Grundläggande statistik

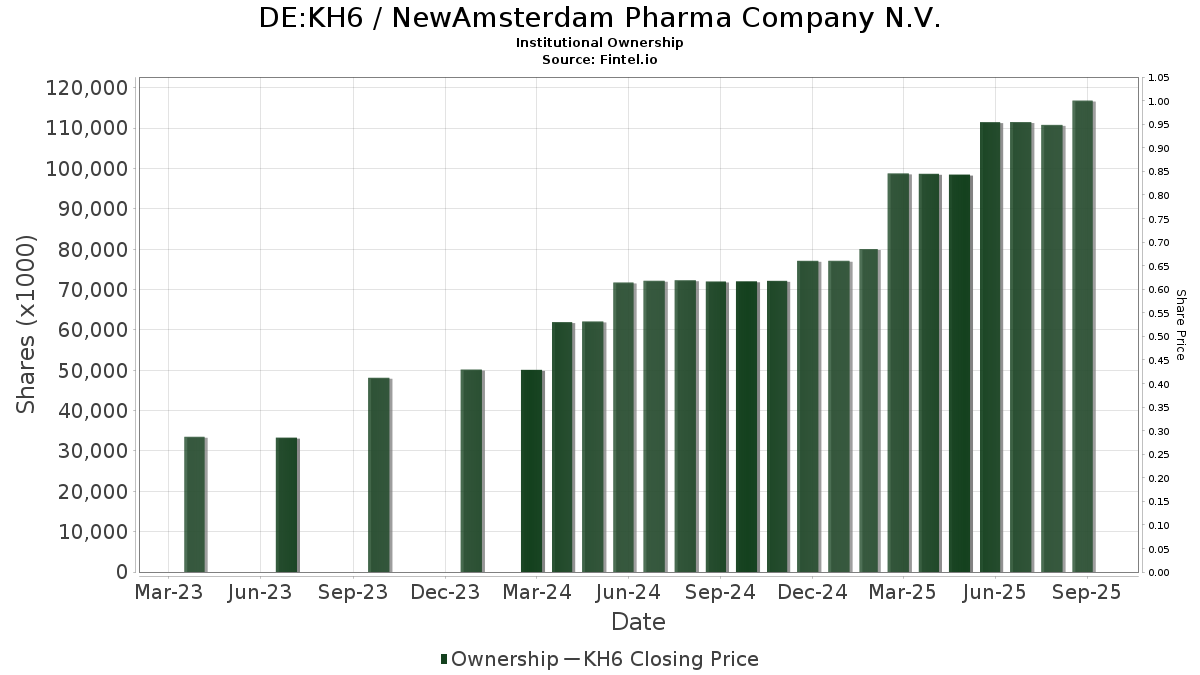

| Institutionella aktier (lång) | 116 850 769 - 103,75% (ex 13D/G) - change of 5,31MM shares 4,76% MRQ |

| Institutionellt värde (lång) | $ 2 094 020 USD ($1000) |

Institutionellt ägande och aktieägare

NewAmsterdam Pharma Company N.V. (DE:KH6) har 150 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 116,850,769 aktier. Största aktieägare inkluderar Frazier Life Sciences Management, L.P., Bain Capital Life Sciences Investors, LLC, Fcpm Iii Services B.v., Ra Capital Management, L.p., Capital World Investors, Viking Global Investors Lp, Deerfield Management Company, L.p. (series C), Wellington Management Group Llp, Adage Capital Partners Gp, L.l.c., and Jennison Associates Llc .

NewAmsterdam Pharma Company N.V. (DB:KH6) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 13 100 | 237 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 74 400 | −13,99 | 1 347 | −23,90 | |||

| 2025-05-12 | 13F | Advisor Group Holdings, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Gilder Gagnon Howe & Co Llc | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 352 952 | 6 392 | ||||||

| 2025-08-12 | 13F | DCF Advisers, LLC | 172 500 | 0,00 | 3 124 | −11,55 | ||||

| 2025-08-12 | 13F | Swiss National Bank | 83 900 | 18,34 | 1 519 | 4,69 | ||||

| 2025-08-06 | 13F | Stone House Investment Management, LLC | 325 | 0,00 | 6 | −16,67 | ||||

| 2025-05-15 | 13F | Lazard Asset Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 99 457 | 15,88 | 1 800 | 2,51 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 89 827 | −39,73 | 1 627 | −46,69 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 30 311 | 2,19 | 549 | −9,72 | ||||

