Grundläggande statistik

| Institutionella ägare | 13 total, 13 long only, 0 short only, 0 long/short - change of 0,00% MRQ |

| Genomsnittlig portföljallokering | 0.0109 % - change of 20,50% MRQ |

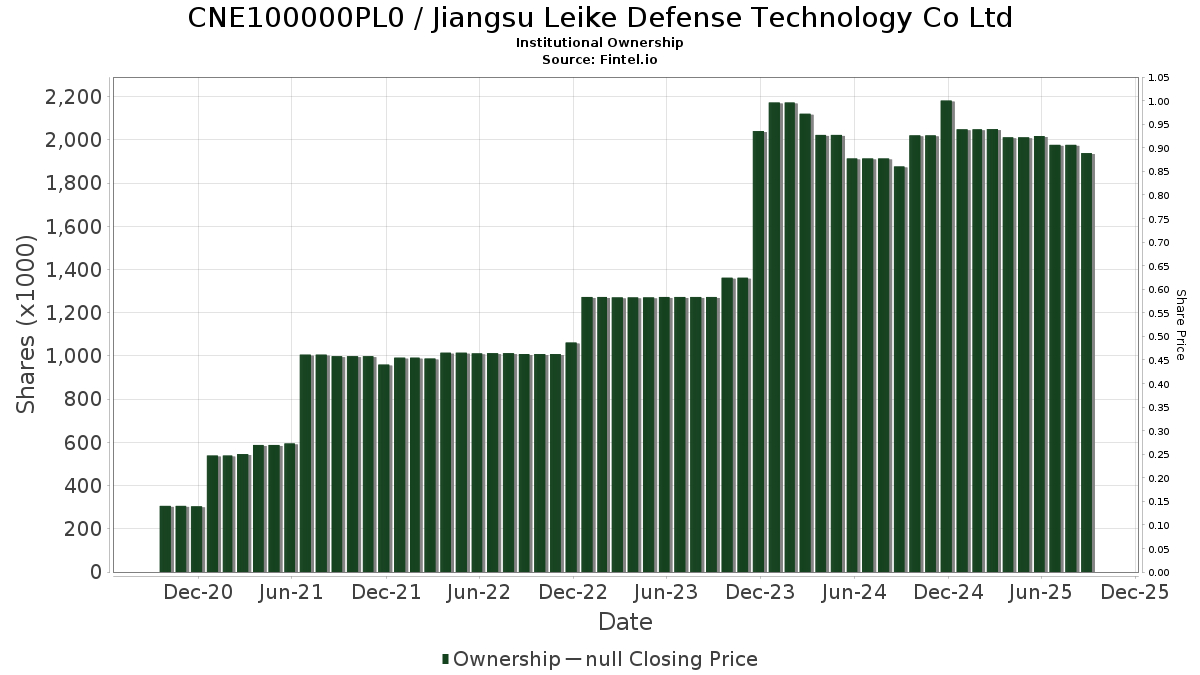

| Institutionella aktier (lång) | 1 939 407 (ex 13D/G) - change of −0,08MM shares −3,92% MRQ |

| Institutionellt värde (lång) | $ 1 296 USD ($1000) |

Institutionellt ägande och aktieägare

Jiangsu Leike Defense Technology Co Ltd (CN:CNE100000PL0) har 13 Institutionella ägare och aktieägare som har lämnat in 13D/G- eller 13F-formulär till Securities Exchange Commission (SEC). Dessa institut innehar totalt 1,939,407 aktier. Största aktieägare inkluderar DFCEX - Emerging Markets Core Equity Portfolio - Institutional Class, Dfa Investment Trust Co - The Emerging Markets Small Cap Series, EWX - SPDR(R) S&P(R) EMERGING MARKETS SMALL CAP ETF, GMF - SPDR(R) S&P(R) EMERGING ASIA PACIFIC ETF, GXC - SPDR(R) S&P(R) CHINA ETF, DFEM - Dimensional Emerging Markets Core Equity 2 ETF, DFAE - Dimensional Emerging Core Equity Market ETF, DFA INVESTMENT DIMENSIONS GROUP INC - Emerging Markets Sustainability Core 1 Portfolio Institutional Class, DFA INVESTMENT DIMENSIONS GROUP INC - Emerging Markets Social Core Equity Portfolio Shares, and DFA INVESTMENT DIMENSIONS GROUP INC - World ex U.S. Targeted Value Portfolio Institutional Class .

Jiangsu Leike Defense Technology Co Ltd (CNE100000PL0) Institutionell ägarstruktur visar institutioners och fonders nuvarande positioner i företaget, samt de senaste förändringarna i positionernas storlek. Större aktieägare kan vara enskilda investerare, fonder, hedgefonder eller institutioner. Bilaga 13D visar att investeraren äger (eller ägde) mer än 5% av företaget och avser (eller avsåg) att aktivt eftersträva en förändring av affärsstrategin. Schedule 13G indikerar en passiv investering på över 5%.

13F- och NPORT-arkiveringar

Detaljer om 13F-arkiveringar är gratis. Detaljer om NP-arkiveringar kräver ett premiummedlemskap. Gröna rader indikerar nya positioner. Röda rader indikerar stängda positioner. Klicka på länk symbolen för att se hela transaktionshistoriken.

Uppgradera

för att låsa upp premiumdata och exportera till Excel ![]() .

.