| Utestående aktier | 241,616,672 shares |

| Insideraktier | 20 346 451 shares |

| Insynsägande | 8,42 % |

| Totalt antal insynspersoner | 37 |

Insider Sentiment Score

Insider sentiment score hittar de företag som köps av foretagsinsynspersoner.

Det är resultatet av en sofistikerad, kvantitativ multifaktormodell som identifierar företag med de högsta nivåerna av insiderackumulation. Poängmodellen använder en kombination av nettoantalet insiders som köpt de föregående 90 dagarna, det totala antalet aktier som köpts i procent av aktiekapitalet och det totala antalet aktier som ägs av insiders. Siffran sträcker sig från 0 till 100, med högre siffror som indikerar en högre nivå av ackumulering för sina kamrater, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Insiders Top Picks, som ger en lista över företag med högsta insiderackumulation.

Office Sentiment Score

Officersentiment Score hittar företag som köps av Corporate Officers.

Per definition Corporate Officers är Corporate Insiders, men till skillnad från vissa av de andra Insiders (10 % aktieägare och styrelseledamöter), arbetar ämbetsmän för företaget dagligen och de använder sina egna pengar när de handlar . (10 % aktieägare och styrelseledamöter är ofta fondförvaltare som förvaltar andras pengar.) Som sådan är insideraffärer som görs av tjänstemän mycket mer betydelsefulla och bör behandlas på lämpligt sätt.

Liksom Insider Sentiment Score är Officer Sentiment Score resultatet av en sofistikerad, kvantitativ multifaktormodell som identifierar företag med de högsta nivåerna av officersackumulering.

Uppdateringsfrekvens: Dagligen

Se insiderns bästa val, vilket ger en lista över företag med högsta insider sentiment.

Viktiga insidernyckeltal

Denna kort visar hur företaget rankas längs olika insidernyckeltal. Procenttilrankningen visar hur detta företag jämförs med andra företag på USA-marknaden. Högre rankingar indikerar bättre situationer.

Till exempel anses det allmänt att insiderköp är en positiv indikator, så företag med mer insiderköp skulle rankas högre än företag med mindre insiderköp (eller til och med insiderförsäljning).

Procent av flytande köpta av insiders (ranking)

-0.126 %( )

10620 out of 11220Procentandelen av aktier köpta av insiders är det totala antalet aktier som köpts av insiders minus det totala antalet aktier som sålts av insiders under de senaste 90 dagarna, dividerat med det totala antalet aktier och multiplicerat med 100.

Insiderhandelsdiagram

Element Solutions Inc insideraffärer visas i följande diagram. Insiders är tjänstemän, styrelseledamöter eller betydande investerare i ett företag. I allmänhet är det i allmänhet olagligt för insiders att göra affärer i sina företag baserat på väsentlig, icke-offentlig information. Detta betyder inte att det är olagligt för dem att göra några affärer i sina egna företag. De måste dock rapportera alla affärer till SEC via ett formulär 4.

Insiderlista och lönsamhetsstatistik

Den här tabellen visar listan över kända insiders och genereras automatiskt från anmälningar som avslöjas till SEC. Förutom namnen, den senaste titeln och direktören, tjänstemannen eller ägarbeteckningen på 10 %, tillhandahåller vi de senaste avslöjade innehaven. Dessutom, när det är möjligt tillhandahåller vi insiderns historiska handelsresultat. Det historiska handelsresultatet är ett vägt genomsnitt av resultatet för faktiska köptransaktioner på den öppna marknaden som insidern gjort. För mer information om hur detta beräknas, titta på detta YouTube-webinarium.

See our leaderboard of most profitable insider traders.

| Insider | Genomsnitt vinst (%) | Aktier Ägda |

Delad Justerad |

|---|---|---|---|

|

William A Ackman

10% Owner -

|

0 | 0 | |

| Ian G H Ashken Director - [D] | 13 410 | 13 410 | |

| Nicolas Berggruen | 0 | ||

| Scot Benson Director - [D] | 337 980 | 337 980 | |

| John L Cordani | 12 255 | ||

| John Edward Capps EVP, General Counsel & Sec. - [O] | 609 790 | 609 790 | |

| Diego Lopez Casanello President - Ag Solutions - [O] | 15 000 | 15 000 | |

| Connolly John P. Chief Financial Officer - [O] | 18 579 | 18 579 | |

| D'Ambrisi Joseph J. EVP Head of Electronics - [O] | 411 853 | 411 853 | |

| Dorman Carey J. EVP, CFO - [O] | 214 837 | 214 837 | |

| Martin E Franklin Director - [D] | 0 | 0 | |

| Elyse Napoli Filon Director - [D] | 23 951 | 23 951 |

| Insider | Genomsnitt vinst (%) | Aktier Ägda |

Delad Justerad |

|---|---|---|---|

| Benjamin Foulk | 10 012 | ||

| Fraser Christopher T. Director - [D] | 60 773 | 60 773 | |

| Fricke Richard L. EVP, Head of Electronics - [O] | 40 829 | 40 829 | |

| Michael F Goss Director - [D] | 23 951 | 23 951 | |

| Mark Gibbens | 13 008 | ||

| Benjamin Gliklich President and CEO, Director - [D] [O] | 864 521 | 864 521 | |

| Michael Goralski Former EVP, Head of I&S - [O] | 147 650 | 147 650 | |

| Hewett Wayne M. | 213 402 | ||

| Ryan Israel | 0 | ||

| David A Jacoboski Corporate Treasurer - [O] | 3 302 | 3 302 | |

| Michael V Kennedy VP of Tax & Treasurer - [O] | 1 000 | 1 000 | |

| Sanjiv Khattri CFO - [O] | 5 000 | 5 000 |

| Insider | Genomsnitt vinst (%) | Aktier Ägda |

Delad Justerad |

|---|---|---|---|

| Daniel H Leever CEO, Director - [D] [O] | 200 000 | 200 000 | |

| Matthew Liebowitz EVP, Strategy and Head of I&S - [O] | 57 353 | 57 353 | |

| Frank Monteiro CFO - [O] | 11 329 | 11 329 | |

| Nichelle Maynard-Elliott Director - [D] | 32 154 | 32 154 | |

| Patricia Mount VP, Program Mgt & Integration - [O] | 640 | 640 | |

| E Stanley Oneal Director - [D] | 291 396 | 291 396 | |

|

PS Management GP, LLC

10% Owner -

|

0 | 0 | |

| Pershing Square Capital Management, L.P. - | 0 | 0 | |

| Rakesh Sachdev Director - [D] | 723 752 | 723 752 | |

|

Stanhope Investments

10% Owner -

|

16 211 408 | 16 211 408 | |

| Sofronas Susan W. Director - [D] | 6 246 | 6 246 | |

| John David Tolbert Chief Human Resources Officer - [O] | 19 747 | 19 747 | |

| Worshek Robert L. | 6 226 |

Report errors via our new Insider Auditing Tool

Track Records av insiderköp - Kortsiktig vinstanalys

I denna sektion analyserar vi lönsamheten för varje oplanerat, öppet-marknads insiderköp gjorda i ESI / Element Solutions Inc. Denna analys hjälper till att förstå om insidern konsekvent genererar onormala avkastningar och är värd att följa. Denna analys är för ett år efter varje handel, och resultaten är teoretiska .

Tabellen nedan visar de senaste köpen på öppna marknaden som inte var en del av en automatisk handelsplan.

Justeringar av aktierär de justerade aktierna efter justerat pris. Justeringar av aktierär de justerade aktierna efter uppdelning.

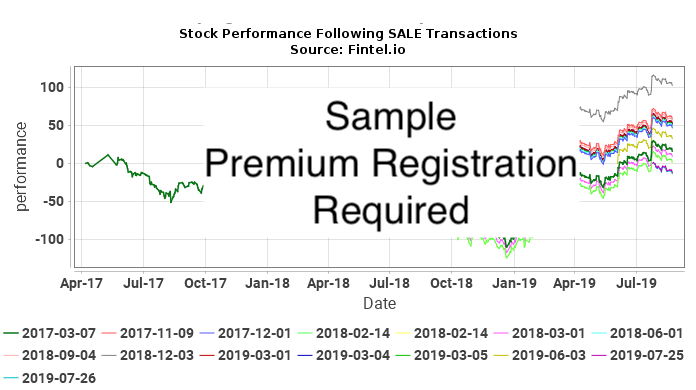

Track Records av insiderförsäljning - Kortsiktig förlustanalys

I denna sektion analyserar vi lönsamheten för varje oplanerat, öppet-marknads insiderköp gjorda i ESI / Element Solutions Inc. Denna analys hjälper till att förstå om insidern konsekvent genererar onormala avkastningar och är värd att följa. Denna analys är för ett år efter varje handel, och resultaten är teoretiska .

Tabellen nedan visar de senaste försäljningarna på öppna marknaden som inte var en del av en automatisk handelsplan.

Justeringar av aktierär de justerade aktierna efter justerat pris. Justeringar av aktierär de justerade aktierna efter uppdelning.

