Grundläggande statistik

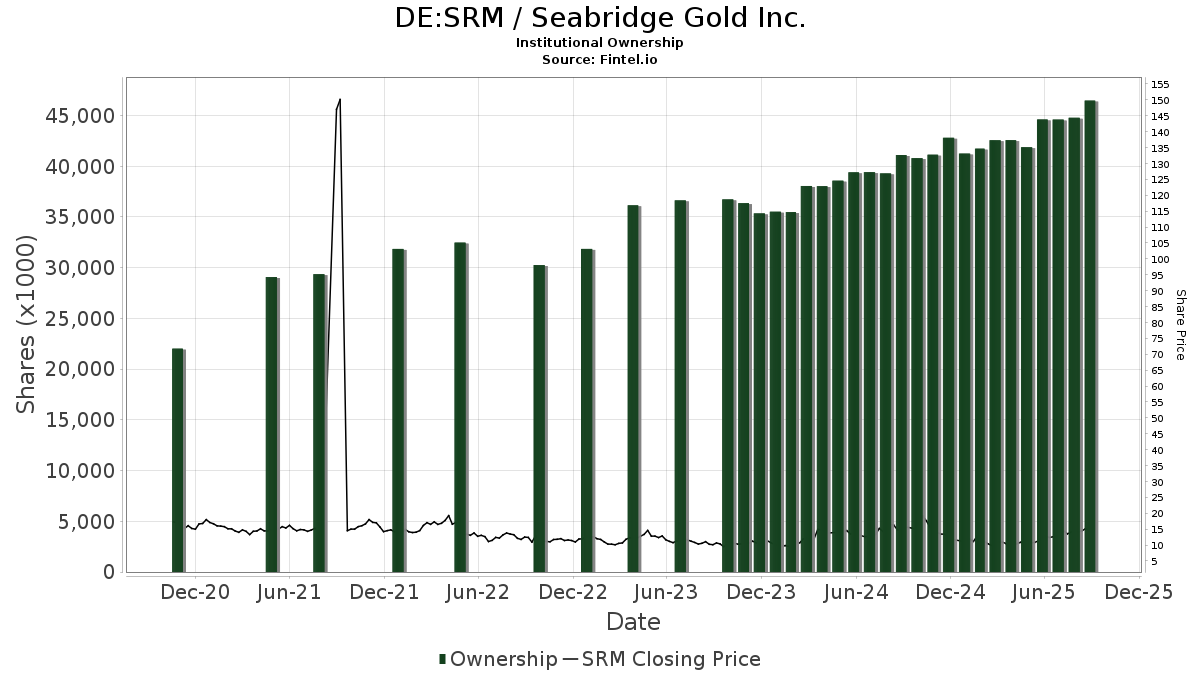

| Institutionella aktier (lång) | 46 475 143 - 45,51% (ex 13D/G) - change of 1,86MM shares 4,17% MRQ |

| Institutionellt värde (lång) | $ 625 642 USD ($1000) |

Institutionellt ägande och aktieägare

Seabridge Gold Inc. (DE:SRM) har 212 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 46,484,299 aktier. Största aktieägare inkluderar Kopernik Global Investors, LLC, Amplify ETF Trust - Amplify Junior Silver Miners ETF, Toroso Investments, LLC, Van Eck Associates Corp, GDXJ - VanEck Vectors Junior Gold Miners ETF, Paulson & Co. Inc., CIBC World Markets Inc., Ontario Teachers Pension Plan Board, KGGAX - KOPERNIK GLOBAL ALL-CAP FUND CLASS A SHARES, and Raymond James Financial Inc .

