| Insideraktier | 3 014 961 shares |

Insider Sentiment Score

Insider sentiment score hittar de företag som köps av foretagsinsynspersoner.

Det är resultatet av en sofistikerad, kvantitativ multifaktormodell som identifierar företag med de högsta nivåerna av insiderackumulation. Poängmodellen använder en kombination av nettoantalet insiders som köpt de föregående 90 dagarna, det totala antalet aktier som köpts i procent av aktiekapitalet och det totala antalet aktier som ägs av insiders. Siffran sträcker sig från 0 till 100, med högre siffror som indikerar en högre nivå av ackumulering för sina kamrater, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Insiders Top Picks, som ger en lista över företag med högsta insiderackumulation.

Office Sentiment Score

Officersentiment Score hittar företag som köps av Corporate Officers.

Per definition Corporate Officers är Corporate Insiders, men till skillnad från vissa av de andra Insiders (10 % aktieägare och styrelseledamöter), arbetar ämbetsmän för företaget dagligen och de använder sina egna pengar när de handlar . (10 % aktieägare och styrelseledamöter är ofta fondförvaltare som förvaltar andras pengar.) Som sådan är insideraffärer som görs av tjänstemän mycket mer betydelsefulla och bör behandlas på lämpligt sätt.

Liksom Insider Sentiment Score är Officer Sentiment Score resultatet av en sofistikerad, kvantitativ multifaktormodell som identifierar företag med de högsta nivåerna av officersackumulering.

Uppdateringsfrekvens: Dagligen

Se insiderns bästa val, vilket ger en lista över företag med högsta insider sentiment.

Viktiga insidernyckeltal

Denna kort visar hur företaget rankas längs olika insidernyckeltal. Procenttilrankningen visar hur detta företag jämförs med andra företag på USA-marknaden. Högre rankingar indikerar bättre situationer.

Till exempel anses det allmänt att insiderköp är en positiv indikator, så företag med mer insiderköp skulle rankas högre än företag med mindre insiderköp (eller til och med insiderförsäljning).

Nettoantalet insiders som köper (rankning)

N/A

Nettoantalet insiders som köper är den totala mängden insiders som säljer minus det totala antalet insiders som säljer under de senaste 90 dagarna. Percentilrankningen visas här (intervall från 0 till 100%).

Procent av flytande köpta av insiders (ranking)

N/A

Procentandelen av aktier köpta av insiders är det totala antalet aktier som köpts av insiders minus det totala antalet aktier som sålts av insiders under de senaste 90 dagarna, dividerat med det totala antalet aktier och multiplicerat med 100.

Insiderhandelsdiagram

Express, Inc. insideraffärer visas i följande diagram. Insiders är tjänstemän, styrelseledamöter eller betydande investerare i ett företag. I allmänhet är det i allmänhet olagligt för insiders att göra affärer i sina företag baserat på väsentlig, icke-offentlig information. Detta betyder inte att det är olagligt för dem att göra några affärer i sina egna företag. De måste dock rapportera alla affärer till SEC via ett formulär 4.

Insiderlista och lönsamhetsstatistik

Den här tabellen visar listan över kända insiders och genereras automatiskt från anmälningar som avslöjas till SEC. Förutom namnen, den senaste titeln och direktören, tjänstemannen eller ägarbeteckningen på 10 %, tillhandahåller vi de senaste avslöjade innehaven. Dessutom, när det är möjligt tillhandahåller vi insiderns historiska handelsresultat. Det historiska handelsresultatet är ett vägt genomsnitt av resultatet för faktiska köptransaktioner på den öppna marknaden som insidern gjort. För mer information om hur detta beräknas, titta på detta YouTube-webinarium.

See our leaderboard of most profitable insider traders.

| Insider | Genomsnitt vinst (%) | Aktier Ägda |

Delad Justerad |

|---|

Report errors via our new Insider Auditing Tool

Track Records av insiderköp - Kortsiktig vinstanalys

I denna sektion analyserar vi lönsamheten för varje oplanerat, öppet-marknads insiderköp gjorda i EXPRQ / Express, Inc.. Denna analys hjälper till att förstå om insidern konsekvent genererar onormala avkastningar och är värd att följa. Denna analys är för ett år efter varje handel, och resultaten är teoretiska .

Tabellen nedan visar de senaste köpen på öppna marknaden som inte var en del av en automatisk handelsplan.

| Handelsdatum | Insider | Rapporterade aktier |

Rapporterat pris |

Justerade aktier |

Justerat pris |

Kostnadsbasis | Dagar til Max |

Pris vid Max |

Maximal vinst ($) |

Maximal avkastning (%) |

|---|---|---|---|---|---|---|---|---|---|---|

| 2023-01-25 | SHMIDMAN YEHUDA | 5 434 783 | 4,6000 | 271 739 | 92,0000 | 25 000 002 | 12 | 27.4 | −17 554 352 | −70,22 |

Justeringar av aktierär de justerade aktierna efter justerat pris. Justeringar av aktierär de justerade aktierna efter uppdelning.

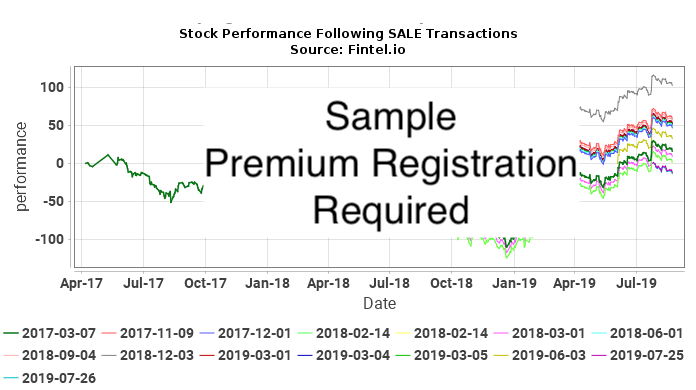

Track Records av insiderförsäljning - Kortsiktig förlustanalys

I denna sektion analyserar vi lönsamheten för varje oplanerat, öppet-marknads insiderköp gjorda i EXPRQ / Express, Inc.. Denna analys hjälper till att förstå om insidern konsekvent genererar onormala avkastningar och är värd att följa. Denna analys är för ett år efter varje handel, och resultaten är teoretiska .

Tabellen nedan visar de senaste försäljningarna på öppna marknaden som inte var en del av en automatisk handelsplan.

Justeringar av aktierär de justerade aktierna efter justerat pris. Justeringar av aktierär de justerade aktierna efter uppdelning.

Transaktionshistorik

Klicka på länkikonen för att se hela transaktionshistoriken. Transaktioner som rapporteras som en del av en automatisk handelsplan 10b5-1 kommer att ha ett X i kolumnen markerad 10b-5.

| Fil datum |

Handel datum |

Schema | Insider | Ticker | Värdepappertitel | Kod | Direkta | Utövningspris | Enhet pris |

Enheter ändrad |

Värde ändrad (1K) |

Kvarvarande Optioner |

Kvarvarande Aktier |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2023-11-21 | 3 | STILL MARK | EXPR | Common Stock, par value $0.01 | D | 2 659 | ||||||||

| 2023-09-18 | 2023-09-15 | 4 | Tervo Sara | EXPR | Common Stock, par value $0.01 | D | 9,7400 | −441 | −4 | 8 447 | ||||

| 2023-04-18 | 2023-04-15 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 0,8400 | −49 673 | −42 | 521 866 | ||||

| 2023-04-18 | 2023-04-15 | 4 | BAXTER TIMOTHY G | EXPR | Common Stock, par value $0.01 | D | 0,8400 | −84 017 | −71 | 794 590 | ||||

| 2023-04-18 | 2023-04-15 | 4 | Tervo Sara | EXPR | Common Stock, par value $0.01 | D | 0,8400 | −13 692 | −12 | 177 758 | ||||

| 2023-04-18 | 2023-04-15 | 4 | Akay Malissa | EXPR | Common Stock, par value $0.01 | D | 0,8400 | −17 359 | −15 | 247 216 | ||||

| 2023-02-16 | 2023-02-15 | 4 | SHMIDMAN YEHUDA | EXPR | Common Stock, par value $0.01 | D | 13 148 | 13 148 | ||||||

| 2023-02-03 | 2023-01-25 | 4 | SHMIDMAN YEHUDA | EXPR | Common Stock, par value $0.01 | I | 4,6000 | 5 434 783 | 25 000 | 5 434 783 | ||||

| 2022-12-15 | 2022-12-15 | 4 | Mehta Satish | EXPR | Common Stock, par value $0.01 | D | 18 544 | 28 544 | ||||||

| 2022-12-07 | 3 | Mehta Satish | EXPR | Common Stock, par value $0.01 | D | 10 000 | ||||||||

| 2022-09-19 | 2022-09-15 | 4 | Akay Malissa | EXPR | Common Stock, par value $0.01 | D | 1,2700 | −16 627 | −21 | 264 575 | ||||

| 2022-09-19 | 2022-09-15 | 4 | Tervo Sara | EXPR | Common Stock, par value $0.01 | D | 1,2700 | −8 807 | −11 | 191 450 | ||||

| 2022-06-09 | 2022-06-08 | 4 | LOPEZ PATRICIA E | EXPR | Common Stock, par value $0.01 | D | 35 813 | 46 583 | ||||||

| 2022-06-09 | 2022-06-08 | 4 | LUCIO ANTONIO | EXPR | Common Stock, par value $0.01 | D | 35 813 | 56 167 | ||||||

| 2022-06-09 | 2022-06-08 | 4 | DEVINE MICHAEL F III | EXPR | Common Stock, par value $0.01 | D | 35 813 | 222 644 | ||||||

| 2022-06-09 | 2022-06-08 | 4 | Leever Karen | EXPR | Common Stock, par value $0.01 | D | 35 813 | 190 784 | ||||||

| 2022-06-09 | 2022-06-08 | 4 | ARCHBOLD MICHAEL G | EXPR | Common Stock, par value $0.01 | D | 35 813 | 218 445 | ||||||

| 2022-06-09 | 2022-06-08 | 4 | DAVENPORT TERRY | EXPR | Common Stock, par value $0.01 | D | 35 813 | 188 891 | ||||||

| 2022-06-09 | 2022-06-08 | 4 | MANGUM MYLLE H | EXPR | Common Stock, par value $0.01 | D | 46 832 | 283 681 | ||||||

| 2022-06-09 | 2022-06-08 | 4 | SWINBURN PETER S | EXPR | Common Stock, par value $0.01 | D | 35 813 | 218 445 | ||||||

