| Insideraktier | 606 112 shares |

Insider Sentiment Score

Insider sentiment score hittar de företag som köps av foretagsinsynspersoner.

Det är resultatet av en sofistikerad, kvantitativ multifaktormodell som identifierar företag med de högsta nivåerna av insiderackumulation. Poängmodellen använder en kombination av nettoantalet insiders som köpt de föregående 90 dagarna, det totala antalet aktier som köpts i procent av aktiekapitalet och det totala antalet aktier som ägs av insiders. Siffran sträcker sig från 0 till 100, med högre siffror som indikerar en högre nivå av ackumulering för sina kamrater, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Insiders Top Picks, som ger en lista över företag med högsta insiderackumulation.

Office Sentiment Score

Officersentiment Score hittar företag som köps av Corporate Officers.

Per definition Corporate Officers är Corporate Insiders, men till skillnad från vissa av de andra Insiders (10 % aktieägare och styrelseledamöter), arbetar ämbetsmän för företaget dagligen och de använder sina egna pengar när de handlar . (10 % aktieägare och styrelseledamöter är ofta fondförvaltare som förvaltar andras pengar.) Som sådan är insideraffärer som görs av tjänstemän mycket mer betydelsefulla och bör behandlas på lämpligt sätt.

Liksom Insider Sentiment Score är Officer Sentiment Score resultatet av en sofistikerad, kvantitativ multifaktormodell som identifierar företag med de högsta nivåerna av officersackumulering.

Uppdateringsfrekvens: Dagligen

Se insiderns bästa val, vilket ger en lista över företag med högsta insider sentiment.

Viktiga insidernyckeltal

Denna kort visar hur företaget rankas längs olika insidernyckeltal. Procenttilrankningen visar hur detta företag jämförs med andra företag på USA-marknaden. Högre rankingar indikerar bättre situationer.

Till exempel anses det allmänt att insiderköp är en positiv indikator, så företag med mer insiderköp skulle rankas högre än företag med mindre insiderköp (eller til och med insiderförsäljning).

Nettoantalet insiders som köper (rankning)

N/A

Nettoantalet insiders som köper är den totala mängden insiders som säljer minus det totala antalet insiders som säljer under de senaste 90 dagarna. Percentilrankningen visas här (intervall från 0 till 100%).

Procent av flytande köpta av insiders (ranking)

N/A

Procentandelen av aktier köpta av insiders är det totala antalet aktier som köpts av insiders minus det totala antalet aktier som sålts av insiders under de senaste 90 dagarna, dividerat med det totala antalet aktier och multiplicerat med 100.

Insiderhandelsdiagram

GCP Applied Technologies Inc insideraffärer visas i följande diagram. Insiders är tjänstemän, styrelseledamöter eller betydande investerare i ett företag. I allmänhet är det i allmänhet olagligt för insiders att göra affärer i sina företag baserat på väsentlig, icke-offentlig information. Detta betyder inte att det är olagligt för dem att göra några affärer i sina egna företag. De måste dock rapportera alla affärer till SEC via ett formulär 4.

Insiderlista och lönsamhetsstatistik

Den här tabellen visar listan över kända insiders och genereras automatiskt från anmälningar som avslöjas till SEC. Förutom namnen, den senaste titeln och direktören, tjänstemannen eller ägarbeteckningen på 10 %, tillhandahåller vi de senaste avslöjade innehaven. Dessutom, när det är möjligt tillhandahåller vi insiderns historiska handelsresultat. Det historiska handelsresultatet är ett vägt genomsnitt av resultatet för faktiska köptransaktioner på den öppna marknaden som insidern gjort. För mer information om hur detta beräknas, titta på detta YouTube-webinarium.

See our leaderboard of most profitable insider traders.

| Insider | Genomsnitt vinst (%) | Aktier Ägda |

Delad Justerad |

|---|

Report errors via our new Insider Auditing Tool

Track Records av insiderköp - Kortsiktig vinstanalys

I denna sektion analyserar vi lönsamheten för varje oplanerat, öppet-marknads insiderköp gjorda i GCP / GCP Applied Technologies Inc. Denna analys hjälper till att förstå om insidern konsekvent genererar onormala avkastningar och är värd att följa. Denna analys är för ett år efter varje handel, och resultaten är teoretiska .

Tabellen nedan visar de senaste köpen på öppna marknaden som inte var en del av en automatisk handelsplan.

Justeringar av aktierär de justerade aktierna efter justerat pris. Justeringar av aktierär de justerade aktierna efter uppdelning.

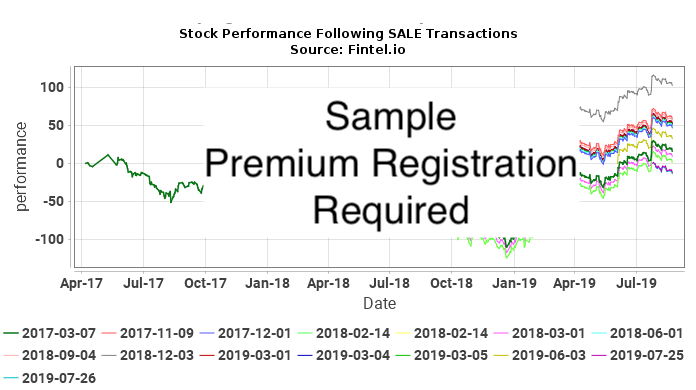

Track Records av insiderförsäljning - Kortsiktig förlustanalys

I denna sektion analyserar vi lönsamheten för varje oplanerat, öppet-marknads insiderköp gjorda i GCP / GCP Applied Technologies Inc. Denna analys hjälper till att förstå om insidern konsekvent genererar onormala avkastningar och är värd att följa. Denna analys är för ett år efter varje handel, och resultaten är teoretiska .

Tabellen nedan visar de senaste försäljningarna på öppna marknaden som inte var en del av en automatisk handelsplan.

| Handelsdatum | Insider | Rapporterade aktier |

Rapporterat pris |

Justerade aktier |

Justerat pris |

Kostnadsbasis | Dagar til Min |

Pris vid Min |

Maximal förlust undvikits ($) |

Maximal förlust undvikits ($) |

|---|---|---|---|---|---|---|---|

| Det finns inga kända oplanerade öppna marknadstransaktioner för denna insynsperson |

Justeringar av aktierär de justerade aktierna efter justerat pris. Justeringar av aktierär de justerade aktierna efter uppdelning.

Transaktionshistorik

Klicka på länkikonen för att se hela transaktionshistoriken. Transaktioner som rapporteras som en del av en automatisk handelsplan 10b5-1 kommer att ha ett X i kolumnen markerad 10b-5.

| Fil datum |

Handel datum |

Schema | Insider | Ticker | Värdepappertitel | Kod | Direkta | Utövningspris | Enhet pris |

Enheter ändrad |

Värde ändrad (1K) |

Kvarvarande Optioner |

Kvarvarande Aktier |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2022-09-28 | 2022-09-27 | 4 | 40 North Latitude Fund LP By SI Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 32,0000 | −2 727 519 | −87 281 | 0 | ||||

| 2022-09-28 | 2022-09-27 | 4 | 40 North Latitude Fund LP By Standard Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 32,0000 | −2 386 285 | −76 361 | 0 | ||||

| 2022-09-28 | 2022-09-27 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 32,0000 | −12 664 548 | −405 266 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Feld Peter A By Starboard Value LP | GCP | Common Stock | I | 32,0000 | −6 540 000 | −209 280 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Feld Peter A | GCP | Common Stock | D | 32,0000 | −18 296 | −585 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Campos David | GCP | Common Stock | D | 32,0000 | −4 903 | −157 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Campos David | GCP | Common Stock | D | 4 903 | 4 903 | ||||||

| 2022-09-27 | 2022-09-27 | 4 | Campos David | GCP | Common Stock | D | 32,0000 | −9 801 | −314 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Campos David | GCP | Common Stock | D | 32,0000 | −4 170 | −133 | 9 801 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Yanker Robert H | GCP | Common Stock | D | 32,0000 | −55 511 | −1 776 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Merrill Craig A | GCP | Common Stock | D | 32,0000 | −18 270 | −585 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Merrill Craig A | GCP | Common Stock | D | 18 270 | 18 270 | ||||||

| 2022-09-27 | 2022-09-27 | 4 | Merrill Craig A | GCP | Common Stock | D | 32,0000 | −9 497 | −304 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Merrill Craig A | GCP | Common Stock | D | 32,0000 | −10 898 | −349 | 9 497 | ||||

| 2022-09-27 | 2022-09-27 | 4 | WELTY LINDA J | GCP | Common Stock | D | 32,0000 | −11 211 | −359 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Waddell James | GCP | Common Stock | D | 32,0000 | −2 289 | −73 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Waddell James | GCP | Common Stock | D | 2 289 | 2 289 | ||||||

| 2022-09-27 | 2022-09-27 | 4 | Waddell James | GCP | Common Stock | D | 32,0000 | −1 588 | −51 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Waddell James | GCP | Common Stock | D | 32,0000 | −561 | −18 | 1 588 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Kiefaber Clay By The Clay Huston Kiefaber Trust | GCP | Common Stock | I | 32,0000 | −750 | −24 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Kiefaber Clay | GCP | Common Stock | D | 32,0000 | −13 988 | −448 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Ross Andrew M | GCP | Common Stock | D | 32,0000 | −16 055 | −514 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Ogilvie Marran H. | GCP | Common Stock | D | 32,0000 | −14 962 | −479 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Mennenga Sherry | GCP | Common Stock | D | 32,0000 | −5 555 | −178 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Mennenga Sherry | GCP | Common Stock | D | 5 555 | 5 555 | ||||||

| 2022-09-27 | 2022-09-27 | 4 | Mennenga Sherry | GCP | Common Stock | D | 32,0000 | −7 682 | −246 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Mennenga Sherry | GCP | Common Stock | D | 32,0000 | −1 458 | −47 | 7 682 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Giesselman Janet Plaut | GCP | Common Stock | D | 32,0000 | −15 312 | −490 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Lauzon Armand F Jr | GCP | Common Stock | D | 32,0000 | −27 384 | −876 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Valente Michael W | GCP | Common Stock | D | 32,0000 | −9 619 | −308 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Valente Michael W | GCP | Common Stock | D | 9 619 | 9 619 | ||||||

