Grundläggande statistik

| Institutionella aktier (lång) | 128 451 060 - 38,28% (ex 13D/G) - change of 8,96MM shares 7,50% MRQ |

| Institutionellt värde (lång) | $ 704 622 USD ($1000) |

Institutionellt ägande och aktieägare

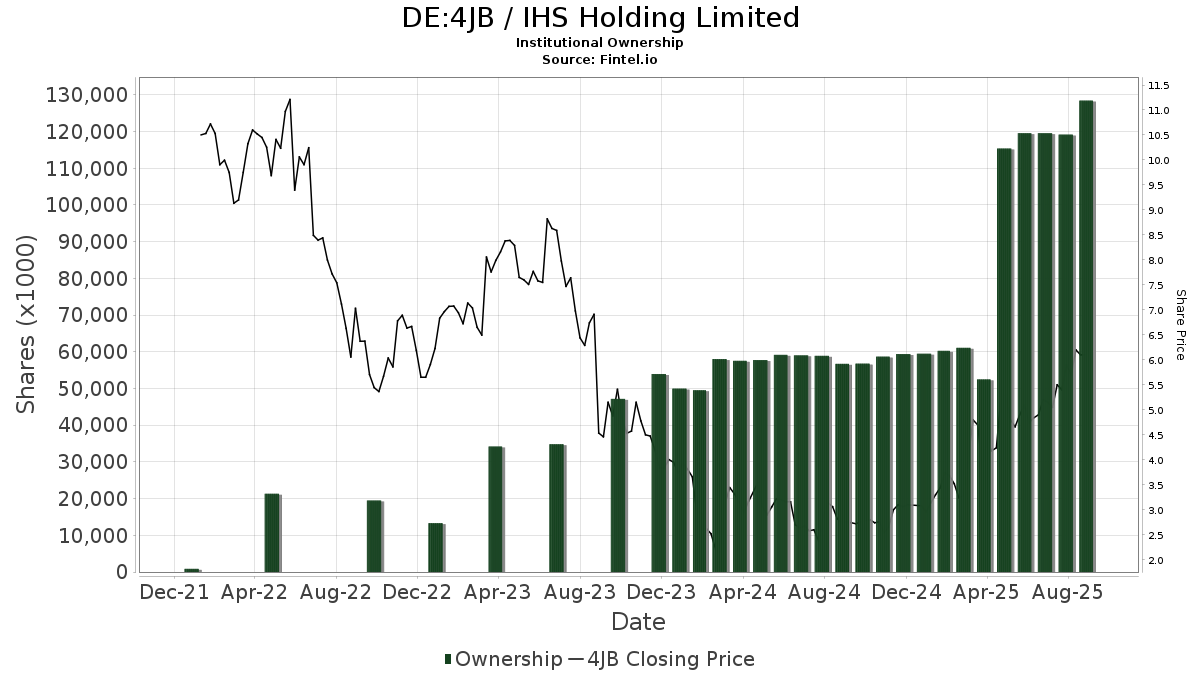

IHS Holding Limited (DE:4JB) har 128 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 128,451,060 aktier. Största aktieägare inkluderar Wendel SE, Korea Investment CORP, Millennium Management Llc, Quaker Capital Investments, LLC, Standard Life Aberdeen plc, Jpmorgan Chase & Co, Bnp Paribas Arbitrage, Sa, Siren, L.L.C., Helikon Investments Ltd, and Morgan Stanley .

IHS Holding Limited (DB:4JB) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 9, 2025 is 6,10 / share. Previously, on September 10, 2024, the share price was 2,68 / share. This represents an increase of 127,61% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | UBS Group AG | 1 004 113 | 161,20 | 5 583 | 178,27 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 31 237 | 183,87 | 0 | |||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 24 693 | 145,02 | 0 | |||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 44 508 | 127,01 | 247 | 142,16 | ||||

| 2025-08-13 | 13F | Siren, L.L.C. | 2 357 520 | 0,00 | 13 108 | 6,51 | ||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 42 411 | 236 | ||||||

| 2025-08-13 | 13F | Hollow Brook Wealth Management LLC | 368 325 | 2 048 | ||||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 13 181 | 28,38 | 73 | 37,74 | ||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 26 770 | 59,63 | 149 | 70,11 | ||||

