Grundläggande statistik

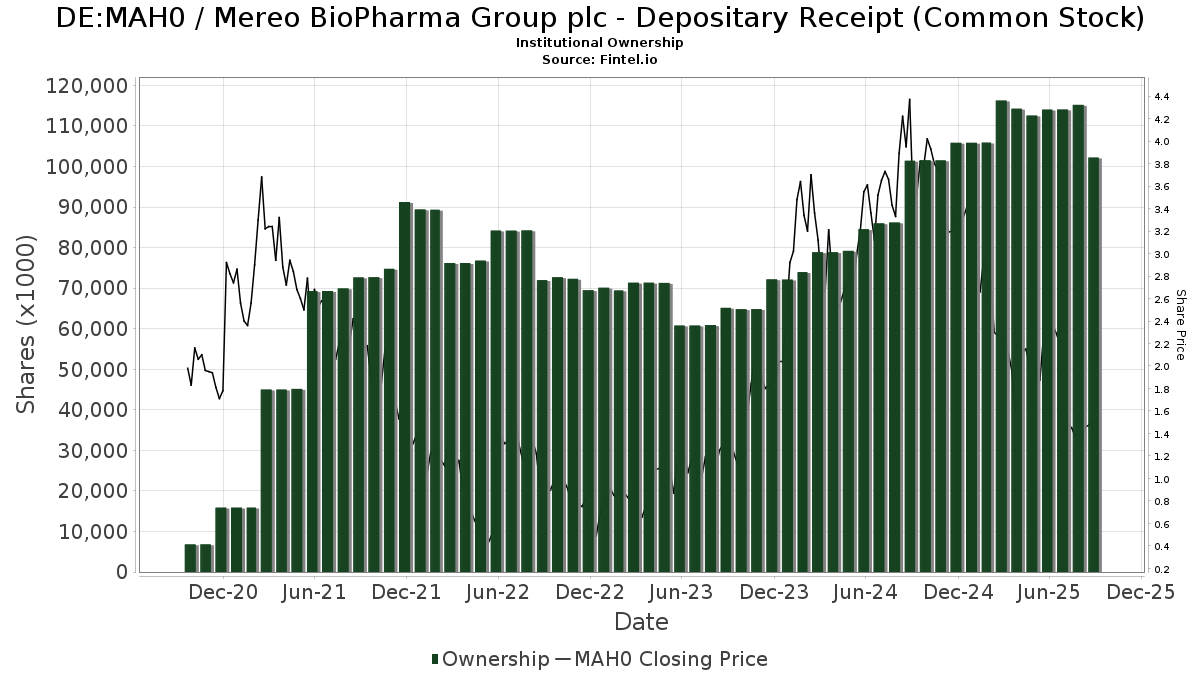

| Institutionella ägare | 99 total, 91 long only, 0 short only, 8 long/short - change of 0,00% MRQ |

| Aktiepris | 1,51 |

| Genomsnittlig portföljallokering | 0.1666 % - change of 1,27% MRQ |

| Institutionella aktier (lång) | 102 204 162 (ex 13D/G) - change of −12,00MM shares −10,50% MRQ |

| Institutionellt värde (lång) | $ 276 370 USD ($1000) |

Institutionellt ägande och aktieägare

Mereo BioPharma Group plc - Depositary Receipt (Common Stock) (DE:MAH0) har 99 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 102,204,162 aktier. Största aktieägare inkluderar Janus Henderson Group Plc, Rubric Capital Management LP, Frazier Life Sciences Management, L.P., Mangrove Partners, Deerfield Management Company, L.p. (series C), Alkeon Capital Management Llc, Rock Springs Capital Management LP, 683 Capital Management, LLC, Clearline Capital LP, and Goldman Sachs Group Inc .