Transaktionshistorik

Klicka på länkikonen för att se hela transaktionshistoriken. Transaktioner som rapporteras som en del av en automatisk handelsplan 10b5-1 kommer att ha ett X i kolumnen markerad 10b-5.

| Fil datum |

Handel datum |

Schema | Insider | Ticker | Värdepappertitel | Kod | Direkta | Utövningspris | Enhet pris |

Enheter ändrad |

Värde ändrad (1K) |

Kvarvarande Optioner |

Kvarvarande Aktier |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025-09-19 | 2025-09-18 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 26,6600 | −40 725 | −1 086 | 214 837 | ||||

| 2025-09-19 | 2025-09-18 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 12,2500 | 31 690 | 388 | 255 562 | ||||

| 2025-09-19 | 2025-09-18 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 11,3400 | 9 634 | 109 | 223 872 | ||||

| 2025-09-19 | 2025-09-18 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 10,5900 | 19 380 | 205 | 214 238 | ||||

| 2025-09-19 | 2025-09-18 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 26,5600 | −117 637 | −3 124 | 864 521 | ||||

| 2025-09-19 | 2025-09-18 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 7,9500 | 20 637 | 164 | 982 158 | ||||

| 2025-09-19 | 2025-09-18 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 11,3400 | 64 227 | 728 | 961 521 | ||||

| 2025-09-19 | 2025-09-18 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 13,3000 | 21 695 | 289 | 897 294 | ||||

| 2025-09-19 | 2025-09-18 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 12,2500 | 74 564 | 913 | 875 599 | ||||

| 2025-09-19 | 2025-09-18 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 26,7700 | −77 674 | −2 079 | 609 790 | ||||

| 2025-09-19 | 2025-09-18 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 12,2500 | 39 146 | 480 | 687 464 | ||||

| 2025-09-19 | 2025-09-18 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 13,3000 | 21 695 | 289 | 648 318 | ||||

| 2025-09-19 | 2025-09-18 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 9,5200 | 25 615 | 244 | 626 623 | ||||

| 2025-09-19 | 2025-09-18 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 11,3400 | 33 719 | 382 | 601 008 | ||||

| 2025-09-19 | 2025-09-17 | 4 | Liebowitz Matthew | ESI | Common Stock, par value $0.01 per share | D | 26,5500 | −50 000 | −1 328 | 57 353 | ||||

| 2025-08-15 | 2025-08-13 | 4 | FRANKLIN MARTIN E By Foundation | ESI | Common Stock, par value $0.01 per share | I | −1 037 000 | 0 | ||||||

| 2025-06-05 | 2025-06-03 | 4 | ONEAL E STANLEY | ESI | Common Stock, par value $0.01 per share | D | 6 045 | 291 396 | ||||||

| 2025-06-05 | 2025-06-03 | 4 | Filon Elyse Napoli | ESI | Common Stock, par value $0.01 per share | D | 6 045 | 23 951 | ||||||

| 2025-06-05 | 2025-06-03 | 4 | Sofronas Susan W. | ESI | Common Stock, par value $0.01 per share | D | 6 045 | 6 246 | ||||||

| 2025-06-05 | 2025-06-03 | 4 | GOSS MICHAEL F | ESI | Common Stock, par value $0.01 per share | D | 6 045 | 23 951 | ||||||

| 2025-06-05 | 2025-06-03 | 4 | ASHKEN IAN G H By Trust | ESI | Common Stock, par value $0.01 per share | I | 6 045 | 13 410 | ||||||

| 2025-06-05 | 2025-06-03 | 4 | ASHKEN IAN G H | ESI | Common Stock, par value $0.01 per share | D | −6 045 | 0 | ||||||

| 2025-06-05 | 2025-06-03 | 4 | ASHKEN IAN G H | ESI | Common Stock, par value $0.01 per share | D | 6 045 | 6 045 | ||||||

| 2025-06-05 | 2025-06-03 | 4 | Fraser Christopher T. | ESI | Common Stock, par value $0.01 per share | D | 6 045 | 60 773 | ||||||

| 2025-03-21 | 2025-03-19 | 4 | FRANKLIN MARTIN E By Martin E. Franklin Revocable Trust | ESI | Common Stock, par value $0.01 per share | I | 26,1000 | −390 900 | −10 202 | 109 100 | ||||

| 2025-03-21 | 2025-03-19 | 4 | FRANKLIN MARTIN E By MEF Holdings, LLLP | ESI | Common Stock, par value $0.01 per share | I | 26,1000 | −1 609 100 | −41 998 | 5 280 413 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Fricke Richard L. | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −498 | −13 | 40 829 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Fricke Richard L. | ESI | Common Stock, par value $0.01 per share | D | 955 | 41 327 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Fricke Richard L. | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −770 | −20 | 40 372 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Fricke Richard L. | ESI | Common Stock, par value $0.01 per share | D | 1 677 | 41 142 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Fricke Richard L. | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −1 612 | −42 | 39 465 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Fricke Richard L. | ESI | Common Stock, par value $0.01 per share | D | 3 477 | 41 077 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Fricke Richard L. | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −1 495 | −39 | 37 600 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Fricke Richard L. | ESI | Common Stock, par value $0.01 per share | D | 2 866 | 39 095 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Liebowitz Matthew | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −1 067 | −28 | 107 353 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Liebowitz Matthew | ESI | Common Stock, par value $0.01 per share | D | 2 388 | 108 420 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Liebowitz Matthew | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −1 320 | −34 | 106 032 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Liebowitz Matthew | ESI | Common Stock, par value $0.01 per share | D | 3 353 | 107 352 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Liebowitz Matthew | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −1 662 | −43 | 103 999 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Liebowitz Matthew | ESI | Common Stock, par value $0.01 per share | D | 4 222 | 105 661 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Liebowitz Matthew | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −2 864 | −74 | 101 439 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Liebowitz Matthew | ESI | Common Stock, par value $0.01 per share | D | 7 166 | 104 303 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −1 280 | −33 | 567 289 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 2 865 | 568 569 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −1 320 | −34 | 565 704 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 3 353 | 567 024 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −1 173 | −30 | 563 671 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 2 980 | 564 844 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −6 765 | −175 | 561 864 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 17 197 | 568 629 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −1 560 | −40 | 194 858 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 3 582 | 196 418 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −2 200 | −57 | 192 836 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 5 589 | 195 036 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −2 346 | −61 | 189 447 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 5 961 | 191 793 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −4 228 | −109 | 185 832 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 10 749 | 190 060 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −6 578 | −170 | 801 035 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 16 718 | 807 613 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −7 698 | −199 | 790 895 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 19 562 | 798 593 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −8 209 | −212 | 779 031 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 20 861 | 787 240 | ||||||

| 2025-02-14 | 2025-02-12 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 25,8100 | −19 738 | −509 | 766 379 | ||||

| 2025-02-14 | 2025-02-12 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 50 158 | 786 117 | ||||||

| 2024-06-05 | 2024-06-04 | 4 | Maynard-Elliott Nichelle | ESI | Common Stock, par value $0.01 per share | D | 7 365 | 32 154 | ||||||

| 2024-06-05 | 2024-06-04 | 4 | ONEAL E STANLEY | ESI | Common Stock, par value $0.01 per share | D | 7 365 | 285 351 | ||||||

| 2024-06-05 | 2024-06-04 | 4 | GOSS MICHAEL F | ESI | Common Stock, par value $0.01 per share | D | 7 365 | 17 906 | ||||||

| 2024-06-05 | 2024-06-04 | 4 | Filon Elyse Napoli | ESI | Common Stock, par value $0.01 per share | D | 7 365 | 17 906 | ||||||

| 2024-06-05 | 2024-06-04 | 4 | ASHKEN IAN G H By Trust | ESI | Common Stock, par value $0.01 per share | I | 7 365 | 7 365 | ||||||

| 2024-06-05 | 2024-06-04 | 4 | ASHKEN IAN G H | ESI | Common Stock, par value $0.01 per share | D | −7 365 | 0 | ||||||

| 2024-06-05 | 2024-06-04 | 4 | ASHKEN IAN G H | ESI | Common Stock, par value $0.01 per share | D | 7 365 | 7 365 | ||||||

| 2024-06-05 | 2024-06-04 | 4 | Fraser Christopher T. | ESI | Common Stock, par value $0.01 per share | D | 7 365 | 54 728 | ||||||

| 2024-06-05 | 3 | Sofronas Susan W. | ESI | Common Stock, par value $0.01 per share | D | 201 | ||||||||

| 2024-03-01 | 2024-02-28 | 4 | Fricke Richard L. | ESI | Common Stock, par value $0.01 per share | D | 23,4000 | −9 500 | −222 | 36 229 | ||||

| 2024-02-21 | 2024-02-17 | 4 | Liebowitz Matthew | ESI | Common Stock, par value $0.01 per share | D | 23,8600 | −683 | −16 | 97 137 | ||||

| 2024-02-21 | 2024-02-17 | 4 | Liebowitz Matthew | ESI | Common Stock, par value $0.01 per share | D | 1 734 | 97 820 | ||||||

| 2024-02-21 | 2024-02-17 | 4 | Fricke Richard L. | ESI | Common Stock, par value $0.01 per share | D | 23,8600 | −585 | −14 | 45 729 | ||||

| 2024-02-21 | 2024-02-17 | 4 | Fricke Richard L. | ESI | Common Stock, par value $0.01 per share | D | 1 261 | 46 314 | ||||||

| 2024-02-21 | 2024-02-17 | 4/A | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 23,8600 | −1 169 | −28 | 147 650 | ||||

| 2024-02-21 | 2024-02-17 | 4/A | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 2 522 | 148 819 | ||||||

| 2024-02-21 | 2024-02-15 | 4/A | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −1 169 | −27 | 146 297 | ||||

| 2024-02-21 | 2024-02-13 | 4/A | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −1 296 | −30 | 144 945 | ||||

| 2024-02-21 | 2024-02-13 | 4/A | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −10 308 | −239 | 143 446 | ||||

| 2024-02-21 | 2024-02-17 | 4/A | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 23,8600 | −1 534 | −37 | 411 853 | ||||

| 2024-02-21 | 2024-02-17 | 4/A | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 3 310 | 413 387 | ||||||

| 2024-02-21 | 2024-02-15 | 4/A | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −1 771 | −41 | 410 077 | ||||

| 2024-02-21 | 2024-02-13 | 4/A | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −1 296 | −30 | 408 027 | ||||

| 2024-02-21 | 2024-02-13 | 4/A | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −13 551 | −314 | 406 528 | ||||

| 2024-02-21 | 2024-02-17 | 4/A | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 23,8600 | −1 489 | −36 | 551 432 | ||||

| 2024-02-21 | 2024-02-17 | 4/A | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 3 783 | 552 921 | ||||||

