| Insideraktier | 105 163 shares |

Insider Sentiment Score

Insider sentiment score hittar de företag som köps av foretagsinsynspersoner.

Det är resultatet av en sofistikerad, kvantitativ multifaktormodell som identifierar företag med de högsta nivåerna av insiderackumulation. Poängmodellen använder en kombination av nettoantalet insiders som köpt de föregående 90 dagarna, det totala antalet aktier som köpts i procent av aktiekapitalet och det totala antalet aktier som ägs av insiders. Siffran sträcker sig från 0 till 100, med högre siffror som indikerar en högre nivå av ackumulering för sina kamrater, och 50 är genomsnittet.

Uppdateringsfrekvens: Dagligen

Se Insiders Top Picks, som ger en lista över företag med högsta insiderackumulation.

Office Sentiment Score

Officersentiment Score hittar företag som köps av Corporate Officers.

Per definition Corporate Officers är Corporate Insiders, men till skillnad från vissa av de andra Insiders (10 % aktieägare och styrelseledamöter), arbetar ämbetsmän för företaget dagligen och de använder sina egna pengar när de handlar . (10 % aktieägare och styrelseledamöter är ofta fondförvaltare som förvaltar andras pengar.) Som sådan är insideraffärer som görs av tjänstemän mycket mer betydelsefulla och bör behandlas på lämpligt sätt.

Liksom Insider Sentiment Score är Officer Sentiment Score resultatet av en sofistikerad, kvantitativ multifaktormodell som identifierar företag med de högsta nivåerna av officersackumulering.

Uppdateringsfrekvens: Dagligen

Se insiderns bästa val, vilket ger en lista över företag med högsta insider sentiment.

Viktiga insidernyckeltal

Denna kort visar hur företaget rankas längs olika insidernyckeltal. Procenttilrankningen visar hur detta företag jämförs med andra företag på USA-marknaden. Högre rankingar indikerar bättre situationer.

Till exempel anses det allmänt att insiderköp är en positiv indikator, så företag med mer insiderköp skulle rankas högre än företag med mindre insiderköp (eller til och med insiderförsäljning).

Nettoantalet insiders som köper (rankning)

N/A

Nettoantalet insiders som köper är den totala mängden insiders som säljer minus det totala antalet insiders som säljer under de senaste 90 dagarna. Percentilrankningen visas här (intervall från 0 till 100%).

Procent av flytande köpta av insiders (ranking)

N/A

Procentandelen av aktier köpta av insiders är det totala antalet aktier som köpts av insiders minus det totala antalet aktier som sålts av insiders under de senaste 90 dagarna, dividerat med det totala antalet aktier och multiplicerat med 100.

Insiderhandelsdiagram

CLARCOR Inc. insideraffärer visas i följande diagram. Insiders är tjänstemän, styrelseledamöter eller betydande investerare i ett företag. I allmänhet är det i allmänhet olagligt för insiders att göra affärer i sina företag baserat på väsentlig, icke-offentlig information. Detta betyder inte att det är olagligt för dem att göra några affärer i sina egna företag. De måste dock rapportera alla affärer till SEC via ett formulär 4.

Insiderlista och lönsamhetsstatistik

Den här tabellen visar listan över kända insiders och genereras automatiskt från anmälningar som avslöjas till SEC. Förutom namnen, den senaste titeln och direktören, tjänstemannen eller ägarbeteckningen på 10 %, tillhandahåller vi de senaste avslöjade innehaven. Dessutom, när det är möjligt tillhandahåller vi insiderns historiska handelsresultat. Det historiska handelsresultatet är ett vägt genomsnitt av resultatet för faktiska köptransaktioner på den öppna marknaden som insidern gjort. För mer information om hur detta beräknas, titta på detta YouTube-webinarium.

See our leaderboard of most profitable insider traders.

| Insider | Genomsnitt vinst (%) | Aktier Ägda |

Delad Justerad |

|---|

Report errors via our new Insider Auditing Tool

Track Records av insiderköp - Kortsiktig vinstanalys

I denna sektion analyserar vi lönsamheten för varje oplanerat, öppet-marknads insiderköp gjorda i CLC / CLARCOR Inc.. Denna analys hjälper till att förstå om insidern konsekvent genererar onormala avkastningar och är värd att följa. Denna analys är för ett år efter varje handel, och resultaten är teoretiska .

Tabellen nedan visar de senaste köpen på öppna marknaden som inte var en del av en automatisk handelsplan.

| Handelsdatum | Insider | Rapporterade aktier |

Rapporterat pris |

Justerade aktier |

Justerat pris |

Kostnadsbasis | Dagar til Max |

Pris vid Max |

Maximal vinst ($) |

Maximal avkastning (%) |

|---|---|---|---|---|---|---|---|

| Det finns inga kända oplanerade öppna marknadstransaktioner för denna insynsperson |

Justeringar av aktierär de justerade aktierna efter justerat pris. Justeringar av aktierär de justerade aktierna efter uppdelning.

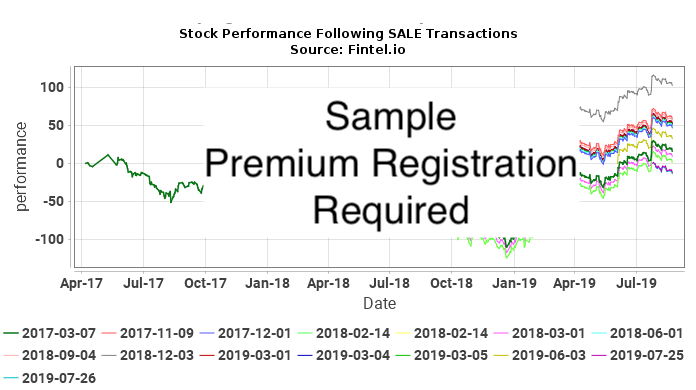

Track Records av insiderförsäljning - Kortsiktig förlustanalys

I denna sektion analyserar vi lönsamheten för varje oplanerat, öppet-marknads insiderköp gjorda i CLC / CLARCOR Inc.. Denna analys hjälper till att förstå om insidern konsekvent genererar onormala avkastningar och är värd att följa. Denna analys är för ett år efter varje handel, och resultaten är teoretiska .

Tabellen nedan visar de senaste försäljningarna på öppna marknaden som inte var en del av en automatisk handelsplan.

Justeringar av aktierär de justerade aktierna efter justerat pris. Justeringar av aktierär de justerade aktierna efter uppdelning.

Transaktionshistorik

Klicka på länkikonen för att se hela transaktionshistoriken. Transaktioner som rapporteras som en del av en automatisk handelsplan 10b5-1 kommer att ha ett X i kolumnen markerad 10b-5.

| Fil datum |

Handel datum |

Schema | Insider | Ticker | Värdepappertitel | Kod | Direkta | Utövningspris | Enhet pris |

Enheter ändrad |

Värde ändrad (1K) |

Kvarvarande Optioner |

Kvarvarande Aktier |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2017-03-06 | 2017-02-28 | 4/A | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −16 930 | −1 405 | 0 | ||||

| 2017-03-06 | 2017-02-28 | 4/A | DONOVAN PAUL | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −1 882 | −156 | 0 | ||||

| 2017-03-06 | 2017-02-28 | 4/A | CLARK WESLEY M | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −8 328 | −691 | 0 | ||||

| 2017-03-06 | 2017-02-28 | 4/A | Emkes Mark A | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −10 825 | −898 | 0 | ||||

| 2017-03-06 | 2017-02-28 | 4/A | Giacomini Thomas | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −5 074 | −421 | 0 | ||||

| 2017-03-06 | 2017-02-28 | 4/A | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −31 802 | −2 640 | 0 | ||||

| 2017-03-06 | 2017-02-28 | 4/A | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −2 375 | −197 | 0 | ||||

| 2017-03-02 | 2017-02-28 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 49,35 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 35,55 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 44,07 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 35,11 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 25,31 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −50 210 | −4 167 | 0 | ||||

| 2017-03-02 | 2017-02-28 | 4 | Emkes Mark A | CLC | Common Stock Par Value $1.00 | D | 49,35 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Emkes Mark A | CLC | Common Stock Par Value $1.00 | D | 44,07 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Emkes Mark A | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −8 943 | −742 | 0 | ||||