| 2022-09-27 | 2022-09-27 | 4 | Valente Michael W | GCP | Common Stock | D | 32,0000 | −11 664 | −373 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Valente Michael W | GCP | Common Stock | D | 32,0000 | −6 089 | −195 | 11 664 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Bates Simon | GCP | Common Stock | D | 32,0000 | −32 247 | −1 032 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Bates Simon | GCP | Common Stock | D | 32 247 | 32 247 | ||||||

| 2022-09-27 | 2022-09-27 | 4 | Bates Simon | GCP | Common Stock | D | 32,0000 | −22 374 | −716 | 0 | ||||

| 2022-09-27 | 2022-09-27 | 4 | Bates Simon | GCP | Common Stock | D | 32,0000 | −88 181 | −2 822 | 22 374 | ||||

| 2022-02-10 | 3 | Campos David | GCP | Common Stock | D | 13 971 | ||||||||

| 2022-02-10 | 3 | Mennenga Sherry | GCP | Common Stock | D | 9 140 | ||||||||

| 2021-12-30 | 2021-12-28 | 4 | Valente Michael W | GCP | Common Stock | D | 31,8900 | −2 238 | −71 | 17 753 | ||||

| 2021-12-30 | 2021-12-28 | 4 | Waddell James | GCP | Common Stock | D | 31,8900 | −234 | −7 | 2 149 | ||||

| 2021-12-30 | 2021-12-28 | 4 | Merrill Craig A | GCP | Common Stock | D | 31,8900 | −2 396 | −76 | 20 395 | ||||

| 2021-12-30 | 2021-12-28 | 4 | Bates Simon | GCP | Common Stock | D | 31,8900 | −37 322 | −1 190 | 110 555 | ||||

| 2021-10-04 | 2021-09-30 | 4 | Giesselman Janet Plaut | GCP | Common Stock | D | 21,9200 | 513 | 11 | 15 312 | ||||

| 2021-10-04 | 2021-09-30 | 4 | Giesselman Janet Plaut | GCP | Common Stock | D | 21,9200 | 513 | 11 | 15 312 | ||||

| 2021-10-04 | 2021-09-30 | 4 | Yanker Robert H | GCP | Common Stock | D | 21,9200 | 998 | 22 | 55 511 | ||||

| 2021-10-04 | 2021-09-30 | 4 | Feld Peter A | GCP | Common Stock, $0.01 par value | D | 21,9200 | 1 768 | 39 | 18 296 | ||||

| 2021-08-05 | 2021-08-03 | 4 | Merrill Craig A | GCP | Common Stock | D | 23,5900 | −161 | −4 | 22 791 | ||||

| 2021-07-01 | 2021-06-30 | 4 | Feld Peter A | GCP | Common Stock, $0.01 par value | D | 23,2600 | 1 666 | 39 | 16 528 | ||||

| 2021-07-01 | 2021-06-30 | 4 | Yanker Robert H | GCP | Common Stock | D | 23,2600 | 940 | 22 | 54 513 | ||||

| 2021-07-01 | 2021-06-30 | 4 | Giesselman Janet Plaut | GCP | Common Stock | D | 23,2600 | 484 | 11 | 14 286 | ||||

| 2021-07-01 | 2021-06-30 | 4 | Giesselman Janet Plaut | GCP | Common Stock | D | 23,2600 | 484 | 11 | 13 802 | ||||

| 2021-05-19 | 2021-05-17 | 4 | Feld Peter A | GCP | Common Stock, $0.01 par value | D | 4 168 | 14 862 | ||||||

| 2021-05-19 | 2021-05-17 | 4 | Yanker Robert H | GCP | Common Stock | D | 4 168 | 53 573 | ||||||

| 2021-05-19 | 2021-05-17 | 4 | WELTY LINDA J | GCP | Common Stock | D | 4 168 | 11 211 | ||||||

| 2021-05-19 | 2021-05-17 | 4 | Ross Andrew M | GCP | Common Stock | D | 4 168 | 16 055 | ||||||

| 2021-05-19 | 2021-05-17 | 4 | Ogilvie Marran H. | GCP | Common Stock | D | 4 168 | 14 962 | ||||||

| 2021-05-19 | 2021-05-17 | 4 | Lauzon Armand F Jr | GCP | Common Stock | D | 4 168 | 27 384 | ||||||

| 2021-05-19 | 2021-05-17 | 4 | Kiefaber Clay | GCP | Common Stock | D | 4 168 | 13 988 | ||||||

| 2021-05-19 | 2021-05-17 | 4 | Giesselman Janet Plaut | GCP | Common Stock | D | 4 168 | 13 318 | ||||||

| 2021-05-17 | 2021-05-15 | 4 | Bates Simon | GCP | Common Stock | D | 26,1200 | −28 813 | −753 | 147 877 | ||||

| 2021-04-02 | 2021-03-31 | 4 | Feld Peter A | GCP | Common Stock, $0.01 par value | D | 24,5400 | 1 579 | 39 | 10 694 | ||||

| 2021-04-02 | 2021-03-31 | 4 | Yanker Robert H | GCP | Common Stock | D | 24,5400 | 892 | 22 | 49 405 | ||||

| 2021-04-02 | 2021-03-31 | 4 | Giesselman Janet Plaut | GCP | Common Stock | D | 24,5400 | 458 | 11 | 9 150 | ||||

| 2021-04-02 | 2021-03-31 | 4 | Giesselman Janet Plaut | GCP | Common Stock | D | 24,5400 | 458 | 11 | 8 692 | ||||

| 2021-03-22 | 2021-03-18 | 4 | van Lent Boudewijn | GCP | Common Stock | D | 24,8400 | −865 | −21 | 15 109 | ||||

| 2021-03-12 | 2021-03-10 | 4 | Valente Michael W | GCP | Common Stock | D | 10 011 | 19 991 | ||||||

| 2021-03-12 | 2021-03-10 | 4 | Waddell James | GCP | Common Stock | D | 2 383 | 2 383 | ||||||

| 2021-03-12 | 2021-03-10 | 4 | Merrill Craig A | GCP | Common Stock | D | 9 286 | 22 952 | ||||||

| 2021-03-12 | 2021-03-10 | 4 | Bates Simon | GCP | Common Stock | D | 33 562 | 176 690 | ||||||

| 2021-02-26 | 2021-02-24 | 4 | Merrill Craig A | GCP | Common Stock | D | 25,4900 | −886 | −23 | 13 666 | ||||

| 2021-02-26 | 2021-02-24 | 4 | van Lent Boudewijn | GCP | Common Stock | D | 25,4900 | −1 314 | −33 | 15 974 | ||||

| 2021-02-23 | 2021-02-22 | 4 | Merrill Craig A | GCP | Common Stock | D | 25,9000 | −222 | −6 | 14 552 | ||||

| 2021-02-23 | 2021-02-21 | 4 | Merrill Craig A | GCP | Common Stock | D | 25,7000 | −274 | −7 | 14 774 | ||||

| 2021-01-21 | 2021-01-18 | 4 | Valente Michael W | GCP | Common Stock | D | 9 980 | 9 980 | ||||||

| 2021-01-04 | 2020-12-31 | 4 | Feld Peter A | GCP | Common Stock, $0.01 par value | D | 23,6500 | 1 638 | 39 | 9 115 | ||||

| 2021-01-04 | 2020-12-31 | 4 | Yanker Robert H | GCP | Common Stock | D | 23,6500 | 925 | 22 | 48 513 | ||||

| 2021-01-04 | 2020-12-31 | 4 | Lauzon Armand F Jr | GCP | Common Stock | D | 23,6500 | 792 | 19 | 23 216 | ||||

| 2021-01-04 | 2020-12-31 | 4 | Giesselman Janet Plaut | GCP | Common Stock | D | 23,6500 | 475 | 11 | 8 234 | ||||

| 2020-11-25 | 2020-11-24 | 4 | Yanker Robert H | GCP | Common Stock | D | 24,6300 | 1 151 | 28 | 47 588 | ||||

| 2020-11-25 | 2020-11-24 | 4 | Giesselman Janet Plaut | GCP | Common Stock | D | 24,6300 | 592 | 15 | 7 759 | ||||

| 2020-11-25 | 2020-11-24 | 4 | Feld Peter A | GCP | Common Stock, $0.01 par value | D | 24,6300 | 2 040 | 50 | 7 477 | ||||

| 2020-11-25 | 2020-11-24 | 4 | Lauzon Armand F Jr | GCP | Common Stock | D | 24,6300 | 987 | 24 | 22 424 | ||||

| 2020-11-18 | 2020-11-17 | 4 | Lauzon Armand F Jr | GCP | Common Stock | D | 24,3580 | 16 000 | 390 | 21 437 | ||||

| 2020-10-21 | 2020-10-19 | 4 | Srinivasan Naren B | GCP | Employee Stock Options (rights to buy) | D | 19,81 | −20 513 | 0 | |||||

| 2020-10-21 | 2020-10-19 | 4 | Srinivasan Naren B | GCP | Common Stock | D | 22,5500 | −19 128 | −431 | 45 370 | ||||

| 2020-10-21 | 2020-10-19 | 4 | Srinivasan Naren B | GCP | Common Stock | D | 19,8100 | 20 513 | 406 | 64 498 | ||||

| 2020-10-09 | 2020-10-01 | 4 | Bates Simon | GCP | Employee Stock Options (rights to buy) | D | 20,96 | 388 348 | 388 348 | |||||

| 2020-10-09 | 2020-10-01 | 4 | Bates Simon | GCP | Common Stock | D | 143 128 | 143 128 | ||||||

| 2020-09-02 | 2020-09-01 | 4 | Dearth Randall S. | GCP | Common Stock | D | 26,5000 | −7 782 | −206 | 103 570 | ||||

| 2020-08-05 | 2020-08-03 | 4 | Merrill Craig A | GCP | Common Stock | D | 1 643 | 15 048 | ||||||