Seabridge Gold Inc. (MUN:SRM) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 12, 2025 is 15,72 / share. Previously, on September 13, 2024, the share price was 16,14 / share. This represents a decline of 2,60% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-13 | 13F | New Harbor Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 17 600 | 32,76 | 256 | 65,58 | ||||

| 2025-06-26 | NP | FTIHX - Fidelity Total International Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 35 358 | −1,27 | 439 | −0,23 | ||||

| 2025-08-14 | 13F | Macquarie Group Ltd | 63 913 | 928 | ||||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 10 222 | −0,66 | 148 | 23,33 | ||||

| 2025-08-14 | 13F | Armor Advisors, L.l.c. | 53 142 | 0,00 | 772 | 24,35 | ||||

| 2025-08-27 | NP | ALLIANZ VARIABLE INSURANCE PRODUCTS TRUST - AZL DFA International Core Equity Fund | 1 200 | 0,00 | 17 | 30,77 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 7 500 | −27,88 | 109 | −10,74 | |||

| 2025-08-14 | 13F | Peak6 Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 13 300 | 3,10 | 193 | 28,67 | |||

| 2025-08-13 | 13F | Walleye Trading LLC | 13 251 | 171,37 | 192 | 242,86 | ||||

| 2025-08-14 | 13F | Eschler Asset Management LLP | 35 000 | 0,00 | 508 | 24,51 | ||||

| 2025-08-07 | 13F | Zurcher Kantonalbank (Zurich Cantonalbank) | 20 819 | −16,56 | 302 | 3,79 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 97 | 51,56 | 1 | |||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 117 468 | 7,90 | 1 706 | 34,25 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 153 | 2 | ||||||

| 2025-07-31 | 13F | Strait & Sound Wealth Management LLC | 131 753 | 2,31 | 1 913 | 27,36 | ||||

| 2025-08-12 | 13F | Dimensional Fund Advisors Lp | 434 335 | 9,86 | 6 304 | 36,63 | ||||

| 2025-06-27 | NP | GOEX - Global X Gold Explorers ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 51 711 | 15,29 | 643 | 16,30 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 97 046 | 17,27 | 1 383 | 47,02 | ||||

| 2025-08-14 | 13F | PDT Partners, LLC | 82 109 | 16,51 | 1 192 | 45,01 | ||||

| 2025-04-21 | 13F | Beacon Capital Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Stansberry Asset Management, Llc | 36 132 | 7,48 | 525 | 33,67 | ||||

| 2025-08-14 | 13F | Crawford Fund Management, LLC | 476 418 | −2,66 | 6 918 | 21,12 | ||||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 14 542 | 23,87 | 211 | 54,41 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 1 200 | 548,65 | 17 | 750,00 | ||||

| 2025-05-14 | 13F | Caitlin John, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Hrt Financial Lp | 162 981 | 2 | ||||||

| 2025-08-11 | 13F | Banque Cantonale Vaudoise | 257 | −88,64 | 0 | |||||

| 2025-08-13 | 13F | Mackenzie Financial Corp | 46 638 | 1,18 | 678 | 26,31 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 3 000 | 100,00 | 44 | 152,94 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 994 424 | 45,19 | 14 439 | 80,67 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 2 332 | 0,26 | 34 | 22,22 | ||||

| 2025-06-26 | NP | IDEV - iShares Core MSCI International Developed Markets ETF | 117 291 | 9,89 | 1 457 | 11,05 | ||||

| 2025-07-23 | 13F | Tcfg Wealth Management, Llc | 10 475 | −54,41 | 152 | −43,28 | ||||

| 2025-06-26 | NP | DFA INVESTMENT TRUST CO - The Canadian Small Company Series This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 180 687 | 135,32 | 2 246 | 135,32 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 174 800 | 142,11 | 2 538 | 201,43 | |||

| 2025-08-14 | 13F | Wealth Preservation Advisors, LLC | 10 329 | 0,00 | 150 | 24,17 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 450 800 | 30,70 | 6 546 | 62,65 | |||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 19 265 | 12,71 | 0 | |||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 53 275 | 19,73 | 774 | 48,94 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | 161 407 | −15,19 | 2 344 | 5,54 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Put | 169 600 | −7,88 | 2 463 | 14,62 | |||

| 2025-08-11 | 13F | Waratah Capital Advisors Ltd. | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Call | 102 000 | 26,24 | 1 481 | 57,22 | |||

| 2025-08-27 | NP | TIFF INVESTMENT PROGRAM - TIFF Multi-Asset Fund | 149 986 | 0,00 | 2 178 | 24,40 | ||||

| 2025-05-05 | 13F | Transce3nd, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 1 049 924 | 143,69 | 15 245 | 203,24 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 348 748 | −0,85 | 5 064 | 23,37 | ||||