| 2017-03-02 | 2017-02-28 | 4 | Giacomini Thomas | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −1 909 | −158 | 0 | ||||

| 2017-03-02 | 2017-02-28 | 4 | CLARK WESLEY M | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −1 669 | −139 | 0 | ||||

| 2017-03-02 | 2017-02-28 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 62,53 | −4 394 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 82,50 | −2 615 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 46,45 | −1 392 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 63,22 | −719 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 61,57 | −403 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 46,45 | −14 250 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 63,22 | −9 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 61,57 | −4 750 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | LINDSAY DAVID J By Family Trust | CLC | Common Stock Par Value $1.00 | I | 83,0000 | −11 002 | −913 | 0 | ||||

| 2017-03-02 | 2017-02-28 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −32 692 | −2 713 | 0 | ||||

| 2017-03-02 | 2017-02-28 | 4 | Thomas Jacob | CLC | Common Stock Par Value $1.00 | D | 62,53 | −4 049 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Thomas Jacob | CLC | Common Stock Par Value $1.00 | D | 82,50 | −3 380 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Thomas Jacob | CLC | Common Stock Par Value $1.00 | D | 46,45 | −1 698 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Thomas Jacob | CLC | Common Stock Par Value $1.00 | D | 46,45 | −25 000 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Thomas Jacob | CLC | Common Stock Par Value $1.00 | D | 46,80 | −1 875 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Thomas Jacob | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −576 | −48 | 0 | ||||

| 2017-03-02 | 2017-02-28 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 62,53 | −4 773 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 82,50 | −2 031 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 46,45 | −1 025 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 63,22 | −514 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 61,57 | −174 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 46,45 | −3 750 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 63,22 | −3 125 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 61,57 | −1 875 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −2 375 | −197 | 0 | ||||

| 2017-03-02 | 2017-02-28 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 62,53 | −5 152 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 82,50 | −3 724 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 46,45 | −2 510 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 63,22 | −1 939 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 61,57 | −616 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 32,78 | −1 719 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 46,45 | −20 625 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 63,22 | −13 750 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 61,57 | −6 875 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −46 503 | −3 860 | 0 | ||||

| 2017-03-02 | 2017-02-28 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 49,35 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 44,07 | −4 407 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −15 048 | −1 249 | 0 | ||||

| 2017-03-02 | 2017-02-28 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 35,55 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 49,35 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 44,07 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 35,11 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 25,31 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −16 453 | −1 366 | 0 | ||||

| 2017-03-02 | 2017-02-28 | 4 | DONOVAN PAUL | CLC | Common Stock Par Value $1.00 | D | 35,55 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | DONOVAN PAUL | CLC | Common Stock Par Value $1.00 | D | 44,07 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | DONOVAN PAUL | CLC | Common Stock Par Value $1.00 | D | 25,31 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | DONOVAN PAUL | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −1 882 | −156 | 0 | ||||

| 2017-03-02 | 2017-02-28 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 31,96 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 49,35 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 44,07 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 35,11 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 25,31 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 35,55 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −54 448 | −4 519 | 0 | ||||

| 2017-03-02 | 2017-02-28 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 44,07 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 49,35 | −7 500 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −29 920 | −2 483 | 0 | ||||

| 2017-03-02 | 2017-02-28 | 4 | Connors Nelda J | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −3 085 | −256 | 0 | ||||

| 2017-03-02 | 2017-02-28 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 62,53 | −12 121 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 82,50 | −16 908 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 46,45 | −12 898 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 63,22 | −5 000 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 61,57 | −1 704 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 32,30 | −1 419 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 32,78 | −1 467 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 36,48 | −737 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 46,45 | −90 000 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 63,22 | −60 000 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 61,57 | −28 750 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −96 917 | −8 044 | 0 | ||||

| 2017-03-02 | 2017-02-28 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 62,53 | −6 288 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 82,50 | −5 267 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 46,45 | −2 985 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 63,22 | −3 091 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 61,57 | −710 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 45,19 | −1 458 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 46,45 | −28 125 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 63,22 | −18 750 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 61,57 | −8 750 | 0 | |||||

| 2017-03-02 | 2017-02-28 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −29 285 | −2 431 | 0 | ||||

| 2017-02-13 | 2017-02-13 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 82,9100 | −10 000 | −829 | 16 453 | ||||

| 2017-02-07 | 2017-02-06 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 82,8900 | −7 725 | −640 | 96 917 | ||||

| 2017-01-23 | 2017-01-18 | 4/A | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 82,9800 | −471 | −39 | 4 447 | ||||

| 2017-01-23 | 2017-01-18 | 4/A | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 82,9800 | 995 | 83 | 4 918 | ||||

| 2017-01-23 | 2017-01-20 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 63,22 | 83,0000 | −258 | −21 | 514 | |||

| 2017-01-23 | 2017-01-20 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −134 | −11 | 2 375 | ||||

| 2017-01-23 | 2017-01-20 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 83,0000 | 258 | 21 | 2 509 | ||||

| 2017-01-23 | 2017-01-23 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 46,45 | 83,0000 | −4 750 | −394 | 14 250 | |||

| 2017-01-23 | 2017-01-23 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 63,22 | 83,0000 | −9 500 | −788 | 9 500 | |||

| 2017-01-23 | 2017-01-23 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 61,57 | 83,0000 | −14 250 | −1 183 | 4 750 | |||

| 2017-01-23 | 2017-01-23 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 45,19 | 83,0000 | −18 000 | −1 494 | 0 | |||

| 2017-01-23 | 2017-01-23 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 49,91 | 83,0000 | −17 000 | −1 411 | 0 | |||

| 2017-01-23 | 2017-01-23 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 42,86 | 83,0000 | −22 000 | −1 826 | 0 | |||

| 2017-01-23 | 2017-01-23 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −3 536 | −293 | 32 692 | ||||

| 2017-01-23 | 2017-01-23 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 46,4500 | 4 750 | 221 | 36 228 | ||||

| 2017-01-23 | 2017-01-23 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −8 186 | −679 | 31 478 | ||||

| 2017-01-23 | 2017-01-23 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 63,2200 | 9 500 | 601 | 39 664 | ||||

| 2017-01-23 | 2017-01-23 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −12 115 | −1 006 | 30 164 | ||||

| 2017-01-23 | 2017-01-23 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 61,5700 | 14 250 | 877 | 42 279 | ||||

| 2017-01-23 | 2017-01-23 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −13 241 | −1 099 | 28 029 | ||||

| 2017-01-23 | 2017-01-23 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 45,1900 | 18 000 | 813 | 41 270 | ||||

| 2017-01-23 | 2017-01-23 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −13 066 | −1 084 | 23 270 | ||||

| 2017-01-23 | 2017-01-23 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 49,9100 | 17 000 | 848 | 36 336 | ||||

| 2017-01-23 | 2017-01-23 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −15 890 | −1 319 | 19 336 | ||||

| 2017-01-23 | 2017-01-23 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 42,8600 | 22 000 | 943 | 35 226 | ||||

| 2017-01-23 | 2017-01-20 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 62,33 | 83,0000 | −360 | −30 | 719 | |||

| 2017-01-23 | 2017-01-20 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −143 | −12 | 13 226 | ||||

| 2017-01-23 | 2017-01-20 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 83,0000 | 360 | 30 | 13 369 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 46,45 | 83,0000 | −30 000 | −2 490 | 90 000 | |||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 63,22 | 83,0000 | −60 000 | −4 980 | 60 000 | |||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 61,57 | 83,0000 | −86 250 | −7 159 | 28 750 | |||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 45,19 | 83,0000 | −100 000 | −8 300 | 0 | |||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 49,91 | 83,0000 | −70 000 | −5 810 | 0 | |||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 42,86 | 83,0000 | −40 000 | −3 320 | 0 | |||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 32,30 | 83,0000 | −15 000 | −1 245 | 0 | |||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 32,78 | 83,0000 | −10 000 | −830 | 0 | |||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 36,48 | 83,0000 | −5 000 | −415 | 0 | |||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −22 332 | −1 854 | 104 642 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 46,4500 | 30 000 | 1 394 | 126 974 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −51 700 | −4 291 | 96 974 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 63,2200 | 60 000 | 3 793 | 148 674 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −73 323 | −6 086 | 88 674 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 61,5700 | 86 250 | 5 310 | 161 997 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −73 556 | −6 105 | 75 747 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 45,1900 | 100 000 | 4 519 | 149 303 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −53 800 | −4 465 | 49 303 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 49,9100 | 70 000 | 3 494 | 103 103 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −28 771 | −2 388 | 33 103 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 42,8600 | 40 000 | 1 714 | 61 874 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −9 682 | −804 | 21 874 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 32,3000 | 15 000 | 484 | 31 556 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −6 488 | −539 | 16 556 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 32,7800 | 10 000 | 328 | 23 044 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −3 427 | −284 | 13 044 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 36,4800 | 5 000 | 182 | 16 471 | ||||