| 2025-08-27 | NP | JNL SERIES TRUST - JNL/RAFI Fundamental U.S. Small Cap Fund (A) | 4 920 | 45,86 | 27 | 58,82 | ||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 34 671 | 193 | ||||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 568 997 | 88,95 | 3 164 | 101,34 | ||||

| 2025-07-28 | 13F | Generali Asset Management SPA SGR | 180 000 | 0,00 | 1 001 | 6,50 | ||||

| 2025-08-29 | NP | PMJIX - PIMCO RAE US Small Fund Institutional Class | 35 607 | 198 | ||||||

| 2025-07-30 | 13F | Drive Wealth Management, Llc | 21 800 | 121 | ||||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 68 437 | 647,62 | 381 | 708,51 | ||||

| 2025-08-13 | 13F | Shelton Capital Management | 42 553 | −33,19 | 237 | −28,92 | ||||

| 2025-07-25 | NP | FNDA - Schwab Fundamental U.S. Small Company Index ETF This fund is a listed as child fund of Charles Schwab Investment Management Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 394 744 | 2 191 | ||||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 1 260 483 | 94,63 | 7 008 | 107,34 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 303 143 | 346,25 | 2 | |||||

| 2025-08-11 | 13F | Semanteon Capital Management, LP | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | GWM Advisors LLC | 15 363 | 85 | ||||||

| 2025-07-23 | 13F | Kingswood Wealth Advisors, Llc | 74 729 | 415 | ||||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 3 288 | 63,99 | 18 | 80,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 40 500 | 153,12 | 225 | 171,08 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 15 000 | 83 | |||||

| 2025-05-14 | 13F | Susquehanna International Group, Llp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-01 | 13F | Zhang Financial LLC | 0 | −100,00 | 0 | |||||

| 2025-06-24 | NP | SFSNX - Schwab Fundamental US Small Company Index Fund Institutional Shares | 81 815 | 401 | ||||||

| 2025-05-14 | 13F | Venture Visionary Partners LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-15 | 13F | Paloma Partners Management Co | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 262 | 1 | ||||||

| 2025-08-12 | 13F | Dynamic Technology Lab Private Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 405 | 0,00 | 2 | 0,00 | ||||

| 2025-07-18 | 13F | Robeco Institutional Asset Management B.V. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 156 718 | 871 | ||||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 72 234 | 402 | ||||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 28 133 | −29,66 | 156 | −25,00 | ||||

| 2025-05-15 | 13F/A | Orion Portfolio Solutions, LLC | 19 606 | −69,46 | 102 | −45,45 | ||||

| 2025-08-13 | 13F | Centiva Capital, LP | 40 915 | 151,71 | 227 | 170,24 | ||||

| 2025-08-14 | 13F | Price T Rowe Associates Inc /md/ | 128 800 | −27,40 | 1 | |||||

| 2025-08-12 | 13F | Pathstone Holdings, LLC | 413 550 | −42,55 | 2 299 | −38,81 | ||||

| 2025-08-28 | NP | Aberdeen Standard Global Infrastructure Income Fund | 1 484 900 | −6,87 | 8 256 | −0,80 | ||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 306 078 | 639,64 | 2 | |||||

| 2025-07-18 | 13F | Truist Financial Corp | 18 556 | 0,00 | 103 | 7,29 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 19 431 | 1,08 | 108 | 8,00 | ||||

| 2025-07-08 | 13F | Quintet Private Bank (Europe) S.A. | 2 400 | 0,00 | 13 | 8,33 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 196 735 | 211,35 | 1 094 | 232,22 | ||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 1 353 300 | 14,39 | 7 524 | 21,85 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 16 906 | −0,29 | 94 | 5,68 | ||||

| 2025-08-04 | 13F | Dumac, Inc. | 112 000 | 0,00 | 623 | 6,51 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 3 | 0,00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 3 552 | 20 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 1 754 | 10 | ||||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 65 151 | −26,85 | 362 | −21,98 | ||||

| 2025-08-14 | 13F | Winton Capital Group Ltd | 25 603 | 142 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 1 843 | −77,66 | 10 | −76,74 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 45 000 | 250 | ||||||