| 2022-04-18 | 2022-04-15 | 4 | Akay Malissa | EXPR | Common Stock, par value $0.01 | D | 3,3100 | −17 468 | −58 | 281 202 | ||||

| 2022-04-18 | 2022-04-15 | 4 | BAXTER TIMOTHY G | EXPR | Common Stock, par value $0.01 | D | 3,3100 | −125 013 | −414 | 878 607 | ||||

| 2022-04-18 | 2022-04-15 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 3,3100 | −79 964 | −265 | 571 539 | ||||

| 2022-04-18 | 2022-04-15 | 4 | Tervo Sara | EXPR | Common Stock, par value $0.01 | D | 3,3100 | −13 692 | −45 | 200 257 | ||||

| 2022-02-15 | 2022-02-15 | 4 | LOPEZ PATRICIA E | EXPR | Common Stock, par value $0.01 | D | 4,0700 | 10 770 | 44 | 10 770 | ||||

| 2021-12-15 | 2021-12-15 | 4 | LUCIO ANTONIO | EXPR | Common Stock, par value $0.01 | D | 3,1800 | 20 354 | 65 | 20 354 | ||||

| 2021-09-17 | 2021-09-15 | 4 | Akay Malissa | EXPR | Common Stock, par value $0.01 | D | 5,3700 | −15 402 | −83 | 298 670 | ||||

| 2021-09-17 | 2021-09-15 | 4 | Tervo Sara | EXPR | Common Stock, par value $0.01 | D | 5,3700 | −8 842 | −47 | 213 949 | ||||

| 2021-07-16 | 2021-07-15 | 4 | BAXTER TIMOTHY G | EXPR | Common Stock, par value $0.01 | D | 4,7900 | −261 635 | −1 253 | 1 003 620 | ||||

| 2021-06-29 | 2021-06-25 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 7,5000 | −33 222 | −249 | 651 503 | ||||

| 2021-06-29 | 2021-06-25 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 8,0100 | −31 900 | −256 | 214 503 | ||||

| 2021-06-10 | 2021-06-09 | 4 | Park Winifred | EXPR | Common Stock, par value $0.01 | D | 5,7100 | 21 891 | 125 | 129 100 | ||||

| 2021-06-10 | 2021-06-09 | 4 | Leever Karen | EXPR | Common Stock, par value $0.01 | D | 5,7100 | 21 891 | 125 | 154 971 | ||||

| 2021-06-10 | 2021-06-09 | 4 | MANGUM MYLLE H | EXPR | Common Stock, par value $0.01 | D | 5,7100 | 28 897 | 165 | 236 849 | ||||

| 2021-06-10 | 2021-06-09 | 4 | SWINBURN PETER S | EXPR | Common Stock, par value $0.01 | D | 5,7100 | 21 891 | 125 | 182 632 | ||||

| 2021-06-10 | 2021-06-09 | 4 | DEVINE MICHAEL F III | EXPR | Common Stock, par value $0.01 | D | 5,7100 | 21 891 | 125 | 186 831 | ||||

| 2021-06-10 | 2021-06-09 | 4 | DAVENPORT TERRY | EXPR | Common Stock, par value $0.01 | D | 5,7100 | 21 891 | 125 | 153 078 | ||||

| 2021-06-10 | 2021-06-09 | 4 | ARCHBOLD MICHAEL G | EXPR | Common Stock, par value $0.01 | D | 5,7100 | 21 891 | 125 | 182 632 | ||||

| 2021-06-04 | 2021-06-02 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 6,5000 | −33 222 | −216 | 684 725 | ||||

| 2021-05-28 | 2021-05-26 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 5,0000 | −100 000 | −500 | 717 947 | ||||

| 2021-04-16 | 2021-04-15 | 4 | Tervo Sara | EXPR | Common Stock, par value $0.01 | D | 3,3500 | −13 746 | −46 | 222 791 | ||||

| 2021-04-16 | 2021-04-15 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 3,3500 | −62 228 | −208 | 817 947 | ||||

| 2021-04-16 | 2021-04-15 | 4 | Akay Malissa | EXPR | Common Stock, par value $0.01 | D | 3,3500 | −17 369 | −58 | 314 072 | ||||

| 2021-04-16 | 2021-04-15 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 3,3500 | −21 239 | −71 | 246 403 | ||||

| 2021-04-16 | 2021-04-15 | 4 | BAXTER TIMOTHY G | EXPR | Common Stock, par value $0.01 | D | 3,3500 | −104 121 | −349 | 1 265 255 | ||||

| 2020-11-02 | 2020-10-31 | 4 | Akay Malissa | EXPR | Common Stock, par value $0.01 | D | 0,6100 | −11 786 | −7 | 331 441 | ||||

| 2020-09-16 | 2020-09-15 | 4 | Tervo Sara | EXPR | Common Stock, par value $0.01 | D | 0,9500 | −8 807 | −8 | 236 537 | ||||

| 2020-09-16 | 2020-09-15 | 4 | Akay Malissa | EXPR | Common Stock, par value $0.01 | D | 0,9500 | −11 050 | −10 | 343 227 | ||||

| 2020-06-11 | 2020-06-10 | 4 | DAVENPORT TERRY | EXPR | Common Stock, par value $0.01 | D | 2,4900 | 47 170 | 117 | 131 187 | ||||

| 2020-06-11 | 2020-06-10 | 4 | Leever Karen | EXPR | Common Stock, par value $0.01 | D | 2,4900 | 47 170 | 117 | 133 080 | ||||

| 2020-06-11 | 2020-06-10 | 4 | SWINBURN PETER S | EXPR | Common Stock, par value $0.01 | D | 2,4900 | 47 170 | 117 | 160 741 | ||||

| 2020-06-11 | 2020-06-10 | 4 | ARCHBOLD MICHAEL G | EXPR | Common Stock, par value $0.01 | D | 2,4900 | 47 170 | 117 | 160 741 | ||||

| 2020-06-11 | 2020-06-10 | 4 | MANGUM MYLLE H | EXPR | Common Stock, par value $0.01 | D | 2,4900 | 62 264 | 155 | 207 952 | ||||

| 2020-06-11 | 2020-06-10 | 4 | Park Winifred | EXPR | Common Stock, par value $0.01 | D | 2,4900 | 47 170 | 117 | 107 209 | ||||

| 2020-06-11 | 2020-06-10 | 4 | DEVINE MICHAEL F III | EXPR | Common Stock, par value $0.01 | D | 2,4900 | 47 170 | 117 | 164 940 | ||||

| 2020-04-17 | 2020-04-15 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 2,0000 | −23 943 | −48 | 880 175 | ||||

| 2020-03-25 | 2020-03-24 | 4 | BAXTER TIMOTHY G | EXPR | Common Stock, par value $0.01 | D | 792 453 | 1 369 376 | ||||||

| 2020-03-25 | 2020-03-24 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 377 358 | 904 118 | ||||||

| 2020-03-25 | 2020-03-24 | 4 | Akay Malissa | EXPR | Common Stock, par value $0.01 | D | 169 811 | 354 277 | ||||||

| 2020-03-25 | 2020-03-24 | 4 | Tervo Sara | EXPR | Common Stock, par value $0.01 | D | 132 075 | 245 344 | ||||||

| 2020-03-25 | 2020-03-24 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 103 774 | 267 642 | ||||||

| 2019-09-17 | 2019-09-15 | 4 | Tervo Sara | EXPR | Common Stock, par value $0.01 | D | 113 269 | 113 269 | ||||||

| 2019-09-17 | 2019-09-15 | 4 | Akay Malissa | EXPR | Common Stock, par value $0.01 | D | 38 835 | 184 466 | ||||||

| 2019-09-17 | 2019-09-15 | 4 | Akay Malissa | EXPR | Common Stock, par value $0.01 | D | 145 631 | 145 631 | ||||||

| 2019-07-17 | 2019-07-15 | 4 | BAXTER TIMOTHY G | EXPR | Employee Stock Option (right to buy) | D | 2,60 | 1 120 000 | 1 120 000 | |||||

| 2019-07-17 | 2019-07-15 | 4 | BAXTER TIMOTHY G | EXPR | Employee Stock Option (right to buy) | D | 2,60 | 1 200 000 | 1 200 000 | |||||

| 2019-07-17 | 2019-07-15 | 4 | BAXTER TIMOTHY G | EXPR | Common Stock, par value $0.01 | D | 576 923 | 576 923 | ||||||

| 2019-07-17 | 2019-07-15 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 2,6000 | −691 | −2 | 163 868 | ||||

| 2019-06-14 | 2019-06-12 | 4 | SWINBURN PETER S | EXPR | Common Stock, par value $0.01 | D | 2,6000 | 48 077 | 125 | 113 571 | ||||

| 2019-06-14 | 2019-06-12 | 4 | DEVINE MICHAEL F III | EXPR | Common Stock, par value $0.01 | D | 2,6000 | 48 077 | 125 | 117 770 | ||||

| 2019-06-14 | 2019-06-12 | 4 | MANGUM MYLLE H | EXPR | Common Stock, par value $0.01 | D | 2,6000 | 63 462 | 165 | 145 688 | ||||

| 2019-06-14 | 2019-06-12 | 4 | Leever Karen | EXPR | Common Stock, par value $0.01 | D | 2,6000 | 48 077 | 125 | 85 910 | ||||

| 2019-06-14 | 2019-06-12 | 4 | Park Winifred | EXPR | Common Stock, par value $0.01 | D | 2,6000 | 48 077 | 125 | 60 039 | ||||

| 2019-06-14 | 2019-06-12 | 4 | ARCHBOLD MICHAEL G | EXPR | Common Stock, par value $0.01 | D | 2,6000 | 48 077 | 125 | 113 571 | ||||

| 2019-06-14 | 2019-06-12 | 4 | DAVENPORT TERRY | EXPR | Common Stock, par value $0.01 | D | 2,6000 | 48 077 | 125 | 84 017 | ||||

| 2019-04-17 | 2019-04-15 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 3,7700 | −14 079 | −53 | 526 760 | ||||

| 2019-04-17 | 2019-04-15 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 3,7700 | −5 555 | −21 | 232 697 | ||||

| 2019-04-17 | 2019-04-15 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 3,7700 | −7 310 | −28 | 297 008 | ||||

| 2019-04-17 | 2019-04-15 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 3,7700 | −6 149 | −23 | 164 559 | ||||

| 2019-04-17 | 2019-04-15 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 3,7700 | −7 310 | −28 | 348 885 | ||||

| 2019-03-21 | 2019-03-19 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 78 089 | 304 318 | ||||||

| 2019-03-21 | 2019-03-19 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 75 758 | 170 708 | ||||||

| 2019-03-21 | 2019-03-19 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 151 515 | 540 839 | ||||||