| 2020-08-04 | 2020-08-01 | 4 | Dearth Randall S. | GCP | Common Stock | D | 22,8200 | −516 | −12 | 111 352 | ||||

| 2020-06-03 | 2020-06-01 | 4 | SHEPHERD DANNY R | GCP | Common Stock | D | 1 242 | 21 498 | ||||||

| 2020-06-03 | 2020-06-01 | 4 | Mora Elizabeth | GCP | Common Stock | D | 1 242 | 16 158 | ||||||

| 2020-06-03 | 2020-06-01 | 4 | Mason Phillip J | GCP | Common Stock | D | 1 242 | 16 158 | ||||||

| 2020-06-03 | 2020-06-01 | 4 | Ogilvie Marran H. | GCP | Common Stock | D | 5 437 | 10 794 | ||||||

| 2020-06-03 | 2020-06-01 | 4 | Feld Peter A | GCP | Common Stock, $0.01 par value | D | 5 437 | 5 437 | ||||||

| 2020-06-03 | 2020-06-01 | 4 | Kiefaber Clay | GCP | Common Stock | D | 5 437 | 9 820 | ||||||

| 2020-06-03 | 2020-06-01 | 4 | Yanker Robert H | GCP | Common Stock | D | 5 437 | 46 437 | ||||||

| 2020-06-03 | 2020-06-01 | 4 | WELTY LINDA J | GCP | Common Stock | D | 5 437 | 7 043 | ||||||

| 2020-06-03 | 2020-06-01 | 4 | Ross Andrew M | GCP | Common Stock | D | 5 437 | 11 887 | ||||||

| 2020-06-03 | 2020-06-01 | 4 | Lauzon Armand F Jr | GCP | Common Stock | D | 5 437 | 5 437 | ||||||

| 2020-06-03 | 2020-06-01 | 4 | Giesselman Janet Plaut | GCP | Common Stock | D | 5 437 | 7 167 | ||||||

| 2020-06-03 | 2020-06-01 | 4 | Brown Kevin W. | GCP | Common Stock | D | 5 437 | 9 437 | ||||||

| 2020-06-03 | 3 | Yanker Robert H | GCP | Common Stock | D | 82 000 | ||||||||

| 2020-06-03 | 3 | Yanker Robert H | GCP | Common Stock | D | 82 000 | ||||||||

| 2020-06-03 | 3 | Yanker Robert H | GCP | Common Stock | D | 82 000 | ||||||||

| 2020-06-03 | 3 | Feld Peter A By Starboard Value LP | GCP | Common Stock, $0.01 par value | I | 13 080 000 | ||||||||

| 2020-06-03 | 3 | Feld Peter A By Starboard Value LP | GCP | Common Stock, $0.01 par value | I | 13 080 000 | ||||||||

| 2020-06-03 | 3 | Feld Peter A By Starboard Value LP | GCP | Common Stock, $0.01 par value | I | 13 080 000 | ||||||||

| 2020-06-03 | 3 | WELTY LINDA J | GCP | Common Stock | D | 3 212 | ||||||||

| 2020-06-03 | 3 | WELTY LINDA J | GCP | Common Stock | D | 3 212 | ||||||||

| 2020-06-03 | 3 | WELTY LINDA J | GCP | Common Stock | D | 3 212 | ||||||||

| 2020-06-03 | 3 | Ross Andrew M | GCP | Common Stock | D | 12 900 | ||||||||

| 2020-06-03 | 3 | Ross Andrew M | GCP | Common Stock | D | 12 900 | ||||||||

| 2020-06-03 | 3 | Ross Andrew M | GCP | Common Stock | D | 12 900 | ||||||||

| 2020-06-03 | 3 | Giesselman Janet Plaut | GCP | Common Stock | D | 3 460 | ||||||||

| 2020-06-03 | 3 | Giesselman Janet Plaut | GCP | Common Stock | D | 3 460 | ||||||||

| 2020-06-03 | 3 | Giesselman Janet Plaut | GCP | Common Stock | D | 3 460 | ||||||||

| 2020-06-03 | 3 | Brown Kevin W. | GCP | Common Stock | D | 8 000 | ||||||||

| 2020-06-03 | 3 | Brown Kevin W. | GCP | Common Stock | D | 8 000 | ||||||||

| 2020-06-03 | 3 | Brown Kevin W. | GCP | Common Stock | D | 8 000 | ||||||||

| 2020-04-10 | 2020-04-08 | 4 | Thompson James E | GCP | Common Stock | D | 17,4600 | −1 303 | −23 | 26 190 | ||||

| 2020-03-20 | 2020-03-18 | 4 | van Lent Boudewijn | GCP | Common Stock | D | 17,0500 | −909 | −15 | 17 288 | ||||

| 2020-03-03 | 2020-03-01 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 19,4700 | −172 | −3 | 9 457 | ||||

| 2020-03-02 | 2020-02-27 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 19,5500 | −275 | −5 | 9 629 | ||||

| 2020-03-02 | 2020-02-27 | 4 | HOLLAND KEVIN | GCP | Common Stock | D | 19,5500 | −536 | −10 | 27 635 | ||||

| 2020-03-02 | 2020-02-27 | 4 | Srinivasan Naren B | GCP | Common Stock | D | 19,5500 | −515 | −10 | 43 985 | ||||

| 2020-03-02 | 2020-02-27 | 4 | Merrill Craig A | GCP | Common Stock | D | 19,5500 | −247 | −5 | 13 405 | ||||

| 2020-02-27 | 2020-02-25 | 4 | Dearth Randall S. | GCP | Common Stock | D | 2 523 | 111 868 | ||||||

| 2020-02-25 | 2020-02-24 | 4 | van Lent Boudewijn | GCP | Common Stock | D | 11 831 | 18 197 | ||||||

| 2020-02-25 | 2020-02-24 | 4 | Thompson James E | GCP | Common Stock | D | 14 197 | 27 493 | ||||||

| 2020-02-25 | 2020-02-24 | 4 | HOLLAND KEVIN | GCP | Common Stock | D | 11 831 | 28 171 | ||||||

| 2020-02-25 | 2020-02-22 | 4 | HOLLAND KEVIN | GCP | Common Stock | D | 21,1300 | −649 | −14 | 16 340 | ||||

| 2020-02-25 | 2020-02-21 | 4 | HOLLAND KEVIN | GCP | Common Stock | D | 21,8600 | −943 | −21 | 16 989 | ||||

| 2020-02-25 | 2020-02-24 | 4 | Srinivasan Naren B | GCP | Common Stock | D | 11 831 | 44 500 | ||||||

| 2020-02-25 | 2020-02-22 | 4 | Srinivasan Naren B | GCP | Common Stock | D | 21,1300 | −699 | −15 | 32 669 | ||||

| 2020-02-25 | 2020-02-21 | 4 | Srinivasan Naren B | GCP | Common Stock | D | 21,8600 | −943 | −21 | 33 368 | ||||

| 2020-02-25 | 2020-02-24 | 4 | Merrill Craig A | GCP | Common Stock | D | 8 282 | 13 652 | ||||||

| 2020-02-25 | 2020-02-22 | 4 | Merrill Craig A | GCP | Common Stock | D | 21,1300 | −222 | −5 | 5 370 | ||||

| 2020-02-25 | 2020-02-21 | 4 | Merrill Craig A | GCP | Common Stock | D | 21,8600 | −275 | −6 | 5 592 | ||||

| 2020-02-25 | 2020-02-24 | 4 | Dearth Randall S. | GCP | Common Stock | D | 47 326 | 109 345 | ||||||

| 2020-02-25 | 2020-02-21 | 4 | Dearth Randall S. | GCP | Common Stock | D | 21,8600 | −1 207 | −26 | 62 019 | ||||

| 2020-02-25 | 2020-02-24 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 2 957 | 9 904 | ||||||

| 2020-02-25 | 2020-02-22 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 21,1300 | −254 | −5 | 6 947 | ||||

| 2020-02-25 | 2019-03-01 | 4 | Korotkin Kenneth S | GCP | Employee Stock Options (rights to buy) | D | 30,18 | 3 140 | 3 140 | |||||

| 2020-02-25 | 2019-03-01 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 1 035 | 7 201 | ||||||

| 2020-02-10 | 3/A | Kiefaber Clay | GCP | Common Stock | D | 750 | ||||||||

| 2020-02-10 | 2019-05-01 | 4/A | Kiefaber Clay | GCP | Common Stock | D | 3 917 | 5 133 | ||||||

| 2020-01-15 | 3/A | Ogilvie Marran H. | GCP | Common Stock | D | 974 | ||||||||

| 2020-01-15 | 2019-05-01 | 4/A | Ogilvie Marran H. | GCP | Common Stock | D | 3 917 | 5 357 | ||||||

| 2019-10-23 | 3 | Merrill Craig A | GCP | Common Stock | D | 11 734 | ||||||||

| 2019-10-23 | 3 | Merrill Craig A | GCP | Common Stock | D | 11 734 | ||||||||

| 2019-10-23 | 3 | Merrill Craig A | GCP | Common Stock | D | 11 734 | ||||||||

| 2019-09-26 | 3 | van Lent Boudewijn | GCP | Common Stock | D | 12 732 | ||||||||

| 2019-09-26 | 3 | van Lent Boudewijn | GCP | Common Stock | D | 12 732 | ||||||||

| 2019-09-26 | 3 | van Lent Boudewijn | GCP | Common Stock | D | 12 732 | ||||||||

| 2019-09-04 | 2019-09-01 | 4 | Dearth Randall S. | GCP | Common Stock | D | 17,3350 | −5 162 | −89 | 63 226 | ||||

| 2019-09-04 | 2019-08-01 | 4 | Dearth Randall S. | GCP | Employee Stock Options (rights to buy) | D | 21,52 | 11 261 | 11 261 | |||||

| 2019-09-04 | 2019-08-01 | 4 | Dearth Randall S. | GCP | Common Stock | D | 3 485 | 68 388 | ||||||

