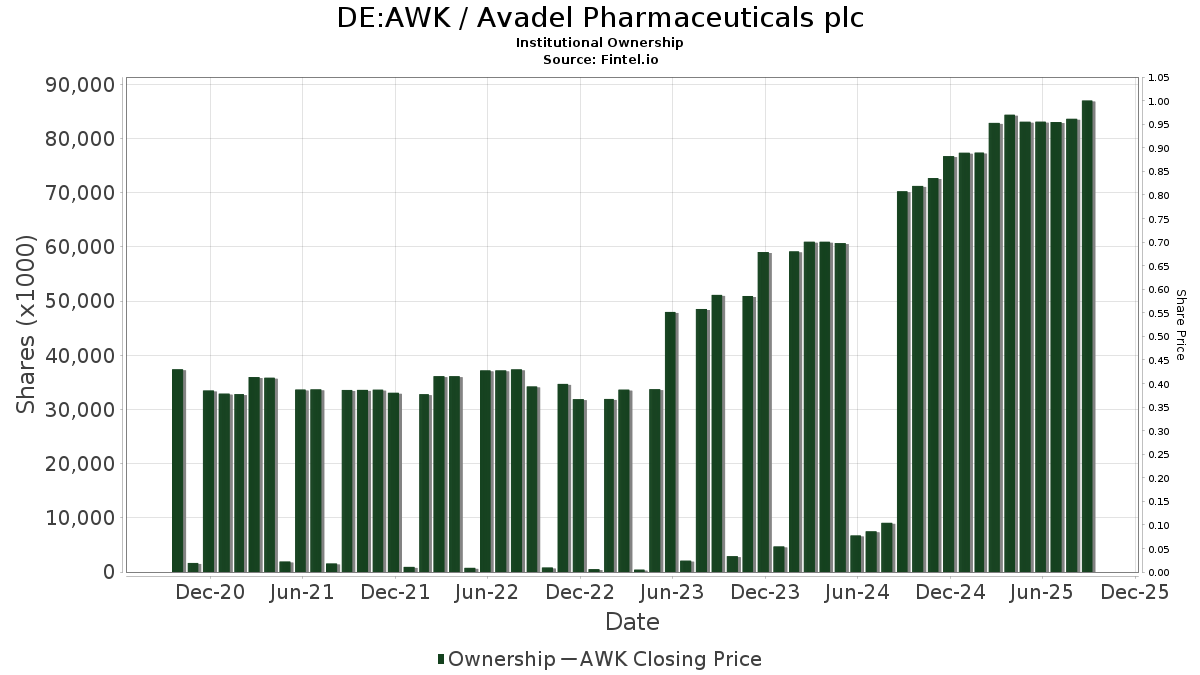

Avadel Pharmaceuticals plc (DE:AWK) har 213 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 86,994,252 aktier. Största aktieägare inkluderar Janus Henderson Group Plc, BlackRock, Inc., Brandes Investment Partners, Lp, Two Seas Capital LP, Vanguard Group Inc, Gendell Jeffrey L, Polar Capital Holdings Plc, VTSMX - Vanguard Total Stock Market Index Fund Investor Shares, Vivo Capital, LLC, and Wealth Effects Llc .

Avadel Pharmaceuticals plc (DB:AWK) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 8 733 | −66,22 | 77 | −61,88 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 49 037 | −1,03 | 434 | 11,89 | ||||

| 2025-08-11 | 13F | Mach-1 Financial Group, Inc. | 37 067 | 328 | ||||||

| 2025-08-12 | 13F | Journey Strategic Wealth Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-08-28 | 13F | China Universal Asset Management Co., Ltd. | 19 430 | 0,53 | 172 | 13,25 | ||||

| 2025-08-06 | 13F | Modera Wealth Management, LLC | 558 972 | −0,00 | 4 947 | 13,03 | ||||

| 2025-08-12 | 13F | Swiss National Bank | 168 000 | 0,00 | 1 487 | 13,00 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 111 889 | −3,52 | 990 | 9,03 | ||||

| 2025-08-14 | 13F | Tang Capital Management Llc | 2 097 500 | 0,00 | 18 563 | 13,02 | ||||

| 2025-08-13 | 13F | Kennedy Capital Management, Inc. | 981 271 | 30,13 | 8 684 | 47,09 | ||||