| 2017-01-23 | 2017-01-20 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 63,22 | 83,0000 | −2 500 | −208 | 5 000 | |||

| 2017-01-23 | 2017-01-20 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −990 | −82 | 11 471 | ||||

| 2017-01-23 | 2017-01-20 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 83,0000 | 2 500 | 208 | 12 461 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 46,45 | 83,0000 | −6 875 | −571 | 20 625 | |||

| 2017-01-23 | 2017-01-23 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 63,22 | 83,0000 | −6 875 | −571 | 20 625 | |||

| 2017-01-23 | 2017-01-23 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 45,19 | 83,0000 | −27 500 | −2 282 | 0 | |||

| 2017-01-23 | 2017-01-23 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 42,86 | 83,0000 | −25 000 | −2 075 | 0 | |||

| 2017-01-23 | 2017-01-23 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 49,91 | 83,0000 | −25 000 | −2 075 | 0 | |||

| 2017-01-23 | 2017-01-23 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 32,30 | 83,0000 | −2 500 | −208 | 0 | |||

| 2017-01-23 | 2017-01-23 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −5 118 | −425 | 46 503 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 46,4500 | 6 875 | 319 | 51 621 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −5 924 | −492 | 44 746 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 63,2200 | 6 875 | 435 | 50 670 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −20 228 | −1 679 | 43 795 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 45,1900 | 27 500 | 1 243 | 64 023 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −19 215 | −1 595 | 36 523 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 49,9100 | 25 000 | 1 248 | 55 738 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −17 976 | −1 492 | 30 738 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 42,8600 | 25 000 | 1 072 | 48 714 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −1 685 | −140 | 23 714 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 32,3000 | 2 500 | 81 | 25 399 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 46,45 | 83,0000 | −9 375 | −778 | 28 125 | |||

| 2017-01-23 | 2017-01-23 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 63,22 | 83,0000 | −18 750 | −1 556 | 18 750 | |||

| 2017-01-23 | 2017-01-23 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 61,57 | 83,0000 | −26 250 | −2 179 | 8 750 | |||

| 2017-01-23 | 2017-01-23 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 45,19 | 83,0000 | −35 000 | −2 905 | 0 | |||

| 2017-01-23 | 2017-01-23 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 49,91 | 83,0000 | −25 000 | −2 075 | 0 | |||

| 2017-01-23 | 2017-01-23 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 33,96 | 83,0000 | −2 735 | −227 | 0 | |||

| 2017-01-23 | 2017-01-23 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −6 979 | −579 | 29 285 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 46,4500 | 9 375 | 435 | 36 264 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −16 157 | −1 341 | 26 889 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 63,2200 | 18 750 | 1 185 | 43 046 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −22 316 | −1 852 | 24 296 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 61,5700 | 26 250 | 1 616 | 46 612 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −25 745 | −2 137 | 20 362 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 45,1900 | 35 000 | 1 582 | 46 107 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −19 209 | −1 594 | 11 107 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 49,9100 | 25 000 | 1 248 | 30 316 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −1 866 | −155 | 5 316 | ||||

| 2017-01-23 | 2017-01-23 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 33,9600 | 2 735 | 93 | 7 182 | ||||

| 2017-01-23 | 2017-01-23 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 31,96 | 83,0000 | −7 500 | −622 | 0 | |||

| 2017-01-23 | 2017-01-23 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 83,0000 | −2 888 | −240 | 50 210 | ||||

| 2017-01-23 | 2017-01-23 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 31,9600 | 7 500 | 240 | 53 098 | ||||

| 2017-01-20 | 2017-01-18 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 46,45 | 82,9800 | −465 | −39 | 902 | |||

| 2017-01-20 | 2017-01-18 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 82,9800 | −185 | −15 | 13 009 | ||||

| 2017-01-20 | 2017-01-18 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 82,9800 | 465 | 39 | 13 194 | ||||

| 2017-01-19 | 2017-01-18 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 46,45 | 82,9800 | −995 | −83 | 2 985 | |||

| 2017-01-19 | 2017-01-18 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 82,9800 | −456 | −38 | 4 462 | ||||

| 2017-01-19 | 2017-01-18 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 82,9800 | 995 | 83 | 4 918 | ||||

| 2017-01-19 | 2017-01-18 | 4 | Thomas Jacob | CLC | Common Stock Par Value $1.00 | D | 46,45 | 82,9800 | −567 | −47 | 1 698 | |||

| 2017-01-19 | 2017-01-18 | 4 | Thomas Jacob | CLC | Common Stock Par Value $1.00 | D | 82,9800 | −186 | −15 | 576 | ||||

| 2017-01-19 | 2017-01-18 | 4 | Thomas Jacob | CLC | Common Stock Par Value $1.00 | D | 82,9800 | 567 | 47 | 762 | ||||

| 2017-01-19 | 2017-01-18 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 46,45 | 82,9800 | −342 | −28 | 0 | |||

| 2017-01-19 | 2017-01-18 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 82,9800 | −177 | −15 | 2 251 | ||||

| 2017-01-19 | 2017-01-18 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 82,9800 | 342 | 28 | 2 428 | ||||

| 2017-01-12 | 2016-12-28 | 4/A | DONOVAN PAUL Spouse | CLC | Common Stock Par Value $1.00 | I | 82,3600 | −1 794 | −148 | 16 | ||||

| 2016-12-29 | 2016-12-19 | 4/A | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 82,3700 | −5 948 | −490 | 22 899 | ||||

| 2016-12-29 | 2016-12-19 | 4/A | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 63,2200 | 6 875 | 435 | 28 847 | ||||

| 2016-12-29 | 2016-12-19 | 4/A | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 82,3700 | −17 602 | −1 450 | 21 972 | ||||

| 2016-12-29 | 2016-12-19 | 4/A | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 61,5700 | 20 625 | 1 270 | 39 574 | ||||

| 2016-12-29 | 2016-12-17 | 4/A | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 82,3700 | −291 | −24 | 18 949 | ||||

| 2016-12-29 | 2016-12-17 | 4/A | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 82,3700 | 693 | 57 | 19 240 | ||||

| 2016-12-29 | 2016-12-16 | 4/A | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 82,3700 | −259 | −21 | 18 547 | ||||

| 2016-12-29 | 2016-12-16 | 4/A | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 82,3700 | 616 | 51 | 18 806 | ||||

| 2016-12-29 | 2016-12-28 | 4 | DONOVAN PAUL Spouse | CLC | Common Stock Par Value $1.00 | I | 82,3600 | −1 794 | −148 | 0 | ||||

| 2016-12-29 | 2016-12-28 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 82,3600 | −12 750 | −1 050 | 54 448 | ||||

| 2016-12-27 | 2016-12-23 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 82,2500 | −7 300 | −600 | 9 961 | ||||

| 2016-12-22 | 2016-12-22 | 4 | Thomas Jacob | CLC | Common Stock Par Value $1.00 | D | 46,80 | 82,2300 | −625 | −51 | 1 875 | |||

| 2016-12-22 | 2016-12-22 | 4 | Thomas Jacob | CLC | Common Stock Par Value $1.00 | D | 82,2300 | −430 | −35 | 195 | ||||

| 2016-12-22 | 2016-12-22 | 4 | Thomas Jacob | CLC | Common Stock Par Value $1.00 | D | 46,8000 | 625 | 29 | 625 | ||||

