Grundläggande statistik

| Institutionella aktier (lång) | 41 620 468 - 95,74% (ex 13D/G) - change of 0,30MM shares 0,73% MRQ |

| Institutionellt värde (lång) | $ 1 097 023 USD ($1000) |

Institutionellt ägande och aktieägare

Kiniksa Pharmaceuticals, Ltd. (US:KNSA) har 268 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 41,620,468 aktier. Största aktieägare inkluderar Rubric Capital Management LP, Vanguard Group Inc, Baker Bros. Advisors Lp, Tang Capital Management Llc, Fairmount Funds Management LLC, Acadian Asset Management Llc, VTSMX - Vanguard Total Stock Market Index Fund Investor Shares, Caption Management, LLC, Braidwell Lp, and Morgan Stanley .

Kiniksa Pharmaceuticals, Ltd. (NasdaqGS:KNSA) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 8, 2025 is 36,57 / share. Previously, on September 9, 2024, the share price was 24,04 / share. This represents an increase of 52,12% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

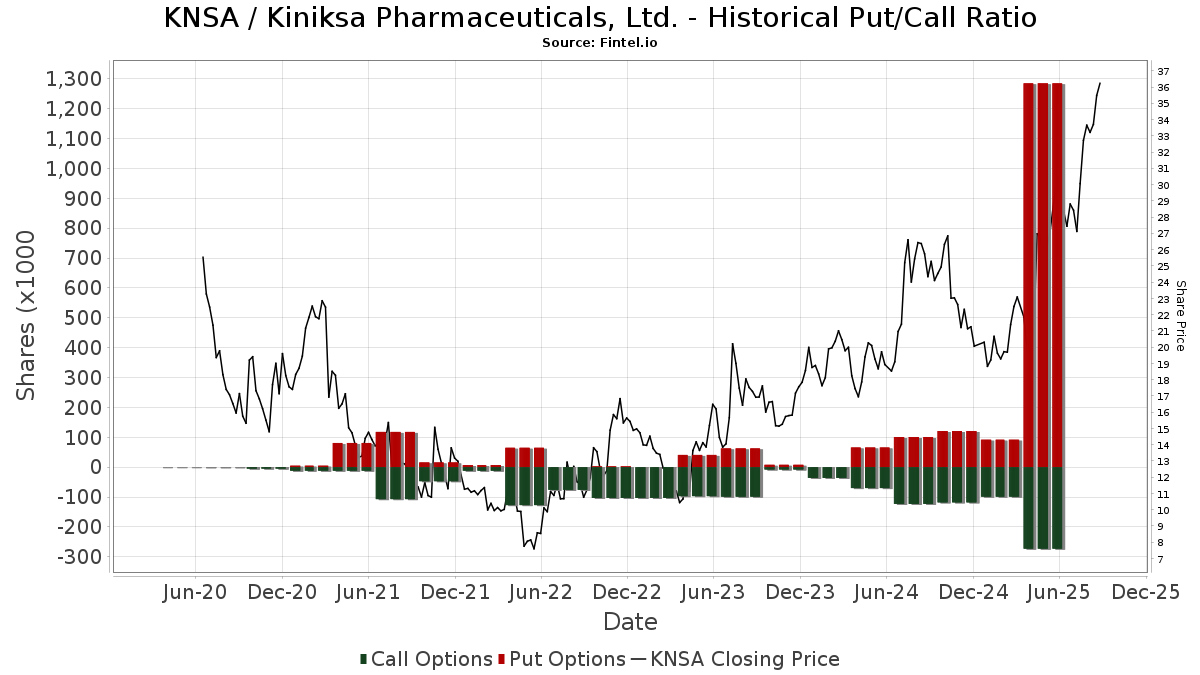

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13D/G-Arkiveringar

Vi presenterar 13D/G-arkiveringar separat från 13F-arkiveringar på grund av att de behandlas olika av SEC. 13D/G-arkiveringar kan lämnas in av grupper av investerare (med en ledare), medan 13F-arkiveringar inte kan det. Detta leder till situationer där en investerare kan lämna in en 13D/G-ansökan med ett värde för de totala aktierna (vilket motsvarar alla aktier som ägs av investerargruppen), men sedan lämna in en 13F-ansökan med ett annat värde för de totala aktierna (vilket motsvarar enbart deras eget ägande). Detta innebär att aktieägandet i 13D/G-arkiveringar och 13F-arkiveringar ofta inte är direkt jämförbara, så vi presenterar dem separat.

Notera: Från och med den 16 maj 2021 visar vi inte längre ägare som inte har lämnat in en 13D/G under det senaste året. Tidigare visade vi hela historiken för 13D/G-arkiveringar. I allmänhet måste enheter som är skyldiga att lämna in 13D/G-arkiveringar lämna in minst en gång per år innan de lämnar in en stängningsarkivering. Fonder avslutar dock ibland positioner utan att lämna in en avslutande arkivering (dvs. de avvecklar), så att visa hela historiken resulterade ibland i förvirring om det nuvarande ägandet. För att förhindra förvirring visar vi nu endast "nuvarande" ägare - det vill säga ägare som har lämnat in en ansökan under det senaste året.

