Grundläggande statistik

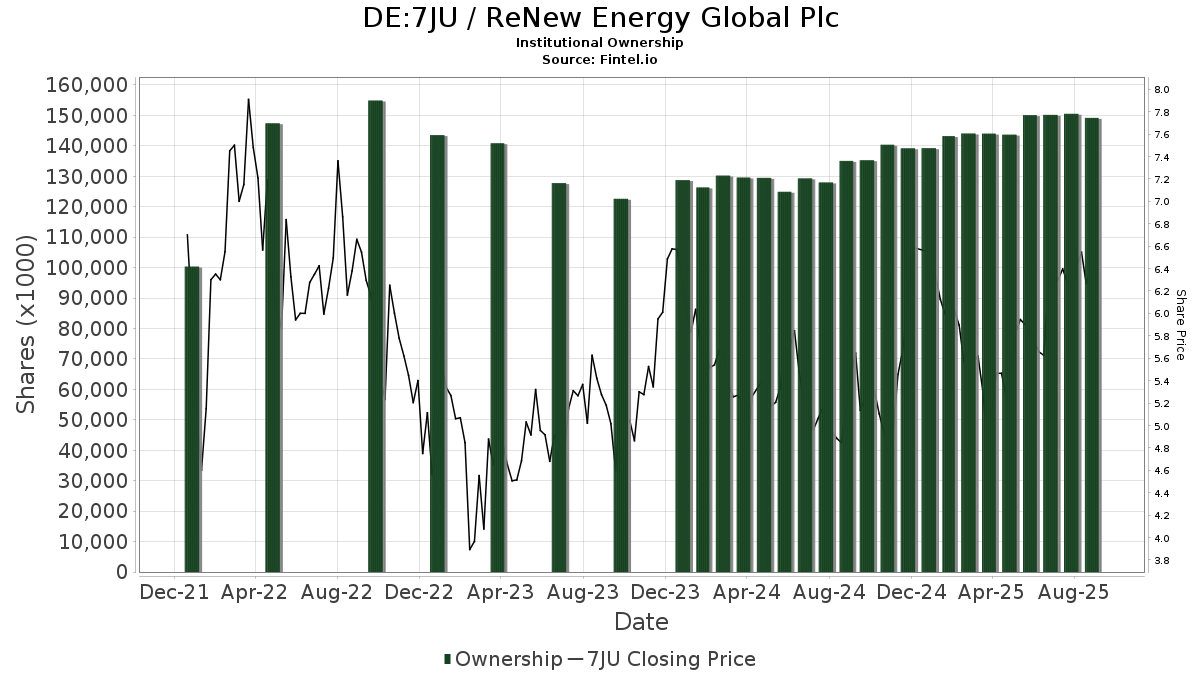

| Institutionella aktier (lång) | 149 161 431 - 61,03% (ex 13D/G) - change of −0,91MM shares −0,60% MRQ |

| Institutionellt värde (lång) | $ 1 053 903 USD ($1000) |

Institutionellt ägande och aktieägare

ReNew Energy Global Plc (DE:7JU) har 134 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 149,161,431 aktier. Största aktieägare inkluderar Canada Pension Plan Investment Board, Rubric Capital Management LP, Franklin Resources Inc, Ubs Asset Management Americas Inc, Millennium Management Llc, BlackRock, Inc., Carrhae Capital LLP, M&G Plc, MSD Partners, L.P., and Invesco Ltd. .

ReNew Energy Global Plc (DB:7JU) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 19, 2025 is 6,42 / share. Previously, on September 20, 2024, the share price was 5,59 / share. This represents an increase of 14,76% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

AI+ Ask Fintel’s AI assistant about ReNew Energy Global Plc.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-13 | 13F | Northwest & Ethical Investments L.P. | 1 287 523 | −5,47 | 8 897 | 10,91 | ||||

| 2025-08-14 | 13F | Sagefield Capital LP | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 82 190 | −44,96 | 568 | −35,49 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 47 766 | 173,31 | 330 | 223,53 | ||||

| 2025-06-26 | NP | USMIX - Extended Market Index Fund | 18 584 | 8,36 | 119 | 6,31 | ||||

| 2025-08-08 | 13F | Everett Harris & Co /ca/ | 40 000 | 0,00 | 276 | 17,45 | ||||

| 2025-04-15 | 13F | SG Americas Securities, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-18 | 13F | Robeco Institutional Asset Management B.V. | 92 459 | −7,91 | 639 | 7,95 | ||||

| 2025-05-29 | NP | CPAEX - Counterpoint Tactical Equity Fund Class A Shares | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-25 | 13F | JustInvest LLC | 50 933 | 103,57 | 352 | 138,78 | ||||