Mereo BioPharma Group plc - Depositary Receipt (Common Stock) (DB:MAH0) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 12, 2025 is 1,51 / share. Previously, on September 16, 2024, the share price was 3,94 / share. This represents a decline of 61,68% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-13 | 13F | Renaissance Technologies Llc | 1 480 471 | 9,63 | 4 012 | 32,06 | ||||

| 2025-07-11 | 13F | Grove Bank & Trust | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | MAI Capital Management | 309 | 0,00 | 1 | |||||

| 2025-07-24 | NP | HRTS - Tema Cardiovascular and Metabolic ETF | 115 837 | −56,69 | 249 | −61,15 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 21 099 | 57 | ||||||

| 2025-08-07 | 13F | Allworth Financial LP | 1 637 | 9,13 | 4 | 33,33 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 75 | 134,38 | 0 | |||||

| 2025-08-11 | 13F | Knott David M Jr | 319 337 | 0,00 | 865 | 20,47 | ||||

| 2025-08-11 | 13F | Persistent Asset Partners Ltd | Call | 3 035 | 155,90 | 244 | 65,31 | |||

| 2025-08-28 | NP | Tekla World Healthcare Fund | 1 681 804 | 29,33 | 4 558 | 55,79 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 4 544 | 206,20 | 12 | 300,00 | ||||

| 2025-07-18 | 13F | PFG Investments, LLC | 37 433 | 0,00 | 101 | 20,24 | ||||

| 2025-08-14 | 13F | Acuta Capital Partners, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | NEOS Investment Management LLC | 102 583 | −84,33 | 278 | −81,11 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | Put | 288 700 | 0,00 | 782 | 20,49 | |||

| 2025-08-14 | 13F | Millennium Management Llc | Call | 153 000 | 415 | |||||

| 2025-08-13 | 13F | Level Four Advisory Services, Llc | 10 000 | 0,00 | 27 | 22,73 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 13 000 | 18,18 | 35 | 45,83 | ||||

| 2025-06-12 | 13F | Sheets Smith Investment Management | 16 890 | 0,00 | 38 | −35,59 | ||||

| 2025-08-19 | 13F | Marex Group plc | 10 000 | 27 | ||||||

| 2025-08-14 | 13F | Diadema Partners Lp | Put | 39 400 | 0,00 | 107 | 20,45 | |||

| 2025-08-14 | 13F | Diadema Partners Lp | Call | 1 317 600 | 155,75 | 3 571 | 208,02 | |||

| 2025-08-14 | 13F | Perceptive Advisors Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 760 659 | 121,35 | 2 061 | 166,62 | ||||

| 2025-08-14 | 13F | Cantor Fitzgerald, L. P. | 342 957 | −3,39 | 929 | 16,42 | ||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 62 200 | −18,69 | 169 | −2,33 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 99 800 | 187,61 | 270 | 246,15 | |||

| 2025-08-15 | 13F | Soleus Capital Management, L.P. | 599 711 | −12,70 | 1 625 | 5,18 | ||||

| 2025-08-14 | 13F | Integral Health Asset Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 785 377 | −63,97 | 2 128 | −56,61 | ||||

| 2025-08-14 | 13F | Caption Management, LLC | 197 599 | 88,58 | 535 | 127,66 | ||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 909 640 | −42,83 | 2 465 | −31,13 | ||||

| 2025-08-14 | 13F | Caption Management, LLC | Call | 437 500 | 43,44 | 1 186 | 72,74 | |||

| 2025-07-14 | 13F | GAMMA Investing LLC | 9 257 | 10,47 | 25 | 38,89 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Millennium Management Llc | 595 673 | 51,02 | 1 614 | 81,96 | ||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 59 200 | 65,29 | 160 | 100,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 361 542 | 107,33 | 980 | 149,74 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 133 600 | 43,66 | 362 | 73,21 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 111 600 | 27,11 | 302 | 53,30 | |||

| 2025-04-11 | 13F | Cranbrook Wealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-14 | 13F | Diadema Partners Lp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-28 | NP | GWX - SPDR(R) S&P(R) International Small Cap ETF | 44 942 | −1,57 | 122 | 18,63 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Fmr Llc | 1 478 500 | 94,77 | 4 007 | 134,68 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 13 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 221 700 | 2,02 | 601 | 22,95 | |||

| 2025-08-14 | 13F | Deerfield Management Company, L.p. (series C) | 6 710 429 | 0,00 | 18 185 | 20,45 | ||||