Upgrade to unlock premium data.

| Fil Datum | Formulär | Investerare | Föregående aktier |

Senaste aktier |

Δ Aktier (Procent) |

Ägande (Procent) |

Δ Ägande (Procent) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-07-17 | BlackRock, Inc. | 2,262,066 | 418,151 | -81.51 | 1.00 | -81.48 | ||

| 2025-07-09 | Rubric Capital Management LP | 3,383,239 | 3,909,806 | 15.56 | 9.24 | 14.78 | ||

| 2025-04-04 | TANG CAPITAL MANAGEMENT LLC | 2,178,609 | 5.20 | |||||

| 2025-02-14 | Fairmount Funds Management LLC | 3,204,841 | 0 | -100.00 | 0.00 | -100.00 | ||

| 2024-11-14 | HILLHOUSE CAPITAL ADVISORS, LTD. | 3,879,426 | 1,582,635 | -59.20 | 3.90 | -60.61 | ||

| 2024-10-08 | BAKER BROS. ADVISORS LP | 2,903,030 | 3,151,029 | 8.54 | 7.70 | -16.30 |

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-05-15 | 13F | Kodai Capital Management LP | 185 364 | 4 117 | ||||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 163 740 | 4 531 | ||||||

| 2025-07-29 | NP | VRTIX - Vanguard Russell 2000 Index Fund Institutional Shares | 192 763 | 8,78 | 5 274 | 46,76 | ||||

| 2025-08-11 | 13F | Vanguard Group Inc | 3 131 602 | −6,77 | 86 651 | 16,15 | ||||

| 2025-08-28 | NP | QCSTRX - Stock Account Class R1 | 1 029 | −99,70 | 28 | −99,63 | ||||

| 2025-05-28 | NP | QCEQRX - Equity Index Account Class R1 | 11 321 | 0,00 | 251 | 12,56 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 6 969 | 762,50 | 193 | 1 029,41 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 85 400 | 2 363 | ||||||

| 2025-08-13 | 13F | Truvestments Capital Llc | 829 | 0,00 | 23 | 22,22 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 7 271 | 201 | ||||||

| 2025-08-27 | NP | NAESX - Vanguard Small-Cap Index Fund Investor Shares | 931 201 | −1,19 | 25 766 | 23,11 | ||||

| 2025-08-26 | NP | DMCRX - Driehaus Micro Cap Growth Fund | 105 610 | 6,88 | 2 922 | 33,18 | ||||

| 2025-07-22 | 13F | Knights of Columbus Asset Advisors LLC | 32 622 | −47,91 | 903 | −35,11 | ||||

| 2025-08-06 | 13F | SOUTH STATE Corp | 179 | 0,00 | 5 | 33,33 | ||||

| 2025-04-25 | NP | VCSLX - Small Cap Index Fund | 2 870 | 0,00 | 58 | −7,94 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 28 438 | 787 | ||||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 32 257 | −13,45 | 893 | 7,86 | ||||

| 2025-08-14 | 13F | Sei Investments Co | 101 496 | 34,19 | 2 808 | 67,24 | ||||

| 2025-08-29 | NP | JAFEX - Total Stock Market Index Trust NAV | 714 | 7,05 | 20 | 35,71 | ||||

| 2025-08-29 | NP | JMCRX - James Micro Cap Fund | 6 909 | 0,00 | 191 | 24,84 | ||||

| 2025-08-18 | 13F/A | Hudson Bay Capital Management LP | 70 780 | −64,61 | 1 958 | −55,92 | ||||

| 2025-05-29 | NP | PACAX - Putnam Dynamic Asset Allocation Conservative Fund Class A shares | 1 063 | 0,00 | 24 | 9,52 | ||||

| 2025-05-14 | 13F | Susquehanna International Group, Llp | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Ubs Oconnor Llc | 37 602 | −73,00 | 1 040 | −66,38 | ||||

| 2025-07-29 | NP | SECAX - SIIT Small Cap II Fund - Class A | 17 397 | 67,12 | 476 | 125,12 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 199 | 0,00 | 6 | 25,00 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 50 942 | −89,92 | 1 408 | −87,47 | ||||

| 2025-08-14 | 13F | ArrowMark Colorado Holdings LLC | 465 899 | −13,03 | 12 891 | 8,35 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 10 440 | 289 | ||||||

| 2025-08-14 | 13F | SummitTX Capital, L.P. | 30 200 | 836 | ||||||

| 2025-05-15 | 13F | Hillhouse Capital Advisors, Ltd. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-06-26 | NP | TSMOX - TIAA-CREF Quant Small/Mid-Cap Equity Fund Retirement Class | 74 530 | 2 010 | ||||||