| 2025-08-13 | 13F | Siren, L.L.C. | 1 194 240 | −37,54 | 21 628 | −44,74 | ||||

| 2025-05-15 | 13F | Caption Management, LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-08 | 13F | TimesSquare Capital Management, LLC | 872 537 | −2,08 | 15 802 | −13,37 | ||||

| 2025-08-27 | NP | OHIO NATIONAL FUND INC - ON Janus Henderson Enterprise Portfolio | 4 477 | 5,61 | 81 | −5,81 | ||||

| 2025-08-14 | 13F | Nicholas Investment Partners, LP | 115 739 | 2 096 | ||||||

| 2025-08-13 | 13F | Capital World Investors | 8 387 725 | 23,37 | 151 902 | 9,15 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 88 | 2 | ||||||

| 2025-08-14 | 13F | Boothbay Fund Management, Llc | 60 054 | −53,40 | 1 088 | −58,79 | ||||

| 2025-08-14 | 13F | State Street Corp | 81 304 | 21,90 | 1 472 | 7,84 | ||||

| 2025-05-15 | 13F | Tudor Investment Corp Et Al | 0 | −100,00 | 0 | |||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 1 400 | −0,64 | 25 | −10,71 | ||||

| 2025-08-07 | 13F | Lisanti Capital Growth, LLC | 49 110 | 0,00 | 889 | −11,54 | ||||

| 2025-07-28 | NP | IBBQ - Invesco Nasdaq Biotechnology ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 4 318 | 22,67 | 78 | 6,85 | ||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Bryce Point Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-28 | NP | DWAS - Invesco DWA SmallCap Momentum ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 107 316 | −7,01 | 1 943 | −19,81 | ||||

| 2025-05-15 | 13F | Boothbay Fund Management, Llc | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Verition Fund Management LLC | 13 828 | −72,60 | 250 | −75,80 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 272 | −57,57 | 5 | −69,23 | ||||

| 2025-05-15 | 13F | Gmt Capital Corp | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F/A | Hudson Bay Capital Management LP | Put | 30 000 | 543 | |||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 31 383 | 5,39 | 568 | −6,73 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 17 871 | 12,50 | 0 | |||||

| 2025-05-15 | 13F | Boothbay Fund Management, Llc | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-06-26 | NP | KCXIX - Knights of Columbus U.S. All Cap Index Fund I Shares | 314 | 7,90 | 6 | 0,00 | ||||

| 2025-08-13 | 13F | Continuum Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | Knights of Columbus Asset Advisors LLC | 32 833 | 595 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 637 707 | 45,75 | 11 549 | 28,94 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 200 | −60,00 | 4 | −70,00 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 8 | 300,00 | 0 | |||||

| 2025-07-14 | 13F | Avanza Fonder AB | 7 505 | 20,95 | 136 | 20,54 | ||||

| 2025-05-15 | 13F | Acuta Capital Partners, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Fcpm Iii Services B.v. | 10 632 113 | −2,77 | 192 548 | −13,98 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 68 092 | −5,95 | 1 233 | −16,75 | ||||

| 2025-08-14 | 13F | Quarry LP | 7 000 | 483,33 | 127 | 425,00 | ||||

| 2025-05-14 | 13F | HAP Trading, LLC | Call | 0 | −100,00 | 0 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 334 212 | 30,60 | 6 053 | 15,54 | ||||

| 2025-08-14 | 13F | Maverick Capital Ltd | 1 531 874 | 178,79 | 27 742 | 146,66 | ||||

| 2025-05-12 | 13F | Ovata Capital Management Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | PSI Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Cutter Capital Management, LP | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-05-15 | 13F | Two Sigma Advisers, Lp | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Opaleye Management Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-14 | 13F | Monashee Investment Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Jennison Associates Llc | 2 946 103 | −25,79 | 53 354 | −34,35 | ||||

| 2025-08-14 | 13F | Ikarian Capital, LLC | 206 800 | 3 745 | ||||||

| 2025-04-29 | 13F | Envestnet Asset Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Invesco Ltd. | 134 035 | 12,70 | 2 427 | −0,29 | ||||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 1 816 725 | 0,26 | 32 902 | −11,30 | ||||

| 2025-06-23 | NP | PPNMX - SmallCap Growth Fund I R-3 | 153 014 | 14,45 | 2 927 | −1,78 | ||||