| 2025-04-15 | 13F | SG Americas Securities, LLC | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | KCXIX - Knights of Columbus U.S. All Cap Index Fund I Shares | 381 | 7,02 | 3 | 50,00 | ||||

| 2025-05-12 | 13F | National Bank Of Canada /fi/ | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-15 | 13F | Schonfeld Strategic Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Krensavage Asset Management, LLC | 958 877 | 0,93 | 8 | 14,29 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Diametric Capital, LP | 77 523 | 31,54 | 686 | 48,81 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 40 637 | −44,92 | 360 | −37,78 | ||||

| 2025-08-08 | 13F | Thoroughbred Financial Services, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Voya Investment Management Llc | 25 327 | −1,88 | 224 | 10,89 | ||||

| 2025-08-14 | 13F | Aster Capital Management (DIFC) Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Samsara BioCapital, LLC | 675 504 | −30,18 | 5 978 | −21,08 | ||||

| 2025-08-12 | 13F | Trexquant Investment LP | 483 400 | 274,21 | 4 278 | 323,15 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 24 177 | −7,09 | 214 | 4,93 | ||||

| 2025-05-13 | 13F | HighTower Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-04-16 | 13F | CVA Family Office, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 3 737 | 15,91 | 33 | 32,00 | ||||

| 2025-08-27 | NP | VBINX - Vanguard Balanced Index Fund Investor Shares | 54 321 | 0,00 | 481 | 12,94 | ||||

| 2025-08-12 | 13F | MAI Capital Management | Call | 27 | 13,04 | |||||

| 2025-08-14 | 13F | Hrt Financial Lp | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Hartford Financial Management Inc. | 1 000 | −33,33 | 9 | −27,27 | ||||

| 2025-08-08 | 13F/A | Sterling Capital Management LLC | 215 | 126,32 | 2 | |||||

| 2025-08-14 | 13F | California State Teachers Retirement System | 80 252 | −1,47 | 710 | 11,46 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 0 | 2 | ||||||

| 2025-08-29 | NP | JAGLX - Janus Henderson Global Life Sciences Fund Class T | 2 308 769 | −6,97 | 20 433 | 5,15 | ||||

| 2025-08-14 | 13F | State Of Wisconsin Investment Board | 223 038 | −0,95 | 1 974 | 11,91 | ||||

| 2025-08-07 | 13F | Los Angeles Capital Management Llc | 79 114 | 700 | ||||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 8 795 | 217,51 | 78 | 266,67 | ||||

| 2025-06-27 | NP | BIVIX - Invenomic Fund Institutional Class shares | 115 167 | −6,93 | 1 024 | 4,71 | ||||

| 2025-06-23 | NP | UAPIX - Ultrasmall-cap Profund Investor Class | 945 | −29,84 | 8 | −20,00 | ||||

| 2025-05-28 | NP | QCEQRX - Equity Index Account Class R1 | 43 102 | 0,00 | 337 | −25,61 | ||||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 50 336 | 445 | ||||||

| 2025-08-26 | NP | BSCAX - BRANDES SMALL CAP VALUE FUND Class A | 184 355 | 20,16 | 1 632 | 35,80 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 134 221 | −49,56 | 1 188 | −43,01 | ||||

| 2025-04-30 | 13F | Cornerstone Planning Group LLC | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 17 079 | −8,98 | 0 | |||||

| 2025-08-14 | 13F | Polar Capital Holdings Plc | 3 999 338 | −8,19 | 35 394 | 3,77 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 46 | 70,37 | 0 | |||||

| 2025-08-14 | 13F | Lion Point Capital, LP | 98 700 | 0,00 | 873 | 13,08 | ||||

| 2025-07-24 | NP | ESML - iShares ESG MSCI USA Small-Cap ETF | 116 342 | 35,81 | 1 060 | 56,43 | ||||

| 2025-05-15 | 13F | Parallax Volatility Advisers, L.P. | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-26 | NP | TRSYX - T. Rowe Price Small-Cap Index Fund This fund is a listed as child fund of Price T Rowe Associates Inc /md/ and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 8 804 | 16,69 | 78 | 30,51 | ||||

| 2025-05-15 | 13F | Parallax Volatility Advisers, L.P. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 0 | −100,00 | 0 | ||||

