Grundläggande statistik

| Institutionella ägare | 123 total, 117 long only, 1 short only, 5 long/short - change of −0,81% MRQ |

| Genomsnittlig portföljallokering | 0.3258 % - change of −12,34% MRQ |

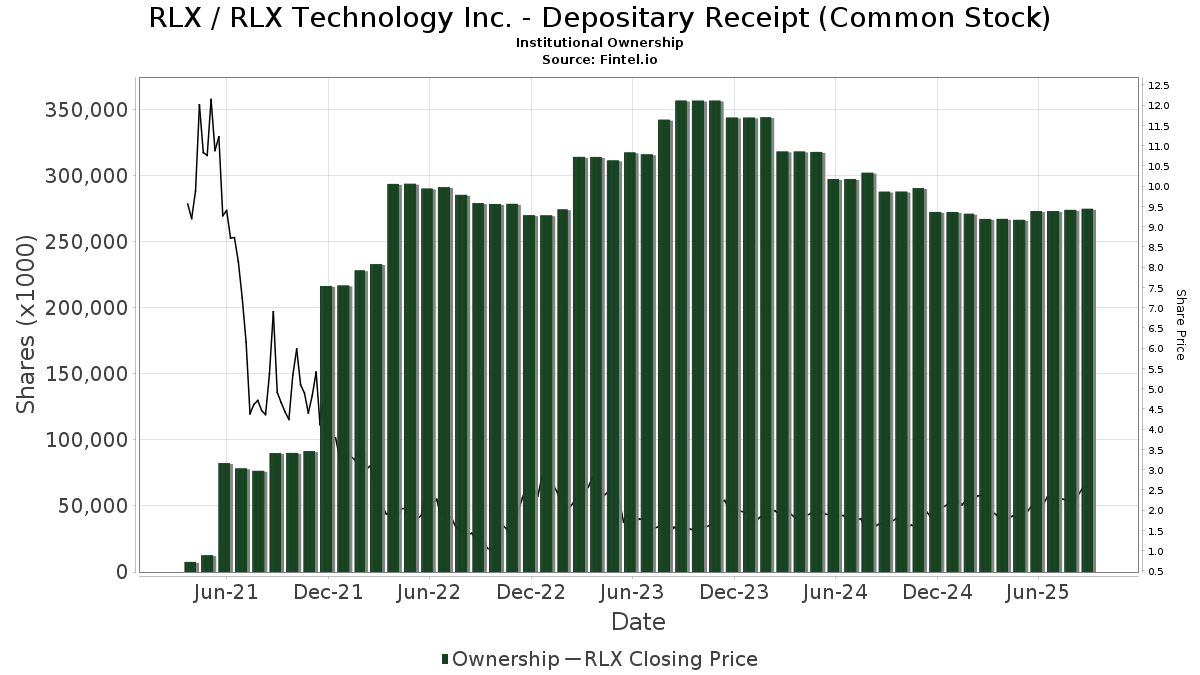

| Institutionella aktier (lång) | 274 935 796 (ex 13D/G) - change of 1,67MM shares 0,61% MRQ |

| Institutionellt värde (lång) | $ 563 981 USD ($1000) |

Institutionellt ägande och aktieägare

RLX Technology Inc. - Depositary Receipt (Common Stock) (US:RLX) har 123 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 274,963,174 aktier. Största aktieägare inkluderar First Beijing Investment Ltd, IDG China Venture Capital Fund V Associates L.P., Vanguard Group Inc, Wildcat Capital Management, LLC, Aspex Management (HK) Ltd, Jane Street Group, Llc, VGTSX - Vanguard Total International Stock Index Fund Investor Shares, VEIEX - Vanguard Emerging Markets Stock Index Fund Investor Shares, BlackRock, Inc., and Goldman Sachs Group Inc .