| 2024-02-21 | 2024-02-15 | 4/A | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −1 128 | −26 | 549 138 | ||||

| 2024-02-21 | 2024-02-13 | 4/A | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −1 320 | −31 | 547 400 | ||||

| 2024-02-21 | 2024-02-13 | 4/A | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −13 106 | −304 | 545 366 | ||||

| 2024-02-21 | 2024-02-17 | 4/A | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 23,8600 | −1 427 | −34 | 179 311 | ||||

| 2024-02-21 | 2024-02-17 | 4/A | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 3 625 | 180 738 | ||||||

| 2024-02-21 | 2024-02-15 | 4/A | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −1 410 | −33 | 177 113 | ||||

| 2024-02-21 | 2024-02-13 | 4/A | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −2 200 | −51 | 174 940 | ||||

| 2024-02-21 | 2024-02-13 | 4/A | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −12 574 | −292 | 171 551 | ||||

| 2024-02-21 | 2024-02-17 | 4/A | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 23,8600 | −6 204 | −148 | 735 959 | ||||

| 2024-02-21 | 2024-02-17 | 4/A | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 15 764 | 742 163 | ||||||

| 2024-02-21 | 2024-02-15 | 4/A | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −6 579 | −153 | 726 399 | ||||

| 2024-02-21 | 2024-02-13 | 4/A | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −7 698 | −179 | 716 259 | ||||

| 2024-02-21 | 2024-02-13 | 4/A | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −53 969 | −1 252 | 704 395 | ||||

| 2024-02-15 | 3 | Fricke Richard L. | ESI | Common Stock, par value $0.01 per share | D | 45 053 | ||||||||

| 2024-02-15 | 3 | Liebowitz Matthew | ESI | Common Stock, par value $0.01 per share | D | 96 086 | ||||||||

| 2024-02-15 | 2024-02-15 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −1 169 | −27 | 146 297 | ||||

| 2024-02-15 | 2024-02-15 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 2 521 | 147 466 | ||||||

| 2024-02-15 | 2024-02-13 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −1 296 | −30 | 144 945 | ||||

| 2024-02-15 | 2024-02-13 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 2 795 | 146 241 | ||||||

| 2024-02-15 | 2024-02-13 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −10 308 | −239 | 143 446 | ||||

| 2024-02-15 | 2024-02-13 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 21 946 | 153 754 | ||||||

| 2024-02-15 | 2024-02-15 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −1 771 | −41 | 410 077 | ||||

| 2024-02-15 | 2024-02-15 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 3 821 | 411 848 | ||||||

| 2024-02-15 | 2024-02-13 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −1 296 | −30 | 408 027 | ||||

| 2024-02-15 | 2024-02-13 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 2 795 | 409 323 | ||||||

| 2024-02-15 | 2024-02-13 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −13 551 | −314 | 406 528 | ||||

| 2024-02-15 | 2024-02-13 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 28 804 | 420 079 | ||||||

| 2024-02-15 | 2024-02-15 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −1 410 | −33 | 177 113 | ||||

| 2024-02-15 | 2024-02-15 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 3 583 | 178 523 | ||||||

| 2024-02-15 | 2024-02-13 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −2 200 | −51 | 174 940 | ||||

| 2024-02-15 | 2024-02-13 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 5 589 | 177 140 | ||||||

| 2024-02-15 | 2024-02-13 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −12 574 | −292 | 171 551 | ||||

| 2024-02-15 | 2024-02-13 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 31 548 | 184 125 | ||||||

| 2024-02-15 | 2024-02-15 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −1 128 | −26 | 549 138 | ||||

| 2024-02-15 | 2024-02-15 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 2 866 | 550 266 | ||||||

| 2024-02-15 | 2024-02-13 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −1 320 | −31 | 547 400 | ||||

| 2024-02-15 | 2024-02-13 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 3 354 | 548 720 | ||||||

| 2024-02-15 | 2024-02-13 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −13 106 | −304 | 545 366 | ||||

| 2024-02-15 | 2024-02-13 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 32 918 | 558 472 | ||||||

| 2024-02-15 | 2024-02-15 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −6 579 | −153 | 726 399 | ||||

| 2024-02-15 | 2024-02-15 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 16 719 | 732 978 | ||||||

| 2024-02-15 | 2024-02-13 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −7 698 | −179 | 716 259 | ||||

| 2024-02-15 | 2024-02-13 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 19 562 | 723 957 | ||||||

| 2024-02-15 | 2024-02-13 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 23,2000 | −53 969 | −1 252 | 704 395 | ||||

| 2024-02-15 | 2024-02-13 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 137 156 | 758 364 | ||||||

| 2023-09-19 | 2023-09-19 | 4 | Maynard-Elliott Nichelle | ESI | Common Stock, par value $0.01 per share | D | 19,6100 | −4 174 | −82 | 24 789 | ||||

| 2023-08-22 | 2023-08-21 | 4 | FRANKLIN MARTIN E By Family Trust | ESI | Common Stock, par value $0.01 per share | I | 400 000 | 400 000 | ||||||

| 2023-08-22 | 2023-08-21 | 4 | FRANKLIN MARTIN E By Martin E. Franklin Revocable Trust | ESI | Common Stock, par value $0.01 per share | I | −400 000 | 500 000 | ||||||

| 2023-06-07 | 2023-06-07 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 19,0700 | −28 000 | −534 | 131 808 | ||||

| 2023-06-07 | 2023-06-06 | 4 | ONEAL E STANLEY | ESI | Common Stock, par value $0.01 per share | D | 6 367 | 277 986 | ||||||

| 2023-06-07 | 2023-06-06 | 4 | Filon Elyse Napoli | ESI | Common Stock, par value $0.01 per share | D | 6 367 | 10 541 | ||||||

| 2023-06-07 | 2023-06-06 | 4 | Maynard-Elliott Nichelle | ESI | Common Stock, par value $0.01 per share | D | 6 367 | 28 963 | ||||||

| 2023-06-07 | 2023-06-06 | 4 | GOSS MICHAEL F | ESI | Common Stock, par value $0.01 per share | D | 6 367 | 10 541 | ||||||

| 2023-06-07 | 2023-06-06 | 4 | Fraser Christopher T. | ESI | Common Stock, par value $0.01 per share | D | 6 367 | 47 363 | ||||||

| 2023-06-07 | 2023-06-06 | 4 | ASHKEN IAN G H By Tasburgh, LLC | ESI | Common Stock, par value $0.01 per share | I | 6 367 | 1 348 895 | ||||||

| 2023-06-07 | 2023-06-06 | 4 | ASHKEN IAN G H | ESI | Common Stock, par value $0.01 per share | D | −6 367 | 0 | ||||||

| 2023-06-07 | 2023-06-06 | 4 | ASHKEN IAN G H | ESI | Common Stock, par value $0.01 per share | D | 6 367 | 6 367 | ||||||

| 2023-06-01 | 2023-06-01 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 18,0000 | −3 656 | −66 | 153 222 | ||||

| 2023-06-01 | 2023-05-31 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 18,0200 | −2 400 | −43 | 156 878 | ||||

| 2023-06-01 | 2023-05-30 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 18,5000 | −23 944 | −443 | 159 278 | ||||

| 2023-06-01 | 2023-06-01 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 18,0100 | −8 469 | −153 | 621 208 | ||||

| 2023-06-01 | 2023-05-31 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 18,0300 | −25 238 | −455 | 629 677 | ||||

| 2023-06-01 | 2023-05-30 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 18,4900 | −166 293 | −3 075 | 654 915 | ||||

| 2023-02-17 | 2023-02-15 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 20,5800 | −1 169 | −24 | 159 808 | ||||

| 2023-02-17 | 2023-02-15 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 2 522 | 160 977 | ||||||

| 2023-02-17 | 2023-02-15 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 20,5800 | −1 170 | −24 | 158 455 | ||||

| 2023-02-17 | 2023-02-15 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 2 523 | 159 625 | ||||||

| 2023-02-17 | 2023-02-15 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 20,5800 | −962 | −20 | 157 102 | ||||

| 2023-02-17 | 2023-02-15 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 1 845 | 158 064 | ||||||

| 2023-02-17 | 2023-02-15 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 20,5800 | −7 832 | −161 | 156 219 | ||||

| 2023-02-17 | 2023-02-15 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 16 612 | 164 051 | ||||||

| 2023-02-17 | 2023-02-15 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 20,5800 | −1 410 | −29 | 182 577 | ||||

| 2023-02-17 | 2023-02-15 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 3 583 | 183 987 | ||||||

| 2023-02-17 | 2023-02-15 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 20,5800 | −1 427 | −29 | 180 404 | ||||

| 2023-02-17 | 2023-02-15 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 3 626 | 181 831 | ||||||

| 2023-02-17 | 2023-02-15 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 20,5800 | −14 078 | −290 | 178 205 | ||||

| 2023-02-17 | 2023-02-15 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 35 302 | 192 283 | ||||||

| 2023-02-17 | 2023-02-15 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 20,5800 | −1 772 | −36 | 391 275 | ||||

| 2023-02-17 | 2023-02-15 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 3 822 | 393 047 | ||||||

| 2023-02-17 | 2023-02-15 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 20,5800 | −1 535 | −32 | 389 225 | ||||

| 2023-02-17 | 2023-02-15 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 3 311 | 390 760 | ||||||

| 2023-02-17 | 2023-02-15 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 20,5800 | −1 925 | −40 | 387 449 | ||||

| 2023-02-17 | 2023-02-15 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 3 691 | 389 374 | ||||||

| 2023-02-17 | 2023-02-15 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 20,5800 | −15 391 | −317 | 385 683 | ||||

| 2023-02-17 | 2023-02-15 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 33 222 | 401 074 | ||||||

| 2023-02-17 | 2023-02-15 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 20,5800 | −6 580 | −135 | 821 208 | ||||

| 2023-02-17 | 2023-02-15 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 16 720 | 827 788 | ||||||