| 2019-03-21 | 2019-03-19 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 53 613 | 238 252 | ||||||

| 2019-03-21 | 2019-03-19 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 78 089 | 356 195 | ||||||

| 2018-12-26 | 2018-12-21 | 4 | Contrarius Investment Management Ltd | EXPR | Common Stock | I | 5,0855 | −431 914 | −2 196 | 6 452 902 | ||||

| 2018-12-21 | 2018-12-20 | 4 | Contrarius Investment Management Ltd | EXPR | Common Stock | I | 5,3599 | −240 425 | −1 289 | 6 884 816 | ||||

| 2018-12-19 | 3 | Contrarius Investment Management (Bermuda) Ltd BY MANAGED ACCOUNT | EXPR | Common Stock | I | 14 250 482 | ||||||||

| 2018-12-19 | 3 | Contrarius Investment Management (Bermuda) Ltd BY MANAGED ACCOUNT | EXPR | Common Stock | I | 14 250 482 | ||||||||

| 2018-12-19 | 3 | Contrarius Investment Management (Bermuda) Ltd BY MANAGED ACCOUNT | EXPR | Common Stock | I | 14 250 482 | ||||||||

| 2018-12-19 | 3 | Contrarius Investment Management (Bermuda) Ltd BY MANAGED ACCOUNT | EXPR | Common Stock | I | 14 250 482 | ||||||||

| 2018-07-17 | 2018-07-16 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 9,3800 | −691 | −6 | 94 950 | ||||

| 2018-06-20 | 2018-06-18 | 4 | Hilt James A | EXPR | Common Stock, par value $0.01 | D | 9,4100 | −11 000 | −104 | 102 557 | ||||

| 2018-06-14 | 2018-06-13 | 4 | MANGUM MYLLE H | EXPR | Common Stock, par value $0.01 | D | 15 790 | 82 226 | ||||||

| 2018-06-14 | 2018-06-13 | 4 | SWINBURN PETER S | EXPR | Common Stock, par value $0.01 | D | 11 962 | 65 494 | ||||||

| 2018-06-14 | 2018-06-13 | 4 | DEVINE MICHAEL F III | EXPR | Common Stock, par value $0.01 | D | 11 962 | 69 693 | ||||||

| 2018-06-14 | 2018-06-13 | 4 | ARCHBOLD MICHAEL G | EXPR | Common Stock, par value $0.01 | D | 11 962 | 65 494 | ||||||

| 2018-06-14 | 2018-06-13 | 4 | Leever Karen | EXPR | Common Stock, par value $0.01 | D | 11 962 | 37 833 | ||||||

| 2018-06-14 | 2018-06-13 | 4 | DAVENPORT TERRY | EXPR | Common Stock, par value $0.01 | D | 11 962 | 35 940 | ||||||

| 2018-06-14 | 2018-06-13 | 4 | Park Winifred | EXPR | Common Stock, par value $0.01 | D | 11 962 | 11 962 | ||||||

| 2018-04-17 | 2018-04-15 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 8,1900 | −7 267 | −60 | 184 639 | ||||

| 2018-04-17 | 2018-04-15 | 4 | Hilt James A | EXPR | Common Stock, par value $0.01 | D | 8,1900 | −8 267 | −68 | 113 557 | ||||

| 2018-04-17 | 2018-04-15 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 8,1900 | −13 099 | −107 | 278 106 | ||||

| 2018-04-17 | 2018-04-15 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 8,1900 | −3 448 | −28 | 95 641 | ||||

| 2018-04-17 | 2018-04-15 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 8,1900 | −13 029 | −107 | 226 229 | ||||

| 2018-04-17 | 2018-04-15 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 8,1900 | −24 940 | −204 | 389 324 | ||||

| 2018-04-17 | 2018-04-15 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 8,1900 | −85 323 | −699 | 901 527 | ||||

| 2018-04-06 | 2018-04-04 | 4 | Hilt James A | EXPR | Common Stock, par value $0.01 | D | 50 725 | 121 824 | ||||||

| 2018-04-06 | 2018-04-04 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 362 319 | 986 850 | ||||||

| 2018-04-06 | 2018-04-04 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 36 232 | 191 906 | ||||||

| 2018-04-06 | 2018-04-04 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 48 551 | 291 205 | ||||||

| 2018-04-06 | 2018-04-04 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 94 203 | 414 264 | ||||||

| 2018-04-06 | 2018-04-04 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 43 478 | 99 089 | ||||||

| 2018-04-06 | 2018-04-04 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 48 551 | 239 258 | ||||||

| 2018-04-05 | 2018-04-03 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 12 280 | 155 674 | ||||||

| 2018-04-05 | 2018-04-03 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 14 327 | 190 707 | ||||||

| 2018-04-05 | 2018-04-03 | 4 | Hilt James A | EXPR | Common Stock, par value $0.01 | D | 14 327 | 71 099 | ||||||

| 2018-04-05 | 2018-04-03 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 27 289 | 320 061 | ||||||

| 2018-04-05 | 2018-04-03 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 92 506 | 624 531 | ||||||

| 2018-04-05 | 2018-04-03 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 14 327 | 242 654 | ||||||

| 2018-03-19 | 2018-03-15 | 4 | Hilt James A | EXPR | Common Stock, par value $0.01 | D | 7,1900 | −1 168 | −8 | 56 772 | ||||

| 2017-07-18 | 2017-07-15 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 6,3300 | −762 | −5 | 55 611 | ||||

| 2017-06-08 | 2017-06-07 | 4 | Leever Karen | EXPR | Common Stock, par value $0.01 | D | 18 797 | 25 871 | ||||||

| 2017-06-08 | 2017-06-07 | 4 | SWINBURN PETER S | EXPR | Common Stock, par value $0.01 | D | 18 797 | 53 532 | ||||||

| 2017-06-08 | 2017-06-07 | 4 | DEVINE MICHAEL F III | EXPR | Common Stock, par value $0.01 | D | 18 797 | 57 731 | ||||||

| 2017-06-08 | 2017-06-07 | 4 | MANGUM MYLLE H | EXPR | Common Stock, par value $0.01 | D | 24 812 | 66 436 | ||||||

| 2017-06-08 | 2017-06-07 | 4 | DAVENPORT TERRY | EXPR | Common Stock, par value $0.01 | D | 18 797 | 23 978 | ||||||

| 2017-06-08 | 2017-06-07 | 4 | ARCHBOLD MICHAEL G | EXPR | Common Stock, par value $0.01 | D | 18 797 | 53 532 | ||||||

| 2017-04-18 | 2017-04-15 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 8,2000 | −9 948 | −82 | 292 772 | ||||

| 2017-04-18 | 2017-04-15 | 4 | McIntyre Erica | EXPR | Common Stock, par value $0.01 | D | 8,2000 | −3 500 | −29 | 64 749 | ||||

| 2017-04-18 | 2017-04-15 | 4 | Hilt James A | EXPR | Common Stock, par value $0.01 | D | 8,2000 | −2 347 | −19 | 57 940 | ||||

| 2017-04-18 | 2017-04-15 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 8,2000 | −1 885 | −15 | 56 373 | ||||

| 2017-04-18 | 2017-04-15 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 8,2000 | −5 160 | −42 | 176 380 | ||||

| 2017-04-18 | 2017-04-15 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 8,2000 | −5 201 | −43 | 228 327 | ||||

| 2017-04-18 | 2017-04-15 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 8,2000 | −21 364 | −175 | 532 025 | ||||

| 2017-04-18 | 2017-04-15 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 8,2000 | −4 487 | −37 | 143 394 | ||||

| 2017-04-04 | 2017-04-02 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 9,1100 | −504 | −5 | 58 258 | ||||

| 2017-03-16 | 2017-03-14 | 4 | Tilson Douglas H | EXPR | Employee Stock Option (right to buy) | D | 9,42 | 17 084 | 17 084 | |||||

| 2017-03-16 | 2017-03-14 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 18 577 | 147 881 | ||||||

| 2017-03-16 | 2017-03-14 | 4 | Campbell Colin | EXPR | Employee Stock Option (right to buy) | D | 9,42 | 22 893 | 22 893 | |||||

| 2017-03-16 | 2017-03-14 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 24 894 | 233 528 | ||||||

| 2017-03-16 | 2017-03-15 | 4 | Hilt James A | EXPR | Common Stock, par value $0.01 | D | 9,4900 | −1 255 | −12 | 60 287 | ||||

| 2017-03-16 | 2017-03-14 | 4 | Hilt James A | EXPR | Employee Stock Option (right to buy) | D | 9,42 | 22 893 | 22 893 | |||||

| 2017-03-16 | 2017-03-14 | 4 | Hilt James A | EXPR | Common Stock, par value $0.01 | D | 24 894 | 61 542 | ||||||

| 2017-03-16 | 2017-03-14 | 4 | McIntyre Erica | EXPR | Employee Stock Option (right to buy) | D | 9,42 | 22 893 | 22 893 | |||||

| 2017-03-16 | 2017-03-14 | 4 | McIntyre Erica | EXPR | Common Stock, par value $0.01 | D | 24 894 | 68 249 | ||||||

| 2017-03-16 | 2017-03-14 | 4 | Rafferty John J | EXPR | Employee Stock Option (right to buy) | D | 9,42 | 22 893 | 22 893 | |||||

| 2017-03-16 | 2017-03-14 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 24 894 | 181 540 | ||||||

| 2017-03-16 | 2017-03-14 | 4 | Pericleous Periclis | EXPR | Employee Stock Option (right to buy) | D | 9,42 | 20 501 | 20 501 | |||||

| 2017-03-16 | 2017-03-14 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 22 293 | 58 762 | ||||||

| 2017-03-16 | 2017-03-14 | 4 | Moellering Matthew C | EXPR | Employee Stock Option (right to buy) | D | 9,42 | 44 419 | 44 419 | |||||

| 2017-03-16 | 2017-03-14 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 48 301 | 302 720 | ||||||

| 2017-03-16 | 2017-03-14 | 4 | Kornberg David G | EXPR | Employee Stock Option (right to buy) | D | 9,42 | 170 843 | 170 843 | |||||

| 2017-03-16 | 2017-03-14 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 185 775 | 553 389 | ||||||

| 2016-11-16 | 2016-11-15 | 4 | DAVENPORT TERRY | EXPR | Common Stock, par value $0.01 | D | 5 181 | 5 181 | ||||||

| 2016-10-18 | 2016-10-15 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 12,1800 | −3 459 | −42 | 367 614 | ||||

| 2016-08-17 | 2016-08-15 | 4 | Leever Karen | EXPR | Common Stock, par value $0.01 | D | 7 074 | 7 074 | ||||||

