Grundläggande statistik

| Institutionella aktier (lång) | 58 983 116 - 51,74% (ex 13D/G) - change of 10,07MM shares 20,58% MRQ |

| Institutionellt värde (lång) | $ 174 120 USD ($1000) |

Institutionellt ägande och aktieägare

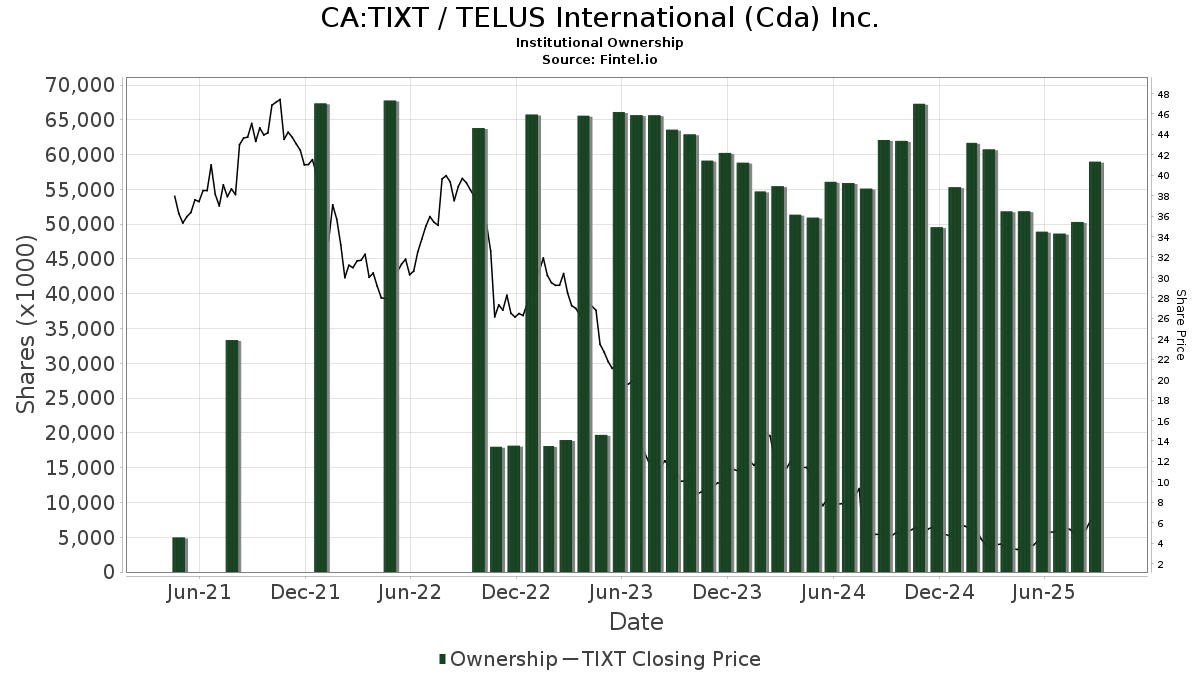

TELUS International (Cda) Inc. (CA:TIXT) har 112 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 58,983,116 aktier. Största aktieägare inkluderar Mackenzie Financial Corp, QV Investors Inc., Clearbridge Investments, LLC, BlackRock, Inc., Medina Singh Partners, LLC, Scheer, Rowlett & Associates Investment Management Ltd., Northwest & Ethical Investments L.P., Arrowstreet Capital, Limited Partnership, Beutel, Goodman & Co Ltd., and Royal Bank Of Canada .

TELUS International (Cda) Inc. (TSX:TIXT) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 10, 2025 is 6,22 / share. Previously, on September 11, 2024, the share price was 4,99 / share. This represents an increase of 24,65% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.

