Grundläggande statistik

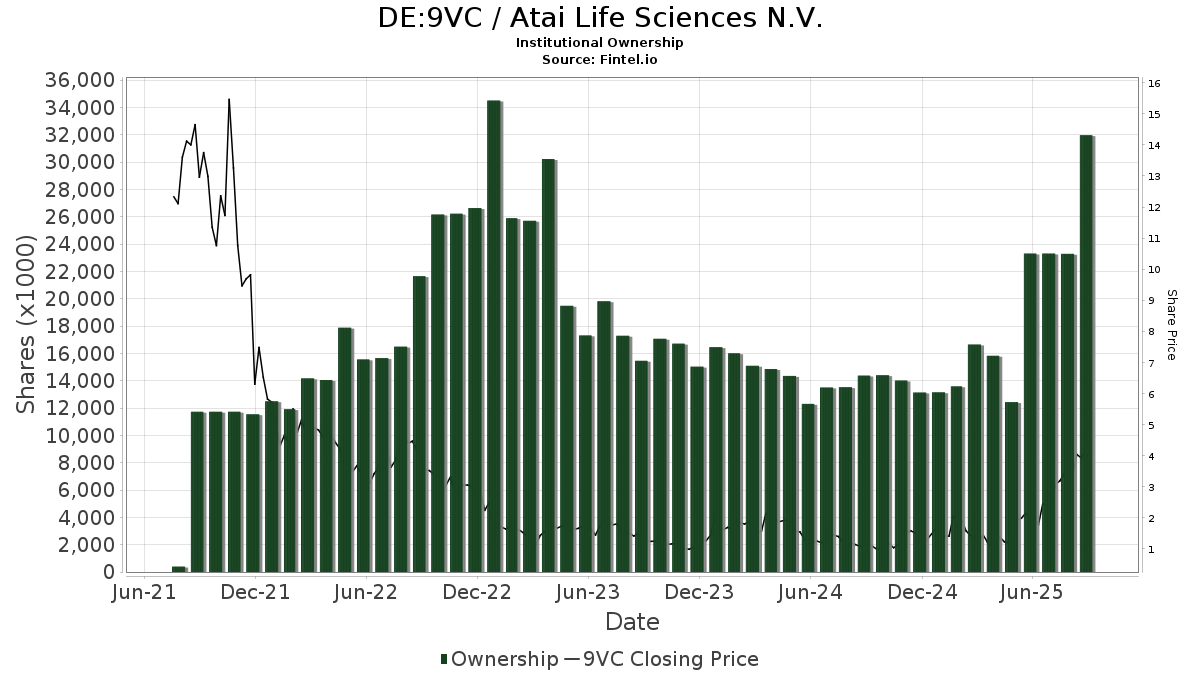

| Institutionella aktier (lång) | 31 966 403 - 14,91% (ex 13D/G) - change of 9,56MM shares 42,70% MRQ |

| Institutionellt värde (lång) | $ 67 949 USD ($1000) |

Institutionellt ägande och aktieägare

Atai Life Sciences N.V. (DE:9VC) har 105 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 31,966,403 aktier. Största aktieägare inkluderar UBS Group AG, Adage Capital Partners Gp, L.l.c., Morgan Stanley, Pale Fire Capital SE, Davidson Kempner Capital Management Lp, Millennium Management Llc, Citadel Advisors Llc, Moore Capital Management, Lp, Brown University, and D. E. Shaw & Co., Inc. .

Atai Life Sciences N.V. (XTRA:9VC) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 12, 2025 is 3,84 / share. Previously, on September 16, 2024, the share price was 1,18 / share. This represents an increase of 226,03% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Williams Jones Wealth Management, LLC. | 10 000 | 0,00 | 22 | 61,54 | ||||

| 2025-07-10 | 13F | Wedmont Private Capital | 25 000 | 0,00 | 66 | 106,25 | ||||

| 2025-08-26 | NP | EQ ADVISORS TRUST - EQ/Morgan Stanley Small Cap Growth Portfolio Class IB | 316 732 | 0,00 | 694 | 61,16 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 1 301 | 76,53 | 3 | 100,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 135 400 | 270,96 | 297 | 504,08 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 455 200 | 96,29 | 997 | 216,19 | |||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 21 117 | 46 | ||||||

| 2025-04-14 | 13F | Regent Peak Wealth Advisors LLC | 20 000 | 27 | ||||||

| 2025-07-24 | 13F | Robertson Stephens Wealth Management, LLC | 16 701 | 0,00 | 37 | 63,64 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | Put | 100 000 | 219 | |||||

| 2025-08-14 | 13F | Millennium Management Llc | 1 188 165 | 4,61 | 2 602 | 68,52 | ||||

| 2025-05-15 | 13F | Optiver Holding B.V. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Cerity Partners LLC | 46 284 | −0,43 | 101 | 60,32 | ||||

