Grundläggande statistik

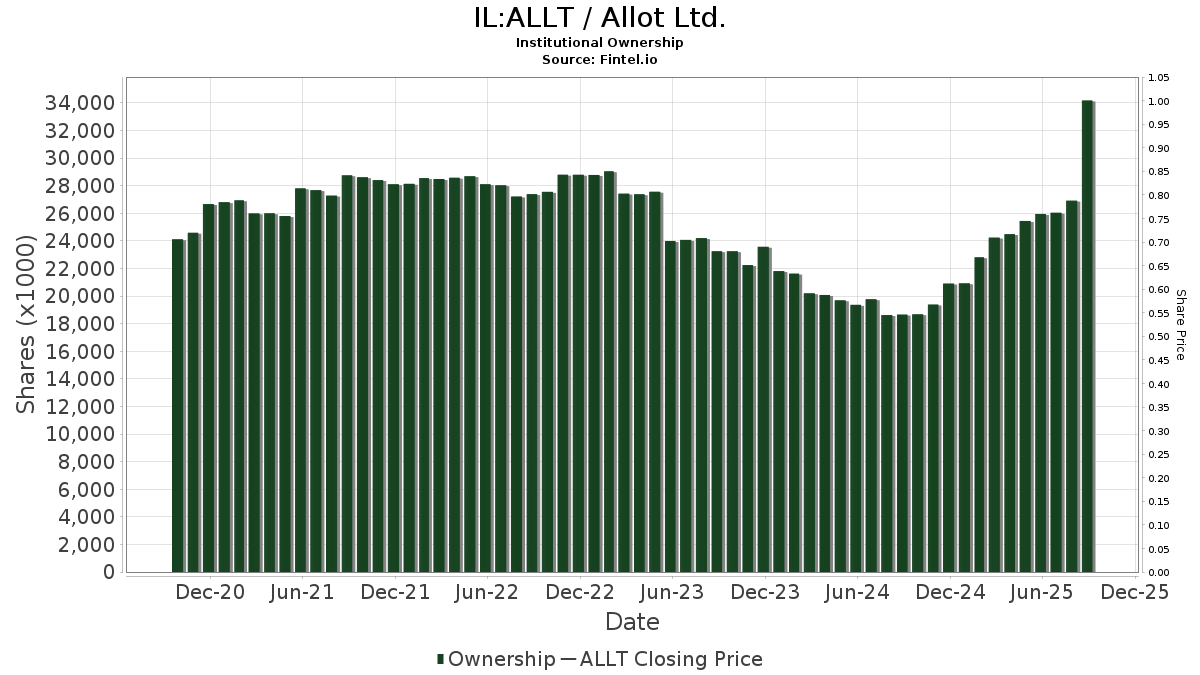

| Institutionella aktier (lång) | 34 173 300 - 72,36% (ex 13D/G) - change of 9,06MM shares 36,06% MRQ |

| Institutionellt värde (lång) | $ 268 812 USD ($1000) |

Institutionellt ägande och aktieägare

Allot Ltd. (IL:ALLT) har 101 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 34,173,300 aktier. Största aktieägare inkluderar Lynrock Lake LP, Kanen Wealth Management LLC, QVT Financial LP, G2 Investment Partners Management LLC, Clal Insurance Enterprises Holdings Ltd, PHLOX - Philotimo Focused Growth and Income Fund, Renaissance Technologies Llc, P.a.w. Capital Corp, Susquehanna International Group, Llp, and Acadian Asset Management Llc .