| 2025-05-05 | 13F | IFP Advisors, Inc | 0 | −100,00 | 0 | |||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 104 056 | 487,42 | 719 | 591,35 | ||||

| 2025-05-09 | 13F | R Squared Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 6 083 048 | 3,40 | 42 034 | 21,30 | ||||

| 2025-08-13 | 13F | Groupe la Francaise | 320 591 | 1,35 | 2 211 | 16,87 | ||||

| 2025-07-28 | NP | TAN - Invesco Solar ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 230 300 | −1,35 | 8 378 | 6,64 | ||||

| 2025-08-14 | 13F | UBS Group AG | 150 870 | −63,54 | 1 043 | −57,24 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Point72 Europe (London) LLP | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 4 235 | 29 | ||||||

| 2025-08-05 | 13F | Carrhae Capital LLP | 2 767 298 | −24,29 | 19 122 | −11,17 | ||||

| 2025-08-12 | 13F | Picton Mahoney Asset Management | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Trexquant Investment LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 18 998 | −51,69 | 131 | −43,29 | ||||

| 2025-08-13 | 13F | First Trust Advisors Lp | 928 603 | 0,06 | 6 417 | 17,38 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 108 096 | 75,04 | 1 | |||||

| 2025-08-13 | 13F | Shelton Capital Management | 39 179 | −0,98 | 271 | 15,88 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 617 742 | −27,32 | 4 269 | −14,74 | ||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 12 382 | 86 | ||||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 11 911 | 0,00 | 82 | 14,08 | ||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 252 503 | −69,01 | 1 745 | −63,65 | ||||

| 2025-07-14 | 13F | Counterpoint Mutual Funds LLC | 0 | −100,00 | 0 | |||||

| 2025-07-16 | 13F | Signaturefd, Llc | 32 896 | 90,76 | 227 | 124,75 | ||||

| 2025-04-28 | 13F | CIBRA Capital Ltd | 148 759 | 876 | ||||||

| 2025-08-01 | 13F | Davy Global Fund Management Ltd | 47 173 | 18,26 | 326 | 38,89 | ||||

| 2025-07-24 | 13F | Standard Life Aberdeen plc | 20 334 | 0,00 | 138 | 15,00 | ||||

| 2025-08-19 | 13F | State of Wyoming | 18 903 | 111,42 | 131 | 150,00 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 86 463 | 118 342,47 | 597 | |||||

| 2025-08-07 | 13F | Allworth Financial LP | 1 069 | 356,84 | 7 | 600,00 | ||||

| 2025-04-30 | 13F | Silphium Asset Management Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 2 564 | 2 656,99 | 18 | |||||

| 2025-08-14 | 13F | Point72 (DIFC) Ltd | 1 614 | 11 | ||||||

| 2025-08-14 | 13F | CoreCommodity Management, LLC | 121 391 | 335,59 | 839 | 410,98 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-10 | 13F | Swedbank AB | 802 400 | 0,00 | 5 545 | 17,31 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 5 720 780 | −9,93 | 39 531 | 5,66 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | Call | 258 333 | 1 390 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 4 300 | 0,00 | 30 | 16,00 | ||||

| 2025-07-14 | 13F | Foster Group, Inc. | 15 167 | 105 | ||||||

| 2025-07-31 | 13F | MQS Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-05 | 13F | Westside Investment Management, Inc. | 1 062 | 7 | ||||||

| 2025-08-12 | 13F | MAI Capital Management | 847 | 6 | ||||||

| 2025-05-15 | 13F | Oxford Asset Management Llp | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 1 371 | 784,52 | 9 | |||||

| 2025-08-14 | 13F | Fieldview Capital Management, LLC | 18 146 | 125 | ||||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 285 212 | −2,65 | 1 971 | 14,20 | ||||

| 2025-08-14 | 13F | Rubric Capital Management LP | 14 438 061 | −0,62 | 99 767 | 16,60 | ||||

| 2025-05-05 | 13F | Kayne Anderson Capital Advisors Lp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 628 | 4 | ||||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 72 647 | 1 217,74 | 502 | 1 465,63 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 17 900 | 124 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 12 618 | 87 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 38 500 | −57,17 | 266 | −49,72 | |||

| 2025-04-30 | 13F | Cornerstone Investment Partners, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Virtu Financial LLC | 37 465 | 0 | ||||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | 71 387 | −0,54 | 0 | |||||

| 2025-05-15 | 13F | Advisors Asset Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 16 064 | −30,27 | 111 | −17,78 | ||||

