Grundläggande statistik

| Institutionella ägare | 155 total, 154 long only, 1 short only, 0 long/short - change of 9,93% MRQ |

| Genomsnittlig portföljallokering | 0.1255 % - change of −48,05% MRQ |

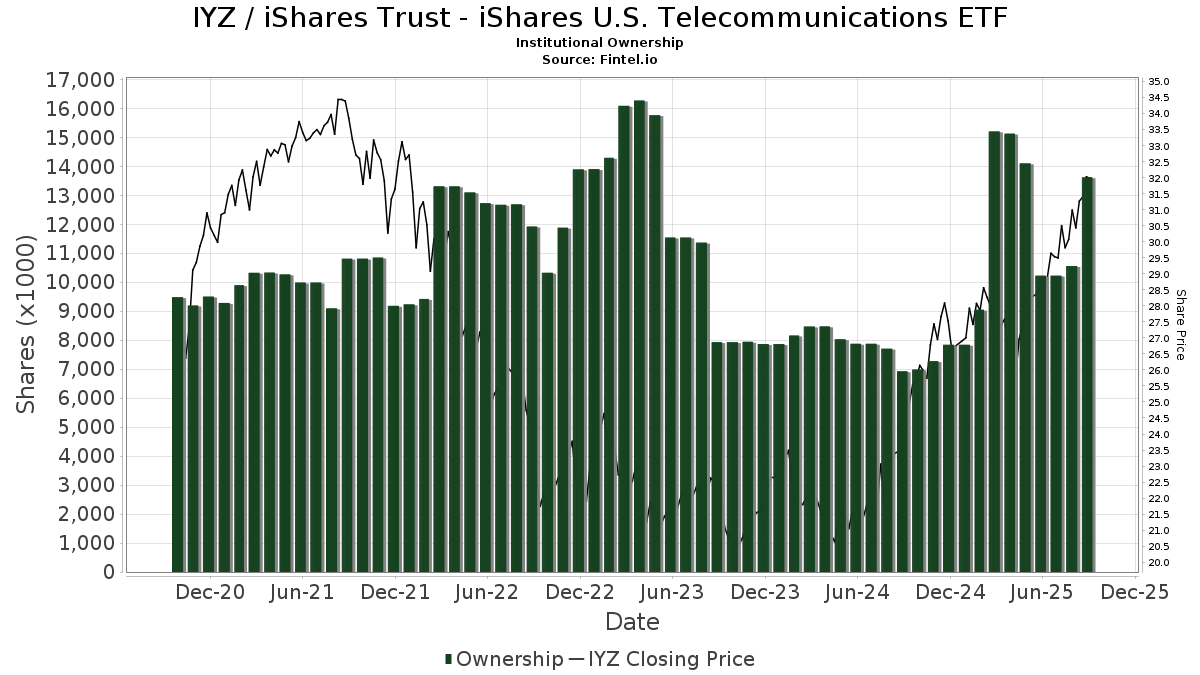

| Institutionella aktier (lång) | 13 618 864 (ex 13D/G) - change of 3,40MM shares 33,21% MRQ |

| Institutionellt värde (lång) | $ 394 292 USD ($1000) |

Institutionellt ägande och aktieägare

iShares Trust - iShares U.S. Telecommunications ETF (US:IYZ) har 155 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 13,662,070 aktier. Största aktieägare inkluderar Morgan Stanley, Bank Of America Corp /de/, Pinkerton Retirement Specialists, LLC, Citigroup Inc, Bnp Paribas Arbitrage, Sa, Royal Bank Of Canada, Camarda Financial Advisors, LLC, Raymond James Financial Inc, LPL Financial LLC, and Millennium Management Llc .

iShares Trust - iShares U.S. Telecommunications ETF (BATS:IYZ) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 18, 2025 is 32,13 / share. Previously, on September 19, 2024, the share price was 24,57 / share. This represents an increase of 30,77% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

AI+ Ask Fintel’s AI assistant about iShares Trust - iShares U.S. Telecommunications ETF.