| 2016-12-20 | 2016-12-17 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 45,19 | 82,3700 | −2 000 | −165 | 0 | |||

| 2016-12-20 | 2016-12-17 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 82,3700 | −792 | −65 | 17 261 | ||||

| 2016-12-20 | 2016-12-17 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 82,3700 | 2 000 | 165 | 18 053 | ||||

| 2016-12-20 | 2016-12-16 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 61,57 | 82,3700 | −1 706 | −141 | 1 704 | |||

| 2016-12-20 | 2016-12-16 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 82,3700 | −676 | −56 | 16 053 | ||||

| 2016-12-20 | 2016-12-16 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 82,3700 | 1 706 | 141 | 16 729 | ||||

| 2016-12-20 | 2016-12-17 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 45,19 | 82,3700 | −486 | −40 | 0 | |||

| 2016-12-20 | 2016-12-17 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 82,3700 | −193 | −16 | 3 923 | ||||

| 2016-12-20 | 2016-12-17 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 82,3700 | 486 | 40 | 4 116 | ||||

| 2016-12-20 | 2016-12-16 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 61,57 | 82,3700 | −712 | −59 | 710 | |||

| 2016-12-20 | 2016-12-16 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 82,3700 | −299 | −25 | 3 630 | ||||

| 2016-12-20 | 2016-12-16 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 82,3700 | 712 | 59 | 3 929 | ||||

| 2016-12-20 | 2016-12-17 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 45,19 | 82,3700 | −358 | −29 | 0 | |||

| 2016-12-20 | 2016-12-17 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 82,3700 | −142 | −12 | 12 265 | ||||

| 2016-12-20 | 2016-12-17 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 82,3700 | 358 | 29 | 12 407 | ||||

| 2016-12-20 | 2016-12-16 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 61,57 | 82,3700 | −403 | −33 | 403 | |||

| 2016-12-20 | 2016-12-16 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 82,3700 | −160 | −13 | 12 049 | ||||

| 2016-12-20 | 2016-12-16 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 82,3700 | 403 | 33 | 12 209 | ||||

| 2016-12-20 | 2016-12-19 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 61,57 | 83,2700 | −6 875 | −572 | 20 625 | |||

| 2016-12-20 | 2016-12-19 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 63,22 | 82,3700 | −20 625 | −1 699 | 6 875 | |||

| 2016-12-20 | 2016-12-19 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 82,3700 | −5 948 | −490 | 22 899 | ||||

| 2016-12-20 | 2016-12-19 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 63,2200 | 6 875 | 435 | 28 847 | ||||

| 2016-12-20 | 2016-12-19 | 4 | Wolfson Richard M | CLC | Common Stock | D | 82,3700 | −17 602 | −1 450 | 21 972 | ||||

| 2016-12-20 | 2016-12-19 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 61,5700 | 20 625 | 1 270 | 39 574 | ||||

| 2016-12-20 | 2016-12-17 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 45,19 | 82,3700 | −693 | −57 | 0 | |||

| 2016-12-20 | 2016-12-17 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 82,3700 | −291 | −24 | 18 949 | ||||

| 2016-12-20 | 2016-12-17 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 82,3700 | 693 | 57 | 19 240 | ||||

| 2016-12-20 | 2016-12-16 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 61,57 | 82,3700 | −616 | −51 | 616 | |||

| 2016-12-20 | 2016-12-16 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 82,3700 | −259 | −21 | 18 547 | ||||

| 2016-12-20 | 2016-12-16 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 82,3700 | 616 | 51 | 18 806 | ||||

| 2016-12-20 | 2016-12-20 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 63,22 | 82,3300 | −3 125 | −257 | 9 375 | |||

| 2016-12-20 | 2016-12-20 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 61,57 | 82,3300 | −5 625 | −463 | 1 875 | |||

| 2016-12-20 | 2016-12-20 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 82,3300 | −2 737 | −225 | 2 086 | ||||

| 2016-12-20 | 2016-12-20 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 63,2200 | 3 125 | 198 | 4 823 | ||||

| 2016-12-20 | 2016-12-20 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 82,3300 | −4 866 | −401 | 1 698 | ||||

| 2016-12-20 | 2016-12-20 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 61,5700 | 5 625 | 346 | 6 564 | ||||

| 2016-12-20 | 2016-12-16 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 61,57 | 82,3700 | −175 | −14 | 174 | |||

| 2016-12-20 | 2016-12-16 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 82,3700 | −82 | −7 | 939 | ||||

| 2016-12-20 | 2016-12-16 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 82,3700 | 175 | 14 | 1 021 | ||||

| 2016-12-20 | 2016-12-19 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 82,33 | 82,3300 | 9 029 | 743 | 9 029 | |||

| 2016-12-20 | 2016-12-19 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 82,33 | 82,3300 | 28 984 | 2 386 | 28 984 | |||

| 2016-12-20 | 2016-12-19 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 82,33 | 82,3300 | 4 482 | 369 | 4 482 | |||

| 2016-12-20 | 2016-12-19 | 4 | Thomas Jacob | CLC | Common Stock Par Value $1.00 | D | 82,33 | 82,3300 | 5 794 | 477 | 5 794 | |||

| 2016-12-20 | 2016-12-19 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 82,33 | 82,3300 | 6 384 | 526 | 6 384 | |||

| 2016-12-20 | 2016-12-19 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 82,33 | 82,3300 | 3 481 | 287 | 3 481 | |||

| 2016-07-13 | 2016-07-12 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 33,75 | 33,7500 | −1 500 | −51 | 0 | |||

| 2016-07-13 | 2016-07-12 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 62,1800 | −1 500 | −93 | 15 023 | ||||

| 2016-07-13 | 2016-07-12 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 33,7500 | 1 500 | 51 | 16 523 | ||||

| 2016-07-13 | 2016-07-13 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 31,96 | 31,9600 | −7 500 | −240 | 0 | |||

| 2016-07-13 | 2016-07-13 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 62,0000 | −7 500 | −465 | 26 453 | ||||

| 2016-07-13 | 2016-07-13 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 31,9600 | 7 500 | 240 | 33 953 | ||||

| 2016-07-12 | 2016-07-08 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 28,13 | 28,1300 | −2 000 | −56 | 0 | |||

| 2016-07-12 | 2016-07-08 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 60,8100 | −2 000 | −122 | 15 023 | ||||

| 2016-07-12 | 2016-07-08 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 28,1300 | 2 000 | 56 | 17 023 | ||||

| 2016-07-12 | 2016-07-12 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 32,30 | 32,3000 | −22 000 | −711 | 0 | |||

| 2016-07-12 | 2016-07-12 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 32,78 | 32,7800 | −8 130 | −267 | 0 | |||

| 2016-07-12 | 2016-07-12 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 62,1400 | −22 000 | −1 367 | 11 806 | ||||

| 2016-07-12 | 2016-07-12 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 32,3000 | 22 000 | 711 | 33 806 | ||||

| 2016-07-12 | 2016-07-12 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 62,1400 | −8 130 | −505 | 11 806 | ||||

| 2016-07-12 | 2016-07-12 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 32,7800 | 8 130 | 267 | 19 936 | ||||

| 2016-07-12 | 2016-07-11 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 32,78 | 32,7800 | −13 870 | −455 | 8 130 | |||

| 2016-07-12 | 2016-07-11 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 62,1400 | −13 870 | −862 | 11 806 | ||||

| 2016-07-12 | 2016-07-11 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 32,7800 | 13 870 | 455 | 25 676 | ||||

| 2016-07-12 | 2016-07-12 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 42,86 | 42,8600 | −25 000 | −1 072 | 0 | |||

| 2016-07-12 | 2016-07-12 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 62,1400 | −25 000 | −1 554 | 3 217 | ||||

| 2016-07-12 | 2016-07-12 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 42,8600 | 25 000 | 1 072 | 28 217 | ||||

| 2016-06-21 | 2016-06-20 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 32,30 | 61,2100 | −5 000 | −306 | 2 500 | |||

| 2016-06-21 | 2016-06-20 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 61,2100 | −5 000 | −306 | 18 190 | ||||

| 2016-06-21 | 2016-06-20 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 32,3000 | 5 000 | 162 | 23 190 | ||||