| 2019-05-02 | 2019-05-01 | 4 | Mason Phillip J | GCP | Common Stock, par value $0.01 per share | D | 3 917 | 14 916 | ||||||

| 2019-05-02 | 2019-05-01 | 4 | CAMBRE RONALD C | GCP | Common Stock, par value $0.01 per share | D | 3 917 | 25 958 | ||||||

| 2019-05-02 | 2019-05-01 | 4 | Kiefaber Clay | GCP | Common Stock | D | 3 917 | 4 383 | ||||||

| 2019-05-02 | 2019-05-01 | 4 | COLELLA GERARD G | GCP | Common Stock | D | 3 917 | 10 455 | ||||||

| 2019-05-02 | 2019-05-01 | 4 | Ogilvie Marran H. | GCP | Common Stock | D | 3 917 | 4 383 | ||||||

| 2019-05-02 | 2019-05-01 | 4 | HENRY JANICE K | GCP | Common Stock, par value $0.01 per share | D | 3 917 | 19 837 | ||||||

| 2019-05-02 | 2019-05-01 | 4 | Mora Elizabeth | GCP | Common Stock, par value $0.01 per share | D | 3 917 | 14 916 | ||||||

| 2019-05-02 | 2019-05-01 | 4 | Kirsch James F | GCP | Common Stock | D | 3 917 | 6 150 | ||||||

| 2019-05-02 | 2019-05-01 | 4 | SHEPHERD DANNY R | GCP | Common Stock, par value $0.01 per share | D | 3 917 | 20 256 | ||||||

| 2019-05-02 | 2019-05-01 | 4 | AVEDON MARCIA J | GCP | Common Stock, par value $0.01 per share | D | 1 298 | 12 297 | ||||||

| 2019-04-09 | 2019-04-08 | 4 | Thompson James E | GCP | Employee Stock Options (rights to buy) | D | 29,52 | 14 089 | 14 089 | |||||

| 2019-04-09 | 2019-04-08 | 4 | Thompson James E | GCP | Common Stock | D | 13 296 | 13 296 | ||||||

| 2019-03-15 | 2019-03-14 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 28,9500 | 6 990 798 | 202 384 | 12 664 548 | ||||

| 2019-03-13 | 2019-03-12 | 4 | Ogilvie Marran H. | GCP | Common Stock | D | 466 | 466 | ||||||

| 2019-03-13 | 2019-03-12 | 4 | Kiefaber Clay | GCP | Common Stock | D | 466 | 466 | ||||||

| 2019-02-28 | 2019-02-27 | 4 | HOLLAND KEVIN | GCP | Common Stock | D | 29,7900 | −541 | −16 | 17 932 | ||||

| 2019-02-28 | 2019-02-27 | 4 | Kapples John W. | GCP | Common Stock | D | 29,7900 | −391 | −12 | 28 448 | ||||

| 2019-02-28 | 2019-02-27 | 4 | Poling Gregory E | GCP | Common Stock | D | 29,7900 | −3 368 | −100 | 86 089 | ||||

| 2019-02-28 | 2019-02-27 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 29,7900 | −242 | −7 | 6 166 | ||||

| 2019-02-28 | 2019-02-27 | 4 | Srinivasan Naren B | GCP | Common Stock | D | 29,7900 | −527 | −16 | 34 311 | ||||

| 2019-02-28 | 2019-02-27 | 4 | Freeman Dean P | GCP | Common Stock | D | 29,7900 | −982 | −29 | 57 052 | ||||

| 2019-02-26 | 2019-02-25 | 4 | Kapples John W. | GCP | Common Stock | D | 26,3100 | −598 | −16 | 28 839 | ||||

| 2019-02-26 | 2019-02-25 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 26,3100 | −316 | −8 | 6 408 | ||||

| 2019-02-26 | 2019-02-25 | 4 | Srinivasan Naren B | GCP | Common Stock | D | 26,3100 | −698 | −18 | 34 838 | ||||

| 2019-02-26 | 2019-02-25 | 4 | Freeman Dean P | GCP | Common Stock | D | 26,3100 | −1 503 | −40 | 58 034 | ||||

| 2019-02-26 | 2019-02-25 | 4 | Poling Gregory E | GCP | Common Stock | D | −400 | 89 457 | ||||||

| 2019-02-26 | 2019-02-25 | 4 | Poling Gregory E | GCP | Common Stock | D | 26,3100 | −4 832 | −127 | 89 857 | ||||

| 2019-02-25 | 2019-02-22 | 4 | Freeman Dean P | GCP | Common Stock | D | 26,3100 | −565 | −15 | 59 537 | ||||

| 2019-02-25 | 2019-02-21 | 4 | Freeman Dean P | GCP | Employee Stock Options (rights to buy) | D | 26,37 | 18 773 | 18 773 | |||||

| 2019-02-25 | 2019-02-21 | 4 | Freeman Dean P | GCP | Common Stock | D | 6 162 | 60 102 | ||||||

| 2019-02-25 | 2019-02-21 | 4 | Freeman Dean P | GCP | Common Stock | D | 8 875 | 53 940 | ||||||

| 2019-02-25 | 2019-02-22 | 4 | Poling Gregory E | GCP | Common Stock | D | 26,3100 | −3 012 | −79 | 94 689 | ||||

| 2019-02-25 | 2019-02-21 | 4 | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 26,37 | 79 427 | 79 427 | |||||

| 2019-02-25 | 2019-02-21 | 4 | Poling Gregory E | GCP | Common Stock | D | 26 071 | 97 701 | ||||||

| 2019-02-25 | 2019-02-21 | 4 | Poling Gregory E | GCP | Common Stock | D | 24 888 | 71 630 | ||||||

| 2019-02-25 | 2019-02-22 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 26,3100 | −223 | −6 | 6 724 | ||||

| 2019-02-25 | 2019-02-21 | 4 | Dearth Randall S. | GCP | Employee Stock Options (rights to buy) | D | 26,37 | 37 547 | 37 547 | |||||

| 2019-02-25 | 2019-02-21 | 4 | Dearth Randall S. | GCP | Common Stock | D | 12 324 | 64 903 | ||||||

| 2019-02-25 | 2019-02-22 | 4 | HOLLAND KEVIN | GCP | Common Stock | D | 26,3100 | −580 | −15 | 12 785 | ||||

| 2019-02-25 | 2019-02-21 | 4 | HOLLAND KEVIN | GCP | Employee Stock Options (rights to buy) | D | 26,37 | 17 329 | 17 329 | |||||

| 2019-02-25 | 2019-02-21 | 4 | HOLLAND KEVIN | GCP | Common Stock | D | 5 688 | 18 473 | ||||||

| 2019-02-25 | 2019-02-22 | 4 | Srinivasan Naren B | GCP | Common Stock | D | 26,3100 | −625 | −16 | 35 536 | ||||

| 2019-02-25 | 2019-02-21 | 4 | Srinivasan Naren B | GCP | Employee Stock Options (rights to buy) | D | 26,37 | 17 329 | 17 329 | |||||

| 2019-02-25 | 2019-02-21 | 4 | Srinivasan Naren B | GCP | Common Stock | D | 5 688 | 36 161 | ||||||

| 2019-02-25 | 2019-02-21 | 4 | Srinivasan Naren B | GCP | Common Stock | D | 3 594 | 30 473 | ||||||

| 2019-02-25 | 2019-02-22 | 4 | Kapples John W. | GCP | Common Stock | D | 26,3100 | −430 | −11 | 29 437 | ||||

| 2019-02-25 | 2019-02-21 | 4 | Kapples John W. | GCP | Common Stock | D | 5 899 | 29 867 | ||||||

| 2019-02-11 | 2019-02-08 | 4 | Poling Gregory E | GCP | Restricted Stock Units | D | −87 391 | 0 | ||||||

| 2019-02-11 | 2019-02-08 | 4 | Poling Gregory E | GCP | Common Stock | D | 24,8400 | −38 846 | −965 | 94 887 | ||||

| 2019-02-11 | 2019-02-08 | 4 | Poling Gregory E | GCP | Common Stock | D | 87 391 | 133 733 | ||||||

| 2019-02-11 | 2019-02-08 | 4 | Korotkin Kenneth S | GCP | Restricted Stock Units | D | −4 347 | 0 | ||||||

| 2019-02-11 | 2019-02-08 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 24,8400 | −2 112 | −52 | 6 947 | ||||

| 2019-02-11 | 2019-02-08 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 4 347 | 9 059 | ||||||

| 2019-02-11 | 2019-02-08 | 4 | Srinivasan Naren B | GCP | Common Stock | D | 24,8400 | −4 332 | −108 | 26 879 | ||||

| 2019-02-11 | 2019-02-08 | 4 | Kapples John W. | GCP | Restricted Stock Units | D | −16 313 | 0 | ||||||

| 2019-02-11 | 2019-02-08 | 4 | Kapples John W. | GCP | Common Stock | D | 24,8400 | −4 928 | −122 | 23 968 | ||||

| 2019-02-11 | 2019-02-08 | 4 | Kapples John W. | GCP | Common Stock | D | 16 313 | 28 896 | ||||||

| 2019-02-11 | 2019-02-08 | 4 | Freeman Dean P | GCP | Restricted Stock Units | D | −27 188 | 0 | ||||||

| 2019-02-11 | 2019-02-08 | 4 | Freeman Dean P | GCP | Common Stock | D | 24,8400 | −8 110 | −201 | 45 065 | ||||

| 2019-02-11 | 2019-02-08 | 4 | Freeman Dean P | GCP | Common Stock | D | 27 188 | 53 175 | ||||||

| 2019-01-18 | 2019-01-17 | 4 | HOLLAND KEVIN | GCP | Common Stock | D | 24,4200 | −5 339 | −130 | 13 365 | ||||

| 2019-01-08 | 2019-01-07 | 4 | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 18,58 | 32 162 | 0 | |||||

| 2019-01-08 | 2019-01-07 | 4 | Poling Gregory E | GCP | Common Stock | D | 25,7000 | −32 162 | −827 | 46 342 | ||||

| 2019-01-08 | 2019-01-07 | 4 | Poling Gregory E | GCP | Common Stock | D | 18,5800 | 32 162 | 598 | 78 504 | ||||

