Grundläggande statistik

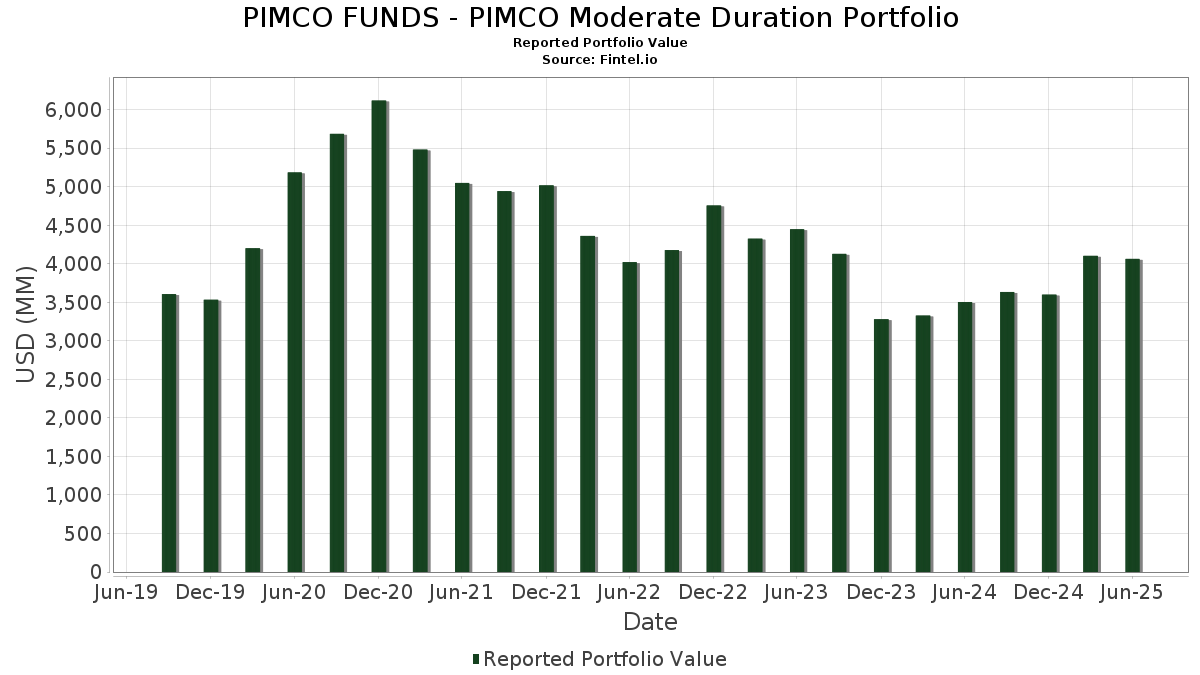

| Portföljvärde | $ 4 063 322 483 |

| Aktuella positioner | 719 |

Senaste innehav, resultat, förvaltat kapital (från 13F, 13D)

PIMCO FUNDS - PIMCO Moderate Duration Portfolio har redovisat 719 totala innehav i sina senaste SEC-arkiveringar. Det senaste portföljvärdet beräknas vara $ 4 063 322 483 USD. Faktiskt förvaltade tillgångar (AUM) är detta värde plus likvida medel (som inte redovisas). PIMCO FUNDS - PIMCO Moderate Duration Portfolios största innehav är UMBS TBA (US:US01F0406854) , U.S. Treasury Notes (US:US91282CJG78) , Ginnie Mae (US:US21H0306827) , FEDERAL NATIONAL MORTGAGE ASSOCIATION 30YR TBA AUG (XX:US01F0226831) , and Uniform Mortgage-Backed Security, TBA (US:US01F0626899) . PIMCO FUNDS - PIMCO Moderate Duration Portfolios nya positioner inkluderar UMBS TBA (US:US01F0406854) , U.S. Treasury Notes (US:US91282CJG78) , Ginnie Mae (US:US21H0306827) , FEDERAL NATIONAL MORTGAGE ASSOCIATION 30YR TBA AUG (XX:US01F0226831) , and Uniform Mortgage-Backed Security, TBA (US:US01F0626899) .

Största ökningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiekurser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 425,50 | 11,8798 | 11,8798 | ||

| 257,81 | 7,1978 | 6,6963 | ||

| 59,39 | 1,6582 | 1,6582 | ||

| 46,51 | 1,2986 | 1,2986 | ||

| 75,18 | 2,0989 | 1,1482 | ||

| 31,05 | 0,8670 | 0,8670 | ||

| 21,33 | 0,5954 | 0,5954 | ||

| 11,55 | 0,3224 | 0,3224 | ||

| 8,84 | 0,2467 | 0,2467 | ||

| 8,71 | 0,2431 | 0,2431 |

Största minskningarna detta kvartal

Vi använder förändringen i portföljallokeringen eftersom det är det mest meningsfulla måttet. Förändringar kan bero på transaktioner eller förändringar i aktiepriser.

| Värdepapper | Aktier (MM) |

Värde (MM$) |

Portfölj % av | ΔPortfölj % av |

|---|---|---|---|---|

| 20,34 | 0,5678 | −7,0832 | ||

| 2,16 | 0,0602 | −3,6836 | ||

| 2,71 | 0,0758 | −2,7137 | ||

| 61,38 | 1,7137 | −2,2923 | ||

| 184,19 | 5,1425 | −2,0220 | ||

| 97,47 | 2,7214 | −0,2401 | ||

| 71,43 | 1,9944 | −0,1797 | ||

| 71,84 | 2,0056 | −0,1433 | ||

| 133,30 | 3,7218 | −0,1375 | ||

| 62,57 | 1,7470 | −0,1345 |

13F- och fond arkiveringar

Denna blankett lämnades in den 2025-08-28 för rapporteringsperioden 2025-06-30. Denna investerare har inte offentliggjort värdepapper som räknas i aktier, så de aktierelaterade kolumnerna i tabellen nedan har utelämnats. Klicka på länksymbolen för att se hela transaktionshistoriken.

Uppgradera för att låsa upp premiumdata och exportera till Excel![]() .

.

| Värdepapper | Typ | ΔAktier (%) |

Värde ($MM) |

Portfölj (%) |

ΔPortfölj (%) |

|

|---|---|---|---|---|---|---|

| REPO BANK AMERICA REPO / RA (000000000) | 425,50 | 11,8798 | 11,8798 | |||

| US01F0406854 / UMBS TBA | 257,81 | 1 528,08 | 7,1978 | 6,6963 | ||

| US91282CJG78 / U.S. Treasury Notes | 184,19 | −25,01 | 5,1425 | −2,0220 | ||

| US TREASURY N/B 07/31 4.125 / DBT (US91282CLD10) | 133,30 | 0,75 | 3,7218 | −0,1375 | ||

| US TREASURY N/B 07/29 4 / DBT (US91282CLC37) | 97,47 | −4,00 | 2,7214 | −0,2401 | ||

| US21H0306827 / Ginnie Mae | 75,18 | 86,24 | 2,0989 | 1,1482 | ||

| FNMA POOL CB2666 FN 01/52 FIXED 3 / ABS-MBS (US3140QM6C32) | 71,84 | −2,49 | 2,0056 | −0,1433 | ||

| FED HM LN PC POOL SD8516 FR 03/55 FIXED 6 / ABS-MBS (US3132DWN905) | 71,43 | −4,16 | 1,9944 | −0,1797 | ||

| FNMA POOL CB2429 FN 12/51 FIXED 3 / ABS-MBS (US3140QMVX96) | 62,57 | −3,00 | 1,7470 | −0,1345 | ||

| US01F0226831 / FEDERAL NATIONAL MORTGAGE ASSOCIATION 30YR TBA AUG | 61,38 | −54,35 | 1,7137 | −2,2923 | ||

| US01F0626899 / Uniform Mortgage-Backed Security, TBA | 59,39 | 1,6582 | 1,6582 | |||

| US3132DWFF59 / Freddie Mac Pool | 49,74 | −2,31 | 1,3888 | −0,0965 | ||

| TSY INFL IX N/B 01/35 2.125 / DBT (US91282CML27) | 46,51 | 1,2986 | 1,2986 | |||

| FREDDIE MAC FHR 5513 MF / ABS-MBS (US3137HKEX87) | 33,91 | −5,18 | 0,9467 | −0,0963 | ||

| US21H0306744 / Ginnie Mae | 31,05 | 0,8670 | 0,8670 | |||

| US3132DWFE84 / Federal Home Loan Mortgage Corp. | 30,64 | −2,25 | 0,8555 | −0,0588 | ||

| FNMA POOL MA5271 FN 02/54 FIXED 5.5 / ABS-MBS (US31418E2D11) | 29,20 | −2,38 | 0,8152 | −0,0572 | ||

| US TREASURY N/B 02/35 4.625 / DBT (US91282CMM00) | 28,69 | −0,11 | 0,8010 | −0,0368 | ||

| US31418ELW83 / Fannie Mae Pool | 27,76 | −2,06 | 0,7751 | −0,0517 | ||

| US31418EHJ29 / Fannie Mae Pool | 25,95 | −2,19 | 0,7244 | −0,0493 | ||

| US3140XLQ274 / FNMA POOL FS4972 FN 05/53 FIXED VAR | 24,88 | −4,27 | 0,6948 | −0,0635 | ||

| FED HM LN PC POOL RA6486 FR 12/51 FIXED 3 / ABS-MBS (US3133KNF325) | 24,37 | −1,15 | 0,6803 | −0,0387 | ||

| US3140XGQ449 / FN FS1374 | 22,68 | −1,57 | 0,6333 | −0,0389 | ||

| US30227FAA84 / Extended Stay America Trust | 22,23 | −0,86 | 0,6208 | −0,0334 | ||

| FED HM LN PC POOL SD6652 FR 11/54 FIXED 3.5 / ABS-MBS (US3132DUL960) | 21,33 | 0,5954 | 0,5954 | |||

| US3132DWG800 / Freddie Mac Pool | 21,08 | −2,06 | 0,5886 | −0,0393 | ||

| US01F0306781 / UMBS TBA | 20,34 | −91,98 | 0,5678 | −7,0832 | ||

| US3140X6KS99 / Fannie Mae Pool | 20,03 | −2,65 | 0,5594 | −0,0409 | ||

| US31418ED649 / Fannie Mae Pool | 19,73 | −1,87 | 0,5509 | −0,0356 | ||

| US62955HAA59 / NYO COMMERCIAL MORTGAGE TRUST 2021-1290 SER 2021-1290 CL A V/R REGD 144A P/P 1.17500000 | 17,98 | 0,55 | 0,5019 | −0,0196 | ||

| FED HM LN PC POOL SD8507 FR 02/55 FIXED 6 / ABS-MBS (US3132DWNY56) | 17,97 | −3,97 | 0,5016 | −0,0441 | ||

| US3132DWGG24 / FHLG 30YR 5% 02/01/2053# | 16,41 | −2,46 | 0,4581 | −0,0325 | ||

| US61747YEK73 / Morgan Stanley | 15,63 | 0,65 | 0,4365 | −0,0166 | ||

| FNMA POOL MA5670 FN 04/55 FIXED 4 / ABS-MBS (US31418FJQ19) | 15,43 | −1,57 | 0,4309 | −0,0265 | ||

| US3132DP3W62 / FED HM LN PC POOL SD2613 FR 01/53 FIXED 4.5 | 15,39 | −1,50 | 0,4297 | −0,0261 | ||

| FED HM LN PC POOL RJ0137 FR 12/53 FIXED 5 / ABS-MBS (US3142GQEK49) | 14,53 | −1,26 | 0,4056 | −0,0236 | ||

| US3132DQFD34 / FED HM LN PC POOL SD2864 FR 03/52 FIXED 3 | 14,08 | −3,42 | 0,3931 | −0,0321 | ||

| US60687YBQ17 / Mizuho Financial Group Inc | 13,37 | 1,50 | 0,3732 | −0,0110 | ||

| FED HM LN PC POOL SD3953 FR 02/52 FIXED 3 / ABS-MBS (US3132E0MA74) | 12,68 | −2,00 | 0,3539 | −0,0234 | ||

| US05522RDG02 / BA Credit Card Trust | 12,66 | −0,03 | 0,3534 | −0,0159 | ||

| FED HM LN PC POOL QE8001 FR 08/52 FIXED 4.5 / ABS-MBS (US3133BH3J35) | 12,63 | −1,50 | 0,3526 | −0,0214 | ||

| US46647PBX33 / JPMorgan Chase & Co | 12,06 | 1,93 | 0,3367 | −0,0084 | ||

| US3140X6S774 / FANNIE MAE POOL UMBS P#FM3241 3.00000000 | 11,68 | −2,10 | 0,3261 | −0,0219 | ||

| FED HM LN PC POOL SD3478 FR 04/52 FIXED 2.5 / ABS-MBS (US3132DQ2K16) | 11,61 | −1,59 | 0,3241 | −0,0200 | ||

| US TREASURY N/B 04/30 3.875 / DBT (US91282CMZ13) | 11,55 | 0,3224 | 0,3224 | |||

| US09778PAA30 / Bon Secours Mercy Health Inc | 11,54 | 1,08 | 0,3222 | −0,0108 | ||

| US880591DM19 / Tennessee Valley Auth 7 1/8% Bonds 5/1/2030 | 11,44 | 0,32 | 0,3195 | −0,0132 | ||

| AVIS BUDGET RENTAL CAR FUNDING AESOP 2024 1A A 144A / ABS-O (US05377RHY36) | 11,31 | 0,52 | 0,3157 | −0,0124 | ||

| US06738ECE32 / Barclays PLC | 10,56 | 1,68 | 0,2948 | −0,0081 | ||

| US902613AE83 / UBS Group AG | 10,38 | 1,86 | 0,2899 | −0,0074 | ||

| WELLS FARGO COMMERCIAL MORTGAG WFCM 2024 5C2 A3 / ABS-MBS (US95003UAD28) | 10,38 | 0,57 | 0,2897 | −0,0112 | ||

| FED HM LN PC POOL SD8488 FR 01/55 FIXED 4 / ABS-MBS (US3132DWND10) | 10,31 | −1,72 | 0,2879 | −0,0181 | ||

| US02582JJZ49 / American Express Credit Account Master Trust 2023-1 | 10,05 | −0,04 | 0,2807 | −0,0127 | ||