| 2025-08-12 | 13F | American Century Companies Inc | 20 333 | 0,00 | 563 | 24,61 | ||||

| 2025-08-19 | 13F | State of Wyoming | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Hrt Financial Lp | 51 964 | 1 | ||||||

| 2025-07-29 | NP | SLPAX - Siit Small Cap Fund - Class A | 20 336 | 35,34 | 556 | 82,89 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 657 475 | 213,17 | 18 192 | 290,22 | ||||

| 2025-08-14 | 13F | State Street Corp | 72 904 | −89,71 | 2 017 | −87,19 | ||||

| 2025-08-12 | 13F | Catalyst Funds Management Pty Ltd | 17 800 | 493 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 223 208 | 8 966,13 | 6 175 | 11 127,27 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 888 364 | 277,82 | 24 581 | 370,72 | ||||

| 2025-05-05 | 13F | Creekmur Asset Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 735 417 | 20 349 | ||||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 514 | −96,63 | 0 | |||||

| 2025-08-14 | 13F | Dark Forest Capital Management Lp | 48 207 | 241,70 | 1 334 | 325,88 | ||||

| 2025-07-29 | NP | LONAX - Longboard Alternative Growth Fund Class A | 6 505 | 178 | ||||||

| 2025-06-30 | NP | VEXPX - VANGUARD EXPLORER FUND Investor Shares | 110 694 | 60,23 | 2 985 | 120,46 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 74 | 236,36 | 2 | |||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 45 | 1 | ||||||

| 2025-08-12 | 13F | EAM Investors, LLC | 105 747 | 2 926 | ||||||

| 2025-07-23 | 13F | Klp Kapitalforvaltning As | 6 600 | −17,50 | 183 | 2,82 | ||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 35 743 | 214,86 | 989 | 292,46 | ||||

| 2025-06-26 | NP | TIEIX - TIAA-CREF Equity Index Fund Institutional Class | 21 130 | 0,00 | 570 | 37,44 | ||||

| 2025-08-12 | 13F | Essex Investment Management Co Llc | 171 437 | −0,71 | 4 744 | 23,71 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 70 315 | −57,22 | 1 946 | −46,71 | ||||

| 2025-08-14 | 13F | Caption Management, LLC | Put | 1 142 500 | 3 708,33 | 31 613 | 4 646,55 | |||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Caption Management, LLC | Call | 230 000 | 666,67 | 6 364 | 855,56 | |||

| 2025-08-26 | NP | NORTHERN FUNDS - NORTHERN SMALL CAP CORE FUND Class K | 7 736 | 214 | ||||||

| 2025-05-28 | NP | TIAA SEPARATE ACCOUNT VA 1 - Stock Index Account Teachers Personal Annuity Individual Deferred Variable Annuity | 706 | 0,00 | 16 | 15,38 | ||||

| 2025-08-12 | 13F | Swiss National Bank | 64 600 | −10,15 | 1 787 | 11,97 | ||||

| 2025-08-11 | 13F | Universal- Beteiligungs- und Servicegesellschaft mbH | 9 140 | 253 | ||||||

| 2025-08-14 | 13F | Lion Point Capital, LP | 45 900 | 0,00 | 1 270 | 24,63 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 228 | 0,00 | 5 | 25,00 | ||||

| 2025-08-14 | 13F | HighVista Strategies LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Man Group plc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 21 368 | −23,67 | 591 | −4,83 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 53 202 | 60,70 | 1 472 | 100,27 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 84 915 | −18,09 | 2 350 | 2,04 | ||||

| 2025-04-25 | NP | VFMFX - Vanguard U.S. Multifactor Fund Admiral Shares | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 947 | −4,05 | 26 | 23,81 | ||||

| 2025-08-27 | NP | VSTCX - Vanguard Strategic Small-Cap Equity Fund Investor Shares | 49 282 | −13,08 | 1 364 | 8,26 | ||||

| 2025-05-27 | NP | NOSGX - Northern Small Cap Value Fund | 10 696 | −5,14 | 238 | 6,28 | ||||

| 2025-05-28 | NP | Profunds - Profund Vp Ultrasmall-cap | 139 | −6,08 | 3 | 50,00 | ||||

| 2025-08-14 | 13F | Macquarie Group Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-06-26 | NP | USCAX - Small Cap Stock Fund Shares | 69 127 | −19,47 | 1 864 | 10,82 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 166 | 5 | ||||||

| 2025-08-14 | 13F | Price T Rowe Associates Inc /md/ | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | VQNPX - Vanguard Growth and Income Fund Investor Shares This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 15 800 | 652,38 | 437 | 850,00 | ||||

| 2025-08-14 | 13F | Oberweis Asset Management Inc/ | 305 200 | 28,67 | 8 445 | 60,29 | ||||

| 2025-06-23 | NP | PPNMX - SmallCap Growth Fund I R-3 | 3 857 | −5,09 | 104 | 31,65 | ||||