Allot Ltd. (TASE:ALLT) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-12 | 13F | EAM Global Investors LLC | 14 160 | 121 | ||||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 104 799 | 588,02 | 896 | 941,86 | ||||

| 2025-05-13 | 13F | Quadrature Capital Ltd | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 500 | 309,84 | 4 | |||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 40 983 | 350 | ||||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 8 | 100,00 | 0 | |||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 18 278 | 156 | ||||||

| 2025-06-25 | NP | IZRL - ARK Israel Innovative Technology ETF | 281 868 | 13,43 | 1 637 | −23,36 | ||||

| 2025-08-12 | 13F | Clal Insurance Enterprises Holdings Ltd | 1 564 990 | 0,00 | 13 | 62,50 | ||||

| 2025-07-11 | 13F | Pinnacle Bancorp, Inc. | 528 | 5 | ||||||

| 2025-08-07 | NP | PHLOX - Philotimo Focused Growth and Income Fund | 1 200 000 | 10,33 | 10 260 | 65,22 | ||||

| 2025-05-14 | 13F | Jump Financial, LLC | 0 | −100,00 | 0 | |||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 27 089 | −11,82 | 0 | |||||

| 2025-08-07 | 13F | Allworth Financial LP | 351 | 3 | ||||||

| 2025-07-09 | 13F | Silverberg Bernstein Capital Management LLC | 146 172 | 38,06 | 1 250 | 106,79 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 970 299 | 2,24 | 8 296 | 53,12 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - World ex U.S. Core Equity Portfolio Institutional Class Shares | 4 114 | 0,00 | 24 | −31,43 | ||||

| 2025-08-14 | 13F | Bluefin Capital Management, Llc | 106 112 | 907 | ||||||

| 2025-08-14 | 13F | RBF Capital, LLC | 10 360 | 0,00 | 89 | 49,15 | ||||

| 2025-08-14 | 13F | Caption Management, LLC | Call | 77 500 | −62,52 | 663 | −43,90 | |||

| 2025-08-14 | 13F | Winton Capital Group Ltd | 0 | −100,00 | 0 | |||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 67 835 | 17,57 | 580 | 75,99 | ||||

| 2025-08-12 | 13F | DCF Advisers, LLC | 35 238 | 45,38 | 301 | 118,12 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 500 | 0,00 | 4 | 100,00 | ||||

| 2025-08-14 | 13F | Caption Management, LLC | 226 146 | −16,42 | 1 934 | 25,11 | ||||

| 2025-08-14 | 13F | Caption Management, LLC | Put | 165 000 | 0,00 | 1 411 | 49,68 | |||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 26 044 | −65,66 | 208 | −53,05 | ||||

| 2025-07-15 | 13F | Kanen Wealth Management LLC | 4 527 823 | 19,60 | 38 713 | 79,09 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 75 600 | −5,85 | 604 | 28,78 | |||

| 2025-08-06 | 13F | Cloud Capital Management, LLC | 75 992 | −4,17 | 1 | |||||

| 2025-08-06 | 13F | Yelin Lapidot Holdings Management Ltd. | 225 943 | 0,00 | 1 932 | 49,69 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 163 412 | 122,46 | 1 397 | 233,41 | ||||

| 2025-08-14 | 13F | Synovus Financial Corp | 15 500 | −29,55 | 133 | 5,60 | ||||

| 2025-06-26 | NP | DFIEX - International Core Equity Portfolio - Institutional Class This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 48 893 | 0,00 | 289 | −30,94 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 0 | −100,00 | 0 | |||||

| 2025-07-30 | 13F | ARK Investment Management LLC | 278 560 | 12,10 | 2 357 | 70,85 | ||||

| 2025-08-14 | 13F | Boothbay Fund Management, Llc | 370 004 | 3 164 | ||||||

| 2025-08-13 | 13F | OMERS ADMINISTRATION Corp | 16 231 | 139 | ||||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 31 374 | 268 | ||||||

| 2025-08-14 | 13F | Ghisallo Capital Management LLC | 323 343 | 2 765 | ||||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 900 | 4 400,00 | 8 | |||||