| 2025-08-07 | 13F | Altium Capital Management LP | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Bridgefront Capital, LLC | 27 464 | 243 | ||||||

| 2025-08-07 | 13F | 1620 Investment Advisors, Inc. | 290 | −71,00 | 3 | −71,43 | ||||

| 2025-08-14 | 13F | Man Group plc | 57 931 | 101,28 | 513 | 127,56 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 23 246 | 115,46 | 206 | 144,05 | ||||

| 2025-08-07 | 13F | Zurcher Kantonalbank (Zurich Cantonalbank) | 37 707 | 0,00 | 334 | 12,88 | ||||

| 2025-08-22 | NP | KGROX - KENNEDY CAPITAL SMALL CAP GROWTH FUND Institutional Class Shares | 274 | 28,64 | 2 | 100,00 | ||||

| 2025-08-14 | 13F | Fmr Llc | 145 737 | −34,16 | 1 290 | −25,62 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 105 | 1 | ||||||

| 2025-05-15 | 13F | Cinctive Capital Management LP | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 8 012 | −1,38 | 71 | 11,11 | ||||

| 2025-08-12 | 13F | Handelsbanken Fonder AB | 34 100 | 0 | ||||||

| 2025-08-13 | 13F | MetLife Investment Management, LLC | 55 961 | 0,00 | 495 | 13,01 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 253 600 | −25,63 | 2 244 | −15,96 | ||||

| 2025-08-13 | 13F | Federated Hermes, Inc. | 1 175 | 10 | ||||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 29 699 | −48,33 | 263 | −41,78 | ||||

| 2025-08-04 | 13F | Atria Investments Llc | 16 841 | −51,33 | 149 | −44,81 | ||||

| 2025-08-14 | 13F | Occudo Quantitative Strategies Lp | 14 046 | 124 | ||||||

| 2025-08-28 | NP | LYFCX - AlphaCentric LifeSci Healthcare Fund Class C | 32 731 | 21,11 | 290 | 36,97 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 35 621 | 315 | ||||||

| 2025-08-01 | 13F | Chilton Capital Management Llc | 1 500 | −50,00 | 13 | −43,48 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | Put | 11 600 | 0,00 | 103 | 13,33 | |||

| 2025-07-15 | 13F | Wealth Effects Llc | 2 354 822 | −0,60 | 20 840 | 12,35 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 403 833 | 7,62 | 3 574 | 21,61 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 703 282 | 39,32 | 6 224 | 57,49 | ||||

| 2025-08-08 | 13F | Police & Firemen's Retirement System of New Jersey | 20 512 | 0,00 | 182 | 13,13 | ||||

| 2025-05-15 | 13F | Shay Capital LLC | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Allworth Financial LP | 116 | 300,00 | 1 | |||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 437 555 | −11,55 | 3 872 | −0,03 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Invenomic Capital Management LP | 802 994 | 252,15 | 7 106 | 298,10 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 119 957 | 1 062 | ||||||

| 2025-07-29 | 13F | Virginia Retirement Systems Et Al | 19 900 | 13,71 | 176 | 28,47 | ||||

| 2025-08-13 | 13F | Summit Financial, LLC | 69 232 | 613 | ||||||

| 2025-08-11 | 13F | Vanguard Group Inc | 5 564 259 | 42,50 | 49 244 | 61,07 | ||||

| 2025-06-23 | NP | PPNMX - SmallCap Growth Fund I R-3 | 9 269 | −4,31 | 82 | 7,89 | ||||

| 2025-08-11 | 13F | Kazazian Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-04-25 | NP | VFMO - Vanguard U.S. Momentum Factor ETF ETF Shares | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Dynamic Technology Lab Private Ltd | 17 439 | 18,81 | 154 | 33,91 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 22 823 | 30,78 | 202 | 47,79 | ||||

| 2025-08-14 | 13F | Iridian Asset Management Llc/ct | 249 586 | 0,00 | 2 209 | 13,00 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 2 485 | 39,61 | 0 | |||||

| 2025-08-19 | 13F | State of Wyoming | 20 813 | −50,12 | 184 | −43,56 | ||||

| 2025-05-15 | 13F | Braidwell Lp | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 12 000 | 0,00 | 106 | 13,98 | ||||

| 2025-04-18 | 13F | Bfsg, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 16 318 | −43,10 | 144 | −35,71 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 181 | 2 | ||||||