| 2023-02-17 | 2023-02-15 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 20,5800 | −6 204 | −128 | 811 068 | ||||

| 2023-02-17 | 2023-02-15 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 15 765 | 817 272 | ||||||

| 2023-02-17 | 2023-02-15 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 20,5800 | −32 670 | −672 | 801 507 | ||||

| 2023-02-17 | 2023-02-15 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 83 062 | 834 177 | ||||||

| 2023-02-17 | 2023-02-15 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 20,5800 | −1 129 | −23 | 525 554 | ||||

| 2023-02-17 | 2023-02-15 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 2 867 | 526 683 | ||||||

| 2023-02-17 | 2023-02-15 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 20,5800 | −1 490 | −31 | 523 816 | ||||

| 2023-02-17 | 2023-02-15 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 3 784 | 525 306 | ||||||

| 2023-02-17 | 2023-02-15 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 20,5800 | −17 317 | −356 | 521 522 | ||||

| 2023-02-17 | 2023-02-15 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 43 608 | 538 839 | ||||||

| 2022-11-22 | 2022-11-18 | 4 | FRANKLIN MARTIN E By Foundation | ESI | Common Stock, par value $0.01 per share | I | 18,9000 | 135 000 | 2 552 | 1 037 000 | ||||

| 2022-11-15 | 2022-11-15 | 4 | FRANKLIN MARTIN E By Foundation | ESI | Common Stock, par value $0.01 per share | I | 19,1400 | 350 000 | 6 699 | 902 000 | ||||

| 2022-11-15 | 2022-11-14 | 4 | FRANKLIN MARTIN E By Foundation | ESI | Common Stock, par value $0.01 per share | I | 19,1100 | 250 000 | 4 778 | 552 000 | ||||

| 2022-11-15 | 2022-11-11 | 4 | FRANKLIN MARTIN E By Foundation | ESI | Common Stock, par value $0.01 per share | I | 18,9600 | 302 000 | 5 726 | 302 000 | ||||

| 2022-06-09 | 2022-06-07 | 4 | ONEAL E STANLEY | ESI | Common Stock, par value $0.01 per share | D | 4 174 | 271 619 | ||||||

| 2022-06-09 | 2022-06-07 | 4 | GOSS MICHAEL F | ESI | Common Stock, par value $0.01 per share | D | 4 174 | 4 174 | ||||||

| 2022-06-09 | 2022-06-07 | 4 | Maynard-Elliott Nichelle | ESI | Common Stock, par value $0.01 per share | D | 4 174 | 22 596 | ||||||

| 2022-06-09 | 2022-06-07 | 4 | Filon Elyse Napoli | ESI | Common Stock, par value $0.01 per share | D | 4 174 | 4 174 | ||||||

| 2022-06-09 | 2022-06-07 | 4 | Fraser Christopher T. | ESI | Common Stock, par value $0.01 per share | D | 4 174 | 40 996 | ||||||

| 2022-06-09 | 2022-06-07 | 4 | ASHKEN IAN G H By Tasburgh, LLC | ESI | Common Stock, par value $0.01 per share | I | 4 174 | 1 342 528 | ||||||

| 2022-06-09 | 2022-06-07 | 4 | ASHKEN IAN G H | ESI | Common Stock, par value $0.01 per share | D | −4 174 | 0 | ||||||

| 2022-06-09 | 2022-06-07 | 4 | ASHKEN IAN G H | ESI | Common Stock, par value $0.01 per share | D | 4 174 | 4 174 | ||||||

| 2022-03-18 | 2022-03-18 | 4 | Maynard-Elliott Nichelle | ESI | Common Stock, par value $0.01 per share | D | 22,6700 | −9 141 | −207 | 18 422 | ||||

| 2022-02-22 | 2022-02-17 | 4 | Goralski Michael | ESI | Restricted Stock Units | D | 0,00 | −1 469 | 0 | |||||

| 2022-02-22 | 2022-02-17 | 4 | Goralski Michael | ESI | Restricted Stock Units | D | 0,00 | −1 846 | 1 846 | |||||

| 2022-02-22 | 2022-02-17 | 4 | Goralski Michael | ESI | Restricted Stock Units | D | 0,00 | −2 523 | 5 045 | |||||

| 2022-02-22 | 2022-02-17 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 24,0200 | −681 | −16 | 147 449 | ||||

| 2022-02-22 | 2022-02-17 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 1 469 | 148 130 | ||||||

| 2022-02-22 | 2022-02-17 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 24,0200 | −856 | −21 | 146 661 | ||||

| 2022-02-22 | 2022-02-17 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 1 846 | 147 517 | ||||||

| 2022-02-22 | 2022-02-17 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 24,0200 | −1 170 | −28 | 145 671 | ||||

| 2022-02-22 | 2022-02-17 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 2 523 | 146 841 | ||||||

| 2022-02-22 | 2022-02-17 | 4 | D'Ambrisi Joseph J. | ESI | Restricted Stock Units | D | 0,00 | −2 939 | 0 | |||||

| 2022-02-22 | 2022-02-17 | 4 | D'Ambrisi Joseph J. | ESI | Restricted Stock Units | D | 0,00 | −3 692 | 3 691 | |||||

| 2022-02-22 | 2022-02-17 | 4 | D'Ambrisi Joseph J. | ESI | Restricted Stock Units | D | 0,00 | −3 311 | 6 621 | |||||

| 2022-02-22 | 2022-02-17 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 24,0200 | −1 362 | −33 | 367 852 | ||||

| 2022-02-22 | 2022-02-17 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 2 939 | 369 214 | ||||||

| 2022-02-22 | 2022-02-17 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 24,0200 | −1 711 | −41 | 366 275 | ||||

| 2022-02-22 | 2022-02-17 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 3 692 | 367 986 | ||||||

| 2022-02-22 | 2022-02-17 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 24,0200 | −1 535 | −37 | 364 294 | ||||

| 2022-02-22 | 2022-02-17 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 3 311 | 365 829 | ||||||

| 2022-02-22 | 2022-02-17 | 4 | Dorman Carey J. | ESI | Restricted Stock Units | D | 0,00 | −3 627 | 7 251 | |||||

| 2022-02-22 | 2022-02-17 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 24,0200 | −1 428 | −34 | 156 981 | ||||

| 2022-02-22 | 2022-02-17 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 3 627 | 158 409 | ||||||

| 2022-02-22 | 2022-02-17 | 4 | Capps John Edward | ESI | Restricted Stock Units | D | 0,00 | −3 784 | 7 567 | |||||

| 2022-02-22 | 2022-02-17 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 24,0200 | −1 490 | −36 | 495 231 | ||||

| 2022-02-22 | 2022-02-17 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 3 784 | 496 721 | ||||||

| 2022-02-22 | 2022-02-17 | 4 | Gliklich Benjamin | ESI | Restricted Stock Units | D | 0,00 | −15 766 | 31 529 | |||||

| 2022-02-22 | 2022-02-17 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 24,0200 | −6 204 | −149 | 751 115 | ||||

| 2022-02-22 | 2022-02-17 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 15 766 | 757 319 | ||||||

| 2022-02-17 | 2022-02-15 | 4 | FRANKLIN MARTIN E | ESI | Performance Stock Units | D | 0,00 | 300 000 | 300 000 | |||||

| 2022-02-17 | 2022-02-15 | 4 | FRANKLIN MARTIN E | ESI | Performance Stock Units | D | 0,00 | −400 000 | 0 | |||||

| 2022-02-17 | 2022-02-15 | 4 | FRANKLIN MARTIN E By Martin E. Franklin Revocable Trust | ESI | Common Stock, par value $0.01 per share | I | 400 000 | 900 000 | ||||||

| 2022-02-17 | 2022-02-15 | 4 | FRANKLIN MARTIN E | ESI | Common Stock, par value $0.01 per share | D | −400 000 | 0 | ||||||

| 2022-02-17 | 2022-02-15 | 4 | FRANKLIN MARTIN E | ESI | Common Stock, par value $0.01 per share | D | 400 000 | 400 000 | ||||||

| 2022-02-17 | 2022-02-15 | 4 | Gliklich Benjamin | ESI | Restricted Stock Units | D | 0,00 | 50 157 | 50 157 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Gliklich Benjamin | ESI | Performance Stock Units | D | 0,00 | 100 316 | 100 316 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Gliklich Benjamin | ESI | Performance Stock Units | D | 0,00 | 1 000 000 | 1 000 000 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Gliklich Benjamin | ESI | Performance Stock Units | D | 0,00 | −58 789 | 0 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Gliklich Benjamin | ESI | Performance Stock Units | D | 0,00 | −909 091 | 0 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 23,2600 | −34 701 | −807 | 741 553 | ||||

| 2022-02-17 | 2022-02-15 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 88 184 | 776 254 | ||||||

| 2022-02-17 | 2022-02-15 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 23,2600 | −357 714 | −8 320 | 688 070 | ||||

| 2022-02-17 | 2022-02-15 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 909 091 | 1 045 784 | ||||||

| 2022-02-17 | 2022-02-15 | 4 | Capps John Edward | ESI | Restricted Stock Units | D | 0,00 | 8 598 | 8 598 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Capps John Edward | ESI | Performance Stock Units | D | 0,00 | 17 197 | 17 197 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Capps John Edward | ESI | Performance Stock Units | D | 0,00 | 120 000 | 120 000 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Capps John Edward | ESI | Performance Stock Units | D | 0,00 | −30 865 | 0 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Capps John Edward | ESI | Performance Stock Units | D | 0,00 | −227 273 | 0 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 23,2600 | −18 219 | −424 | 492 937 | ||||

| 2022-02-17 | 2022-02-15 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 46 298 | 511 156 | ||||||

| 2022-02-17 | 2022-02-15 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 23,2600 | −89 541 | −2 083 | 464 858 | ||||

| 2022-02-17 | 2022-02-15 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 227 273 | 554 399 | ||||||