| 2025-08-12 | 13F | LPL Financial LLC | 32 541 | 73,92 | 278 | 162,26 | ||||

| 2025-08-05 | 13F | Prosperity Wealth Management, Inc. | 35 300 | 302 | ||||||

| 2025-08-29 | NP | JAJDX - International Small Company Trust NAV | 2 103 | 0,00 | 18 | 54,55 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 17 900 | 70,48 | 0 | ||||

| 2025-06-26 | NP | DFA INVESTMENT DIMENSIONS GROUP INC - International Sustainability Core 1 Portfolio Shares | 5 136 | 0,00 | 30 | −30,23 | ||||

| 2025-08-13 | 13F | Hbk Investments L P | 125 000 | 1 069 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 145 300 | −4,09 | 1 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 116 214 | 7,46 | 1 | |||||

| 2025-08-13 | 13F | Northern Trust Corp | 282 489 | 0,96 | 2 415 | 51,22 | ||||

| 2025-07-18 | 13F | PFG Investments, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Trexquant Investment LP | 120 352 | 129,62 | 1 029 | 244,15 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 3 000 | 42 757,14 | 2 536 | |||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 271 311 | 2 320 | ||||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 35 074 | −9,54 | 300 | 35,29 | ||||

| 2025-08-14 | 13F | Maven Securities LTD | 50 000 | 428 | ||||||

| 2025-08-13 | 13F | Greenhaven Road Investment Management, L.P. | 626 024 | 271,97 | 5 353 | 457,50 | ||||

| 2025-05-14 | 13F | HAP Trading, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | 14 000 | 33,33 | 0 | |||||

| 2025-08-13 | 13F | HAP Trading, LLC | Put | 165 100 | 0,00 | 32 | −78,91 | |||

| 2025-08-14 | 13F | Group One Trading, L.p. | 114 748 | 15,82 | 981 | 73,63 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 491 500 | 9,44 | 4 202 | 63,88 | |||

| 2025-05-09 | 13F | R Squared Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 31 800 | −45,73 | 272 | −18,86 | |||

| 2025-08-12 | 13F | BlackRock, Inc. | 27 865 | 122,37 | 238 | 235,21 | ||||

| 2025-08-14 | 13F | QVT Financial LP | 4 505 793 | 22,18 | 36 598 | 73,80 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 11 612 | 0 | ||||||

| 2025-07-23 | 13F | Meitav Dash Investments Ltd | 36 780 | 0,00 | 314 | 49,52 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 609 | 0 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 260 263 | 2 225 | ||||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 1 928 | 0,00 | 16 | 45,45 | ||||

| 2025-08-27 | NP | INSAX - Catalyst Insider Buying Fund Class A | 39 400 | 0,00 | 337 | 50,00 | ||||

| 2025-08-14 | 13F | Sig Brokerage, Lp | 14 873 | 127 | ||||||

| 2025-05-08 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-07-24 | NP | FNCMX - Fidelity Nasdaq Composite Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 21 262 | 0,00 | 183 | 46,40 | ||||

| 2025-04-25 | 13F | Emerald Advisors, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Peak6 Llc | 0 | −100,00 | 0 | |||||

| 2025-05-08 | 13F | Baader Bank INC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-31 | 13F | Acuitas Investments, LLC | 65 298 | 558 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 4 898 | −79,41 | 42 | −69,12 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 35 857 | 139,21 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna Portfolio Strategies, LLC | 18 753 | 160 | ||||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 166 013 | 1 358,81 | 1 419 | 2 117,19 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 203 365 | −27,47 | 1 739 | 8,56 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 38 567 | 56,57 | 330 | 135,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 785 800 | 9,11 | 6 719 | 63,38 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 35 200 | −50,97 | 301 | −26,65 | |||

| 2025-07-31 | 13F | Catalyst Capital Advisors LLC | 39 400 | 0,00 | 337 | 50,00 | ||||

| 2025-08-28 | NP | SEEIX - Sit International Equity Fund - Class I | 32 904 | 281 | ||||||