RLX Technology Inc. - Depositary Receipt (Common Stock) (NYSE:RLX) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 10, 2025 is 2,64 / share. Previously, on September 11, 2024, the share price was 1,67 / share. This represents an increase of 58,08% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

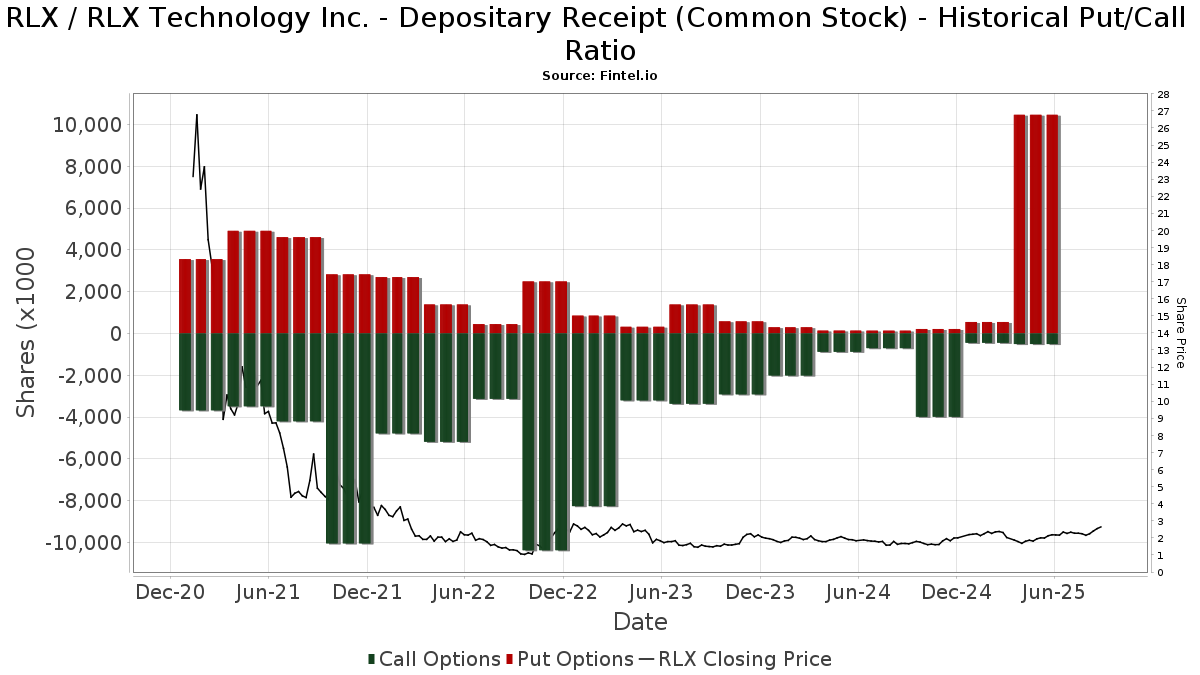

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-13 | 13F | Invesco Ltd. | 555 756 | −5,84 | 1 228 | 10,73 | ||||

| 2025-06-27 | NP | PGJ - Invesco Golden Dragon China ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 586 875 | 9,88 | 1 092 | −7,93 | ||||

| 2025-08-27 | NP | TIFF INVESTMENT PROGRAM - TIFF Multi-Asset Fund | Short | −27 378 | 1,05 | −61 | 20,00 | |||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 6 000 | −93,40 | 0 | ||||

| 2025-08-14 | 13F | Fmr Llc | 732 | −13,88 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Point72 Hong Kong Ltd | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Bayesian Capital Management, LP | 0 | −100,00 | 0 | |||||

| 2025-08-26 | NP | AZBAX - AllianzGI Small-Cap Fund Class A | 43 796 | 97 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 12 197 | 21,97 | 27 | 42,11 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 3 057 | 0,00 | 7 | 20,00 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 238 373 | 119,33 | 1 | |||||

| 2025-08-08 | 13F | Creative Planning | 72 419 | −6,17 | 160 | 10,34 | ||||

| 2025-05-15 | 13F | Caption Management, LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 10 600 | −33,75 | 0 | ||||

| 2025-04-17 | 13F | Vista Wealth Management Group, LLC | 2 061 263 | 0,00 | 3 875 | −12,96 | ||||

| 2025-08-08 | 13F | Police & Firemen's Retirement System of New Jersey | 130 114 | 0,00 | 288 | 17,62 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 333 267 | 242,08 | 737 | 302,19 | ||||

| 2025-08-14 | 13F | Jain Global LLC | 22 900 | 51 | ||||||

| 2025-08-14 | 13F | Susquehanna Fundamental Investments, Llc | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | FTIHX - Fidelity Total International Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 176 446 | −9,73 | 328 | −24,25 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 3 143 | 7 | ||||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 0 | −100,00 | 0 | |||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 22 087 | 7,29 | 49 | 23,08 | ||||

