Grundläggande statistik

| Institutionella ägare | 0 total, 0 long only, 0 short only, 0 long/short - change of 0,00% MRQ |

| Genomsnittlig portföljallokering | 0.0137 % - change of 0,00% MRQ |

Institutionellt ägande och aktieägare

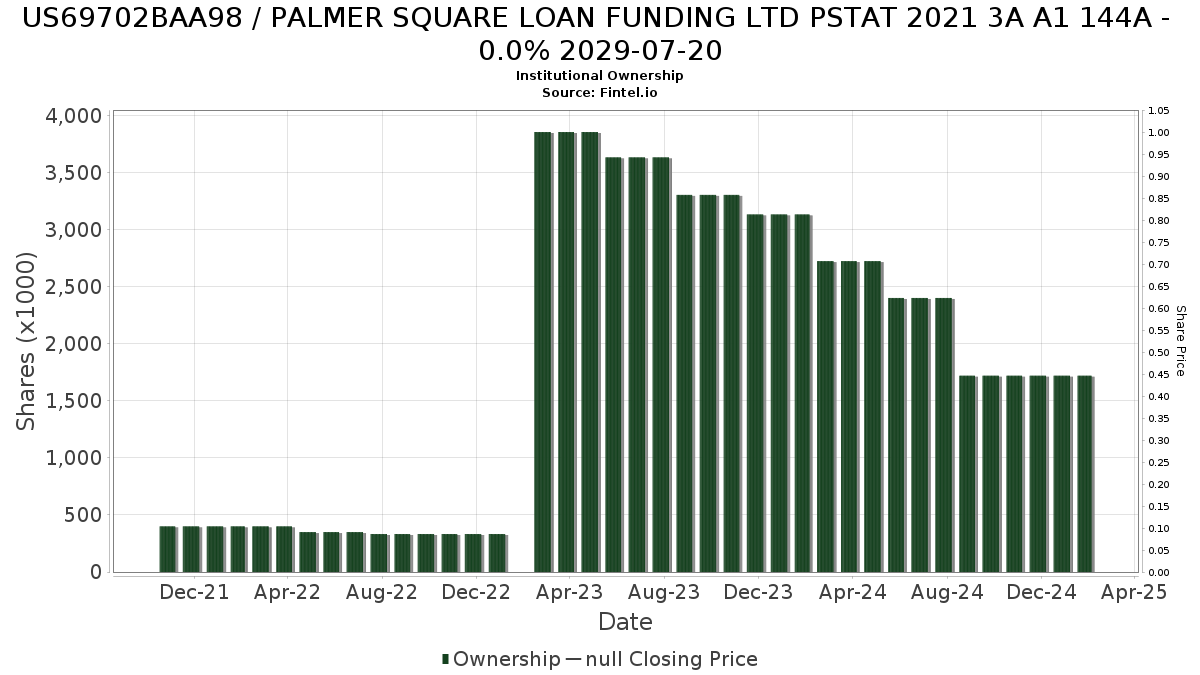

PALMER SQUARE LOAN FUNDING LTD PSTAT 2021 3A A1 144A (KY:US69702BAA98) har 0 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Största aktieägare inkluderar .

PALMER SQUARE LOAN FUNDING LTD PSTAT 2021 3A A1 144A (US69702BAA98) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

AI+ Ask Fintel’s AI assistant about PALMER SQUARE LOAN FUNDING LTD PSTAT 2021 3A A1 144A.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.