| 2025-08-27 | NP | VMNFX - Vanguard Market Neutral Fund Investor Shares This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | Short | −58 279 | −31,31 | −516 | −22,44 | |||

| 2025-08-11 | 13F | Principal Securities, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-08 | 13F/A | Salem Investment Counselors Inc | 450 | 0,00 | 4 | 0,00 | ||||

| 2025-08-14 | 13F | J. Goldman & Co LP | 263 363 | 21,93 | 2 331 | 37,79 | ||||

| 2025-08-14 | 13F | J. Goldman & Co LP | Call | 14 300 | 127 | |||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | GWM Advisors LLC | 121 | 1 | ||||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 48 950 | −10,81 | 433 | 0,93 | ||||

| 2025-05-14 | 13F | First Trust Advisors Lp | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 26 600 | 0,00 | 0 | |||||

| 2025-08-14 | 13F/A | Barclays Plc | 182 858 | −45,40 | 2 | −50,00 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 7 393 | 65 | ||||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 274 | 26,85 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Clear Street Markets Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 38 306 | 339 | ||||||

| 2025-08-12 | 13F | Rhumbline Advisers | 131 978 | 3,90 | 1 168 | 17,40 | ||||

| 2025-05-13 | 13F | HighTower Advisors, LLC | Call | 0 | −100,00 | 0 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 0 | −100,00 | 0 | |||||

| 2025-06-27 | NP | RSSL - Global X Russell 2000 ETF | 56 126 | 6,59 | 499 | 20,00 | ||||

| 2025-05-15 | 13F | Checkpoint Capital L.P. | 0 | −100,00 | 0 | |||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 576 | −34,92 | 5 | −16,67 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 30 700 | 186,92 | 272 | 226,51 | ||||

| 2025-08-27 | NP | BBGSX - Bridge Builder Small/Mid Cap Growth Fund | 18 471 | 3,21 | 163 | 16,43 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 421 284 | −42,12 | 3 728 | −34,59 | ||||

| 2025-06-26 | NP | TISBX - TIAA-CREF Small-Cap Blend Index Fund Institutional Class | 109 973 | −8,74 | 978 | 2,73 | ||||

| 2025-07-23 | 13F | Klp Kapitalforvaltning As | 17 000 | −17,87 | 150 | −7,41 | ||||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 12 147 | 16,54 | 108 | 33,33 | ||||

| 2025-05-15 | 13F | Atom Investors LP | 0 | −100,00 | 0 | |||||

| 2025-07-09 | 13F | Aaron Wealth Advisors LLC | 23 597 | 4,22 | 209 | 17,51 | ||||

| 2025-08-08 | 13F | Intech Investment Management Llc | 58 466 | −11,80 | 517 | −0,39 | ||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | Signaturefd, Llc | 815 | 36,97 | 7 | 75,00 | ||||

| 2025-08-13 | 13F | Jackson Creek Investment Advisors LLC | 44 230 | 0 | ||||||

| 2025-07-22 | 13F | Gf Fund Management Co. Ltd. | 2 467 | 0,00 | 22 | 10,53 | ||||

| 2025-08-13 | 13F | Centiva Capital, LP | Put | 0 | −100,00 | 0 | ||||

| 2025-07-29 | NP | VRTIX - Vanguard Russell 2000 Index Fund Institutional Shares | 465 600 | 9,70 | 4 242 | 26,33 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-08-13 | 13F | Centiva Capital, LP | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 786 446 | 247,31 | 6 960 | 292,55 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 91 444 | 8,68 | 809 | 22,95 | ||||

| 2025-08-08 | 13F | Quinn Opportunity Partners LLC | 30 100 | 0,00 | 266 | 13,19 | ||||

| 2025-07-30 | 13F | Exencial Wealth Advisors, Llc | 10 485 | 0,25 | 93 | 13,58 | ||||

| 2025-08-26 | NP | NORTHERN FUNDS - NORTHERN SMALL CAP CORE FUND Class K | 11 307 | 100 | ||||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 0 | −100,00 | 0 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | 25 560 | −36,15 | 226 | −27,80 | ||||

| 2025-08-27 | NP | VQNPX - Vanguard Growth and Income Fund Investor Shares This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 29 500 | −7,87 | 261 | 4,40 | ||||