| 2016-04-28 | 2016-04-27 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 36,48 | 59,5200 | −21 700 | −1 292 | 0 | |||

| 2016-04-28 | 2016-04-27 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 59,5200 | −21 700 | −1 292 | 11 806 | ||||

| 2016-04-28 | 2016-04-27 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 36,4800 | 21 700 | 792 | 33 506 | ||||

| 2016-04-13 | 2016-04-11 | 4 | Connors Nelda J | CLC | Common Stock Par Value $1.00 | D | 56,2500 | 1 200 | 68 | 3 085 | ||||

| 2016-04-13 | 2016-04-11 | 4 | Connors Nelda J | CLC | Common Stock Par Value $1.00 | D | 56,2500 | 1 885 | 106 | 1 885 | ||||

| 2016-03-30 | 2016-03-29 | 4 | DONOVAN PAUL | CLC | Common Stock Par Value $1.00 | D | 58,4600 | 1 882 | 110 | 1 882 | ||||

| 2016-03-30 | 2016-03-29 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 58,4600 | 1 882 | 110 | 16 930 | ||||

| 2016-03-30 | 2016-03-29 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 58,4600 | 1 882 | 110 | 67 198 | ||||

| 2016-03-30 | 2016-03-29 | 4 | Giacomini Thomas | CLC | Common Stock Par Value $1.00 | D | 58,4600 | 1 882 | 110 | 5 074 | ||||

| 2016-03-30 | 2016-03-29 | 4 | Giacomini Thomas | CLC | Common Stock Par Value $1.00 | D | 58,4600 | 1 283 | 75 | 3 192 | ||||

| 2016-03-30 | 2016-03-29 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 58,4600 | 1 882 | 110 | 45 598 | ||||

| 2016-03-30 | 2016-03-29 | 4 | CLARK WESLEY M | CLC | Common Stock Par Value $1.00 | D | 58,4600 | 1 882 | 110 | 8 328 | ||||

| 2016-03-30 | 2016-03-29 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 58,4600 | 1 882 | 110 | 26 453 | ||||

| 2016-03-30 | 2016-03-29 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 58,4600 | 1 882 | 110 | 31 802 | ||||

| 2016-03-30 | 2016-03-29 | 4 | Emkes Mark A | CLC | Common Stock Par Value $1.00 | D | 58,4600 | 1 882 | 110 | 10 825 | ||||

| 2016-03-07 | 2016-03-03 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 35,66 | 35,6600 | −7 500 | −267 | 45 000 | |||

| 2016-03-07 | 2016-03-03 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 50,4400 | −5 303 | −267 | 24 571 | ||||

| 2016-03-07 | 2016-03-03 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 50,4400 | 7 500 | 378 | 29 874 | ||||

| 2016-02-10 | 2016-02-09 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 35,66 | 35,6600 | −7 500 | −267 | 0 | |||

| 2016-02-10 | 2016-02-09 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 46,3900 | −5 877 | −273 | 65 316 | ||||

| 2016-02-10 | 2016-02-09 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 46,3900 | 7 500 | 348 | 71 193 | ||||

| 2016-01-21 | 2016-01-20 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 63,22 | 46,7400 | −258 | −12 | 772 | |||

| 2016-01-21 | 2016-01-20 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 46,7400 | −134 | −6 | 846 | ||||

| 2016-01-21 | 2016-01-20 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 46,7400 | 258 | 12 | 980 | ||||

| 2016-01-21 | 2016-01-20 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 63,22 | 46,7400 | −2 500 | −117 | 7 500 | |||

| 2016-01-21 | 2016-01-20 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 46,7400 | −990 | −46 | 15 023 | ||||

| 2016-01-21 | 2016-01-20 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 46,7400 | 2 500 | 117 | 16 013 | ||||

| 2016-01-21 | 2016-01-20 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 63,22 | 46,7400 | −360 | −17 | 1 079 | |||

| 2016-01-21 | 2016-01-20 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 46,7400 | −143 | −7 | 11 806 | ||||

| 2016-01-21 | 2016-01-20 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 46,7400 | 360 | 17 | 11 949 | ||||

| 2016-01-19 | 2016-01-18 | 4 | Thomas Jacob | CLC | Common Stock Par Value $1.00 | D | 46,45 | 46,4500 | 2 265 | 105 | 2 265 | |||

| 2016-01-19 | 2016-01-18 | 4 | Thomas Jacob | CLC | Common Stock Par Value $1.00 | D | 46,45 | 46,4500 | 25 000 | 1 161 | 25 000 | |||

| 2016-01-19 | 2016-01-18 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 46,45 | 46,4500 | 12 898 | 599 | 12 898 | |||

| 2016-01-19 | 2016-01-18 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 46,45 | 46,4500 | 120 000 | 5 574 | 120 000 | |||

| 2016-01-19 | 2016-01-18 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 46,45 | 46,4500 | 2 510 | 117 | 2 510 | |||

| 2016-01-19 | 2016-01-18 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 46,45 | 46,4500 | 27 500 | 1 277 | 27 500 | |||

| 2016-01-19 | 2016-01-18 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 46,45 | 46,4500 | 1 857 | 86 | 1 857 | |||

| 2016-01-19 | 2016-01-18 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 46,45 | 46,4500 | 19 000 | 883 | 19 000 | |||

| 2016-01-19 | 2016-01-18 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 46,45 | 46,4500 | 3 980 | 185 | 3 980 | |||

| 2016-01-19 | 2016-01-18 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 46,45 | 46,4500 | 37 500 | 1 742 | 37 500 | |||

| 2016-01-19 | 2016-01-18 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 46,45 | 46,4500 | 1 367 | 63 | 1 367 | |||

| 2016-01-19 | 2016-01-18 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 46,45 | 46,4500 | 15 000 | 697 | 15 000 | |||

| 2015-12-18 | 2015-12-17 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 45,19 | 48,5600 | −2 000 | −97 | 2 000 | |||

| 2015-12-18 | 2015-12-17 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 48,5600 | −839 | −41 | 13 513 | ||||

| 2015-12-18 | 2015-12-17 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 48,5600 | 2 000 | 97 | 14 352 | ||||

| 2015-12-18 | 2015-12-16 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 61,57 | 48,8500 | −1 706 | −83 | 3 410 | |||

| 2015-12-18 | 2015-12-16 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 48,8500 | −716 | −35 | 12 352 | ||||

| 2015-12-18 | 2015-12-16 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 48,8500 | 1 706 | 83 | 13 068 | ||||

| 2015-12-18 | 2015-12-17 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 45,19 | 48,5600 | −359 | −17 | 358 | |||

| 2015-12-18 | 2015-12-17 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 48,5600 | −151 | −7 | 11 589 | ||||

| 2015-12-18 | 2015-12-17 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 45,1900 | 359 | 16 | 11 740 | ||||

| 2015-12-18 | 2015-12-16 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 61,57 | 48,8500 | −404 | −20 | 806 | |||

| 2015-12-18 | 2015-12-16 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 48,8500 | −170 | −8 | 11 381 | ||||

| 2015-12-18 | 2015-12-16 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 48,8500 | 404 | 20 | 11 551 | ||||

| 2015-12-18 | 2015-12-16 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 61,57 | 48,8500 | −712 | −35 | 1 422 | |||

| 2015-12-18 | 2015-12-16 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 48,8500 | −299 | −15 | 3 217 | ||||

| 2015-12-18 | 2015-12-16 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 48,8500 | 712 | 35 | 3 516 | ||||

| 2015-12-18 | 2015-12-17 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 45,19 | 48,5600 | −695 | −34 | 693 | |||

| 2015-12-18 | 2015-12-17 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 48,5600 | −292 | −14 | 18 190 | ||||

| 2015-12-18 | 2015-12-17 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 48,5600 | 695 | 34 | 18 482 | ||||

| 2015-12-18 | 2015-12-16 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 61,57 | 48,8500 | −616 | −30 | 1 232 | |||

| 2015-12-18 | 2015-12-16 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 48,8500 | −259 | −13 | 17 787 | ||||

| 2015-12-18 | 2015-12-16 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 48,8500 | 616 | 30 | 18 046 | ||||