| 2025-07-09 | 13F | Pallas Capital Advisors LLC | 8 535 | 236 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 1 127 | 31 | ||||||

| 2025-08-13 | 13F | Walleye Capital LLC | 119 885 | 39,07 | 3 317 | 73,30 | ||||

| 2025-05-27 | NP | NSIDX - Northern Small Cap Index Fund | 17 636 | 0,00 | 392 | 12,36 | ||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 623 689 | 56,02 | 17 257 | 94,38 | ||||

| 2025-07-29 | NP | ORSIX - NORTH SQUARE DYNAMIC SMALL CAP FUND CLASS I | 62 379 | 69,65 | 1 707 | 128,99 | ||||

| 2025-08-14 | 13F | Algert Global Llc | 232 187 | 0,75 | 6 | 20,00 | ||||

| 2025-08-27 | NP | VTSMX - Vanguard Total Stock Market Index Fund Investor Shares | 1 218 354 | 5,38 | 33 712 | 31,28 | ||||

| 2025-07-28 | 13F | Allianz Asset Management GmbH | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Arizona State Retirement System | 9 857 | −8,02 | 273 | 14,29 | ||||

| 2025-08-14 | 13F | Point72 (DIFC) Ltd | 2 600 | 181,69 | 72 | 255,00 | ||||

| 2025-08-14 | 13F | Baker Bros. Advisors Lp | 2 824 669 | 0,23 | 78 159 | 24,87 | ||||

| 2025-05-30 | NP | NCGFX - New Covenant Growth Fund | 801 | 0,00 | 18 | 13,33 | ||||

| 2025-05-27 | NP | Columbia Funds Variable Series Trust II - Variable Portfolio - Partners Small Cap Growth Fund Class 1 | 5 014 | −0,65 | 111 | 12,12 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 1 019 968 | 20,40 | 28 223 | 50,01 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 272 629 | 13,76 | 7 544 | 41,73 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 1 267 989 | 22,59 | 35 | 59,09 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 791 305 | 98,95 | 21 895 | 147,88 | ||||

| 2025-08-14 | 13F | Point72 Asia (Singapore) Pte. Ltd. | 25 904 | 717 | ||||||

| 2025-08-01 | 13F | Teacher Retirement System Of Texas | 9 144 | −9,12 | 253 | 13,45 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 369 502 | −6,34 | 10 224 | 16,69 | ||||

| 2025-07-28 | NP | MSSM - Morgan Stanley Pathway Small-Mid Cap Equity ETF | 1 755 | 23,85 | 48 | 71,43 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 31 739 | −73,95 | 878 | −67,55 | ||||

| 2025-08-28 | NP | ASQIX - Small Company Fund Investor Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 20 333 | 0,00 | 563 | 24,61 | ||||

| 2025-08-14 | 13F | Legato Capital Management LLC | 50 641 | −0,24 | 1 401 | 24,31 | ||||

| 2025-08-14 | 13F | PDT Partners, LLC | 102 886 | 121,70 | 2 847 | 176,31 | ||||

| 2025-08-13 | 13F | Amundi | 15 972 | 0,00 | 438 | 26,22 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 267 393 | 340,90 | 7 399 | 449,63 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 32 200 | 166,12 | 891 | 232,09 | |||

| 2025-07-22 | NP | DSMFX - Destinations Small-Mid Cap Equity Fund Class I | 24 801 | 3,36 | 679 | 39,51 | ||||

| 2025-08-14 | 13F | Rubric Capital Management LP | 3 909 806 | 15,56 | 108 184 | 43,97 | ||||

| 2025-08-12 | 13F | Clear Street Markets Llc | 1 486 | 41 | ||||||

| 2025-08-14 | 13F | Opaleye Management Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Nordea Investment Management Ab | 130 160 | 1,65 | 3 582 | 24,81 | ||||

| 2025-08-14 | 13F | Parkman Healthcare Partners LLC | 488 796 | −35,91 | 13 525 | −20,15 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 527 | 26,68 | 15 | 55,56 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 702 880 | −79,52 | 19 449 | −74,49 | ||||

| 2025-06-26 | NP | DFAS - Dimensional U.S. Small Cap ETF | 102 914 | 0,00 | 2 776 | 37,58 | ||||

| 2025-05-28 | NP | TLSTX - Stock Index Fund | 561 | 0,00 | 12 | 9,09 | ||||

| 2025-08-14 | 13F | Voya Investment Management Llc | 20 056 | −35,02 | 555 | −19,12 | ||||

| 2025-04-30 | 13F | M&t Bank Corp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Dimensional Fund Advisors Lp | 648 336 | −16,05 | 17 941 | 4,58 | ||||

| 2025-05-08 | 13F | Jefferies Financial Group Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | Gf Fund Management Co. Ltd. | 1 064 | 0,00 | 29 | 26,09 | ||||

| 2025-08-08 | 13F | Massachusetts Financial Services Co /ma/ | 64 232 | 1,25 | 1 777 | 26,21 | ||||