| NISSAN AUTO LEASE TRUST NALT 2024 A A3 / ABS-O (US65481CAD65) | 10,04 | −0,06 | 0,2803 | −0,0127 | ||

| FED HM LN PC POOL RJ0049 FR 10/53 FIXED 5 / ABS-MBS (US3142GQBT84) | 10,04 | −2,02 | 0,2802 | −0,0186 | ||

| US95000U2L65 / WELLS FARGO + COMPANY SR UNSECURED 04/31 VAR | 9,95 | 1,24 | 0,2779 | −0,0089 | ||

| US3136BCVD95 / FANNIE MAE FNR 2020 77 DP | 9,80 | −0,65 | 0,2735 | −0,0141 | ||

| US639057AC29 / NatWest Group PLC | 9,73 | 0,87 | 0,2718 | −0,0097 | ||

| US17305EGW93 / CITIBANK CREDIT CARD ISSUANCE TRUST SER 2023-A1 CL A1 REGD 5.23000000 | 9,63 | −0,16 | 0,2689 | −0,0125 | ||

| CBAMR LTD CBAMR 2019 9A AR 144A / ABS-CBDO (US14987VAN91) | 9,22 | 0,12 | 0,2576 | −0,0112 | ||

| EMPIRE DISTRICT BONDCO SR SECURED 01/35 4.943 / DBT (US291918AA87) | 9,20 | 0,31 | 0,2568 | −0,0107 | ||

| US650036AV86 / NEW YORK ST URBAN DEV CORP REV NYSDEV 03/27 FIXED 1.496 | 9,03 | 0,88 | 0,2522 | −0,0090 | ||

| US88240TAA97 / Texas Electric Market Stabilization Funding N LLC | 9,00 | 0,25 | 0,2512 | −0,0106 | ||

| US3133KNYX55 / FED HM LN PC POOL RA7026 FR 03/52 FIXED 3 | 8,92 | −0,73 | 0,2489 | −0,0131 | ||

| FNMA POOL BZ3619 FN 04/30 FIXED 4.6 / ABS-MBS (US3140NYAV35) | 8,84 | 0,2467 | 0,2467 | |||

| FLORIDA POWER + LIGHT CO FLORIDA POWER + LIGHT CO / DBT (US341081GT84) | 8,80 | 0,73 | 0,2457 | −0,0091 | ||

| FNMA POOL BZ3505 FN 04/30 FIXED 4.25 / ABS-MBS (US3140NX3P67) | 8,71 | 0,2431 | 0,2431 | |||

| MASSMUTUAL GLOBAL FUNDIN MASSMUTUAL GLOBAL FUNDIN / DBT (US57629W5B21) | 8,54 | 0,48 | 0,2384 | −0,0095 | ||

| US06540AAB70 / BANK BANK 2019 BN20 ASB | 8,49 | −4,98 | 0,2370 | −0,0236 | ||

| US14041NGD75 / CAPITAL ONE MULTI-ASST EXEC TR 4.42% 05/15/2028 | 8,31 | 0,05 | 0,2320 | −0,0103 | ||

| YALE UNIVERSITY SR UNSECURED 04/32 4.701 / DBT (US98459LAD55) | 8,22 | 0,2295 | 0,2295 | |||

| US05377RHG20 / AESOP 23-6 A 144A 5.81% 12-20-29/28 | 8,22 | 0,29 | 0,2294 | −0,0096 | ||

| US42806MBW82 / HERTZ 23-2 A 144A 5.57% 09-25-29/28 | 8,18 | 0,44 | 0,2283 | −0,0092 | ||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 8,17 | −0,04 | 0,2280 | −0,0103 | ||

| NRUC / National Rural Utilities Cooperative Finance Corporation - Corporate Bond/Note | 8,13 | 0,20 | 0,2271 | −0,0097 | ||

| US14318XAC92 / CarMax Auto Owner Trust 2023-4 | 8,12 | −0,27 | 0,2266 | −0,0108 | ||

| US29003JAC80 / Elmwood CLO 15 Ltd | 8,00 | 0,00 | 0,2234 | −0,0100 | ||

| US61772WAA53 / Morgan Stanley Capital I Trust 2021-230P | 7,99 | −0,95 | 0,2231 | −0,0122 | ||

| US78403DAP50 / SBA Tower Trust | 7,87 | 0,85 | 0,2197 | −0,0079 | ||

| FNMA POOL BL6406 FN 05/27 FIXED 1.63 / ABS-MBS (US3140HYDL99) | 7,84 | 0,94 | 0,2189 | −0,0077 | ||

| BENCHMARK MORTGAGE TRUST BMARK 2025 V14 A4 / ABS-MBS (US08164BAD29) | 7,72 | 0,90 | 0,2155 | −0,0076 | ||

| US3133KJDA79 / Freddie Mac Pool | 7,66 | −1,67 | 0,2138 | −0,0133 | ||

| US3140MNA483 / UMBS | 7,64 | −1,07 | 0,2134 | −0,0120 | ||

| US539439AQ24 / Lloyds Banking Group PLC | 7,64 | 0,79 | 0,2132 | −0,0078 | ||

| VERIZON MASTER TRUST VZMT 2024 7 A 144A / ABS-O (US92348KDJ97) | 7,53 | 0,76 | 0,2102 | −0,0078 | ||

| FED HM LN PC POOL RA7346 FR 06/52 FIXED 3 / ABS-MBS (US3133KPET12) | 7,43 | −0,71 | 0,2075 | −0,0108 | ||

| US12597BAV18 / CSAIL COMMERCIAL MORTGAGE TRUS CSAIL 2019 C17 ASB | 7,30 | −5,60 | 0,2038 | −0,0217 | ||

| US3140MMYJ12 / Fannie Mae Pool | 7,29 | −1,05 | 0,2035 | −0,0114 | ||

| BMO MORTGAGE TRUST BMO 2024 5C7 A3 / ABS-MBS (US09660WAU53) | 7,23 | 0,64 | 0,2018 | −0,0077 | ||

| US3128MJ3M09 / FREDDIE MAC GOLD POOL FG G08803 | 7,22 | −2,04 | 0,2016 | −0,0134 | ||

| US86562MBP41 / Sumitomo Mitsui Financial Group Inc | 7,11 | 1,35 | 0,1985 | −0,0061 | ||

| US06738EBV65 / Barclays PLC | 7,08 | 2,09 | 0,1978 | −0,0046 | ||

| US38141GWL49 / GOLDMAN SACHS GROUP INC SR UNSECURED 06/28 VAR | 7,08 | 0,53 | 0,1976 | −0,0078 | ||

| US3140QPR749 / FANNIE MAE POOL UMBS P#CB4109 3.00000000 | 7,06 | −0,91 | 0,1970 | −0,0107 | ||

| US12528YAC75 / CF 2019 CF2 MTG TR 06/29 0 | 6,98 | −4,62 | 0,1950 | −0,0186 | ||

| PG+E RECOVERY FND LLC SR SECURED 06/35 4.838 / DBT (US71710TAG31) | 6,98 | −7,98 | 0,1949 | −0,0264 | ||

| US86944BAG86 / Sutter Health | 6,96 | 1,77 | 0,1943 | −0,0052 | ||

| US3132DWFQ15 / FHLG 30YR 4.5% 12/01/2052# | 6,86 | −2,11 | 0,1916 | −0,0129 | ||

| US64971XJD12 / NEW YORK CITY NY TRANSITIONAL NYCGEN 11/27 FIXED 2.98 | 6,83 | 0,63 | 0,1908 | −0,0073 | ||

| TRINITAS CLO LTD TRNTS 2020 14A A1R 144A / ABS-CBDO (US89641QAN07) | 6,80 | 0,12 | 0,1900 | −0,0083 | ||

| APIDOS CLO LTD APID 2012 11A AR4 144A / ABS-CBDO (US03763YBY14) | 6,80 | −0,04 | 0,1898 | −0,0086 | ||

| GM FINANCIAL REVOLVING RECEIVA GMREV 2024 2 A 144A / ABS-O (US379925AA81) | 6,75 | 0,63 | 0,1884 | −0,0072 | ||

| ATHENE GLOBAL FUNDING ATHENE GLOBAL FUNDING / DBT (US04685A4A66) | 6,73 | 0,12 | 0,1879 | −0,0082 | ||

| OCTAGON INVESTMENT PARTNERS 40 OCT40 2019 1A A1RR 144A / ABS-CBDO (US67592BAY48) | 6,66 | −0,45 | 0,1860 | −0,0092 | ||

| FED HM LN PC POOL QF7428 FR 02/53 FIXED 5 / ABS-MBS (US3133BVHD02) | 6,60 | −0,97 | 0,1843 | −0,0101 | ||

| US03444RAB42 / Andrew W Mellon Foundation/The | 6,58 | 1,29 | 0,1836 | −0,0058 | ||

| HYUNDAI AUTO LEASE SECURITIZAT HALST 2025 B A3 144A / ABS-O (US44935DAD12) | 6,55 | 0,1828 | 0,1828 | |||

| US3132DWHE66 / UMBS | 6,49 | −2,11 | 0,1811 | −0,0122 | ||

| GM FINANCIAL REVOLVING RECEIVA GMREV 2024 1 A 144A / ABS-O (US36269KAA34) | 6,45 | 0,56 | 0,1800 | −0,0070 | ||

| US3132DPFG81 / Freddie Mac Pool | 6,35 | −1,60 | 0,1774 | −0,0109 | ||

| US09659W2P81 / BNP Paribas SA | 6,32 | 1,90 | 0,1764 | −0,0044 | ||

| US3138LHW915 / FANNIE MAE POOL UMBS P#AN5171 3.29000000 | 6,32 | 0,48 | 0,1763 | −0,0070 | ||

| WOODSIDE FINANCE LTD WOODSIDE FINANCE LTD / DBT (US980236AR40) | 6,30 | −0,21 | 0,1758 | −0,0082 | ||

| US40139LBH50 / Guardian Life Global Funding | 6,28 | 0,45 | 0,1753 | −0,0070 | ||

| BMO MORTGAGE TRUST BMO 2024 5C5 A3 / ABS-MBS (US05593RAC60) | 6,26 | 1,02 | 0,1748 | −0,0060 | ||

| US3140QQKN48 / FNCL UMBS 4.5 CB4800 10-01-52 | 6,25 | −1,25 | 0,1746 | −0,0101 | ||

| AMERICAN EXPRESS CREDIT ACCOUN AMXCA 2024 2 A / ABS-MBS (US02582JKF65) | 6,25 | 0,64 | 0,1745 | −0,0067 | ||

| BIRCH GROVE CLO LTD. BGCLO 19A A1RR 144A / ABS-CBDO (US09075JAU34) | 6,22 | 0,32 | 0,1738 | −0,0072 | ||

| EAI / Entergy Arkansas, LLC - Corporate Bond/Note | 6,18 | 0,1726 | 0,1726 | |||

| US25160PAN78 / Deutsche Bank AG | 6,15 | −0,28 | 0,1718 | −0,0082 | ||

| US05377RGC25 / Avis Budget Rental Car Funding AESOP LLC | 6,12 | 0,29 | 0,1710 | −0,0071 | ||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q034 APT2 / ABS-MBS (US3137HLY301) | 6,10 | 0,1703 | 0,1703 | |||

| FFH.PRH / Fairfax Financial Holdings Limited - Preferred Stock | 6,09 | 0,1699 | 0,1699 | |||

| US00138CAU27 / Corebridge Global Funding | 6,08 | −0,21 | 0,1697 | −0,0080 | ||

| NORTHWESTERN UNIVERSITY UNSECURED 12/35 4.94 / DBT (US668444AT96) | 6,04 | 0,97 | 0,1688 | −0,0059 | ||

| SAFEHOLD GL HOLDINGS LLC SAFEHOLD GL HOLDINGS LLC / DBT (US785931AA40) | 6,04 | 1,14 | 0,1686 | −0,0056 | ||

| US225401AU28 / Credit Suisse Group AG | 5,99 | 1,96 | 0,1673 | −0,0041 | ||

| US3138LMSA22 / FANNIE MAE POOL UMBS P#AN8612 3.29000000 | 5,96 | 0,76 | 0,1665 | −0,0061 | ||

| AIMCO AIMCO 2015 AA AR3 144A / ABS-CBDO (US00900LAY02) | 5,96 | 0,13 | 0,1664 | −0,0072 | ||

| SYSTEM ENERGY RESOURCES 1ST REF MORT 12/34 5.3 / DBT (US871911AV54) | 5,93 | 300,00 | 0,1656 | 0,1224 | ||

| BNH / Brookfield Finance Inc. - Corporate Bond/Note | 5,90 | 0,1648 | 0,1648 | |||

| GA GLOBAL FUNDING TRUST SECURED 144A 01/30 5.4 / DBT (US36143L2R50) | 5,86 | 0,79 | 0,1635 | −0,0060 | ||

| SAMMONS FINANCIAL GLOBAL SECURED 144A 06/30 4.95 / DBT (US79587J2C65) | 5,82 | 0,1624 | 0,1624 | |||

| US06675FBB22 / Banque Federative du Credit Mutuel SA | 5,76 | 0,51 | 0,1609 | −0,0064 | ||

| US90278MAY30 / UBS Commercial Mortgage Trust | 5,73 | −5,00 | 0,1601 | −0,0160 | ||

| US232989AD58 / DLLMT 2023-1 LLC | 5,73 | −0,09 | 0,1600 | −0,0073 | ||

| PROLOGIS TARGETED US PROLOGIS TARGETED US / DBT (US74350LAB09) | 5,72 | 0,83 | 0,1598 | −0,0058 | ||

| US087598AA60 / BETHP 2021 3ML+113 01/15/2035 144A | 5,70 | 0,14 | 0,1592 | −0,0069 | ||

| US78432WAA18 / SFO Commercial Mortgage Trust 2021-555 | 5,68 | 1,00 | 0,1585 | −0,0055 | ||

| SWEPCO STORM RECOVERY FU SR SECURED 09/41 4.88 / DBT (US870696AA94) | 5,67 | −0,47 | 0,1583 | −0,0079 | ||

| US36268DAA00 / GMREV 23-2 A 144A 5.77% 08-11-36/11-13-28 | 5,66 | 0,27 | 0,1579 | −0,0066 | ||

| JACKSON NATL LIFE GLOBAL SECURED 144A 06/28 4.7 / DBT (US46849CJP77) | 5,64 | 0,1574 | 0,1574 | |||

| US06541TAZ21 / BANK BANK 2020 BN29 ASB | 5,63 | 1,06 | 0,1572 | −0,0053 | ||

| DTE ELECTRIC CO GENL REF MOR 05/35 5.25 / DBT (US23338VAY20) | 5,60 | 0,1564 | 0,1564 | |||

| CHUBB INA HOLDINGS LLC CHUBB INA HOLDINGS LLC / DBT (US171239AL07) | 5,60 | 0,88 | 0,1563 | −0,0056 | ||

| US08162UAW09 / Benchmark 2018-B8 Mortgage Trust | 5,59 | 1,01 | 0,1560 | −0,0053 | ||