| 2025-08-13 | 13F | Worth Venture Partners, LLC | 41 995 | 359 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-14 | 13F | Millennium Management Llc | 221 981 | 69,35 | 1 898 | 153,61 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-06-26 | NP | Dfa Investment Trust Co - The Continental Small Company Series This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 171 830 | −7,46 | 1 015 | −35,92 | ||||

| 2025-05-14 | 13F | CIBC Private Wealth Group, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-29 | NP | JISAX - International Small Company Fund Class NAV | 1 502 | −39,65 | 13 | −20,00 | ||||

| 2025-08-12 | 13F | Magnetar Financial LLC | 20 212 | 173 | ||||||

| 2025-08-14 | 13F | G2 Investment Partners Management LLC | 1 657 913 | 14 175 | ||||||

| 2025-05-13 | 13F | Quantbot Technologies LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Heights Capital Management, Inc | 100 000 | 855 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 360 013 | −0,42 | 3 078 | 49,13 | ||||

| 2025-06-26 | NP | DFIS - Dimensional International Small Cap ETF | 14 156 | 1 064,14 | 82 | 720,00 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 778 254 | 12,49 | 7 | 100,00 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 303 | 293,51 | 3 | |||||

| 2025-08-13 | 13F | MYDA Advisors LLC | 250 000 | 2 138 | ||||||

| 2025-06-26 | NP | DFAI - Dimensional International Core Equity Market ETF | 3 092 | 0,00 | 18 | −34,62 | ||||

| 2025-08-14 | 13F | Alyeska Investment Group, L.P. | 150 000 | 1 282 | ||||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 62 010 | 61,50 | 530 | 142,01 | ||||

| 2025-06-26 | NP | DFIC - Dimensional International Core Equity 2 ETF | 2 852 | 7 822,22 | 17 | |||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 21 349 | 0,41 | 183 | 50,41 | ||||

| 2025-08-14 | 13F | Sei Investments Co | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 147 065 | 1 115,11 | 1 257 | 1 721,74 | ||||

| 2025-05-15 | 13F | Centiva Capital, LP | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 30 000 | 256 | ||||||

| 2025-08-06 | 13F | Stone House Investment Management, LLC | 117 | 1 | ||||||

| 2025-08-08 | 13F | Gts Securities Llc | 0 | −100,00 | 0 | |||||

| 2025-08-27 | NP | Brighthouse Funds Trust II - Brighthouse/Dimensional International Small Company Portfolio Class A | 10 216 | 0,00 | 86 | 53,57 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 657 | 0 | ||||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 525 | 0,00 | 4 | 33,33 | ||||

| 2025-08-14 | 13F | Lynrock Lake LP | 10 018 661 | 14,26 | 85 660 | 71,08 | ||||

| 2025-08-12 | 13F | P.a.w. Capital Corp | 905 000 | −13,40 | 7 738 | 29,68 | ||||

| 2025-05-15 | 13F | Shay Capital LLC | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 59 968 | 513 | ||||||

| 2025-08-11 | 13F | Blue Bell Private Wealth Management, Llc | 122 | 1 | ||||||

| 2025-08-08 | 13F | Calamos Advisors LLC | 29 680 | 254 | ||||||

| 2025-08-19 | 13F | State of Wyoming | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 291 255 | 12,63 | 2 490 | 68,70 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 85 000 | 727 | |||||

| 2025-06-26 | NP | Dfa Investment Dimensions Group Inc - Va International Small Portfolio This fund is a listed as child fund of Dimensional Fund Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 4 540 | 40,64 | 27 | −3,70 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 476 136 | 47,57 | 4 071 | 120,96 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 29 900 | 353,03 | 256 | 589,19 | |||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 10 900 | −85,68 | 93 | −78,57 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 356 400 | 50,70 | 3 047 | 125,70 | |||

| 2025-08-14 | 13F | Jane Street Group, Llc | 58 815 | −6,22 | 503 | 40,22 |