| 2025-08-08 | 13F | Creative Planning | 27 419 | −0,63 | 398 | 23,99 | ||||

| 2025-05-14 | 13F | Campbell & CO Investment Adviser LLC | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | Pacifica Partners Inc. | 135 | 0,00 | 2 | 0,00 | ||||

| 2025-07-09 | 13F | Krilogy Financial LLC | 138 150 | 2 006 | ||||||

| 2025-08-14 | 13F | Paulson & Co. Inc. | 2 070 000 | 0,00 | 30 056 | 24,42 | ||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 1 572 | 0,00 | 23 | 22,22 | ||||

| 2025-05-15 | 13F | Two Sigma Investments, Lp | 0 | −100,00 | 0 | |||||

| 2025-07-28 | NP | AVDS - Avantis International Small Cap Equity ETF | 2 564 | 79,93 | 31 | 106,67 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | Call | 180 000 | 0,00 | 2 615 | 24,77 | |||

| 2025-08-07 | 13F | David R. Rahn & Associates Inc. | 10 300 | 0,00 | 150 | 24,17 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | Put | 180 000 | 0,00 | 2 615 | 24,77 | |||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 508 265 | −3,31 | 7 384 | 20,66 | ||||

| 2025-05-14 | 13F | Synovus Financial Corp | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Peak6 Llc | Put | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 4 262 | −89,75 | 62 | −87,42 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 25 025 | −50,95 | 0 | |||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 27 272 | 49,57 | 396 | 86,32 | ||||

| 2025-07-23 | 13F | Godsey & Gibb Associates | 160 | 0,00 | 2 | 100,00 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 80 097 | −0,93 | 1 163 | 23,33 | ||||

| 2025-08-14 | 13F | Knoll Capital Management, LLC | 317 003 | 0,00 | 4 603 | 24,41 | ||||

| 2025-08-28 | NP | Amplify ETF Trust - Amplify Junior Silver Miners ETF | 2 731 868 | −14,58 | 39 667 | 6,28 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 3 000 | 0,00 | 44 | 22,86 | ||||

| 2025-08-13 | 13F | Summit Financial, LLC | 160 000 | −0,62 | 2 323 | 23,70 | ||||

| 2025-05-15 | 13F | Nomura Holdings Inc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-12 | 13F | Invesco Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 143 | 0,70 | 2 | 100,00 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 600 | 0,00 | 8 | 33,33 | ||||

| 2025-07-24 | NP | FSAGX - Gold Portfolio This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 652 000 | 0,00 | 8 000 | 13,20 | ||||

| 2025-08-25 | NP | SPROTT FUNDS TRUST - Sprott Junior Gold Miners ETF | 513 521 | 8,29 | 7 456 | 34,76 | ||||

| 2025-07-08 | 13F | Quintet Private Bank (Europe) S.A. | 300 | 0,00 | 4 | 33,33 | ||||

| 2025-07-15 | 13F | MCF Advisors LLC | 65 | 0,00 | 1 | |||||

| 2025-08-12 | 13F | Nuveen, LLC | 59 493 | −10,51 | 862 | 11,38 | ||||

| 2025-07-28 | 13F/A | Penbrook Management LLC | 96 545 | −2,67 | 1 402 | 21,09 | ||||

| 2025-08-14 | 13F | Brevan Howard Capital Management LP | 22 769 | 331 | ||||||

| 2025-05-30 | NP | EHLS - Even Herd Long Short ETF | Short | −9 156 | −107 | |||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 2 635 492 | −11,34 | 38 | 11,76 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 32 587 | 6,43 | 0 | |||||

| 2025-08-14 | 13F | Van Den Berg Management I, Inc | 753 003 | −0,37 | 10 934 | 23,96 | ||||

| 2025-04-29 | 13F | Lee Danner & Bass Inc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 453 013 | 12,33 | 6 578 | 39,76 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-21 | NP | GDXJ - VanEck Vectors Junior Gold Miners ETF | 2 420 826 | −12,89 | 35 150 | 8,38 | ||||

| 2025-08-12 | 13F | Dynamic Technology Lab Private Ltd | 16 683 | −43,44 | 242 | −29,65 | ||||