| US09659X2M33 / BNP PARIBAS SR UNSECURED REGS 09/28 VAR | 5,57 | 1,31 | 0,1555 | −0,0048 | ||

| PRINCIPAL LFE GLB FND II SECURED 144A 01/28 4.8 / DBT (US74256LFC81) | 5,57 | 0,34 | 0,1554 | −0,0064 | ||

| US03880RAA77 / Arbor Realty Collateralized Loan Obligation Ltd | 5,55 | −15,77 | 0,1549 | −0,0372 | ||

| US3132DWFB46 / Freddie Mac Pool | 5,47 | −1,79 | 0,1528 | −0,0098 | ||

| US14044EAD04 / CAPITAL ONE PRIME AUTO RECEIVABLES TRUST 2023-2 5.82% 06/15/2028 | 5,47 | −0,18 | 0,1527 | −0,0071 | ||

| US210518DV59 / CMS ENERGY CORPORATION | 5,41 | 0,82 | 0,1512 | −0,0055 | ||

| US08162YAG70 / BENCHMARK MORTGAGE TRUST BMARK 2019 B14 ASB | 5,35 | −2,62 | 0,1493 | −0,0109 | ||

| US606822BU78 / Mitsubishi UFJ Financial Group Inc | 5,33 | 2,03 | 0,1488 | −0,0035 | ||

| US59217GER65 / Metropolitan Life Global Funding I | 5,32 | 1,06 | 0,1485 | −0,0050 | ||

| BARCLAYS COMMERCIAL MORTGAGE S BBCMS 2024 5C31 A3 / ABS-MBS (US07336YAC93) | 5,29 | 0,65 | 0,1477 | −0,0056 | ||

| US61691UBC27 / Morgan Stanley Capital I Trust 2019-L3 | 5,28 | −5,61 | 0,1475 | −0,0158 | ||

| STANFORD UNIVERSITY SR UNSECURED 03/35 4.679 / DBT (US85440KAE47) | 5,27 | 0,40 | 0,1472 | −0,0060 | ||

| US126395AA04 / CSMC 2020-FACT CSMC 2020-FACT A | 5,27 | 0,30 | 0,1470 | −0,0061 | ||

| EQUITABLE AMERICA GLOBAL SECURED 144A 06/30 4.95 / DBT (US29446Q2B87) | 5,26 | 0,1468 | 0,1468 | |||

| US76209PAC77 / RGA GLOBAL FUNDING | 5,25 | 0,25 | 0,1465 | −0,0062 | ||

| FLORIDA ST BRD OF ADMIN FIN CO FLSGEN 07/34 FIXED 5.526 / DBT (US341271AH76) | 5,24 | 0,06 | 0,1463 | −0,0064 | ||

| US477143AH41 / JetBlue 2019-1 Class AA Pass Through Trust | 5,22 | −2,28 | 0,1458 | −0,0101 | ||

| VERDELITE STATIC CLO LTD BVSTAT 2024 1A A 144A / ABS-CBDO (US92338VAA98) | 5,21 | −5,93 | 0,1454 | −0,0161 | ||

| US91412GU945 / UNIV OF CALIFORNIA CA REVENUES | 5,20 | 0,35 | 0,1452 | −0,0060 | ||

| NEW YORK NY CITY TRANSITIONAL NYCGEN 05/37 FIXED OID 4.375 / DBT (US64972JLP11) | 5,20 | −0,50 | 0,1451 | −0,0072 | ||

| PACIFIC LIFE GF II SECURED 144A 08/29 4.5 / DBT (US6944PL3C15) | 5,18 | 0,86 | 0,1446 | −0,0052 | ||

| CABK / CaixaBank, S.A. | 5,17 | 0,82 | 0,1444 | −0,0052 | ||

| WIND RIVER CLO LTD WINDR 2016 1KRA A1R3 144A / ABS-CBDO (US97314DAN84) | 5,16 | −0,44 | 0,1440 | −0,0071 | ||

| US379930AE07 / GM Financial Consumer Automobile Receivables Trust 2023-4 | 5,13 | 0,06 | 0,1433 | −0,0063 | ||

| US87166PAL58 / SYNIT 23-A2 A 5.74% 10-15-29/26 | 5,09 | −0,20 | 0,1422 | −0,0066 | ||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 5,09 | 0,1421 | 0,1421 | |||

| VIRGINIA POWER FUEL SEC SR SECURED 05/33 4.877 / DBT (US92808VAB80) | 5,09 | 0,57 | 0,1420 | −0,0055 | ||

| US172967MS77 / Citigroup Inc | 5,08 | 1,84 | 0,1418 | −0,0037 | ||

| PUBLIC SERVICE COLORADO 1ST MORTGAGE 05/34 5.35 / DBT (US744448CZ26) | 5,07 | 0,89 | 0,1417 | −0,0050 | ||

| US05377RGU23 / Avis Budget Rental Car Funding AESOP LLC | 5,07 | −0,04 | 0,1414 | −0,0064 | ||

| DK0009391104 / JYSKE REALKREDIT A/S /DKK/ REGD SER 321E 1.00000000 | 5,04 | 0,90 | 0,1406 | −0,0050 | ||

| FANNIE MAE FNR 2025 52 FB / ABS-MBS (US3136BWUZ70) | 5,01 | 0,1399 | 0,1399 | |||

| US13077DMP41 / CALIFORNIA ST UNIV REVENUE | 4,99 | 1,65 | 0,1393 | −0,0039 | ||

| S1NN34 / Smith & Nephew plc - Depositary Receipt (Common Stock) | 4,90 | 20,80 | 0,1367 | 0,0185 | ||

| US3140XLSR00 / FNMA UMBS, 30 Year | 4,87 | −0,91 | 0,1361 | −0,0074 | ||

| US3137HAMH63 / Freddie Mac Multifamily Structured Pass Through Certificates | 4,87 | 0,45 | 0,1360 | −0,0054 | ||

| US404280CC17 / HSBC Holdings PLC | 4,87 | 1,18 | 0,1360 | −0,0044 | ||

| US26833BAB99 / ECMC GROUP STUDENT LOAN TRUST ECMC 2020 3A A1B 144A | 4,84 | −1,81 | 0,1350 | −0,0086 | ||

| HONDA AUTO RECEIVABLES OWNER T HAROT 2024 3 A3 / ABS-O (US43813YAC66) | 4,73 | 0,11 | 0,1320 | −0,0057 | ||

| BMO MORTGAGE TRUST BMO 2024 5C8 A3 / ABS-MBS (US09661XAC20) | 4,67 | 0,82 | 0,1305 | −0,0047 | ||

| ING / ING Groep N.V. - Depositary Receipt (Common Stock) | 4,61 | 1,54 | 0,1287 | −0,0037 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 01/30 5.38 / DBT (US04685A4G37) | 4,60 | 0,83 | 0,1285 | −0,0047 | ||

| US78486BAA26 / STARWOOD COMMERCIAL MORTGAGE T STWD 2021 FL2 A 144A | 4,59 | −27,32 | 0,1281 | −0,0560 | ||

| US88240TAB70 / Texas Electric Market Stabilization Funding N LLC | 4,53 | −0,15 | 0,1265 | −0,0059 | ||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 4,52 | 0,85 | 0,1261 | −0,0045 | ||

| US88258MAA36 / TEXAS NATURAL GAS SECURITIZTN FIN CORP REVENUE | 4,52 | −3,89 | 0,1261 | −0,0110 | ||

| ICG US CLO LTD ICG 2021 3A AR 144A / ABS-CBDO (US449249AS08) | 4,50 | 0,29 | 0,1257 | −0,0053 | ||

| ELEVATION CLO LTD AWPT 2018 3A A1R2 144A / ABS-CBDO (US28623VAN91) | 4,50 | 0,09 | 0,1257 | −0,0055 | ||

| US95001VAU44 / Wells Fargo Commercial Mortgage Trust 2019-C51 | 4,46 | 1,25 | 0,1244 | −0,0039 | ||

| US87277JAA97 / TRTX 2022-FL5 Issuer Ltd | 4,43 | −7,98 | 0,1236 | −0,0167 | ||

| US55953WAA80 / Magnetite XXXII Ltd., Series 2022-32A, Class A | 4,40 | 0,02 | 0,1230 | −0,0055 | ||

| US23346TAA97 / DTE Electric Securitization Funding II LLC | 4,38 | −0,27 | 0,1224 | −0,0058 | ||

| US54627RAM25 / LOUISIANA ST LOCAL GOVT ENVRNMNTL FACS & CMNTY DEV AUTH | 4,36 | 0,93 | 0,1216 | −0,0043 | ||

| ICG US CLO LTD ICG 2015 2RA A1R 144A / ABS-CBDO (US44933WAL37) | 4,34 | −13,10 | 0,1211 | −0,0245 | ||

| RGA GLOBAL FUNDING SECURED 144A 05/29 5.448 / DBT (US76209PAE34) | 4,34 | 0,60 | 0,1211 | −0,0046 | ||

| PRICOA GLOBAL FUNDING 1 SECURED 144A 08/31 4.65 / DBT (US74153WCV90) | 4,31 | 1,05 | 0,1204 | −0,0041 | ||

| US20268JAF03 / CommonSpirit Health | 4,31 | 1,77 | 0,1202 | −0,0032 | ||

| US55361AAU88 / MSWF Commercial Mortgage Trust 2023-2 | 4,29 | 0,56 | 0,1198 | −0,0047 | ||

| US257375AJ44 / Dominion Energy Gas Holdings LLC | 4,27 | 0,83 | 0,1192 | −0,0043 | ||

| US88880LAJ26 / TOBACCO SETTLEMENT FIN AUTH WV TOBGEN 06/27 FIXED 2.02 | 4,21 | 1,03 | 0,1175 | −0,0040 | ||

| ANCHORAGE CAPITAL CLO LTD ANCHC 2021 21A AR 144A / ABS-CBDO (US03331KAJ88) | 4,20 | 0,57 | 0,1173 | −0,0046 | ||

| PARALLEL LTD PARL 2021 1A AR 144A / ABS-CBDO (US69916HAL42) | 4,19 | 0,14 | 0,1171 | −0,0051 | ||

| US92867WAD02 / Volkswagen Auto Loan Enhanced Trust, Series 2023-1, Class A3 | 4,19 | −5,36 | 0,1169 | −0,0121 | ||

| COOPERATIEVE RABOBANK UA 144A 01/33 VAR / DBT (US74977RDU59) | 4,17 | 1,22 | 0,1163 | −0,0037 | ||

| US358266CH59 / FRESNO CNTY CA PENSN OBLG FREGEN 08/30 ZEROCPNOID 0 | 4,12 | 1,25 | 0,1149 | −0,0036 | ||

| US12595EAD76 / COMM 2017-COR2 Mortgage Trust | 4,10 | 0,69 | 0,1144 | −0,0043 | ||

| FREDDIE MAC FHR 5439 FK / ABS-MBS (US3137HF3S28) | 4,10 | −8,51 | 0,1144 | −0,0162 | ||

| US09659W2K94 / BNP Paribas SA | 4,09 | 1,71 | 0,1143 | −0,0031 | ||

| US66815L2M02 / Northwestern Mutual Global Funding | 4,08 | 0,59 | 0,1139 | −0,0044 | ||

| US37310PAE16 / GEORGETOWN UNIVERSITY SR UNSECURED 04/30 2.247 | 4,07 | 2,57 | 0,1138 | −0,0021 | ||

| NATIONAL SECS CLEARING SR UNSECURED 144A 05/30 4.7 / DBT (US637639AQ81) | 4,07 | 0,1136 | 0,1136 | |||

| COOPERAT RABOBANK UA/NY 10/29 4.494 / DBT (US21688ABH41) | 4,05 | 1,30 | 0,1130 | −0,0036 | ||

| BANK OF AMERICA AUTO TRUST BAAT 2023 2A A4 144A / ABS-O (US06054YAD94) | 4,04 | −0,15 | 0,1127 | −0,0052 | ||

| US06540WBD48 / Bank 2019-BNK19 | 4,03 | 1,10 | 0,1124 | −0,0037 | ||

| US456837AX12 / ING Groep NV | 4,01 | −0,17 | 0,1120 | −0,0052 | ||

| US902613AS79 / UBS Group AG | 4,01 | 0,20 | 0,1119 | −0,0048 | ||

| US12635RAX61 / CSAIL 2015-C4 Commercial Mortgage Trust | 4,01 | −28,01 | 0,1118 | −0,0504 | ||

| FREDDIE MAC FHR 5511 FG / ABS-MBS (US3137HKKP89) | 4,00 | −9,07 | 0,1117 | −0,0166 | ||

| US78448TAK88 / SMBC Aviation Capital Finance DAC | 4,00 | 0,60 | 0,1117 | −0,0043 | ||

| US38382A5Y79 / Ginnie Mae REMICS | 4,00 | −2,27 | 0,1116 | −0,0077 | ||

| US007944AF80 / Adventist Health System/West | 4,00 | 0,65 | 0,1116 | −0,0042 | ||

| US13077DMQ24 / CALIFORNIA ST UNIV REVENUE | 3,99 | 1,71 | 0,1113 | −0,0030 | ||

| US80281LAG05 / Santander UK Group Holdings PLC | 3,92 | 0,75 | 0,1095 | −0,0041 | ||

| US34535CAA45 / FORDR_23-2 | 3,92 | 0,59 | 0,1094 | −0,0042 | ||

| NLG GLOBAL FUNDING SECURED 144A 01/30 5.4 / DBT (US62915W2A05) | 3,91 | 1,08 | 0,1093 | −0,0036 | ||

| US00774MAV72 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 3,90 | 0,83 | 0,1088 | −0,0039 | ||

| US3137F66L68 / FREDDIE MAC FHR 5042 CA | 3,81 | −8,54 | 0,1065 | −0,0152 | ||

| US08162DAC20 / BENCHMARK MORTGAGE TRUST BMARK 2019 B13 ASB | 3,79 | 0,80 | 0,1059 | −0,0039 | ||

| US46652DAA37 / JP Morgan Chase Commercial Mortgage Securities Corp | 3,77 | −5,28 | 0,1051 | −0,0108 | ||