| 2016-07-18 | 2016-07-15 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 14,3600 | −759 | −11 | 36 469 | ||||

| 2016-06-09 | 2016-06-08 | 4 | MANGUM MYLLE H | EXPR | Common Stock, par value $0.01 | D | 11 096 | 41 624 | ||||||

| 2016-06-09 | 2016-06-08 | 4 | Killion Theo | EXPR | Common Stock, par value $0.01 | D | 8 406 | 33 410 | ||||||

| 2016-06-09 | 2016-06-08 | 4 | ARCHBOLD MICHAEL G | EXPR | Common Stock, par value $0.01 | D | 8 406 | 34 735 | ||||||

| 2016-06-09 | 2016-06-08 | 4 | SWINBURN PETER S | EXPR | Common Stock, par value $0.01 | D | 8 406 | 34 735 | ||||||

| 2016-06-09 | 2016-06-08 | 4 | DEVINE MICHAEL F III | EXPR | Common Stock, par value $0.01 | D | 8 406 | 38 934 | ||||||

| 2016-04-19 | 2016-04-15 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 19,5400 | −4 241 | −83 | 208 634 | ||||

| 2016-04-19 | 2016-04-15 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 19,5400 | −20 589 | −402 | 371 073 | ||||

| 2016-04-19 | 2016-04-15 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 19,5400 | −11 661 | −228 | 254 419 | ||||

| 2016-04-19 | 2016-04-15 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 19,5400 | −4 211 | −82 | 156 646 | ||||

| 2016-04-19 | 2016-04-15 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 19,5400 | −4 242 | −83 | 247 531 | ||||

| 2016-04-19 | 2016-04-15 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 19,5400 | −3 763 | −74 | 129 304 | ||||

| 2016-04-19 | 2016-04-15 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 19,5400 | −1 169 | −23 | 37 228 | ||||

| 2016-04-19 | 2016-04-15 | 4 | McIntyre Erica | EXPR | Common Stock, par value $0.01 | D | 19,5400 | −2 542 | −50 | 43 355 | ||||

| 2016-04-19 | 2016-04-15 | 4 | Hilt James A | EXPR | Common Stock, par value $0.01 | D | 19,5400 | −1 319 | −26 | 36 648 | ||||

| 2016-04-15 | 2016-04-13 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 20,0000 | −10 000 | −200 | 160 857 | ||||

| 2016-04-13 | 2016-04-11 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 20,0200 | −8 000 | −160 | 266 080 | ||||

| 2016-04-05 | 2016-04-02 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 21,3900 | −2 120 | −45 | 212 875 | ||||

| 2016-04-05 | 2016-04-02 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 21,3900 | −5 283 | −113 | 391 662 | ||||

| 2016-04-05 | 2016-04-02 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 21,3900 | −5 386 | −115 | 274 080 | ||||

| 2016-04-05 | 2016-04-02 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 21,3900 | −2 105 | −45 | 170 857 | ||||

| 2016-04-05 | 2016-04-02 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 21,3900 | −3 262 | −70 | 251 773 | ||||

| 2016-04-05 | 2016-04-02 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 21,3900 | −2 044 | −44 | 133 067 | ||||

| 2016-04-05 | 2016-04-02 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 21,3900 | −450 | −10 | 38 397 | ||||

| 2016-04-05 | 2016-04-02 | 4 | McIntyre Erica | EXPR | Common Stock, par value $0.01 | D | 21,3900 | −941 | −20 | 45 897 | ||||

| 2016-04-01 | 2016-03-30 | 4 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 128 598 | 1 541 972 | ||||||

| 2016-04-01 | 2016-03-30 | 4 | Campbell Colin | EXPR | Employee Stock Option (right to buy) | D | 21,14 | 11 053 | 11 053 | |||||

| 2016-04-01 | 2016-03-30 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 11 589 | 214 995 | ||||||

| 2016-04-01 | 2016-03-30 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 14 693 | 203 406 | ||||||

| 2016-04-01 | 2016-03-30 | 4 | Kornberg David G | EXPR | Employee Stock Option (right to buy) | D | 21,14 | 78 947 | 78 947 | |||||

| 2016-04-01 | 2016-03-30 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 82 781 | 396 945 | ||||||

| 2016-04-01 | 2016-03-30 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 31 576 | 314 164 | ||||||

| 2016-04-01 | 2016-03-30 | 4 | Moellering Matthew C | EXPR | Employee Stock Option (right to buy) | D | 21,14 | 20 526 | 20 526 | |||||

| 2016-04-01 | 2016-03-30 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 21 523 | 279 466 | ||||||

| 2016-04-01 | 2016-03-30 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 28 255 | 257 943 | ||||||

| 2016-04-01 | 2016-03-30 | 4 | Rafferty John J | EXPR | Employee Stock Option (right to buy) | D | 21,14 | 11 053 | 11 053 | |||||

| 2016-04-01 | 2016-03-30 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 11 589 | 172 962 | ||||||

| 2016-04-01 | 2016-03-30 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 14 693 | 161 373 | ||||||

| 2016-04-01 | 2016-03-30 | 4 | St. Pierre Jeanne L | EXPR | Employee Stock Option (right to buy) | D | 21,14 | 11 053 | 11 053 | |||||

| 2016-04-01 | 2016-03-30 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 11 589 | 255 035 | ||||||

| 2016-04-01 | 2016-03-30 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 14 693 | 243 446 | ||||||

| 2016-04-01 | 2016-03-30 | 4 | Tilson Douglas H | EXPR | Employee Stock Option (right to buy) | D | 21,14 | 8 684 | 8 684 | |||||

| 2016-04-01 | 2016-03-30 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 9 106 | 135 111 | ||||||

| 2016-04-01 | 2016-03-30 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 13 281 | 126 005 | ||||||

| 2016-04-01 | 2016-03-30 | 4 | Pericleous Periclis | EXPR | Employee Stock Option (right to buy) | D | 21,14 | 8 684 | 8 684 | |||||

| 2016-04-01 | 2016-03-30 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 9 106 | 38 847 | ||||||

| 2016-04-01 | 2016-03-30 | 4 | McIntyre Erica | EXPR | Employee Stock Option (right to buy) | D | 21,14 | 11 053 | 11 053 | |||||

| 2016-04-01 | 2016-03-30 | 4 | McIntyre Erica | EXPR | Common Stock, par value $0.01 | D | 11 589 | 46 838 | ||||||

| 2016-04-01 | 2016-03-30 | 4 | McIntyre Erica | EXPR | Common Stock, par value $0.01 | D | 8 476 | 35 249 | ||||||

| 2016-04-01 | 2016-03-30 | 4 | Hilt James A | EXPR | Employee Stock Option (right to buy) | D | 21,14 | 11 053 | 11 053 | |||||

| 2016-04-01 | 2016-03-30 | 4 | Hilt James A | EXPR | Common Stock, par value $0.01 | D | 11 589 | 37 967 | ||||||

| 2016-04-01 | 2016-03-30 | 4 | Hilt James A | EXPR | Common Stock, par value $0.01 | D | 1 697 | 26 378 | ||||||

| 2016-03-24 | 2016-03-22 | 4 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 21,0700 | −50 000 | −1 054 | 1 413 374 | ||||

| 2016-03-24 | 2016-03-22 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 21,0100 | −1 197 | −25 | 188 713 | ||||

| 2016-03-24 | 2016-03-22 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 21,0100 | −1 569 | −33 | 282 588 | ||||

| 2016-03-24 | 2016-03-22 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 21,0100 | −2 771 | −58 | 229 688 | ||||

| 2016-03-24 | 2016-03-22 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 21,0100 | −1 188 | −25 | 146 680 | ||||

| 2016-03-24 | 2016-03-22 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 21,0100 | −1 198 | −25 | 228 753 | ||||

| 2016-03-24 | 2016-03-22 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 21,0100 | −1 006 | −21 | 112 724 | ||||

| 2016-03-24 | 2016-03-22 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 21,0100 | −321 | −7 | 29 741 | ||||

| 2016-03-24 | 2016-03-22 | 4 | McIntyre Erica | EXPR | Common Stock, par value $0.01 | D | 21,0100 | −675 | −14 | 26 773 | ||||

| 2016-03-16 | 2016-03-15 | 4 | Hilt James A | EXPR | Common Stock, par value $0.01 | D | 20,7100 | −1 297 | −27 | 24 681 | ||||

| 2016-03-11 | 3 | Hilt James A | EXPR | Common Stock, par value $0.01 | D | 51 956 | ||||||||

| 2016-03-11 | 3 | Hilt James A | EXPR | Common Stock, par value $0.01 | D | 51 956 | ||||||||

| 2016-03-11 | 2016-03-11 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 20,8200 | −10 000 | −208 | 229 951 | ||||

| 2016-03-11 | 2016-03-09 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 20,2600 | −13 000 | −263 | 239 951 | ||||

| 2016-02-05 | 3 | McIntyre Erica | EXPR | Common Stock, par value $0.01 | D | 54 896 | ||||||||

| 2016-02-05 | 3 | McIntyre Erica | EXPR | Common Stock, par value $0.01 | D | 54 896 | ||||||||

| 2015-12-16 | 2015-09-22 | 4 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 265 271 | 1 463 374 | ||||||

| 2015-12-16 | 2015-09-22 | 4 | Weiss Michael A By the Michael A. Weiss Trust Agreement Gamma #5 | EXPR | Common Stock, par value $0.01 | I | −265 271 | 334 729 | ||||||

| 2015-12-16 | 2015-09-22 | 4 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 236 732 | 1 198 103 | ||||||

| 2015-12-16 | 2015-09-22 | 4 | Weiss Michael A By the Michael A. Weiss Trust Agreement Gamma #4 | EXPR | Common Stock, par value $0.01 | I | −236 732 | 0 | ||||||

| 2015-10-16 | 2015-10-15 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 18,8000 | −3 459 | −65 | 284 157 | ||||

| 2015-09-02 | 2015-09-01 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 20,2000 | −4 423 | −89 | 287 616 | ||||

| 2015-09-02 | 2015-09-01 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 20,2000 | −4 368 | −88 | 147 868 | ||||

| 2015-09-02 | 2015-09-01 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 20,2000 | −4 441 | −90 | 189 910 | ||||

| 2015-09-02 | 2015-09-01 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 20,2000 | −3 527 | −71 | 113 730 | ||||

| 2015-09-02 | 2015-09-01 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 20,2000 | −4 404 | −89 | 232 459 | ||||

| 2015-09-02 | 2015-09-01 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 20,2000 | −4 392 | −89 | 252 951 | ||||