| 2015-12-18 | 2015-12-16 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 61,57 | 48,8500 | −175 | −9 | 349 | |||

| 2015-12-18 | 2015-12-16 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 48,8500 | −82 | −4 | 722 | ||||

| 2015-12-18 | 2015-12-16 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 48,8500 | 175 | 9 | 804 | ||||

| 2015-12-14 | 2015-12-11 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 49,91 | 49,9100 | −331 | −17 | 0 | |||

| 2015-12-14 | 2015-12-11 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 47,1500 | −139 | −7 | 11 147 | ||||

| 2015-12-14 | 2015-12-11 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 47,1500 | 331 | 16 | 11 286 | ||||

| 2015-12-14 | 2015-12-11 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 43,72 | 43,7200 | −1 683 | −74 | 0 | |||

| 2015-12-14 | 2015-12-11 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 49,91 | 49,9100 | −399 | −20 | 0 | |||

| 2015-12-14 | 2015-12-11 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 47,1500 | −875 | −41 | 2 804 | ||||

| 2015-12-14 | 2015-12-11 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 47,1500 | 1 683 | 79 | 3 679 | ||||

| 2015-12-14 | 2015-12-11 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 47,1500 | 399 | 19 | 1 996 | ||||

| 2015-12-14 | 2015-12-11 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 47,15 | 49,9100 | −375 | −19 | 0 | |||

| 2015-12-14 | 2015-12-11 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 47,1500 | −158 | −7 | 17 430 | ||||

| 2015-12-14 | 2015-12-11 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 47,1500 | 375 | 18 | 17 588 | ||||

| 2015-12-14 | 2015-12-11 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 49,91 | 47,1500 | −1 329 | −63 | 0 | |||

| 2015-12-14 | 2015-12-11 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 47,1500 | −558 | −26 | 11 362 | ||||

| 2015-12-14 | 2015-12-11 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 59,2200 | 68 | 4 | 11 920 | ||||

| 2015-12-14 | 2015-12-11 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 47,1500 | 1 329 | 63 | 11 852 | ||||

| 2015-10-21 | 2015-10-20 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 35,66 | 35,6600 | −7 500 | −267 | 0 | |||

| 2015-10-21 | 2015-10-20 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 46,6900 | −7 500 | −350 | 43 716 | ||||

| 2015-10-21 | 2015-10-20 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 35,6600 | 7 500 | 267 | 51 216 | ||||

| 2015-08-12 | 2015-08-10 | 4 | Giacomini Thomas | CLC | Common Stock Par Value $1.00 | D | 59,9500 | 1 909 | 114 | 1 909 | ||||

| 2015-07-02 | 2015-07-01 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 32,78 | 32,7800 | −10 213 | −335 | 24 787 | |||

| 2015-07-02 | 2015-07-01 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 916 | 50 578 | ||||||

| 2015-07-02 | 2015-07-01 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 793 | 49 662 | ||||||

| 2015-07-02 | 2015-07-01 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 62,5000 | −10 213 | −638 | 48 869 | ||||

| 2015-07-02 | 2015-07-01 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 32,7800 | 10 213 | 335 | 59 082 | ||||

| 2015-04-22 | 2015-04-20 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 32,30 | 66,7800 | −2 500 | −167 | 7 500 | |||

| 2015-04-22 | 2015-04-20 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 66,7800 | −2 500 | −167 | 17 213 | ||||

| 2015-04-22 | 2015-04-20 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 32,3000 | 2 500 | 81 | 19 713 | ||||

| 2015-03-26 | 2015-03-24 | 4 | DONOVAN PAUL Spouse | CLC | Common Stock Par Value $1.00 | I | 65,9100 | 1 669 | 110 | 1 799 | ||||

| 2015-03-25 | 2015-03-24 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 65,9100 | 1 669 | 110 | 15 048 | ||||

| 2015-03-25 | 2015-03-24 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 65,9100 | 1 669 | 110 | 22 374 | ||||

| 2015-03-25 | 2015-03-24 | 4 | CLARK WESLEY M | CLC | Common Stock Par Value $1.00 | D | 65,9100 | 1 669 | 110 | 6 446 | ||||

| 2015-03-25 | 2015-03-24 | 4 | Emkes Mark A | CLC | Common Stock Par Value $1.00 | D | 65,9100 | 1 669 | 110 | 8 943 | ||||

| 2015-03-25 | 2015-03-24 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 65,9100 | 1 669 | 110 | 43 716 | ||||

| 2015-03-25 | 2015-03-24 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 65,9100 | 1 669 | 110 | 29 920 | ||||

| 2015-03-25 | 2015-03-24 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 65,9100 | 1 669 | 110 | 63 693 | ||||

| 2015-03-17 | 2015-03-17 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 25,89 | 25,8900 | −7 500 | −194 | 0 | |||

| 2015-03-17 | 2015-03-17 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 65,4300 | −2 968 | −194 | 62 024 | ||||

| 2015-03-17 | 2015-03-17 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 25,8900 | 7 500 | 194 | 64 992 | ||||

| 2015-01-27 | 2015-01-23 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 63,96 | 63,9600 | 1 000 | 64 | 524 | |||

| 2015-01-27 | 2015-01-23 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 63,9600 | −464 | −30 | 629 | ||||

| 2015-01-27 | 2015-01-23 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 63,9600 | 1 000 | 64 | 1 093 | ||||

| 2015-01-21 | 2015-01-20 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 63,22 | 63,2200 | 1 030 | 65 | 1 030 | |||

| 2015-01-21 | 2015-01-20 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 63,22 | 63,2200 | 12 500 | 790 | 12 500 | |||

| 2015-01-21 | 2015-01-20 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 63,22 | 63,2200 | 10 000 | 632 | 10 000 | |||

| 2015-01-21 | 2015-01-20 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 63,22 | 63,2200 | 120 000 | 7 586 | 120 000 | |||

| 2015-01-21 | 2015-01-20 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 63,22 | 63,2200 | 3 091 | 195 | 3 091 | |||

| 2015-01-21 | 2015-01-20 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 63,22 | 63,2200 | 37 500 | 2 371 | 37 500 | |||

| 2015-01-21 | 2015-01-20 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 63,22 | 63,2200 | 1 939 | 123 | 1 939 | |||

| 2015-01-21 | 2015-01-20 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 63,22 | 63,2200 | 27 500 | 1 739 | 27 500 | |||

| 2015-01-21 | 2015-01-20 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 63,22 | 63,2200 | 1 439 | 91 | 1 439 | |||

| 2015-01-21 | 2015-01-20 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 63,22 | 63,2200 | 19 000 | 1 201 | 19 000 | |||

| 2015-01-21 | 2015-01-20 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 63,22 | 63,2200 | 2 515 | 159 | 2 515 | |||

| 2015-01-21 | 2015-01-20 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 63,22 | 63,2200 | 35 000 | 2 213 | 35 000 | |||

| 2014-12-19 | 2014-12-17 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 62,99 | 62,9900 | −1 411 | −89 | 143 958 | |||

| 2014-12-19 | 2014-12-17 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 62,9900 | −583 | −37 | 10 955 | ||||

| 2014-12-19 | 2014-12-17 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 62,9900 | 1 411 | 89 | 11 538 | ||||

| 2014-12-19 | 2014-12-17 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 62,99 | 62,9900 | −2 846 | −179 | 214 008 | |||

| 2014-12-19 | 2014-12-17 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 62,9900 | −1 308 | −82 | 48 869 | ||||

| 2014-12-19 | 2014-12-17 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 62,9900 | 2 846 | 179 | 50 177 | ||||

| 2014-12-19 | 2014-12-17 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 62,99 | 62,9900 | −175 | −11 | 1 524 | |||

| 2014-12-19 | 2014-12-17 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 62,9900 | −82 | −5 | 93 | ||||

| 2014-12-19 | 2014-12-17 | 4 | WHITE KEITH A | CLC | Common Stock Par Value $1.00 | D | 62,9900 | 175 | 11 | 175 | ||||

| 2014-12-19 | 2014-12-17 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 62,99 | 62,9900 | −1 111 | −70 | 128 895 | |||

| 2014-12-19 | 2014-12-17 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 62,9900 | 1 111 | 70 | 1 597 | ||||