| 2025-08-01 | 13F | Brookwood Investment Group LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-06-24 | NP | TLTD - FlexShares Morningstar Developed Markets ex-US Factor Tilt Index Fund | 3 604 | 0,00 | 45 | 0,00 | ||||

| 2025-08-12 | 13F | Swiss National Bank | 154 200 | 2,66 | 2 230 | 27,50 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 1 132 | 0,00 | 16 | 23,08 | ||||

| 2025-06-26 | NP | KGGAX - KOPERNIK GLOBAL ALL-CAP FUND CLASS A SHARES | 1 422 848 | −48,47 | 17 680 | −48,49 | ||||

| 2025-05-08 | 13F | Savant Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Searle & Co. | 0 | −100,00 | 0 | |||||

| 2025-08-21 | NP | UNWPX - World Precious Minerals Fund | 20 000 | 0,00 | 290 | 24,46 | ||||

| 2025-08-14 | 13F | Kopernik Global Investors, LLC | 7 382 606 | 0,54 | 107 195 | 25,09 | ||||

| 2025-05-09 | 13F | GeoWealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-03-13 | 13F | PKO Investment Management Joint-Stock Co | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | Put | 11 800 | 171 | |||||

| 2025-05-12 | 13F | Fiduciary Family Office, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 309 | 11,15 | 4 | 33,33 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F/A | Perritt Capital Management Inc | 1 000 | 15 | ||||||

| 2025-08-13 | 13F | Northwest & Ethical Investments L.P. | 3 669 | 9,56 | 53 | 35,90 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 600 | 0,00 | 9 | 14,29 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 464 | 673,33 | 7 | |||||

| 2025-08-12 | 13F | Virtu Financial LLC | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 48 810 | 2,09 | 709 | 27,11 | ||||

| 2025-08-14 | 13F | CIBC Asset Management Inc | 73 264 | −23,03 | 1 063 | −4,06 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 24 399 | −50,66 | 354 | −38,65 | ||||

| 2025-06-18 | NP | RAZAX - Multi-Asset Growth Strategy Fund Class A | 24 534 | 60,80 | 305 | 60,85 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | Call | 21 700 | 326 | |||||

| 2025-07-29 | NP | JISAX - International Small Company Fund Class NAV | 4 151 | −45,75 | 51 | −39,02 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 1 204 496 | 0,45 | 17 489 | 24,98 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 100 | 0,00 | 1 | 0,00 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 0 | −100,00 | 0 | |||||

| 2025-03-31 | NP | AIM SECTOR FUNDS (INVESCO SECTOR FUNDS) - Invesco Oppenheimer Gold & Special Minerals Fund Class C | 10 000 | 0,00 | 123 | −29,31 | ||||

| 2025-08-14 | 13F | Nebula Research & Development LLC | 27 657 | 36,36 | 402 | 69,92 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 984 169 | −17,49 | 14 275 | 2,67 | ||||

| 2025-07-25 | NP | WSML - iShares MSCI World Small-Cap ETF | 4 550 | 56 | ||||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 22 180 | 0,56 | 321 | 25,39 | ||||

| 2025-08-12 | 13F | Aviso Financial Inc. | 50 | 0,00 | 1 | |||||

| 2025-08-05 | 13F | Uniting Wealth Partners, LLC | 11 200 | −8,20 | 163 | 14,08 | ||||

| 2025-08-13 | 13F | De Lisle Partners LLP | 40 000 | 0,00 | 580 | 24,46 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 93 352 | 35,62 | 1 355 | 68,74 | ||||

| 2025-07-17 | 13F | Oakworth Capital, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Plante Moran Financial Advisors, LLC | 37 | −94,49 | 1 | −100,00 | ||||

| 2025-08-13 | 13F | Amundi | 703 281 | −16,84 | 10 662 | 13,79 | ||||

| 2025-08-27 | NP | RYDEX VARIABLE TRUST - Precious Metals Fund Variable Annuity | 21 898 | −0,02 | 318 | 24,31 | ||||

| 2025-08-14 | 13F | Beaird Harris Wealth Management, LLC | 524 | 0,00 | 8 | 16,67 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 357 | 127,39 | 5 | 400,00 | ||||