| 2025-08-14 | 13F | Cormorant Asset Management, LP | 2 175 000 | −23,01 | 39 389 | −31,88 | ||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 4 471 | −31,67 | 81 | −39,85 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Walleye Capital LLC | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Jump Financial, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-26 | NP | GSCYX - SMALL CAP EQUITY FUND Institutional | 73 100 | −3,19 | 1 324 | −14,37 | ||||

| 2025-08-08 | 13F | Letko, Brosseau & Associates Inc | 11 775 | 213 | ||||||

| 2025-08-07 | 13F | Zurcher Kantonalbank (Zurich Cantonalbank) | 7 540 | 25,88 | 137 | 11,48 | ||||

| 2025-05-15 | 13F | Voloridge Investment Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-28 | NP | AVSC - Avantis U.S. Small Cap Equity ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 2 565 | 46 | ||||||

| 2025-08-14 | 13F | StemPoint Capital LP | 152 652 | 45,96 | 2 765 | 29,16 | ||||

| 2025-08-13 | 13F | Affinity Asset Advisors, LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Hrt Financial Lp | 26 208 | −19,71 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 500 | 9 | ||||||

| 2025-05-15 | 13F | Alyeska Investment Group, L.P. | 0 | −100,00 | 0 | |||||

| 2025-07-08 | 13F | Ptm Wealth Management, Llc | 12 900 | 256 | ||||||

| 2025-06-27 | NP | GURU - Global X Guru Index ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 29 452 | 563 | ||||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 7 640 | 0,00 | 138 | 20,00 | ||||

| 2025-08-12 | 13F | Legal & General Group Plc | 44 235 | 33,52 | 801 | 18,14 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | OHIO NATIONAL FUND INC - ON Janus Henderson Venture Portfolio | 11 438 | −2,31 | 207 | −13,39 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 3 | 200,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 5 604 | 121,68 | 0 | |||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 131 430 | 10,40 | 2 380 | −2,30 | ||||

| 2025-08-14 | 13F | ArrowMark Colorado Holdings LLC | 358 614 | −0,86 | 6 494 | −12,29 | ||||

| 2025-05-15 | 13F | Glenmede Trust Co Na | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Crestline Management, LP | 0 | −100,00 | 0 | |||||

| 2025-03-31 | NP | JSFBX - John Hancock Seaport Long/Short Fund Class A | 22 123 | 493 | ||||||

| 2025-08-14 | 13F | Bellevue Group AG | 20 555 | −5,71 | 372 | −16,59 | ||||

| 2025-08-14 | 13F | Janus Henderson Group Plc | 1 962 060 | −10,80 | 35 592 | −25,69 | ||||

| 2025-08-18 | 13F/A | Hudson Bay Capital Management LP | 10 739 | 194 | ||||||

| 2025-06-27 | NP | AACRX - Strategic Allocation: Conservative Fund R Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 176 | 0,00 | 3 | 0,00 | ||||

| 2025-05-14 | 13F | Maven Securities LTD | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Caption Management, LLC | Put | 30 000 | 543 | |||||

| 2025-08-14 | 13F | Caption Management, LLC | 6 000 | −80,60 | 109 | −82,94 | ||||

| 2025-08-13 | 13F | OMERS ADMINISTRATION Corp | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Slate Path Capital LP | 319 000 | 0,00 | 5 777 | −11,52 | ||||

| 2025-07-22 | 13F | Gf Fund Management Co. Ltd. | 2 365 | 0,00 | 43 | −12,50 | ||||

| 2025-08-14 | 13F | California State Teachers Retirement System | 47 862 | 146,66 | 867 | 118,14 | ||||

| 2025-08-14 | 13F | Polar Capital Holdings Plc | 2 517 779 | 11,90 | 45 597 | −1,00 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 208 081 | 118,68 | 3 768 | 93,53 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 320 143 | −53,05 | 5 798 | −58,47 | ||||

| 2025-04-30 | 13F | M&t Bank Corp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 41 700 | −45,70 | 755 | −51,97 | |||

| 2025-07-25 | NP | CZMSX - Multi-Manager Small Cap Equity Strategies Fund Institutional Class | 104 025 | 1 884 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 36 500 | −57,51 | 661 | −62,40 | |||

| 2025-08-12 | 13F | Handelsbanken Fonder AB | 341 600 | 31,38 | 6 | 20,00 | ||||