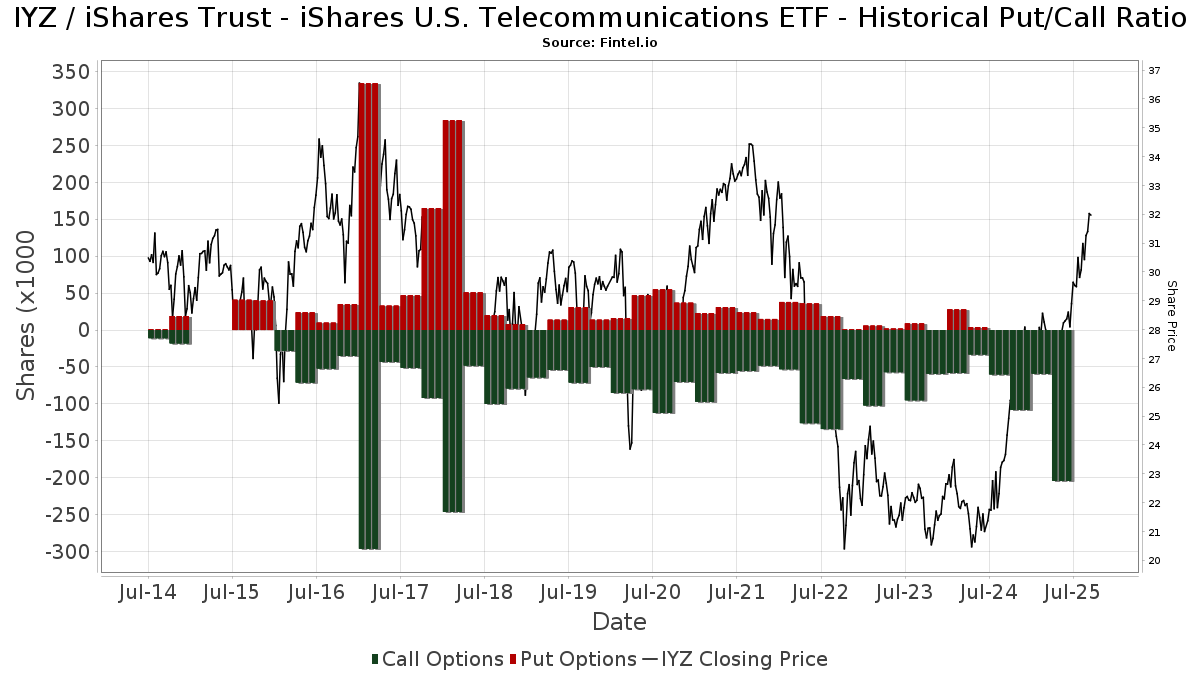

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-04 | 13F | Assetmark, Inc | 104 | 67,74 | 3 | 200,00 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 33 535 | 999 | ||||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 46 139 | 30,09 | 1 374 | 41,50 | ||||

| 2025-07-25 | 13F | Second Half Financial Partners, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 1 826 858 | 19,86 | 54 404 | 30,32 | ||||

| 2025-08-26 | NP | LCR - Leuthold Core ETF | 39 073 | 2,52 | 1 164 | 11,51 | ||||

| 2025-08-12 | 13F | Gladstone Institutional Advisory LLC | 7 753 | 231 | ||||||

| 2025-05-13 | 13F | Tocqueville Asset Management L.p. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 29 747 | 886 | ||||||

| 2025-05-15 | 13F | Wolverine Trading, Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 23 750 | 707 | ||||||

| 2025-05-14 | 13F | Brown Brothers Harriman & Co | 0 | −100,00 | 0 | |||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 21 280 | −0,06 | 634 | 8,58 | ||||

| 2025-07-15 | 13F | EWG Elevate Inc. | 102 987 | −5,98 | 3 067 | 2,20 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 159 725 | 501,65 | 4 757 | 554,20 | ||||

| 2025-07-17 | 13F/A | Capital Investment Advisors, LLC | 10 217 | −6,19 | 304 | 2,01 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 151 | 0,00 | 4 | 0,00 | ||||