| 2025-08-07 | 13F | Bck Capital Management Lp | 389 770 | −30,29 | 2 693 | −18,22 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 861 | 925,00 | 6 | |||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 2 005 | 14 | ||||||

| 2025-08-14 | 13F | Alpine Global Management, LLC | 142 000 | −47,41 | 981 | −38,30 | ||||

| 2025-08-07 | 13F/A | Credit Industriel Et Commercial | 114 503 | 0,00 | 791 | 17,36 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 211 562 | 28 841,45 | 1 462 | 36 425,00 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 17 913 | 124 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 20 800 | 45,45 | 144 | 70,24 | |||

| 2025-07-31 | 13F | Carrera Capital Advisors | 330 881 | 164,50 | 2 286 | 210,60 | ||||

| 2025-08-06 | 13F | Harvest Portfolios Group Inc. | 40 183 | −3,76 | 278 | 13,06 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 22 200 | 46,05 | 153 | 71,91 | |||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 10 695 | 74 | ||||||

| 2025-06-27 | NP | RNRG - Global X YieldCo & Renewable Energy Income ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 61 821 | −10,22 | 394 | −11,66 | ||||

| 2025-08-14 | 13F | Caption Management, LLC | 56 271 | −35,69 | 389 | −24,66 | ||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 1 881 | −33,98 | 13 | −23,53 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 28 983 | 200 | ||||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 778 098 | 5,52 | 5 377 | 23,79 | ||||

| 2025-08-04 | 13F | Daymark Wealth Partners, Llc | 664 755 | −12,50 | 4 593 | 2,66 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 25 473 | 0 | ||||||

| 2025-08-13 | 13F | Aristides Capital LLC | 132 100 | 0,00 | 913 | 17,22 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 26 085 | 9,33 | 180 | 28,57 | ||||

| 2025-08-14 | 13F | Caption Management, LLC | Call | 90 000 | −68,97 | 622 | −63,64 | |||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 329 873 | −13,34 | 2 279 | 1,65 | ||||

| 2025-06-30 | NP | PRFZ - Invesco FTSE RAFI US 1500 Small-Mid ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 93 763 | −28,44 | 598 | −29,56 | ||||

| 2025-08-08 | 13F | M&G Plc | 2 188 498 | 14,60 | 15 319 | 33,71 | ||||

| 2025-08-28 | NP | ECOAX - Ecofin Global Renewables Infrastructure Fund A Class | 1 743 746 | 0,00 | 12 049 | 17,32 | ||||

| 2025-08-13 | 13F | Victory Capital Management Inc | 150 304 | −0,64 | 1 039 | 16,63 | ||||

| 2025-08-13 | 13F | Norges Bank | 452 798 | 3 129 | ||||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Carmignac Gestion | 50 000 | 0,00 | 346 | 17,35 | ||||

| 2025-08-13 | 13F | Centiva Capital, LP | 36 650 | 253 | ||||||

| 2025-08-14 | 13F | Point72 Asia (Singapore) Pte. Ltd. | 2 366 | 16 | ||||||

| 2025-08-12 | 13F | BlackRock, Inc. | 5 270 149 | 24,77 | 36 417 | 46,38 | ||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 17 400 | 120 | ||||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 3 271 | 1 535,50 | 23 | 2 100,00 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | −100,00 | 0 | ||||

| 2025-07-23 | 13F | USCF Advisers LLC | 2 600 | 0,00 | 18 | 13,33 | ||||

| 2025-08-12 | 13F | Clear Street Markets Llc | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Spire Wealth Management | 571 | 0,00 | 4 | 0,00 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 13 239 | 1 870,09 | 91 | 2 933,33 | ||||

| 2025-08-14 | 13F | Decagon Asset Management LLP | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Legal & General Group Plc | 5 117 | −89,04 | 35 | −87,23 | ||||

| 2025-08-12 | 13F | Aigen Investment Management, Lp | 10 039 | 69 | ||||||

| 2025-08-14 | 13F | Canada Pension Plan Investment Board | 76 501 166 | 0,00 | 528 623 | 17,32 | ||||

| 2025-08-13 | 13F/A | StoneX Group Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 14 187 989 | 21,81 | 98 039 | 42,91 | ||||

| 2025-06-25 | NP | CCNR - ALPS | CoreCommodity Natural Resources ETF | 90 719 | 579 | ||||||

| 2025-08-08 | 13F | Creative Planning | 83 367 | 178,94 | 576 | 227,27 | ||||

| 2025-05-15 | 13F | Manufacturers Life Insurance Company, The | 0 | −100,00 | 0 | |||||