| US90931GAA76 / United Airlines 2020-1 Class A Pass Through Trust | 3,73 | −6,56 | 0,1043 | −0,0123 | ||

| US38122ND336 / GOLDEN ST TOBACCO SECURITIZATI GLDGEN 06/32 FIXED 3.037 | 3,73 | 0,98 | 0,1040 | −0,0036 | ||

| US12595VAD91 / COMM 2018-COR3 Mortgage Trust | 3,72 | 0,57 | 0,1037 | −0,0040 | ||

| US26829GAA67 / ECMC Group Student Loan Trust 2018-2 | 3,69 | −1,76 | 0,1031 | −0,0066 | ||

| PUBLIC SERVICE ELECTRIC SECURED 08/34 4.85 / DBT (US74456QCS30) | 3,69 | 0,60 | 0,1031 | −0,0040 | ||

| US05377RHM97 / Avis Budget Rental Car Funding AESOP LLC | 3,66 | 0,14 | 0,1023 | −0,0044 | ||

| TRANS ALLEGHENY INTERSTA SR UNSECURED 144A 01/31 5 / DBT (US893045AF16) | 3,66 | 0,1023 | 0,1023 | |||

| AERCAP IRELAND CAP/GLOBA COMPANY GUAR 09/29 4.625 / DBT (US00774MBL81) | 3,65 | 1,14 | 0,1020 | −0,0034 | ||

| US3140QNQX35 / FNMA 30YR 3% 03/01/2052#CB3169 | 3,65 | −2,51 | 0,1018 | −0,0073 | ||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 3,63 | 0,66 | 0,1015 | −0,0038 | ||

| US3132VLPD35 / Freddie Mac Gold Pool | 3,63 | −1,52 | 0,1013 | −0,0062 | ||

| US12594MBC10 / COMM 16-COR1 A4 3.091% 10-10-49/08-10-26 | 3,63 | 1,60 | 0,1012 | −0,0029 | ||

| DRYDEN SENIOR LOAN FUND DRSLF 2021 95A AR 144A / ABS-CBDO (US262487AJ07) | 3,59 | −0,22 | 0,1003 | −0,0047 | ||

| AMEREN MISSOURI SEC FU I SR SECURED 10/41 4.85 / DBT (US023940AA78) | 3,57 | −0,39 | 0,0998 | −0,0049 | ||

| US3137FYEX00 / FREDDIE MAC FHR 5092 XA | 3,57 | −2,56 | 0,0998 | −0,0072 | ||

| US42806MCE75 / HERTZ 23-4 A 144A 6.15% 03-25-30/03-26-29 | 3,55 | 0,71 | 0,0992 | −0,0037 | ||

| MARS INC SR UNSECURED 144A 03/30 4.8 / DBT (US571676AY11) | 3,55 | 0,77 | 0,0990 | −0,0037 | ||

| US694308KF34 / Pacific Gas and Electric Co | 3,54 | 0,17 | 0,0989 | −0,0043 | ||

| US3140QNW249 / FNMA POOL CB3364 FN 04/52 FIXED 3 | 3,51 | −2,20 | 0,0980 | −0,0067 | ||

| GREYSTONE COMMERCIAL REAL ESTA GSTNE 2025 FL4 A 144A / ABS-CBDO (US39810MAA71) | 3,50 | 0,0978 | 0,0978 | |||

| OFSI FUND LTD OFSBS 2021 10A AR 144A / ABS-CBDO (US67115PAW59) | 3,50 | 0,17 | 0,0978 | −0,0042 | ||

| US14040HDC60 / Capital One Financial Corp | 3,50 | 1,45 | 0,0978 | −0,0029 | ||

| US06675FBA49 / Banque Federative du Credit Mutuel SA | 3,50 | −0,09 | 0,0978 | −0,0045 | ||

| US01026CAD39 / Alabama Economic Settlement Authority | 3,49 | 0,69 | 0,0975 | −0,0037 | ||

| US78473JAA07 / SREIT Trust 2021-IND | 3,49 | 0,61 | 0,0974 | −0,0037 | ||

| RFR USD SOFR/3.00000 02/12/25-30Y LCH / DIR (EZ5QDLRMVJ80) | 3,46 | 15,75 | 0,0966 | 0,0094 | ||

| FED HM LN PC POOL SD3942 FR 01/53 FIXED 4.5 / ABS-MBS (US3132E0LX86) | 3,46 | −1,40 | 0,0966 | −0,0057 | ||

| US90276UAU51 / UBS COMMERCIAL MORTGAGE TRUST UBSCM 2017 C6 ASB | 3,43 | −11,83 | 0,0957 | −0,0177 | ||

| BARCLAYS COMMERCIAL MORTGAGE S BBCMS 2025 C32 A4 / ABS-MBS (US07337AAC09) | 3,41 | 0,50 | 0,0952 | −0,0037 | ||

| VIRGINIA POWER FUEL SEC SR SECURED 05/29 5.088 / DBT (US92808VAA08) | 3,36 | −21,56 | 0,0939 | −0,0311 | ||

| FNMA POOL FS6035 FN 06/51 FIXED VAR / ABS-MBS (US3140XMV520) | 3,36 | −1,35 | 0,0938 | −0,0055 | ||

| US31418CZJ60 / Fannie Mae Pool | 3,30 | −3,20 | 0,0921 | −0,0073 | ||

| US3140HMN264 / Federal National Mortgage Association | 3,30 | −2,48 | 0,0921 | −0,0066 | ||

| VOYA CLO LTD VOYA 2017 3A A1RR 144A / ABS-CBDO (US92915QBG73) | 3,29 | −0,36 | 0,0918 | −0,0045 | ||

| EXTRA SPACE STORAGE LP COMPANY GUAR 06/35 5.4 / DBT (US30225VAU17) | 3,27 | 1,11 | 0,0913 | −0,0030 | ||

| T MOBILE USA INC T MOBILE USA INC / DBT (US87264ADM45) | 3,25 | 0,65 | 0,0907 | −0,0034 | ||

| ANTX / AN2 Therapeutics, Inc. | 3,24 | 0,75 | 0,0903 | −0,0034 | ||

| US88880LAH69 / TOBACCO SETTLEMENT FIN AUTH WV ASSET BACKED | 3,22 | 0,78 | 0,0900 | −0,0033 | ||

| US636274AD47 / National Grid PLC | 3,21 | 0,94 | 0,0896 | −0,0031 | ||

| JAMESTOWN CLO LTD JTWN 2021 16A AR 144A / ABS-CBDO (US47048RAL96) | 3,19 | 0,03 | 0,0891 | −0,0040 | ||

| TVC / Tennessee Valley Authority - Preferred Stock | 3,18 | 0,28 | 0,0889 | −0,0037 | ||

| US04002VAA98 / AREIT Trust, Series 2022-CRE6, Class A | 3,17 | −0,28 | 0,0886 | −0,0042 | ||

| US21071BAA35 / Consumers 2023 Securitization Funding LLC | 3,16 | −0,57 | 0,0881 | −0,0045 | ||

| US3137HAMP89 / FHLMC Multifamily Structured Pass-Through Certificates, Series KJ47, Class A2 | 3,13 | 0,45 | 0,0875 | −0,0035 | ||

| FLORIDA POWER + LIGHT CO 1ST MORTGAGE 06/34 5.3 / DBT (US341081GU57) | 3,09 | 0,72 | 0,0864 | −0,0032 | ||

| BBV / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 3,09 | 0,49 | 0,0863 | −0,0034 | ||

| US67113DAW48 / OZLM XXIV Ltd | 3,08 | −23,53 | 0,0861 | −0,0315 | ||

| BRIGHTHSE FIN GLBL FUND BRIGHTHSE FIN GLBL FUND / DBT (US10921U2L15) | 3,08 | 0,89 | 0,0859 | −0,0031 | ||

| MASSMUTUAL GLOBAL FUNDIN SECURED 144A 01/30 4.95 / DBT (US57629TBV89) | 3,07 | 1,39 | 0,0856 | −0,0026 | ||

| SAN DIEGO G + E 1ST MORTGAGE 04/35 5.4 / DBT (US797440CG74) | 3,06 | 1,36 | 0,0856 | −0,0026 | ||

| US3137FQHG16 / FREDDIE MAC FHR 4936 AP | 3,06 | −4,43 | 0,0854 | −0,0080 | ||

| US70462GAB41 / PeaceHealth Obligated Group | 3,06 | 0,69 | 0,0853 | −0,0032 | ||

| US232989AC75 / DLLMT_23-1A | 3,05 | −21,19 | 0,0852 | −0,0278 | ||

| FED HM LN PC POOL SD4115 FR 10/52 FIXED 4.5 / ABS-MBS (US3132E0SC76) | 3,05 | −1,55 | 0,0852 | −0,0052 | ||

| US92943AAA25 / WSTN_23-MAUI | 3,05 | −0,29 | 0,0850 | −0,0041 | ||

| FNMA POOL BR6304 FN 04/51 FIXED 2.5 / ABS-MBS (US3140L5AE69) | 3,04 | −2,57 | 0,0848 | −0,0061 | ||

| US743820AC66 / Providence St Joseph Health Obligated Group | 3,04 | 0,23 | 0,0847 | −0,0036 | ||

| GIB.A / CGI Inc. | 3,03 | 0,97 | 0,0846 | −0,0029 | ||

| US780097BA81 / Natwest Group PLC | 3,01 | −0,07 | 0,0840 | −0,0038 | ||

| US17108JAA16 / CHRISTUS Health | 3,00 | 0,84 | 0,0838 | −0,0030 | ||

| SMB PRIVATE EDUCATION LOAN TRU SMB 2025 A A1A 144A / ABS-O (US83207EAA47) | 3,00 | 0,0837 | 0,0837 | |||

| US05608RAA32 / BX Trust | 3,00 | 0,17 | 0,0837 | −0,0036 | ||

| MASSMUTUAL GLOBAL FUNDIN MASSMUTUAL GLOBAL FUNDIN / DBT (US57629W4T48) | 2,98 | 0,47 | 0,0833 | −0,0033 | ||

| US90931EAA29 / United Airlines Pass Through Trust, Series 2019-1, Class A | 2,97 | −0,27 | 0,0830 | −0,0040 | ||

| BANK BANK 2024 BNK48 A4 / ABS-MBS (US06541GAC15) | 2,97 | 1,06 | 0,0828 | −0,0028 | ||

| WEIR GROUP INC COMPANY GUAR 144A 05/30 5.35 / DBT (US94877DAA28) | 2,94 | 0,0821 | 0,0821 | |||

| US023770AA81 / American Airlin Bond | 2,94 | −4,27 | 0,0821 | −0,0075 | ||

| US74368CBC73 / Protective Life Global Funding | 2,94 | 0,79 | 0,0820 | −0,0030 | ||

| US694308HS91 / Pacific Gal Elec Bond | 2,93 | 0,55 | 0,0819 | −0,0032 | ||

| US62878U2A90 / NBN Co Ltd | 2,93 | 0,65 | 0,0817 | −0,0031 | ||

| US694308KP16 / PACIFIC GAS AND ELECTRIC CO SR SEC 1ST LIEN 6.95% 03-15-34 | 2,91 | −0,65 | 0,0812 | −0,0042 | ||

| US036752AP88 / Anthem Inc | 2,87 | 1,59 | 0,0803 | −0,0023 | ||

| US91412HFP38 / UNIV OF CALIFORNIA CA REVENUES UNVHGR 05/27 FIXED 1.366 | 2,86 | 1,17 | 0,0799 | −0,0026 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2015 2A ARV 144A / ABS-CBDO (US03329LAS07) | 2,85 | 1,21 | 0,0795 | −0,0026 | ||

| US46590LAT98 / JPMDB Commercial Mortgage Securities Trust 2016-C2 | 2,85 | 0,99 | 0,0795 | −0,0028 | ||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 2,84 | 0,0793 | 0,0793 | |||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 2,84 | 1,03 | 0,0792 | −0,0027 | ||

| US88880LAK98 / TOBACCO SETTLEMENT FIN AUTH WV TOBGEN 06/28 FIXED 2.351 | 2,83 | 1,25 | 0,0790 | −0,0025 | ||

| NEUBERGER BERMAN CLO LTD NEUB 2021 43A AR 144A / ABS-CBDO (US64134AAJ16) | 2,80 | −0,11 | 0,0781 | −0,0036 | ||

| NEUBERGER BERMAN CLO LTD NEUB 2021 45A AR 144A / ABS-CBDO (US64134MAJ53) | 2,79 | −0,21 | 0,0780 | −0,0036 | ||

| US68235PAN87 / ONE Gas Inc | 2,77 | 0,33 | 0,0772 | −0,0032 | ||

| FLATIRON CLO LTD FLAT 2019 1A AR2 144A / ABS-CBDO (US33883JAW18) | 2,75 | −8,27 | 0,0768 | −0,0107 | ||

| US05608XAA00 / BXMT LTD BXMT 2020 FL3 A 144A | 2,75 | −2,59 | 0,0767 | −0,0056 | ||

| US48129RAZ82 / JPMDB COMMERCIAL MORTGAGE SECU JPMDB 2019 COR6 ASB | 2,75 | −4,29 | 0,0767 | −0,0070 | ||

| CALIFORNIA ST CAS 09/35 FIXED 5.1 / DBT (US13063EHV11) | 2,74 | −0,11 | 0,0766 | −0,0035 | ||

| MARS INC SR UNSECURED 144A 03/32 5 / DBT (US571676AZ85) | 2,74 | 0,92 | 0,0764 | −0,0027 | ||

| US3128MJ6P03 / Federal Home Loan Mortgage Corp. | 2,73 | −2,67 | 0,0763 | −0,0056 | ||

| US26828HAA59 / ECMC Group Student Loan Trust 2018-1 | 2,72 | −1,45 | 0,0759 | −0,0046 | ||

| EW / Edwards Lifesciences Corporation | 2,71 | −96,92 | 0,0758 | −2,7137 | ||

| US95000U2S19 / Wells Fargo & Co | 2,70 | 0,97 | 0,0753 | −0,0026 | ||

| JACKSON NATL LIFE GLOBAL SECURED 144A 10/29 4.6 / DBT (US46849LVB43) | 2,70 | 0,90 | 0,0753 | −0,0027 | ||

| FNMA POOL FS6048 FN 02/53 FIXED VAR / ABS-MBS (US3140XMWJ11) | 2,70 | −3,16 | 0,0753 | −0,0059 | ||

| US3140QMRX43 / FANNIE MAE POOL UMBS P#CB2301 3.00000000 | 2,65 | −1,74 | 0,0740 | −0,0047 | ||

| US00217VAA89 / AREIT 2022-CRE7 LLC | 2,64 | −10,77 | 0,0738 | −0,0126 | ||

| US36264BAA89 / GPMT LTD. GPMT 2021 FL3 A 144A | 2,62 | −19,43 | 0,0732 | −0,0217 | ||

| US80281LAR69 / Santander UK Group Holdings PLC | 2,61 | 0,73 | 0,0730 | −0,0027 | ||