| 2025-08-13 | 13F | Capital Analysts, Inc. | 1 539 | 0 | ||||||

| 2025-07-18 | 13F | USA Financial Portformulas Corp | 122 001 | 3 633 | ||||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 24 592 | 1 | ||||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 1 491 | 0,00 | 44 | 10,00 | ||||

| 2025-08-14 | 13F | Fmr Llc | 2 572 | 8,57 | 77 | 18,75 | ||||

| 2025-07-16 | 13F | Register Financial Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 29 018 | 21,15 | 864 | 31,71 | ||||

| 2025-07-09 | 13F | Lifestyle Asset Management, Inc. | 33 543 | 999 | ||||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 270 626 | 48,03 | 8 | 60,00 | ||||

| 2025-07-22 | 13F | DAVENPORT & Co LLC | 10 495 | −6,43 | 313 | 1,63 | ||||

| 2025-05-09 | 13F | Three Seasons Wealth, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 82 500 | −59,40 | 2 457 | −55,87 | ||||

| 2025-08-12 | 13F | Park Square Financial Group, LLC | 600 | 0,00 | 18 | 6,25 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 8 150 | 243 | ||||||

| 2025-07-16 | 13F/A | CX Institutional | 7 373 | −10,80 | 0 | |||||

| 2025-08-15 | 13F | WFA of San Diego, LLC | 850 | 25 | ||||||

| 2025-08-05 | 13F | C2P Capital Advisory Group, LLC d.b.a. Prosperity Capital Advisors | 36 421 | 61,10 | 1 085 | 74,56 | ||||

| 2025-04-15 | 13F | First United Bank Trust/ | 0 | −100,00 | 0 | |||||

| 2025-07-10 | 13F | Family Legacy Financial Solutions, LLC | 1 891 | 56 | ||||||

| 2025-08-05 | 13F | Huntington National Bank | 127 | 0,00 | 4 | 0,00 | ||||

| 2025-07-24 | 13F | Forefront Analytics, LLC | 75 634 | 2 252 | ||||||

| 2025-08-14 | 13F | J. Goldman & Co LP | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | WESPAC Advisors, LLC | 72 515 | 94,73 | 2 159 | 111,87 | ||||

| 2025-08-07 | 13F | Fountainhead AM, LLC | 12 112 | 361 | ||||||

| 2025-05-07 | 13F | New Republic Capital, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Strengthening Families & Communities, LLC | 1 248 | −82,85 | 34 | −78,48 | ||||

| 2025-08-08 | 13F | MTM Investment Management, LLC | 270 | 0,00 | 8 | 14,29 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-02 | 13F | HBW Advisory Services LLC | 0 | −100,00 | 0 | |||||

| 2025-04-16 | 13F | Goldstone Financial Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | CHICAGO TRUST Co NA | 8 514 | −1,96 | 254 | 6,75 | ||||

| 2025-04-29 | 13F | Resources Investment Advisors, LLC. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-15 | 13F | Barclays Plc | 0 | −100,00 | 0 | |||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 140 407 | 9,43 | 4 191 | 19,27 | ||||

| 2025-07-16 | 13F | Moisand Fitzgerald Tamayo, LLC | 300 | 0,00 | 9 | 0,00 | ||||

| 2025-08-05 | 13F | Westside Investment Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-04-14 | 13F | City Center Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-29 | 13F | Balboa Wealth Partners | 88 699 | 2 641 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 102 451 | −20,65 | 3 051 | −13,74 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 31 | 0,00 | 1 | |||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 19 715 | −11,52 | 1 | |||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 9 006 | 268 | ||||||

| 2025-04-28 | 13F | Clear Creek Financial Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Financial Counselors Inc | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 35 312 | 3,55 | 1 052 | 12,53 | ||||

| 2025-07-23 | 13F | Kingswood Wealth Advisors, Llc | 7 652 | −34,05 | 228 | −28,39 | ||||

| 2025-05-06 | 13F | Proficio Capital Partners LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-29 | 13F | Mezzasalma Advisors, LLC | 8 458 | 0,25 | 252 | 8,66 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 10 400 | −7,64 | 310 | 0,32 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 7 213 | 85,76 | 215 | 101,89 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 30 528 | 286,82 | 909 | 320,83 | ||||