| 2025-07-25 | 13F | Cwm, Llc | 80 000 | 0,00 | 0 | |||||

| 2025-08-13 | 13F | Jump Financial, LLC | 322 061 | 227,30 | 1 791 | 248,93 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 19 400 | 977,78 | 108 | 1 088,89 | |||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 734 079 | 135,39 | 4 | 300,00 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 1 137 | 0,00 | 6 | 50,00 | ||||

| 2025-08-14 | 13F | Anson Funds Management LP | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 127 100 | 707 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 1 872 837 | 148,34 | 10 413 | 164,53 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 39 400 | 2 930,77 | 219 | 3 550,00 | |||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 912 990 | 119,59 | 5 076 | 133,92 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 27 446 | −18,44 | 153 | −13,14 | ||||

| 2025-06-26 | NP | OWSMX - Old Westbury Small & Mid Cap Strategies Fund | 57 493 | 88,96 | 282 | 183,84 | ||||

| 2025-07-28 | 13F | Allianz Asset Management GmbH | 49 707 | 276 | ||||||

| 2025-08-26 | NP | WAR - U.S. Global Technology and Aerospace & Defense ETF | 9 231 | 51 | ||||||

| 2025-07-07 | 13F | Versant Capital Management, Inc | 510 | 3 | ||||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | Creative Planning | 13 869 | 0,00 | 77 | 6,94 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 66 | −95,49 | 0 | |||||

| 2025-08-06 | 13F | Savant Capital, LLC | 15 494 | 86 | ||||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 462 | 3 | ||||||

| 2025-08-19 | 13F | State of Wyoming | 53 910 | 300 | ||||||

| 2025-08-14 | 13F | Quarry LP | 729 | 4 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 26 075 | −0,72 | 145 | 5,11 | ||||

| 2025-08-13 | 13F | Diametric Capital, LP | 76 723 | −19,39 | 427 | −14,11 | ||||

| 2025-07-14 | 13F | Counterpoint Mutual Funds LLC | 70 615 | 393 | ||||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 27 790 | 155 | ||||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 18 273 | 0 | ||||||

| 2025-08-12 | 13F | Trexquant Investment LP | 174 824 | 972 | ||||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 100 991 | 562 | ||||||

| 2025-08-14 | 13F | Susquehanna Fundamental Investments, Llc | 36 708 | −22,72 | 204 | −17,41 | ||||

| 2025-08-13 | 13F | Korea Investment CORP | 21 666 802 | 0,00 | 120 467 | 6,51 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 606 500 | 189,22 | 3 372 | 208,23 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 341 730 | −4,15 | 1 900 | 2,10 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 42 048 | 234 | ||||||

| 2025-06-13 | NP | AIAFX - Aberdeen Global Infrastructure Fund Class A | 107 226 | −28,04 | 525 | 7,58 | ||||

| 2025-08-14 | 13F | PDT Partners, LLC | 155 443 | 185,47 | 864 | 204,23 | ||||

| 2025-07-23 | 13F | Armbruster Capital Management, Inc. | 165 347 | 0,00 | 919 | 6,49 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 15 408 | −46,57 | 86 | −43,33 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 4 414 254 | 13,46 | 24 543 | 20,85 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 199 240 | 33,75 | 1 108 | 42,47 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 765 831 | 54,01 | 4 258 | 64,08 | ||||

| 2025-08-14 | 13F | Petrus Trust Company, LTA | 59 019 | 328 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 2 405 394 | 16,95 | 13 374 | 24,56 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 1 985 646 | 124,11 | 11 040 | 138,70 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | SMLF - iShares Edge MSCI Multifactor USA Small-Cap ETF | 135 237 | 9,47 | 663 | 63,46 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 244 149 | −0,13 | 1 357 | 6,35 | ||||

| 2025-08-14 | 13F | Numerai GP LLC | 84 134 | 419,09 | 468 | 455,95 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 342 376 | 74,79 | 1 904 | 86,20 | ||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 37 030 | −0,56 | 206 | 5,67 | ||||

| 2025-08-08 | 13F | Helikon Investments Ltd | 2 357 338 | 64,43 | 13 107 | 75,14 | ||||