| ANCHORAGE CAPITAL CLO LTD ANCHC 2015 6A AR3 144A / ABS-CBDO (US03328QBL41) | 2,61 | 0,15 | 0,0728 | −0,0031 | ||

| US87241EAQ89 / TCW CLO 2019-1 AMR Ltd | 2,60 | 0,23 | 0,0727 | −0,0031 | ||

| FNMA POOL FS5365 FN 02/50 FIXED VAR / ABS-MBS (US3140XL6B98) | 2,58 | −2,16 | 0,0720 | −0,0049 | ||

| US38376RTJ58 / GOVERNMENT NATIONAL MORTGAGE A GNR 2016 H09 FB | 2,58 | −18,15 | 0,0720 | −0,0199 | ||

| US53948HAA41 / LoanCore 2021-CRE6 Issuer Ltd | 2,57 | −8,71 | 0,0717 | −0,0103 | ||

| US38376RUH73 / GOVERNMENT NATIONAL MORTGAGE A GNR 2016 H10 FA | 2,56 | −17,73 | 0,0715 | −0,0193 | ||

| FNMA POOL BZ3406 FN 03/30 FIXED 4.32 / ABS-MBS (US3140NXYC15) | 2,54 | 0,60 | 0,0708 | −0,0027 | ||

| USU5009LAZ32 / Kraft Heinz Foods Co | 2,53 | 0,52 | 0,0708 | −0,0028 | ||

| US06051GJL41 / Bank of America Corp | 2,53 | 1,89 | 0,0706 | −0,0018 | ||

| US78445QAE17 / SLM Private Education Loan Trust 2010-C | 2,52 | −3,92 | 0,0705 | −0,0062 | ||

| US46647PBE51 / JPMorgan Chase & Co | 2,52 | 1,61 | 0,0703 | −0,0020 | ||

| US3140N0D854 / FNCL UMBS 4.0 BW7326 09-01-52 | 2,52 | −5,38 | 0,0703 | −0,0073 | ||

| US 10YR NOTE (CBT)SEP25 XCBT 20250919 / DIR (000000000) | 2,51 | 0,0702 | 0,0702 | |||

| US02582JJX90 / American Express Credit Account Master Trust, Series 2022-4, Class A | 2,50 | −0,08 | 0,0699 | −0,0032 | ||

| US3140QKNN41 / Fannie Mae Pool | 2,50 | −2,38 | 0,0697 | −0,0049 | ||

| NWE / NorthWestern Energy Group, Inc. | 2,44 | 0,83 | 0,0681 | −0,0024 | ||

| FANNIE MAE FNR 2024 104 FA / ABS-MBS (US3136BUEQ99) | 2,43 | −4,25 | 0,0679 | −0,0062 | ||

| US3128MJ5Z93 / FED HM LN PC POOL G08863 FG 02/49 FIXED 4.5 | 2,41 | −3,14 | 0,0673 | −0,0053 | ||

| US36361UAL44 / Gallatin CLO VIII 2017-1 Ltd | 2,40 | −1,23 | 0,0670 | −0,0039 | ||

| FREDDIE MAC FHR 5440 F / ABS-MBS (US3137HDY795) | 2,40 | −9,82 | 0,0670 | −0,0106 | ||

| US78448YAB74 / SMB PRIVATE EDUCATION LOAN TRUST | 2,39 | −3,79 | 0,0666 | −0,0057 | ||

| US38376RR404 / GOVERNMENT NATIONAL MORTGAGE A GNR 2017 H03 HA | 2,39 | −6,03 | 0,0666 | −0,0074 | ||

| FNMA POOL BZ3419 FN 03/30 FIXED 4.32 / ABS-MBS (US3140NXYR83) | 2,37 | 0,64 | 0,0661 | −0,0025 | ||

| US26828VAA44 / ECMC Group Student Loan Trust 2017-2 | 2,37 | −1,50 | 0,0661 | −0,0040 | ||

| US76209PAB94 / RGA Global Funding | 2,35 | 0,30 | 0,0655 | −0,0027 | ||

| CHESAPEAKE FUNDING II LLC CFII 2024 1A A1 144A / ABS-O (US165183DE19) | 2,34 | −11,69 | 0,0652 | −0,0119 | ||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 2,32 | 1,76 | 0,0647 | −0,0017 | ||

| US3136ATY731 / FANNIE MAE FNR 2016 76 CF | 2,32 | −3,18 | 0,0647 | −0,0051 | ||

| US55285BAA35 / MF1 2022-FL10 LLC MF1 2022-FL10 A | 2,31 | −5,63 | 0,0646 | −0,0069 | ||

| US38376RCB06 / GNMA, Series 2015-H14, Class FA | 2,31 | −13,47 | 0,0644 | −0,0134 | ||

| US13077DMR07 / CALIFORNIA ST UNIV REVENUE CASHGR 11/30 FIXED 1.74 | 2,30 | 1,86 | 0,0642 | −0,0016 | ||

| US025816DN68 / American Express Co. | 2,29 | 0,79 | 0,0639 | −0,0023 | ||

| US38375UYN44 / Government National Mortgage Association | 2,29 | −13,83 | 0,0638 | −0,0135 | ||

| FANNIE MAE FNR 2024 77 DF / ABS-MBS (US3136BTWY58) | 2,28 | 0,0637 | 0,0637 | |||

| US694308JW85 / Pacific Gas and Electric Co | 2,28 | 0,97 | 0,0637 | −0,0022 | ||

| US98164FAD42 / WOART 23-C A3 5.15% 11-15-28 | 2,27 | −5,97 | 0,0633 | −0,0070 | ||

| 69511JD28 / PACIFICORP | 2,27 | 0,93 | 0,0633 | −0,0022 | ||

| 30064K105 / Exacttarget, Inc. | 2,25 | 1,08 | 0,0628 | −0,0021 | ||

| FNMA POOL BZ3405 FN 03/30 FIXED 4.32 / ABS-MBS (US3140NXYB32) | 2,24 | 0,63 | 0,0624 | −0,0024 | ||

| US62829D2A73 / Mutual of Omaha Cos. Global Funding | 2,23 | 0,13 | 0,0624 | −0,0027 | ||

| US3137BTTH46 / FREDDIE MAC FHR 4637 WF | 2,23 | −4,94 | 0,0623 | −0,0062 | ||

| NISSAN AUTO LEASE TRUST NALT 2024 A A4 / ABS-O (US65481CAE49) | 2,21 | 0,00 | 0,0618 | −0,0028 | ||

| ELEVATION CLO LTD AWPT 2022 16A A1AR 144A / ABS-CBDO (US28623YAU73) | 2,20 | 0,73 | 0,0615 | −0,0023 | ||

| US12434FAA57 / BX Commercial Mortgage Trust 2021-CIP | 2,20 | −3,81 | 0,0614 | −0,0053 | ||

| SUTTER HEALTH UNSECURED 08/32 5.213 / DBT (US86944BAP85) | 2,16 | 0,0603 | 0,0603 | |||

| US01F0226757 / Uniform Mortgage-Backed Security, TBA | 2,16 | −98,26 | 0,0602 | −3,6836 | ||

| US31418DKK71 / Fannie Mae Pool | 2,15 | −3,29 | 0,0600 | −0,0048 | ||

| US38376RN858 / Government National Mortgage Association | 2,14 | −9,72 | 0,0596 | −0,0094 | ||

| US07274EAK91 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.375% 11-21-30 | 2,13 | 1,48 | 0,0594 | −0,0018 | ||

| US00138CAV00 / Corebridge Global Funding | 2,09 | 0,43 | 0,0584 | −0,0024 | ||

| US31351DDT54 / Freddie Mac Strips | 2,09 | −5,66 | 0,0582 | −0,0062 | ||

| US92331AAU88 / Venture XXVIII CLO Ltd | 2,08 | −41,97 | 0,0582 | −0,0466 | ||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 2,08 | 0,73 | 0,0580 | −0,0021 | ||

| US649840CU75 / New York State Electric & Gas Corp | 2,07 | 0,53 | 0,0579 | −0,0023 | ||

| US44236PLT39 / HOUSTON TX CMNTY CLG HOUHGR 02/29 FIXED 5 | 2,07 | 0,58 | 0,0578 | −0,0022 | ||

| US3133ATPE55 / Freddie Mac Pool | 2,07 | −0,86 | 0,0577 | −0,0031 | ||

| PROTECTIVE LIFE GLOBAL SECURED 144A 01/32 5.432 / DBT (US74368CCB81) | 2,07 | 0,63 | 0,0577 | −0,0022 | ||

| CMCS34 / Comcast Corporation - Depositary Receipt (Common Stock) | 2,06 | 0,88 | 0,0576 | −0,0021 | ||

| US04002BAA35 / AREIT_23-CRE8 | 2,06 | −0,67 | 0,0576 | −0,0030 | ||

| CNO GLOBAL FUNDING CNO GLOBAL FUNDING / DBT (US18977W2D15) | 2,05 | 0,15 | 0,0574 | −0,0025 | ||

| SRG / Snam S.p.A. | 2,04 | 0,0571 | 0,0571 | |||

| US02582JKB51 / AMXCA 23-2 A 4.80% 05-15-30/28 | 2,04 | 0,99 | 0,0571 | −0,0020 | ||

| US379930AD24 / GM Financial Consumer Automobile Receivables Trust 2023-4 | 2,02 | −0,15 | 0,0565 | −0,0026 | ||

| US3137H0VQ85 / FREDDIE MAC FHR 5115 DA | 2,01 | −3,37 | 0,0561 | −0,0045 | ||

| MARATHON CLO LTD MCLO 2019 1A AAR2 144A / ABS-CBDO (US56579ABJ88) | 2,01 | −7,97 | 0,0561 | −0,0076 | ||

| US539439AT62 / Lloyds Banking Group PLC | 2,01 | 0,75 | 0,0560 | −0,0021 | ||

| US977100HA74 / WISCONSIN ST GEN FUND ANNUAL A WISGEN 05/28 FIXED 2.299 | 2,00 | 0,76 | 0,0558 | −0,0021 | ||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 2,00 | 1,42 | 0,0558 | −0,0017 | ||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2021 18A A1R 144A / ABS-CBDO (US04943EAQ44) | 2,00 | −0,10 | 0,0558 | −0,0025 | ||

| US80281LAM72 / Santander UK Group Holdings PLC | 1,99 | 0,86 | 0,0556 | −0,0020 | ||

| US61691ABL61 / Morgan Stanley Capital I Trust 2015-UBS8 | 1,99 | 0,20 | 0,0555 | −0,0023 | ||

| US694308KM84 / Pacific Gas and Electric Co. | 1,99 | 0,05 | 0,0555 | −0,0025 | ||

| FCT / Fincantieri S.p.A. | 1,97 | 1,44 | 0,0550 | −0,0016 | ||

| US91756TAR23 / UTAH ST MUNI PWR AGY PWR SPLY UTSPWR 07/28 FIXED 3.237 | 1,96 | 0,83 | 0,0546 | −0,0020 | ||

| US06051GHD43 / Bank of America Corp | 1,96 | 0,88 | 0,0546 | −0,0020 | ||

| US74533ANE46 / PUGET SOUND ENERGY INC | 1,94 | 0,67 | 0,0542 | −0,0020 | ||

| US606940AC86 / MMAF EQUIPMENT FINANCE LLC MMAF 2022 B A3 144A | 1,94 | −34,28 | 0,0541 | −0,0319 | ||

| US07335YAA47 / BDS 2021-FL10 LTD / BDS 2021-FL10 LLC 1ML+135 12/18/2036 144A | 1,93 | −18,07 | 0,0540 | −0,0149 | ||

| US07274EAL74 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.5% 11-21-33 | 1,93 | 2,06 | 0,0539 | −0,0013 | ||

| US90276VAC37 / UBS Commercial Mortgage Trust 2018-C8 | 1,92 | −8,01 | 0,0536 | −0,0073 | ||

| US38378U8L44 / Government National Mortgage Association | 1,87 | −9,66 | 0,0522 | −0,0081 | ||

| US63940CAA27 / Navient Student Loan Trust 2017-5 | 1,87 | −2,30 | 0,0522 | −0,0036 | ||

| US982674NH26 / WYANDOTTE CNTY/KANSAS CITY KS WYAUTL 09/28 FIXED 1.861 | 1,86 | 0,59 | 0,0520 | −0,0020 | ||

| F+G GLOBAL FUNDING SECURED 144A 01/30 5.875 / DBT (US30321L2J09) | 1,85 | 1,09 | 0,0517 | −0,0017 | ||

| US023761AA74 / American Airlines Pass Through Trust, Series 2017-1, Class AA | 1,85 | 0,27 | 0,0515 | −0,0021 | ||

| PROTECTIVE LIFE GLOBAL PROTECTIVE LIFE GLOBAL / DBT (US74368CBX11) | 1,82 | 0,06 | 0,0508 | −0,0022 | ||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 1,80 | 0,0503 | 0,0503 | |||

| S1YK34 / Stryker Corporation - Depositary Receipt (Common Stock) | 1,80 | 1,07 | 0,0502 | −0,0017 | ||

| US31847RAH57 / First American Financial Corp | 1,79 | 1,18 | 0,0501 | −0,0016 | ||

| US3132DWEK53 / Freddie Mac Pool | 1,79 | −2,08 | 0,0500 | −0,0033 | ||

| BARCLAYS COMMERCIAL MORTGAGE S BBCMS 2025 C32 A5 / ABS-MBS (US07337AAD81) | 1,79 | 0,45 | 0,0500 | −0,0020 | ||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 1,78 | 0,11 | 0,0496 | −0,0021 | ||

| CMS.PRB / Consumers Energy Company - Preferred Stock | 1,78 | 1,02 | 0,0496 | −0,0017 | ||

| US00500RAA32 / ACREC 2021-FL1 Ltd | 1,76 | −4,09 | 0,0491 | −0,0044 | ||

| US60687YBL20 / Mizuho Financial Group Inc | 1,75 | 1,63 | 0,0489 | −0,0014 | ||