| 2025-06-26 | NP | FBTAX - Fidelity Advisor Biotechnology Fund Class A This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 759 100 | 1 966 | ||||||

| 2025-08-14 | 13F/A | Forefront Analytics, LLC | 19 138 | −59,82 | 52 | −52,34 | ||||

| 2025-08-14 | 13F | UBS Group AG | 373 505 | −59,93 | 1 012 | −51,74 | ||||

| 2025-05-15 | 13F | Verition Fund Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Clearline Capital LP | 3 618 163 | 12,44 | 9 805 | 35,43 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 187 | 1 | ||||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 92 534 | 0,41 | 251 | 20,77 | ||||

| 2025-08-12 | 13F | Rhumbline Advisers | 9 878 | 49,94 | 27 | 85,71 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 659 158 | 168,82 | 1 786 | 224,14 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 25 000 | 7,76 | 0 | ||||

| 2025-08-14 | 13F | Knoll Capital Management, LLC | 260 470 | 0,00 | 706 | 20,31 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 201 141 | 4 785,62 | 1 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 199 200 | 250,09 | 1 | ||||

| 2025-07-14 | 13F | HealthInvest Partners AB | 764 901 | 96,13 | 2 073 | 136,26 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 455 365 | 65,97 | 1 234 | 100,00 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 230 | −81,30 | 1 | −100,00 | ||||

| 2025-07-15 | 13F | Significant Wealth Partners LLC | 22 261 | 61,65 | 60 | 100,00 | ||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 18 300 | 0,00 | 50 | 19,51 | ||||

| 2025-08-14 | 13F | Paloma Partners Management Co | 296 659 | 804 | ||||||

| 2025-08-14 | 13F | Janus Henderson Group Plc | 17 688 592 | −22,20 | 48 113 | −8,19 | ||||

| 2025-08-11 | 13F | Persistent Asset Partners Ltd | Put | 2 303 | 2 430,77 | 1 025 | 14 542,86 | |||

| 2025-08-14 | 13F | Alkeon Capital Management Llc | 4 698 100 | 0,00 | 12 732 | 20,44 | ||||

| 2025-08-14 | 13F | J. Goldman & Co LP | 52 384 | −34,01 | 142 | −20,79 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 3 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Artia Global Partners LP | 475 361 | 12,82 | 1 288 | 35,86 | ||||

| 2025-08-14 | 13F | ADAR1 Capital Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-24 | NP | Tema ETF Trust - Tema Oncology ETF | 147 616 | −43,59 | 317 | −49,52 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 849 | 2 | ||||||

| 2025-08-14 | 13F | 683 Capital Management, LLC | 4 350 000 | −6,15 | 11 788 | 13,04 | ||||

| 2025-05-15 | 13F | Eversept Partners, LP | 0 | −100,00 | 0 | |||||

| 2025-04-18 | 13F | Bfsg, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 33 825 | −23,14 | 92 | −8,08 | ||||

| 2025-07-14 | 13F | Avanza Fonder AB | 38 235 | 35,97 | 104 | 56,06 | ||||

| 2025-08-13 | 13F | Centiva Capital, LP | 25 000 | 0,00 | 68 | 19,64 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 69 341 | 188 | ||||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Blue Owl Capital Holdings LP | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | BIT Capital GmbH | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | LMR Partners LLP | Call | 125 000 | 339 | |||||

| 2025-06-26 | NP | IDNA - iShares Genomics Immunology and Healthcare ETF | 242 039 | −1,85 | 627 | −15,63 | ||||

| 2025-05-15 | 13F | Polar Asset Management Partners Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 144 600 | 393,52 | 392 | 501,54 | ||||

| 2025-08-14 | 13F | Mangrove Partners | 8 636 485 | 0,00 | 23 405 | 20,44 | ||||

| 2025-05-14 | 13F | Walleye Capital LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 767 744 | 0,00 | 2 081 | 20,44 | ||||

| 2025-07-24 | NP | FNCMX - Fidelity Nasdaq Composite Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 92 156 | 0,00 | 198 | −10,41 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-07 | 13F | Monaco Asset Management SAM | 395 000 | −5,15 | 1 070 | 14,19 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 0 | −100,00 | 0 | |||||