| 2025-08-14 | 13F | Point72 (DIFC) Ltd | 5 033 | 529,12 | 73 | 711,11 | ||||

| 2025-08-08 | 13F | Everett Harris & Co /ca/ | 11 700 | 0,00 | 170 | 24,26 | ||||

| 2025-05-13 | 13F | Semanteon Capital Management, LP | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | U S Global Investors Inc | 40 000 | 0,00 | 581 | 24,46 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 2 731 868 | −14,58 | 39 667 | 6,28 | ||||

| 2025-08-11 | 13F | Sprott Inc. | 51 844 | −71,80 | 753 | −64,94 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 309 649 | 6,60 | 4 496 | 32,66 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 6 250 | 0,00 | 91 | 25,00 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 51 445 | −45,84 | 747 | −32,67 | ||||

| 2025-07-30 | 13F | Privium Fund Management B.V. | 44 074 | 0,00 | 648 | 26,07 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 81 022 | −0,48 | 1 176 | 23,79 | ||||

| 2025-06-18 | NP | RMYAX - Multi-Strategy Income Fund Class A | 8 471 | 59,17 | 105 | 61,54 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 35 900 | 48,35 | 1 | ||||

| 2025-08-11 | 13F | Vanguard Group Inc | 65 917 | 5,79 | 957 | 31,86 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 1 222 | −97,32 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 190 300 | 4,50 | 3 | 0,00 | |||

| 2025-08-14 | 13F | Fmr Llc | 652 000 | 0,00 | 9 467 | 24,43 | ||||

| 2025-08-28 | NP | QCSTRX - Stock Account Class R1 | 66 478 | 0,00 | 965 | 24,84 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 4 794 | −0,66 | 70 | 23,21 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 27 833 | 404 | ||||||

| 2025-08-12 | 13F | Aigen Investment Management, Lp | 15 676 | −20,79 | 284 | −14,50 | ||||

| 2025-05-15 | 13F | Tudor Investment Corp Et Al | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Catalyst Funds Management Pty Ltd | 79 720 | 1 158 | ||||||

| 2025-05-09 | 13F | R Squared Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 25 838 | 375 | ||||||

| 2025-08-14 | 13F | DecisionPoint Financial, LLC | 61 | 1 | ||||||

| 2025-06-26 | NP | Dfa Investment Dimensions Group Inc - Va International Small Portfolio This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 8 288 | 171,03 | 103 | 178,38 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 337 961 | 629,51 | 4 906 | 806,84 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 1 968 | −63,41 | 29 | −54,84 | ||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 68 418 | 1 | ||||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 217 | 0,00 | 3 | 0,00 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - International Sustainability Core 1 Portfolio Shares | 13 094 | 0,00 | 163 | 0,62 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | Call | 19 000 | −82,71 | 276 | −78,55 | |||

| 2025-08-12 | 13F | Legal & General Group Plc | 75 122 | −3,16 | 1 088 | 20,62 | ||||

| 2025-08-13 | 13F | Luminist Capital LLC | 700 | 10 | ||||||

| 2025-08-13 | 13F | Walleye Capital LLC | Put | 28 000 | −54,25 | 407 | −43,14 | |||

| 2025-08-13 | 13F | Walleye Capital LLC | 122 | 2 | ||||||

| 2025-08-14 | 13F | Millennium Management Llc | 684 033 | 149,08 | 9 931 | 209,93 | ||||

| 2025-07-23 | 13F | Shell Asset Management Co | 4 412 | 7,30 | 0 | |||||

| 2025-05-15 | 13F | Mountain Lake Investment Management LLC | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - World ex U.S. Core Equity Portfolio Institutional Class Shares | 10 332 | 0,00 | 128 | 0,79 | ||||

| 2025-08-15 | 13F | Great West Life Assurance Co /can/ | 6 346 | −76,59 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 58 800 | 10,94 | 854 | 38,03 | |||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 15 035 | 0,00 | 218 | 24,57 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 225 | 3 | ||||||

| 2025-08-29 | NP | JOHN HANCOCK INVESTMENT TRUST - John Hancock Diversified Real Assets Fund Class NAV | 25 469 | −7,26 | 370 | 15,31 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 286 000 | 193,33 | 4 153 | 265,17 | |||