| 2022-02-17 | 2022-02-15 | 4 | Dorman Carey J. | ESI | Restricted Stock Units | D | 0,00 | 10 748 | 10 748 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Dorman Carey J. | ESI | Performance Stock Units | D | 0,00 | 21 497 | 21 497 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Dorman Carey J. | ESI | Performance Stock Units | D | 0,00 | 320 000 | 320 000 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Dorman Carey J. | ESI | Performance Stock Units | D | 0,00 | −17 312 | 0 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Dorman Carey J. | ESI | Performance Stock Units | D | 0,00 | −8 819 | 0 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Dorman Carey J. | ESI | Performance Stock Units | D | 0,00 | −113 637 | 0 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Dorman Carey J. | ESI | Performance Stock Units | D | 0,00 | −68 182 | 0 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 23,2600 | −10 219 | −238 | 154 782 | ||||

| 2022-02-17 | 2022-02-15 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 25 968 | 165 001 | ||||||

| 2022-02-17 | 2022-02-15 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 23,2600 | −5 358 | −125 | 139 033 | ||||

| 2022-02-17 | 2022-02-15 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 13 229 | 144 391 | ||||||

| 2022-02-17 | 2022-02-15 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 23,2600 | −44 717 | −1 040 | 131 162 | ||||

| 2022-02-17 | 2022-02-15 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 113 637 | 175 879 | ||||||

| 2022-02-17 | 2022-02-15 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 23,2600 | −26 830 | −624 | 62 242 | ||||

| 2022-02-17 | 2022-02-15 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 68 182 | 89 072 | ||||||

| 2022-02-17 | 2022-02-15 | 4 | D'Ambrisi Joseph J. | ESI | Restricted Stock Units | D | 0,00 | 11 464 | 11 464 | |||||

| 2022-02-17 | 2022-02-15 | 4 | D'Ambrisi Joseph J. | ESI | Performance Stock Units | D | 0,00 | 22 930 | 22 930 | |||||

| 2022-02-17 | 2022-02-15 | 4 | D'Ambrisi Joseph J. | ESI | Performance Stock Units | D | 0,00 | −17 637 | 0 | |||||

| 2022-02-17 | 2022-02-15 | 4 | D'Ambrisi Joseph J. | ESI | Performance Stock Units | D | 0,00 | −181 818 | 0 | |||||

| 2022-02-17 | 2022-02-15 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 23,2600 | −12 429 | −289 | 362 518 | ||||

| 2022-02-17 | 2022-02-15 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 26 456 | 374 947 | ||||||

| 2022-02-17 | 2022-02-15 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 23,2600 | −84 255 | −1 960 | 348 491 | ||||

| 2022-02-17 | 2022-02-15 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 181 818 | 432 746 | ||||||

| 2022-02-17 | 2022-02-15 | 4 | Goralski Michael | ESI | Restricted Stock Units | D | 0,00 | 7 564 | 7 564 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Goralski Michael | ESI | Performance Stock Units | D | 0,00 | 15 130 | 15 130 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Goralski Michael | ESI | Performance Stock Units | D | 0,00 | −8 818 | 0 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Goralski Michael | ESI | Performance Stock Units | D | 0,00 | −181 818 | 0 | |||||

| 2022-02-17 | 2022-02-15 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 23,2600 | −6 309 | −147 | 144 318 | ||||

| 2022-02-17 | 2022-02-15 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 13 227 | 150 617 | ||||||

| 2022-02-17 | 2022-02-15 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 23,2600 | −84 255 | −1 960 | 137 390 | ||||

| 2022-02-17 | 2022-02-15 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 181 818 | 221 645 | ||||||

| 2021-07-09 | 2021-07-08 | 4 | ONEAL E STANLEY By Trust | ESI | Common Stock, par value $0.01 per share | I | 28 538 | 28 538 | ||||||

| 2021-07-09 | 2021-07-08 | 4 | ONEAL E STANLEY By Trust | ESI | Common Stock, par value $0.01 per share | I | 28 539 | 28 539 | ||||||

| 2021-07-09 | 2021-07-08 | 4 | ONEAL E STANLEY By Trust | ESI | Common Stock, par value $0.01 per share | I | −57 077 | 0 | ||||||

| 2021-06-09 | 2021-06-08 | 4 | ONEAL E STANLEY | ESI | Restricted Stock Units | D | 0,00 | 4 174 | 4 174 | |||||

| 2021-06-09 | 2021-06-08 | 4 | ONEAL E STANLEY | ESI | Restricted Stock Units | D | 0,00 | −9 141 | 0 | |||||

| 2021-06-09 | 2021-06-08 | 4 | ONEAL E STANLEY | ESI | Common Stock, par value $0.01 per share | D | 9 141 | 267 445 | ||||||

| 2021-06-09 | 2021-06-08 | 4 | Maynard-Elliott Nichelle | ESI | Restricted Stock Units | D | 0,00 | 4 174 | 4 174 | |||||

| 2021-06-09 | 2021-06-08 | 4 | Maynard-Elliott Nichelle | ESI | Restricted Stock Units | D | 0,00 | −9 141 | 0 | |||||

| 2021-06-09 | 2021-06-08 | 4 | Maynard-Elliott Nichelle | ESI | Common Stock, par value $0.01 per share | D | 9 141 | 27 563 | ||||||

| 2021-06-09 | 2021-06-08 | 4 | GOSS MICHAEL F | ESI | Restricted Stock Units | D | 0,00 | 4 174 | 4 174 | |||||

| 2021-06-09 | 2021-06-08 | 4 | GOSS MICHAEL F | ESI | Restricted Stock Units | D | 0,00 | −9 141 | 0 | |||||

| 2021-06-09 | 2021-06-08 | 4 | GOSS MICHAEL F | ESI | Common Stock, par value $0.01 per share | D | 9 141 | 151 683 | ||||||

| 2021-06-09 | 2021-06-08 | 4 | Fraser Christopher T. | ESI | Restricted Stock Units | D | 0,00 | 4 174 | 4 174 | |||||

| 2021-06-09 | 2021-06-08 | 4 | Fraser Christopher T. | ESI | Restricted Stock Units | D | 0,00 | −9 141 | 0 | |||||

| 2021-06-09 | 2021-06-08 | 4 | Fraser Christopher T. | ESI | Common Stock, par value $0.01 per share | D | 9 141 | 36 822 | ||||||

| 2021-06-09 | 2021-06-08 | 4 | Benson Scot | ESI | Restricted Stock Units | D | 0,00 | −9 141 | 0 | |||||

| 2021-06-09 | 2021-06-08 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 9 141 | 337 980 | ||||||

| 2021-06-09 | 2021-06-08 | 4 | ASHKEN IAN G H | ESI | Restricted Stock Units | D | 0,00 | 4 174 | 4 174 | |||||

| 2021-06-09 | 2021-06-08 | 4 | ASHKEN IAN G H | ESI | Restricted Stock Units | D | 0,00 | −9 141 | 0 | |||||

| 2021-06-09 | 2021-06-08 | 4 | ASHKEN IAN G H By Tasburgh, LLC | ESI | Common Stock, par value $0.01 per share | I | 9 141 | 1 338 354 | ||||||

| 2021-06-09 | 2021-06-08 | 4 | ASHKEN IAN G H | ESI | Common Stock, par value $0.01 per share | D | −9 141 | 0 | ||||||

| 2021-06-09 | 2021-06-08 | 4 | ASHKEN IAN G H | ESI | Common Stock, par value $0.01 per share | D | 9 141 | 9 141 | ||||||

| 2021-03-04 | 2021-03-02 | 4 | Benson Scot | ESI | Stock Option (Right to Buy) | D | 11,34 | 11,3400 | −55 409 | −628 | 0 | |||

| 2021-03-04 | 2021-03-02 | 4 | Benson Scot | ESI | Stock Option (Right to Buy) | D | 11,34 | 11,3400 | −8 818 | −100 | 0 | |||

| 2021-03-04 | 2021-03-02 | 4 | Benson Scot | ESI | Stock Option (Right to Buy) | D | 12,25 | 12,2500 | −66 401 | −813 | 0 | |||

| 2021-03-04 | 2021-03-02 | 4 | Benson Scot | ESI | Stock Option (Right to Buy) | D | 12,25 | 12,2500 | −8 163 | −100 | 0 | |||

| 2021-03-04 | 2021-03-02 | 4 | Benson Scot | ESI | Stock Option (Right to Buy) | D | 13,30 | 13,3000 | −24 794 | −330 | 0 | |||

| 2021-03-04 | 2021-03-02 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 18,5800 | −1 499 | −28 | 328 794 | ||||

| 2021-03-04 | 2021-03-02 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 18,5800 | −120 501 | −2 239 | 330 293 | ||||

| 2021-03-04 | 2021-03-02 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 11,3400 | 55 409 | 628 | 450 794 | ||||

| 2021-03-04 | 2021-03-02 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 11,3400 | 8 818 | 100 | 395 385 | ||||

| 2021-03-04 | 2021-03-02 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 12,2500 | 66 401 | 813 | 386 567 | ||||

| 2021-03-04 | 2021-03-02 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 12,2500 | 8 163 | 100 | 320 166 | ||||

| 2021-03-04 | 2021-03-02 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 13,3000 | 24 794 | 330 | 312 003 | ||||

| 2021-02-19 | 2021-02-19 | 4 | Mount Patricia | ESI | Restricted Stock Units | D | 0,00 | −1 084 | 0 | |||||

| 2021-02-19 | 2021-02-19 | 4 | Mount Patricia | ESI | Common Stock, par value $0.01 per share | D | 17,6800 | −444 | −8 | 640 | ||||

| 2021-02-19 | 2021-02-19 | 4 | Mount Patricia | ESI | Common Stock, par value $0.01 per share | D | 1 084 | 1 084 | ||||||

| 2021-02-19 | 2021-02-19 | 4 | Goralski Michael | ESI | Restricted Stock Units | D | 0,00 | −1 470 | 1 470 | |||||