| 2025-08-26 | NP | NORTHERN FUNDS - NORTHERN SMALL CAP CORE FUND Class K | 1 007 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Rubric Capital Management LP | 15 307 347 | 0,00 | 41 483 | 20,44 | ||||

| 2025-08-08 | 13F | New England Capital Financial Advisors LLC | 300 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 27 000 | 126,89 | 73 | 180,77 | |||

| 2025-08-14 | 13F | Jane Street Group, Llc | 247 441 | 70,88 | 671 | 106,15 | ||||

| 2025-08-14 | 13F | Frazier Life Sciences Management, L.P. | 9 440 112 | 20,72 | 25 583 | 45,40 | ||||

| 2025-05-15 | 13F | J. Goldman & Co LP | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 4 000 | 0,00 | 11 | 11,11 | ||||

| 2025-08-14 | 13F | Dauntless Investment Group, LLC | 134 122 | 363 | ||||||

| 2025-08-28 | NP | Tekla Life Sciences Investors | 1 347 068 | 65,88 | 3 651 | 99,78 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 1 570 | 4 | ||||||

| 2025-05-15 | 13F | Manufacturers Life Insurance Company, The | 0 | −100,00 | 0 | |||||

| 2025-05-09 | 13F | GeoWealth Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Jump Financial, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 438 661 | −0,00 | 1 189 | 20,36 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 25 399 | 11,95 | 69 | 35,29 | ||||

| 2025-08-13 | 13F | Tema Etfs Llc | 102 583 | −84,33 | 278 | −81,11 | ||||

| 2025-08-13 | 13F | Tejara Capital Ltd | 2 430 437 | −3,60 | 6 586 | 16,11 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 5 377 | 75,55 | 15 | 133,33 | ||||

| 2025-08-14 | 13F | Woodline Partners LP | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F/A | Hudson Bay Capital Management LP | 450 000 | 0,00 | 1 220 | 20,45 | ||||

| 2025-07-14 | 13F | Clear Harbor Asset Management, LLC | 42 000 | 0,00 | 114 | 20,21 | ||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | State Street Corp | 44 942 | −1,57 | 122 | 18,63 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 20 668 | 15,26 | 56 | 40,00 | ||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 26 930 | 73 | ||||||

| 2025-08-14 | 13F | Rock Springs Capital Management LP | 4 465 292 | −33,20 | 12 101 | −19,54 | ||||

| 2025-08-15 | 13F/A | Exome Asset Management LLC | 14 600 | 40 | ||||||

| 2025-08-14 | 13F | Graham Capital Management, L.P. | 21 176 | −57,15 | 57 | −48,65 | ||||

| 2025-07-14 | 13F | Golden State Equity Partners | 19 900 | 0,00 | 54 | 20,45 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 1 500 | 0,00 | 4 | 33,33 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 56 100 | −33,29 | 152 | −19,58 | |||

| 2025-07-24 | 13F | Standard Life Aberdeen plc | 3 028 872 | 38,41 | 8 208 | 66,73 | ||||

| 2025-08-14 | 13F | Sit Investment Associates Inc | 970 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 489 900 | 13,25 | 1 328 | 36,38 | |||

| 2025-08-18 | 13F/A | Nomura Holdings Inc | 125 000 | 339 | ||||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 3 090 068 | 45,35 | 8 374 | 75,08 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 139 559 | 307,10 | 378 | 390,91 | ||||

| 2025-08-13 | 13F | Transce3nd, LLC | 127 | 0,00 | 0 | |||||

| 2025-08-13 | 13F/A | DLD Asset Management, LP | Call | 25 000 | 68 | |||||

| 2025-06-25 | NP | BBC - Virtus LifeSci Biotech Clinical Trials ETF | 44 024 | 170,19 | 114 | 132,65 | ||||

| 2025-08-14 | 13F | Adage Capital Partners Gp, L.l.c. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Persistent Asset Partners Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Great Point Partners Llc | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 470 | 1 |