| 2014-12-19 | 2014-12-17 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 62,99 | 62,9900 | −2 103 | −132 | 120 330 | |||

| 2014-12-19 | 2014-12-17 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 62,9900 | 2 103 | 132 | 17 213 | ||||

| 2014-12-19 | 2014-12-17 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 62,99 | 62,9900 | −5 728 | −361 | 372 568 | |||

| 2014-12-19 | 2014-12-17 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | −2 403 | 10 523 | ||||||

| 2014-12-19 | 2014-12-17 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 62,9900 | 5 728 | 361 | 12 926 | ||||

| 2014-11-03 | 2014-10-31 | 4 | DONOVAN PAUL | CLC | Common Stock Par Value $1.00 | D | 31,96 | 31,9600 | −2 500 | −80 | 22 500 | |||

| 2014-11-03 | 2014-10-31 | 4 | DONOVAN PAUL | CLC | Common Stock Par Value $1.00 | D | 66,7000 | −2 500 | −167 | 0 | ||||

| 2014-11-03 | 2014-10-31 | 4 | DONOVAN PAUL | CLC | Common Stock Par Value $1.00 | D | 31,9600 | 2 500 | 80 | 2 500 | ||||

| 2014-11-03 | 2014-10-31 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 33,75 | 33,7500 | −35 000 | −1 181 | 216 854 | |||

| 2014-11-03 | 2014-10-31 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 36,48 | 36,4800 | −35 000 | −1 277 | 251 854 | |||

| 2014-11-03 | 2014-10-31 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 65,8100 | −35 000 | −2 303 | 47 331 | ||||

| 2014-11-03 | 2014-10-31 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 36,4800 | 35 000 | 1 277 | 82 331 | ||||

| 2014-11-03 | 2014-10-31 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 66,2900 | −35 000 | −2 320 | 47 331 | ||||

| 2014-11-03 | 2014-10-31 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 33,7500 | 35 000 | 1 181 | 82 331 | ||||

| 2014-10-28 | 2014-10-28 | 4 | DONOVAN PAUL | CLC | Common Stock Par Value $1.00 | D | 31,96 | 31,9600 | −5 000 | −160 | 25 000 | |||

| 2014-10-28 | 2014-10-28 | 4 | DONOVAN PAUL | CLC | Common Stock Par Value $1.00 | D | 64,6900 | −5 000 | −323 | 0 | ||||

| 2014-10-28 | 2014-10-28 | 4 | DONOVAN PAUL | CLC | Common Stock Par Value $1.00 | D | 31,9600 | 5 000 | 160 | 5 000 | ||||

| 2014-10-24 | 2014-10-23 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 25,89 | 25,8900 | −7 500 | −194 | 52 500 | |||

| 2014-10-24 | 2014-10-23 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 62,7100 | −7 500 | −470 | 20 705 | ||||

| 2014-10-24 | 2014-10-23 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 25,8900 | 7 500 | 194 | 28 205 | ||||

| 2014-10-23 | 2014-10-21 | 4 | DONOVAN PAUL Spouse | CLC | Common Stock Par Value $1.00 | I | 60,9800 | −1 840 | −112 | 130 | ||||

| 2014-09-25 | 2014-09-23 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 35,11 | 35,1100 | −7 500 | −263 | 15 000 | |||

| 2014-09-25 | 2014-09-23 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 35,55 | 35,5500 | −7 500 | −267 | 22 500 | |||

| 2014-09-25 | 2014-09-23 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 35,66 | 35,6600 | −7 500 | −267 | 30 000 | |||

| 2014-09-25 | 2014-09-23 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 63,8100 | −22 500 | −1 436 | 28 251 | ||||

| 2014-09-25 | 2014-09-23 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 35,1100 | 7 500 | 263 | 50 751 | ||||

| 2014-09-25 | 2014-09-23 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 35,5500 | 7 500 | 267 | 43 251 | ||||

| 2014-09-25 | 2014-09-23 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 35,6600 | 7 500 | 267 | 35 751 | ||||

| 2014-09-25 | 2014-09-24 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 25,89 | 25,8900 | −7 500 | −194 | 52 500 | |||

| 2014-09-25 | 2014-09-24 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 64,0800 | −7 500 | −481 | 42 047 | ||||

| 2014-09-25 | 2014-09-24 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 25,8900 | 7 500 | 194 | 49 547 | ||||

| 2014-09-23 | 2014-09-22 | 4 | Emkes Mark A | CLC | Common Stock Par Value $1.00 | D | 38,06 | 38,0600 | −5 500 | −209 | 15 050 | |||

| 2014-09-23 | 2014-09-22 | 4 | Emkes Mark A | CLC | Common Stock Par Value $1.00 | D | 64,0500 | −5 500 | −352 | 7 274 | ||||

| 2014-09-23 | 2014-09-22 | 4 | Emkes Mark A | CLC | Common Stock Par Value $1.00 | D | 38,0600 | 5 500 | 209 | 12 774 | ||||

| 2014-09-23 | 2014-09-22 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 33,75 | 33,7500 | −21 700 | −732 | 145 369 | |||

| 2014-09-23 | 2014-09-22 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 28,79 | 28,7900 | −21 700 | −625 | 167 069 | |||

| 2014-09-23 | 2014-09-22 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 64,0300 | −43 400 | −2 779 | 10 127 | ||||

| 2014-09-23 | 2014-09-22 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 33,7500 | 21 700 | 732 | 53 527 | ||||

| 2014-09-23 | 2014-09-22 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 28,7900 | 21 700 | 625 | 31 827 | ||||

| 2014-09-23 | 2014-09-22 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 32,30 | 32,3000 | −2 500 | −81 | 122 433 | |||

| 2014-09-23 | 2014-09-22 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 64,0000 | −2 500 | −160 | 15 110 | ||||

| 2014-09-23 | 2014-09-22 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 32,3000 | 2 500 | 81 | 17 610 | ||||

| 2014-03-28 | 2014-03-26 | 4/A | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 57,0000 | −7 500 | −428 | 28 251 | ||||

| 2014-03-28 | 2014-03-26 | 4/A | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 31,9600 | 7 500 | 240 | 35 751 | ||||

| 2014-03-28 | 2014-03-25 | 4/A | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 57,1700 | 1 925 | 110 | 28 251 | ||||

| 2014-03-28 | 2014-03-25 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 57,1700 | 1 925 | 110 | 57 492 | ||||

| 2014-03-28 | 2014-03-25 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 57,1700 | 1 925 | 110 | 42 047 | ||||

| 2014-03-28 | 2014-03-25 | 4 | CLARK WESLEY M | CLC | Common Stock Par Value $1.00 | D | 57,1700 | 1 925 | 110 | 4 777 | ||||

| 2014-03-28 | 2014-03-25 | 4 | Emkes Mark A | CLC | Common Stock Par Value $1.00 | D | 57,1700 | 1 925 | 110 | 7 274 | ||||

| 2014-03-28 | 2014-03-25 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 57,1700 | 1 925 | 110 | 13 379 | ||||

| 2014-03-28 | 2014-03-25 | 4 | DONOVAN PAUL Spouse | CLC | Common Stock Par Value $1.00 | I | 57,1700 | 1 925 | 110 | 1 970 | ||||

| 2014-03-28 | 2014-03-25 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 57,1700 | 1 925 | 110 | 20 705 | ||||

| 2014-03-27 | 2014-03-26 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 31,96 | 31,9600 | −7 500 | −240 | 37 500 | |||

| 2014-03-27 | 2014-03-26 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 57,0000 | −7 500 | −428 | 26 326 | ||||

| 2014-03-27 | 2014-03-26 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 31,9600 | 7 500 | 240 | 33 826 | ||||

| 2013-12-18 | 2013-12-17 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 61,57 | 61,5700 | −3 224 | −199 | 286 854 | |||

| 2013-12-18 | 2013-12-17 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 61,5700 | −1 610 | −99 | 47 331 | ||||

| 2013-12-18 | 2013-12-17 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 61,5700 | 3 224 | 199 | 48 941 | ||||

| 2013-12-18 | 2013-12-16 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 61,57 | 2 383 | 290 078 | |||||