| 2025-07-14 | 13F | Toth Financial Advisory Corp | 10 700 | 296 | ||||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 25 275 | 1 539,11 | 699 | 1 955,88 | ||||

| 2025-08-08 | 13F | BIT Capital GmbH | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Ameritas Investment Partners, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-30 | NP | IUSCX - Fisher Investments Institutional Group U.S. Small Cap Equity Fund | 50 | 0,00 | 1 | 0,00 | ||||

| 2025-05-29 | NP | PAEAX - Putnam Dynamic Asset Allocation Growth Fund Class A shares | 9 529 | −2,08 | 212 | 9,90 | ||||

| 2025-08-14 | 13F | Aster Capital Management (DIFC) Ltd | 21 398 | 1 369,64 | 592 | 1 941,38 | ||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 134 404 | 1 746,72 | 4 | |||||

| 2025-08-07 | 13F | Hughes Financial Services, LLC | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | TISEX - TIAA-CREF Quant Small-Cap Equity Fund Institutional Class | 331 000 | −2,43 | 8 927 | 34,28 | ||||

| 2025-05-30 | NP | SLLAX - SIMT Small Cap Fund Class F | 10 247 | −23,11 | 228 | −13,69 | ||||

| 2025-08-06 | 13F | Sterling Capital Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | California State Teachers Retirement System | 31 498 | −8,23 | 872 | 14,30 | ||||

| 2025-08-14 | 13F | State Of Wisconsin Investment Board | 84 067 | −16,80 | 2 326 | 3,65 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 398 232 | −19,02 | 11 019 | 0,89 | ||||

| 2025-08-13 | 13F | Wealthquest Corp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Jump Financial, LLC | 226 038 | 6 254 | ||||||

| 2025-08-14 | 13F | Braidwell Lp | 1 102 580 | −43,83 | 30 508 | −30,02 | ||||

| 2025-06-26 | NP | TISBX - TIAA-CREF Small-Cap Blend Index Fund Institutional Class | 50 664 | 0,00 | 1 366 | 37,56 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 31 | 1 | ||||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 16 026 | −10,11 | 443 | 12,15 | ||||

| 2025-05-14 | 13F | Bellevue Group AG | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Victory Capital Management Inc | 58 964 | 10,59 | 1 632 | 37,75 | ||||

| 2025-05-28 | NP | Profunds - Profund Vp Small-cap | 87 | −8,42 | 2 | 0,00 | ||||

| 2025-08-08 | 13F | Intech Investment Management Llc | 0 | −100,00 | 0 | |||||

| 2025-07-29 | NP | SMXAX - SIIT Extended Market Index Fund - Class A | 6 700 | 0,00 | 183 | 35,56 | ||||

| 2025-07-15 | 13F | SJS Investment Consulting Inc. | 37 | 1 | ||||||

| 2025-08-11 | 13F | Martingale Asset Management L P | 52 434 | 4,87 | 1 451 | 30,63 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 135 282 | 16,21 | 3 743 | 44,80 | ||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 1 565 | 43 | ||||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 61 095 | −26,53 | 1 705 | −9,36 | ||||

| 2025-08-07 | 13F | Zurcher Kantonalbank (Zurich Cantonalbank) | 15 487 | 0,00 | 429 | 24,78 | ||||

| 2025-08-13 | 13F | MetLife Investment Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Tang Capital Management Llc | 2 328 609 | 9,91 | 64 433 | 36,93 | ||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 1 635 | 12,76 | 46 | 36,36 | ||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Jain Global LLC | 55 554 | 1 537 | ||||||

| 2025-08-07 | 13F | Allworth Financial LP | 64 | 2 | ||||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 416 572 | 186,17 | 11 527 | 256,51 | ||||

| 2025-08-21 | NP | MXMTX - Great-West Small Cap Growth Fund Investor Class | 46 859 | 1,73 | 1 297 | 26,81 | ||||

| 2025-08-14 | 13F | Globeflex Capital L P | 88 596 | 0,00 | 2 451 | 24,61 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 7 286 | −88,38 | 202 | −85,56 | ||||

| 2025-08-12 | 13F | Axq Capital, Lp | 10 455 | 289 | ||||||

| 2025-06-26 | NP | DFUS - Dimensional U.S. Equity ETF | 9 628 | 17,31 | 260 | 61,88 | ||||

| 2025-05-28 | NP | TLEQX - Small-Cap Equity Fund | 6 595 | −3,92 | 146 | 8,15 | ||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 383 668 | 145,43 | 10 616 | 205,76 | ||||

| 2025-07-28 | NP | IBBQ - Invesco Nasdaq Biotechnology ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 658 | 4,67 | 45 | 40,63 | ||||

| 2025-05-29 | NP | JAFVX - Strategic Equity Allocation Trust Series NAV | 5 572 | 0,00 | 124 | 11,82 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 795 | 22 | ||||||