| 2025-08-13 | 13F | Global Frontier Investments LLC | 0 | 0 | ||||||

| 2025-05-15 | 13F | Glen Eagle Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Moore Capital Management, Lp | 952 380 | 0,00 | 2 086 | 61,00 | ||||

| 2025-05-15 | 13F | Tower Research Capital LLC (TRC) | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Diametric Capital, LP | 53 024 | −7,01 | 116 | 50,65 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 3 494 292 | 6,10 | 7 652 | 70,84 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-07-15 | 13F | North Star Investment Management Corp. | 15 675 | 0,00 | 34 | 61,90 | ||||

| 2025-07-23 | 13F | Kingswood Wealth Advisors, Llc | 60 000 | 0,00 | 131 | 63,75 | ||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 20 745 | −7,01 | 45 | 50,00 | ||||

| 2025-05-09 | 13F | Pnc Financial Services Group, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 229 | 1 | ||||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 109 898 | −47,64 | 241 | −15,79 | ||||

| 2025-07-22 | 13F | Capital Advisors Inc/ok | 50 000 | −28,57 | 110 | 14,74 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 65 197 | 488,69 | 143 | 853,33 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-24 | NP | FNCMX - Fidelity Nasdaq Composite Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 92 619 | 0,00 | 214 | 33,96 | ||||

| 2025-08-13 | 13F | Pale Fire Capital SE | 2 640 384 | 1,84 | 5 782 | 64,03 | ||||

| 2025-08-14 | 13F | Hyperion Capital Advisors LP | 168 416 | 0,00 | 369 | 60,70 | ||||

| 2025-08-14 | 13F | Peak6 Llc | 208 548 | −9,27 | 457 | 46,15 | ||||

| 2025-04-22 | 13F | Bright Futures Wealth Management, LLC. | 25 000 | 0,00 | 36 | −5,41 | ||||

| 2025-07-23 | 13F | Proffitt & Goodson Inc | 2 000 | 4 | ||||||

| 2025-08-05 | 13F | Westside Investment Management, Inc. | 1 250 | 0,00 | 3 | 200,00 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 347 868 | 252,66 | 762 | 467,91 | ||||

| 2025-08-25 | NP | PSIL - AdvisorShares Psychedelics ETF | 389 762 | −4,65 | 854 | 53,69 | ||||

| 2025-07-29 | NP | VHCIX - Vanguard Health Care Index Fund Admiral Shares | 387 009 | −1,12 | 894 | 32,69 | ||||

| 2025-05-15 | 13F | Davidson Kempner Capital Management Lp | 1 413 443 | 48,88 | 1 922 | 52,30 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 4 763 | −96,43 | 10 | −94,48 | ||||

| 2025-08-14 | 13F | Shay Capital LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 6 410 | 0,00 | 14 | 75,00 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 50 | 0 | ||||||

| 2025-07-11 | 13F | Caldwell Securities, Inc | 500 | 0,00 | 1 | |||||

| 2025-07-07 | 13F | Global Wealth Strategies & Associates | 126 | 0 | ||||||

| 2025-08-29 | 13F | Evolution Wealth Management Inc. | 4 016 | 9 | ||||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 13 445 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 1 179 543 | 4 612,14 | 2 583 | 7 497,06 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 39 100 | −62,19 | 86 | −39,29 | |||

| 2025-08-14 | 13F | UBS Group AG | 7 699 759 | 39,10 | 16 862 | 123,99 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 79 600 | −40,15 | 174 | −3,33 | |||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 13 432 | 0,00 | 29 | 61,11 | ||||

| 2025-08-08 | 13F | BIT Capital GmbH | 23 218 | −94,71 | 51 | −91,62 | ||||

| 2025-05-14 | 13F | Legend Financial Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 510 061 | 37,13 | 1 117 | 121,19 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 200 | 0 | ||||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 94 | 0 | ||||||

| 2025-08-05 | 13F | Verity Asset Management, Inc. | 10 000 | 0,00 | 22 | 61,54 | ||||

| 2025-07-22 | 13F | Hunter Perkins Capital Management, LLC | 14 741 | −14,50 | 0 | |||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 35 984 | 0,00 | 79 | 62,50 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 695 031 | −30,03 | 1 522 | 12,74 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 19 125 | 4,94 | 42 | 70,83 | ||||

| 2025-08-22 | NP | MSSGX - Inception Portfolio CLASS I | 511 994 | 0,00 | 1 121 | 61,06 | ||||

| 2025-08-14 | 13F | Ruane, Cunniff & Goldfarb L.P. | 42 112 | 0,00 | 92 | 61,40 | ||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 58 246 | 128 | ||||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 400 | 0,00 | 1 | |||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 4 106 | 185,14 | 9 | 700,00 | ||||

| 2025-08-08 | 13F | Brown University | 718 500 | 0,00 | 1 574 | 61,00 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 40 925 | 39,72 | 90 | 128,21 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 12 296 | 27 | ||||||