| 2013-12-18 | 2013-12-16 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 61,57 | 61,5700 | 35 000 | 2 155 | 287 695 | |||

| 2013-12-18 | 2013-12-16 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 793 | 45 717 | ||||||

| 2013-12-18 | 2013-12-17 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 61,57 | 61,5700 | −1 397 | −86 | 188 769 | |||

| 2013-12-18 | 2013-12-17 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | −586 | 10 127 | ||||||

| 2013-12-18 | 2013-12-17 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 61,5700 | 1 397 | 86 | 10 713 | ||||

| 2013-12-18 | 2013-12-16 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 61,57 | 1 613 | 190 166 | |||||

| 2013-12-18 | 2013-12-16 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 61,57 | 61,5700 | 19 000 | 1 170 | 188 553 | |||

| 2013-12-18 | 2013-12-17 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 61,57 | 61,5700 | −399 | −25 | 130 006 | |||

| 2013-12-18 | 2013-12-17 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 61,5700 | −167 | −10 | 486 | ||||

| 2013-12-18 | 2013-12-17 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 61,5700 | 399 | 25 | 653 | ||||

| 2013-12-18 | 2013-12-16 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 61,57 | 2 846 | 130 405 | |||||

| 2013-12-18 | 2013-12-16 | 4 | Fallon David Joseph | CLC | Common Stock Par Value $1.00 | D | 61,57 | 61,5700 | 35 000 | 2 155 | 127 559 | |||

| 2013-12-18 | 2013-12-17 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 61,57 | 61,5700 | −2 011 | −124 | 124 933 | |||

| 2013-12-18 | 2013-12-17 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 61,5700 | −844 | −52 | 15 110 | ||||

| 2013-12-18 | 2013-12-17 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 61,5700 | 2 011 | 124 | 15 954 | ||||

| 2013-12-18 | 2013-12-16 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 61,57 | 2 464 | 126 944 | |||||

| 2013-12-18 | 2013-12-16 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 61,57 | 61,5700 | 27 500 | 1 693 | 124 480 | |||

| 2013-12-18 | 2013-12-17 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 61,57 | 61,5700 | −4 024 | −248 | 378 296 | |||

| 2013-12-18 | 2013-12-17 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 61,5700 | −1 688 | −104 | 7 198 | ||||

| 2013-12-18 | 2013-12-17 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 61,5700 | 4 024 | 248 | 8 886 | ||||

| 2013-12-18 | 2013-12-16 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 61,57 | 6 822 | 382 320 | |||||

| 2013-12-18 | 2013-12-16 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 61,57 | 61,5700 | 115 000 | 7 081 | 375 498 | |||

| 2013-12-18 | 2013-12-16 | 4 | Conway Christopher | CLC | Common Stock Par Value $1.00 | D | 491 | 4 862 | ||||||

| 2013-10-18 | 2013-10-17 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 35,11 | 35,1100 | −7 500 | −263 | 15 000 | |||

| 2013-10-18 | 2013-10-17 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 25,31 | 25,3100 | −7 500 | −190 | 22 500 | |||

| 2013-10-18 | 2013-10-17 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 35,55 | 35,5500 | −7 500 | −267 | 30 000 | |||

| 2013-10-18 | 2013-10-17 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 31,96 | 31,9600 | −7 500 | −240 | 37 500 | |||

| 2013-10-18 | 2013-10-17 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 35,66 | 35,6600 | −7 500 | −267 | 45 000 | |||

| 2013-10-18 | 2013-10-17 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 33,43 | 33,4300 | −1 250 | −42 | 52 500 | |||

| 2013-10-18 | 2013-10-17 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 56,5943 | −38 750 | −2 193 | 11 454 | ||||

| 2013-10-18 | 2013-10-17 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 35,1100 | 7 500 | 263 | 50 204 | ||||

| 2013-10-18 | 2013-10-17 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 25,3100 | 7 500 | 190 | 42 704 | ||||

| 2013-10-18 | 2013-10-17 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 35,5500 | 7 500 | 267 | 35 204 | ||||

| 2013-10-18 | 2013-10-17 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 31,9600 | 7 500 | 240 | 27 704 | ||||

| 2013-10-18 | 2013-10-17 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 35,6600 | 7 500 | 267 | 20 204 | ||||

| 2013-10-18 | 2013-10-17 | 4 | Bradford James W | CLC | Common Stock Par Value $1.00 | D | 33,4300 | 1 250 | 42 | 12 704 | ||||

| 2013-09-25 | 2013-09-24 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 20,57 | 20,5700 | −7 500 | −154 | 60 000 | |||

| 2013-09-25 | 2013-09-24 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 55,2600 | −7 500 | −414 | 18 780 | ||||

| 2013-09-25 | 2013-09-24 | 4 | BURGSTAHLER ROBERT J | CLC | Common Stock Par Value $1.00 | D | 20,5700 | 7 500 | 154 | 26 280 | ||||

| 2013-09-25 | 2013-09-25 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 20,57 | 20,5700 | −7 500 | −154 | 60 000 | |||

| 2013-09-25 | 2013-09-25 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 55,7600 | −7 500 | −418 | 40 122 | ||||

| 2013-09-25 | 2013-09-25 | 4 | JENKINS ROBERT H | CLC | Common Stock Par Value $1.00 | D | 20,5700 | 7 500 | 154 | 47 622 | ||||

| 2013-09-25 | 2013-09-25 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 20,57 | 20,5700 | −7 500 | −154 | 60 000 | |||

| 2013-09-25 | 2013-09-25 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 56,0700 | −2 866 | −161 | 55 567 | ||||

| 2013-09-25 | 2013-09-25 | 4 | PACKARD JAMES L | CLC | Common Stock Par Value $1.00 | D | 20,5700 | 7 500 | 154 | 58 433 | ||||

| 2013-09-25 | 2013-09-24 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 25,89 | 25,8900 | −7 500 | −194 | 45 000 | |||

| 2013-09-25 | 2013-09-24 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 25,31 | 25,3100 | −7 500 | −190 | 52 500 | |||

| 2013-09-25 | 2013-09-24 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 55,3700 | −15 000 | −831 | 26 326 | ||||

| 2013-09-25 | 2013-09-24 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 25,8900 | 7 500 | 194 | 41 326 | ||||

| 2013-09-25 | 2013-09-24 | 4 | LOCHNER PHILIP R | CLC | Common Stock Par Value $1.00 | D | 25,3100 | 7 500 | 190 | 33 826 | ||||

| 2013-07-26 | 2013-07-25 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 32,78 | 32,7800 | −6 250 | −205 | 96 980 | |||

| 2013-07-26 | 2013-07-25 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 55,2300 | −6 250 | −345 | 13 943 | ||||

| 2013-07-26 | 2013-07-25 | 4 | Wolfson Richard M | CLC | Common Stock Par Value $1.00 | D | 32,7800 | 6 250 | 205 | 20 193 | ||||

| 2013-07-22 | 2013-07-22 | 4 | DONOVAN PAUL | CLC | Common Stock Par Value $1.00 | D | 35,66 | 35,6600 | −7 500 | −267 | 30 000 | |||

| 2013-07-22 | 2013-07-22 | 4 | DONOVAN PAUL | CLC | Common Stock Par Value $1.00 | D | 55,4000 | −7 500 | −416 | 0 | ||||

| 2013-07-22 | 2013-07-22 | 4 | DONOVAN PAUL | CLC | Common Stock Par Value $1.00 | D | 35,6600 | 7 500 | 267 | 7 500 | ||||

| 2013-07-17 | 2013-07-16 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 26,08 | 26,0800 | −23 000 | −600 | 169 553 | |||

| 2013-07-17 | 2013-07-16 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 54,5100 | −23 000 | −1 254 | 9 316 | ||||

| 2013-07-17 | 2013-07-16 | 4 | LINDSAY DAVID J | CLC | Common Stock Par Value $1.00 | D | 54,7700 | 23 000 | 1 260 | 32 316 | ||||

| 2013-07-12 | 2013-07-12 | 4 | FERRISE SAM | CLC | Common Stock Par Value $1.00 | D | 28,79 | 28,7900 | −35 000 | −1 008 | 252 695 | |||