| 2025-08-13 | 13F | Baird Financial Group, Inc. | 55 312 | 1 530 | ||||||

| 2025-07-15 | 13F | Fortitude Family Office, LLC | 249 | 0,00 | 7 | 20,00 | ||||

| 2025-08-14 | 13F | Susquehanna Fundamental Investments, Llc | 60 125 | −38,64 | 1 664 | −23,58 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Soleus Capital Management, L.P. | 254 689 | −45,75 | 7 047 | −32,42 | ||||

| 2025-08-26 | NP | AFMCX - Acuitas US Microcap Fund Institutional Shares | 7 131 | −49,80 | 197 | −37,46 | ||||

| 2025-08-14 | 13F | Fred Alger Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 911 | 140,37 | 25 | 212,50 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 20 715 | −6,33 | 1 | |||||

| 2025-05-14 | 13F | Smartleaf Asset Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F/A | Barclays Plc | 12 052 | −78,22 | 0 | −100,00 | ||||

| 2025-06-26 | NP | DCOR - Dimensional US Core Equity 1 ETF | 2 100 | 0,00 | 57 | 36,59 | ||||

| 2025-08-08 | 13F | Police & Firemen's Retirement System of New Jersey | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Franklin Resources Inc | 108 574 | 62,19 | 3 004 | 102,15 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 59 564 | 1 648 | ||||||

| 2025-08-12 | 13F | Nuveen, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Trexquant Investment LP | 456 987 | 93,24 | 12 645 | 140,75 | ||||

| 2025-08-14 | 13F | Nebula Research & Development LLC | 69 884 | 82,40 | 1 934 | 127,41 | ||||

| 2025-07-29 | 13F | Cannon Global Investment Management, LLC | 17 300 | 479 | ||||||

| 2025-08-08 | 13F | Principal Financial Group Inc | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | OHIO NATIONAL FUND INC - ON BlackRock Advantage Small Cap Growth Portfolio | 1 408 | −89,38 | 39 | −87,07 | ||||

| 2025-08-14 | 13F | Gotham Asset Management, LLC | 14 676 | 406 | ||||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 3 488 | −23,22 | 97 | −4,00 | ||||

| 2025-08-04 | 13F | Strs Ohio | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 0 | 0 | ||||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Vestal Point Capital, LP | 0 | −100,00 | 0 | |||||

| 2025-04-25 | NP | VFMO - Vanguard U.S. Momentum Factor ETF ETF Shares | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | State Board Of Administration Of Florida Retirement System | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Janus Henderson Group Plc | 12 179 | 0,00 | 337 | 20,00 | ||||

| 2025-06-26 | NP | DFAC - Dimensional U.S. Core Equity 2 ETF | 88 003 | 3,72 | 2 373 | 42,69 | ||||

| 2025-06-26 | NP | KCXIX - Knights of Columbus U.S. All Cap Index Fund I Shares | 150 | 4,17 | 4 | 100,00 | ||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 46 916 | 7,54 | 1 298 | 34,09 | ||||

| 2025-08-14 | 13F | Granahan Investment Management Inc/ma | 310 992 | −14,07 | 8 605 | 7,07 | ||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 68 751 | 37,92 | 1 902 | 71,82 | ||||

| 2025-08-28 | 13F | China Universal Asset Management Co., Ltd. | 8 503 | 0,91 | 235 | 25,67 | ||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 113 990 | 25,22 | 3 154 | 56,06 | ||||

| 2025-08-11 | 13F | Great Lakes Advisors, Llc | 126 789 | 3 508 | ||||||

| 2025-08-12 | 13F | Prudential Financial Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 21 103 | 2,34 | 584 | 27,57 | ||||

| 2025-07-29 | NP | VHCIX - Vanguard Health Care Index Fund Admiral Shares | 117 748 | 1,05 | 3 222 | 36,31 | ||||

| 2025-08-28 | NP | OBMCX - Oberweis Micro-Cap Fund Investor Class | 305 200 | 28,67 | 8 445 | 60,29 | ||||

| 2025-06-23 | NP | UAPIX - Ultrasmall-cap Profund Investor Class | 394 | −29,77 | 11 | 0,00 | ||||

| 2025-08-13 | 13F | Kilter Group LLC | 61 | 2 | ||||||

| 2025-07-18 | 13F | Robeco Institutional Asset Management B.V. | 8 436 | 233 | ||||||

| 2025-08-04 | 13F | Amalgamated Bank | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Legal & General Group Plc | 30 858 | −22,72 | 854 | −3,72 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 12 521 | 9,44 | 346 | 36,22 | ||||

| 2025-08-07 | 13F | ProShare Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Quantessence Capital LLC | 27 066 | 749 | ||||||

| 2025-08-14 | 13F | Fairmount Funds Management LLC | 1 772 839 | 60,84 | 49 054 | 100,38 | ||||

| 2025-08-13 | 13F | Healthcare Of Ontario Pension Plan Trust Fund | 67 500 | 1 868 | ||||||