| 2021-02-19 | 2021-02-19 | 4 | Goralski Michael | ESI | Restricted Stock Units | D | 0,00 | −1 847 | 3 691 | |||||

| 2021-02-19 | 2021-02-19 | 4 | Goralski Michael | ESI | Restricted Stock Units | D | 0,00 | −813 | 0 | |||||

| 2021-02-19 | 2021-02-19 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 17,6800 | −760 | −13 | 39 827 | ||||

| 2021-02-19 | 2021-02-19 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 1 470 | 40 587 | ||||||

| 2021-02-19 | 2021-02-19 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 17,6800 | −954 | −17 | 39 117 | ||||

| 2021-02-19 | 2021-02-19 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 1 847 | 40 071 | ||||||

| 2021-02-19 | 2021-02-19 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 17,6800 | −420 | −7 | 38 224 | ||||

| 2021-02-19 | 2021-02-19 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 813 | 38 644 | ||||||

| 2021-02-19 | 2021-02-17 | 4 | Goralski Michael | ESI | Restricted Stock Units | D | 0,00 | 7 568 | 7 568 | |||||

| 2021-02-19 | 2021-02-17 | 4 | Goralski Michael | ESI | Performance Stock Units | D | 0,00 | 15 134 | 15 134 | |||||

| 2021-02-19 | 2021-02-19 | 4 | Capps John Edward | ESI | Restricted Stock Units | D | 0,00 | −5 690 | 0 | |||||

| 2021-02-19 | 2021-02-19 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 17,6800 | −1 529 | −27 | 327 126 | ||||

| 2021-02-19 | 2021-02-19 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 5 690 | 328 655 | ||||||

| 2021-02-19 | 2021-02-17 | 4 | Capps John Edward | ESI | Restricted Stock Units | D | 0,00 | 11 351 | 11 351 | |||||

| 2021-02-19 | 2021-02-17 | 4 | Capps John Edward | ESI | Performance Stock Units | D | 0,00 | 22 702 | 22 702 | |||||

| 2021-02-19 | 2021-02-19 | 4 | D'Ambrisi Joseph J. | ESI | Restricted Stock Units | D | 0,00 | −2 710 | 0 | |||||

| 2021-02-19 | 2021-02-19 | 4 | D'Ambrisi Joseph J. | ESI | Restricted Stock Units | D | 0,00 | −2 940 | 2 939 | |||||

| 2021-02-19 | 2021-02-19 | 4 | D'Ambrisi Joseph J. | ESI | Restricted Stock Units | D | 0,00 | −3 692 | 7 383 | |||||

| 2021-02-19 | 2021-02-19 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 17,6800 | −993 | −18 | 250 928 | ||||

| 2021-02-19 | 2021-02-19 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 2 710 | 251 921 | ||||||

| 2021-02-19 | 2021-02-19 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 17,6800 | −913 | −16 | 249 211 | ||||

| 2021-02-19 | 2021-02-19 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 2 940 | 250 124 | ||||||

| 2021-02-19 | 2021-02-19 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 17,6800 | −1 214 | −21 | 247 184 | ||||

| 2021-02-19 | 2021-02-19 | 4 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 3 692 | 248 398 | ||||||

| 2021-02-19 | 2021-02-17 | 4 | D'Ambrisi Joseph J. | ESI | Restricted Stock Units | D | 0,00 | 9 932 | 9 932 | |||||

| 2021-02-19 | 2021-02-17 | 4 | D'Ambrisi Joseph J. | ESI | Performance Stock Units | D | 0,00 | 19 864 | 19 864 | |||||

| 2021-02-19 | 2021-02-19 | 4 | Dorman Carey J. | ESI | Restricted Stock Units | D | 0,00 | −1 084 | 0 | |||||

| 2021-02-19 | 2021-02-19 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 17,6800 | −322 | −6 | 20 890 | ||||

| 2021-02-19 | 2021-02-19 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 1 084 | 21 212 | ||||||

| 2021-02-19 | 2021-02-17 | 4 | Dorman Carey J. | ESI | Restricted Stock Units | D | 0,00 | 10 878 | 10 878 | |||||

| 2021-02-19 | 2021-02-17 | 4 | Dorman Carey J. | ESI | Performance Stock Units | D | 0,00 | 21 756 | 21 756 | |||||

| 2021-02-19 | 2021-02-19 | 4 | Gliklich Benjamin | ESI | Restricted Stock Units | D | 0,00 | −5 690 | 0 | |||||

| 2021-02-19 | 2021-02-19 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 17,6800 | −1 866 | −33 | 136 693 | ||||

| 2021-02-19 | 2021-02-19 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 5 690 | 138 559 | ||||||

| 2021-02-19 | 2021-02-17 | 4 | Gliklich Benjamin | ESI | Restricted Stock Units | D | 0,00 | 47 295 | 47 295 | |||||

| 2021-02-19 | 2021-02-17 | 4 | Gliklich Benjamin | ESI | Performance Stock Units | D | 0,00 | 94 590 | 94 590 | |||||

| 2021-01-05 | 2020-12-31 | 4 | Goralski Michael | ESI | Performance Stock Units | D | 0,00 | −16 781 | 0 | |||||

| 2021-01-05 | 2020-12-31 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 17,7300 | −7 777 | −138 | 37 831 | ||||

| 2021-01-05 | 2020-12-31 | 4 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 16 781 | 45 608 | ||||||

| 2020-12-28 | 3 | Goralski Michael | ESI | Common Stock, par value $0.01 per share | D | 28 827 | ||||||||

| 2020-12-28 | 3 | D'Ambrisi Joseph J. | ESI | Common Stock, par value $0.01 per share | D | 244 706 | ||||||||

| 2020-11-05 | 2020-11-03 | 4 | Mount Patricia By Trust | ESI | Common Stock, par value $0.01 per share | I | 11,8500 | −3 000 | −36 | 32 862 | ||||

| 2020-10-08 | 2020-10-06 | 4 | FRANKLIN MARTIN E By Martin E. Franklin Revocable Trust | ESI | Common Stock, par value $0.01 per share | I | 11,5000 | 500 000 | 5 750 | 500 000 | ||||

| 2020-09-17 | 2020-09-15 | 4 | Fraser Christopher T. | ESI | Common Stock, par value $0.01 per share | D | 11,4800 | 1 427 | 16 | 27 681 | ||||

| 2020-09-17 | 2020-09-15 | 4 | Fraser Christopher T. | ESI | Common Stock, par value $0.01 per share | D | 11,4900 | 6 573 | 76 | 26 254 | ||||

| 2020-08-28 | 2020-08-27 | 4 | Mount Patricia By Trust | ESI | Common Stock, par value $0.01 per share | I | −1 000 | 35 862 | ||||||

| 2020-07-16 | 2020-07-14 | 4 | Benson Scot | ESI | Performance Stock Units | D | 0,00 | −58 789 | 0 | |||||

| 2020-07-16 | 2020-07-14 | 4 | Benson Scot | ESI | Performance Stock Units | D | 0,00 | −43 904 | 0 | |||||

| 2020-07-16 | 2020-07-14 | 4 | Benson Scot | ESI | Restricted Stock Units | D | 0,00 | −7 316 | 0 | |||||

| 2020-07-16 | 2020-07-14 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 11,0500 | −23 134 | −256 | 287 164 | ||||

| 2020-07-16 | 2020-07-14 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 58 789 | 310 298 | ||||||

| 2020-07-16 | 2020-07-14 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 11,0500 | −17 277 | −191 | 251 509 | ||||

| 2020-07-16 | 2020-07-14 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 43 904 | 268 786 | ||||||

| 2020-07-16 | 2020-07-14 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 11,0500 | −2 879 | −32 | 224 882 | ||||

| 2020-07-16 | 2020-07-14 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 7 316 | 227 761 | ||||||

| 2020-07-16 | 2020-07-14 | 4 | Dorman Carey J. | ESI | Performance Stock Units | D | 0,00 | 68 182 | 68 182 | |||||

| 2020-06-18 | 2020-06-16 | 4 | ASHKEN IAN G H | ESI | Restricted Stock Units | D | 0,00 | 9 141 | 9 141 | |||||

| 2020-06-18 | 2020-06-16 | 4 | Benson Scot | ESI | Restricted Stock Units | D | 0,00 | 9 141 | 9 141 | |||||

| 2020-06-18 | 2020-06-16 | 4 | Fraser Christopher T. | ESI | Restricted Stock Units | D | 0,00 | 9 141 | 9 141 | |||||

| 2020-06-18 | 2020-06-16 | 4 | GOSS MICHAEL F | ESI | Restricted Stock Units | D | 0,00 | 9 141 | 9 141 | |||||

| 2020-06-18 | 2020-06-16 | 4 | Maynard-Elliott Nichelle | ESI | Restricted Stock Units | D | 0,00 | 9 141 | 9 141 | |||||

| 2020-06-18 | 2020-06-16 | 4 | ONEAL E STANLEY | ESI | Restricted Stock Units | D | 0,00 | 9 141 | 9 141 | |||||

| 2020-06-05 | 2020-06-05 | 4 | ASHKEN IAN G H | ESI | Restricted Stock Units | D | 0,00 | −9 681 | 0 | |||||

| 2020-06-05 | 2020-06-05 | 4 | ASHKEN IAN G H By Trust | ESI | Common Stock, par value $0.01 per share | I | 9 681 | 26 283 | ||||||

| 2020-06-05 | 2020-06-05 | 4 | ASHKEN IAN G H | ESI | Common Stock, par value $0.01 per share | D | −9 681 | 0 | ||||||

| 2020-06-05 | 2020-06-05 | 4 | ASHKEN IAN G H | ESI | Common Stock, par value $0.01 per share | D | 9 681 | 9 681 | ||||||

| 2020-06-05 | 2020-06-05 | 4 | Fraser Christopher T. | ESI | Restricted Stock Units | D | 0,00 | −9 681 | 0 | |||||