| 2025-04-23 | 13F | Continuum Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Oasis Management Co Ltd. | 6 037 031 | 5,49 | 13 342 | 24,01 | ||||

| 2025-05-15 | 13F | Lazard Asset Management Llc | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | JustInvest LLC | 40 168 | 73,83 | 89 | 104,65 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-05-14 | 13F | Walleye Trading LLC | Call | 0 | −100,00 | 0 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 27 500 | −17,91 | 61 | −3,17 | |||

| 2025-05-15 | 13F | Boothbay Fund Management, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Point72 Asia (Singapore) Pte. Ltd. | 0 | −100,00 | 0 | |||||

| 2025-05-12 | 13F | Pinpoint Asset Management Ltd | 49 850 | −71,99 | 94 | −75,78 | ||||

| 2025-08-28 | NP | GXC - SPDR(R) S&P(R) CHINA ETF | 112 832 | −10,17 | 249 | 5,51 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 48 300 | 20,45 | 107 | 41,33 | |||

| 2025-08-12 | 13F | IDG China Venture Capital Fund V Associates L.P. | 60 068 870 | 0,00 | 132 752 | 17,55 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 603 723 | 5 794,01 | 1 334 | 6 921,05 | ||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 624 467 | −6,39 | 1 380 | 10,05 | ||||

| 2025-07-31 | 13F | Ground Swell Capital, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 81 600 | −59,32 | 180 | −52,25 | |||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 1 255 | 1 083,96 | 3 | |||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 50 078 | −35,31 | 111 | −24,14 | ||||

| 2025-08-28 | NP | SPGM - SPDR(R) Portfolio MSCI Global Stock Market ETF | 37 407 | 2,96 | 83 | 20,59 | ||||

| 2025-08-12 | 13F | Clear Street Markets Llc | 19 288 | 156,49 | 43 | 200,00 | ||||

| 2025-08-28 | NP | QCSTRX - Stock Account Class R1 | 275 300 | −13,29 | 608 | 2,01 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 13 000 | 0,00 | 29 | 16,67 | ||||

| 2025-04-15 | 13F | Ameliora Wealth Management Ltd. | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | Signaturefd, Llc | 58 136 | −6,61 | 128 | 9,40 | ||||

| 2025-07-14 | 13F | Ridgewood Investments LLC | 16 000 | 0,00 | 35 | 16,67 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 5 870 | 13 | ||||||

| 2025-08-11 | 13F | Vanguard Group Inc | 27 035 683 | −3,22 | 59 749 | 13,77 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 44 757 | 99 | ||||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 1 225 | −95,25 | 3 | −95,83 | ||||

| 2025-05-09 | 13F | Pnc Financial Services Group, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Optiver Holding B.V. | 1 | −100,00 | 0 | −100,00 | ||||

| 2025-07-25 | NP | ECNS - iShares MSCI China Small-Cap ETF | 155 216 | −6,19 | 320 | −22,38 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 54 064 | 308,18 | 119 | 395,83 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 9 185 | 0,00 | 20 | 17,65 | ||||

| 2025-08-28 | NP | SSGVX - State Street Global Equity ex-U.S. Index Portfolio State Street Global All Cap Equity ex-U.S. Index Portfolio This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 89 100 | −66,12 | 197 | −60,32 | ||||

| 2025-07-25 | NP | SCHE - Schwab Emerging Markets Equity ETF This fund is a listed as child fund of Charles Schwab Investment Management Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 866 827 | 0,00 | 1 786 | −17,28 | ||||

| 2025-06-23 | NP | UGPIX - UltraChina ProFund Investor Class | 27 007 | −30,41 | 50 | −41,86 | ||||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 198 067 | −24,07 | 438 | −10,82 | ||||

| 2025-08-14 | 13F | Barometer Capital Management Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | West Family Investments, Inc. | 41 577 | 0,00 | 92 | 16,67 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 150 038 | 0,00 | 332 | 17,38 | ||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 1 603 605 | 15,30 | 3 544 | 35,54 | ||||

| 2025-08-26 | NP | FLAX - Franklin FTSE Asia ex Japan ETF | 2 466 | −11,80 | 5 | 0,00 | ||||