| 2015-08-28 | 2015-08-26 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 19,9000 | −11 294 | −225 | 257 343 | ||||

| 2015-08-28 | 2015-08-26 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 20,0000 | −13 000 | −260 | 152 236 | ||||

| 2015-08-28 | 2015-08-26 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 20,0700 | −16 500 | −331 | 117 257 | ||||

| 2015-08-28 | 2015-08-26 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 20,0800 | −8 000 | −161 | 236 863 | ||||

| 2015-08-03 | 2015-07-30 | 4 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 18,2700 | −39 240 | −717 | 961 371 | ||||

| 2015-07-16 | 2015-07-15 | 4 | Pericleous Periclis | EXPR | Employee Stock Option (right to buy) | D | 18,84 | 8 527 | 8 527 | |||||

| 2015-07-16 | 2015-07-15 | 4 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 9 103 | 30 062 | ||||||

| 2015-07-15 | 3 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 41 918 | ||||||||

| 2015-07-15 | 3 | Pericleous Periclis | EXPR | Common Stock, par value $0.01 | D | 41 918 | ||||||||

| 2015-06-12 | 2015-06-10 | 4 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 11 914 | 1 000 611 | ||||||

| 2015-06-11 | 2015-06-10 | 4 | Chawla Sona | EXPR | Common Stock, par value $0.01 | D | 6 808 | 27 040 | ||||||

| 2015-06-11 | 2015-06-10 | 4 | Killion Theo | EXPR | Common Stock, par value $0.01 | D | 6 808 | 25 004 | ||||||

| 2015-06-11 | 2015-06-10 | 4 | MANGUM MYLLE H | EXPR | Common Stock, par value $0.01 | D | 6 808 | 30 528 | ||||||

| 2015-06-11 | 2015-06-10 | 4 | DEVINE MICHAEL F III | EXPR | Common Stock, par value $0.01 | D | 6 808 | 30 528 | ||||||

| 2015-06-11 | 2015-06-10 | 4 | SWINBURN PETER S | EXPR | Common Stock, par value $0.01 | D | 6 808 | 26 329 | ||||||

| 2015-06-11 | 2015-06-10 | 4 | ARCHBOLD MICHAEL G | EXPR | Common Stock, par value $0.01 | D | 6 808 | 26 329 | ||||||

| 2015-06-09 | 2015-06-08 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 18,8500 | −7 000 | −132 | 268 637 | ||||

| 2015-05-01 | 2014-06-17 | 5/A | Weiss Michael A By the Michael A. Weiss Trust Agreement Gamma #5 | EXPR | Common Stock, par value $0.01 | I | 600 000 | 600 000 | ||||||

| 2015-05-01 | 2014-06-17 | 5/A | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | −600 000 | 988 697 | ||||||

| 2015-05-01 | 2014-04-15 | 5/A | Weiss Michael A By the Michael A. Weiss Trust Agreement Gamma #4 | EXPR | Common Stock, par value $0.01 | I | −313 268 | 236 732 | ||||||

| 2015-05-01 | 2014-04-15 | 5/A | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 313 268 | 1 588 697 | ||||||

| 2015-05-01 | 2013-08-23 | 5/A | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 339 686 | 1 275 429 | ||||||

| 2015-05-01 | 2013-08-23 | 5/A | Weiss Michael A By the Michael A. Weiss Trust Agreement Gamma #3 | EXPR | Common Stock, par value $0.01 | I | −339 686 | 0 | ||||||

| 2015-05-01 | 2015-01-30 | 4/A | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 13,4900 | 6 081 | 82 | 935 743 | ||||

| 2015-04-16 | 2015-04-15 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 17,1500 | −833 | −14 | 194 351 | ||||

| 2015-04-16 | 2015-04-15 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 17,1500 | −1 783 | −31 | 292 039 | ||||

| 2015-04-16 | 2015-04-15 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 17,1500 | −1 589 | −27 | 244 863 | ||||

| 2015-04-16 | 2015-04-15 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 17,1500 | −820 | −14 | 165 236 | ||||

| 2015-04-16 | 2015-04-15 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 17,1500 | −824 | −14 | 275 637 | ||||

| 2015-04-16 | 2015-04-15 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 17,1500 | −748 | −13 | 133 757 | ||||

| 2015-04-16 | 2015-04-15 | 4 | Dascoli Dominic P | EXPR | Common Stock, par value $0.01 | D | 17,1500 | −741 | −13 | 49 179 | ||||

| 2015-04-06 | 2015-04-02 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 16,6300 | −2 077 | −35 | 195 184 | ||||

| 2015-04-06 | 2015-04-02 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 16,6300 | −3 580 | −60 | 293 822 | ||||

| 2015-04-06 | 2015-04-02 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 16,6300 | −3 961 | −66 | 246 452 | ||||

| 2015-04-06 | 2015-04-02 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 16,6300 | −2 043 | −34 | 166 056 | ||||

| 2015-04-06 | 2015-04-02 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 16,6300 | −3 160 | −53 | 276 461 | ||||

| 2015-04-06 | 2015-04-02 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 16,6300 | −2 002 | −33 | 134 505 | ||||

| 2015-04-06 | 2015-04-02 | 4 | Dascoli Dominic P | EXPR | Common Stock, par value $0.01 | D | 16,6300 | −1 842 | −31 | 49 920 | ||||

| 2015-03-31 | 2015-03-30 | 4 | Kornberg David G | EXPR | Employee Stock Option (right to buy) | D | 16,28 | 77 022 | 77 022 | |||||

| 2015-03-31 | 2015-03-30 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 85 995 | 297 402 | ||||||

| 2015-03-30 | 2015-03-26 | 4 | Campbell Colin | EXPR | Employee Stock Option (right to buy) | D | 16,28 | 10 109 | 10 109 | |||||

| 2015-03-30 | 2015-03-26 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 11 287 | 197 261 | ||||||

| 2015-03-30 | 2015-03-26 | 4 | Moellering Matthew C | EXPR | Employee Stock Option (right to buy) | D | 16,28 | 19 255 | 19 255 | |||||

| 2015-03-30 | 2015-03-26 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 21 498 | 250 413 | ||||||

| 2015-03-30 | 2015-03-26 | 4 | Rafferty John J | EXPR | Employee Stock Option (right to buy) | D | 16,28 | 10 109 | 10 109 | |||||

| 2015-03-30 | 2015-03-26 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 11 287 | 168 099 | ||||||

| 2015-03-30 | 2015-03-26 | 4 | St. Pierre Jeanne L | EXPR | Employee Stock Option (right to buy) | D | 16,28 | 10 109 | 10 109 | |||||

| 2015-03-30 | 2015-03-26 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 11 287 | 279 621 | ||||||

| 2015-03-30 | 2015-03-26 | 4 | Tilson Douglas H | EXPR | Employee Stock Option (right to buy) | D | 16,28 | 8 665 | 8 665 | |||||

| 2015-03-30 | 2015-03-26 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 9 674 | 136 507 | ||||||

| 2015-03-30 | 2015-03-26 | 4 | Dascoli Dominic P | EXPR | Employee Stock Option (right to buy) | D | 16,28 | 8 665 | 8 665 | |||||

| 2015-03-30 | 2015-03-26 | 4 | Dascoli Dominic P | EXPR | Common Stock, par value $0.01 | D | 9 674 | 51 762 | ||||||

| 2015-03-24 | 2015-03-22 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 16,5000 | −1 224 | −20 | 185 974 | ||||

| 2015-03-24 | 2015-03-22 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 16,5000 | −1 569 | −26 | 211 407 | ||||

| 2015-03-24 | 2015-03-22 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 16,5000 | −2 789 | −46 | 228 915 | ||||

| 2015-03-24 | 2015-03-22 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 16,5000 | −1 204 | −20 | 156 812 | ||||

| 2015-03-24 | 2015-03-22 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 16,5000 | −1 212 | −20 | 268 334 | ||||

| 2015-03-24 | 2015-03-22 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 16,5000 | −978 | −16 | 126 833 | ||||

| 2015-03-24 | 2015-03-22 | 4 | Dascoli Dominic P | EXPR | Common Stock, par value $0.01 | D | 16,5000 | −444 | −7 | 42 088 | ||||

| 2015-03-13 | 2014-06-17 | 5 | Weiss Michael A By the Michael A. Weiss Trust Agreement Gamma #5 | EXPR | Common Stock, par value $0.01 | I | 600 000 | 600 000 | ||||||

| 2015-03-13 | 2014-06-17 | 5 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | −600 000 | 669 130 | ||||||

| 2015-03-13 | 2014-04-15 | 5 | Weiss Michael A By the Michael A. Weiss Trust Agreement Gamma #4 | EXPR | Common Stock, par value $0.01 | I | −313 268 | 236 732 | ||||||

| 2015-03-13 | 2014-04-15 | 5 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 313 268 | 1 269 130 | ||||||

| 2015-02-20 | 2015-02-18 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 14,3300 | −1 198 | −17 | 269 546 | ||||

| 2015-02-20 | 2015-02-18 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 14,3300 | −1 267 | −18 | 127 811 | ||||

| 2015-02-20 | 2015-02-18 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 14,3300 | −1 217 | −17 | 187 198 | ||||

| 2015-02-20 | 2015-02-18 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 14,3300 | −1 197 | −17 | 158 016 | ||||

| 2015-02-20 | 2015-02-18 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 14,3300 | −1 081 | −15 | 212 976 | ||||

| 2015-02-20 | 2015-02-18 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 14,3300 | −2 150 | −31 | 231 704 | ||||

| 2015-02-06 | 2015-01-30 | 4/A | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 13,4900 | 6 081 | 82 | 955 862 | ||||

| 2015-02-02 | 2015-01-30 | 4 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 13,0800 | −20 119 | −263 | 929 662 | ||||

| 2014-10-20 | 2014-10-17 | 4 | Dascoli Dominic P | EXPR | Common Stock, par value $0.01 | D | 14,0100 | −834 | −12 | 42 532 | ||||

| 2014-10-16 | 2014-10-15 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 13,8000 | −2 414 | −33 | 214 057 | ||||

| 2014-06-24 | 2014-06-12 | 4 | ARCHBOLD MICHAEL G | EXPR | Common Stock, par value $0.01 | D | 9 225 | 19 521 | ||||||

| 2014-06-24 | 2014-06-12 | 4 | Chawla Sona | EXPR | Common Stock, par value $0.01 | D | 9 225 | 20 232 | ||||||

| 2014-06-24 | 2014-06-12 | 4 | DEVINE MICHAEL F III | EXPR | Common Stock, par value $0.01 | D | 9 225 | 23 720 | ||||||