| 2025-08-11 | 13F | Vanguard Group Inc | 436 932 | 12,27 | 957 | 80,72 | ||||

| 2025-08-19 | NP | GARTX - Goldman Sachs Absolute Return Tracker Fund Class A | 15 809 | −25,19 | 35 | 21,43 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 27 221 | −0,40 | 60 | 59,46 | ||||

| 2025-08-08 | 13F | Creative Planning | 18 232 | 39,05 | 40 | 129,41 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 4 400 | −98,58 | 10 | −97,86 | ||||

| 2025-07-25 | 13F | Verdence Capital Advisors LLC | 19 178 | 0,36 | 42 | 68,00 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 10 700 | 23 | ||||||

| 2025-08-14 | 13F | Peak6 Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 16 198 | 35 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 3 202 | −88,21 | 7 | −80,56 | ||||

| 2025-05-14 | 13F | Susquehanna International Group, Llp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-22 | NP | MSVDX - Vitality Portfolio Class I | 14 368 | 2,41 | 31 | 63,16 | ||||

| 2025-08-14 | 13F | Principia Wealth Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Virtu Financial LLC | 95 746 | 810,13 | 0 | |||||

| 2025-08-07 | 13F/A | Tortoise Investment Management, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 164 887 | −0,05 | 0 | |||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 51 752 | −15,75 | 113 | 36,14 | ||||

| 2025-08-04 | 13F | AdvisorShares Investments LLC | 389 762 | −4,65 | 854 | 68,58 | ||||

| 2025-08-28 | NP | GWX - SPDR(R) S&P(R) International Small Cap ETF | 40 646 | −1,57 | 89 | 58,93 | ||||

| 2025-07-23 | 13F | Detalus Advisors, LLC | 10 000 | 0,00 | 22 | 61,54 | ||||

| 2025-07-08 | 13F | Ptm Wealth Management, Llc | 12 500 | 35 | ||||||

| 2025-07-30 | 13F | Strategic Blueprint, LLC | 23 500 | 0,00 | 51 | 64,52 | ||||

| 2025-08-12 | 13F | American Century Companies Inc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F/A | Claudia M.p. Batlle, Crp (r) Llc | 49 922 | 0,00 | 109 | 62,69 | ||||

| 2025-08-07 | 13F | Resolute Advisors LLC | 16 777 | 37 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-28 | NP | AVSBX - Avantis U.S. Small Cap Equity Fund G Class | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-14 | 13F | CRA Financial Services, LLC | 12 903 | 0,00 | 28 | 64,71 | ||||

| 2025-08-14 | 13F | Gould Capital, LLC | 10 000 | 0,00 | 22 | 61,54 | ||||

| 2025-05-29 | 13F/A | Legal & General Group Plc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-05 | 13F | Freestone Capital Holdings, LLC | 20 000 | −33,33 | 44 | 7,50 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 17 217 | 38 | ||||||

| 2025-05-08 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-05-09 | 13F | R Squared Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 3 150 | 0,00 | 7 | 50,00 | ||||

| 2025-08-15 | 13F | Audent Global Asset Management, LLC | 16 837 | 0,00 | 37 | 63,64 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 30 900 | 68 | ||||||

| 2025-08-12 | 13F | MAI Capital Management | 300 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | State Street Corp | 79 546 | −0,81 | 174 | 59,63 | ||||

| 2025-05-15 | 13F | ADAR1 Capital Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Woodline Partners LP | 290 943 | 3,10 | 637 | 66,32 | ||||

| 2025-08-14 | 13F | Adage Capital Partners Gp, L.l.c. | 5 434 782 | 11 902 | ||||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 2 154 | −76,94 | 5 | −66,67 | ||||

| 2025-07-28 | NP | AVSC - Avantis U.S. Small Cap Equity ETF This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 50 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Moneta Group Investment Advisors Llc | 12 746 | −1,12 | 28 | 58,82 | ||||

| 2025-08-07 | 13F | Evoke Wealth, Llc | 26 600 | 58 | ||||||

| 2025-07-30 | 13F | Crewe Advisors LLC | 5 540 | 0,00 | 12 | 71,43 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 32 222 | 70 | ||||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 79 533 | 0 | ||||||

| 2025-04-29 | 13F | Quattro Financial Advisors Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Catalio Capital Management, LP | 196 858 | 0,00 | 431 | 61,42 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 11 456 | −58,53 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 96 540 | 179,64 | 211 | 358,70 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 1 080 | 0,00 | 2 | 100,00 | ||||

| 2025-07-22 | 13F | Wealthcare Advisory Partners LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 144 369 | 55,87 | 316 | 152,80 | ||||

| 2025-07-30 | 13F | Rehmann Capital Advisory Group | 10 500 | 23 | ||||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 37 753 | −34,68 | 83 | 5,13 | ||||

| 2025-05-08 | 13F | Essential Planning, LLC. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 356 357 | 0,00 | 780 | 61,16 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 279 874 | 613 |