| 2025-08-14 | 13F | First Turn Management, LLC | 521 097 | 9 437 | ||||||

| 2025-08-12 | 13F | BlackRock, Inc. | 571 673 | 14,80 | 10 353 | 1,56 | ||||

| 2025-08-13 | 13F | Decheng Capital LLC | 770 000 | 0,00 | 13 945 | −11,53 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 27 345 | 91,22 | 495 | 69,52 | ||||

| 2025-08-13 | 13F | Cheviot Value Management, LLC | 796 | 20 | ||||||

| 2025-08-04 | 13F | Keybank National Association/oh | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | USSCX - Science & Technology Fund Shares | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 3 322 997 | −6,18 | 60 179 | −17,00 | ||||

| 2025-07-14 | 13F/A | Venture Visionary Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 41 700 | −10,52 | 755 | −20,78 | |||

| 2025-08-07 | 13F | Readystate Asset Management Lp | 231 194 | 0,67 | 4 187 | −10,96 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 4 747 | 31,24 | 86 | 14,86 | ||||

| 2025-08-14 | 13F | HighVista Strategies LLC | 19 274 | 349 | ||||||

| 2025-08-14 | 13F | Bvf Inc/il | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Duquesne Family Office LLC | 832 175 | 3,98 | 15 | −6,25 | ||||

| 2025-08-28 | 13F | China Universal Asset Management Co., Ltd. | 22 549 | 2,37 | 408 | −9,33 | ||||

| 2025-08-13 | 13F | Kennedy Capital Management, Inc. | 13 675 | 248 | ||||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-06 | 13F | True Wealth Design, LLC | 21 | 950,00 | 0 | |||||

| 2025-07-23 | 13F | Klp Kapitalforvaltning As | 9 100 | 51,67 | 165 | 34,43 | ||||

| 2025-07-07 | 13F | Roxbury Financial LLC | 264 | 282,61 | 5 | 300,00 | ||||

| 2025-07-08 | 13F | Medicxi Ventures Management (Jersey) Ltd | 2 869 565 | 0,00 | 51 968 | −11,53 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 29 277 | 4,49 | 530 | −7,50 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 45 | 1 | ||||||

| 2025-07-24 | 13F | Standard Life Aberdeen plc | 735 032 | 95,04 | 13 311 | 72,56 | ||||

| 2025-07-15 | 13F | Yarbrough Capital, LLC | 23 960 | 0,00 | 434 | −11,63 | ||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 320 804 | 11,34 | 5 810 | −1,51 | ||||

| 2025-08-12 | 13F | CenterBook Partners LP | 68 190 | −69,32 | 1 235 | −72,87 | ||||

| 2025-08-14 | 13F | Fred Alger Management, Llc | 22 037 | −19,63 | 399 | −28,88 | ||||

| 2025-06-27 | NP | ANONX - Small Cap Growth Fund I Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 453 541 | 65,92 | 8 676 | 42,42 | ||||

| 2025-06-27 | NP | TWSMX - Strategic Allocation: Moderate Fund Investor Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 757 | 0,00 | 14 | −12,50 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 14 279 | 259 | ||||||

| 2025-08-13 | 13F | Affinity Asset Advisors, LLC | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-13 | 13F | Saturn V Capital Management LLC | 220 695 | 89,68 | 3 997 | 67,83 | ||||

| 2025-08-12 | 13F | American Century Companies Inc | 532 916 | 0,77 | 9 651 | −10,85 | ||||

| 2025-05-15 | 13F | Marshall Wace, Llp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Deerfield Management Company, L.p. (series C) | 5 115 953 | 24,66 | 92 650 | 10,29 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 595 | 350,76 | 11 | 400,00 | ||||

| 2025-05-13 | 13F | Sei Investments Co | 9 382 | 0,60 | 240 | 0,42 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 1 458 897 | 47,17 | 26 421 | 30,20 | ||||

| 2025-07-14 | 13F | HealthInvest Partners AB | 157 223 | 45,87 | 2 847 | 29,06 | ||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 0 | −100,00 | 0 | |||||

| 2025-05-09 | 13F | Pamalican Asset Management Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Capital International Investors | 2 062 535 | 0,00 | 37 353 | −11,53 | ||||

| 2025-08-14 | 13F | Artia Global Partners LP | 27 319 | 495 | ||||||

| 2025-05-14 | 13F | Arrowstreet Capital, Limited Partnership | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Parkman Healthcare Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 548 | −23,03 | 10 | −35,71 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 937 | 680,83 | 0 | |||||

| 2025-08-14 | 13F | Cormorant Asset Management, LP | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Legato Capital Management LLC | 18 789 | 340 | ||||||