| US14889DAJ72 / Catamaran CLO 2014-1 Ltd | 1,75 | −38,60 | 0,0488 | −0,0342 | ||

| US12551YAA10 / CIFC 2018-3A A | 1,75 | −17,40 | 0,0488 | −0,0129 | ||

| US3140X47J93 / FANNIE MAE POOL UMBS P#FM1796 3.50000000 | 1,74 | −6,41 | 0,0485 | −0,0057 | ||

| US74923EAA64 / Rad CLO 5 Ltd | 1,71 | −15,84 | 0,0478 | −0,0115 | ||

| US69291QAA31 / PFP III PFP 2022 9 A 144A | 1,68 | −21,86 | 0,0469 | −0,0158 | ||

| US3137F7YY55 / FREDDIE MAC FHR 5051 MA | 1,65 | −5,33 | 0,0462 | −0,0048 | ||

| US3140MM4J44 / FNMA 30YR 4% 08/01/2052#BV8024 | 1,64 | −2,50 | 0,0457 | −0,0033 | ||

| US38375UVD98 / GOVERNMENT NATIONAL MORTGAGE A GNR 2015 H08 FD | 1,62 | −17,97 | 0,0453 | −0,0124 | ||

| US816851BQ16 / Sempra Energy | 1,62 | 0,12 | 0,0451 | −0,0019 | ||

| US3140X5BM48 / FNMA POOL FM1843 FN 11/34 FIXED VAR | 1,59 | −3,52 | 0,0444 | −0,0037 | ||

| US3137F7TN55 / FREDDIE MAC FHR 5050 YA | 1,59 | −7,95 | 0,0443 | −0,0060 | ||

| US36143L2A26 / GA Global Funding Trust | 1,57 | 0,83 | 0,0439 | −0,0016 | ||

| US07336CAA18 / BDS 2022-FL12 LLC | 1,56 | −27,84 | 0,0437 | −0,0195 | ||

| US95000GAY08 / Wells Fargo Commercial Mortgage Trust 2016-BNK1 | 1,56 | 0,91 | 0,0436 | −0,0015 | ||

| US48252AAA97 / KKR Group Finance Co VI LLC | 1,55 | 0,65 | 0,0434 | −0,0017 | ||

| US3137H0VA34 / Freddie Mac REMICS | 1,53 | −2,73 | 0,0428 | −0,0032 | ||

| US46188BAA08 / Invitation Homes Operating Partnership LP | 1,53 | 1,73 | 0,0428 | −0,0011 | ||

| SAMMONS FINANCIAL GLOBAL SECURED 144A 01/28 5.05 / DBT (US79587J2B82) | 1,52 | 0,26 | 0,0425 | −0,0018 | ||

| OHIO EDISON CO SR UNSECURED 144A 12/29 4.95 / DBT (US677347CJ38) | 1,52 | 0,0425 | 0,0425 | |||

| US63939KAC36 / Navient Private Education Loan Trust, Series 2015-BA, Class A3 | 1,52 | −11,64 | 0,0424 | −0,0077 | ||

| GREENSAIF PIPELINES BIDC SR SECURED 144A 02/36 5.8528 / DBT (US39541EAD58) | 1,52 | −0,13 | 0,0424 | −0,0020 | ||

| US08163MAF41 / BENCHMARK MORTGAGE TRUST BMARK 2021 B31 AAB | 1,51 | 1,27 | 0,0423 | −0,0013 | ||

| US3136AUH536 / FANNIE MAE FNR 2016 100 WF | 1,50 | −2,78 | 0,0420 | −0,0031 | ||

| HSBC26C / HSBC Holdings PLC | 1,50 | 0,13 | 0,0418 | −0,0018 | ||

| US3136AUTX94 / FANNIE MAE FNR 2016 88 AF | 1,49 | −6,54 | 0,0415 | −0,0049 | ||

| US3137BNCR31 / FHLMC, REMIC, Series 4559, Class AF | 1,48 | −7,41 | 0,0412 | −0,0053 | ||

| US89240HAD70 / Toyota Lease Owner Trust, Series 2023-B, Class A3 | 1,45 | −27,75 | 0,0406 | −0,0181 | ||

| US3138EQAD40 / FNMA POOL AL7203 FN 08/45 FIXED VAR | 1,44 | −0,55 | 0,0403 | −0,0020 | ||

| US12655TBJ79 / COMM MORTGAGE TRUST | 1,44 | −5,14 | 0,0402 | −0,0041 | ||

| US06054AAW99 / BANC OF AMERICA COMMERCIAL MORTGAGE TRUST 3.441% 09/15/2048 2015-UBS7 A3 | 1,44 | −55,33 | 0,0401 | −0,0538 | ||

| US3137HAST48 / FHMS K509 A2 | 1,43 | 0,42 | 0,0399 | −0,0016 | ||

| US404280CH04 / HSBC Holdings PLC | 1,42 | 1,72 | 0,0396 | −0,0011 | ||

| US38375UXM79 / Government National Mortgage Association | 1,40 | −16,85 | 0,0391 | −0,0100 | ||

| NBN CO LTD NBN CO LTD / DBT (US62878U2J00) | 1,40 | 0,65 | 0,0390 | −0,0015 | ||

| US3137BTH385 / FREDDIE MAC FHR 4638 FA | 1,39 | −5,17 | 0,0389 | −0,0040 | ||

| US567830BU72 / MARIN CNTY CA MAR 08/26 FIXED 5.41 | 1,38 | −0,29 | 0,0387 | −0,0018 | ||

| US59447TXR93 / MICHIGAN ST FIN AUTH REVENUE MISFIN 12/26 FIXED 2.596 | 1,38 | 0,66 | 0,0384 | −0,0015 | ||

| US03076CAN65 / Ameriprise Financial Inc | 1,36 | 0,74 | 0,0380 | −0,0014 | ||

| US90932JAA07 / United Airlines 2019-2 Class AA Pass Through Trust | 1,36 | −2,52 | 0,0379 | −0,0027 | ||

| US 10YR ULTRA FUT SEP25 XCBT 20250919 / DIR (000000000) | 1,35 | 0,0378 | 0,0378 | |||

| NORTHWESTERN MUTUAL GLBL SECURED 144A 01/30 4.96 / DBT (US66815L2U28) | 1,33 | 0,68 | 0,0371 | −0,0014 | ||

| US50220PAC77 / LSEGA Financing PLC | 1,32 | 1,23 | 0,0368 | −0,0012 | ||

| US90320WAG87 / UPMC | 1,31 | 1,40 | 0,0365 | −0,0011 | ||

| US3133KRLT94 / FR RA9338 | 1,31 | −21,04 | 0,0365 | −0,0118 | ||

| US63942AAB26 / Navient Private Education Loan Trust 2020-I | 1,30 | −5,25 | 0,0363 | −0,0037 | ||

| US3140XJYX57 / FNMA 30YR 4.5% 09/01/2052#FS3425 | 1,28 | −3,39 | 0,0359 | −0,0029 | ||

| US86944BAD55 / Sutter Health | 1,28 | 1,34 | 0,0358 | −0,0011 | ||

| US3136AUKR18 / Fannie Mae REMICS | 1,27 | −4,09 | 0,0353 | −0,0031 | ||

| US95002EAZ07 / WELLS FARGO COMMERCIAL MORTGAGE TRUST 2020-C55 SER 2020-C55 CL ASB REGD 2.65100000 | 1,26 | −2,86 | 0,0351 | −0,0027 | ||

| US694308KL02 / Pacific Gas and Electric Co | 1,24 | 0,24 | 0,0347 | −0,0015 | ||

| US06738EBR53 / Barclays PLC | 1,24 | 1,89 | 0,0347 | −0,0009 | ||

| AU3FN0029609 / AAI Ltd | 1,23 | 1,74 | 0,0343 | −0,0009 | ||

| US02379KAA25 / American Airlines 2021-1 Class A Pass Through Trust | 1,22 | 0,33 | 0,0342 | −0,0014 | ||

| FED HM LN PC POOL QE1102 FR 04/52 FIXED 2.5 / ABS-MBS (US3133BAGK17) | 1,22 | −2,24 | 0,0341 | −0,0023 | ||

| DK0009391104 / JYSKE REALKREDIT A/S /DKK/ REGD SER 321E 1.00000000 | 1,21 | 1,26 | 0,0336 | −0,0011 | ||

| US3128MJ3H14 / Freddie Mac Gold Pool | 1,17 | −1,60 | 0,0326 | −0,0020 | ||

| US38376RRG38 / GOVERNMENT NATIONAL MORTGAGE A GNR 2016 H07 FE | 1,16 | −11,36 | 0,0323 | −0,0058 | ||

| US58003UAA60 / MF1 Multifamily Housing Mortgage Loan Trust | 1,15 | −35,58 | 0,0321 | −0,0199 | ||

| US902055AA09 / 225 Liberty Street Trust 2016-225L | 1,15 | 0,97 | 0,0320 | −0,0011 | ||

| US91412HGF47 / UNIV OF CALIFORNIA CA REVENUES | 1,15 | 1,24 | 0,0320 | −0,0010 | ||

| US36179RNW50 / Ginnie Mae II Pool | 1,14 | −2,15 | 0,0318 | −0,0022 | ||

| US TREASURY N/B 01/32 4.375 / DBT (US91282CMK44) | 1,13 | 0,63 | 0,0314 | −0,0012 | ||

| US797440BZ64 / San Diego Gas & Electric Co., Series VVV | 1,12 | 2,29 | 0,0312 | −0,0007 | ||

| FED HM LN PC POOL RA9541 FR 07/53 FIXED 2.5 / ABS-MBS (US3133KRS626) | 1,10 | −0,81 | 0,0307 | −0,0017 | ||

| US90276RBC16 / UBS Commercial Mortgage Trust, Series 2017-C4, Class ASB | 1,10 | −11,66 | 0,0307 | −0,0056 | ||

| US64129KBE64 / Neuberger Berman CLO XV | 1,09 | −21,59 | 0,0305 | −0,0101 | ||

| US59447TXQ11 / MICHIGAN ST FIN AUTH REVENUE MISFIN 12/25 FIXED 2.466 | 1,09 | 0,46 | 0,0305 | −0,0012 | ||

| US55284AAA60 / MF1 2021-FL7 Ltd | 1,08 | −36,20 | 0,0300 | −0,0192 | ||

| US3137H02A58 / FREDDIE MAC FHR 5104 UB | 1,07 | −2,28 | 0,0299 | −0,0021 | ||

| US38376RHB50 / GOVERNMENT NATIONAL MORTGAGE A GNR 2015 H22 FD | 1,06 | −13,35 | 0,0295 | −0,0061 | ||

| PROTECTIVE LIFE GLOBAL SECURED 144A 12/28 5.467 / DBT (US74368CBV54) | 1,04 | 0,68 | 0,0289 | −0,0011 | ||

| US63942TAA34 / NAVIENT STUDENT LOAN TRUST 23-BA A1A 6.48% 03/15/2072 144A | 1,03 | −10,78 | 0,0287 | −0,0049 | ||

| US48252KAA79 / KKR CLO 21 Ltd | 1,03 | −26,05 | 0,0286 | −0,0118 | ||

| US3128MJ4W71 / Federal Home Loan Mortgage Corp. | 1,02 | −1,74 | 0,0284 | −0,0018 | ||

| US78436TAD81 / SBALT 2023-A A4 | 1,01 | −0,49 | 0,0283 | −0,0014 | ||

| HONDA AUTO RECEIVABLES OWNER T HAROT 2024 3 A4 / ABS-O (US43813YAD40) | 1,01 | 0,40 | 0,0281 | −0,0011 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 1,01 | 0,30 | 0,0281 | −0,0012 | ||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 1,00 | 0,60 | 0,0280 | −0,0011 | ||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2021 17A AR 144A / ABS-CBDO (US04942FAL31) | 1,00 | 0,40 | 0,0279 | −0,0011 | ||

| LCM LTD PARTNERSHIP LCM 36A A1R 144A / ABS-CBDO (US50190LAL27) | 1,00 | 0,10 | 0,0278 | −0,0012 | ||

| US92331LBC37 / VENTURE CDO LTD VENTR 2017 27A AR 144A | 0,97 | −42,33 | 0,0272 | −0,0221 | ||

| US80281LAQ86 / Santander UK Group Holdings PLC | 0,97 | 0,83 | 0,0271 | −0,0010 | ||

| US3136AUPW57 / Fannie Mae REMICs | 0,95 | −8,71 | 0,0267 | −0,0038 | ||

| US61747YED31 / Morgan Stanley | 0,95 | 1,71 | 0,0266 | −0,0007 | ||

| US13077DMN92 / CALIFORNIA ST UNIV REVENUE CASHGR 11/27 FIXED 1.338 | 0,94 | 1,07 | 0,0263 | −0,0009 | ||

| FANNIE MAE FNR 2025 16 FA / ABS-MBS (US3136BU5D84) | 0,94 | −5,53 | 0,0262 | −0,0028 | ||

| MAGNETITE CLO LTD MAGNE 2015 12A AR4 144A / ABS-CBDO (US55953HBD44) | 0,94 | −34,01 | 0,0262 | −0,0153 | ||

| US59333NT370 / MIAMI DADE CNTY FL SPL OBLIG MIAGEN 10/28 FIXED 1.936 | 0,93 | 1,19 | 0,0261 | −0,0008 | ||

| US3132XV2R33 / FED HM LN PC POOL Q53483 FG 01/48 FIXED 3 | 0,93 | −0,75 | 0,0260 | −0,0014 | ||

| US3140QSSW21 / FNMA 30YR 5% 07/01/2053#CB6832 | 0,93 | −1,18 | 0,0258 | −0,0015 | ||

| US3133B5CB66 / FHLG 30YR 2.5% 02/01/2052#QD7266 | 0,92 | −1,07 | 0,0258 | −0,0014 | ||

| EVERGY METRO EVERGY METRO / DBT (US30037DAD75) | 0,92 | 0,88 | 0,0257 | −0,0009 | ||

| US76913CBF59 / RIVERSIDE CNTY CA PENSN OBLG COUNTY OF RIVERSIDE CA | 0,92 | 0,33 | 0,0257 | −0,0011 | ||

| US64971M4Q23 / NEW YORK CITY NY TRANSITIONAL NEW YORK CITY TRANSITIONAL FINANCE AUTHORITY FUTUR | 0,92 | 0,33 | 0,0256 | −0,0011 | ||