| 2025-05-12 | 13F | Wolverine Asset Management Llc | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-05-12 | 13F | Wolverine Asset Management Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 207 378 | 6,73 | 2 | 0,00 | ||||

| 2025-08-13 | 13F | OMERS ADMINISTRATION Corp | 39 000 | 0,00 | 345 | 13,11 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 66 554 | −2,00 | 589 | 10,92 | ||||

| 2025-07-28 | NP | IBBQ - Invesco Nasdaq Biotechnology ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 3 788 | 3,19 | 35 | 17,24 | ||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 230 | 43,75 | 2 | 100,00 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 450 | 80,00 | 4 | 100,00 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | Investors Asset Management Of Georgia Inc /ga/ /adv | 133 075 | −4,93 | 1 178 | 7,39 | ||||

| 2025-04-16 | 13F | Krilogy Financial LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Vivo Capital, LLC | 2 684 109 | 0,00 | 23 754 | 13,03 | ||||

| 2025-05-15 | 13F | Advisory Services Network, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Arizona State Retirement System | 25 353 | 2,05 | 224 | 15,46 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-07-25 | NP | PMSAX - Global Multi-Strategy Fund Class A | 157 | −8,72 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 273 736 | 81,94 | 2 423 | 105,60 | ||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 7 693 | 0,00 | 68 | 13,33 | ||||

| 2025-08-26 | NP | BISAX - BRANDES INTERNATIONAL SMALL CAP EQUITY FUND Class A | 1 403 427 | 64,23 | 12 420 | 85,62 | ||||

| 2025-08-14 | 13F | AWM Investment Company, Inc. | 316 189 | 671,19 | 2 798 | 771,65 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 1 542 | 170,05 | 14 | 225,00 | ||||

| 2025-07-25 | 13F | Stephens Consulting, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | HAP Trading, LLC | 42 832 | 19,49 | 379 | 35,36 | ||||

| 2025-08-14 | 13F | Janus Henderson Group Plc | 11 132 131 | −18,10 | 98 495 | −9,50 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 30 331 | 31,43 | 268 | 48,89 | ||||

| 2025-08-27 | NP | VITNX - Vanguard Institutional Total Stock Market Index Fund Institutional Shares This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 45 222 | −10,36 | 400 | 1,27 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 748 875 | 1 407,58 | 6 628 | 1 607,99 | ||||

| 2025-08-11 | 13F | Knott David M Jr | 426 000 | 0,00 | 3 770 | 13,04 | ||||

| 2025-07-29 | NP | VRTGX - Vanguard Russell 2000 Growth Index Fund Institutional Shares | 80 838 | −4,57 | 736 | 9,85 | ||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 21 436 | 190 | ||||||

| 2025-05-19 | 13F/A | Jane Street Group, Llc | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-13 | 13F | Silverback Asset Management Llc | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 2 169 018 | 82,33 | 19 198 | 106,12 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 51 | 292,31 | 0 | |||||

| 2025-08-14 | 13F | Mpwm Advisory Solutions, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 38 939 | 9,19 | 345 | 23,30 | ||||

| 2025-08-26 | NP | TLSTX - Stock Index Fund | 1 424 | 0,00 | 13 | 9,09 | ||||

| 2025-07-22 | NP | DSMFX - Destinations Small-Mid Cap Equity Fund Class I | 2 410 | 0,00 | 22 | 10,53 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 251 839 | 7,57 | 2 229 | 21,55 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 0 | −100,00 | 0 | ||||

| 2025-07-29 | NP | SMXAX - SIIT Extended Market Index Fund - Class A | 15 200 | 0,00 | 138 | 15,00 | ||||

| 2025-08-14 | 13F | Wexford Capital Lp | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | SNTKX - Steward International Enhanced Index Fund Class A | 35 008 | 0,00 | 311 | 12,68 | ||||

| 2025-05-14 | 13F | Smartleaf Asset Management LLC | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 543 | 17,28 | 5 | 33,33 | ||||

| 2025-08-27 | NP | VEXMX - Vanguard Extended Market Index Fund Investor Shares | 1 519 447 | 13 447 | ||||||