| 2025-07-29 | NP | VRTTX - Vanguard Russell 3000 Index Fund Institutional Shares | 3 245 | 0,00 | 89 | 35,38 | ||||

| 2025-08-14 | 13F | Daiwa Securities Group Inc. | 139 | 0,00 | 0 | |||||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 133 014 | −27,76 | 3 680 | −10,00 | ||||

| 2025-08-28 | NP | SPWIX - Simt Small Cap Growth Fund Class I | 10 388 | −67,66 | 287 | −64,21 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 15 181 | 428,77 | 0 | |||||

| 2025-04-29 | NP | SVYAX - SIIT U.S. Managed Volatility Fund - Class A | 7 666 | −21,66 | 155 | −28,24 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 976 | −21,16 | 27 | 0,00 | ||||

| 2025-06-30 | NP | PRFZ - Invesco FTSE RAFI US 1500 Small-Mid ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 10 549 | 285 | ||||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 15 410 | 13,61 | 430 | 42,52 | ||||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 984 597 | −13,17 | 27 244 | 8,18 | ||||

| 2025-06-26 | NP | USMIX - Extended Market Index Fund | 4 768 | −2,57 | 129 | 34,74 | ||||

| 2025-08-11 | 13F | Citigroup Inc | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-13 | 13F | Cerity Partners LLC | 41 904 | 2,94 | 1 159 | 28,21 | ||||

| 2025-06-26 | NP | KCSIX - Knights of Columbus Small Cap Fund I Shares | 57 431 | 1,43 | 1 549 | 39,59 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 76 347 | 2 113 | ||||||

| 2025-08-14 | 13F | Polymer Capital Management (US) LLC | 10 486 | 14,70 | 290 | 42,86 | ||||

| 2025-08-14 | 13F | Artia Global Partners LP | 29 200 | 808 | ||||||

| 2025-07-18 | 13F | Ami Asset Management Corp | 43 141 | −44,47 | 1 194 | −30,84 | ||||

| 2025-08-12 | 13F | Hillsdale Investment Management Inc. | 200 574 | 5 550 | ||||||

| 2025-08-27 | NP | ALLIANZ VARIABLE INSURANCE PRODUCTS TRUST - AZL DFA U.S. Core Equity Fund | 2 011 | 56 | ||||||

| 2025-08-11 | 13F | Citigroup Inc | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Laurion Capital Management LP | 13 170 | 364 | ||||||

| 2025-05-29 | NP | PABAX - Putnam Dynamic Asset Allocation Balanced Fund Class A shares | 6 940 | 0,17 | 154 | 12,41 | ||||

| 2025-08-14 | 13F | Fmr Llc | 806 898 | 0,34 | 22 327 | 25,01 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 28 000 | 775 | |||||

| 2025-08-14 | 13F | UBS Group AG | 30 616 | −38,75 | 847 | −23,69 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 11 300 | 313 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 558 392 | 331,89 | 15 451 | 438,14 | ||||

| 2025-08-14 | 13F | ADAR1 Capital Management, LLC | 56 540 | 36,53 | 1 564 | 70,18 | ||||

| 2025-05-14 | 13F | Van Hulzen Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-30 | NP | SVOAX - Simt Us Managed Volatility Fund Class F | 4 012 | −28,18 | 89 | −19,09 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | 14 385 | 398 | ||||||

| 2025-06-23 | NP | SLPIX - Small-cap Profund Investor Class | 37 | −11,90 | 1 | |||||

| 2025-08-07 | 13F | Sound View Wealth Advisors Group, LLC | 12 505 | −14,68 | 346 | 6,46 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 1 163 | 724,82 | 32 | 966,67 | ||||

| 2025-08-27 | NP | BBGSX - Bridge Builder Small/Mid Cap Growth Fund | 1 357 | −81,76 | 38 | −77,58 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 2 266 | 0,71 | 63 | 26,53 | ||||

| 2025-04-17 | NP | FLSPX - SPECTRUM FUND Retail Class | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-28 | NP | SFLO - VictoryShares Small Cap Free Cash Flow ETF | 54 137 | 11,69 | 1 498 | 39,13 | ||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 104 705 | 87,05 | 2 897 | 133,07 | ||||

| 2025-07-31 | 13F/A | Avion Wealth | 43 | 0 | ||||||

| 2025-08-08 | 13F | Creative Planning | 12 942 | 358 | ||||||

| 2025-05-29 | NP | JAEWX - Small Cap Index Trust NAV | 7 644 | −0,97 | 170 | 11,18 | ||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 133 276 | 311,57 | 4 | |||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 425 947 | 88,95 | 11 786 | 135,42 | ||||

| 2025-07-29 | NP | VRTGX - Vanguard Russell 2000 Growth Index Fund Institutional Shares | 33 651 | −4,60 | 921 | 28,67 | ||||

| 2025-06-27 | NP | RSSL - Global X Russell 2000 ETF | 23 385 | 6,95 | 631 | 47,20 | ||||