| 2025-08-14 | 13F | Group One Trading, L.p. | 106 192 | −23,47 | 1 542 | −4,82 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 54 464 | −0,95 | 791 | 23,24 | ||||

| 2025-08-14 | 13F | Sei Investments Co | 251 705 | 0,00 | 3 655 | 24,41 | ||||

| 2025-06-23 | NP | PMPIX - Precious Metals Ultrasector Profund Investor Class | 6 343 | 29,55 | 79 | 30,00 | ||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 18 298 | −77,49 | 266 | −72,05 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 78 800 | 1 144 | |||||

| 2025-08-28 | NP | GWX - SPDR(R) S&P(R) International Small Cap ETF | 21 972 | −1,57 | 318 | 22,78 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 44 686 | 9,78 | 652 | 36,12 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 800 861 | 196,70 | 11 629 | 269,26 | ||||

| 2025-08-14 | 13F | Optiver Holding B.V. | 147 | 2 | ||||||

| 2025-07-14 | 13F | U.S. Capital Wealth Advisors, LLC | 11 000 | 160 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 31 000 | 450 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 8 351 | −10,45 | 121 | 12,04 | ||||

| 2025-07-09 | 13F | Reyes Financial Architecture, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Tradewinds Capital Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp | 51 857 | 17,88 | 753 | 47,07 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 308 600 | 122,82 | 4 345 | 166,89 | |||

| 2025-07-25 | NP | SLVP - iShares MSCI Global Silver and Metals Miners ETF | 110 542 | 0,20 | 1 357 | 13,56 | ||||

| 2025-08-13 | 13F | OMERS ADMINISTRATION Corp | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 77 200 | −29,11 | 1 087 | −15,16 | |||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | Call | 12 200 | 177 | |||||

| 2025-08-27 | NP | RYPMX - Precious Metals Fund Investor Class | 95 570 | 9,90 | 1 388 | 36,79 | ||||

| 2025-05-14 | 13F | Northwestern Mutual Wealth Management Co | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 55 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 431 946 | 44,38 | 6 272 | 79,71 | ||||

| 2025-07-21 | 13F | Credential Qtrade Securities Inc. | 50 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | Toronto Dominion Bank | 1 003 191 | 0,05 | 14 574 | 24,85 | ||||

| 2025-07-25 | 13F | LRI Investments, LLC | 442 | 0,00 | 6 | 20,00 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 206 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 542 398 | 275,70 | 7 876 | 367,64 | ||||

| 2025-08-11 | 13F | Nations Financial Group Inc, /ia/ /adv | 296 927 | 1,83 | 4 311 | 26,72 | ||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Peak6 Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 154 | 0,00 | 2 | 100,00 | ||||

| 2025-08-13 | 13F | Everstar Asset Management, LLC | 13 000 | 189 | ||||||

| 2025-08-14 | 13F | SummitTX Capital, L.P. | 30 600 | 444 | ||||||

| 2025-08-13 | 13F | Diametric Capital, LP | 28 103 | 408 | ||||||

| 2025-05-05 | 13F | Formidable Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 1 828 709 | 49,16 | 26 570 | 86,15 | ||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 38 416 | 0,00 | 558 | 24,33 | ||||

| 2025-08-01 | 13F | Rossby Financial, LCC | 37 900 | −1,04 | 550 | 16,77 | ||||

| 2025-08-11 | 13F | Alps Advisors Inc | 513 521 | 8,29 | 7 456 | 34,76 | ||||

| 2025-04-21 | 13F | PSI Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Creekmur Asset Management LLC | 599 | 27,45 | 9 | 60,00 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 679 | −62,55 | 10 | −57,14 | ||||

| 2025-08-28 | NP | FRANK FUNDS - Camelot Event Driven Fund Class A Shares | 195 000 | 0,00 | 2 831 | 24,44 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 265 | 4 | ||||||

| 2025-08-12 | 13F | XTX Topco Ltd | 16 528 | −24,91 | 240 | −6,64 | ||||

| 2025-08-14 | 13F | LMR Partners LLP | 40 000 | 581 | ||||||

| 2025-08-11 | 13F | Fore Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 121 570 | 96,74 | 1 765 | 144,80 | ||||