| 2014-06-24 | 2014-06-12 | 4 | Killion Theo | EXPR | Common Stock, par value $0.01 | D | 9 225 | 18 196 | ||||||

| 2014-06-24 | 2014-06-12 | 4 | MANGUM MYLLE H | EXPR | Common Stock, par value $0.01 | D | 9 225 | 23 720 | ||||||

| 2014-06-24 | 2014-06-12 | 4 | SWINBURN PETER S | EXPR | Common Stock, par value $0.01 | D | 9 225 | 19 521 | ||||||

| 2014-05-14 | 2014-05-12 | 4 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 14,9100 | −734 | −11 | 949 781 | ||||

| 2014-05-14 | 2014-05-12 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 14,9100 | −82 | −1 | 188 415 | ||||

| 2014-05-14 | 2014-05-12 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 14,9100 | −102 | −2 | 216 471 | ||||

| 2014-05-14 | 2014-05-12 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 14,9100 | −122 | −2 | 233 854 | ||||

| 2014-05-14 | 2014-05-12 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 14,9100 | −101 | −2 | 159 213 | ||||

| 2014-05-14 | 2014-05-12 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 14,9100 | −101 | −2 | 270 744 | ||||

| 2014-05-14 | 2014-05-12 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 14,9100 | −82 | −1 | 129 078 | ||||

| 2014-04-03 | 2014-04-02 | 4 | Keane Michael | EXPR | Common Stock, par value $0.01 | D | 16,7100 | −2 061 | −34 | 41 224 | ||||

| 2014-04-03 | 2014-04-01 | 4 | Keane Michael | EXPR | Employee Stock Option (right to buy) | D | 15,88 | 12 122 | 12 122 | |||||

| 2014-04-03 | 2014-04-01 | 4 | Keane Michael | EXPR | Common Stock, par value $0.01 | D | 9 824 | 43 285 | ||||||

| 2014-04-03 | 2014-04-01 | 4 | Keane Michael | EXPR | Common Stock, par value $0.01 | D | 18 557 | 33 461 | ||||||

| 2014-04-03 | 2014-04-02 | 4 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 16,7100 | −28 723 | −480 | 950 515 | ||||

| 2014-04-03 | 2014-04-01 | 4 | Weiss Michael A | EXPR | Employee Stock Option (right to buy) | D | 15,88 | 155 158 | 155 158 | |||||

| 2014-04-03 | 2014-04-01 | 4 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 83 832 | 979 238 | ||||||

| 2014-04-03 | 2014-04-01 | 4 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 117 146 | 895 406 | ||||||

| 2014-04-03 | 2014-04-02 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 16,7100 | −2 083 | −35 | 188 497 | ||||

| 2014-04-03 | 2014-04-01 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 15,88 | 12 122 | 12 122 | |||||

| 2014-04-03 | 2014-04-01 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 9 824 | 190 580 | ||||||

| 2014-04-03 | 2014-04-01 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 18 557 | 180 756 | ||||||

| 2014-04-03 | 2014-04-02 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 16,7100 | −3 578 | −60 | 216 573 | ||||

| 2014-04-03 | 2014-04-01 | 4 | Kornberg David G | EXPR | Employee Stock Option (right to buy) | D | 15,88 | 26 050 | 26 050 | |||||

| 2014-04-03 | 2014-04-01 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 21 112 | 220 151 | ||||||

| 2014-04-03 | 2014-04-01 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 32 118 | 199 039 | ||||||

| 2014-04-03 | 2014-04-02 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 16,7100 | −3 957 | −66 | 233 976 | ||||

| 2014-04-03 | 2014-04-01 | 4 | Moellering Matthew C | EXPR | Employee Stock Option (right to buy) | D | 15,88 | 23 311 | 23 311 | |||||

| 2014-04-03 | 2014-04-01 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 18 892 | 237 933 | ||||||

| 2014-04-03 | 2014-04-01 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 35 687 | 219 041 | ||||||

| 2014-04-03 | 2014-04-02 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 16,7100 | −2 043 | −34 | 159 314 | ||||

| 2014-04-03 | 2014-04-01 | 4 | Rafferty John J | EXPR | Employee Stock Option (right to buy) | D | 15,88 | 12 122 | 12 122 | |||||

| 2014-04-03 | 2014-04-01 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 9 824 | 161 357 | ||||||

| 2014-04-03 | 2014-04-01 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 18 557 | 151 533 | ||||||

| 2014-04-03 | 2014-04-02 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 16,7100 | −3 154 | −53 | 270 845 | ||||

| 2014-04-03 | 2014-04-01 | 4 | St. Pierre Jeanne L | EXPR | Employee Stock Option (right to buy) | D | 15,88 | 12 122 | 12 122 | |||||

| 2014-04-03 | 2014-04-01 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 9 824 | 273 999 | ||||||

| 2014-04-03 | 2014-04-01 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 28 548 | 264 175 | ||||||

| 2014-04-03 | 2014-04-02 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 16,7100 | −1 984 | −33 | 129 160 | ||||

| 2014-04-03 | 2014-04-01 | 4 | Tilson Douglas H | EXPR | Employee Stock Option (right to buy) | D | 15,88 | 10 956 | 10 956 | |||||

| 2014-04-03 | 2014-04-01 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 8 880 | 131 144 | ||||||

| 2014-04-03 | 2014-04-01 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 18 023 | 122 264 | ||||||

| 2014-04-03 | 2014-04-02 | 4 | Dascoli Dominic P | EXPR | Common Stock, par value $0.01 | D | 16,7100 | −1 842 | −31 | 43 366 | ||||

| 2014-04-03 | 2014-04-01 | 4 | Dascoli Dominic P | EXPR | Employee Stock Option (right to buy) | D | 15,88 | 10 956 | 10 956 | |||||

| 2014-04-03 | 2014-04-01 | 4 | Dascoli Dominic P | EXPR | Common Stock, par value $0.01 | D | 8 880 | 45 208 | ||||||

| 2014-04-03 | 2014-04-01 | 4 | Dascoli Dominic P | EXPR | Common Stock, par value $0.01 | D | 16 950 | 36 328 | ||||||

| 2014-03-25 | 2014-03-22 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 16,4700 | −1 234 | −20 | 162 199 | ||||

| 2014-03-25 | 2014-03-22 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 16,4700 | −1 568 | −26 | 166 921 | ||||

| 2014-03-25 | 2014-03-22 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 16,4700 | −2 787 | −46 | 183 354 | ||||

| 2014-03-25 | 2014-03-22 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 16,4700 | −1 210 | −20 | 132 976 | ||||

| 2014-03-25 | 2014-03-22 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 16,4700 | −1 215 | −20 | 235 627 | ||||

| 2014-03-25 | 2014-03-22 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 16,4700 | −975 | −16 | 104 241 | ||||

| 2014-03-25 | 2014-03-22 | 4 | Dascoli Dominic P | EXPR | Common Stock, par value $0.01 | D | 16,4700 | −440 | −7 | 19 378 | ||||

| 2014-03-14 | 2014-03-12 | 4 | Keane Michael | EXPR | Common Stock, par value $0.01 | D | 16,0500 | −4 225 | −68 | 14 904 | ||||

| 2014-02-20 | 2014-02-18 | 4 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 17,7400 | −38 348 | −680 | 778 260 | ||||

| 2014-02-20 | 2014-02-18 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 17,7400 | −1 261 | −22 | 163 433 | ||||

| 2014-02-20 | 2014-02-18 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 17,7400 | −1 196 | −21 | 168 489 | ||||

| 2014-02-20 | 2014-02-18 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 17,7400 | −2 218 | −39 | 186 141 | ||||

| 2014-02-20 | 2014-02-18 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 17,7400 | −1 239 | −22 | 134 186 | ||||

| 2014-02-20 | 2014-02-18 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 17,7400 | −1 236 | −22 | 236 842 | ||||

| 2014-02-20 | 2014-02-18 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 17,7400 | −1 257 | −22 | 105 216 | ||||

| 2013-12-05 | 2013-12-03 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 25,0000 | −6 900 | −172 | 135 425 | ||||

| 2013-12-05 | 2013-12-03 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 25,0000 | −10 000 | −250 | 238 078 | ||||

| 2013-12-05 | 2013-12-03 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 25,0000 | −6 100 | −152 | 106 473 | ||||

| 2013-12-02 | 2013-12-02 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 24,4900 | −6 000 | −147 | 169 685 | ||||

| 2013-11-13 | 2013-11-13 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 24,2700 | −8 571 | −208 | 188 359 | ||||

| 2013-11-01 | 2013-11-01 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 23,1000 | −6 000 | −139 | 175 685 | ||||

| 2013-10-25 | 2013-09-13 | 4/A | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 22,0900 | −8 571 | −189 | 205 501 | ||||

| 2013-10-25 | 2013-10-24 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 23,0000 | −8 571 | −197 | 196 930 | ||||

| 2013-10-18 | 2013-10-17 | 4 | Dascoli Dominic P | EXPR | Common Stock, par value $0.01 | D | 22,2600 | −4 169 | −93 | 19 818 | ||||

| 2013-10-16 | 2013-10-15 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 21,9500 | −3 198 | −70 | 181 685 | ||||

| 2013-10-01 | 2013-10-01 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 23,6800 | −6 000 | −142 | 184 883 | ||||

| 2013-09-26 | 2013-09-26 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 24,0000 | −10 700 | −257 | 164 694 | ||||

| 2013-09-26 | 2013-09-25 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 24,0000 | −2 500 | −60 | 175 394 | ||||

| 2013-09-26 | 2013-09-26 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 24,0000 | −9 100 | −218 | 142 325 | ||||

| 2013-09-26 | 2013-09-25 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 24,0000 | −1 900 | −46 | 151 425 | ||||

| 2013-09-26 | 2013-09-25 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 24,0000 | −9 398 | −226 | 112 573 | ||||

| 2013-09-24 | 2013-09-23 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 24,0000 | −16 800 | −403 | 177 894 | ||||

| 2013-09-24 | 2013-09-20 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 24,0000 | −4 000 | −96 | 194 694 | ||||

| 2013-09-24 | 2013-09-23 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 24,0000 | −11 600 | −278 | 153 325 | ||||

| 2013-09-24 | 2013-09-20 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 24,0000 | −2 400 | −58 | 164 925 | ||||

| 2013-09-24 | 2013-09-23 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 24,0000 | −5 500 | −132 | 121 971 | ||||

| 2013-09-24 | 2013-09-20 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 24,0000 | −1 766 | −42 | 127 471 | ||||

| 2013-09-23 | 2013-09-23 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 24,0000 | −8 200 | −197 | 190 883 | ||||