| 2025-04-29 | 13F | Moody Aldrich Partners Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Ra Capital Management, L.p. | 10 138 938 | 0,00 | 183 616 | −11,53 | ||||

| 2025-07-30 | NP | SBIO - ALPS Medical Breakthroughs ETF | 76 222 | 6,28 | 1 380 | −8,37 | ||||

| 2025-08-13 | 13F | Arizona State Retirement System | 12 768 | 21,76 | 231 | 7,94 | ||||

| 2025-08-14 | 13F | Daiwa Securities Group Inc. | 375 | 0,00 | 0 | |||||

| 2025-07-30 | 13F | Dupont Capital Management Corp | 1 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 249 | 5 | ||||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 1 981 | 8,13 | 36 | −5,41 | ||||

| 2025-08-14 | 13F | ADAR1 Capital Management, LLC | 112 359 | 2 035 | ||||||

| 2025-08-01 | 13F | Teacher Retirement System Of Texas | 11 700 | 212 | ||||||

| 2025-08-14 | 13F | Viking Global Investors Lp | 6 978 534 | 0,00 | 126 381 | −11,53 | ||||

| 2025-08-14 | 13F | Bain Capital Life Sciences Investors, LLC | 10 719 110 | 0,00 | 194 123 | −11,53 | ||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 4 337 | 18,01 | 79 | −1,27 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 484 004 | −26,59 | 8 765 | −35,05 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 225 | 4 | ||||||

| 2025-05-06 | 13F | Assetmark, Inc | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Fmr Llc | 1 904 550 | 97,60 | 34 491 | 74,82 | ||||

| 2025-08-14 | 13F | Algert Global Llc | 18 140 | 0 | ||||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | −100,00 | 0 | |||||

| 2025-08-19 | 13F | State of Wyoming | 550 | 10 | ||||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 2 331 583 | 4,00 | 42 225 | −7,99 | ||||

| 2025-05-15 | 13F | Cinctive Capital Management LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 4 594 | −1,59 | 83 | −12,63 | ||||

| 2025-08-14 | 13F | Frazier Life Sciences Management, L.P. | 16 607 074 | 3,04 | 300 754 | −8,84 | ||||

| 2025-08-13 | 13F | Affinity Asset Advisors, LLC | 275 000 | −15,38 | 4 980 | −25,14 | ||||

| 2025-08-14 | 13F | Avidity Partners Management LP | 0 | −100,00 | 0 | |||||

| 2025-06-27 | NP | AAARX - Strategic Allocation: Aggressive Fund R Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 911 | 0,00 | 17 | −15,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 647 | −6,10 | 12 | −21,43 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 18 332 | 96,36 | 332 | 73,82 | ||||

| 2025-08-13 | 13F | Kilter Group LLC | 10 | 0 | ||||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 13 420 | 243 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 627 719 | 57,66 | 11 368 | 39,49 | ||||

| 2025-08-12 | 13F | Trexquant Investment LP | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Axa S.a. | 242 916 | 0,16 | 4 399 | −11,38 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 949 980 | 53,33 | 17 204 | 35,66 | ||||

| 2025-08-11 | 13F | Alps Advisors Inc | 60 551 | −22,33 | 1 097 | −31,29 | ||||

| 2025-08-15 | 13F/A | Exome Asset Management LLC | 36 574 | 662 | ||||||

| 2025-08-14 | 13F | Eversept Partners, LP | 414 430 | 47,51 | 7 505 | 30,50 | ||||

| 2025-08-14 | 13F | Rock Springs Capital Management LP | 536 111 | 0,00 | 9 709 | −11,54 | ||||

| 2025-08-28 | NP | NPSGX - NICHOLAS PARTNERS SMALL CAP GROWTH FUND Institutional Shares | 28 311 | 513 | ||||||

| 2025-08-11 | 13F | Vanguard Group Inc | 178 846 | 486,84 | 3 239 | 419,74 | ||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 2 000 | 0,00 | 36 | −10,00 | ||||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 0 | 0 | ||||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 10 868 | 5,27 | 197 | −7,11 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 28 392 | −32,17 | 514 | −39,95 | ||||

| 2025-08-14 | 13F | Woodline Partners LP | 1 897 197 | −22,32 | 34 358 | −31,28 | ||||

| 2025-08-14 | 13F | Adage Capital Partners Gp, L.l.c. | 3 013 009 | 54,46 | 54 566 | 36,66 |

Other Listings

| US:NAMS | 24,19 US$ |