| 2020-06-05 | 2020-06-05 | 4 | Fraser Christopher T. | ESI | Common Stock, par value $0.01 per share | D | 9 681 | 19 681 | ||||||

| 2020-06-05 | 2020-06-05 | 4 | GOSS MICHAEL F | ESI | Restricted Stock Units | D | 0,00 | −9 681 | 0 | |||||

| 2020-06-05 | 2020-06-05 | 4 | GOSS MICHAEL F | ESI | Common Stock, par value $0.01 per share | D | 9 681 | 142 542 | ||||||

| 2020-06-05 | 2020-06-05 | 4 | Maynard-Elliott Nichelle | ESI | Restricted Stock Units | D | 0,00 | −9 681 | 0 | |||||

| 2020-06-05 | 2020-06-05 | 4 | Maynard-Elliott Nichelle | ESI | Common Stock, par value $0.01 per share | D | 9 681 | 18 422 | ||||||

| 2020-06-05 | 2020-06-05 | 4 | ONEAL E STANLEY | ESI | Restricted Stock Units | D | 0,00 | −9 681 | 0 | |||||

| 2020-06-05 | 2020-06-05 | 4 | ONEAL E STANLEY | ESI | Common Stock, par value $0.01 per share | D | 9 681 | 258 304 | ||||||

| 2020-06-05 | 2020-06-05 | 4 | SACHDEV RAKESH | ESI | Restricted Stock Units | D | 0,00 | −9 681 | 0 | |||||

| 2020-06-05 | 2020-06-05 | 4 | SACHDEV RAKESH By Trust | ESI | Common Stock, par value $0.01 per share | I | 9 681 | 723 752 | ||||||

| 2020-06-05 | 2020-06-05 | 4 | SACHDEV RAKESH | ESI | Common Stock, par value $0.01 per share | D | −9 681 | 0 | ||||||

| 2020-06-05 | 2020-06-05 | 4 | SACHDEV RAKESH | ESI | Common Stock, par value $0.01 per share | D | 9 681 | 9 681 | ||||||

| 2020-05-15 | 2020-05-15 | 4 | Mount Patricia By Trust | ESI | Common Stock, par value $0.01 per share | I | 33 162 | 36 862 | ||||||

| 2020-05-15 | 2020-05-15 | 4 | Mount Patricia | ESI | Common Stock, par value $0.01 per share | D | −33 162 | 0 | ||||||

| 2020-03-18 | 2020-03-18 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 6,5300 | 500 | 3 | 20 128 | ||||

| 2020-03-18 | 2020-03-17 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 6,9800 | 500 | 3 | 19 628 | ||||

| 2020-03-18 | 2020-03-16 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 6,5900 | 1 500 | 10 | 19 128 | ||||

| 2020-03-11 | 2020-03-09 | 4 | ASHKEN IAN G H By IGHA Holdings, LLLP | ESI | Common Stock, par value $0.01 per share | I | 8,9200 | 50 000 | 446 | 598 880 | ||||

| 2020-03-10 | 2020-03-06 | 4 | Benson Scot | ESI | Stock Option (Right to Buy) | D | 7,95 | −10 212 | 0 | |||||

| 2020-03-10 | 2020-03-06 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 9,7700 | 15 000 | 147 | 220 445 | ||||

| 2020-03-10 | 2020-03-06 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 7,9500 | 10 212 | 81 | 205 445 | ||||

| 2020-03-03 | 2020-02-28 | 4 | Gliklich Benjamin | ESI | Stock Option (Right to Buy) | D | 7,95 | −10 000 | 20 637 | |||||

| 2020-03-03 | 2020-02-28 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 7,9500 | 10 000 | 80 | 132 869 | ||||

| 2020-02-27 | 2020-02-27 | 4 | ASHKEN IAN G H By Tasburgh, LLC | ESI | Common Stock, par value $0.01 per share | I | 1 302 929 | 1 302 929 | ||||||

| 2020-02-27 | 2020-02-27 | 4 | ASHKEN IAN G H By Mariposa Acquisition, LLC | ESI | Common Stock, par value $0.01 per share | I | −1 302 929 | 0 | ||||||

| 2020-02-27 | 2020-02-25 | 4 | ASHKEN IAN G H By Mariposa Acquisition, LLC | ESI | Series A Preferred Stock, par value $0.01 per share | I | 0,00 | −119 992 | 0 | |||||

| 2020-02-27 | 2020-02-25 | 4 | ASHKEN IAN G H By Mariposa Acquisition, LLC | ESI | Common Stock, par value $0.01 per share | I | 119 992 | 1 302 929 | ||||||

| 2020-02-27 | 2020-02-27 | 4 | FRANKLIN MARTIN E By RSMA, LLC | ESI | Common Stock, par value $0.01 per share | I | 2 605 861 | 2 848 971 | ||||||

| 2020-02-27 | 2020-02-27 | 4 | FRANKLIN MARTIN E By MEF Holdings, LLLP | ESI | Common Stock, par value $0.01 per share | I | 4 452 063 | 6 889 512 | ||||||

| 2020-02-27 | 2020-02-27 | 4 | FRANKLIN MARTIN E By Mariposa Acquisition, LLC | ESI | Common Stock, par value $0.01 per share | I | −11 509 987 | 0 | ||||||

| 2020-02-27 | 2020-02-25 | 4 | FRANKLIN MARTIN E By Mariposa Acquisition, LLC | ESI | Series A Preferred Stock, par value $0.01 per share | I | 0,00 | 1 060 000 | 0 | |||||

| 2020-02-27 | 2020-02-25 | 4 | FRANKLIN MARTIN E By Mariposa Acquisition, LLC | ESI | Common Stock, par value $0.01 per share | I | 1 060 000 | 11 509 987 | ||||||

| 2020-02-21 | 2020-02-19 | 4 | Mount Patricia | ESI | Non-Qualified Stock Options (Right to Buy) | D | 12,25 | 1 292 | 1 292 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Mount Patricia | ESI | Incentive Stock Options (Right to Buy) | D | 12,25 | 8 029 | 8 029 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Mount Patricia | ESI | Performance Stock Units | D | 0,00 | 6 922 | 6 922 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Mount Patricia | ESI | Performance Stock Units | D | 0,00 | −5 038 | 0 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Mount Patricia | ESI | Restricted Stock Units | D | 0,00 | −2 481 | 0 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Mount Patricia | ESI | Restricted Stock Units | D | 0,00 | −1 084 | 1 084 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Mount Patricia | ESI | Common Stock, par value $0.01 per share | D | 12,0400 | −2 060 | −25 | 36 862 | ||||

| 2020-02-21 | 2020-02-19 | 4 | Mount Patricia | ESI | Common Stock, par value $0.01 per share | D | 5 038 | 38 922 | ||||||

| 2020-02-21 | 2020-02-19 | 4 | Mount Patricia | ESI | Common Stock, par value $0.01 per share | D | 12,0400 | −1 006 | −12 | 33 884 | ||||

| 2020-02-21 | 2020-02-19 | 4 | Mount Patricia | ESI | Common Stock, par value $0.01 per share | D | 2 481 | 34 890 | ||||||

| 2020-02-21 | 2020-02-19 | 4 | Mount Patricia | ESI | Common Stock, par value $0.01 per share | D | 12,0400 | −380 | −5 | 32 409 | ||||

| 2020-02-21 | 2020-02-19 | 4 | Mount Patricia | ESI | Common Stock, par value $0.01 per share | D | 1 084 | 32 789 | ||||||

| 2020-02-21 | 2020-02-19 | 4 | Gliklich Benjamin | ESI | Non-Qualified Stock Options (Right to Buy) | D | 12,25 | 66 401 | 66 401 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Gliklich Benjamin | ESI | Incentive Stock Options (Right to Buy) | D | 12,25 | 8 163 | 8 163 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Gliklich Benjamin | ESI | Performance Stock Units | D | 0,00 | 55 374 | 55 374 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Gliklich Benjamin | ESI | Performance Stock Units | D | 0,00 | −19 736 | 0 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Gliklich Benjamin | ESI | Restricted Stock Units | D | 0,00 | −9 869 | 0 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Gliklich Benjamin | ESI | Restricted Stock Units | D | 0,00 | −5 691 | 5 690 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 12,0400 | −6 403 | −77 | 122 869 | ||||

| 2020-02-21 | 2020-02-19 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 19 736 | 129 272 | ||||||

| 2020-02-21 | 2020-02-19 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 12,0400 | −3 193 | −38 | 109 536 | ||||

| 2020-02-21 | 2020-02-19 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 9 869 | 112 729 | ||||||

| 2020-02-21 | 2020-02-19 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 12,0400 | −1 842 | −22 | 102 860 | ||||

| 2020-02-21 | 2020-02-19 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 5 691 | 104 702 | ||||||

| 2020-02-21 | 2020-02-19 | 4 | Benson Scot | ESI | Non-Qualified Stock Options (Right to Buy) | D | 12,25 | 66 401 | 66 401 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Benson Scot | ESI | Incentive Stock Options (Right to Buy) | D | 12,25 | 8 163 | 8 163 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Benson Scot | ESI | Performance Stock Units | D | 0,00 | 55 374 | 55 374 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Benson Scot | ESI | Performance Stock Units | D | 0,00 | −22 556 | 0 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Benson Scot | ESI | Restricted Stock Units | D | 0,00 | −11 279 | 0 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Benson Scot | ESI | Restricted Stock Units | D | 0,00 | −7 317 | 7 316 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 12,0400 | −8 929 | −108 | 195 233 | ||||

| 2020-02-21 | 2020-02-19 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 22 556 | 204 162 | ||||||

| 2020-02-21 | 2020-02-19 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 12,0400 | −4 439 | −53 | 181 606 | ||||

| 2020-02-21 | 2020-02-19 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 11 279 | 186 045 | ||||||