| 2025-08-12 | 13F | BlackRock, Inc. | 6 803 399 | 24,75 | 60 210 | 41,00 | ||||

| 2025-08-14 | 13F | Dark Forest Capital Management Lp | 295 136 | 64,48 | 2 612 | 85,97 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 13 010 | −61,05 | 115 | −55,94 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-04 | 13F | Kovack Advisors, Inc. | 13 000 | 13,04 | 115 | 27,78 | ||||

| 2025-06-23 | NP | SLPIX - Small-cap Profund Investor Class | 90 | −11,76 | 1 | |||||

| 2025-08-14 | 13F | Daiwa Securities Group Inc. | 332 | 0,00 | 0 | |||||

| 2025-08-08 | 13F | King Wealth | 35 000 | 0,00 | 0 | |||||

| 2025-08-26 | NP | Profunds - Profund Vp Small-cap | 204 | −1,92 | 2 | 0,00 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 96 901 | −56,49 | 858 | −50,83 | ||||

| 2025-08-11 | 13F | Covestor Ltd | 158 | 177,19 | 0 | |||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 4 000 | 0,00 | 35 | 12,90 | ||||

| 2025-05-13 | 13F | Nations Financial Group Inc, /ia/ /adv | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 70 408 | 382,11 | 1 | |||||

| 2025-08-01 | 13F | Teacher Retirement System Of Texas | 23 442 | 0,43 | 207 | 13,74 | ||||

| 2025-08-04 | 13F | Amalgamated Bank | 3 198 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Gotham Asset Management, LLC | 50 112 | −11,14 | 443 | 0,45 | ||||

| 2025-08-07 | 13F | ProShare Advisors LLC | 21 933 | −9,94 | 194 | 2,11 | ||||

| 2025-08-28 | NP | SPWIX - Simt Small Cap Growth Fund Class I | 29 500 | 261 | ||||||

| 2025-07-29 | NP | VRTTX - Vanguard Russell 3000 Index Fund Institutional Shares | 7 651 | 0,00 | 70 | 15,00 | ||||

| 2025-08-14 | 13F | Price T Rowe Associates Inc /md/ | 44 743 | 10,89 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 1 528 317 | −31,92 | 13 526 | −23,06 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 177 000 | 14,56 | 1 566 | 29,53 | |||

| 2025-05-15 | 13F | Caption Management, LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-06-04 | 13F | Pvg Asset Management Corp | 0 | −100,00 | 0 | |||||

| 2025-07-28 | NP | MSSM - Morgan Stanley Pathway Small-Mid Cap Equity ETF | 4 495 | 22,81 | 41 | 42,86 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | Call | 7 900 | −69,85 | 70 | −66,34 | |||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Walleye Capital LLC | 71 871 | 16 931,04 | 636 | 21 100,00 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 361 | −2,43 | 3 | 50,00 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 21 756 | −65,50 | 193 | −61,05 | ||||

| 2025-04-30 | 13F | Crossmark Global Holdings, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 202 815 | 93,00 | 1 795 | 118,25 | ||||

| 2025-08-14 | 13F | Gendell Jeffrey L | 5 176 611 | −15,51 | 45 813 | −4,51 | ||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | Call | 20 200 | 0,00 | 179 | 12,66 | |||

| 2025-07-31 | 13F | Nisa Investment Advisors, Llc | 3 304 | 164,53 | 29 | 222,22 | ||||

| 2025-06-26 | NP | TIEIX - TIAA-CREF Equity Index Fund Institutional Class | 74 237 | 0,00 | 660 | 12,46 | ||||

| 2025-05-28 | NP | QCSTRX - Stock Account Class R1 | 171 200 | 1 340 | ||||||

| 2025-08-14 | 13F | Caption Management, LLC | 264 910 | 0,00 | 2 344 | 13,02 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 1 192 606 | 15,27 | 10 555 | 30,28 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 84 519 | 503,66 | 748 | 585,32 | ||||

| 2025-08-14 | 13F | Silverarc Capital Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Nuveen, LLC | 296 023 | −42,85 | 2 620 | −35,41 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 114 380 | 9,39 | 1 012 | 23,72 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 18 883 | −1,45 | 167 | 11,33 | ||||

| 2025-08-11 | 13F | Royce & Associates Lp | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 97 038 | 16,72 | 49 | −92,62 | ||||

| 2025-05-27 | NP | Columbia Funds Variable Series Trust II - Variable Portfolio - Partners Small Cap Growth Fund Class 1 | 12 045 | −0,64 | 94 | −25,98 | ||||

