Grundläggande statistik

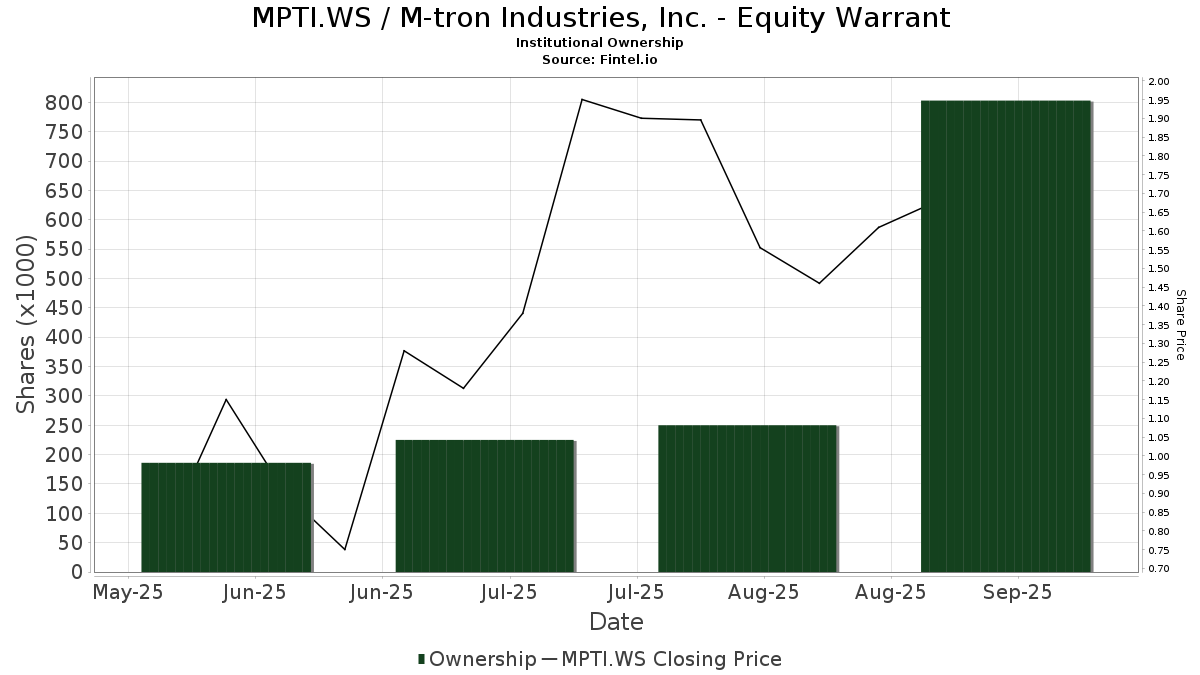

| Institutionella ägare | 66 total, 66 long only, 0 short only, 0 long/short - change of 509,09% MRQ |

| Genomsnittlig portföljallokering | 0.0013 % - change of 8 531,75% MRQ |

| Institutionella aktier (lång) | 803 508 (ex 13D/G) - change of 0,62MM shares 330,87% MRQ |

| Institutionellt värde (lång) | $ 994 USD ($1000) |

Institutionellt ägande och aktieägare

M-tron Industries, Inc. - Equity Warrant (US:MPTI.WS) har 66 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 803,508 aktier. Största aktieägare inkluderar Gamco Investors, Inc. Et Al, Vanguard Group Inc, Bard Associates Inc, Next Century Growth Investors Llc, VTSMX - Vanguard Total Stock Market Index Fund Investor Shares, Advisor Group Holdings, Inc., VEXMX - Vanguard Extended Market Index Fund Investor Shares, Clear Street Llc, Susquehanna International Group, Llp, and G2 Investment Partners Management LLC .

M-tron Industries, Inc. - Equity Warrant (NYSEAM:MPTI.WS) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 5, 2025 is 1,64 / share. Previously, on April 30, 2025, the share price was 1,75 / share. This represents a decline of 6,29% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

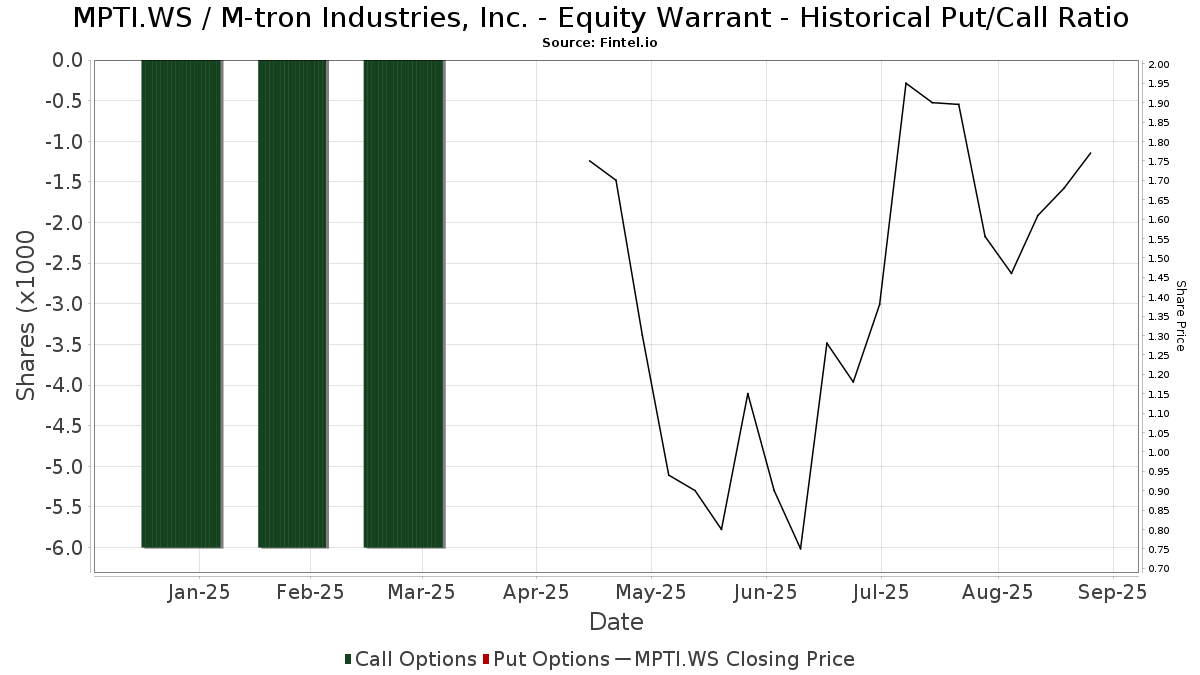

Institutionell sälj/köp-kvot

Förutom att rapportera vanliga eget kapital- och skuldemissioner måste institutioner med mer än 100MM tillgångar under förvaltning också avslöja sina innehav av sälj- och köpoptioner. Eftersom säljoptioner i allmänhet indikerar ett negativt sentiment och köpoptioner indikerar ett positivt sentiment, kan vi få en uppfattning om det övergripande institutionella sentimentet genom att plotta förhållandet mellan säljoptioner och köpoptioner. Diagrammet till höger visar det historiska förhållandet mellan sälj- och köpoptioner för detta instrument.

Genom att använda sälj/köp-kvoten som en indikator på aktieägarnas sentiment undviker man en av de största bristerna med att använda det totala institutionella ägandet, nämligen att en betydande del av de förvaltade tillgångarna investeras passivt för att följa index. Passivt förvaltade fonder köper vanligtvis inte optioner, så indikatorn för sälj/köp-kvoten ger en bättre bild av stämningen i aktivt förvaltade fonder.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.