| 2013-09-23 | 2013-09-20 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 24,0000 | −1 800 | −43 | 199 083 | ||||

| 2013-09-16 | 2013-09-13 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 22,0900 | −8 571 | −189 | 205 501 | ||||

| 2013-09-04 | 2013-09-03 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 21,2000 | −6 000 | −127 | 200 883 | ||||

| 2013-09-04 | 2013-09-01 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 20,9900 | −4 421 | −93 | 206 883 | ||||

| 2013-09-04 | 2013-09-01 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 20,9900 | −4 453 | −93 | 198 694 | ||||

| 2013-09-04 | 2013-09-01 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 20,9900 | −4 407 | −93 | 214 072 | ||||

| 2013-09-04 | 2013-09-01 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 20,9900 | −4 368 | −92 | 167 325 | ||||

| 2013-09-04 | 2013-09-01 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 20,9900 | −3 494 | −73 | 129 237 | ||||

| 2013-09-04 | 2013-09-01 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 20,9900 | −4 368 | −92 | 248 078 | ||||

| 2013-09-03 | 2013-08-29 | 4 | MANGUM MYLLE H | EXPR | Employee Stock Option (right to buy) | D | 17,55 | 17,5500 | −7 500 | −132 | 0 | |||

| 2013-09-03 | 2013-08-29 | 4 | MANGUM MYLLE H | EXPR | Common Stock, par value $0.01 | D | 21,2800 | −7 500 | −160 | 14 495 | ||||

| 2013-09-03 | 2013-08-29 | 4 | MANGUM MYLLE H | EXPR | Common Stock, par value $0.01 | D | 17,5500 | 7 500 | 132 | 21 995 | ||||

| 2013-08-29 | 2013-08-28 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 22,0200 | −8 571 | −189 | 218 479 | ||||

| 2013-08-02 | 2013-08-01 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 22,8800 | −6 000 | −137 | 211 304 | ||||

| 2013-07-19 | 2013-07-15 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 23,0000 | −9 000 | −207 | 217 304 | ||||

| 2013-07-16 | 2013-07-15 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 22,9600 | −8 571 | −197 | 227 050 | ||||

| 2013-07-16 | 2013-07-15 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 23,1200 | −25 000 | −578 | 171 693 | ||||

| 2013-07-16 | 2013-07-15 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 23,0300 | −14 166 | −326 | 132 731 | ||||

| 2013-07-12 | 2013-07-11 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 23,0000 | −1 000 | −23 | 226 304 | ||||

| 2013-07-10 | 2013-07-08 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 22,0100 | −4 810 | −106 | 203 147 | ||||

| 2013-07-10 | 2013-07-08 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 22,0100 | −3 752 | −83 | 196 693 | ||||

| 2013-07-02 | 2013-07-01 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 21,0100 | −6 000 | −126 | 227 304 | ||||

| 2013-06-14 | 2013-06-13 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 21,3300 | −8 571 | −183 | 235 621 | ||||

| 2013-06-12 | 2013-06-12 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 22,0100 | −7 100 | −156 | 207 957 | ||||

| 2013-06-12 | 2013-06-10 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 22,0100 | −16 890 | −372 | 215 057 | ||||

| 2013-06-12 | 2013-06-10 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 22,0000 | −8 368 | −184 | 233 304 | ||||

| 2013-06-12 | 2013-06-12 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 22,0100 | −6 000 | −132 | 200 445 | ||||

| 2013-06-12 | 2013-06-10 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 22,0100 | −13 500 | −297 | 206 445 | ||||

| 2013-06-10 | 2013-06-06 | 4 | DEVINE MICHAEL F III | EXPR | Common Stock, par value $0.01 | D | 4 796 | 14 495 | ||||||

| 2013-06-10 | 2013-06-06 | 4 | SWINBURN PETER S | EXPR | Common Stock, par value $0.01 | D | 4 796 | 10 296 | ||||||

| 2013-06-10 | 2013-06-06 | 4 | MANGUM MYLLE H | EXPR | Common Stock, par value $0.01 | D | 4 796 | 14 495 | ||||||

| 2013-06-10 | 2013-06-06 | 4 | Killion Theo | EXPR | Common Stock, par value $0.01 | D | 4 796 | 8 971 | ||||||

| 2013-06-10 | 2013-06-06 | 4 | ARCHBOLD MICHAEL G | EXPR | Common Stock, par value $0.01 | D | 4 796 | 10 296 | ||||||

| 2013-06-10 | 2013-06-06 | 4 | Chawla Sona | EXPR | Common Stock, par value $0.01 | D | 4 796 | 11 007 | ||||||

| 2013-06-10 | 2013-06-10 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 22,0200 | −10 000 | −220 | 146 897 | ||||

| 2013-06-10 | 2013-06-10 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 22,0200 | −10 000 | −220 | 252 446 | ||||

| 2013-06-03 | 2013-05-31 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 22,0000 | −4 200 | −92 | 231 947 | ||||

| 2013-06-03 | 2013-05-30 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 20,5684 | −33 000 | −679 | 236 147 | ||||

| 2013-06-03 | 2013-06-03 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 21,8000 | −6 000 | −131 | 241 672 | ||||

| 2013-06-03 | 2013-05-31 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 22,0000 | −1 632 | −36 | 247 672 | ||||

| 2013-06-03 | 2013-05-30 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 20,5500 | −12 000 | −247 | 249 304 | ||||

| 2013-06-03 | 2013-05-30 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 20,6183 | −40 000 | −825 | 244 192 | ||||

| 2013-06-03 | 2013-05-31 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 22,0000 | −1 748 | −38 | 219 945 | ||||

| 2013-06-03 | 2013-05-30 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 20,7185 | −50 000 | −1 036 | 221 693 | ||||

| 2013-06-03 | 2013-05-30 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 20,6183 | −10 000 | −206 | 262 446 | ||||

| 2013-06-03 | 2013-05-30 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 20,8120 | −30 000 | −624 | 156 897 | ||||

| 2013-05-14 | 2013-05-12 | 4 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 19,0300 | −732 | −14 | 816 608 | ||||

| 2013-05-14 | 2013-05-12 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 19,0300 | −82 | −2 | 269 147 | ||||

| 2013-05-14 | 2013-05-12 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 19,0300 | −102 | −2 | 261 304 | ||||

| 2013-05-14 | 2013-05-12 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 19,0300 | −122 | −2 | 284 192 | ||||

| 2013-05-14 | 2013-05-12 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 19,0300 | −100 | −2 | 271 693 | ||||

| 2013-05-14 | 2013-05-12 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 19,0300 | −100 | −2 | 272 446 | ||||

| 2013-05-14 | 2013-05-12 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 19,0300 | −80 | −2 | 186 897 | ||||

| 2013-04-16 | 2013-04-15 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 18,3000 | −15 000 | −274 | 272 546 | ||||

| 2013-04-03 | 2013-04-02 | 4 | Keane Michael | EXPR | Employee Stock Option (right to buy) | D | 17,49 | 19 760 | 19 760 | |||||

| 2013-04-03 | 2013-03-12 | 4 | Keane Michael | EXPR | Common Stock, par value $0.01 | D | 18,8500 | −871 | −16 | 19 129 | ||||

| 2013-04-03 | 2013-04-02 | 4 | Weiss Michael A | EXPR | Employee Stock Option (right to buy) | D | 17,49 | 146 640 | 146 640 | |||||

| 2013-04-03 | 2013-03-07 | 4 | Weiss Michael A By the Michael A. Weiss Trust Agreement Gamma #2 | EXPR | Common Stock, par value $0.01 | I | −27 902 | 0 | ||||||

| 2013-04-03 | 2013-02-18 | 4 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 18,5100 | −38 691 | −716 | 817 340 | ||||

| 2013-04-03 | 2013-02-15 | 4 | Weiss Michael A By the Michael A. Weiss Trust Agreement Gamma #4 | EXPR | Common Stock, par value $0.01 | I | 550 000 | 550 000 | ||||||

| 2013-04-03 | 2013-02-15 | 4 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | −550 000 | 856 031 | ||||||

| 2013-04-03 | 2013-04-02 | 4 | Campbell Colin | EXPR | Employee Stock Option (right to buy) | D | 17,49 | 19 760 | 19 760 | |||||

| 2013-04-03 | 2013-04-01 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 17,4900 | −1 234 | −22 | 269 229 | ||||

| 2013-04-03 | 2013-04-01 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 14 595 | 270 463 | ||||||

| 2013-04-03 | 2013-02-18 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 18,5100 | −1 247 | −23 | 255 868 | ||||

| 2013-04-03 | 2013-02-18 | 4 | Gavales Lisa A | EXPR | Common Stock, par value $0.01 | D | 18,5100 | −1 231 | −23 | 178 473 | ||||

| 2013-04-03 | 2013-04-02 | 4 | Kornberg David G | EXPR | Employee Stock Option (right to buy) | D | 17,49 | 34 200 | 34 200 | |||||

| 2013-04-03 | 2013-04-01 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 17,4900 | −1 568 | −27 | 261 406 | ||||

| 2013-04-03 | 2013-04-01 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 18 575 | 262 974 | ||||||

| 2013-04-03 | 2013-02-18 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 18,5100 | −1 180 | −22 | 244 399 | ||||

| 2013-04-03 | 2013-04-02 | 4 | Rafferty John J | EXPR | Employee Stock Option (right to buy) | D | 17,49 | 19 760 | 19 760 | |||||

| 2013-04-03 | 2013-04-01 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 17,4900 | −1 210 | −21 | 271 793 | ||||

| 2013-04-03 | 2013-04-01 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 14 595 | 273 003 | ||||||

| 2013-04-03 | 2013-02-18 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 18,5100 | −1 224 | −23 | 258 408 | ||||

| 2013-04-03 | 2013-04-02 | 4 | Moellering Matthew C | EXPR | Employee Stock Option (right to buy) | D | 17,49 | 38 000 | 38 000 | |||||

| 2013-04-03 | 2013-04-01 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 17,4900 | −2 791 | −49 | 284 314 | ||||

| 2013-04-03 | 2013-04-01 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 33 170 | 287 105 | ||||||

| 2013-04-03 | 2013-02-18 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 18,5100 | −2 241 | −41 | 253 935 | ||||

| 2013-04-03 | 2013-04-02 | 4 | St. Pierre Jeanne L | EXPR | Employee Stock Option (right to buy) | D | 17,49 | 30 400 | 30 400 | |||||

| 2013-04-03 | 2013-04-01 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 17,4900 | −1 210 | −21 | 287 546 | ||||