| Fil Datum | Källa | Investerare | Typ | Genomsnittligt pris (beräknat) |

Aktier | Δ Aktier (%) |

Rapporterat värde (1000 USD) |

Δ Värde (%) |

Portföljallokering (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Ionic Capital Management LLC | 175 000 | 635 | ||||||

| 2025-08-11 | 13F | Citigroup Inc | 52 831 | 1 734,41 | 192 | 2 628,57 | ||||

| 2025-05-27 | NP | FDTS - First Trust Developed Markets ex-US Small Cap AlphaDEX Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1 398 | 1,45 | 4 | −40,00 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 18 131 | −55,24 | 67 | −37,74 | ||||

| 2025-08-14 | 13F | Caption Management, LLC | Put | 0 | −100,00 | 0 | ||||

| 2025-08-14 | 13F | Caption Management, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 751 175 | 18,93 | 2 727 | 60,45 | ||||

| 2025-05-12 | 13F | Simplex Trading, Llc | 0 | −100,00 | 0 | |||||

| 2025-07-25 | 13F | JustInvest LLC | 17 271 | 14,32 | 63 | 55,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 0 | −100,00 | 0 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 4 848 417 | 0,00 | 17 600 | 34,94 | ||||

| 2025-08-12 | 13F | Legal & General Group Plc | 62 025 | 0,00 | 225 | 35,54 | ||||

| 2025-04-21 | 13F | Ronald Blue Trust, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 206 906 | −34,18 | 749 | −10,42 | ||||

| 2025-08-13 | 13F | Beutel, Goodman & Co Ltd. | 2 035 150 | −3,16 | 7 | 40,00 | ||||

| 2025-08-14 | 13F | Optiver Holding B.V. | 1 651 | −80,67 | 6 | −77,27 | ||||

| 2025-08-27 | NP | ALLIANZ VARIABLE INSURANCE PRODUCTS TRUST - AZL DFA International Core Equity Fund | 2 200 | 0,00 | 8 | 40,00 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 728 979 | 0,11 | 3 | 100,00 | ||||

| 2025-08-14 | 13F | LMR Partners LLP | 300 000 | 1 089 | ||||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 73 778 | 141,15 | 268 | 225,61 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 37 546 | −7,39 | 137 | 25,93 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 581 199 | −47,48 | 2 110 | −29,13 | ||||

| 2025-08-08 | 13F | Creative Planning | 731 047 | 0,00 | 2 654 | 34,94 | ||||

| 2025-08-13 | 13F | Northwest & Ethical Investments L.P. | 2 209 937 | 31,80 | 8 029 | 78,42 | ||||

| 2025-05-14 | 13F | Susquehanna International Group, Llp | Call | 0 | −100,00 | 0 | −100,00 | |||

| 2025-08-29 | NP | GABCX - The Gabelli Abc Fund Class Aaa | 10 000 | 36 | ||||||

| 2025-08-12 | 13F | Dimensional Fund Advisors Lp | 47 390 | −34,15 | 172 | −11,40 | ||||

| 2025-07-31 | 13F | QV Investors Inc. | 7 614 325 | 25,80 | 28 | 68,75 | ||||

| 2025-08-14 | 13F | Circumference Group LLC | 399 998 | −40,74 | 1 452 | −20,06 | ||||

| 2025-08-28 | NP | QCSTRX - Stock Account Class R1 | 59 590 | −29,05 | 217 | −4,00 | ||||

| 2025-08-14 | 13F | Harvest Management Llc | 230 000 | 835 | ||||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | 50 000 | 0 | ||||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 197 900 | 37,72 | 718 | 86,01 | ||||

| 2025-08-15 | 13F | WealthCollab, LLC | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Amundi | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | CLARET ASSET MANAGEMENT Corp | 224 866 | 59,06 | 1 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 4 619 | 89,77 | 17 | 166,67 | ||||

| 2025-04-14 | 13F | PFW Advisors LLC | 0 | −100,00 | 0 | |||||

| 2025-08-12 | 13F | Franklin Resources Inc | 103 122 | −12,56 | 375 | 18,67 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 92 809 | 337 | ||||||

| 2025-08-14 | 13F | GWM Advisors LLC | 3 912 | 3 080,49 | 14 | |||||

| 2025-07-31 | 13F | Cardinal Point Capital Management, ULC | 106 385 | 386 | ||||||

| 2025-08-06 | NP | LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Dimensional International Core Equity Fund Standard Class | 5 904 | 0,00 | 21 | 40,00 | ||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 12 772 | 0,00 | 47 | 35,29 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 207 408 | 1,02 | 1 | |||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 58 822 | −20,00 | 214 | 8,12 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 1 170 322 | 298,95 | 4 249 | 439,21 | ||||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 12 655 | 0,00 | 46 | 36,36 | ||||

| 2025-05-09 | 13F | Charles Schwab Investment Management Inc | 0 | −100,00 | 0 | |||||