| 2025-04-29 | NP | PMIYX - Putnam Income Strategies Portfolio - | 365 | −1,08 | 7 | −12,50 | ||||

| 2025-08-01 | 13F | Peregrine Capital Management Llc | 288 636 | −6,65 | 7 987 | 16,30 | ||||

| 2025-08-27 | NP | VITNX - Vanguard Institutional Total Stock Market Index Fund Institutional Shares This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 19 703 | 12,30 | 545 | 40,10 | ||||

| 2025-08-11 | 13F | Rice Hall James & Associates, Llc | 638 233 | 2,19 | 17 660 | 27,31 | ||||

| 2025-08-14 | 13F | Weiss Asset Management LP | 111 710 | 3 091 | ||||||

| 2025-08-27 | NP | VBINX - Vanguard Balanced Index Fund Investor Shares | 21 265 | 0,00 | 588 | 24,58 | ||||

| 2025-03-27 | NP | SUNAMERICA SERIES TRUST - SA Small Cap Index Portfolio Class 1 | 829 | 0,00 | 16 | −11,11 | ||||

| 2025-05-14 | 13F | Brown Brothers Harriman & Co | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Voloridge Investment Management, Llc | 333 923 | 412,86 | 9 240 | 538,93 | ||||

| 2025-08-12 | 13F | Corebridge Financial, Inc. | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 1 380 | −6,31 | 38 | 18,75 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 20 418 | 1 | ||||||

| 2025-08-07 | 13F | Los Angeles Capital Management Llc | 8 037 | −81,98 | 222 | −77,58 | ||||

| 2025-08-12 | 13F | Aigen Investment Management, Lp | 9 410 | 260 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 1 066 279 | −0,94 | 29 504 | 23,41 | ||||

| 2025-07-31 | 13F | Asset Management One Co., Ltd. | 13 470 | 624,19 | 373 | 807,32 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 110 | 0,00 | 3 | 50,00 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 59 275 | 1 640 | ||||||

| 2025-06-26 | NP | DFAU - Dimensional US Core Equity Market ETF | 6 896 | 0,00 | 186 | 37,04 | ||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 18 941 | −61,14 | 524 | −51,57 | ||||

| 2025-05-15 | 13F | Woodline Partners LP | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 139 782 | 157,53 | 3 868 | 220,91 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 115 400 | 3 193 | |||||

| 2025-07-25 | NP | PMSAX - Global Multi-Strategy Fund Class A | 68 | 2 | ||||||

| 2025-08-11 | 13F | Covestor Ltd | 12 | −33,33 | 0 | |||||

| 2025-08-06 | 13F | True Wealth Design, LLC | 687 | 29,87 | 19 | 72,73 | ||||

| 2025-08-14 | 13F | Point72 Hong Kong Ltd | 11 839 | 328 | ||||||

| 2025-08-28 | NP | STMSX - Simt Tax-managed Small/mid Cap Fund Class F | 31 021 | 0,00 | 858 | 24,71 | ||||

| 2025-08-13 | 13F | Fisher Asset Management, LLC | 102 259 | −29,11 | 2 830 | −11,68 | ||||

| 2025-07-31 | 13F | Linden Thomas Advisory Services, LLC | 116 115 | −0,99 | 3 213 | 23,35 | ||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | VSEQX - Vanguard Strategic Equity Fund Investor Shares | 120 051 | 0,00 | 3 322 | 24,57 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Advantage Alpha Capital Partners LP | 11 020 | −18,95 | 305 | 1,00 | ||||

| 2025-08-14 | 13F | Silverarc Capital Management, Llc | 75 959 | −13,89 | 2 102 | 7,25 | ||||

| 2025-08-27 | NP | VISGX - Vanguard Small-Cap Growth Index Fund Investor Shares | 518 472 | −1,74 | 14 346 | 22,43 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 5 117 | −74,96 | 142 | −68,87 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 115 | 15,00 | 3 | 50,00 | ||||

| 2025-08-14 | 13F | Driehaus Capital Management Llc | 647 980 | 6,00 | 17 930 | 32,06 | ||||

| 2025-07-31 | 13F | Nisa Investment Advisors, Llc | 105 | −31,82 | 3 | −33,33 | ||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 848 549 | −26,18 | 23 479 | −8,03 | ||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 0 | −100,00 | 0 | |||||

| 2025-08-25 | NP | QWVOX - Clearwater Small Companies Fund | 34 222 | −49,89 | 947 | −49,92 | ||||

| 2025-05-15 | 13F | SRS Capital Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-05-30 | NP | SEIS - SEI Select Small Cap ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Twin Peaks Wealth Advisors, LLC | 1 | 0 | ||||||

| 2025-08-13 | 13F | Invesco Ltd. | 20 289 | −39,42 | 561 | −24,50 | ||||

| 2025-05-12 | 13F | National Bank Of Canada /fi/ | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Northern Trust Corp | 54 587 | −81,25 | 1 510 | −76,65 |