| 2025-08-27 | NP | VTSMX - Vanguard Total Stock Market Index Fund Investor Shares | 2 938 217 | 3,59 | 26 003 | 17,09 | ||||

| 2025-08-13 | 13F | Silverback Asset Management Llc | 130 000 | 1 150 | 13,08 | |||||

| 2025-05-15 | 13F | Zimmer Partners, LP | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F/A | Point72 Asset Management, L.P. | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Cibc World Markets Corp | 11 008 | −46,32 | 97 | −39,37 | ||||

| 2025-08-14 | 13F | Tri Locum Partners LP | 1 014 456 | 8 978 | ||||||

| 2025-08-06 | 13F | Pekin Hardy Strauss, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-01 | 13F | Harbor Investment Advisory, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Two Seas Capital LP | 6 155 074 | 24,43 | 54 472 | 40,65 | ||||

| 2025-07-29 | NP | NKMCX - North Square Kennedy MicroCap Fund Class I | 10 335 | 135,05 | 94 | 176,47 | ||||

| 2025-08-14 | 13F | Jain Global LLC | 26 314 | 233 | ||||||

| 2025-06-26 | NP | NUSC - Nuveen ESG Small-Cap ETF | 103 714 | 73,67 | 922 | 95,75 | ||||

| 2025-07-14 | 13F | Edge Wealth Management LLC | 25 000 | 0,00 | 220 | 12,82 | ||||

| 2025-08-08 | 13F | Creative Planning | 19 376 | 9,98 | 171 | 24,82 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 839 117 | 31,14 | 7 426 | 48,22 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 520 476 | 85,97 | 4 606 | 110,22 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 144 233 | −87,10 | 1 276 | −85,42 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 207 000 | 32,18 | 1 832 | 49,35 | |||

| 2025-08-14 | 13F | Woodline Partners LP | 897 086 | 0,03 | 7 939 | 13,06 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 40 800 | −20,16 | 361 | −9,75 | |||

| 2025-07-15 | 13F | Fortitude Family Office, LLC | 55 | 0 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 128 368 | 60,76 | 1 136 | 81,76 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 678 116 | 0,22 | 6 001 | 13,27 | ||||

| 2025-08-13 | 13F | Brandes Investment Partners, Lp | 6 487 642 | 14,48 | 57 416 | 29,39 | ||||

| 2025-08-29 | NP | JAVTX - Janus Henderson Venture Fund Class T | 1 480 446 | 0,00 | 13 102 | 13,03 | ||||

| 2025-07-29 | NP | VHCIX - Vanguard Health Care Index Fund Admiral Shares | 272 468 | −1,11 | 2 482 | 13,91 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Corebridge Financial, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | TIAA SEPARATE ACCOUNT VA 1 - Stock Index Account Teachers Personal Annuity Individual Deferred Variable Annuity | 2 201 | 0,00 | 19 | 11,76 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 18 000 | −81,13 | 159 | −78,69 | ||||

| 2025-08-12 | 13F | Legal & General Group Plc | 123 538 | 46,52 | 1 093 | 65,61 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 19 706 | 174 | ||||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 77 955 | 18,59 | 690 | 34,05 | ||||

| 2025-08-26 | NP | NSIDX - Northern Small Cap Index Fund | 40 544 | −4,69 | 359 | 7,51 | ||||

| 2025-05-15 | 13F | D. E. Shaw & Co., Inc. | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-13 | 13F | Jump Financial, LLC | 138 954 | 1 230 | ||||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 875 239 | −32,39 | 7 746 | −23,59 | ||||

| 2025-08-14 | 13F | State Street Corp | 2 071 409 | 24,84 | 18 332 | 41,09 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 95 850 | 848 | ||||||

| 2025-05-19 | 13F/A | Jane Street Group, Llc | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-12 | 13F | Prudential Financial Inc | 10 795 | 96 | ||||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 38 587 | −6,75 | 341 | 5,57 | ||||

| 2025-08-14 | 13F | Quarry LP | 38 300 | 219,17 | 339 | 263,44 | ||||

| 2025-08-26 | NP | Profunds - Profund Vp Ultrasmall-cap | 312 | −6,59 | 3 | 0,00 |

Other Listings

| US:AVDL | 15,38 US$ |