| 2025-05-14 | 13F | Orion Portfolio Solutions, LLC | 12 427 | 0,00 | 49 | 0,00 | ||||

| 2025-07-23 | 13F | Shell Asset Management Co | 4 192 | 0,00 | 0 | |||||

| 2025-07-18 | 13F | Gold Investment Management Ltd. | 400 | 0,00 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | Sagefield Capital LP | 42 548 | 154 | ||||||

| 2025-07-21 | 13F | Credential Qtrade Securities Inc. | 56 590 | 13,00 | 479 | 11,40 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 310 200 | −0,30 | 1 128 | 35,25 | ||||

| 2025-08-14 | 13F | Moore Capital Management, Lp | 140 000 | 508 | ||||||

| 2025-08-11 | 13F | Vanguard Group Inc | 56 812 | 0,00 | 207 | 35,53 | ||||

| 2025-08-15 | 13F | Great West Life Assurance Co /can/ | 7 836 | 0,00 | 0 | |||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 112 127 | 21,63 | 405 | 66,26 | ||||

| 2025-05-15 | 13F | Bayesian Capital Management, LP | 0 | −100,00 | 0 | |||||

| 2025-06-26 | NP | DXIV - Dimensional International Vector Equity ETF | 1 500 | 15,38 | 4 | −40,00 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 78 893 | 0 | ||||||

| 2025-08-14 | 13F | Atom Investors LP | 254 077 | −4,06 | 922 | 29,49 | ||||

| 2025-08-13 | 13F | NINE MASTS CAPITAL Ltd | 130 000 | 472 | ||||||

| 2025-08-12 | 13F | XTX Topco Ltd | 108 000 | 392 | ||||||

| 2025-08-14 | 13F | K2 Principal Fund, L.p. | 835 087 | 3 031 | ||||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 653 335 | 95,90 | 2 372 | 164,33 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 896 403 | 65,50 | 3 254 | 123,42 | ||||

| 2025-08-14 | 13F | Alpine Global Management, LLC | 153 933 | 559 | ||||||

| 2025-08-12 | 13F | Dynamic Technology Lab Private Ltd | 0 | −100,00 | 0 | |||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 47 236 | 4,28 | 171 | 41,32 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | Skandinaviska Enskilda Banken AB (publ) | 100 000 | 363 | ||||||

| 2025-08-27 | NP | FAIEX - PFM Multi-Manager International Equity Fund Institutional Class | 8 400 | 0,00 | 31 | 36,36 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 1 591 340 | 80,19 | 5 776 | 143,20 | ||||

| 2025-08-08 | 13F | Vestcor Inc | 68 907 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Scoggin Management Lp | 553 950 | 2 011 | ||||||

| 2025-07-25 | NP | FNDC - Schwab Fundamental International Small Company Index ETF This fund is a listed as child fund of Charles Schwab Investment Management Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 165 876 | −18,50 | 472 | −19,62 | ||||

| 2025-08-12 | 13F | Nuveen, LLC | 59 590 | −29,05 | 216 | −4,00 | ||||

| 2025-07-29 | NP | WEUSX - Siit World Equity Ex-us Fund - Class A | 10 500 | 0,00 | 30 | −3,33 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 28 235 | −88,29 | 102 | −84,26 | ||||

| 2025-07-29 | NP | SSEAX - SIIT Screened World Equity Ex-US Fund - Class A | 7 800 | 0,00 | 22 | 0,00 | ||||

| 2025-08-07 | 13F | Scheer, Rowlett & Associates Investment Management Ltd. | 3 667 490 | 2,45 | 13 394 | 39,47 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 38 384 | 0,63 | 0 | |||||

| 2025-06-24 | NP | SFILX - Schwab Fundamental International Small Company Index Fund Institutional Shares | 33 376 | −10,86 | 82 | −43,75 | ||||

| 2025-06-25 | NP | NTKLX - Voya Multi-Manager International Small Cap Fund Class A | 10 400 | 0,00 | 25 | −37,50 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 111 872 | −15,70 | 406 | 14,08 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 222 311 | 296,27 | 807 | 437,33 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 627 565 | 82,02 | 2 281 | 146,49 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 23 000 | −50,80 | 83 | −33,60 | ||||

| 2025-05-12 | 13F | Horrell Capital Management, Inc. | 0 | −100,00 | 0 | |||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 12 669 | 0 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 31 600 | −38,52 | 115 | −17,39 | |||