| 2025-08-14 | 13F | Cache Advisors, LLC | 71 777 | 0,00 | 159 | 17,91 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 4 111 174 | −26,78 | 9 086 | −13,94 | ||||

| 2025-04-22 | NP | APIE - ActivePassive International Equity ETF | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-15 | 13F | Parallax Volatility Advisers, L.P. | Call | 0 | −100,00 | 0 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 88 297 | 229,00 | 195 | 290,00 | ||||

| 2025-08-14 | 13F | Orland Properties Ltd | 4 612 138 | −17,82 | 10 193 | −3,39 | ||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 323 016 | 9,22 | 714 | 28,24 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Mariner, LLC | 21 770 | −15,45 | 48 | 0,00 | ||||

| 2025-08-14 | 13F | State Street Corp | 3 477 238 | −4,10 | 7 685 | 12,73 | ||||

| 2025-05-13 | 13F | Quantbot Technologies LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 147 | 0 | ||||||

| 2025-07-29 | NP | RBB FUND, INC. - Aquarius International Fund | 23 295 | 0,00 | 48 | −18,97 | ||||

| 2025-07-11 | 13F | Assenagon Asset Management S.A. | 580 015 | 1 282 | ||||||

| 2025-08-07 | 13F | Profund Advisors Llc | 33 299 | −12,42 | 74 | 2,82 | ||||

| 2025-08-14 | 13F | Susquehanna Portfolio Strategies, LLC | 301 058 | 665 | ||||||

| 2025-06-30 | NP | VEU - Vanguard FTSE All-World ex-US Index Fund ETF Shares | 1 498 147 | 3,99 | 2 787 | −12,88 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 183 824 | −5,65 | 406 | 10,93 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 1 000 | 0,00 | 2 | 100,00 | ||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 150 | 0 | ||||||

| 2025-08-14 | 13F | Polymer Capital Management (HK) LTD | 859 867 | 1 900 | ||||||

| 2025-07-25 | NP | EEMS - iShares MSCI Emerging Markets Small-Cap ETF | 91 509 | 3,51 | 189 | −14,55 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 1 946 802 | 4 302 | ||||||

| 2025-08-14 | 13F | Wetherby Asset Management Inc | 49 890 | −4,33 | 110 | −1,79 | ||||

| 2025-05-19 | 13F/A | Jane Street Group, Llc | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-05-09 | 13F | GeoWealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 13 823 | −48,13 | 31 | −40,00 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 679 951 | −7,04 | 1 503 | 9,24 | ||||

| 2025-08-15 | 13F | First Beijing Investment Ltd | 62 864 424 | 53,19 | 138 930 | 80,08 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | −100,00 | 0 | |||||

| 2025-07-15 | 13F | Ballentine Partners, LLC | 14 745 | 0,00 | 33 | 18,52 | ||||

| 2025-06-30 | NP | VT - Vanguard Total World Stock Index Fund ETF Shares | 467 145 | 0,00 | 869 | −16,30 | ||||

| 2025-08-07 | 13F | Hosking Partners LLP | 2 025 895 | −3,24 | 4 477 | 13,74 | ||||

| 2025-05-12 | 13F | Virtu Financial LLC | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 263 907 | −1,67 | 1 | |||||

| 2025-06-30 | NP | VGTSX - Vanguard Total International Stock Index Fund Investor Shares | 10 137 501 | −0,61 | 18 856 | −16,73 | ||||

| 2025-08-27 | 13F | Abn Amro Investment Solutions | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-13 | 13F | Pinpoint Asset Management (Singapore) Pte. Ltd. | 49 850 | 110 | ||||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 1 131 096 | −43,21 | 2 500 | −33,25 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 720 | 0,00 | 2 | 0,00 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 9 379 | 21 | ||||||

| 2025-08-14 | 13F | Canada Pension Plan Investment Board | 3 804 284 | 53,72 | 8 407 | 80,72 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Smartleaf Asset Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F/A | Barclays Plc | 6 155 466 | −2,99 | 14 | 18,18 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 32 084 | −56,44 | 0 | |||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 6 017 137 | 35,22 | 13 298 | 58,96 | ||||

| 2025-08-12 | 13F | Nuveen, LLC | 208 700 | −34,27 | 461 | −22,65 | ||||

| 2025-05-15 | 13F | Cubist Systematic Strategies, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 201 947 | 2,18 | 446 | 20,22 | ||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 128 240 | 0,00 | 283 | 17,43 | ||||