| 2025-07-14 | 13F | Abacus Wealth Partners, LLC | 12 265 | 85 | ||||||

| 2025-07-15 | 13F | Ballentine Partners, LLC | 127 083 | 363,32 | 878 | 445,34 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 145 518 | 82,44 | 1 006 | 114,29 | ||||

| 2025-06-30 | NP | PBW - Invesco WilderHill Clean Energy ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 738 001 | 19,56 | 4 708 | 17,73 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 11 041 | 765,96 | 76 | 985,71 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 522 | 4 | ||||||

| 2025-07-31 | 13F | State of New Jersey Common Pension Fund D | 649 491 | 0,00 | 4 488 | 17,31 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 28 643 | 6,90 | 198 | 25,48 | ||||

| 2025-08-07 | 13F | Readystate Asset Management Lp | 93 736 | 648 | ||||||

| 2025-08-11 | 13F | Covestor Ltd | 12 135 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 25 000 | −75,25 | 173 | −71,04 | |||

| 2025-08-14 | 13F | Verition Fund Management LLC | 476 871 | −23,20 | 3 295 | −9,90 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 109 422 | 483,93 | 756 | 587,27 | ||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 22 483 | −45,43 | 155 | −35,95 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | PDT Partners, LLC | 63 062 | −39,71 | 436 | −29,38 | ||||

| 2025-05-14 | 13F | Walleye Capital LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 642 397 | 94,02 | 4 439 | 127,59 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 481 629 | 35,91 | 3 328 | 59,46 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 1 873 804 | −24,33 | 12 948 | −11,23 | ||||

| 2025-08-14 | 13F | Decagon Asset Management LLP | Put | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 192 706 | −27,84 | 1 332 | −15,33 | ||||

| 2025-07-30 | 13F | Evermay Wealth Management Llc | 30 000 | 0,00 | 207 | 17,61 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 176 268 | 1 | ||||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 116 800 | 237,57 | 807 | 297,54 | ||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 25 961 | 7,16 | 179 | 26,06 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | State Street Corp | 481 674 | −31,89 | 3 328 | −20,10 | ||||

| 2025-08-04 | 13F | GAM Holding AG | 190 000 | 18,75 | 1 313 | 39,28 | ||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 88 237 | −12,95 | 610 | 2,01 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 122 613 | −60,44 | 847 | −53,59 | ||||

| 2025-08-14 | 13F | Aperture Investors, LLC | 408 003 | −32,54 | 2 819 | −20,86 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 3 528 | −85,92 | 24 | −83,67 | ||||

| 2025-08-14 | 13F | MSD Partners, L.P. | 2 091 480 | 0,00 | 14 452 | 17,32 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 147 184 | 1 | ||||||

| 2025-08-01 | 13F | Jennison Associates Llc | 17 102 | −47,11 | 118 | −37,89 | ||||

| 2025-08-08 | 13F | Fiera Capital Corp | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Moore Capital Management, Lp | 0 | −100,00 | 0 | |||||

| 2025-07-30 | NP | WNDY - Global X Wind Energy ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 7 759 | −10,05 | 53 | −3,70 | ||||

| 2025-08-15 | 13F | WealthCollab, LLC | 3 145 | 0,00 | 22 | 16,67 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 13 153 | 15,37 | 91 | 34,33 | ||||

| 2025-08-12 | 13F | PSI Advisors, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | LMR Partners LLP | 250 000 | 0,00 | 1 728 | 17,32 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 0 | −100,00 | 0 | |||||

| 2025-07-10 | 13F | TT International Asset Management LTD | 184 695 | −38,72 | 28 833 | 1 524,34 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 29 343 | −19,85 | 203 | −6,05 | ||||

| 2025-08-13 | 13F | Tejara Capital Ltd | 412 512 | −26,89 | 2 850 | −14,23 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 14 354 | 1,18 | 99 | 19,28 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 1 689 | −33,11 | 12 | −21,43 | ||||

| 2025-08-14 | 13F | Gotham Asset Management, LLC | 11 386 | 79 | ||||||

| 2025-08-14 | 13F | Parallax Volatility Advisers, L.P. | 16 478 | 114 | ||||||

| 2025-08-14 | 13F | Parallax Volatility Advisers, L.P. | Put | 154 700 | 1 069 | |||||

| 2025-08-14 | 13F/A | Barclays Plc | 35 440 | 139,90 | 0 | |||||

| 2025-08-14 | 13F | Mariner, LLC | 81 109 | 162,20 | 560 | 207,69 | ||||

| 2025-08-08 | 13F | Helikon Investments Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Weiss Asset Management LP | 60 264 | −53,64 | 416 | −45,62 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 4 456 | 230,07 | 26 | 188,89 |

Other Listings

| US:RNW | 7,61 US$ |