| 2018-10-22 | 2018-10-18 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 24,5051 | 36 250 | 888 | 5 673 750 | ||||

| 2018-10-22 | 2018-10-18 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 24,9997 | 30 000 | 750 | 5 637 500 | ||||

| 2018-10-22 | 2018-10-18 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,0813 | 80 000 | 2 007 | 5 607 500 | ||||

| 2018-10-22 | 2018-10-18 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,3671 | 19 900 | 505 | 5 527 500 | ||||

| 2018-10-22 | 2018-10-18 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 24,8464 | 91 762 | 2 280 | 5 507 600 | ||||

| 2018-10-17 | 2018-10-17 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,4150 | 200 | 5 | 5 415 838 | ||||

| 2018-10-17 | 2018-10-16 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,4442 | 3 357 | 85 | 5 415 638 | ||||

| 2018-10-17 | 2018-10-15 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,3758 | 28 400 | 721 | 5 412 281 | ||||

| 2018-10-12 | 2018-10-12 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 24,8236 | 40 000 | 993 | 5 383 881 | ||||

| 2018-10-12 | 2018-10-12 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 24,9113 | 20 000 | 498 | 5 343 881 | ||||

| 2018-10-12 | 2018-10-12 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 24,8500 | 50 000 | 1 242 | 5 323 881 | ||||

| 2018-10-12 | 2018-10-12 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 24,9075 | 54 700 | 1 362 | 5 273 881 | ||||

| 2018-10-12 | 2018-10-11 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 24,9992 | 50 000 | 1 250 | 5 219 181 | ||||

| 2018-10-12 | 2018-10-11 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 24,9764 | 75 000 | 1 873 | 5 169 181 | ||||

| 2018-10-12 | 2018-10-11 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,0502 | 105 903 | 2 653 | 5 094 181 | ||||

| 2018-10-12 | 2018-10-10 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,2482 | 110 000 | 2 777 | 4 988 278 | ||||

| 2018-10-12 | 2018-10-10 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,0971 | 145 072 | 3 641 | 4 878 278 | ||||

| 2018-10-12 | 2018-10-10 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,0932 | 70 000 | 1 757 | 4 733 206 | ||||

| 2018-10-09 | 2018-10-09 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,7908 | 90 000 | 2 321 | 4 663 206 | ||||

| 2018-10-09 | 2018-10-09 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,5792 | 200 000 | 5 116 | 4 573 206 | ||||

| 2018-10-09 | 2018-10-09 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,6814 | 55 053 | 1 414 | 4 373 206 | ||||

| 2018-10-09 | 2018-10-08 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 26,2276 | 15 321 | 402 | 4 318 153 | ||||

| 2018-10-09 | 2018-10-05 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 26,2475 | 25 000 | 656 | 4 302 832 | ||||

| 2018-10-09 | 2018-10-05 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 26,1391 | 57 000 | 1 490 | 4 277 832 | ||||

| 2018-10-09 | 2018-10-05 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 26,0802 | 35 000 | 913 | 4 220 832 | ||||

| 2018-10-04 | 2018-10-04 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 26,2952 | 25 000 | 657 | 4 185 832 | ||||

| 2018-10-04 | 2018-10-04 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 26,1131 | 10 000 | 261 | 4 160 832 | ||||

| 2018-10-04 | 2018-10-03 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 26,2213 | 49 080 | 1 287 | 4 150 832 | ||||

| 2018-10-04 | 2018-10-02 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 26,4000 | 10 000 | 264 | 4 101 752 | ||||

| 2018-10-04 | 2018-10-02 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 26,3988 | 7 820 | 206 | 4 091 752 | ||||

| 2018-10-01 | 2018-10-01 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 26,1881 | 64 000 | 1 676 | 4 083 932 | ||||

| 2018-10-01 | 2018-10-01 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 26,1129 | 100 000 | 2 611 | 4 019 932 | ||||

| 2018-10-01 | 2018-10-01 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 26,1546 | 50 600 | 1 323 | 3 919 932 | ||||

| 2018-10-01 | 2018-09-28 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 26,4819 | 25 350 | 671 | 3 869 332 | ||||

| 2018-10-01 | 2018-09-27 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 26,1819 | 26 475 | 693 | 3 843 982 | ||||

| 2018-10-01 | 2018-09-27 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 26,0058 | 27 100 | 705 | 3 817 507 | ||||

| 2018-10-01 | 2018-10-01 | 4 | Kirsch James F | GCP | Common Stock | D | 2 233 | 2 233 | ||||||

| 2018-09-25 | 2018-09-21 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 26,2500 | 50 000 | 1 312 | 3 790 407 | ||||

| 2018-09-25 | 2018-09-21 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 26,5289 | 34 298 | 910 | 3 740 407 | ||||

| 2018-09-19 | 2018-09-19 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,9500 | 80 000 | 2 076 | 3 706 109 | ||||

| 2018-09-19 | 2018-09-19 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,9484 | 17 031 | 442 | 3 626 109 | ||||

| 2018-09-19 | 2018-09-18 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,9625 | 150 000 | 3 894 | 3 609 078 | ||||

| 2018-09-19 | 2018-09-18 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,9612 | 22 500 | 584 | 3 459 078 | ||||

| 2018-09-19 | 2018-09-17 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,9468 | 30 156 | 782 | 3 436 578 | ||||

| 2018-09-14 | 2018-09-14 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,4818 | 55 000 | 1 401 | 3 406 422 | ||||

| 2018-09-14 | 2018-09-14 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,3750 | 49 600 | 1 259 | 3 351 422 | ||||

| 2018-09-14 | 2018-09-13 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,4402 | 118 274 | 3 009 | 3 301 822 | ||||

| 2018-09-14 | 2018-09-13 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,3408 | 4 900 | 124 | 3 183 548 | ||||

| 2018-09-14 | 2018-09-12 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 24,6647 | 250 478 | 6 178 | 3 178 648 | ||||

| 2018-09-05 | 2018-09-01 | 4 | Dearth Randall S. | GCP | Employee Stock Options (rights to buy) | D | 25,20 | 37 937 | 37 937 | |||||

| 2018-09-05 | 2018-09-01 | 4 | Dearth Randall S. | GCP | Common Stock | D | 52 579 | 52 579 | ||||||

| 2018-08-10 | 3 | 40 North Management LLC By 40 North Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 7 500 089 | ||||||||

| 2018-08-10 | 3 | 40 North Management LLC By 40 North Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 7 841 323 | ||||||||

| 2018-08-10 | 3 | 40 North Management LLC By 40 North Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 7 500 089 | ||||||||

| 2018-08-10 | 3 | 40 North Management LLC By 40 North Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 7 841 323 | ||||||||

| 2018-08-10 | 3 | 40 North Management LLC By 40 North Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 7 500 089 | ||||||||

| 2018-08-10 | 3 | 40 North Management LLC By 40 North Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 7 841 323 | ||||||||

| 2018-08-10 | 3 | 40 North Management LLC By 40 North Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 7 500 089 | ||||||||

| 2018-08-10 | 3 | 40 North Management LLC By 40 North Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 7 500 089 | ||||||||

| 2018-08-10 | 3 | 40 North Management LLC By 40 North Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 7 841 323 | ||||||||

| 2018-08-10 | 3 | 40 North Management LLC By 40 North Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 7 500 089 | ||||||||

| 2018-08-10 | 3 | 40 North Management LLC By 40 North Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 7 841 323 | ||||||||

| 2018-08-10 | 3 | 40 North Management LLC By 40 North Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 7 500 089 | ||||||||

| 2018-08-10 | 3 | 40 North Management LLC By 40 North Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 7 841 323 | ||||||||

| 2018-08-10 | 3 | 40 North Management LLC By 40 North Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 7 500 089 | ||||||||

| 2018-08-10 | 3 | 40 North Management LLC By 40 North Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 7 841 323 | ||||||||

| 2018-08-10 | 3 | 40 North Management LLC By 40 North Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 7 841 323 | ||||||||

| 2018-08-10 | 3 | 40 North Management LLC By 40 North Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 7 500 089 | ||||||||

| 2018-08-10 | 3 | 40 North Management LLC By 40 North Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 7 841 323 | ||||||||

| 2018-08-10 | 3 | Heyman Ronnie F. | GCP | Common Stock, $0.01 par value | D | 4 237 340 | ||||||||

| 2018-08-10 | 3 | Heyman Ronnie F. | GCP | Common Stock, $0.01 par value | D | 4 237 340 | ||||||||

| 2018-08-10 | 3 | Heyman Ronnie F. | GCP | Common Stock, $0.01 par value | D | 4 237 340 | ||||||||

| 2018-08-10 | 3 | Heyman Ronnie F. | GCP | Common Stock, $0.01 par value | D | 4 237 340 | ||||||||

| 2018-08-10 | 3 | Heyman Ronnie F. | GCP | Common Stock, $0.01 par value | D | 4 237 340 | ||||||||

| 2018-08-10 | 3 | Heyman Ronnie F. | GCP | Common Stock, $0.01 par value | D | 4 237 340 | ||||||||

| 2018-08-10 | 3 | Heyman Ronnie F. | GCP | Common Stock, $0.01 par value | D | 4 237 340 | ||||||||

| 2018-08-10 | 3 | Heyman Ronnie F. | GCP | Common Stock, $0.01 par value | D | 4 237 340 | ||||||||

| 2018-08-10 | 3 | Heyman Ronnie F. | GCP | Common Stock, $0.01 par value | D | 4 237 340 | ||||||||

| 2018-08-10 | 2018-08-09 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,4152 | 5 297 | 135 | 2 928 170 | ||||

| 2018-08-10 | 2018-08-09 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,4960 | 6 900 | 176 | 2 922 873 | ||||

| 2018-08-10 | 2018-08-08 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,0645 | 395 000 | 9 900 | 2 915 973 | ||||

| 2018-08-10 | 2018-08-08 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,3804 | 49 303 | 1 251 | 2 520 973 | ||||

| 2018-08-10 | 2018-08-08 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,1149 | 153 000 | 3 843 | 2 471 670 | ||||