| 2025-04-16 | 13F | Verity & Verity, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Leuthold Group, Llc | 42 014 | 2,63 | 1 251 | 11,60 | ||||

| 2025-07-24 | 13F | Blair William & Co/il | 8 173 | −0,57 | 243 | 8,00 | ||||

| 2025-05-13 | 13F | Quadrature Capital Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Destination Wealth Management | 71 628 | −2,29 | 2 133 | 6,28 | ||||

| 2025-08-29 | 13F | Centaurus Financial, Inc. | 6 327 | 0 | ||||||

| 2025-04-29 | 13F | Sharp Financial Services, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-07 | 13F | Norden Group Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Pinnacle Family Advisors, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-01 | 13F | Boyd Watterson Asset Management Llc/oh | 150 | 0,00 | 4 | 0,00 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 193 183 | −59,22 | 5 753 | −55,67 | ||||

| 2025-05-15 | 13F | Captrust Financial Advisors | 0 | −100,00 | 0 | |||||

| 2025-05-12 | 13F | Townsquare Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Integrated Advisors Network LLC | 80 469 | 2 396 | ||||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 4 800 | 200,00 | 143 | 230,23 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 342 903 | −8,92 | 9 392 | −7,01 | ||||

| 2025-05-15 | 13F | Citadel Advisors Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-08-13 | 13F | Virtue Capital Management, LLC | 6 886 | 205 | ||||||

| 2025-05-15 | 13F | Citadel Advisors Llc | 0 | −100,00 | 0 | |||||

| 2025-07-23 | 13F | West Paces Advisors Inc. | 1 105 | 33 | ||||||

| 2025-08-11 | 13F | Strategic Wealth Partners, Ltd. | 1 250 | 37 | ||||||

| 2025-04-10 | 13F | Iams Wealth Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F/A | Curat Global, LLC | 861 | 26 | ||||||

| 2025-05-02 | 13F | Apollon Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 1 987 | 0,00 | 59 | 9,26 | ||||

| 2025-07-29 | 13F | Fundamentun, Llc | 7 791 | −9,32 | 232 | −1,28 | ||||

| 2025-08-13 | 13F | VestGen Advisors, LLC | 19 020 | 0,43 | 566 | 9,27 | ||||

| 2025-04-30 | 13F | Moloney Securities Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 72 | −46,67 | 2 | −33,33 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 51 233 | 0,04 | 1 526 | 8,77 | ||||

| 2025-07-16 | 13F | St Germain D J Co Inc | 13 496 | −4,85 | 402 | 3,35 | ||||

| 2025-08-05 | 13F | Kesler, Norman & Wride, LLC | 32 775 | 114,61 | 976 | 133,49 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 63 726 | −21,24 | 1 898 | −14,40 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 24 006 | −75,54 | 715 | −73,44 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 465 395 | 181,50 | 13 860 | 206,16 | ||||

| 2025-08-14 | 13F | Zurich Insurance Group Ltd/FI | 350 290 | 10 397 | ||||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 5 203 | 0,39 | 155 | 9,22 | ||||

| 2025-04-30 | 13F | Stonebrook Private Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Freestone Capital Holdings, LLC | 17 190 | 110,33 | 512 | 129,15 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 1 961 | 63,55 | 58 | 81,25 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 334 711 | −2,39 | 9 968 | 6,12 | ||||

| 2025-04-03 | 13F | Central Pacific Bank - Trust Division | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-07 | 13F | First Citizens Financial Corp | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Advanced Asset Management Advisors Inc | 7 007 | −10,06 | 209 | −2,35 | ||||

| 2025-07-17 | 13F | Oakworth Capital, Inc. | 300 | 0,00 | 9 | 0,00 | ||||

| 2025-07-14 | 13F | Narus Financial Partners, LLC | 7 177 | 214 | ||||||

| 2025-08-11 | 13F | FSA Wealth Management LLC | 1 462 | 0,14 | 44 | 10,26 | ||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 20 764 | 0,00 | 618 | 8,80 | ||||