| 2025-05-14 | 13F | Jump Financial, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | City State Bank | 250 | 0,00 | 4 | 50,00 | ||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 4 000 | 0,00 | 58 | 26,09 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 250 | 0,00 | 0 | |||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-21 | NP | PSPFX - Global Resources Fund | 20 000 | 0,00 | 290 | 24,46 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 45 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 39 391 | 572 | ||||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | Signaturefd, Llc | 2 136 | 5,64 | 31 | 34,78 | ||||

| 2025-08-14 | 13F | SIG North Trading, ULC | 43 517 | 242,20 | 632 | 326,35 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 541 886 | 11,36 | 7 868 | 38,57 | ||||

| 2025-08-14 | 13F | Point72 Asia (Singapore) Pte. Ltd. | 13 668 | 198 | ||||||

| 2025-08-14 | 13F | SIG North Trading, ULC | Call | 40 400 | 34,67 | 587 | 67,43 | |||

| 2025-08-14 | 13F | SIG North Trading, ULC | Put | 13 600 | −57,63 | 197 | −47,33 | |||

| 2025-08-28 | NP | SSGVX - State Street Global Equity ex-U.S. Index Portfolio State Street Global All Cap Equity ex-U.S. Index Portfolio This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 20 400 | −20,00 | 296 | −0,34 | ||||

| 2025-08-08 | 13F | Ontario Teachers Pension Plan Board | 1 490 415 | 10,82 | 21 652 | 38,29 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | DFIEX - International Core Equity Portfolio - Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 135 926 | 0,00 | 1 690 | 0,96 | ||||

| 2025-08-29 | 13F | Total Investment Management Inc | 1 900 | 28 | ||||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 1 800 | 26 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 527 835 | 42,08 | 7 664 | 76,79 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 380 200 | 214,21 | 5 521 | 290,93 | |||

| 2025-08-14 | 13F/A | Barclays Plc | 138 066 | −14,99 | 2 | 100,00 | ||||

| 2025-08-14 | 13F | Numerai GP LLC | 66 665 | 968 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 428 500 | 105,91 | 6 222 | 156,22 | |||

| 2025-08-14 | 13F | UBS Group AG | 395 584 | 173,34 | 5 744 | 240,23 | ||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 89 023 | 4,01 | 1 288 | 28,70 | ||||

| 2025-06-27 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - International Social Core Equity Portfolio Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 8 910 | 15,91 | 111 | 17,02 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 12 822 | −11,40 | 186 | 10,71 | ||||

| 2025-08-25 | NP | SPROTT FUNDS TRUST - Sprott Gold Miners ETF | 50 194 | −10,72 | 729 | 11,31 | ||||

| 2025-08-29 | NP | JAJDX - International Small Company Trust NAV | 4 762 | 68,27 | 69 | 115,63 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 20 000 | 0 | ||||||

| 2025-07-28 | 13F | Td Asset Management Inc | 248 111 | 11,54 | 3 595 | 38,87 | ||||

| 2025-05-13 | 13F | HighTower Advisors, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-06-26 | NP | IXUS - iShares Core MSCI Total International Stock ETF | 147 452 | 0,79 | 1 832 | 1,89 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-01 | 13F | Confluence Investment Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Chilton Capital Management Llc | 3 400 | 0,00 | 49 | 25,64 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 28 870 | 10,25 | 439 | 43,93 | ||||

| 2025-07-30 | 13F | Bleakley Financial Group, LLC | 86 488 | 51,79 | 1 256 | 89,01 | ||||

| 2025-08-27 | NP | Brighthouse Funds Trust II - Brighthouse/Dimensional International Small Company Portfolio Class A | 8 233 | 0,00 | 120 | 23,96 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 10 780 | −73,55 | 157 | −67,16 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 25 591 | 70,31 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 6 323 | 104,83 | 92 | 160,00 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-15 | 13F | Ewing Morris & Co. Investment Partners Ltd. | 12 100 | 0,00 | 175 | −13,37 | ||||

| 2025-08-11 | 13F | Fore Capital, LLC | Call | 0 | −100,00 | 0 | ||||

| 2025-08-13 | 13F/A | StoneX Group Inc. | 0 | −100,00 | 0 | −100,00 |