| 2018-08-10 | 2018-08-08 | 4 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 25,0829 | 200 000 | 5 017 | 2 318 670 | ||||

| 2018-05-09 | 2018-05-07 | 4 | Poling Gregory E | GCP | Restricted Stock Units | D | −39 009 | 0 | ||||||

| 2018-05-09 | 2018-05-07 | 4 | Poling Gregory E | GCP | Common Stock | D | 28,7500 | −17 340 | −499 | 78 256 | ||||

| 2018-05-09 | 2018-05-07 | 4 | Poling Gregory E | GCP | Common Stock | D | 39 009 | 95 596 | ||||||

| 2018-05-09 | 2018-02-27 | 4 | Poling Gregory E By Trust | GCP | Common Stock | I | −300 | 161 739 | ||||||

| 2018-05-09 | 2018-05-07 | 4 | Freeman Dean P | GCP | Restricted Stock Units | D | −9 033 | 0 | ||||||

| 2018-05-09 | 2018-05-07 | 4 | Freeman Dean P | GCP | Common Stock | D | 28,7500 | −2 661 | −77 | 25 987 | ||||

| 2018-05-09 | 2018-05-07 | 4 | Freeman Dean P | GCP | Common Stock | D | 9 033 | 28 648 | ||||||

| 2018-05-09 | 2018-05-07 | 4 | Srinivasan Naren B | GCP | Common Stock | D | 28,7500 | −1 825 | −52 | 31 211 | ||||

| 2018-05-03 | 2018-05-02 | 4 | CAMBRE RONALD C | GCP | Common Stock, par value $0.01 per share | D | 3 571 | 22 041 | ||||||

| 2018-05-03 | 2018-05-02 | 4 | AVEDON MARCIA J | GCP | Common Stock, par value $0.01 per share | D | 3 571 | 10 999 | ||||||

| 2018-05-03 | 2018-05-02 | 4 | COLELLA GERARD G | GCP | Common Stock | D | 3 571 | 6 538 | ||||||

| 2018-05-03 | 2018-05-02 | 4 | HENRY JANICE K | GCP | Common Stock, par value $0.01 per share | D | 3 571 | 15 920 | ||||||

| 2018-05-03 | 2018-05-02 | 4 | SHEPHERD DANNY R | GCP | Common Stock, par value $0.01 per share | D | 3 571 | 16 339 | ||||||

| 2018-05-03 | 2018-05-02 | 4 | Mora Elizabeth | GCP | Common Stock, par value $0.01 per share | D | 3 571 | 10 999 | ||||||

| 2018-05-03 | 2018-05-02 | 4 | Mason Phillip J | GCP | Common Stock, par value $0.01 per share | D | 3 571 | 10 999 | ||||||

| 2018-04-13 | 3 | 40 North Latitude Fund LP By 40 North Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 7 500 089 | ||||||||

| 2018-04-13 | 3 | 40 North Latitude Fund LP By 40 North Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 7 500 089 | ||||||||

| 2018-04-13 | 3 | 40 North Latitude Fund LP By 40 North Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 7 841 323 | ||||||||

| 2018-04-13 | 3 | 40 North Latitude Fund LP By 40 North Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 7 500 089 | ||||||||

| 2018-04-13 | 3 | 40 North Latitude Fund LP By 40 North Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 7 841 323 | ||||||||

| 2018-04-13 | 3 | 40 North Latitude Fund LP By 40 North Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 7 841 323 | ||||||||

| 2018-04-13 | 3 | 40 North Latitude Fund LP By 40 North Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 7 500 089 | ||||||||

| 2018-04-13 | 3 | 40 North Latitude Fund LP By 40 North Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 7 841 323 | ||||||||

| 2018-04-13 | 3 | 40 North Latitude Fund LP By 40 North Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 7 841 323 | ||||||||

| 2018-04-13 | 3 | 40 North Latitude Fund LP By 40 North Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 7 500 089 | ||||||||

| 2018-04-13 | 3 | 40 North Latitude Fund LP By 40 North Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 7 841 323 | ||||||||

| 2018-04-13 | 3 | 40 North Latitude Fund LP By 40 North Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 7 500 089 | ||||||||

| 2018-04-13 | 3 | 40 North Latitude Fund LP By 40 North Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 7 841 323 | ||||||||

| 2018-04-13 | 3 | 40 North Latitude Fund LP By 40 North Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 7 500 089 | ||||||||

| 2018-04-13 | 3 | 40 North Latitude Fund LP By 40 North Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 7 841 323 | ||||||||

| 2018-04-13 | 3 | 40 North Latitude Fund LP By 40 North Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 7 500 089 | ||||||||

| 2018-04-13 | 3 | 40 North Latitude Fund LP By 40 North Latitude SPV-D LLC | GCP | Common Stock, $0.01 par value | I | 7 841 323 | ||||||||

| 2018-04-13 | 3 | 40 North Latitude Fund LP By 40 North Latitude Master Fund Ltd. | GCP | Common Stock, $0.01 par value | I | 7 500 089 | ||||||||

| 2018-04-13 | 3 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 4 187 340 | ||||||||

| 2018-04-13 | 3 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 4 187 340 | ||||||||

| 2018-04-13 | 3 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 4 187 340 | ||||||||

| 2018-04-13 | 3 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 4 187 340 | ||||||||

| 2018-04-13 | 3 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 4 187 340 | ||||||||

| 2018-04-13 | 3 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 4 187 340 | ||||||||

| 2018-04-13 | 3 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 4 187 340 | ||||||||

| 2018-04-13 | 3 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 4 187 340 | ||||||||

| 2018-04-13 | 3 | Dalbergia Investments LLC | GCP | Common Stock, $0.01 par value | D | 4 187 340 | ||||||||

| 2018-03-12 | 2018-03-12 | 4 | SHEPHERD DANNY R | GCP | Common Stock | D | 31,3500 | 2 388 | 75 | 12 768 | ||||

| 2018-03-06 | 2018-03-05 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 31,4300 | −6 889 | −217 | 4 712 | ||||

| 2018-02-28 | 2018-02-27 | 4 | HOLLAND KEVIN | GCP | Common Stock | D | 30,4500 | −423 | −13 | 18 704 | ||||

| 2018-02-28 | 2018-02-27 | 4 | Srinivasan Naren B | GCP | Common Stock | D | 30,4500 | −542 | −17 | 33 036 | ||||

| 2018-02-28 | 2018-02-27 | 4 | Freeman Dean P | GCP | Common Stock | D | 30,4500 | −647 | −20 | 19 615 | ||||

| 2018-02-28 | 2018-02-27 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 30,4500 | −163 | −5 | 11 601 | ||||

| 2018-02-28 | 2018-02-27 | 4 | Kapples John W. | GCP | Common Stock | D | 30,4500 | −379 | −12 | 12 583 | ||||

| 2018-02-28 | 2018-02-27 | 4 | Poling Gregory E | GCP | Common Stock | D | 30,4500 | −3 368 | −103 | 56 587 | ||||

| 2018-02-26 | 2018-02-25 | 4 | Freeman Dean P | GCP | Common Stock | D | 32,7000 | −1 069 | −35 | 20 262 | ||||

| 2018-02-26 | 2018-02-22 | 4 | Freeman Dean P | GCP | Employee Stock Options (rights to buy) | D | 32,60 | 16 937 | 16 937 | |||||

| 2018-02-26 | 2018-02-22 | 4 | Freeman Dean P | GCP | Common Stock | D | 5 751 | 21 331 | ||||||

| 2018-02-26 | 2018-02-25 | 4 | Srinivasan Naren B | GCP | Common Stock | D | 32,7000 | −782 | −26 | 33 578 | ||||

| 2018-02-26 | 2018-02-22 | 4 | Srinivasan Naren B | GCP | Employee Stock Options (rights to buy) | D | 32,60 | 12 420 | 12 420 | |||||

| 2018-02-26 | 2018-02-22 | 4 | Srinivasan Naren B | GCP | Common Stock | D | 4 217 | 34 360 | ||||||

| 2018-02-26 | 2018-02-25 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 32,7000 | −214 | −7 | 11 764 | ||||

| 2018-02-26 | 2018-02-22 | 4 | Korotkin Kenneth S | GCP | Employee Stock Options (rights to buy) | D | 32,60 | 4 516 | 4 516 | |||||

| 2018-02-26 | 2018-02-22 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 1 533 | 11 978 | ||||||

| 2018-02-26 | 2018-02-25 | 4 | Poling Gregory E | GCP | Common Stock | D | 32,7000 | −4 832 | −158 | 59 955 | ||||

| 2018-02-26 | 2018-02-22 | 4 | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 32,60 | 32,6000 | 59 846 | 1 951 | 59 846 | |||

| 2018-02-26 | 2018-02-22 | 4 | Poling Gregory E | GCP | Common Stock | D | 20 322 | 64 787 | ||||||

| 2018-02-26 | 2018-02-25 | 4 | Kapples John W. | GCP | Common Stock | D | 32,7000 | −706 | −23 | 12 962 | ||||

| 2018-02-26 | 2018-02-22 | 4 | Kapples John W. | GCP | Employee Stock Options (rights to buy) | D | 32,60 | 12 872 | 12 872 | |||||

| 2018-02-26 | 2018-02-22 | 4 | Kapples John W. | GCP | Common Stock | D | 4 371 | 13 668 | ||||||

| 2018-02-26 | 2018-02-22 | 4 | HOLLAND KEVIN | GCP | Employee Stock Options (rights to buy) | D | 32,60 | 11 517 | 11 517 | |||||

| 2018-02-26 | 2018-02-22 | 4 | HOLLAND KEVIN | GCP | Common Stock | D | 3 911 | 19 127 | ||||||

| 2018-01-08 | 2018-01-05 | 4 | Korotkin Kenneth S | GCP | Restricted Stock Units | D | −10 471 | 0 | ||||||

| 2018-01-08 | 2018-01-05 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 33,5100 | −3 582 | −120 | 10 445 | ||||

| 2018-01-08 | 2018-01-05 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 10 471 | 14 027 | ||||||

| 2018-01-05 | 2018-01-04 | 4 | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 15,36 | −36 686 | 0 | |||||