| 2025-07-21 | 13F | Ascent Group, LLC | 22 719 | 126 | ||||||

| 2025-08-12 | 13F | Magnetar Financial LLC | 37 403 | 208 | ||||||

| 2025-08-14 | 13F | State Street Corp | 14 963 | 83 | ||||||

| 2025-08-11 | 13F | Blue Bell Private Wealth Management, Llc | 161 | 1 | ||||||

| 2025-08-28 | NP | CPAEX - Counterpoint Tactical Equity Fund Class A Shares | 70 615 | 393 | ||||||

| 2025-04-29 | 13F | Calamos Advisors LLC | Put | 0 | −100,00 | 0 | ||||

| 2025-08-04 | 13F | Pinnacle Associates Ltd | 73 350 | −11,31 | 408 | −5,57 | ||||

| 2025-08-07 | 13F | Compass Rose Asset Management, LP | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Principal Street Partners, LLC | 25 902 | 158,07 | 144 | 176,92 | ||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 48 700 | 0 | ||||||

| 2025-08-15 | 13F | State of Tennessee, Treasury Department | 22 438 | 125 | ||||||

| 2025-08-11 | 13F | Greenland Capital Management LP | 120 000 | −37,66 | 667 | −33,57 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 12 861 | 72 | ||||||

| 2025-07-28 | 13F | Wendel SE | 62 975 396 | 0,00 | 350 143 | 6,51 | ||||

| 2025-05-13 | 13F | State of New Jersey Common Pension Fund D | 0 | −100,00 | 0 | |||||

| 2025-06-30 | NP | PRFZ - Invesco FTSE RAFI US 1500 Small-Mid ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 82 545 | −12,59 | 404 | 30,74 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 261 920 | −11,24 | 1 456 | −5,45 | ||||

| 2025-07-22 | 13F | Merit Financial Group, LLC | 10 182 | 57 | ||||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 195 535 | −32,34 | 1 087 | −27,92 | ||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 1 113 427 | 457,05 | 6 191 | 493,48 | ||||

| 2025-07-24 | 13F | Standard Life Aberdeen plc | 2 565 900 | −7,59 | 14 266 | −1,57 | ||||

| 2025-08-14 | 13F | Jain Global LLC | 79 391 | 508,31 | 441 | 548,53 | ||||

| 2025-07-29 | 13F | Stratos Wealth Advisors, LLC | 10 403 | 58 | ||||||

| 2025-08-04 | 13F | Assetmark, Inc | 34 | 0 | ||||||

| 2025-05-15 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 0 | −100,00 | 0 | |||||

| 2025-08-04 | 13F | Spire Wealth Management | 566 | −33,65 | 3 | −25,00 | ||||

| 2025-05-09 | 13F | Deutsche Bank Ag\ | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 80 640 | −7,25 | 448 | −1,10 | ||||

| 2025-08-12 | 13F | Moon Capital Management Lp | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Dark Forest Capital Management Lp | 120 198 | −37,56 | 668 | −33,47 | ||||

| 2025-06-25 | NP | TRAMX - T. Rowe Price Africa & Middle East Fund This fund is a listed as child fund of Price T Rowe Associates Inc /md/ and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 177 400 | −9,99 | 869 | 34,52 | ||||

| 2025-08-12 | 13F | Rare Infrastructure Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-28 | NP | GWX - SPDR(R) S&P(R) International Small Cap ETF | 14 963 | 83 | ||||||

| 2025-08-14 | 13F | Occudo Quantitative Strategies Lp | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Sona Asset Management (us) Llc | 1 802 674 | −14,27 | 10 023 | −8,68 | ||||

| 2025-08-14 | 13F | Man Group plc | 106 733 | −0,04 | 593 | 6,46 | ||||

| 2025-08-14 | 13F | Susquehanna Portfolio Strategies, LLC | 87 728 | 488 | ||||||

| 2025-08-14 | 13F | Quaker Capital Investments, LLC | 4 215 205 | 0,00 | 23 437 | 6,51 | ||||

| 2025-07-25 | NP | FNDB - Schwab Fundamental U.S. Broad Market Index ETF This fund is a listed as child fund of Charles Schwab Investment Management Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 3 186 | 18 | ||||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 2 394 160 | 177,44 | 13 312 | 195,54 |

Other Listings

| US:IHS | 7,22 US$ |