| 2025-07-18 | 13F | Wildcat Capital Management, LLC | 18 046 195 | 0,00 | 39 882 | 17,56 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 3 149 | −18,82 | 6 | −37,50 | ||||

| 2025-05-12 | 13F | FIL Ltd | 0 | −100,00 | 0 | |||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 17 193 | −15,18 | 38 | −2,63 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 4 276 | 9 | ||||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 181 488 | 0 | ||||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 142 300 | −10,39 | 314 | 5,37 | |||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 8 479 968 | 0,83 | 18 741 | 18,53 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 365 600 | 127,36 | 808 | 167,22 | |||

| 2025-06-26 | NP | IXUS - iShares Core MSCI Total International Stock ETF | 729 181 | 0,83 | 1 356 | −15,51 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 4 786 | −0,27 | 11 | 11,11 | ||||

| 2025-08-13 | 13F | Wealthquest Corp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Aspex Management (HK) Ltd | 12 123 409 | 0,00 | 27 | 18,18 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 18 100 | −51,34 | 40 | −42,03 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 4 286 183 | 186,92 | 9 472 | 237,32 | ||||

| 2025-07-23 | 13F | Shell Asset Management Co | 28 411 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | BlackRock, Inc. | 8 893 303 | −5,86 | 19 654 | 10,66 | ||||

| 2025-08-26 | NP | FLCH - Franklin FTSE China ETF | 46 736 | 1,23 | 103 | 19,77 | ||||

| 2025-04-21 | 13F | Catalina Capital Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Put | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 49 000 | 2,73 | 108 | 21,35 | |||

| 2025-08-14 | 13F | Perseverance Asset Management International | 6 643 226 | −24,04 | 14 682 | −10,71 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 2 359 964 | −12,44 | 5 216 | 2,94 | ||||

| 2025-08-14 | 13F | Man Group plc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 20 800 | −42,22 | 46 | −32,84 | |||

| 2025-06-24 | NP | TLTE - FlexShares Morningstar Emerging Markets Factor Tilt Index Fund | 14 168 | 684,06 | 26 | 550,00 | ||||

| 2025-06-30 | NP | VEIEX - Vanguard Emerging Markets Stock Index Fund Investor Shares | 9 134 015 | 0,77 | 16 989 | −15,57 | ||||

| 2025-08-28 | NP | SPEM - SPDR(R) Portfolio Emerging Markets ETF | 1 054 403 | 9,52 | 2 330 | 28,80 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 866 827 | 0,00 | 1 916 | 17,56 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 10 000 | 0,00 | 0 | |||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 122 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | Legal & General Group Plc | 761 154 | −1,90 | 1 684 | 15,27 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 10 216 500 | 4 687,49 | 22 578 | 5 530,42 | |||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 886 100 | −0,02 | 1 958 | 17,53 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 53 831 | −5,44 | 119 | 10,28 | ||||

| 2025-08-14 | 13F | LMR Partners LLP | 29 358 | 0,00 | 65 | 16,36 | ||||

| 2025-08-14 | 13F | Point72 (DIFC) Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | BRIGHT VALLEY CAPITAL Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Millennium Management Llc | 894 411 | −70,00 | 1 977 | −64,74 | ||||

| 2025-08-18 | 13F/A | Nomura Holdings Inc | 2 590 622 | −53,37 | 5 725 | −45,18 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 112 078 | −45,05 | 248 | −35,51 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 1 133 093 | 29,35 | 2 504 | 52,13 | ||||

| 2025-08-14 | 13F | UBS Group AG | 526 467 | −57,09 | 1 163 | −49,57 | ||||

| 2025-07-25 | NP | IEMG - iShares Core MSCI Emerging Markets ETF | 3 663 205 | 1,30 | 7 546 | −16,19 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 472 256 | −4,06 | 1 044 | 12,76 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 7 225 | −99,73 | 16 | −99,70 | ||||

| 2025-08-07 | 13F | Sierra Ocean, Llc | 534 | 0,00 | 1 | 0,00 | ||||

| 2025-08-28 | NP | GMF - SPDR(R) S&P(R) EMERGING ASIA PACIFIC ETF | 37 602 | −6,51 | 83 | 10,67 |

Other Listings

| DE:3CM | 2,24 € |