| 2018-01-05 | 2018-01-04 | 4 | Poling Gregory E | GCP | Common Stock | D | 32,9100 | −26 233 | −863 | 54 918 | ||||

| 2018-01-05 | 2018-01-04 | 4 | Poling Gregory E | GCP | Common Stock | D | 15,3600 | 36 686 | 563 | 81 151 | ||||

| 2017-11-08 | 2017-11-06 | 4 | Mason Phillip J By Trust | GCP | Common Stock, par value $0.01 per share | I | 29,9580 | 3 000 | 90 | 9 000 | ||||

| 2017-10-20 | 2017-05-04 | 4/A | SHEPHERD DANNY R | GCP | Common Stock | D | 2 967 | 10 380 | ||||||

| 2017-10-20 | 2017-10-19 | 4 | Srinivasan Naren B | GCP | Common Stock | D | 29,2000 | −3 277 | −96 | 30 143 | ||||

| 2017-05-25 | 2017-04-03 | 4 | Poling Gregory E By Trust | GCP | Common Stock | I | −300 | 141 341 | ||||||

| 2017-05-05 | 2017-05-04 | 4 | COLELLA GERARD G | GCP | Common Stock | D | 2 967 | 2 967 | ||||||

| 2017-05-04 | 2017-05-04 | 4 | HENRY JANICE K | GCP | Common Stock, par value $0.01 per share | D | 2 967 | 12 349 | ||||||

| 2017-05-04 | 2017-05-04 | 4 | CAMBRE RONALD C | GCP | Common Stock, par value $0.01 per share | D | 2 967 | 18 470 | ||||||

| 2017-05-04 | 2017-05-04 | 4 | SHEPHERD DANNY R | GCP | Common Stock | D | 2 967 | 5 919 | ||||||

| 2017-05-04 | 2017-05-04 | 4 | Mason Phillip J | GCP | Common Stock, par value $0.01 per share | D | 2 967 | 7 428 | ||||||

| 2017-05-04 | 2017-05-04 | 4 | AVEDON MARCIA J | GCP | Common Stock, par value $0.01 per share | D | 2 967 | 7 428 | ||||||

| 2017-05-04 | 2017-05-04 | 4 | Mora Elizabeth | GCP | Common Stock, par value $0.01 per share | D | 2 967 | 7 428 | ||||||

| 2017-03-09 | 3 | Srinivasan Naren B | GCP | Common Stock | D | 66 840 | ||||||||

| 2017-03-09 | 3 | Srinivasan Naren B | GCP | Common Stock | D | 66 840 | ||||||||

| 2017-03-07 | 2017-02-25 | 4/A | Freeman Dean P | GCP | Common Stock | D | 26,4000 | −1 192 | −31 | 8 952 | ||||

| 2017-03-07 | 2017-02-25 | 4/A | Korotkin Kenneth S | GCP | Common Stock | D | 26,4000 | −274 | −7 | 1 899 | ||||

| 2017-03-07 | 2017-02-25 | 4/A | Kapples John W. | GCP | Common Stock | D | 26,4000 | −766 | −20 | 5 320 | ||||

| 2017-03-07 | 2017-02-25 | 4/A | Mahmood Saber Zain | GCP | Common Stock | D | 26,4000 | −1 195 | −32 | 8 949 | ||||

| 2017-03-07 | 2017-02-25 | 4/A | Poling Gregory E | GCP | Common Stock | D | 26,4000 | −5 115 | −135 | 27 493 | ||||

| 2017-03-01 | 2017-02-27 | 4 | HOLLAND KEVIN | GCP | Employee Stock Options (rights to buy) | D | 26,40 | 10 542 | 10 542 | |||||

| 2017-03-01 | 2017-02-27 | 4 | HOLLAND KEVIN | GCP | Common Stock | D | 3 645 | 3 645 | ||||||

| 2017-03-01 | 2017-02-27 | 4 | Kapples John W. | GCP | Employee Stock Options (rights to buy) | D | 26,40 | 11 500 | 11 500 | |||||

| 2017-03-01 | 2017-02-27 | 4 | Kapples John W. | GCP | Common Stock | D | 3 977 | 8 034 | ||||||

| 2017-03-01 | 2017-02-27 | 4 | Korotkin Kenneth S | GCP | Employee Stock Options (rights to buy) | D | 26,40 | 4 791 | 4 791 | |||||

| 2017-03-01 | 2017-02-27 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 1 657 | 3 105 | ||||||

| 2017-03-01 | 2017-02-27 | 4 | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 26,40 | 65 717 | 65 717 | |||||

| 2017-03-01 | 2017-02-27 | 4 | Poling Gregory E | GCP | Common Stock | D | 22 727 | 44 465 | ||||||

| 2017-03-01 | 2017-02-27 | 4 | Mahmood Saber Zain | GCP | Employee Stock Options (rights to buy) | D | 26,40 | 19 167 | 19 167 | |||||

| 2017-03-01 | 2017-02-27 | 4 | Mahmood Saber Zain | GCP | Common Stock | D | 6 628 | 13 390 | ||||||

| 2017-03-01 | 2017-02-27 | 4 | Freeman Dean P | GCP | Employee Stock Options (rights to buy) | D | 26,40 | 19 167 | 19 167 | |||||

| 2017-03-01 | 2017-02-27 | 4 | Freeman Dean P | GCP | Common Stock | D | 6 628 | 13 390 | ||||||

| 2017-02-28 | 2017-02-25 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 26,4000 | −725 | −19 | 1 448 | ||||

| 2017-02-28 | 2017-02-25 | 4 | Mahmood Saber Zain | GCP | Common Stock | D | 26,4000 | −3 382 | −89 | 6 762 | ||||

| 2017-02-28 | 2017-02-25 | 4 | Freeman Dean P | GCP | Common Stock | D | 26,4000 | −3 382 | −89 | 6 762 | ||||

| 2017-02-28 | 2017-02-25 | 4 | Poling Gregory E | GCP | Common Stock | D | 26,4000 | −10 870 | −287 | 21 738 | ||||

| 2017-02-28 | 2017-02-25 | 4 | Kapples John W. | GCP | Common Stock | D | 26,4000 | −2 029 | −54 | 4 057 | ||||

| 2017-02-13 | 2017-02-10 | 4 | Poling Gregory E | GCP | Common Stock | D | 27,2000 | −3 158 | −86 | 3 553 | ||||

| 2017-02-13 | 2017-02-10 | 4 | Poling Gregory E | GCP | Common Stock | D | 6 711 | 6 711 | ||||||

| 2017-01-30 | 2017-01-17 | 4 | HOLLAND KEVIN | GCP | Common Stock | D | 11 571 | 11 571 | ||||||

| 2017-01-05 | 2017-01-04 | 4 | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 9,71 | −40 280 | 0 | |||||

| 2017-01-05 | 2017-01-04 | 4 | Poling Gregory E | GCP | Common Stock | D | 27,2300 | −26 700 | −727 | 26 610 | ||||

| 2017-01-05 | 2017-01-04 | 4 | Poling Gregory E | GCP | Common Stock | D | 9,7100 | 40 280 | 391 | 53 310 | ||||

| 2017-01-05 | 2017-01-03 | 4 | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 9,71 | −40 280 | 40 280 | |||||

| 2017-01-05 | 2017-01-03 | 4 | Poling Gregory E | GCP | Common Stock | D | 26,2000 | −27 250 | −714 | 13 030 | ||||

| 2017-01-05 | 2017-01-03 | 4 | Poling Gregory E | GCP | Common Stock | D | 9,7100 | 40 280 | 391 | 40 280 | ||||

| 2017-01-05 | 2016-03-09 | 4 | Poling Gregory E By Trust | GCP | Common Stock | I | −500 | 105 723 | ||||||

| 2016-05-09 | 2016-05-05 | 4 | CAMBRE RONALD C | GCP | Common Stock, par value $0.01 per share | D | 4 461 | 15 503 | ||||||

| 2016-05-09 | 2016-05-05 | 4 | Mora Elizabeth | GCP | Common Stock, par value $0.01 per share | D | 4 461 | 4 461 | ||||||

| 2016-05-09 | 2016-05-05 | 4 | FOX MARYE ANNE | GCP | Common Stock, par value $0.01 per share | D | 4 461 | 54 728 | ||||||

| 2016-05-09 | 2016-05-05 | 4 | SHEPHERD DANNY R | GCP | Common Stock, par value $0.01 per share | D | 4 461 | 7 413 | ||||||

| 2016-05-09 | 2016-05-05 | 4 | AVEDON MARCIA J | GCP | Common Stock, par value $0.01 per share | D | 4 461 | 4 461 | ||||||

| 2016-05-09 | 2016-05-05 | 4 | HENRY JANICE K | GCP | Common Stock, par value $0.01 per share | D | 4 461 | 9 382 | ||||||

| 2016-05-09 | 2016-05-05 | 4 | Mason Phillip J | GCP | Common Stock, par value $0.01 per share | D | 4 461 | 4 461 | ||||||

| 2016-03-11 | 2016-03-09 | 4 | McCall William J. | GCP | Employee Stock Options (rights to buy) | D | 8,47 | −3 314 | 0 | |||||

| 2016-03-11 | 2016-03-09 | 4 | McCall William J. | GCP | Common Stock | D | 18,6250 | −1 507 | −28 | 5 567 | ||||

| 2016-03-11 | 2016-03-09 | 4 | McCall William J. | GCP | Common Stock | D | 18,6250 | −587 | −11 | 7 074 | ||||

| 2016-03-11 | 2016-03-09 | 4 | McCall William J. | GCP | Common Stock | D | 8,4700 | 3 314 | 28 | 7 661 | ||||

| 2016-02-29 | 2016-02-25 | 4 | Poling Gregory E | GCP | Common Stock | D | 17,1100 | −12 004 | −205 | 97 018 | ||||

| 2016-02-29 | 2016-02-25 | 4 | Poling Gregory E | GCP | Common Stock | D | 25 405 | 109 022 | ||||||