| 2013-04-03 | 2013-04-01 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 14 595 | 288 756 | ||||||

| 2013-04-03 | 2013-02-18 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 18,5100 | −1 224 | −23 | 274 161 | ||||

| 2013-04-03 | 2013-04-02 | 4 | Tilson Douglas H | EXPR | Employee Stock Option (right to buy) | D | 17,49 | 19 190 | 19 190 | |||||

| 2013-04-03 | 2013-04-01 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 17,4900 | −976 | −17 | 186 977 | ||||

| 2013-04-03 | 2013-04-01 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 11 940 | 187 953 | ||||||

| 2013-04-03 | 2013-02-18 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 18,5100 | −1 257 | −23 | 176 013 | ||||

| 2013-04-03 | 2013-04-02 | 4 | Dascoli Dominic P | EXPR | Employee Stock Option (right to buy) | D | 17,49 | 18 050 | 18 050 | |||||

| 2013-04-03 | 2013-04-01 | 4 | Dascoli Dominic P | EXPR | Common Stock, par value $0.01 | D | 17,4900 | −456 | −8 | 23 987 | ||||

| 2013-04-03 | 2013-04-01 | 4 | Dascoli Dominic P | EXPR | Common Stock, par value $0.01 | D | 5 305 | 24 443 | ||||||

| 2013-04-03 | 2012-10-17 | 4 | Dascoli Dominic P | EXPR | Common Stock, par value $0.01 | D | 11,7500 | −862 | −10 | 19 138 | ||||

| 2013-02-05 | 2012-11-29 | 5 | Weiss Michael A By the Michael A. Weiss Trust Agreement Gamma #2 | EXPR | Common Stock, par value $0.01 | I | −542 751 | 27 902 | ||||||

| 2013-02-05 | 2012-11-29 | 5 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 542 751 | 1 406 031 | ||||||

| 2013-02-05 | 2012-10-01 | 5 | Weiss Michael A By the Michael A. Weiss Trust Agreement Gamma #3 | EXPR | Common Stock, par value $0.01 | I | −526 677 | 339 686 | ||||||

| 2013-02-05 | 2012-10-01 | 5 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 526 677 | 863 280 | ||||||

| 2013-02-05 | 3 | Keane Michael | EXPR | Common Stock, par value $0.01 | D | 20 000 | ||||||||

| 2013-01-09 | 2013-01-08 | 4 | Gavales Lisa A | EXPR | Common Stock, par value $0.01 | D | 15,0400 | −48 280 | −726 | 179 704 | ||||

| 2013-01-09 | 2013-01-07 | 4 | Gavales Lisa A | EXPR | Common Stock, par value $0.01 | D | 15,0565 | −21 720 | −327 | 227 984 | ||||

| 2012-10-17 | 2012-10-15 | 4 | Kornberg David G | EXPR | Employee Stock Option (right to buy) | D | 11,29 | 27 100 | 27 100 | |||||

| 2012-10-17 | 2012-10-15 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 28 600 | 245 579 | ||||||

| 2012-08-02 | 2012-08-01 | 4 | Chawla Sona | EXPR | Common Stock, par value $0.01 | D | 6 211 | 6 211 | ||||||

| 2012-05-15 | 2012-05-12 | 4 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 23,7100 | −652 | −15 | 336 603 | ||||

| 2012-05-15 | 2012-05-12 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 23,7100 | −80 | −2 | 257 115 | ||||

| 2012-05-15 | 2012-05-12 | 4 | Gavales Lisa A | EXPR | Common Stock, par value $0.01 | D | 23,7100 | −100 | −2 | 249 704 | ||||

| 2012-05-15 | 2012-05-12 | 4 | Horowitz Bonadies Fran | EXPR | Common Stock, par value $0.01 | D | 23,7100 | −99 | −2 | 414 587 | ||||

| 2012-05-15 | 2012-05-12 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 23,7100 | −99 | −2 | 216 979 | ||||

| 2012-05-15 | 2012-05-12 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 23,7100 | −119 | −3 | 256 176 | ||||

| 2012-05-15 | 2012-05-12 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 23,7100 | −98 | −2 | 259 632 | ||||

| 2012-05-15 | 2012-05-12 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 23,7100 | −98 | −2 | 275 385 | ||||

| 2012-05-15 | 2012-05-12 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 23,7100 | −78 | −2 | 177 270 | ||||

| 2012-05-10 | 2012-05-09 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 23,1064 | −39 000 | −901 | 256 295 | ||||

| 2012-05-08 | 2012-05-08 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 23,1860 | −5 000 | −116 | 275 483 | ||||

| 2012-05-07 | 2012-05-07 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 23,5549 | −16 500 | −389 | 177 348 | ||||

| 2012-05-02 | 2012-05-01 | 4 | Horowitz Bonadies Fran | EXPR | Common Stock, par value $0.01 | D | 23,8509 | −6 500 | −155 | 414 686 | ||||

| 2012-04-30 | 2012-04-26 | 4 | Killion Theo | EXPR | Common Stock, par value $0.01 | D | 4 175 | 4 175 | ||||||

| 2012-04-26 | 2012-04-26 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 24,0000 | −10 000 | −240 | 280 483 | ||||

| 2012-04-10 | 2012-04-09 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 24,2400 | −16 500 | −400 | 193 848 | ||||

| 2012-04-10 | 2012-04-09 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 24,2400 | −19 500 | −473 | 295 295 | ||||

| 2012-04-10 | 2012-04-09 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 24,2400 | −10 000 | −242 | 290 483 | ||||

| 2012-04-03 | 2012-04-02 | 4 | Horowitz Bonadies Fran | EXPR | Common Stock, par value $0.01 | D | 25,0582 | −6 500 | −163 | 421 186 | ||||

| 2012-03-28 | 2012-03-27 | 4 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 25,7415 | −110 393 | −2 842 | 337 255 | ||||

| 2012-03-28 | 2012-03-27 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 26,0147 | −5 800 | −151 | 259 730 | ||||

| 2012-03-28 | 2012-03-27 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 26,0144 | −2 500 | −65 | 257 195 | ||||

| 2012-03-26 | 2012-03-22 | 4 | MANGUM MYLLE H | EXPR | Common Stock, par value $0.01 | D | 3 960 | 9 699 | ||||||

| 2012-03-26 | 2012-03-22 | 4 | DEVINE MICHAEL F III | EXPR | Common Stock, par value $0.01 | D | 3 960 | 9 699 | ||||||

| 2012-03-26 | 2012-03-26 | 4 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 25,5965 | −89 607 | −2 294 | 447 648 | ||||

| 2012-03-26 | 2012-03-22 | 4 | Weiss Michael A | EXPR | Employee Stock Option (right to buy) | D | 25,25 | 181 200 | 181 200 | |||||

| 2012-03-26 | 2012-03-26 | 4 | Campbell Colin | EXPR | Common Stock, par value $0.01 | D | 25,5292 | −20 000 | −511 | 259 695 | ||||

| 2012-03-26 | 2012-03-22 | 4 | Campbell Colin | EXPR | Employee Stock Option (right to buy) | D | 25,25 | 13 560 | 13 560 | |||||

| 2012-03-26 | 2012-03-26 | 4 | Gavales Lisa A | EXPR | Common Stock, par value $0.01 | D | 25,6365 | −60 000 | −1 538 | 249 804 | ||||

| 2012-03-26 | 2012-03-22 | 4 | Gavales Lisa A | EXPR | Employee Stock Option (right to buy) | D | 25,25 | 16 030 | 16 030 | |||||

| 2012-03-26 | 2012-03-26 | 4 | Kornberg David G | EXPR | Common Stock, par value $0.01 | D | 25,3918 | −60 000 | −1 524 | 217 078 | ||||

| 2012-03-26 | 2012-03-22 | 4 | Kornberg David G | EXPR | Employee Stock Option (right to buy) | D | 25,25 | 17 260 | 17 260 | |||||

| 2012-03-26 | 2012-03-26 | 4 | Horowitz Bonadies Fran | EXPR | Common Stock, par value $0.01 | D | 25,5850 | −6 500 | −166 | 427 686 | ||||

| 2012-03-26 | 2012-03-22 | 4 | Horowitz Bonadies Fran | EXPR | Employee Stock Option (right to buy) | D | 25,25 | 17 260 | 17 260 | |||||

| 2012-03-26 | 2012-03-26 | 4 | Moellering Matthew C | EXPR | Common Stock, par value $0.01 | D | 25,3934 | −19 500 | −495 | 314 795 | ||||

| 2012-03-26 | 2012-03-22 | 4 | Moellering Matthew C | EXPR | Employee Stock Option (right to buy) | D | 25,25 | 30 820 | 30 820 | |||||

| 2012-03-26 | 2012-03-26 | 4 | St. Pierre Jeanne L | EXPR | Common Stock, par value $0.01 | D | 25,3934 | −20 000 | −508 | 300 483 | ||||

| 2012-03-26 | 2012-03-22 | 4 | St. Pierre Jeanne L | EXPR | Employee Stock Option (right to buy) | D | 25,25 | 13 560 | 13 560 | |||||

| 2012-03-26 | 2012-03-26 | 4 | Rafferty John J | EXPR | Common Stock, par value $0.01 | D | 25,5072 | −100 000 | −2 551 | 265 530 | ||||

| 2012-03-26 | 2012-03-22 | 4 | Rafferty John J | EXPR | Employee Stock Option (right to buy) | D | 25,25 | 13 560 | 13 560 | |||||

| 2012-03-26 | 2012-03-26 | 4 | Tilson Douglas H | EXPR | Common Stock, par value $0.01 | D | 25,3934 | −16 500 | −419 | 210 348 | ||||

| 2012-03-26 | 2012-03-22 | 4 | Tilson Douglas H | EXPR | Employee Stock Option (right to buy) | D | 25,25 | 11 100 | 11 100 | |||||

| 2012-03-26 | 2012-03-22 | 4 | Dascoli Dominic P | EXPR | Employee Stock Option (right to buy) | D | 25,25 | 4 930 | 4 930 | |||||

| 2012-03-21 | 2012-03-19 | 4 | OLSHANSKY JOSH | EXPR | Common Stock, par value $0.01 | I | 24,5600 | −3 707 349 | −91 052 | 0 | ||||

| 2012-02-22 | 2011-09-28 | 5 | Weiss Michael A By the Michael A. Weiss Trust Agreement Gamma #2 | EXPR | Common Stock, par value $0.01 | I | −283 534 | 570 653 | ||||||

| 2012-02-22 | 2011-09-28 | 5 | Weiss Michael A | EXPR | Common Stock, par value $0.01 | D | 283 534 | 573 865 | ||||||