| US3140QSDY42 / FNMA POOL CB6418 FN 05/53 FIXED 5 | 0,92 | −1,93 | 0,0256 | −0,0017 | ||

| US98164FAE25 / WOART 23-C A4 5.03% 11-15-29 | 0,91 | 0,00 | 0,0255 | −0,0011 | ||

| SFS AUTO RECEIVABLES SECURITIZ SFAST 2024 1A A3 144A / ABS-O (US78435VAC63) | 0,90 | −0,11 | 0,0252 | −0,0012 | ||

| US38122ND252 / Golden State Tobacco Securitization Corp | 0,90 | 1,13 | 0,0250 | −0,0008 | ||

| US90353DAW56 / UBS Commercial Mortgage Trust | 0,89 | −6,88 | 0,0250 | −0,0030 | ||

| US77587UAL61 / ROMARK CLO LTD RMRK 2017 1A A1R 144A | 0,87 | −36,96 | 0,0243 | −0,0160 | ||

| US3140XH4D62 / Fannie Mae Pool | 0,87 | −1,92 | 0,0243 | −0,0016 | ||

| US36262TAA16 / GPMT 2021-FL4 LTD | 0,87 | −2,37 | 0,0242 | −0,0017 | ||

| US126650BS86 / CVS PASS THROUGH TRUST PASS THRU CE 144A 01/32 7.507 | 0,85 | −4,60 | 0,0238 | −0,0023 | ||

| US3137FUKP89 / Freddie Mac REMICS | 0,83 | −5,46 | 0,0232 | −0,0024 | ||

| US92916MAF86 / VOYA CLO LTD VOYA 2017 1A A1R 144A | 0,82 | −24,75 | 0,0230 | −0,0089 | ||

| US95001NAW83 / Wells Fargo Commercial Mortgage Trust 2018-C45 | 0,82 | −7,11 | 0,0230 | −0,0029 | ||

| P1NW34 / Pinnacle West Capital Corporation - Depositary Receipt (Common Stock) | 0,82 | 0,0229 | 0,0229 | |||

| US31418ED565 / FNMA 30YR 2.5% 06/01/2052#MA4623 | 0,81 | −1,57 | 0,0227 | −0,0014 | ||

| US90278PAY60 / UBS Commercial Mortgage Trust | 0,80 | −5,53 | 0,0224 | −0,0024 | ||

| US3133BT5Z95 / UMBS | 0,80 | −0,99 | 0,0224 | −0,0012 | ||

| US3133C5RV55 / FR QG5000 | 0,78 | −0,77 | 0,0217 | −0,0012 | ||

| US3132DWFL28 / Freddie Mac Pool | 0,77 | −2,05 | 0,0214 | −0,0014 | ||

| US3140XBS685 / Fannie Mae Pool | 0,76 | −1,17 | 0,0212 | −0,0012 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2015 1A ARV 144A / ABS-CBDO (US033296AG97) | 0,76 | −0,79 | 0,0211 | −0,0011 | ||

| US3132DWDJ99 / Freddie Mac Pool | 0,71 | −2,07 | 0,0198 | −0,0013 | ||

| US3137FUKQ62 / Freddie Mac REMICS | 0,71 | −6,70 | 0,0198 | −0,0024 | ||

| US3132DWFY49 / UMBS | 0,71 | −1,12 | 0,0198 | −0,0011 | ||

| US3140XLGV40 / FN FS4711 | 0,70 | −1,83 | 0,0195 | −0,0013 | ||

| US3132A5G331 / UMBS Pool | 0,70 | −2,11 | 0,0194 | −0,0013 | ||

| US90931LAA61 / United Airlines 2016-1 Class AA Pass Through Trust | 0,69 | 0,58 | 0,0194 | −0,0007 | ||

| US3140MWPY61 / FN BW4938 | 0,68 | −0,73 | 0,0191 | −0,0010 | ||

| US61691NAE58 / Morgan Stanley Capital I 2017-HR2 | 0,68 | 0,89 | 0,0191 | −0,0007 | ||

| US80317LAJ26 / Saranac Clo VI Ltd | 0,64 | −14,25 | 0,0180 | −0,0039 | ||

| COLUMBIA UNIVERSITY UNSECURED 10/35 4.355 / DBT (US198643AD00) | 0,64 | 0,0180 | 0,0180 | |||

| US05369AAD37 / Aviation Capital Group LLC | 0,60 | 0,34 | 0,0167 | −0,0007 | ||

| US768874SG56 / RIVERSIDE CA ELEC REVENUE | 0,59 | −1,17 | 0,0165 | −0,0009 | ||

| US3128MJXX32 / Freddie Mac Gold Pool | 0,58 | −1,69 | 0,0162 | −0,0010 | ||

| US88283LHT61 / Texas (State of) Transportation Commission State Highway Fund, Series 2010 B, RB | 0,58 | −49,16 | 0,0161 | −0,0170 | ||

| US3140MVS827 / FNCL UMBS 2.5 BW4142 07-01-52 | 0,58 | −1,20 | 0,0161 | −0,0009 | ||

| FED HM LN PC POOL RA8828 FR 04/52 FIXED 2.5 / ABS-MBS (US3133KQYZ35) | 0,56 | −1,05 | 0,0158 | −0,0009 | ||

| US31418CYL26 / Federal National Mortgage Association | 0,55 | −2,30 | 0,0154 | −0,0011 | ||

| US982674NJ81 / WYANDOTTE CNTY/KANSAS CITY KS WYAUTL 09/29 FIXED 1.961 | 0,55 | 0,55 | 0,0153 | −0,0006 | ||

| US11271LAE20 / Brookfield Finance Inc | 0,54 | 0,74 | 0,0152 | −0,0005 | ||

| US3133BJPF30 / UMBS | 0,54 | −1,10 | 0,0151 | −0,0009 | ||

| US11042CAA80 / British Airways 2021-1 Class A Pass Through Trust | 0,53 | −1,50 | 0,0147 | −0,0009 | ||

| US3140MA2S24 / FNCL UMBS 2.5 BU8884 03-01-52 | 0,52 | −2,44 | 0,0145 | −0,0010 | ||

| US90931MAA45 / United Airlines 2016-1 Class A Pass Through Trust | 0,52 | 0,58 | 0,0145 | −0,0006 | ||

| FED HM LN PC POOL QE1488 FR 04/52 FIXED 2.5 / ABS-MBS (US3133BAUM17) | 0,52 | −1,15 | 0,0145 | −0,0008 | ||

| US14315LAA26 / Carlyle Global Market Strategies CLO 2014-3-R Ltd | 0,51 | −40,16 | 0,0144 | −0,0107 | ||

| SFS AUTO RECEIVABLES SECURITIZ SFAST 2024 1A A4 144A / ABS-O (US78435VAD47) | 0,51 | 0,40 | 0,0142 | −0,0006 | ||

| US08161CAF86 / BENCHMARK MORTGAGE TRUST BMARK 2018 B2 ASB | 0,50 | −10,97 | 0,0138 | −0,0024 | ||

| TESLA SUSTAINABLE ENERGY TRUST TSET 2024 1A A2 144A / ABS-O (US88164AAB08) | 0,49 | −3,19 | 0,0136 | −0,0011 | ||

| US3140XLVT29 / Fannie Mae Pool | 0,48 | −2,23 | 0,0135 | −0,0009 | ||

| US05609CAA53 / BX Commercial Mortgage Trust 2021-21M | 0,48 | −55,56 | 0,0133 | −0,0180 | ||

| US61690FAM59 / Morgan Stanley Bank of America Merrill Lynch Trust 2015-C22 | 0,47 | −60,20 | 0,0130 | −0,0211 | ||

| US31418D4Y57 / FNMA, 30 Year | 0,46 | −2,56 | 0,0128 | −0,0009 | ||

| US3140MJ4S15 / FNCL UMBS 2.5 BV5332 04-01-52 | 0,46 | −1,93 | 0,0128 | −0,0008 | ||

| US70410DAC20 / PAWNEEE EQUIPMENT RECEIVABLES SERIES 2022 1 LLC | 0,45 | −44,99 | 0,0126 | −0,0113 | ||

| US3132XTQZ46 / FED HM LN PC POOL Q51371 FG 10/47 FIXED 3 | 0,45 | −2,83 | 0,0125 | −0,0009 | ||

| FED HM LN PC POOL QE9261 FR 09/52 FIXED 4 / ABS-MBS (US3133BKJE02) | 0,45 | −0,67 | 0,0125 | −0,0007 | ||

| US3140MEBV70 / FNMA 30YR 4% 09/01/2052#BV0951 | 0,45 | −0,67 | 0,0124 | −0,0006 | ||

| US78449VAC00 / SMB Private Education Loan Trust 2020-PT-A | 0,44 | −7,22 | 0,0122 | −0,0015 | ||

| US3140QPSK44 / FANNIE MAE POOL UMBS P#CB4121 4.00000000 | 0,42 | −2,57 | 0,0117 | −0,0008 | ||

| SUTTER HEALTH UNSECURED 08/35 5.537 / DBT (US86944BAQ68) | 0,41 | 0,0115 | 0,0115 | |||

| US3133B7XK92 / FREDDIE MAC POOL FR QD9682 | 0,41 | −15,56 | 0,0114 | −0,0027 | ||

| US3132Y3EW08 / FED HM LN PC POOL Q59148 FG 10/48 FIXED 4.5 | 0,41 | −0,98 | 0,0113 | −0,0006 | ||

| US3140QP2M86 / FANNIE MAE POOL | 0,40 | −0,74 | 0,0113 | −0,0006 | ||

| US3140MHH779 / UMBS | 0,40 | −0,98 | 0,0113 | −0,0006 | ||

| US46644YAU47 / JPMBB Commercial Mortgage Securities Trust 2015-C31 | 0,38 | −67,25 | 0,0105 | −0,0230 | ||

| US38376RQ331 / GNMA_17-H03 | 0,35 | −8,64 | 0,0098 | −0,0014 | ||

| FED HM LN PC POOL QD4256 FR 01/52 FIXED 2.5 / ABS-MBS (US3133B1WR84) | 0,34 | −1,16 | 0,0095 | −0,0005 | ||

| US3136ARPM47 / FANNIE MAE FNR 2016 11 CF | 0,34 | −3,46 | 0,0094 | −0,0007 | ||

| US3132L9F597 / Federal Home Loan Mortgage Corporation | 0,33 | −0,90 | 0,0093 | −0,0005 | ||

| US3140MWMV59 / FN BW4871 | 0,32 | −0,94 | 0,0088 | −0,0005 | ||

| US31418EKS80 / FNMA 30YR 4% 11/01/2052#MA4804 | 0,32 | −1,86 | 0,0088 | −0,0006 | ||

| US3140XGY450 / Federal National Mortgage Association, Inc. | 0,31 | −1,59 | 0,0086 | −0,0005 | ||

| US3133BNAY95 / Freddie Mac Pool | 0,30 | −0,98 | 0,0085 | −0,0005 | ||

| ACDVF4 / Air Canada 2015-2 Class AA Pass Through Trust | 0,30 | −4,43 | 0,0085 | −0,0008 | ||

| FED HM LN PC POOL QC0373 FR 04/51 FIXED 3 / ABS-MBS (US3133AJMW09) | 0,30 | −0,67 | 0,0083 | −0,0005 | ||

| US3136AQKY56 / FANNIE MAE FNR 2015 79 FE | 0,30 | −3,91 | 0,0083 | −0,0007 | ||

| US31418EE225 / Fannie Mae Pool | 0,29 | −2,37 | 0,0081 | −0,0006 | ||

| US3138WPG249 / Fannie Mae Pool | 0,28 | −3,09 | 0,0079 | −0,0006 | ||

| US3138WAPY77 / FNMA POOL AS1338 FN 12/43 FIXED 5 | 0,28 | −1,40 | 0,0079 | −0,0005 | ||

| US63941BAC90 / Navient Private Education Refi Loan Trust 2019-A | 0,27 | −21,26 | 0,0077 | −0,0025 | ||

| US61255QAJ58 / MONTEREY PK CA PENSN OBLIG | 0,27 | 1,51 | 0,0075 | −0,0002 | ||

| US3132Y0NH90 / Freddie Mac Gold Pool | 0,27 | −1,11 | 0,0075 | −0,0004 | ||

| US48251JAL70 / KKR CLO 18 Ltd | 0,27 | −32,66 | 0,0075 | −0,0041 | ||

| US3140QNHF20 / Fannie Mae Pool | 0,26 | −4,38 | 0,0073 | −0,0007 | ||

| US3132XWFR77 / FED HM LN PC POOL Q53775 FG 01/48 FIXED 3 | 0,26 | −0,78 | 0,0071 | −0,0004 | ||

| US38375B4Y56 / GNMA, Series 2013-H16, Class FA | 0,25 | −13,38 | 0,0069 | −0,0014 | ||

| US3132DWF810 / FNCL UMBS 2.5 SD8291 11-01-52 | 0,24 | −5,60 | 0,0066 | −0,0007 | ||

| US61255QAG10 / MONTEREY PK CA PENSN OBLIG MTPGEN 06/28 FIXED 1.63 | 0,23 | 1,30 | 0,0065 | −0,0002 | ||

| US61767FAY79 / MORGAN STANLEY CAPITAL I TRUST 2016-UB11 MSC 2016-UB11 ASB | 0,23 | −25,32 | 0,0064 | −0,0025 | ||

| US46643GAE08 / JPMBB Commercial Mortgage Securities Trust 2014-C24 | 0,23 | −4,24 | 0,0063 | −0,0006 | ||

| US38376RMX16 / GNMA_15-H31 | 0,22 | 0,46 | 0,0061 | −0,0003 | ||

| US31418EBS81 / FNMA UMBS, 30 Year | 0,22 | −2,26 | 0,0061 | −0,0004 | ||

| US3133AJN906 / Freddie Mac Pool | 0,22 | −1,37 | 0,0060 | −0,0004 | ||

| FED HM LN PC POOL RJ0147 FR 09/53 FIXED 2.5 / ABS-MBS (US3142GQEV04) | 0,21 | −0,95 | 0,0059 | −0,0003 | ||

| US31398NKX11 / FANNIE MAE FNR 2010 107 KF | 0,21 | −5,50 | 0,0058 | −0,0006 | ||

| US3133BH4K98 / Freddie Mac Pool | 0,20 | −0,98 | 0,0057 | −0,0003 | ||

| US3140XCUS55 / Federal National Mortgage Association, Inc. | 0,20 | −1,97 | 0,0056 | −0,0004 | ||