| 2016-02-26 | 2016-02-25 | 4 | Korotkin Kenneth S | GCP | Restricted Stock Units | D | 17,04 | 7 653 | 7 653 | |||||

| 2016-02-26 | 2016-02-25 | 4 | Korotkin Kenneth S | GCP | Common Stock | D | 2 173 | 2 173 | ||||||

| 2016-02-26 | 2016-02-25 | 4 | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 17,04 | 114 795 | 114 795 | |||||

| 2016-02-26 | 2016-02-25 | 4 | Poling Gregory E | GCP | Common Stock | D | 32 608 | 83 617 | ||||||

| 2016-02-26 | 2016-02-25 | 4 | Freeman Dean P | GCP | Employee Stock Options (rights to buy) | D | 17,04 | 35 714 | 35 714 | |||||

| 2016-02-26 | 2016-02-25 | 4 | Freeman Dean P | GCP | Common Stock | D | 10 144 | 10 144 | ||||||

| 2016-02-26 | 2016-02-25 | 4 | Mason Phillip J By Trust | GCP | Common Stock | I | 17,0720 | 6 000 | 102 | 6 000 | ||||

| 2016-02-26 | 2016-02-25 | 4 | Kapples John W. | GCP | Employee Stock Options (rights to buy) | D | 17,04 | 21 428 | 21 428 | |||||

| 2016-02-26 | 2016-02-25 | 4 | Kapples John W. | GCP | Common Stock | D | 6 086 | 6 086 | ||||||

| 2016-02-26 | 2016-02-25 | 4 | Mahmood Saber Zain | GCP | Employee Stock Options (rights to buy) | D | 17,04 | 17,0400 | 35 714 | 609 | 35 714 | |||

| 2016-02-26 | 2016-02-25 | 4 | Mahmood Saber Zain | GCP | Common Stock | D | 10 144 | 10 144 | ||||||

| 2016-02-26 | 2016-02-25 | 4 | McCall William J. | GCP | Employee Stock Options (rights to buy) | D | 17,04 | 15 306 | 15 306 | |||||

| 2016-02-26 | 2016-02-25 | 4 | McCall William J. | GCP | Common Stock | D | 4 347 | 4 347 | ||||||

| 2016-02-24 | 2016-02-24 | 4 | SHEPHERD DANNY R | GCP | Common Stock | D | 16,9090 | 2 952 | 50 | 2 952 | ||||

| 2016-02-24 | 2016-02-22 | 4 | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 8,27 | −9 945 | 0 | |||||

| 2016-02-24 | 2016-02-22 | 4 | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 8,47 | −59 674 | 0 | |||||

| 2016-02-24 | 2016-02-22 | 4 | Poling Gregory E | GCP | Common Stock | D | 17,0000 | 30 000 | 510 | 51 009 | ||||

| 2016-02-24 | 2016-02-22 | 4 | Poling Gregory E | GCP | Common Stock | D | 16,9650 | −34 641 | −588 | 21 009 | ||||

| 2016-02-24 | 2016-02-22 | 4 | Poling Gregory E | GCP | Common Stock | D | 16,9650 | −13 969 | −237 | 55 650 | ||||

| 2016-02-24 | 2016-02-22 | 4 | Poling Gregory E | GCP | Common Stock | D | 8,2700 | 9 945 | 82 | 69 619 | ||||

| 2016-02-24 | 2016-02-22 | 4 | Poling Gregory E | GCP | Common Stock | D | 8,4700 | 59 674 | 505 | 59 674 | ||||

| 2016-02-10 | 2016-02-08 | 4 | Korotkin Kenneth S | GCP | Restricted Stock Units | D | 4 347 | 14 818 | ||||||

| 2016-02-10 | 2016-02-08 | 4 | Freeman Dean P | GCP | Restricted Stock Units | D | 27 188 | 36 221 | ||||||

| 2016-02-10 | 2016-02-08 | 4 | Freeman Dean P | GCP | Employee Stock Options (rights to buy) | D | 17,25 | 47 044 | 47 044 | |||||

| 2016-02-10 | 2016-02-08 | 4 | Poling Gregory E | GCP | Restricted Stock Units | D | 87 391 | 126 400 | ||||||

| 2016-02-10 | 2016-02-08 | 4 | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 17,25 | 151 311 | 151 311 | |||||

| 2016-02-10 | 2016-02-08 | 4 | Kapples John W. | GCP | Restricted Stock Units | D | 16 313 | 16 313 | ||||||

| 2016-02-10 | 2016-02-08 | 4 | Kapples John W. | GCP | Employee Stock Options (rights to buy) | D | 17,25 | 28 244 | 28 244 | |||||

| 2016-02-10 | 2016-02-08 | 4 | Mahmood Saber Zain | GCP | Restricted Stock Units | D | 27 188 | 37 345 | ||||||

| 2016-02-10 | 2016-02-08 | 4 | Mahmood Saber Zain | GCP | Employee Stock Options (rights to buy) | D | 17,25 | 47 074 | 47 074 | |||||

| 2016-02-10 | 2016-02-08 | 4 | McCall William J. | GCP | Restricted Stock Units | D | 11 652 | 15 552 | ||||||

| 2016-02-10 | 2016-02-08 | 4 | McCall William J. | GCP | Employee Stock Options (rights to buy) | D | 17,25 | 20 174 | 20 174 | |||||

| 2016-02-08 | 2016-02-04 | 4/A | Freeman Dean P | GCP | Employee Stock Options (rights to buy) | D | 19,38 | 45 156 | 45 156 | |||||

| 2016-02-08 | 2016-02-04 | 4/A | Korotkin Kenneth S | GCP | Restricted Stock Units | D | 10 471 | 10 471 | ||||||

| 2016-02-08 | 2016-02-08 | 4/A | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 19,23 | 195 045 | 195 045 | |||||

| 2016-02-08 | 2016-02-04 | 4/A | Poling Gregory E | GCP | Restricted Stock Units | D | 39 009 | 39 009 | ||||||

| 2016-02-08 | 2016-02-04 | 4/A | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 18,58 | 32 162 | 32 162 | |||||

| 2016-02-08 | 2016-02-04 | 4/A | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 15,36 | 36 686 | 36 686 | |||||

| 2016-02-08 | 2016-02-04 | 4/A | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 9,71 | 80 560 | 80 560 | |||||

| 2016-02-08 | 2016-02-04 | 4/A | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 8,27 | 9 945 | 9 945 | |||||

| 2016-02-08 | 2016-02-04 | 4/A | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 8,47 | 59 674 | 59 674 | |||||

| 2016-02-08 | 2016-02-04 | 4 | Korotkin Kenneth S | GCP | Restricted Stock Units | D | 10 471 | 10 471 | ||||||

| 2016-02-08 | 2016-02-04 | 4 | Freeman Dean P | GCP | Employee Stock Options (rights to buy) | D | 20,00 | 45 156 | 45 156 | |||||

| 2016-02-08 | 2016-02-04 | 4 | Poling Gregory E | GCP | Restricted Stock Units | D | 39 009 | 39 009 | ||||||

| 2016-02-08 | 2016-02-04 | 4 | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 20,00 | 195 045 | 195 045 | |||||

| 2016-02-08 | 2016-02-04 | 4 | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 18,58 | 32 162 | 32 162 | |||||

| 2016-02-08 | 2016-02-04 | 4 | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 15,36 | 36 686 | 36 686 | |||||

| 2016-02-08 | 2016-02-04 | 4 | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 9,71 | 80 560 | 80 560 | |||||

| 2016-02-08 | 2016-02-04 | 4 | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 8,27 | 9 945 | 9 945 | |||||

| 2016-02-08 | 2016-02-04 | 4 | Poling Gregory E | GCP | Employee Stock Options (rights to buy) | D | 8,47 | 59 674 | 59 674 | |||||

| 2016-02-08 | 2016-02-04 | 4 | Mahmood Saber Zain | GCP | Restricted Stock Units | D | 10 157 | 10 157 | ||||||

| 2016-02-08 | 2016-02-04 | 4 | McCall William J. | GCP | Restricted Stock Units | D | 3 900 | 3 900 | ||||||

| 2016-02-08 | 2016-02-04 | 4 | McCall William J. | GCP | Employee Stock Options (rights to buy) | D | 19,23 | 19 504 | 19 504 | |||||

| 2016-02-08 | 2016-02-04 | 4 | McCall William J. | GCP | Employee Stock Options (rights to buy) | D | 18,58 | 3 216 | 3 216 | |||||

| 2016-02-08 | 2016-02-04 | 4 | McCall William J. | GCP | Employee Stock Options (rights to buy) | D | 15,36 | 2 935 | 2 935 | |||||

| 2016-02-08 | 2016-02-04 | 4 | McCall William J. | GCP | Employee Stock Options (rights to buy) | D | 9,71 | 3 221 | 3 221 | |||||

| 2016-02-08 | 2016-02-04 | 4 | McCall William J. | GCP | Employee Stock Options (rights to buy) | D | 8,47 | 3 314 | 3 314 | |||||

| 2016-02-05 | 2016-02-03 | 4 | Poling Gregory E By Trust | GCP | Common Stock, par value $0.01 per share | I | 41 813 | 41 813 | ||||||

| 2016-02-05 | 2016-02-03 | 4 | FOX MARYE ANNE | GCP | Common Stock, par value $0.01 per share | D | 50 267 | 50 267 | ||||||

| 2016-02-05 | 2016-02-03 | 4 | HENRY JANICE K | GCP | Common Stock, par value $0.01 per share | D | 4 921 | 4 921 | ||||||

| 2016-02-05 | 2016-02-03 | 4 | CAMBRE RONALD C | GCP | Common Stock, par value $0.01 per share | D | 11 042 | 11 042 | ||||||

| 2016-02-05 | 2016-02-03 | 4 | W R GRACE & CO | GCP | Common Stock, par value $0.01 per share | D | −70 538 445 | 0 | ||||||

| 2016-01-15 | 3 | W R GRACE & CO | GCP | Common Stock, par value $0.01 per share | D | 200 | ||||||||

| 2016-01-15 | 3 | W R GRACE & CO | GCP | Common Stock, par value $0.01 per share | D | 200 |