| 2025-08-14 | 13F | Verition Fund Management LLC | 367 462 | 1 334 | ||||||

| 2025-08-08 | 13F | Police & Firemen's Retirement System of New Jersey | 15 517 | 0,00 | 56 | 36,59 | ||||

| 2025-08-14 | 13F | Medina Singh Partners, LLC | 4 246 563 | 99,68 | 15 415 | 169,49 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 606 074 | 237,00 | 2 200 | 355,49 | ||||

| 2025-08-13 | 13F | Mackenzie Financial Corp | 8 010 430 | −3,39 | 29 136 | 31,01 | ||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 2 293 | 8 | ||||||

| 2025-07-17 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 23 383 | 85 | ||||||

| 2025-06-26 | NP | DFAI - Dimensional International Core Equity Market ETF | 31 041 | 0,00 | 76 | −37,50 | ||||

| 2025-08-12 | 13F | Clearbridge Investments, LLC | 5 009 672 | −5,74 | 18 185 | 27,20 | ||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 277 229 | 1 006 | ||||||

| 2025-08-12 | 13F | Swiss National Bank | 141 000 | 0,00 | 511 | 34,92 | ||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Graham Capital Management, L.P. | 0 | −100,00 | 0 | |||||

| 2025-08-11 | 13F | Lowe Brockenbrough & Co Inc | 50 000 | 182 | ||||||

| 2025-08-12 | 13F | Aviso Financial Inc. | 60 651 | 25,24 | 220 | 70,54 | ||||

| 2025-08-14 | 13F | PDT Partners, LLC | 22 446 | −20,00 | 81 | 8,00 | ||||

| 2025-08-08 | 13F | Alberta Investment Management Corp | 195 000 | 708 | ||||||

| 2025-08-14 | 13F | Mariner, LLC | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Two Sigma Securities, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-28 | NP | SSGVX - State Street Global Equity ex-U.S. Index Portfolio State Street Global All Cap Equity ex-U.S. Index Portfolio This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 22 100 | 0,00 | 80 | 35,59 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Slotnik Capital, LLC | 540 776 | 1 963 | ||||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Toronto Dominion Bank | 56 001 | 204 | ||||||

| 2025-08-01 | 13F | Brinker Capital Investments, LLC | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-05-15 | 13F | Balyasny Asset Management Llc | 0 | −100,00 | 0 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 199 | 0,00 | 1 | |||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 581 800 | 61,88 | 2 112 | 118,53 | ||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 2 202 138 | 0,00 | 8 006 | 35,43 | ||||

| 2025-05-12 | 13F | Advisor Group Holdings, Inc. | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Polar Asset Management Partners Inc. | 700 000 | 2 541 | ||||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 15 982 | 58 | ||||||

| 2025-08-07 | 13F | Zurcher Kantonalbank (Zurich Cantonalbank) | 38 086 | 0,00 | 138 | 35,29 | ||||

| 2025-08-13 | 13F | Bank Of Nova Scotia | 160 605 | −37,70 | 584 | −15,63 | ||||

| 2025-07-28 | 13F | Td Asset Management Inc | 0 | −100,00 | 0 | |||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 46 400 | 169 | ||||||

| 2025-05-13 | 13F | Geode Capital Management, Llc | 0 | −100,00 | 0 | −100,00 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 72 623 | 264 | ||||||

| 2025-08-11 | 13F | Covestor Ltd | 41 223 | 0 | ||||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 5 092 | 18 | ||||||

| 2025-08-13 | 13F | Gabelli Funds Llc | 10 000 | 36 | ||||||

| 2025-08-19 | 13F | State of Wyoming | 0 | −100,00 | 0 | |||||

| 2025-05-15 | 13F | Aquatic Capital Management LLC | 0 | −100,00 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 329 371 | 2 799,14 | 1 196 | 3 883,33 | ||||

| 2025-08-14 | 13F | UBS Group AG | 587 742 | −39,15 | 2 134 | −17,90 | ||||

| 2025-06-26 | NP | DFIS - Dimensional International Small Cap ETF | 5 215 | −76,01 | 13 | −77,36 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 0 | −100,00 | 0 | |||||

| 2025-08-21 | NP | LUSIX - Lazard US Systematic Small Cap Equity Portfolio Institutional Shares | 17 553 | −3,45 | 64 | 31,25 |