| US3138EQM581 / Fannie Mae Pool | 0,20 | −2,97 | 0,0055 | −0,0004 | ||

| US3138W94X50 / Fannie Mae Pool | 0,19 | −0,52 | 0,0054 | −0,0003 | ||

| US3128MJ2B52 / Freddie Mac Gold Pool | 0,17 | −1,70 | 0,0049 | −0,0003 | ||

| US3140X8C964 / Fannie Mae Pool | 0,17 | −2,26 | 0,0049 | −0,0003 | ||

| US3136AQWE64 / Fannie Mae REMICS | 0,17 | −4,47 | 0,0048 | −0,0004 | ||

| US3137A9HT60 / Freddie Mac REMICS | 0,17 | −2,86 | 0,0048 | −0,0004 | ||

| US3137A9HU34 / FREDDIE MAC FHR 3843 FG | 0,17 | −2,86 | 0,0048 | −0,0004 | ||

| US3140QCQ905 / Fannie Mae Pool | 0,14 | −2,05 | 0,0040 | −0,0002 | ||

| US3137BEH494 / Freddie Mac REMICS | 0,14 | −3,57 | 0,0038 | −0,0003 | ||

| US3140KEYF91 / Fannie Mae Pool | 0,14 | −3,57 | 0,0038 | −0,0003 | ||

| US3136AT6Z24 / Fannie Mae REMICS | 0,13 | −4,96 | 0,0038 | −0,0004 | ||

| US3136AUAW13 / FANNIE MAE FNR 2016 82 FM | 0,13 | −6,47 | 0,0036 | −0,0004 | ||

| US3138EN6K06 / Fannie Mae Pool | 0,13 | −2,31 | 0,0036 | −0,0003 | ||

| US31398RXN06 / FNMA, REMIC, Series 2010-58, Class FY | 0,12 | −2,40 | 0,0034 | −0,0002 | ||

| US3140QRUK71 / FN CB5985 | 0,12 | −1,64 | 0,0034 | −0,0002 | ||

| US3138EP2Y90 / Fannie Mae Pool | 0,12 | −4,00 | 0,0034 | −0,0003 | ||

| US3138ENQF92 / Fannie Mae Pool | 0,12 | −2,48 | 0,0033 | −0,0002 | ||

| US38376RHR03 / GNMA, Series 2015-H27, Class FA | 0,11 | −19,72 | 0,0032 | −0,0010 | ||

| US3140X7TX76 / Fannie Mae Pool | 0,11 | −1,74 | 0,0032 | −0,0002 | ||

| US31396V5C86 / FANNIE MAE REMICS SER 2007-50 CL FN V/R 1.94800000 | 0,11 | −4,42 | 0,0030 | −0,0003 | ||

| RFR USD SOFR/3.30000 12/02/24-4Y* CME / DIR (EZ2F419XN3M4) | 0,11 | −49,52 | 0,0029 | −0,0031 | ||

| US3138Y63F99 / Fannie Mae Pool | 0,10 | −4,59 | 0,0029 | −0,0003 | ||

| US31410KJE55 / Fannie Mae Pool | 0,10 | −3,74 | 0,0029 | −0,0002 | ||

| US917542QV70 / UTAH ST | 0,10 | 0,00 | 0,0027 | −0,0001 | ||

| FED HM LN PC POOL QB1701 FR 08/50 FIXED 3 / ABS-MBS (US3133A73J62) | 0,10 | −2,02 | 0,0027 | −0,0002 | ||

| US46646RAK95 / JPMDB Commercial Mortgage Securities Trust 2016-C4 | 0,09 | −13,21 | 0,0026 | −0,0005 | ||

| US3140KPDZ32 / Fannie Mae Pool | 0,09 | −2,20 | 0,0025 | −0,0002 | ||

| US31418EVM91 / Fannie Mae Pool | 0,09 | −15,38 | 0,0025 | −0,0006 | ||

| US31418RRF00 / FNMA 30YR 5.0% 05/01/2040#AD4085 | 0,08 | −1,22 | 0,0023 | −0,0001 | ||

| US31418U4W12 / Fannie Mae Pool | 0,07 | −2,67 | 0,0021 | −0,0001 | ||

| US3128MJ5B26 / FREDDIE MAC GOLD POOL FG G08841 | 0,07 | −1,35 | 0,0020 | −0,0001 | ||

| AT&T INC SNR S* ICE / DCR (EZVHX8BNGL14) | 0,07 | 7,46 | 0,0020 | 0,0001 | ||

| US38376RSG29 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2016-H06 CL FD V/R 2.91725000 | 0,07 | −20,22 | 0,0020 | −0,0006 | ||

| US3128MJUR90 / Freddie Mac Gold Pool | 0,07 | −2,90 | 0,0019 | −0,0001 | ||

| US31416TYN35 / FNMA 30YR 5.0% 07/01/2039#AA9716 | 0,07 | 0,00 | 0,0019 | −0,0001 | ||

| US31405MA645 / FANNIE MAE POOL FN 793029 | 0,07 | −2,90 | 0,0019 | −0,0001 | ||

| US3136ASK880 / FANNIE MAE FNR 2016 40 AF | 0,07 | −5,80 | 0,0018 | −0,0002 | ||

| US31419AE452 / Fannie Mae Pool | 0,07 | −2,99 | 0,0018 | −0,0001 | ||

| US3138LNGZ83 / FANNIE MAE POOL UMBS P#AN9215 3.43000000 | 0,06 | 0,00 | 0,0018 | −0,0001 | ||

| US3138WAA236 / Federal National Mortgage Association, Inc. | 0,06 | −11,27 | 0,0018 | −0,0003 | ||

| US38375UBF66 / Government National Mortgage Association | 0,06 | −13,89 | 0,0017 | −0,0004 | ||

| US3138E26J95 / FNMA POOL AJ9872 FN 01/42 FIXED 5 | 0,06 | 0,00 | 0,0017 | −0,0001 | ||

| US3132DQJG29 / FR SD2963 | 0,06 | −1,75 | 0,0016 | −0,0001 | ||

| US3138WAXY85 / Fannie Mae Pool | 0,05 | −1,85 | 0,0015 | −0,0001 | ||

| US3138WCBK85 / FNMA POOL AS2741 FN 06/44 FIXED 5 | 0,05 | 0,00 | 0,0013 | −0,0001 | ||

| US3140QPSG32 / Fannie Mae Pool | 0,05 | −2,17 | 0,0013 | −0,0001 | ||

| US31415ARP83 / FNMA POOL 981194 FN 04/38 FIXED 5.5 | 0,04 | −2,27 | 0,0012 | −0,0001 | ||

| US3128MJXR63 / Freddie Mac Gold Pool | 0,04 | −2,33 | 0,0012 | −0,0001 | ||

| US3137AA3B72 / FREDDIE MAC FHR 3838 PF | 0,04 | 0,00 | 0,0012 | −0,0001 | ||

| US3132DQYN05 / UMBS | 0,04 | 0,00 | 0,0011 | −0,0001 | ||

| US3133BSDF66 / Freddie Mac Pool | 0,04 | 0,00 | 0,0010 | −0,0001 | ||

| US3137A0MZ56 / FREDDIE MAC FHR 3688 NF | 0,04 | −2,70 | 0,0010 | −0,0001 | ||

| US3138WCBJ13 / FNMA POOL AS2740 FN 06/44 FIXED 5 | 0,03 | 0,00 | 0,0010 | −0,0001 | ||

| US31418W5L02 / Fannie Mae Pool | 0,03 | 0,00 | 0,0009 | −0,0001 | ||

| EZRRBYCX3652 / BOEING CO/THE SNR S* ICE | 0,03 | 0,00 | 0,0009 | −0,0000 | ||

| US31407Y6T10 / FNMA POOL 845182 FN 11/35 FIXED 5.5 | 0,03 | −3,03 | 0,0009 | −0,0001 | ||

| US12591QAR39 / Commercial Mortgage Trust, Series 2014-UBS4, Class A5 | 0,03 | −37,50 | 0,0009 | −0,0006 | ||

| US31418MML36 / FNMA POOL AD0362 FN 10/39 FIXED VAR | 0,03 | 0,00 | 0,0009 | −0,0000 | ||

| US3140MF2S15 / FNCL UMBS 2.5 BV2584 07-01-52 | 0,03 | 0,00 | 0,0009 | −0,0000 | ||

| US3128MJ2R05 / Freddie Mac Gold Pool | 0,03 | −3,23 | 0,0009 | −0,0001 | ||

| US31414QPG63 / FNMA POOL 973023 FN 03/38 FIXED 5 | 0,03 | −3,33 | 0,0008 | −0,0000 | ||

| US3140KHPF24 / Fannie Mae Pool | 0,03 | 0,00 | 0,0008 | −0,0000 | ||

| US31410G2B80 / FNMA POOL 889170 FN 02/38 FIXED VAR | 0,03 | 0,00 | 0,0008 | −0,0000 | ||

| US31410LNY47 / Fannie Mae Pool | 0,03 | −3,70 | 0,0007 | −0,0001 | ||

| US3140L8MQ01 / Fannie Mae Pool | 0,03 | 0,00 | 0,0007 | −0,0000 | ||

| US31416JYL96 / FNMA POOL AA1614 FN 01/39 FIXED 5.5 | 0,03 | 0,00 | 0,0007 | −0,0000 | ||

| US3138EGRE67 / FANNIE MAE POOL UMBS P#AL0484 5.50000000 | 0,02 | −4,00 | 0,0007 | −0,0000 | ||

| FED HM LN PC POOL QH3374 FR 10/53 FIXED 2.5 / ABS-MBS (US3133CFXB03) | 0,02 | −4,35 | 0,0006 | −0,0000 | ||

| US3133KQT972 / UMBS | 0,02 | 0,00 | 0,0006 | −0,0000 | ||

| US31412S3D54 / FNMA POOL 933796 FN 05/38 FIXED 5.5 | 0,02 | 0,00 | 0,0006 | −0,0000 | ||

| US3140QHNG60 / Fannie Mae Pool | 0,02 | −4,55 | 0,0006 | −0,0000 | ||

| US31418EAN04 / FN MA4512 | 0,02 | −4,55 | 0,0006 | −0,0000 | ||

| US3140MF4U43 / Fannie Mae Pool | 0,02 | 0,00 | 0,0006 | −0,0000 | ||

| EZBLK0RXQ2F2 / AT&T INC SNR S* ICE | 0,02 | −42,86 | 0,0006 | −0,0005 | ||

| US31407U2C03 / Fannie Mae Pool | 0,02 | −4,76 | 0,0006 | −0,0001 | ||

| US31418P7G43 / FNMA POOL AD2694 FN 05/40 FIXED 5 | 0,02 | −5,00 | 0,0006 | −0,0000 | ||

| US95000FAU03 / Wells Fargo Commercial Mortgage Trust 2016-C35 | 0,02 | −43,75 | 0,0005 | −0,0004 | ||

| US31394CTW28 / FANNIE MAE FNR 2005 21 FM | 0,02 | −5,26 | 0,0005 | −0,0000 | ||

| US3138EH6E71 / Fannie Mae Pool | 0,02 | −5,26 | 0,0005 | −0,0000 | ||

| US3133BBKZ13 / FHLG 30YR 2.5% 05/01/2052# | 0,02 | −20,00 | 0,0005 | −0,0001 | ||

| US31371NYW90 / Fannie Mae Pool | 0,01 | −6,67 | 0,0004 | −0,0001 | ||

| US3138EBFR12 / FNMA POOL AK6475 FN 02/42 FIXED 5 | 0,01 | −7,14 | 0,0004 | −0,0000 | ||

| US3128MJYY06 / Freddie Mac Gold Pool | 0,01 | 0,00 | 0,0004 | −0,0000 | ||

| US3138A7YK84 / FNMA POOL AH6113 FN 03/41 FIXED 5.5 | 0,01 | 0,00 | 0,0004 | −0,0000 | ||

| US12657VAA08 / CSWF 2021-SOP2 | 0,01 | −85,71 | 0,0004 | −0,0021 | ||

| US3132XUR312 / FED HM LN PC POOL Q52305 FG 11/47 FIXED 3 | 0,01 | 0,00 | 0,0003 | −0,0000 | ||

| AT&T INC SNR S* ICE / DCR (000000000) | 0,01 | 0,0002 | 0,0002 | |||

| US38375UBR05 / GOVERNMENT NATIONAL MORTGAGE A GNR 2013 H24 FB | 0,01 | −27,27 | 0,0002 | −0,0001 | ||

| US38376RRJ76 / Government National Mortgage Association | 0,01 | 0,00 | 0,0002 | −0,0000 | ||

| US31371NQJ71 / Fannie Mae Pool | 0,01 | −14,29 | 0,0002 | −0,0000 | ||

| US31371M5Q66 / FANNIE MAE POOL UMBS P#256555 5.50000000 | 0,01 | −16,67 | 0,0001 | −0,0000 | ||

| US31396AJG04 / FREDDIE MAC FHR 3034 FL | 0,01 | 0,00 | 0,0001 | −0,0000 | ||

| AT&T INC SNR S* ICE / DCR (EZHQ4Q1W91G8) | 0,00 | −25,00 | 0,0001 | −0,0000 | ||

| US3138LMVK66 / FANNIE MAE POOL UMBS P#AN8717 3.02000000 | 0,00 | 0,0000 | −0,0000 | |||

| US38376RKZ81 / Government National Mortgage Association | 0,00 | 0,0000 | −0,0000 | |||

| US38376RXJ03 / GNMA, Series 2016-H17, Class FM | 0,00 | 0,0000 | −0,0000 | |||

| US31371MMM63 / Fannie Mae Pool | 0,00 | 0,0000 | −0,0000 | |||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | −0,10 | −0,0027 | −0,0027 | |||

| RFR USD SOFR/3.62000 02/14/25-5Y LCH / DIR (EZMDBB3P1KY1) | −0,44 | −371,17 | −0,0124 | −0,0171 | ||

| RFR USD SOFR/4.01150 02/14/25-10Y LCH / DIR (EZSQMTV543V9) | −1,04 | 31,82 | −0,0292 | −0,0060 | ||

| RFR USD SOFR/3.80000 09/05/23-5Y LCH / DIR (EZ5N3TF4YV54) | −1,10 | −9 241,67 | −0,0306 | −0,0310 | ||

| RFR USD SOFR/3.75000 09/02/25-7Y* LCH / DIR (000000000) | −2,14 | −0,0598 | −0,0598 |