| 2025-08-08 | 13F | Family Firm, Inc. | 14 441 | 0,40 | 430 | 9,41 | ||||

| 2025-07-10 | 13F | Farmers & Merchants Trust Co of Chambersburg PA | 750 | 0,00 | 0 | |||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 1 727 | 0,29 | 51 | 8,51 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 868 097 | −10,26 | 25 852 | −2,43 | ||||

| 2025-07-16 | 13F | PFS Partners, LLC | 780 | 0,52 | 23 | 9,52 | ||||

| 2025-05-12 | 13F | Independent Advisor Alliance | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 79 903 | −8,50 | 2 380 | −0,50 | ||||

| 2025-04-11 | 13F | Vanguard Capital Wealth Advisors This fund is a listed as child fund of Vanguard Group Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 153 | 0,00 | 5 | 33,33 | ||||

| 2025-08-14 | 13F | KKM Financial LLC | 28 330 | 844 | ||||||

| 2025-07-29 | 13F | Koshinski Asset Management, Inc. | 25 967 | 0,00 | 773 | 8,72 | ||||

| 2025-05-01 | 13F | Coastal Investment Advisors, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 17 400 | −70,81 | 518 | −68,26 | |||

| 2025-04-29 | NP | EBI - Longview Advantage ETF | 371 | 11 | ||||||

| 2025-08-12 | 13F | MAI Capital Management | 3 003 | 0,00 | 89 | 8,54 | ||||

| 2025-05-15 | 13F | StoneX Group Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 428 782 | 15,42 | 12 769 | 25,49 | ||||

| 2025-08-14 | 13F | MGB Wealth Management, LLC | 9 222 | −7,04 | 273 | 0,37 | ||||

| 2025-08-14 | 13F | Smartleaf Asset Management LLC | 9 199 | 270 | ||||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 1 435 758 | −16,24 | 42 757 | −8,93 | ||||

| 2025-08-08 | 13F | Capital Investment Advisory Services, LLC | 80 | 0,00 | 2 | 0,00 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 68 200 | 2 031 | ||||||

| 2025-08-13 | 13F | Baker Avenue Asset Management, LP | 132 014 | 8,02 | 3 931 | 17,45 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 24 213 | −14,55 | 721 | −7,09 | ||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 28 750 | 856 | ||||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 39 181 | 0,02 | 1 167 | 8,77 | ||||

| 2025-07-09 | 13F | Summit Financial Consulting LLC | 223 167 | −0,10 | 6 646 | 8,61 | ||||

| 2025-07-30 | 13F | Retirement Planning Group | 18 242 | −52,83 | 543 | −48,73 | ||||

| 2025-08-05 | 13F | Mountain Hill Investment Partners Corp. | 33 | 3,12 | 1 | |||||

| 2025-07-24 | 13F | Williams & Novak, LLC | 10 865 | −12,13 | 324 | −4,72 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 2 074 | 0,00 | 0 | |||||

| 2025-08-11 | 13F | Great Lakes Advisors, Llc | 8 514 | −1,96 | 254 | 6,75 | ||||

| 2025-07-30 | NP | EMPB - Efficient Market Portfolio Plus ETF | Short | −43 206 | 137,64 | −1 210 | 134,50 | |||

| 2025-07-23 | 13F | Nbt Bank N A /ny | 37 506 | −1,73 | 1 117 | 6,79 | ||||

| 2025-07-18 | 13F | Trust Co Of Vermont | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-18 | 13F | Truist Financial Corp | 81 633 | −1,07 | 2 431 | 7,57 | ||||

| 2025-03-21 | 13F | Prostatis Group LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Pinkerton Retirement Specialists, LLC | 1 154 002 | 34 366 | ||||||

| 2025-08-06 | 13F | Rps Advisory Solutions Llc | 18 487 | 551 | ||||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Hrt Financial Lp | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Oribel Capital Management, LP | Call | 187 500 | 44 756 | |||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 14 460 | 22,31 | 424 | 31,37 | ||||

| 2025-07-09 | 13F | St. Louis Financial Planners Asset Management, LLC | 21 485 | −50,53 | 640 | −46,26 | ||||