| 2020-02-21 | 2020-02-19 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 12,0400 | −2 880 | −35 | 174 766 | ||||

| 2020-02-21 | 2020-02-19 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 7 317 | 177 646 | ||||||

| 2020-02-21 | 2020-02-19 | 4 | Capps John Edward | ESI | Non-Qualified Stock Options (Right to Buy) | D | 12,25 | 30 983 | 30 983 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Capps John Edward | ESI | Incentive Stock Options (Right to Buy) | D | 12,25 | 8 163 | 8 163 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Capps John Edward | ESI | Performance Stock Units | D | 0,00 | 29 072 | 29 072 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Capps John Edward | ESI | Performance Stock Units | D | 0,00 | −19 736 | 0 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Capps John Edward | ESI | Restricted Stock Units | D | 0,00 | −9 869 | 0 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Capps John Edward | ESI | Restricted Stock Units | D | 0,00 | −5 691 | 5 690 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 12,0400 | −7 947 | −96 | 322 965 | ||||

| 2020-02-21 | 2020-02-19 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 19 736 | 330 912 | ||||||

| 2020-02-21 | 2020-02-19 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 12,0400 | −3 884 | −47 | 311 176 | ||||

| 2020-02-21 | 2020-02-19 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 9 869 | 315 060 | ||||||

| 2020-02-21 | 2020-02-19 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 12,0400 | −2 240 | −27 | 305 191 | ||||

| 2020-02-21 | 2020-02-19 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 5 691 | 307 431 | ||||||

| 2020-02-21 | 2020-02-19 | 4 | Dorman Carey J. | ESI | Non-Qualified Stock Options (Right to Buy) | D | 12,25 | 23 527 | 23 527 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Dorman Carey J. | ESI | Incentive Stock Options (Right to Buy) | D | 12,25 | 8 163 | 8 163 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Dorman Carey J. | ESI | Performance Stock Units | D | 0,00 | 23 534 | 23 534 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Dorman Carey J. | ESI | Performance Stock Units | D | 0,00 | −5 038 | 0 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Dorman Carey J. | ESI | Restricted Stock Units | D | 0,00 | −2 481 | 0 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Dorman Carey J. | ESI | Restricted Stock Units | D | 0,00 | −1 084 | 1 084 | |||||

| 2020-02-21 | 2020-02-19 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 12,0400 | −2 250 | −27 | 17 628 | ||||

| 2020-02-21 | 2020-02-19 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 5 038 | 19 878 | ||||||

| 2020-02-21 | 2020-02-19 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 12,0400 | −1 037 | −12 | 14 840 | ||||

| 2020-02-21 | 2020-02-19 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 2 481 | 15 877 | ||||||

| 2020-02-21 | 2020-02-19 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 12,0400 | −417 | −5 | 13 396 | ||||

| 2020-02-21 | 2020-02-19 | 4 | Dorman Carey J. | ESI | Common Stock, par value $0.01 per share | D | 1 084 | 13 813 | ||||||

| 2019-12-20 | 3 | Mount Patricia | ESI | Common Stock, par value $0.01 per share | D | 63 410 | ||||||||

| 2019-12-20 | 3 | Mount Patricia | ESI | Common Stock, par value $0.01 per share | D | 63 410 | ||||||||

| 2019-12-20 | 3 | Mount Patricia | ESI | Common Stock, par value $0.01 per share | D | 63 410 | ||||||||

| 2019-08-15 | 2019-08-14 | 4 | Capps John Edward | ESI | Common Stock, par value $0.01 per share | D | 9,0000 | 10 000 | 90 | 301 740 | ||||

| 2019-08-14 | 2019-08-13 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 9,3000 | 7 000 | 65 | 170 329 | ||||

| 2019-08-14 | 2019-08-13 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 9,5400 | 3 000 | 29 | 163 329 | ||||

| 2019-08-09 | 2019-08-08 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 9,6300 | 5 000 | 48 | 99 011 | ||||

| 2019-08-09 | 2019-08-07 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 9,3500 | 2 500 | 23 | 94 011 | ||||

| 2019-06-13 | 2019-06-11 | 4 | SACHDEV RAKESH | ESI | Incentive Stock Option (Right to Buy) | D | 7,95 | 7,9500 | −183 824 | −1 461 | 0 | |||

| 2019-06-13 | 2019-06-11 | 4 | SACHDEV RAKESH | ESI | Common Stock, par value $0.01 per share | D | 10,7100 | −28 764 | −308 | 714 071 | ||||

| 2019-06-13 | 2019-06-11 | 4 | SACHDEV RAKESH | ESI | Common Stock, par value $0.01 per share | D | 10,7100 | −155 060 | −1 661 | 742 835 | ||||

| 2019-06-13 | 2019-06-11 | 4 | SACHDEV RAKESH | ESI | Common Stock, par value $0.01 per share | D | 7,9500 | 183 824 | 1 461 | 897 895 | ||||

| 2019-06-07 | 2019-06-05 | 4 | Fraser Christopher T. | ESI | Restricted Stock Units | D | 0,00 | 9 681 | 9 681 | |||||

| 2019-06-07 | 2019-06-05 | 4 | Maynard-Elliott Nichelle | ESI | Restricted Stock Units | D | 0,00 | 9 681 | 9 681 | |||||

| 2019-06-07 | 2019-06-05 | 4 | Maynard-Elliott Nichelle | ESI | Restricted Stock Units | D | 0,00 | −8 741 | 0 | |||||

| 2019-06-07 | 2019-06-05 | 4 | Maynard-Elliott Nichelle | ESI | Common Stock, par value $0.01 per share | D | 8 741 | 8 741 | ||||||

| 2019-06-07 | 2019-06-05 | 4 | ONEAL E STANLEY | ESI | Restricted Stock Units | D | 0,00 | 9 681 | 9 681 | |||||

| 2019-06-07 | 2019-06-05 | 4 | ONEAL E STANLEY | ESI | Restricted Stock Units | D | 0,00 | −8 741 | 0 | |||||

| 2019-06-07 | 2019-06-05 | 4 | ONEAL E STANLEY | ESI | Common Stock, par value $0.01 per share | D | 8 741 | 248 623 | ||||||

| 2019-06-07 | 2019-06-05 | 4 | SACHDEV RAKESH | ESI | Restricted Stock Units | D | 0,00 | 9 681 | 9 681 | |||||

| 2019-06-07 | 2019-06-05 | 4 | ASHKEN IAN G H | ESI | Restricted Stock Units | D | 0,00 | 9 681 | 9 681 | |||||

| 2019-06-07 | 2019-06-05 | 4 | ASHKEN IAN G H | ESI | Restricted Stock Units | D | 0,00 | −8 741 | 0 | |||||

| 2019-06-07 | 2019-06-05 | 4 | ASHKEN IAN G H By Trust | ESI | Common Stock, par value $0.01 per share | I | 8 741 | 16 602 | ||||||

| 2019-06-07 | 2019-06-05 | 4 | ASHKEN IAN G H | ESI | Common Stock, par value $0.01 per share | D | −8 741 | 0 | ||||||

| 2019-06-07 | 2019-06-05 | 4 | ASHKEN IAN G H | ESI | Common Stock, par value $0.01 per share | D | 8 741 | 8 741 | ||||||

| 2019-06-07 | 2019-06-05 | 4 | GOSS MICHAEL F | ESI | Restricted Stock Units | D | 0,00 | 9 681 | 9 681 | |||||

| 2019-06-07 | 2019-06-05 | 4 | GOSS MICHAEL F | ESI | Restricted Stock Units | D | 0,00 | −8 741 | 0 | |||||

| 2019-06-07 | 2019-06-05 | 4 | GOSS MICHAEL F | ESI | Common Stock, par value $0.01 per share | D | 8 741 | 132 861 | ||||||

| 2019-05-15 | 2019-05-13 | 4 | Benson Scot | ESI | Common Stock, par value $0.01 per share | D | 10,5000 | 20 000 | 210 | 160 329 | ||||

| 2019-04-24 | 3 | Fraser Christopher T. | ESI | Common Stock, par value $0.01 per share | D | 20 000 | ||||||||

| 2019-04-24 | 3 | Fraser Christopher T. | ESI | Common Stock, par value $0.01 per share | D | 20 000 | ||||||||

| 2019-04-24 | 3 | Fraser Christopher T. | ESI | Common Stock, par value $0.01 per share | D | 20 000 | ||||||||

| 2019-04-19 | 2018-12-21 | 4/A | FRANKLIN MARTIN E By MEF Holdings II, LLLP | ESI | Common Stock, par value $0.01 per share | I | −2 419 258 | 2 419 500 | ||||||

| 2019-03-19 | 2019-03-18 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 10,4700 | −46 132 | −483 | 91 511 | ||||

| 2019-03-19 | 2019-03-15 | 4 | Gliklich Benjamin | ESI | Performance Stock Units | D | 0,00 | −50 000 | 0 | |||||

| 2019-03-19 | 2019-03-15 | 4 | Gliklich Benjamin | ESI | Restricted Stock Units | D | 0,00 | −15 723 | 0 | |||||

| 2019-03-19 | 2019-03-15 | 4 | Gliklich Benjamin | ESI | Performance Stock Units | D | 0,00 | −50 159 | 0 | |||||

| 2019-03-19 | 2019-03-15 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 50 000 | 137 643 | ||||||

| 2019-03-19 | 2019-03-15 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 15 723 | 87 643 | ||||||

| 2019-03-19 | 2019-03-15 | 4 | Gliklich Benjamin | ESI | Common Stock, par value $0.01 per share | D | 50 159 | 71 920 | ||||||

| 2019-03-19 | 2019-03-18 | 4 | SACHDEV RAKESH | ESI | Common Stock | D | 10,4900 | −157 073 | −1 648 | 714 071 | ||||

| 2019-03-19 | 2019-03-15 | 4 | SACHDEV RAKESH | ESI | Restricted Stock Units | D | 0,00 | −94 340 | 0 | |||||