Grundläggande statistik

| Institutionella aktier (lång) | 4 295 001 - 1,40% (ex 13D/G) - change of 0,00MM shares 0,00% MRQ |

| Institutionellt värde (lång) | $ 4 191 USD ($1000) |

Institutionellt ägande och aktieägare

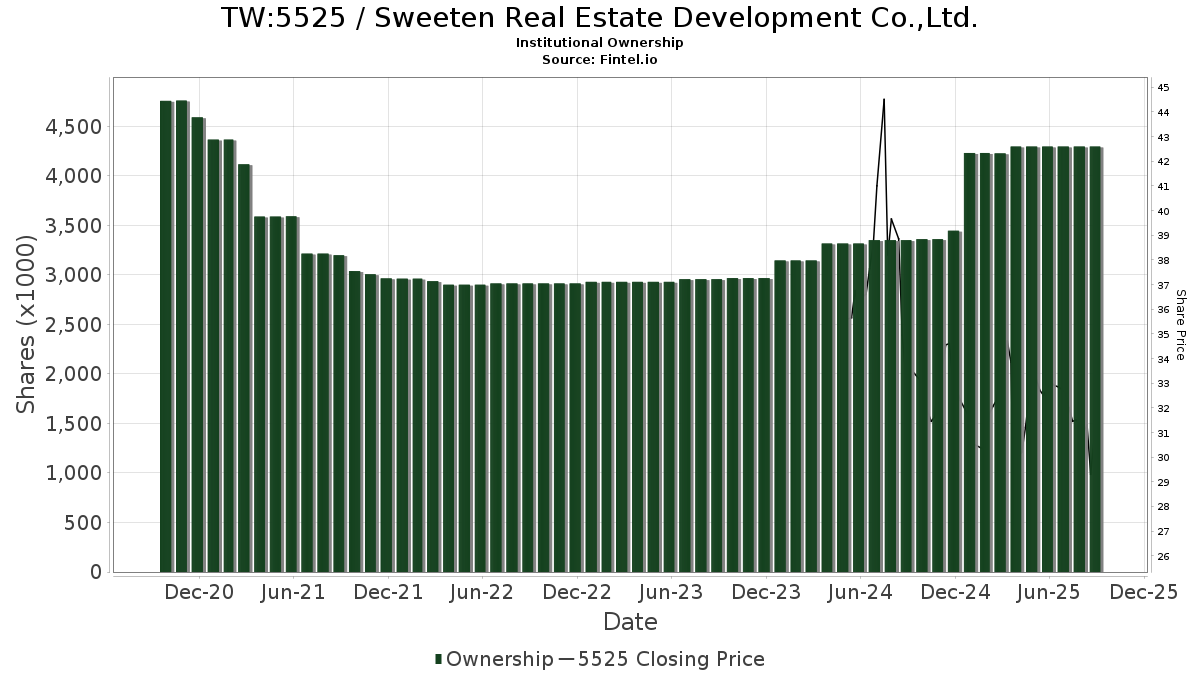

Sweeten Real Estate Development Co.,Ltd. (TW:5525) har 18 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 4,295,001 aktier. Största aktieägare inkluderar DFCEX - Emerging Markets Core Equity Portfolio - Institutional Class, Dimensional Emerging Markets Value Fund - Dimensional Emerging Markets Value Fund, Dfa Investment Trust Co - The Emerging Markets Small Cap Series, VGRLX - Vanguard Global ex-U.S. Real Estate Index Fund Admiral, DFEM - Dimensional Emerging Markets Core Equity 2 ETF, DFA INVESTMENT DIMENSIONS GROUP INC - Emerging Markets Social Core Equity Portfolio Shares, EWX - SPDR(R) S&P(R) EMERGING MARKETS SMALL CAP ETF, DFAX - Dimensional World ex U.S. Core Equity 2 ETF, DFA INVESTMENT DIMENSIONS GROUP INC - World ex U.S. Targeted Value Portfolio Institutional Class, and DFA INVESTMENT DIMENSIONS GROUP INC - Emerging Markets Sustainability Core 1 Portfolio Institutional Class .

Sweeten Real Estate Development Co.,Ltd. (TWSE:5525) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

The share price as of September 12, 2025 is 31,05 / share. Previously, on September 16, 2024, the share price was 35,40 / share. This represents a decline of 12,29% over that period.

Fondsentimentets poäng

Fondsentimentet poängen(fka Ägarackumulation-poäng) visar vilka aktier som är mest köpta av fonder. Det är resultatet av en sofistikerad kvantitativ flerfaktormodell som identifierar företag med de högsta nivåerna av institutionell ackumulering. Poängsättningsmodellen använder en kombination av den totala ökningen av redovisade ägare, förändringarna i portföljallokeringarna för dessa ägare och andra mått. Siffran sträcker sig från 0 till 100, där högre siffror indikerar en högre nivå av ackumulering i förhållande till sina konkurrenter, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Ownership Explorer, som innehåller en lista över de högst rankade företagen.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.