| 2025-07-30 | 13F | Whittier Trust Co | 37 | 0,00 | 1 | 0,00 | ||||

| 2025-08-06 | 13F | Eukles Asset Management | 281 | 8 | ||||||

| 2025-08-08 | 13F | Gts Securities Llc | 18 452 | 15,13 | 550 | 25,34 | ||||

| 2025-08-13 | 13F | Green Harvest Asset Management LLC | 84 101 | −0,07 | 2 505 | 8,63 | ||||

| 2025-08-11 | 13F | Ritter Daniher Financial Advisory LLC / DE | 17 | 0,00 | 1 | |||||

| 2025-05-01 | 13F | Fulcrum Equity Management | 0 | −100,00 | 0 | |||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 30 | −33,33 | 1 | −100,00 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 1 450 | 0,00 | 43 | 10,26 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 184 398 | 14,40 | 5 491 | 24,40 | ||||

| 2025-08-12 | 13F | AlphaCore Capital LLC | 5 957 | 14 792,50 | 177 | 17 600,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 135 327 | 480,50 | 4 030 | 531,66 | ||||

| 2025-08-07 | 13F | Alpha Cubed Investments, LLC | 12 934 | 0,00 | 385 | 8,76 | ||||

| 2025-08-12 | 13F | South Plains Financial, Inc. | 365 | 0,00 | 11 | 11,11 | ||||

| 2025-08-15 | 13F | Nikulski Financial, Inc. | 43 289 | 58,39 | 1 289 | 72,33 | ||||

| 2025-08-04 | 13F | Buck Wealth Strategies, LLC | 36 234 | 55,78 | 1 079 | 69,39 | ||||

| 2025-08-14 | 13F | Sunbelt Securities, Inc. | 100 | 0,00 | 3 | 0,00 | ||||

| 2025-07-29 | 13F | Stratos Wealth Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Camarda Financial Advisors, LLC | 463 019 | 13 789 | ||||||

| 2025-07-21 | 13F | Financial Services Advisory Inc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 425 982 | 26,70 | 12 686 | 37,76 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 388 671 | 11 575 | ||||||

| 2025-08-11 | 13F | Synergy Investment Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 129 576 | 444,85 | 3 859 | 492,63 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Fortis Group Advisors, LLC | 45 | 0,00 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 156 016 | −41,83 | 4 646 | −36,75 | ||||

| 2025-07-21 | 13F | Yeomans Consulting Group, Inc. | 35 231 | 1 048 | ||||||

| 2025-08-04 | 13F | Atria Investments Llc | 16 672 | −24,01 | 496 | −17,33 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 13 399 | 44,06 | 0 | |||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 567 609 | 77,87 | 16 903 | 93,40 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 907 | −98,61 | 27 | −98,49 | ||||

| 2025-08-04 | 13F | Creative Financial Designs Inc /adv | 827 | −14,12 | 25 | −7,69 | ||||

| 2025-08-14 | 13F | Snowden Capital Advisors LLC | 17 437 | −14,00 | 519 | −6,49 | ||||

| 2025-08-07 | 13F | Atala Financial Inc | 0 | −100,00 | 0 | |||||

| 2025-05-07 | 13F | First Heartland Consultants, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-09-15 | 13F/A | Migdal Insurance & Financial Holdings Ltd. | 1 080 | 0 | ||||||

| 2025-08-08 | 13F | Schwarz Dygos Wheeler Investment Advisors Llc | 21 415 | −5,80 | 638 | 2,41 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 4 229 | 202,29 | 126 | 228,95 | ||||

| 2025-04-18 | 13F | Optivise Advisory Services LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Comerica Bank | 15 797 | −13,88 | 470 | −6,37 | ||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 168 618 | 30,09 | 5 021 | 41,44 | ||||

| 2025-07-23 | 13F | Lakeshore Capital Group, Inc. | 30 859 | −6,45 | 919 | 1,66 | ||||

| 2025-08-07 | 13F | Commerce Bank | 10 621 | 0,00 | 316 | 8,97 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Fisher Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Midwest Trust Co | 11 971 | 356 | ||||||

| 2025-08-08 | 13F | Croban | 75 634 | 0,60 | 2 252 | 9,38 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | −100,00 | 0 |